INTELLIGENT IMPACT THAT MATTERS

Who

planning professionals increasingly acknowledge that herein lies the future of personal advice. 8

36 When trusts go wrong

Experts relate case studies of how not to run a trust

39 Invest (and live) in Zanzibar Africa’s “Spice Islands” now open to investment

44 A tax guide for working across international borders

When you and your employer are in different countries

46 Starting a business Tips on business structure, tax, and succession planning

2 Upfront It’s personal

4 Book review

Books on financial topics

5 Your letters

Readers’ queries answered by experts

48 Millennial view

Four lessons in personal finance

50 Ombud case file

Insurance, advice and retirement fund disputes

52 Fund focus

MiPlan IP Global Macro Fund

54 On the contrary

Before you sell, have you considered your manager’s investment philosophy?

55 A list of the adjudicators and the ombuds who can assist you with your complaints, followed by the unit trust quarterly results, tax rates and annuity rates

The sponsored article by private wealth manager Melville Douglas on pages 34 and 35 ends with the words “it’s personal”, referring to the quality of client service on which the company prides itself. But without detracting from what Melville Douglas has to offer, I believe “it’s personal” has become the bar above which financial services companies will need to operate in the future to succeed.

The relationship between the industry and the consumer has been a rocky one. For decades, products and services were weighted in favour of the industry: the predominant business model, where you were persuaded to buy inappropriate products on the “advice” of commission-driven salespeople, put company profits before your interests.

There is still much room for improvement, but the “democratisation” of financial services – first through the proliferation of unit trust funds and more recently the rise of digital disruptors offering, among other things, quick-and-easy insurance and access to the stock market – forced the large incumbents and their adviser networks to bring you, the client, into the centre of their business model.

It goes further. Professional financial advisers and planners worth their salt are finding that “it’s personal” goes beyond putting you into appropriate products. There’s a psychological element to managing money and optimising your chances of building wealth. The adviser needs to act as a coach or mentor: holding your hand, educating you in the ways of investing and managing money, guiding you through difficult periods to prevent a knee-jerk response undoing years of good work.

Read Anna Rich’s well-researched article on page 8 to find out more about this new breed of advisers.

As always, the magazine contains articles on a diverse array of financially related topics for your information and edification.

Enjoy the read.

AnIndependentMedia (Pty)Ltdpublication

Editor

ANA Publishing CEO

ANA Publishing CFO

Head of Production

Head of Design Designer

MartinHesse martin.hesse@inl.co.za

VasanthaAngamuthu SoorenRamdenee

MugamadJacobs

MatthewNaudé

ThabangBoshielo

ADVERTISING

TonyMalek tony.malek@anapublishing.com

SUBSCRIPTIONS subscriptions@anapublishing.com

OFFICE MANAGER

CarynWessels caryn.wessels@inl.co.za

IMAGERY Freepik.comandAP

INDEPENDENT MEDIA BOARD OF DIRECTORS Dr.MohammedIqbalSurvé,TakudzwaT.Hove, AzizaB.Amod,IsmetAmod,YuexingWang,JinghuaDong

EDITORIAL ENQUIRIES

Tel:0214884187

Physicaladdress: Fourthfloor,NewspaperHouse, 122StGeorge’sMall, CapeTown,8001

Postaladdress: POBox56,CapeTown,8000

Personal Finance magazine(ISSN1562-3750)is publishedbytheproprietors,IndependentMedia(Pty) Ltd,StarBuilding,47SauerStreet,Johannesburg,2001

All products appearing in PersonalFinance are available and all prices are correct at time of print, subject to change.

Author: Arnold Singh

Publisher: Beyond the Vale Publishing

Order the book from asinghfp@gmail.com (R200 + R100 postage)

Arnold Singh has an Advanced Post-graduate Diploma in Financial Planning from Free State University and a Masters degree in taxation from North West University. He was a financial planner for 17 years and lectured in wealth management to post-graduate students at the University of KwaZuluNatal. He has distilled his vast knowledge and experience of personal finance into this comprehensive book, which covers all aspects of daily money management and wealth creation.

Levels of financial literacy in South Africa are unacceptably low. This state of affairs has led to high levels of indebtedness among consumers and low saving rates, with the consequence that only a small minority of South Africans (the figure most quoted is 6%) are able to retire comfortably on reaching retirement age.

Singh writes in the opening pages: "Since schools, colleges and universities do not teach personal finance as a subject, investors are not equipped with the necessary

knowledge and skills to manage their finances wisely when they commence work and hence end up in debt, do not save and invest enough, and end up poor in retirement. This book is intended to fill this gap in their knowledge so that they become empowered to handle their finances in an informed and effective manner and so enjoy financial freedom..."

In an easy-to-read, accessible presentation, Singh covers financial planning, debt management, insurance, banking, investing for the long term, tax, medical cover, and estate planning, among other topics. I can think of few books on the market which give such a solid and practical grounding for money management in the home.

My one niggle, as an editor with some experience in page design, concerns the layout of many of the tables in the book, which, to my mind, need improvement regarding clarity and readability.

That said, the book makes an important contribution to addressing South Africa's financial literacy crisis and deserves to be widely read. – Martin Hesse

Author: Tania Weich

Publisher: Zebra Press

Retail price: R150

While a minority of financial planners suggest it’s better to rent a property and rather build wealth in the stock market, it’s generally acknowledged that owning a property provides a solid foundation on which you can build wealth. However, the property market is becoming more and more out of reach for first-time buyers – and this applies to countries such as the United States as much as it does to South Africa.

Tania Weich is emphatic: owning a home is not for the select few – as a young person at the start of your career, you can realise your dream of having a property

you can call your own.

Weich is a property finance specialist, having been in the property business since the age of 22, when she became an estate agent and bought her first home.

Having run her own real estate company for more than 10 years, she assists buyers from all over the world to buy property in South Africa.

Her book breaks down the seemingly complex process of buying a property into simple, logical steps that are easy to follow. It also highlights pitfalls to which novice buyers are prone. Forewarned is forearmed: Weich’s guide is a must-read for anyone entering the property market. – Martin Hesse

I’ve just started a company together with three other shareholders and we are currently mapping out the employee benefits. Has Covid-19 changed anything fundamental in this space? Given the current troubled health landscape of Covid-19, increasing mental illness rates and mounting financial pressure on staff, what are the key benefits that we should be focusing on to ensure a healthy, safe and productive environment?

Name withheld

John Cranke, PSG Wealth, Midlands, replies: Apart from the inclusion of vaccination, testing for and treatment of Covid-19 into the Prescribed Minimum Benefits for medical schemes, not much has changed from a legislative perspective for businesses wanting to extend employee benefits packages to their employees for the first time. However, the pandemic has definitely reinforced the importance of employee benefits, including the mental wellbeing and financial assistance/ coaching aspects you mention.

In order to craft a relevant employee benefits package for your company, we would need information relating to the type of business you are in, the number of employees and their occupations/incomes / demographics (gender/ age) and geographical spread.

We would generally recommend including the following benefits:

• Health insurance (primary healthcare)

• Medical scheme cover

• Gap cover

• Employee assistance programme (EAP)

• Group risk cover (death, disability and funeral benefits)

• Retirement funding

The fact that medical schemes are obliged to cover the Prescribed Minimum Benefits as set out in the Medical Schemes Act makes them unaffordable to many employees, and we therefore include health insurance cover to provide cover for primary healthcare (in a private setting) for those employees. The EAP offers cover to all employees for, among other benefits, the psychosocial wellness aspects that have become elevated during the pandemic. Depending on the size of the group, we would be able to negotiate favourable underwriting on your behalf with providers.

For the retirement fund and group risk benefits we usually propose a phased-in approach in order

to build both of these up to pre-determined (often negotiated) levels, to ensure appropriate, meaningful funding in the event of retirement, death or disability.

There are also several other considerations for you as an employer, including but not limited to:

• Who qualifies for what benefit/s? (including dependants)

• Will cover be voluntary or compulsory?

