EXPLORING THE ISSUES THAT SHAPE TODAY’S BUSINESS WORLD SUMMER 2019 Unconscious + Capitalizing on Opportunity Zones Becoming a Corporate Finance Futurist Winning Clients as Tech Takes Over New Columns From: MARK GILBERT TINA GOLSCH MARTY GREEN TIM JIPPING ART KUESEL JON LOKHORST ELIZABETH PITTELKOW KITTNER TODD SHAPIRO KEITH STAATS The can’ t - miss event of t he summer! Augus t 27-28, 2019 Dona d E Stephens Convention Center Rosemont, Ill nois SEE INSIDE!

CPACharge is an easy-to-use practice management tool trusted by more than 60,000 successful professionals, developed exclusively for CPAs to help manage payments and grow revenue in their practice.

DESIGNED FOR CPAs

0%, $2/TRANSACTION eCHECK PROCESSING

RECURRING BILLING AND SCHEDULED PAYMENTS

SECURE, CUSTOMIZABLE PAYMENT PAGES

PCI COMPLIANCE INCLUDED ($150 VALUE)

SIMPLE REPORTING AND RECONCILIATION

UNLIMITED SUPPORT BY PHONE, LIVE CHAT, AND EMAIL

866-526-7320

SIMPLE ONLINE PAYMENTS

CPA FIRMS

FOR

cpacharge.com/icpas

Special offer for ICPAS members CPACharge s a reg stered agent o Wel s Fargo Bank N A Conco d CA and Ci izens Bank N A Prov

Exp Card Number CVV **** **** **** 9998 001 Invoice Number 1005 NOV 2021 Payment Detail Submit to Smith Johnson, CPA Pay CPA P O W E R E D B Y

is proud to be a vetted and approved Member Benefit of the Illinois CPA Society

$1,000

CPACharge

2 INSIGHT | www icpas org/insight SUMMER 2019 www icpas org/insight CAPITALIZING ON OPPORTUNITY ZONES 2 02 3 2 42 7 CREATING UNCONSCIOUS INCLUSIVITY BECOMING A CORPORATE FINANCE FUTURIST spotlights 4 Today ’s CPA Leadership: The CPA Profession Needs You By Todd Shapiro 6 Capitol Report Illinois’ New Government Goes to Work By Marty Green, Esq 8 Seen & Heard 5 Reasons to Cultivate a Cannabis Practice By Andrew Hunzicker, CPA 42 Gen Next Tomorrow Is Another Day By Julia M Haried 44 IN Play Q&A With Shepard Schwartz & Harris Managing Partner Mary K Fuller, CPA By Eric Scott trends 10 Practice Management Specialize and Humanize: Two Keys to Winning Clients as Tech Takes Over By Brad Sargent, CPA/CFF, CFE, CFS, CCA , FABFA 12 Leadership & People Management The Act of Improv(ing) You By Bridget McCrea 14 Business Development Inheriting Heirs: How to Hold on to a Client ’ s Family or Survivors By Jeff Stimpson insights 28 Firm Journey Turning Small Tech Bets Into Big Wins By Tim Jipping, CPA , CGMA 30 Corporate Calling 7 Steps for Assessing Your Company ’ s Technology Needs By Tina Golsch 32 Leadership Matters 3 Keys to Attracting and Retaining Accounting and Finance Talent By Jon Lokhorst, CPA , ACC 34 Practice Perspectives The Risk of Trading Relationships for Technology By Art Kuesel 36 Financially Speaking Can Secure Choice Secure Illinoisans’ Retirements? By Mark J Gilbert, CPA/PFS, MBA 38 Ethics Engaged The Importance of Ethics in Change Management By Elizabeth Pittelkow Kittner, CPA , CGMA , CITP, DTM 40 Tax Decoded Weighing the Taxes on Legal Weed By Keith Staats, JD 1 61 9

ILLINOIS CPA SOCIET Y

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

www icpas org

Publisher/President & CEO

Todd Shapiro

Editor Derrick Lilly

Creative Director

Gene Levitan

Copy Editors

Nancy Clarke | Mari Watts

Photography Derrick Lilly

Circulation

John McQuillan

ICPAS OFFICERS

Chairperson

Geoffrey J Harlow, CPA | Wipfli LLP

Vice Chairperson

Dorri C McWhorter, CPA, CGMA, CITP | YWCA Metropolitan Chicago

Secretar y

Thomas B Murtagh, CPA, JD | BKD LLP

Treasurer

Elizabeth Pittelkow Kittner, CPA, CGMA, CITP, DTM

International Legal Technology Association

Immediate Past Chairperson

Rosaria Cammarata, CPA, CGMA | Mattersight Corporation/Nice Ltd

ICPAS BOARD OF DIRECTORS

John C Bird, CPA | RSM US LLP

Brian J Blaha, CPA | Wipfli LLP

Jennifer L Cavanaugh, CPA | Grant Thornton LLP

Jon S Davis, CPA (AZ Ret ) | University of Illinois

Stephen R Ferrara, CPA | BDO USA LLP

Mary K Fuller, CPA | Shepard Schwartz & Harris LLP

Jennifer L Goettler, CPA, CFE | Heinold Banwart Ltd

Jonathan W Hauser, CPA | KPMG LLP

Scott E Hurwitz, CPA | Deloitte LLP

Joshua D Lance, CPA, CGMA | Lance CPA Group

Deborah K Rood, CPA, MST | CNA Insurance

Seun Salami, CPA | Teachers Insurance and Annuity Association of America

Stella Marie Santos, CPA | Adelfia LLC

Andrea K Urban, CPA | ThoughtWorks Inc

BACK ISSUES + REPRINTS

Back issues may be available Articles may be reproduced with permission

Please send requests to lillyd@icpas org

ADVERTISING

Want to reach 25,000 accounting and finance professionals? Advertising in INSIGHT and with the Illinois CPA Society gives you access to Illinois’ largest financial community Contact Mike Walker at mike@rwwcompany com

INSIGHT is the magazine of the Illinois CPA Society Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards

The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Summer, Fall, and Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312 993 0407 Copyright © 2019 No part of the contents may be reproduced by any means without the written consent of INSIGHT Send requests to the address above Periodicals postage paid at

cont act

x7653.

9 A Good Day for Doing Good! Be par t of t he Illinois CPA Society’s 1 0TH annual CPA Day of Ser vice. It ’s as easy as 1 - 2 - 3 : Choose a community organization or charity to help Register your volunteer activity plans at www.icpas.org/CPADayofSer vice Receive a free CPA Day of Ser vice t-shir t (while supplies last, free to ICPAS members) Volunteer as an individual, or get a g roup toget her and volunteer as a team.

can choose ANY volunteer activity you

vice for ideas

Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Questions? Please

Eric Scott at scotte@icpas.org or 800.993.0407,

9.20.1

You

like See our website www.icpas.org/CPADayofSer

today’sCPA

ICPAS

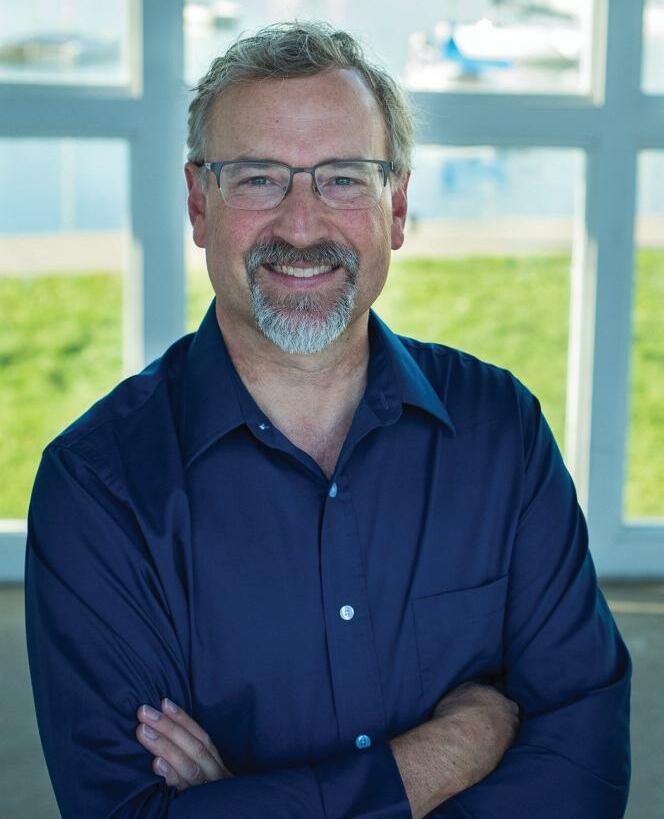

Leadership: The CPA Profession Needs You

Leaders are defined as the people who lead or command a group, organization, or country That’s a simple definition, because real leaders exhibit more than command; leaders exemplify courage, inspiration, vision, creativity, and innovation

When I think of some of the great leaders of our time, Abraham Lincoln, Franklin Delano Roosevelt, and our country’s Founding Fathers come to mind Today, we look back at these individuals and admire their courage and vision when leading our country through some of its most changing and challenging times Yet, in their day, many citizens were upset or scared by the changes they were advocating I see the same thing happening in the accounting profession now

