In competitive swimming, fractions of a second can make all the difference between first and last place; a single stroke can mean either victory or defeat. So it is in the fast-paced accounting and finance industries where the smallest details can make all the difference. You need highly skilled candidates

who possess mental toughness and personal endurance You need Accounting Principals and Parker + Lynch. Aligning companies who strive for professional excellence with top performers is what we do so you can focus on meeting your clients’ needs. Take the plunge: contact us today!

Among

{Follow Todd on Twitter @Todd ICPAS}

{Watch Todd’s CEO Video Series on YouTube}

Technology

We’ve all heard the term work-life “balance ” Now there’s also work-life “integration” and work-life “flexibility” But what do all of these terms mean? And, more importantly, how are we supposed to manage a workplace when each term means different things to different people?

The workplace has changed dramatically over the past 20 years, driven heavily by smaller and faster technologies that have made us more mobile, more nimble, and more available We seamlessly check our emails, make transactions, and remote into our office networks from the devices we hold in the palms of our hands Te c h n o l o g y n o w t e t h e r s u s t o w o r k 2 4 / 7 / 3 6 5 w e c a n w o r k anytime and anywhere

But, what has that done to the culture of the “workplace” and our ability to actually have work-life balance? And when I say worklife balance, I mean a defined time when one is truly disconnected both mentally and physically from one’s job (not counting when you’re asleep) Our constant connectivity doesn’t just affect oneself, it can and does affect the coworkers around us

Now, I openly admit to checking and responding to email almost every night and weekend because that’s when I have free time, but I also proactively tell my employees that there’s no expectation of an immediate response. However, I’m learning that’s not always the case in today’s firms and companies

In some firms, it’s not unusual for a staff person to get an email from a partner on the Friday of a holiday weekend asking them to c o m p l e t e a t a s k b y 5 p m o n S a t u r d a y I s t h a t c o n s i d e r e d work-life integration?

A p a r t n e r o r s e n i o r e x e c u t i v e m a y t a l k o f g o i n g t o a c h i l d ’s sporting event but then takes conference calls at the event Is that work-life flexibility?

On the flipside, staffers may have the option to work anytime, which might mean 7 p m to 2 a m The only way for the manager on the receiving end of their middle-of-the-night emails to disconnect is to literally turn off his or her smartphone.

My point is, technology and our morphing work anytime and anyw h e r e p o l i c i e s h a v e b l u r r e d , a n d m a y b e e v e n e l i m i n a t e d , o u r w o r k p l a c e b o u n d a r i e s t h o s e b e i n g t h e p h y s i c a l o f f i c e a n d “9-to-5” workday, and if you had work to do beyond it, you stayed late or went back into the office on the weekend There was only so much you could do or would do at home, and checking work email wasn’t part of it.

Technology has “freed” us to work anytime and anywhere And yet, staff retention is always identified as a key business challenge.

So, what are we to do? What do young professionals want? As we shot my recent CEO video, we talked with graduating accounting s t u d e n t s f r o m D e P a u l U n i v e r s i t y a b o u t t h e i r e x p e c t a t i o n s f o r w o r k - l i f e “ s o m e t h i n g ” . N o t s u r p r i s i n g l y, t h e i r a n s w e r s w e r e a l l across the board Some anticipate some level of work-life integration; others want jobs where they can truly get away from it all on nights and weekends.

It’s easy to get caught up in trends as we try to attract and retain talent In the end, I think we business leaders need to pause and a s

we truly want to create for our teams. We have the oppor-

“whatever-you-want-to-call-it” help advance the value of the CPA profession?

Editorial Offices

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

Publisher/President & CEO Todd Shapiro

Editor Derrick Lilly

Creative Director Gene Levitan

Photography Jay Rubinic, Derrick Lilly, Nancy Cammarata

Circulation John McQuillan

Advertising Michael W Walker | mike@rwwcompany com

Chairperson, Lisa Har tkopf, CPA Ernst & Young LLP

Vice Chairperson, Rosaria Cammarata, CPA , CGMA Mattersight Corporation

Secretary, Geof frey Harlow, CPA Kessler Orlean Silver & Co , PC

Treasurer, Kevin V Wydra, CPA Crowe Horwath LLP

Immediate Past Chairperson, Scott D Stef fens, CPA Grant Thornton LLP

Michael Bedell, Ph D Northeastern Illinois University

Terry A Bishop, CPA Sikich LLP

Jon S Davis, CPA University of Illinois at Urbana

Jonathan W Hauser, CPA KPMG LLP

Elizabeth S Pittelkow, CPA, CITP, CGMA ArrowStream Inc

Christopher F Beaulieu, CPA, MST CliftonLarsonAllen LLP

Stephen R Ferrara, CPA BDO USA LLP

Anne M Kohler, MBA, CPA, CGMA The Mpower Group

Maria de J Prado, CPA Prado & Renteria CPAs

Andrea K Urban, CPA ThoughtWorks Inc

Brian Blaha, CPA Wipfli LLP

Dorri C McWhorter, MBA, CPA, CGMA, CITP YWCA Metropolitan Chicago

Thomas B Murtagh, CPA, JD BKD LLP

Stella Marie Santos, CPA Adelfia LLC

INSIGHT is the magaz ne of the Ill nois CPA Society Statements or ar icles of opinion appearing n INSIGHT are no necessari y the views of the llinois CPA Soc ety The materials and nformation contained with n NSIGHT are offered as information only and not as practice, financ a , accounting, legal or other professional advice Readers are strongly encouraged to consult w th an appropriate professional advisor before acting on he informat on contained in this publication t is INS GHT’s policy no to know ngly accept advertising that d scriminates on the basis of race religion sex age or origin The Illinois CPA Society reserves the right to re ect paid advert sing that does not mee INSIGHT’s qualifications or that may detract from its professiona and ethical standards The I linois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about he products or services they may provide or

“Great things in business are never done by one person, they’re done by a team of people.” – Steve Jobs

Anyone with a sleep-deprived schedule knows it all too well; it’s the 3 p.m. slump where your overworked brain and body finally say, “No more, not today; put that spreadsheet away. ”

For many of us, this means slinking off to the employee lounge to top off our “World’s Best Accountant” mug with some lukewarm liquid energy (you know, coffee or whatever else is caffeinated), but experts say we ’ ve got it all wrong

By studying chronically sleep-deprived students in a controlled experiment, researchers from the University of Georgia found that 10 minutes of walking up and down stairs at a regular pace

is more likely to reenergize your appetite for work than ingesting 50 milligrams of caffeine, or the equivalent of a can of soda

“We found, in both the caffeine and the placebo conditions, that there was not much change in how they felt, but with exercise they did feel more energetic and vigorous,” says Patrick J O'Connor, a professor in the department of kinesiology and co-author of the study which aimed to simulate typical office workday conditions

So there you have it The best way to beat back the 3 p m slump is to schlep up and down the stairs for a bit or maybe just go for a walk outside since it’s summer and all

If anything can unite finance leaders across the country, it’s the need to thwart cybercrime In “Cyber and Data Security in the Middle Market,” a study of companies with annual revenues between $25 million and $500 million, CFO Research found that 21 percent of respondents had their business activities disrupted by hackers in the past two years

While that’s not a particularly startling figure, the fact that it compares to 37 percent who reported having had physical property stolen during that same period puts it in perspective cyberthefts will likely outstrip traditional thefts very soon

Even companies that didn’t suffer an all-out business disruption were impacted by cyber threats over the last two years Sixty percent of respondents reported losing time and resources as a result of managing a security breach; 23 percent lost revenue; 20 percent lost valuable information; 19 percent lost credibility with customers, suppliers, or the public; and 15 percent lost financial assets

As cyberattacks continue to target all levels of organizations, it’s becoming increasingly important for top executives to communicate the gravity and seriousness of a breach to the rest of the company

63%

of consumers believe AI will help solve complex problems that plague modern societies.