• Will the company subsidise and by how much?

Everything of the best in your new venture!

I’d like to invest money offshore. However, in this volatile market, it seems like too big a risk. What is the best route to take to ensure a safe return on investment? Name withheld

Pierre Puren, PSG Wealth, Jeffrey’s Bay, replies:

I’d suggest you start with the end in sight. Focus on your specific goal and add to that another factor you do have control over, time. By focusing on the uncontrollable factors (such as future growth, interest rates and politics), you’ll lose focus and run the risk of falling victim to short term “noise” and making emotionally driven decisions. It is well documented that certain asset classes outperform others, if one takes time into account. If your specific goal has a short term focus (less than two years), it’s best to consider investment into an asset class that will provide certainty, such as a money market fund. This means that when the time comes to withdraw your capital to address your need, you won’t be susceptible to market fluctuations.

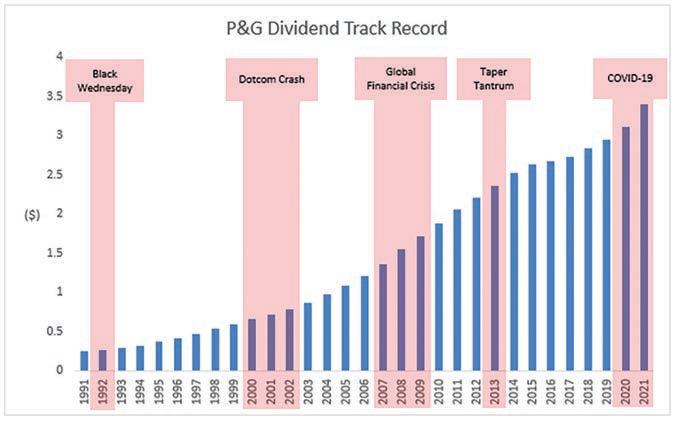

Conversely, if your goal is to save for the long term (more than seven years), you could consider an investment into equities because your money should have time to overcome any short term volatility. Much research exists that proves equities provide inflation-beating returns over longer term periods.

Once you have identified these factors, the decision whether to invest now or wait (in a volatile market) becomes more or less irrelevant as your investment returns will be relatively certain given your needs and time horizon.

Note: These letters are selected from “Your Questions Answered”, a monthly feature in Personal Finance in the Saturday newspapers, sponsored by PSG Wealth.

Most of us are greedy, dreaming of an unrealistically high return on our hard-earned money.

To earn higher returns we must take on extra risk, but higher risk does not always result in higher returns. Just ask those who invested in African Bank to get a slightly higher interest rate or investors in Steinhoff who ended up with losses. On the other hand, to leave our money in cash at current interest rates means that we may think that we are earning a good return, but our money is losing value in buying power.

One of the saddest stories I recall is that of a relative who worked hard for many years and then retired, to live on the income from her investments. She was cautious and invested all her money in a savings account at a large and reputable bank, very prudently, or so she believed. She enjoyed good health and

lived in a lovely flat at the coast, living off the interest from her investments. All well until some 20 years later when the cheque for her flat levy bounced, and she was forced to sell her flat. She had been living off her interest, not realizing that inflation was destroying the value of her savings and after 20 years the capital had been depleted. Nobody wants to grow old, but even worse to be old and poor.

What is so important for the long term is to ensure that you are earning enough to stay ahead of inflation. My first car cost R2 000, new; today that car would be R150 000, a 75 fold increase. We have enjoyed a decade of moderate inflation in South Africa, but it does appear that our inflation rate may be spiking up, driven by the soaring oil and food prices, administered prices such as electricity and water, as well as the effects of supply chain disruptions. The USA has seen consumer inflation of 8.5% and Germany 7.4%, the highest levels since the 1980’s.

Given high debt levels in much of the world, it will be difficult to prop up economies through fiscal policy, while Central Banks will have to choose between propping up economies with cheap funding and the risks of higher inflation. The risk of recession next year is high. Anyone investing for the long term should target a return at least equal to inflation. The Sasfin BCI Stable Fund targets inflation plus 4% p.a. over the medium term, while aiming to keep the risk profile of the Fund moderate. This is done by investing in a prudent mix of selected shares, to a maximum of 40%, plus inflation protected bonds and other fixed income assets to keep the risk profile reasonable while earning a “good” return. The manager of the Sasfin BCI Stable Fund has been doing this for more than 30 years, through high and low inflation periods, and hopefully will continue to protect investors through what could be a turbulent period ahead.

There’s a new kind of financial advice offering that aims to optimise our financial behaviour. How does the financial coach fit in with the existing advisory framework? And how can they help you? By Anna Rich.

taken in financial planning, management and more. He had long recognised the behavioural aspect to our personal finances, so during his last 15 years at Absa, he started to think about how he could bring coaching and financial planning together, and now provides personal financial coaching, financial coaching certification and coaching for financial planners.

Rob Macdonald of Fundhouse, providers of advisory services to financial advisers and institutions, draws parallels with our health. “We all know what to do to be healthy – exercise, don’t eat too much, don’t smoke – but we don't always implement what we know. A financial adviser can say, ‘You really must spend less money,’ but nine times out of ten, it doesn't happen. The client’s behaviour has the biggest impact on their financial outcomes, which is why coaching is important.”

“Financial planners do ‘coach’ clients to a degree,” says Jacoby. “But we are used to having a solution for the client. After all, isn’t that why they come to see us? As a result of our perception that we have the answers, the art of listening is the key challenge for advisers.”

“Not all financial planners have the ability to identify emotional barriers that keep clients in harmful financial behaviours, which is why financial plans sometimes fail,” notes Lelané Bezuidenhout, CFP, who is CEO of the Financial Planning Institute (FPI). “So financial planners must upskill themselves, and undertake ongoing training in financial psychology and behavioural finance.”

The terms coach and adviser are not interchangeable in the area of personal finance. Bezuidenhout makes these

distinctions:

• A financial adviser provides financial planning.

• A CFP (and member of the FPI) gives professional financial advice.

• A financial therapist or psychologist or counsellor offers financial therapy.

And a coach? Read on.

Bezuidenhout stresses that coaches and therapists cannot give financial advice unless they are licensed as financial advisers under the Financial Advisory and Intermediary Services Act, and cannot do financial planning unless they are a CFP. “Can one person be a therapist, coach and financial planner? Yes – as long as they meet all the competency requirements and understand that there is a difference between coaching, counselling and pure financial planning.”

As Crafford sees it, a big difference between financial coaching and financial planning is that a client comes to see a financial planner for his or her expertise whereas the financial coach sees the client as the expert of their life. “As coaches, we’re there to guide you to your own definition of prosperity.”

Your history shapes your financial behaviour. “The starting point of coaching is ‘What is the money story we tell ourselves?’” says Crafford. “Our upbringing, culture, and personality all influence how we engage with money.”

Jacoby stresses that the client’s money story is the most important part of their financial journey. “I cannot discuss numbers or planning with a client until this narrative is understood.”

To elicit the client’s money story, she explains that the coach needs to ask the right questions, and to explore the client’s beliefs about money. “A money belief is usually unconscious, yet it drives financial

behaviour. And although such beliefs can be destructive, people are often resistant to change.”

Consider this scenario: a young woman goes to a financial adviser for a second opinion on where to invest her hardearned savings. She has been holding down several jobs while studying. What does the adviser do? Offer further quotes? For Jacoby, the fact that the student is working multiple jobs and already has a quote from another financial adviser offers key insights into her money story. Her approach would be to use an assessment tool to confirm this, and then to take the young woman through a coaching process – if she is open to that – to help her to understand the reasons for her anxiety, lack of trust, and indecisiveness related to her finances, and to find a solution. “We would only reassess the investment decision after this process.”

Jacoby lists some of the behaviours that can arise from a disordered relationship with money: attachment to money, workaholism, hoarding, financial denial, gambling, enabling adult children, impulsive or compulsive buying, and financial infidelity. She comments that the last of these is highly prevalent: money is often at the root of conflict in marriages. However, she also points out that not all these issues are within the scope of a financial coach; for example, gambling is an addiction that needs to be treated by a qualified therapist.

