T he Economic Outlook

The

WINTER 2020 Exploring the issues that shape today’s business world

Sailing Into 2021:

+ Career Development During COVID Planning for an Uncertain Future

The 2021 Tax Update

Keep Your Star Players on the Roster

Expanded Board Agenda for 2021

How to Survive 2021 License Renewal Season

www.icpas.org/knowledgehub ICPAS KnowledgeHub consists of vendor-sponsored insights and thought leadership resources designed to be helpful in your business, practice area, or career Check out this new resource today!

2 | www icpas org/insight WINTER 2020 www icpas org/insight YOUR CAREER IN THE TIME OF COVID SAILING INTO 2021: THE ECONOMIC OUTLOOK PLANNING FOR THE FUTURE IN UNPRECEDENTED TIMES spotlights 4 Today ’s CPA A Look Back, a Race Forward By Todd Shapiro 6 Capitol Report Don’t Be a Casualty: How to Survive 2021CPA License Renewal By Marty Green, Esq 8 Seen & Heard Building a Bridge to the Future By Hilary Collins 42 Gen Next Yes, No, Maybe So: How Culture Impacts Communication By Dixon Chan, CPA 44 IN Play Q&A With Edward K Zollars, CPA By Derrick Lilly trends 10 Tax What ’ s New for the Next Tax Season? By Daniel F Rahill, CPA , JD, LL M , CGMA 12 Hiring & Retention How to Keep Your Star Players on the Roster By Bridget McCrea insights 26 Director ’s Cut The Expanded 2021 Board Agenda By Kristie P Paskvan, CPA , MBA 28 Ethics Engaged The Ethics of Remote Work By Elizabeth Pittelkow Kittner, CPA , CGMA , CITP, DTM 30 Leadership Matters Skate Shorter Shifts: A Strategy for Focus By Jon Lokhorst, CPA , ACC 32 Firm Journey People: The Driver of Your CPA Firm’s Success By Tim Jipping, CPA , CGMA 34 Practice Perspectives Don’t Just Survive: Thrive By Art Kuesel 36 Financially Speaking Four Financial Planning Lessons for Turbulent Times By Mark J Gilbert, CPA/PFS, MBA 38 Tax Decoded How Tax Reductions Pass the Buck By Keith Staats, JD 40 Inside Finance Five Areas of Change as Audits Go Virtual By Nancy Miller, CPA 14 18 22

Looking for top accounting and finance talent?

ILLINOIS CPA SOCIET Y

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

www icpas org

Publisher/President & CEO

Todd Shapiro

Editor Derrick Lilly

Assistant Editor

Hilary Collins

Creative Director

Gene Levitan

Copy Editors

Nancy Clarke | Mari Watts | Jennifer Schultz, CPA

Photography Derrick Lilly | iStock

Circulation

John McQuillan

ICPAS OFFICERS

Chairperson

Dorri C McWhorter, CPA, CGMA, CITP | YWCA Metropolitan Chicago

Vice Chairperson

Thomas B Murtagh, CPA, JD | BKD CPAs & Advisors

Secretar y

Mary K Fuller, CPA | Shepard Schwartz & Harris LLP

Treasurer

Jonathan W Hauser, CPA | KPMG LLP

Immediate Past Chairperson

Geoffrey J Harlow, CPA | Wipfli LLP

ICPAS BOARD OF DIRECTORS

John C Bird, CPA | RSM US LLP

Brian J Blaha, CPA | Wipfli LLP

Jennifer L Cavanaugh, CPA | Grant Thornton LLP

Stephen R Ferrara, CPA | BDO USA LLP

Jennifer L Goettler, CPA, CFE | Sikich LLP

Scott E Hurwitz, CPA | Deloitte LLP

Joshua D Lance, CPA, CGMA | Lance CPA Group

Enrique Lopez, CPA | Lopez and Company CPAs Ltd

Elizabeth Pittelkow Kittner, CPA, CGMA, CITP, DTM | International Legal Technology Association

Deborah K Rood, CPA | CNA Insurance

Seun Salami, CPA | Teachers Insurance and Annuity Association of America

Stella Marie Santos, CPA | Adelfia LLC

Brian B Stanko, Ph D , CPA | Loyola University

Mark W Wolfgram, CPA | Bel Brands USA Inc

BACK ISSUES + REPRINTS

Back issues may be available Articles may be reproduced with permission

Please send requests to lillyd@icpas org

ADVERTISING

Want to reach 23,000+ accounting and finance professionals? Advertising in Insight and with the Illinois CPA Society gives you access to Illinois’ largest financial community Contact Mike Walker at mike@rwwcompany com

Insight is the magazine of the Illinois CPA Society Statements or articles of opinion appearing in Insight are not necessarily the views of the Illinois CPA Society The materials and information contained within Insight are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is Insight ’ s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet Insight ’ s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within Insight, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for Insight The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering Insight Insight (ISSN1053-8542) is published four times

spring, summer,

winter,

the

CPA Society,

W

Chicago,

Copyright © 2020 No part of the contents may be reproduced by any means without the written consent of Insight Send requests to the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: Insight, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Check it out today at: www.icpas.org/careers

a year, in

fall, and

by

Illinois

550

Jackson, Suite 900,

IL 60661, USA, 312 993 0407

Our job seeker s are ready to help you get back to business. 23K Illinois CPA Society Member s 185 Job Listings Last Year 17 Nationwide Par tner ’s Job Seeker s/Listings Post a Job Reach quickly and easily our 23,000+ member s (295 average views per job ) Search Resume Dat abase Gain access to thousands of qualif ied candidates and search with ease Receive Aler ts Create customized resume search aler ts to f ind the r ight candidates

today’sCPA

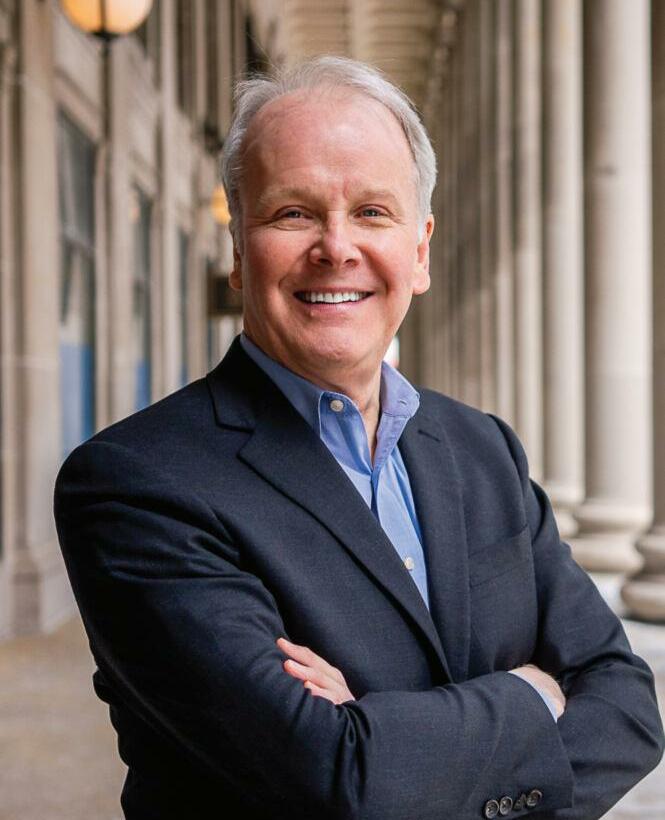

INSIGHTS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO @Todd ICPAS

A Look Back, a Race Forward

Whatmore can be said about 2020, a year for the ages?

