Iwant to talk about culture Not how you hold a teacup, but how you shape the environment that exists in your workplace Over the past year, we’ve discussed many factors impacting our organizations: an aging workforce, multiple generations, work-life balance, work anytime-anywhere, and unlimited PTO These things, among others, greatly impact the cultures within our workplaces. So, what kind of culture do you want to create?

F i r s t o f f , c a n y o u d e f i n e y o u r o rg a n i z a t i o n ’s c u l t u r e ? I f y o u c a n , i s i t s i l o e d o r c o l l a b o r a t i v e , t e a m o r i e n t e d o r i n d i v i d u a l focused? Does it value diversity of gender, race, and ethnicity?

D o e s i t e n c o u r a g e p r o f e s s i o n a l a d v a n c e m e n t a n d e m p h a s i z e work-life balance?

Culture can have a huge impact on one’s organization It impacts staff recruitment and retention, and innovation and implementation of new business development Culture can literally drive the success or failure of your business Which means it’s critical that everyone understands the culture in your organization

A collaborative culture, for instance, doesn’t just happen you need to foster it. You’ll need to encourage staff to work together. If you have a work anytime-anywhere or sporadic work-at-home p r o g r a m , i t ’s c r i t i c a l t o a l s o h a v e t e c h n o l o g y t o o l s t h a t s t i l l enable collaboration

While you may value gender, race, and ethnic diversity, does your culture reinforce that? Women are significantly underrepresented in the partner ranks of firms and the offices of CEOs and CFOs. We excuse that by saying that women choose not to pursue the lead-

ership track in order to have a family Maybe that’s true if your organization requires executives to work endless nights and weeke n d s ; h o w e v e r, i f w e t r u l y v a l u e g e n d e r d i v e r s i t y, n o w o m a n should ever feel that she must make that choice On the other side, why should men feel that they must choose not to be part of raising the family if they want to progress into leadership?

If you value work-life balance, does your culture support it? If staff, especially young staff, leave early for a personal function or to coach their child’s sports team, do the older partners or directors comment on their commitment? You may think that no one knows what you say, but they do, and it impacts the culture If you truly value work-life balance in your workplace, all need to embrace and support it.

If you are in a leadership position at a firm or company, do you know what the culture of your organization is, and is it the culture you want it to be? Do your employees understand the kind of culture you want the organization to have?

Many studies show that collaborative, diverse environments drive better business results: greater innovation, higher revenues, and increased profits Still, it can be argued that there is no right or wrong answer when it comes to the culture of an organization. So, I’ll ask you this: Are you truly fostering the culture you want? And in the end, will you drive it or will it drive you?

meaningful suppor tive inspir ational

The Illinois CPA Society’s char it able par tner provides life-c hanging oppor tunities to accounting s tudents across t he s t ate Annuall y, we award $1 95,000 in scholar ships and training prog rams to more than 150 diver se and deser ving future CPAs

Ever y year, we have more q ualif ied applicants t han awards to give Your gif t will help close that gap and directly suppor t future CPAs.

Make success possible. Donate today.

www.icpas.org/annualfund

ILLINOIS CPA SOCIET Y

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661 www.icpas.org

Publisher/President & CEO

Todd Shapiro

Editor Derrick Lilly

Creative Director Gene Levitan

Photography Jay Rubinic + Derrick Lilly

Circulation John McQuillan

Chairperson

Lisa Hartkopf, CPA | Ernst & Young LLP

Vice Chairperson

Rosaria Cammarata, CPA, CGMA | Mattersight Corporation

Secretar y

Geoffrey J Harlow, CPA | Kessler Orlean Silver & Co , PC

Treasurer

Kevin V Wydra, CPA | Crowe Horwath LLP

Immediate Past Chairperson

Scott D Steffens, CPA | Grant Thornton LLP

Christopher F Beaulieu, CPA, MST | CliftonLarsonAllen LLP

Michael D Bedell, Ph D | Northeastern Illinois University

Terry A Bishop, CPA | Sikich LLP

Brian J Blaha, CPA | Wipfli LLP

Jon S Davis, CPA | University of Illinois

Stephen R Ferrara, CPA | BDO USA LLP

Jonathan W Hauser, CPA | KPMG LLP

Anne M Kohler, CPA, CGMA | The Mpower Group

Dorri C McWhorter, CPA, CGMA, CITP | YWCA Metropolitan Chicago

Thomas B Murtagh, CPA, JD | BKD LLP

Elizabeth S Pittelkow, CPA, CGMA, CITP | Litéra Microsystems

Maria de J Prado, CPA | Prado & Renteria CPAs

Stella Marie Santos, CPA | Adelfia LLC

Andrea K Urban, CPA | ThoughtWorks Inc

BACK ISSUES + REPRINTS

Back issues may be available Articles may be reproduced with permission

Please send requests to lillyd@icpas org

Want to reach 24,000 accounting and finance professionals? Advertising in INSIGHT and with the Illinois CPA Society gives you access to Illinois’ largest financial community Contact Mike Walker at mike@rwwcompany com

INSIGHT is the magazine of the Illinois CPA Society Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Summer, Fall, and Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312 993 0407 Copyright © 2017 No part of the contents may be reproduced by any means without the written consent of INSIGHT Send requests to the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

As CPAs, we ’ re often lauded as watchdogs of the public good, the most trusted business advisors, and gatekeepers of corporate financial integrity But ongoing audit quality issues threaten the credibility, objectivity, and integrity that our profession is built on

Back in 2015, our INSIGHT Special Feature, “Audit Quality & the CPA Brand,” shed light on the risks audit deficiencies pose and the unreasonably high percentage of audits with deficiencies (39 percent among the Big Four) We also joined other voices in the profession to encourage CPAs and professional bodies to do more to restore overall audit quality, particularly in complex audit areas Recent survey data shows there’s still a long way to go

First, the good news: Progress has been made Analyzing Public Company Accounting Oversight Board (PCAOB) data from 2009 to 2016, Acuitas’ 2017 “Survey of Fair Value Audit Deficiencies” reveals the percentage of deficient audits has dropped from its dramatic peak in 2013 The not so good news is that the percentage of audits with deficiencies still stands at 31 6 percent

“It ’ s apparent that the number of audit deficiencies remains high,” says Mark Zyla, a leading expert on fair value and managing director of Atlanta-based valuation and litigation consultancy firm Acuitas Inc

Zyla points to the surge in merger and acquisition (M&A) activity as one of the modern drivers of audit deficiencies and financial risks In fact, the robust pace of M&A activity

has caught the PCAOB’s eye, who warns it poses economic risks and escalates the prospect of material misstatements

“Fair value measurement (FVM) and impairment audit deficiencies are increasingly attributable to a surge in business combination engagements,” Zyla explains “FVM deficiencies related to business combinations increased to 68 percent in 2015, up from 56 percent in 2014 ”

“Based on our analysis, failures to assess audit risks as well as test internal controls and assumptions underlying prospective financial information are the root causes of most FVM and impairment audit deficiencies,” Zyla continues

To stem the risks of reverting back to rising audit deficiencies across the board, the PCAOB is calling for heightened responsiveness from management and increased use of quality control aids Zyla seconds that by encouraging the industry and accounting firm leaders to commit to more quality control measures and ensuring due professional care. Most of all, CPAs involved in the audit process must commit to seeing audit deficiency improvements especially in critical and complex audit areas and fulfilling their responsibility of providing the highest quality

Acuitas’ survey reveals several trends and statistics critical to understanding the root causes of spiking FVM and impairment audit deficiencies. The complete survey is available from Zyla via email (mzyla@acuitasinc com) The INSIGHT Special Feature, “Audit Quality & the CPA Brand,” can be downloaded at www icpas org/insight-quality htm

When Bitcoin debuted in 2009, it became the first mathematically-backed digital currency, created and held electronically, independent of any central authority Bitcoins aren’t printed like dollars, they ’ re mined by an open community of people (anyone can join) who dedicate their high-powered computers to networks of machines cracking complex mathematical problems put forth by the Bitcoin open- source consortium No one controls Bitcoin other than a protocol that mathematically limits the creation of Bitcoins to 21 million units These units can be divided down to onehundred-millionth of a Bitcoin, named a “Satoshi” after Bitcoin founder Satoshi Nakamoto, which allows the currency to scale to demand and the transactional needs of its payment network.

