Falling in Love With Corporate America

The idea of the soulless

is becoming a thing of the past as more companies focus on not only doing well, but also doing good

The idea of the soulless

is becoming a thing of the past as more companies focus on not only doing well, but also doing good

As the experts in nancial recruiting and sta ng, Accounting Principals and Parker + Lynch know the Chicagoland area inside and out. We have an intimate understanding of the local job market, salary trends and business climate, which helps us connect great talent to great companies better than anyone else in the industry.

To learn more, visit us online or call your local o ce.

when i joined the illinois cpa society back in 1998, i thought this must be a pretty staid profession. how wrong I was.

As I look towards the New Year, I realize that CPAs, more than ever, are performing what used to be called “nontraditional services.” This came to roost in my own home not so long ago with my son, Michael, who was then enrolled in the business school at the University of Illinois, Urbana-Champaign. After a fair amount of discussion with the CEO of the Illinois CPA Society (aka dad), Michael decided to major in accounting, though he was unsure about the “traditional” areas of audit and tax In his junior year, he interviewed for an internship with the Deal Advisory group at a Chicago accounting firm. The rest, as they say, is history. He graduated in May 2014, started working at the firm and passed the final part of the CPA exam this past February.

I write about Michael’s experience not as a parent, but more to highlight the increasing number of CPAs who practice in areas other than audit and tax In essence, we’re seeing an expansion of consulting services to include areas such as personal financial planning, strategic consulting and outsourced CFO services, to name a few This phenomenon really shows the power of the credential and solidifies the CPA as the trusted business advisor

What does this accelerating expansion mean for the profession? In a word, opportunity.

Last year I met with about 25 small firms and sole practitioners over breakfast One of the things these practitioners brought up was the Society’s radio advertising campaign to promote the profession and the CPA credential They asked me to talk about not just tax, but also the CPA’s role in providing business counsel We discussed how consulting was becoming a bigger part of the practice and a very profitable one at that. As has been said throughout history, accounting is the language of business and CPAs know accounting It’s a win-win for clients too, since they benefit from the positive growth and management of their businesses.

The expansion of CPA services also helps when it comes to recruiting new, young talent I’ve seen this firsthand with Michael The trend is that while there are more accounting majors than ever before, the number of graduates sitting for the CPA exam is flat or declining. Therefore, the more opportunities available outside of traditional services, the greater the chance that young talent will see public accounting as a means to advance their career goals rather than looking elsewhere for those opportunities.

That said, we can’t take our eyes off audit and tax services, or understate their importance Countless individuals and companies rely on CPAs for tax preparation and advice; CPAs are the only professionals who can perform financial audits and, as such, they carry the responsibility of protecting the public good

The expansion of CPA services is just one of the issues we’ll be talking about in 2016. Hot topics extend from the CPA pipeline and diversity and inclusion to ongoing challenges with practice monitoring and everything in between. You’ll hear more on these in future columns.

On a personal note, I’ve learned that this is a constantly changing profession with new opportunities every day I am humbled to be the CEO of one of the nation’s leading state CPA societies, charged with the inspiring mission of “Enhancing the Value of the CPA Profession.”

A healthy, joyous and prosperous New Year to you all

Publisher/President & CEO Todd Shapiro

Editor-in- Chief Judy Giannetto

Art Direction & Layout Judy Giannetto

Production Design Rosa Garcia

Assistant Editor Derrick Lilly

Photography Jay Rubinic, Derrick Lilly, Nancy Cammarata

Circulation Carl Siska

National Sales & Advertising

Michael W Walker

The RW Walker Company P: 213 896 9210

E : mike@rwwcompany com

Editorial Offices

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

Chairperson, Edward J Hannon, CPA, JD, LLM Quarles & Brady LLP

Vice Chairperson, Scott D Steffens, CPA Grant Thornton LLP

Secretary, Lisa A Hartkopf, CPA Ernst & Young LLP

Treasurer, Margaret M Hunn, CPA, CFE, CFF Rozovics Group LLP

Immediate Past Chairperson, Daniel F Rahill, CPA, JD, LLM FGMK, LLC

Brent A Baccus, CPA, Washington, Pittman & McKeever, LLC

Jared J Bourgeois, CPA/ABV, CFE PricewaterhouseCoopers LLP

Terry A Bishop, CPA, Sikich LLP

Rose Cammarata, CPA, CGMA, CME Group Inc

Jon S Davis, CPA, University of Illinois at Urbana

Rose G Doherty, CPA, Legacy Professionals LLP

Eileen M. Felson, CPA, CFF, PricewaterhouseCoopers LLP

Gary S Hart, CPA, MBA, Gary Hart & Associates, Ltd

Jonathan W Hauser, CPA, KPMG LLP

David V Kalet, CPA, MBA, Retired

Thomas B Murtagh, CPA, JD, BKD, LLP

Elizabeth S Pittelkow, CPA, CITP, CGMA ArrowStream, Inc

Kelly Richmond Pope, Ph D , CPA, DePaul University

Kevin V Wydra, CPA, Crowe Horwath LLP

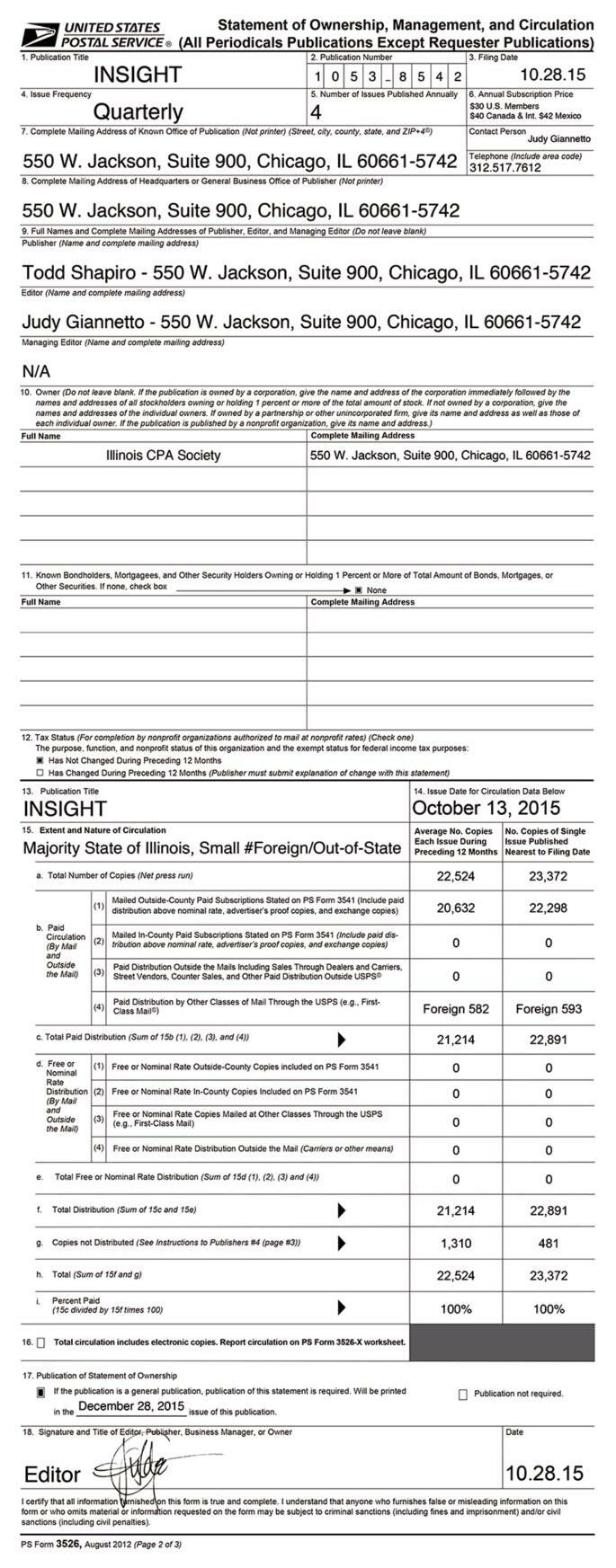

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Fall, Fall, Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312 993 0407 or 800 993 0407, fax: 312 993 7713

of the contents may be reproduced by any means without the written consent of INSIGHT

Specialist, at the address above

predicted 2016 sal ary bump for accounting and finance professionals. [accountemps]