In hindsight, it’s easy to look back and see who has proven to be a true leader The accounting profession has grown into a major component of our global capital markets thanks, in part, to driven leaders like Arthur E Andersen and Elijah Watt Sells and those who helped form international accounting firms Their leadership was, and is, not without controversy that’s OK Today, I view AICPA CEO Barry Melancon as a great leader in the CPA profession One may not agree with everything he says or does, but he has a passion for the profession and is visionary, creative, and innovative

The same can be said about many of the leaders of your Illinois CPA Society I recently came across the original minutes from the first meeting of the Illinois CPA Society’s founders in 1897 They had the vision to create a professional society for CPAs in Illinois that lives to this day Mary T Washington Wylie and Lester McKeever also come to mind because of their roles in helping African Americans start and advance in the CPA profession Bringing diversity to our profession in the 40s, 50s, 60s and still today was a challenge they stepped up to change

I talk about leadership not just because the Society recently held its Leadership Recognition and Awards Dinner to honor those who are trying to make real differences in the accounting profession, but because the need for leadership and great leaders in our profession is more critical than ever Our profession is at the precipice of change unlike any we ’ ve ever seen

Technology, over the next 10 years and beyond, will radically alter what CPAs do and how we define ourselves Yes, we ’ ve always been impacted by technology, from the adding machine, to the 10key, to calculators, to Excel, to tax and audit software It’s different this time, and I know that you have heard that before But these productivity tools only helped us do our jobs more timely, efficiently, and effectively Artificial intelligence, machine learning, and robotic process automation, on the other hand, will revolutionize not just how we do things but what we do these technologies won’t just help us, they can ultimately replace us in many ways We’re also witnessing the largest exodus of talent in our profession’s history as baby boomers (the largest working generation before millennials came along) move into retirement

This is where you come in The change we must make to remain competent, competitive, and relevant will be upsetting and scary, and some may balk or pushback on the direction of our profession The change ahead of us will require vision, courage, creativity, and innovation The change that is inevitable and unstoppable requires leaders to take command and guide us toward a profession of the future Will you be that leader?

The change that is inevitable and unstoppable requires leaders to take command and guide us toward a profession of the future.

INSIGHTS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO @Todd

4 INSIGHT | www icpas org/insight

• Multi-state payroll • Live and after-the-fact payroll • Bookkeeping • Accounts payable and receivable • On-the- y forms processing • Free e- ling of Forms 94x, W-2, and 1099 • And more Comprehensive Accounting Software for an Honest Price Toll-Free 800.890.9500 | Accounting.DrakeSoftware.com | DAS@DrakeSoftware.com You don’t have to choose between functionality and user experience.

INSIGHTS FROM

@GreenMarty

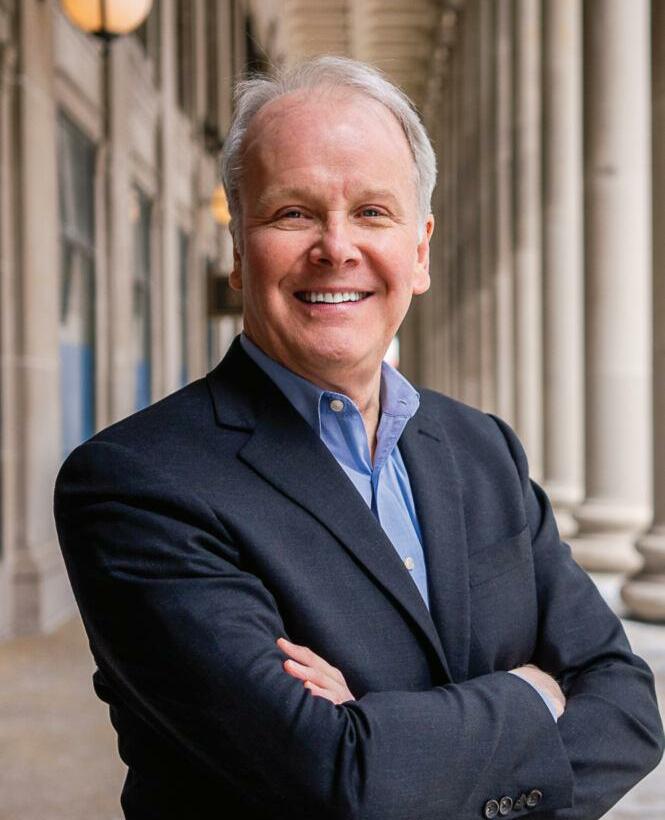

Illinois’ New Government Goes to Work

Inmy spring column (at the beginning of the spring legislative session), I openly questioned if newly installed Gov J B Pritzker would maximize the “honeymoon” period and goodwill associated with being a new Springfield politician to pass his comprehensive legislative program aimed at balancing the state’s finances I got my answer Pritzker easily scored early victories, signed executive orders, and muscled an impressive legislative agenda through the Democrat-controlled House and Senate

Included in the governor ’ s victories are passage of Senate Joint Resolution Constitutional Amendment 1, which allows for the amending of the Illinois Constitution to move from a flat income tax rate to a graduated income tax rate; Senate Bill 687, which establishes income tax rates if Illinois voters approve amending the Constitution in November 2020; House Bill 62, which puts in motion a $45 billion vertical and horizontal capital infrastructure program; Senate Bill 262/Senate Bill 1814, which establish the state’s FY 2020 “balanced” state operating budget; House Bill 1438, which legalizes recreational cannabis; and Senate Bill 690, which expands gaming and sports betting throughout the state

The General Assembly also passed legislation to pay for Pritzker’s $45 billion infrastructure plan with the passage of Senate Bill 1939 and House Bill 142, which raise the gas tax and vehicle fees to pay for the horizontal program of roads and bridges The vertical portion will be funded through the expanded gaming legislation, which restructures taxes on video gaming terminals and allows for expanding gaming terminals throughout the state and building six new casinos This is an impressive list of monumental accomplishments for a first-term governor, let alone it all came during Pritzker’s first legislative session

The Illinois CPA Society also had a good legislative session with the passage of Senate Bill 1806, an ICPAS initiative to amend the Municipal Audit Act, County Audit Act, and the Governmental Audit Act This trailer legislation updates the cited audit acts to reflect contemporary accounting and audit practices and terminology and follows ICPAS’ success in the 2018 spring legislative session where legislation was passed to grandfather units of local government who use cash basis accounting for financial reporting to the Local Government Division of the Illinois Comptroller’s Office

We also monitored over 6,000 bills filed during the spring session Here are a few highlights:

• Senate Bill 1379 – Cook County Assessor Data Reporting – A coalition of stakeholders attempted to work with the Cook County assessor to address our concerns about terminology and confidential taxpayer information and proposed making the data reporting program a pilot

6 INSIGHT | www icpas org/insight

With partisan gridlock largely dislodged, Illinois’ new governor and General Assembly score early victories in their first legislative session.

capitolreport

LEGISLATIVE

MARTY GREEN, ESQ , ICPAS VP OF GOVERNMENT RELATIONS

to evaluate the legislation’s impact Downstate counties would have had an opt-in option Ultimately, the stakeholder coalition prevented this legislation from being called for a vote

• Senate Bill 1881 – Local Government Recapture – As amended, this comprehensive legislation would allow counties and municipalities to contract with third-party vendors to perform analysis on business sales tax payments to the Illinois Department of Revenue and remit it to local governments The third-party vendors would have gained access to confidential taxpayer information ICPAS worked with a large stakeholder group, including the Taxpayers’ Federation of Illinois, Illinois Retail Merchants Association, State Chamber of Commerce, Illinois Department of Revenue, and the Chairman of the House Revenue Committee, Mike Zalewski, to include adequate safeguards for taxpayer information, registration of third-party vendors, and creation of a certified audit program for businesses to utilize in rebutting IDOR referrals There was a general agreement on legislative language during the closing days of the spring session when the proponents filed a last-minute amendment changing the effective date, thus moving us and the stakeholder group from neutral to opposed The bill was not called for concurrence of the amended language in the House and was not passed

• House Bill 2975/Senate Bill 1829 – Arbitration – As originally introduced, provisions in these bills would have prohibited preemployment arbitration agreements Many firms use arbitration clauses to resolve employment disputes and client disputes The U S Supreme Court also has recently opined that states cannot place restrictions on arbitration agreements In both instances, ICPAS worked with respective sponsors to generally preserve arbitration as a venue for resolution of employment disputes

• House Bill 2127/Senate Bill 1326 – State Procurement Vendor Spyware – These bills would require firms and professionals who provide services to the state through the procurement process to install spyware on their IT systems The spyware software monitors computer keystrokes to measure the amount of time a vendor employee spends on a state contract It is our position that this legislation is a solution looking for a problem (i e , to ferret out procurement fraud) There are adequate safeguards to address procurement fraud in state contracting This legislation is also opposed by the Computing Technology Industry Association, National Association of State Chief Information Officers, and Illinois State Chamber of Commerce This bill was not called in committee for a hearing

The business community also got a win with Senate Bill 689 This legislation gradually repeals the Corporate Franchise Tax and expands the Manufacturing Machinery Credit Exemption and other specific tax credits

