FOR ALL

THE BUSINESS INTERRUPTION SAGA

COVID-19 AND THE PROPERTY MARKET INVESTING IN COMMODITIES

TRACK YOUR FORTUNE WITH OUR DATABANK WWW .PERSFIN.CO.ZA

For more information call 0800 600 168, email assetmanagement@psg.co.za or visit www.psg.co.za PUBLICISMACHINE 17966MMS/E Seeing the bigger picture tells the full story. We never stop pursuing your future success. Affiliates of the PSG Konsult Group are authorised financial services providers. Wealth Asset Management Insure

COVER STORY

Free education? It’s here!

The internet is providing boundless learning opportunities for anyone with a smartphone 9

REGULARS

14 A n end to innocence: the business interruption saga Insurers caught off guard by pandemic and ensuing lockdowns.

19 Real estate gets real – how the pandemic is changing the property market

“New normal” dawns for residential and commercial property.

24

ow Covid-19

The journey from ostrich shells to Bitcoin. 30

33 Taxpayers ‘shouldn’t be bullied’ Recourse when SARS oversteps the mark.

36 T he future of fi nancial advice

New-generation advisers thrive under lockdown

38 A p assion for resolving disputes

The CEO of the Ombudsman for ShortTerm Insurance.

40 Beneficiary funds explained The Fidentia scandal’s positive legacy.

44 S etting up a business in the UK

Get your paperwork in order.

48 W hen dog-bite cases go to court

Owners rarely get sympathy from judges.

50 L ooping the loop

Relaxing regulation of loop structures.

4 Upfront Lockdown

8

DATABANK

55 A list of the adjudicators and the ombuds who can assist you with your complaints, followed by the unit trust quarterly results, tax rates and annuity rates

FEATURES

H

has boosted illicit trade Consumers bear the costs of a rise in smuggling. 26 I nvesting in commodities What are they and how can you invest in them? 28 T he evolution of money

The

new world of crypto

From far-out fad to fact of life

Your letters Readers’ queries answered by experts

47 Millenial View Let what you value lead the way

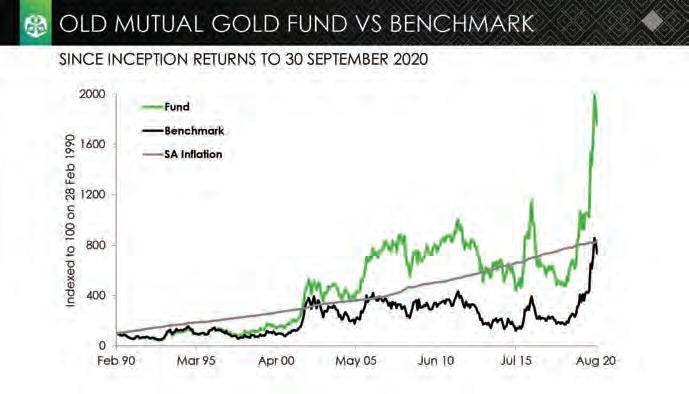

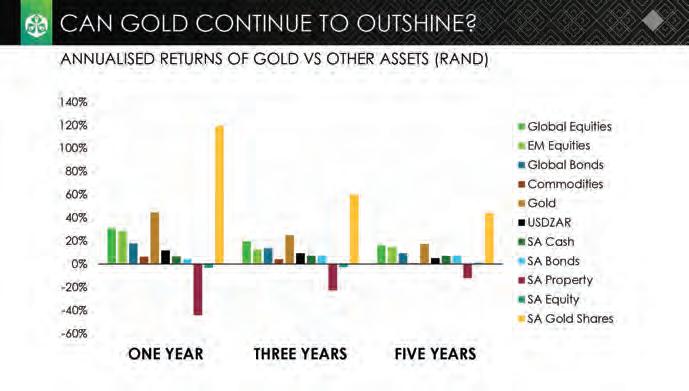

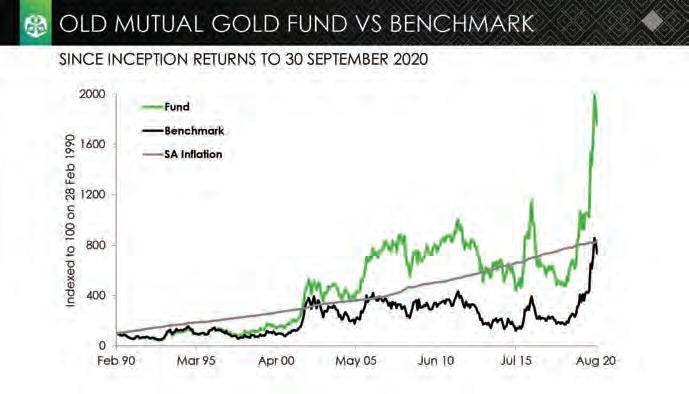

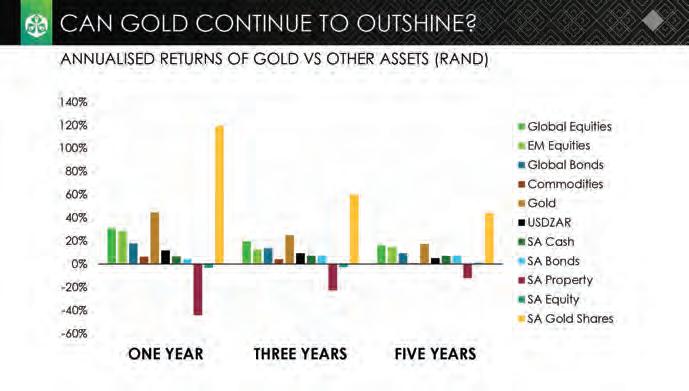

52 Fund focus The Old Mutual Gold Fund 54 O n the contrary Rebuilding wealth after a crisis

MARTIN HESSE

COVID AS CATALYST

While I wouldn’t wish another 2020 on my worst enemy, there have been some positive aspects to the pandemic. Commentators in various fields refer to how the lockdowns acted as a catalyst in accelerating trends, largely driven by technology, that had begun well before Covid-19. Two in particular come to mind: the shift to e-commerce and the work-from-home phenomenon.

These shifts precipitated fundamental change in the commercial and residential property markets, although other factors, such as the lowering of interest rates, also played a role. The commercial property sector – particularly office and retail space – suffered a huge knock and is now searching for ways to reinvent itself. On the other hand, residential property in soughtafter areas boomed once the restrictions on estate agents were eased. Alan Duggan explores these trends in his thoroughlyresearched article on page 17.

A huge but massively under-reported and under-appreciated trend in the past decade or so has been the growth of online learning. Here too the pandemic has provided a welcome boost. For thousands of people with access to the internet, completing a course online was a productive way of spending time during lockdown. Anna Rich’s story on page 7 emphasises how easy and affordable it is to better yourself, no matter how humble your background and no matter how old you are.

So much for the positives. One of the darkest stories to come out of the pandemic is the collective legal battle hundreds of small businesses in many different countries are having with their insurers on claims for business interruption cover. In a sea of inflamed passions, specialist insurance writer Gareth Stokes takes a cool, objective and balanced view of the saga – on page 12. Also in this issue: learn about commodities, crypto, beneficiary funds and the financial implications of dog bites. Oh, and there’s the amazing performance of the Old Mutual Gold Fund.

Enjoy the read.

VOLUME 85

4th QUARTER 2020

An Independent Media (Pty) Ltd publication

Editor

ANA Publishing CEO

ANA Publishing CFO

Production Manager

Head of Design Designer Office Manager Imagery

Martin Hesse martin.hesse@inl.co.za

Vasantha Angamuthu Sooren Ramdenee Mugamad Jacobs

Matthew Naudé Rowan Abrahams Caryn Wessels Shutterstock, Freepik.com

INDEPENDENT MEDIA BOARD OF DIRECTORS

Dr. Mohammed Iqbal Survé, Takudzwa T. Hove, Aziza B. Amod, Ismet Amod, Yuexing Wang, Jinghua Dong

PRODUCTION CONSULTANTS

African News Agency (ANA) Publishing

PRINTING

Novus Holdings

DISTRIBUTION

Allied Publishing Ltd / Media Support

ADVERTISING

Daniel Kgaladi

Email: daniel.kgaladi@inl.co.za

SUBSCRIPTIONS

Caryn Wessels

Email: caryn.wessels@inl.co.za

EDITORIAL INQUIRIES

Tel: 021 488 4187

Physical address:

Fourth floor, Newspaper House, 122 St George’s Mall, Cape Town, 8001 Postal address: PO Box 56, Cape Town, 8000

Personal Finance magazine (ISSN 1562-3750) is published by the proprietors, Independent Media (Pty) Ltd, Star Building, 47 Sauer Street, Johannesburg, 2001

All products appearing in Personal Finance are available and all prices are correct at time of print, subject to change.