Of course, there’s an easier way to acquire Bitcoins trade them secondhand via one of the cryptocurrency exchanges that have popped up around the globe Investors and speculators have been piling into Bitcoin and similar cryptocurrencies in droves, creating vast sums of wealth in a ballooning industry Bitcoin’s move has been meteoric, increasing in value from mere pennies at its debut to over $11,000 per unit as of Dec. 4, 2017.

Of course, the way Bitcoin and other cryptocurrencies came into existence creates a lot of confusion and misconceptions Since Bitcoins are not issued by a central banking authority or government, owners are surely anonymous, and there can’t possibly be any tax implications, right? Wrong

As Bitcoin and other cryptocurrencies have moved from the mysterious to the mainstream, governments worldwide are looking for ways to track and regulate trading in attempt to stop money launderers, cyber criminals, and other illicit groups there are also billions in tax dollars at stake In fact, the IRS has been actively trying to track Bitcoin tax evaders since 2015 and is currently in a legal dispute with U S -based Coinbase over whether or not the Bitcoin exchange will have to reveal U S customer personal information and transactions dating back to 2013.

For tax reporting purposes, the IRS classifies Bitcoin and “other virtual currencies” in Notice 2014-21 as property, meaning owners are legally obliged to report the capital gains and losses incurred from cryptocurrency holdings during each calendar year This sounds simple enough, but the IRS classification also creates challenges in calculating the basis in the property, as well as conflicts with Foreign Account Tax Compliance Act (FACTA) and Foreign Financial Accounts (FABR) reporting

So, with the tax man coming, there’s a clear business opportunity for CPAs who understand cryptocurrencies and can advise investors and miners and the businesses accepting cryptocurrencies for payments in how to track, compile, and report their cryptocurrency activities in order to adhere to the current tax reporting requirements and all the others yet to come

Finally, there’s a professional, affordable online payment solution made just for CPAs. Collect payment in your office or online, with no equipment or swipe required. Your clients get the convenient pay m e n t o p t i o n s t h ey wa n t, w h i l e yo u g et 1 0 0 p e rce n t of yo u r pay m e n ts a n d rea l - t i m e re p o r t i n g fo r ea sy, a cc u ra te re co n c i l i a t i o n .

We handle PCI compliance and data security for you, at no extra charge, and our expert in-house support team is always available when you need them. Get the peer-approved payment solution that’s used by 45,000 professionals and offered as an official AICPA Member Discount Partner CPACharge.

We know the details matter to you. Visit us online for pricing information and more.

These simple steps can help you create new wealth in the year ahead.

BY MARK GILBERT, CPA, PFS

BY MARK GILBERT, CPA, PFS

My opinion may be biased, but I am a firm believer that everyone has the capability to create wealth regardless of their income level. Sure, creating wealth requires a real wish to improve your financial position, and some disciplined saving and spending, but it’s not as hard as it may seem.

So, as we enter the time of year when many of you will start setting goals and making wishes for the year ahead, here are some simple money moves many of which you may have overlooked that can help you create new money in the new year.

Tracking your expenses for 30 to 90 days will teach you how, and how much, you spend. Chances are you’ll be surprised to see all the things you buy, and how costly they are, when you honestly account for your spending habits When you know where your money goes, it’s easy to ask yourself if the things you’re spending your hard-earned paycheck on are necessary And if they are, perhaps there’s a cheaper way to acquire them This is a simple exercise that will help you identify if and how you can trim your expenses to immediately start growing your wealth

One of the best ways to build wealth is to automate it So, instead of personally setting aside your newfound savings (see above) at the end of the month or whenever you see your checking account balance increase (the leftover dollars after expenses), save and invest first by directing your employer to automatically deposit a portion of your paycheck into a savings or investment account (or both).

One option is to have a flat dollar amount, say $200, deposited into a savings account and the rest of your net pay deposited into your checking account Another option is to specify a withholding percentage of your gross pay, say 10 percent, to deposit into your employer-sponsored 401(k) or 403(b), or any other type of savings or investment account permitted While you’re at it, if your employer offers a matching contribution on retirement account contributions, try to contribute at least the amount required to earn the full company match Making these money moves will make you money, and I bet you won’t even notice the “missing” money from your checking account you’ll be too busy appreciating the new wealth you’re building

I’m sure you’re familiar with the well-known personal finance recommendation of setting aside a minimum of three to nine months of living expenses in an account that’s only accessed, you guessed it, in case of an emergency It’s a basic component of creating wealth because you don’t want to be forced to draw funds from your long-term savings and investment accounts for a shortterm emergency

The size of your emergency fund should consider variables like monthly spending, how quickly you think you can find a new job if necessary, and whether a spouse’s or significant other ’s resources are sufficient to meet emergencies This fund doesn’t always require cash For example, in some cases, a home equity line of credit could serve as an alternative emergency fund. In addition, the cash

value of whole life, or other permanent life insurance products, could be suitable choices for an emergency fund.

Unless you’re older than 85, or have a special health situation, I recommend setting a minimum 10-year time horizon for your investments This means allocating a healthy portion of your investments to equities Current interest rates are just too low for most people to accumulate wealth by investing exclusively or even largely in traditional bonds, savings accounts, and CDs The right mix of these asset classes depends on your own financial situation goals, resources, risk tolerance, and other factors and I recommend meeting with a personal financial planner to develop a plan that takes all of this into account to establish an appropriate equity allocation

Don’t worry about timing the market, worry about time in the market For most investors, wealth creation comes from committing dollars to an investment and regularly adding more dollars to it in good times and in bad times

It’s easy to get caught up in trying to catch a piece of a bull market or invest heavily at a market bottom, but if 2017 has taught us anything, it’s that markets are extraordinarily difficult to predict Instead, it’s generally better to stick with making regular investments according to a preset timetable (weekly, monthly, quarterly, etc.). Keep those dollars invested, especially in equities. Further, a schedule for investing in equity mutual funds or exchange-traded funds (ETFs) can take the emotion out of deciding which individual equities to purchase and when to sell them

We’ve all heard the adage of successful stock market investing: Buy low and sell high If you have the tolerance for it, one way to

any

there will be

d u s t r i a l s , Te c h n o l o g y, e t c t h a t outperform or underperform the broader market Market makers and investors can be fickle and may sell off last quarter ’s winning sectors and rotate into others as company, financial, economic, and geopolitical news is released You can take advantage of this b y p e r i o d i c a l l y o v e r w e i g h t i n g y o u r p o r t f o l i o i n l o w e r- r e t u r n i n g s e c t o r s W h i l e y o u m a y t e m p o r a r i l y s e e l o s s e s , m o r e o f t e n than not you will be rewarded with higher valuations if you allow a l o n g e r- t e r m h o r i z o n f o r y o u r i n v e s t m e n t s t o g r o w. T h e r e a r e m a n y s e c t o r- s p e c i f i c m u t u a l f u n d s a n d E T F s t h a t m a k e t h i s strategy easy to implement

Your career is probably the most significant tool you have for creating wealth For example, investing in technical and managerial training for yourself could drastically increase your earning and career potential Take stock of your present career path, assess the likelihood of future and financial success, and make the changes needed to achieve your goals.

