COVID-19 THE DAMAGES

RETIREMENT BENEFITS

COUNSELLING

21 QUESTIONS TO ASK AN ADVISER SIDE HUSTLES

TRACK YOUR FORTUNE WITH OUR DATABANK VOLUME 83 • 2 nd QUARTER 2020 WWW.PERSFIN.CO.ZA

We provide a complete advertising solution to reach subscribed property buyers

Access the following advertising platforms under one account:

• Property Portal Online Listings

• Banner Slots

• Featured Agent Slots

• Digital Magazine

• Newspapers

• Cape Community Newspapers

• Brand Editorial Content

• Social Media Reach

• Weekly Newsletter

We also do HOME LOANS A mortgage origination solution to assist your buyers, so send your clients our way and you can advertise your listings on our portal for… FREE

Contact us to package the right deal for you help@property360.co.za

interest rates from all major banks and speedy approvals

Best

COVER STORY

Short, sharp shock or another Great Depression? Will economies bounce back relatively quickly once Covid-19 is brought under control, or will the damage be so severe that it takes years to recover?

10

FEATURES

16 Your employment contract in a crisis

Can your employer invoke a “force majeure” clause to retrench you?

18 Something on the side The things people do to supplement their income.

23 First-quarter bloodbath

Don’t make rash decisions after seeing the unit trust results.

24 Joining a medical scheme in a crisis Restrictions and penalties that schemes may inflict on you.

26 IMF aid: help or hindrance?

Why seeking IMF assistance may be to our benefit.

30 21 questions to ask a financial adviser

Now more than ever, you need an adviser you can trust.

34 Why retirement benefits counselling is good for you

Regulations demand that you are counselled on your savings.

39 Boutique firm is Manager of the Year

Raging Bull Awards for unit trust performance to the end of 2019.

46 Selling property properly

A new Act directed at estate agents will benefit you, the consumer.

50 Accrual: beware the pitfalls

Each marital regime has its drawbacks and this one is no exception.

52 A novel way of investing offshore

The ins and outs of actively managed certificates.

REGULARS

4 Upfront An unforeseen catastrophe

6 Your letters Readers’ queries answered by experts

8 Book review Our pick of financial books

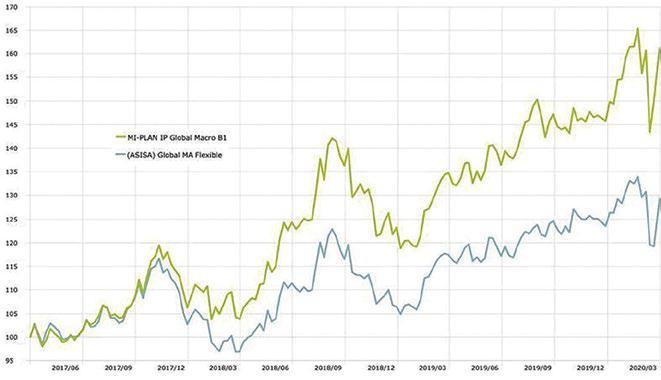

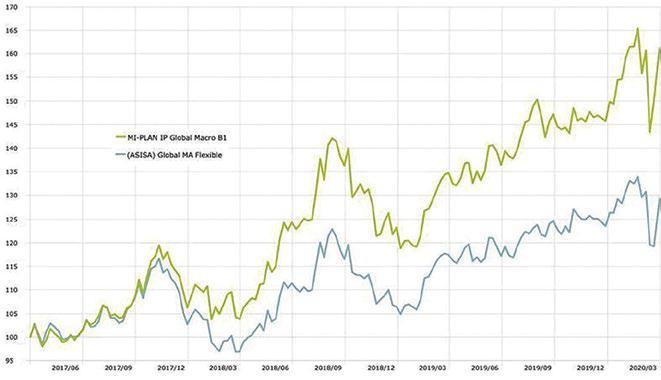

54 Fund focus The Mi-Plan IP Global Macro Fund

56 On the contrary Keeping perspective in times of fear

DATABANK

57 A list of the adjudicators and the ombuds who can assist you with your complaints, followed by the unit trust quarterly results, tax rates and annuity rates

3 PERSONAL FINANCE | 2 ND QUARTER 2020

MARTIN HESSE

AN UNFORESEEN CATASTROPHE

Five years ago, Bill Gates, in a now-famous TED talk, warned of the dangers of a worldwide pandemic. He was not the only one who foresaw such a catastrophe, but for most people, including world leaders, a pandemic of the magnitude of Covid-19 was nowhere on the radar. A small outbreak of Ebola or bird flu, perhaps, which could quickly be contained, but nothing like this, which claimed a quarter of a million lives (at least, as figures are probably understated) within four months.

Humans have spent trillions over the years on defence against other humans. But precious little has funded the fight against an invisible common enemy, potentially more lethal than any human threat save a nuclear war.

More worrying than the disease itself is its economic impact. Companies that, before the crisis, were only just surviving or had high levels of debt, have been knocked hard. Many will go under.

While the unemployment figures coming out of the United States are scary, the developing world is experiencing a humanitarian crisis of unprecedented proportions, with millions facing starvation.

Are we entering the Great Depression of the 21st Century? Let’s not forget that World War 2 was a direct consequence of the last one.

In this edition we examine possible outcomes, but we also offer practical advice on a range of pandemic-related issues. Can your employer rely on a “force majeure” clause to retrench you? How easy is it to become a member of a medical scheme in a crisis? What do you do after seeing your unit trust values plummet? What questions should you ask to establish whether you can trust a financial adviser, at a time when you need one the most?

Also in this information-packed digital-only edition, we explore the implications for consumers of the new Property Practitioners Act, why recently-legislated retirement benefits counselling is likely to drive better retirement outcomes, and what you should do about your life policies if you are moving overseas, temporarily or permanently.

VOLUME 83

2nd QUARTER 2020

An Independent Media (Pty) Ltd publication

Editor

ANA Publishing CEO

ANA Publishing CFO

Head of Production

Head of Design Designers

Martin Hesse martin.hesse@inl.co.za

Vasantha Angamuthu

Valentine Dzvova

Mugamad Jacobs

Matthew Naudé Rowan Abrahams Thabang Boshielo

ADVERTISING

Kyle Villett kyle.Villet@africannewsagency.com

Daniel Kgaladi daniel.kgaladi@inl.co.za

OFFICE MANAGER

Caryn Wessels caryn.wessels@inl.co.za

IMAGERY Shutterstock, Freepik.com

INDEPENDENT MEDIA BOARD OF DIRECTORS

Dr. Mohammed Iqbal Survé, Takudzwa T. Hove, Aziza B. Amod, Ismet Amod, Yuexing Wang, Jinghua Dong

EDITORIAL ENQUIRIES

Tel: 021 488 4187

Physical address: Fourth floor, Newspaper House, 122 St George’s Mall, Cape Town, 8001 Postal address: PO Box 56, Cape Town, 8000

Personal Finance magazine (ISSN 1562-3750) is published by the proprietors, Independent Media (Pty) Ltd, Star Building, 47 Sauer Street, Johannesburg, 2001 All products appearing in Personal Finance are available and all prices are correct at time of print, subject to change.

A recent study shows that 64% of South African women are underinsured*. As a professional Financial Adviser, you understand that it’s vital for South African women to acquire the best comprehensive cover to protect and provide for their families, should things not go according to plan.

Liberty’s Lifestyle Protector includes critical illness cover, which provides comprehensive cover for over 150 conditions related to critical illness and trauma.

Consider Liberty’s Lifestyle Protector Range and give your clients more than life cover – give them cover for life.

For more details about benefits, definitions, guarantees, fees, tax, limitations, charges, premiums or other conditions and associated risks, visit www.liberty.co.za

Now, she runs the team. LIBERTY LIFESTYLE PROTECTOR *Source: The

of Women in South Africa: A Flux

Report, 2019. Liberty Group Ltd is the Insurer of Lifestyle

Authorised

Terms and

apply. TBWA\HUNT\LASCARIS 923765

AT 25, CHANCES ARE YOUR CLIENT WAS THE ONLY WOMAN ON HER TEAM.