[PwC]

Board of Directors

CHAIRPERSON

Lisa Har tkopf

Ernst & Young LLP

VICE CHAIRPERSON

Rosaria Cammarata

Mattersight Corporation

SECRETARY

Geof frey J Harlow

Kessler Orlean Silver & Co , PC

TREASURER

Kevin V Wydra

Crowe Hor wath LLP

IMMEDIATE PAST CHAIRPERSON

Scott D Stef fens

Grant Thornton LLP

DIRECTORS

Christopher F Beaulieu

Clif tonLarsonAllen LLP

Michael D Bedell

Nor theastern Illinois University

Terr y A Bishop Sikich LLP

Brian J Blaha

Wipfli LLP

Jon S Davis

University of Illinois

Stephen R Ferrara

BDO USA , LLP

Jonat han W Hauser

KPMG LLP

Anne M Kohler

The Mpower Group, Inc

Dorri C McWhor ter

YWCA Metropolitan Chicago

Thomas B Mur tagh

BKD, LLP

Elizabet h S Pittelkow

ArrowStream, Inc

Maria de J Prado

Prado & Renteria CPAs

Stella Marie Santos

Adelfia LLC

Andrea K Urban

ThoughtWorks Inc

Chapter Presidents

CENTRAL

Steven S Howard RSM US LLP

CHICAGO METRO

Anna M Harris

CHICAGO SOUTH

Lawrence E Mish

FOX RIVER TRAIL

Kur t L Schneider

Exemplar Accounting and Tax Advisors

FOX VALLEY

Gar y P Steeno

Ayotte Decker LLC

NORTHERN

Jakob J. Thompson

Benning Group LLC

O’HARE

Deborah L. Kur tzke

Grieco Kur tzke & Adelman LLC

Committee Chairs

ACCOUNTING PRINCIPLES

Ryan Brady Grant Thornton LLP

AUDIT & ASSURANCE SERVICES

James R. Javorcic

CBIZ / Mayer Hof fman

McCann P C

AWARDS

Kenton J Klaus

Deloitte Tax LLP

EMPLOYEE BENEFITS

JoAnn E Cassell

Cassell Plan Audits, Inc

ETHICS

Lawrence A . Hor wich Wipfli, LLP

GOVERNMENTAL EXECUTIVE

Christine A . Torres

Crowe Hor wath LLP

GOVERNMENTAL REPORT REVIEW

Stephanie I Blanco

John Kasperek Co Inc CPA

ILLINOIS CPAS FOR POLITICAL ACTION

Floyd D. Perkins

Nixon Peabody

NOMINATING

Scott D Stef fens

Grant Thornton LLP

NOT-FOR -PROFIT

ORGANIZATIONS

Melissa E Struck

Clif tonLarsonAllen LLP

The Illinois CPA Society thanks its volunteer leaders for their tireless service and contributions. Volunteers like you are the foundation of the Society, and without you, we would not be able to achieve our core mission of enhancing the value of the CPA profession.

PEER REVIEW REPORT

ACCEPTANCE

Russell J Wilson Por te Brown LLC

SCHOL ARSHIP SELECTION

Kenton J. Klaus Deloitte Tax LLP

TAX ADVISORY GROUP

Eunice K. Sullivan

S & P Tax Solutions Ltd

TAXATION BUSINESS

Ryan J Vaughan Ernst & Young LLP

TAXATION ESTATE, GIFT & TRUSTS

Paige B. Goepfer t RSM US LLP

TAXATION EXECUTIVE

Jeremy A Dubow

NDH Group Ltd

TAXATION FLOW-THROUGH

ENTITIES

James B Eisenmenger

Mar tin, Hood, Friese & Associates, LLC

TAXATION INDIVIDUAL

Matt hew J Zaba FGMK, LLC

TAXATION INTERNATIONAL

Madhuri Thaker

TAXATION PRACTICE & PROCEDURES

Mark Heroux

Baker Tilly Virchow Krause, LLP

TAXATION STATE & LOCAL

David J Kupiec

Kupiec & Mar tin, LLC

WOMEN’S CONNECTIONS

Mar y E McCormick

WOMEN’S EXECUTIVE

Eileen M Iles

Crowe Hor wath LLP

Conference Planning

Task Force Chairs

ACCOUNTING & AUDITING

Jodi Seelye

Mueller & Company LLP

ADVANCED TOPICS IN FLOWTHROUGH TAXATION

Jef frey D Butler

Kessler, Orlean, Silver & Company, PC

EMPLOYEE BENEFITS - SPRING

Rose Ann Abraham

Baker Tilly Virchow Krause, LLP

EMPLOYEE BENEFITS - WINTER

Janice L Forgue

Marcum LLP

ESTATE AND GIFT TAX

Lee A Arbus

Levun, Goodman & Cohen, LLP

FINANCIAL INSTITUTIONS

Ryan Abdoo

Plante Moran, PLLC

FRAUD & FORENSIC

Frank L Der y

PricewaterhouseCoopers LLP

GOVERNMENT

Linda S. Abernet hy RSM US LLP

HEALTHCARE COMPLIANCE & FRAUD

Howard L Stone

Stone, McGuire & Siegel, PC

IRS/TAX PRACTITIONERS

SYMPOSIUM

Michael J Singer

Michael J Singer & Co , PC

FINANCIAL REPORTING

SYMPOSIUM

Joseph Howell

Workiva

NOT-FOR -PROFIT - ROSEMONT

Susan Greggo Warady & Davis LLP

NOT-FOR -PROFIT - SPRINGFIELD

Lori K Milosevich

Estes, Bridgewater & Ogden CPA s

NOT-FOR -PROFIT ADVANCED AND EMERGING ACCOUNTING AND A-133 ISSUES

Jennifer Richards

Crowe Hor wath LLP

STATE AND LOCAL TAX

David J Kupiec

Kupiec & Mar tin, LLC

TAXATION ON REAL ESTATE

Rober t Beesley

Deloitte Tax LLP

WOMEN’S LEADERSHIP FORUM

Lindy R Ellis Ernst & Young LLP

Member Forum Groups Chairs

FUTURES, SECURITIES & DERIVATIVES

Adam J Wilhite

RSM US LLP

MANAGEMENT CONSULTING

Milan G. Weber

Kwikclarity

NOT-FOR -PROFIT

Alison H Fetzer

ORBA

PERSONAL FINANCIAL

PL ANNING

Elizabet h D Buf fardi

Crescendo Financial Planners

Brian J. Kearns

EmberHouse

Task Force Chairs

COMMITTEE STRUCTURE & VOLUNTEERISM

Rona Bezman

Rona Bezman, CPA

CPA EXAM AWARD

Elizabet h A Murphy

DePaul University

LEGISL ATOR TAX GUIDE

Victor V Scimeca

Victor V Scimeca, CPA

LIFETIME ACHIEVEMENT AWARD

Scott D. Stef fens

Grant Thornton LLP

Other Volunteer Group Chairs

DIVERSIT Y ADVISORY COUNCIL

Seun Salami

Jones Lang LaSalle Inc

YOUNG LEADERS

ADVISORY COUNCIL

Megan P Angle

Por te Brown LLC

YOUNG PROFESSIONALS GROUP

Kate Burian

CohnReznick

Meghan K. Rzepczynski

Crowe Hor wath LLP

Ken Jennings was untouchable. Beating back competitor after competitor, he strung together a winning streak for the ages, which, to this day, remains the longest winning streak in Jeopardy history. Then, in February 2011, Jennings squared off against his most formidable opponent in his historic 74th game. Watson.

Weighing in at just under 1,500 pounds and having 200 million pages of information committed to memory, Watson didn’t look like the 144 people Ken had defeated In fact, Watson wasn’t a person at all. Watson was IBM’s AI (artificial intelligence) supercomputer, and unseating the greatest trivia expert of all time was just the coming out party for what appears to be a long and disruptive livelihood.

Its latest endeavor? Accounting

A pioneer of cognitive computing, Watson is quickly becoming whoever you need it to be. Unlike basic computing, which only works with structured data in databases, Watson relies on natural language processing to understand and process unstructured data Meaning, rather than solely looking for keyword matches, it evaluates words and phrases to interpret the context and draw inferences about the meaning and intent just like you and me

When Watson begins in a new domain like tax, for instance it begins with a basic collection of information as the foundation of its knowledge Then, with the help of human experts, it refines its knowledge through a process known as machine learning, where it evaluates pairs of questions and answers to understand linguistic patterns in the data Like humans, Watson uses information to form and analyze options, develop hypotheses, make decisions, and ingest results, getting “smarter” with each feedback loop.

In Watson’s first commercial application, it outpaced real doctors in successfully diagnosing lung cancer. IBM has since partnered with many industry leaders in education, financial services, healthcare, and more, and is by all accounts looking to be the central AI engine powering all business and consumer applications through its developer ecosystem and open application program interface

It was just a matter of time before Watson would take on the accounting world, and that time is now

After all, Watson excels at analyzing terabytes of disparate, unstructured data to apply order and context Watson processes this data and makes determinations on it in mere milliseconds In many ways, evaluating data and applying “rules” is the bedrock of traditional accounting work, leaving Watson poised to disrupt a significant amount of the work being done.