The answer to workforce contentment, apparently, is free food Yes, the stomach is the way to an employee’s heart, according to a new study released by Illinois-based grocery delivery service Peapod The study found that companies offering free food and snacks at the office generally boasted happy, productive, hard-working employees Specifically, while 56% of the full-time workers surveyed said they are either " very happy" or "extremely happy" with their jobs, percentages got a major boost to 67% among employees who are also offered free food What’s more, 48% of Millennials said their decision-making processes rely heavily on the quantity and quality of employee perks free food included Your next employee retention investment might well be a gourmet food truck

For financial planners and advisors, at least, it seems several demographic groups are underrepresented FINRA Investor Education Foundation’s report, A Snapshot of Investor Households in America, reveals that 36% of “white households” own taxable investment accounts, compared to 25% of Hispanic and 22% of black households Households headed by Millennials (20%) and single women (15%) are also less likely than caucasian and Baby Boomer (40%) households to hold taxable investment accounts

For the first time in five years, business leaders rated the United States as their most important market for overseas growth, according to PwC ’ s Annual Global CEO Survey Specifically, 61% of global CEOs and 67% of US CEOs believe their companies have more growth opportunities today than they did three years ago Other important overseas markets for business growth ranked by U S CEOs include China, Germany, the United Kingdom, Canada, Mexico, Brazil and Japan

“If I had a dollar for every time someone came to me with not only a problem but also a possible solution to that problem, I’d have six dollars.” Brian Vaszily

ialists, w t t C t et a Fi tem inancial S y u th suppor vide y e developed a un ne danc e the one-on-one t s ca s o to pro o c ou t nee s our g guidance eed , ommunication o b and reso u t e es ou a you w ur o build your business you y.

$1,055,173.69

elvis presley’s non-interest-bearing checking account bal ance upon his death. [BPP401K.com]

Illinois taxation debates always come with a lot of hoopla, but maybe things are actually getting better In the Tax Foundation’s 12th annual State Business Tax Climate Index, Illinois ranked as the 23rd most competitive tax code in the nation, an eight-place jump from last year Part of the reason is Illinois’ decision to sunset its temporary corporate and individual income tax increases, intended to address the state’s backlog of unpaid bills Overall, the report measures how well- structured each state’s tax code is by analyzing more than 100 tax variables in five different categories, including corporate, individual income, sales, property and unemployment insurance taxes States are called out for overly complex, burdensome and economically harmful tax codes but rewarded for transparent and neutral tax codes that do not distort business decisions Here’s how Illinois fared (1st is best, 50th is worst):

n Overall tax climate #23

n Corporate tax structure #36

n Individual income tax structure #10

n Sales tax structure #33

n Property tax structure #45

n Unemployment insurance tax structure #39 For the full report visit taxfoundation org

9% increase in e-filed business tax returns in 2015. [IRS]

Only 100 of the 10k multimillion-dollar consumer companies around the world can claim to be an “apostle brand” one that inspires enduring trust, loyalty and virtually evangelical endorsement among customers, according to Rocket: Eight Lessons to Secure Infinite Growth, the latest book from The Boston Consulting Group (BCG) Rocket tells the story of 16 business leaders, illustrating how each made their customers fall in love with them.

Eight rules to help forge that emotional connection include:

1) Your customers won’t know what they want until you show them

2) Woo your biggest fans, because they ’ re absolutely worth it

3) Welcome customer scorn, because you’ll come back stronger

4). Looks count people really do judge a book by its cover.

5) Transform employees into passionate disciples love is infectious

6) Ramp up your virtual relationships; that’s what customers are doing

7) Take giant leaps, because you ’ re not going to win with timid ones

8 ) Learn all about “schismogenesis” how brand love can turn to hate

The Trans-Pacific Partnership (TPP), a new trade agreement between the United States and several Asian nations, could be a boon for Illinois’ economy, according to U S Secretary of Commerce Penny Pritzker She points out in a Chicago Business Journal interview that more than 56% of Illinois' exports went to TPP nations in 2014, worth about $38 3B The TPP is expected to strengthen trade and lower the costs of doing business in these markets by eliminating 18,000 tariffs on American-made products, including Illinois' top exports of chemicals, machinery, and information and communication technologies

An October 2015 Google Consumer Survey for GOBankingRates com reveals that approximately 62% of Americans have less than $1k in their savings accounts Even worse, 21% don’t have a savings account at all And in case there was any doubt, a similar survey by personal finance site Bankrate com found that 62% of Americans have no emergency savings for things like an ER visit or car repair In fact, in an emergency, consumers would cut spending (26%), borrow from family and/or friends (16%) or use credit cards (12%) It seems the country ’ s most recent recession is a major culprit of the U S savings crisis According to a U S Federal Reserve survey, among those who had savings prior to 2008, 57% used some or all of their nest eggs in the Great Recession

Driverless cars may be far out in the future, but Advanced Driver Assistance Systems (ADAS) features like forward collision warnings, adaptive cruise control, blind spot detection, night vision, and more could dramatically reduce accidents if stakeholders and consumers jump onboard, says The Boston Consulting Group (BCG) in its report, A Roadmap to Safer Driving Through Advanced Driver Assistance Systems If widely adopted, ADAS -equipped vehicles could prevent 28% of all auto accidents in the United States, reducing costs by $251B, and saving nearly 10,000 lives annually According to U S government estimates, auto casualties and repairs cost the country nearly $910B a year, or about 6% of the U S GDP

63%

It’s unpleasant to have people looking over your shoulder and to catch prying eyes watching your laptop HP’s solution to nosey individuals is to upgrade its line of business notebook PCs with 3M privacy screens The new machines, to be released in 2016, will likely offer an on-demand electronic privacy solution that limits viewing to only the person looking at the screen head-on, and allows users to enable or disable the security screen as needed

Documents, books, photos, receipts scanning is made easy with the Zcan Wireless mouse Simply swipe over what you want to digitize and you’ll have a digital file at your fingertips instantly The Zcan Wireless mouse features built-in OCR tools that stitch and convert scanned images into editable and searchable Word, Excel or PowerPoint formats, and even allows you to convert or translate text into 200 languages This productivity mouse works with Windows and Mac devices and is available in wired and wireless versions. Learn more at d-toi com/zcanwireless html

Luxury electric car manufacturer Tesla Motors is on track to open a Michigan Avenue showroom The luxury automaker would be the first to land space on the Mag Mile Tesla’s vehicles have become somewhat of a status symbol, so it ’ s fitting that its flagship showroom will likely fill the space previously occupied by Giorgio Armani at 800 N Michigan Avenue Tesla currently has four stores or galleries in Illinois, including one in Chicago, Highland Park, Oak Brook and Skokie

As of June 2014, total global losses from cybercrime rounded out at $445B With the number of cyberattacks growing, the cyber-risk insurance market has grown from $850M in 2012 to an estimated $2.5B in 2014, according to a report from Timetric. The need for cyber-risk insurance reportedly has ballooned among businesses that hold sensitive consumer information, like financial services organizations, telecom companies and other retailers Additionally, it ’ s predicted that world governments will become increasingly involved in combating cyberthreats In Europe, for example, a new General Data Protection (GDPR) law is expected to come into force by 2017, making data breach notification compulsory and increasing company penalties Mandatory cyber-risk insurance seems soon to follow

I do a lot of presenting and attend a lot of meetings as a part of the Society ’ s Member Outreach team In every situation, body language proves to be my best ally Here are four tips I’ve learned along the way

1. Use a power pose to boost conf idence. These poses raise testosterone levels and reduce cortisol levels to ease your anxieties

2 Remove physical bar r iers Crossing your arms or holding a cup of coffee in front of you gives the impression that you ’ re putting up barriers and closing off channels of communication, even if that ’ s not your intention.

3 Smile to encourage positivity A simple smile goes a long way in demonstrating that you are approachable, friendly and cooperative

4. Talk wit h your hands. Gesticulating helps you clarify your thoughts and ideas, so go ahead and let your hands do the talking

Make a campus connection

Practice your public speaking skills by presenting to Illinois accounting students The ICPAS travels to campuses across the state and encourages members to share advice with a captivated audience For more information, simply email me at herrmanns@icpas org

How did you get the job everyone wants? “After six years at KPMG, going through busy seasons, I decided it was time for a change I was specifically looking for a controller position, and as luck would have it, I saw a job posting for a controller at the Chicago Fire Soccer Club. After reading the job description, I realized this was my dream job I grew up watching the Fire and followed the team since the inaugural season in 1998 My dad would take us to games at Soldier Field and we had a blast cheering on the Fire That's when I started following soccer. It also helped that three former Polish National team players were playing for the Fire, one of them being my favorite soccer player of all time, Piotr Nowak.”