EMERGENCY ADVICE IN A TIME OF CRISIS

Secure Your Retirement – How to Beat the Effects of Corruption, Ratings Downgrades and a Global Pandemic

Authors: Bruce Cameron and Wouter Fourie

Authors: Bruce Cameron and Wouter Fourie

Publisher: Zebra Press (Penguin Random House)

Price: R190

This book came out in a hurry, with good reason. Apart from the devastating health crisis, South Africans are facing an economic crisis of unprecedented proportions – unprecedented at least in the post-1994 era. Most people are extremely worried about their financial security, which is inextricably linked with the future of the country. While young people starting out in their careers are flexible and adaptable, and have fewer commitments that may tie them to a specific job or place, older people who are coming to the end of their careers or already in retirement have far fewer options, with little choice but to face the storm.

And it has been a perfect storm. Unlike in 2008 when, with a relatively robust economy, we were able to withstand the shocks of the global financial crisis, the pandemic hit us this year like a kick to the stomach of someone already down, our economy and institutions pummeled by a decade of state plunder.

The book is based on a series of columns Bruce Cameron wrote for The Daily Maverick. It follows on from his and Wouter Fourie’s best-selling. The Ultimate Guide to Retirement in South Africa (also Zebra Press).

“I decided to write the columns when I saw how pensioners were panicking in the wake of the Covid-19 pandemic and nine years of the Zuma regime,” Cameron

writes in the upfront acknowledgements section. “I was so concerned about the situation in South Africa that I offered to write the columns for free. I thought at the time there would be about three of them. In the end, the project grew into 20 columns.”

Secure Your Retirement unpacks the challenges facing older South African investors, which are not likely to dissipate any time soon. As Cameron points out: “Normally one would say to most investors, including pensioners, ‘Wait it out’. Unfortunately, you cannot wait for the crisis to pass this time around. The future is going to be different, but we still don’t know how different it will be…”

The book provides guidance on selecting pension products (you have a choice of a living annuity, a life, or guaranteed, annuity and a hybrid product) for those who haven’t done so, or who are still able to change. It looks at drawdown strategies for living annuity pensioners in order to avoid or delay for as long as possible that financial point of no return when you reach the maximum annual drawdown of 17.5 percent. It gives advice for women, who are particularly at risk, and it deals with the rising costs of health care and the increasing threat of dementia.

Cameron, founder of Personal Finance and founding editor of this magazine, is now semi-retired. Fourie heads up the financial planning practice Ascor Independent Wealth Managers in Pretoria and was the Financial Planning Institute’s Financial Planner of the Year for 2015/16. Their work is based on research by the country’s largest pension fund administrator, Alexander Forbes, as well as life companies Just SA and Sanlam – Martin Hesse

YOUR LETTERS

WORKERS’ RETIREMENT FUND CONTRIBUTIONS

I run a small business and many of my employees are asking if they can opt out of contributing to our company’s group retirement annuity (RA) fund in favour of more money in their pockets. I can continue the company contributions, but how do I emphasise why it’s important to keep their contributions in place too?

Name withheld

Jac de Wet, a financial adviser from PSG Wealth Somerset West Mall, responds: This is understandable given the tough economy, but it is best to encourage continued contributions. Most insurers or investment platforms offering group RAs do not have the same rules as pension funds, for example. It will also depend on the wording in your employment contracts, but generally RA contributions are voluntary, and it is ultimately your decision to contribute on your employees’ behalf.

While the rules of most funds allow an employer to terminate or pause its participation in the fund, and thus the payment of contributions to it, on written notice to the fund, please first get clarification from the fund administrators if you are allowed to make any changes.

Your employees also need to understand that they currently enjoy a tax deduction because of their retirement contributions and if they opt to receive these as a salary increase instead, this may result in them falling into a higher tax bracket, which would mean that they would effectively be paying more tax.

The long-term benefits of regularly contributing as much as possible to retirement funds cannot be emphasised enough. Not only do employees compromise the compounded return they could get if they cease contributions, but they also forgo the opportunity to put themselves in the best possible position to be financially free later in life. I’d encourage you to present what a change would look like, compared with staying invested. Consulting a financial adviser to assist for an accurate comparison would also help.

CASH PORTION OF RETIREMENT PAYOUT

I’m retiring from my company’s pension fund soon and would like to reinvest the cash portion I will be paid out. Is it a better idea to include it

with the rest of my retirement savings to buy into a living or life annuity, or should I look at something else? Ideally, I’d like to access the money (and hopefully good profits) in 5-10 years, and I am relatively healthy.

Name withheld

Pierre Puren, a financial adviser from PSG

Jeffrey’s Bay, responds:

Given your needs, as provided, it would be wise to opt for a withdrawal equal to the portion needed to address your liquidity needs postretirement. Keep in mind that you are granted the opportunity to access up to one third in cash of your pension fund, but that any amount over R500 000 will be subject to a once-off tax deduction as per the retirement tax tables.

Once an annuity has been purchased (life- or living) no further lump sum withdrawals are permitted. In the case of a living annuity, you will have the opportunity to amend your chosen income annually to an amount no less than 2.5 percent or more than 17.5 percent of your c apital value, by means of monthly, quarterly, bi-annual or annual payment.

Working closely with a financial adviser will help to ensure all considerations are included in your decision.

COVER WHEN WORKING FROM HOME

I am an administration worker in a large company and have been able to work from home during the Covid-19 lockdown, using my own desktop computer.

Once the lockdown is over, my company will let me work from home three days a week on a permanent basis. How will this affect my household contents and building cover?

Name withheld

Luzanne Wait, an insurance adviser from PSG Jeffrey’s Bay, responds:

The computer would still be covered under household contents. This will not influence your household goods and building insurance. Please note that the personal liability section of your policy excludes any work-related incidents, if, for instance, a client visits you at home.

It is, however, best to check with your own insurer, as not all policies are the same and the cover may differ. Also be aware that there might be a higher risk of cyber-crime at home, so make sure your device security is up to date.