Not buying it? Several of the largest firms in the industry have already begun deploying Watson in exactly this way While they’ve not disclosed all of the specifics around its application, KPMG is leveraging Watson in its audit practice to analyze large volumes of structured and unstructured data related to a company’s financial information Watson is being trained by KPMG’s auditors to fine-tune assessments, giving them faster access to precise measurements used to analyze anomalies

An increasingly important component of assurance work is performing analytic procedures on individual transaction data Historically, these procedures have been limited and basic, restricted by the computing power of humans and their laptop computers. But with Watson, all bets are off. And as the technology

behind the AI supercomputer improves, it will continue to make more sense for firms, like KPMG, to use Watson to develop a much richer understanding of the enormous amounts of data that we’re increasingly producing

H&R Block is another noteworthy player leveraging Watson to disrupt traditional business practices, but this time it’s for tax preparation

“By using Watson, H&R Block’s tax professionals highlight additional areas of possible tax implications based on a personalized cognitive interview,” explains George Guastello, H&R Block vice president of client experience “The client can follow along with the tax professional on a monitor that brings to life key focus areas for deductions, making tax preparation more engaging and transparent ”

What’s interesting about the H&R Block/Watson partnership is that it offers us a glimpse into the future of human and machine interaction According to Guastello, Watson isn’t replacing tax preparers, but rather helping them do their jobs better

“Tax professionals are the heart and brain of the client experience, that role will not change,” says Guastello “Watson augments and expands human intelligence, it does not replace it This is man and machine working together; the best tax professionals working with the best technology to deliver the best outcome for clients.”

In this, we begin to see a future for how AI and humans will exist symbiotically. In professional service industries where trust is foundational to the relationship, automation alone is unable to service the need However, when automation and client service combine, the promise is a higher quality product at a lower cost, benefiting both the accountant and the client in the long run

It’s unclear what IBM’s true intent is for Watson in the accounting space, but clearly opportunities for AI in the industry exist broadly Machine learning systems are increasingly being implemented into accounting platforms, automating manually repetitive tasks. For instance, cloud-based accounting software provider Xero recently applied machine learning capabilities to its “Find and Recode” function, a function designed to help accountants and bookkeepers tidy up their clients’ incorrectly coded entries.

The model learns from invoice coding behaviors, noting any mistakes recognized and corrected by the advisor, and then offers suggestions and predictions Next time the user tries to affix an incorrect code to an invoice, the machine learning system suggests a label that should be used instead.

What’s next? Imagine a big data engine that can monitor credit worthiness against thousands of indicators and approve financing in seconds Consider the possibility of an audit quality system that can perform real-time benchmarking against a perfectly comparable peer group Perhaps we’ll one day see a program that can do smart forecasting based on company-specific and macro-economic trends They’re all likely scenarios that will bring change to accountancy

There will never be a future without human accountants and bookkeepers, but those who will succeed in the age of automation and machine learning will welcome the disruption In this future, the accounting professional will be focused on offering intuitive insights and more value to their clients And the mundane, dirty work? Well, we’ll leave that for the machines.

Ryan Watson, CPA is a founder and principal of tech-savvy accounting firm Upsourced Accounting and Xero’s Midwest ambassador He can be reached at rwatson@upsourcedaccounting com

Among turbulent legislative times in Washington, D.C., the possibility of a controversial border adjustment tax has resurfaced

By Robert J DerocherCalling themselves the American Made Coalition, CEOs from some of the U S ’s largest companies and corporations have urged Congress to tackle our outdated tax system, passing “big and bold” tax reform including a border adjustment tax (BAT)

When it comes to deciphering the details and divining the direction of a so-called BAT along with the broader issue of federal tax reform it might be a good idea to have a good accountant, a knowledgeable economist, and a plugged-in D.C. insider on your team

“There’s a lot of complexity to this, and one of the biggest challenges is tracking it all,” says Joseph Calianno, CPA, JD, LLM, partner and international technical tax practice leader in Washington, D.C. for Chicago-based BDO USA. “There are a lot of things you have to be prepared for You need to think about all of the potential implications You can’t just ignore it ”

As Congress and the presidential administration continue to maneuver through turbulent legislative times in the District, talk of tax reform and the possibility of an often controversial BAT has resurfaced

While the BAT itself didn’t immediately appear on President Trump’s tax reform agenda, tax and finance observers say that doesn’t mean it’s completely off the table.

The question of just what the BAT might mean in the world of corporate finance and trade particularly for some Illinois firms who would like to see it enacted remains an open-ended one It’s also one that has CPAs and finance professionals on edge as they work to help their clients plan for the seemingly unplannable: guidance from Washington, D.C.

The BAT gained traction last year as part of an overall U S tax reform package promoted by House Republicans, known more widely as the House Blueprint The Blueprint’s highlights included cutting the corporate tax rate from the current 35 percent to 20 percent as a means of spurring economic growth and reinvestment.

The idea behind the BAT? Shifting corporate taxes from an “originbased tax” (where goods are manufactured) to a “destination-based cash flow tax” (where goods are consumed), often referred to as a territorial tax system In short, a BAT would tax U S imports while exempting U S manufacturing exports

“It ignores cross-border payments and is trying to capture the net value of consumption in the U S , ” explains Rob Clary, principal in the international tax practice for KPMG in Chicago And, predictably, the BAT has backers and opponents.

“On the pro side, people say it encourages domestic production of goods in the U.S.,” he says. “On the con side, people say we have a global economy that is built on imports, and the import scenario will lead to higher priced products because of the higher taxes ”

Illinois-based manufacturing heavyweights with significant global sales, such as Chicago-based Boeing and Peoria-headquartered Caterpillar, have joined forces with similar-minded companies in the American Made Coalition, a lobbying and public information group to support the BAT And while the coalition includes other corporate titans such as General Electric, Johnson & Johnson, MillerCoors, and United Technologies, it also includes smaller but wide-reaching players like Mount Prospect, Ill -based Cummins Allison Corp , the only U S -based manufacturer and supplier of coin and currency handling products

In a posting on the American Made Coalition website (www. americanmadecoalition org), company Chairman and CEO William Jones spelled out his support for the BAT

“Cutting business taxes and rebating taxes on my exported machines would allow my company to increase sales,” he wrote “Although my costs would rise somewhat because I have to import certain components that are no longer made domestically, the border tax would compensate for that loss by canceling out the taxrebate advantage currently enjoyed by my foreign competitors.” And increased sales, he adds, would lead to more local hiring and more local tax revenues for an improved economy It’s a theme echoed by American Made Coalition spokesman John Gentzel, who calls the BAT a vital component of the House Blueprint. The BAT, he says, is not a stand-alone tax and is part of overall tax reform

“People recognize that the current tax code is broken and that it’s too complex,” Gentzel says “Our broad hope is for pro-growth tax reform That’s what we’re hoping to see accomplished here ”

At the same time, the National Retail Federation (NRF), whose members range from big-box retailers to mom-and-pop shops, has also launched a strident anti-BAT campaign, predicting that a BAT would substantially drive up the tax bills of many import-dependent retailers particularly small business owners

The NRF has produced a series of As Seen on TV-style commercials taking aim at the BAT:

“It’ll tax your car, your food, your gas, your medicine, your clothes you name it, BAT will tax it!

And that’s not all. As a special bonus, we’ll include the new jobkilling formula for free! You’ll get it all the income-chilling, taxbringing, job-killing BAT ”

Further pressing the concern, a survey of the University of Chicago’s Initiative on Global Market Economic Experts Panel in April found that 40 percent of respondents agreed that a BAT would “substantially raise prices for U S consumers,” with just 19 percent disagreeing

“The big concern is that if you’re a net importer, this could have a significant impact on your tax position,” Calianno says

While the University of Chicago’s panel findings raised concern about rising prices under the BAT, they also highlighted the biggest: uncertainty. Because, while 40 percent of those surveyed said higher prices were likely under the BAT, the same percentage said that they just weren’t sure

And for many financial observers, that’s just where the problem lies now tax reform has become an unpredictable waiting game.

“It still isn’t clear where the administration is on this,” Clary says. “We have a lot of proposals out there in the Tax Reform Sweepstakes, and the BAT is still out there ”

Questions also linger about the survivability of a BAT, either as proposed or in an amended form

“How will it affect importers? How will it affect costs? This is something that is outside of the scope of tax geeks,” Clary adds.

