For a sustainable tomorrow

Höganäs AB commits to reduce absolute scope 1 and 2 GHG emissions 51% by 2030 from a 2018 base year.* Höganäs AB also commits to reduce absolute scope 3 GHG emissions from purchased goods and services, upstream transportation and distribution, and business travel 30% within the same timeframe.

*The target boundary includes land-related emissions and removals from bioenergy feedstocks.

Our climate tagret is validated by Science Based Targets initiative.

For more info scan the QR Code

www.hoganas.com

Publisher & Editorial Offices

Inovar Communications Ltd

11 Park Plaza

Battlefield Enterprise Park Shrewsbury SY1 3AF United Kingdom

Tel: +44 (0)1743 469909 www.pm-review.com

Managing Director & Editor

Nick Williams, nick@inovar-communications.com

Group News Editor

Paul Whittaker, paul@inovar-communications.com

Advertising Sales Director

Jon Craxford, jon@inovar-communications.com Tel: +44 (0)207 1939 749

Assistant News Editor

Charlie Hopson-VandenBos charlie@inovar-communications.com

Editorial Assistant

Amelia Gregory, amelia@inovar-communications.com

Consulting Editor

Dr David Whittaker

Technical Consultant

Dr Martin McMahon

Digital Marketer

Mulltisa Moung, mulltisa@inovar-communications.com

Production Manager

Hugo Ribeiro, hugo@inovar-communications.com

Operations & Partnerships Manager

Merryl Le Roux, merryl@inovar-communications.com

Office & Accounts Manager

Jo Sheffield, jo@inovar-communications.com

Subscriptions

PM Review is published on a quarterly basis. It is available as a free electronic publication or as a paid print subscription. The annual subscription charge is £150.00 including shipping.

Accuracy of contents

Whilst every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions or for any consequences arising there from. Inovar Communications Ltd cannot be held responsible for views or claims expressed by contributors or advertisers, which are not necessarily those of the publisher.

Advertisements

Although all advertising material is expected to conform to ethical standards, inclusion in this publication does not constitute a guarantee or endorsement of the quality or value of such product or of the claims made by its manufacturer.

Reproduction, storage and usage

Single photocopies of articles may be made for personal use in accordance with national copyright laws. All rights reserved. Except as outlined above, no part of this publication may be reproduced or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner.

Design and production

Inovar Communications Ltd.

ISSN: 2050-9693 (PRINT)

ISSN: 2050-9707 (ONLINE)

© 2024 Inovar Communications Ltd.

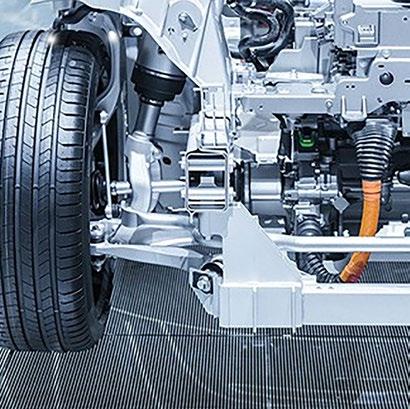

A celebration of PM’s success

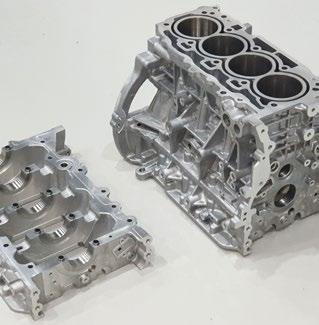

The Powder Metallurgy industry continues to innovate, supporting end-users around the world with costcompetitive, high-precision components for the automotive industry and beyond. Combined with the technology’s superior material utilisation and lower overall energy consumption compared to competing technologies, PM is a compelling solution for the next generation of applications.