Worth

Trend

Protector and an

Financial Services Provider (no. 2409).

Conditions

YOUR LETTERS

RA TAX BREAK

I am 67 years old and in retirement. Can I still take advantage of the 27.5 percent allowance as a tax deduction? How and when will I have access to the funds so acquired? – Name withheld

Dulcie Weyks, a financial adviser from PSG Wealth Pretoria Irene Sovereign Drive, replies: Retirement annuity (RA) payments do not have an age limit. Contributions can be claimed for tax at any age and tax certificates will be issued by the RA provider.

The 27.5 percent allowance is based on your annual taxable income (limited to R350 000). This can include income from various sources, including income derived from annuities or rental properties.

Please take note of liquidity restrictions that apply to RAs as indicated below.

You are allowed access to your RA any time from the age of 55 and onwards. The following options are available once you formally retire from the product:

• If the fund balance is below R247 500, the full amount may be withdrawn as a lump sum. This will be subject to tax, which is explained below.

• If the fund balance is more than R247 500, up to one-third of the investment may be withdrawn as a lump sum. The remaining two-thirds must be used to purchase a compulsory annuity for pension income.

• Should you not have a need to withdraw a lump sum, the full amount may be used to purchase the annuity.

Any lump sum withdrawal will be taxed according to the special retirement fund lump sum benefit table. (See table on page 71.)

Currently the first R500 000 is tax-free. The R500 000 could, however, be reduced as a result of various lump sums or severance benefits you’ve received in the past. Tax on lump-sum benefits are calculated cumulatively over your lifetime and will be aggregated. The tax is calculated on the actual lump sum taken and not the fund value.

The pension that you would receive from the compulsory annuity is deemed to be normal income. This, together with any other income

you earn, will be subject to normal income tax. There are a variety of compulsory annuity options. I would suggest that you consult a qualified financial adviser to assist you with the various choices and any impact this may have on your personal situation.

VOLATILITY EXPLAINED

I have read a lot recently about volatility as an indicator in stock markets, especially with the COVID-19 virus making headlines. But I don’t really understand it? Can you explain? – Name withheld

Schalk Louw, a wealth manager at PSG Wealth Old Oak replies:

Volatility is not a directional indicator, but rather a measure used to express changes in pricing as a percentage. If share A’s price rises from 100c to 101c, it indicates a positive change of one percent. If share B’s price moves from 200c to 198c, it is seen as a negative change of one percent. The volatility ratio (VR) of both these shares is the same (one percent), therefore the VR of share A is equal to that of share B.

So, volatility doesn’t tell you whether the market is heading up or down, but the VR can be used to determine the risk of a particular investment. When an investment in a particular share, for example, has a VR of 20, it means that the investment has already moved up and down by 20 percent during the period in question. This means that if you do decide to buy this share, you have an opportunity to grow your investment by 20 percent, but you also risk losing 20 percent of its value.

Emotions play a big role in decision-making during times of high volatility, and investors tend to force markets to levels well below fair value. This presents opportunities for future growth. In times of low volatility, on the other hand, investors are so confident that the market will not drop that they force it upwards – a lot like the market has behaved during the last 12 months. An unexpected event, such as the Covid-19 outbreak, can turn this on its head. Before making any decisions during times of fear or heightened emotions, be sure to check in with your financial adviser.

4

Wealth Asset Management Insure We never stop short in pursuing your long-term success. Affiliates of the PSG Konsult Group are authorised financial services providers. Please visit psg.co.za to find an adviser near you. For more information contact your financial adviser, call 0800 600 168 or email assetmanagement@psg.co.za Seeing the bigger picture gives you the advantage. PUBLICISMACHINE 908713/E

PRACTICAL GUIDE TO BUY-TO-LET

Financial Freedom Through Property

Author: Laurens Boel

Publisher: Zebra Press (Penguin Random House)

Retail price: R220

The investment world is divided into people who believe property (in the form of physical property from which you earn a rental income, as opposed to listed property) is a worthwhile investment and those who believe you’ll do better investing in the stock market. Most financial advisers I know are in the latter camp, but the proponents of property investing are a passionate bunch whose arguments are compelling. Their guru is Robert Kiyosaki, author of Rich Dad, Poor Dad and subsequent books, whose property investing programme is hugely popular globally.

The underlying premise is very appealing: you buy an apartment or house and let it out, using the rental to pay off the bond. Once the bond is paid off, you have a steady, never-ending, inflation-linked income stream, and the value of the property appreciates over time.

But it’s not that simple or easy. For starters, being a landlord is a demanding job – the buy-to-let route is not for armchair investors. And then there are the costs and issues that tend to cloud this rosy picture: maintenance, bad tenants, rates and levies, insurance, conveyancing and transfer costs, regulations regarding the rights of tenants, red tape. There’s also the risk of a property losing value –something that has happened rarely in the past in South Africa, but which may be more prevalent in the future owing to our weak economy.

If you are keen to venture into property investing, Laurens Boel’s book provides an excellent guide. You need to be determined and dedicated, and prepared to learn as you go along, as you’ll probably make some mistakes initially. This book, which is aimed at the lay reader and written in an easy-to-understand, conversational style, provides valuable insights and tricks of the trade to put you on the right path and help minimise costly mistakes.

Buy-to-let investing is not for the faint-hearted, but if you are savvy and work hard, the rewards can be great. To reiterate: it’s not a passive way of earning an income.

– Martin Hesse

ANALYSING INEQUALITY

Capital and Ideology

Author: Thomas Piketty

Publisher: Belknap/Harvard

Retail price: R625

This is French economist Thomas Piketty’s second book on inequality, the first being the widely read and influential Capital in the 21st Century, published in 2013. It expands on the first by delving into history and looking at political regimes that have either exacerbated the gap between rich and poor or had some success in reducing that gap.

YOUR BUSINESS AS AN ASSET OF VALUE

Sweat, Scale, Sell

Author: Pavlo Phitidis

Publisher: Macmillan

Author: Pavlo Phitidis

Publisher: Macmillan

Retail price: R290

It’s fair to say that there are two types of small business owners. The first group comprises those who have had careers in the corporate world and who have left this secure environment to start something on their own. They may remain in a field related to their career or they may branch off in an unrelated direction, for which they may have long held a passion - for example, an accountant starting a boutique winery. This group includes those “reluctant entrepreneurs” who have been forced out of the corporate world through retrenchment or compulsory retirement, who need to do something on their own to continue earning a living.

The second group comprises the true entrepreneurs. These are the guys who mostly don’t have a corporate background and may not even have much of a formal tertiary education. They probably started young, by selling sweets or marbles to their school buddies, and have an inherent knack for business and for finding “gaps in the market”, often through innovation and disruption. The nature of the business is not as important to them as the profits they can make from it,

although this is not necessarily to say that they are out to make a quick buck. They are street smart and market smart.

Pavlo Phitidis’s book is directed at both groups, though it may find more traction in the second. It is about growing a business to become bigger than yourself, to become a valuable, marketable asset in its own right.

Phitidis says an astonishing 95 percent of businesses are not sold; they simply close their doors. Many go under financially, but many close because the owner has been the sole generator of business, and when he or she dies or retires, there is no-one to step in to keep the business operating.

The author has enormous experience in building businesses and coaching entrepreneurs, and hosts the TV show The Growth Engines on BDTV. His book shares stories and advice on what business owners can do to grow their businesses – for example, by having a succession plan in place.

While many businesses will die along with their owners, the more that take on a life of their own, the greater the employment opportunities will be and the more South Africa will prosper.