Once foreign concepts, Zoom meetings and social distancing are now parts of our daily lives We’ve taken to wearing masks to protect ourselves and each other, and the Merriam-Webster Dictionary “Word of the Year” is “pandemic ”

Like our lives, the CPA profession was dramatically impacted by the pandemic over the past year Our offices moved to remote working in an instant, tax deadlines shifted, and we had to learn everything about the Paycheck Protection Program (PPP) and other government relief programs overnight in order to help our clients and companies survive COVID-19 and thrive in the future

Despite the darkness that engulfed much of 2020, there are some bright spots for our profession Moving to remote work environments forced an immediate and, I think, long-lasting change to a more employee-friendly workplace The work-from-home flexibility will almost certainly help us retain some of our best and brightest talent Our deeper embrace of new technology, especially the cloud, has proven critical in enabling our employees and clients to get their jobs done while, in many cases, improving productivity and profitability Most of all, I’ve seen many firms, which for years had been viewed exclusively as auditors or tax preparers, step up to become critical advisors to companies and clients Providing this insight was a strong step toward positioning CPAs as the most trusted and strategic business advisors

I also think 2020 has provided us with a bit of a glimpse into the future, which I believe will be dominated by technology and changing expectations Human insight and strategic advice will be

demanded and must be provided for the profession to maintain its relevance We’ve talked a lot about these trends over the past couple of years The past year didn’t change those trends and, if anything, it may have accelerated them

Recently, we released our newest Insight Special Feature, “CPA Profession 2027: Racing for Relevance ” In it, we detail what’s driving many of these trends and challenges and what they mean for us all We sifted through countless articles, interviews, reports, studies, and surveys and conducted some of our own and coalesced the findings into seven powerful predictions for what the future of the CPA profession may hold and what it may look like in 2027

Yes, I said 2027 While many strategic plans are looking just one, two, or maybe three years out right now, I believe we cannot risk being shortsighted given the long-term implications of everything that’s changing around us Will these predictions all play out perfectly? Not likely Do I firmly believe they’re directionally correct? Yes, and I hope these insights will rev up conversations that help us chart a roadmap for ensuring the sustainability, relevance, and growth of the CPA profession for many years to come

We will emerge from the COVID-19 crisis, and we will need to be stronger and more prepared for the future

To share your thoughts, email me at shapirot@icpas org or just give me a call 800 993 0407

If this year taught us anything, it should be that, together, there are no challenges we can’t overcome.

4 | www icpas org/insight

LEGISLATIVE INSIGHTS FROM

MARTY GREEN, ESQ , ICPAS VP OF GOVERNMENT RELATIONS @GreenMarty

Don’t Be a Casualty: How to Survive 2021

CPA License Renewal

WhenI was a captain in the Air Force, my wing commander would tell me that there are always casualties in large-scale operations The 2021 CPA license renewal process is undoubtedly a large-scale operation, but I have plenty of information to help ensure you ’ re not a casualty of it

All Illinois licensed and registered CPA credentials will expire on Sept 30, 2021 period No waivers, no extensions, no excuses There’s no change in the number of live continuing professional education (CPE) hours required, either You heard it here

The first step in renewing your CPA credential is to ensure that the Illinois Department of Financial and Professional Regulation (IDFPR) has your current email address This is necessary because the IDFPR has gone paperless, meaning you’ll no longer receive the yellow postcard renewal notice as you have in the past Instead, you’ll receive your renewal notice in June via email from dpr@illinois gov You can easily update your email address by going to https://www idfpr com/applications/licensereprint and clicking on the “Click Here to Change Your Email” link at the top of the page

Remember: If you are a partner in a firm, it’s important that you renew your individual license in a timely manner so that the firm license can be renewed, as the firm license is tied to each partner’s individual license If one of the partners has not renewed their individual license, the firm license will not be able to be renewed

Right now is the perfect time to start knocking out the 120 hours of required CPE for licensed CPAs Included in the 120 hours are four hours of ethics and, new for this renewal cycle, one additional hour of sexual harassment prevention training You must have all CPE requirements completed by the time you renew your license You’ll be asked to confirm that you ’ ve completed the required 120 hours of CPE during the online renewal process Answer truthfully and retain documentation of your CPE hours for a minimum of six years as IDFPR internal auditors do perform CPE audits

If you or your firm performed an audit, a review of historical financial statements, and/or examinations of prospective financial statements during the preceding three-year period, a peer review is also required for license renewal Licensees impacted by this requirement should be mindful of the time required to satisfactorily complete a peer review before licensure renewal and get ahead of the process

The renewal deadline is September 30 for individual CPAs and November 30 for firms The Illinois CPA Society’s Peer Review Alliance has communicated with impacted sole practitioners and firms letting them know they must engage a peer reviewer for peer review acceptance in time to renew their individual or firm license In response to the coronavirus, the AICPA Peer Review Board granted automatic six-month extensions for those enrolled in peer review, but that extension does not apply to your required license renewal If you need to complete a peer review, do not delay

During the 2018 license renewal period, we were contacted by many licensed CPAs who wanted to switch to being registered CPAs The registered CPA is an expired status that closed on June 30, 2012 No new applications are accepted for that designation In other words, there is no way to become a registered CPA unless you were grandfathered in having applied for that title prior to June 30, 2012 If you did actively apply within that time period, you ’ re eligible for life to renew or restore your status as a registered CPA

We also heard from licensees who wanted to change their status to CPA (inactive) because they didn’t complete the required 120 hours of CPE For those of you considering that change, I encourage you to thoroughly review the limitations of this title Once you ’ re inactive, you may use the CPA (inactive) title but you may not use any skills or competencies as a CPA unless you are performing governance functions on a non-profit volunteer board (but not serving as an audit committee financial expert) The use of CPA (inactive) is extremely limited in nature and shouldn’t be used as a way to forgo CPE requirements and continue practicing outside of the narrowly defined parameters If you ’ re behind on your CPE hours at renewal time, it may be best to simply place your license on inactive status and then restore it with IDFPR as soon as you accumulate the required hours You must refrain from using the CPA designation until the license has been fully restored To request inactive status, your license must be in good standing (i e , not expired)

2021 is shaping up to be another hectic year, and it will be easy to lose track of these licensing requirements in the rush of another complicated busy season Take my advice and get ahead of these requirements so your CPA credential won’t be a casualty of the rush to renew

6 | www icpas org/insight

Getting ahead of the rush to renew your CPA credential might be the most important thing on your 2021 to - do list.

capitolreport

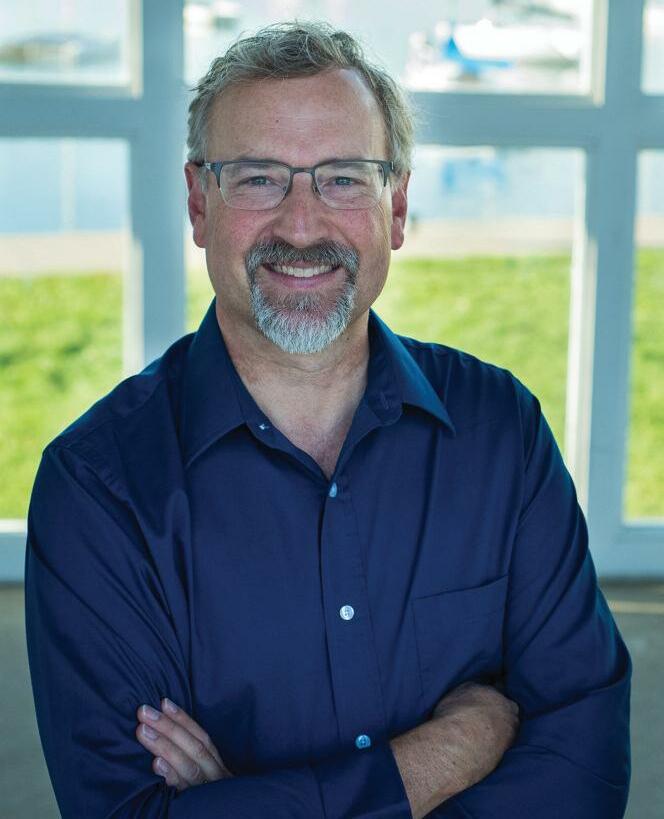

Building a Bridge to the Future

The Illinois CPA Society ’ s

BY HILARY COLLINS

or decades, CPA firms have navigated change with a can-do attitude a practice that has largely brought them great success But the complexity and speed of the changes confronting the profession today, as well as each firm’s unique specialties, necessitate a deep strategic dive

“When I talk to groups of CPAs, I often ask whether or not they think the profession has been through a technological revolution in the last 25 years, ” says Todd Shapiro, president and CEO of the Illinois CPA Society “Almost every hand goes up yes, we ’ ve had a technological revolution But I don’t believe we have We’ve seen an evolution of productivity tools: Excel, software, machine calculations But we haven’t yet seen a technological revolution like the one that’s coming ”

Technologies like robotic process automation and artificial intelligence have the potential, and are in fact incredibly likely, to change the accounting profession forever Shapiro says that after Insight’s winter 2019 “Becoming a Firm of the Future” feature was published discussing these coming changes, he received a call from a firm that wanted to learn how to prepare That call ended up being the inspiration behind the Illinois CPA Society’s new strategic consulting service

“This service is ultimately a way for the Society to enact its mission of enhancing the value of the CPA profession,” Shapiro says “We want to help our members and their firms build firms of the future ”

The strategic consulting service offers firms an in-depth exploration of what the future holds for them, and assistance in building a plan to survive and thrive amidst the coming technological revolution The roadmap to the future could be completely different for each firm, given their unique situations and their specific goals

“When we help a firm with strategic planning, we sit down and define their strengths, challenges, opportunities, and threats,” Shapiro explains “We use this knowledge to build a bold future vision and a bridge to that future Where do you want this firm to be in three-to-five years and how do you get there? What do you need to do now?”

