Bridget McCrea

Bridget McCrea

We understand that you, our members, have had your lives disrupted by the COVID -19 pandemic, and we hope that you are safe and healthy. As we all look forward to a post-pandemic future, we hope this issue of Insight provides you with thoughtful information on aiding our economic recovery and addressing the important issues impacting the accounting and finance profession

ILLINOIS CPA SOCIET Y 550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

www icpas org

Publisher/President & CEO

Todd Shapiro

Editor Derrick Lilly

Assistant Editor

Hilary Collins

Creative Director

Gene Levitan

Copy Editors

Nancy Clarke | Mari Watts | Jennifer Schultz, CPA

Photography

Derrick Lilly | iStock

Circulation

John McQuillan

Chairperson

Dorri C McWhorter, CPA, CGMA, CITP | YWCA Metropolitan Chicago

Vice Chairperson

Thomas B Murtagh, CPA, JD | BKD CPAs & Advisors

Secretar y

Mary K Fuller, CPA | Shepard Schwartz & Harris LLP

Treasurer

Jonathan W Hauser, CPA | KPMG LLP

Immediate Past Chairperson

Geoffrey J Harlow, CPA | Wipfli LLP

John C Bird, CPA | RSM US LLP

Brian J Blaha, CPA | Wipfli LLP

Jennifer L Cavanaugh, CPA | Grant Thornton LLP

Stephen R Ferrara, CPA | BDO USA LLP

Jennifer L Goettler, CPA, CFE | Heinold Banwart Ltd

Scott E Hurwitz, CPA | Deloitte LLP

Joshua D Lance, CPA, CGMA | Lance CPA Group

Enrique Lopez, CPA | Lopez and Company CPAs Ltd

Elizabeth Pittelkow Kittner, CPA, CGMA, CITP, DTM | International Legal Technology Association

Deborah K Rood, CPA | CNA Insurance

Seun Salami, CPA | Teachers Insurance and Annuity Association of America

Stella Marie Santos, CPA | Adelfia LLC

Brian B Stanko, Ph D , CPA | Loyola University

Mark W Wolfgram, CPA | Bel Brands USA Inc

Back issues may be available Articles may be reproduced with permission Please send requests to lillyd@icpas org

Want to reach 23,000+ accounting and finance professionals? Advertising in Insight and with the Illinois CPA Society gives you access to Illinois’ largest financial community Contact Mike Walker at mike@rwwcompany com

Insight is the magazine of the Illinois CPA Society Statements or articles of opinion appearing in Insight are not necessarily the views of the Illinois CPA Society The materials and information contained within Insight are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is Insight ’ s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet Insight ’ s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within Insight, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for Insight The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering Insight Insight (ISSN1053-8542) is published four times a year, in spring, summer, fall, and winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312 993 0407

Copyright © 2020 No part of the contents may be reproduced by any means without the written consent of Insight Send requests to the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: Insight, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

We’ve got

Take advantage of all the ways your ICPAS membership can help you to keep moving forward.

WhenI penned my spring column in late February (published in April), I had no idea what was around the corner I was aware of COVID-19 but thought it could be controlled or limited in its spread Then, while visiting the Maryland Association of CPAs in early March, I was stunned by the news that Harvard University was telling its students not to come back from spring break Little did I know that much of the country would shut down in the days and weeks ahead

What followed, as they say, is history The COVID-19 pandemic unleashed massive upheaval in our lives and our profession Tax deadlines were extended or altered, the government approved historic stimulus programs, accounting was deemed an essential business, and we learned the term “social distancing ” Offices of all types, including many accounting firms, pivoted to remote work environments overnight, and we learned just how dependent we are on technology and the cloud that is if you had been smart or lucky enough to have already moved in that direction

What this became for our profession was, truly, a chance to shine Businesses of all types were turning to their trusted advisors their CPAs in search of advice and, in some cases, strategic insight for how to sustain, survive, and thrive again CPAs, who were facing their own challenges with remote workers, technology issues, and changing rules and regulations worked long hours to provide vital assistance to their clients and communities in a time of need

I can’t thank you enough for all you did But what about all that’s left to do? Now is a great time to step back and, as lifelong learners, figure out what was learned from all of this and how it can help move us forward

I believe that one of the key lessons learned was the critical role that technology plays in everything we do Adoption of cloud-based systems stood out as a game changer, as working remotely came

more easily for early adopters However, the degree to which clients were comfortable with technology also had a huge impact on the success firms had in shifting to a remote work environment For the benefits of a firm’s automation and technology to be fully realized, it needs to be end-to-end from the firm to the client A lesson for the future as we embrace new technologies, we must ensure our clients are moving forward with us

Another key lesson learned is that clients truly value strategic insight CPAs became the go-to people for helping clients and companies to project cash flows, prepare Paycheck Protection Program applications, and navigate other government assistance programs Many firms also proactively reached out to their clients to advise them on other alternatives to help their businesses survive This crisis became a significant opportunity to go beyond a compliance service relationship (tax and audit) and build deeper relationships that demonstrate how CPAs are strategic business advisors

So, where do we go from here? The pandemic will end, and eventually business will return to normal Soon enough, we’ll be back to debating the dramatic impacts that artificial intelligence and robotic process automation will have on the profession, particularly with regard to traditional compliance services The profession will be best served if we build upon the value we added by providing strategic insights when businesses needed them most Long term, CPAs will ensure their relevance by moving beyond being the “most trusted advisor” to embracing their roles as clients’ “most trusted and strategic advisor ”

Whenthe pandemic first hit, our state and federal governments focused on responding to the public health implications, taking such major steps as transforming Chicago’s McCormick Place Convention Center into an overflow hospital and executing a statewide stay-at-home order But as the infection curve flattens and public health operations stabilize, the focus has pivoted to the magnitude of the economic crisis While many of us have seen firsthand the enormity of the COVID-19 crisis, we are just beginning to glimpse the real economic challenges that lie ahead

In my career, I have responded to natural disasters as an Air Force judge advocate and as an assistant to former Gov Jim Edgar, and I have learned that imperfect circumstances result in imperfect solutions Moving forward as trusted and strategic advisors to individuals and businesses, we must understand the State of Illinois is in a very imperfect situation, which will undoubtedly lead to solutions that are themselves far from perfect By embracing that broader perspective, we can best serve and advise our clients in these difficult times and those that lie ahead

Even before COVID-19 hit here, the major bond ratings firms were warning that Illinois was illprepared to withstand an economic downturn Fitch, Moody’s, and Standard & Poor’s all stated that Illinois’ public finances had not rebounded from the 2008 economic recession or resolved its public pension debt In mid-March, Gov J B Pritzker and his budget office estimated that the state was looking at a combined $7 4 billion budget gap for fiscal years 2020 and 2021

Prior to the COVID-19 outbreak, Pritzker’s “Fair Tax” amendment, moving Illinois from a flat tax rate to a graduated rate, was viewed as a philosophical panacea to cure Illinois’ economic woes Now that COVID-19 has driven the loss of significant tax revenues, an economic downturn, and investment losses by public pension funds, Illinois’ economic environment is even more desperate It’s clear now that additional tax revenue and any federal assistance money the state may receive will not do much to fill the budget gap

While it can be argued that these economic circumstances lay the groundwork for the passage of the “Fair Tax” amendment this November, it will not be enough The need to close the structural budget deficit, address our public pension system’s shortcomings, and fix the high rate of property taxes necessitates the need for the General Assembly to look for additional revenues

What does all of this mean for the CPA profession? It means potential risk to our practice areas Many think tanks and advocacy groups have proposed the need for Illinois to expand its tax base When the Illinois General Assembly begins looking for new revenue lines, they will likely revisit the idea of taxing professional services As recently as 2017, in the budget standoff between former Gov Bruce Rauner and the Illinois House and Senate, the Senate passed a bill that taxed a number of consumer services While that particular item did not pass the House then instead, increased income tax rates for individuals and corporations were signed into law a tax on services is likely to come up again now

As the state’s health crisis stabilizes, its economic crisis is only beginning.