– Martin Hesse

Piketty argues that the roots of inequality are ideological. It is a society’s political, educational and legal systems that determine the nature of its economy and how wealth generated by economic activity is distributed among the population. He also states that the underlying ideology governing an economy seeks to justify why the wealth is distributed in the way it is. Unlike Marx, who argued that there is a set progression from feudalism to capitalism to socialism, Piketty maintains that, at certain critical points, a society can choose among a number of different pathways, some of which will reduce inequality and others that will increase it. And it is these “choices” that different countries have made in their history that form the focus of this hefty 1000-page tome: from slavery and colonialism to Russia’s failed experiment with communism, China’s post-communist economy (which has uplifted the poor more successfully than India has) and Sweden’s socialist democracy – one of the most equitable economies in the world.

It’s a fascinating study, and although its academic detail may become a little overbearing for a more casual reader, the language, translated into English from the original French by Arthur Goldhammer, is not overly dense or abstruse.

You may not agree with everything Piketty says, or his suggestions to reduce inequality (through higher taxes but also through better education). But it is bound to stimulate debate about a more equitable future for mankind, particularly now, at the height of an economic crisis that may well be a turning point in our history. – Martin Hesse

BOOK WINNERS

Congratulations to the winners of the 1st-quarter book giveaway. Beauty Monenebe, Dave Porter, Ian Siddall and Alan Schoeman will each receive a copy of You’re Not Broke, You’re Pre-Rich by Mapalo Makhu, published by Zebra Press.

WEALTH•INVESTMENT•PROSPERITY PERSONAL FINANCE | 2 nd QUARTER 2020 9

SHORT, SHARP SHOCK OR ANOTHER GREAT DEPRESSION?

How extreme the effects of the Covid-19 pandemic will be on the global and local economies depends on how long it takes to bring the virus under control and how soon thereafter people can begin working and consuming again.

THE MARKET downturn caused by the Covid-19 pandemic will be the worst downturn in our history. The only time South Africa faced a similar crisis was between 1918 and 1920 when the Spanish Flu ravaged the country, but in those days we did not have a statistical agency that compiled national accounts. That is why this downturn will go down as the worst so far, as it will be deeper than the recessions of 1983, 1992 or 2009.

There are also no gross domestic product records for the Great Depression of the 1930s. As a result of the United Kingdom and other countries going off the gold standard in the early 1930s, South Africa’s gold mining industry boomed, partially offsetting the decline in exports from other sectors. In the mid-1930s South Africa was buying the highest number of new cars per capita out of all the major countries.

Although this will be the worst downturn that South Africa has experienced, economists are also concerned about the recovery. To help them visualise the recovery, they have labeled the types of recoveries as “U”, “V”, “W” or “L”.

A U-recovery sees a sharp downturn lasting one quarter, then a stabilisation of, say, three quarters, before an upturn to the previous level. A V-recovery sees a sharp drop and then an equally sharp climb. A W-recovery consists of two Vs back-to-back, when the initial lockdown period is followed by a sharp recovery as people go back to work, but then a spike in coronavirus cases forces another lockdown. A L-recovery is what happens when so many businesses go bankrupt and individuals die that, when the crisis has passed, there are far fewer companies and people employed, while surviving companies may lack the necessary skilled labour force, as people with essential skills will have died.

It is to prevent an L-recovery scenario that governments, central banks and multilateral development financial

Helmo Preuss looks at different scenarios on how the crisis will play out.

institutions rushed to cut interest rates, while providing liquidity so that the financial system does not seize up as it did in 2008/9, while governments eased the purse strings so to provide support for businesses and individuals. That is why central banks around the world cut interest rates so many times since the outbreak of the novel coronavirus was first reported in January. They also injected trillions of dollars of liquidity into the financial system, launched a flurry of loan programmes for businesses

10 PERSONAL FINANCE | 2 nd QUARTER 2020

and bought bonds in liquidity management programmes to prevent a global recession from becoming a global depression.

The cost of the coronavirus pandemic could be as high as $4 trillion, or almost 5percent of global gross domestic product, according to the Asian Development Bank. The cost is a tradeoff between human lives and economic activity. A shorter containment period could limit the damage to $2 trillion, or 2.3 percent of world output. The estimate considers the immediate impact on tourism, consumption and investment. Remember that even during a time of a loss of revenue, debts still have to be serviced, which is why some banks have offered “repayment holidays” of a limited duration. At the end of last year, global debt surpassed $250 trillion, which is

more than 250 percent of the world’s GDP.

‘WARTIME’ DEFICITS

To compensate for this loss in revenue, government fiscal deficits will surge to levels only seen in wartime, as governments try to support businesses and individuals during the lockdown period and its recovery.

Morgan Stanley estimates that the US fiscal deficit will total at least $3.7 trillion in 2020, with an additional $3 trillion in

11 PERSONAL FINANCE | 2 nd QUARTER 2020

2021. It expects the fiscal deficit relative to the size of the economy could even approach 15 percent to 20 percent. Those are the kind of deficits last seen during World War 2.

President Donald Trump had bipartisan support for a new infrastructure spending bill worth $2 trillion, while the Fed launched a temporary lending facility allowing foreign central banks to convert their US Treasury holdings to dollars, as the coronavirus resulted in a shortage of US dollars.

The US dollar is used around the world for purchasing commodities, settling a large portion of international trade, and providing financing for companies between nations, and it accounts for roughly a third of inter-country financial flows. However, the usage of the dollar has exceeded the growth of the US economy and US money supply, which has led to a global US dollar shortage. This shortage becomes particularly acute during global economic slowdowns or recessions, such as in 2008, as during those times world trade declines, and commodity prices fall in US dollar terms.

When global trade slows down and commodity prices fall, the global dollar flows changes from a gushing river to a small trickle, so the $12 trillion worth of US dollar debts held outside the US, according to the Bank for International Settlements, suddenly become a lot harder to service thanks to a scarcity of dollars outside of the US.

In addition, foreigners own $40 trillion in US assets, which include government debt, corporate debt, equities, and real estate. Americans own just $29 trillion in foreign assets, so the US has a negative $11 trillion net international investment position, which is about half their $22 trillion economy.

The reason economists need to take this into consideration when constructing their economic scenarios is that foreigners have two ways to get US dollars when they really need them. They can participate in international trade and get dollars for their goods or services, or they can sell their US dollar-denominated assets. In normal times, foreigners choose

to trade, but during a global slowdown or recession, that trade dries up, so they have to resort to the second option. That is why in times of crisis all asset classes tend to fall together, whereas in normal times, safe havens such as gold and bonds gain when equities tank. So, when US dollar debts need servicing, they are forced to sell US assets to get dollars to service their debts. Central banks hold foreign-exchange reserves so that in times of illiquidity they can still service external obligations if necessary. That is why foreign exchange reserves also enter the risk calculation matrices of rating agencies such as S&P Global Ratings and Moody’s.

It is also one of the reasons why the US dollar tends to gain in value during recessions. International trade slows, dollar-denominated debts become an international problem, and everyone scrambles to get their hands on dollars. Emerging market currencies such as the rand lose in value relative to the US dollar.

LOCAL ECONOMY

Adrian Saville, the chief executive at Cannon Asset Managers said this year’s economic contraction was unprecedented.

“Financial modelling reveals that the South African economy could shrink as much as 5 percent in real terms this year, a figure that is unprecedented in recent times. By comparison, the economy shrunk by around two percent as a result of past crises in 1983, 1992 and 2009,” Saville said.

“Additionally, while revenue from personal income tax may remain relatively resilient in the near term, it is likely to fall throughout the rest of the fiscal year. VAT intakes will likewise dive off a cliff in March and April, with the possibility of a reasonable recovery thereafter, while corporate income tax levels will step down dramatically in line with economic growth. This Covid-19 fiscal gap means that the budget deficit will come under severe pressure this year. We had already penned in a deficit of 6.8 percent of GDP at the reading of the National Budget in February. Just four

weeks later, it looked like that figure could blow out into double digits.”.

President Cyril Ramaphosa ordered a national 21-day lockdown that started on March 27 as the containment measures announced by the South African government on March 15 had failed to “flatten the curve”, with South Africa reporting a larger number of cases than either Italy or China in the first 20 days since the first case was reported on March 5. South Africa has been far more aggressive in its containment policies as it has a large population of people living with HIV and tuberculosis. These people’s immune systems are compromised and they are 20 times more likely to die than healthy people, based on South Africa’s experience with the 2009 H1N1 virus.