Initially, it was doubtful that the General Assembly would be able to pass this long list of transformational legislation However, Pritzker and the legislative leaders did something we haven’t seen in some time they collectively worked together They passed an imperfect but balanced state operating budget and other legislation that marks the end of partisan gridlock under the Capitol Dome Now, let’s hope that the passed transformational legislation will allow the governor to restore fiscal stability in Illinois and position the state to be a Midwest leader again

Author’s Note: This column includes my personal observations of the evolution of the legislative environment and are not necessarily the views of the Illinois CPA Society

www icpas org/insight | SUMMER 2019 7 Join us for an event near you! As technologies can now automate the CPA profession’s core ser vices, it’s time to embrace change and redef ine the CPA’s role. Please join Geof f Harlow, CPA , Chair of the ICPAS Board of Director s and Todd Shapiro, President and CEO, for a conver sation on becoming the strategic business advisor s that your clients and companies seek all prog rams: CPE: 1 5 Credit Hour s Cost: FREE Complimentar y breakfast or lunch included REGISTRATION Please call 800 993 0407 or visit www icpas org 2019 ILLINOIS

TOWN HALL FORUMS TIME TO REDEFINE 11 8 19 Rockford 12 6 19 Collinsville 11.14.19 Springfield 12.11.19 Chicago 11 15 19 Champaign-Urbana 12 12 19 Oakbrook Terr ace 11.19.19 Bloomington-Normal 12.13.19 Glenview 11.20.19 East Peoria

CPA SOCIETY

Growing a successful firm in today’s CPA industry requires two things: finding good clients and providing them with world class service Sounds simple, but the secret sauce that helps with both is finding a great niche and becoming an expert in it If you ’ re a CPA like me, you love the challenge of navigating complex accounting and tax issues, implementing systems and controls, and helping your clients manage the financial health of their business and maximize cash flow, which means you’ll love the opportunities available in the cannabis industry Think that’s taboo? Think again

I picked cannabis as my niche in 2015, and business has been growing exponentially The list of states which have legalized cannabis use is expanding rapidly as Americans increasingly support medicinal and recreational cannabis use, including in Illinois where lawmakers recently approved recreational cannabis sales and possession to become legal Jan 1, 2020 Simply put, cannabis is not just a niche, it’s a national movement with many passionate individuals who truly believe in the medical, social, and economic benefits And, cannabis is going to drive a multi-billion-dollar industry that’s going to need you

So, here are five reasons why to get familiar with the nuances, rules, and complex entities of the cannabis industry and start serving them today:

1 You’ll Make More Money

Several factors play into the fact that accounting professionals working in or with the cannabis industry earn more For one, it’s still a federally illegal industry more risk, more reward Cannabis is also a very complex industry with several types of businesses think cultivation, chemical manufacture, food and beverage production, labs, transportation, retail, and more Cannabis businesses are also high earners; the average “ mom and pop ” cannabis company will generate seven-plus figure revenues and are able and willing to pay higher fees for specialized professional services

Clients need help navigating several complex issues, including rapidly changing laws, business valuations, lack of access to traditional banking services, financial reporting, tax liabilities, audit and compliance, and more Couple this complexity with an extreme lack of CPAs serving the industry and you have a perfect storm allowing you to realize much higher fees

5 Reasons to Cultivate a Cannabis Practice

With full legalization coming soon, Illinois CPAs have a growing industry to capitalize on.

BY ANDREW HUNZICKER, CPA

BY ANDREW HUNZICKER, CPA

2 The Niche Is Underserved

The U S cannabis industry is only legal at the state level, which means most accounting firms, including the Big Four, are largely avoiding serving the industry I estimate 90 percent of existing cannabis businesses are using bookkeepers that have QuickBooks or Xero training but not the expertise to perform complex GAAP and cost accounting they truly require Meaning now is the time to establish your expertise in the industry

3 It’s the Fastest Growing Industry (Globally)

More than 35 states have legalized cannabis to some degree and each year more join the list Cannabis is a real solution for several medical issues, it provides jobs and tax revenues, reduces black market activity, and is one solution to the opiate crisis It’s no wonder billions of dollars are backing many of these companies, growth rates are extremely high, and M&A activity is picking up There’s a big book of business waiting for CPAs who can help these companies succeed in a highly competitive, complex, and regulated global business environment

4. You Can Streamline Your Practice and Clients Will Seek You Out

When your systems and practices are in place for use across similar companies, the work you do becomes easier and more efficient, which saves you time, makes you more money, and allows you to do better work for your clients It’s also much easier to market your services to a single industry and become established as an expert in it, which ultimately attracts clients to you

5. It’s Fun and Exciting

From the people you meet to the events you can attend, this industry is simply fun So, if you are looking for an industry that is innovating and growing with some of the most dynamic and brilliant minds in the country, then the cannabis industry is right for you

MARK YOUR CALENDAR!

Cannabis Industry Conference

Wednesday, November 6

8 INSIGHT | www icpas org/insight

Andrew Hunzicker, CPA, is the CEO and managing partner of DOPE CFO and CFO Bend He can be reached at andrew@cfobend com

Specialize and Humanize: Two Keys to Winning Clients as Tech Takes Over

Technology is driving two shifts that are set to shake your accounting world, and both require very human responses.

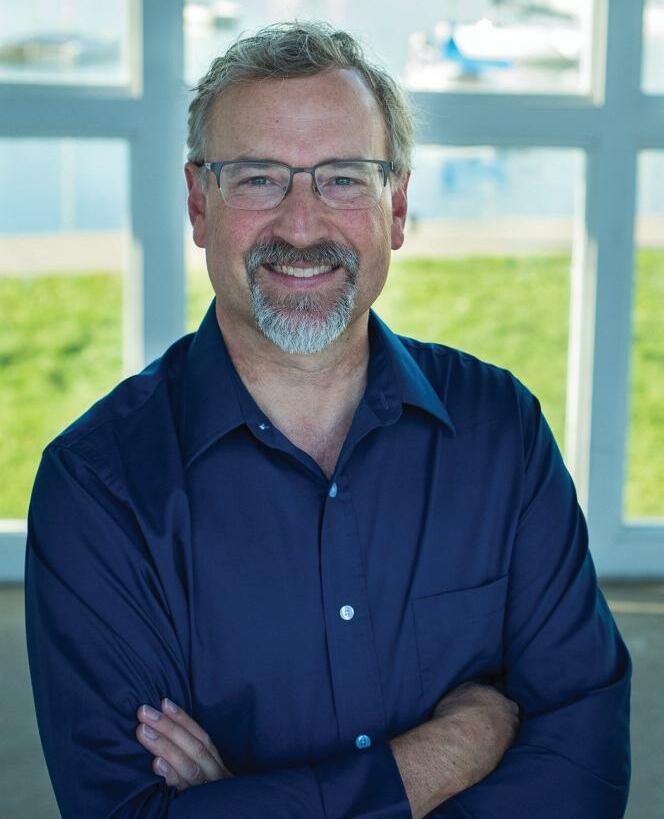

BY BRAD SARGENT, CPA/CFF, CFE, CFS, CCA, FABFA – THE SARGENT CONSULTING GROUP

Twomajor tectonic plate shifts in the accounting world are going to make a serious impact in your career and practice The first shift I initially detected long ago, but it’s on the move in a big way now: Specialization

“Find your niche” is now an industry-wide mantra Undeniably, there will always be a need for bookkeeping and basic accounting services, but increased competition and price wars are driving profits in this sector lower and lower Many firms are simply moving out of this space to focus solely on high-margin niche consulting services Most universities, who are motivated to place their graduates successfully in the market, have recognized this evolution and are providing more specialized classes in business valuation, financial management, forensic accounting, and accounting information services In my focus area, forensic accounting, the old adage was “get two-to-three years in audit and then come see me ” to be considered for an entry-level position Now, firms recognize the need to get professionals into a niche at the onset of their careers and recruit accounting students as early as their sophomore year for internships and potential long-term

positions This is more than a trend; this is a permanent movement in the U S accounting industry

The second major shift in accounting is the profession’s increasing reliance on technology Some will argue that we ’ ve already been impacted greatly by technology, while others will say the profession moves at a glacier’s pace in adopting new technologies No matter your take, the pace of change will never be slower than it is today And, there are more technologies at our disposal for every aspect of our business than ever before Take social media, which has forever changed how accountants from students to managing partners can, and will, connect and market themselves and their professional services Myriad tools are available to measure and manage social media engagement By recording visits to websites and professional profiles, accountants can track, tweak, and direct their branding efforts Even the term SEO, or search engine optimization, has become familiar to accountants across industries Technology has helped level the competitive playing field for small accounting firms by providing access to programs and software at a low cost (if not “ open source ” at no charge)

10 INSIGHT | www icpas org/insight P R A C T I C E M A N A G E M E N T

There is no denying that technology has made access to information faster and easier But as a service professional moves across the spectrum from commodity-service provider to specialized-service provider, consumers need more than just information and data to make decisions A deeper dive into a potential service provider is going to go beyond our technologydriven marketing and a simple Google search What I am saying here is that despite our growing reliance on technology to provide valuable services to our clients, more than ever, strong interpersonal skills are going to be required to capture an opportunity and retain that client over the long term Think of this scenario: A loved-one has suddenly become extremely ill This is a life-threatening scenario You need to find a specialist with just the right skills to perform an emergency procedure You enter key search terms into your search engine and find a list of individuals who all appear to be highly qualified How do you determine who you will consult or hire? Remember, this is life or death You will want to see this person and speak directly with this person If you ’ re younger or more tech savvy, you’ll research the individual online and read the available reviews A more traditional approach would be to ask for the doctor’s patient referrals While this may seem dramatic, I argue that the process for seeking specialized accounting services are the same The higher margin specialty services come with much higher client expectations Potential clients want to see and speak directly with the subject matter expert(s) They want to hear what past and present clients have to say, either in reviews or as direct references Great marketing concepts and execution can lead to more opportunities, but known and respected referral sources often

ultimately seal the deal Having a credible source vouch for you can be the difference between winning the engagement or not