LEGISLATIVE INSIGHTS FROM MARTY GREEN, ESQ , ICPAS VP OF GOVERNMENT RELATIONS @GreenMarty

The services considered may be consumer services or professional services Last summer, Chicago Mayor Lori Lightfoot talked about placing a value-added tax on large law firms and international accounting firms In response, we established a coalition of stakeholders and pursued several strategic lines of effort to discourage any legislation to authorize a municipal professional services tax We were successful no such legislation was introduced If such a proposal presents itself again, our advocacy processes are in place to represent the CPA profession

My message is this: The extent of the damage that COVID-19 has inflicted on Illinois’ economy and the nation’s is yet unknown Restarting the economy with the existing budget gap will present enormous challenges for all of us The “Fair Tax” amendment is only the beginning of a long struggle to right the ship Let us hope that the governor and the General Assembly will use this crisis to address the structural changes needed in state government with the delivery of services, public pension funding, and longterm budgeting processes

COVID-19 has changed our lives, but during the worst of times, we see the best in people We have learned to work remotely, using technology to do business and stay in touch Healthcare professionals, at great risk to themselves, have worked tirelessly to provide care and compassion Communities and neighbors have reached out to those in need, working with food banks, assisting their neighbors, and supporting local businesses We are a resilient people By working together, our state and country will emerge from the economic crisis CPAs will play an important role, serving as essential strategic advisors to individuals, businesses, and the government, both in weathering COVID-19 and achieving longterm economic health

But overcoming the current crisis and the long, tough road ahead depends on us continuing to work together and show our best selves It reminds me of these words from General Dwight Eisenhower, issued upon the Allied victory in 1945: “[L]et us remind ourselves that our common problems of the immediate and distant future can best be solved in the same conceptions of cooperation and devotion to the cause ” Eisenhower’s call for cooperation in the wake of worldwide struggle is a reminder that together we can overcome the doubleheaded crisis before us

Author’s Note: This column includes my personal observations of the evolution of the legislative environment and are not necessarily the views of the Illinois CPA Society

S trategic programs focused on real-world solutions

• ICPAS VIRTUAL SUMMIT20: Corporate Finance Track

August 25-26, 2020

• Financial Repor ting Symposium

September 24, 2020

• Controller s Conference

March 202 1

The go-to resource for your entire corporate finance team, all for one low price.

Quar terly programs to expand your knowledge base, share best practices and network

Bi-monthly e-publication delivered to your email box featuring insightful corporate finance news and trends

Connect with fellow corporate finance professionals to ask questions, discuss issues and receive input

Tools to help you climb the corporate ladder including job postings, aler ts, resume posting and career coaching

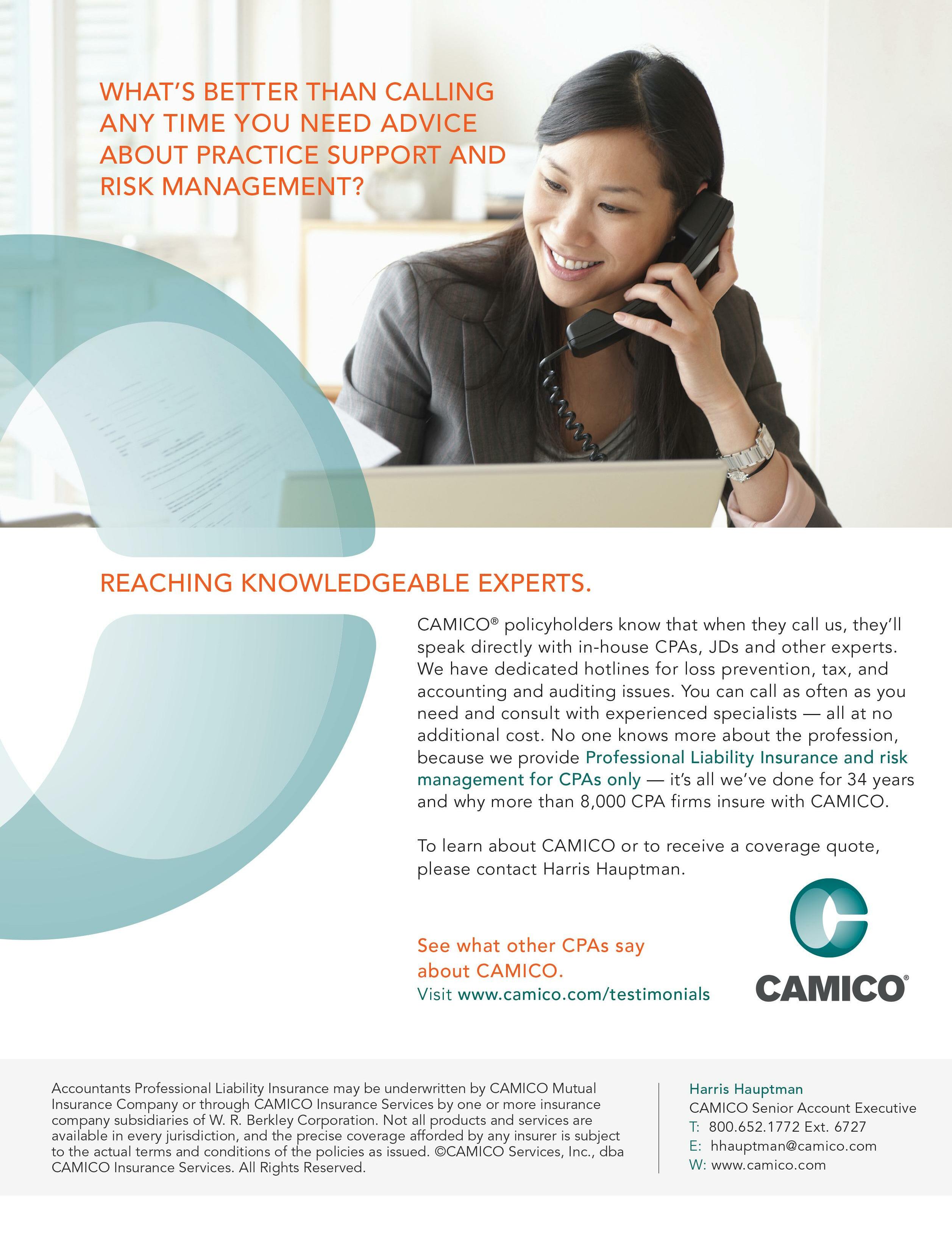

SUMMIT20 keynote speaker Donny Shimamoto shares his tech outlook for 2020 and beyond.

BY HILARY COLLINSchanges so rapidly that it often feels impossible to keep up, but Donny Shimamoto, CPA, CITP, CGMA, says the best way to keep up is to look for patterns from the past Shimamoto is the founder and managing director of IntrapriseTechKnowlogies LLC, where he helps small and midsize organizations use technology to grow, achieve strategic goals, and manage risks Here are his top six predictions for how technology will evolve in the next year, how the COVID-19 pandemic will affect technological decision-making, and what innovations will be most impactful for CPAs moving forward

1. The rise of remote work

Forced into utilizing a remote workforce during the pandemic, many workplaces will have a hard time coming up with reasons for why employees can’t work from home once things get back to normal “I think that one of the benefits that I've seen from the coronavirus crisis is the accelerated adoption of remote work,” Shimamoto says “One of the biggest hurdles that the profession has had to remote work is the question of whether people can be equally productive working remotely, and I’m hoping that after this the answer will be yes ”

2. A boom of budgeting and forecasting software

Another surge that will be born from coronavirus: increased use of financial planning and analysis technology like budgeting and forecasting software “This will be a big thing as people try to make tough decisions in volatile environments When do we reopen? How much money do we need from PPP or EIDL programs? How would we use that money? Can we pay it back? When can we pay it back? What happens if we have to close again? Budgeting and forecasting tools can really help with these kinds of questions,” Shimamoto says

3 Broader business continuity planning

While business continuity planning is not directly a technological issue, many of the tools that can help businesses operate seamlessly are technological And in the wake of the coronavirus pandemic, leaders will return to business continuity planning with a new perspective “In the past, business continuity focused on natural disasters and disaster recovery, ” Shimamoto explains “Now, continuity planning will consider various other situations that could disrupt normal business activities It reminds me a little of the

anthrax scare in the early 2000s, where we had physical issues like opening mail or gaining entry to office buildings Now, again, you've lost access to your physical office How do you operate? What do you do? Those solutions are likely to be technological ”

In the coming year, accounting firms that haven’t already are likely to warm up to client portals, both to facilitate remote work for employees and to provide touch-free convenience for clients Organizations will also see increased use of collaboration software, like Slack or Microsoft Teams, where they can share files, have asynchronous conversations, and electronically manage workplans with employees and business partners “Having the ability to exchange information electronically, easily, and effectively from the comfort of your own home, or from the client's or business partner’s perspective from the comfort of their own home or their own office, will be a high priority,” Shimamoto notes

5.