4

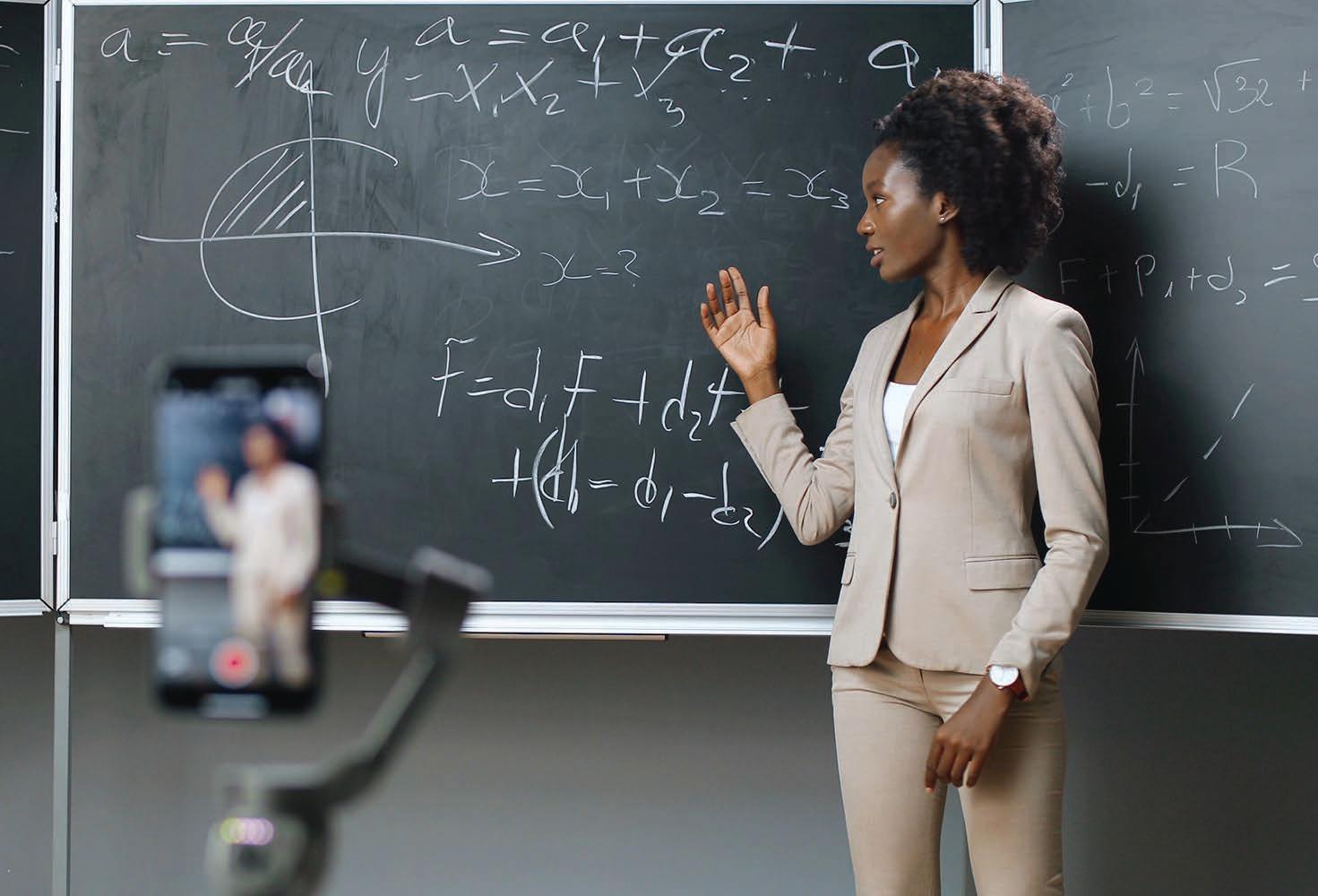

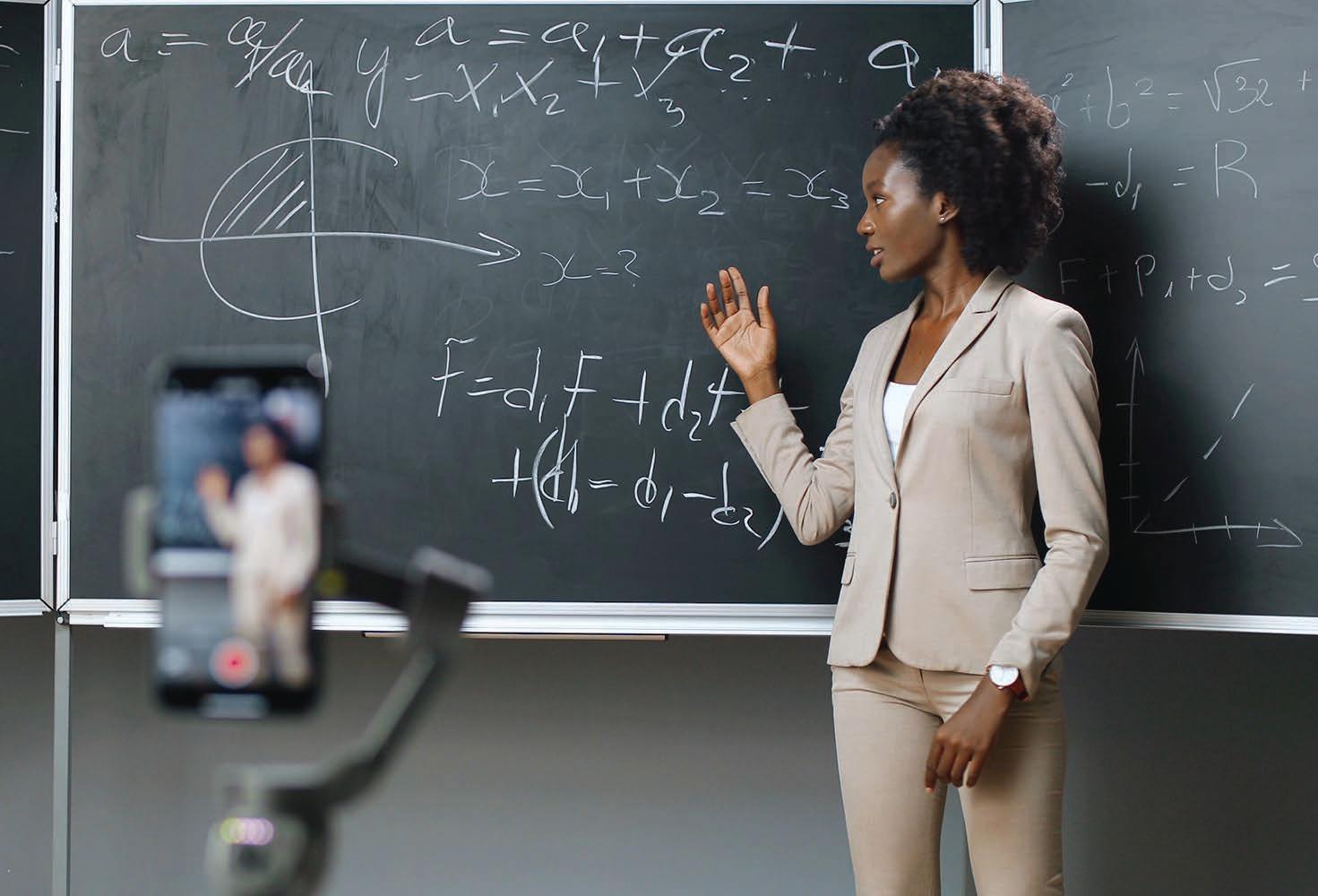

FREE EDUCATION? IT’S HERE!

While quality varies, the number of courses you can access online has risen exponentially in recent years, providing boundless learning opportunities for anyone with a smartphone. Anna Rich explored the free-education phenomenon.

The doors to learning have been opened, thanks to the internet.

Thousands of online courses are at your fingertips, and it would be wise to start using them.

Let’s take a quick temperature check of the global job market back in January 2018. A World Economic Forum (WEF) report, “Towards a Reskilling Revolution: A Future of Jobs for All”, pointed out some

intensifying trends:

• Our skill sets don’t match those we need to do our jobs, said one in four survey participants in OECD (Organisation for Economic Co-operation and Development) countries.

• Even if we have a good job, technological changes threaten to make our skills outdated at best, and irrelevant at worst.

The Covid-19 pandemic has turned up the heat, causing massive job losses, and accelerating our reliance on technology. But even before Covid-19 set in here, Stats SA’s labour force survey for the first quarter of 2020 showed that unemployment numbers increased to 7.1 million, and almost two-thirds of this group are aged 15 to 34.

The antidote? Though graduate

9 PERSONAL FINANCE | 4 TH QUARTER 2020

people’s prospects in the labour market, commented Stats SA.

But we shouldn’t stop once we’ve graduated. “Individual workers will have to engage in life-long learning if they are to remain not just employable but are to achieve fulfilling and rewarding careers,” WEF founder Klaus Schwab wrote in the jobs report.

Enter the Moocs phenomenon

It’s barely 30 years since the early days of the internet. But as the web widened, so too did the realisation that it offered the possibility of making educational resources open to all. Or at least to all who have internet access and a suitable device.

An online course can be “massive” or, in other words, conducted at a scale far in excess of courses in physical venues. And it can be “open”, in that it has no barriers to entry, such as competencies, location, or cost. The concept is neatly summed up in the acronym Mooc: massive open online course.

The first course to be labelled “Mooc” was presented in 2008, by Canadian academics. Aptly, it was an interactive course on connective knowledge, and in addition to a small in-person group, a couple of thousand people participated online.

and Udacity. And in 2012, along with Harvard, MIT launched their non-profit Mooc, edX. In the same year, FutureLearn was set up in the UK, by Open University. Some Moocs started outside universities. In 2008, Salman Khan tutored his cousins on the internet, then posted maths lessons on YouTube, which morphed into Khan Academy. And it’s no wonder Eren Bali was inspired to start Udemy, with co-founders, in 2010. He grew up in a poorly resourced Turkish village, but after his family bought a computer, he was able to tap into online communities that helped him succeed at the International Maths Olympiad.

Zooming in on edX

Many different universities provide courses on Moocs platforms, and they work in a fairly similar way. We’ll take edX as our first example. To help you decide whether a course is suitable, they outline:

• What you’ll learn

• Who the instructors are

• Which academic institution offers it

• Whether any prior knowledge is necessary

• The duration of the course

• The hours per week you need to spend on it

• Testimonials from previous learners

The price for a verified certificate. Typically, courses are delivered in a series of videos, often under 10 minutes long, with transcripts. They’re mostly pre-recorded, so you can access them at a time that fits your schedule. After every few videos, there is a discussion forum. While they give a sense of connection with your fellow learners, the value of their input is questionable. Readings are also supplied, and there are practice tasks – often multiple-choice questions on the video

At the start of your studies, you are prompted to choose whether to pursue the “audit” or the “verified” track. “Auditing” the course means doing it free of charge. EdX encourages learners to pursue verification. This gives you unlimited access to the course materials, while with the audit, you lose all access and progress at the end date. Also, it gives you access to the graded exercises. If you pass these, you will receive a certificate. EdX statistics show that when learners pay for verification, it incentivises them to complete the course. The price of a verified certificate varies, but many are USD49. It doesn’t sound like much, but at current exchange rates, this is over R800.

In partnership with universities all over the world – including Wits University – edX now offers over 3 000 courses. They have had more than 34 million learners to date.

The most popular courses – judging by enrolment figures – are Harvard’s “Introduction to Computer Science (CS50)” with almost 2.5 million enrolled, and MIT’s “Introduction to Computer Science and Programming Using Python”.

If computer programming isn’t for you, perhaps a creative approach to chemistry might pique your interest. In “Science & Cooking: From Haute Cuisine to Soft Matter Science”, Harvard researchers work with chefs like Ferran Adrià, formerly of world renowned El Bulli restaurant, to show how chemical reactions affect taste and flavour.

Or there’s “The Science of Happiness”, which explores research based practices

PERSONAL FINANCE | 4 TH QUARTER 2020 10

to Needs”.

And if you think a subject like illustration is beyond the ambit of online, two University of Newcastle professors prove that it can be done, in their course titled, “Drawing Nature, Science and Culture: Natural History Illustration 101”. They won an edX prize for “excellent, innovative course design and delivery”.

A word on Coursera

While this (even larger) platform also offers “audit” or “certificate” options, most of the courses are not free. You can do a free

receive. Besides Andrew Ng’s free machine learning course that sparked the launch of Coursera, another free standout is “Financial Markets”, delivered by Nobel Prize winner and Yale economics professor Robert Shiller.