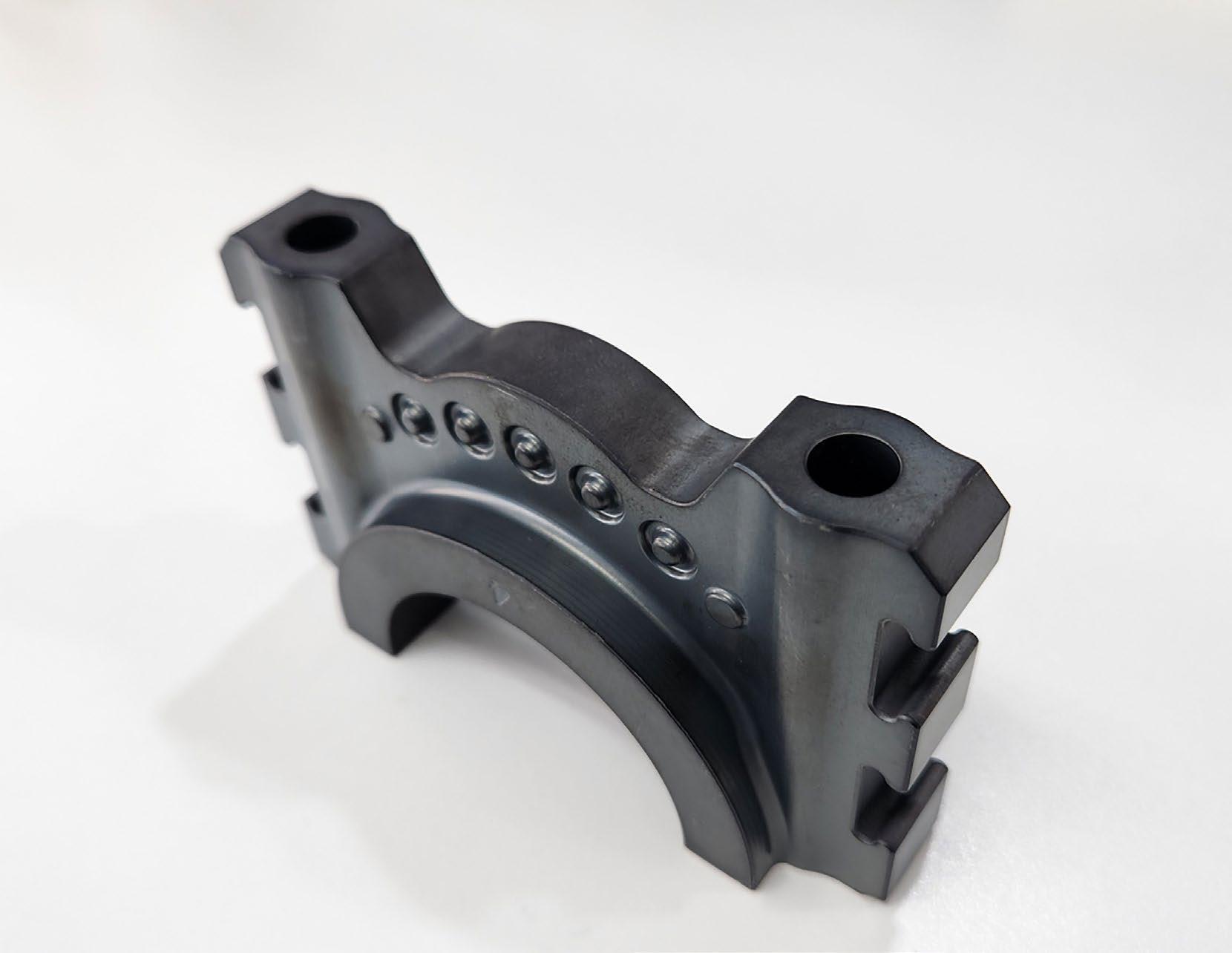

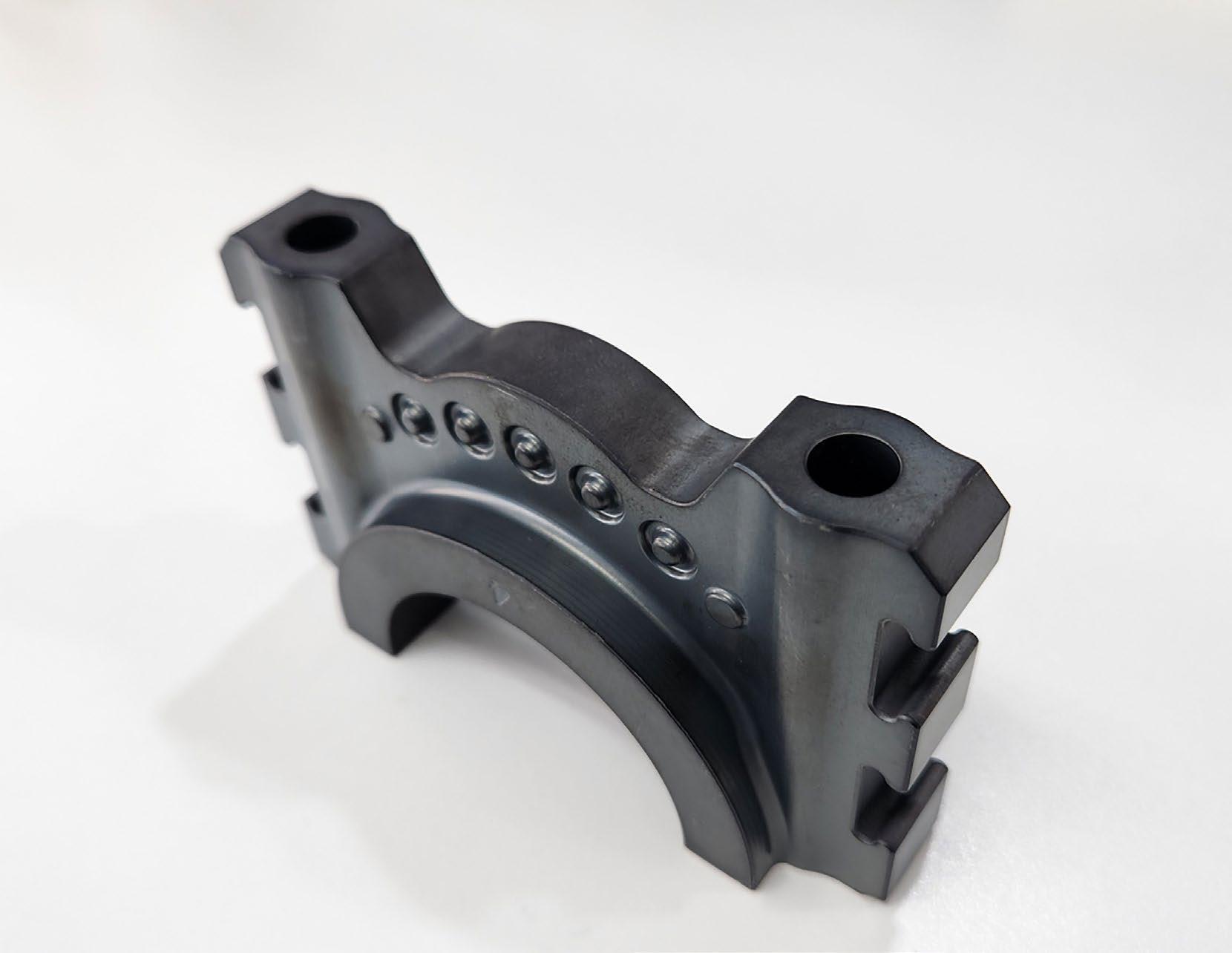

In this issue of PM Review , we present two such nextgeneration PM components, developed for Hyundai Motors by Korea Sintered Metal and Höganäs AB. These components, one of which won an internal award at Hyundai, will feature in a new generation of ICE engines and serve to raise awareness of PM technology within the company and, more widely, within automotive producers worldwide. Further PM innovations are also highlighted in our coverage of the Metal Powder Industries Federation’s 2024 PM Design Excellence awards where applications beyond automotive –in green energy, agricultural equipment, power tools and the medical sector – are celebrated.

We cannot, of course, dismiss what is happening in the automotive industry when considering the future trajectory of PM; how the shift towards an electrified future plays out is a matter on everyone’s mind. This is only further complicated by the rise of China as a global automotive superpower – a development that happened faster than many predicted.

Let us hope that conversations at World PM2024 Yokohama bring insight and a new vision of the global PM industry’s future. I look forward to seeing you there.