“The economists are continuing to deliberate on this ”

Calianno adds that the complexity of modern global trade only increases uncertainty. Many companies regularly import and export raw materials and goods to create products, he says, which could blur the lines of what’s taxable and what isn’t Questions also remain about services, aside from physical products

As a result, Clary and Calianno say that accounting firms are spending more time with their clients talking about what may or may not happen, and how to prepare for what comes out of Washington, D C

“Our clients are preparing for multiple scenarios We’re sitting down with them and helping them understand the potential impacts to their business,” Clary explains

And all that complexity and those concerns could bring a mixed bag for accountants, as well, Calianno says “To a large degree, accounting firms are providing a service, and they’re providing this service all over the globe,” he says, meaning, while many CPAs would do well to develop sophisticated tracking systems for their clients, firms themselves need to consider their own tax implications.

To a great degree, this all adds up to a great deal of uneasiness for finance professionals “It’s a challenging pill to swallow,” Clary says. “And businesses don’t like uncertainty.”

Once upon a time, caring only about the comings and goings in your neighborhood or city, and maybe even your state, was enough to get by in life and business Those days are gone Today, if you’re not looking at everything through a global lens, you may as well be blind

“You’ll be so far behind, you’ll never catch up. Your competitors will surpass you and get the business,” stresses Debra Benton, author of “The Leadership Mind Switch ” “And you’ll miss out on some great food that your mama never made!”

All joking aside, “any business leader who is worth the role simultaneously thinks about globalization, changing demographics, and technology changes all of the time,” she adds “It’s the new world of work ”

“Gone are the days when you could confine your thinking to domestic implications,” says Suz O’Donnell, executive advisor at global management consulting and leadership coaching company Thrivatize “Whether you think your work is global or not, there are always global implications ”

What this all means is it’s imperative to build a global mindset if you want your career and business to keep moving forward

“The higher you rise, the less important the basic duties of your job become. Crunching numbers, consistent accuracy, and critical thinking are all job requirements that got you to where you are now. Thinking globally will take you to the next level,” O’Donnell says But what does thinking globally really mean?

The challenge for most CPAs is that global thinking is a relatively new concept “Most CPAs don’t think globally because we were never taught, nor encouraged, to do so. Most of us were simply taught to take good care of our clients which meant doing quality work on a timely basis for a reasonable fee,” explains Howard Rosen, CPA, JD, AEP, director of business development at Mesa, Ariz -based Schmidt Westergard & Company PLLC “That’s not the world of today. Today we all compete on a global basis, and if we cannot do so, our future is in peril ”

The mindset behind global thinking isn’t just about sustainability or survival, though; it’s about making you a better professional and building a better profession Here’s how to get started

“If you don’t want to get left behind, move forward,” says John Norman, CPA, partner at Charlotte, N C -based CPA and advisory firm GreerWalker LLP Simply having technical knowledge and know-how isn’t enough anymore if you want to build lasting business relationships

“‘Globalization’ has become the buzzword of the last two decades. Our industry in general might not have adjusted to the new market conditions as fast as other industries have,” he says, “but you clearly see that’s changing ”

“You need to have a genuine thirst for knowledgeable about economic, political, and cultural issues around the world, and to look into the complexity of international affairs,” Norman continues, suggesting tapping into the news and resources from

organizations like World Affairs Councils of America, The World Trade Association, and the international chambers of commerce where your customers or clients do business as a good way to start growing your global mindset.

The point is a global mindset isn’t an innate feature, but it can be developed, adds Dr. Lilac Nachum, professor at Baruch College’s Zicklin School of Business in New York and an international business executive educator and consultant “Social interaction with people outside one’s usual circles, and connection with people that differ from one’s own, is a particularly effective means for the development of a global mindset,” she explains “Research shows that professionals across all business areas considerably improve their scores on global mindset tests after engaging in such activities ”

Thinking beyond the world you live in means also thinking more about the world your customers and clients live in. Truth is, today, even if your company or your clients are domestic, they have global competitors or suppliers affecting their business

“Talk with your clients See how they interact with their customers and learn how they do business outside their local markets,” Rosen suggests. “Global thinking is looking at your market on a worldwide basis Do you have clients with operations in Canada or Mexico? Do your clients sell into Europe or Africa? It’ll amaze you how much international business your clients do once you ask them about it.”

Being curious not only benefits you, it likely benefits business relations, too Sharing his experience, Rosen recalls a client from the printing industry “One of their customers was a foreign auto manufacturer who had plants in the U.S. Our client printed owners’ manuals for the cars When we did a bit of inquiry, we discovered a portion of the autos built in the U S were shipped to other countries for end-user sale. This created a tax planning opportunity that

wouldn’t have been available if the cars were sold only in the U.S. Thinking globally allowed us to assist our client in an ongoing technique that lowered their taxes.”

“To me, global thinking also means thinking about business opportunities existing outside of our boundaries and how our services can create value when we address the needs of foreignowned entities doing business in the U S and domestic companies doing business in other parts of the world,” Norman explains.

What better way to learn about the needs of your foreign counterparts and the value you can bring them than straight from the source?

“Join one of the many international associations of accountants. Attend regional and worldwide conferences that accounting associations sponsor. Meet members from other countries,” Rosen encourages “These are the best sources ”

For those of you already working in a global organization or firm that does business abroad, it would behoove you to take on a global role or expatriate assignment to enhance your global mindset, grow your leadership profile, and also to spice up your work life

After all, even if you think you’re not currently working in a global environment, we’ve got news for you: You are.

“The reality of today’s business environment is that we’re competing with businesses throughout the world If you’re still thinking that your competitors are just down the street, you will probably not stay in business for very long, at least not very successfully,” Norman says

“The sooner we recognize this, the better,” Rosen adds “If we don’t recognize the importance of global thinking, we as an industry are doomed to failure.”

If you’re a CPA with a specialized interest, you can build on the value of your license by adding an AICPA advisory service credential: Personal Financial Specialist (PFS™ ), Accredited in Business Valuation (ABV ® ), Certi ed in Financial Forensics (CFF® ) or Certi ed Information Technology Professional (CITP® ) developed for the profession by the profession AICPA credentials make a statement They set you apar t and get you noticed. And, they can seriously boost your career.