Is Nowak your role model? ”I’m a big fan, but really my role models are my parents They worked hard all their lives to make sure my siblings and I were set up to succeed. The number one goal for them was having all three of us graduate from college. They succeeded in that ”

What’s the biggest perk of working with the Chicago Fire? “There are too many to list, but I would say that one of them is working for a sports team t h a t I i d o l i z e d a s a k i d . A s e c o n d o n e i s w o r k i n g w i t h v e r y t a l e n t e d a n d motivated individuals who have a true passion for the sport and the team ” What made you decide to become a CGMA? ”The CPA’s role is always changing, and accountants are constantly tasked with looking at various areas of the business to make informed decisions and contribute to the company’s strategic plan The CPA is not just a number cruncher The skills necessary to be successful and move up the ranks include business, people and leadership skills, all of which are tested as part of the CGMA exam ”

What’s your best advice for young pros? “Work hard, stay humble ”

Eight must-have apps for smartphone savvy CPAs.

By Derrick Lilly and Jabari Jones

By Derrick Lilly and Jabari Jones

Bigger, better, faster is the name of the game So start playing it If you’re never without your smartphone, tablet or laptop, make the most of them for business of course Here we highlight eight proven apps that will help to make you more efficient and productive and a positively tech-savvy accounting and finance pro

If you have too many passwords to remember and really, who doesn’t? the 1Password app has cracked the “forgot your password” code F r o m e m a i l l o g i n s t o b a n k a n d c r e d i t c a r d a c c e s s c o d e s ,

and organizes all your passwords, and makes them accessible through a single master p a s s w o

your favorite websites right from the app, so you can skip the typical username/password entry steps altogether The 1Password app is available for Windows, Mac, Android and iOS devices a n d o f f e r s a f r e e 3 0 - d a y t r i a l b e f o r e a p a i d licensed version is required

W h e t h e r y o u ’ r e t r a c k i n g t i m e a n d m i l e a g e , recording business receipts, importing all your credit card statements, or trying to make sense o f y o u r f o r e i g n t r a v e l t r a n s a c t i o n s , E x p e n s i f y means you can stop dreading expense reporting altogether Don’t believe us? With over 2 5 million users and 300,000 companies around the world using Expensify, the tech community regards it as today’s leading expense reporting

app Expensify is available for Android and iOS devices and offers a free 30-day trial before a paid subscription is required

Every finance and accounting pro needs a secure portal for sending or sharing important files and documents with clients and colleagues, right? Dropbox allows users to store their digital forms, files, photos, videos and more in a secure cloud storage space that’s accessible via any Internet-connected device, like your laptop, tablet or smartphone Dropbox offers desktop and mobile solutions that automatically sync together, and there are free and subscriptionbased solutions for all.

Used by Apple’s own pros, at a mere $5.99 Notability is arguably one of the best note-taking apps for iOS devices (iPhone, iPad, Mac) Annotate documents, sketch out illustrations, record lectures, write notes, edit images and more with this intuitive app that’s intended as a productivity powerhouse Notability has a variety of text, voice and graphic tools that make creating notes and documents simple, collaborative, and easy to share via email, Dropbox (hint, hint), Google Drive and AirDrop

Scanners are pretty handy, but they’re not exactly portable Thankfully the Scanner Pro app makes scanning on the go quick and easy with nothing more than your iPhone or iPad camera Scanner Pro converts all sorts of paper documents into professional-looking PDF files paper documents, receipts, checks, contracts whatever it is that you need to digitize Scanner Pro also integrates with your email, Dropbox (you’re using this now, right?), Evernote, Google Drive and iCloud to make saving and sharing your files even easier For $2 99, this may be one of the best-value apps you can buy for your iOS devices.

Counting on your fingers does nothing for your image. Thankfully, the PowerOne Finance Pro Calculator puts the pro back in professional with its algebraic calculator that allows you to calculate complex formulas for mortgages, real estate, financial investments and much, much more It even allows you to create custom templates for equations you use over and over. The PowerOne Finance Pro Calculator app is free to try and cheap to buy, so get it for your Android and iOS devices now

Simply can’t keep away from your smartphone? Focus Lock is your best option if you love your social, game-playing and shopping apps a little too much Simply select the apps that are distracting you most and Focus Lock physically locks you out of them for a set amount of time. You can then reward all of your hard work with s c h e d u l e d b r e a k s t h a

When your break time runs out, your apps are locked and it’s back to being a productive professional. Best yet, this is a free app for Android devices

Every pro needs to stay in the know Here then is a free app that doesn’t disappoint. CNN Mobile has you covered when you’re on the go with an app that streams the latest stories and breaking news from around the world Displayed in a mobile-friendly layout, from business and politics to entertainment, it’s easy to find the headlines that matter most from any Android or iOS device

Between 80 and 90 percent of accounting and finance professionals will work with a recruiter at some point in their careers, according to John Bullock, practice manager in the Finance Division of Chicago-based Advanced Resources. “In today’s market, a talented candidate may be one of thousands applying for the same job,” he explains. “If you partner with a recruiter, there’s a greater likelihood that you’ll have a direct line to the hiring manager.”

“A good recruiter can help to identify appropriate openings and work with you throughout

the hiring process to eventually land that great new job,” adds Marilyn Bird, district president for Robert Half in Chicago

Not only that, but they can get you post-interv i e w f e e d b a c k t h a t ’s d i f f i c u l t t o g e t o n y o u r own “The hiring process can be daunting to the average applicant. Often candidates don’t even know if their resume was received by a company,” Bullock explains. “Others may go on two interviews and then never hear back Recruiters w o r k c l o s e l y w i t h h i r i n g m a n a g e r s , w h i c h ensures you’ll get the feedback you need.”

So how do savvy finance pros find the best recruiters? Here are six tips.

Don’t limit your search; rather, take a broad strategy that calls on multiple recruiters to build and leverage multiple professional networks

“I’ve worked with many different recruiting firms. As a candidate, you can’t attach yourself to one recruiter,” says James Miranda, vice president of corporate finance and accounting operations at AIT Worldwide Logistics in Chicago. “You need to focus on multiple recruiters, because some search firms specialize in particular industries ”

“Just as you would research any employer you plan to interview with, you should research recruiters before you contact or meet with them as well,” says Bird. “Look for a recruiter with a proven track record in placing people in the kinds of jobs in which you’re interested ”

By targeting recruiters that specialize in placing accounting and finance professionals specifically, you’ll be able to tap into the expert industry knowledge and professional networks necessary to find precisely the right jobs

“In addition, look for a staffing firm that provides access to online training and other career resources,” Bird suggests.

3 Tap into your own network

Network with friends and colleagues to get word-of-mouth recommendations. If you’re a member of a professional association, get in touch and ask if recruiter referral services are available Also take advantage of social media to find the most highly rated firms and to read “user” reviews Take a look at Glassdoor com and HeadhuntersDirectory com for starters

4. Make yourself the priority

Narrow in on a recruiter that really takes the time to understand your motivations and career aspirations, rather than viewing you as part of a recruitment production line

“A good recruiter understands the industry and the subtle but important differences in different positions,” says Bird. “A good recruiter should take the time to talk to you and really understand your experience, skills and career goals Job opportunities presented to you should match your skills and interests You shouldn’t be connected with jobs for which you’re under or overqualified, for example ”

A good recruiter will not try to “put a square peg in a round hole,” Bullock adds

5. Nurture relationships

Regular contact with recruiters is important to long-term success “If a candidate can be responsive and communicate regularly, that’s half the battle right there,” says Bullock. Regular contact might include updating the recruiter on any new skills or certifications received or any changes in career goals and priorities

6. Go in prepared

Once you have a meeting with a prospective recruiter scheduled, take the time to prepare for your interview. At the very least,

n Update your resume

n Create a customizable cover letter summarizing your skills

n Prepare a list of references and make sure you have their permission

n Prepare answers to common interview questions

n Research salaries for your current position or the position you aspire to

If you’ve taken all the necessary measures to find just the right recruiter and establish a relationship for the long-term, the next most important step is to take their advice

“ R e m e m b e r, t h e y ’ r e e x p e r t s a t f i n d i n g f i n a n c e p r o f e s s i o n a l s r e w a r d i n g e m p l o yment opportunities,” says Bird “They do it every day, so job seekers are smart to listen to their guidance and follow it ”

Resources to navigate the upcoming busy season.

• Tax Alerts and Articles - Original insights written by the ICPAS Taxation Committees.

•Practice Advantage - ePublication delivered to your inbox twice a month.

• The NETWORK - Live help from tax committee members who provide quick, informal assistance for tax questions.