Nick Williams Managing Director, PM Review

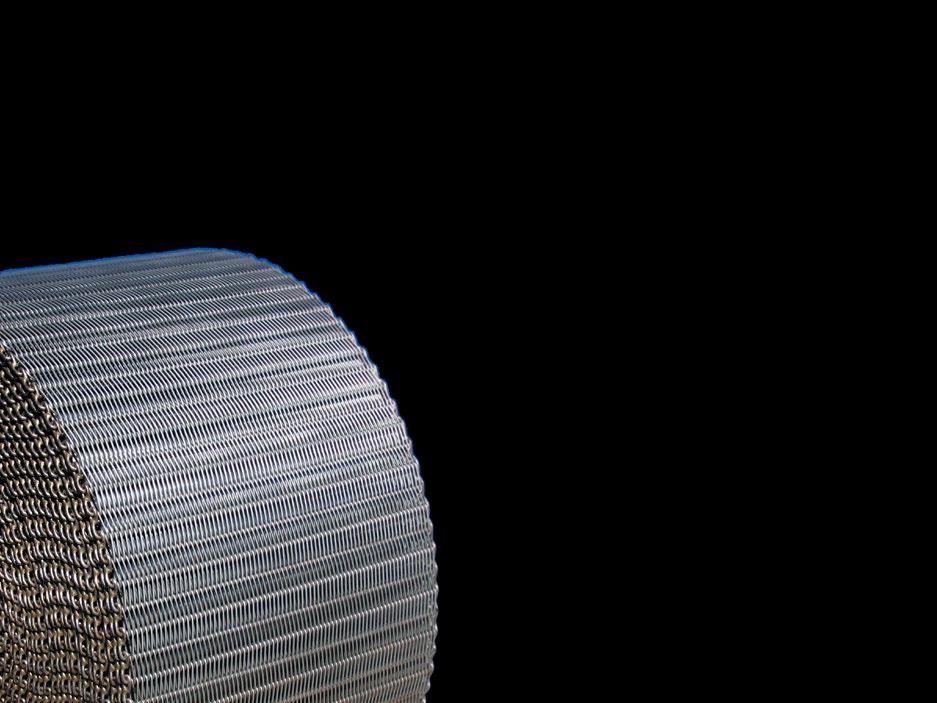

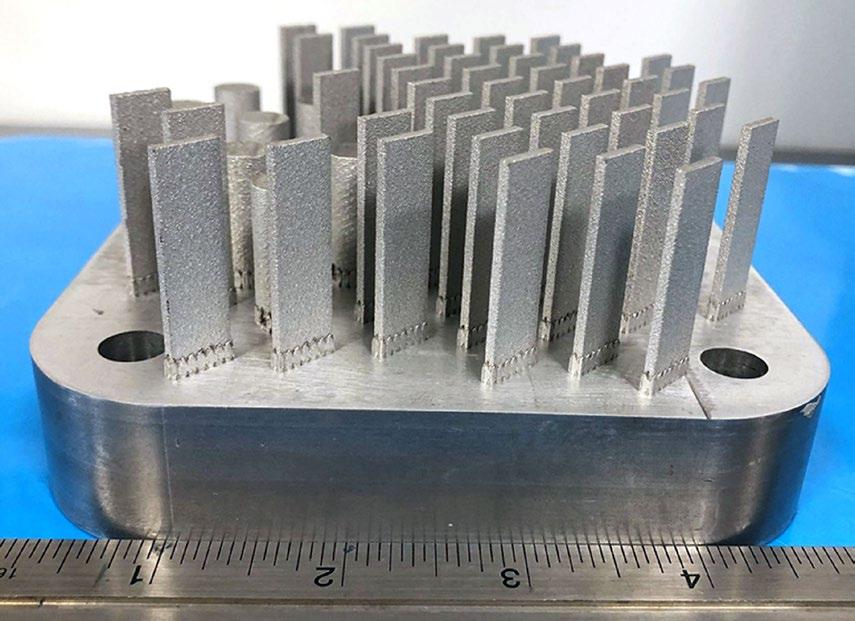