Shimamoto says that, prior to the pandemic, a rise in process automation would have been at the top of his list of tech predictions While more pressing concerns have knocked it down a few notches, automation specifically robotic process automation (RPA) will offer a unique opportunity to businesses willing to explore its possibilities “As we look toward 2021, we’ll see automation come back into focus, and RPA will be the technology leading the way, ” Shimamoto explains

6.

Underlying every technological advance is the need for improved cybersecurity Organizations who are implementing new tech should address the accompanying cyber risks before, not after, they move forward “A lot of people will use cybersecurity as the excuse: ‘We can’t do that because it might lead to a data breach,’” Shimamoto notes “But if you plan ahead and address cybersecurity upfront, then you can come out much more secure than you were before ”

Want to hear more from Donny? Join us for his technology keynote at ICPAS SUMMIT20 Register now at www icpas org/summit

What other s have said about ICPAS’ vir tual education prog rams:

“I am ver y grateful for the simulcast The technology worked ver y well and I will do it again next year!”

“I have never done vir tual CPE before, but think ever yone did a great job in presenting in this format ”

“The electronic format worked and saved me 3-4 hours of travel time!”

“Greatly appreciated being able to attend via simulcast.”

(SEE DAY ONE AND T WO AT- A -GL ANCE FOR DETAILS)

• Accounting & Auditing

• Corporate S trategy/Human Capital

• Ethics/Government

• Tax

• Technology Solutions/Advisor y Ser vices

Vir tual visits and one-on-one video chat appointments with top-tier exhibitors, including Thomson Reuter s, Intuit, Smar t Vault, Paymerang, Rober t Half, Af finipay and many more.

• Vir tual Networking Oppor tunities • Scavenger Hunts

• Giveaways and Prize Raf fles • Flash Solution Sessions

• Q&A Chats

Session Recordings All Access Pass Attendees will receive access to recordings of ALL SUMMIT sessions so the learning can continue af ter the event ends.

(Recordings available for 60 days af ter SUMMIT20 ends No CPE provided with the post-event recordings )

To register or for more det ails, visit www.icpas.or g/summit.

G L A N C

r

D A Y O N E A

H o w T e c h n o l o g y H e l p s A c c o u n t a n t s M i t i g a t e P a n d e m i c R i s k s D o n n y S h m

# M e T o o a n d Y o u : P r e v e n t i n g a n d I n v e s t i g a t i n g S e x u a l a n d O t h e r H a r a s s m e n t C o d e : 1 2 3 C L E : . 7 5 S e x u a l H a r a s s m e n t P r e v e n t i o n T r a i n i n g : 1

T r a n s i t i o n i n g F i r m O w n e r s h i p C o d e : 1 2 4

F r o m C o m p l i a n c e t o C o n s u l t i n g C o d e : 1 2 5

P r a c t i c i n g P r o f e s s i o n a l S k e p t i c i s m C o d e : 1 1 8 E t h i c s : 1 C L E 7 5

e : 1 1 3 E t h i c s : 1 C L E : 7 5

B u i l d i n g a W i n n i n g F i n a n c e T e a m C o d e : 1 1 9

T h e F i n a n c e L e a d e r a n d S t r a t e g y : A r e Y o u P l a y i n g a B i g E n o u g h R o l e ? C o d e : 1 1 4

H o w t o B u i l d a H i g hP e r f o r m a n c e T e a m C o d e 1 0 9

B e a N e t w o r k i n g N i n j a !B o d y L a n g u a g e T i p s f o r M a k i n g t h e M o s t o f E v e r y E v e n t C o d e : 1 0 4

R P A a n d t h e C P A : A P r a c t i c a l A p p r o a c h t o I m p l e m e n t i n g R o b o t i c P r o c e s s A u t o m a t i o n C o d e : 1 1 0

G r o w i n g a n d S c a l i n g a n E n t r e p r e n e u r i a l C P A F i r m C o d e : 1 0 5

C o r p o r a t e S t r a t e g y /

H u m a n C a p i t a l

T e c h n o l o g y S o l u t i o n s / A d v i s o r y S e r v i c e s

o d e :

I n t e r n e t T a x F r e e d o m A c t : P r o t e c t o r F r o m t h e T a x m a n ? C

L e a s e s : P o s t A d o p t i o n C o n s i d e r a t i o n s C o d e : 2 2 2

Y e l l o w B o o k U p d a t e : I m p l e m e n t a t i o n S t r a t e g i e s

C o d e 2 2 3

Y e l l o w B o o k : 1

F r a u d R i s k M a n a g e m e n t a n d A n t iC o r r u p t i o n P r o g r a m s C o d e : 2 2 4

N u t s a n d B o l t s o f C r y p t o c u r r e n c y T a x a t i o n : D e a l i n g w i t h I R S N o t i c e s C o d e 2 2 5

C L E : 7 5 C F P : 1 E A : 1

S e c t i o n 1 9 9 A : W h a t W e ' v e L e a r n e d C o d e : 2 1 6

a t i o n s C o d e : 2 1 1 C L E : 7 5 C F P : 1 E A : 1

A c c o u n t i n g & A u d i t i n g f o r D i g i t a l A s s e t s C o d e : 2 1 7

E m p l o y e e B e n e f i t P l a n s : T h e N e w A u d i t R e p o r t C o d e : 2 1 2

G A T A T i p s a n d T a c t i c s C o d e : 2 1 8 Y e l l o w B o o k : 1

C l i e n t R e l a t i o n s h i p R e d F l a g s : S p o t t i n g T h e m E a r l y C o d e : 2 1 3 E t h i c s : 1 C L E 7 5

T u r n i n g B u d g e t i n g a n d P l a n n i n g I n t o a C o m p e t i t i v e A d v a n t a g e C o d e : 2 1 9

S e v e n I n s i d e r S e c r e t s o f G r e a t L e a d e r s W h o P r o d u c e E x t r a o r d i n a r y R e s u l t s

2 1 4

C o d e :

K e e p i t S i m p l e : D a t a S e c u r i t y a n d T h i r dP a r t y R i s k M a n a g e m e n t C o d e : 2 2 0

U n l o c k i n g t h e P o w e r o f D a t a A n a l y t i c s a n d I n t e l l i g e n t A u t o m a t i o n C o d e : 2 1 5

R e v e n u e R e c o g n i t i o n : W h a t ' s N e x t C o d e : 2 0 7

L e a s e A c c o u n t i n g S t a n d a r d s : I m p a c t s a n d I m p l e m e n t a t i o n C o d e : 2 0 2

C o r p o r a t e G o v e r n a n c e : W h e n M i s t a k e s A r e M a d e C o d e : 2 0 8 C L E : 7 5

A c h i e v i n g P a r i t y : W o m e n i n t h e W o r k f o r c e C o d e : 2 0 3

B e s t P r a c t i c e s i n F i n a n c i a l P l a n n i n g a n d A n a l y s i s a n d P e r f o r m a n c e M a n a g e m e n t

S e l l i n g t h e C l o s e l y H e l d B u s i n e s s : O p t i m i z i n g V a l u e a n d M a r k e t T r e n d s

2 0 9 C F P : 1

C o d e :

P e r s o n a l i z i n g F i r m T e c h n o l o g y t o L i v e a B e t t e r L i f e C o d e : 2 1 0

2 0 4

C o d e :

B u s i n e s s F u n d a m e n t a l s : S t a y i n g O u t o f T r o u b l e W i t h t h e I R S C o d e : 2 0 5

C L E : 7 5 C F P : 1 E A : 1

E t h i c s / G o v e r n m e n t

C o r p o r a t e S t r a t e g y / H u m a n C a p i t a l

T e c h n o l o g y

S o l u t i o n s / A d v i s o r y S e r v i c e s

In the midst of reckoning with COVID -19, strategic thinkers are taking notes for the next crisis

