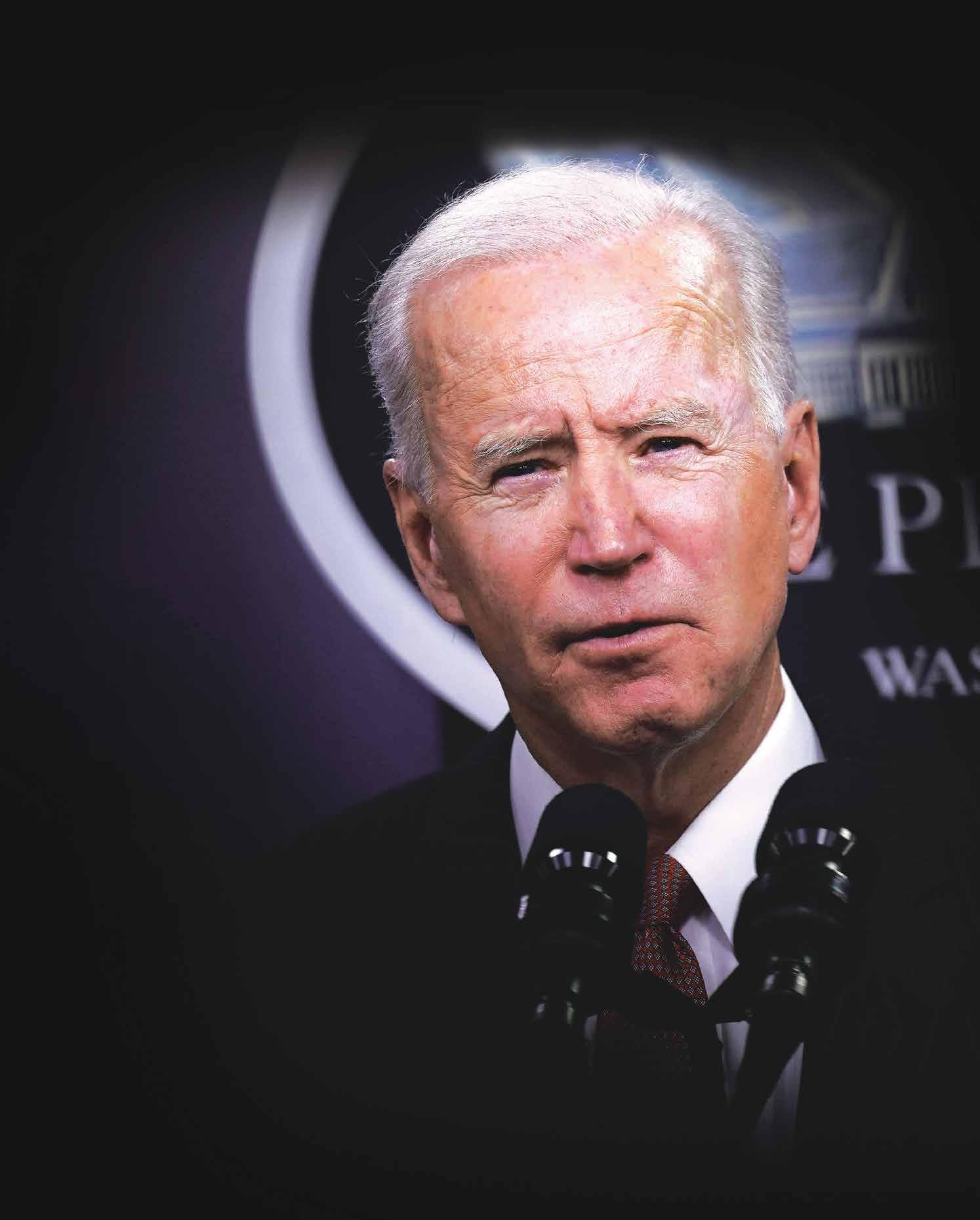

HOW BIDEN

WILL BOOST SA

REGISTERING A SMALL BUSINESS

INVESTING IN WINE WITHER INFLATION?

TRACK YOUR FORTUNE WITH OUR DATABANK VOLUME 86 • 1 st QUARTER 2021 WWW.PERSFIN.CO.ZA

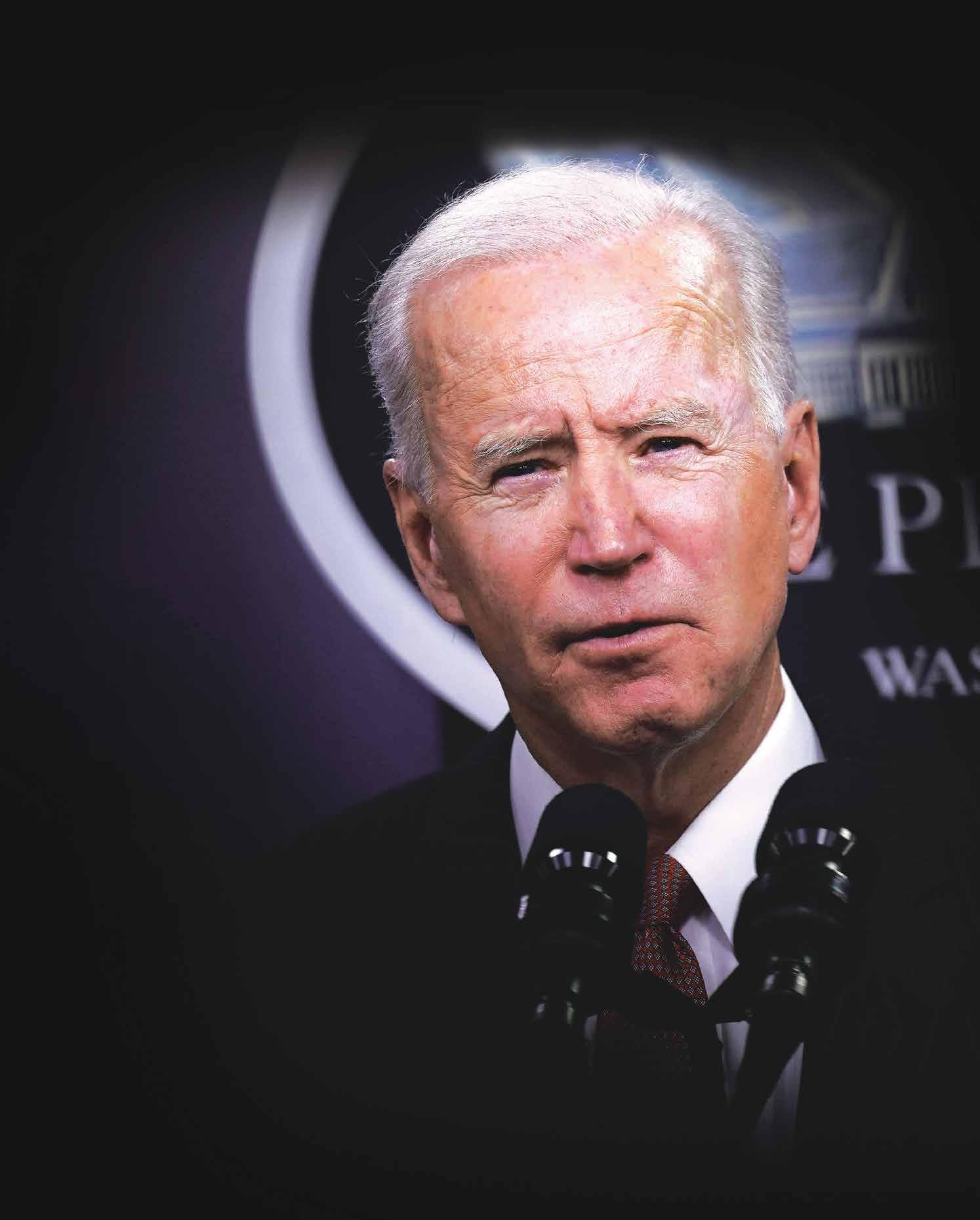

COVER STORY ‘Act Big’ is South Africa’s silver

bullet

Having Joseph Biden and his administration installed at the White House is good news for South Africa, but it’s up to our government to seize the moment.

FEATURES

12 Inflation: coming to an economy near you? Has the low-inflation environment lulled us into complacency?

15 Do you need to register your small business?

Answers to questions small business owners need to consider.

20 Provident funds align with pension funds Changes to withdrawals take effect on March 1.

22

31 Does fine wine a fine investment make?

Putting profit before pleasure.

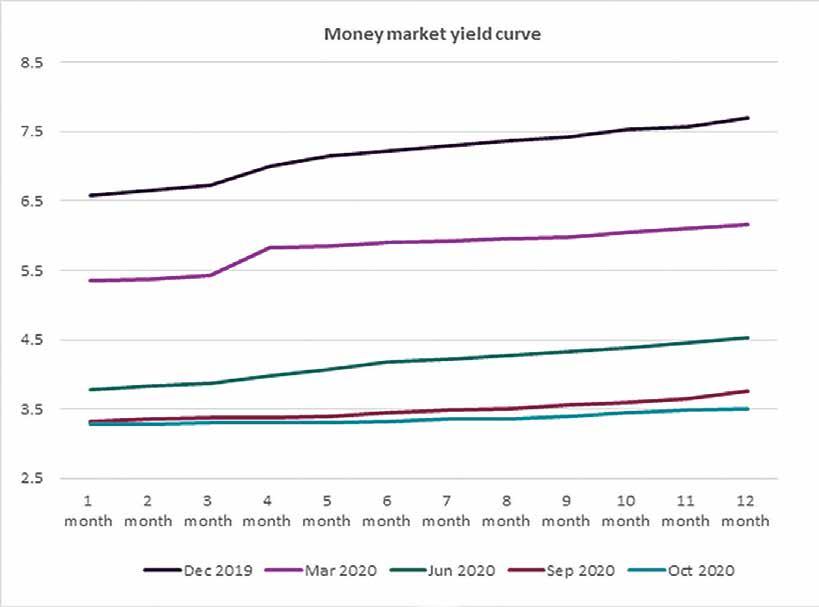

35 Money market funds: some are more equal than others

The differences between these funds explained.

