When Women Leave the Workforce

Ditch the paper mess – SafeSend Organizers transforms your client organizer PDF into a 昀llable form. Stop spending time, money, and effort for little-to-no return. Digital organizers increase the client completion rate and support your remote work昀ow. Schedule a demo at safesend.com/ILCPASummer SafeSend Returns®

ILLINOIS CPA SOCIETY

550 W. Jackson Boulevard, Suite 900, Chicago, IL 60661 www.icpas.org

Publisher/President & CEO

Todd Shapiro Editor Derrick Lilly

Assistant Editor

Hilary Collins

Creative Director

Gene Levitan

Copy Editors

Mari Watts | Jennifer Schultz, CPA

Photography Derrick Lilly | iStock

Circulation

John McQuillan

Chairperson

Thomas B. Murtagh, CPA, JD | BKD CPAs & Advisors

Vice Chairperson

Mary K. Fuller, CPA | Shepard Schwartz & Harris LLP

Secretary

Deborah K. Rood, CPA, MST | CNA Insurance

Treasurer

Jonathan W. Hauser, CPA | KPMG LLP

Immediate Past Chairperson

Dorri C. McWhorter, CPA, CGMA, CITP | YMCA Metropolitan Chicago

John C. Bird, CPA | RSM US LLP

Brian J. Blaha, CPA | Wipfli LLP

Jennifer L. Cavanaugh, CPA | Grant Thornton LLP

Pedro A. Diaz De Leon, CPA, CFE | Kemper Corporation

Kimi L. Ellen, CPA | Benford Brown & Associates LLC

Stephen R. Ferrara, CPA | BDO USA LLP

Jennifer L. Goettler, CPA, CFE | Sikich LLP

Scott E. Hurwitz, CPA | Deloitte LLP

Joshua D. Lance, CPA, CGMA | Lance CPA Group

Enrique Lopez, CPA | Lopez & Company CPAs Ltd.

Stella Marie Santos, CPA | Adelfia LLC

Brian B. Stanko, PhD, CPA | Loyola University

Richard C. Tarapchak, CPA | II-VI Inc.

Mark W. Wolfgram, CPA, MST | Bel Brands USA Inc.

Back issues may be available. Articles may be reproduced with permission. Please send requests to lillyd@icpas.org.

Want to reach 22,600+ accounting and finance professionals? Advertising in Insight and with the Illinois CPA Society gives you access to Illinois’ largest financial community. Contact Mike Walker at mike@rwwcompany.com.

Insight is the magazine of the Illinois CPA Society. Statements or articles of opinion appearing in Insight are not necessarily the views of the Illinois CPA Society. The materials and information contained within Insight are offered as information only and not as practice, financial, accounting, legal or other professional advice. Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication. It is Insight’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin. The Illinois CPA Society reserves the right to reject paid advertising that does not meet Insight’s qualifications or that may detract from its professional and ethical standards. The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within Insight, and makes no representation or warranties about the products or services they may provide or their accuracy or claims. The Illinois CPA Society does not guarantee delivery dates for Insight. The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering Insight. Insight (ISSN1053-8542) is published four times a year, in spring, summer, fall, and winter, by the Illinois CPA Society, 550 W. Jackson, Suite 900, Chicago, IL 60661, USA, 312.993.0407. Copyright © 2021. No part of the contents may be reproduced by any means without the written consent of Insight. Send requests to the address above. Periodicals postage paid at Chicago, IL and at additional mailing offices. POSTMASTER: Send address changes to: Insight, Illinois CPA Society, 550 W. Jackson, Suite 900, Chicago, IL 60661, USA.

here’s no arguing that technology is having, and will continue to have, a seismic impact on the accounting and finance profession. As reported in the 2020 Insight Special Feature, “CPA Profession 2027: Racing for Relevance,” in a strategic planning survey of the Illinois CPA Society’s board of directors and executive and leadership staff, 96 percent of respondents agreed that artificial intelligence and robotic process automation will permeate businesses of all types and sizes and be utilized in the performance of every function a CPA performs by the year 2027. However, the COVID-19 pandemic has accelerated the adoption of these technologies.

So, how do we ensure the relevance of CPAs now and into the future? It comes down to people. I believe providing strategic insight to our clients and companies, particularly where technology can’t, will ensure our value and relevance for years to come. I was recently talking with a firm managing partner about the future of the CPA profession who was in complete agreement that helping clients and companies become more profitable would help demonstrate CPAs’ value and relevance. I also believe moving our mindset in this direction will make becoming a CPA more attractive to students and young professionals. Young people increasingly want purpose in their lives and careers and that goes hand in hand with helping Main Street businesses grow and achieve success.

The challenge we face is making sure that our people are prepared to excel in roles that go far beyond traditional accounting, audit, and tax preparation skills—strategic thinking skills will be key to adding new value to the services that CPAs provide in public accounting firms and companies alike. However, strategic thinking is not overtly tested on the CPA exam, hence it’s not necessarily something that we demand our students learn. The CPA Evolution initiative, which aims to launch a new CPA licensure model and CPA exam in 2024, will emphasize a focus on data analytics, but analyzing data is just one component of strategic thinking.

For instance, what if we asked our staffs, as part of any audit or business tax return, to identify one thing that would help our clients become more profitable? When I ask managing partners this question, they almost always say their people wouldn’t know where to begin. We need to fix this and focus more on helping our people develop relevant strategic thinking skills that our clients and companies are increasingly demanding. This fall, your Illinois CPA Society will be launching a new Strategy Academy which will solely focus on developing these crucial competencies.

Another mindset change we need to embrace in the profession is that diversity in thinking can also drive innovative solutions for our clients and companies. Ensuring our organizations reflect gender, racial, and ethnic diversity at all levels of staff and management will result in richer discussions and recommendations. Diversity, equity, and inclusion is no longer optional, it’s a business imperative.

Yes, technology will continue to have a seismic impact on the profession. However, at the end of the day, our value, relevance, and success are still driven by the most important asset of our firms and finance departments—our people. The CPA profession has been and, if it’s to remain relevant, always will be a people business. Are you ensuring your staff has the skills and competencies to win in the race for relevance?

As technology increasingly permeates the CPA profession, we must still focus on the fact that people are our most important asset.

You probably already have life insurance. But do you have enough?

Over the years, your living expenses may have increased. Could your current life insurance benefits:

• Help your family maintain their lifestyle?

• Pay for your kids’ college education?

• Allow your spouse to retire comfortably?

It’s always a struggle to lose someone you love. But your family’s emotional struggles don’t need to be compounded by financial problems.

That’s why the Group 10-Year Level Term Life Insurance Plan is made available to ICPAS members.* This valuable insurance program offers:

• Your choice of benefit amounts up to $250,000.

• Rates that are locked in for 10 full years.

• Benefit amounts remain steady for the 10-year coverage period. There are no age reductions.

See

Two thirds (67 percent) of Americans say the pandemic has been a wake-up call for them to reevaluate their finances.1

As society began pivoting to post-vaccination normalcy, the Illinois General Assembly spent the spring legislative session conducting business in a hybrid manner, with committee hearings being held virtually and legislators meeting in person in the House and Senate chambers for floor action. As they wrapped up the spring session on June 1, 2021—one day after the adjournment deadline— they had addressed many major issues and challenges, while others remained untouched. Here’s my analysis of the big issues.

Early in the spring legislative session, Gov. J.B. Pritzker formally presented his proposed $41.6 billion budget to fund state government operations. There was a $1.3 billion gap in the proposed budget, which Pritzker planned to close by eliminating “corporate tax loopholes.” Also hanging over state finances was the remaining $2 billion balance of the Federal Reserve loan the state received to cover state operating expenses and revenue shortfalls during the height of the COVID-19 pandemic. As budgeters began negotiations, they received the good news that Illinois would receive $8.1 billion in federal stimulus money from the American Rescue Plan Act. The Governor’s Office of Management and Budget also announced that state revenues were on pace to bring in $1.5 billion more than originally projected, with an additional $842 million in the coming fiscal year. With this in mind, the governor, president of the Senate, speaker of the House, and state comptroller agreed that the remaining Federal Reserve debt should be repaid to avoid costly interest payments. State leaders initially planned on using money from the federal stimulus program, but U.S. Treasury rules stipulate that these funds should be used to provide relief to residents—not to satisfy debt burdens or to facilitate tax cuts. State leaders remain committed to repaying the outstanding federal debt, and this commitment essentially impounds money and prevents the creation of new ongoing programs with this one-time large cash influx.