He notes that the pace of change will never be slower than it is now For firms who haven’t yet taken the time to look far into the future and determine how they want to get there, now is the time to begin

To learn more about ICPAS’ Strategic Consulting Service, contact Todd Shapiro at shapirot@icpas org

8 | www icpas org/insight

On the cusp of a historic technological shift, strategy is key to future success

new consulting service is here to help your firm create that strategy.

OUR PROCESS: Illinois CPA Society’s interactive planning sessions will help your leadership team:

• Reflect on the past.

•Think strategically about the future.

•Prioritize realistic actionable steps to move forward together.

OUTCOMES:

Walk away with a tailored roadmap to the future that is:

Strategic | Actionable | Achievable

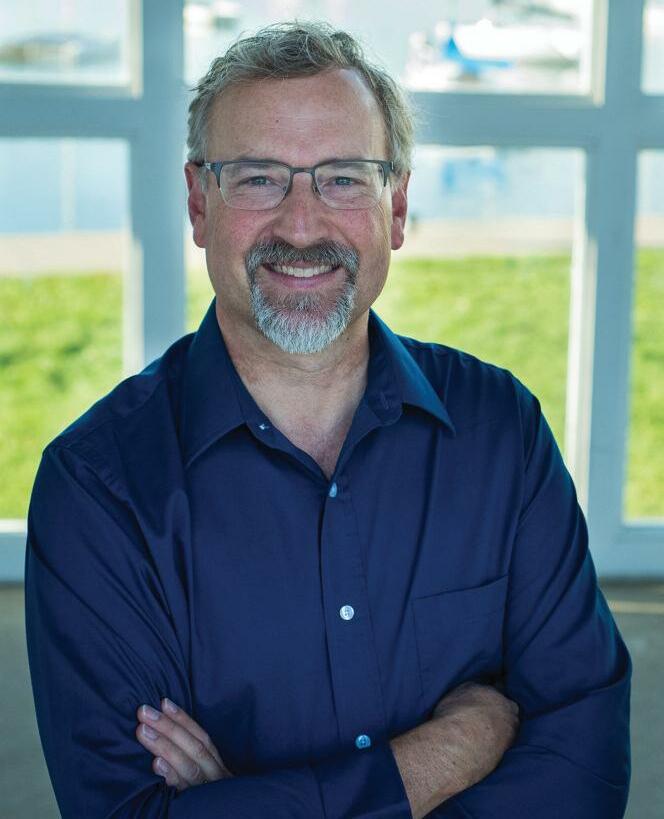

Are you controlling your future, or is the future controlling you? Dealing with issues like AI, RPA, the future of client services, employee expectations, and firm succession planning, you may be asking yourself: What do we do? Where do we go next? To be a firm of the future, you need to be IN the future! That’s where we can help. The Illinois CPA Society has launched a new, tailored strategic planning service for public accounting firms to help you discover how you can compete in the future, serve your clients, and be a place where people want to work. TO LEARN MORE, CONTACT: Todd Shapiro | shapirot@icpas.org | 312.517.7601 CONSULTANT/ FACILITATOR: Todd Shapiro President & CEO,

CPA Society

top 100 influential

NEW SERVICE!

Illinois

Named

people in accounting by Accounting Today.

What ’ s New for the Next Tax Season?

2020 was a year of legislation with significant tax implications here are the biggest changes that may impact your clients in the coming tax filing season.

BY DANIEL F. RAHILL, CPA, JD, LL.M., CGMA

BY DANIEL F. RAHILL, CPA, JD, LL.M., CGMA

o characterize the past year as one of change would be an understatement At the beginning of 2020, we might have guessed that the Setting Every Community Up for Retirement Enhancement (SECURE) Act would be the big tax story A major overhaul of the rules for retirement plans and IRAs, this act was designed to encourage savings and make it easier for employers to offer retirement plans

But everything changed with COVID-19’s arrival, shutting down the country and sending the economy into a recession By the end of March, Congress had passed three COVID-19 relief packages, most importantly the Families First Coronavirus Response Act and the Coronavirus Aid, Relief, and Economic Security (CARES) Act These stimulus packages were designed to absorb some of COVID’s impact on individuals, businesses, nonprofits, and state and local governments via tax, grant, and loan provisions Of course, a number of significant tax implications accompany these subsidies

Here are the most important legislative changes to be aware of heading into the 2021 busy season

THE SECURE ACT’S BIG IMPACTS

Maximum Age Repealed for Traditional IRA Contributions

The act ends the age restriction on contributions to a traditional IRA once the individual has attained the age of 70 5 Therefore, taxpayers with earned income can make IRA contributions at any age beginning in 2020

Age Increased for Required Minimum Distributions

Under previous law, participants were generally required to begin taking distributions from their retirement plans at age 70 5 The new law increases the required minimum distribution age to 72 for people who turn 70 5 after Dec 31, 2019

Penalty-Free Withdrawals Permitted for Birth or Adoption

While the previous law exempted certain distributions from qualified plans from the 10 percent tax penalty on early withdrawals prior to age 59 5, the new law includes qualified birth or adoption distributions as qualifying for such penalty-free withdrawals

Annuity Portability Options Expanded

The legislation permits qualified defined contribution plans, section 403(b) plans, or governmental section 457(b) plans to make a direct trustee-to-trustee transfer to another employer-sponsored retirement plan or IRA

Allowable 529 Plan Withdrawals Expanded

The new law expands 529 education savings accounts to cover costs associated with registered apprenticeships; homeschooling; up to $10,000 of qualified student loan repayments (including those for siblings); and private elementary, secondary, or religious schools

Part-Time Worker Participation in 401(k) Plans Required

Except in the case of collectively bargained plans, the new law requires employers maintaining a 401(k) plan to have a dual

10 | www icpas org/insight

T A X

eligibility requirement under which an employee must complete either the one-year-of-service requirement (with a 1,000-hour rule) or three consecutive years of service where the employee completes at least 500 hours of service In the case of employees who are eligible solely by reason of the latter new rule, the employer may elect to exclude such employees from testing under the nondiscrimination and coverage rules, and from the application of the top-heavy rules

Start-Up Costs Credit Increased for Small Business Owners

Prior to the new law, small businesses could claim a credit equal to 50 percent of the start-up costs of a qualified plan, up to a maximum of $500 The new law increases the credit limit to a maximum of $5,000 for each of the first three years effective for 2020 and later years

Automatic Enrollment Credit Created

To encourage greater employee participation in qualified retirement plans, the act creates a new tax credit of up to $500 per year to employers to defray start-up costs for new section 401(k) plans and SIMPLE IRA plans that include automatic enrollment The credit is in addition to the plan start-up credit allowed under previous law and will be available for three years It will also be available to employers that convert an existing plan to an automatic enrollment design

Stretch IRA Required Minimum Distributions Established

Under the new law, “stretch” IRA distributions to individuals other than the account owner ’ s surviving spouse or minor child, disabled or chronically ill individuals, or individuals who are less than 10 years younger than the account owner are generally required to be distributed within 10 years of the account owner ’ s death

Other Non-Retirement Tax Law Changes Enacted

The act repeals excise taxes on high-cost employer-sponsored health coverage (“Cadillac” plans), the medical device tax, and the fee on health insurance providers In addition, the estate and trust tax rates applied to certain unearned income of children (the “kiddie tax” provision) have been changed to the parents’ tax rate Finally, a number of expired tax provisions were extended through 2020, including the 7 5 percent (instead of 10 percent) adjusted gross income floor for medical expense deductions and the above-theline deduction for qualified tuition and related expenses