37 What to know about life annuity guarantees

Benefits for your heirs if you die prematurely.

39 Leaving South Africa? This is what you must know about tax

With our complex tax system, it pays to be informed.

42 How do offshore assets fit into your estate planning?

Depending on where they are, things can get complicated.

44 There’s more to Section 12J investing than the tax break

The case for diversification and economic growth.

REGULARS

4 Upfront Big Spender

6 Book review Our pick of financial books

7 Your letters Readers’ queries answered by experts

48 Millennial view How 2021 changed my relationship with money

49 Fund focus The Absa Inflation Beater Fund

51 On the contrary Investment solutions for a new world

DATABANK

52 A list of the adjudicators and the ombuds who can assist you with your complaints, followed by the unit trust quarterly results, tax rates and annuity rates

Why saving in a retirement fund is hard to beat Research confirms taxbreak advantages over other investments.

26 From Pretoria with love Financial Planner of the Year, Hester van der Merwe.

28 The road to universal health care Is NHI the answer to South Africa’s healthcare ills?

8

MARTIN HESSE

BIG SPENDER

Since the 2008 global financial crisis, economists and governments of developed countries have converged on the Keynesian view that the best way to handle a financial crisis is to spend your way out of it. The difference between how the US and Europe emerged from the crisis made it clear: austerity only makes things worse.

The question then becomes where should the money be spent?

After the 2008 crash, the Obama administration bailed out big finance, slashed interest rates and embarked on quantitative easing, which was wonderful for investors, who benefited from the longest bull market in US history. But was it beneficial for the man in the street?

The answer appears to be no, or else working and middle-class Americans would not have become so disenchanted in their government that they were seduced by the populist rhetoric of Donald J Trump.

The Covid-19 crisis has been very different, in that it has not seriously undermined the financial system. But it has hit the man in the street much harder: depriving him of business, employment and income on a scale not seen since the Great Depression.

The US government stepped in with massive relief packages, aimed directly at citizens, simply to enable them to survive, month in and month out.

When that relief started drying up at the end of 2020, the question was to what extent it should be extended. After all, even with the advent of vaccines, no one knew (and still doesn’t) how long it would take for the virus to be defeated and life to get back to normal. Even a country as rich as America couldn’t afford to sustain its population indefinitely.

With Biden winning the White House, and Janet Yellen being appointed Treasury Secretary, the answer was decided. Much more spending and QE was needed to see America through the crisis.

Of course, Biden has been good for America and the global economy in numerous other ways, and there has been almost immediate improvement in relations with its traditional allies.

As we read in financial analyst Ryk de Klerk’s insightful article on page 6, the by now cash-strapped South African government may not be able to offer the same sort of relief to its citizens that the US can, but it can take advantage of any international support in the offing.

Positioning South Africa as an investment-friendly destination is a vital step.

VOLUME 86

1st QUARTER 2021

An Independent Media (Pty) Ltd publication

Editor

ANA Publishing CEO

ANA Publishing CFO

Head of Production

Head of Design Designer

Martin Hesse martin.hesse@inl.co.za

Vasantha Angamuthu Sooren Ramdenee

Mugamad Jacobs

Matthew Naudé Thabang Boshielo

ADVERTISING

Tony Malek tony.malek@anapublishing.com

Daniel Kgaladi daniel.kgaladi@inl.co.za

OFFICE MANAGER

Caryn Wessels caryn.wessels@inl.co.za

IMAGERY Freepik.com and AP

INDEPENDENT MEDIA BOARD OF DIRECTORS

Dr. Mohammed Iqbal Survé, Takudzwa T. Hove, Aziza B. Amod, Ismet Amod, Yuexing Wang, Jinghua Dong

EDITORIAL ENQUIRIES

Tel: 021 488 4187

Physical address: Fourth floor, Newspaper House, 122 St George’s Mall, Cape Town, 8001 Postal address: PO Box 56, Cape Town, 8000

Personal Finance magazine (ISSN 1562-3750) is published by the proprietors, Independent Media (Pty) Ltd, Star Building, 47 Sauer Street, Johannesburg, 2001 All products appearing in Personal Finance are available and all prices are correct at time of print, subject to change.

Now is not the time to sit by idly.

Now is the time to question.

The time to challenge.

Now is the time to act.

To believe in something bigger than ourselves.

Now is the time to help small business.

Big business.

And nurture new business.

Now is the time to put our money where it matters.

By investing R2,25bn of our own capital.

To jumpstart the economy.

To keep business doors open.

And keep food on the table.

Now is the time to plan.

We know the importance of keeping as many businesses going as possible. That’s why we’re actively supporting businesses that have been negatively impacted by COVID-19 by creating the Sanlam Investors’ Legacy Range –three impact funds with the core objective of helping to preserve current jobs and creating new ones. To find out more about the Sanlam Investors’ Legacy Range, visit www.sanlamintelligence.co.za/institutional/.

www.sanlaminvestments.com

KINGJAMES 51104/RR

Sanlam Investment Management is an Authorised Financial Services Provider.

EXPERT ADVICE ON DEALING WITH SARS

Practical Guide to Handling Tax Disputes

Author: Nico Theron

Publisher: LexisNexis

Retail price (print or e-book): R546.25

Taxpayers and businesses are under increasing pressure as a result of the economic downturn and impact of Covid-19. Equally, the South African Revenue Service (SARS) is under pressure to meet revenue targets. A possible outcome of this scenario, according to experts, is the potential for an increased number of tax disputes in the near future.

“Tax disputes have become increasingly complex,” says Nico Theron, tax expert and author of the newly released guide by LexisNexis South Africa. “There is no single detailed analysis of the rules and, as a result, there seems to often be various interpretations as to what the rules actually are, which makes for increasingly complex outcomes.”

The guide spells out taxpayer options, providing fair opportunity for taxpayers to fight their case and assisting in preventing the collection of taxes and penalties that

are not due. It offers grounds for taxpayers to defend themselves against SARS, the remedies available and tactics for dealing with the pay-now-argue-later rule that SARS typically enforces.

Including templates and dispute resolution forms, the title fills a key gap in existing literature. It will be useful both for individual taxpayers and tax professionals, including lawyers, accountants, auditors, and other tax practitioners.

Nico Theron has an MCom Taxation and is the founder and managing partner of Unicus Tax Specialists SA, a niche tax advisory firm with a key focus on tax dispute resolution. Before founding Unicus in 2017, he was a partner at a tax consulting firm, and he worked at various other tax firms in South Africa. Theron lectures honours students at the University of Pretoria on tax administration and presents seminars for the South African Institute for Tax Professionals.

INTRIGUING MIX OF TALES ABOUT MONEY

Upshot: Stories of Financial Futures

Curated by Lauren Beukes

Publisher: RisCura

Available online, to read or to listen to, on www.riscura.com/upshot

This anthology of fiction about financial realities, by a group of top writers and curated by internationally acclaimed author Lauren Beukes, launched online in January.

The seven stories take society’s present concerns and translate them into future scenarios that require readers to think about their life and investment choices in new and revelatory ways.

Contributors include Tade Thompson, Sam Beckbessinger (whose financial self-help book, Manage Your Money Like a F***ing Grownup, was a runaway success), Angela Makholwa, Bongani Kona and Mohale Mashigo.

“The stories range from a rollicking pension schemer wheeler-dealer with space bikes to a blue-economy love story set in the kelp forests, and an AI financial adviser that wants to make life decisions for you.

Readers will also encounter would-be retirees faking their own deaths, a moving debt slavery reality TV show, a nuanced take on a universal basic income experiment in Nigeria, and every parent’s nightmare in a kid-repossession story,” says Beukes.

The anthology was commissioned by investment firm RisCura. “Upshot is an anthology of stories that contemplate an uncertain future through a financial lens. Financial decisions that may seem abstract to us today will impact us and our future world in 2050 or 2070. We need to start today to invest in the life and the world we want — the implications of our decisions are critical for us and the fate of the planet,” says Malcolm Fair, RisCura’s managing director.

“The stories pose important questions about how we can create safe and prosperous futures through the financial choices we make. They are a call to action for the fatalist and a wake-up call for the unconscious,” he says.

YOUR LETTERS

RETIREMENT FUND SHARE PORTFOLIO

I have heard you can include a share portfolio as part of some retirement products. I am considering this, as my RA has not been performing well at all. In fact, it seems to be losing value. What are the advantages and disadvantages of doing this? I have about R2.5 million in a preservation fund from when I left my last job. I am still saving in my current employer’s pension fund and I am retiring when I’m 65, in 10 years’ time. – Name withheld

Graham Lovely, a financial adviser from PSG Wealth Claremont responds:

You can indeed have a personal share portfolio (PSP) in certain retirement investments, such as an RA, equity-linked living annuity or preservation fund. A PSP is a long-term insurance licensed portfolio made up of various securities such as equities and bonds. Some advantages include:

• Active participation: you’ll have more say in the management of your retirement money.

• Estate planning: at death, the distribution of your benefits is determined by the product in which your PSP is housed. No estate duty will be levied on your benefits. Executor’s fees might be charged on the benefits if the benefits are paid to your estate.

• Creditor protection: retirement benefits are secured from attachment in the event of sequestration. Keep the risks in mind too, such as:

• Capital risk: this is not a guaranteed investment, as the value of your investment is linked to the market value of the securities you hold.

• Costs associated with the investment: fees within the investment product include an ongoing platform administration fee, adviser fee and the underlying fees relating to the share portfolio such as portfolio management fees and brokerage.