The Illinois Constitution requires that Illinois legislative districts be redrawn to reflect population trends by June 30, 2021. Preliminary general information released by the U.S. Census Bureau indicates that Illinois will lose two congressional seats, but the release of the more detailed census data typically used to draw state legislative maps has been delayed. In order to meet the June 30 deadline for the General Assembly to approve redrawn legislative maps, House and Senate majority leaders determined that the five-year American Community Survey data would be used to redraw the maps. After a great deal of speculation, House and Senate Democratic leaders released proposed maps late in the legislative session. At stake for Illinois voters is representation in Springfield and Washington, as well as majority party control of the Illinois House and Senate. Additionally, the five Illinois Supreme Court judicial districts were redrawn for the first time since 1963, putting the balance of the Illinois Supreme Court in play. Despite ongoing efforts by public interest groups to make Illinois’ redistricting process independent, it remains a political and partisan process where the majority party draws the maps. If the General Assembly is unable to approve redrawn maps by June 30, a bipartisan eight-person panel will be convened to create new maps which five of the eight members must approve. If the panel is unable to approve a proposal, the Illinois Supreme Court will submit the names of two people from each political party and the secretary of state will hold a drawing to see which person will act as the tiebreaking ninth member.

There has been a push for House ethics reform in the wake of a number of high-profile indictments of Chicago aldermen, former aldermen, sitting legislators, and associates of former Speaker of the House Mike Madigan. Proposals included measures to slow the “revolving doors” of legislators becoming paid lobbyists

As the Illinois General Assembly wrapped up its work for the spring legislative session, Illinois faced big questions about the state operating budget, redistricting, and other intricate issues.LEGISLATIVE INSIGHTS FROM MARTY GREEN, ESQ., ICPAS VP OF GOVERNMENT RELATIONS @GreenMarty

throughout government; enhanced oversight of legislators through improvements to the Legislative Ethics Commission and the Legislative Inspector General’s Office; greater financial disclosure and greater transparency, including disclosure of statements of economic interest; and expanded authority of the statewide grand jury allowing it to investigate public corruption.

Illinois lawmakers and energy stakeholders hoped to pass an energy overhaul in the spring legislative session and several clean energy proposals were introduced, including Pritzker’s Climate First Act. The goal of these proposals is to transition Illinois to carbonfree energy, including nuclear power. Other proposals include the Clean Energy Jobs Act, which would create energy investments in wind turbines and solar power and electrify the transportation sector. Overcoming the scrutiny and stigma of the flawed 2016 clean energy law that provided subsidies to nuclear power plants in Illinois is central to successful energy overhaul. The exposure of pay-to-play politics and Commonwealth Edison’s deferred prosecution agreement with federal prosecutors further escalated support for utility accountability and ethics provisions.

Aside from the overriding issues outlined above, I would like to touch upon two other pieces of legislation in the General Assembly. First, both the House and Senate unanimously passed Illinois CPA Society-sponsored legislation (SB 1723) to amend the Illinois Public Accounting Act, changing the 150-hour requirement to sit for the CPA exam in Illinois to 120 credit hours with 150 credit hours still being required for licensure. Second, the General Assembly also

passed legislation (HB 1443) to dislodge the stalled issuance of cannabis dispensary licenses. Two lotteries prioritizing Black, Hispanic, and other minority Illinoisans will award 110 new licenses and a separate lottery will award the 75 licenses authorized to be awarded by May 2020.

There were two significant long-term issues left unresolved. The first is that no substantive legislation for meaningful public pension reform was introduced. Illinois public pensions continue to consume evergreater portions of the state operating budget, and the governor and members of the General Assembly have avoided addressing this monster. Second, in response to the COVID-19 pandemic, state and federal officials assisted unemployed workers with enhanced unemployment insurance benefits. Currently, the Unemployment Insurance Trust Fund has an estimated deficit of $5 billion. The viability of this fund is maintained through employer taxes. Legislative leaders and the governor have allocated $100 million from the $8.1 billion the state received from the American Rescue Plan to this fund, and the business community continues to negotiate with the Pritzker administration on ways to replenish the fund.

Overall, the spring session of the 102nd General Assembly was very busy with a large volume of far-reaching bills passed by the House and Senate. Here, our legislative goals were to help pass SB 1723, support legislation that positively impacts the accounting profession, support collaborative work with our stakeholder partners to advance good tax policy, and mitigate mandates on businesses and employers. As with any legislative session, we had both victories and losses, and we remain as committed as ever to serving CPAs and the accounting profession as Illinois moves forward.

EMPLOYEE

In 2021, access to health care is more critical than ever. Here’s your guide to what’s changed since President Biden took office, other changes that are underway, and one unique money-saving strategy.

BY NATALIE ROONEYn the immediate aftermath of a global pandemic, it makes sense that health care is a hot topic. A new presidential administration is making short work of Trump-era health care rollbacks, while at the state level Illinois is seeing a push to make health care more equitable. There are also new pandemic-specific policies for employers and employees to navigate, changes to how health care is being offered, and overlooked strategies that people could be utilizing.

It can be hard to keep up with all the health care changes already enacted or underway, so here are the five biggest things CPAs should know now to best advise their clients—and make choices themselves.

President Joe Biden began his term with a flurry of executive orders, many of which were revisions to Trump’s Affordable Care Act (ACA) rollbacks. So far, the Biden administration has restored funding for navigators and ACA marketplace enrollment outreach to consumers and established an ACA special enrollment period for uninsured and under-insured Americans to seek coverage.

The Biden administration hopes to overturn more Trump-era health care policies that shortened marketplace open enrollment from three months to just six weeks, allowed states to loosen requirements for the essential health benefits required by plans sold on the ACA marketplaces, and loosened rules for Section 1332 waivers, which allowed states to experiment with different coverage options. They also hope to roll back changes to the formula for indexing increases in ACA plan premiums, broaden LGBTQ+ civil rights protections in the ACA, and restore funding for marketplace operations.

While CPAs should keep abreast of all this activity, there are no real changes to health insurance, employee benefits, or tax implications, says Marcus Newman, RHU, CBC, vice president of benefits consulting for GCG Financial in Chicago. “President Biden hasn’t done much more than open the ACA back up so far,” he says.

Changes are also underway at the state level in Illinois. On April 27, Gov. J.B. Pritzker signed HB 158 into law, a bill that focuses on health care equity for minority and low-income populations by,

among other things, enhancing mental health services, requiring bias training for doctors, and creating a community health worker program that improves oversight and transparency.

“The bill is about equity and accessibility,” says Chris Manson, vice president of government relations for OSF HealthCare, headquartered in Peoria, Ill. “We’re supportive of any efforts to help address long-term health care disparities and inequities in marginalized communities. It’s more of a matter of how we go about accomplishing that.”

Newman says the issues surrounding health care and health insurance come down to three basic factors: accessibility, affordability, and delivery/education. That final component is especially tricky now.

“We used to put everyone in the same room and explain their health insurance options. In the COVID-19 era, we can’t do that anymore,” he explains. “Now how do we educate people and help them make the best possible decisions about their insurance and care? If I don’t know that my wellness visit is 100 percent covered by the preventative care element of the ACA, I don’t get a checkup. That education component is critical.”

Illinois CPA Society member Michelle Carrothers, CPA, vice president of strategic reimbursement at OSF HealthCare, says the pandemic not only demonstrated how vital it is that health care be accessible to everyone—it also made it clear that innovative ways to access health care will remain a common feature moving forward.

OSF HealthCare was already seeking new ways for patients to contact providers prior to the pandemic, but COVID-19 put those efforts into high gear. The results? A dedicated COVID-19 hotline and innovation center. “We worked with the state and clinicians to get these programs up and running to screen people for COVID19 and get them to the right health care provider,” Carrothers says.