REACTING TO THE FAMILIES FIRST CORONAVIRUS RESPONSE ACT

Payroll Tax Credit Established for Emergency Sick Leave

The act requires all public and private employers with fewer than 500 employees to provide those employees two weeks of paid sick time To help small and medium-sized businesses cope with the impact of the legislation, the relief bill contains several payroll tax credits for employers Subject to certain limitations, the act provides an employer payroll tax credit equal to 100 percent of the qualified sick leave wages paid by the employer

Payroll Tax Credit Established for Emergency Family Leave

Subject to certain limitations, the act provides an employer payroll tax credit equal to 100 percent of the qualified family leave wages paid by the employer The credit is available for eligible wages paid through Dec 31, 2020 The credit is generally available for up to $200 in wages for each day an employee receives qualified family leave wages A maximum of $10,000 in wages per employee would be eligible for the credit

NAVIGATING THE CARES ACT

Economic Impact Payments Distributed

The act includes relief in the form of immediate cash payments of as much as $1,200 for single taxpayers, $2,400 for married joint filers, plus $500 for each dependent child under the age of 17 They are reduced for higher income taxpayers, with phase-outs beginning at $75,000 for single taxpayers and $150,000 for married joint filers, and do not apply for single taxpayers with incomes exceeding $99,000 and married joint filers with no children and incomes exceeding $198,000

The payments are treated as advance refunds of a 2020 tax credit Taxpayers will reduce the amount of the credit available on their 2020 tax return by the amount of the advance refund payment they received This means individuals who did not receive the full amount they were entitled to can claim the difference as a credit on their 2020 return

Retirement Account Rules Relaxed

The act temporarily waives required minimum distribution requirements for 2020 This permits those who do not need immediate funds to avoid cashing out investments at depressed values For individuals qualifying for coronavirus-related distributions as defined below, the 10 percent early withdrawal penalty is waived for distributions up to $100,000 in 2020 In addition, income from such distributions would be subject to tax over three years and the taxpayer may recontribute to an eligible retirement plan within three years without regard to the annual cap

Individuals qualifying for coronavirus-related distributions also have increased borrowing capabilities against their retirement assets The maximum amount of loans (when combined with existing loans) which can be taken from retirement accounts is the lesser of $100,000 (up from $50,000) or 100 percent of the participant’s accrued benefit (up from 50 percent) Repayment of these loans may be delayed for up to one year This change will be in effect through 2020

Student Loan Relief Provided

A provision in the act provides a temporary income tax exclusion for individuals who get student loan repayment assistance from their employer Through Dec 31, 2020, an employer may contribute up to $5,250 annually toward an employee’s student loans, and such payment would be excluded from the employee’s income

Charitable Deduction Limits Relaxed

Taxpayers who do not otherwise elect to itemize deductions are allowed an above-the-line deduction of up to $300 for charitable contributions made in cash (not stock), excluding donor-advised funds For individuals who itemize, as well as corporations, the act temporarily increases limitations on deductions for charitable contributions made in 2020 For individuals, the 60 percent of adjusted gross income limitation is suspended for 2020 For contributions of food inventory, the limitation is increased from 15 percent to 25 percent Excess contributions may be carried forward to future years based on the existing charitable contribution carryforward rules

There are signs that the 2021 tax season will be just as challenging as the 2020 season, but with the knowledge we gained then as well as foresight and planning, we will rise to that challenge

www icpas org/insight | WINTER 2020 11

How to Keep Your Star Players on the Roster

It ’ s time to rethink the workplace, how work gets done, and what leaders can do to keep top performers on the team now and as the job market recovers

BY BRIDGET MCCREA

f you think your best employees will stay put right now because the global pandemic has driven up unemployment rates and minimized mobility, think again And if you don’t believe your top performers are worth fighting for, you could be in for a big surprise when it comes time to recruit their replacements

“Top performers do four times the work of others and the math proves it,” says Dick Finnegan, CEO at C-Suite Analytics, pointing to a study that found that the top 5 percent of any company ’ s workforce produced 26 percent of that company ’ s total output This holds true during all economic conditions, he notes, and it’s particularly relevant right now

“Our COVID-driven national unemployment rate is high, and you ’ re going to hear things like, ‘James quit, but there are a lot of people looking for work right now, so go find me another James,’” Finnegan says “You can easily find a warm body to fill the seat, but if James was a top performer, you probably won’t find another one like him ”

Citing the U S Bureau of Labor Statistics, Finnegan also points out

that when you compare the number of people who are voluntarily quitting their jobs right now versus the same period in 2019, the difference comes to just 18 percent That means 82 percent of workers are still quitting and moving to new jobs voluntarily “There’s a lot of action in the job market, even though we tend to think there isn’t,” Finnegan says

Clearly accounting firms still have to think about employee retention and particularly about retaining that small percentage of team members who do four times the work of others at a time when an economic recession, a global pandemic, and other outside forces are capturing most of their attention

Put simply, this isn’t the time to sit back and assume those star players will stay on the roster just because their lives have been upended by the events of 2020 “A company might think it has it made because the firm offers career ladders, a great benefits package, or some other perk, but those are not the things that make people want to stay,” Finnegan says

12 | www icpas org/insight H I R I N G & R E T E N T I O N

FINDING AND KEEPING STAR PLAYERS

As head of professional recruitment for Adecco, Jason Kaiman has his finger on the pulse of the employment market Regardless of factors like the potential for COVID spikes, political unrest, and economic uncertainty, Kaiman says companies should remember that the underlying crisis is health-related and not specifically an economic crisis “Knowing this, a lot of organizations that we ’ re working with continue to hire and grow their teams, the obvious market conditions notwithstanding,” he explains

Specifically, Kaiman says professional services firms are scouting for “A-level talent” that will help them become more efficient, nimble, and technologically adept Achieving that goal requires a different mindset than the one companies had pre-COVID A recent Adecco survey of 8,000 professionals (including those working in accounting and finance) pinpointed scheduling flexibility, the ability to work remotely, and a company ’ s ability to adapt to change as the “ new ” employee retention criteria

“About 76 percent of the individuals surveyed said that the mix of remote work and office work in the future will be critical,” Kaiman says, pointing out that accounting firms aren’t generally known for their flexible work arrangements This presents a great opportunity for firms willing to provide remote work options for parents whose children are now learning from home and for workers with health concerns who don’t want to come into an office

With 84 percent of the employees surveyed by Adecco expressing confidence in their employers’ ability to transform and change, Kaiman tells accounting firms to consider their current resiliency levels and how they can be improved “Historically, accounting organizations have been somewhat conservative,” he explains “Now, some are taking a lead role in transformation while others are waiting to figure out what their next step will be ”

Finally, with 21 2 percent of people nationwide working remotely as of the Bureau of Labor Statistics’ October count, Kaiman says accounting firms must rethink not only where their star employees are performing their work, but also how they’re managing those tasks outside of the conventional office environment That could mean rethinking the traditional hourly schedule and shifting over to more of a project- and deadline-centric workflow

“Consider adding flexibility into how the job gets done, versus the number of hours that someone is clocking in on a daily basis,” Kaiman advises “That’s going to be the new norm on the other side of all of this, and most employers have already adjusted to it ”

OPENING COMMUNICATIONS

Along with setting up more flexible work arrangements and allowing star players to do their work on their own terms, Finnegan says accounting firms should also be talking regularly to their employees about their job satisfaction Organizations can implement the “stay interview” (a concept Finnegan invented in 2012) to open lines of communication with their existing employees that often go unexplored between the hiring interview and the exit interview

Finnegan says that every organization should implement stay interviews to help managers better connect with their team members A structured discussion that takes place between a manager and each individual employee, the stay interview should focus on the specific actions that the company can take to strengthen that employee’s engagement and satisfaction with the organization

Finnegan boils down the stay interview to five key questions, each of which should prompt an open discussion that the interviewer can use to impact change in the organization: When you travel to work

each day, what things do you look forward to? What are you learning here? Why do you stay here? When was the last time you thought about leaving our team and what prompted it? What can I do to make your experience at work better for you?

“The employee’s responses to these questions opens the door to retention and engagement solutions,” Finnegan says “Ask yourself, ‘How can I make small changes to my employees’ jobs so they can do more of what they want?’”