Although we had no national accounts a century ago, we did have good data on deaths and hospitalisation, and these show that the earlier you move to contain a pandemic the better. It also shows that, in most cases, there are three waves, as after a while you try to return to normalcy and get economic activity going again. That then results in the second wave, which is then met by a longer lockdown. After about six months you then have a seasonal recurrence, but by then many people have developed an immunity to the virus.

The hope this time around is that with modern science it will take far less time to develop a vaccine and a test that is easy to administer and gives you a result in a short time. Johnson & Johnson said they are making good progress on a coronavirus vaccine, while Abbott Laboratories, who are one of the suppliers of the normal seasonal flu vaccine in South Africa, said a five-minute detection kit is ready for rollout.

An extended lockdown could see the number of unemployed jump to 13 million, according to a “guesstimate” from Mike Schussler of economists.co.za.

“All I can do is guess. I am working on employment, but my best guess is that one in eight jobs go if longer than say two or three months. Unemployment could then peak above 13 million,” Schussler said.

12 PERSONAL FINANCE | 2 nd QUARTER 2020

To put this into context, the St Louis Federal Reserve did some modelling on what a national lockdown would mean in the US. At the time of writing, in April, the lockdown had only been enforced in disparate states and cities, despite the fact that the US had the largest number of cases in the world.

Their model showed that a national lockdown could cost 47 million jobs and send the unemployment rate above 32 percent, from only 3.5 percent in February. This reflects the fact that more than 70 percent of jobs are in the services sector, whereas in 1918 far more jobs proportionally were in agriculture and manufacturing. That, in turn, would see the US economy contract anywhere between 6 percent and 25 percent, depending on how long the lockdown lasts and how many people with essential skills die during the pandemic. And if the US gets the flu, the rest of the world sneezes.

Maarten Ackerman, chief economist and advisory partner at Citadel, speaking in April, said he expected two quarters of contraction, before a recovery in the second half of the year.

“Broadly speaking, we are going to remain in a recession. We are in a technical recession right now, but we will stay here given the current environment both locally and globally. We expect that Q1 and Q2 will probably record a decline anywhere from - three percent to - five percent quarter-on-quarter, seasonally adjusted, annualised. If we are able to open up the economy before [July], we might see some strong rebound in the second half of the year. However, our GDP assumption for this year has been reduced quite significantly,” he said. He hoped that this crisis would force the government to really get going with the structural reforms that are so desperately needed.

“For now, it’s really a matter of cutting back on unnecessary expenditure and making some of those tough decisions around some of the stateowned enterprises (SOEs), which are definitely not going to be able to sustain themselves through this crisis. The extent

and timing of our funding requirements will depend on those actions and decisions. But if we can have some decisive action from government in the next few months, the amount that we might require from some of these sources might be manageable. However, the loans might come with their own shackles in terms of fiscal discipline constraints,” he noted.

“There is potentially more pain in the pipeline, but for markets today it seems that global factors are more important than the local factors in terms of our capital market movements. In terms of banks and liquidity in the market, the South African Reserve Bank made it clear that it has more than enough ammunition available and ready to use, if needed, to keep the market afloat, so we don’t foresee any systemic risk at this point in time,” he said.

Elna Moolman, an economist at Standard Bank, expected a sharp downturn and a strong recovery, but noted that this implied that there would be no growth between late 2019 and late 2021.

“We expect a 33 percent contraction at a seasonally adjusted and annualised quarter-on-quarter rate in the second quarter. I then expect a strong rebound of around 17 percent in the third quarter, which, of course, means that we’re not

quite recovering from the second quarter contraction. For the full year, I expect a five percent contraction. This is somewhat optimistic, as I expect that some of the consumption and production ‘lost’ during the lockdown is merely delayed, so that we catch it up later on. But if the lockdown is extended, the impact would be disproportionately big, as it would get increasingly difficult to catch up on the delayed production and the permanent damage may be worse. Following - five percent in 2020, I expect +4.6 percent in 2021. Again, it seems like a sharp bounce, but it implies we’re only back at 2019 GDP levels late in 2021,” Moolman said.

Dawie Roodt, the chief economist at Efficient Group, said it was difficult to make a forecast as there were so many moving parts, such as the length of the lockdown, any supply disruptions and how fast industry would recover.

“Our forecasts change all the time, but what we expect now is a long and flat U-shaped recovery. After the virus we still need to fix the SOEs and state finances. For now we expect a - two percent drop in the first quarter, a 10 percent or worse decline in the second quarter, another small drop in the third quarter depending very much on how deep the decline was in the second quarter and around zero for the fourth quarter. For the year it can be - five percent or worse! Next year we just don’t know yet,” Roodt said.

He expected most of the rest of the world to go into recession in 2020, with China narrowly averting one.

WEALTH•INVESTMENT•PROSPERITY 13 PERSONAL FINANCE | 2 nd QUARTER 2020

WORST-CASE SCENARIO

Anumber of prominent economists and analysts have warned that the world is on the precipice of an economic depression worse than the Great Depression of the 1930s.

Among them is Nouriel Roubini, professor of economics at New York University's Stern School of Business and chairman of Roubini Macro Associates, who is known in financial circles as “Dr Doom” for his pessimistic views generally. In an article penned in March, he wrote: “The shock to the global economy from Covid-19 has been both faster and more severe than the 2008 global financial crisis and even the Great Depression. In those two previous episodes, stock markets collapsed by 50 percent or more, credit markets froze up, massive bankruptcies followed, unemployment rates soared above 10 percent, and GDP contracted at an annualised rate of 10 percent or more. But all of this took around three years to play out. In the current crisis, similarly dire macroeconomic and financial outcomes have materialised in three weeks.”

The extent of the calamity was underscored by the subsequent unprecedented spike in Americans applying for unemployment benefits – by 23 April the unemployment rate in the US

was 20 percent and 26.5 million jobs had been lost.

Rubini said we shouldn’t be thinking of a V or U-shaped recovery, or even an L. The situation the world finds itself in, he said, is an I – “straight down!”

The global growth outlook is dismal: the International Monetary Fund predicts negative three percent GDP for 2020. Compare this with the negative 0.1 percent of the global financial crisis of 2008.

Apart from the suddenness of this year’s downturn, there are, as economists and historians recognise, fundamental differences between 1930 and today, both in causes and how the Great Depression played out compared with how the current crisis is expected to play out, taking into account the lessons we learned from the 1930s.

Wall Street crash

The Great Depression was triggered by the Wall Street crash of October 1929. The crash was the implosion of a massive bubble in share prices, which had been inflated by a frenzy of speculation. The US in the 1920s was riding a wave of prosperity. Americans from all walks of life, most of whom had never “invested” before, were drawn to the stock market

in anticipation of instant riches, many borrowing money to buy shares.

The Dow Jones Industrial Average plummeted from about 350 points (off its peak of 381 points, reached in August 1929) to about 200 points (a drop of 43 percent) within four weeks. It climbed to almost 300 by April 1930 but then declined steadily over the next two years to reach a low of 41 points in July 1932. From peak to trough, the index dropped by 89 percent. It was not to reach its precrash 381 level until 1954, 25 years later.

There was some government intervention in 1930 by the Hoover administration to shore up the financial system, but this was largely ineffective. Highly damaging were the protectionist policies his government instituted in that year, imposing tariffs on imported goods. Other countries responded with similar measures, and world trade collapsed – to a third of the pre-crash level.

Apart from the plunge in the stock market and the collapse of global trade, the Great Depression was marked in the US by a deflation spiral and the failure of thousands of banks.

Dr Ben Bernanke, who chaired the US Federal Bank through the 2008 global financial crisis, had made a study of the Great Depression. According to Wikipedia, Bernanke argued that “when deflation is severe, falling asset prices along with debtor bankruptcies lead to a decline in the nominal value of assets on bank balance sheets. Banks react by tightening

their credit conditions, which in turn leads to a credit crunch that seriously harms the economy.