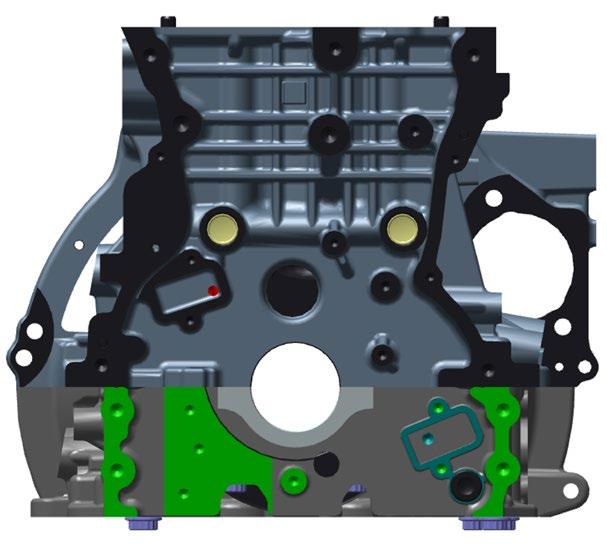

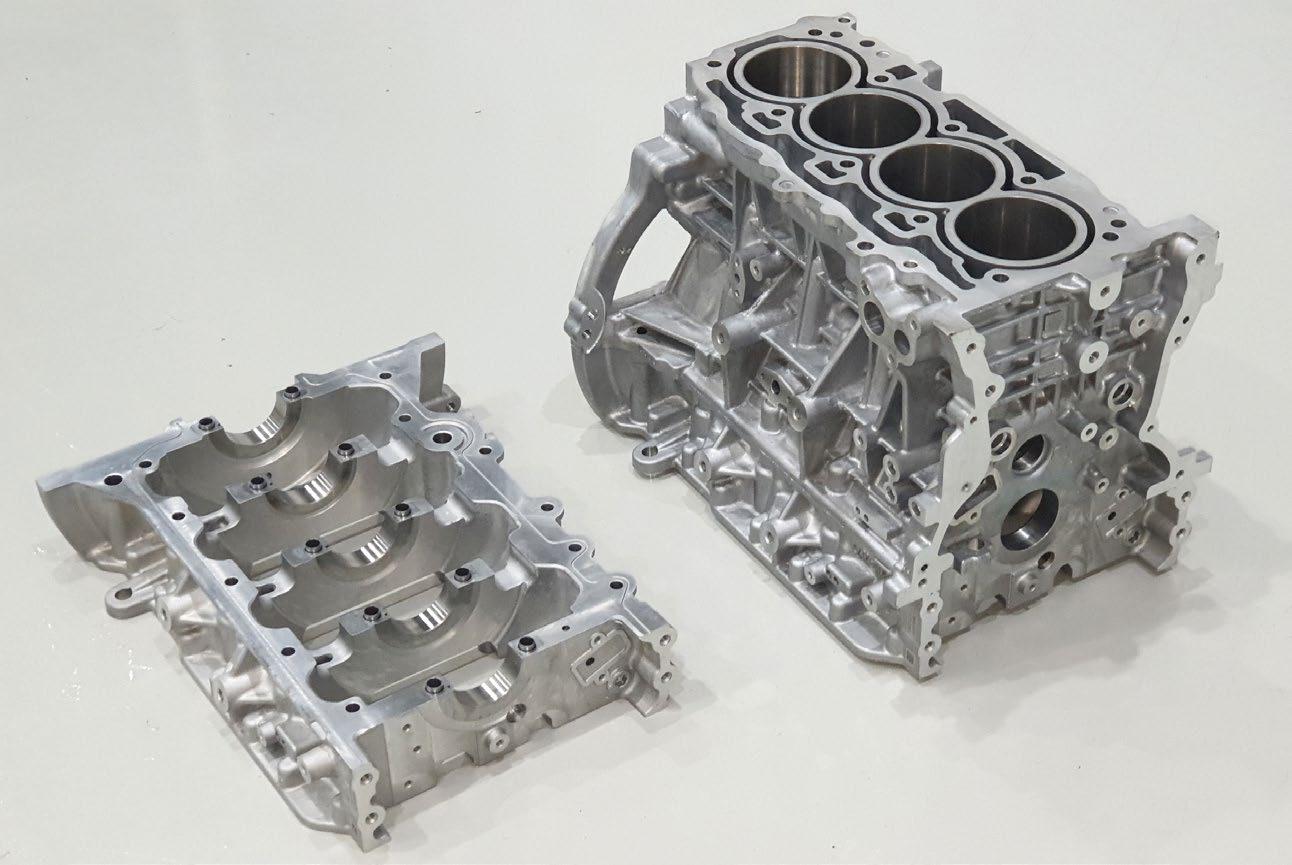