BY NATALIE ROONEYn the early days of 2020, RSM US LLP’s leadership team was carefully monitoring the COVID-19 pandemic The firm quickly set up an incident response team to share information A second team, representing every facet of the firm’s business, was formed to gather input and provide updates to firm leadership and the board

On March 17, the firm went 100 percent virtual

In late April, yet another team was formed, dedicated to reopening offices “We wanted a comprehensive approach to protect our employees and get them back into offices in a safe, productive environment,” says RSM Chief Operating Officer Bill Gorman

At Wipfli, the management team made the decision for its workforce to work from home over a weekend “We were able to get people working from home with essentially the snap of a finger,” says Brian Blaha, CPA, growth partner and industry leader, and a member of the Illinois CPA Society’s board of directors

Having strategic crisis plans in place and a solid technological footing were critical to both firms’ ability to move quickly Although the existing plans were designed for natural disasters, the general framework guided leaders as COVID-19 took shape “We scaled our plan across the organization and adapted as information became available,” Gorman says

Communication, both internal and external, proved critical as businesses went virtual Gorman describes getting into a “communication cadence” with partners and employees, and Blaha says his team relied on video and conference calls to help with clarity of work

At Wipfli, daily calls addressed the firm’s internal communications with employees and external communications with clients The goal was to drive current and prospective clients to the firm’s website, a

strategy that worked almost too well “Our website traffic went off the charts,” Blaha says “People were thirsty for regulatory and legislative information ”

Teams worked overnight to update the website each time Congress released new information The fast turnaround led to an unexpected outcome: new clients “If you get information out ahead of your competitors, prospective clients see you in a positive light and are eager to connect,” Blaha explains

When information about the CARES Act was released, Gorman says RSM made it a point to ensure “caring” was front and center in all client efforts: “At RSM, we speak openly of our values, culture, and behaviors, and every decision we make is grounded in those values We asked, how can we care for our clients? What do they need?”

At first, clients needed guidance to navigate the regulations flowing from Congress RSM modified and enhanced its technology platforms and then launched a COVID-19 resource center addressing five critical issues: federal programs; liquidity; supply chain; workforce; and security, privacy, and technology

“We put our shoulder behind making sure the resources were there so we could help care for our clients and solve their problems,” Gorman says “It wasn’t about getting a sale or delivering a product It was about helping clients get through this pandemic ”

But these firms soon discovered there was a lot of opportunity beyond the regulatory and legislative issues

Clients who were also suddenly shifting to remote work needed technological help even more than they needed regulatory advice “The dynamic of how we were talking to our clients changed overnight,” Gorman says “Now, I don’t think we’ll ever go back to where we were Where that pendulum ends up will be an incredible journey ”

The next natural step became helping clients rethink their strategic plans and imagine a different future: What could their businesses look like in a post-pandemic world?

“A crisis highlights deficiencies,” Blaha says “Many clients are taking the time to think strategically and address gaps and opportunities that have come to light After this, our technology team will be even more critical in helping clients remain relevant in a digital world Changes were coming anyway, but COVID-19 accelerated the time frame ”

Gorman adds many companies have realized how quickly they can actually adapt: “There are clients who are developing new longterm objectives and adjusting their business models to be in a position of strength as we come through this ”

Blaha says technological investments over the years were key to the firm’s quick transition to a work-at-home environment “As painful as it might be, invest in your technology,” he advises “You need to prepare as if this isn’t the last time this will happen The technology will pay off, not just in how work will be done, but also in how you communicate with clients ”

In a post-pandemic world, the shift to advisory and consulting services from tax work is even more critical “Clients are moving to do-it-yourself tax platforms,” Blaha says “If tax prep is a chunk of your business, it will impact your revenue stream Think through how you’ll diversify There are opportunities to come out stronger

Those who adopt a mindset of continuous improvement will weather this crisis, as well as future crises, better than others ”

Wipfli saw sales numbers drop a week before Illinois’ shelter-inplace executive order went into effect “But we jumped on it right away because just like production, we needed to be into service extensions and new clients,” Blaha says “New clients told us their existing providers hadn’t reached out, and we had proactively contacted them It shortened our sales cycle, which was a learning moment for us Look holistically at all aspects of your go-to market strategies Don’t just be in client delivery mode in times like this Focus not just on production but also on building your pipeline ”

Gorman suggests taking time to evaluate and understand your position in this new normal Does the post-pandemic environment change your focus on an industry or service element? Is there an investment you need to make to be faster at those services? How do you use that investment to help clients? How do you turn what you ’ ve learned into a position of strength? Who stepped up as leaders so we can position ourselves for the future? As an advisor, how do you differentiate yourself by increasing the depth of value to clients?

“We’ve been in crisis mode,” Gorman says “Now take the opportunity that comes from what we learned about ourselves to reflect Regardless of firm size, CPAs are so important for the integrity and objectivity their advice brings This is the time to really position ourselves to be helpful and valuable to our clients ”

y now, your traditional busy season should already be in your rearview mirror, having wound down shortly after April 15 In years past, you would have already pored over the numbers, doublechecked the calculations, and filed the necessary tax forms on behalf of your company or clients You would be ready to take a breather, schedule some time off from work, and plan that summer vacation you ’ ve been anticipating

Not this year The global coronavirus pandemic threw a wrench in this scenario, taking a heavy toll on human life and day-to-day activities, and extending the tax season to July 15 and as of this writing, possibly further This likely left you, along with your fellow CPAs across the country, to balance several unforeseen challenges at once: managing the “ new ” busy season, helping clients/employers navigate unprecedented financial scenarios, ensuring everyone at home is safe, and maintaining personal emotional wellbeing

Any one of these tasks is arguably monumental, but when they began compounding upon one another during the spring and early summer, it became easy to see how any CPA could be left feeling overwhelmed and depleted of both physical and mental resources

“This is a really stressful, anxiety-provoking, and dehumanizing time for all of us, but particularly for those in professions that are tension-

evoking and have time pressures associated with them,” says Jessica Lippman, Ph D , a clinical psychologist

“Spring is a busy season to begin with for CPAs,” she explains “Most of them are generally dealing with the mounting pressure of having too much work squeezed into too little time not to mention looming tax deadlines ” The impact of this perfect storm of pressure can be downright overwhelming on a CPA’s psyche, Lippman says, and can take a toll on professionals’ mental health as they rush to meet deadlines, work long hours, eat on the run, and neglect their own needs

In March, for example, Lippman found herself working with one CPA whose anxiety levels were so high that he was forced to take a leave of absence from work “He was on overload,” she explains, “and questioning every action that he had taken and obsessing over what mistakes he had made or would make ”

To survive busy season and now COVID-19 with their mental health intact, there are simple and pragmatic steps CPAs should take

Managing busy season is stressful in a normal year, but it’s especially strenuous during a global pandemic With COVID-19 continuing to stir up emotions like stress, anxiety, fear, sadness, and

loneliness, the Mayo Clinic recommends getting enough sleep; participating in regular physical activity; eating healthy meals; avoiding tobacco, alcohol, and drugs; limiting screen time on computers and mobile devices; and taking time to relax and recharge as needed

While these pointers may sound simplistic, a sound night’s sleep or a healthy meal instead of takeout can make a big difference for mental health

Jay Scherer, president of Scherer Executive Advisors, says one of the best things CPAs can do to reduce their stress levels right now is to exercise regularly With social distancing rules impacting health club attendance, he advises professionals to set up mini home gyms: invest in a treadmill, bike, or elliptical machine, plus a few dumbbells and a yoga mat, and use them on a regular basis

“With the long hours that CPAs work, there’s a natural tendency to push their own health and wellbeing to the back burner,” Scherer says “This can be detrimental because the best defense against anxiety and stress is a good diet, good food, good sleep, and working out ”

During difficult periods, Scherer says it’s important to stay focused on the light at the end of the tunnel While this tunnel may seem particularly long and dark, maintaining a positive attitude as you progress through it is key to maintaining your mental health

Planning a fun activity for the future can help snap you out of a negative mindset Someone who typically takes an extended break at the end of the busy season, for instance, can start the early planning stages of taking this break in the fall