If you ’ re just starting out with a specialized skill, how do you obtain these critical referrals and client reviews? Simply, do your very best work each and every day Great results lead to great relationships

But be prepared for mistakes we make them every day The lowest hourly rates, best education, and professional credentials won’t matter when a project goes sideways, and it was a problem you could have prevented Don’t shy away from mistakes; be willing and have the fortitude to ask a client for feedback when a project has not gone as well as expected It is my experience that the brightest and the best are continuous learners, and there is no better teacher than a preventable mistake Again, by employing the human touch you can strengthen your client relationships and find that clients are more willing to look past errors when they perceive a candid desire to correct the situation Low-tech communication (i e , a phone call) can rescue a relationship that’s headed toward the abyss

The day may come when specialized accounting services are available on Amazon or Craigslist, but we are simply not there yet Technology provides ever-evolving tools to help expand our services and brand awareness But don’t forget that in the world of accounting specialization, the personal touch still matters By combining new-school skills and technologies with old-school communication and relationship building, you can grow personally and professionally There is no substitute for relationship-building skills, so as you specialize skills and technologize your services, don’t lose sight of the importance of humanizing your work

CPA Endowment Fund of Illinois

Paving the Way for Tomor row’s CPAs

The CPA Endowment Fund of Illinois, the Illinois CPA Society’s char it able par tner, annually awards $200,000 in scholar ships and training prog rams to more t han 170 diver se and deser ving accounting students across the st ate

Ever y year, we have more qualif ied candidates than awards to give Your gif t will help us close that gap and provide additional oppor tunities to future CPAs

www icpas org/insight | SUMMER 2019 11

m e a n i n g f u l | s u p p o r t i v e | i n s p i r a t i o n a l Make success possible. Donate today. www.icpas.org/annualfund

The Act of Improv(ing) You

CPAs can use improv-based sketch comedy to improve their business and communication skills all while having a little fun

BY BRIDGET McCREA

Whatif we told you that the place where some of the world’s most talented comedians cut their teeth including “Saturday Night Live” alumni John Belushi, Mike Myers, and Martin Short is where you can learn better business communication and development skills?

While many of us know The Second City as an improv-based sketch comedy club that opened in Chicago in 1959, what many don’t know is that the same organization which has grown into an influential comedy empire known for cultivating several generations of comedic superstars also helps professionals break out of their “all business” shells, become better listeners, and interact with others on a light, fun level In fact, through its Second City Works division, the organization handles both entertainment and content for a wide swath of companies

“When we first started doing classes, we were teaching people who wanted to either get on our stage or get on ‘Saturday Night Live;’ it was a lot of actors,” says Kelly Leonard, creative consultant at The Second City in Chicago “As we started to offer more beginner

classes, we were also attracting doctors, lawyers, and people who had just gone through a break-up They weren’t using improvisation to get onto ‘Saturday Night Live’ they were using it to make their day-to-day lives better ”

Second City Works uses the same methods as its sister division, based on the improvisational games developed by social worker Viola Spolin in the 1920s, to create professional development, content, and events that drive personal growth and organizational improvement “A lot of companies hire us to tackle all kinds of problems, be it poor communication, teams that aren't functioning well, or people who need to ‘unlock’ their ability to innovate,” Leonard explains, noting that the division has grown significantly since inception

Leonard says improv is the perfect platform for achieving those goals because it gives participants a non-judgmental environment in which to let loose and be themselves It also picks up where formal education leaves off “For most of us, the educational

12 INSIGHT | www icpas org/insight

L E A D E R S H I P & P E O P L E M A N A G E M E N T

experience is not about navigating the unknown,” he says “Yet, what gets thrown at you in business is nothing that you can figure out by doing well on a standardized test It’s something you ’ re going to figure out by being thrown to the wolves, and that’s hard for people ”

HUMAN BEING PRACTICE

We’re all terrible listeners In fact, most of us are thinking about what we ’ re going to say before the person (or people) we ’ re listening to is even finished talking Knowing this, Second City Works developed a workshop called Last Word to help people acknowledge and overcome this bad habit “The bulk of the time, we ’ re on autopilot,” Leonard says “We get the gist of what people are saying, but then we move into our own brains and basically cut off the last part of what they’re saying ” For the Last Word, individuals are paired up and asked to start a conversation The only rule is that Speaker B must include the last word spoken by Speaker A

The exercise is a lot harder than it sounds (try it sometime) “People have a very hard time doing this,” Leonard says, “because they’re not used to listening all the way to the end of other peoples’ sentences ” From this experience, students unlearn the bad habits they’ve developed over time and replace them with more thoughtful listening

“When you thoughtfully listen to someone, take it all in, pause, and then respond, it can be immensely gratifying,” Leonard says, “and much better than just rapid-firing back as if you haven’t even listened to what the other person has said ”

This is just one example of how Second City Works uses “human being practice” to help professionals improve their soft skills “We give people a very safe space to fall on their faces, laugh about it, and get up and try it again,” Leonard says in pointing out that people generally learn more from their failures than their successes “Unfortunately, both in education and in business, we don't give people enough space to fail their way to success ”

GETTING ENGAGED

Second City Works caters to a wide range of business professionals who want to know what it’s like to fall on their faces and then get back up on their feet and try, try again “Whether you ’ re a first job newbie or a grizzled exec, if you want to perform better, we can give you an edge,” the organization’s website states “Our offerings are designed to get people engaged and energized, and they’re unrivaled at driving action and improving critical skills like communication, collaboration, creativity, and agility ”

Leonard says accountants and CPAs are perfect candidates for the experience “Much like a doctor, a CPA’s training focuses on very specific tasks (i e , knowing the year-end numbers, performing audits, doing tax returns correctly, etc ) They weren’t schooled in the art of emotional intelligence (being aware of, controlling, and expressing one ’ s emotions) or storytelling ”

While CPAs may not immediately correlate feelings like empathy and the ability to tell good stories with success in the field, Leonard says being able to create a narrative for ourselves (or co-create a narrative with someone else) can give professionals a leg up in the business world

“As the world becomes more automated, and as we look at what the needs are for the future of work, those needs include storytelling, divergent thinking, problem solving, agility, and

resilience,” Leonard says “These aren’t skills that you ’ re going to get if you sit in front of a computer monitor all day ”

Improv also helps stoke inner happiness, even for introverted personality types that wouldn’t necessarily take an acting class or get up on stage “Improvisation gives you the ability to find the agency within yourself to be happier, and we usually get that in social settings,” Leonard says “Improv is great for people who are introverted because it gives them more agency and skills to navigate social situations and not get drained by those experiences ”

PRACTICE MAKES PERFECT

Getting up on stage with a group of people and doing things you normally wouldn’t do in your day-to-day life may sound daunting to anyone who hasn’t done it before, but breaking out of that shell can have a profound impact on the participant’s life and work

“It really boils down to giving people practice and helping them take the games and exercises into their day-to-day lives,” Leonard says By taking the improv experience with them and continuing to practice games like Last Word, students can continue improving their communication and people skills “I've seen so many people open up by doing this work,” he says “It’s one thing to hear it in a lecture or read it in a book, but when you ’ re physically practicing it in a room and looking someone else in the eyes that’s how you get to real behavioral changes and improvement ”

New at ICPAS SUMMIT19, The Second City Works Players will help you walk away with the skills and the confidence to deal with disruption head-on in their interactive keynote on Aug 28, “Innovation in Times of Change: Using Improv to Deal With Disruption!” Learn more and register at www icpas org/summit

www icpas org/insight | SUMMER 2019 13

Imagine... a chair without a desk Trent Holmes 800-397-0249 Trent@APS.net www.APS.net D e l i v e r i n g R e s u lt s - O n e P r a c t i c e At a t i m e

Inheriting Heirs: How to Hold on to a Client ’ s Family or Survivors

CPAs often discuss their firm’s succession plans, but what about the smooth succession of your long-time client ’ s business to their heirs, business partners, and other beneficiaries?

BY JEFF STIMPSON

Imagineyou ’ re a tax or financial advisor whose long-time client just died You’ve never worked closely with the widow or widower and probably at least one of the surviving children doesn’t know you at all How do you have or even start hard conversations about aging, death, and what to do next, whether that be with a business or an estate? And, maybe more importantly to you, how do you become or remain a trusted and valued advisor to this family?