• Find a CPA Directory - Online directory of firm profiles that is searchable by consumers.

• Hire Tax Season Staff - Post your permanent and seasonal job openings and search resumes.

• Marketing Toolkit - Shine a light on your tax expertise for current and potential clients.

• Tax Education - Live and OnDemand CPE programs to prepare you for the tax season.

• Thomson Online Tax Library - Exclusive access to a specially-created online library of tax content for a $69 annual fee.

• Wolters Kluwer Publications - Discounts on tax (and accounting) print publications.

www.icpas.org/tax.htm

Questions, contact Gayle Floresca, CPA, Assistant Director, Professional Standards at florescag@icpas.org or 800.993.0407, ext. 7618.

Th e a c c o u n t i n g p r o f e s s i o n p r e s e n t s a u n i q u e s e t o f c h a l l e n g e s f o r t h o s e w i t h a s p i r a t i o n s o f o n e d a y b e i n g lauded as an inspirational role model the boss who’s simp l y u n f o rg e t t a b l e , t h e m e n t o r t o w h o m u n d e r l i n g s o w e their meteoric success. The biggest obstacle for many lies in the fact that while CPAs are technically astute, the softer skills needed to manage, lead and direct teams are often sought with far less gusto

“The main reason people get into accounting is because they enjoy the technical side of the field,” says Elizabeth Pittelkow, director of accounting and compliance at ArrowStream Inc in Chicago “When individuals who perform well on the technical side get promoted into management roles, they need an entirely different set of skills to succeed.”

In other words, they need people skills. “The sooner you can start amassing managerial and strategic skills, the better off you’ll be,” Pittelkow advises “It’s much easier to start developing your leadership style early in your career versus having to pull it together once you become a manager and having to figure it all out after the fact ”

1. Awareness & Perception. Role models need to objectively evaluate the people around them and the work world in which they thrive

2. Commitment. Successful role models are unwaveringly committed to developing the people around them into the leaders of tomorrow

3 Empathy Role models need to be able to “stand in your shoes” and accept imperfection

4 Decision-making Being a confident decision-maker and having good instincts about what ’ s to come are among the traits that give leaders and therefore role models their “mojo ”

5 Listening Truly listening to the people who look up to you empowers and validates them It ’ s an indispensable skill, and the mark of a successful role model

6 . Pe r s u a s i o n . Ro l e m o d e l s a r e d i s t i n g u i s h e d b y t h e i r ability to influence, motivate and mold.

Source: Sharlyn Lauby, HRbartender com

S t e p o n e i s t o a s k y o u r s e l f , “ H o w g o o d a r e m y s o f t skills?” You know, those personal attributes that help you i n t e r a c t e f f e c t i v e l y a n d h a r m o n i o u s l y w i t h o t h e r s ? I t ’s pretty much a guarantee that any CPA who achieves role m o d e l s t a t u s h a s e x c e l l e d a t t h e a r t o f c o m m u n i c a t i o n , and, in fact, Pittelkow sees speaking and listening skills as core competencies for anyone striving to become the type of leader others can’t help but follow

“ W h e n y o u ’ r e t h e b o s s , y o u n e e d t o m a k e s u r e y o u r team members are advocating for you and standing behind y o u , ” s h e s a y s “ O n e o f t h e b e s t w a y s t o i n s p i r e t r u s t among your team members is by opening up those lines of communication, fielding feedback, asking for input, and then listening to what they have to say about where your company and/or department is heading.”

Taking the communication component a step further, Pittelkow suggests asking employees exactly how they want to be communicated with, what motivates them in the workplace, and how they’d like to receive praise and feedback

“What works for one person may not work for another, so it’s important to learn everyone’s communication style and preferences,” she explains “Then, through open dialogue, you can really help to motivate your team and be able to quickly hone in on any successes or problem points ”

Aside from soft skills, role model worthy leaders know when they should be accountable for their own actions and those of their team They live by the motto, “If the team succeeds, we all succeed; if the team fails, we all fail ”

“ Yo u n e e d t o b e a b l e t o t a k e r e s p o n s i b i l i t y, e v e n i f i t ’s n o t directly your fault,” says Pittelkow “It’s about having the confid e n c e a n d h u m b l e n e s s t o s t e p i n a n d s u p p o r t t h e d e p a r t m e n t through both its successes and its failures ”

Helping others perform “at the highest possible levels” is where your focus as a role model should be, adds Geoffrey Harlow, CPA, a partner at the Deerfield, Ill firm of Kessler Orlean Silver & Company He admits, however, that “None of us are born knowing how to do that; we all have to learn ”

You need to “treat people like you w o u l d w a n t t o b e t r e a t e d , ” h e s a y s , d e s p i t e t h e s t r e s s e s t h a t m i g h t b e s w i r l i n g a r o u n d t h e o f f i c e . “ Tr y t o always be positive when dealing with y o u r s t a f f a n d k e e p i n m i n d t h a t y o u ’ r e t r y i n g t o b e t t e r t h e m , ” h e e x p l a i n s W h e n p r o v i d i n g f e e d b a c k on a particular situation, for example, “try to keep in mind that it’s really a t r a i n i n g p o i n t , v e r s u s c r i t i c i z i n g t h e individual for not doing something the way you wanted him or her to do it ”

Shahla Khan, a learning and development expert with Pink Boss Blue Boss, points out that being a role model is more than just a title; it’s an attitude “All human beings have the basic desire to be respected and appreciated for their efforts,” she says “But with leadership comes power, and that pow-er can get into your head.”

To avoid ego becoming a problem, Khan offers up these three tips:

1 . L e a v e P r e t e n s i o n s a t t h e D o o r. Practice humility from day one By a d o p t i n g a m o d e s t v i e w o f y o u r o w n i m p o r t a n c e , e m p l o y e e s w i l l be more apt to warm up to you and see you as a role model.

2. Don’t Aspire to Be Flawless. Admit f a i l u r e a n d s a y, “ I d o n ’t k n o w ” when you don’t know “Stop being p r e t e n t i o u s a n d c r e a t e t r a n s p a rency for your team,” says Khan.

3. Be Yourself. Don’t be afraid to bring your personality along Employees are more productive and engaged when they have fun “No one likes to be around a know it all,” Khan admonishes “Professional boundaries are one thing, but giving clients and employees a reason to smile can help you quickly blast through objections and boredom.”

The idea is for CPAs to not only be-come good role models, says Harlow, but also develop effective teams that nurture the next wave of role models

“The key is to make sure the people who work for you are comfortable and that they know where they stand and that you’ll be honest with them,” he says “In return, you’ll wind up with a team that truly loves its work and workplace, and that has the same good experience that you’ve had ”

By Selena Chavis

By Selena Chavis

To be considered an exemption or to itemize a m e d i c a l e x p e n s e , H a r e s t r e s s e s t h a t t h e deduction has to be associated with a human being who has a valid Social Security number they can produce at any given moment.

On an interesting side note, if you relocate f o r a j o b , y o u c a n d e d u c t m o v i n g e x p e n s e s incurred for pets Pets are classified as personal effects in this case Armour ran into this situation when a client wanted to hire a pet transfer agency to ship an animal to Alaska Upon further research, this expense was identified as an appropriate write-off “I was a little surprised myself,” he admits

Visit irs gov/taxtopics/tc602 html for more on child and dependent care credits

You gambled You won big And then you lost even bigger.

Unfortunately, the IRS doesn’t weigh losses as they do winnings, says Hare. Just because clients have to pay up for big jackpots doesn’t mean they can then write off losses.

Just when you think you’ve seen and heard it all, in walks a client with an absolutely ludicrous tax deduction And since you’re likely in the midst of yet another busy season, we decided to call on two of the state’s tax experts Kelley Hare, CPA, MST, tax partner with Porte Brown Chicago and Michael Armour, CPA, CFP of Bird Armour LLC in Springfield, Ill to share a few of their favorites

The stork’s joyful home visit and your pet’s joyless vet visit both have something in common they fall into the “not a chance” category Hare explains that, “We have people who come in and say ‘I’m pregnant, so I have a dependent,’” adding that it’s not unusual for clients to think of their pets as children as well, therefore requesting deductions for veterinary bills and other expenses including neutering.