Another proponent of the stay interview, Jennifer Lee, executive director of learning and development at JB Training Solutions, says the firms using the concept to both listen to and share information with their star performers will have a better chance of retaining them once the work world begins to normalize and the job market picks back up Additionally, a satisfied employee’s enthusiasm can spread across the team and lift overall retention for the firm

Lee says recognizing superstar team members for their efforts, supporting them with relevant training, and coaching them virtually will go a long way toward keeping them on the roster in all business conditions “Your superstars are the people who are always there for you, doing a good job, and 100 percent all-in for the organization,” Lee says “The more you can recognize that, the better ”

Finally, remember this “ new normal” isn’t going away anytime soon, so changes are probably in order “The way you did business in the past can’t be the way you do business going forward,” says Illinois CPA Society member Gary Shutan, CPA, MBA, partner at Wipfli LLP “We’re all dealing with this right now, and the firms that do a great job at adapting to those changes will be the ones that don’t have to worry about their people leaving In fact, more people are going to want to come to work for them ”

www icpas org/insight | WINTER 2020 13

Trent Holmes 800-397-0249 Trent@APS.net www.APS.net IF YOU ARE RE ADInG THIS... S o Is Your Buyer! CONNECTING MORE SELLERS AND BUYERS D e l i v e r i n g R e s u lt s - O n e P r a c t i c e At a t i m e

Your Career in the Time of COVID

Professional

By Cassandra Morrison

14 | www icpas org/insight

growth looks different now, but with self-reflection, intentionality, and perseverance, you can make progress in these tough times.

www icpas org/insight | WINTER 2020 15

Prior to March 2020, we had a mostly shared vision of what success looked like Whether you worked at the Big Four, in a private company, with a nonprofit, or for the government, a successful career meant networking, professional development, and climbing the ladder But in a pandemic-stricken world where networking events, conferences, raises, and new opportunities have largely halted, how can you keep moving forward?

A recent survey of 1,000 employees found the respondents were split on whether their career development was stalled or progressing during COVID though more felt stymied with nearly 41 percent reporting it had stalled and 36 percent reporting progress With professionals describing such vastly different experiences, it leaves one to wonder if the “ new normal” job market is much like the old one all about what you make of it

Time to Reflect

Much of 2020 has felt a lot like treading water never getting anywhere new but staying afloat For the 22 million that lost their jobs or the many more that hunkered down in the same job when the pandemic hit, 2020 was a time of surviving rather than thriving But for those trying to build a career, just getting by doesn’t offer much solace unless you change your perspective

“This opportunity if you start to think about it as such offers you a chance to really do your due diligence; to stand back and think about where you are, where you want to be, and what you might want to do differently,” says Duncan Ferguson, career consultant and managing director of Vantage Leadership

“Take some time, take a deep breath, and do some analysis about who you are as a person and what your value to the market is You can figure this out by looking at the jobs you ’ ve had and what you ’ ve accomplished in them,” he adds “Ask people in your network your friends, family, mentors, people that you really trust what they think your value is And never underestimate your personal values as part of what you offer ”

For those who have remained employed but discontented throughout the pandemic, now is a good time to reassess “the reasons for wanting to leave and, instead, trying to create a better situation where you are with job crafting,” says Douglas Slaybaugh, CPA, owner of the CPA Coach

Job crafting is the practice of approaching your career with an eye to what you can tweak and adjust within your job structure and duties to align it more with your talents and goals This can be a change to what duties you take on, who you work with, or how you approach and interpret your job

“Consider if the reason you wanted to leave or shift careers is still there Some of the reasons that made you want to shift careers pre-COVID, like flexibility or a lengthy commute, may no longer be issues,” he says “Look at the new landscape and see if it’s possible to enjoy the new environment There’s also a chance you may have leeway with your current employer to craft your job to better align with the path that you want to pursue ”

A recent study from O C Tanner found that 48 percent of employees are considering a career move after COVID-19 settles down Wecruiter io Founder and CEO Jack Kelly posits that the unfathomable amount of deaths caused by the pandemic has “sobered everyone up ”

“Professional development looks a lot like personal development right now, and I think that’s a positive step forward,” Kelly says “COVID-19 has been a shock to the system that gives you time to reflect, to start thinking about what you really want to spend your life doing and once you decide that, your next step is making a game plan ”

Keep Showing Up

Carla Wright, CPA placement executive at Valintry Financial, says it’s crucial to keep doing great work and advocating for yourself in this remote landscape even if you ’ re looking to move to a new company or a completely different field

“If you ’ re working from home, you need to make sure that you ’ re still very visible Do not be late for a Zoom call, always look professional, and interject with new ideas You do not want to give the impression that you ’ re not working,” Wright says “At the end of the day, you have to work harder at the impression you ’ re giving because no one sees you in the office You have to learn to be very vocal about the things that you ’ re doing don’t be shy about projects and accomplishments ”

In addition to touting your accomplishments, it’s no secret that learning new skills and gaining new credentials are key to career development “Say you ’ ve been putting off your continuing education courses, or

maybe you ’ ve never taken your CPA exam now is the time to tackle those,” Kelly says “Take graduate classes, grow yourself without anyone asking you to do so But also carve out some time for something that you just want to do so that you get a victory Little victories get you through tough times ”

Because 2021 is a reporting year for CPAs’ continuing professional education (CPE) hours, this presents a unique opportunity to truly take advantage of courses that will both propel your career forward and fulfill your licensing requirements As Slaybaugh notes, one of the perks of a virtual environment is the fact that these classes are now online: “Frankly, COVID-19 has made getting your CPE hours easier and more accessible it’s only a click away, so take advantage of that ”

Take Time to Connect

Networking used to mean shaking a few hands, going to a few industry events, grabbing a drink after work or a coffee in the morning showing up with a smile and an open attitude, ready to find out how someone could help you move on or up Now that we ’ re largely relegated to emails, Zoom cocktail hours, and social media, the pandemic is forcing a reset of how we network and why

“Networking in the past put a lot of pressure on someone because you were only reaching out when you needed something from them; I like to believe that it’s more about relationships than networking now, ” Ferguson says “When we ’ re all having this shared, collective experience, it makes sense to reach out and ask someone how they are and truly listen ”

“Take this pause to really check in with those in your network, without needing anything in return,” Slaybaugh agrees Kelly encourages professionals aspiring to new opportunities to spend time fixing up their online presence and fostering relationships now: “Start making connections before you need a new job and remember to reach out when things are good instead of out of desperation ”

To stand out in a remote environment, Kelly recommends putting time and effort into your LinkedIn profile showcase what you do, what you ’ ve done, and what you ’ re hoping to do next You should also put some thought into who you connect with “Cultivate your connections: decisionmaking people, thought leaders, those who work at organizations and in positions that

16 | www icpas org/insight

you want to break into, so when you reach out, you have a better possibility of getting a lead,” he says

All in all, networking has changed greatly and that’s better for some people, especially introverts “Sending a message on a screen is a lot easier for some people than starting up a conversation at a crowded event,” Slaybaugh notes

Be Intentional

While COVID-19 has changed many things, evidence and research suggest that companies are still looking for top-tier talent But Wright says if you want to climb the ladder, you may need to change your perspective and reevaluate how you ’ re planning to get there

“The top 50 firms have absolutely started laying off people and furloughed some of their best employees, whereas medium and smaller firms have forged ahead, taking advantage of these great assets becoming available Maybe the key is to rethink your preferences do you really want to target only big companies? Maybe you could craft a better career by joining a smaller firm,” she suggests “Smaller and regional firms allow you to specialize in more areas, and ultimately to grow yourself ”

In fact, being open to a nonlinear career path may be the answer to success in this environment A recent survey found that 64 percent of employees would be willing to accept a promotion even if it didn’t include a raise Being open to nontraditional moves, either up the ladder without the accompanying pay hike, laterally, or to a different industry or smaller firm could be rewarding

Though professional development, career advancement, and networking may look different now, what hasn’t changed is that anyone looking to make a move can benefit from taking the time to think about what they really want from their career And in a time when everyone is feeling a little burned out, it’s the perfect opportunity to see the humans behind the jobs

“We’re all working harder as parents, as spouses, as homeowners, and especially as professionals I think there needs to be some expectation of understanding and empathy from both sides,” Slaybaugh says “The recent success stories I’ve heard are from employers who are providing accommodations for their employees, and those employees are the ones that stay loyal and work harder whether in the office or at home ”

www icpas org/insight | WINTER 2020 17

“COVID-19 has been a shock to the system that gives you time to reflect, to start thinking about what you really want to spend your life doing.”