From a business development perspective, attracting heirs as clients seems important, but it’s also important to have the soft skills to empathize with a family member in that position especially if your goal is to build a relationship that lasts another lifetime

“Too often CPAs aren’t proactively bringing this topic up to their clients” amid the chaos of compliance work, says Jason Vanden Bosch, CPA, senior managing director in the Chicago office of CBIZ MHM “Consider if the CPA’s entire relationship with a client consists of the client showing up once a year to have a tax return prepared, the client may trust the CPA to do a good job filling out tax forms but will generally not trust the CPA with key business or personal decisions or other matters ”

“Most people are concerned with transitioning control of their business over to the next generation or the next group of ownership,” Bosch says “Our clients have spent years building up their businesses and they won’t easily turn the keys over to someone else, especially when it has financial implications for their future So, a key factor is figuring out how to have an orderly transition in both control and financial ownership Topics like this, and the hard discussions that come with them, truly separate valueadded CPAs from compliance-oriented CPAs The CPA needs to show they’re a part of the client’s advisory team and involved in the client’s business and life beyond compliance work ”

SCARY STATS

Figures vary, but some $30 trillion in wealth is expected to change hands from aging baby boomers to their children or other beneficiaries over the next few decades That’s a potentially rich prize for CPAs and advisors who are prepared Consider the following:

• Some two-thirds (and some estimates point to more than 95 percent) of younger investors leave their parents’ financial planners when they inherit wealth

14 INSIGHT | www icpas org/insight B U S I N E S S D E V E L O P M E N T

• Many long-time clients’ children feel that their parents’ advisors haven’t established a relationship with them

• Three-quarters of investors say their children have never met their financial advisors

• Nearly half of benefactors avoid discussing inheritance plans with their children, many because they don’t want their children to feel entitled to wealth

Yet, personal succession planning and the related estate and tax planning are big issues for many clients, according to Cory Gallivan, CPA, a principal of Scheffel Boyle in Alton, Ill Retiring based on the value of assets, tax cost of liquidation of those assets, timing to claim Social Security benefits, and how to pay for health insurance, among other issues, are all things aging clients and their heirs must know how to navigate, Gallivan stresses

“Health concerns can certainly ignite conversations with heirs on a myriad of topics, including medical directives, power of attorney, burial planning, and legacy planning,” says Dean Mioli, Oaks, Pa -based director of investment planning for Independent Advisor Solutions by SEI, which has an office in Chicago “Any communication is far better than no communication, and it can come in various forms not necessarily face-to-face The one thing parents don’t want their children to say is that they haven’t been told about their parents’ wishes ”

One initial challenge for CPAs and other advisors is often the lack of communication within a family “Family members who aren’t involved with the client’s business or financial affairs are probably not taking part in the current crucial decisions and conversations we ’ re having with our client, so they don’t know the value we are bringing,” Bosch says “They may know our name in conversation, but they have no experience with us ”

Gallivan points out another challenge: “Family members may have different plans or expectations with the business or assets than their parents did ”

And, of course, there’s the common issue of “quarrelling siblings,” warns Meg Al-Qassas, CPA, a senior manager in the Skokie, Ill office of MichaelSilver and chair of the Illinois CPA Society’s Taxation Estate, Gift & Trust Committee In these situations AlQassas admits that “ we sometimes lose one, ” referring to a client’s heir But, if there’s a conflict of interest in one of these situations, “It may be just as well,” she says

REACHING OUT, HOLDING ON

While CPAs and advisors should note that reaching out to a family member needs prior client approval due to confidentiality, Gallivan says, that a client’s family is often the first to reach out if they see a sign of the client needing help in the future “The family members would usually call or attend meetings with a parent in those situations With business clients, it’s common that meetings are held with both generations present ” This is a good opportunity to form relationships with your client’s family or business partners

“If mom or dad trusts the CPA, it is likely that the children or other family members will put a lot of faith in them as well,” Gallivan suggests “In general, if the client is happy with us, this translates to the child and, as they become adults, we try to provide them the level of service that retained their parents,” Al-Qassas says, noting that her firm tries to pair “the kids with staff who are closer to the same point in life to foster a relationship at the generational level ”

Adopting modern tools and tactics also can help advisors accelerate the transition to working with clients’ heirs Advisory

firms often offer financial literacy courses or guidance on investing and taxes for young adults And as more firms roll out new automation software and cloud-based solutions that free up advisors’ time, more of their focus can go toward bringing valueadded services to the complex needs of older clients Further, adopting virtual practices, like utilizing Skype or other virtualmeeting technologies, can help make connecting with clients’ tech-savvy children easier and get them to put a face with an advisors’ name and voice much sooner

Whichever way you decide to approach the client succession topic, there is one constant tip: Don’t wait

“Start early and have discussions with your client regarding transition of their business and/or personal financial matters to the next generation These aren’t decisions that can be made in six months or even a year, ” Bosch says “This will generally involve the older generation slowly giving up control and decision-making authority to the younger The same is true with personal financial matters estate planning, trusts, and so on sometimes take a very long time ”

The decision to begin these discussions shouldn’t rest solely with one advisor, either, Mioli suggests “It may or may not be the CPA’s role to take point on succession planning,” Mioli says “The financial quarterback should coordinate with the client’s other professionals, such as the CPA and estate planning attorney ”

FINDING THE RIGHT WORDS

If you struggle with what to say following the passing of a client or when your client experiences a loss of their own, Conversational com ’ s “How to Write a Meaningful Condolence Letter to Your Client” offers this advice to help you reach out during this difficult time:

Acknowledge the loss. “Your condolence letter should open with you acknowledging the loss as you understand it Depending on the relationship with the client, you could write the letter from a personal point of view as the business owner (using ‘I’ statements) or from your business’ perspective (using ‘ we ’ statements) ”

Express your condolences “Once you ’ ve acknowledged the loss your client is experiencing, you should express your condolences It doesn’t have to be a lengthy or emotional expression simply iterating your sympathy for your client during this time will be appreciated ”

Discuss the relationship “Next, it’s appropriate to discuss the relationship you have to the deceased, even if it’s only through your client You don’t have to have a personal relationship with the deceased to be able to comment on the effects they’ve had in your clients’ or your life ”

Offer assistance “You may choose to close your condolence letter to your client with an offer to lend assistance, depending on the length and depth of the relationship you ’ ve built with the client Including a statement about your willingness to help or provide additional assistance will be appreciated by your client Chances are, they’ll never call on you for help, but letting them know you’ll be there if they need you is an exercise in building trust and offering meaningful condolences ”

www icpas org/insight | SUMMER 2019 15

H i d d e n G e

s i n t h e Ta x C ut s a n d J o b s A ct

By NATALIE ROONEy

Illinois hasn’t had a lot to tout from an economic standpoint in recent years. It has the fifth largest GDP in the nation, but stories of fiscal woes and a worsening tax and business environment dominate the headlines. Now, a provision in the new U.S. tax law (Pub. L. No. 115-97, enacted Dec. 22, 2017) that created 8,761 “Opportunity Zones” across the U S may bring a breath of fresh air to the Illinois economy while giving blighted communities a badly needed boost.

16 INSIGHT | www icpas org/insight

m

www icpas org/insight | SUMMER 2019 17

Finding the Opportunity

Opportunity Zones are census tracts composed of economically distressed communities, according to criteria outlined in the Tax Cuts and Jobs Act People and businesses can get federal tax breaks on capital gains they put into special funds that then invest in these designated zones Opportunity Zones have been designated in all 50 states, the District of Columbia, and five U S territories, including hundreds across Illinois

“Opportunity Zones are areas where residents need more employment opportunities and higher wages, ” explains Charity Greene of the Illinois Department of Commerce & Economic Opportunity (IDCEO) “Receiving an Opportunity Zone designation puts these areas on the map for a national network of investors that may not have previously considered them ”

In Illinois, 1,305 qualifying census tracts were originally identified by the federal government Illinois under then-Gov Rauner was able to nominate 25 percent (327 total, of which 181 are in Cook County) of these tracts to be formally designated as Opportunity Zones, which were chosen based on their poverty rates, unemployment rates, total number of children in poverty, violent crime rates, and populations The Federal Reserve Bank of Chicago also points out that a unique feature of the Opportunity Zones designation process is that tracts contiguous to low-income tracts are allowed to be designated, provided they meet other parameters; a state’s designated tracts may contain up to 5 percent non-low-income contiguous tracts

IDCEO is working with the governor, the General Assembly, local partners, and the business community to encourage broad-based investment and growth in Illinois “In the process, we strive to take advantage of any opportunity to leverage federal programs, like Opportunity Zones, as well as support from the nonprofit and private sectors,” Greene says “Opportunity Zones are one important part of a larger coordinated effort to encourage investment in low-income communities ”

The Nuts and Bolts

The Opportunity Zones provide tax benefits to investors under certain conditions:

• Investors can defer tax on any prior capital gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged, or Dec 31, 2026 If the QOF investment is held for longer than five years, there is a 10 percent exclusion of the deferred gain If held for more than seven years, the 10 percent becomes 15 percent

• If the investor holds the investment in the QOF for at least 10 years, the investor is eligible for an increase in basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged

A QOF is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is in a Qualified Opportunity Zone Investors can get the tax benefits, even if they don’t live, work, or have a business in an Opportunity Zone Investors just need to invest a recognized gain in a QOF and elect to defer the tax on that gain

The best thing? These opportunities aren’t just for those with millions of dollars of capital gains to invest Anyone with a business idea or

who has recently made a return on their investments can take advantage of the program in any Opportunity Zone in the country Investment options include retail stores, grocery stores, research facilities, hotels, restaurants, office buildings, and manufacturing and mixed-use developments Creating a QOF is as simple as checking a box on IRS Form 8996 and submitting it to the IRS