However, they’ve made some popular courses completely free – with a certificate on completion – until 31 December.

Udemy: a very different option

On university-affiliated Moocs, course presenters tend to be lecturers. In contrast, anyone can teach on Udemy: click the

the quality and relevance of the courses. “I’ve always wanted to help to make a difference in education, and particularly in maths,” she says. “During lockdown, I was searching for ways to make my content available when I found Udemy. And since there is so much English content available, I decided to concentrate on maths in Afrikaans.” Bisschoff explains that Udemy has pricing tiers for tutors. There’s a business option too: Udemy markets your course in exchange for half of your profits. “But I haven’t seen results,” she says.

Udemy reached over 35 million students

PERSONAL FINANCE | 4 TH QUARTER 2020 11

in January 2020, just under 10 years since its inception. Courses are delivered in over 65 languages. Prices start at R180, and they offer a 30-day money back guarantee and a gift option. Over 8 000 courses are free.

The types of courses offered include some that have no chance of featuring in a university line-up. Consider “Radiate Confidence: How to Create a 1000 Watt Presence”, or “Tarot Card Success – The Complete Tarot Reading Course”.

Their most purchased business course, with 380 000 students (and counting), is “An Entire MBA in 1 Course: Award

course. I'm just grateful there is the 2X function so the wasted time was limited.”

Will completing a Mooc help me land a job?

“To be honest, I’d never heard of Moocs,” says Glenda Pillay, a recruitment consultant at Affirmative Portfolios in Umhlanga, KwaZulu-Natal. However, she is familiar with online courses in general, and says “these do carry weight for junior roles”.

Client specifications for vacancies are either a diploma, a bachelors, honours or masters degree, or a board certificate,

experience is rather different. “We are seeing a massive increase in the number of short courses completed by applicants,” he says. “Moocs and short courses are seen as an add-on to an existing qualification.” They are of value when the job applicant actively uses what they learned from them in their daily work, he adds. “A course does not equate to a skill unless proficiency is demonstrable.”

Durandt’s agency specialises in IT and digital, engineering, executive and office recruitment, and he highlights programming as an area in which Moocs

PERSONAL FINANCE | 4 TH QUARTER 2020 12

This local loves Moocs

Shireen Fisher, a freelance journalist, was introduced to Moocs while studying in-person at university, ironically.

“We did Moocs for each module at varsity because our lecturer set them as assignments.” The one that stood out for her was “Data Journalism Fundamentals”, through the University of Hong Kong.

“I have actually used those data journalism skills,” says Fisher.

“I learned to dig through information and extract facts to build a story from that. When you speak to a source, they

might not be telling you everything.”

Fisher didn’t stop her Moocs experience at that. Last year, she signed up for “Visual Journalism: Looking at the other in the age of the selfie” from the Knight Center for Journalism, which addressed new ways of reaching audiences, using both social media and traditional platforms. “I just did it for fun, and I really enjoyed it,” says Fisher. “Everyone has a phone, so everyone is a photographer now. But this course required you to put thought into how you capture images.”

In May, she completed “Journalism in a pandemic: covering Covid-19 now and

in the future”, led by an award-winning journalist. “This course came out when we were all wondering what on earth was happening. I did it because I wanted to know more than you would find in news articles.

I learned interesting facts about previous pandemics, like the Spanish flu, and found some parallels in the way the current pandemic was portrayed by the media and certain political figures.”

Fisher has included these Moocs courses on her CV, and hopes that they will contribute to her career progress. “I am continuing to upskill with Moocs, as I search for stability, job-wise.”

too. South Africa is usually a bit behind the curve.”

But are their clients receptive to Moocs? Would they consider a candidate who had completed only the audit track, without certification, but could show that they had acquired relevant skills?

There is no definitive answer, says O’Brien. Although it is tempting to complete the courses on the free audit track, she feels that it is probably worthwhile to pay for certification. “However, in IT in particular, they want the person who can do the job. If the candidate can program in a certain language or perform a certain function, and the assessment shows that they are at the appropriate skills level, our clients often don’t care about certification.”

For some of the traditional corporates, even certified completion of Moocs is not enough. “They are still stuck on formal qualifications,” says O’Brien. “But I’m sure clients of the future are going to look at Moocs.”

EdX and similar platforms are a very exciting option for South Africans who have to overcome cost and location barriers to access tertiary education, she adds. O’Brien flags another advantage to studying Moocs. “If I interview someone who says they’ve been unemployed for a year, I’ll ask, ‘How do you spend your time?’ to find out if they’re trying to bring in an income, or to upskill themselves. Is this someone who says, ’I started tutoring

my neighbour’s kids, and walking dogs,’ or someone who says, ‘Well, I sleep late and watch TV.’

“If they have been unemployed, I want to see that they have had a productive outlet for their time, such as studying. They’ve asked, ‘How can I upskill myself?’ This shows that they’re proactive, which gives them a sense of hope, and it shows a prospective employer that they are ambitious, self-motivated, and not afraid of new challenges. And when they do land a job interview, it gives them confidence,” she adds. “There is just no harm in doing Moocs; they can only benefit you.”

An upside of the post-Covid world is that location will no longer be an issue, says O’Brien. “As a South African, you will able to apply for a job in New York, London, or wherever else.”

She advises job seekers to look at global job postings to identify patterns in the skill sets required.

Analysing the types of courses offered on Moocs platforms provides valuable insights into global trends – and into industries that are not dying. “Moocs enable you to acquire skills that often aren’t yet available here, which allows you

to stay a little ahead of the curve.”

“With shrinking employment prospects post-Covid-19, job seekers have to do whatever they can to set themselves apart from all the other candidates,” O’Brien says. “Studying through Moocs is one way of doing so. And it demonstrates that they are committed to their career.”

PERSONAL FINANCE | 4 TH QUARTER 2020 13 WEALTH•INVESTMENT•PROSPERITY

AN END TO INNOCENCE THE BUSINESS INTERRUPTION SAGA

The worldwide legal dilemma on whether or not businesses were covered for anything as drastic as governments locking down economies in response to the Covid-19 pandemic will force insurers to rethink their risk mitigation strategies, writes Gareth Stokes.

Thousands of non-life commercial insurance policyholders will be forced to rethink their comprehensive risk mitigation and risk transfer strategies as the world comes to terms with the patchiness of the business interruption (BI) cover extensions offered before the pandemic. Many insurers entered 2020 with an incomplete understanding of the risk events their insurance policies covered against; but the extent of business losses suffered due to pandemic and subsequent national lockdowns has forced them to wise up, fast.

The fallout between business owners and non-life insurers following the Covid19 outbreak is already well-documented. Initial misunderstandings about the type of risk events covered under different sections of an insurance policy have since morphed into disputes about whether the BI-specific sections of a policy were intended to perform for perils such as lockdown and pandemic at all.

Wikipedia describes BI insurance as “cover for the loss of income that a business suffers following a disaster, due to the disaster-related closing of a

business facility or due to the rebuilding process after a disaster”.

This definition fails to mention that a standard BI cover only performs for a predefined set of loss events, and only if that event causes material or physical damage to an asset that is insured on the policy.

For example, a restaurant that is forced to close down for three weeks following a serious fire in its kitchen can recover the cost of the resulting physical damage against the fire section of its commercial insurance policy. A payout on this section will allow it to rebuild and refurbish the kitchen and other affected parts of the premises. If its policy contained a standard BI section, it would also be able to claim for the loss of profits suffered by the restaurant due to its closure as a consequence of the fire event.

Standard BI cover is not automatically included on a commercial insurance policy but is added by the insured or insurance broker as a separate section alongside asset sections for buildings or fire.

There are many risk events that might cause business interruption without any

accompanying physical damage. Common examples include data breaches, bookings or event cancellations, or infectious disease outbreaks. These perils can be insured against under a subcategory of BI insurance referred to as non-physical damage BI, which is typically included on commercial insurance policies as extensions to standard BI cover. A business that is comprehensively insured might have a commercial insurance policy with an assets section, a standard BI section, and a BI extension.

Returning to our example, assume that the restaurant was closed by health authorities as a result of some of its patrons testing positive for a notifiable infectious disease. In this case there is no physical damage and the restaurant would only be able to claim for loss of profits if it had a contagious or infectious disease outbreak extension under the BI section of its policy, with all other terms and conditions met.

A year like no other

As we entered 2020 the South African insured environment consisted of firms

14 PERSONAL FINANCE | 4 TH QUARTER 2020

that had no insurance cover on the one hand, and firms that had commercial insurance policies without BI cover, with standard BI cover only, or with standard BI cover and various BI cover extensions, on the other.

On studying their policy wordings, the vast majority of South Africa’s small, medium and micro enterprise (SMMEs) discovered that they had no cover for BI losses. These businesses fell away at the earliest stage of the “insured or not” debate; but those with standard BI sections went the same way. The absence of physical damage meant that a business with standard BI cover could not be indemnified against its pandemic losses. And that leaves a relatively small sub-set of policyholders with BI extensions to weigh up their interpretations of policy

wordings against that of their insurers and reinsurers.