The start of a new year is a great time to assess where you are personally, professionally, and financially, and make positive changes for the year ahead Whatever New Year ’s resolutions you come up with, make creating wealth and ensuring a solid financial future one of them

Gain insights about the global economy and learn how to st ay ahead of the cur ve in 2018 Hear from a panel of nancial experts on their forecasts for the economy, t axes, the markets, interest rates, and regulator y changes that are likely to impact your investments and business decisions

T ick ets

Member: $105

Nonmember: $155

Tables Member: $1,20 0

Nonmember: $1,70 0

2018

Diane Swonk Founder, DS Economics

Savage

NationallySyndicated Columnist, Terr y Savage Productions

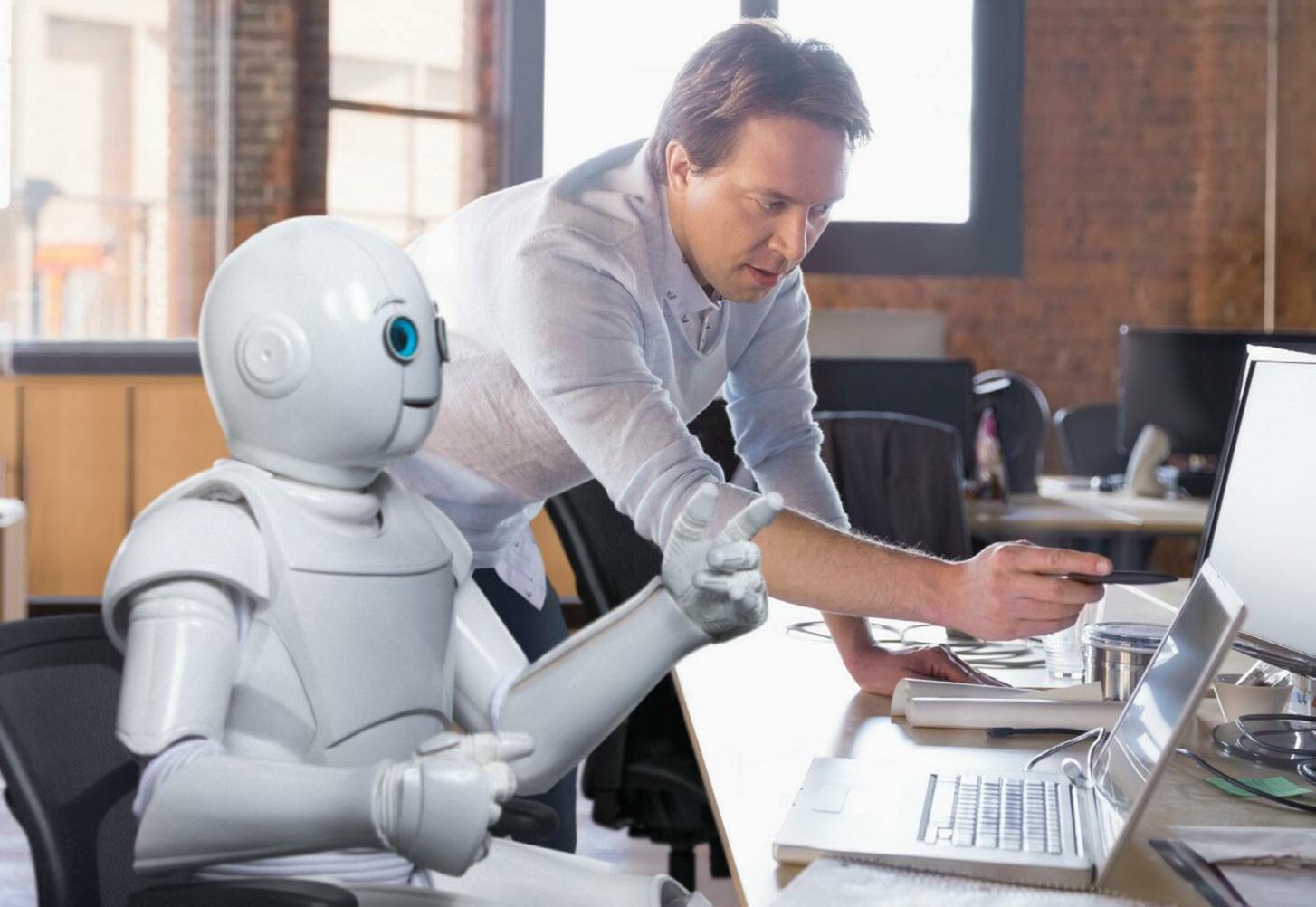

The age of the robo-advisor is among us

Over the last few years, industry leaders like Vanguard, Morgan Stanley, H&R Block, EY, and others, have made their first ventures into the world of artificial intelligence (AI) and machine learning and that’s going to mean big changes throughout the financial services industry

The question many ask, however, is whether customers and clients will simply trust emotionless, lightning-fast computers and their complex algorithms to help them make their most important business and financial decisions. The answer: They already are many without even realizing it

And therein lies the threat To what extent will human advisors particularly those resistant to change be replaced by the rise of machines?

“It’s impossible to know what the job losses will look like because of AI, and rapid advances have made that uncertainty greater,” says Brian Uzzi, a thought leader on social networks and big data, professor of Leadership and Organizational Change at the Kellogg School of Management, and co-director of the Northwestern Institute on Complex Systems (NICO).

What’s more, companies that embrace AI are using it to expand their businesses and relationships with clients, which also impacts labor needs. “The world of AI is creating efficiencies in industries where the bottom line is the top priority,” Uzzi says, pointing to Morgan Stanley’s move earlier this year to arm 16,000 financial advisors with algorithms that recommend trades and take responsibilities for more mundane tasks as proof of concept And for those who are reluctant to adopt such technology? Well, they’ll get left behind. “I think in some industries, particularly the financial services industry, job loss is not necessarily seen as a problem, but deeply embraced,” Uzzi says.

Indeed, many firms will likely be eager to phase out and automate some human jobs in pursuit of profits “AI will eliminate people who are doing the routine stuff, so you have to move them over to the predictive stuff,” suggests Willard Zangwill, professor emeritus at the University of Chicago Booth School of Business “CPAs, accountants, and finance professionals are in a fantastic position because they understand data, particularly financial data, that is important to business they will be tasked with understanding how data is going to help the different aspects of a company.”

In fact, we’re already seeing the merging of man and machine, accountant and AI, in the tax space.

In February 2017, H&R Block, perhaps the most widely recognized tax preparation company in the industry, announced an alliance with IBM’s Watson, an AI system that originally gained fame by competing, and winning, as a contestant on the television quiz show “Jeopardy!” in 2011.

“We are introducing something this tax season that is totally new, and is in fact, a first in the tax preparation category,” H&R Block President and CEO Bill Cobb wrote at the time of the rollout. He went on to claim the combination of “the human expertise, knowledge, and judgment of our tax professionals with the cutting-edge cognitive computing power of Watson” will benefit both tax professionals and clients

Cobb noted in Watson’s introduction that customers and tax professionals are faced with “a federal tax code with more than 74,000 pages and thousands of yearly tax law changes ” And that’s where Watson comes in With its extreme computing power, Watson can parse and present the subtlest changes in the tax code, alerting tax preparers to discrepancies in filings and arcane rules that, when accounted for, can equal big savings for clients. The beauty of Watson is the more data it is fed, the smarter it gets, making the tasks of tax preparers and accounting professionals easier as they go.

“This technology allows for the best of man and machine,” says Meg Sutton, H&R Block’s director of retail client experience She explains that the company views Watson as “augmented intelligence” rather than “artificial,” because in an AI platform the computer is making the decisions for the user. With Watson, the tax pros still make the final decisions It’s a refrain commonly heard among the companies arming themselves with AI that still want to ensure their clients that their money is safe in the hands of a human being but even this is changing

The upstart firm Dream Forward, a technology-based provider of modern 401(k), 403(b), and 457 plans for businesses and nonprofits, has built its business around an AI platform designed to lower costs, simplify retirement investing, help employees feel emotionally confident in planning and saving for retirement, and help advisors understand what their clients are thinking i.e. worrying about college savings, how matching works, or asset allocations

Actions like early withdrawals, major shifts in investment strategy, or simply taking too long to make a decision can trigger Dream Forward’s always-on AI chatbot to ask questions and issue warnings to users in easy-to-understand English as they navigate their accounts

Grant Easterbrook, the former robo-advisor analyst and consultant turned Dream Forward co-founder, describes the Emotional Advisor technology they developed as “conversational AI used to talk to clients and keep them on track.” For example, if the client lowers their savings amount, the AI, which looks like an online chat, will pop up and ask why the client did that in an attempt to talk through the concerns and reasoning

“The goal of the technology is to keep users from taking negative actions,” says Easterbrook, who believes that mission is best accomplished with technology that's designed to work with human financial advisors rather than replace them Dream Forward’s AI shares what it has learned from clients so the human financial advisors working with the clients can custom tailor their outreach based on specific needs or concerns.

Here again, we see the merging of man and machine rather than replacement for now Uzzi says he believes smaller companies, particularly those operating in the retail space of financial management and traditional brokerage services are susceptible to an Uber-like disruption; however, the high net-worth clientele segment is more likely to be protected due to the importance of personal relationships.