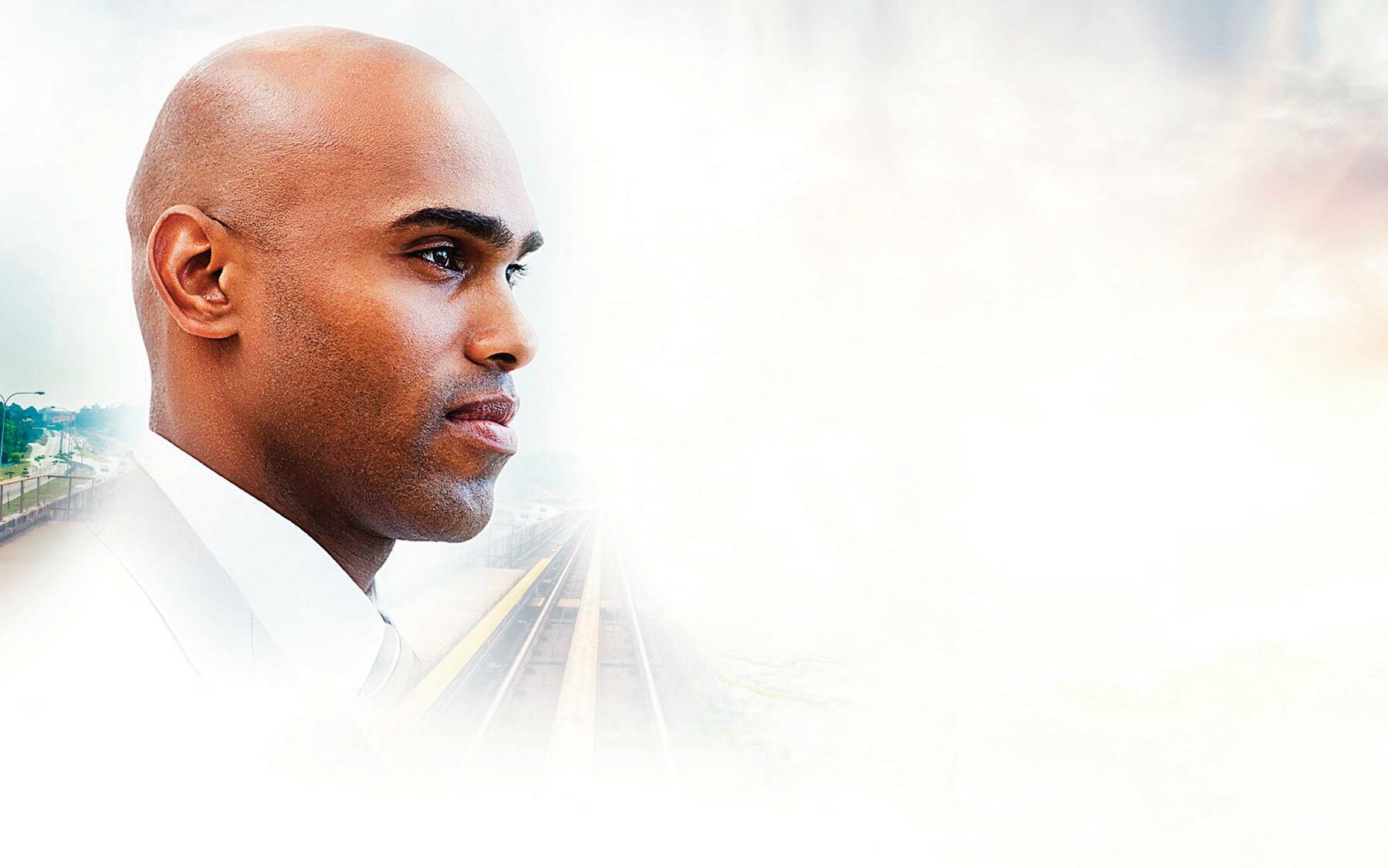

Increasingly tasked with being all things to all people, today ’ s CFOs are being asked to make the impossible possible

By Carolyn KmetThe last decade has forcefully redefined the role of the chief financial officer (CFO) from a shadowed back-office numbers-cruncher into a power figure whose presence and influence permeates the entire organization

To little surprise, 85 percent of CFOs surveyed by Robert Half Finance & Accounting say their roles have expanded outside of traditional accounting and finance over the past few years, with human resources and information technology as two of the most commonly cited new areas.

Which begs the question: Is pushing and pulling CFOs away from focusing only on mission-critical finance functions in the best interest of the business world? Or, perhaps it doesn’t matter right or wrong, this is the new norm

“ T h e C F O r o l e h a s e v o l v e d f r o m b e i n g t h e s c o r e k e e p e r t o b e i n g a t r u s t e d b u s i n e s s p a r t n e r, ” explains Ken Hager, who experienced the evolution of the modern CFO firsthand as he helmed the CFO role at DST Systems Inc from 1988 until retiring in 2014 “Effective CFOs need to understand not only the financial dynamics of the business, but also the business itself, the markets served, and all of the challenges facing businesses ahead ”

If that’s not enough, the CFO’s purview now extends beyond internal operations, too. Today, it’s common to see CFOs at the forefront of representing their organizations to customers and clients, consultants and advisors, and stakeholders, shareholders, and investors alike. Which, as Jason Heath, CFO of Leadpages and former CFO of Media Temple, says, requires today’s current and prospective CFOs to develop “a deep understanding of the customer and what challenges they face ”

What’s accelerating this endless evolution is our increasing reliance on technology and data in driving decision making.

Whether you want to improve technology, increase staff, or expand your CPA practice through acquisition, Oak Street Funding can fund your growth plan. We specialize in financing for CPAs based on future fees rather than personal assets. From initial growth through the development and eventual divestiture of your practice, we can provide capital to meet your goals.

•

•

•

•

•

“ To d a y ’s C F O s h a v e a c c e s s t o i n f o r m a t i o n a b o u t t h e d e t a i l s o f resource consumption and the efficiency of invested capital that empowers them to be more proactive, and also more concerned about the entire spectrum of company performance and not just financial results,” says Ian Charles, CFO of Host Analytics “It’s expected that today’s CFO will deliver strategic, data-driven guidance and apply critical thinking to decisions across the organization ”

“This oversight of all aspects of the organization has turned today’s C F O i n t o a s t r a t e g i c p a r t n e r f o r t h e C E O a n d n o t j u s t a b e a n counter,” Charles continues “Now the CEO is empowered with a valuable partner who is armed with data that allows for accurate, quick, and insightful business decisions.”

The truly successful CFOs, however, will be those that embrace these expectations and continue to evolve, both personally and professionally, to meet them

“Now, successful CFOs must be adept at navigating not only technical accounting, but also human resources, risk management, developing and monitoring key performance indicators (KPIs) for operations, and constantly worrying and planning for what’s next,” says Matthew Hinson, CPA, principal at Live Oak Advisors, who points to the demands of middle-market and private companies as big drivers of the continually evolving CFO role

With this increased exposure and reach into functions beyond traditional corporate accounting and finance comes the opportunity and responsibility to guide, advise, and inspire departments across an entire organization.

“Modern CFOs are expected to deliver strategic guidance that will positively impact the company’s bottom line,” explains John Sadofsky, director of permanent placement services for Chicago-based Robert Half Finance & Accounting

For example, Sadofsky says CFOs are increasingly collaborating with HR to contribute to decisions aimed at attracting and retaining the best talent while also spending efficiently and effectively on that talent. Not only do these decisions impact an organization’s bottom line, they play a key role in managing risks in an increasingly competitive business environment

H a g e r e x p l a i n s t h a t t h e c u r r e n t e m p h a s i s o n r i s k m a n a g e m e n t across all business functions is requiring CFOs to gather and assess both quantitative and qualitative metrics in order to generate a holistic view of organizational performance.

While developing risk management strategies has always been a traditional expectation of CFOs, Heath says that today’s leading

finance officers must take it a step further “The CFO must develop strategies that objectively hold departments accountable to their results, while at the same time encouraging, allowing, and assisting teams to take risks and invest in new business ideas that ultimately drive growth,” Heath says

R e a l l y, i n o r d e r f o r C F O s t o e f f e c t i v e l y f u l f i l l t h e i r “ b a s i c ” j o b duties today, they must fully understand the increasingly competi t i v e a n d c o m p l e x n a t u r e o f t o d a y ’s b u s i n e s s e n v i r o n m e n t a tough task when our technological and regulatory environments are in a constant state of change

“These forces require a broad skill set to triage and identify where there is value and opportunity for investment and innovation and where the organization should focus its time,” Heath says Right or wrong, organizations are increasingly being scrutinized for their decisions in these arenas, further heightening the visibility and significance of the CFO

In short, “It’s tough out there!” Hinson says

With such broad responsibilities, the question now becomes, can one truly prepare to be a CFO?

Those already on course for the C-suite would be well-served to actively build relationships across functions within their organizations, Heath says. “Sit with customer service to learn what customers need; meet with engineers to understand cutting edge technologies; work with marketing to help evaluate performance of a new campaign or branding exercise,” he encourages “A strategic CFO must have a strong understanding of the undercurrent that drives the business if they hope to create and drive value ”

“Those who aspire to the position definitely need to pay their dues in accounting and finance first,” Charles suggests. “Work for an accounting firm; work in investment banking; work for large companies, small companies, and even go the route of an entrepreneur if you can ”

Point being, managing your career to get as much experience as possible is what’s needed first; because today’s CFOs have oversight and influence over the entire organization, they must have a broad background that spans functions as well as industries.

Sometimes scars can be seen, and sometimes they can’t The important takeaway is that scar tissue often teaches you what not to do as much as it teaches you what to do,” Charles says. “But remember, it takes a passion to build, grow, and preserve the value of a business.”

“Effective CFOs need to understand not only the financial dynamics of the business, but also the business itself, the markets served, and all of the challenges facing businesses ahead.”

Over the years, your living expenses may have increased Could your current life insurance benefits:

• Help your family maintain their lifestyle?

• Pay for your kids’ college education?

• Allow your spouse to retire comfortably?

It’s always a struggle to lose someone you love. But your family’s emotional struggles don’t need to be compounded by financial problems

That’s why the Group 10-Year Level Term Life Insurance Plan is made available to ICPAS members.* This valuable insurance program offers:

• Your choice of benefit amounts up to $250,000.

• Rates that are locked in for 10 full years.

• Benefit amounts remain steady for the 10-year coverage period. There are no age reductions.