“CPAs like routine and enjoy having summers off, or at least some downtime during that period,” Scherer points out “The fact that the tax deadline falls in July interrupts these plans, not to mention the fact that there will be extensions filed and more work to do even when the actual deadline passes ”

To manage this uncertainty, Jasmine Young, CPA, founder and CEO of Atlanta-based Southern Tax Preparation & Services, says she’s creating daily to-do lists, sticking to a schedule, and allotting ample time daily for self-care “Setting a daily to-do list keeps me from being overwhelmed by the amount of work that has to be completed,” she says “I also prioritize tasks on the to-do lists to ensure client deadlines and expectations are met ”

Young says she’s also setting working hours and sticking to those hours to prevent burnout With more people working from home and feeling “always on, ” setting these parameters is more important “Staying within your working hours not only sets boundaries for clients and employers,” Young says, “but it also establishes boundaries for CPAs to ensure there is work-life balance ”

When it comes to self-care, Young says it can be as simple as setting aside time to take a walk outside for some fresh air, meditating, having lunch away from your desk, or simply doing nothing at all “This supports good work-life balance and allows CPAs time to wind down from the stress of the work required during this busy season, ” she says

Knowing that their team members are dealing with more than the usual number of personal challenges right now, managers and owners can also play a role in supporting mental health Scherer says opening lines of communication is a good first step, followed

by questions like: What challenges are you working through? How can I be helpful to you? What do you need from us?

“If a leader is oblivious to the individual needs of his or her team, those issues will be exposed pretty quickly when things rev back up, ” Scherer says He also cautions managers and owners to not push their teams too hard to make up for lost revenues due to COVID-19: “You’re not going to make it all up this year, so don’t even try especially if you ’ re billing hourly Cut yourself some slack and acknowledge that it’s just not going to be a great year; otherwise, you ’ re going to put too much pressure on your people ”

Pointing out the fallacy that partners don’t get ulcers they give them Lippman says now is also a good time to define the role and the scope of each CPA’s position “Firms hire very competitive personalities in a profession where quantitative overload and time pressures are the greatest stressors,” she says “This, in turn, leads to job tension and psychosomatic stress, the latter of which is both real and genuinely felt ”

Along with the tips already mentioned, Lippman says limiting exposure to news media and regularly connecting with others via phone, email, video chat, social media, and even snail mail can all help CPAs maintain their emotional health during a crisis

To managers, Lippman says simply acknowledging that team members are working very hard despite what’s going on in the world around them can go a long way in helping them feel appreciated and respected “Providing this level of support is incredibly important at all times,” Lippman says, “but it’s more critical now than ever ”

While these suggestions are relatively minor, small changes can make a big difference to mental resilience to the end of the busy season and beyond

By Annie Mueller

By Annie Mueller

While the economic upheaval of a global pandemic affects everyone in different ways, there’s one feeling shared by all: uncertainty For CPAs who hope to offer clients strategic insights, responding to the pandemic is about more than helping them make decisions about what is happening now A wise response requires looking to the future sifting through scenarios, weighing potential outcomes, factoring in the unexpected, keeping up with continually changing guidelines, and assessing best options for each unique situation Oh, and trying to survive then recover

While the strategic advisory role of a CPA is often seen as a bonus to the core services they’re trusted to provide, in uncertain times, having a trustworthy partner to help make these tough decisions is an essential need These five CPAs and their firms grasped that need instinctively, and have found smart, safe ways to be there for their clients even when “there” often means anywhere but together

Curt Mastio doesn’t view what he’s doing as a special service; it’s part of being a good CPA “I’ve noticed during this time how important that advisory aspect of a real CPA is to my clients,” he says Mastio, who is also an adjunct lecturer at Northwestern University, started Founder’s CPA in 2015 to work primarily with startups He notes that entrepreneurs and new businesses frequently do not or cannot allocate much of their budget to accounting needs and often end up using an automated service “That seems okay until you ’ re in the middle of an uncertain situation like we all are now, ” Mastio says “There’s so much value in having a real, live CPA on your side helping you decide what to do next ”

That’s exactly what Mastio and his firm have been providing: help, advice, and expertise in unpredictable times “Most of our clients don’t have an accounting or financial background,” he explains “So even as federal and state resources, loans, and other options become available in response to the pandemic, it’s a lot to navigate the options and know what applies We’re doing our best to fill that knowledge gap ”

Filling the knowledge gap means stepping up without physically being there, so Mastio and his team at Founder’s CPA regularly send emails, host webinars, and meet virtually with clients “A lot of this is talking through various scenarios so our clients can make the most informed decisions possible even with so many unknowns and variables,” he says Additionally, his firm has created an online resource guide, which is regularly updated to help clients stay informed about developments impacting their unique businesses

Mastio encourages other CPAs to do the same in their own way “One complaint I’ve heard is that there’s not enough communication,” Mastio says “It goes a long way when you respond and make sure your clients know you care Let them know you ’ re here and you want to help ”

For many CPAs right now, being there for clients means facing difficult truths with them “We work primarily with service-based businesses,” says Tim Jipping “In these businesses, when you go from running at 100 percent to 5 percent overnight, it’s painful to watch ”

Clients now need much more than tax preparation or typical financial planning “There’s a bit of therapist, technical advisor, and friend in the mix of advisory services now, ” Jipping stresses “All of a sudden, we ’ re having tough conversations about whether to lay people off, what to tell employees, how to handle vendor relationships, and even how to close down a business And I say, ‘We’ll help you figure it out ’”

Jipping’s firm, though only two years old itself, has handled the disruption to business-as-usual with agility “Our firm was built for this We were already on Zoom and using automated systems We’re experiencing the benefit of being up-to-speed with current technology,” Jipping says Right now, he is focused on providing up-to-the-minute information for his clients “We work with clients across the country, and the situation is wildly different from state to state What helps is to keep clients as updated as possible on what we know We send emails less frequently but we ’ re very specific with them We say things like, ‘As of 10 a m today, this is what we know and what you should consider ’”

The dual challenge for clients is dealing with an economic shutdown and ensuing regulations while also looking ahead to what might come next “We’re trying to navigate what new regulations might be and how consumer expectations might change,” Jipping says “It’s a day-by-day thing ”

The most important piece in supporting clients now is to be there and be honest, Jipping emphasizes “This is an opportunity to build long-term, deep relationships It’s about being a partner,” he says “Be a fellow human who’s going through this same weird journey at the same time Be honest even when it’s tough to be optimistic Then help them think about the future and keep looking ahead ”

To survive long enough to look ahead, many businesses must do things differently now “Food and beverage and hospitality companies who aren’t trying new service methods are going to really struggle and may not make it through this,” says Joshua Lance “Our experience in virtual work is helping us help our clients reframe the situation and find ways to do things that are not traditional but still work ”

The Lance CPA Group is a fully remote and virtual CPA firm, which enables Lance and his team to provide exactly what their clients particularly those in the food and beverage and hospitality industries need during this time “Our craft brewery clients are figuring out how to change up their operations,” Lance explains “Most operated tap rooms and are now trying to pivot to offer to-go, deliveries, and other options they weren’t focused on previously ”

Making a big change in operations is no small feat, especially while adjusting to restrictions, keeping employees and suppliers safe, and handling inevitable cash flow challenges “Our goal is to be proactive in addressing the needs of our clients,” Lance stresses “Some of our brewery clients have found that the new methods we ’ ve suggested are good alternative revenue sources that may be worth holding on to, even when they can resume business as usual ”

To further support their clients, Lance and his team offer informational videos and daily virtual office hours They also set up an online community offering real-time help “With our craft brewery group, we set up a Slack group and invited all our brewery clients, plus others in the brew space and other breweries,” Lance says “We’ve been able to share information, and it’s rewarding to see people who are competitors in this space coming together to help each other ”

Helping clients during this time, Lance says, is about taking time to think creatively and solve problems with them “You don’t have to have all the answers, ” he explains “No one does Your clients need you to get in the trenches with them and let them know you ’ re in this together ”

Having a trusted partner in the trenches can make all the difference for clients struggling to keep their businesses alive “As a firm, we have done our best to reach out to as many clients we can by calling or emailing specific information to them,” says Jim Hogge, who is providing as much help as possible to all asking for guidance