Caroline da Silva, deputy executive officer for regulatory policy at the Financial Sector Conduct Authority (FSCA), estimated that only three percent of BI policies in force locally had a contagious diseases extension. “These policies did not respond in the way that customers expected them to,” she said, during a media briefing on the fair treatment of financial services customers during the Covid-19 outbreak. The ensuing debates, fuelled by a pro-consumer media, have seen large insurers go head to head with policyholders and state market regulators to seek legal certainty.

The UK Financial Conduct Authority (FCA) brought a test case against eight insurers in an attempt to bring legal

certainty to policyholders, insurers and reinsurers as to how their non-physical damage BI extensions should perform. This action was intended to provide a steer for 370 000 policyholders, on cover under 700 policy wordings, issued by 60 different insurers in that market.

On 15 September 2020 the UK High Court handed down its ruling on the interpretation of 21 clauses commonly included in policy wordings.

“We brought the test case in order to resolve the lack of clarity and certainty that existed for many policyholders making BI claims,” explained Christopher Woolard, interim chief executive of the FCA. He said that the court had found “substantially in [the regulator’s – and policyholders’] favour”. The court ruling may have influenced some UK insurers to

15 PERSONAL FINANCE | 4 TH QUARTER 2020

pay more of their outstanding claims; but it has also given them a steer on which claims need not be considered. It was likely, at the time of going to press, that one or more of the affected insurers would challenge the ruling all the way to the UK Supreme Court.

South Africa’s FSCA was in constant communication with local insurers between March and September this year. In their initial communications they intimated that lockdown “could not reasonably be interpreted to be a trigger for a valid BI insurance claim”; but their position softened as the causation debate worked its way through local and offshore courts (see below). The main thrust of the FSCA’s BI insurance position was published as Communication 34 of 2020, dated 18 June. It informed insurers, insurance brokers and policyholders of how six broad categories of BI extension policy wordings should be interpreted.

The FSCA is on record that the contractual agreement between an insurer and insured, as set out in the

policy wording, takes precedent. “We have agreed with South Africa’s nonlife insurers that we need to gain legal certainty,” said Da Silva. “We were going to take the matter to court, with the regulator acting on behalf of policyholders, but we struggled with the local court system because of our locus standi.” Local non-life insurers have since indicated, through the FSCA, that substantial legal certainty will follow from the test case brought by the FCA in the UK and the cases currently before the South African courts. There are two court challenges to consider.

Restaurants versus insurers

In Café Chameleon v Guardrisk Insurance, handed down by the Western Cape High Court on 26 June 2020, the judge held the insurer liable to indemnify its policyholder for losses suffered since 27 March 2020 as a result of the Covid-19 outbreak in South Africa. Law firm Cliffe Dekker Hofmeyr (CDH) referred to the decision as “groundbreaking”. It is worth considering some of

the facts.

Café Chameleon had an insurance policy with Guardrisk that included a policy extension for BI occasioned by “human infectious or human contagious disease, an outbreak of which the competent local authority has stipulated shall be notified to them within a 50 kilometre radius of the insured’s property”. Café Chameleon was forced to close during level five of lockdown, from 26 March until 16 April 2020, and was unable to trade or receive customers under lockdown level four either. It duly claimed under its BI policy extension.

The ensuing uncertainty around insurer liability moved Café Chameleon to petition the High Court for a “declaratory order with regard to Guardrisk’s antecedent liability under the policy”. There were three important outcomes:

1. Covid-19 is a notifiable disease.

“The court held that in interpreting the business policy contract, the interpretation must be sensible and not have an un-business-like result and

PERSONAL FINANCE | 4 TH QUARTER 2020 16

that these factors should be considered holistically,” wrote CDH, in an article following the judgement.

2. Covid-19 caused or materially contributed to the lockdown regulations.

3. Lockdown was sufficient for legal liability to arise for the harm suffered by the insured. “It was accepted by the court that there is a clear nexus between the Covid-19 outbreak, and the regulatory regime that interrupted Café Chameleon’s business,” wrote CDH.

Guardrisk has taken the ruling on appeal and a decision is expected in the final quarter of 2020.

Few would argue that the pandemic and lockdown situation that played out through the second and third quarters of 2020 could have been anticipated. “The extent of the lockdown was not something that insurers considered when they were completing their pricing and risk management exercises,” said Andrew Coutts, head of intermediated business at Santam. The insurer is processing and managing claims in accordance with the guidance offered by the FSCA and will seek legal certainty where this is deemed necessary. And that brings us to the second court case.

Proximate cause is at the heart of the High Court challenge Ma-Afrika Hotels & Stellenbosch Kitchen and Insurance Claims Africa v Santam. The respondent’s position is similar to that offered in the Guardrisk case. “The insurer is not liable unless the insured can show a link between Covid-19 and the reduction in business … the loss cannot be due to an intervening cause such as a general fear among the public or a national lockdown, because those are not events that are covered by the policy,” said Coutts.

The matter was heard early in September; but judgment has been reserved. Santam has already indicated that it is prepared to appeal an unfavourable ruling up to the Supreme Court of Appeal, “depending on the nature of the [High Court] decision”.

The case for legal certainty

Can an insurer not use its discretion to indemnify policyholders where there is

an overarching economic imperative? Insurers are in a difficult position when interpreting policy wordings because they risk being tried in the court of public opinion. “We believe our policy wordings are clear in what they cover and what they do not cover,” said Coutts. “If we were to pay claims outside of the mandate of what is covered by the policy, we would not be able to recover [our losses] from reinsurance”.

It is not surprising that insurers are concerned over their potential liability for BI claims under the pandemic setting. “The exposure that local insurers have to

incurred through lockdown, which we believe the insurer should not be held accountable for, and the insured losses,” said Coutts. This position frequently emerges in the natural catastrophe environment, where reinsurers report the total economic cost of a natural disaster under the headings "economic loss" and "insured loss".

Interim relief

Another major issue that has arisen is with the timing of claims pay-outs. In many cases businesses were under threat of liquidation while their insurer’s liability remained unclear. This explains why the FSCA called on local insurers to consider the economic impact of delaying claims settlements. Insurers were advised to communicate frequently and openly with their policyholders on the progress of their claims, and to provide interim relief pay-outs as swiftly as possible. “The process to gain legal certainty takes a long time, we did not want policyholders to be devastated by the delays in receiving payments, so we negotiated with all insurers to make interim payments to their policyholders,” said Da Silva.

contingent BI extensions varies widely depending on whether their reinsurers come to the party or not,” said Da Silva. Assuming all reinsurance treaties perform, the industry could face liabilities in the region of R12 billion; but without reinsurance the exposure is much higher.

Reinsurers will play an important part in the ongoing non-physical damage BI debate, with early thought leadership pieces on future pandemic cover leaning towards a pooled risk solution similar to that used by the global insurance industry for exposures to damages caused by nuclear accidents, terrorism and war.

A central component of the debate is that insurers never foresaw, nor intended to cover, the economic losses suffered by insureds due to national lockdown.

“We see a clear distinction between the economic losses that every business

Heeding this call, Santam had paid out almost R870 million in interim relief payments to a subset of its policyholders in the hospitality, leisure and nonessential retail services industries by the end of August 2020. “These relief payments are being made to some of the most vulnerable small and mediumsized policyholders who have been worst impacted by the lockdown,” said Lizé Lambrechts, Santam group chief executive. The insurer’s half-year results to June 2020 reflect a R1.29 billion provision as its best estimate of exposures to contingent BI claims.

At the end of September, South Africa’s non-life insurers fell loosely into one or more of the following camps: insurers that have settled non-physical damage BI claims in line with their policy wordings; those that have offered settlements to sub-sets of their policyholders; and those that are seeking further clarity from the courts. The media’s relentless focus on insurers’ failures to compensate

WEALTH•INVESTMENT•PROSPERITY PERSONAL FINANCE | 4 TH QUARTER 2020 17

'The insurer is not liable unless the insured can show a link between Covid-19 and the reduction in business'

policyholders has deflected from the fact that many insurers have already indemnified policyholders with BI extensions. Most local insurers have also responded proactively by offering settlements to qualifying policyholders while the court process plays out. Santam explains: “The relief payments are the outcome of our proposal to the regulator to help policyholders who have claimed for losses during the Covid-19 period while awaiting the outcome of the legal processes.”

Policyholders should not be misled by the pro-consumer reporting following the UK High Court and Guardrisk rulings. An important concession made by the FCA following its apparent victory is that “the judgment did not say that the eight defendant insurers are liable across all of

the 21 different types of policy wordings in the representative sample … each policy needs to be considered against the detailed judgment to work out what it means for that policy”. And the same holds in a South African context.

We will have to wait for the court processes to play out before celebrating the outcomes.

An industry in the crosshairs

Suggestions by the media that the business interruption matter has shaken trust in the short-term insurance sector should be weighed against the intention with which each party entered into their respective insurance contracts.

Yes, there will be some who expected their policies to perform; but many who are vociferously backing today’s court

actions were aware of the potential limitations of their cover. The next public storm will unfold when policyholders, with full foreknowledge of the sums insured on their policies, will contest that the quantum of their claim settlements are insufficient to stave off bankruptcy.