“These clients often make financial decisions based on emotion and want the sense that the human they’re talking to is watching their backs,” Uzzi elaborates. But that could change as time goes on and the more tech-savvy generations begin saving more “If I create a machine that provides the same sense of emotional security, and it makes a better decision than a human being, I think people will be happy to work with a machine,” he says.

The machine learning used by Watson, for instance, is the same kind of technology being used in developing self-driving cars. If consumers are willing to put their immediate lives in the care of a machine, will they do the same for their financial lives? Uzzi thinks so, but as more firms and consumers turn to AI and other technologies, it’s only a matter of time before safeguards will have to be put in place

Easterbrook says this has been a topic of great interest to his company, and Dream Forward has been careful to build its AI platform in a way that does not create a liability. “Our technology will not tell you to buy this or sell that Our investment lineup is picked by an investment fiduciary and uses low-cost institutional funds; there’s no proprietary AI-driven active management strategy,” Easterbrook explains. “There’s no case law on using AI for financial advice yet But Dream Forward isn’t taking any chances; this is a whole new area that hasn’t been dealt with before.”

What hasn’t been dealt with yet surely will be, and Uzzi believes that it will be AI technologies at the forefront “As technology advances, consumers will become increasingly comfortable using AI to help make important life decisions,” he says “In the future, the most important contact in your social network might not be a human being but a machine ”

Taxpayers and tax preparers alike may soon face whether their identifying information has been stolen and used to steal a lot more

BY JEFF STIMPSONMajor hacks such as that of Equifax in which data thieves swiped sensitive information of more than 145 million people should make both taxpayers and tax and accounting professionals worry. Authorities now fear that Equifax’s stolen information may ravage the coming tax season as crooks race to use the stolen data to falsify returns

One tax-related red flag of a stolen ID: More than one tax return being filed for a consumer, says the IRS Although, we’d be remiss to not point out that the IRS itself was an Equifax client, awarding the company a multi-million-dollar, short-term, no-bid contract for ID verification

“Most fraudulent tax returns are filed within the first few weeks of the year since the only way criminals can potentially scam the IRS is if they file the return before the taxpayer does,” says Louis Sands, CPA, tax director at Sikich in Naperville, Ill “So, by the time the CPA starts working on a client’s tax return, the damage is usually already done It’s also difficult for CPA firms to directly help their clients who have been victims of ID theft The IRS is typically unwilling to deal with anyone other than the taxpayer, especially when ID theft is suspected.”

A taxpayer who wants to find out if another return has been filed in their name should contact the IRS or the state taxation agency

by phone Confirmed victimized taxpayers will receive a letter from the IRS or state tax authority with a case number and specific instructions as to what to do and where to send a response or additional documentation.

“Electronic filing will speed up that process since a taxpayer cannot submit a return electronically if one has already been filed,” Sands says. “Paper filing will also uncover ID theft, though the matching process takes longer ”

For federal returns, victims are asked to complete Form 14039, “Identity Theft Affidavit ” Once it’s determined that a phony return has been filed, the victim can request a copy of the return by filing a Form 4506-F, “Request for a Copy of a Fraudulent Tax Return ” The IRS will investigate and may issue an identity-protection number (IP PIN) which in itself requires submission of large amounts of personal information

“Children are especially vulnerable,” Sands warns, “so taxpayers should closely monitor their children’s credit reports and can even request a transcript of their children’s accounts from the IRS to see which returns, if any, have been filed

“CPAs also should know the process a client needs to go through as a victim of ID theft,” Sands says “Practitioners should set expectations about the lengthiness of the process. It can take months to correct.”

Michelle Erickson, financial services risk consultant, and Michael Lucas, risk consulting senior manager, both of Crowe Horwath in Chicago warn that additional signs of ID theft include tax return amounts that seem incorrect; owing money that you weren’t expecting; notifications of data breaches from companies that have your information; and records of new accounts being opened in your name.

In the age of data theft, both firms and clients must diligently ask how sensitive information is accessed, says Dr. Sean Stein Smith, CPA, assistant professor in the Department of Economics and Business at Lehman College in New York and member of the American Institute of CPAs’ Financial Literacy Commission. “Is the information stored in the cloud or a proprietary server? How often is the information accessed by individuals from public places? Are there any procedures in place at the firm that could potentially expose client information?”

Keeping sensitive client data safe has been a tax and accounting industry priority for decades, but as digital data thefts become more common, firms must respond by increasing investments in IT security hardware, software, and staff training

Tax specialist Jessica Grant and Help Desk specialist Mike Wills at Smith & Gesteland in Madison, Wis say some simple, smart practices can help firms:

• Disallow use of portable digital media storage, like USB and portable hard drives. Instead, pass digital files and emails between firm and client through encrypted email and filesharing software

• Communicate to clients the latest IRS information on hacker strategies, especially warnings about phony tax notices and phishing schemes, and discuss current firm information security policies with clients

• Consult with internal audit and IT departments to review recent data breaches, and follow up with an action plan that includes possible areas of weaknesses and steps to address within the firm Compare current hardware, software, and training with best practices established by professional organizations

Speaking of passwords, complex passwords have long been the requirement, but Grant and Wills note that complexity can also cause problems If password rules are too complex, users may not remember them and may write them down or keep them in an unprotected document on their desktop Password management software and apps, on the other hand, allow users to securely access all their login credentials with only one access key

Further increasing security, enabling Multi-Factor Authentication when available allows a secondary requirement, usually an instantly generated code, to accompany the traditional password login. That code can be presented through an email, text message, or on something like a key fob, phone app, or even a specific USB device that must be plugged in by the user to work

The Equifax breach may be in focus now, but there are many data breaches throughout the year Grant and Wills warn and all data breaches are serious, whether small or large.

Action plans should be in place for not if, but when, a data breach or loss occurs Tax and accounting professionals experiencing a data breach should contact their local IRS stakeholder liaison who will relay information to the necessary parties within the IRS, including the agency’s Return Integrity and Compliance Services and Criminal Investigation divisions. The liaisons will need a list of the affected taxpayers, including their names and Social Security numbers. Other post-breach steps for firms include contacting law enforcement and state taxing authorities where the tax returns were filed Tax professionals can email the Federation of Tax Administrators at StateAlert@taxadmin org to get more information on how to report victim information to various states You may also need to notify a given state’s attorney general

“Send an individual letter to all [client] victims to inform them of the breach,” the IRS adds, “but work with law enforcement on timing ”

In response to the latest breaches, many state taxation departments are requiring special validation codes on W-2s and driver ’s license numbers to electronically file returns In 2018, a new verification code box will appear on all W-2 forms. The IRS will also ask tax professionals to collect more information on their business clients to help authenticate the tax return being submitted Those filing returns for businesses, estates, and trusts may need to provide payment history, the name and Social Security number of the individual authorized to sign the business return, and parent company information.

And for a closing note of caution, “The IRS will never start a proceeding with a taxpayer via email or telephone,” Stein Smith says. “Even with the extra attention and interest on potential tax fraud this year, this will not change.”

BY ERIC SCOTT

BY ERIC SCOTT

Trust, reliability, intelligence, confidence everything you’d look for in a strategic advisor; everything you as an advisor must be. But these aren’t the easiest of qualities to portray, and getting to the point where clients, colleagues, and others regularly seek you out for professional advice may take a while After all, there’s that whole “getting to know you” period for building lasting business relationships and reputations But if you’re going to make the m o v e f r o m b a c k r o o m s t a f f a c c o u n t a n t t o f u l l - f l e d g e d s t r a t e g i c advisor, proving yourself while seeking promising opportunities is exactly what you’ll have to do daily.

“Your clients and colleagues have to view you as more than just a tax or accounting wonk,” says Geoff Harlow, CPA, partner with the a c c o u n t i n g f i r m K e s s l e r O r l e a n S i l v e r i n D e e r f i e l d , I l l . H a r l o w r e c a l l s a c o n v e r s a t i o n w i t h a c o l l e a g u e t h a t b e c a m e a n u n e xpected turning point early in his career, inspiring the approach to building business relationships he still uses today

“I think back to a cab ride I shared with a senior partner as he described his relationship with a private equity firm. He explained to me that he made it a point to be able to answer any question on any topic that they had,” Harlow recounts “So, they got in the habit of contacting him, even on things that weren’t tax related They’d ask him about a good French restaurant in Manhattan, a corporate finance issue He made a point of being broad and gathering a lot of information things that were way beyond the narrow scope of tax services he provided. I try to take that approach myself.”