“Since the start of the pandemic, my focus has shifted to staying on top of new legislation and the related guidance that is continually being issued,” Hogge explains “The main challenge is communicating with all the clients that can use the government assistance Some are closely monitoring legislation but others, unaware of their options, risk missing the help and information they need ”

COVID-19 has been devastating to many of Hogge’s clients and friends even clients with businesses deemed essential that can stay open are struggling to do so With schools closed, many employees have children at home, but no childcare options “The businesses that are still working are having difficulty finding staffing,” he explains “They are doing their best to just hang on ”

Hogge and his colleagues are focused on helping their clients understand their options and make wise decisions “I’m proud of the way the firm has pulled together to help our clients,” Hogge says “We understand that clients are scared about their livelihoods and are trying their best to keep their businesses going We’re here to do whatever we can to help as many clients as possible This is an overwhelming time, but we will all get through this together ”

Helping clients get through a pandemic requires a new kind of strategic approach “In the past, our consulting efforts have been aimed at helping clients grow, ” says Brad Werner “Now, with sustainability, strategic planning, and cash management as the top priorities, our consulting services have taken a different form ”

The same, but different: While there is “still demand for core services,” Werner says, “there’s a hunger for immediate strategic business advice CPAs who are ahead of the game in communicating current trends and proactive strategies are going to see opportunities emerge If you are helping companies and individuals sustain and thrive through these trying times, that’s an opportunity to build trust you cannot buy ”

Clients facing business challenges and complex situations is, of course, nothing new What is new are the amount and type of challenges “Clients are in triage mode to compensate for the shroud of uncertainty facing their businesses in the near-term,” Werner says He helps clients focus on four key strategic areas: enabling productive remote work environments, managing and enhancing cash flow, minimizing losses until normal operations can resume, and understanding how to best apply provisions from the CARES Act and other emerging federal, state, and local assistance programs To help clients navigate these areas, Wipfli created an online COVID-19 resource center “I’m actively consuming as much content around those topics as I can, ” Werner says “All it takes is one good idea that you can share with a client to make all the difference ”

Even in the best of times, reminds Werner, most businesses rank their accountant as their most trusted business advisor In times of uncertainty, that advisory role becomes even more important “It is the obligation of a trusted business advisor to be thinking of ways to help clients manage their businesses more effectively,” Werner says “You’re doing your practice and your clients a disservice if you ’ re not actively reaching out to discuss their business issues and strategies that might help ”

As an industry, the accounting profession relies on accuracy, attention to detail, professionalism, and solid numbers In a crisis, however, other factors come into play: the bond of humanity and shared experience These CPAs have found that it’s not about knowing it all or having all the answers It’s about being in the uncertainty together, and together finding ways to navigate challenges as they arise

in the wake of the CoViD-19 pandemic, the u.S. economy suffered a major downturn. As unemployment spiked from historic lows to historic highs, businesses shuttered their doors, and markets wildly fluctuated, the situation drew more comparisons to the Great Depression than the Great recession. But while some businesses suffer, others offer a silver lining in illinois, businesses flourishing before the pandemic offer glimmers of hope for continued growth as normalcy returns.

even in hard times, these illinois industries are seeing major growth. Here’s how CPAs can get on board.

Xupply chain links like renewable energy; transportation and trucking; distribution and warehousing; home healthcare; and cannabis have not taken the same hits as others and are most likely to succeed during a recession or quickly bounce back And as these businesses grow, so will their need for the expertise and strategic advice of CPAs

Illinois’ renewable energy industry has boomed in recent years, driven by standards requiring a percentage of electricity sold by utilities companies to be from renewable sources “Illinois wants to reach 100 percent renewable energy by 2050 and to be carbon-free by 2030,” says Nelson Gomez, CPA, a partner at CohnReznik LLP

According to research from the Center for Climate and Energy Solutions, renewable energy is the fastest growing energy source in the U S , increasing 100 percent from 2000 to 2018, and expected to grow another 54 percent by 2048 The rise of renewable energy is great news for CPAs

“There is a tremendous amount of opportunity,” Gomez says “While there might be potential negative impacts from the coronavirus, I think there is tremendous optimism As the sector grows, there is a need for experienced CPAs There are a lot of financial and accounting needs that are unique to the industry ”

A startup business in renewable energy, for example, could need assistance with audited statements that are consistent with GAAP standards, revenue recognition, tax issues, and the accounting related to structuring deals “These projects are heavily taxincentivized,” Gomez says “As those incentives sunset, we have to think of new ways to finance the deals ”

While Gomez sees a lot of potential in consulting for renewable energy firms, he emphasizes that CPAs need to immerse themselves in the industry

“It’s continually evolving,” he says “The structures, markets, and trends There is continuous change as states take on more goals for clean energy Staying on top of that and being truly involved in the industry is a challenge It requires a large investment of time ”

Transportation, particularly trucking, is another industry seeing a rise in demand Freight hauled by trucks is projected to grow by more than 25 percent and revenues by more than 53 percent, according to the 2019-2030 forecast released by the American Trucking Associations in August 2019

Small firms from a single truck to a few trucks appear to be growing faster than large companies, says Kathy Orlando, CPA, CEO and president of Kathleen Orlando & Associates Inc , who has been

working with trucking firms for the last decade Orlando says her firm’s most valuable services are helping clients manage payroll, as well as assisting small trucking firms in managing their costs

“A lot of time they need to get financing,” Orlando says “I have a cost accounting background I can look at cost-per-mile or costper-day to let them know their break-even point We have to work with financing companies to show our drivers in their best light ”

Succeed in doing that with one client and you may land others Word-of-mouth is everything among small trucking firms, Orlando notes: “Once you become known, instead of having one client, you might have three or four A personal referral is worth a lot ”

In some cases, Orlando starts by handling personal taxes of trucking companies and lets them know she is also capable of handling their business needs However, small trucking firms are usually not businesses with high profit margins “These drivers don’t have the funds to pay big accounting bills,” Orlando says “You have to be conscious of that so you don’t do too much work for them and be too far down the pecking order to get paid You want to keep things current and keep the dialogue regular ”

Rob Jonker, CPA, managing partner of Jonker & Associates, suggests starting with a small to medium-sized intermodal company that is looking to expand to get a feel for the industry before taking on larger clients “It’s really critical in that business that you get to know all the moving parts,” Jonker cautions

If a CPA has worked with one manufacturing firm, for example, Jonker says understanding the next manufacturing client is going to be a lot easier That’s not necessarily so for transportation, which has a separate set of costs “Our most common service is making sure our clients, particularly small trucking firms, have capital,” explains Jonker “We also help control for variables ” For example, what does the company do if a driver is unable to deliver a load by tomorrow? “You have to make sure your owner has back-ups for any contingency,” Jonker says

Illinois’ distribution and warehousing industry is also seeing a major boom, driven by the prevalence of e-commerce, among other factors

“It’s a broad industry in Illinois and the Chicago area, ” says Bill Finestone, CA, CPA, managing partner of Lipshultz, Levin & Gray LLC, which consults with startups as well as billion-dollar businesses

“If you don’t have it as a piece of your practice, then I think you are missing out on a lot of clients ”

His firm commonly helps such clients with financial reporting to banks, investors, and other lenders including conducting audits as well as

basic tax work “A lot of our clients are doing business across the country and, increasingly, overseas, ” Finestone says “Whether that changes as a result of the pandemic remains to be seen ”

Odds are that growth among distribution and warehousing businesses will still offer new opportunities: Some CPAs may conduct research and development for tax credits or do cost segregation studies to reduce checks and liabilities, while others develop accounting systems “Clients have a lot of inventory that needs to be tracked,” Finestone says “You need to have a really good system in place to work out the real costs to get the pricing right and physically track the goods ”

Distributors and warehouses must track how much product is on hand, where it is, how much it costs, and be able to predict future needs, and that tracking system must integrate with the accounting system CPAs can be an enormous help in managing these challenges

“We can set up systems to do that,” Finestone says “I would say that’s a very good source of business for CPAs ”

CPAs can also assist clients with budgeting, forecasting, cash flow projections, and liquidity analysis, along with making sure clients are in compliance with any bank covenants, he says

In recent years, many distribution centers have begun working directly with end-users rather than middlemen “That raises other issues, like sales tax, where CPAs are needed,” Finestone says