She explains that IRS guidelines relating to g a m b l i n g i n c o m e a n d l o s s e s a r e p r e t t y s t r i ngent, and it’s important that tax professionals advise clients about the ins and outs of tracking how money is spent

“ G a m b l i n g l o s s e s c a n b e d e d u c t e d t o t h e extent that they have gambling winnings,” she says “If a person won $5k and can substantia t e t h a t t h e y l o s t $ 5 k , t h e n t h e y c a n d e d u c t those losses from their winnings Alternatively, if they lost $10k and won $5k, they can only deduct half of the losses ”

I n a n o t h e r k i n d a - s o r t a r e l a t e d i n s t a n c e , A r m o u r r e j e c t e d a c l i e n t r e q u e s t t o d e d u c t mileage associated with taking an 86-year-old a u n t t o t h e c a s i n o e v e r y w e e k a s e e m i n g l y valid consideration given the fact that she was a “professional gambler,” right? Oh, so wrong To claim mileage, the expense must be associated with a legitimate business activity, and the claimer must be able to prove professional association with the business or trade

“My ex owes me back child support and hasn’t paid, so I can take that off right?” Wrong, says Armour. That client will have to take the matter up with the courts

Breaking up is certainly hard to do and it’s even harder when i t

clients asked to claim the previous year ’s tax bill expense as a bad debt, simply because it had been filed jointly with her former husband It goes without saying that claiming bad debt requires a valid loan agreement whether with a person or business and proof that the debt could not be collected by normal means Bad matrimonial decisions, unfortunately, do not apply. Visit irs gov/publications/p504/ar02 html for more on rules governing deductions for divorced and separated couples

There are uniform expenses and then there are Armani suit and salon haircut expenses And while all are paid for with the intent of looking the part at work, they simply can’t be and aren’t treated the same way, says Hare Day at the spa? Leave it off your tax deductions please!

To clarify where lines are drawn, the IRS stipulates that claiming a deduction for buying clothing requires that the purchase be m a n d a t o r y f o r a j o b a n d u n s u i t a b l e f o r e v e r y d a y w e a r F o r instance, buying a suit for a corporate presentation wouldn’t quali f y b e c a u s e t h e s u i t c o u l d b e w o r n o n o t h e r o c c a s i o n s . B u t i f you’re required to wear a shirt brandishing the company logo and it’s not paid for by your employer, then that counts as a deductible expense

Visit irs gov/publications/p529/ix01 html for more on IRS rules governing miscellaneous deductions, including work clothes and uniforms

Bad behavior is, well, bad behavior. So if your client gets a DUI and has to appear in court three times, he shouldn’t expect to get his lost wages reimbursed Sadly, for one of Armour ’s clients, the logic of the principle just didn’t play “If you are a cash-basis taxpayer, there really isn’t an instance where you can claim lost wages,” he explains “You can’t deduct income against something you don’t have ”

Visit irs gov/pub/irs-pdf/p525 pdf for guidelines on taxable and nontaxable income.

Armour remembers a client who wanted to deduct the value of blood given in a blood drive Weird? Well, yes

“While it is a medical procedure to give blood,” he explains, “it’s like valuing a service and claiming a deduction You can’t do that ”

That’s not to say medical expenses can’t be deducted The IRS a l l o w s f o r s p e c i f i c d o c t o r p r e s c r i b e d a n d r e f e r r e d a c t i v i t i e s , i n c l u d i n g c l i n i c v i s i t s , m e d i c a l p r o c e d u r e s t h a t i m p a c t h e a l t h and well-being, hospital stays, and more.

Visit irs gov/taxtopics/tc502 html for detailed IRS rules governing medical and dental expenses

What moves you? What makes you stand out? What are you effortlessly good at? And maybe more importantly, who needs you?

The answers to these questions may or may not lead to the same end, but they’ll surely tip you in a direction that melds your passions with your work In other words, this is the first step in identifying your niche that thing that makes you special, fulfills you, makes you proud

serve them

It’s a little sour upfront, but it coats the tongue and goes down smooth; the hint of mango makes it pretty refreshing We’re talking beer here a Berliner Weisse to be exact

what you should expect when you meet with the leaders of CliftonLarsonAllen LLP’s Chicago Craft Brewery Industry Group

Out of their Oak Brook, Ill. office, CPAs Chris Gugora, Tim Irvin and Alex Warner have brewed up a niche specializing in the tax, accounting and advisory needs of the region’s booming craft beer industry.

“We took the approach that craft breweries needed their own designated industry group, and the firm has taken notice of the success we’ve had here They see where the craft beer market is going it’s exciting to be part of an industry that is experiencing such a period of growth and therein lies the potential for the firm itself,” Irvin explains “As service providers, we are just at the tip of the iceberg of how we can help craft breweries get to where they want to be whether that’s being a small neighborhood brewery or a large production facility ”

t s p r i n g s t o m i n d . B u t t h a t ’s e x a c t l y

What’s especially unique about this industry is the business owners themselves While some

We are pleased to announce the 2014 revised hardcover edition of . . .

b y Robert F. Reilly and Robert P. Schweihs

b y Robert F. Reilly and Robert P. Schweihs

have strong business acumen, many are startup brewers learning on the fly.

“It’s a clientele that from the financial side of things could really use some help because they aren’t always coming from t r a d i t i o n a l b u s i n e s s b a c k g r o u n d s , ” s a y s

Wa r n e r H e p o i n t s o u t t h a t m a n y c r a f t breweries are a mix of manufacturing and distribution entities, and with that comes some specialized tax considerations

This 745-page book, published by Public Accountants, includes the following topics, among others:

“A lot of these breweries just want to get t h e i r t a x r e t u r n s f i l e d t h e c h e a p e s t w a y possible, but it’s really important to have a service provider that knows the industry to really take advantage of the benefits available,” he says. “Take R&D tax credits for example; there’s a considerable amount of trial and error and experimentation that goes on within this industry. There’s equipment depreciation. If you have tip-earning employees, there’s a fairly lucrative payroll tax credit available that we often see clients overlooking.”

“Whether we are helping our clients on the tax side, or with operations, accounting, internal controls, fraud protection, risk management, wealth advisory, employee b e n e f i t s o r s t o c k o w n e r s h i p , t h e r e ’s t h e potential for a lot of growth for a firm like ours,” says Irvin.

It’s hard to argue with that when nationally a new brewery is opening every day and another is being acquired every five. B u t t a rg e t i n g a n i c h e l i k e t h i s i s a b o u t m o r e t h a n j u s t b u s i n e s s ; i t o f f e r s t h e s e C PA s t h e c h a n c e t o w o r k a n d c o n n e c t with clients that truly interest them.

Available for $142.50 plus shipping! Visit www.willamette.com/books _intangibles.html.

Willamette Management Associates is actively recruiting valuation analysts for our offices in Chicago, Atlanta, and Portland. We are seeking qualified candidates at the managing director, manager, and associate levels. For more information, please visit our website at www.willamette.com.

“The biggest attraction for me is that we help hardworking, down-to-earth people make high-quality products that bring people together,” says Irvin. “The people in this industry look after each other; it’s not craft brewery against craft brewery, it’s all of them working together to grow.”

“It excites us,” adds Warner “I would be h a r d - p r e s s e d t o f i n d a n o t h e r i n d u s t r y group where the people are as passionate a b o u t t h e i r p r o d u c t s . I t ’s f r a n k l y a f u n group of people to work with And personally, working in this group has given me a sense of fulfillment. I take some pride in the products of my clients ”

“I guarantee you that I’m not an opera singer, but I have a number of opera singer clients You see, anytime you’re building a

practice, you wind up with a client base that develops in no small part from your social networks You pick up a few clients, you develop an expertise like reading pay statements from German opera houses word gets around, and before you know it you’ve developed a niche,” says Greg Mermel, CPA, founder of H. Gregory Mermel, CPA, PC, Accounting and Financial Services in Chicago’s Lakeview neighborhood

As Mermel describes it, the process of carving out your niche seems easy enough A CPA since 1974, Mermel built a practice that serves two areas close to his heart: The performing arts and LGBT (lesbian, gay, bisexual and transgender) communities

“ I ’ v e h a d a s o m e t i m e s p r o f e s s i o n a l , sometimes avocational, interest in the performing arts, and I am a gay man Surprise, I have a lot of clients in both of those communities,” he jests. “If you want to develop a niche practice, you really have to know the ins and outs of it In my market there has to be a whole lot of empathy both groups of clients need to feel comfortable R e l a t i o n s h i p s a r e m u c h m o r e c e n t r a l t o t h e i r i d e n t i t y ; i t ’s s o m e t h i n g t h a t i s s o intensely personal.”