The takeaway here is to be mindful of positioning yourself to reach beyond your core competency, because the business world won’t wait for you to catch up.

The fast-changing nature of the accounting and finance industries are demanding the transition of accountants into strategic advisors within firms and companies These diverse and sometimes specialized professionals are increasingly being called upon to help navigate the current era of business disruptions and rapid technological advances influencing the business world

“ T h e a c c o u n t a n t w i l l p l a y a n i n c r e a s i n g l y i m p o r t a n t r o l e a s a strategic advisor in the future,” says Willard Zangwill, professor of management science at The University of Chicago Booth School of Business “Firms are becoming more complex This means more complex handling of the financial information and the need to understand how the different parts of the firm interact.”

T h e r e i n l i e s o p p o r t u n i t y. Z a n g w i l l p o i n t s o u t t h a t i n c r e a s i n g c o m p l e x i t i e s t e n d t o s h i n e t h e s p o t l i g h t o n t h e s t a f f m e m b e r s with expertise in business-critical areas, making them the default “go-to” resources.

Zangwill highlights several areas where firms and companies need strategic advisors. For one, business is becoming increasingly international “Even smaller firms are participating internationally But accounting procedures and standards are different in different countries Someone has to understand that complexity,” he explains

Zangwill also points to opportunities in big data and information p r o c e s s i n g “ B i g d a t a [ u s e ] i s i n c r e a s i n g T h e a c c o u n t a n t n o t only understands numbers but also the business,” he says “Hence, the accountant is in a pivotal position to integrate the numbers and

the business aspects, and the role of information will only increase in the future.”

Next, there is both threat and opportunity in artificial intelligence “Similar to big data, the person who understands the numbers and business is the accountant That role will increase,” Zangwill says, eluding to accountants increasing their dependence on artificial intelligence for completing their menial job functions, freeing up time for strategic business decision-making and advising, business development, and other functions dependent on human interaction

All in all, these are examples of trending areas where there are big opportunities for accounta n t s t o r a m p u p t h e i r e x p e r t i s e a n d b e c o m e internal and external strategic advisors.

M a y b e w a t c h i n g e n d l e s s r e r u n s o f t h e g a m e s h o w “ J e o p a r d y ! ” i s n ’t t h e b e s t w a y t o ramp up your expertise in disparate pieces of i n f o r m a t i o n t h a t m i g h t c o m e i n h a n d y a s a s t r a t e g i c a d v i s o r, b u t b e i n g c u r i o u s , l e a r n i n g new things, and learning how to present details are good starting points

“There’s always a certain amount of time that one needs to spend as a professional to acquire m o r e k n o w l e d g e A n d i f y o u ’ r e n o t g o i n g t o s p e n d a m i n u t e f r o m t h e o f f i c e r e a d i n g o t h e r things, you’re going to have a problem,” Harlow says, adding that the core element of becoming a s t r a t e g i c a d v i s o r i s a s o l i d f o u n d a t i o n o f knowledge, credibility, and trust.

CPAs often applaud themselves for being considered the “most trusted business advisors,” but s i m p l y h a v i n g c r e d e n t i a l s a t t h e e n d o f y o u r name doesn’t make you a truly trusted voice To be a true go-to strategic advisor, you need to be a b l e t o d i s c u s s t h i n g s “ w i t h s o m e d e g r e e o f a u t h o r i t y, ” H a r l o w s a y s . T h a t m e a n s e q u a l l y being honest about your knowledge.

“Clients want to know that they’re getting the most trusted information,” says Janel O’Connor, chief human resources officer with Sikich LLP in Naperville, Ill. “They want to put trust in growi n g a r e l a t i o n s h i p w i t h t h e i r s t r a t e g i c a d v i s o r. The more you can demonstrate you grasp the information, the quicker a move can be done ”

A t t h e s a m e t i m e , i n t e g r i t y i s p a r a m o u n t I n o t h e r w o r d s , d o n ’t “ w i n g - i t ” b y o f f e r i n g u p a n s w e r s y o u r e a l l y c a n ’t s u p p o r t o r t r y t o impress others by being something you’re not. H a r l o w c a u t i o n s t h a t s m a r t c l i e n t s a n d c o lleagues will catch on to a phony fast “ Yo u d o n ’t n e e d t o b e a n e x t r o v e r t o r l i f e - o ft h e - p a r t y t o b e a s t r a t e g i c a d v i s o r, ” H a r l o w says. “One just has to recognize their strengths a n d w e a k n e s s e s a n d w o r k w i t h i n t h e l e v e l of their skills.”

So, when is the right time to make your move from the backroom or sea of cubicles to the client meeting table? Should you take the initiative right away or keep a low profile for a while?

“Don’t wait for it take the initiative Take your tactical aptitude and translate that into strategy,” O’Connor suggests. “Be proactive in asking career progression questions, and don’t be too passive in hoping opportunities come your way The more you can be in the driver ’s seat, the better your chances of being successful ”

O’Connor sums up her take on the backroom accountant-to-strategic advisor transition by offering this: “The best accountants are the ones who get a seat at the table and engage and troubleshoot with their clients It’s about really getting that rich client experience and face time and providing the most value as soon as possible ”

Attention always turns to tax policy and how it might change d u r i n g t h e f i r s t y e a r o f a n y n e w a d m i n i s t r a t i o n i n Wa s h i n g t o n , D C By most accounts, year 2017 has been the same, albeit things have turned out to be a little different than expected.

Despite near-perfect legislative conditions majority party, protax reform rule in both the White House and Congress the first real attempts at tax overhaul in 30 years have been a slugfest right up to the year-end Congressional recess.

What’s the lesson? Any time federal or state legislators take an ambitious run at the tax code tax professionals and finance executives need to do everything possible to stay flexible, stay focused, and stay fixated on the best options for their businesses and their clients all while staying calm

For Renato Zanichelli, national managing partner of Grant Thornt o n ’s Ta x R e p o r t i n g & A d v i s o r y S e r v i c e s p r a c t i c e , t h a t ’s m e a n t

“urging all of my clients to create models for potential outcomes. Step one is to understand how tax reform is going to impact them Step two is to look for ways to position them for future success.”

And once a deal in D C is finally done? Be ready for the sprint “Many clients are looking at what they should be doing now to prepare for financial reporting requirements if and when tax reform passes,” Zanichelli says “They realize there will be a lot of work to do in a short period of time ”

While top administration officials had predicted tax reform by the end of this rather tumultuous year, by the fall, public board members seemed less confident

The 2017 BDO Board Survey, released in September, found that 78 percent of public company directors anticipated that tax reform will be achieved during President Donald Trump's current fouryear term, but just 22 percent said they believed it would happen by the end of this year. Another 22 percent said they didn’t think tax reform would happen at all during Trump’s term

However, by press time, a budget deal appeared imminent, setting the stage for some form of tax reform by the end of 2017

So how do internal and external CPA professionals navigate such uncertainties for the businesses and clients they serve? It seems

their advisory skill is less about prognosticating and more about listening lately listening very closely

Daniel Rahill, CPA, CGMA, a tax partner with BDO USA, LLP in Chicago, figures he’s given “over a dozen” tax reform presentations since the election. At the start, he reflects that “most of us believed that significant changes were imminent with a Republican Congress and president all moving in the same general direction of rate reduction and a territorial tax system.”

But as the final quarter began, things had clearly changed, at least from Rahill’s point of view.

“The current mood can be summed up in three words: interested, inquisitive, and cautiously optimistic,” he reckons. “Clients are n o t ‘ c o n c e r n e d ’ a b o u t t h i s a s m u c h a s t h e y n o w a r e c u r i o u s bystanders watching to see if a fractured political party can pull itself together enough to propose tax legislation to make the U S more competitive globally.”