“Once you understand your values, planning is no longer just a numbers exercise, and it becomes easier to set up a strategy,” says Crafford. “Often, we don’t need money to satisfy the things that are really important to us. We have been forced to be consumers, rather than citizens, but we get more joy by giving and sharing, than spending,” he adds. The coach can help you to align your financial goals with what you value.

Setting goals is not as simple as it may seem. People don’t really know what goals they want to save for, says Crafford, citing Mining for Goals: How Nudges Can Help Investors Discover More Meaningful Goals, a summary of research by US financial services company Morningstar. Their results suggest that “there’s indeed a gap between the goals investors initially think they want and the goals that are truly relevant and important to them”.

This report advocates guidance in setting goals because without it, “individuals often fail to identify as many as half of the goals that they later recognise to be central to their plans”. When the Morningstar master list of financial goals was used, people prioritised goals that were “more personalised, detailed, and emotionally grounded”.

In ordinary practice, says Crafford, financial planning does not usually go beyond death, disability, trauma, the children’s education, and retirement. “What about the other dreams you have?”

For Crafford, “the planner has the ability to see what the numbers say, but if they have developed coaching skills, they are able to stand back and listen to what the client is sharing. The client might not be able to articulate their story, or might not even be aware of it.”

He recounts an interview he heard, which illustrates his point. “A planner told the story of a client who wanted to buy an expensive yacht. Yes, he could afford it, but it would require a fair bit of sacrifice. His client mentioned that the most wonderful thing about being on a yacht was taking a sip of his whisky out on the deck as the sun went down. ‘But that’s a damn expensive whisky,’ the adviser said. This sparked a realisation for the client: ‘It's not really about the yacht; it's about sitting peacefully with my wife, watching the sun set over the sea and sipping the whisky. I could just rent a yacht to get that feeling!’”

There are other scenarios we need to plan for. “What happens if your child

finishes university and doesn't find a job? What about your mom who needs to go to the sick bay in the old age home but doesn't have the means to pay?” asks Crafford. “These kinds of scenarios will impact the best dreams you've got.”

There are certain competencies you need in order to manage your finances and a coach is the right person to help you learn these, says Crafford. For example, if you’re in debt, you might approach a financial adviser for help. However, he says the adviser might not be willing to assist if their remuneration is based on selling products. Another port of call might be a debt counsellor. Crafford does not see this as the best solution either. “If you go to a debt counsellor, you don’t take ownership of your debt. Instead, the coach can guide you through the process of getting out of debt: approaching creditors and renegotiating the terms. If you go through that process and engage with your money in a new way, you’ll achieve a sense of pride,” he says. “Before swiping your credit card in future, you’ll remember the painful process and think twice.”

One of the key competencies is budgeting. “Most people avoid budgeting like the plague,” says Jacoby. “So I don’t use the word ‘budget’ in my coaching, as the word itself brings about negative connotations. I reframe it more positively.”

Crafford offers some examples of how we might choose naming conventions that are in keeping with our values. He suggests that for people who love to save, a “prosperity plan” is a great substitute for the term “budget”, because you’re creating wealth for yourself. Big spenders might prefer the term “spending plan” even though it’s about putting guard rails around their spending. Crafford feels that the term “emergency fund” sounds as if we’re building up for something bad. He prefers the way behavioural economist

Dr Sarah Newcomb frames it in her book, Loaded: Money, Psychology, and How to Get Ahead without Leaving Your Values Behind, as a “freedom plan”. “Your freedom plan means that no matter what happens, you have the money to provide for it.”

“Conversations about money are emotional and difficult,” Jacoby says. “It is the one aspect of life that no one wants to talk about. But we need to get talking if we want a society that makes good financial decisions.”

Crafford gives some examples of awkward conversations that a financial coach could facilitate. Perhaps you need to have a discussion with your daughter

occurs. “Some clients know what they want, and don’t want the coaching element,” says Jacoby. And some clients just aren’t ready for coaching.

One of Jacoby’s prospective clients was a woman in her late fifties who lost her job because her company closed as a result of the pandemic. She did have a

‘unemployed’.” Jacoby realised that she wasn’t in a fit state of mind to deal with investing her money. “I had to understand her fears and insecurities and allow her the space to deal with this. When the time is ready, she will deal with her pension fund. Whether or not I will be the right fit for her as an adviser is her choice.”

my instinct is to rather ask, ‘Who’s a good financial adviser who works in this way?’ He advocates looking for financial advisers with the CFP designation, but with coaching skills over and above their technical financial skills.

As mentioned, certain issues – such as addictive behaviours – are outside

the ambit of the adviser and the coach. Crafford says a coach will understand when the client’s needs are beyond their scope, and is ethically obliged to refer them to a therapist.

In this market, South Africa is still very young in terms of financial coaching, although there are a few providers who do financial coach training for financial planners, Crafford says.

He mentions the four principal providers of coaching training: Rob Macdonald; Sharon Moller, at Old Mutual Wealth, who trains their financial planners in “integrated wealth planning”, which helps planners to have a coaching conversation; Mary J Fourie, founder of My Journey 2 Freedom, who trains financial professionals to be professional financial coaches; and himself.

Crafford’s coaching course – a 12-week standalone SAQA accredited NQF6 course – forms part of the UFS School for Financial Planning Law’s short-learning programme.

Crafford is also working on an 11-month course that he hopes will be rolled out later this year.

“Those who complete the course as well as 150 coaching hours will be able to become credentialled members of the Coaching and Mentoring Association of South Africa (Comensa).”

“Mary J, Sharon and I have started collaborating with Comensa,” says Crafford. “We run a special interest group for financial coaches, to set a common standard for financial coaching, and to share best practices.

About 45 financial planners are registered for our monthly conversation.”

Crafford says that at present, coaching is not governed by legislation, so you risk seeing someone who is not appropriately qualified.

Coaching will come to the fore Technology is disrupting the financial planning industry, and one facet of this is robo-advice, says Macdonald. “There’s going to come a point when clients bypass product salespeople. You’re going to say, ‘Hang on, I don’t need the broker or adviser. I can get this product directly, at a tenth of what I’m paying a broker.’” And it goes beyond disintermediation: the internet offers you the tools to do your own calculations, he says. “So now you don’t

need a financial planner to tell you how much you need to save for retirement.”

This begs the question of the future role of the financial adviser. “It becomes about what to do with the information. You need the adviser to help you make decisions about your life and your money.”

However, he notes that the bulk of the industry is still sales oriented. Again, Macdonald uses a medical analogy. “If a pharmaceutical company says, ‘We've got this great new antibiotic’ and you go to your doctor and say, ‘I want that antibiotic,’ your doctor won’t give it to you until he or she has checked whether you actually need it. The financial services industry needs to recognise that financial products are a means to an end, and you need to know what the end is before you decide which product is appropriate.”

He continues the analogy to make the point that the remuneration model for advisers should not be founded on commission from product sales. “It’s like saying I’m only going to pay my doctor if he prescribes medicine.” The remuneration system is critically important, says Macdonald.

• Mel Jacoby: For details about her course, “Your relationship and behaviour with money”, see https://hello.profileme.app/ meljacoby, and click on the “Our services” tab.

• Hendrik Crafford: https:// craffiescoaching.co.za

• Mary J Fourie, My Journey 2 Freedom: https://myjourney2freedom.com

Whether it’s an hourly fee or a retainer, it has to be separated from the product. If I'm not benefiting from product sales, then I will engage with you in the way that's best for you. We need a model where I act in your best interests rather than mine.