Admittedly, now that there are no longer differing federal and state distinctions on marriage, working with same-sex couples has become easier There are fewer “what ifs” to account for when devising tax and estate plans, and there’s less splitting and c o m b i n i n g o f t a x d a t a B u t t h a t d o e s n ’t m e a n t h e w o r k h a s l o s t i t s u n i q u e n e s s Mermel’s clients are often entrepreneurial and self-employed, and many are cleaning u p p r e v i o u s l y f i l e d s e p a r a t e t a x r e t u r n s , amending returns to account for benefits coverage changes, and retroactively correcting marriage statuses

W h i l e M e r m e l i s n ’t o n e t o s e n d o u t press releases or write tweets touting his n i c h e p r a c t i c e , h e a d m i t s t h a t t h e r e ’s a s t r o n g s e n s e a m o n g t h e p e r f o r m i n g a r t s a n d L G B T c o m m u n i t i e s o f w a n t i n g t o “keep it in the family” when doing business His involvement in both communities, in addition to the Chicago Area Gay & Lesbian Chamber of Commerce, keeps a steady flow of business coming his way.

“I have a great luxury in my work life. I do work that I enjoy For the most part I do it for clients that I like And I run my small practice on my own terms,” he states with satisfaction

“It’s been a really interesting run; it’s a tremendous opportunity. It’s like nothing else,” says Jim Marty, CPA, ABV, MS, owner of CPA and consulting firm Jim Marty and Associates LLC in Colorado What he’s referring to is the budding legal marijuana industry Serving legalized dispensaries and growers could be a hit for accounting and finance professionals across the nation willing to roll on both sides of the law (bad puns intended)

At the time of writing, 23 states and Wa s h i n g t o n D . C . h a d l e g a l i z e d m a r ij u a n a u s e i n s o m e f o r m , w i t h m a n y m o r e c o n s i d e r i n g m e d i c i n a l u s e a n d r e c r e a t i o n a l u s e l a w s H e r e i n I l l i n o i s ,

2 0 1 4 ’s C o m p a s s i o n a t e U s e o f M e d i c a l

In November, Illinois finally began issuing official identification cards to qualified medical marijuana patients as it nears implementation of the Compassionate Use of Medical Cannabis Pilot Program Act signed into law in January 2014. The Chicago Tribune reports that this is one of the final steps required before full implementation of the Act, a process that ’ s been slowed by cautious regulators So far, only 6 of 60 dispensaries and 13 of 22 cultivation centers have been approved to operate in the state What ’ s more, only 3,200 people have been approved as medical marijuana patients Initially, the patient pool was estimated at about 100,000 people The Act currently allows for medicinal use of marijuana to treat 39 conditions and diseases In October, the Medical Cannabis Advisory Board recommended that eight additional conditions and diseases be considered for approved treatment, including chronic pain due to trauma, Chronic Pain Syndrome, Chronic Post- Operative Pain, Intractable Pain, Osteoarthritis, Autism, Irritable Bowel Syndrome, and Post-Traumatic Stress Syndrome (PTSD).

C a n n a b i s P i l o t P r o g r a m A c t c r e a t e d a f o u r- y e a r r o l l o u t a l l o w i n g s i c k a n d dying patients suffering from debilitating m e d i c a l c o n d i t i o n s a c c e s s t o m e d i c a l cannabis The Act permits up to 22 cannabis-growing operations and 60 licensed retail dispensaries to operate across the state all of which will ultimately create jobs, generate revenues, occupy real estate, pay taxes, require audits, and more

“That’s how it starts,” says Marty. “What happened in Colorado i s t h a t w e h a d m e d i c a l m a r i j u a n a f o r f o u r o r f i v e y e a r s , a n d shortly thereafter full legalization came along.”

When it is time to transition out of your practice you want to do it right. We are the largest facilitator in North America for selling accounting and tax practices. We provide a free estimate of your firm’s value, market extensively, assist in negotiations and find you the right situation.

Contact us today so your last decision will be your best.

The Holmes Group Trent Holmes Toll Free: 800.397.0249

AccountingPracticeSales.com

trent@accountingpracticesales.com

Legal marijuana was a $700M industry in 2014 for Colorado, and it could surpass $1B in 2016 Marty, whose firm has grown rapidly based on its marijuana industry expertise, estimates that Illinois’ marijuana businesses eventually could generate $2B.

So what does this mean for Illinois CPAs? The answer is cautious optimism. For starters, it’s important to note that risks exist; s t a t e l a w s c o n f l i c t w i t h f e d e r a l l a w s , a n d m a r i j u a n a r e m a i n s a Schedule 1 drug subject to federal prosecution. But Illinois’ medical marijuana program is highly regulated and essentially mandates CPA interaction with licensed growers and dispensaries

Bridget Carlson, deputy director of Medical Cannabis at the Illinois Department of Financial and Professional Regulation, points o u t t h a t I l l i n o i s ’ A d m i n i s t r a t i v e R u l e s s u p p o r t i n g t h e m e d i c a l cannabis program require dispensaries to engage in, and submit to the Department, annual audits compiled and certified by an auditor or CPA

“It’s a very strict statute and there are strict regulations for these operations to follow,” Carlson explains Among other state departments, two that CPAs know quite well are involved in marijuana oversight. The Illinois Department of Financial and Professional Regulation registers, licenses and regulates the dispensaries, and the Illinois Department of Revenue regulates marijuana taxation, which is subject to privilege taxes, occupation taxes and other industry specific surcharges.

While opportunities are there, Illinois CPAs are encouraged to p r o c e e d w i t h c a u t i o n S p e a k i n g f r o m h i s e x p e r i e n c e s e r v i n g cannabis industry clients, Michigan-based CPA James Campbell of N U M B E R S P r o f e s s i o n a l A c c o u n t i n g S e r v i c e s w a r n s t h a t h i g h l y c o m p l e x a n d d i s c o u r a g i n g b u s i n e s s a r r a n g e m e n t s o f t e n e x i s t within this particular industry

“Marijuana taxation by itself is a complicated affair, but I feel there are far more complex issues hiding out there,” he says “Medical marijuana may not be a good niche for a small practitioner in Illinois to enter right now But Illinois Medical Marijuana Version 2 0 may be more attractive in a few years ”

The idea of the soulless corporation is becoming a thing of the past as more companies focus on not only doing well, but also doing good.

By Clare FitzgeraldCall them socially conscious, purpose-driven or simply good corporate citizens

Companies focused on cracking the make-money-do-good nut are using a variety of corporate responsibility and sustainability initiatives to make a difference. While they’re working to drive change on social and environmental issues, they’re also boosting profits, increasing customer and employee loyalty, and gaining a competitive advantage.

Doing good appears to be good for business

According to a March 2015 Small Business Pulse Survey from The Alternative Board, a business advisory organization, nearly twice as many socially driven business owners expected revenues to increase in the next year, and 48 percent characterized themselves as “ahead of the competition ”

consumers seek out

out-of-10 expect companies to do more than make a profit.

When it comes to socially responsible organizations often characterized as companies that focus on their people and strive to positively contribute to society big names like Google, Microsoft, The Container Store, Patagonia, Whole Foods and Starbucks often get all the press But they aren’t the only ones focused on doing well by doing good From the big to the small, many national and regional corporate citizens are working to fulfill their own lofty goals of contributing to the greater good Here are just a few

Northbrook, Ill -based Allstate provides auto, home, life and other insurance and financial services to approximately 16-million households and it’s the nation’s largest publicly held personal lines insurer In addition to protecting policyholders from the mayhem of life’s uncertainties, the company also works to be a “force for good,” according to Craig Keller, Allstate’s director of corporate responsibility and sustainability Keller says the phrase has become an internal mantra at Allstate, and explains that, “Corporate responsibility is as much a part of who we are as our products and services ” In fact, Allstate was ranked 74th on the 2015 100 Best Corporate Citizens list compiled by Corporate Responsibility magazine, and was recently named as a 2015 World's Most Ethical Company® by the Ethisphere Institute

Included among the company’s chosen causes are teen safety while driving, youth empowerment and domestic violence When it comes to the issue of domestic violence, the company’s efforts focus on financially empowering domestic abuse survivors since, “The number one reason cited for staying in abusive relationships is lack of financial resources,” explains Sue Duchak, senior manager at the Allstate Foundation. The company sponsors financial literacy programs, awards grants to local organizations working on

n s d i r e c t l y t o v i c t i m s . “ We ’ v e invested $43M on this issue over the last 10 years and have cont r i b u t e d t o h e l p i n g n e a r l y 6 0 0 , 0 0 0 s u r v i v o r s g e t b a c k o n t h e i r feet,” Duchak states proudly.