At the same time, health care providers had to continue caring for individuals who had health issues completely unrelated to COVID19. “We’ve tried to meet patients where they are,” Manson says. “Telehealth is one avenue that allowed us to continue to address the needs of the community so chronic health care issues don’t go untreated, while at the same time minimizing the spread.”

While the pandemic was and remains an enormous drain on health care providers, Carrothers hopes that it will recede into the distance while the new methods providers implemented to make health care more accessible will stay. “We’ll see the benefits down the road as we’re trying to serve our communities and help them become healthier,” she says.

The American Rescue Plan signed into law in March 2021 contains a health care provision that has raised quite a few challenges. In an effort to support Americans who lost their jobs and help them maintain access to health care, the federal government will pay 100 percent of COBRA insurance premiums for eligible employees and their covered relatives through September 2021, allowing them to stay on their company-sponsored health plan.

The subsidy has proven difficult to navigate for some small businesses. Ultimately, these subsidies will be funded by refundable quarterly payroll tax credits, but employers must first come up with the funds to pay the state continuation premiums. “Some employers have laid off 50 percent of their staff because they didn’t have any revenue,” Newman says. “There’s no payroll tax to cover the COBRA premiums of those individuals, so what are

they supposed to do?” In addition, the onus is on small employers to notify employees of their eligibility. “Employers shouldn’t be in that situation,” he says. “It’s not within the financial reality of small businesses.”

And for former employees still on unemployment, the question is whether to take the COBRA subsidy or not.

Kelley Long, CPA/PFS, CFP, offers financial coaching for do-ityourself financial planners and investors via her independent firm in Chicago, Financial Bliss With Kelley Long, and has a unique passion for helping clients use their health care options strategically. She notes that the COBRA provision presents CPAs with the opportunity to discuss an under-utilized provision that has the potential to help but can also be difficult to claim. “The COBRA subsidy could be a huge headache for folks who are still unemployed,” she says. “Even if people who lost their jobs prior to the pandemic could get at least one month subsidized by the federal government, they have to look back and decide if it’s worth the trouble to claim it. This is a great opportunity for CPAs to help.”

Long, an Illinois CPA Society member who will be presenting on health care strategies at ICPAS SUMMIT21, says, post-pandemic, people are more in need of savvy financial advice surrounding health care than ever before—and that is an often overlooked advising opportunity for CPAs. “The biggest mistake people make is spending all their HSA money,” she says. “They reimburse themselves for smaller expenses like bandages, vitamins, PPE, and menstrual products, but you can—and should—let that money build up if you can afford to.”

Long says that savers should allow their HSAs to build up and invest the funds, treating it more like a supplemental 401(k) plan or an IRA where the growth can be invested for future use, such as Medicare premiums or long-term care in retirement. An HSA can even be used to save for the future children you might have with someone you haven’t even met yet. “For people who think about it early enough, you can build up a sizable amount,” Long says. “Health care is the biggest wild card of retirement and an HSA can help mitigate that.”

Being well-versed in the nuances of HSAs can help CPAs stand out with clients who need help making difficult decisions about benefit plans. “As the trusted advisor, you should know if an HSA plan would fit a client’s finances,” Long says. “The higher the income and more emergency funds someone has, the more an HSA-eligible plan makes sense. You’re helping them save taxes and also fund retirement—you’ll sound like a genius.”

Overall, understanding the rapidly changing health care space is an important insight CPAs can offer to their clients. “We have to understand where you can cut costs, eliminate waste, and get people the right solution for them,” Carrothers says. “There’s an opportunity in understanding government reimbursements and add-ons, Medicaid complexities, and forecasting for bond financing. Hopefully, we CPAs are also benefitting by serving our communities in a more effective manner. Getting patients into the right setting, whether that’s telehealth or outpatient, and being more proactive with preventative care and screenings so we save costs and don’t have health problems down the road is better for the patients—and better for all of us.”

Employees and employers alike must reckon with the tax implications of remote work policies.

BY JEFF STIMPSON

BY JEFF STIMPSON

uch has been written about the rise of remote work over the past year. When COVID-19 struck, organizations sent their employees home with laptops and varying degrees of preparedness. While employers that did not have work-from-home policies and infrastructures in place may have been at a disadvantage initially, it seems many organizations have warmed to the idea: A 2021 survey from Buffer found that 45 percent of employees continue to work from home a year after the pandemic’s first wave and about the same number say their company plans to make remote work a permanent policy.

Now that remote work is here to stay, it’s likely that employees will take advantage of their newfound freedom of movement and employers will take advantage of the larger candidate pool that comes with a greater geographic range. But once employers and employees find themselves in different states, a new question emerges: How does working remotely impact taxes for both organizations and their team members?

As employees and employers seek to understand how their tax obligations might shift when they’re in different states, the answers require a detailed look at the tax laws of each state. The first step for employers is knowing where their employees are.

“The migration of workers from the workplace to working from home, then from a primary home to a secondary home, has made keeping up with tax obligations difficult,” notes Jessica L. Macklin, senior manager for tax at Wipfli LLP in Lincolnshire, Ill.

Employers will need to create a process to gather and maintain records on where employees are actually working, perhaps with a quick survey or by simply asking their employees to keep them in the loop. “A few of my clients have started a list of states in which they have approved people to move or work based on their current tax obligations and the minimal impact hiring people in those states would have on their filings,” Macklin says.

Shawn Kane, partner and leader of the state and local tax services group at Crowe LLP in Oakbrook Terrace, Ill., says that some of his clients are exploring the use of software on company laptops or handheld devices to track the physical location of employees, but notes that this tactic can trigger privacy concerns. However they choose to do it, employers have to start by getting a clear picture of exactly where their employees are—then dive into what that means.

“Generally, a state sees an employee who works in their state as having taxable compensation in their state—although there are exceptions, including reciprocal agreements and the length of time the worker spends in the state,” says Angie Vaughn, a manager in the accounting services group of Sikich in Peoria, Ill.

Illinois has reciprocal agreements with Iowa, Kentucky, Michigan, and Washington that can simplify tax processes if employers and employees find themselves split between any of those states. Under these agreements, if an Illinois resident works in any of those states, tax on their compensation is paid to Illinois. The same goes for a resident of Iowa, Kentucky, Michigan, or Washington who comes to work in Illinois—their payroll taxes go to their state of residence.

But outside of the agreement, things get more complicated. Factors like how each state defines “residency” come into play. For example, Illinois defines a “resident” as someone who was domiciled in the state for the entire year. Meanwhile, Wisconsin defines a “resident” as a person who maintains his or her domicile in Wisconsin, whether or not that person is physically present in Wisconsin or not. In other states, where someone lives can be determined by other factors such as where they vote, register their vehicle, or own or rent property.

But a worker doesn’t have to be a technical resident of a state to be taxed—each state has a different threshold. For example, Illinois law states that nonresidents must pay taxes to Illinois if they work in the state for more than 30 days.

“In a number of states, a nonresident employee is subject to withholding on the first day of travel into the states. Other states have a threshold like Illinois—New York’s is 14 days, for example,” Kane says. “Many states also provide an exemption for nonresidents performing services in a state during a declared disaster, such as the pandemic.”

Whether a state or city can continue to tax wages of a nonresident employee if the employee no longer is present in the state continues to be litigated in various courts, including in Massachusetts and New Hampshire, where legal wrangling over taxing remote workers recently involved the Supreme Court and the U.S. solicitor general. This new tax world will continue to evolve as governmental bodies and regulators try to figure out who they can and can’t tax, wherever those taxpayers happen to be.

Companies’ work-anywhere policies—not new but popularized by the pandemic—can present sticky tax issues. “It’s not just about payroll taxes,” explains Eric Fader, managing director for BDO in Chicago. “Businesses may also be subject to new tax filings, including state income or franchise taxes and sales and use taxes. They may also need to answer non-tax questions, such as whether the business is required to qualify with the secretary of state in the secondary location.”

The tax issues that arise from a dispersed workforce shine a spotlight on nexus, the connection between a taxing state and a business. Some states have offered nexus relief in light of the pandemic and consequent remote work boom, but that varies by

location, with some states limiting relief to corporate income and franchise tax. Then there are states like Kentucky, which considers nexus relief on a case-by-case basis. Much like the growth of online commerce forced a legal reckoning on sales tax, the boom in remote work may very well force a reexamination of payroll taxes and more at the federal level.