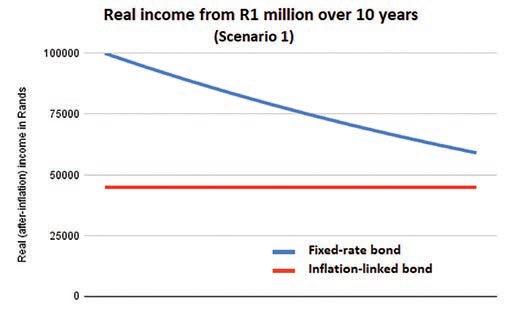

The government’s savings bonds for consumers offer an alternative to commercial products. Martin Hesse explores using them to provide an income in retirement.

RSA Retail Savings Bonds are attractive to people wanting to save, but they’re also an attractive proposition for retirees requiring a risk-free, steady retirement income from discretionary savings.

These bonds, issued by National Treasury and available to South Africa consumers, traditionally came in two types: those that have a fixed interest rate for the term of the bond, and inflation-linked bonds, which have a lower rate but in which the capital is adjusted by the inflation rate. (A third type, the top-up bond, has recently been added. See page 15.)

While the fixed-rate bonds can be used for saving or for income, as interest compounds over the term if reinvested, the inflation-linked bonds can only practically be used for income, because interest is paid out and therefore does not accumulate and compound.

The rates are competitive against comparable bank or money-market investments. Working on the February Consumer Price Index inflation (CPI) rate of 5.7% and on the bond rates as at April 2022:

• On a fixed-rate bond over five years (the maximum term), you get an annual return

of 10%, which is 4.3% above February CPI.

• On an inflation-linked bond over 10 years (the maximum term), you get an annual return of 4.5% in addition to your capital (and hence income) being adjusted twice a year for inflation.

On top of the attractive rates, there are zero fees. As on any investment, you pay income tax on interest, subject to exemptions and deductions applicable to you. We’ll return later to the tax aspects of using these bonds for income.

If you are investing a lump-sum for an

income, you need to weigh up which – the fixed-rate or the inflation-linked bond –will serve you better, and this will depend on several factors:

• For how long you intend to remain invested;

• Whether you want to preserve the real (after-inflation) value of your capital – so that it has the same buying power at the end of the term as when you invested it –or are willing to let your capital depreciate by inflation over the term in exchange for receiving a higher income initially; and

• Your view of inflation: do you expect it to remain contained within the government's 3-6% range, or to increase beyond 6%?

I compared a R1 million investment in the two products over 10 years under two inflation scenarios. To simplify the comparison I kept the rate for the fixedrate bond constant for the 10-year period, although you would need to re-invest after five years at what could be a different rate. My reasoning was that if inflation was the same after five years, the rate would probably remain the same, and if inflation was higher after five years, the rate would be higher, which would benefit you even more than I have calculated. Also, I adjusted capital for inflation only once a year, at the end of each year.

In this scenario inflation remains a constant 5.7% over the 10 years. (If fluctuations were minor, both up and down, then you could work on 5.7% being an average.)

a) Inflation-linked bond: At an interest rate of 4.5%, you would receive an income of R45 000 in the first year. This would

increase by the inflation rate each year, as would your capital, so that in year 10 you would receive R74 112 and your capital at the end of the year would be R1 740 804.

b) Fixed-interest bond: At an interest rate of 10% you would receive an income of R100 000 each year for 10 years. With inflation reducing the buying power of that amount, in the 10th year, your income would be worth R58 966 at today's rand value. However, the R100 000 you receive would still be higher than the R74 112 (R45 000 at today's rand value) you would receive in year 10 of the inflation-linked bond (see graph). But your capital would have depreciated by about 44% to R556 054 at today's rand value.

In this scenario, inflation rises by 0.5% a year so that in the 10th year it is 10%.

a) Inflation-linked bond: Again, you start with an income of R45 000 in the first year, rising by inflation so that you would receive R86 220 in the 10th year. Your capital would have increased to R2 107 594 by the end of the 10th year.

b) Fixed-interest bond: The R100 000 you receive each year would be ravaged by inflation, but in year 10 it will still be more than the R87 674 you receive from an inflation-linked bond (see graph). However, your capital would be severely depleted, having lost over 56% of its value – it would be worth R436 224 at today's rand value. In both inflation scenarios, over 10 years, your real (after-inflation) income from a fixed-rate bond at 10% will be higher than that from an inflation-linked bond at 4.5%. The cost will be the depleted value of your

capital. Over longer periods, however, the inflation-linked bond slowly gains the upper hand, while your capital retains its original buying power.

A feature of the fixed-rate bond is that, if interest rates rise, you have the option to “restart” your bond after a year at the new, higher rate. This can be highly advantageous in a rising-interest-rate environment, such as we’re looking at for the next few years. If, for example, you take out a five-year bond, currently offering 10%, and after a year, with rising inflation and correlated rising interest rates, the bond rate rises to 10.5%. You can restart your bond for a fresh five-year term at the 10.5% rate.

After doing the calculations, a tax-related question presented itself. Would there be capital gains tax (CGT) to pay on the capital gain (of R740 804 over 10 years in scenario 1 above) in the inflation-linked bond? Interest-bearing investments do not attract CGT, but you do pay income tax on interest earned. But what happens in this case, where you have a product on which you receive interest, and in addition your capital increases by the inflation rate? Do you pay CGT on the inflation-based gain? Or does SARS treat it as part of your interest earned?

Dale Cridlan, director at Norton Rose Fulbright Tax services, was very helpful in providing answers to these questions. The answer to the first one was an unequivocal “no”. You do not pay CGT on a

The answer to the second was “yes”: the gain is taxed as interest. Cridlan explains further: “An Inflation Linked RSA Retail Savings Bond is regarded as a ‘variable rate instrument’ for purposes of section 24J of the Income Tax Act. This means that any adjustments for inflation made to such bonds will be regarded as interest rather than capital gains in the bond holder’s hands. All interest earned on RSA Retail Savings Bonds will be subject to the provisions of the Income Tax Act that apply to interest. As a general rule, bond holders treat interest received as ordinary revenue for purposes of income tax. Bond holders who are natural persons may be entitled to the tax exemption of a portion of or all of the interest. The quantum of the tax exemption available will depend on the personal circumstances and age group of the bond holder.” Let’s try another example, simplifying things slightly by assuming capital is adjusted for inflation once a year instead of twice, according to the terms of the bonds. Also, I distinguish between “living income”, which is the income in rands you receive from the bond on which to live, and “interest income”, which refers to all your interest including the inflationrelated gain on your capital.

Say you are 65 years of age and put R5 million in the 10-year inflation-linked bond, offering 4.5%. In the first year you earn interest of 4.5% and your capital increases by inflation, at a rate of 5.7%. Your annual living income will be R225 000 and your capital will have increased by R285 000, totalling R510 000 in interest income. At age 65, you have an exemption of R34 500 (for under-65s the exemption is R23 800). So your taxable income before deductions, assuming no other sources of income, would be R475 500.

Compare this with the fixed-rate bond, which is offering 10% on the five-year product. Your interest in the first year (and

each subsequent year) would be R500 000. With the exemption of R34 500, this would bring your annual taxable income, before deductions, to R465 500. However, because your living income is more than double what you’d receive on an inflation-linked bond, the proportion of it going to SARS would be a lot lower.

Assuming no deductions (which is somewhat unrealistic, considering there are generous tax credits for pensioners on medical expenses), according to the 2022/23 income tax table, on an inflationlinked bond you would pay tax of R86 245, taking into account the primary and secondary rebates totalling R25 425. This would reduce your living income by

38%, from R225 000 to R138 755.

The fixed-rate bondholder would pay tax of R83 145 (after exemption and rebates) on his or her living income of R500 000, reducing it by 17%. But the buying power of the R5 million capital would decrease by 5.7%, or R285 000.

While the bonds, both fixed-rate and inflation-linked, offer attractive rates, tax on interest, which may be substantial, must be taken into account. It is therefore advisable to consider a wider array of income products with the help of an independent professional adviser/planner before making a decision.

National Treasury has added a third product to its RSA Retail Savings Bonds, the Top Up Bond. Unlike its existing Fixed Rate and Inflation Linked Bonds, which require a lump-sum deposit, the Top Up Bond allows investors to make deposits into the bond at any time during the term of the bond, which is three years.