“Where the insurer determines that cover is provided by a policy, in principle, the next stage will be adjusting the loss,” wrote Flaxmans, a group of UK-based insurance claims advocates, in an article for the Chartered Insurance Institute.

“It must be anticipated that losses will be less than expected by the insured and of course there are unlikely to be many cases where the full sum insured will be payable.”

Regardless of what happens in local or offshore courts, the Covid-19 pandemic has changed the face of insurance forever.

PERSONAL FINANCE | 4 TH QUARTER 2020 18

REAL ESTATE GETS REAL HOW THE PANDEMIC IS CHANGING THE PROPERTY MARKET

As the coronavirus continues to wreak havoc across every sector of society, evidence suggests that the property market will look and function very differently in the months and years to come. Alan Duggan investigates the causes and possible effects.

In a New York Times opinion piece a few months ago, American comedian Jerry Seinfeld delivered an impassioned rebuttal of “some putz on LinkedIn” who claimed New York was essentially dead because everyone was leaving and wouldn’t be back.

As Seinfeld told it, intangibles such as energy, attitude and personality could not be “remoted” through even the best fibre-optic lines, explaining: “That’s the whole reason many of us moved to New York in the first place.”

Millions of New Yorkers want to agree

with him, but the unpalatable truth is that the pandemic has delivered a gut punch to the world’s greatest city, with farreaching implications for both residential and commercial property owners – and it’s a sad fact that midtown Manhattan (not to mention the city’s downtown

19 PERSONAL FINANCE | 4 TH QUARTER 2020

financial hub) has seen only a small uptick in the reoccupation of office spaces.

South Africa’s business districts have witnessed a similarly disastrous exit, albeit slightly relieved by the loosening of restrictions on trade and office occupation.

It goes without saying that the workfrom-home trend – necessitated by lockdown rules of varying severity – is only one of several factors influencing the property market: among the others are historically low interest rates and pent-up demand. However, there’s no doubt that the pandemic has prompted home buyers and office workers to re-examine their lifestyle.

As a self-employed financial consultant puts it: “People are questioning whether their quality of life has been subverted by the daily commute to city or suburban office blocks, often in heavy traffic, and nine-to-five working days that sap their will to live.

“Whether the work-from-home trend is good or bad obviously depends on

where your money is invested, how your boss feels about it, whether you’re re-thinking your future employment, your home type and location, and other factors. Personally, I believe that remote working is the future, and I’m in.”

Some estate agents report that increasing numbers of families in apartments, presumably driven to distraction by months in close proximity to partners and children, are moving into houses with gardens. Other homeowners are moving away from the cities, reasoning – quite logically, in many cases – that they can continue to earn a living from just about anywhere armed with little more than a computer and a good fibre connection.

John Loos, a property sector strategist at FNB Commercial Property Finance, says although many corporate CEOs appear to be planning for greater levels of remote work, it’s too early to determine the pace and magnitude of the trend.

“While many companies may have

embraced remote work because they were forced to, the true extent of this enthusiasm for remote work from management teams and employees will only become clearer once the Covid-19 crisis has passed and office buildings are 100 percent open once more.”

Whereas various employee surveys appear to confirm the popularity of remote working among service sector employees, adds Loos, some concerns have been flagged, among them compromised working relationships.

“The lockdowns have also contributed to a very deep recession, putting significant financial pressure on many businesses across the world. Many CFOs will be eyeing cost-cutting opportunities – and reducing the amount of expensive office space owned or leased by their companies would surely be one such opportunity.”

Loos cites a recently released survey of 315 corporate CEOs (including 100 in the US) by accounting firm KPMG that points

PERSONAL FINANCE | 4 TH QUARTER 2020 20

to a widespread desire to scale back on office space, a formidable 68 percent of respondents indicating that they planned to downscale.

Interestingly, some 72 percent of the CEOs saw a benefit from remote working in terms of widening their talent pool. Loos believes this makes sense, saying: “Many of us have considered a job prospect based in part on where the job is located.”

Commuting time on South Africa’s increasingly congested roads is also an issue, he adds. “It’s realistic to expect that … a greater portion of the office worker population will find themselves working from home, either full-time or part-time.

“This has potentially major implications not only for office property landlords, already faced with significant vacancy rates, but also for the likes of residential developers and urban planners, as many households’ location and lifestyle decisions change.”

Forecasting is not an exact science

Dr Andrew Golding, chief executive of the Pam Golding Property group, concedes that the social and economic consequences of the initial lockdown and subsequent easing of restrictions make it very difficult to predict movements in the South African property market.

Market analysts were surprised by the level of activity in the housing market in the months since real estate agencies were allowed to reopen at the beginning of June, he says. “For example, FNB recently noted that not only has the volume of new mortgage applications rebounded beyond pre-lockdown levels across the price spectrum, (but) the level of buyer interest on property portals has also surpassed levels seen in early 2020, when Covid-19 was but a distant threat.”

Golding says one of the “obvious but significant” consequences of the pandemic has been the Reserve Bank’s bold decision to slash interest rates to an almost 50-year low of seven percent (to date). “For many homeowners, this unprecedented low, coupled with the price correction in the local residential

market in recent years to more realistic levels, has resulted in a clear message that this may well represent a ‘once in a lifetime’ opportunity for buyers.”

This is new and appealing territory for many buyers and especially firsttimers, says Golding, and they appear to be taking the message to heart. He cites a report by bond originator ooba, which notes a surge in first-time and 100-percent bond applications in recent months. “According to ooba, home loan

Virtual-reality marketing

Tony Clarke, managing director of the Rawson Property Group, believes technology has quickly become an important enabler in property transactions. He says: “Now more than ever, having the right technology is vital to maintaining operations, including being able to communicate with clients. Thanks to the pandemic, we have to accept that the world will never be the same again, and this also applies to our industry.

“Given these precarious times, we believe it is the sellers who will start insisting that agents use virtual tools to market their homes rather than

applications rebounded in June, and by July volumes were over 60 percent above year-earlier levels. In June, 68 percent of ooba’s home loan applications were for 100 percent bonds, with an approval rate of over 80 percent.”

First-time home buyers are taking advantage of cheaper finance to acquire more expensive properties, says Golding. According to ooba, these accounted for almost 53 percent of home loans during the second quarter of this year. “As we

open their homes to large volumes of people who might contaminate their space. We have to learn to adapt and thrive under these circumstances, and our group has invested heavily in a technology ecosystem that we are leveraging to its fullest.

“To deliver real estate services as seamlessly as possible, we have introduced six products: virtual valuations, 3-D virtual tours, virtual showhouses, electronically signed documentation, and online meetings. These will serve as important stopgaps during social distancing and ultimately form part of a much larger service strategy.”

WEALTH•INVESTMENT•PROSPERITY PERSONAL FINANCE | 4 TH QUARTER 2020 21

Sometimes, it’s personal Marketing consultant Alwyn Fourie took the gap four months into lockdown, selling his luxury flat on Cape Town’s Atlantic seaboard and moving into a tree-lined suburb with a big garden, pocketing some useful change along the way.

Fourie explains his reasoning: “We get on very well as a family, but after being cooped up in a flat together for months, everyone decided that we needed space. Our new home has plenty of that, and we couldn’t be happier.

“We sometimes miss the sea view and spectacular sunsets, but against that, we have lots of braais – sometimes even when it’s pouring with rain – and have adopted a rescue dog. We were not allowed pets in our apartment, so the kids are over the moon. The coronavirus is a global tragedy, of course, but it has made us aware of the things that are most important.”

Much as they love it, their suburban doublestorey may not be their “forever” home, adds Fourie. “We’ve proved to ourselves that we can adapt to change, so maybe we will move to the country in a few years’ time, depending on the availability of good schools. My wife and I have jobs that allow remote working for at least 90 percent of the time, so employment won’t be an issue.”

James O’Connor* started working from home on the first day of South Africa’s lockdown and says he’s never looked back. “I know it’s not for everyone, and I’m lucky to have a study in which I can operate undisturbed, but I quickly found that remote working improved my productivity, reduced my stress levels and definitely boosted my quality of life.

“Best of all, I don’t have to attend pointless meetings and listen to people droning on with PowerPoint presentations that could be summarised in a single slide or email. The other things I don’t miss are the ‘teambuilding’ strategies that our managers loved, but which seemed designed to embarrass us. I can handle the occasional awkwardness of Zoom meetings because all participants are in the same boat.”

O’Connor mentions a journalist friend whose insecure boss used to become agitated whenever he saw an empty desk. “He came from a bean-counter background and didn’t seem to understand that journalists cannot rely entirely on the internet to write their stories. To do their job properly, they need to get out there to see what’s happening, and to interview people face-to-face. The pandemic and workfrom-home strategy cured him of that, and now everyone is much happier.”

*not his real name

have noted previously, South Africa’s young population, with nearly twothirds of citizens currently below the average age of a first-time buyer (34 years), provides the market with a solid underpinning.”

Encouraging as they are, the numbers should be kept in perspective, warns Golding: “To temper any expectations of an unrealistically buoyant property market, it’s important to note that there has not been any significant increase in new stock volumes coming on to the market.