Regulation 28 of the Pension Funds Act applies to PSP investments that form part of retirement annuities and preservation pension funds and the Preservation Provident Funds. The asset allocation of a total portfolio must comply with Regulation 28, which, among other things, requires that the equity (share) part of your portfolio is limited to 75%.

A PSP may be suitable for some investors, but it depends on your unique circumstances. Since a PSP is likely to invest predominantly in shares, you should be prepared to accept the associated volatility. Bear in mind that you need to understand the reasons for underperformance in your current investments before deciding to move. I suggest you consult with a qualified financial adviser, to ensure your asset allocation is suited to your needs.

STAFF PENSION FUND VERSUS AN RA

I’ve just received a new job offer. Until now I have saved into my own retirement annuity (RA), but my new employer offers a staff pension fund, and they require that all employees are members. What is the difference? – Name withheld

Pierre de Bruyn, a financial adviser at PSG Wealth Northcliff responds:

Membership in a pension fund depends on an employer-employee relationship and may be required in terms of your employment contract. The underlying investments are usually managed according to the investment strategies followed by the fund’s trustees. An RA is not dependent on an employment relationship, and you, with your adviser’s help, can make your own investment choices.

Both vehicles offer the same tax benefits. Your total contributions made to any retirement funds are deductible for income tax purposes, limited to 27.5% of the greater of your taxable income or remuneration, capped at R350 000 per year. Depending on how your RA contribution is made, you may need to claim back tax from The South African Revenue Service.

Your contributions to an RA can be made paid up; however, penalties could apply. It will depend on the product provider, and it’s always best to first request a quotation to assess the impact.

I suggest you consult a qualified financial adviser, who can advise you accordingly.

4

‘ACT BIG’ IS SOUTH AFRICA’S SILVER BULLET

Financial analyst Ryk de Klerk looks at what the new Biden administration means for South Africa’s fortunes, and why our government can take a page from America’s book to stimulate the economy.

8 PERSONAL FINANCE | 1 ST QUART ER 2021

United States President Biden has hit the ground running and his plans unequivocally underscore the World Bank’s recent views that global economic output is likely to expand by four percent in 2021. Although world growth will have a positive rub-off on South Africa, it is not the silver bullet the country has been waiting for.

Within a few days of President Biden’s inauguration he made significant sweeping changes, as promised during his election campaign. Human dignity and equality have been restored with immediate effect. Biden also rescinded Trump’s withdrawal from agreements such as the Paris Accord on Climate Change and made a recommitment to the World Health Organisation (WHO). A massive effort is underway to vaccinate American people to create herd immunity against Covid-19 as soon as possible and stimulus cheques are to be boosted to US$2000.

Treasury nominee Janet Yellen, during her confirmation hearing before the Senate Finance Committee, argued that massive fiscal support is needed to “defeat the pandemic, to provide relief to American people, and then make long-term investments that will help the economy grow”. This is Yellen’s “Act Big” stimulus plan.

The massive stimulus encompasses quantitative easing through the purchasing of US government bonds. This will put a lid on US government bond yields. Likewise, the postpandemic recovery in the Eurozone requires further massive fiscal stimulus.

The search for yield during the massive quantitative easing is likely to underpin capital inflows to emerging market and developing economies, propping up their currencies relative to hard currencies such as the US dollar, euro and Japanese yen. The market volatility in 2020 just confirmed how fickle international capital flows are.

Foreign inflows seldom end up in fixed investment in emerging markets, and they turn into outflows as soon as foreign investors perceive risks tilting to the downside. That is, unless there is a buy-in and, according to the World Bank, “a comprehensive policy … to rekindle robust, sustainable, and equitable growth”.

The normalisation of ties between the US and its former trade partners will improve global trade and reduce the prospects of supply shocks. Furthermore, the geopolitical environment will improve tremendously, as the new administration is likely to rescind Trump’s withdrawal from agreements such as the Iran nuclear deal. Early indications from China are that the trade war with the US may moderate somewhat as well.

But growth worldwide will be asynchronous owing to the various stages of where major economic zones find themselves in the war against the coronavirus and its various strains, especially regarding the availability and rollout of vaccines.

Dark times

Apart from the East Asia and the Pacific region benefiting from a solid rebound in China, the World Bank expects growth prospects in other

emerging market and developing economies, including South Africa, to be severely hamstrung by the coronavirus’s impact on consumption and investment.

Janet Yellen’s statement “I think we need to get through these dark times before the vaccination programme enables us to get back to life as we knew it” is hair-raising and so is WHO Director-General Tedros Adhanom Ghebreyesus’s recent warning that “the world is on the brink of a catastrophic moral failure” due to the inequitable access to vaccines, and “the price of this failure will be paid with lives and livelihoods in the world’s poorest countries”.

The South African government and other debt-ridden governments have no room for further fiscal policy measures to preserve lives during the pandemic. South Africa and many other developing and underdeveloped economies simply do not have the means to get through the “dark times”. They had to end their income-relief programmes for citizens who have lost pay and jobs as a result of the pandemic. Nor do they have funds to secure and ensure the roll-out of vaccination programs.

That is why it is so senseless for the government to ban the sale of alcohol and forego tax income on it. The entire industry is at risk, while job losses and starvation are facing many of the country’s people.

Poor countries’ plight

South Africa is now part of the world’s poorest countries desperately in need of support during the coronavirus pandemic. South

9 PERSONAL FINANCE | 1 ST QUARTER 2021 WEALTH•INVESTMENT•PROSPERITY

Africa and other poor nations cannot afford to borrow more as they are in a severe debt crisis inter alia as a result of the major disruptions in the global economy caused by the coronavirus pandemic.

Yellen, previously US Federal Reserve chair from 2014 to 2018, comes most recently from the Brookings Institution and is acutely aware of the poorer countries’ and specifically Africa’s dire debt problem. In April 2019 already, Brookings warned about an impending debt crisis in Africa and recalled that Africa’s past debt crises have been devastating.

The tendency of the South African government over the past few years was to impose austerity measures and cut expenditure to reduce the fiscal deficit. According to Brookings, similar actions during the debt crisis in the ’80s did not work: they had severe impacts on social spending and caused severe hardship. In

US relations and investment

South Africa is likely to benefit strongly from improved relations with the US. The new Biden administration is a valuable and strong ally of South Africa: we are the US’s largest trade and investment partner in Africa, while the US is South Africa’s third-largest export market. President Biden has promised greater US investment into the South African economy. The tariffs on imports of aluminium and steel imposed by Trump are likely to be revisited, and Biden is likely to overturn the Trump administration’s revocation of South Africa’s “developing country” status in 2020. It means that South Africa will again enjoy the preferential trade treatment for purposes of US subsidies and countervailing duty investigations.

The Biden administration is also likely to strongly support the African Continental Free Trade Area initiative that aims for Africa to become self-reliant.

WEALTH•INVESTMENT•PROSPERITY PERSONAL FINANCE | 1 ST QUARTER 2021 10

Private sector funding

I still believe that President Ramaphosa’s Economic Reconstruction and Recovery Plan is feasible, but it is still a mystery how it will be funded. The South African government will be unable to contribute as, according to Mike Schussler, chief economist at Economists.co.za, in a piece on Bloomberg, “the shouts for funding will become screams as state-owned enterprises like Eskom, the SABC, Denel and others will need money from the fiscus”.

The stimuli have to come from the private sector as well as the savings industry, specifically retirement funds and financial institutions.

I am on record – and took a lot of stickthat I supported Cosatu’s original proposal of the effective reintroduction of prescribed assets for all retirement funds, life assurance industry and assets managed by the Public Investment Corporation, as it makes sense. Furthermore, by setting minimum exposures to investments in domestic developmental projects, such as in infrastructure and green energy, the stage will be set for much-needed investment in the economy, as it is one of the crucial pillars of economic growth and employment.

Debt relief

South Africa and other heavily indebted developing countries should be able to join the current list of 39 countries eligible or potentially eligible for HIPC Initiative assistance where 36 are receiving full debt relief from the IMF and other creditors.

According to IMF factsheets, the HIPC

Initiative was supplemented by the Multilateral Debt Relief Initiative (MDRI). The MDRI allows for 100-percent relief on eligible debts by three multilateral institutions – the IMF, the World Bank, and the African Development Fund – for countries completing the HIPC Initiative process.

pandemic and safeguarding the lives and livelihoods of millions of the most vulnerable people. Since it took effect on May 1, 2020, the initiative has delivered about $5 billion in relief to more than 40 eligible countries”.

But the devastation of the pandemic is such that much more should be done. Countries such as South Africa will not be able to get out of this hole. This is especially true given the World Bank’s current view that “risks to the outlook are tilted to the downside”. Debt service suspension could or should make way for the partial cancellation of debt.

In June 2005 the G8 finance ministers agreed to provide enough funds to the World Bank, the IMF and the African Development Bank to cancel $40 to $55 billion in debt owed by members of the heavily indebted poor countries.

Partial cancellation of debt or blanket debt relief for highly indebted poor and developing countries such as South Africa will enable these countries to embark on a sustainable growth path again.

Countries must meet certain criteria, commit to poverty reduction through policy changes, and demonstrate a good track record over time. The IMF and World Bank provide interim debt relief in the initial stage and, when a country meets its commitments, full debt relief is provided.

According to the World Bank’s Brief on Covid 19: Debt Service Suspension Initiative (DSSI), dated 12 January this year, the World Bank and the IMF urged G20 countries to establish the DSSI “to help countries concentrate their resources on fighting the

The silver bullet is, to put Yellen’s words into the South African context, massive domestic and international support to “defeat the pandemic, provide relief to all South African people, and then make long-term investments that will help the economy grow”.