A credit crunch lowers investment and consumption, which results in declining aggregate demand and additionally contributes to the deflationary spiral.”

Bernanke argued for, and succeeded in implementing in late 2008, massive state bank and government interventions to prevent runs on banks and ease tightened credit. These took the form of bailouts, cutting interest rates, and quantitative easing, which injected liquidity into the economy.

Covid-19 crisis

While the 1918-1920 Spanish Flu may have been more virulent and killed a higher percentage of people it infected, it did not result in a blanket lockdown of business activity. With the world already depressed coming out of World War One, its economic effects were relatively minor.

In contrast, this year a relatively thriving global economy was “switched off” almost overnight. Roubini remarked: “Not even during the Great Depression and World War II did the bulk of economic activity literally shut down, as it has in China, the United States, and Europe today.”

Switching economies back on again is a slower, phased process, as countries, one by one, emerge from the darkness.

Fears are that even if the developed world becomes economically active

again by the second half of 2020, developing markets, which came later in the infection wave and are likely to be harder hit because of higher-density, poorer populations, will be a huge drag on the global economy. There are also fears of a second wave of infection hitting countries that have already been devastated by the pandemic.

And if we take this depressing scenario further, let’s not forget what the Great Depression led to: social upheaval, political extremism and the horrors of World War 2.

Avoiding doomsday

While in some ways the Covid-19 crisis is worse than the Great Depression, certainly in its severity and its suddenness, there are important differences, which may be enough to stave off the despair and poverty that epitomise that unhappy era.

• It didn’t come about through speculation and the bursting of a stock market bubble. Stock markets were relatively healthy.

• Governments have responded by throwing money at the problem. This is in contrast to the austerity approach initially adopted in the 1930s. Governments then were also hampered by their adherence to the gold standard, which they eventually abandoned.

• Banks and stock markets are better regulated and more robust. While the financial system may not be as robust as

it was in the years following the global financial crisis, with some slackening of regulation, it’s a far cry from the 1920s, when you could buy $100 worth of shares with $10 and a 90 percent loan from the broker.

• Technology is a game-changer. Today’s technology enables interconnectedness, the sharing of information and co-operation.

It’s co-operation, experts agree, the world needs most. If nations retreat into protectivist cocoons, that should trigger alarm bells. While countries may need to relook supply chains, particularly of essential goods such as medical equipment, global trade should not suffer unduly.

This is a time for collaboration, not competition, between nations and within them. This is the view of Klaus Schwab, founder and executive chairman of the World Economic Forum, who writes: “To prevent an economic collapse, governments will need to take on large and unprecedented roles in securing business continuity and jobs.

"The [ensuing] public debt … will need to be carried by the strongest shoulders – the companies and individuals most able to take it on. The crucial principle, that everyone will need to subscribe to, is that we’re all in this together, for the long haul, and we must all come out of it together ... We’ll overcome this crisis, but only if we work together and dig in.”

– Martin Hesse

YOUR EMPLOYMENT CONTRACT IN A CRISIS

Your employer may, in a crisis such as we are currently facing, resort to a force majeure clause in your employment contract to terminate your employment or to alter the conditions of the contract. Kyle Torrington, co-founder of the Hello Contract website, answers questions on what such a clause means for employees.

What is force majeure?

Force majeure events are those which give rise to circumstances beyond the reasonable control of one or more parties to a particular agreement. Examples include strikes, lockouts, epidemics, riots, fire and acts of God. These events, if they do arise, will prevent one or both parties from performing their obligations in terms of a contract. Parties to a contract are free to include as many or as few force majeure events as they wish. As such, events constituting instances of force majeure might differ from contract to contract. However, events such as the Covid-19 epidemic are normally recognised and included as events of force majeure.

Typically a force majeure clause will allow either party to terminate a contract if a force majeure event arises and persists for a particularly lengthy period. Some contracts might specify an exact such period; others might not.

A force majeure clause protects a party from the consequences of not being able to perform in terms of the contract until the force majeure event has ceased, or, if the force majeure event continues for a lengthy period, will allow for the contract to be terminated without any of the parties being held liable.

What if my employment contract does not contain a force majeure clause?

It is generally regarded that, should a contract not contain a force majeure clause, if a party does not perform in terms of the contract, the other party may demand performance or at least damages (compensation) for inability to perform in terms of the contract. There is, however, the possibility that a party affected, for example, by the coronavirus lockdown, who cannot perform as a result thereof, may raise a legal defence known as “supervening impossibility of performance”. This generally means that since entering into a contract, the ability of one or both parties to perform in terms of a contract has become impossible. In this regard, it is unlikely that the party not being able to perform will escape liability unless a court rules that it is equitable in the circumstances.

Is my employer allowed to terminate my employment contract due to Covid-19?

If your contract includes a force majeure clause, and if the force majeure clause regards epidemics as an event of force majeure, and provided that the processes contained in the force majeure clause

are followed, such as abiding by notice periods, the contract may be terminated.

Can my employer dismiss me if the business begins to suffer?

Should the operations of your employer have been affected to such an extent that the company is no longer able to afford the salaries of its employees, in certain circumstances your employer may be able to justify your dismissal based on the operational requirements of the business. This is a form of retrenchment and needs to be considered only as a last resort. This is a requirement in terms of the Labour Relations Act.

Prior to dismissing you, your employer will have to have a consultation with you in order for you to be heard and at which your employer must show that the reason for the dismissal is genuine and justifiable. It’s strongly advisable for a labour lawyer to be consulted.

Can my employer reduce my salary?

Unless there is a clause in your employment agreement permitting salary reduction, your employer may not unilaterally reduce the salary of

16 PERSONAL FINANCE | 2 nd QUARTER 2020

any employee. Your employer may, however, enter into negotiations with its employees, and if they agree to such salary reduction, record the new terms in an addendum to their pre- existing employment agreement.

Can my employer reduce my working hours?

Yes, your employer may reduce your working hours, but may not effect a salary reduction unless there is a clause in the employment agreement

Force majeure and Covid-19

By Georg Kahle and Yasmine Wilson

There are specific circumstances and criteria that need to be met for force majeure to be relied on to suspend obligations under a contract. Businesses should be careful to not simply rely on force majeure to escape their contractual obligations. Doing so could result in specific performance or damages claims being brought against that party.

Businesses should seek legal advice before not honouring contractual obligations because of issues related to the Covid-19 outbreak.

The principal objective of a force majeure clause in a contract is to relax obligations and to set a limit to the strict liability imposed on a party to perform in terms of a contract in the event of certain circumstances arising, which prevent or have an effect on the party’s ability to perform.

It provides protection to a party from being liable for damages for a breach of contract provided that it can be classified within the ambit of the definition of force majeure; and it halts the parties’ contractual obligations to each other for a period of time.

If force majeure clauses are vague and incomprehensive, their interpretation could be problematic. South African law applies presumptions of

interpretation to determine the meaning of words in contracts when the intention is not clear from the way a clause is drafted. To interpret the agreement, the court will presume that the words used are used precisely and exactly, that the parties chose their words carefully to express their intention, and that no superfluous words were included.

In the case of Sucden Middle- East v Yagci Denizcilik ve Ticaret Ltd Sirketi, the UK court noted that the phrase “force majeure” is simply a phrase to label a list that includes a mixture of matters. The list informs the meaning of the phrase, and not the other way around.

The South African courts would likely follow the same approach. The parties cannot simply rely on a clause that is labelled as a force majeure clause or contains those words, but does not list or elaborate on what the parties agree a force majeure to be. Force majeure clauses must be detailed and specifically list the force majeure events (such as an epidemic) that the parties agree will suspend their performance of

which permits a reduction of your salary in such circumstances.

Hello Contracts is South Africa's first legal document platform, providing legal support for business owners.

the contract. In this regard, parties should specifically list broad catch- all wording to contracts such as ‘act of God’ or ‘acts of authorities’ that they can rely on to encompass events they may not reasonably have foreseen.