Jack Kelly Wecruiter io Founder and CEO

Sailing

2021: T he Economic Outlook

18 | www icpas org/insight

Into

After2020’s rough waters, economists predict smoother sailing in 2021 with a fe w cav eats. Here’s what’s on the horizon in the ne w year.

BY CAROLYN KMET

www icpas org/insight | WINTER 2020 19

Given the year we ’ ve had, it seems almost foolhardy to attempt to predict what 2021 will hold after all, who could’ve foreseen the historic and bizarre events of 2020? But it’s part of the job for economists, and they’re cautiously optimistic for the coming year As we head into 2021, despite uncertainty surrounding COVID-19 and its wide-ranging impacts, they say that while it will be slow going, growth and normalcy are on the horizon

The COVID Recovery

According to a survey conducted in October by the National Association for Business Economists (NABE), the median forecast for real GDP growth in 2021 is 3 6 percent Roughly half of those surveyed put the odds of a double-dip recession at 20 percent or lower

“NABE panelists have become more optimistic, on balance, but remain concerned about a potential second wave of COVID-19,” explains NABE Survey Chair, Eugenio Aleman, an economist with Wells Fargo Bank “Thirty-eight percent of panelists believe that the economy will have returned to pre-pandemic GDP levels by the second half of 2021, 32 percent expect it to reach that level in the first half of 2022, and 30 percent believe it will occur in the second half of 2022 or later ”

John Behringer, partner and national financial institutions consulting leader with RSM, describes the U S economic recovery as a “Nike swoosh ” He explains that the shallow curve is due in part to uneven recovery across industries Some sectors experienced a sharp drop-off, like travel and hospitality, while other sectors, such as consumer staples, saw minimal decline

“Some industries are absolutely going to have a V-shaped recovery, ” Behringer says “Meanwhile, travel may not return to prepandemic levels until 2024 definitely not a V-shaped recovery ”

Seth Green, founding director of Loyola University’s Baumhart Center, agrees that recovery will vary sharply across sectors

“All signs currently point to a K-shaped recovery, where parts of our economy will fully rebound, and other parts will remain challenged Hotels, restaurants, and retail in particular are likely to see this downturn continue until most of the country is vaccinated, hopefully by mid-2021,” Green says “The size of that downturn depends most of all on the course of the disease, and whether the political environment enables government stimulus ”

Political Pressures

With Democrats stepping into the White House and retaining control of the House of Representatives in 2021, the likelihood and size of further fiscal stimulus may depend on the outcome of the Georgia Senate runoff race on January 5 In 2020, the deadlock in stimulus negotiations between political parties prevented at least $1 8 trillion of federal government aid from flowing to struggling households, businesses, and state and local governments, says Derek Sasveld, chief strategic for BMO Global Asset Management

“If they win at least one of the Georgia runoffs in January, Republicans will keep control of the Senate,” Sasveld says “That would limit the amount of fiscal stimulus that a Democratic House and Biden White House will surely push for Limited stimulus means lower inflation and interest rates, but it also probably means slower economic growth and lower risk as well ”

Sasveld believes the U S economy will benefit from foreign growth, though more through rises in key commodity prices than trade “Agricultural grains, industrial metals, and energy prices have bounced back since the COVID shock at the end of the first quarter,” Sasveld observes “Some of this is COVID-related China has apparently dealt with the pandemic well, while India and Latin America have struggled by comparison But many countries have applied plenty of stimulus, with China seeing full recovery in exports ”

Sasveld believes that all this stimulus activity will add up to “higherthan-expected, solid-but-not-spectacular” economic growth for 2021 “Also, the Federal Reserve will likely increase its efforts to support economic growth until a vaccine is available,” he notes

Managing Inf lation

Some economists suggest that we’ll see inflationary growth along with recovery Phillip Allan, economic policy analyst with the New Physiocratic League, an organization that envisions economic reform through land value taxation rather than earned income, warns that further expansion of the money supply could trigger inflation “At the moment, this risk is subdued due to reduced monetary velocity and weak consumer demand That might not be the case by the end of 2021,” Allan says

Despite that, Allan believes the dynamism of the U S economy will remain strong when compared to other parts of the world “The inflation risk is equally great in much of the world Therefore, the U S dollar will maintain its strength, in part due to the relative weakness of its trading partners,” Allan explains

Certainly, the Federal Reserve is prepared to stabilize the U S economy through the use of what it calls “flexible inflation targeting ”

In a speech delivered at a Federal Reserve Bank of Kansas City symposium in August 2020, Fed Chair Jerome H Powell explained how persistently low inflation can pose serious risks to the economy

“Inflation that runs below its desired level can lead to an unwelcome fall in longer-term inflation expectations, which, in turn, can pull actual inflation even lower, resulting in an adverse cycle of everlower inflation and inflation expectations,” Powell said

20 | www icpas org/insight

In an economic downturn, the Fed typically cuts interest rates to boost employment However, as inflation decreases, interest rates decline in tandem As interest rates decline, the Fed has less latitude to stabilize the economy through interest rate cuts As such, the Fed signaled that it intends to apply appropriate monetary policy to achieve a long-run goal of a 2 percent inflation rate

To achieve that 2 percent objective, Sasveld explains that Fed guidance indicates near-zero policy rates through 2023 to spur economic growth

“The Fed’s new five-year statement on monetary policy promises to run the economy hotter than typical for an extended period in order to heal the post-COVID unemployment problem, and eventually bring about higher expected inflation,” Sasveld says

Shifting Consumer Behavior

Reverberations from shifts in consumer behavior and workplace structure will also play out in the 2021 U S economy “Many families are stretched thin right now, ” observes John Kilpatrick, Ph D , managing director of Seattle-based Greenfield Advisors “We’re seeing a good bit of refinancing to take advantage of rock-bottom interest rates, but we ’ re also seeing families tapping out their savings and credit cards ”

This will likely lead to longer purchase cycles on consumer durables, such as cars, appliances, and computers, as well as reduced discretionary spending Kilpatrick predicts these factors will in turn lead to long-term stagnation in multiple areas of the economy

“Universities and health care are tapped right now Health care is already seeing significant declines in discretionary patient load if you can avoid going to the doctor right now, you do If you can take a year off from college, you do that, too Universities are probably less affected than health care, but both sectors are going to see some very real issues in 2021,” Kilpatrick says

With the almost instantaneous shutdown across the U S in March, standard retail operations had to turn on a dime, with many stores and restaurants quickly adding curbside pickup and delivery “Your customer base didn’t want to come into your buildings, but they still

needed to be able to transact,” Behringer recalls “If now we can just pull up curbside, and they put our purchases in our trunks, why does that have to change because there’s a vaccine?”

The change in transaction processes has led to a shift in payment processes Digital payment options have become more important than ever “COVID-19 has influenced consumers to consider digital payments in order to limit physical contact,” Michael Hammelburger, CEO of Cost Reduction Consultants, says “Going paperless and fully digital allows businesses to save a lot of money in terms of their operational costs More and more enterprises are offering interesting online services by partnering with fintech companies ”

In 2021, we’ll see these changes in consumer expectations play out While universities, health care, and consumer spending may eventually revert to pre-COVID standards, other changes, like those in retail, transactions, and payment processes, are likely here to stay

A New Way Forward

Another COVID change likely to have impacts in the coming year is the decreased demand for corporate real estate During the shutdown, businesses of all sizes and in all industries shifted to a remote work environment Prior to the shutdown, Behringer noted that within the consulting industry, many clients preferred in-person meetings and on-site engagements “Now that we ’ ve demonstrated that we don’t necessarily need to be on-site to be productive and to finish the audit, the consulting project, or the tax return, that will change how our clients choose to consume our services,” Behringer says

Behringer predicts that as businesses realize that employees can be effective and productive working remotely, investments will migrate away from office space and toward technology “Even with a vaccine, are they going to spend hundreds of thousands of dollars a year on occupancy costs, or are they going to spend half of that on technology and have some really happy employees? Not to mention that as a virtual organization, the cost footprint comes down substantially,” Behringer says “2021 is going to be interesting in that we ’ re going to see what will revert back to the old way and what changes are permanent even after we get a vaccine ”

Even older generations that have historically been in-person service stalwarts have switched allegiances during COVID-19’s upheaval Using banks as an example, Behringer explains that branches existed primarily to serve Baby Boomers, since younger generations were already conducting most of their banking online During the shutdown, Baby Boomers were forced to change their behavior “Now that Baby Boomers realize they can do their business over the phone and on their computer safely, I don’t see them going back They love convenience as much as all the other generational cohorts; it was just a trust and comfort issue,” Behringer says

As the saying goes, the only certainty is uncertainty 2020 brought more surprises and upheaval than the average year People and businesses were forced to either accelerate into the future or accept the heightened risks of doing things the same old way as before As the U S economy confronts COVID, re-engineers processes, and shifts fiscal and monetary policy, the 2021 economy may be more of a quantum leap than the continuation of our existing curve

www icpas org/insight | WINTER 2020 21

Planning for the in Unprecedented Times

if the tumult of 2020 has you wondering how to even begin planning for 2021, fear not: scenario planning can help finance professionals budget, strategize, and position their organizations for success.