M a r k Wo l f g r a m , C PA , s e n i o r t a x c o m p l i a n c e m a n a g e r a t B e l

Brands USA says chalk talks about various tax scenarios throughout this year have proven useful for the leading Chicago cheese company, but ultimately, rapidly changing domestic events and c o m p e t i n g p r i o r i t i e s o u t o f Wa s h i n g t o n h a v e m a d e i t t o u g h t o cement a clear prediction on how tax reform might look “ A t B e l , w e ’ v e u s e d t h e i n f o r m a t i o n c o m i n g o u t o f D . C . t o d o some initial planning,” he explains For example, the company began to “model out” how the proposed Border Adjustment Tax (BAT) would impact its business “We involved the various players supply chain, finance, tax, etc. and established a flow of communication around the model Now that the BAT seems to have been shelved, the modeling for that piece is on hold ”

Still, Wolfgram says it was an exercise that produced real dividends “Having open lines of communication is important as true t a x r e f o r m i s n o t j u s t a b o u t h o w a b u s i n e s s c o m p u t e s t a x a b l e income Tax reform is the opportunity to look at all our business processes to see if there’s an opportunity to optimize what we do to maximize our return on investment ”

The events of the past year seem to have increased the value of testing scenarios and optimizing one’s analytical skills Wolfgram recalls the meeting he had with Bel’s CFO and one of its board members on November 9, 2016, the day after the election “ I b e g a n t o o u t l i n e t o t h e m t h a t t a x r e f o r m a n d r e p e a l o f t h e Affordable Care Act were now going to happen within 12 months So far that has not happened and the more days which pass m a k e t h e s e t w o t h i n g s l e s s l i k e l y t o h a p p e n . ” S p e a k i n g i n l a t e September, Wolfgram said he believed “real tax ‘reform’ is going to be replaced by a simple tax ‘cut,’ and real meaningful reforms to the U S tax system and the Affordable Care Act are not likely until 2019 at the earliest.”

Rahill concurs, adding that currently there are not a lot of “viable ways to pay for tax reform, which would mean an increase to an a l r e a d y b l o a t e d d e f i c i t A n d w h a t d o e s t a x r e f o r m r e a l l y m e a n today?” he asks “When I think of tax reform, I think of the early 1980s tax legislation, when we had significant tax acts in 1981, 1982, 1984, and 1986 The Tax Reform Act of 1986 was so significant in changing the tax law that Congress renamed the Internal Revenue Code from the Code of 1954 to the Code of 1986 That was significant tax reform,” he explains “If any tax legislation is enacted, it may simplify the current tax regime and lower tax rates, but it will not be significant tax reform.”

the most trusted business advisors is b

“That said, in situations where a client can defer a transaction with potentially affected tax implications to a later date, when tax reform is more predictable, we would recommend that they take a waitand-see position assuming no negative implications to waiting,” he says. “Examples would include estate planning until we know if the estate tax will be repealed; intellectual property migration to a lower taxed jurisdiction (outside the country) until we see what the U S tax rates will be in the future; or a purchase of a home until we see how itemized deductions, including mortgage interest and property taxes, would be impacted by any proposed legislation ”

Alternatively, you can take Wolfgram’s approach: “It’s business as usual. It has to be. Certainly, our company would like to see tax reform happen, allowing us to pay less tax and use that money to invest in the business,” he says. “But we realize there’s uncertainty surrounding the process and that we should not count on tax savings to make investments at this point. Now we’re viewing potential tax reform benefits to be a windfall instead of relying on them to make the numbers work ”

In the meantime, as we all eagerly await the outcome of this tax reform showdown, accounting and finance professionals should simply do their best to stay informed.

“

spectrum is the best way for me to stay up-to-date I read and listen to everything I can get my hands on I sign up for newsletters from the largest accounting firms in the country and I listen to all their webinars I follow tax policy experts on Twitter and read their think p

Committee during each meeting on the latest updates and prognostications,” Wolfgram says. “It’s a lot of work, but when you’re a tax nerd like me, it’s fascinating to watch how this unfolds.”

“ True tax reform is not just about how a business computes taxable income. Tax reform is the opportunity to look at all our business processes to see if there’s an opportunity to optimize what we do to maximize our return on investment.”

For more than 15 years, American vacation time was drifting in a downward spiral For those in accounting and finance professions, some would argue it has been even longer Our always-on work culture is a challenge in itself But, let’s face it, year-end and tax season are historically even more grueling times for everyone in the tax, accounting, and finance spaces That’s why “taking the time to clear your head, destress, and recharge afterwards will help you excel at your job and find better balance in your own personal life,” says Jeramy Kaiman, vice president of executive search firm Parker + Lynch

Kaiman, who is deeply in tune with staff and executives in the accounting and finance industry, says more of these professionals are getting better about “taking off” after their busy seasons to rest and recharge away from their home bases, especially during the months of May, June, and July. “Given the sheer number of hours and commitments that they’ve had up until that point of the year, taking time off has become the norm,” he adds. “And in many cases that time off involves travel and getting out and experiencing the world firsthand.”

Millennials, for instance, are spending more of their discretionary income on travel than their predecessors, enjoying “sensible” trips that germinate from budget travel websites and platforms like Airbnb Internet Marketing Inc ’s numbers tell the story: 86 percent of millennials travel to experience a new culture; 85 percent check multiple sites before booking to get the best deal; 75 percent wish to travel abroad as much as possible; and millennials enjoy last-minute trips to satisfy “sudden wanderlust ”

But couldn’t we all benefits from some newfound post-busy season wanderlust? Research says, “Yes.”

So, we’re here to remind you to take some time off

W i th ye a r- e n d c l o s i n g , a n d t a x s e a s o n wrapping up in jus t a few shor t months, it’s time to s tar t planning your pos t-busy season escape.

“American workers hold fast to the belief that the path to career success requires sacrificing vacation and embracing work martyrdom,” states Project: Time Off’s survey and report, “The State of the American Vacation 2017.” “But the data is unmistakably clear: planning for and taking time off benefits individual wellbeing and professional success, business performance, and the broader economy ”

Kaiman adds that low-tech or tech-free vacations have immediate and tangible perks and benefits, including stress reduction, improved concentration, better mental clarity, and improved health, to name just a few

And since we’re all numbers people, we’d like to point out that vacation time also has overlooked costs to you In 2016, Project: Time Off reveals that the average amount of vacation days earned by employees increased to 22 6 days But, the average American worker uses less than 17 vacation days per year That means roughly 662 million vacation days were left on the table last year “By forfeiting vacation days, American workers gave up $66 4 billion in 2016 benefits alone,” Project: Time Off says “That means that last year employees effectively donated an average of $604 in work time to their employer America’s work culture has a long way to go to rewire its thinking ”

Here’s a thought: “After a stressful busy season, my top recommendation is an all-inclusive vacation to the Caribbean or another sunny, warm place,” says Roshni Agarwal, CPA, co-founder of the travel planning company The Vacation Hunt.

A major advocate of post-busy season vacations for weary accountants, Agarwal adds that such packages are pretty straightforward to book online, which means “CPAs don’t have to take the time to plan an elaborate trip right in the middle of their busy seasons ”

Agarwal points to late spring as a great time to get away too, because it's after the peak holiday travel and tourist seasons. And the further out you plan, the better deals, flights, and hotel availability you’re going to find, she adds and the more likely you are to actually take that time off

“The most effective remedy for American workers who want to use more vacation days is better planning,” Project: Time Off says “A majority (52 percent) of workers who say they set aside time each year to plan out their vacation days take all their time off, compared to just 40 percent of non-planners. The benefits of planning extend beyond the days spent away from the office. Planners are happier

than non-planners in every category measured Planners report they are ‘very’ or ‘extremely’ happy with their relationships, health and well-being, company, and job ”

“Start by sitting down and figuring out some dates that will work with your schedule,” Agarwal says “Next, consider exactly what you’d like to do during your time off. Do you want a relaxing beach getaway, an ‘active’ vacation that involves hiking and adventure, or one that incorporates that destination half-marathon that you’ve wanted to do? Whatever your preference, find a place that incorporates these ‘wants’ while also allowing you to destress ”

And, while you’re trying to get away from the numbers for a bit, Agarwal reminds to factor your budget into the equation The good news is that there is a mix of in-state, out-of-state, and far-off travel options that can accommodate any taste or preference “Everyone loves Michigan’s Upper Peninsula, especially during the summer months,” Agarwal says, “but there are also more exotic things you can be doing depending on your budget and goals ”

As a lifestyle writer for Travel + Leisure and a regular on-air CBS contributor, Jeanette Zinno travels a lot for work and understands the need to “get away” and destress For accounting and finance pros looking for the light at the end of the busy season tunnel, Zinno says one of her top tips is to pick a destination that has no cell service or at least a hotel with a “digital detox concierge.”