Under the current circumstances, an agreement should also specifically state that the force majeure events include a pandemic and acts by government. This would remove any doubt that the consequences of the coronavirus will be covered by the force majeure clause.

George Kahle is a director and Yasmine Wilson an associate at Norton Rose Fulbright. This is an extract from their article “Force majeure and contractual obligations (Covid-19)” that appeared on the firm’s Financial Institutions Legal Snapshot blog site.

WEALTH•INVESTMENT•PROSPERITY 17 PERSONAL FINANCE | 2 nd QUARTER 2020

It goes without saying that the pandemic has thrown a spanner in the works of many people engaged in “something on the side”. Against that, the unfolding tragedy has forced many people to reevaluate their lives and careers, and in some cases, prompted them to explore money-making ideas that were previously unthinkable.

Granted, many side hustles do not

SOMETHING ON THE SIDE

As the economy takes a dive and fallout from the coronavirus pandemic affects absolutely everyone, you may be exploring additional sources of income, aka “side hustles”. Alan Duggan tells a few stories that began in the pre-lockdown era.

progress beyond the stage of “Hey, I’ve had this amazing idea”, but others have proved so successful that they’ve become mainstream. Whether their success will survive the pandemic remains to be seen. Appealing as they sound, side hustles aren’t for everyone. Your employment contract may prohibit outside work, your home circumstances may not allow you any free time, your skill set may limit your

opportunities, or you may simply be in the wrong place at the wrong time.

Personal Finance asked Jonathan Cherry, a futurist and consultant on strategic business and brand development, whether the coronavirus had upended most projections in terms of employment and business opportunities.

In short, yes. Says Cherry: “The global pandemic, as well as the government’s

18 PERSONAL FINANCE | 2 ND QUARTER 2020

response to the crisis, is a significant change that will have a dramatically disruptive influence on all organisations. I can’t imagine that too many business entities would have factored in a global pandemic in their strategic planning rosters. Financial projections will now look quite different as supply chains come back online and organisations begin to rebuild.

“The worldview that emerges after the lockdown will be very different from that of the past. Many avenues for business growth simply will not exist any longer, whereas others will have opened up. The opportunities lie in the ability to be flexible enough to see and take advantage of the new landscape.”

Significant change that has a dramatic impact on our lives tends to carry with it a cloak of fear and panic, says Cherry. “Change itself is neither positive nor negative, but the resistant attachment to the old status quo can cause lots of anxiety in society. In many respects, it forces a refresh of our thinking about the world. There are already signs that people are mobilising to help one another, large organisations are collaborating with their competitors to deliver goods and services to the people that need it most, massive production lines are being retooled to produce much needed goods and services that solve our immediate problems. These are all positive signs reflecting an optimism that in partnership with each other, we can overcome the panic.”

Does he have any advice for someone who has lost their job and will be seeking employment in a radically changed world? For instance, don’t be shackled by your experience or your current field of employment... be brave and try something outrageously different?

Cherry says: “Rather than go out there determined to be brave and outrageously unique because you believe that ‘you have nothing to lose’, I suggest you take this time to consider your options from a far more strategic point of view. There are a significant number of jobs that need to be done in the world, and the value of taking the time to adopt a strategic mindset shouldn’t be discarded. Think about your options strategically and ask yourself honest and probing questions:

1. What does the world need now?

2. What might the world need in the future?

3. What will people pay me money to do?

4. What is unique about me?

5. What do I love?

6. What do I want to be known for?

7. What are my values?

8. What am I good at?

9. What do I want to explore?

The idea is to understand and package the unique value that you have to offer, but at the same time to see where that value can best be placed in the world in order to financially leverage it.”

CASE STUDY #1: ERNST THOMPSON (SCIENTIST AND BUSINESSMAN)

Ernst Thompson earned his PhD in nutrition physiology, focusing on biotech, and went on to co-found Beonics, a company that develops and markets agricultural feed supplements. He admits to becoming bored very quickly and says he has “small shares in lots of little businesses”, primarily because he loves crossing over to other disciplines.

His newest and arguably most exciting venture involves bees and a somewhat anachronistic product of these insects’ legendary “work ethic”. Ernst explains: “I love bees. Years ago, I had a friend from varsity whose father kept bees on his farm; I think he had about 80 hives. We used to go there regularly to work with him, and later started extracting propolis (a natural resinous substance produced by honey bees that’s highly valued for its claimed anti-bacterial and other properties) and selling a propolis tincture to health shops – to earn extra beer money.

But propolis was only the start; the next and most logical step, according to Ernst, was to explore the opportunity to produce and sell mead, reputed to be the world’s oldest alcoholic beverage. “A good friend in Grahamstown was making a very nice mead, and we decided to give it a go.”

Calling on technical and

other expertise from their network, he and his colleagues set out to produce a palatable and viable product. However, they soon discovered that the apparently simple recipe for mead involved some complex challenges.

“Aside from the production process, one of the biggest hurdles we face is the association of mead with sweetness, which is not surprising when one considers that it’s made from honey. We didn’t want that, so we fixed it. We established the Cape Town Mead Company and in 2018, after two years of research and planning, we opened the city’s first meadery.”

One of the “big guns” in his operation is business partner Matthew Krone, a 12thgeneration winemaker whose family have been producing fine wines for over 300 years.

Ernst credits Matthew as the guiding force behind Melaurea. “He’s one of only three people in the world who makes Champagne-style mead. We now produce Melaurea Brut Mead, a bottle-fermented mead crafted in the authentic méthode traditionnelle style, and Pale Ale Braggot. You could think of it as a sort of Weiss beer shandy, and it’s aimed primarily at women.”

Personal Finance: Is the market receptive to something as radically different as mead?

ET: So far the response has been very positive. These are premium products – the limited-release Melaurea sells for about R300 and the Braggot costs the same as a good craft beer – and we’re seeing a good response from upscale restaurants. I visit these places with samples, introduce myself and explain the history of mead as the original celebratory drink. I also do regular tastings.

WEALTH•INVESTMENT•PROSPERITY

When people hear the back story, they tend to be more receptive to trying something new and different. We also promote our products via social media, but we’re not very good at it!

PF: When did mead production segue from hobby to established business?

ET: About three years ago. I still have a day job but could easily scale up if the opportunity arises. I’m not drawing a salary, but we were starting to break even on costs when the coronavirus hit.

PF: Do you remain optimistic?

ET: Yes, still optimistic. Our approach to marketing is to use the best of the beer industry and the best of the wine industry; you need to exploit all the techniques you can. Mead has been around for many centuries, but our technology is anything but old. We’re still talking to investors. Ultimately, our targets are America, China and Europe.

CASE STUDY #2: NAOMI JANSEN (TRAVEL CONSULTANT AND WRITER)

After nearly 30 years in the travel industry, Naomi decided she’d had enough, so when she was retrenched, all manner of opportunities beckoned. With a mixed bag of experience behind her – she had trained as a teacher and worked as a missionary for a while – she was ready to tackle something entirely different. A new book beckoned.

Writing was not a new experience for Naomi. Back in 2017, she co-wrote a tribute to her mother, Song for Sarah: Lessons From My Mother, with her brother, Jonathan Jansen, the respected writer, public speaker and former Vice-Chancellor of the University of the Orange Free State.

But this one would be different. Having travelled to and from work on a Metrorail train every day for many years, she had experienced the best (and the worst) of the commuting experience – “and there was definitely a book in there”. Says Naomi: “I started out by posting my thoughts and

experiences on Facebook, and the idea grew from there. My book is written firmly and unapologetically in the Cape Flats vernacular, because that’s the way it is.

“As an evangelical black woman from a traditional household, I haven’t always fitted into a neat category, but those daily train journeys have enabled me to overcome my reserve and engage with complete strangers. This book will give me a chance to tell my story. You’ll meet the gangsters, the preachers and everyone in between.”

Naomi is something of a serial entrepreneur. For a while, she helped raise money for Operation Smile, a charity that funds operations for children with a cleft lip or palate, by recycling plastic bottles in their thousands.

Personal Finance: What’s next?