By natalie rooney

By natalie rooney

22 | www icpas org/insight

www icpas org/insight | WINTER 2020 23

Think back to your business plan and budget for 2020 Your organization likely spent some time making plans and building out finances for the coming year and that plan was likely scrapped by March

In the past, budgets were created by taking the prior year ’ s information and rolling it forward with updated forecasts, but we can’t reliably do that anymore, says Donny Shimamoto, CPA, CITP, CGMA, founder and managing director of IntrapriseTechKnowlogies LLC “The key is switching to a more forward-looking mindset to figure out what’s realistic given the changing business conditions,” he says

Given the shocks of 2020, business leaders are looking for new ways to plan for the future Jack Alexander, CPA, founder of Jack Alexander and Associates LLC, says scenario planning can be a powerful tool for these turbulent times, as it offers a structured way for dealing with uncertainty by identifying a range of possible outcomes and estimated impacts and then evaluating potential actions

Scenario planning also tends to be an underutilized tool While presenting at a November 2019 conference, Alexander asked the audience of finance professionals about the assumptions for the economy in their business and financial plans A majority had no assumptions at all

“A single-track scenario is dangerous and creates a false sense of security,” he says “It’s almost certain the future will deviate ”

Defining Scenario Planning

Scenario planning and analysis can help prepare an organization to think about various business outcomes such as winning or losing a major contract, or even unforeseen disasters such as a global pandemic and the impact those events may have on the organization as a whole Scenario planning can be used to map out cash flow projections, succession planning, and even black swan events

Alexander asserts that scenario planning should be organizationwide and part of each planning cycle, whether that’s a budget, a strategic plan, or a capital investment decision The point of scenario planning is to create a tested and approved process to respond to all outcomes, including crisis events “All of these things can be prepared for in advance,” Alexander says

2021’s Possibilities

Claire Burke, CPA, treasurer and vice president of finance at Dearborn Group, says her budgeting and financial planning process begins with a lot of questions For 2021, her team is asking questions such as: Will the economy continue in its current state? Will it get better? Will it get worse? What about COVID-19?

Jack Alexander , CPA Founder of Jack Alexander and Associates LLC

Alexander shares the following (very basic) steps for scenario planning: First, identify critical uncertainties What are the big openended questions your organization needs to consider? Second, develop a robust model with explicit assumptions that’s capable of generating key outcomes Third, determine the most likely outcome as well as alternative plausible scenarios Fourth, model out those outcomes with estimated impacts and trigger events that would signal the need for an organizational response Finally, monitor those assumptions, focusing on critical drivers and the indicators leading up to trigger events

Given current levels of uncertainty, she advises that a conservative approach be taken with administrative expenses, noting she would rather have some cushion in case things take a turn for the worse versus having to make major cuts quickly later on This could include keeping headcount where it is and cutting non-essential expenses Scenario planning is a very helpful tool in determining the appropriate expense level for 2021, as well as providing a better understanding of potential risks and opportunities

Burke also advises looking to 2022 and 2023 “The impact of the pandemic could continue for multiple years, ” she cautions “Stress test the worst- and best-case scenarios tailored to your industry Look at the levers you might want to change, the what-ifs Help the senior leadership team understand the range of possibilities for the years ahead based on various decisions ”

While COVID-19 has created many challenges, there are upsides that could provide a competitive advantage in the future “Don’t just focus on the challenges,” Burke advises “Look for opportunities to pursue or change your business model a lot of organizations are shifting to digital Understand how this could help better position your company for the future You could potentially leapfrog your competition ”

For instance, remote work at Dearborn has generated streamlined processes, the elimination of paper, and digital approvals in the finance area “Our team is in a stronger position now than we were earlier in the year, ” Burke says “Our close process has improved significantly We now spend more time analyzing and providing quality information to management ”

The Strategic Value of Finance and Accounting

As his company looks ahead to 2021, their scenario modeling has become more comprehensive and granular, says Steve Latreille, vice president and corporate controller at Ingredion Inc Because Ingredion is a global company, the many different scenarios being

24 | www icpas org/insight

“A single-track scenario is dangerous and cre ates a false sense of security. It ’ s almost certain the future will deviate.”

“Don’t just focus on the challenges . Look for opportunities to pursue or change your business model . You could potentially le apfrog your competition . ”

Claire Burke , CPA Treasurer and Vice President of Finance , Dearborn Group

modeled must also be tailored by country and region to reflect the differing impacts of the pandemic across the globe “This gives us confidence that we have a risk-balanced plan going forward,” he says “Our modeling is now more robust and agile than what we ’ ve done in the past ”

The pandemic and recession combined have reinforced how important it is for the finance function to have a seat at the table for budget and strategy discussions “It’s crucial for finance to lead the planning and modeling processes and then help executives communicate the results to the investors and board of directors,” Latreille emphasizes “Your leadership team is relying on a tightly disciplined corporate finance group to keep the organization aligned ”

That sentiment is echoed by Burke “The biggest value we can bring to our organizations is providing timely, relevant data that not only shows what happened and why, but also provides indicators of the future,” she says “We can interpret that data and help our senior leadership team connect those dots when making business decisions With all this incredible uncertainty, data is the only consistent thing we can rely on ”

It’s important to remember that business leaders are looking to the finance function to tell a complete story not just sharing the numbers, but explaining the reasons for them and their implications “Sometimes we assume everyone interprets a set of data the same way we would,” Latreille says “They really don’t Be more specific and qualitative when communicating with business teams to help them make decisions Clear insights are important ”

Latreille stresses that the finance function serves a critical role in times of significant uncertainty, and finance professionals need to be broad-minded thought partners “As we look ahead to 2021, finance and accounting professionals can help build consensus based on connectivity,” he says “We play a critical part and should remain focused on continuing that leadership role going forward ”

Whatever role CPAs play in the organization, Latreille says it pays to get out of your lane every now and then and have deeper discussions about everything from obstacles in manufacturing to what your customers are saying “Be as broad-thinking as you can be Build relationships outside of your function Don’t just rely on existing reporting mechanisms Pressure test and seek to understand the signals throughout the organization,” he advises And don’t forget, you ’ re playing the long game “Continue to make strategic investments and bets,” Latreille says “This isn’t a time to totally pause and reflect Make sure you continue to focus on pathways for growth if you have the opportunity to do so You still have a strategic roadmap to follow Keep the organization focused and aligned ”

Opportunities for All

Effective scenario planning isn’t just for large organizations in fact, smaller businesses might actually find themselves better able to plan and pivot than larger organizations that are more complex and unwieldy Shimamoto says the key is figuring out likely or even unlikely scenarios and then running the numbers using those drivers

Importantly, effective scenario planning helps educate an organization’s senior team as to how bad certain situations could be and how to mitigate the damage “Focus on areas that you might have control over and develop remediation plans,” Alexander says It’s a strategy he has used in the past to get the whole senior team working together “Once finance put together those scenarios, walked people through them, and explained details, we were able to home in on areas we could influence to keep us on track ”

That doesn’t mean there still won’t be a lot of zigging and zagging as organizations continue to navigate the pandemic, but Alexander says it’s about keeping your eye on the ball: “It’s not a linear route It was, and still is, a roller coaster, but we ’ re not letting up on our diligence We’re leveraging data so we can understand what’s going on and be proactive ”