Alabama, the District of Columbia, Georgia, Illinois, Indiana, Iowa, Massachusetts, Minnesota, Mississippi, New Jersey, North Dakota, Pennsylvania, Rhode Island, and South Carolina have all provided explicit guidance for the nexus challenges arising from a remote workforce. Employers should certainly read the guidance, but they may still need the specialized expertise of a CPA licensed in the relevant state to understand all the implications of state and local tax law.

Employees will have to consider most of the above questions, but their tax issues are likely to be a little simpler as they’ll probably have only two states’ laws to navigate. However, those laws can extend beyond having to simply file tax returns in multiple states to include higher withholding for county, school district, state disability taxes, and more.

Employees should also clearly communicate both their current locations and how long their planned stays might be to their employers. Though this may seem intrusive, it helps ensure that both parties can do as much as possible to meet their tax obligations.

“Communicate with HR,” Macklin says. “Make sure your employer knows if your location changes from temporary to permanent. Some states have offered relief from their typical withholding rules for individuals located on a temporary basis in the state but that same relief doesn’t extend to individuals who have taken a temporary situation and made it permanent.”

States’ residency audits so far largely target taxpayers who have actually moved to lower-tax states and telecommute, but there’s reason to wonder if more states will try this tactic against all remote workers as COVID-19 continues to hammer tax coffers.

According to moveBuddha.com, a national moving company, Illinois has seen a 6.1 percent rise in the number of residents leaving the state from March to September of 2020. Already financially strapped and saddled with a relatively large out-of-state commuter population, Illinois could very well change or more harshly enforce their tax structures as more companies announce fully remote work policies.

As it is, states are clarifying their tax positions on remote work during the pandemic slowly and piecemeal—California and Massachusetts recently became two of the latest to issue or update guidance on unemployment insurance and other employment taxes—but legislation at the federal level would help create uniformity with the various states, Kane says.

“This kind of legislation has been introduced frequently in past years, with the most recent being the Mobile Workforce State Income Tax Simplification Act. While that proposal did not get enough support, the pandemic has highlighted this issue for employers and employees,” he says. “Perhaps in the future a similar bill will make its way into law.”

Jeff Stimpson is a writer based in New York. He has covered tax concerns for more than 20 years for various industry publications, including Accounting Today and Financial Advisor.

COVID-19 is forcing women out of the workforce in record numbers. What do we lose when women leave the workplace, and how can we make it possible for them to stay?

BY ANNIE MUELLER

BY ANNIE MUELLER

Early in 2020, Sandra Adam became one of the 2.3 million women that would lose their jobs over the course of the COVID-19 pandemic. During the following job hunt, she questioned her path forward. “I was looking for a leadership role, but the only available positions were lower-level,” says Adam, who is a CPA with more than 20 years of experience in forensic accounting and consulting. “It really made me question if I wanted to stay in public accounting because of how difficult it had been to build my career as a woman and how quickly it ended.”

Adam’s layoff happened early in the pandemic, when the numbers were still accumulating and the effects still unclear. But by December 2020, the COVID-19 economy’s effect on women in the workforce was clear—and disturbing: Of the 140,000 jobs cut that month, every single one belonged to a woman. In fact, that month women lost 156,000 jobs—while men gained 16,000. According to analysis of U.S. Bureau of Labor Statistics data, throughout the course of the pandemic, women have lost 5.4 million jobs, 1 million more jobs than men. And according to Oxfam International, women lost $800 billion in income in 2020 alone.

“This loss absolutely sets us back from a number of perspectives, including participation, lost innovation, and economic impact,” says Dorri McWhorter, CPA, CEO and president of the YMCA of Metropolitan Chicago and immediate past board chair of the Illinois CPA Society. “From a company’s perspective, it’s devastating. Organizations need to prioritize retaining women in the workforce as they look toward their own recovery.”

While many women lost their jobs to pandemic-related layoffs or furloughs, a new crisis for working women is looming. A recent study from McKinsey found that one in four women are considering stepping back from their careers or leaving the workforce altogether, compared to one in five men. This is a dramatic shift: Pre-pandemic research has never shown women voluntarily leaving the workforce at higher rates than men.

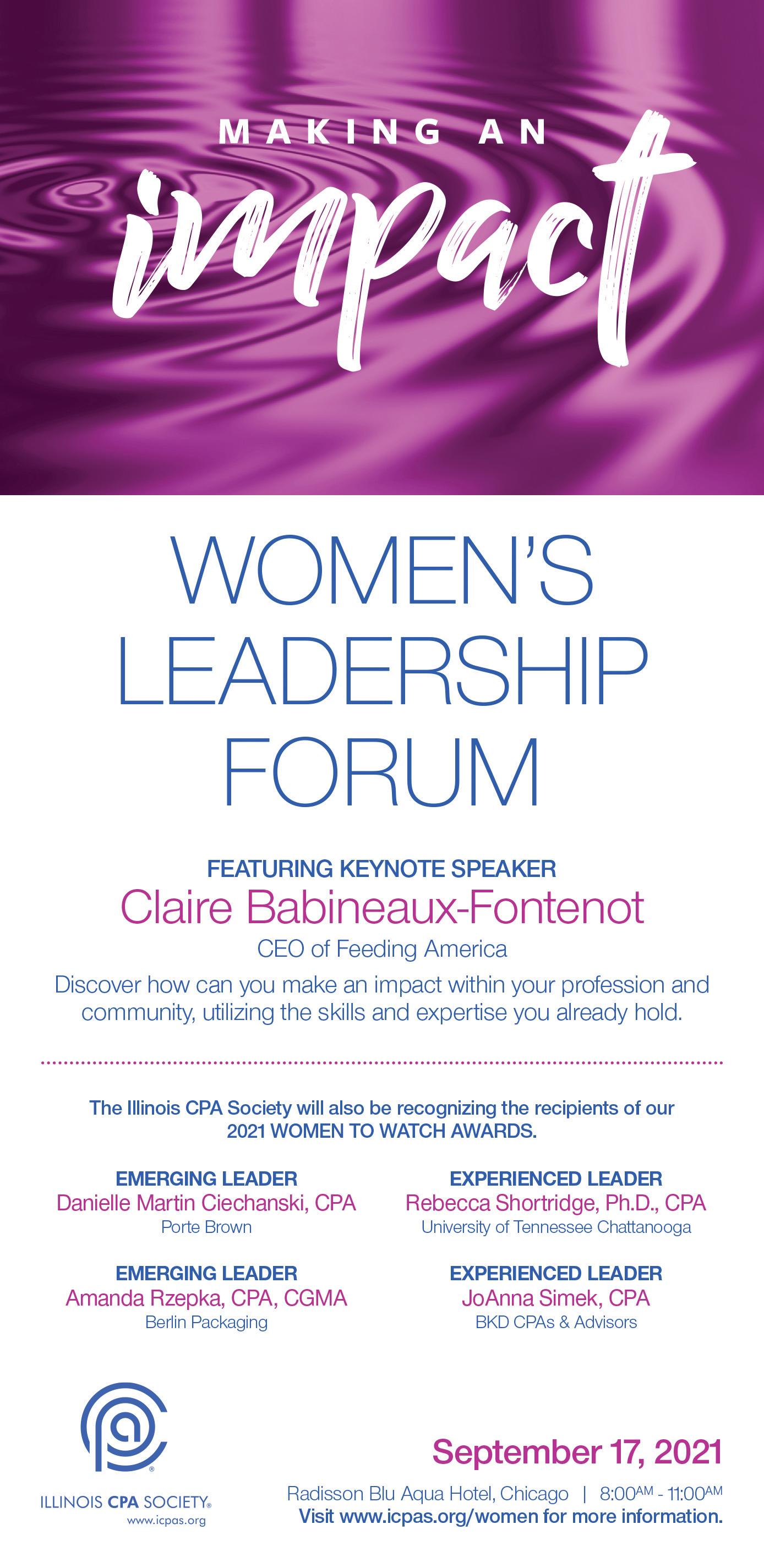

“Early on, I remember two fairly prominent CFOs—women who had been in that role for a long time—saying, ‘I need to help my employer find my successor because I’m leaving the workforce to care for my family right now,’” says JoAnna Simek, CPA, MST, partner at BKD CPAs & Advisors and an Illinois CPA Society 2021 Women to Watch award winner. “These are executives, and they feel like they can’t stay on.”