NJ: Lots of things. I now attend Toastmasters breakfasts to pick up constructive advice and criticism. I’ve already spoken at weddings and other functions, so that could be a useful opportunity to create a new income stream. Who knows, I may even become a stand-up comic… why the hell not? After all, how many 60-year-old conservative female comedians – with dreadlocks! – are out there?

PF: What would you tell the wannabe side-hustlers out there?

NJ: Just do it. Be brave and be prepared to try anything. I’ve sold second-hand clothes, marketed lavender for a friend … anything goes.

CASE STUDY #3: DAVID ROPER (IT CONSULTANT)

When David began to explore the side hustle known ironically as “investing for fun and profit”, just about everyone –from knowledgeable friends to financial advice columnists – warned him to think

of it as a long-term game fraught with fears and pitfalls, and to beware of panic overwhelming good sense when markets took a downturn. They also urged him to emulate Warren Buffett (the billionaire investor and CEO of Berkshire Hathaway) and do his homework on a company before committing any money. You know: due diligence.

Says David: “Being young and foolish, I ignored their advice and instead relied on my hunches and instincts. When I quoted the famous ‘monkey with darts’ example from the 1970s of how random stock selections can outperform the index, they basically threw up their hands. But I persevered, and between January and midDecember 2019, I made a profit of just over R22 000 simply by using a little psychology and buying shares in companies that reflected social trends and serviced them accordingly.

“I’m aware that there are hordes of PhDs out there who use statistical analyses and advanced maths to do the same thing, and probably more efficiently, but I’m very happy with the results of my amateur efforts. I broke all the rules and ignored the global funds, which under normal circumstances is not a clever thing to do. Of course, I’m very much in the Little League, but when the world returns to normal, as it will later this year, it will open up all sorts of interesting opportunities.

Personal Finance: Did you take a serious hit when the coronavirus hammered the markets?

DR: No, but I escaped the pain due to luck rather than good judgment. I liquidated just about everything in mid-December, weeks before the Chinese government told the World Health organisation about the coronavirus outbreak, because I needed the cash to renovate my flat.

The money is sitting in a 32-day fixed deposit, where it’s earning reasonable interest while I decide what to do next.

20 PERSONAL FINANCE | 2 ND QUARTER 2020 WEALTH•INVESTMENT•PROSPERITY

PF: Any side-hustle advice for other novice investors?

DR: Yes – don’t do what I did! Aside from the obvious investment advice channels, you need to explore social media, and Facebook in particular, to find out what people really want and need, and perhaps even what they fear. It’s an amazing window into society’s inner workings.

If you approach your research from the proper perspective, you may discover a potentially lucrative business opportunity. The markets will recover; the trick is to get in now, if you can afford it, by selecting a sensible mix of funds. But more importantly, never, ever play with money you can’t afford to lose. The coronavirus pandemic is a global tragedy, but it is also a world-changer in terms of habits. For instance, people may now feel apprehensive about overseas travel. Does this mean we can expect a massive surge in local travel? If so, does this offer new investment opportunities, or openings for side hustles?

CASE STUDY #4: TONY N (ACCOUNTANT)

When your employer requires you to spend most of your working hours staring at columns of figures, says Tony, the temptation to scream and throw things can sometimes become overwhelming.

Having said that, he needs his day job, so instead of switching careers, he’s opted for a form of therapy that satisfies his urge to do something completely different while earning some extra cash. On Saturdays and occasionally on Sundays, he cooks for his relatives and a network of friends, then delivers oven-ready meals to their doorsteps.

As side hustles go, it may not be especially innovative, but Tony reckons he can net a useful R1 000-plus over a good weekend, and that takes into account the ingredients, the disposable containers, the gas and electricity for his big stove and the cost of transport. His speciality is one-dish meals for busy families, ranging from lasagnes to chicken curries and that old standby, mac ‘n cheese.

As Tony tells it, the formula is breathtakingly simple: if he spends R75 on preparing and delivering a generous-sized meal for four, he charges the customer R150. “It goes without saying that economies of scale kick in once I sell a certain number of meals. I could easily scale up my service but then I wouldn’t have a life.”

Personal Finance: Why is your product better than anyone else’s?

TN: My customers know that I use goodquality mature cheddar, very good pasta,

genuine free-range chicken and so on. If I screw up, you can be sure my family and friends will let me know, so I’m very careful. I also make sure that the food looks good and has a decent texture, which is half of the battle for any cook. I average 12 to 15 big meals at a time

PF: Can’t the supermarkets beat you on pricing?

TN: Not a chance. My family meals fill a large foil container, whereas the typical supermarket ready-made meals are much smaller and obviously bulk-produced. You should see the so-called bechamel sauce on some lasagnes … it’s some sort of instant stuff; once the dish is cooked, it emerges like sludge and you need to eat it with a spoon.

PF: Doesn’t this side hustle ruin your weekends?

TN: Not really. I still have Saturday evening and most of Sunday afternoon to chill with friends, and if I really need to be somewhere over the weekend, I don’t mind using one of my weeknights to cook. My girlfriend often helps me, so that’s not an issue.

PF: Any free advice?

TN: Top of my list, and an important consideration for everyone, is a reminder not to neglect your day job – your primary source of income. Rather over-perform at the office.

21

ARE SIDE HUSTLES FOR ME?

There are many things to consider before venturing into side hustles, among them the fine print of your employment contract: does it prohibit you from engaging in any outside enterprise, or does it refer only to your company’s field of operations? If there’s any doubt, ask your boss before proceeding (or be very, very discreet).

Do you genuinely have the time to do it? Consider the side hustle’s likely impact on your family time (if any), its effect on your personal relationships and regular job, whether it will severely compromise your leisure time or sleeping patterns, the possible tax implications, whether there is a genuine need for your skills or services, whether the market may be over-traded in your field of interest, whether your pricing is realistic, and – importantly – why you are doing it in the first place.

If it’s a question of survival, a side hustle is a no-brainer; if it’s to supplement your savings, is it the best way to use your time? if it’s simply for fun, would you be prepared to give it up when it stops being fun?

But it’s certainly not impossible to secure a useful income stream to supplement your regular salary. In fact, many people have vaulted tall hurdles – and in some cases, ignored outright ridicule – to make a success of side hustles, in some cases barely breaking even and in others becoming so successful that they have given up their original jobs.

Okay, what can you do?

• Rent out a spare room, a flat or an entire house, if you have one. People will always need a place to live.

• Go online and search for jobs that you can do from home. Be warned: the so-called “micro-payment” industry, which offers teensy payments for everything from online surveys to copy-and-paste jobs that risk death by boredom, is peppered with dodgy offers. Against that, many of these opportunities are legitimate sources of income, albeit in small increments. Do your homework.

• Explore freelance sites such as Upwork to get an idea of what’s out there, and if your CV is still on paper (Boomer alert!), be prepared to update it with a professional-

looking online version that features the best of your work.

• If you identify an opportunity, invest in it – not necessarily with big bucks, but with social media backup, word-of-mouth campaigns, personal interactions and whatever it takes to get you noticed. If you’re reserved by nature, get over it. But do not invest money you cannot afford to lose.

• Don’t be too casual about your side hustle working hours. If you need to set aside two or three hours a day to do it, stick to your schedule as if a boss is watching you.

• Don’t get bogged down with the creation of a fancy website, catchy pay-off line or logo. Rather focus on working and selling.

• Before you go public, experiment on your long-suffering family and friends. Their feedback is likely to be honest and useful, if occasionally painful.

• This one could be difficult: if you love what you’re doing but it isn’t generating a profit, it’s not a side hustle, it’s a fun hobby. Know the difference.

22 PERSONAL FINANCE | 2 ND QUARTER 2020

FIRST-QUARTER BLOODBATH

The only reason to look at your first-quarter unit trust statement should be to assess whether your portfolio is delivering in line with its mandate, suggests an investment expert.

Only one of the 168 unit trust funds in the South African general equity category (see DataBank, page 55) managed to eke out a small positive return in the three months to the end of March 2020, while the rest delivered negative returns. The worst performing fund lost almost 35% of its value over this period.