By Robert J Derocher

By Robert J Derocher

There are bean counters, and then there are laugh counters No, wait I’m being absolutely serious In Barcelona, Spain, the Teatraneu Theatre uses facial recognition technology to register each laugh and charges customers on a per-smile basis The result? A 25 percent revenue increase over previous ticket prices, says Steven Tiell, senior principal at Accenture Labs in San Jose, Calif

“It’s no longer about selling products and services; it’s about selling more meaningful outcomes,” Tiell explains. “It upends long-held notions of how superior products and services are defined.”

Thanks to continued technological advances, companies no longer need to just sell a widget or a service and move on Now, they can learn about the consumer who bought that widget and what they did with it, in the hopes of selling more widgets, making better widgets, and being more useful to consumers down the road. And that’s likely to mean more precise tracking, auditing, and financial analysis in the future as the global economy shifts towards more precise measurement of who buys what and why and how it all works out in the end

Helge Tennø, a technology consultant, writer, and speaker in Oslo, Norway, traces the beginnings of the Outcome Economy to GE Chairman Jeffrey Immelt’s discussions about the company’s cloudbased platform for the Industrial Internet, Predix, in 2014

“GE could move to an economy where the business model was based on the measured output of their solutions,” Tennø explains. “Since then, there has been an emergence of smarter and smarter hardware as in sensors, software as in AI (artificial intelligence), and machine learning which has increased our ability to measure whatever ”

One of the keys to the acceleration of the Outcome Economy, according to Tiell, has been the ability among more companies to place that intelligent hardware where digital and physical worlds intersect, allowing companies to capture meaningful data that can generate information and insights into how customers use products and services

And in this new technological frontier, the term “hardware” is not confined to the traditional computer lingo of servers, networking gear, and PCs, Tiell explains. How about getting feedback and information from your washing machine, the activity tracker on your wrist, nearby security cameras, or your office elevator?

“With this feedback loop, companies are, for the first time, able to have a quantifiable, end-to-end understanding of how their products perform not just for their customers, but for their customers’ customers,” Tiell adds. “The Outcome Economy is defined by companies’ abilities to create value by delivering solutions to customers that, in turn, lead to quantifiable, measurable results ”

And that, in turn, brings a deeper understanding of what customers ultimately want from those products and services.

The concepts, collectively referred to as the Outcome Economy nowadays, are not entirely new, says Swaminathan Sridharan, John and Norma Darling Distinguished Professor in the Accounting Information and Management Department at the Kellogg School of Management, Northwestern University, Evanston, Ill “Measuring data related to products and services delivered, customer behavior including customer satisfaction, and the efficiency of such operations at every link of the value chain is something we’ve been studying and practicing for several years now. The difference now is that companies are able to measure more precisely a greater number of such aspects throughout the value chain thanks to improved flow of information ”

The obvious benefit, he says, is more data, more quickly, which enables real-time decision-making to meet customer demands

In just a few short years, the Outcome Economy has picked up momentum across the globe In Europe, Tennø credits Finnish companies and groups such as Siemens and Smart & Clean (a public-private partnership dedicated to improving environmental sustainability in metropolitan Helsinki) with driving interest and changing established mindsets.

“What we were basically saying was, ‘Get off of autopilot, you can measure anything,’” he says “Don’t let that stop you from identifying new ways of finding and measuring what is important and valuable for your company, however.”

A 2015 report issued by World Economic Forum and co-author Accenture illustrates the growing potential for the Outcome Economy “Agricultural companies now have the data necessary to calculate how many bushels of wheat can be produced on a given piece of farmland with a particular mix of seed, fertilizer, water, soil chemistry, and weather conditions. By combining analytics software with connected tractors, tillers, and planters, they can apply the precise mix of seed and fertilizer to maximize crop yield at harvest,” the report stated.

Tiell cites two other specific examples of successful outcome-driven programs that illustrate this new economic approach:

The City of Los Angeles has 7,000 smart parking spaces that communicate real-time parking conditions to smartphone apps, telling

drivers where parking is available These connected parking spaces have delivered tangible outcomes: Parking revenue increased 2 percent; average parking costs decreased 11 percent; and space utilization increased 11 percent

Proteus Digital Health, billing itself as the world’s first digital medicine service, integrates a tiny, inert sensor in the pills it produces The sensor acts together with a wearable device and mobile app to provide full “adherence transparency,” indicating to patients, healthcare providers, and payers when medication is taken or missed Not only can the Proteus hardware-based system determine when patients take their medications, but it also can send alerts and reminders to patients if they forget to take a pill. What kind of economic impact might that have? A 2007 study by the New England Healthcare Institute estimated that missed medications cost $100 billion annually in excess hospitalizations alone.

“Delivering customer outcomes is a strategy for sustaining competitive advantage today,” Tiell contends. “It will be a turnaround strategy in the next few years, and a survival strategy beyond that.”

This new technology-fueled landscape is likely to mean a combination of old and new approaches to accounting and finance in the years ahead, Tiell and others say. Books will still need to be audited, finances analyzed, and information collected and disseminated, but just what’s in those numbers and how they’re analyzed is already changing, as is the finance approach behind them.

“There are new ways to accrue revenue, such as micro-payments, new commission-based roles, and ecosystem partners,” Tiell explains. “Similarly, raising capital has been upended. No longer are banks and capital markets the only options for financing new endeavors; crowdfunding or ‘customer-funded’ financing models are now as much a financial strategy as they are business and product strategies ”

The ready availability of more and more data also opens up possibilities for accountants and potential pitfalls, Sridharan warns.

“Accountants have always been looking for ways of going beyond our traditional business boundaries,” he explains “We now have quite a lot of data available Now auditors can gain access to off-balance sheets, and more access to computer networks I can foresee huge conflicts of interest Do you want insurance companies to know some of this information?”

Tennø worries that companies may misuse the surplus of data to the disadvantage of customers as well as their own employees “The prerequisite for understanding the market is measurable data However this leaves out troves of valuable data that gives insight and understanding, but is just not measurable,” he says “With the Outcome Economy, we are trying to capture more data that can be measured, but also make sense of data that is important but not measurable.”

Tiell foresees “an ecosystem-driven digital economy” with increasing business/technology partnerships continuing to drive change “In fact, one of the key trends we identified in the Accenture Technology Vision 2017 report is that to fulfill their digital ambitions, companies will need to take on a leadership role to help shape the new rules of the game,” he says.

While there still may be some ethical minefields, Sridharan agrees that the Outcome Economy will present opportunities for the accounting and finance industry, with versatility and technological literacy being important requirements.

“We can’t call ourselves by just one name we’re not just accountants,” he says “It’s a very exciting time to be a student of economics And if you’re a practice manager, you better learn about what’s happening ”

As regional managing partner of the Great Lakes Region of RSM US LLP, Donna Sciarappa, CPA has more than 25 years of assurance and business advisory experience. She recently completed a four-year term on RSM US LLP’s board of directors; she’s also a member of Leadership Cleveland’s class of 2010, a past recipient of YWCA Greater Cleveland’s Women of Achievement Award, and was named to Crain’s Cleveland Business’

In other words, Sciarappa doesn’t really need any more credentials or credits to her name, but when The Committee of 200 (C200), an invitation-only professional organization for the world’s most successful women entrepreneurs and corporate leaders and one of the more exclusive membership organizations headquartered in Chicago came onto her radar two years ago, this CPA simply couldn’t ignore the opportunity.

After all, Sciarappa had recently taken on the role of regional managing partner at her firm and found herself spending more and more time in Chicago

“I really didn’t have a network in Chicago, so I was looking forward to an opportunity to get to know other women professionals in the community,” Sciarappa recalls. Working with C200’s membership coordinator, Sciarappa completed the process of joining and soon found herself immersed in an invaluable network of women and resources

Sciarappa says C200 has since exposed her to several “extremely well done” group events where she’s tapped the minds of many successful, entrepreneurial women “That creates a lot of energy and enthusiasm,” Sciarappa says, adding that she often shares the insights and knowledge she’s gleaned from those interactions with her Chicago colleagues and coworkers

“It’s been very positive for our ability to connect with people within the community,” Sciarappa says, noting that she’s looking forward to forging deeper bonds with fellow members under a new council.

C200 is in the process of setting up a new, more intimate council in Chicago, of which Sciarappa will be a member “It will be a smaller group, so we’ll all have the opportunity to spend more time with one another, really getting to know the group on a more informal basis,” she says “That's just one of the things I’m looking forward to as a member ”

Sciarappa’s story is just one example of what can come from being part of Chicago’s exclusive executive membership club scene, which dates back nearly 150 years to when The Chicago Club and The Standard Club both founded in 1869 paved the way for exclusive clubs and organizations.