Ryk de Klerk is analyst-at-large. Contact rdek@ iafrica.com. The views expressed above are his own. You should consult your broker and/ or investment adviser for financial advice. Past performance is no guarantee of future performance.

11 PERSONAL FINANCE | 1 ST QUARTER 2021

Debt relief for poor countries will enable them to be sustainable again.

INFLATION COMING TO AN ECONOMY NEAR YOU?

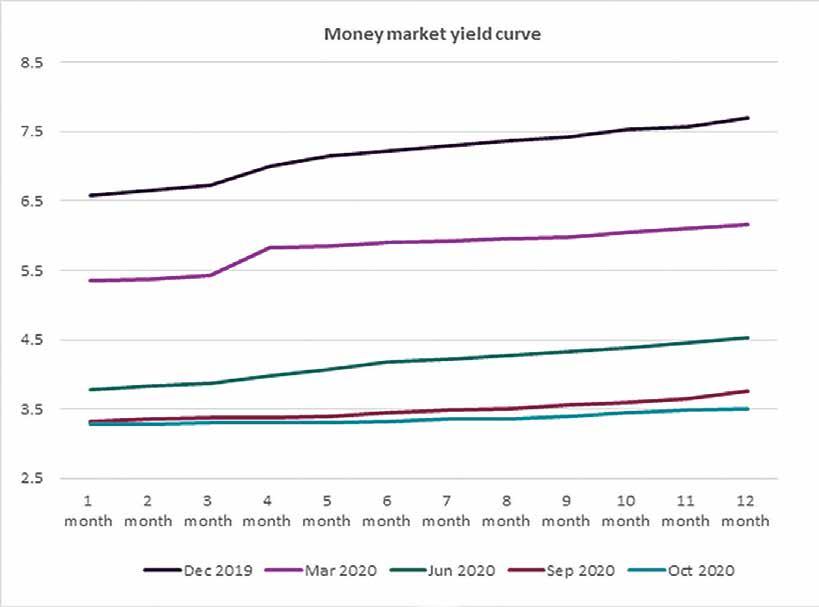

Could Covid-19 be the catalyst that finally lets the inflation genie out of the bottle? Now is a good time for investors to consider how it could impact them. Sahil Mahtani and Russell Silberston explain why they think inflation risk has increased.

We haven’t had a sustained period of price rises for years. Could the coronavirus be the catalyst that finally lets inflation loose? Now may be a useful time for investors to think through the portfolio implications of a more inflationary environment.

What causes inflation?

The massive stimulus implemented by central banks to help economies recover

from Covid-19 has sparked speculation in some quarters that inflation may follow. Traditional economic theory certainly suggests that a major expansion of central banks’ balance sheets should drive up prices. However, the relationship between money supply and inflation only holds over multi-decade periods. In the shorter term, inflation is tough to predict. That was amply demonstrated following the 2008/9 Global Financial Crisis (GFC), when widespread

forecasts that prices would start increasing –in response to super-accommodative monetary policies – proved wide of the mark.

That inflation has been subdued in the decade since partly explains why many investors seem sanguine about the inflation outlook now. We hesitate to write these words, but this time it could be different: we see a significantly higher risk of inflation in the next 10 years than in the last 10.

12 PERSONAL FINANCE | 1 ST QUARTER 2021

WEALTH•INVESTMENT•PROSPERITY

Why 2020 isn’t 2008

Remember ‘Helicopter Ben’? That was the nickname given to former United States Federal Reserve Chairman Ben Bernanke, whose strategy following the GFC was to shower the US economy with money. Partly because of his policies, the US monetary base expanded 5.5 times between January 2008 and November 2020, while the consumer price index rose only 20 percent.

So why haven’t prices increased in response to the expansion of the money supply? One theory is that, to get going, inflation requires a double-whammy of monetary expansion and the right policy environment. Specifically, governments must be:

Targeting fiscal expansion while being reluctant to impose higher taxes to pay for it.

Aiming to lower the unemployment rate. We didn’t have these twin policies following the GFC. But we do now, implemented by governments trying to deal with the immense economic and social challenges of the pandemic.

Two other developments make inflation more likely:

1. The shift by many central banks to ‘make-up’ inflation strategies, under which inflation is allowed to run above the target to compensate for periods when it ran below it (until very recently, most central banks aimed always to keep inflation below the target).

2. The retreat from globalisation, which

for many years has held down prices by allowing companies to shift production to low-cost locations.

In combination, these factors could finally unleash the inflationary consequences of the money-supply expansion following the GFC and the coronavirus pandemic.

Why 2020 isn’t the 1970s That said, we don’t expect a re-run of the soaraway prices of the 1970s. That type of inflationary episode is extremely unusual, because it requires a set of circumstances that come together only very rarely:

Significant inflations ferment over many years and require multiple policy missteps based on analytical errors.

They result from a concatenation of numerous factors, both domestic and international.

Moreover, certain specific drivers of the 1970s inflation, such as a supply-side oil shock, are unlikely to recur. So we see a very low chance of runaway prices now. Nevertheless, today’s economic and social backdrop, which we explore below, might be conducive of modestly higher inflation than has dominated the post-GFC era to date.

Some inflation-limiting factors are weakening

As economist Edward Yardeni has put it, there have been four powerful deflationary forces in recent decades: détente, disruption, debt and demography – to

which we would add ‘disparities’. Some are intact, but others are weakening.

• Détente. If conflict is inflationary, peace is deflationary. The years immediately following the GFC generally featured cooperation among the major global powers. Status: détente seems to be ending, with superpower competition in security and trade intensifying. This is likely to contribute to inflation pressures.

• Disruption. The shift to e-commerce is thought to have subdued inflation by increasing price competition (by as much as 0.23 percent every year, according to one study). Other disruptive technologies, such as automation and artificial intelligence, are believed to have similar effects. Status: intact.

• Debt. In the short-term, consumption and GDP growth accelerate when debt levels rise. But in the longer term, increases in household debt have the opposite effect, reducing growth rates. Debt has been rising in much of the West. Status: intact.

• Demography. Demographic trends –specifically, rising life expectancy and falling birth rates – are thought to be disinflationary. But the jury is out on the extent to which these effects are offset by related trends, such as the growing participation of women in the labour force. Status: studies suggest demographics’ impact on global growth peaked in the mid-2010s. If that’s right, this check on rising prices should weaken.

• Disparity. Wealth inequality has increased in recent decades. This depresses

13 PERSONAL FINANCE | 1 ST QUARTER 2021

WEALTH•INVESTMENT•PROSPERITY

inflation because richer people tend to save a bigger proportion of their income; consequently, concentrating wealth in their hands reduces consumption. Status: intact, but a wild card. Global coordination of tax policy could start to weaken or even reverse the ‘rich-get-richer’ trend.

Taken together, we think these five factors suggest that the outlook is for marginally higher inflation, but still in the context of a period of low inflation.

Pressures building in the US?

Finally, we take a deeper dive into the inflation outlook for the US. Several dynamics suggest a higher chance of inflation following the Covid-crisis than after the GFC, including that:

The millennial generation (20-40) is now forming households and taking on debt; the deflationary impact of the baby-boomer generation is weakening.

The banking sector is healthier than after the GFC, with a greater ability to lend.

The US government appears more willing to expand its balance sheet, while (as noted earlier) the US Federal Reserve is likely to let the economy run ‘hot’.

In our view, inflation looks more likely in the US than in other major economies, given the stronger deflationary headwinds in Japan and the eurozone, and China’s more balanced inflationary outlook. In the table below we contrast the status of inflationary/ deflationary pressures in the US now and following the GFC: green is pro-inflationary, red is deflationary, and amber is neutral.

Inflation: prepare for the risk of a modest return

Overall, we think the chances of inflation taking hold in the next decade are significantly higher than they were after

the GFC, particularly in the US. Inflationary pressures are mild at present and we don’t expect a return to the 1970s. Moreoever, inflation tends to take time to get going. But investors should keep a close eye on

inflationary dynamics and be prepared for how they may affect portfolios.

Sahil Mahtani is a strategist at the Ninety One Investment Institute and Russell Silberston is a portfolio manager at Ninety One.

Economic conditions after the general financial crisis of 2008 versus those after the Covid-19 crisis of March 2020

Household balance sheets

Post-GFC

Households heavily indebted, with an ageing population (boomers) entering a deleveraging cycle High debt-service costs consume income

Housing market Deflating housing bubble weighs on household balance sheets and consumption

Demographics Sharp decline in working-age population growth; ageing population trend

Financial sector Overleveraged Regulation forces balance sheets to shrink

Non-financial corporate sector Relatively healthy balance sheets with ability to take on leverage

Monetary policy Aggressive easing supports assets prices and a wealth effect

Fiscal policy Supportive fiscal policy, particularly financial-sector guarantees

Real incomes

Real incomes declined and then stagnated in the years immediately after the GFC

Post-Covid-19

Households have deleveraged and debt service costs are at record lows (partly due to very low interest rates) Millennial generation entering a phase of life when borrowing increases

Relatively healthy housing market, supported by cheap borrowing and millennial household formation

Working age population growth troughing Large millennial generation enters a higher-spending phase

Banking system is relatively healthy, though question marks remain over pandemic impacts Some deregulation

Corporate leverage is extended and debt service is somewhat elevated, but not at previous highs

Very aggressive easing supports asset prices, a wealth effect and corporate growth

Strong fiscal support with direct increase in money pumped into the real economy

Real incomes have risen due to fiscal support

The pace of the recovery and whether there is additional fiscal support will determine whether or not this gain is maintained

14 PERSONAL FINANCE | 1 ST QUARTER 2021

DO YOU NEED TO REGISTER YOUR SMALL BUSINESS?

Got a side hustle? Newly self-employed? Working in the gig economy? Anna Rich answers your questions on why, when and how to register your business – and whether it’s really necessary.