McKinsey’s research also showed that women in senior management positions, Black women, and working mothers face the biggest challenges in maintaining their career tracks or keeping their jobs. What makes it possible for some women to continue working, and even move forward in their careers, while others are laid off or forced to opt out? The same factors that have kept women from the workforce or caused them to leave in the past. Consider the outcomes of pay inequity during the pandemic: If one spouse makes significantly more than the other, whose career will be sacrificed to stay home and care for children or aging parents? It may make financial sense in that moment to keep the bigger paycheck, but it hurts everyone in the long run.

“Study after study shows that achieving gender parity across a number of factors will yield trillions of dollars. Pick a GDP, pick a country—it always improves, period,” McWhorter says.

For women in the early stages of their careers, remote work has made gaining key skills and experiences more difficult. “It’s challenging for people who are newer, as so much learning

and growth comes from observing the senior people in the organization,” says Hollis Hanson-Pollock, CPA, audit senior manager at Crowe and Illinois CPA Society 2020 Women to Watch award winner. “Observation is a huge part of learning how to communicate and interact in a business environment.”

Remote work offers another unique challenge for workers at any stage of their career, with or without families: the always-on dilemma. “In the CPA world, we’ve adapted well to working remotely, but it leads to a sense of always having to be available,” Simek says. “You can’t leave the office, close the door, and not think about work. Your laptop is always there on the kitchen table. It creates a lot of stress for people.”

The long-term effects of pandemic stress, or post-COVID-19 stress disorder, are still unknown, but they are apparent and far-reaching. Here, too, Henry J. Kaiser Family Foundation research reports that there’s a gender gap, with 53 percent of women reporting a negative impact on their mental health compared to 37 percent of men. That gap is even wider in mothers versus fathers. The same report found that 49 percent of women versus 40 percent of men say their lives have been majorly disrupted by the pandemic. “COVID-19 amplified everything, and it’s not just limited to women with families.” Simek says. “All of those gender issues that were already in play pre-pandemic just became magnified.”

Over the last 50 years, much work has gone into bridging the gaps between working men and women, but COVID-19 showed exactly how fragile that bridge was. As parental responsibilities increased when schools closed, the burden on women increased significantly more than the burden on men: An October 2020 Pew Research Center survey found that among employed parents who were working from home, mothers were more likely than fathers to say they had to juggle a lot of child-care responsibilities while working,

and working mothers with children younger than 12 at home were more likely than fathers to say it had been difficult for them to handle child care during the coronavirus outbreak. The result? Burnout, unfeasible choices, and women leaving the workforce.

“The burnout happens because women are not getting any separation from home duties while being at work, because now they’re at home, working. It’s impossible,” McWhorter explains.

While working mothers have been hit hard, unmarried or childless women face obstacles as well: The glass ceiling of advancement becomes that much thicker when women in senior management leave the workforce. Women are still underrepresented as senior leaders and partners in the accounting profession, and without their presence as mentors and advocates, women just beginning their careers face a dearth of role models.

“Having mentors is not just an important part of your development and training, it’s also a big part of your job satisfaction,” HansonPollock says. “It’s a big problem when your organization loses female leaders. When you’re thinking about your own career path, it’s helpful to see people you can identify with at the top.”

“There’s a real uneasiness about what the future holds and what that means for your own career progression,” says Lauren Bruce, CPA, CIA, director of internal controls at Abbvie and an Illinois CPA Society 2020 Women to Watch award winner. “In March of 2020, when we went into lockdown, I was about six months pregnant and had a four-year-old at home with me. Fortunately, when I got pregnant my mentors didn’t automatically say, ‘Well, I assume you’re in a career slowdown now.’ They said, ‘Let’s communicate and keep going.’ There wasn’t an assumption that I stopped wanting to grow and advance because I have two kids in a pandemic. I had my second daughter in June of 2020, took a nice maternity leave, and have been back at work—remotely—since September.”

There’s a bigger picture to look at beyond the individual impact of pandemic-induced career absence among women. “The talent loss is enormous,” Simek says. “That is the biggest problem: the loss of highly trained, highly technical, really smart people in the industry.”

With loss of talent comes loss of innovation. “Without the perspectives of women in the workforce due to this significant loss, we will absolutely lose out on innovation and ideas that help advance society,” McWhorter says. “There are also long-term impacts from an economic perspective: earning losses, less spending, and less retirement savings, all of which have a ripple effect.”

The accounting profession and individual organizations can respond in ways that exacerbate the issues, or finally help solve them. “Leadership embracing flexibility and understanding what it means to be a working mother makes a huge difference,” Bruce says. McWhorter also notes the importance of calls for flexibility from the top: “We’ve been extremely mindful of how we schedule meetings and have been asking our people to work with their leaders to accommodate their needs because we know there’s zero wiggle room now,” she says.

The flexibility offered must come without stigma, or the positive effects will be short-lived. “When my daughter was young, flexibility was an option, but came with potential repercussions,” Adam admits. The problem is an outdated model. “What we’ve done in the past is slightly tweak things,” McWhorter says. “I don’t think it’s fair to tweak the margins anymore. We must reimagine the world we’re now placed in—what makes sense and what doesn’t.”

To reimagine and recreate the structure of work—including mental health support, flexibility in scheduling and workspace, and modernized practical benefits—requires organizational openness and originality. “Visible relatable leadership is so important to show people many different paths to become successful,” Simek says. “People think it’s option A or option B. I’m in my job 110 percent, or I’m totally out. They need visible examples of people who have successfully gone with option C or option D.”

The pandemic has created a scenario of forced change, which can be funneled into forward momentum if organizations will listen to what women are telling them. “We need women articulating what they need, because they have a lived experience no one else has,” McWhorter says. Bruce agrees: “It requires being honest with those around you about what you need as well as knowing that what you need can change on any given day.”

There’s a risk in such honesty, just as there’s risk in organizational change. But a quick cost-benefit analysis is clear: Losing women in the workforce hurts the industry, the economy, and the women themselves. The pandemic has exposed the fragility of the gender equity work that has been done, but also created the potential for a massive shift. The future of work is wide open, and organizations have been offered the perfect opportunity to put an end to the impossible situation women have inherited and improve the workforce for everyone.

“Throughout my career, I’ve helped women get through all of it as much as I could. Because how do you choose between your family and your career? That’s the ridiculous choice we often have to make,” Adam says. After several months of uncertainty, she began working independently in real estate forensic accounting and consulting. “Why does a woman have to make this choice?” she asks. “That’s the heart of the problem.”

Annie Mueller is an experienced Puerto Rico-based financial writer. She is a frequent contributor to various industry publications.

You might need convincing, but it’s true: Narrowing your focus can actually expand your client base and help your firm flourish.

BY KASIA WHITE

ften you start your career as a generalist. But to grow, you have to find your niche—the unique corner of the world where you can become an expert. No matter the size of your firm, finding and embracing a niche industry is key to growth.

But where do you start? We checked in with four CPAs who serve different markets, including craft beer, tech startups, cannabis, and cryptocurrency/blockchain. Here’s how they each found their niche and some actionable insights on how you too can become a strategic business advisor to niche clients.

“We’re able to help our clients pivot and come up with ideas to provide new services or change how they sell to their clients,” he says. “We also helped them with their Paycheck Protection Program applications and their employer retention credits to where even though their businesses suffered, we were probably the last expense they would ever cut because we were providing so much value.”

That value comes from having deep industry knowledge gained from industry events, which Lance says are crucial to attend.

“We’re not necessarily looking to get new clients there. We sit in on sessions about brewing techniques, wastewater treatment, things that are not accounting topics but allow us to learn so much more about the industry,” Lance explains.