To find clients in distribution and warehousing, Finestone recommends joining industry groups the narrower you can define that, the better and, if possible, speaking at their events

“The key is to differentiate yourself,” Finestone says “That comes through personal services Smaller firms might be better positioned than larger firms to provide that ”

It’s always helpful to have specialized knowledge of the industry for which a CPA is consulting, Finestone adds: “When a client comes across an issue, it might be the first time they’ve seen it It shouldn’t be the first time their CPA has seen it We work as a vehicle to transfer knowledge based on experience ”

As baby boomers continue to retire and age, the need for home healthcare is projected to increase According to the U S Bureau of Labor statistics, the number of home healthcare workers is expected to increase by 511,300 from 2018 to 2028

The best thing about this? While the home healthcare industry is likely to see major growth, the actual business needs are simple “I would say it’s pretty straightforward There is nothing really specialized from an accounting standpoint that needs to be

done,” says David Robbins, CPA, partner of Nieminski Robbins & Associates CPAs LLC

Robbins’ firm handles all aspects of accounting for home healthcare clients, including payroll, bookkeeping, tax returns and, more recently, Paycheck Protection Program (PPP) loans The biggest challenge for CPAs serving this industry outside of helping them prosper during a pandemic is understanding the Medicare system since the bulk of payments come from Medicare

Not surprisingly, the state’s cannabis industry is on the rise following the legalization of adult-use recreational marijuana on Jan 1, 2020 Tony Michelotti, CPA, a partner at Eder, Casella & Co , is seeing a lot of startup companies seeking assistance with the application process, structuring a legal entity, raising capital and, perhaps most difficult, navigating their banking needs

“From a federal level, cannabis is still illegal,” Michelotti says “FDICinsured banks can’t serve these businesses until legislation is passed to allow it We help connect them to credit unions or find other ways to manage all the cash that comes in ”

CPAs need a deep understanding of both federal tax laws and state legislation and regulation to best serve cannabis businesses Neil Prasad, partner in the Chicago office of Marcum LLP, stresses that a thorough understanding of the cannabis industry is critical Prasad has been working with cannabis cultivators and dispensaries across the U S for the last eight years and in Illinois for the last two

Specifically, he says CPAs need a complete understanding of Internal Revenue Code 280E, which prevents cannabis companies from taking tax deductions or credits “CPAs that do audits also need to understand how it will impact financial statements,” Prasad says

That said, there’s a lot of potential for CPAs consulting to the cannabis industry “I think it’s an opportunity with growth for everybody,” Prasad says “Not just with cultivators and dispensaries but with all the ancillary providers in the supply chain ”

Within rapidly expanding industries like these, CPAs and their clients can form a strong symbiotic bond While CPAs are eager to serve resilient businesses, their sound and strategic advice can help a booming business grow even more

Finestone urges CPAs to differentiate themselves: “Be proactive for your clients Take general advice and customize it to particular clients ” That’s how you stand out And that’s how you flourish in the Land of Lincoln

By liSA wilDer

By liSA wilDer

On Jan 1, 2020, a near-lifetime ago given the explosive health and economic developments since, Illinois became the 11th state to legalize recreational cannabis for adult use Compared to the COVID-19 pandemic ravaging industries and markets across the globe since March, dispensary-sold recreational cannabis seemed destined for mid- to low-point status in Illinois’ economic yearbook except for one thing

According to the most recent numbers, in the first four months of 2020 including the April lockdown month where monthly sales were the highest on record yet Illinois dispensaries sold nearly $150 million of legal recreational cannabis

That’s $150 million of recreational weed from roughly 50 licensed sellers, with a planned 75 more on the way in the coming months

In 2019, estimates put the size of Illinois’ total recreational cannabis business at $2 billion Yet, for Illinois accounting firms, there’s much more to serving this industry than simply taking on a rich new vein of business Even though two-thirds of Americans support marijuana legalization, in accounting, cannabis is complicated

“Even as federal legalization has gotten closer, ethical, cultural, and promotional dilemmas have always defined cannabis work within the accounting industry,” explains Nathan M Summers, CPA, principal with Miller Cooper & Co “Cannabis is still illegal on the federal level as it is classified as a Schedule 1 substance, and while any businesses touching the plant itself may be completely legal in Illinois, they’re currently breaking federal law That has tax implications, and most importantly, it means federal banks still can’t get involved for business or payment services, so these are primarily cash businesses ”

Add a complex tax and regulatory framework that’s still in flux, potential PR risk to firms, and a considerable need for cannabis industry expertise within the accounting industry itself, and Summers concludes there are “real challenges for firms new to the cannabis industry ”

However, whatever the obstacles in this fast-moving industry, firms shouldn’t rule out a business with a controversial history Besides the current boom in recreational weed, cannabis businesses may open opportunities in agriculture, textiles, food, beverage, and consumer products, and eventually a more conventional financial and supply chain ecosystem for such businesses to operate in And it should be noted that many of the dispensaries now in Illinois’ legal recreational cannabis business have been selling medical marijuana since late 2015

In short, Summers says now might not be a bad time to get in on the ground floor

Right now, the market for state-by-state legal recreational cannabis is eye-popping In 2019 alone, the industry jumped nearly 46 percent to $14 9 billion in sales after a relatively modest 17 percent jump in 2018, and global consumer spending for cannabis flower (the smokable part of the cannabis plant) as well as extracts from other parts of the plant are projected to hit $32 billion by 2022,

according to a January report from Arcview Group and BDS Analytics With those projections and the shifting political landscape, 2020 could be a pivotal year for cannabis

“With this being an election year, we ’ re not likely to see any major changes to cannabis legislation in the next quarter,” Summers predicts “But if you get a new regime in Washington, I think things could change very quickly ”

Even so, there are several developments some very recent that could have a wide-ranging impact on new and future cannabis industry clients

In late March, the U S Treasury General for Tax Administration released a report with a straightforward title: “The Growth of the Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional Guidance ” In it, the agency recommended that the IRS develop a “comprehensive compliance approach for the marijuana industry” that zeroes in on how cannabis companies have been improperly reporting business deductions and credits under Internal Revenue Code Section 280E covering “expenditures in connection with the illegal sale of drugs ” In other words, cannabis companies can expect more audits

“This is definitely the biggest hot-button issue in the industry right now, as it potentially may disallow deduction of virtually all cannabis companies’ operating expenses, ” Summers says Under Section 280E, cannabis companies generally are limited to deducting only their cost of goods sold

Summers notes that there’s “ a handful of companies” in the industry that may be found to have significant tax liabilities as a result of not understanding this rule: “I think it is critical for CPAs to have a thorough understanding of how 280E applies to the cannabis industry now and to watch for future changes regarding legalization at the federal level, as well as staying current on IRS court cases ”

Due to marijuana’s Schedule 1 drug status, conventional banks are restricted from taking on cannabis companies as business clients for regular banking services essential to most companies, such as business and payroll accounts as well as credit card acceptance for B2B and B2C sales

That’s why cannabis remains largely a cash business and a red flag for the IRS Until federal law addresses the situation, alternative banking solutions remain speculative, with some advocates even promoting cryptocurrency-based systems as a way to manage all that cash

However, there is action in Washington on the cannabis industry and its access to the traditional banking system, and it’s at the top of the legislative pipeline The question is whether the political environment will change enough to get it across the finish line

Michael R Hartley, audit quality leader at Crowe LLP, points to two key bills that could change everything the STATES Act, which would recognize legalized cannabis industries at the state level, and the SAFE Banking Act, which would finally allow federal banks to extend services more easily to the cannabis industry

“Essentially, SAFE would allow cannabis companies to deposit money in a conventional bank, which would be an enormous breakthrough,” Hartley says “However, unless marijuana gets off Schedule 1, you ’ re not likely to see a lot of change, either in the Senate or at the IRS ”

Most experts don’t expect movement before January 2021, when an incoming Democratic president could signal federal legalization soon But even if President Trump wins a second term, Attorney General William Barr signaled during his confirmation process in 2019 that he did not intend to crack down on legal cannabis like his predecessor Jeff Sessions