WEALTH•INVESTMENT•PROSPERITY

PERSONAL FINANCE | 1 ST QUARTER 2021 15

Is this the first you’ve heard about the possibility of registering your business?

If so, whether you realise it or not, your business is probably a sole proprietorship (or “sole prop”). You run your business in your own name, and haven’t jumped through any hoops in terms of legalities –besides perhaps getting a trading licence if your municipality requires it.

As a sole proprietor, there is no clear line between your personal assets and the assets of the business, because your business is not a separate legal entity. Even if you’ve given your business a name, as a sole proprietor you only have to file one tax return, which includes both personal and business income.

First principles

It’s very important to separate your business finances from your personal finances, says Petro Bothma, group enterprise development manager and programme manager for the SME Toolkit at Business Partners. “I cannot stress that enough. Even if you bake cupcakes for home industries, or sell products at a weekend market, and make very little profit, keep the money separate. If you have only one bank account, it just muddles things.”

Bothma takes this advice a step further, urging anyone with a small business to “be serious about it”. “Keep records of your cash flows; keep every invoice, every receipt.” These records could allow you to claim tax deductions.

If you are disciplined about keeping financial records, it is easier for an accountant to help you if you decide to register as a private company, and it’s easier to source finance and to seize opportunities that arise, she adds.

Bothma has particular insight into missed opportunities. Business Partners and other financial institutions administered relief programmes to help businesses impacted by Covid-19 (if they were financially viable prior to the pandemic). To qualify, businesses had to be formally registered, and show tax and regulatory compliance. “Many entrepreneurs who applied didn’t have financial records, and were using

their business and personal money interchangeably,” she says. “So they missed out.”

Types of businesses

Companies come in different forms and legal structures. Our government sets out the standards for running companies in the Companies Act of 2008, which includes the terms for legally forming a company (known as incorporation), registering, organising and managing it. The Act also provided for the establishment of the Financial Reporting Standards Council to advise on requirements for financial record-keeping and reporting by companies.

Working on the assumption that you’re running a business to make money, let’s put non-profit companies aside. Non-profits are for public benefit, or to promote a cultural, social or group interest.

For-profit companies include public, private and personal liability companies. A personal liability company is used by professionals like lawyers or doctors, and a public company offers the public the opportunity to buy shares. The type you’re most likely to look at forming legally is a private company.

What about a close corporation? This was a similar entity to a private company, only with fewer legal requirements. But when the new Companies Act took effect, no new close corporations were permitted to be registered.

To register or not to register as a private company?

“It isn’t as simple as a yes or no,” says Bo Bissict. “You need to look at your particular situation and work out what's best for you.” Bissict is co-founder of Govchain, which helps their clients with company registration and compliance. “If you’re a small, simple company not looking to grow anytime soon, then you’re probably better off trading as a sole proprietor. If you have plans to build your business, then you’re likely to want to register it.”

Ideally, we want to encourage small businesses to register and grow, says Jacques Sibomana, founder and managing

director of Kuba Technologies, a digital platform that aims to unlock the potential of small businesses. “But we advise business owners that they need to be emotionally ready to take the step of registering, as it is not as smooth-sailing as it might seem.”

“Do you really need to go through the hassle of registering a business?” asks Bothma. “There’s a lot of admin involved, and thereafter, a private company is subject to several legislative requirements. So start with ‘why?’” she advises. “Ask yourself ‘Why do I want to register?’”

Question 1: Do you need to protect your personal assets?

“As a sole prop, you’re trading in your own personal name, so if anything goes wrong, you and your personal assets are liable,” explains Bissict. “Your creditors will take everything – your house, your car,” adds Bothma.

On the other hand, a registered company is a separate legal entity. “The legal aspect of limited liability is one of the greatest innovations in modern economic history,” says Bissict. “This means that if a registered company gets into debt, the owner’s assets are protected and only company assets are liable,” he explains.

“This holds true unless you have provided security for the company’s debt in your personal capacity,” Bothma notes.

Consider the level of risk your business poses to your personal assets. “If you’re doing something small and safe like selling orange juice at a market or freelance web work for clients, it’s fine to be a sole prop, but if it’s anything risky, you’re safer having a registered company,” says Bissict.

Bothma flags the implications for your business if you are married in community of property, the default in South Africa if you did not set up an antenuptial contract.

Spouses married in community of property own all assets jointly. “But being married in community of property also entails that you are liable, in full, for all debts and liabilities incurred by your spouse before and during the marriage,” explains Ann-Suhet Kamffer, who is part of the litigation team at Van Deventer and

16 PERSONAL FINANCE | 1 ST QUARTER 2021 WEALTH•INVESTMENT•PROSPERITY

Van Deventer Incorporated. “It is possible for creditors to claim from a business owned by one spouse to settle outstanding debt of the other spouse.”

Registering a private company (proprietary limited) does not exclude the company, or its assets and liabilities, from the marriage, adds Kamffer. “The liabilities of the company also form part of the debt of the joint estate, which is owned and managed by both spouses, so both are held liable for its payment.”

There is a way to avoid this scenario. “If both parties agree,” says Kamffer, “in terms of Section 21 of the Uniform Rules of the Court, they can apply to the High Court to change the status of their marital regime. The court must be satisfied that the rights of creditors of the parties are preserved and no other person will be prejudiced by this amendment.”

Question 2: Could you pay less tax if you registered your company? Again, there is no simple answer; it depends on your particular circumstances. “If you’re a sole proprietor, you’re taxed at the rates that apply to you on a personal level, but if your business is registered as a private company, then the company is generally taxed at a flat rate of 28% of profit,” says Bothma. ”If you earn very little from your sole proprietorship, you might pay no tax at all.”

For the 2021 tax year, if you are younger than 65, and earn less than R83 100, you are not liable (with some provisos) to pay any income tax. After that, if you earn up to R205 900, you are taxed at 18% of taxable income. And so on it goes, through seven different tax brackets, to the top bracket at which you are taxed R559 464 plus 45% of taxable income above R1 577 300. (See “rates of tax for individuals” on the SARS website, sars.gov.za.)

“People often avoid registering a company because they think it's simpler running it through their own personal accounts,” says Bissict. “But at the end of the day, all the transactions need to be reported to SARS and it’s often easier to do this through a separate single purpose entity rather than mixed in with your own personal tax.”

If your business is small, with an annual turnover of R1 million or less, this is known as a micro business within the tax framework – and it might qualify for turnover tax. These tax rates are low, with turnover of up to R335 000 taxed at 0%; R335 001 to R500 000 at 1% of each R1 above R335 000, and so on. This could apply to you, whether you are operating as an individual (sole proprietor) or as a registered private company. Though you don’t need to be registered with the Companies and Intellectual Property Commission (CIPC) as a private company, you do need to qualify for these rates (check this on the turnover tax page on the SARS website), and if you do, you need to register with SARS for turnover tax. Another positive of turnover tax is that it simplifies your need for accounting/ record keeping, says Bissict. It replaces income tax, VAT (unless you decide to stay in the VAT system), provisional tax, capital gains tax, and dividends tax.

Perhaps you’ve registered with the CIPC, and are playing in the “small business corporation” space, rather than at a “micro” level. “SARS is doing good work to assist with promoting growth in small businesses,” Bissict notes. “They recently introduced a tax type for Small Business Corporations (SBC), which can reduce a small business’s taxes.”

Find out if your business qualifies as a Small Business Corporation by going through the checklist on the Tax Tim website (taxtim.com). Two of the key determiners are that your business is

registered with the CIPC, and that its gross income is less than R20 million in a financial year. They also have a handy Small Business Taxable Income calculator on their site.

Question 3: Would registering allow you to access more opportunities?

“In many cases, registering as a private company is the way to go,” says Bothma. “If you want to submit tenders to government, you have to be registered. And corporates often work only with registered companies.”

“By registering your company, you are formalising it to the world,” says Bissict. “People prefer dealing with registered entities as they feel safer.”

Sibomana attests to this. “Most companies want to work with a registered entity with clear legal documents and a business account to avoid fraud and other issues,” he says. “And consumers see you as more credible too.” But he has also found that you experience a shift in mindset: “Your behaviour changes when your business is registered. You start taking greater responsibility, as you wish to see it grow.”

Besides opening up the possibility of landing government contracts, “the government offers training and financial incentives that are not available to unregistered companies,” adds Bissict. “This was clear during lockdown when the government excluded informal traders from operating as essential services.”

Another set of possibilities that could open up if you are registered is B2B, which means business-to-business – businesses working with other businesses, explains Bissict. “In this large trade sector, products and services are supplied to companies. Some companies only work with other registered companies, and some offer significant discounts to registered businesses. We’ve heard of people

17 PERSONAL FINANCE | 1 ST QUARTER 2021

WEALTH•INVESTMENT•PROSPERITY

dropping their expenses by 10 to 15% by registering their companies.”

Bothma says that if you are an Exempted Micro Enterprise (EME), and more than 50% black-owned, or a qualifying sole enterprise, with an annual total revenue of

R10 million or less, you can apply to various corporations for supplier development.

Another benefit to registering as a company is when you need finance, says Bothma. “Once you start buying business assets – perhaps a fancy machine from

China, or a vehicle, or a commercial property – it’s much easier if you’re a registered company.” Sibomana agrees: “Once you register your company, this sets you apart, making it is easier to access finance.”

WHERE TO REGISTER OR GET HELP

If you decide to set up a private company – designated by the abbreviation (Pty) Ltd (for Proprietary Limited) after the name –the Companies Act requires that you register it as a legal entity with the Companies and Intellectual Property Commission (CIPC). The CIPC is tasked with monitoring and enforcing compliance with the Act: registering companies and corporate names, maintaining data, and regulating governance and disclosure by companies. You’ll need to fill in several forms and pay the accompanying filing fees. Visit www.cipc.co.za.