Hotels like the Ritz-Carlton Key Biscayne in Miami and the Grand Velas Riviera Nayarit in Mexico use clever strategies like curated, non-digital itineraries and removing TVs from rooms to help guests wean themselves off phones, tablets, laptops, and other electronics. “This is a great way to totally disconnect after a long work season that doesn’t allow you to leave your phone for a minute because a client may call,” Zinno says

Of course, using technology ahead of your trip can still be helpful Zinno suggests tech-savvy travelers could explore some mobile apps to help plan the perfect getaway For example, Chatnbook allows you to enter a destination to be presented with hotel choices to “thumbs up” or “thumbs down” as you browse the options, while TripHappy helps you pick specific areas and neighborhoods to stay in “This app is best for someone who is going to Paris, for example, and wants to find a chic area to stay in that’s close enough to great restaurants, but far enough for a quiet escape,” Zinno says Your time away from work doesn’t have to conform to the traditional idea of a “vacation” either Wellness getaways are very popular all around the world Bookyogaretreats com, for example, helps users find the best possible destinations that meet their needs “If you’re not into yoga, try a destination like Canyon Ranch,” Zinno advises. “It’s a luxury all-inclusive resort and spa with destinations around the country ”

Finally, don’t overlook the staycation “It may not be the most glamorous option, especially if you have a beach cabana in mind, but think of how many amazing things there are in your city or close by that you’ve never seen,” Zinno says “From museums to sightseeing, to shows to restaurants, there are plenty of things you’ve been too busy to do over the last few months ”

At the end of the day, Zinno says picking the right R&R spot depends on what you’re searching for and how you want to spend your time “And if you can’t decide on where to visit,” she adds, “I recommend writing your top three destinations on a piece of paper and picking one out of a hat.”

www caldwellhouse com

Every year, The Caldwell House Bed & Breakfast in New York’s Hudson Valley puts together a special travel deal for tax preparers: Stay one night at this country inn and get a second night free in April The stay includes complimentary three-course breakfasts each morning, bottomless snacks, complimentary parking, and free Wi-Fi. “Plan ahead and you can add on a massage to help with stiff calculator neck and carpel tunnel,” quips Maria Coder of Bed & Brunch PR.

www neworleansonline com

As much of the country is still emerging from the cold, New Orleans is just reaching its ideal season Even better, New Orleans is affordable to the point of downright cheap Because New Orleans is such a destination for food, nightlife, and festivals, it’s easy to get an amazing experience At the end of April, New Orleans celebrates both the French Quarter Festival and the New Orleans Jazz & Heritage Festival “With a flight time of just over two hours from Chicago,” says Sam Olmsted of La Galerie Hotel, “New Orleans is a great destination even for a weekend trip ”

www tensingpen com

Tensing Pen offers a tropical sanctuary where you can truly be alone and intimately celebrate the end of a busy season Hugging the turquoise waters of Negril, Tensing Pen is much different from most touristy Jamaican hotels with large pools, crowded lobbies, and hundreds of rooms “Instead, guests may peacefully recharge in a secluded paradise with breathtaking views after feeling drained from months of interacting with clients and crunching numbers,” says spokesperson Maggie Sullivan Accommodations include private bungalows and cottages, and rooms without phones or televisions, giving guests an opportunity to disconnect from technology and reconnect to leisure.

Career resolutions can be as tough to tackle as those other popular New Year ’ s Eve resolutions that seem to last for about a week, like losing weight, exercising more, and eating healthier But if you ’ re eager to join the senior ranks of the accounting and finance profession in the year ahead, it ’ s smart to set the lofty goal of developing the best version of your professional self But be prepared to dig deep to create that new you, because the firm partners and corporate CFOs of tomorrow are expected to have a broader, deeper mastery of skills and a nimble, innovative mindset to keep up with ever-expanding roles and an unrelenting pace of change.

Indeed, technical competence only gets you so far, according to Tom Murtagh, tax partner at BKD CPAs and Advisors in Chicago “So much of success in this profession is dependent on how we manage, interact, communicate, and lead,” he says “ You have to master a wide variety of skills, and you can’t let anything slip to the point that you ’ re not paying attention to it ”

In other words, seniority isn’t enough to put you on the short list for an executive seat According to Murtagh, too many professionals mistakenly think that simply putting in the time will be enough to rise through the ranks “Things won’t happen just because you ’ ve been there ‘long enough,’” he warns “ You need to understand expectations and take control of the direction of your career ”

Resolving to become a well-rounded professional capable of meeting high demands takes tenacity and a proactive approach But focusing on relationships, acumen, and drive can help you gain momentum and boost your chances of C -suite success.

This is your year to build the skills and mindset needed to step into the accounting and finance profession’s senior ranks.

“So much of our work is relational, whether it ’ s internal team building or external work with clients and referral sources, ” says Murtagh, pointing to the trend of high-level finance roles becoming increasingly visible, requiring frequent interaction with team members and other departments, clients and customers, and outside partners and shareholders

Unfortunately, people skills comprise one of the biggest skills gaps in today ’ s accounting and finance professionals, according to Ash Noah, CPA, FCMA, CGMA, vice president of CGMA external relations at the American Institute of Certified Public Accountants A former CFO himself, Noah studies the evolving role of the CFO to help prepare the future pipeline of finance leaders To close that skills gap, Noah recommends getting involved in team efforts and projects that require partnering and collaboration.

Serving as a mentor or coach and helping to build talent also can help you develop relationships and leadership skills “It goes without saying that you need to be able to motivate and engage team members and manage and lead teams by example,” says Stacy Kelly, who leads search efforts for C -suite accounting and finance roles for Baker Tilly Search and Staffing in Chicago “Being able to create a strong bench and knowing how to give people the opportunity to shine will reflect well on you when you ’ re being considered for a more senior role,” she adds, noting that it ’ s important to take advantage of leadership training programs to develop those abilities

And don’t neglect your personal relationships and connections either stay active in industry associations, business clubs, and online networking. “So many C-suite positions are filled through networks,” Kelly says “The people who build strong networks don’t have to engage in job searches. They are sought out when a job becomes available ”

Historically, the accounting function focused on reporting what happened in the business, but future finance leaders need to be more forward thinking “Tomorrow ’ s CFOs, for example, will need to be out in front. Rather than reporting on revenue, they ’ll need to be leading the efforts for generating revenue They ’ll need to analyze the numbers to find creative and innovative ways to grow the business,” Kelly says, noting that her clients are looking for people who can find better, more effective ways to do business. “ You need to be in charge of making processes in these roles,” she says

Noah says this often requires making a mental shift from skeptic to influencer “Instead of reviewing information and saying why the company shouldn’t do something, shift to becoming the person who says why it can be done and how it should be done,” he says “Finance professionals are used to providing information and analysis about what happened. Now they need to provide information on what’s going to happen and how it’s going to happen It’s a subtle shift from ‘ no ’ to ‘how.’”

That mindset will be increasingly important as the CFO role continues its stretch into having greater involvement in strategy and operations. According to Noah, finance professionals will be increasingly called upon to help guide organizations through disruptions to their traditional business models “How we serve customers and create value is changing,” he explains “Companies need greater and greater investments in technology, but the value of those investments can be vague, which puts pressure on management teams Finance professionals need to be able to look ahead, see how strategies may change, and prepare for and invest in that change ”

On the operations side, the finance function needs to be able to provide quick decisions and analysis of data to help execute strategy “Companies are looking for people who can not only come up with solutions but who can execute solutions,” Noah says Developing the intangible business skills how to make sound decisions, deploy solutions, and identify what drives value often comes down to gaining greater exposure to the business and a deeper understanding of its operations “ You need to have a solid understanding of the products, customers, and competitors,” Noah says.

Demonstrating strong business acumen and administrative instincts is important in firm settings too “Many firms look at talent from a balanced scorecard perspective,” Murtagh says “The emphasis will be on production, billable time, revenue generation, and expanding services.”