As all businesses are operating now with some form of pandemic filter, cannabis companies large and small are dealing with common issues that involve access to capital and product shortages For CPAs seeking insight into pandemic-related challenges, current public cannabis companies offer a high-level view of the industry These companies are facing a range of issues related to financing, investment, product cultivation, valuation, and availability, as well as M&A interest from established food, beverage, and tobacco conglomerates looking to the future

Hartley and Summers point out that product valuation skills will become increasingly important in the cannabis industry as it diversifies Summers says there’s never been a call for historical or benchmarking data in this area before, but CPAs will need it “You have live plants that certainly add levels of comp inventory, and there’s a need for expertise,” Su “The question is, who will become the valuation ex legal industry and how those services will be prov

Accounting firms take on lines of business with v complexity and controversy every day Yet, even a mainstream, most experts suggest that leadersh and even key clients should take part in the earlie whether providing accounting, tax, audit, or othe industry is right for the firm

Here are some questions Illinois CPAs should cons take on cannabis clients

As long as marijuana is grouped with cocaine Schedule 1 drug, CPAs should carefully conside state accounting boards, the Drug Enforcement Ad

Department of Justice, and other regulatory bodies before wading into weed While Chicago and Illinois might welcome cannabis businesses, oversight isn’t so lenient at the federal level

Accountants should also ask themselves if their firms are likely to face any additional risks for getting into this business Potential new danger spots include reputational, financial, or legal risk, effects to malpractice or professional liability insurance, and risks of being disciplined or sanctioned

It can be helpful to take a look around and see how other CPAs are navigating these issues Accountants can examine the services other Illinois CPAs are offering cannabis businesses, or even reach out to firms in other states to see how they’ve prevented missteps and what growth opportunities they’ve seen

Taking on a new and complicated line of business could potentially have major impacts for any firm Firms as a whole should have an appropriate level of expertise before entering the cannabis industry Even if taking on cannabis clients is an unmitigated win, it can change the culture of the firm and the kind of future hires the firm needs Firms should consider the changes even a best-case scenario could bring and enter the field with a strategy for which services they hope to provide and the long-term growth they hope to achieve

Summers thinks cannabis is a promising business for CPA firms that are willing to build the time, expertise, and human talent necessary to making it a success

“We’re going to need CPAs who think outside the box, get creative, and adapt quickly This industry is moving at 300 miles per hour and often the accounting function is in the right-hand lane going

kppaskvan10@gmail com | ICPAS member since 1984

Board committee work these days is anything but boring While many boards typically meet four times a year, in a crisis, boards and their respective committees must meet and communicate far more frequently And while financial matters in prior meetings may have focused mainly on company income statements, crisis management demands a deep focus on the balance sheet Is there enough cash flow to meet short-term obligations? Are there debt obligations that can be renegotiated or refinanced?

Finances aside, corporate leaders should be looking for ways to act, not just react, and boards should encourage executive management to actively seek out opportunities During turbulent market periods and economic recessions, there are always opportunities for new talent, new partnerships, and new consolidations While we are all trying to imagine a new normal, we also are given a rare chance to reimagine operations and technology solutions through creative problem-solving

During a crisis, getting a multitude of perspectives on strategic decisions is more important than ever Often, critical decisions occurring in boardrooms are vetted initially in a committee structure Risk committee agenda items permeate throughout the entire organization, and frequent disclosures of regulatory and other material risks are required and discussed in management discussion and analysis (MD&A) reporting The overlap that exists between the risk and the audit committees has increased as risk disclosures continue to expand, meaning risk matters often end up on multiple agendas The regular discussion of risk in each committee and among the broader board of directors is critical to the understanding of a business’ growth strategy, scenario analysis, and mitigation plan As businesses retool, recover, and rebuild in a crisis, they need a playbook of potential paths forward This is easier with the comprehensive and collaborative ownership of risk matters throughout the organization all the way up to board oversight

The AICPA and N C State University’s Poole College of Management collaborate each year in publishing an annual look at the state of enterprise risk management In the 2020 findings published in April, they observed:

• Over 80 percent of large organizations and public companies have management-level risk committees

• Most respondents (59 percent) believe the volume and complexity of risks is increasing extensively over time

It’s not a game; how corporate boards analyze and respond to risk is critical in a crisis.Leadership Fellow, National Association of Corporate Directors

• But only 24 percent of the organizations’ board of directors substantively discuss top risk exposures in a formal manner when they discuss the organization’s strategic plan

Of the 563 survey respondents, which included public, private, and not-for-profit entities, only about 54 percent had assigned risk oversight to a separate committee Lacking a separate risk committee, risk matters are generally assigned to the audit committee for review, with the HR and compensation committee dealing with talent risk and second-tier succession matters

By necessity, crisis management board work often focuses on short-term emergency decision-making It should also highlight risk measures and contingency planning initiatives that have been successful, as well as evaluate and strengthen those that need improvement As each board committee meets on critical matters, here are some of the most prominent risk areas to be discussed:

The pandemic has highlighted the real risk of not having a distributed supply chain with multiple third-party relationships Companies and their boards should be evaluating overseas suppliers of raw materials, manufacturing plants, distribution arrangements, and everything in between

Has management been communicating the dangers of cyber threats? Hacking and phishing are rising risks as cyber criminals try to take advantage of increasingly distributed workforces and many newly remote workers potentially sharing devices with family members which may leave personal and business data vulnerable

You’ve no doubt read about the retail bankruptcies filed for J Crew, J C Penney, and Neiman Marcus There will be many more illiquid organizations forced to consolidate locations or stop doing business altogether despite government response programs to stem the impact of COVID-19 Bankruptcy doesn’t work in all cases, and it can leave employees without pensions unless you carefully construct the filing Scenario planning is critical in these uncertain times Boards should expect, or request if necessary, frequent updates on plans to evaluate and strengthen access to capital and refinance debt given current low interest rates Boards should also evaluate any share buyback programs in place and, if necessary, terminate them

Many industry-wide company valuations have declined and it’s unclear how long they may be depressed Evaluating revenue stream scenarios is necessary, along with frequent reviewing of client/customer touchpoints Companies will be reporting balance sheet impairments or new reserve requirements Many companies should also renegotiate and rethink leases as they reconstruct office layouts that are conducive to social distancing and account for more remote workers Boards should be made aware that regulatory agencies are calling for specific disclosures about the effects coronavirus is having on companies

The Department of Labor reported the U S unemployment rate hit 19 5 percent in April when adjusted for errors Besides being the highest rate since the Great Depression, more than 20 5 million jobs vanished in the worst monthly loss on record Whether these job losses are temporary or permanent is still to be seen Still,

companies must devise plans to reskill and upskill employees While this has been on the radar for some time, the move to virtual work environments highlights the need for workstreams dedicated to enhanced training and retooling

HR and compensation committees should be evaluating incentive compensation structures, including considering executive pay cuts and retention packages for key succession personnel At the same time, the marketplace may be offering an opportunity to go after previously unavailable talent

Bain & Company’s 2020 Global Private Equity Report lists 2019 cash-ready reserves at $2 5 trillion The challenge in getting this money off the sidelines and invested in new deals is that due diligence will be tougher than normal if all activity is done virtually and digitally After all, meeting company leaders and evaluating culture and values has generally been done through in-person conversations In addition, deal structures may change depending on the target industry and any reliance on overseas supply chains I suspect only companies with liquidity reserves and already targeted M&A opportunities may be in the marketplace in the nearterm However, with company valuations depressed, boards may want to explore previously unavailable acquisition targets

Major economic events require teams to come together A board that is engaged and informed can strengthen its committee structure and its ability to do the planning and evaluative work necessary to mitigate risks Ensuring your board and its committees are evaluating and responding to risks as quickly and with as much information as possible puts your organization in the best position to be responsive and transformative

Par ticipating is as easy as 1-2-3: Choose a community organization or charity to help Register your volunteer activity plans at www.icpas.org/CPADayofSer vice.

Receive a free CPA Day of Ser vice t-shir t (while supplies last, free to Illinois CPA Society members)

Unlike previous years, you can give a day, ANY day! Pick a date t his fall t hat works best for you and t he organization you want to help.

While the pandemic may restr ict the size of your volunteer g roups, the call to suppor t those in need has never been stronger

Questions? Please cont act Derrick Lilly at lillyd@icpas.org or 800.993.0407, x7614.