To register in person, find your nearest office by clicking “Access" on the home page of the CIPC website, then "CIPC Self Service Centres and Partner Sites". These might be closed temporarily, depending on Covid-19 regulations.

More of an online type?

On the CIPC home page, select “Register your Business”, “Register a Company”, then under “Register”, “Private Company with a Standard MOI”, if you don’t

need to customise the MOI. MOI? The Memorandum of Incorporation is the document in which the owner/s set out the rules for managing and maintaining the company. See what the standard MOI entails by clicking the link on that page. If it works for you, follow the fourstep process spelled out in detail on the website. Here’s the general idea:

• Register online as a customer to get your CPIC customer code.

• Deposit the company registration fee (R125/R175) into the CIPC account.

• Reserve your corporate name. It’s possible to use your company’s enterprise number instead.

• Register your private company with standard MOI by clicking on “Online transacting” then “Private Company Registrations”. After completing the process, you’ll receive an email requesting documents such as certified copies of the director/s ID and the name confirmation certificate, if applicable.

Or go through the collaborating bank

First National Bank offers CIPC registration, online or at a branch. From the www.fnb.co.za home page, click on “For my business”, then under “Value

Adds + Rewards”, you’ll find CIPC.

Or outsource the process

“The dark side of starting a business is the admin,” says Bissict. “Incorporating, bookkeeping, contracts, taxes, payments. All this you must do even if you’re a small business. While trying to survive, these things are often done poorly, resulting in costly mistakes and distractions.”

If this makes you anxious, get a thirdparty company to take you through the process (for a fee), though there’s no getting around filling in forms. One of these companies is Govchain. “We’ve built a solution to create a pain-free entry point into the formal economy,” says Bissict. “We handle all the complexity of starting a business and dealing with compliance admin, while you focus on the real hustle which is building a successful product/service.”

Go to www.govchain.co.za

Another company that provides help to small business is Kuba, which offers tools and opportunities for growth, including company registration. Kuba also connects corporations with BEE compliant suppliers. https://kuba. services

18 PERSONAL FINANCE | 1 ST QUARTER 2021

WEALTH•INVESTMENT•PROSPERITY

Access the SME Toolkit, a free online resource

“The SME Toolkit consists of over 5 000 pieces of content on starting, managing and growing a business,” says Petro Bothma, group enterprise development manager and programme manager for the SME Toolkit at Business Partners. “For Business Partners, it’s our way of giving back, and of building entrepreneurship.” Go to smetoolkit.businesspartners.co.za.

19 PERSONAL FINANCE | 1 ST QUARTER 2021 WEALTH•INVESTMENT•PROSPERITY

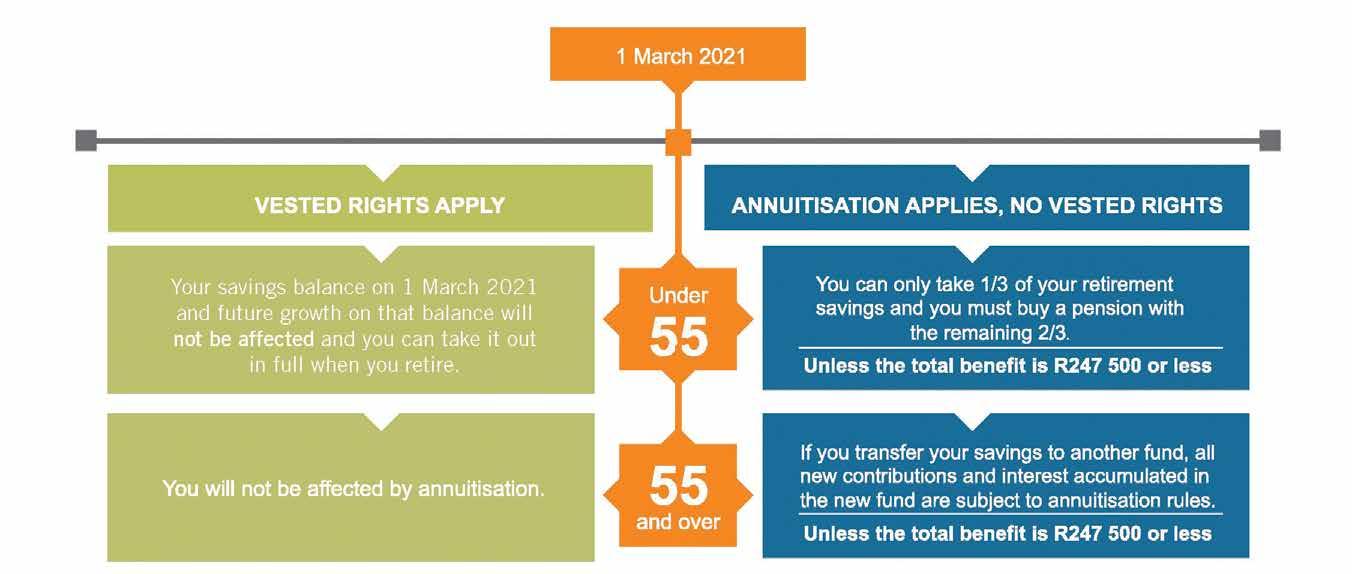

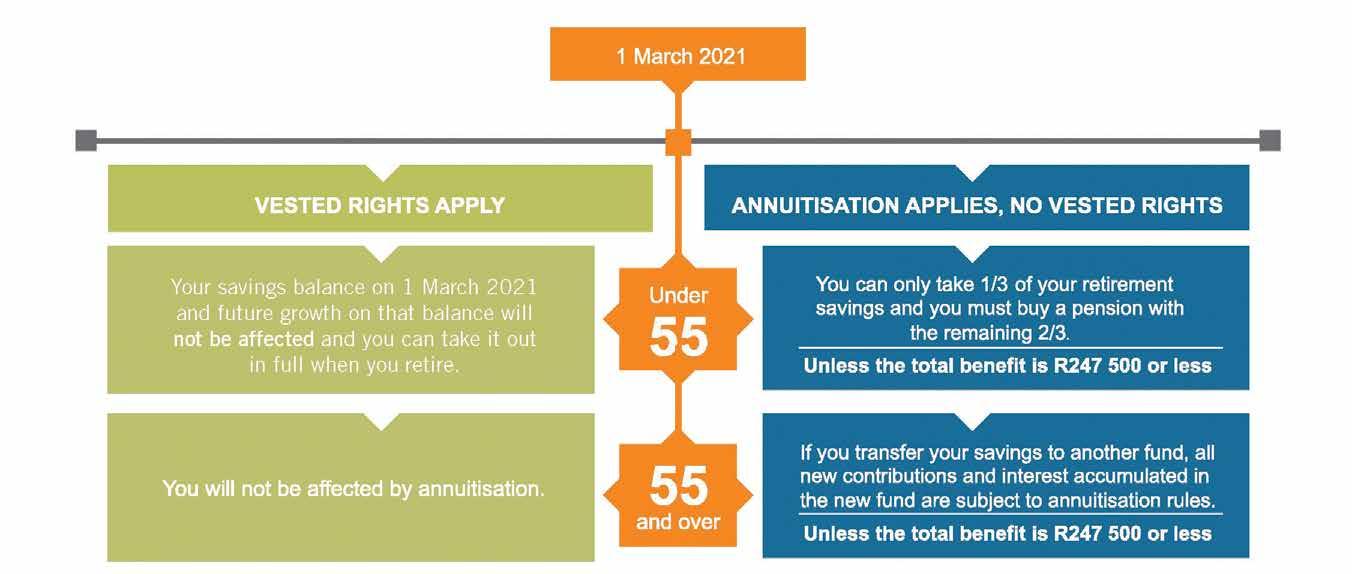

PROVIDENT FUNDS ALIGN WITH PENSION FUNDS

The government’s retirement fund reform programme, which it initiated about a decade ago, was designed to encourage working people to save for their retirement and to discourage them from cashing in their retirement savings every time they changed jobs. March 1 sees another milestone in this reform: the so-called “annuitisation” of provident fund benefits at retirement.

Changes to retirement benefits for provident fund members, initially meant to come in five years ago and now scheduled for March, will see tax uniformity for all who contribute towards retirement, whether it be in pension funds or provident funds. These changes, under the Taxation Laws Amendment Act, will also encourage greater savings, something South Africa desperately needs as it seeks to crawl its way out of an economic hole.

Dolana Conco, regional executive of consulting at Alexander Forbes, says: “One of the aims of retirement reform is to create a uniform retirement fund system for all types of retirement savings vehicles, such as pension, provident and retirement annuity funds. This will allow all members to receive the same tax treatment of the money

contributed and how benefits can be paid at retirement.”

Alexander Forbes Member Watch analysis shows that about half of members retire with less than one-fifth of their final salary to live on in retirement.

Many reforms have been implemented over the last few years, but it has been a long journey to this next vital step. “The changes are beneficial for most retirement fund members and encourage greater savings for retirement and address issues in the retirement system,” Conco says.

She says: “Currently, provident fund members can take their retirement benefit as a full cash lump sum and do not have to buy a pension (annuity) from a registered insurer when they retire. Pension fund members, on the other hand, must use at least two-thirds of their retirement benefit

to buy a pension, unless the total benefit is less than R247 500.”

How members will be affected

From 1 March this year, retirement benefits from provident funds will be treated in the same way as pension funds for the part of the benefit based on member contributions. Conco says the changes for provident fund members are:

• They will have the same annuitisation rules as pension funds. This means that members will have to buy a pension (annuity) from a registered insurer with at least two-thirds of their retirement benefit, unless the total benefit is less than R247 500.