The product, which was launched in April, is targeted at investors who want to save small amounts regularly, say once a month. The initial minimum deposit is R500 and subsequent deposits must be at least R100. The current interest rate on the threeyear bond is 8.75% a year, compounded.

Anyone with a valid South African ID number and bank account can start investing. Informal groups, such as social clubs and stokvels, are also eligible to invest.

You can register online, on the RSA Retail Savings Bond website. You will need to complete the registration form and provide a copy of your ID and proof of your bank account. You will be given a unique number, which you can then use via online banking or at your bank branch to deposit money into the bond.

The interest rate is fixed for the three-year term, and you are penalised if you want to access your money during the term. (You have to keep at least R500 in the bond.)

You may “roll over” your investment once the three years are up, for a further threeyear term at the new interest rate. Another feature is the Top Up Switch function, which allows you, at any time during the term of the bond, to switch a portion or the full amount in the Top Up Bond to either the Fixed or Inflation Linked RSA Retail Savings Bonds once the capital amount reaches a minimum of R1 000.

For more information regarding the RSA Retail Savings Top Up Bond or the other types of bonds, email queries@rsaretailbonds.gov.za or call the helpline on 012 315 5888.

While the government streamlines the financial-sector ombud framework, protection for consumers remains top of mind, writes Gareth Stokes.

The legislative enhancements being made to South Africa’s extensive network of financial-sector ombud schemes are largely cosmetic and should not affect the protections afforded by these bodies to consumers. Affected ombud schemes are taking a business-asusual approach to their customer-facing activities while legislative changes that alter funding mechanisms, oversight structures and reporting requirements play out in the background.

The need to tweak certain aspects of the country’s financial-sector ombud schemes environment traces back to early discussions on a suitable regulatory framework. As far back as 2014, National Treasury published a discussion document titled “Treating customers fairly in the financial sector: a draft market conduct policy framework for South Africa” in which it concluded that a strong consumer protection framework also required an effective, accessible and efficient alternative dispute resolution mechanism.

The Financial Sector Regulation (FSR) Act, which was eventually signed into law on 21 August 2017, set out the country’s transition to a twin-peaks model of financial sector regulation. For the uninformed, “twin peaks” introduced a Prudential Authority (PA) within the administration of the South African Reserve Bank to preside over banks, insurers, co-operative financial institutions, financial conglomerates and certain market infrastructures.

It also established a market conduct regulator, the Financial Sector Conduct Authority (FSCA), which replaced the Financial Services Board (FSB).

According to Treasury, the main motivation for the FSR Act was to create “a safer and fairer financial system that is able to serve all citizens”. As such, the Act entrenches treating customers fairly (TCF) principles into every aspect of the financial sector regulatory environment and introduces stronger supervision for

those bodies responsible for hearing and resolving consumer protection matters.

Chapter 14 of the Act gave effect to an Ombud Council, which was put in place from 1 November 2020 after multiple amendments to a commencement notice first published on 29 May 2020.

Some context is necessary to better understand how the FSR Act changes the country’s financial-sector ombud schemes landscape.

At the time the Act was enacted, South Africa had a mix of statutory and voluntary schemes. The FAIS Ombud and Pension Funds Adjudicator were statutory schemes brought about by their respective legislations, the Financial Advisory and Intermediary Services (FAIS) Act and Pension Funds Act respectively, whereas the Ombudsman for Banking Services, Credit Ombud, JSE Ombud and Ombudsmen for Long- and Short-term Insurance were voluntary, alternative dispute resolution mechanisms established by industry participants.

Statutory ombud schemes were governed by the Financial Services Ombud Schemes (FSOS) Act, which created an FSOS Council, while voluntary schemes were merely recognised by the FSOS Council in terms of the same Act.

According to Treasury, the low number of complaints received by both statutory and voluntary schemes relative to the number of financial transactions in their respective industries pointed to poor consumer awareness and/or poor access to the complaints resolution bodies.

There was also concern about gaps in coverage and jurisdictional inefficiencies; differences and inconsistencies in approach among the ombud schemes; disputes in the amounts that could be adjudicated on; and difficulties in measuring performance due to different governing structures and reporting periods.

In a nutshell, the FSR Act dealt with these concerns by creating consumer protection supervisory mechanisms through the establishment of the Ombud Council, and appointing a Chief Ombud to that structure. This structure, announced midway through 2021, is something the media immediately labelled a “super ombud”. In truth, the individual ombud schemes continue to exist; only their reporting structures and oversight channels change. The Ombud Council now operates as the regulator of both statutory and voluntary dispute resolution mechanisms, with authority to standardise best practices and promote and coordinate cooperation between them.

In announcing the change, Treasury said: “The objective of the Ombud Council is to assist in ensuring that financial customers have access to and are able to use affordable, effective, independent and fair alternative dispute resolution processes for complaints about financial institutions in relation to financial products, financial services and services provided by financial infrastructures”. Commenting around the same time, the FSCA noted that the Ombud Council “established a single point of entry into the ombud system, by clarifying the relationships between the ombud Council, the various ombud schemes, financial institutions and the FSCA”. In practice, consumers still approach the relevant financial sector ombud scheme for assistance.

In an article published on FAnews.co.za, 20 July 2021, this writer noted that all of the existing industry schemes would continue to be recognised while the council worked towards establishing consistent governance procedures and standards of practice. In other words, consumers should welcome the change as a sensible step towards simplifying and streamlining the submission to and resolution of complaints against financial services providers and product providers.

It was up to the then Minister of Finance, Tito Mboweni, to appoint the Ombud Council Board and Chief Ombud, which he did on 24 May 2021, announcing that Eileen Meyer would start an effective three-year term with a backdated start date of 1 November 2020.

This establishment and staffing of the Ombud Council will have little if any impact on consumers. All it means is that the various statutory and voluntary schemes are now accountable to an Ombud Council, with the chairperson of the council being the authority of final resort in all matters arising. The council is required to oversee the recognition, co-operation and promotion of public awareness of ombud schemes, as well as serving as the sole oversight authority of everything in the financial sector dispute resolution space.

One response worth noting is that the Ombudsman for Long-term and Shortterm Insurance took a proactive, costsaving decision early on in the process,

announcing a joint ombudsman to cover both industries from 1 January 2020. This, they said, was to heed Treasury’s calls for a self-rationalisation process for the country’s voluntary schemes.

“Against the backdrop of changes in the policy and insurance environment, the boards of both insurance ombudsman schemes made an in-principle decision to enter into a shared services agreement and have a single ombudsman for the adjudication of both short-term and long-term insurance complaints,” they wrote. Both offices remain in existence and continue to operate separately within their defined jurisdictions, but consumers benefit from a single port of entry for complaints.

Why

So, why operate a financial-sector ombud scheme in the first place? The primary objective remains to protect financial consumers from unfair treatment by more powerful financial services and

product providers. One can turn to the mission statements of various schemes for clarity. For example, the FAIS Ombud exists “to promote consumer protection and enhance the integrity of the financial services industry by the fair and expeditious resolution of complaints, informally and free of charge.” It considers and disposes of complaints by consumers against providers for advice-related shortcomings in terms of the FAIS Act and its accompanying rules.

The Ombudsman for Short-term Insurance, meanwhile, offers “the insuring public and the short-term industry with a free, efficient and fair dispute resolution mechanism through an alternative dispute resolution process, applying the law and principles of fairness and equity”. Consumers who run into unresolvable issues with a short-term insurer that supplied them with cover for buildings, household contents, motor, cell phone, travel or disability and credit protection insurance – as well as commercial covers

for small businesses and sole proprietors –can approach this office.

And the Ombudsman for Long-term Insurance “resolves disputes between complainants and insurers arising from long-term insurance policies”, with jurisdiction over complaints about longterm insurance products such as life insurance, funeral, long-term disability, credit life and health insurance policies.

These and other ombud schemes continue to function independently under the Ombud Council, with consumers advised to carefully consider which aspect of the financial services universe their complaint relates to before seeking redress.