Andrew Davison, deputy chair of the Investments Committee of the Actuarial Society of South Africa, says that while seeing double-digit negative returns on your quarterly unit trust portfolio statement may have caused distress, there is no point in drawing any material conclusions from such a short performance period.

“The reality is that it’s not business as usual. Stock markets, bond markets and the rand experienced significant falls because of anxiety about the effects of Covid-19 on the global economy and businesses of all sorts and sizes,” he says.

While this is not the time for knee-jerk investment decisions, Davison says this is, however, a good opportunity to assess whether the portfolio you are invested in is performing in line with its mandate.

“Periods of stress like this can shine a spotlight on inadequacies that aren’t obvious when markets are positive. As Warren Buffett once said, ‘when the tide goes out you get to see who’s been swimming without trunks on’.”

Same volatility, different outcomes

Davison says the FTSE/JSE All Share index lost 23% in the first three months of this year. Yet, while all portfolios and asset managers were exposed to the same extreme volatility, there were marked differences in the outcomes achieved by different portfolios and managers.

A key reason for the wide disparity in returns is that the mandates of the portfolios differ. Some portfolios are, for example, limited to JSE-listed stocks while others are allowed up to 30% in global listed stocks and another 10% in stocks listed in the rest of Africa.

Davison says there was also disparity among passive index-tracking funds, depending on the index being tracked. Tracking the FTSE/ JSE Top 40, for example, would have resulted in a loss of just under 20%, whereas tracking the FTSE/JSE Rafi 40 would have resulted in a loss of almost 29%. “In general, the index trackers did a good job of tracking their designated indices, with a small lag due to fees. However, two funds strayed materially from the indices they purport to track – one delivered a much better return and the other a much lower return.”

Davison says it is noteworthy that roughly a quarter of the active managers underperformed all of the major indices (All Share, Top 40, Swix and Capped Swix). On the other end of the spectrum, roughly a quarter of them outperformed all of these indices.

Insights for investors

Davison reminds investors that any losses remain paper losses until a disinvestment is made. Therefore, he says, the only reason you should be analysing your portfolio at this time is to assess aspects such as the following:

• If it is an index tracker, is it tracking the index closely?

• If the mandate of the portfolio states “low volatility” and the portfolio is one of the biggest fallers, is it doing its job correctly?

• If the portfolio is allowed to invest a portion offshore and the rand has weakened, has the portfolio captured the extra diversification benefits?

• If it is a fund of funds and it is one of the worst performers, does the multi-manager have the ability to select and blend different managers?

• Assessing the ability of an actively managed portfolio to deliver better risk-adjusted returns than the index requires a much longer period than three months. However, actively-managed unit trusts that have dropped further than all the indices should expect some scrutiny. Davison encourages you to assess your portfolio together with your financial adviser, who is likely to have deeper insights into the investment style of the asset manager and performance against the stated benchmarks and the portfolio’s mandate. – supplied by the Actuarial Society of Southern Africa

23 PERSONAL FINANCE | 2 ND QUARTER 2020

JOINING A MEDICAL SCHEME IN A CRISIS

Martin Hesse explores your options if you are not currently a member of a medical scheme but, in the light of the coronavirus pandemic, want to join one.

If you are not a member of a medical scheme at present, you may be considering joining one to cover yourself and your family in the event of Covid-19 infection.

By law you cannot be refused membership of an open medical scheme; however, schemes can impose restrictions and/or penalties to mitigate their risks. In the absence of these restrictions and penalties, people could join and leave medical schemes at whim, when they felt the need for cover or not. This would place a far heavier burden on the membership of a scheme as a whole, and would make contributions unaffordable.

There are two ways medical schemes are permitted to counter this practice, which is known as antiselection. They can impose “late-joiner” penalties on people who have not belonged to a medical scheme before or who have let more than three months pass between leaving one scheme and joining another; and they can impose a “waiting period”, during which you may not claim.

LATE-JOINER PENALTIES

Sandy van Dijl, health branch manager at Alexander Forbes, says the Medical Schemes Act allows schemes to apply a late-joiner penalty when you join a scheme after the age of 35 or when you have had a break in cover for more than three months.

Van Dijl says medical schemes would consider an applicant a late joiner if the applicant:

• Is 35 years or older;

• Was not a member or a dependant of a registered South African medical scheme on or before April 1, 2001 (“Cover outside of South Africa is not accepted as previous medical scheme cover,” she says); and

• Has allowed a break in membership of a registered scheme of more than three consecutive months since April 1, 2001.

Van Dijl says: “The late-joiner penalty is

calculated taking into consideration the number of years you had cover with a registered South African medical scheme since the age of 35. This penalty is added onto your monthly contribution and remains with you for life.

It is important to note that any cover you may have had under the age of 21 is excluded.

The penalty is applied based on the risk

24 PERSONAL FINANCE | 2 ND QUARTER 2020

contribution payable to the medical scheme; it is not applied to any savings component of the monthly contribution.”

• The penalties, based on the number of years without cover after the age of 35, are:

• 1 to 4 years: 5% of risk contribution;

• 5 to 14 years: 25% of risk contribution;

• 15 to 24 years: 50% of risk contribution; and 25 years or more: 75% of risk contribution.

member of a scheme since the age of 35 is: 58 - 35 + 12 = 11 years. Therefore, the penalty will be 25%.

Van Dijl says that to avoid these penalties you should avoid buying medical scheme cover only when you are older or when you need it.

“It is important to have medical scheme cover in place not only when the need arises, but also for emergencies. Treatment for any severe illness or medical emergency can be very costly.”

Van Dijl says upper-tier medical scheme options may be expensive, and you may find lower-tier options more affordable. But beware of short-term health insurance solutions, especially hospital cash plans that cover you for a specified daily amount in hospital. Cover of R2000 a day, for example, may, on the face of it, seem a significant amount. But such an amount would fall far short of the costs that would mount up if you were severely infected by the virus and required intensive care. Research published in the South African Medical Journal in January last year showed that, at a central publicsector hospital, the cost of intensive care was almost R23 000 a day.

Van Dijl also points out that hospital cash plans and other short-term health insurance products, foreign medical cover and cover under the age of 21 are not recognised as previous medical scheme cover if you want to join a scheme.

WAITING PERIODS

Medical schemes may also apply certain waiting periods over and above a latejoiner penalty, on application. This is an initial period of membership during which you may not claim. The waiting periods you may be exposed to are:

Access to the prescribed minimum benefits (PMBs) – a set of life-threatening conditions that all medical schemes must cover on risk benefits – will also be determined by the medical scheme on application. Access to PMBs is also affected by previous medical scheme cover, duration of cover and any breaks in membership.

GAP COVER

Gap cover is extra insurance you can take out to bridge the payment gap between what specialists and hospitals charge and what medical schemes pay out. The Council for Medical Schemes has indicated that hospitalisation as a result of coronavirus infection is deemed to be a PMB, so the medical scheme will pick up the entire cost of your hospital admission.

Martin Rimmer, chief executive of Sirago Underwriting Managers, a provider of gap cover, says there should be no shortfall you would need to cover in this instance. “However, all the testing and pathology tests leading up to the positive diagnosis are deemed primary care benefits, and if you have gap cover which caters for these benefits, it will cover the gap portion of these costs subject to the defined annual limits, provided you have waited out the prescribed waiting periods.”

He says on Sirago policies, which are fairly representative of gap cover generally, there is:

The formula used to calculate the penalty is your current age (on the date of registration) minus 35 plus the number of years of previous cover with a registered scheme.

For example, your age on the date of registration is 58 years.

You previously belonged to a medical scheme for 12 years.

The number of years you were not a

• A three-month general waiting period; and

• A 12-month pre-existing conditionspecific waiting period.

“These waiting periods will be determined by the medical scheme at time of joining, but are dependent on the previous medical scheme cover you have had, how long you have had cover and if you have or have not had a break in membership prior to joining,” Van Dijl says.