• Vested rights will apply – in other words, provident fund members will not lose their rights on their existing savings. Retirement savings will be ring-fenced as follows before

PERSONAL FINANCE | 1 ST QUARTER 2021 20 WEALTH•INVESTMENT•PROSPERITY

the new legislation takes effect:

• Any provident fund balance saved before 1 March 2021 plus the future growth on this until retirement won’t be affected and can be taken in cash on retirement.

• Members who are 55 years or older on 1 March 2021 will not be affected by this change at all if they stay a member of the same provident fund (or provident preservation fund), until retirement. This means that the retirement benefit will be treated in the same way as it is currently treated when these members retire. If these members transfer to another fund, they will still have vested rights, but any savings in the new fund will be subject to the new rules – they will have to buy a pension with two-thirds of the retirement benefit. The benefit of this change is that funds will be able to transfer members’ savings tax efficiently.

Considerations for employers and trustees

Many employers offer both a provident fund and a pension fund to their employees. Conco suggests that employers who have multiple retirement funds consider consolidating these funds, as pension funds, provident funds and retirement annuity funds will be harmonised in the tax treatment of contributions and the retirements benefits at the time of retirement. Consolidation requires other factors to be considered – for example, understanding the implications on vested rights when transferring provident fund members who are 55 or older on 1 March. Other factors include:

• The size of the funds,

• Potential cost savings or cost implications,

• Transfer requirements under Section 14 of the Pension Funds Act,

• Deregistration, and

• Liquidation requirements of the transferor fund.

“The changes to ensure further harmonisation between pension funds, provident funds and retirement annuity funds take effect on 1 March. It is important for trustees to start implementing plans to get ready for these changes. Amendments to rules, communication to members, and fund consolidation will be some of the matters to consider,” Conco says.

–

PERSONAL FINANCE | 1 ST QUARTER 2021 21 WEALTH•INVESTMENT•PROSPERITY

Supplied by Alexander Forbes

WHY SAVING IN A RETIREMENT FUND IS HARD TO BEAT

The recent superior performance of investment funds invested in offshore markets has led some financial advisers to advocate using discretionary funds, which are not restricted in their offshore exposure, to save for retirement, rather than retirement funds, which are. Martin Hesse reports that research by Alexander Forbes shows that this is not a good idea.

22 PERSONAL FINANCE | 1 ST QUARTER 2021

WEALTH•INVESTMENT•PROSPERITY

Retirement funds were designed for people to save for their retirement. Although they have built-in limitations, they have distinct advantages over discretionary investments. Do the advantages outweigh the limitations, even when

market conditions favour discretionary investments? Research by financial services firm Alexander Forbes shows that they do.

Many investment professionals are critical of Regulation 28, the rule under the Pension Funds Act that imposes limits on the extent to which retirement funds (which comprise occupational pension and provident funds, retirement annuity funds and preservation funds) can invest offshore and in higher-risk asset classes, such as property and equities. The critics maintain that the limits are too restrictive and that funds should have more flexibility to invest where they choose, to optimise long-term returns for their members.

A major point of contention is the limit on investing offshore, which restricts funds to a maximum of 30percent in foreign markets and a further 10percent in Africa outside of South Africa. In other words, a minimum of 60percent of any retirement fund portfolio must be invested locally.

Calls from the investment community for retirement funds to be allowed greater access to offshore markets have become louder in recent years because of the poor performance of JSE-listed equities and the ongoing depreciation of the rand against the major foreign currencies, both indicative of South Africa’s shaky economy. The stellar performance in 2020 of the United States stock market, driven largely by a handful of giant tech companies, further fuelled antiReg-28 sentiment.

Treasury circular

There was a flutter of excitement in November, when National Treasury, in an attempt to encourage foreign investment in South Africa, issued a circular that changed the status of JSE-listed rand-denominated offshore instruments to domestic instruments. Providers of exchange traded funds (ETFs) tracking offshore market indices saw this as a way of circumventing Regulation 28’s offshore limit. However, when the government became aware of this “loophole”, it withdrew the circular.

The offshore brigade was appalled at this

seeming about-turn. Some financial advisers went so far as to advise their clients to put as much as they could of their retirement savings into discretionary investments, in which the only offshore limits are the rand amounts imposed by the exchange control regulations. (Your offshore investment allowance is R10 million a year.)

How responsible were these advisers in giving such advice? Would you genuinely be better off having the bulk of your retirement savings offshore? Or are you better off in a retirement fund, even if the JSE performs poorly?

Media presentation

John Anderson, executive of investments, products and enablement at Alexander Forbes, and his team of actuaries set about finding answers to these questions, and he shared the results at a recent media presentation.

Unlike many countries, Anderson said, South Africa does not have a safety net for pensioners, apart from the paltry old-age grants for the destitute. It’s left to us as individuals to save for retirement, and, unfortunately, we don’t appear to do that very well. Fewer than one in 10 South Africans preserve their retirement savings when they change jobs throughout their careers, he said.

It’s in the government’s interests that we save enough for our retirement – it cannot afford old-age grants for everyone. But there is another good reason for maintaining a large pot of retirement savings within South Africa: it’s one of the country’s largest resources for economic development. In 2018, retirement fund assets totalled R4.2 trillion, according to the 2017/18 Annual Report of the Registrar of Pension Funds. At least three-quarters of this money is invested locally, mostly in listed equities and bonds. South Africa’s largest pension fund, the Government Employees’ Pension Fund, which manages assets of about R1.6 trillion, has half of its portfolio invested in domestic equity and 31percent in domestic government and corporate bonds.

23 PERSONAL FINANCE | 1 ST QUARTER 2021

WEALTH•INVESTMENT•PROSPERITY

Retirement fund tax breaks

The government provides powerful incentives for us to save in retirement funds, in the way of generous tax breaks on what goes into them, but it also restricts how you can use the money you have saved. The major features of retirement funds are:

• You can deduct your contributions from your taxable income. The tax break applies on contributions up to 27.5percent of your annual gross remuneration, and up to R350 000 a year. If you contribute more, you can roll over the excess amount, to be deducted in a subsequent year.

• The investment itself is not taxed: income tax on interest earned, capital gains tax, and the 20 percent withholding tax on dividends do not apply to retirement funds.

• When you retire, you can take up to one-third of your savings as a lump sum, of which R500 000 is tax-free. With the remaining two-thirds (or more), you must buy a pension (annuity), which can take various forms. In these post-retirement investments returns are not taxed, but you do pay income tax on your pension.

• To counteract the generous tax breaks and encourage preservation, you are taxed heavily if you cash in your retirement savings when you change jobs or take the allowed once-off cash withdrawal from a preservation fund.

If you save in anything other than a retirement fund – for example, in a collective investment scheme such as a unit trust fund or ETF – you do so using after-tax funding. These discretionary investments are subject to taxes on interest, dividends and capital gains. However, there are no restrictions on deposits and withdrawals. Anderson said there are vehicles, such as tax-free savings accounts, which have some tax benefits. A rule of thumb, he said, is that the more flexibility you have, the fewer tax incentives there are.

He said it is important that you have a greater allocation to South African assets than offshore ones because your liabilities – your expenses, such as food, accommodation and debt repayments – are in rands. The volatile exchange rate can work against you both when taking money offshore and when bringing it home. “In three months (from August to November),

the rand went from R19 to R15 to the dollar, an increase of 26 percent. When it was at R19 people were jumping up and down saying we should go offshore. This is typical: at the point of greatest pain, people tend to make the wrong decisions, and forget about good investment principles,” Anderson said.

Alexander Forbes research Anderson’s team of actuaries first considered what the optimal offshore allocation would be for a retirement fund, bearing in mind the prudential requirements for such funds. They targeted returns of five percentage points above inflation, while seeking to keep investment risk as low as possible. Looking backwards over the past 15 years, the team found that the optimal offshore allocation would have been 40 to 45 percent. However, looking forwards, based on the Alexander Forbes house view of the markets in November, they found that the optimal offshore allocation was likely to be lower, at 25 to 27.5 percent. These figures are not far off the Regulation 28 limits and “nowhere near 100 percent offshore allocation recommended by some advisers”, Anderson said.

He said: “We believe additional flexibility would be welcome, but on the whole you don't need more flexibility than up to 50 percent. So our view is that a gradual raising of the current limits is desirable, but it should be done in a way that balances the other objectives that the regulations are aiming to achieve.”

The team then compared the performance of formal retirement savings with that of discretionary investments with a 100 percent offshore allocation over 35 years into the future. Their model considered a range of outcomes under different income brackets (contributing 15 percent of income) and under different equity return scenarios, where local returns were higher than offshore returns and vice versa. They took into account an average annual depreciation of the rand of 7.2 percent a year over the 35 years, and based their calculations on the 2020/21 tax tables adjusted for inflation over the period. They did not take investment costs into account.

The actuaries considered three scenarios: where offshore and local returns were roughly the same (base case), where offshore equities outperformed local equities, and where local equities outperformed offshore equities. The asset allocation of the portfolios was as follows:

• Retirement fund portfolio: local equities 45 percent, local bonds 25 percent, offshore equity 30 percent, in line with the Regulation 28 restrictions.

• Discretionary vehicle: 100 percent in offshore equities for the base-case scenario and the scenario in which offshore equities provided the best returns; 100 percent local equities in the scenario in which local equities provided the best returns.

The results, Anderson said, were quite staggering. They found that, under all scenarios, and whatever your income level, the retirement fund significantly outperformed the discretionary offshore investment, and this was wholly due to the tax benefits. And the more you earned, the more the tax benefits worked in your favour.

In the base-case scenario, where the average before-tax real (after-inflation) returns of the two portfolios were almost equal (retirement portfolio 5.58 percent a year; discretionary portfolio 5.60 percent a year), the after-tax real returns in the discretionary portfolio were:

• 3.82 percent for someone earning R500 000 a year. You’d need a real return of 7.55 percent to compensate.