Lance also encourages fellow CPAs to network with some of the other professionals serving that niche industry, like lawyers, insurance agents, and bankers. “You learn a lot from making those kinds of connections—and they’re good resources,” he says.

If you’re unsure of what industry to niche into, Lance suggests looking at the clients you already have and enjoy working with.

“General accounting isn’t going to cut it anymore, and it’s not what clients want. They want experts in their industries; they want someone to do more than just tax work,” says Joshua Lance, CPA, Illinois CPA Society board member and managing director of the Lance CPA Group, a boutique virtual firm in Chicago.

That’s why when Lance started the firm in 2013, he knew he wanted to focus primarily on serving craft breweries from coast to coast.

“When you focus on a niche, specifically one industry, you’re able to provide a lot more service and a lot more value to those clients than a general accountant who serves a bunch of different industries,” explains Lance, who himself has a personal interest in home brewing. “We’ve been able to help breweries that are small and just getting off the ground as well as breweries that distribute in 30 states and have big operations. Through this, we’re going deeper into the industry and becoming better strategic advisors to our clients.”

In addition to standard bookkeeping and tax preparation services, Lance and his team put together an extensive benchmarking study each year, which provides their clients with insights into how they compare to their competition, how they can improve, and 12 key performance indicators to track.

“That shows our expertise in the industry because we can specifically pinpoint what items need to change for them and what they need to improve,” Lance says. “We also provide other advisory services, like forecasts, KPI analysis, and cash flow analysis.” To date, craft breweries account for about 40 percent of the firm’s portfolio, and Lance is cautiously optimistic about the industry’s growth.

“It’s been growing rapidly over the last 10 years or so,” he says. “The pandemic has had a bit of a negative impact on that. It’s still expected to grow, just not as fast as it did in the past.”

May 2021 research published by the Brewers Association shows that the retail dollar sales of craft beer decreased by 22 percent to $22.2 billion, and now account for just under 24 percent of the $94 billion U.S. beer market (previously $116 billion). The craft beer industry was hit hard by the COVID-19 pandemic as breweries were forced to close their taprooms, a main source of revenue. Despite this, Lance’s firm grew its brewery niche by 30 percent in 2020.

“You already work with those clients, so you already know something about their industry. Use that as a launching pad,” he says. “Dig into their industry, join their associations, and read their newsletters. Become a sponge to what’s going on in that industry, and then combine it with your accounting knowledge to focus on ways you can better serve and advise them.”

Illinois CPA Society member Michael Carney, CPA, president and founder of MWC Accounting in Chicago, understands the value of making industry connections.

“I’m really involved with the Founders Institute here in Chicago. It’s been a great referral source for me,” he acknowledges. “I will sponsor events there, get up and talk myself, and work with a lot of the Founders Institute alumni. It’s awesome because you start out with these clients from the very beginning. It allows you to help them grow and develop a healthy business every step of the way.”

Since 2009, Carney has focused on serving tech startups. Today, more than 50 percent of the firm’s client base has a heavy tech focus.

“We do everything from accounting, consulting, and tax returns to tax preparation,” Carney says. “We’ll handle outsourced CFO work and help them develop models, budgets, and financing rounds— whatever they need. We run the whole gamut.”

Carney’s words of advice for CPAs looking to enter a niche are simple: “Find something you enjoy. I’ve always enjoyed technology, so taking my accounting knowledge and applying it to that industry is fun—I might not be able to program an app to save my soul, but I could understand what they were trying to accomplish and speak their language.”

Carney believes that connecting to the niche on a personal, passionate level is the most important thing.

“If you have a passion for farming, go talk to farmers,” he says. “It’s really about getting out there and talking to people in the industry that you enjoy. I think that passion will come across to your clients and they’ll refer you to other people in that niche. You get to combine two things you enjoy—the industry you’re helping and the work you’re doing.”

Like Lance and Carney, fellow Illinois CPA Society member Curt Mastio, CPA, owner of Founder’s CPA in Chicago, believes that sharing a passion and language with your clients is critical when it comes to niche accounting. Hence, Mastio and his team of nine experts are fluent in the languages of cryptocurrency and blockchain.

Walt McGrail, CPA, managing director with Chicago-based Cendrowski Corporate Advisors, says the cannabis niche found him.

“I worked with a young attorney in Chicago who saw an opportunity to launch himself into a newly legalized industry back in 2015,” McGrail recalls. “He was willing to oversee my learning curve to make sure that I could provide him with the right expertise in this area. It was serendipity.”

Since then, McGrail has helped cannabis businesses and dispensaries with tax planning and business organizational structuring. The cannabis niche roughly translates to about 6 percent of the company’s top line. And while the cannabis space is the latest industry the firm is serving, McGrail says going niche isn’t anything new for Cendrowski Corporate Advisors.

“We made that decision 20 years ago,” McGrail says. “Very early on, we decided that the traditional green-visor accounting services shouldn’t be the entire scope of our practice. We branched out into things like valuation, expert testimony, and forensic accounting. So, when something new—like cannabis—came along, we weren’t afraid to jump in with both feet and take a stab at it.”

McGrail strongly advises other CPAs to consider the cannabis industry. “In my lifetime, the federal government will remove the undue tax burden on cannabis—even if they don’t somehow adopt it as a legalized substance—and that will create opportunities for folks like me,” he says.

In Illinois, dispensaries are on track to sell more than $1.5 billion worth of cannabis in 2021, according to data from the Illinois Department of Financial and Professional Regulation.

“I think cannabis as an industry will continue to grow,” McGrail says. “The weight of evidence is just insurmountable that the industry is here to stay. The best thing I can tell you is you probably have clients that are interested in the space—and they’re going to go somewhere else where they’ve got the expertise.”

But even if cannabis isn’t right for your firm, McGrail’s parting words of wisdom apply to all CPAs seeking their niche: “If you want to add an expertise or a new venture to your professional practice, you have to learn as much as you can about that industry or that particular aspect. You can’t go into it blind. You need to go out and educate yourself—whatever it takes so that you can provide expert advice to your clients.”

“I can’t count the amount of times I’ve talked to a high-net-worth individual who bought Bitcoin back in 2016 and told me they’ve talked to five accountants who said they did cryptocurrency tax returns but they didn’t really know anything about it,” he says. “You have to immerse yourself in that niche, in that industry, and really focus on it, and be able to speak the same language that your clients speak.”

When asked how he and his employees gained this specialized knowledge needed to serve the cryptocurrency and blockchain niche, Mastio answered simply: “Honestly, most of it just came from becoming personally involved in the space. We just started trading and then applying the accounting principles and tax knowledge that we already have. There are some good resources from a professional development standpoint, but it’s still a new industry that’s lacking in that regard. The best way that we found to learn is just to actively engage in that ecosystem.”

Even so, the team runs into hurdles. Mastio points out that one major challenge they face is the lack of guidance from the IRS or the AICPA when handling new types of transactions or topics in the cryptocurrency space, especially in decentralized finance. “We have to make judgment calls and look at what the transaction is most like in the universe of what we already know and advise clients to the best of our ability. I wish I could say we have this one resource with all the answers, but the space isn’t at that point just yet,” Mastio explains.

Currently, cryptocurrency and blockchain clients make up more than 25 percent of the firm’s book of business, and Mastio says he believes that interest in digital assets will continue to skyrocket.

“It hasn’t slowed down since we started getting involved with clients in that space,” Mastio enthuses. “You see a lot of institutional money starting to move into cryptocurrencies. You see companies like Tesla buying and holding it on their balance sheet. The younger generations of investors are more interested in holding something like Bitcoin than gold, and a big wealth transfer from the Boomers to the younger generations is expected over the next few years.”

Mastio and his small, yet nimble, team are ready to provide accounting, tax, and CFO services to those clients.

“The more you focus your attention on a particular customer profile and their particular needs, the easier it becomes to deliver on that and do so in a scalable and repeatable manner,” Mastio says. “The more you try to be a generalist and just take anybody who’s willing to give you a dollar for your services, the more you hold yourself back over time if one of your primary goals is to grow and scale.”

Kasia White is a freelance writer who specializes in profiling small businesses and leaders of global companies.

As the Asian American community experiences increasing violence, now is the time to offer understanding and support to the largest ethnic minority population in the accounting and finance profession.