South Africa’s ombud schemes also serve as a valuable feedback mechanism to assist regulators in identifying gaps in the regulatory framework or emerging risks. These gaps, according to the FSCA, become evident when reflecting on “undesirable practices or recurring poor outcomes identified directly or through external stakeholders such as ombudsman schemes or industry associations”. An example of this practice in action is that all FAIS Ombud determinations must be referred to the FSCA for further consideration, including whether any regulatory action needs to be taken.

The FSCA works closely with the various ombud schemes and holds frequent meetings with the Ombudsman for Banking Services and the Offices of the Long-term and Short-term Insurance Ombudsmen to “foster stronger relationships; create strategic alignment between the offices and to identify systemic and conduct risks”.

The shift to new regulation is not an overnight happenstance. For one thing, the Financial Services Ombud Schemes (FSOS) Act, which previously informed the approach to statutory Ombud schemes and oversaw voluntary schemes was repealed from 31 May 2021. All Ombud schemes recognised in terms of this Act were subsequently deemed recognised by the Ombud Council from that date until

November 2021, following which a renewal process had to be instituted. The council did, however, make a formal request that the FAIS Ombud continue addressing complaints as it had under the FSOS Act, prior to the Act’s repeal. Rising costs consequent to increased

enterprise in the form of a Corporation for Deposit Insurance. Questions were also raised about whether the bill conflated the issue of levies and taxation: tough issues both, best left for a separate platform.

How much will the financial services industry end up paying, and how much could consumers potentially pay for their “free” dispute resolution mechanisms in the future? According to Mark Bechard, managing editor at Moonstone, these bills will result in providers “paying significantly higher levies”. By his estimate, a soleperson financial services provider will pay 12.61% more in levies under the proposed bills, compared with the 2021 total, while a financial services company with a key individual and 10 representatives will pay about 30% more.

Bechard’s calculations support longstanding concerns that the introduction of a more formalised statutory structure for ombud schemes would result in a heavier compliance burden, the cost of which would end up being borne by industry stakeholders and inevitably passed on to consumers. That said, it will prove incredibly difficult to quantify the cost to end-consumers of higher-touch regulation in this space given that most ombud scheme complaint processes are offered free of charge.

compliance and supervision could be a concern for financial consumers. The FSCA already contributes to the funding of the FAIS Ombud, the Pension Fund Adjudicator and the Ombud Council, among others, but it seems the legislative process to amend chapter 16 of the FSR Act and formalise fee collections, industry levies and subsequent disbursements has hit a snag.

In December last year, National Treasury replaced the Financial Sector Levies and Financial Sector Levies (Administration) Bill, legislation that was proposed in 2020, with a new Draft Financial Sector and Deposit Insurance Levies Bill (and associated administration) Bill. The publication of these draft bills drew harsh criticism from some quarters, most notably for the decision to create yet another state-owned

Further fine-tuning of consumer complaints resolution is inevitable. In its 2020/21 Annual Report, the FSCA references a research project commissioned by the National Treasury through the World Bank. This project aims to assess the country’s financial sector ombud system. “The World Bank diagnostic report on the financial sector ombud system will make recommendations for improving the alternative dispute resolution system for financial customers; this contributes to a stronger customer protection framework and complements the work of the FSCA as conduct regulator of financial institutions,” noted the FSCA.

“The establishment of the Ombud Council to transform the financial sector comes with many advantages and expectations,” concluded the FSCA, at the time of its establishment.

“Not only will financial customers enjoy more customer-centric services and products from financial institutions, they will also get better protection from a dispute resolution process that is effective, independent, fair and timely.”

ow-cost cover for primary health care is quickly becoming an important component of the employee benefits package companies provide for their workers. For a number of reasons, this type of cover is proving popular among employers and employees alike.

Global financial services firm NMG, which operates a large employee benefits division in South Africa, has successfully incorporated low-cost primary health cover into the range of products and services it offers employers.

Gary Feldman, executive head of healthcare consulting at NMG Benefits, says the new products have largely replaced the old-style occupational health products, which use to cover employees only. “About 12 years ago, the demand became prevalent for cover for spouses and child dependants, and so there was a migration from the occupational health products to insurance-type products, most of which fall under a short-term insurance licence, with some elements falling under a long-term insurance licence,” he says.

Looking at the medical scheme environment, medical scheme membership has become unaffordable to a large percentage of the South African population, Feldman says. “In the last five or six years, we have seen a stagnation in the membership of medical schemes, and the number of schemes has declined, from 27 open schemes 12 years ago to 17 today.”

Under the so-called “demarcation regulations” implemented by the government in 2016, a clear distinction was drawn between what medical schemes cover and cover provided by health insurance products offered by insurance companies. Medical schemes by definition are required to cover the Prescribed Minimum Benefits (PMBs) – benefits relating to the treatment of specified life-threatening conditions and cover for emergency procedures – on all their options. Feldman says cover for the PMBs alone costs between R600 and R700 a month per beneficiary, pushing even the cheapest medical scheme options out of reach of employees earning less than the average salary in South Africa, which is about R15 000 a month.

While medical scheme cover is effective for covering “big-ticket” procedures in private hospitals, the health insurance products now being offered to lowerearning employees focus on primary health care: day-to-day access to general practitioners, opticians and dentists within designated networks of service providers, as well as covering prescribed medicines and blood tests. Because these products don’t cover the PMBs, and have no cover or limited cover for in-hospital procedures, they are affordable for lower earners (from about R700 for a family of four per month), particularly if their premiums are subsidised by the employer, Feldman says. Such employees would need to – and are generally happy to – rely on state facilities for serious conditions requiring hospitalisation, but their dayto-day medical needs are taken care of. The group risk setting offers advantages for employees over taking cover individually: risks are pooled and rates are lower. “The big advantage of doing it via an employer group – and we’ve seen huge growth in this space –

The benefits for employers are substantial, Feldman says. “If you have an employee who has to rely on state-run day clinics or hospitals for even minor ailments like a cold, it’s a day out of work. With primary health cover, the employee can make an appointment, see the doctor at a certain time, and ultimately be in and out within half an hour. They get their medication and are on the road to recovery, which helps productivity.”

Feldman recommends that those who can afford it should have medical aid cover because of the range of protections it offers. However, the primary health care products will fill an important gap in the market until the government’s National Health Insurance (NHI) system is finalised and implemented - and that day may be further away than anticipated because of the many challenges it poses.

“The fact is that, until a genuine NHI framework is eventually introduced, which is not likely to happen soon, all employers and the broader medical aid industry have a role to play in protecting working South Africans from the financial consequences of unexpected health events. This brings a challenge for many employers, who must try and cut through the confusion and identify the most appropriate products for their staff,” he says.

Employers and employees introduced to these products for the first time need education and guidance regarding their benefits, processes and procedures.

“It’s vital for employers to work with specialists to identify the most suitable products on the market for their employees, and to educate their employees on the exact benefits of each product. These specialists are often able to negotiate reductions in premiums, compared with what the employees would

pay as individuals, and employers can generally facilitate payment via payroll deduction,” Feldman says.

NMG offers just such a specialised service, with a range of educational interventions and tools for employers and employees, including on-site or virtual member sessions, letters, posters, and frequently-asked-question (FAQ) brochures.

According to Feldman, factors making NMG a leader in this space and in healthcare consulting in general include its:

• Independence;

• Actuarial analytical capabilities;

• Solid relationships it has with providers in the industry;

• Product analysis, comparing price, benefit and underwriting concessions;

• Ongoing consultations at a strategic, operational and member level; and

• Individual, personalised member support.

In January, for the second year in succession, Ninety One won the coveted Raging Bull Award for South African Manager of the Year. Martin Hesse reports.

Asset manager Ninety One attributes its Raging Bull Award for the South African Manager of the Year to the global nature of its highly experienced investment team.