Allstate’s teen driving programs date back to 1952, when the Allstate Foundation awarded one of its first grants to a nonprofit dedicated to keeping teens safe on the road Today the company continues to operate educational and awareness campaigns designed to change the ways teens think and act behind the wheel The company also conducts research to better understand the causes of car accidents involving teens and to develop prevention strategies

In recent years Allstate has strengthened its commitment to youth empowerment by launching a new partnership with international charity Free The Children and investing in other nonprofit organizations that help young people build the life skills they need to succeed in school and the workplace Programs offer curriculums and activities that encourage student volunteerism and leadership, improve money management, develop entrepreneurial skills, and promote adult-to-teen and teen-to-teen mentoring

In addition to these issues, the company invests in the passions of its employees and agency owners by offering several grant programs to support favorite charities In 2014, Allstate, the Allstate Foundation and its agency owners and employees gave $34M to nonprofits across the nation and volunteered more than 200,000 hours. “Corporate philanthropy is part of our DNA,” says Duchak.

Sustainability and environmental stewardship are also at the top of Allstate’s priority list. According to Keller, a cross-functional team develops sustainability goals for energy use, facilities construction and management, and recycling and conservation. The company recently met its long-term goal of a 20-percent reduction in energy use from the baseline it established in 2007. Allstate also monitors the environmental practices of its vendors and recently incorporated sustainability criteria into key supplier contracts

The overarching goal of the company’s corporate responsibility program is to improve local communities. Doing so actively builds

employees and consumers

“Impact can be hard to measure, but we see corporate responsibility as a key intangible that makes an important difference to how people perceive us and the choices they make,” says Keller

ITW manufactures industrial equipment for everything from cars, oilrigs and bridges to aerospace technology, restaurant ovens and mobile devices Operating in 57 countries and employing 49,000 people, the Glenview, Ill -based company has gained quite a reputation for being a good corporate citizen, and was recently named a top socially responsible dividend stock by the Dividend Channel

Corporate responsibility has been part of the company’s value system since it was founded in 1912, but has become an increasingly measured and monitored component in the past several years. “Everyone on our leadership team believes that corporate responsibility makes good business sense. It’s part of our overall business strategy,” says Alison Donnelly, ITW’s director of communications.

It’s also integrated into daily operations, adds Renita Dixon, ITW’s sustainability and environmental coordinator “Corporate responsibility and sustainability are really woven into what we do on a daily basis,” she says, noting that the manufacturer prioritizes efficiency, employee safety, diversity in leadership and product responsibility

Community involvement is another key “Giving back to the communities where we live and work is deeply ingrained in our culture,” Donnelly explains Among its initiatives, the manufacturer funds and supports The David Speer Academy, a recently founded charter school in Chicago’s Belmont-Cragin neighborhood. The Academy is devoted to science, technology, engineering and math (STEM) education, and is named for ITW’s former chairman and CEO, who was passionate about STEM education and supporting underserved communities

ITW strongly encourages its workforce to follow in its footsteps The ITW Foundation, for example, donates $10 for every hour employees spend volunteering at approved organizations, and offers a unique 3-to-1 matching program for employee donations to approved nonprofits

“These types of programs show our recruits and other stakeholders how we’re touching lives and changing lives,” says Dixon “They show the heart of the company beyond what’s in the stock report.”

Chicago-based Pekin Singer Strauss is an independent investment advisory firm that also happens to be a benefit corporation, or B corp. A relatively recent classification for businesses, B corps are for-profit businesses certified by the nonprofit B Lab to meet rigorous standards of social and environmental performance, accountability and transparency. There are currently about 1,000 certified B corps in 33 countries; Pekin Singer Strauss is the first Chicago investment provider to gain the status

According to Adam Strauss, co-chief executive officer and portfolio manager, the firm’s designation as a B corp acknowledges just how the firm has been operating since it was founded in 1990. “Everything begins and ends with integrity,” he says

Central to the firm’s B corp designation is its Appleseed mutual fund, which seeks to generate market-beating returns by investing in quality, undervalued companies screened for social and environmental responsibility. The firm relies on third-party research, sustainability reports and its own research to identify those organizations.

“We look for companies that have strong environmental, social and governance objectives,” Strauss asserts, noting that companies focused on creating enduring value rather than simply quarterly earnings are a good match for the firm’s investors The fund particularly appeals to Millennials and others who want to invest in socially conscious companies

“It used to be that investors just wanted returns That’s not the case anymore,” says Strauss “People are interested in understanding what they’re investing in We’re seeing more prospects and clients who want portfolios that perform but also that reflect their values ”

He explains that the firm works to customize investments, and cites the example of a client who wanted to avoid companies that used genetically modified organisms “We can structure investments to achieve their financial goals while also allowing them to sleep at night,” he says

T h e f i r m ’s c o m m i t m e n t t o e t h i c s a n d s u s t a i n a b i l i t y h a s a n impact internally, too, Strauss explains “It gives all of us a sense of purpose above and beyond collecting a paycheck ”

As the global leader in water, hygiene and energy technologies and services, corporate responsibility and sustainability are core c o m p o n e n t s o f E c o l a b ’s b u s i n e s s m o d e l T h e $ 1 4 B c o m p a n y delivers solutions and onsite services to promote safe food, maint a i n c l e a n e n v i r o n m e n t s , o p t i m i z e w a t e r a n d e n e rg y u s e , a n d improve operational efficiencies for customers in food, healthcare, energy, hospitality and industrial markets in more than 170 coun-

tries. Ecolab also has a strong presence in Illinois Nalco, its water process services division, is based in Naperville.

“ O u r e n g a g e m e n t a r o u n d s u s t a i n a b i l i t y i s a r e s o u rc e f o r growth for ourselves and for our customers,” says Emilio Tenuta, VP of Sustainability at the St. Paul, Minn.-based company. “And o u r i m p a c t i s s i g n i f i c a n t , n o t o n l y t h r o u g h o u r w o r k w i t h c u st o m e r s t o h e l p t h e m m e e t t h e i r s u s t a i n a b i l i t y a n d o p e r a t i o n a l goals, but also by managing the environmental footprint of our own operations ”

If sustainability recognition is any indication, Ecolab is succeeding. The company is ranked ninth on Corporate Responsibility magazine’s 2015 list of 100 Best Corporate Citizens, and Chairman and CEO Douglas M Baker, Jr received the magazine’s 2014 Responsible CEO of the Year Award. The company also was named to the 2015 Dow Jones Sustainability Indices North America index

Added to all that, Ecolab has become a leader in advancing global water stewardship standards and conservation programs. I t ’s a f o u n d i n g p a r t n e r o f t h e A l l i a n c e f o r Wa t e r S t e w a r d s h i p ’s (AWS) International Water Stewardship Standard, a globally consistent and locally adaptable framework that informs decisions and encourages collective action to promote sustainable freshwater u s e I n f a c t , o n e o f E c o l a b ’s m a n u f a c t u r i n g f a c i l i t i e s i n C h i n a became the first in the world to be certified under the AWS standard. What’s more, the company partners with organizations like t h e Wo r l d Wi l d l i f e F u n d a n d T h e N a t u r e C o n s e r v a n c y t o h e l p advance water conservation and stewardship initiatives in priority regions such as China, Mexico and the United States.

As a growing company with a focus on managing increasingly scarce natural resources, Ecolab garners plenty of interest from job seekers. “Our vision to make the world cleaner, safer and healthier motivates our teams and resonates with young people who are passionate about working for a company that aims to make the world a better place,” says Tenuta.

“84% of global consumers seek out responsible products whenever possible, and 9-out-of-10 expect companies to do more than make a profit.”

Diversity is no longer defined solely by a mix of race, gender, sexual orientation or age. The new frontier also encompasses diversity of thought.

By Kristine Blenkhorn RodriguezIn a growing number of select boardrooms across America, you can hear an “amen” from sage C-suite execs Not necessarily because they believe in diversity and inclusion (D&I) personally, or even because business magazines like Forbes trumpet diversity’s merits Rather, it’s because D&I has become good business.