BY CAROLYN TANG KMET2020 was a year of palpable angst here in the United States. A pandemic unprecedented in our lifetimes ran riot, and underneath the drumbeat of COVID-19 deaths and economic impacts we could hear the constant hum of racial tension. And while the ongoing protests over the deaths of Black Americans in police custody hit a fever pitch after the killing of George Floyd, communities already struggling with job losses and the deaths of loved ones found a scapegoat in Asian Americans.

According to analysis of police data compiled by the Center for the Study of Hate and Extremism at California State University, San Bernardino, anti-Asian hate crime increased by 146 percent across 26 of America’s largest jurisdictions in 2020. This increase in antiAsian sentiment correlated with the rise of COVID-19, often called by such stigmatizing terms as “Kung Flu,” “China Virus,” or “Wuhan Flu.” This trend in anti-Asian violence sustained through the first quarter of 2021, where police data from the 16 most populous cities in the country showed a 164 percent increase in anti-Asian attacks. In the first 89 days of this year, there were at least 95 incidents of reported anti-Asian hate crimes.

While this should concern all Americans, it hits especially hard in the finance and accounting profession. According to Data USA—a visualization engine developed by Deloitte and based on U.S. Census data—as of 2019, Asians make up 12.2 percent of accountants and auditors in the United States. This makes them the largest ethnic minority in the profession—and it makes the challenge to support our Asian American colleagues and fight the trend of anti-Asian sentiment all the more pressing.

For Asian Americans in the accounting industry, struggling with stereotypes and different expectations is part of the job. “We can’t change perceptions, but we can disprove them,” says Anna Gomez, CPA, a first-generation Filipina and Illinois CPA Society member.

Gomez holds a degree in economics from one of the top universities in Asia, and before coming to the United States in the early 1990s, she owned and operated two restaurants. But once she arrived in the States, it was a struggle to break into the professional workforce.

She took the first job she was offered as a “copy girl” for a law firm in Chicago, churning out copies eight hours a day.

“I found out pretty quickly that no one wanted to hire someone without a U.S. education or U.S. experience. It was a tough realization for me, a 24-year-old mother who thought she had everything figured out,” Gomez recollects.

The solution came from an unlikely source: A group of people on her daily train commute from Indiana to Chicago advised her to sit for the CPA exam. She didn’t pass on her first try. Or her second try. “But I kept on and I’m glad I did. The CPA certification made me a credible candidate for all my future jobs,” Gomez says.

Today, Gomez is the global chief accounting officer and international chief financial officer for IRI Worldwide and a published author of multicultural women’s literature. Throughout her career, she has championed diversity and inclusion and battled ageism, believing that the ideas, innovation, and progress that make businesses successful are the combined effort of diverse minds. She cautions against equating diversity with inclusion, noting that retaining and promoting diverse employees to leadership positions remains a challenge in many organizations.

“Diverse employees often don’t feel like they belong, or that they have the ability to progress in an organization that has no diverse role models at the top,” Gomez observes. “Inclusion means advocating for diverse talent in ways that will allow them to stay, grow, and succeed—and that means celebrating every single life story.”

Illinois CPA Society member Roxanne Chow, CPA, a secondgeneration Chinese American and senior manager in EY’s financial accounting advisory services practice, was shaken by the recent increase in attacks against the Asian community.

“What impacted me most was seeing the videos of Asian elders being punched or slashed. It felt like I was seeing my grandma, my cousin, my aunts or uncles being attacked,” Chow recalls. “Even though I felt personally safe in the very diverse, liberal bubble of Chicago, I was still terrified for my family.”

As a child, Chow remembers being embarrassed by her parents’ Chinese accent. She recalls wanting so badly to fit in, which to her meant being white. This feeling of being an outsider and struggling to fit in is an experience shared by many second-generation immigrants. But as an adult, she is proud and deeply grateful that her parents immigrated to the United States.

“They were incredibly courageous and brave to come to the United States and to communicate and interact in a language that was not their mother tongue,” Chow says.

Chow counts herself lucky that EY walks the talk when it comes to diversity and inclusion, treating them as business imperatives. Following the recent rash of race-motivated attacks, Chow was able to draw strength and support from her coworkers, noting that she was only able to have these very open conversations with her team members because organizational leadership had been very vocal in their support of the fight for equality and justice.

“Be visible and lead by example,” Chow says. “I always go back to, ‘What are the things I can change? What are the things that I can do personally?’”

Chow suggests donating time and money to organizations that fight back against hate crimes, as well as voting at the local, state, and national level. Chow herself volunteers for Ladder Up, a non-profit organization that provides free financial consulting to the underserved, helping with taxes, college financial aid, and financial literacy. “Donating money is important, but sometimes donating your time is much more powerful,” she says. “Become an advocate for rejecting aggression and hate and building awareness. Talk to anyone who will listen and share your perspective.”

Stella Marie Santos, CPA, a first-generation Filipina, has accounting in her blood: Her father was an accountant with the Philippine Commission on Audit and both of her sisters are CPAs. In 2011, Santos founded Adelfia LLC in Chicago with her sisters, and she currently sits on the Illinois CPA Society Board of Directors.

“We named the firm not after our own names as is typical of CPA firms, but with a name that every employee can take ownership and have pride in,” Santos explains. “Adelfia means brotherhood, sisterhood. We want Adelfia’s success to belong to the entire team. This foundational principle drives a feeling of equality among our team members.”

Santos’ warmth and smile are contagious, but sometimes those aren’t the first qualities people notice: Santos has been in situations where people make assumptions about her technical knowledge or ability because of her accent. “On multiple occasions, I felt some irritation from the person I was talking to because of my diction, and have sometimes felt dismissed,” Santos relates.

Santos suspects that today’s racial tension is partially a result of lagging economic conditions. “Many Caucasian Americans have been displaced in their work, and I think sometimes they think their jobs and opportunities were taken from them by a minority. I think that idea was encouraged by the previous presidential administration, and society has become really divided,” Santos says.

Of course, not all tension is born of anger—some arises from a simple lack of cultural understanding. During a regional audit, a client mentioned their surprise at Adelfia’s diverse team’s command of English. “We explained to them that in the Philippines, from elementary school until college, our medium of instruction is English,” Santos laughs.

Santos’ approach in fraught situations is to recognize that it is common for people to have a reaction to someone different from themselves. “When you feel as though your skills or abilities are being underestimated because of your heritage, try not to let those reactions make you feel like less of a person. Prove them wrong by communicating what you know and getting the job done. The quality of your work will speak for itself,” Santos advises.

More importantly, Santos advises approaching these situations openly and with empathy. “Sometimes their reactions or comments are due to a lack of awareness. Let them know how they made you feel, but in an empathetic tone. Share with them stories of where you came from, how you were educated, and the experience you have gained. When you share your story, your human spirit comes out,” Santos says.

Santos is conscious that sometimes she also makes assumptions about others, relating an instance where she approached a client because she felt their tone was undermining her work. “She assured me that’s not at all how she meant it. That moment opened my mind, because I realized I was reading too much into what she had said,” Santos shares.

During that discussion, both the client and Santos realized how much their preconceptions of each other impacted their communication. Today, they are very good friends.

“The lesson I learned is that we have to understand each other. I think the reason we’re having these problems is because one side or the other tends to be closed-minded. When there is closedmindedness, how can we have reconciliation?” Santos says.

Faye Zhang, CPA, is an audit manager at Crowe LLP and an Illinois CPA Society member and while accounting came naturally to her, math did not. “Because I’m Chinese American, people assume I’m good at math. In group projects in college, they would try to hand me the math-heavy portion of the work, and I’m like, ‘I don’t know how to do this,’ Zhang laughs.

She advises her fellow minority accountants to own their abilities and to be proud of them. In too many cases, she says, younger interns and new hires are hesitant to share their accomplishments.

“I do a lot of interviews for my firm. Some people come in with this really amazing resume and when I ask them questions about it, they’re super shy about the work they did. You have to bring it out of them, and prompt them with, ‘Oh, what did you do there?’” Zhang says.