The Sleeper in the Tax Law

For a month or so after the passage of the TCJA in December 2017, Opportunity Zones hovered under the radar, playing second fiddle to all the news coverage on tax reform lowering the corporate tax rate

Then, in January 2018, Dan Rahill, CPA, a tax partner with BDO in Chicago and a former chair of the Illinois CPA Society Board of Directors, received a phone call from a friend who sat on the board of a company and wondered if they could rezone in an Opportunity Zone The new Opportunity Zone provisions had not received much attention to date, so Rahill took a closer look at this new tax provision What he saw was intriguing

“Up until then, none of us really saw the opportunity that was buried within the law,” Rahill says “I started reading and discussing the possibilities with other advisors and potential investors It became the topic of the day Opportunity Zones could be the most talked about opportunity for investors to come out of the tax act for the next decade ”

Opportunity Zones are intended to release the private investment potential of over $6 trillion of captive capital gains into distressed communities to help jump-start growth, create jobs, and lift incomes Treasury Secretary Steven Mnuchin has predicted that more than $100 billion dollars in private capital will be invested in Opportunity Zones

“If that’s true, this could really have an impact,” Rahill says “Hopefully the Opportunity Zones hit the mark of their intended purpose to drive investments into areas that need revitalization ” He offers the former Michael Reese Hospital site and the long vacant South Works on Chicago’s South Side as examples

While there is now plenty of enthusiasm from investors, many delayed spending because of uncertainty about how the incentives would work On April 17, 2019, the Treasury released the second tranche of regulatory guidance, providing answers to many questions, to help guide investors, fund managers, and others

Full Speed Ahead

Rob Nowak, CPA, a partner in Baker Tilly’s Chicago office, says Opportunity Zones led to a new subset in the firm’s real estate practice “Our clients and their investors recognized that a financial model for an Opportunity Zone deal is significantly different because of the tax benefits,” he says “As a result, we ’ re gearing our services toward helping clients develop financial models that highlight the benefits Opportunity Zones bring to table ”

Nowak calls Opportunity Zones the most significant change in the real estate industry in 20 years “The market is excited about it, and clients are excited about it,” he says, adding that clients aren’t looking only at projects in Illinois; Chicago clients are looking at Denver, Nashville, Phoenix, Cleveland, and Houston “This isn’t just a local incentive ”

18 INSIGHT | www icpas org/insight

Chris Boehm, co-founder and managing partner of Cresset Partners, says from the outset, the economics of the Opportunity Zones program were not only compelling from an investor perspective, but also because of the underlying policy of making an impact where investment is needed to create growth “We saw equal applicability in real estate development and operating businesses that were already running,” he says “It’s a really interesting opportunity to raise and deploy capital into Opportunity Zones on behalf of our investors ”

Cresset Partners recently announced the completion of an investment in a multi-family development in Houston The firm is exploring the range of opportunities for real estate and operating companies now that the second tranche of regulatory guidance has been released

Community Impact

Even with all the apparent positives that Opportunity Zones offer, there are still concerns that local communities won’t benefit to the extent that has been promoted At the last minute, specific reporting requirements were dropped from the bill In April, the Treasury asked stakeholders to offer feedback about how to measure the community impact from Opportunity Zone investments

“We also need some method of measurement as to the effectiveness of the law,” Rahill says “How do we know that investment is being driven by Opportunity Zone development? The cities and states don’t know where funding is coming from Was it because of the Opportunity Zone or not? The investment may have happened anyway ”

The lack of accountability at the local level is especially concerning to Mohammed Elahi, deputy director for the Cook County Bureau of Economic Development “There is no requirement for investors to deal with the local government for any purpose aside from traditional permitting,” he says “The second tranche of regulatory guidance didn’t cover reporting requirements or the role of local government or economic development representatives ”

Elahi suggests that if Opportunity Zones are truly meant to benefit the local communities, the qualified investment dollars wouldn’t be limited to only capital gains “Why can’t ordinary investible dollars enjoy the same tax benefit of at least not paying taxes on future capital gains if the investments are held in an Opportunity Zone for 10 years?”

He also questions why the investment clock starts arbitrarily ticking in 2019 for a seven-year hold to enjoy a 15 percent reduction on an adjustable basis instead of when the actual investments are made As of now, Opportunity Zones will sunset in 2047 “Why shouldn’t investors of future years be allowed to count the years from the date of their investment to enjoy the reduced adjustable basis of 10 percent and 15 percent for five-year and seven-year holds, respectively, along with deferment of taxes accordingly?” he asks “The limitation on the source of qualified investible dollars to capital gains only will widen the gulf between the ‘haves’ and ‘havenots’ because average people don’t have capital gains to invest I might have 50 friends with $100,000 each It’s just their savings, but why can’t they have the same tax benefit if they’re investing in an Opportunity Zone?”

Those are all fair questions As is, will Opportunity Zones create jobs and revenue at the local level? Elahi isn’t sure He uses the

data storage boom as an example Large amounts of real estate are needed to build data storage facilities “They’re great for investors,” he says “You’ll never run out of tenants But even though a physical facility will pay property taxes to the towns, how many jobs will they create for those towns? Half a billion dollars will be spent to construct a data storage building, but it will only employ four or five people That’s it And in 10 years ’ time, that building is gold [for the investors] Yes, towns are happy because new property taxes will be paid, but it only creates four to five jobs There’s no ‘community development’ test for this as the law is written now Community development organizations are unhappy because there is no measurable and defined public benefit for Opportunity Zone investments ”

Elahi is hopeful a potential third tranche of proposed regulations will address these issues In the interim, he says, “I’m not optimistic about the actual community benefit ” He has heard this same sentiment expressed by his peers in other states “They’re also frustrated that accountability isn’t there ”

Nowak says Baker Tilly clients who have projects in process are hearing positive feedback from communities: “New investments and new jobs in a previously underserved area are well received ”

Boehm comments that Opportunity Zones aren’t a silver bullet “They certainly won’t solve all the problems, but it’s a way of bringing progress and investment to underinvested areas, and that’s a positive thing Opportunity Zones are one of a range of tools ”

Greene says the IDCEO is committed to ensuring that all residents have a chance to benefit from new investments and economic growth in Illinois “We will continue to partner with local governments and economic development organizations throughout this process, and we will prioritize state investments that accomplish community goals and lead to sustainable growth ”

In early May, lawmakers in the U S House and Senate took a step toward addressing the lack of transparency, proposing requirements for information the Treasury would have to collect about Opportunity Zones

Opportunities for CPAs

The body of law surrounding Opportunity Zones will continue to evolve, Nowak says “There’s no fixed body of knowledge It’s critically important for CPAs in any market to recognize that as the law continues to evolve, so must their understanding of the law ” Rahill encourages CPAs to understand the rules, especially those business-focused guidelines released on April 17 “We should be prepared to discuss these opportunities with our clients, because in most cases, they haven’t identified the opportunity for themselves,” he says “It’s an education process, and more importantly, a very viable investment alternative with significant tax benefits It won’t apply to everyone, but you need to be able to recognize when it will apply to your clients and bring it to the table Opportunity Zones are a very legitimate planning topic Even if the fact pattern doesn’t end up being right for a client, now you ’ re having a tax and investment planning discussion, and that’s our goal ”

Family offices and high-net-worth individuals are sitting on trillions of unrealized capital gains, Rahill adds “For them, this discussion is an absolute no brainer ”

www icpas org/insight | SUMMER 2019 19

Creating an Unconsciously Inclusive Business Culture

By ANNIE MUELLER

By ANNIE MUELLER

Here’s a scenario that’s becoming increasingly common in the accounting and finance industry: the conference table is full, the people around it diverse, with a wide range of backgrounds, genders, ethnicities, beliefs, orientations, and life experiences. A senior partner raises a question, and three people provide ideas. The ideas are sound, but eerily similar. There’s a brief discussion, a mild backand-forth that results in consensus within 30 minutes. Everyone leaves the productive meeting for a culturally inclusive celebration, where they exchange pleasantries and don’t ask each other too many questions.

It’s easy to reach consensus when the options are similar: it’s like choosing between three brands of vanilla ice cream There are slight differences in quality and variations in taste and texture, but in the end, it’s all vanilla When diversity in hiring is considered a final achievement, and diversity in thinking is treated as an organizational threat, the only ideas offered will be vanilla ideas. Organizations will suffer from a lack of diverse thinking and employees who aren’t satisfied with vanilla thinking will find the nearest exit.