Today, Chicago is home to many elite business clubs and organizations that provide benefits like important networking opportunities, access to industry events and experts, connections with potential clients, and in most cases the opportunity to enjoy some great

A peek inside some of Chicago’s most exclusive business clubs reveals a few good reasons why they’re the place to be for r ising accounting and finance pros.

food and wine, making Chicago a virtual hotbed for “joiners” who want to explore new horizons with like-minded professionals

Zachary Weiner, CEO at Chicago PR firm Emerging Insider, says social clubs have become key for professionals who want to expand their networking opportunities and entrench themselves in the social scene “As more and more consultants preach ‘digital,’ an investment towards face-to-face marketing is a factor of differentiation for savvy CPAs,” Weiner says “Social clubs offer this differentiating capability ”

For example, Weiner says clubs will often help qualified and credible CPAs reach out to their communities in a “non-promotional” manner, in person and outside of the digital noise “This persona-

C200 org

In 1982, a handful of the mos t power ful women in business gathered in Los Angeles to raise $200,000 for The National Association for Women Business Owners, a networ k dedicated to women entrepreneurs Once the group raised the funds, the member s recognized the collective s trength of the infor mal community they had created Ultimately, the founders, including K athar ine Graham and Chr is tie Hefner, conceived a broader agenda that became what ’s now The Committee of 200 (C200), with a membership that has far surpassed the original goal

From its first days, C200 has ser ved as a vit al networ k and community for women with common business leadership experiences and like-minded goals to come tog ether to share their successes and to suppor t each other. C200’s primar y mission is to foster, celebrate, and advance women ’s leadership in business through unique programming and professional and personal networking C200 leaders seek to promote success shared among the membership and with future generations of female leaders, and its members represent an innovative, suppor tive community of women Its uniq ue mix of cor porate leaders and entrepreneurs form an exclusive network

Membership is by invit ation onl y Annual dues: $1,800

based marketing and exposure carries far more weight than a Facebook ad, email, cold call, or webinar ever could,” he says

It’s not just CPAs that benefit from being part of business and executive clubs, either Trave Harmon, CEO of managed IT services provider Triton Technologies in Worcester, Mass , certainly isn’t a CPA, but he can attest to the value of joining multiple professional organizations and prestigious social groups

“When I started my business, I got involved with various clubs, chambers, and events that helped me make proper introductions to the ‘movers and shakers’ in the area,” Harmon says, who’s since met some of his largest clients through these groups “I’ve even met CPAs, attorneys, doctors, and business professionals who to this day are still helping me grow my business ”

Executivesclub org

Since 1911, The Executives’ Club of Chicago has helped shape Chicago business and economic growth as one of the countr y’s premier executive member ship development and networking organizations

From its founding, the org anization has ser ved as a platform for senior-level executives; up-and-coming young leaders; professionals and entrepreneurs of large and small, local, national, and multinational corporations; leaders of universities; state and city government of ficials; and foreign dignit ar ies to build relationships, share ideas, develop new business oppor tunities, and par ticipate in wor ld-class programming

Each year, The Executives’ Club presents prog rams on cur rent business and economic trends that hosts some of the most influential global and local business trailblazers of the time think Amelia Earhar t, Bill Gates, Chr is tine Lag arde, Jamie Dimon, and Michelle Obama

Membership is by invitation only, and new members must be nominated by a current member Annual dues: Undisclosed

EOChicago org

The Entrepreneurs’ Organization (EO) is a global business network of more than 12,000 entrepreneurs spread around the globe Founded in 1987 by a group of young entrepreneurs, EO aims to inspire business owners to engage in its expanding peer-to-peer networked and to learn from each other, leading to greater business success and an enriched personal life

The organization provides resources in the form of global events, leadership-development prog rams, an online entrepreneur forum, and executive education oppor tunities, among other of ferings designed for personal and professional growth What ’s impor tant about this global organization is that it also has local chapters fur thering its mission

EO Chicago, named one of Chicago’s mos t exclusive entrepreneur ial clubs by Crain’s Chicago Business, has more than 136 local members and puts on its own regional events designed to help members build their businesses and gain inspiration from other local entrepreneurs

Prospective members must meet rigorous q ualif ications to appl y Annual dues: EO Global $1,900; EO Chicago $2,033 (excluding application and initiation fees)

Without a doubt, Chicago’s exclusive business club scene is replete with oppor tunities for all professionals. Below are just six wor th explor ing

Regardless of which group you join, or which events you decide to par ticipate in, Sciarappa says professionals who put the time and energy into the organization will def initely get more than their fair share out of it “Ever y time you meet with someone and give back a bit of your time and energy, the relationships that form are incredible,” Sciarappa says

“I belong to a few dif ferent groups, but I’m pretty selective, and I make sure that I can spend the time and energy to develop those relationships I would encourage others to do the same,” Sciarappa adds In particular, she says CPAs should seek out the business groups that will help them keep their fingers on the pulse of the local and global business communities “As CPAs, when we advise our clients, it’s really impor tant that we get a sense for what’s going on in the business world,” she says. “This is a great way to accumulate that knowledge while forming relationships and giving back to the community at the same time ”

TheChicagoNetwork org

A letter went out in the summer of 1979 “calling together women distinguished by their achievements in business, the ar ts, the professions, government, and academia ” Of the 113 recipients, 97 exceptional Chicago women accepted the invit ation to meet for the f ir s t time And so, The Chicago Network (TCN) was formed Today, TCN has more than 450 members from Chicago’s business, professional, cultural, nonprofit, and educational communities set on a mission to connect for professional and per sonal g rowth; advance civic, business, and philanthropic communities; and inspire and suppor t the next generation of leaders TCN has various initiatives aimed at leveling the playing field for women in business, including expanding their presence in boardrooms and executive suites.

Membership is by invit ation onl y Annual dues: Undisclosed

Commercialclubchicago org

“From Wacker Drive to Grant Park to the Museum of Science and Industr y, The Commercial Club of Chicago and its af filiate organizations have played a role in shaping Chicago ” That ’s a nice introduction to this organization that was founded in 187 7 Membership, however, is limited to onl y 350 active members, and tot al membership is approximately 500, including active, life, and non-resident members, making The Commercial Club of Chicago quite exclusive That ’s before you consider that to even be considered for membership, you must be nominated in writing by a Commercial Club member and seconded by at least six other members

But gaining entr y is cer tainly wor th it The Commercial Club of Chicago br ings tog ether leading men and women of Chicago’s metropolit an area business, professional, cultural, philanthropic, and educational communities

“If an issue is cr itical to Chicago, it ’s impor tant to us,” the organization states on its website “ That includes economic, development, and social issues ” The group holds luncheons nine months out of the year which draw in leaders from business, government, and the civic arenas both locally and nationally to discuss key “news of the day ”

Election to membership is highly limited

Annual dues: Undisclosed

ChicagoFinanceExchange org

Chicago F inance Exchang e (CFE) was founded in 1980 as the premier networ k for accom plished women leader s in f inance in Chicago’s public, pr ivate, and non-profit business communities This includes the likes of CFOs, CPAs, commercial and investment bankers, treasurers, venture capitalists, and more Launched with 25 member s, CFE has over 230 member s today and provides member s with an assor tment of professional and networ king events aimed at better ing its community and the business wor ld through the exchanging of ideas, experiences, and exper tise

According to CFE’s website, its key organizational goals include actively exploring and sharing ideas and exper tise impor tant to today's financial decision makers; creating a professional and personal community resource within the engaged member base; and contr ibuting ideas, exper tise, and talent to the Chicago and global business communities

Member ship is by invit ation onl y and an existing member must sponsor new members Annual dues: $600

CPAs are sticklers for the numbers adding up, balancing out In the public accounting profession, however, despite women accounting for roughly half of all accounting education program enrollments and employee counts, they hold fewer than 25 percent of firm partner roles, according to research by the AICPA’s Women’s Initiatives Executive Committee (WIEC). These numbers just don’t add up, no matter how you crunch them

This isn’t “news ” Despite years of articles, surveys, and reports highlighting the issues and challenges women face in accounting and finance, and calls for dedicated efforts and initiatives to promote women’s advancement within firms, the numbers of women at leadership levels still come up short Despite women holding commanding representation within the new professional and associate ranks, and even among senior managers and senior associates in many segments, their numbers decline rapidly at top leadership levels

It’s a cold reminder of the “frozen middle” as Andrea March, CEO and cofounder of the Women’s Leadership Exchange, calls it the point in a woman’s career where she has reached the ranks of middle management and then must seemingly leave a firm for outside opportunities or be content to progress no further

At a time when most organizations are lacking gender equality in their leadership ranks, it takes best-in-class empathy to make change and strive for greater representation of women in executive accounting and finance roles.