“What we have seen is that the residential property market has come out of the gates very strongly after the restart of real estate activities at the beginning of June and during July 2020, with most of this activity driven by realistic pricing expectations and motivated sellers. Notably in the Western Cape and other sought-after locations in South Africa, well-priced properties are now attracting strong buyer interest.”

Good time to buy?

Citing the strong buyer’s market, coupled with a prime interest rate at an historic low (and expected to remain there for quite some time), Golding believes savvy home buyers seeking access to finance are well placed to make sound investment property acquisitions across all price ranges and property types – “perhaps particularly in the price band up to around R3 million”.

In the residential property market, his company is seeing the most interest and activity in the price bands up to R2.5 million and R3 million, followed by the middle-market price band between R3 million and R8 million, and upwards. He also notes a strong appetite among first-time buyers to enter the property market, “driven in part by former renters who prefer to put down roots and gain security of tenure by purchasing their own homes rather than pay rent”.

Adds Golding: “Many millennials

who used to remain mobile, maintaining flexibility to travel globally, seem to be looking at getting apartments and ‘settling down’ for now.

“Trends evident in the marketplace include relocation to smaller or coastal towns, downsizing due to financial pressures, or upsizing – to satisfy the need for work-from-home space and more outdoor space. In this regard, we are seeing a shift back to freestanding homes and an increasing demand for homes in secure lifestyle estates. There is even talk that the number of separations and divorces has increased after lockdown, which would create activity in the residential property market.”

Business as usual? Not quite Adrian Goslett, regional director and CEO of Re/Max of Southern Africa, says although the property market saw a boom following a period of inactivity during lockdown, it’s by no means business as usual – and he’s candid about the effect on his company.

“Despite record sales months of R2.4 billion and R3.3 billion in July and August respectively, our total sales figure year-to-date for August is still down by nine percent. When broken down by region, the Free State and Northern Cape regions seem to be hit the hardest, with a 17 percent drop in sales this year. Least affected are central Gauteng and KZN, both of which reflect a three percent drop.”

The company discovered that many buyers were searching for “a higher quality of life” and looking for homes with a study space plus a room or flatlet to accommodate multi-generational living. It wasn’t a universal trend, though: whereas some areas reported higher levels of downsizing as a result of affordability issues, others reported no such increases.

Property broker Maurice Lodewick, owner of Re/Max Lifestyle Estates in Nelspruit, says that since the start of lockdown, buyers in his area have been looking for larger stands, and

PERSONAL FINANCE | 4 TH QUARTER 2020 22

ideally, views of green belts or other open spaces. They also want outbuildings that can be converted into school rooms or granny flats.

“There has also been a notable increase in downsizing, with more than half of sellers in our area selling because of affordability issues – mostly in the higher-upper-market segment (above R5 million). Sellers in this price segment are looking to downscale to a home worth around R2.5 million.”

Chris van der Merwe, manager of Re/ Max Coastal, says his office has noted an influx of buyers in Knysna, Sedgefield and Wilderness from bigger metros such as Johannesburg and Cape Town. He says: “Many of these buyers are looking to work from home and commute between the city and coastal towns. We have experienced an increase in younger, professional couples and first-time buyers. They’re looking for properties with a study or home office space and fibre internet.”

Barbara Larney, owner of Re/Max Town and Country in Hermanus, says many of her buyers feel cooped up in their current

situation and want to explore what the country lifestyle has to offer. “Many are looking for a place where their children are free to play outdoors in safety.”

At the same time, she’s aware that some of her clients have been badly affected by the economic downturn and are being forced to sell. “I know of a number of people who are merging households because of the tough economic situation.

Because assisted living costs are very high, our older clients are choosing to move in with their children and grandchildren, combining the households by selling their homes and building their own private in-law suite on one plot. Some of the European ‘swallows’ are selling and moving back to Europe because nobody knows when South Africa will reopen its borders.”

How permanent is the trend?

Having examined the move towards remote working and its impact on the property market, the FNB’s Loos reckons there are some important questions that remain unanswered, among

them specifics about the timing and magnitude of the trend.

“Many corporates have rapidly scaled up their remote working capabilities, but for many, the offices and their costly infrastructure are still fully functional and ready for their inhabitants to return, albeit in smaller numbers in some cases due to social distancing measures within the buildings. At what speed does the amount of office space get scaled down? This may be influenced in part by lease expiry dates or, in some cases, whether a building can be repurposed.

“Also, we have yet to ascertain to what extent management is comfortable with staff working remotely. It’s one thing to take a positive view of something when you have no choice – for instance, when management has been forced to accept remote work for the time being – but it’s a different matter when you have a choice. When the Covid-19 crisis ends and offices are fully open again, we will see to what extent old management habits have changed – or not.”

Another question concerns those adversely impacted by remote working, adds Loos, among whom the most obvious victims are office landlords.

“With a likely drop in demand for office space, the landlords will be required to get creative with their buildings. Inner cities have perhaps shown us a way, with significant repurposing of unused office space into high-density – often affordable – residential property.

“In tandem with the question around office space, we would need to ask the same question regarding high-density residential property in close proximity to major office nodes. If there is far less daily commuting, with fewer people working in major office nodes, how will this impact on the demand for high-density residential living?”

If business travel and physical company events are also set to decline, asks Loos, how will this affect the demand for corporate-driven hotel and conference venues? “Finally, do companies further de-centralise their offices, with smaller cities and towns potentially picking up a greater chunk of whatever office ‘pie’ is left?”

WEALTH•INVESTMENT•PROSPERITY PERSONAL FINANCE | 4 TH QUARTER 2020 23

HOW COVID-19 HAS BOOSTED ILLICIT TRADE

The pandemic has had the effect of increasing illicit trade in South Africa, among other countries, and it’s you, the consumer, who will ultimately suffer – and not only financially.

Amanda Visser reports

South African consumers are being exposed to substandard and unregulated products because of a drastic increase in the illicit trade in alcohol, tobacco, fuel and fake medicine. During the national lockdown the illicit markets in many of those products soared.

A World Health Organisation report shows Africa alone accounts for 42 percent of globally detected cases of substandard

PERSONAL FINANCE | 4 TH QUARTER 2020 24

and fake medical products. Many illicit drugs are associated with mental health disorders and can also lead to social, legal, financial and emotional problems.

The 2019 Transnational Alliance to Combat Illicit Trade (Tracit) report also referred to a Euromonitor global study on illicit alcohol trade.

According to that report, South Africa loses around $480 million annually to illicit alcohol. This is the largest fiscal loss out of the seven African countries measured in the 2018 global study.

Smuggling represents 28 percent of illicit alcohol activity. This activity is driven by a challenging economic environment, a large price variance (51 percent) between what consumers pay for legal alcohol and what they pay for illicit alcohol, weak enforcement of regulations and taxation strategies that drive up the prices of legal alcohol, the study found.

Tax revenues

In a normal year the South African Revenue Service (SARS) is able to collect around R30 billion in excise duties on alcohol, R14bn on tobacco products and R4bn in sugar taxes. However, 2020 has been everything but normal. The strict national lockdown to curb the Covid-19 pandemic saw a complete ban on the sale of cigarettes and alcohol. This will translate into significant revenue losses for the fiscus.

Telita Snyckers, former SARS executive, author and independent illicit trade consultant, said at this year’s virtual Tax Indaba that excisable products should be “easy money” for government.

“However, that is only true if there are proper production controls in place, which South Africa does not have. Even before the lockdown we saw that 15 percent of alcohol sales in South Africa was illicit and in some places in the country it was as much as 40 percent.”

Corné van Walbeek, director of the Research Unit on the Economics of Excisable Products (Reep) at the University of Cape Town, says that even before the lockdown about one third of all the cigarettes sold in South Africa were sold at such low prices that it was impossible that the full tax has been paid.

Shifts in behaviour

The research unit’s figures showed a significant shift in the number of brands sold in the market. The majority of the brands sold during the ban were from local manufacturers.

“Our theory is that local companies already had ‘pretty good’ links into the informal (illicit) market and they have simply expanded their presence in this market,” Van Walbeek says.

The research unit conducted a study during lockdown by interviewing 12 000 smokers in a first round and 23 000 in a second round.

“Although there are some caveats in the research, the important thing we found was that nine percent of smokers were able to quit, and 93 of those who were unable to quit were able to buy cigarettes during the ban.”

The research also showed a significant change in the market structure and distribution channels.

Before the lockdown about 70 percent of cigarettes were sold in “formal outlets”, specifically tobacco outlets, supermarkets and garage stores.

During lockdown, new distribution methods emerged – such as the use of WhatsApp groups, buying through acquaintances and street vendors.

Other “distributors” included drug dealers and black market operators. About two percent of the participants said they were buying their cigarettes from “very unsavoury characters”.

The cost of smoking

Van Walbeek says the excise tax on a packet of cigarettes is currently R17.40 whereas the production cost ranges between R2 and R2.50. “The point is that it is miniscule in comparison to the retail price most people are paying.”

During lockdown prices increased by up to 350 percent in the Western Cape and about 160 percent in Gauteng, Limpopo and Mpumalanga.

These profits are certainly not going to translate in more corporate income tax or VAT or excise duties.