This is where opportunity for accounting and finance professionals presents itself “We’re the ones who can analyze the numbers, design the models, ask the right questions, and look at the different scenarios and implications,” Shimamoto says “We can help organizations work through the changes to their business models You can’t predict the future, but you can anticipate scenarios and plan responses ” Corporate finance and accounting teams and CPAs alike can use scenario planning as part of ongoing efforts in developing plans and projections, whether it’s for their own organizations or for their clients Shimamoto encourages CPAs to think of their mission as providing peace of mind, vision, and hope to their clients something scenario planning can really help with “Let’s figure out how to not just survive, but thrive,” he says “Provide different roadmaps for different scenarios Create clarity on what needs to be done should certain trigger events start to happen If we stay focused on the positive and how to get through this instead of focusing on everything that’s going wrong, we can thrive and bring hope to the world that we will make it through this pandemic together ”

Burke says she’s happy to be part of a team that’s leading more than 1,000 employees through these crazy times “We’re all under stress, but this won’t last forever As finance professionals, we ’ re going to get through this,” she says “I like to view these challenges as opportunities for our profession to show the value we can provide to our organizations and clients This is our time to shine ”

www icpas org/insight | WINTER 2020 25

“ If we stay focused on how to get through this inste ad of focusing on ever ything that’s going wrong , we can bring hope to the world that we will make it through this pandemic together.”

Donny Shimamoto, CPA , CITP, CGMA Founder and Managing Director of IntrapriseTechKnowlogies LLC

“Continue to make strategic investments and be ts. This isn’t a time to totally pause and reflect. You still have a strategic roadmap to follow. Keep the organization focused and aligned.”

Steve Latreille Vice President and Corporate Controller , Ingredion Inc.

Kristie P. Paskvan, CPA, MBA

The Expanded 2021 Board Agenda

The extreme and unusual pressures of 2020 have necessitated new areas of focus for directors heading into 2021.

If you ask any board member what the role of a board is, you will generally hear the following areas of focus that almost all boards have in common: strategy, governance, executive compensation, succession planning, ethics, and risk Of course, many organizations have other areas of focus specific to their situation and industry At companies where there is a high capital infrastructure investment or businesses competing for funding, capital resource allocation reviews by the board are critical to ensuring that businesses have the necessary tools to thrive For an acquisitive, high-growth company, M&A will be a key part of the board agenda as acquisitions or lift-outs are a critical component of growth for these firms

But how agile have boards been in adjusting to the advent of COVID-19? How have board agendas changed as the calls for diversity and social justice have increased? Boards and executive committees have stepped up and met more often, communicated more widely, and added new topics to their regular agendas, including supply chain disruption, innovation, scenario planning, liquidity, climate change, and increased operational and cyber risk As we set our board agendas for 2021, three of the most important topics that should receive enhanced attention are talent, culture, and ESG (environmental, social, and corporate governance)

TALENT MANAGEMENT AND CULTURE

2020 brought major changes to the job market and the workplace Some of the changes were positive: Many organizations moved to remote work and U S hiring managers reported more short-term productivity gains than losses Employees no longer need to live within commuting distance of their office, allowing for broader geographic options as well as commute cost and time savings

But at home, employees are juggling childcare, partner job losses, and a lower number of interactions overall with coworkers and loved ones and may be experiencing fatigue and stress Organizational culture has taken a hit as employees are no longer able to learn things by just listening to conversations around the workspace or through random interactions with coworkers The essential process of onboarding new employees has always leveraged mentors and shadowing practices that are extremely challenging in a remote work environment Social connections are an important part of an employee’s success, and organizations will need to find ways to address this lack of in-person interaction

26 | www icpas org/insight

D I R E C T O R ’ S C U T STRATEGIES FOR TODAY’S

CORPORATE FINANCE LEADERS

Board Director, First Women’s Bank and SmithBucklin

com | ICPAS member since

Leadership Fellow, National Association of Corporate Directors

kppaskvan10@gmail

1984

Boards should engage in dialogue about long-term policy changes that will enhance productivity as well as focus on the well-being of employees While obvious for essential businesses, the safety and well-being of all employees is now a top concern for us all Empathy for employees has never seemed higher, but organizations must take concrete actions to benefit their workforce

Flexible arrangements and benefits that address the challenges that come with remote work will improve company talent retention and recruitment strategies However, analysis of a U S Bureau of Labor Statistics monthly jobs report discovered that women are leaving work at four times the rate of men: In September alone, 865,000 women left the workforce If women make the difficult choice to remain out of the workforce for a significant period of time, this will be a setback to the gains made in gender diversity as well as succession planning for many organizations

Overall, the needs of employees and their families are top-of-mind for management teams, and therefore for boards Critical aspects of training, mentoring, promotion, and succession are at risk in the current environment and will require thoughtful, extensive action to keep steady

ESG MATTERS

Organizations, CEOs, and their boards are continuing to confront social and racial inequity while educating themselves and creating action plans around social justice and the Black Lives Matter movement Boards are discussing commitments for additional community philanthropy as well as substantive changes to hiring, promotions, purchasing, and equity plans

The National Association of Corporate Directors (NACD) has held meetings with Fortune 500 board committee chairs to discuss specific steps boards can take, including being clear about expectations for improvements across the entire organization, tying executive compensation to the results of any company-wide plans, and regularly discussing diversity and inclusion at board meetings Investors’ expectations are growing as they review company responses and monitor business policies and practices through ESG rankings

In its August Advisory Council Brief, the NACD outlined two frameworks that it recommended to organizations and boards looking to advance diversity and inclusion initiatives Developed by the Black Corporate Directors Conference, the people, purchasing, and philanthropy framework focuses on three areas: hiring and retaining a diverse workforce, directing purchasing power to minority-owned businesses, and philanthropic outreach The second framework, the paradigm for parity, seeks to address gender equality by eliminating biases, promoting women from within, and providing women with mentors and sponsors, among other actions

Whatever framework the board selects, it’s important for organizations to embrace accountability by being vocal about their goals and reporting on progress Boards should regularly review the data related to all these initiatives to ensure that programs are actually effecting change Cultural change is difficult and requires constant communication, but effective ESG initiatives will be a necessary component of business success in 2021 and beyond

During any crisis, short-term changes are expected, and executive teams and boards must refocus on immediate plans to shore up the company But 2021 will see the board agenda expanding for the long term The focus on talent, culture, and ESG can create gains that not only impact bottom lines, but also separate the truly empathetic organizations from others Boards are taking notice

www icpas org/insight | WINTER 2020 27 Increase your visibility! List your firm on ICPAS’ FIND A CPA Directory today. This FREE benefit is exclusively for ICPAS members. The user friendly online directory allows individuals, businesses, and not-for-profits to access your firm’s information through a simple search on our website. Add or update your firm’s listing today, visit www.icpas.org/firmdirectory

Elizabeth Pittelkow Kittner

CPA, CGMA, CITP, DTM Head of Finance, International Legal Technology Association ethicscpa@gmail com | ICPAS member since 2005

CPA, CGMA, CITP, DTM Head of Finance, International Legal Technology Association ethicscpa@gmail com | ICPAS member since 2005

The Ethics of Remote Work

Organizations around the world have moved all or some of their staff to remote working environments While this change may be a boon for public health concerns, remote work has different ethical implications and fraud prevention considerations than a traditional inperson work environment Here is how to evaluate how well your work-from-home practices are implemented and where you can improve them

PRODUCTIVITY

Employers not used to virtual work environments may be concerned about their remote employees’ productivity One way to address productivity is to set clear goals and expectations of what needs to be accomplished and in what time frame Results should be prioritized over the hours worked or perception of hours worked Consider holding weekly one-on-one meetings with your team members to discuss progress and remove obstacles to increase efficiency Highlight achievements and celebrate individual successes you might consider using a tool to record results and demonstrate ongoing praise for accomplishments

Some employers have implemented productivity monitoring software to determine how much their employees are working; be careful with this kind of solution as it can send a message to your staff that you do not trust them You can remind your employees of using their company-issued equipment for business purposes only, which should reduce time spent on non-business websites You can also forbid time theft in your internal code of conduct and require employees to review and sign it You can ask hourly employees to complete detailed hours per project and assess how efficient they are with using their time toward achieving goals; they can also sign timesheets attesting that their time is accurate

WELLNESS