For the second year in a row, the company was crowned South African Manager of the Year at the annual Raging Bull Awards,

for the superior performance of their unit trust funds to the end of 2021. In second place was last year’s runner-up, Cape Town boutique asset manager Mi-Plan, and third was Coronation Fund Managers.

investment arm of the Standard Bank group.

The awards, hosted by Personal Finance and Business Report, were sponsored this year by the JSE, Sanlam Investments, and Melville Douglas. The data suppliers were

Fund Ratings.

As a result of the ongoing restrictions around the Covid-19 pandemic, instead

of the traditional gala dinner, which had become an annual highlight for the investment industry, this year’s ceremony, as last year, took the form of a video presentation, which can be viewed on the IOL News Youtube channel.

Apart from the Manager of the Year awards, eight Raging Bull Awards and 30 page 24).

Ninety One is one of the most wellestablished asset management companies in South Africa, with a highly experienced investment team that has a presence in major centres across the globe.

The company changed its name at the beginning of 2020, from Investec Asset Management to Ninety One, when it separated from Investec Bank. It has received many accolades at the Raging Bull Awards over the years.

In an interview with Personal Finance, Sangeeth Sewnath, deputy managing director at Ninety One, said winning the award for a second time in a row in the two years since the company’s demerger was

Investec Asset Management. “We’ve spent a lot of time explaining to our clients that despite the demerger and the listing, what we do hasn’t changed, the people that they deal with haven’t changed, and I think this award emphasises and reinforces what we’ve been saying for the last two years,” Sewnath said.

When asked the reasons behind Ninety One’s performance over and above the performance of the markets (what is known in the industry as “alpha”), Sewnath pointed to the global nature of the company’s substantial investment team. “We have over 250 investment professionals in our business, and more than two thirds of those people sit outside of South Africa – Hong Kong, London, New York, Singapore – and we think that has done two really important things for us: it has allowed us to become better money managers and it has allowed us to win this war on talent in the industry, because not only are people focused on

SA-particular investments or stocks, but they have a far broader universe on which to focus on, and we’ve managed to attract and train a lot of talent on the back of this globally integrated business.”

Sewnath said that while the Raging Bull years, it was a source of pride that over 20 and 30 years, the company’s track record was “absolutely stellar”. Take, for example,

One Opportunity Fund: over 20 years it has delivered an annualised return of 13.92%,

The winning South African manager scored an average 4.24 PlexCrowns over its 18 qualifying funds, which collectively had R222.8 billion under management at the end of last year Four funds scored average four PlexCrowns, and four scored funds were the Ninety One Equity Fund and the manager’s three South African multiasset funds: the Cautious Managed Fund, Managed Fund and Opportunity Fund.

PlexCrowns over its eight qualifying funds, which collectively had R9.25 billion under management at the end of last year. Two funds, the Mi-Plan IP Global Macro Fund and the Mi-Plan IP Enhanced Income Fund, three PlexCrowns.

Mike Laws, the managing director of Melville Douglas, was thrilled to hear of his company’s award. “This win means the world to the Melville Douglas team. The Raging Bull Awards have always been regarded as the top recognition for the unit trust industry in South Africa. Winning the

for 2021 award validates the work our team does in providing clients with long-term returns without putting capital at undue risk.

“As a private client asset manager, we look tends to be short-term in nature Instead, we focus on a much longer timeframe, where volatility and ensuring no permanent loss of capital are more important to our clients.

year risk-adjusted returns across our global fund range, vindicates that what we promise our clients has been delivered: superior, riskadjusted long-term returns,” Laws said.

After a four-year absence, Coronation Fund Managers are back in the top three. The second runner-up scored an average 3.51 PlexCrowns over its 19 qualifying funds, which had assets under management of R316.78 billion at the end of last year. Two funds, the Coronation Equity Fund and the Coronation Smaller Companies Fund, scored average four PlexCrowns, and there were seven funds with three PlexCrowns.

the Year had three qualifying funds that it markets to South African investors, and they scored an average of four PlexCrowns. Two funds, the Melville Douglas Global Growth Fund (USD) and the Melville Douglas Income

MANAGER OF THE YEAR AWARDS

South African Manager of the Year (Raging Bull Trophy)

Ninety One

South African Manager of the Year – 2nd Place (certificate)

MI-PLAN

South African Manager of the Year – 3rd Place (certificate)

Coronation Fund Managers

Offshore Manager of the Year (Raging Bull Trophy)

Melville Douglas

AWARDS FOR STRAIGHT PERFORMANCE OVER THREE YEARS

Best South African Equity

General Fund

Counterpoint SCI Value Fund

Best South African Interest-Bearing Fund

Absa Bond Fund

Best (SA-Domiciled) Global Equity General Fund

Sygnia FAANG Plus Equity Fund

Best (FSCA-Approved) Offshore Global Equity Fund

Baillie Gifford Worldwide Long Term Global Growth Fund

AWARDS FOR RISK-ADJUSTED PERFORMANCE OVER FIVE YEARS

Best South African Equity General Fund on a Risk-Adjusted Basis

Counterpoint SCI Value Fund

Best South African Multi-Asset Equity Fund on a Risk-Adjusted

Basis

Gryphon Prudential Fund

Best South African Multi-Asset Flexible Fund on a Risk-Adjusted

Basis

Bateleur Flexible Prescient Fund

Best (FSCA-Approved) Offshore Global Asset Allocation Fund on a Risk-Adjusted Basis

Sarasin IE Multi Asset Strategic Fund

CERTIFICATES FOR STRAIGHT PERFORMANCE OVER THREE YEARS

DOMESTIC FUNDS

Best South African Equity Resources Fund

Sanlam Investment Management

Resources Fund

Best South African Equity Midand Small-Cap Fund

Coronation Smaller Companies Fund

Best South African Multi-Asset Flexible Fund

Centaur BCI Flexible Fund

Best South African Multi-Asset Low Equity Fund

Absa Smart Alpha Defensive Fund

Best South African Multi-Asset Medium Equity Fund

Southern Charter BCI Balanced Fund of Funds

Best South African Multi-Asset High Equity Fund

Emperor IP Balanced Fund

Best South African Multi-Asset Income Fund

Saffron SCI Active Bond Fund

Best South African Interest-Bearing ShortTerm Fund

Truffle SCI Income Plus Fund

Best South African Interest-Bearing Variable-Term Fund

Absa Bond Fund

Best South African Real Estate Fund

Harvard House BCI Property Fund

SA-DOMICILED GLOBAL AND WORLDWIDE FUNDS

Best (SA-Domiciled) Global Multi-Asset Flexible Fund

Global IP Opportunity Fund

Best (SA-Domiciled) Worldwide MultiAsset Flexible Fund

Naviga BCI Worldwide Flexible Fund

OFFSHORE FUNDS

Best (FSCA-Approved) Offshore Europe Equity General Fund

STANLIB European Equity Fund

Best (FSCA-Approved) Offshore United States Equity General Fund

Franklin US Opportunities Fund

Best (FSCA-Approved) Offshore Far East

Equity General Fund

Schroder International Selection Fund All China

Best (FSCA-Approved) Offshore Global Fixed-interest Bond Fund

Allan Gray Africa Bond Fund

Best (FSCA-Approved) Offshore Global Real Estate General Fund

Reitway Enhanced Global Property Fund

DOMESTIC FUNDS

Best South African Multi-Asset Low Equity Fund on a Risk-Adjusted Basis

Amplify SCI Wealth Protector Fund

Best South African Multi-Asset Medium Equity Fund on a RiskAdjusted Basis

Southern Charter BCI Balanced Fund of Funds

Best South African Multi-Asset High Equity Fund on a Risk-Adjusted Basis

Gryphon Prudential Fund

Best South African Multi-Asset Income Fund on a Risk-Adjusted Basis

Sasfin BCI Flexible Income Fund

Best South African Interest-Bearing Short-Term Fund on a Risk-Adjusted Basis

PSG Income Fund

Best South African Interest-Bearing Variable-Term Fund on a RiskAdjusted Basis Absa Bond Fund