20 INSIGHT | www icpas org/insight

Inclusivity begins with conscious, intensive efforts; over time, efforts become habits, and inclusion becomes the cultural default. Imagine what that can do for your firm or company operating in an anything but vanilla business world.

www icpas org/insight | SUMMER 2019 21

“Often, if someone feels that the culture of the organization is not one where diverse opinions and ideas are welcomed, they will not say anything,” says Mary Morten, president of The Morten Group, a national consulting firm focused on racial equity and customized approaches for organizational development Morten, a lifelong activist dedicated to providing a voice for marginalized communities, explains that in many cases, employees from underrepresented communities are treated as the “token representative” for entire groups and communities, if not excluded altogether from high-level conversations that involve organizational planning It’s not uncommon for them to be “routinely passed over for promotions and, in some cases, even asked to train the person who has less experience for a new position,” Morten adds “Some employees may have hope that things change; others just leave and hope it is better at the next organization ”

EMPLOYEE EXODUS

As a result, firms large and small face a reddening bottom line when it comes to talent: the costs of hiring, on-boarding, and training new, diverse employees can’t mature into an investment with a positive return if employees leave six months after hitting productivity

“At a high level, what prevents businesses and people from being inclusive is a lack of knowledge,” says Suri Surinder, cofounder & CEO of CTR Factor, which advises organizations in leadership, diversity, and inclusion Surinder, with 30 years of business experience in various C-level roles and as a consultant in multiple industries, argues that lack of knowledge and lack of self-awareness together form “the single biggest cause for absence of inclusion in the workplace ”

At heart, most people want to do what’s right They have empathy for others They understand the pain of exclusion There’s just one big barrier to expressing empathy, making new connections, and stepping into unfamiliar territory in order to create a more inclusive workplace: nobody seems to know how “People are hungry to learn how to interact with those who are ‘Other,’” says Ellie Krug, lawyer, writer, activist, and founder of Human Inspiration Works “Companies do not get inclusivity because they can't see it They get diversity because they can see it,” she explains Krug, who has presented on diversity and inclusion to governmental entities, court systems, Fortune 100 companies, law firms, and organizations across North America confirms that “ a company will spend a lot of time to bring in diverse people And then they’ll forget about it ”

Diversity is not an item on a checklist that, once achieved, will cause a firm to evolve into the innovative, inclusive company it wants to be Further, there are different types of diversity, and

only when both types of diversity are valued can a company shift to a culture of inclusivity a culture that actually receives the full potential from its diverse hires

ATTRIBUTE VS ACTIVE DIVERSITY

Attribute diversity is a familiar concept for most: it’s what people mean when they say things like, “We need more diversity in the accounting industry ”

“Attribute diversity is really all of the aspects of who we are that are driven by either intrinsic things or explicit things or organizational variables,” Surinder says Intrinsic variables, he explains, include things that are visible but not changeable: race, ethnicity, generation, sexual orientation Extrinsic variables, on the other hand, are not always visible, but they are changeable: education, experience, marital status, so on Then there are organizational attributes, such as functional expertise and specialization

“All of these attributes intrinsic, extrinsic, organizational will result in our thinking and our behaving differently,” Surinder explains Variations in thinking can, and often will, lead to more disagreements, longer meetings, more intense discussions, and more opportunities for conflict That’s the perfect opportunity to welcome and support active diversity the missing ingredient for many companies but it often feels like an organizational step backwards It might become harder to reach consensus, which feels inefficient And relating to people who are “other” makes many people uncomfortable “Our natural instincts are to gravitate toward people like ourselves,” Surinder says “That's the herd mentality for safety, built into our psychology ”

Krug calls this instinct grouping and labeling “We need to have tribes that provide for identity and security,” she says “But it’s also very problematic In my training sessions, I will identify the tribes that are in the room You’ll have all the accounting people sitting with each other All the people in the sales team sitting together ”

In other words, companies can do everything right to increase diversity, and still end up with distinct groups, stifled individuals, and little to no real communication

Surinder points out that there also are two different types of inclusion cultural inclusion, and leadership inclusion and many organizations focus solely on the first Human Resources adds a few “diverse” holidays to the company calendar and calls it a day But inclusion must extend beyond an organization’s social activities Inclusion, Morten explains, “is the act of creating environments in which any individual or group can be and feel welcomed, respected, supported, and valued to fully participate ”

Cultural inclusion is good, but it’s a first step, not a final one Leadership inclusion asks the question: “What do you want to be included in?” and then responds to the answer with action

22 INSIGHT | www icpas org/insight

“There are 20 different shades of inclusion from financial to recognition to decision-making that we have discovered as part of our research,” Surinder says Leadership inclusion requires an individualized approach, and that’s where most organizations hit a wall

TOOLS AND TRAINING

To break through that wall, people need tools they can use and understand, tools that make sense, and tools that can become second nature And, in most cases, they need training Be warned that a cookie-cutter approach won’t work One-size-fitsall programs and methodologies are, in a sense, the antithesis of what inclusivity truly is Individuals and companies are asked to conform to a certain set of parameters, regardless of size, resources, mindset, culture, history, and previous efforts Not only are such programs often ineffective and costly, they also give many organizations a “free pass ” mentality that, they feel, excuses the need for further effort “A lot of diversity and inclusivity training becomes one-off,” Krug cautions

D&I (diversity and inclusion) or DEI (diversity, equity, and inclusion) training that works is customized, clear, and action oriented Morten’s work starts with an organization-wide assessment and targeted training, and results in a customized plan of action Krug uses an approach called Gray Area Thinking™ to give individuals and companies a toolset that includes increased awareness, risktaking (consciously moving away from what is familiar and toward what is perceived as “other”), and compassionate acts Surinder teaches from a model that asks and helps individuals and organizations to apprehend, assess, and act

Their approaches are memorable, adaptable, and focused on specific, measurable changes Further, they come from a personal passion and long-term interest in the ongoing work of creating inclusive workplaces A minimally trained rep, reading a dry inclusivity presentation from a three-ring binder, won’t inspire change Consultants and trainers who have life experiences and deep interest in the process of cultivating inclusivity bring enthusiasm and curiosity to their work, which motivates others to participate fully Their experiences also enable them to answer questions, solve problems, and help organizations develop the individualized plans of action that will make a difference

If finding and implementing the right training down to the level of individual customization recommended seems overwhelming, there’s help The answer is to handle it the same way any complex, organization-wide task would be handled: with technology

AUTOMATING INCLUSIVITY

“Companies will micro-segment customers,” Surinder points out “But they don't spend the time to segment their own employees

and say, ‘We have five different segments of employees in this organization, all wanting a different type of inclusion Now let's put in place some methods and processes, some actions, and some initiative to address these inclusion needs of employees ’’’

The same tools that enable customer segmentation to the furthest degree enable employee segmentation as well A company-wide survey could ask employees to rank the different types of leadership inclusion according to what is most important to them After the data is collected, the results can be sorted and prioritized according to importance Once the needs are known, it’s a process of addressing them, one by one Even the process of addressing needs can become a means of creating inclusivity; when companies present a transparent plan of action, diverse employees can breathe a sigh of relief Knowing that there is a plan, and that the organization’s leadership supports it, can keep dissatisfied employees from walking out the door

To meet the needs, there must be support from leadership and a willingness to invest resources “An individual department manager or supervisor will have nominal impact, if any, without the support of leadership,” Morten says The cost of employee turnover is often enough to convince hesitant leaders Every employee who leaves, frustrated by the exclusion and limitation they feel, costs thousands of dollars upwards of 33 percent of an employee’s annual salary, according to a 2017 Employee Benefit News report

Until the problem of exclusionary culture is corrected, the same scenario will repeat If there’s no buy-in from the top tiers of management, Krug says, that’s where you go to convince them of the need for individual, thoughtful inclusivity training that helps people understand why, what, and how to change Go to the money Make it talk

“Your employees are your first customers,” Surinder says “Take care of your employees and they'll take care of your customers ”

Support from leadership, willingness to invest resources, and truly valuing employees indicate organizational readiness Organizational readiness paired with individualized, actionoriented training can result in real culture shift, the kind that turns attribute diversity into active diversity, and makes inclusivity the normal mode of the workplace

The goal may seem daunting, but the only requirement for any organization is to start somewhere and start now Diverse employees who feel unheard and overlooked are not asking for miracles they are asking for clear changes and defined processes “The initial efforts are high,” Surinder agrees “But once you focus on it long enough, it becomes an unconscious habit That is really the progression of a successful leader and organization: they become unconsciously inclusive ”

www icpas org/insight | SUMMER 2019 23

24 INSIGHT | www icpas org/insight

Put the Past Behind You

Companies demanding deeper insights and better business strategies are focusing their finance teams on the future.

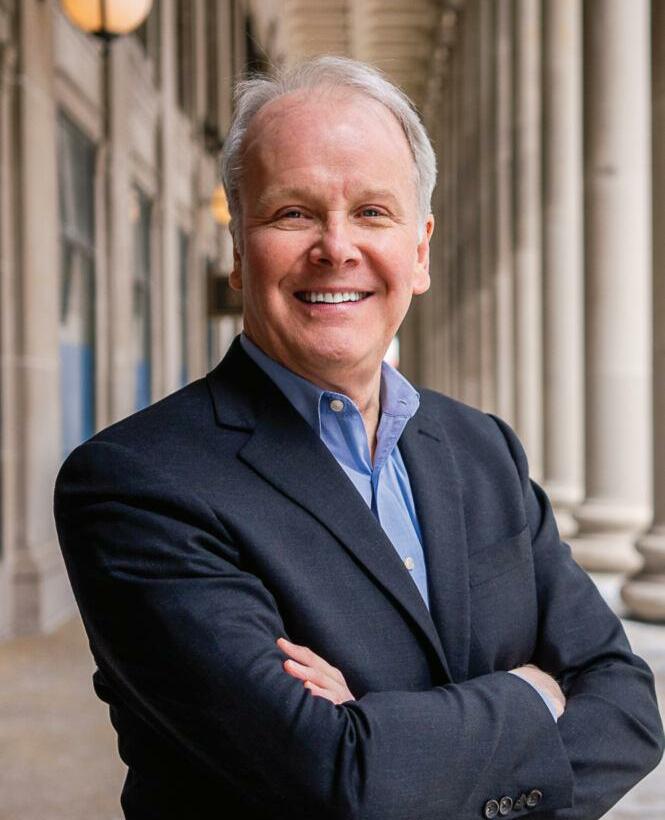

BY KRISTINE BLENKHORN RODRIGUEZ

BY KRISTINE BLENKHORN RODRIGUEZ

“No amount of sophistication is going to allay the fact that all of your knowledge is about the past and all your decisions are about the future.” The words of GE’s former strategic planner and founder of its “future studies” group, Ian Wilson, still hold true But finance profes sionals today have more tools at their disposal than ever to help them think like futurists and plot their companies’ futures as well as their own.