It’s time for this to change.

Where do women go if they’re not advancing in public accounting firms? Career changes are an obvious choice, but they’re not the only one The WIEC 2015 CPA Firm Gender Survey found that women make up 43 percent of partners at firms with two to 10 professionals, indicating that women stalled within larger firms may be deciding to take ownership into their own hands, in their own firms. This is a noble and commendable move one that’s certainly a positive development for the profession as a whole But we still should question why it has come to this.

Illinois CPA Society members Alyssia Benford, CPA and Kimi Ellen, CPA are prime examples of that 43 percent Following decades of combined Big Four and corporate finance, advisory, and audit experience, the former college sorority sisters founded Benford Brown & Associates LLC in 1996 as a certified minority and woman-owned CPA firm.

“We had to create what worked for us because the firms we worked for didn’t,” says Benford Referring to herself as a pragmatist, Benford readily admits that owning her own firm was her solution to advancement and work-life balance after being unable to find it at large accounting firms and corporations

“I needed to be in a place where hours were not unreasonable, quotas were not the basis for partnership, and where being a woman more significantly, a woman of color was not hurting my career,” she explains “It was about me taking the initiative rather than waiting for a firm to do it for me ”

Benford’s public accounting and corporate experience isn’t an anomaly or isolated case In fact, McKinsey & Company released research earlier this year indicating that regardless of how compelling gender diversity and equality may be among organizations, progress towards gender parity remains slow across the business world

Much like in public accounting, women are struggling to tip the scales in public and private companies and board rooms in the U.S. and abroad In the U S , only 17 percent of executivecommittee members are women, and women comprise fewer than 19 percent of members of corporate boards, according to McKinsey & Company’s report, “Women Matter 2016: Reinventing the Workplace to Unlock the Potential of Gender Diversity.” Among companies listed in Western Europe’s major market indexes, the respective numbers are 17 percent among executive committees and 32 percent among boards.

Paula Loop, director of PwC’s Governance Insights Center, told Forbes last year: “Typically, boards look for a candidate that has been a CEO or held another executive role, as boards often want current or former CEOs as directors But a mere four percent of S&P 500 CEOs are female and only 14 percent of the top five leadership positions at the companies in the S&P 500 are held by women That doesn’t make for a big pool of potential candidates ”

We’ve seen millions of women marching in unity in Washington, D C , and around the globe, to push for greater representation, a stronger voice, and equality in business and politics, among other things. With reinvigorated women’s movements garnering mainstream public attention, and board diversity becoming a visible and actionable shareholder concern, organizations must focus more on filling their pipelines with female talent sooner rather than later But how?

What are the organizations succeeding at advancing and retaining women doing differently?

McKinsey & Company’s report reveals three gamechangers among “best-in-class” organizations:

• Persistence. Best-in-class companies initiated diversity programs earlier, indicating that it takes time to effect tangible, sustainable results

• CEO commitment, cascading down to all management levels. Companies that have built gender diversity successfully at the leadership level are twice as likely to place gender diversity among the top three priorities on their strategic agenda, to have strong support from the CEO/management, and to integrate gender diversity at all levels of the organization

• Comprehensive transformation programs. Best-in-class companies have initiated change programs that ingrain gender diversity in all aspects of the business Specifically, those companies are more likely to have change agents and role models at all levels of the organization. They also have developed and communicated a compelling change story to support the programs, policies, and processes they have put in place.

At the ground level, two rather straightforward initiatives repeatedly come up among women in accounting leadership roles that encompass these game-changer ideas: sponsorship and flex-work programs

While mentoring programs have become fairly common at most large professional services firms, programs alone don’t create change McKinsey & Company puts it clearly: “Although having a critical mass of measures is important, volume alone

does not explain women’s representation in top management Fifty-two percent of the companies in our sample implemented more than 50 percent of the gender equality measures, but only 24 percent of them reported having more than 20 percent of women in top management positions.”

What’s lacking for women, and what is a studied solution to the current bias towards men in leadership, March says, is actual sponsorship “Companies can’t say they have mentorship programs for women and leave it at that anymore,” March says “Women need sponsorship if we are to tip the scales anytime soon ”

“A mentor walks beside you. An executive sponsor walks ahead of you, and opens doors for you,” states the 2016 Accounting MOVE Project report, “Sponsorship: Stepping Up Success ” In other words, an executive sponsor puts his or her influence on the line for the benefit of another. A sponsor has the goal of helping a particular candidate gain a targeted position or assignment it’s about providing opportunity, pure and simple.

“Sponsorship is one of the most powerful and overlooked dynamics for propelling women through the talent pipeline,” according to the Accounting MOVE Project.

An unfortunate blockage in the pipeline for many women is the notion of a “baby penalty ”

“Women will not achieve equality in leadership ranks until the baby penalty is openly addressed by upper management,” March says “We need to speak about it without dodging the issue.”

What she’s referring to is the need to overcome the stigma that a woman simply can’t grow both her family and her career at the same time the idea that it must be one or the other.

“We generally tend to lose women at the manager level And usually, it’s because they get married and want to have a family Until we figure out how to exceed client expectations while also tending to a family, we’ll continue to have this dilemma,” explains Eileen Iles, CPA, CGMA, CIA, CFSA, CCSA, CRMA, chair of the ICPAS Women’s Executive Committee and a partner in Crowe Horwath’s Risk Management Financial Institution Group

Jackie Rosenfeldt, CPA, is just one example of how that dilemma can be overcome Rosenfeldt earned her place among Grant Thornton’s partner ranks while both working a reduced, flexible schedule about 80 percent of a “typical” workload and raising a young family. Her career has now surpassed 15 years with Grant Thornton, where she’s currently a partner and key leader in the firm’s Chicago audit services practice.

“As long as I kept working hard and focused, it all seemed to work out,” Rosenfeldt says “It’s a marathon, not a sprint You’ll still have some people who think you are not as motivated because you work flex time Take the long view Don’t take it personally Just deliver the results you need to get to that next career goal in the way that works for you,” Rosenfeldt adds, encouraging women to be mindful not to stifle their opportunities and to make finding a sponsor a priority, particularly those on flexible schedules, because as she puts it, “men often progress faster because they build relationships faster Women, instead, sit behind and finish the work up many times so they can get home to their kids ”

That said, Iles says she sees “more men taking time off to participate at home after a baby is born It’s a start and the more firms that accept it as a matter of course, regardless of gender, the quicker we’ll get to a more equitable gender leadership picture ”

In fact, as generational changes are pushing organizations to rethink their corporate cultures and be more considerate of staff wants and needs in terms of work-life balance, there’s hope that more balance and opportunity will come to all, which will in turn open more equal opportunities for women’s advancement.

One move Crowe Horwath has made to benefit all of the firm’s employees is launching its “Measuring What Matters” program In short, Iles explains that Crowe Horwath is aiming to increase flexibility when staff isn’t facing clients “Work from home, Starbucks wherever works for you. That’s the fundamental idea We emphasize results over chargeable hours How you get to the result is what works best for you ”

Crowe Horwath isn’t alone in this mentality; roughly 65 percent of the selected firms surveyed by the Accounting MOVE Project offer formal flex-work arrangements, and every generational change is expected to bring greater calls for flexibility and equality in the workforce

“You have to think that children raised by a female breadwinner will have different expectations about capability and equality at home and at work,” Benford says

Today’s best-in-class firms and companies are realizing this and are making equal representation of women within their organizations a serious science What remains to be seen, however, is whether the rest of the accounting profession, and the rest of the business world, will follow suit and put gender inequality in leadership to rest If so, it may be the first time the gender equality books are balanced ever.

There’s no question that politically and financially the state is in disarray that news is pushed on us day in and day out With billions in pension and healthcare debt, education missteps, and political inaction, it’s simple to see the issues lingering over the state like a dark cloud threatening to engulf any potential progress but there are some sunny spots on the horizon, like Illinois’ bright tech sector. Here’s what some of the top minds in the state think about Illinois’ business climate