People have shown their willingness to pay these exorbitant prices for their

addiction. Van Walbeek believes an increase in excise duties of anything between R20 and R50 on a packet of cigarettes is “conceivable”. “The important thing is then to have proper illicit trade controls,” he adds.

Snyckers says there are some “very simple policy choices” SARS can implement. These include:

• The introduction of production controls at manufacturing plants;

• Expanding audits to include the inputs that are used in manufacturing to match output volumes;

• Improved tracking of the importation and sale of cigarette filters. There are only three companies in the world that manufactures filters. By keeping track of import and sales figures, government will get a better sense of production volumes;

• The introduction of “Know Your Customer” obligations to ensure manufacturers only sell to traders who are controlling their own supply chain.

Lack of proper enforcement

Keith Engel, chief executive of the South African Institute of Tax Professionals and organiser of the annual Tax Indaba, says it is clear that having legislation in place is one thing, but enforcing it is something else.

“That is the real issue in South Africa. You can have as many laws as you want, but if there is a group of people who are flouting the law and nothing happens to them, it is like being an emperor without clothes.”

Tax evaders should be brought to book instead of more taxes being imposed on the honest to make up for losses due to criminal activity, he warns.

The Tracit report concludes that combating illicit trade is necessarily linked with the need for a stable economic, political and social environment that encourages investments and innovation in the local economy.

“Failure to address the structural problems that allow illicit trade to flourish will weaken growth prospects and hamper efforts to reduce unemployment and inequality.”

This is more true now than ever before.

WEALTH•INVESTMENT•PROSPERITY PERSONAL FINANCE | 4 TH QUARTER 2020 25

INVESTING IN COMMODITIES

Chantal Marx and Nicholas Riemer unpack what commodities are, what affects their prices, and ways to invest in them.

During recent market volatility, investors showed interest in gold as an investment. Gold prices tend to go up during periods of uncertainty and then subside during periods of stability. Gold is also priced in dollars, which means that it provides protection against a depreciating rand exchange rate.

Oil also received quite a bit of attention as a potential investment after falling to near two-decade lows in the first quarter. Oil prices are linked to economic activity and are also a function of the supply of oil –the prospect of weak economic growth and continued high levels of supply resulted in unsustainably low oil prices at the time.

Gold and oil form part of a wider set

of investable commodities. Different commodities have different underlying drivers, and understanding these drivers will offer investors the clarity required to successfully invest in this space – be it directly or indirectly.

What are commodities?

A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Commodities are used as a key ingredient in the production of other goods and services or, in the case of gold, as a store of value. The quality of the commodity can differ slightly; however, it is essentially uniform across producers, resulting in a

standard value.

Commodities are broken down into two categories: hard and soft. Hard commodities require drilling activities, such as mining.

These include gold, copper, platinum group metals (PGMs) and oil to name a few. Soft commodities refer to raw materials that do not require drilling and are grown or farmed. Examples include wheat, maize and coffee beans.

What causes commodity price changes?

Supply and demand trends of the commodity causes prices to change. When there is an oversupply relative to demand, prices will

PERSONAL FINANCE | 4 TH QUARTER 2020 26

decrease. This is what was seen in the oil market recently. A shortage of a commodity or high demand will push the price up. This can happen on account of a drought reducing the supply of soft commodities and buyers increasing demand on fears of losing production inputs.

The basic concept when trying to understand commodity prices fundamentally is to evaluate global trends.

What products are in high demand or short supply and how is this expected to change?

The simple commodity formulae when evaluating trends are:

• Expected supply > expected demand = price decrease

• Expected demand > expected supply = price increase

Megatrends and commodity demand

Understanding global trends is key when looking to invest in commodities. Megatrends are powerful, transformative forces that can change the trajectory of the global economy by shifting the priorities of societies, driving innovation and redefining business models. Identifying the potential for structural change and investing in expected transformations early can be a key driver of successful commodity investing.

Megatrends are long-term structural forces that evolve over time. In 2016, the “emerging global wealth” megatrend primarily focused on China’s rise.

But since then, it has broadened to incorporate the emerging middle class in India, southeast Asia, and other developing economies. “Rapid urbanisation” has similarly incorporated the advent of smart cities and on-demand business models along with the infrastructure needed to support emerging megacities.

In the past decade there has been a huge increase in city developments in emerging economies requiring significant infrastructure. As cities develop, they require telecommunication networks. This requires twisted copper wire as copper is generally the most common mode of transmission used today.

Emerging cities account for a significant

percentage of a country’s population as jobs and opportunities attract citizens. Transportation needs to evolve, which means increased demand for cars, trains, and buses as well as fuel. Raw inputs into the production of cars include platinum, steel, rubber and aluminium. Higher fuel usage pushes up demand for oil while a shift to electric-powered vehicles means batteries that utilise lithium and cobalt in the production process will be in high demand.

When analysing megatrends, investors need to link the demand to raw products that are required in the manufacturing process. If there is an increased demand in electric vehicles, this might mean a decrease in demand for oil and PGMs (used in catalytic converters) and an increase in demand for cobalt and lithium.

Looking at long-term investment opportunities in the commodity market means fundamentally understanding the evolving megatrends within the global economy. It is also important to take note of short-term factors when considering an investment in commodities, such as supply disruptions or supply gluts, or sudden declines in demand.

Investing in commodities

There are several ways for long-term investors to gain exposure to commodities:

1. Investing directly in the commodity. Investors have the option of purchasing and storing the physical commodity itself. This requires identifying a seller of the commodity, storing and insuring the physical raw material as well as then locating a buyer.

Acquirers of the actual raw commodity are more often manufacturers looking to secure supply, as investors do not want the burden of buying, collecting, storing and selling the goods. Precious metals are bought and sold in their raw form such as Krugerrands; however, receiving and storing barrels of oil might not be as practical for an investor. Fortunately for long-term investors there are alternative ways of gaining exposure.

2. Commodity exchange-traded funds (ETFs): A commodity ETF allows investors to gain exposure to commodities through an exchange-traded fund

invested in physical commodities. JSElisted commodity ETFs include platinum, palladium and rhodium ETFs, which track the prices of these PGMs in rands. There is also a choice of gold ETFs (AfricaGold, NewGold and FirstRand Krugerrand Custodial Certificates).

3. Commodity exchange-traded notes (ETNs): A commodity ETN allows investors to gain exposure to commodity prices through a structure that invests in derivative contracts. It is quite complicated but, most of the time, these notes will track the underlying price of the commodity quite closely. In addition to some of the commodities tracked by ETFs, JSE-listed commodity ETNs include trackers of oil and silver along with soft commodity ETNs tracking corn or wheat.

4. Shares in commodity producers/ miners: This option allows you to gain exposure to the commodity market by purchasing shares in a company that produces the raw material (or in commodity-focused unit trust funds that invest primarily in these companies). Mining companies such as Anglo American Platinum or AngloGold Ashanti mine for precious metals while Anglo American and BHP mine a variety of commodities. Anglo American’s main commodities mined are copper, platinum, iron ore and diamonds. BHP has substantial exposure to iron ore, oil, copper and coal. A key consideration is that share performance will not be based solely on commodity price changes. There are internal performance measures that must be considered, such as the management team, producer country currency changes, and regulatory and political factors.

Of course, there are also many companies that are indirectly impacted by commodity price changes – for example retailers tend to do well when oil prices are low because lower fuel prices place more cash in consumers’ pockets. The reach is endless but as you move along the supply chain, the impact of major trend changes will be diluted.

WEALTH•INVESTMENT•PROSPERITY PERSONAL FINANCE | 4 TH QUARTER 2020 27

Chantal Marx is head of research and Nicholas Riemer is head of investment education at FNB Wealth and Investments.

During the 17th and 18th centuries, a variety of monies were used alongside one another in southern Africa: ostrich shell beads, copper assegai tips, and the Rixdollar. The Rixdollar was the first banknote in Southern Africa; it was backed by silver. The Lombaard Bank was instituted in 1793 to manage the issuance and value of the Rixdollar, which circulated widely in the Cape.

In the 1800s, gold grew in prominence as a currency around the world, and its adoption also proliferated in southern Africa. By the mid-1800s, there were 32 private banks, two mining companies and one trading company all issuing private banknotes that were a claim on gold.

Each of these banknotes was like a certificate issued by a bank and bore the

THE EVOLUTION OF MONEY

issuing bank’s name. The Zuid Afrikaansche Republiek suffered a severe fiscal crisis in the late 1800s and the Rixdollar collapsed. Gold survived as money.

Monetary technologies

As society and its technologies change, so do its monies. In the 19th century when money was an element on the periodic table, anyone who could build a gold vault and write and issue a banknote certificate could get into the business of banking. There were virtually no licensing requirements to enter this market.

Similarly, a payments business was a courier company that moved banknotes or gold between banks and/or merchants and/or consumers.

American Express was the first major payments company in America. For many years, it had a virtual monopoly on the movement of express shipments of goods, securities, and currency on the East Coast.

When some American Express directors objected to a proposal that the company expand its operations to California, two directors started Wells Fargo & Co in 1852. Wells Fargo’s famous logo is the

stagecoach, because between 1852 to 1918 it was the largest stagecoach company in the world. The purpose of these stagecoaches? Shipment of goods, securities and currency.