Best South African Real Estate Fund on a Risk-Adjusted Basis

Harvard House BCI Property Fund

SA-DOMICILED GLOBAL AND WORLDWIDE FUNDS

Best (SA-Domiciled) Global Equity General Fund on a Risk-Adjusted Basis

BlueAlpha BCI Global Equity Fund

Best (SA-Domiciled) Global MultiAsset Low Equity Fund on a RiskAdjusted Basis

M&G Global Inflation Plus Feeder Fund

Best (SA-Domiciled) Global MultiAsset High Equity Fund on a RiskAdjusted Basis

STANLIB Global Balanced Feeder Fund

Best (SA-Domiciled) Global MultiAsset Flexible Fund on a RiskAdjusted Basis

MI-PLAN IP Global Macro Fund

Best (SA-Domiciled) Global Real Estate Fund on a Risk-Adjusted Basis

Reitway BCI Global Property Feeder Fund

Best (SA-Domiciled) Worldwide Multi-Asset Flexible Fund on a RiskAdjusted Basis

Select BCI Worldwide Flexible Fund

(for results to December 31, 2021)

Trends in online education and telecommuting are changing how we study, where we work and when we retire,

writes Eugene Yiga

writes Eugene Yiga

from

sunny Spain.Once upon a time, things were simple. You’d finish school, go to university, get a degree, find a job, and spend 40 years with the same company until you retired with a gold watch and pension for life. But those days are gone. Indeed, even before the pandemic turned the world upside down, several trends were shaking up the professional world.

Nowadays, it’s rare for a person to stay with the same job for life. In fact, according to the Labour Market Dynamics Report from Statistics South Africa, the median job tenure (how long the typical employee sticks around) is just four years and two months. This number could go down further in light of what’s been called the Great Resignation, a trend that’s seen many people quit their jobs.

The pandemic has also turned remote work from what used to be a luxury for the few into a norm that nobody wants to give up. Sure, there are benefits to working with colleagues face-to-face, but surveys show that people would rather be out of the office permanently or have a hybrid approach that lets them show up in person one or two days a week.

This freedom to work from anywhere means that people are no longer tied to the city or country their employer is in. As long as they’re in more or less the same time zone and have reliable internet access, they can move to a much cheaper location, thereby stretching their salary further. Combine this with the trend for short tenure and the result is people who work at a company for a few years, take some time off to travel to a new location, and then start a new job from somewhere else.

Another option for these “gap years” between jobs is to go back to school to develop new skills. Again, this is a trend that existed before the pandemic, simply because it’s unrealistic to assume

that what you learn in university will be enough for the rest of your career. Maybe it’s different if you’re in specialised field such as plumbing or dentistry, but just about every other industry is constantly changing. This means that the only way to stay relevant is to keep refreshing what you know.

Of course, most education used to happen in person until remote learning, like remote work, became something of a norm. And while there’s an obvious benefit of being among peers (especially for kids), the freedom to study through online platforms means that we now have access to resources that previous generations could only dream of. This, combined with the fact that you can get a certification in just a few months, means that people can sprinkle these learning experiences throughout their careers.

Obviously this wouldn’t apply to fields like medicine or engineering, where it’s best to finish one’s studies in full before bridges fall down or people die. But for “softer” fields it could work well. In other words, instead of insisting that teenagers commit to four or more years of studying when they’re unlikely to know what they want from their lives, they could start by spending one year studying an area they’re curious about. Then they’d go to work for a few years, quit their jobs, and then study something that either builds on what they were doing (if they liked it) or else change track completely (if they didn’t). They’d keep repeating this cycle until it was time to retire.

Of course, the idea of retirement is changing too. Most people still think of it as something you have to wait for until you’re in your sixties or seventies when you’ll (hopefully) have enough money to sustain you for the last few decades of your life. And yet there’s also the risk that you’ll have all the financial resources to live out your dreams but won’t be physically capable of doing so. Indeed, it’s exciting to see how the trends in remote work and remote

education are also driving the idea of “mini-retirements”. This is a concept Tim Ferriss talked about in his book The 4-Hour Workweek. His suggestion was that instead of waiting until you’re old, you should schedule time off (at least six months but up to a few years) throughout your life so that you can travel and do all the things people typically save for their golden years. Combine this with the previous suggestions and the pattern would be to study for a bit, work for a bit, and then retire for a bit. Rinse and repeat as often as you’d like.

All this flexibility to work, study, and live anywhere in the world is something I’ve seen in my own life, even though I haven’t fully recognised it until now. At first, I was set to go down a traditional path. I finished high school and did a four-year degree in finance (plus a oneyear post-grad in accounting) because it felt like a sensible decision at the time. But the fact that I was good at it wasn’t enough, which is why I ended up working in market research for a few years before quitting, taking a few months off, and then becoming a fulltime writer.

But as time went on and freelancing got tougher, I knew it was time to make a change. That’s why, during those dark days of lockdown two years ago, I consulted with a career coach and, after a series of tests, decided to pursue a career in data science. I spent a year completing dozens of courses in Python programming and data analysis, all through Coursera.org. This led to me being accepted into a fully online Master of Applied Data Science programme from the University of Michigan, which I’ll be doing while living in Spain (see sidebar).

All in all, it just goes to show that your life needn’t be the kind of restrictive or standard path that prevents you from doing what you love. If anything, there’s never been a better time to start crafting it the way you want.

When the pandemic caused tourism to crash, many countries realised they had to change their approach. To boost their revenues, they started promoting longterm visas for the millions of people who were now able to work remotely. In fact, even though South African passport holders aren’t able to travel with as much freedom as they would like, several countries offer remote work visas, including Barbados, Bermuda, Costa Rica, Croatia, Czech Republic, Dubai, Estonia, France, Georgia, Germany, Greece, Iceland, Malta, Mauritius, Mexico, Norway, Portugal, and Spain.

Given that I’d be studying online, I realised that I might as well do so from a new part of the world, never mind how much I’ve grown attached to Cape Town over the last 18 years. But since I wasn’t up for cold northern European winters nor did I want to be in a country where the language and culture were a complete mystery, I settled on Spain. (I’ve been learning Spanish on an off ever since I travelled to Argentina and Colombia back in 2010.)

At the time of writing, Spain has yet to start their remote work visa. That’s why I applied for what’s called a non-lucrative visa. These are essentially designed for people who want to retire in the country for a year (after which the visa can be renewed for a further two years) provided they have the financial means to support themselves and any family members who are coming along for the ride.

Beyond proving that you have the money (for example, through bank statements and income tax returns) you’ll also have to get a medical certificate to prove that you’re in good health, a police clearance certificate to prove that you’re not wanted for any crimes, and be in the possession of a valid passport. In some but not all cases, these documents need to be translated into

Spanish by an official translator, include originals and copies, and be accompanied by an apostille certificate to prove that they’re real.

Who should you contact?

Unless you have a particular fondness for filling out forms and navigating complex bureaucracy, I don’t recommend that you do this yourself. Indeed, reading the first sentence in the requirements – “applicants for a non-lucrative national residence visa should not find themselves in the period of commitment of no return to Spain, due to the voluntary return to their country of origin at a previous time” – left me so befuddled that it was clear I needed help. Thank goodness I came across a company called Jobbatical, which I first learned about after watching a TED

Talk by the company’s founder and CEO Karoli Hindriks about why the passport needs an upgrade. And so, after a Zoom consultation, I hired them to complete all the paperwork for me. I just had to upload some information to their online platform and they took care of the rest. (They’ve agreed to offer free consultations for Personal Finance readers. Email joona@ jobbatical.com and sebastian@jobbatical. com with “Personal Finance Magazine consultation” in the subject line.)

When should you apply?

I started the application process six months before I planned to leave just to factor in the inevitable delays. That turned out to be a good idea! Getting my police clearance certificate took a month (and no longer includes free couriering; that’s now for

your own expense). Then, even though I’d couriered the forms to Pretoria and had the certificate couriered back to Cape Town, I had to courier it back to Pretoria again to get the apostille certificate.