The question remains, are ar tificial intelligence (AI), robotic proces s automation (RPA), machine learning, predictive analytics, and other digital technologies the cr ystal balls and magic bullets so many have wished for?

www icpas org/insight | SUMMER 2019 25

Bots & Bytes

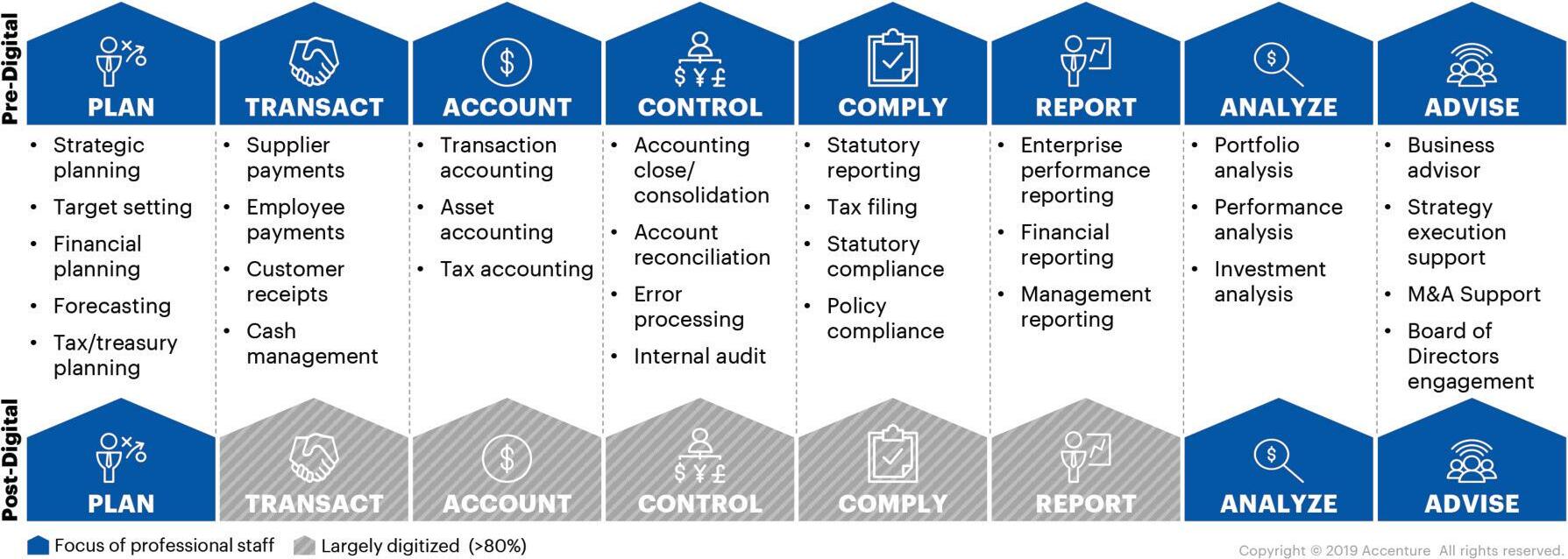

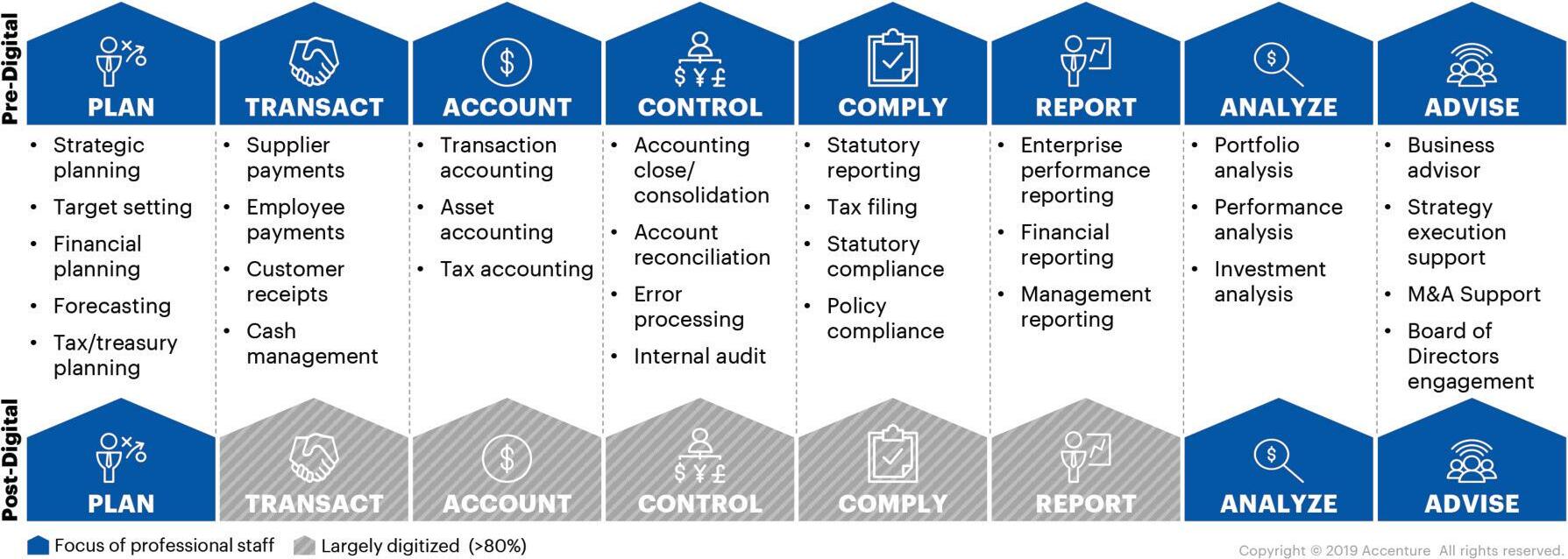

Finance roles and responsibilities are expected to be among the most impacted by digital technologies like AI and RPA For now, though, many finance departments are planning for the 21st century while working with methods still belonging to the prior

The average corporate finance team spends roughly 80 percent of its time on non-value-added manual processes like gathering, verifying, consolidating, and formatting data, leaving just 20 percent of their time for higher-level financial planning and analysis, according to findings in Adaptive Insights’ CFO Indicator Report So much for being futurists

The risk is that many of today’s finance professionals are focusing most of their time on tasks that could soon be automated, leaving them vulnerable as more sophisticated forms of AI and RPA creep into daily finance functions and organizations increasingly ask for deeper business insight and strategy from the finance team “Very quickly we ’ re going to be in a world where, if you don’t have skills in robotics and the related technologies, you will be obsolete as a finance person, ” KPMG CFO David Turner recently told CFO com

At the beginning of 2019, Turner, an RPA bull, said the firm was about 55 percent of the way toward achieving an initial goal of creating 200,000 hours of workforce capacity savings

Bots can process transactions, monitor compliance, and audit processes automatically And many of the bots being developed today learn as they go Through machine learning, bots improve all on their own, based on new data and new experiences, which cuts down on the manual work finance professionals have previously done and, arguably, has held them back from largely becoming more strategic business advisors

Accenture’s David Axson, global lead of CFO strategies, says some executives are surprised when they see just how much of corporate finance’s day-to-day can be done by technology: “Many are dismayed because they’ve traditionally seen their job as the preparer of financial reports and now technology is usurping that role What they don’t realize is that in today’s digital era, finance’s job begins when they deliver the report or analysis Their role is now primarily an advisor on major business decisions, not a report compiler ”

The scenario is increasingly playing out In “Bots, Algorithms, and the Future of the Finance Function,” McKinsey & Company highlights how AI can outdo veteran talent: “At a heavy-equipment producer, managers had long used spreadsheets to forecast monthly sales and production Frustrated with the time consumed and the imprecision of manual forecasts, they tasked a team of four data scientists with developing an algorithm that would automate the entire process Their initial algorithm used all the original sales and operations data, as well as additional external information (about weather and commodities, for example) In this case, within six months the company eliminated most of the manual work required for planning and forecasting with the added benefit that the algorithm was better at predicting market changes and business-cycle shifts ”

Another case in point: Willis Towers Watson’s use of RPA “Intelligent automation boosts both day-to-day finance functions and the

quality of finance’s strategic insight,” says Willis Towers Watson CFO