She encourages her fellow young minorities to understand their worth and be more assertive. “Don’t sell yourself short. Go fight for the same opportunities—you’re worth it,” she says.

As Asian Americans in accounting and finance take steps to own their worth and push forward, the rest of us must also step up and do our parts to make the profession more welcoming by embracing the unique stories and perspectives within our organizations, putting aside preconceptions, and pushing back against hateful attitudes and actions within society as a whole.

“I do think this country is great. I do think there are so many amazing people out there. If we can all do our part, even if it’s a just a little one, we can make this world a better place,” Chow says.

Carolyn Tang Kmet, MBA is a senior lecturer at the Quinlan School of Business at Loyola University Chicago and the director of affiliate marketing for Groupon.

CAMICO ® policyholders know that when they call us, they’ll speak directly with in-house CPAs, JDs and other experts. We have dedicated hotlines for loss prevention, tax, and accounting and auditing issues. You can call as often as you need and consult with experienced specialists — all at no additional cost. No one knows more about the profession, because we provide Professional Liability Insurance and risk management for CPAs only — it’s all we’ve done for 35 years and why more than 8,000 CPA firms insure with CAMICO.

To learn about CAMICO or to receive a coverage quote, please contact Harris Hauptman.

See

CAMICO. Visit www.camico.com/testimonials

Harris Hauptman Senior Account ExecutiveT: 800.652.1772 Ext. 6727

E: hhauptman@camico.com

W: www.camico.com

As stay-at-home and similar restrictions are being lightened or lifted across the country, you are likely wondering what going back to the of昀ce will look like for your 昀rm, your staff, and your clients as you adapt to this “new normal.” In this post, we’re digging into some things that accounting professionals will want to keep top of mind as they consider re-opening and start getting back to business as usual, with the strong caveat that “usual” is going to be a relative term in the coming months.

When thinking about returning to the of昀ce, safety is the thing that most people are concerned about, and so it needs to be your primary focus. What does that look like practically in your office, though? Here are a few tangible examples of what you can do to alleviate fears and make your workspace safer for everyone.

Most people have been conditioned recently to maintain at least 6 feet of separation between themselves and someone else, to help limit the spread of germs. Many of your staff will feel most comfortable maintaining this same separation in your office. If you can, move workspaces or stagger your staff, so that people can remain 6 feet apart while working.

Make sure that you are well-stocked with cleaning supplies throughout your of昀ce. In addition to providing antibacterial hand soap in the restrooms and hand sanitizer throughout the of昀ce, you’ll want to disinfect surfaces with products that meet the EPA criteria for use against SARS-COV-2. You might also want to consider a professional cleaning crew who can come and give your of昀ce a thorough cleaning at intervals of your choosing. Also have a plan ready for how you are going to restock your cleaning supplies.

Don’t wait for chaos to come to you—be proactive in how you will deal with a potential breach in your safety protocols. The moments and days after something bad happens probably isn’t the best time to start thinking about what the right course of action is. What happens if someone who is working in the of昀ce tests positive for COVID-19? What if someone’s immediate family member tests positive? Your team is likely to have all of these questions and more, so prepare in advance and make sure you have plans and backup plans for a variety of healthcrisis scenarios. How you respond to these variables will likely depend on the size of your of昀ce and your staff’s 昀exibility to work from home and the of昀ce. Much grace will need to be given over the coming months as we all adapt to the 昀uctuations that accompany COVID-19.

Once you’ve made the decision to re-open your of昀ce and you have all necessary cleaning supplies and plans/procedures in place, you’re ready to start thinking about opening the doors and letting people come back to the of昀ce. However, you’re not simply 昀ipping a switch, throwing open the doors, and returning to the way things were in early 2020. Here are a few things to keep in mind when sending out the signal for folks to come back to the of昀ce.

In order to maintain proper social distancing, consider staggering your staff’s return to the of昀ce so that people have plenty of room to do their job while still staying a safe distance apart. There are a few ways you can do this; one option is to kick off a voluntary return to the of昀ce. This way, people who are more productive and successful in the of昀ce can put their names down 昀rst, while those who are successfully working from home or who have mitigating circumstances can continue to work remotely. A voluntary return also gives your staff more personal autonomy to make a choice with which they are comfortable.

If you have more people who volunteer to return than you can accommodate whilst maintaining social distancing, consider a rotating schedule so that a set max number of people can enjoy working in the of昀ce each day. Keep in mind, you will likely have a “hybrid setup,” where some, but not all, of your team is present in the of昀ce. Expect to have this hybrid system for a few weeks to months while situations progress and slowly normalize.

Some members of your team are going to have a harder time returning to the of昀ce than others. This could be parents whose child care is no longer available, those caring for elderly or immunocompromised relatives, or those with health concerns themselves. It’s important to be as accommodating as you can for these individuals. While the rest of your staff might be eager to be back in the of昀ce, be understanding of the very real dangers and hardships these individuals are dealing with and how that could in昀uence their decision to come back to the of昀ce or continue working remotely. In addition, liability for employers in relation to COVID-19 is still up in the air, and great care should be taken if you are considering a blanket “everyone returns to the of昀ce” mandate.

At this time, it’s not just the needs of your colleagues you need to consider, but also the needs of your clients. While much, if not almost all, of your work has likely been done face to face in recent years, the last few months have shown that providing exceptional client support and superior services are possible, even in remote working scenarios. With this in mind, know that one of the most impactful things you can do to impress your existing clients and bring in new clients is to be accommodating.

All the circumstances we mentioned above regarding your colleagues will likely apply to your clients, and prospective clients, as well. Some will have limited to no child care. Some will be caring for sick family members, or dealing with illness themselves. The more you can be 昀exible and accommodate their preferred communication, meeting, and payment preferences, the better.

Let your clients set the tone for how you interact, and give them multiple options. Let them call in for a meeting in lieu of an in-person conference, or set up a Zoom call if you want to be able to video chat. Allow clients to pay for your services online through an accounting-specific payment solution like CPACharge so that paying is fast, simple, and convenient. You’d be hard-pressed to find someone who wants to pay with cash at this point in the pandemic.

The more accommodating you can be with your clients now, and in the months and years to come, the more likely they will be to come back to you and recommend your services to others. Doing everything you can to delight your clients now and exceed their expectations will set you up for future success in the post-COVID-19 world to come. The challenges aren’t going away any time soon, but it is still possible for your 昀rm to rise to the occasion and thrive, even in uncertain times.

If you’re interested in learning how CPACharge can bene昀t your 昀rm, visit cpacharge.com/icpas or call 866-526-7320. ICPAS members get their monthly program fee waived for three months.

The pandemic has highlighted the importance of mental health, physical health, and healthy boundaries— here’s what organizations can do to promote wellness in the workplace.

At the beginning of the pandemic, we all had high hopes: We would work out more, start meditating, or spend more time with our families. But as it became clear that the pandemic was more of a marathon than a sprint, we began to face obstacles: unhealthy work boundaries, anxiety and depression, feelings of burnout, and some of us may have even worked out less.

This makes the pending return to normal the perfect time for organizations to take a long look at workplace wellness and see what changes they can make to foster health in body, mind, and workplace culture. Here are four things I learned over this past year that have enhanced my personal wellness and allowed me to make my workplace a healthier place for everyone.

In a recent class, the facilitator made a provocative statement: “Your staff does not show up as their authentic selves.” The problem is that organizations go out of their way to promote and encourage work-life balance—a largely outdated concept that may no longer exist in a post-pandemic world. When we tell our employees about our commitment to work-life balance, we are inadvertently telling them they must separate their work from their “real” lives and try to balance both in a way that is essentially no longer possible. Because of this, my organization is making the switch from work-life balance to work-life integration.

What’s the difference? Work-life integration means realizing the defined workday is outdated. It means that leaders recognize that there will be times during the workday that employees will need to take personal calls, meet the plumber, or run errands. It also means there will be times when employees may have to work longer hours to meet important deadlines. One way in which organizations can embrace this shift is emphasizing project or task completion rather than hours logged. The payoff for this shift is meaningful: Employees will be better able to integrate their real lives into the workplace. And 2020 research by the University of Arkansas shows that employees are more productive when they can be their whole, authentic selves.