Companies on the cutting edge are now slicing and d i c i n g d i v e r s i t y i n t o t w o c a t e g o r i e s : I n h e r e n t a n d acquired collectively called “2D diversity ” Inherent diversity involves inborn traits such as gender, ethnicity a n d s e x u a l o r i e n t a t i o n A c q u i r e d d i v e r s i t y i n v o l v e s t r a i t s g a i n e d f r o m e x p e r i e n c e w o r k i n g i n a n o t h e r country can help a person appreciate cultural differences, for example

Research from the Center for Talent Innovation, publ i s h e d i n t h e D e c 2 0 1 3 i s s u e o f H a r va r d B u s i n e s s Review , f o u n d t h a t o rg a n i z a t i o n s w i t h a t l e a s t t h r e e t r a i t s i n e a c h c a t e g o r y o u t - i n n o v a t e a n d o u t p e r f o r m others. Employees at these companies are 45 percent more likely to report that their firm’s market share grew over the previous year, and are 70 percent more likely to report that the firm captured a new market

And yet, 78 percent of study respondents said they worked at companies that lack 2D diversity in leadership. Without this diversity, women are 20 percent less l i k e l y t h a n h e t e r o s e x u a l w h i t e m e n t o w i n e n d o r s ement for their ideas, people of color are 24 percent less likely, and LGBTs are 21 percent less likely

The more Machiavellian among us may ask why this matters to the bottom line. Here’s your answer.

When ideas from minority members of a firm lack key sponsorship (meaning they’re not heard or considered on an equal playing field with ideas from “mainstream” peers), crucial market opportunities are squandered Why? Because inherently diverse contributors better understand the unmet needs of underleveraged markets The Center for Talent Innovation study found that when at least one member of a team shares traits with the end user, the entire team better understands that user. A team with a member who shares a client’s ethnicity is 152 percent more likely to understand that client which translates into millions of dollars when applied to tailoring products and services

Basic training Deloitte’s report Global Human Capital Trends 2014 lists diversity/inclusion as one of the least important issues f a c i n g l e a d e r s i n t h e a r e a o f h u m a n r e s o u rc e s A n d y e t , 2 0 1 5 a n a l y s i s c o n d u c t e d b y G r a n t T h o r n t o n s h o w s t h a t t h e f e w S & P 5 0 0 c o m p a n i e s t h a t h a v e m a l e - o n l y e x e c u t i v e d i r e c t o r s missed out on $567B of investment returns, compared to companies with more diverse boards and women executives

This analysis reiterates our earlier point: D&I is no longer a human resources matter, but rather a business matter.

There are bright spots, however. Intel’s CEO Brian Krzanich used his time on the platform at the 2015 International Consumer Electronics Show to announce his company’s Diversity in Technology initiative It includes new hiring and retention goals, as well as a $300M allotment for building a pipeline of female and other underrepresented engineers and computer scientists

Also in 2015, California State Treasurer John Chiang called on the two largest pension funds in the United States to redouble their efforts to increase diversity in corporate boardrooms. In a further challenge to the status quo, Chiang called for a broadening of the definition of diversity to include sexual orientation and gender identity

A diverse workforce is not in and of itself a panacea, however “You can have a diverse workforce but an intimidating environment,” warns Dr. Sondra Thiederman, a workplace diversity consultant. “In that case your diversity does you no good because everyone is afraid to speak up and be heard. Diversity means getting your biases out of the way and really listening, taking in new ideas and approaches ”

Scott Steffens, chair of the ICPAS Diversity Advisory Council and partner at Grant Thornton, sees this happen all too often “When we looked at the numbers through a diversity lens several years ago, they suggested underperformance in big accounting firms by professionals of color. Assuming we hire equally qualified professionals regardless of color, this suggests these individua l s d i d n ’t h a v e t h e a p p r o p r i a t e s p o n s o r s h i p t o s u c c e e d E i t h e r they’re not being heard and recognized for their contributions, or they’re not being properly indoctrinated into firm culture Either way, we have an issue ”

Dr Rohini Anand, Sodexo’s chief diversity officer, suggests that while buy-in is underplayed in some circles, it does in fact remain the lynchpin. “The CEO has to buy-in, as well as the executive team And then we tend to forget about middle management Your 34 INSIGHT icpas org/insight htm

r a n k - a n d - f i l e m i d d l e m a n a g e r s h a v e t o b e b r o u g h t i n b e c a u s e they are the ones hiring individuals and making things happen ”

Anand’s lens broadens beyond race, gender and sexual orientation to generational diversity, too In an era where talent shortages are fast fading as a concept and gaining ground as a reality, she has her eye on sustaining Sodexo’s attractiveness to Gen Y and beyond. “How do we create a culture where they want to come to us, work and stay? How do we keep them engaged?” she asks “They’ll vote with their feet They won’t hesitate to leave, unlike Baby Boomers who stuck it out ”

Goodbye attendance

In the salad days of diversity and inclusion, a check-the-box mentality prevailed Many employees were required to attend diversity training, either in person or online, records were kept and the letter of the law was followed As inclusion becomes an issue with dollar signs attached to it, however, this approach has changed, says Thiederman. “One-on-one mentoring is changing the face of business ”

Anand cites the example of a global CEO in Europe, assigned to mentor a female professional responsible for several high-security facilities within his organization. “He told me that if he would h a v e b e e n p r e s e n t e d w i t h t w o c a n d i d a t e s , o n e m a l e a n d o n e female, a couple of years prior, he would have chosen the man for this role without a second thought But after spending time with his mentee, he realized that this soft-spoken woman was i n c r e d i b l y e f f e c t i v e a t h e r j o b H e a d m i t t e d t o h a v i n g t o s e e beyond style, appearance and stereotypes ”

A similar program at Chase Bank of Texas “instituted two-way mentoring between mainly female Filipino tellers and white male executives,” Thiederman explains. “The results were amazing, as the experiences began to give rise to awareness of commonalities, f r o m w o r r i e s a b o u t p a y i n g t h e b i l l s t o c a r i n g f o r a g i n g f a m i l y m e m b e r s T h e s c o p e a n d s c a l e m a y h a v e v a r i e d , b u t t h e t w o groups started to see each other less as group members and more as individuals That’s where bias starts to break down and you yield real results.”

S o m e t i m e s m e n t o r i n g i s n ’t t h e c u r e - a l l , t h o u g h . R a t h e r, y o u may need to mix things up with a new diversity ratio. Sodexo recently completed a gender-balance study for this purpose In order to help quantify the impact of women in management, the company analyzed key performance indicators (KPIs) from 100 global entities and 52,000 managers The intent was to isolate whether gender-balanced teams, defined as having 40-60 percent women in management, had higher KPI results than those without gender balance. For this initial work, the performance measures were focused on employee engagement, brand awareness, client retention and financial performance

The preliminary results were powerful, indicating that entities with gender-balanced management teams performed better in the KPIs identified Specifically, in FY14, 65 percent of subsidiaries with gender-balanced management saw an increase in gross profit over the last three consecutive years, compared to 42 percent among other management subsidiaries. Also in FY14, 71 percent o f s u b s i d i a r i e s w i t h g e n d e r- b a l a n c e d m a n a g e m e n t t e a m s s a w

“Diversity: the art of thinking independently together,” was the way he put it.

positive operating profit over the last three consecutive years, versus 60 percent for other management subsidiaries And teams with gender-balanced management groups were 12 percent more likely to see an increase in client retention

What’s more, 45 percent of entities saw positive organic growth over three consecutive years, versus 32 percent among other mana g e m e n t t e a m s W h e n i t c a m e t o i n d i c a t o r s s u c h a s e m p l o y e e engagement and brand image, gender-balanced teams again outperformed other management teams by 3 percent and 5 percent, respectively, over a two-year period

“It’s clear that on both financial and non-financial indicators, gender-balanced teams outperformed those that weren’t,” says Anand “At the end of the day, the conclusion for us is that genderbalanced teams consistently perform more sustainably and predictably ”

Diversity leaders According to DiversityInc's annual ranking, the 10 most diverse companies across the globe range from pharmaceutical and credit card companies to insurance agencies and consumer product giants and of course, accounting firms You’ll see Anand’s work recognized, as Sodexo ranks number five on the list, just behind Novartis, Kaiser Permanente, PwC and Ernst & Young in the t o p f o u r s p o t s M a s t e r C a r d , AT & T, P r u d e n t i a l , J o h n s o n & Johnson and Procter & Gamble round out the list.

Challenges remain, however “Achieving real diversity is complicated,” says Julie Goodridge, CEO of NorthStar Asset Management, a socially responsible investing firm “But I’ve been doing this for decades, since the early ‘80s, and we’re getting there. Just yesterday I was on a telephone call with a staffer who had been on a call discussing how financial companies vote on various proxy resolutions There were some very heavy hitters on this call. According to my colleague, most of the people participating understood the importance of diversity and were inclined to vote in favor of any resolutions talking about diversity It's taken decades to get to that point But we’re seeing it finally We’ve reached a point where there is a lot of shareholder attention focused on diversity as a key driver of corporate success ”