• 3.44 percent for someone earning R1 million a year (8.10percent needed to compensate).

• 3.16 percent for someone earning R2 million a year (8.50percent needed to compensate).

In this scenario, for someone earning R500 000 a year, after 35 years the accumulated savings in the retirement fund was R7.3 million. In the discretionary investment it was just over half of that: R3.9 million.

In the scenario where the retirement portfolio delivered 5.60% and the offshore discretionary portfolio did better, providing an average annual pre-tax real return of 6.50%, the after-tax real returns in the discretionary portfolio were:

24 PERSONAL FINANCE | 1 ST QUARTER 2021

WEALTH•INVESTMENT•PROSPERITY

• 4.62 percent for someone earning R500 000 a year. You’d need a real return of 7.65 percent to compensate.

• 4.21 percent for someone earning R1 million a year (8.15percent needed to compensate).

• 3.91 percent for someone earning R2 million a year (8.55 percent needed to compensate).

In the third scenario, where local equities surprised investors and performed well, the advantages of being in the retirement fund were even more pronounced. Where the retirement portfolio delivered 7.27 percent percent and the discretionary portfolio

(now also invested in local equities) delivered a pre-tax real return of 7.50 percent, the after-tax real returns in the discretionary portfolio were:

• 5.51 percent for someone earning R500 000 a year. You’d need a real return of 9.50 percent to compensate.

• 5.06 percent for someone earning R1 million a year (10.10percent needed to compensate).

• 4.75 percent for someone earning R2 million a year (10.55percent needed to compensate).

The tax benefits do not stop at retirement, Anderson said. His team showed that outcomes in a formal postretirement vehicle such as a living annuity continued to surpass those offered by a discretionary investment.

Retiring offshore?

The situation becomes more complicated if you plan to leave the country at some point – for instance, if you aim to retire in Mauritius.

Anderson said that over the 35-year period modelled, you would still be better off investing in a local retirement fund. “Such a strategy would make sense for younger members who have that period of time and who don’t need to be overly concerned with shorter-term currency fluctuations.

“However, as the term to retirement decreases, it becomes increasingly important for the assets to be invested in a way that reduces shorter-term currency risk. This is because once one starts drawing an income, sequence-of-returns risk becomes important. Many retirees would find it hard to absorb the short-term currency fluctuations in their income in retirement,” he said.

Therefore, Anderson said, you would need to phase your investments into a vehicle that would better match the currency of your ultimate retirement destination. “This would need to be done carefully – and over a sufficient period to ensure short-term currency risks are smoothed out – in the period before starting to draw an income.

“For individuals close to or in retirement, it remains important for their investment strategy to reflect the currency they need their income in,” he said.

25 PERSONAL FINANCE | 1 ST QUARTER 2021

WEALTH•INVESTMENT•PROSPERITY

FROM PRETORIA WITH LOVE

For Hester van der Merwe, the Financial Planning Institute’s 2020/21 Financial Planner of the Year, there’s nothing boring about playing it safe. As the world grapples with one unprecedented disaster after the next, she has shown just how important it is to go back to basics. Linda Graham caught up with her.

26 PERSONAL FINANCE | 1 ST QUARTER 2021

Hester van der Merwe receives the Financial Planner of the Year Award from Lelane Bezuidenhout, chief executive of the Financial Planning Institute, at a scaled-down ceremony in October 2020.

Spend five minutes chatting to Hester van der Merwe and it feels like you’ve known her for years. The latest winner of South Africa’s most prestigious award for the financial planning profession has nothing to hide: she speaks with warmth and intelligence, and her wry smile and sense of humour defuses any awkwardness that might derail a first meeting between two strangers. For a planner at the very top of her game, this kind of humility is rare and refreshing.

“Trust is the single most important factor when dealing with somebody’s financial life,” she says. “It’s not something that can be developed overnight, so it’s vital to start the relationship in an open and honest way. I find that being professional does not exclude being friendly; creating an atmosphere where a person feels safe and where they know that their wellbeing is paramount.”

Van der Merwe, 51, has lived in Pretoria all her life. The youngest of four sisters – “a proper laatlammetjie” – she grew up in a “typical Afrikaans family” where her father Fanie was a government official and her mother Olivia was a housewife. Both parents were creative: “My mom taught me to love reading and she was an amazing gardener and baker. My dad was artistic and could draw anything he saw. He would have loved to have been a full-time artist, but he felt that he had to have a ‘responsible’ job to provide for his family.”

Tragedy struck the Van der Merwe family when Hester was only 12 years old: Fanie passed away after a prolonged illness, but thankfully his life policies and retirement plans were all in place and the family was able to grieve without having to stress about money.

“My mom had always done the household accounts, even when my dad was alive,” Van der Merwe says. “It was a process that took place behind closed doors, and she was never in a good mood on accounts day…”

As the years went by and Hester got older, she was sometimes allowed to watch if she promised to keep quiet. “Watching my mom gave me a sense of

how important it is to have order and method when dealing with finances,” she says. “I tried to copy her process with my own pocket money, and I learnt a hard lesson alongside her when she lost some money by trusting an unscrupulous adviser. I also started noticing the relationships that my friends’ families had with money, and I realised that there isn't a one-size-fits-all approach to creating and sustaining wealth.”

Lessons along the way

After studying law at the University of Pretoria, Van der Merwe began her professional career as an assistant to a blind attorney. Like a musician’s amanuensis, she listened attentively, took notes and transcribed dictations. “It was challenging to work in such close proximity with another person, but I learned the importance of building solid relationships, and to constantly improve on what I was doing,” she says.

Thereafter, she joined Boland Bank in the debt-collection department, where

she dealt with insolvent estates and accounts that had to be handed over to attorneys. Even though she found the environment harsh and unenjoyable, she stuck it out for seven years and taught herself to do her best regardless of the circumstances.

“After Boland Bank, I did a short stint at a firm of attorneys for more of the same,” she says. “We mainly dealt with the collection of micro loans and it was then that I properly understood how important it is for clients to understand the documents they sign. So many people don’t understand the terms of their loan agreements, and the consequences are often devastating.”

Even though the epiphany piqued Van der Merwe’s interest in financial planning, she never actually intended to become a planner. In 2003, after having taken a step back from work to raise her children, she was looking for a half-day job and joined a practice under the mentorship of Spalding Fourie, who was “an amazing planner”, in Van der Merwe’s words. His attention to

WEALTH•INVESTMENT•PROSPERITY PERSONAL FINANCE | 1 ST QUARTER 2021 27

Hester and her son Deon prepare to take a bike ride in the rain.

detail and his close relationships with his clients showed just how much was possible in the profession, and how rewarding it could be.

Inspired, Van der Merwe enrolled for a Postgraduate Diploma in Financial Planning at the University of the Free State. At first, this was “just to improve [her] spreadsheets”, but once the bug had bitten there was no turning back. She persisted with her qualifications until she was able to write CFP (Certified Financial Planner) behind her name.

She had finally found her professional calling. She worked at FNB for a few years, heading up a small team of advisers, and joined Ultima Financial Planners in 2015, where she has been given the freedom to carve out her own brand focused on practical advice, detailed planning and unwavering commitment to her clients.

The retirement challenge

“I mainly deal with clients around retirement age,” Van der Merwe explains. “It’s a strange time in a person’s life, full of stress and uncertainty. You typically retire when you're at the height of your profession; an expert with a wealth of knowledge accumulated over years and years. Then you retire and all that is left behind – you find yourself in a confusing world with a multitude of choices, so much financial jargon, an overload of information online and strangers who suddenly want to take care of your money … It’s a perfect storm.

“I always start off by creating a safe environment. I tell my clients that they might not have all the answers and neither do I, but if we work together then we’ll have a better chance of building a stable financial future.”

One particular client was kind enough to summarise Van der Merwe’s approach as follows: “Right from our first meeting, I was treated with respect and dignity. I had no idea what was going to happen to me financially, but Hester had my back and still has. Nothing has ever been too much for her. My endless enquiries and questions have always been handled with patience and kindness.”

Blushing faintly at the praise, Van der

Merwe nods: “You have to be aware of where your clients are in their lives at any particular moment, and be sensitive to their state of mind. That’s the only way you’ll get them to stick to a long term financial plan.”

And when she’s creating that plan, Van der Merwe sees no reason to overcomplicate things. “I have five planning tips that I almost always adhere to,” she says. “Live within your means; get rid of your debt; maintain an emergency fund; make long-term goals and live with open hands –be generous, in other words. These are simple values but they’re tremendously powerful, and they’re timeless. My parents lived by these values and I’ve tried to instil them in my own children, too.”

The human touch

Not content to rest on her laurels, the Financial Planner of the Year is currently in the process of becoming a certified financial coach – a relatively new field that combines pure financial advice with life coaching, to help clients not only become financially secure but also to embolden them to achieve more in their personal lives.

“Fintech is developing at an incredible rate and soon robo-advice will be the norm,” Van der Merwe says. “For financial planners to remain relevant, we have to offer what a machine cannot: compassion, ethical decision-making, friendship… all the human traits that combine to form trust. Coaching is a fascinating field and it’s the future of financial planning, in my opinion.”

Indeed, this forward-thinking professional devotes little time to dwelling on the past. Asked whether she would do anything differently if she had the chance to start all over again, she smiles her trademark smile and shakes her head: “I wouldn’t change a thing. We are formed as much by our successes as by our failures. It’s important to learn from our mistakes and try to become better versions of ourselves.”

Hester’s tips for aspiring financial planners

• Don’t settle for anything less than becoming a Certified Financial Planner.

• Surround yourself with a strong team –this will enable you to play to your own strengths.

• Always do what is right, not what is easy.

• Keep learning and pushing yourself. There are always ways to improve.

• Ask for assistance when you need it.

• Don’t be afraid to show your own vulnerability.