In addition to growing the business, you’ll need to prove you can effectively manage the practice Demonstrating good billing, time recording, budgeting, data analysis, and project management skills will help prove your capability as a potential partner “ You need to be able to manage multiple projects and keep your finger on the pulse of what ’ s moving along. You have to be able to see where you ’ re generating efficiencies and where there are bottlenecks so you can schedule workflow and improve delivery to clients,” Murtagh explains, adding that accounting professionals need to develop flexibility in their thinking, and embrace the pace of change in technology, to handle those tasks

Tapping into your passions can make it easier to go that extra mile. “ The best way to build the career you want is with passion,” Murtagh says. “If you don’t have passion for your work, things can quickly become a grind But if you find ways to get involved in interesting projects, or with clients or issues that you ’ re passionate about, it will feel a lot less like work, and your passion will be evident to others ”

Senior-level executives also are expected to display their enthusiasm for their work outside of the office As Kelly explains, you need to be involved in your industry ’ s community, bringing ideas to the marketplace as a thought leader And thought leaders need passion to effectively tell the story of their industry or organization “The most successful CFOs are the ones who get authentically excited about the product or service they ’ re championing,” she says.

A commitment to personal professional development and lifelong learning also is important. Murtagh suggests looking beyond the education and training your firm or organization provides Attending conferences, reading extensively, and listening to TED Talks and podcasts are all good ways to expand your knowledge base “Anything you can do to develop your skills beyond the technical is going to help,” he says “One of my colleagues always says that what you do from 8 a m to 5 p m defines your current income, but what you do from 5 p.m. to 8 p.m. defines your future income. Investing those hours in yourself or your business can help you get to the next level of your career ”

But be sure those flames of passion don’t burn out Sustaining high performance in high-pressure positions can be extremely draining, which is why you can’t ignore work-life balance. Kelly suggests establishing boundaries around your availability and defining what qualifies as an emergency “ You have to take time out of the office,” she stresses “People under you will work harder when they see that you ’ re not working all the time and trust that the team can keep the ship afloat ”

DriveA fast-paced, constantly changing business environment demands driven, passionate leaders “Things are moving so fast today, so there won’t ever be time to sit down and bask in the glory of what you did yesterday You need to bring 100 percent effort every day You have to show you have a willingness to take on extra projects, to jump in and do what’s needed to help the firm,” Murtagh says. “Having a good attitude about doing what needs to get done can be really helpful, too.”

Seconding Kelly ’ s suggestion, Murtagh also stresses the need for maintaining a well-rounded life “Technology makes it easy to work 24/7, which is why you have to be mindful about removing yourself from the work space It ’ s hard to be completely out of pocket, but you need to look for ways to limit connectivity,” he says. “Be very intentional about your outside life.”

Meaning, take time for the things that help you relieve stress, recharge, and be a better person and professional your ascension to the C -suite depends on it.

On Jul y 29, 20 1 7, Equifax, one of the three largest credit agencies in the United States, discovered it was the target of perhaps the most critical data breach in histor y. Hackers exploited a vulnerability in an open-source sof tware package that allowed them to heist Social Security numbers, driver’s license numbers, bir thdates, addresses, full legal names, and other sensitive personal information of more than 143 million consumers. This single attack, just one of many in recent times, exposes more than 40 percent of the U S population to a ver y high risk of credit fraud. You, me, your clients and customers all are at risk, not just from this attack but also from the ones yet to come.

A ccording to IdentityForce, a provider of identity thef t, pr ivacy, and credit protection solutions, the number of repor ted data breaches from 2015 to 2016 jumped 40 percent And while 2017 isn’t quite over, some of the largest com panies we know, com panies such as Blue Cross Blue Shield/Anthem, Deloitte, Dun & Brads treet, InterContinent al Hotels Group, Whole Foods, and many more, have all been breached by var ying degrees this year

As our reliance on connected technologies and the internet grows, so do the threats Today, the data landscape is vastly dif ferent Ever ything exists in digit al for m: financial records, medical repor ts, legal dat a and it ’s all fair game for motivated hackers

Greg Edwards, CEO of cybersecur ity provider WatchPoint, believes that one of the primar y drivers behind the increased number of data breaches is the increasing ability of cyber criminals to monetize stolen dat a S tolen per sonall y identif iable infor mation (PII) records are adver tised for sale on the “deep web,” which is the sub-realm of the internet not indexed by standard search engines Cyber criminals or syndicates who purchase the data use it to commit a variety of crimes including fraud, identity thef t, espionag e, blackmail, and extor tion According to TrendMicro, health information and medical data fetch an averag e of $59 80 per individual record Passwords are the mos t valued pieces of dat a, averaging $75 80 each Social Secur ity numbers ring in at $55 70

The hacking industr y has become, in a sense, industrialized “ While cyberattacks in the past were poorly planned, oppor tunistic ef for ts by individuals or small g roups, today there are larg e, well-funded org anizations t aking a business-like approach to committing cybercr ime,” says Kip Boy le, founder and CEO of Cyber Risk Oppor tunities, an executive cyber risk advisor y firm

Today’s hacker s have access to a vas t mar ketplace of cr iminal technology A decade ago, hackers needed a broad range of technical exper tise to breach secur ity sys tems and monetize the dat a In contrast, today’s hackers just need to know who to approach to buy the exper tise they need to get the job done

“Hacking has been democratized, so now anyone can do it,” says Mark Herschberg, a cybersecurity exper t and CTO at Averon “ Today, there is an ecosystem as com plex as any we f ind in legitimate industr ies Individuals and teams specialize in each step. For example, you can buy ransomware created by one hacker, phishing email tools from

another, and an email list from a third You simply use the phishing tools to email people with links that install the ransomware, and then you sit back and make money ”

While most cybercrimes are driven by the allure of financial gain, there are other motives that organizations need to protect against

“An ang r y em ployee might reveal a trade secret A political hacking group might want to deface your website or send embarrassing tweets from your account Someone else might want to s teal your client ’s account det ails Other s may jus t want to extor t money from your com pany These are dif ferent people with dif ferent motives and dif ferent types of attacks,” Herschberg warns

For ex am ple, in 20 12, hacker s associated with an activis t g roup identif ied onl y as Anonymous, published over three gigs wor th of email and data taken from Puckett & Faraj, the law firm representing a s t af f serg eant accused of leading a g roup of Mar ines responsible for the deaths of 24 unarmed Iraqi civilians The firm never recovered from the breach

“First, hackers collaborate across geographical locations, making it dif ficult to track the attacking source Second, complexity and attack pay loads are evol ving rapidl y, making it slow to monitor and prevent many vulnerabilities and consequences in synergistic cyber networks Third, advanced, per sis tent threats are im planted across multiple stages, making it troublesome to catch real-time incidents out of normal network traf fic Last but not least, it is extremely hard to manage the volume, velocity, and complexity of the data generated by the myriad of security tools,” explains Swapnil Deshmukh, a senior director at V isa responsible for attesting security for emerging technologies

Swapnil’s harsh reality means organizations must be far more proactive rather than reactive in their defenses, investing in policy management, automation, and continual analysis to stay ahead of attackers

“A proactive measure of defense, like a backup or disaster recover y strategy, is much less costly and ef fective in the event of a ransomware attack,” says Jeremy Steiner t, CTO at WSM International, a provider of mig ration and specialized cloud ser vices For ex am ple, networ k segmentation can help mitigate risks and costs “ The first thing we look

at is segmentation and separation of workloads to isolate the ser vers with special compliance requirements The goal is to reduce the target footprint within the IT infrastructure,” Steiner t explains

Other defenses should include active threat monitor ing, and regular secur ity and sof tware patches and updates The cos ts associated with these activities var y by IT infras tr ucture, but can be a fraction of what ’s incur red due to a business disr uption or remediation steps following a breach

“ We are a tremendousl y digital wor ld, and yet too many people and com panies s till do not update their sof tware prog rams or secur ity sof tware,” Steiner t says While this may seem like commonsense, the Equifax data breach may have been avoided or minimized if a security patch issued months ear lier had been applied The WannaCr y ransomware attack that shut down U K hospitals, crippled FedEx, and infiltrated Deutsche Bahn in May 2017, exploited vulnerabilities in the W indow s XP operating sys tem, a platfor m that has been long abandoned and is no longer updated by Microsof t “No one should have been using that operating system,” Steiner t says “And yet, even today, many still do ”