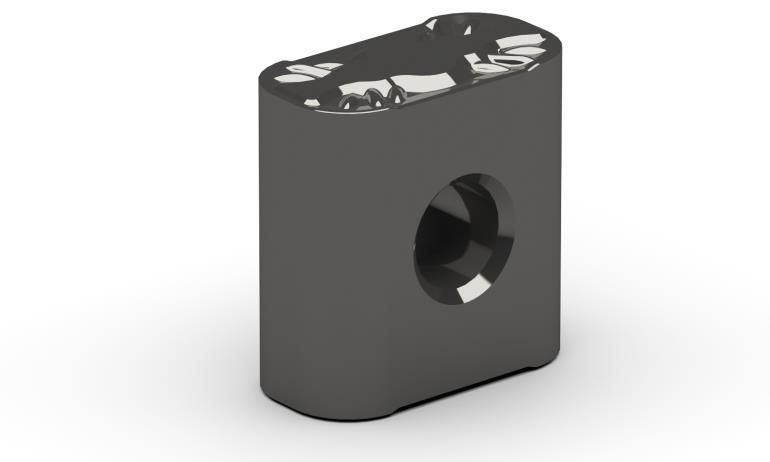

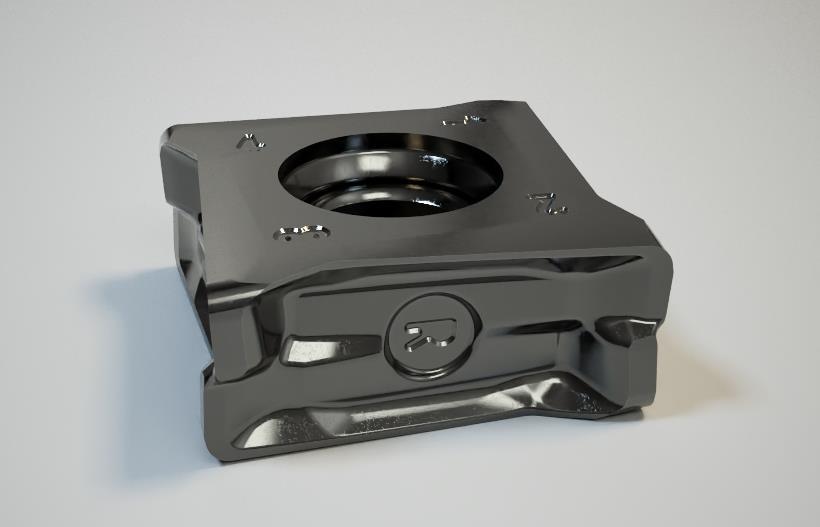

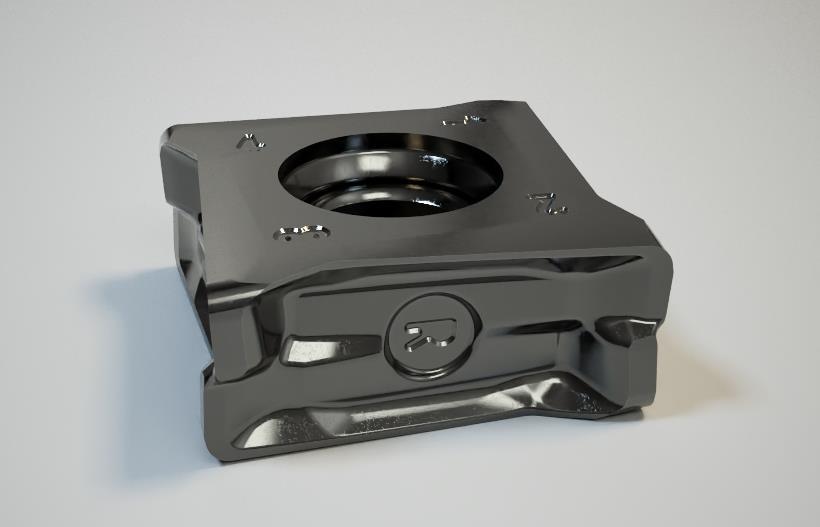

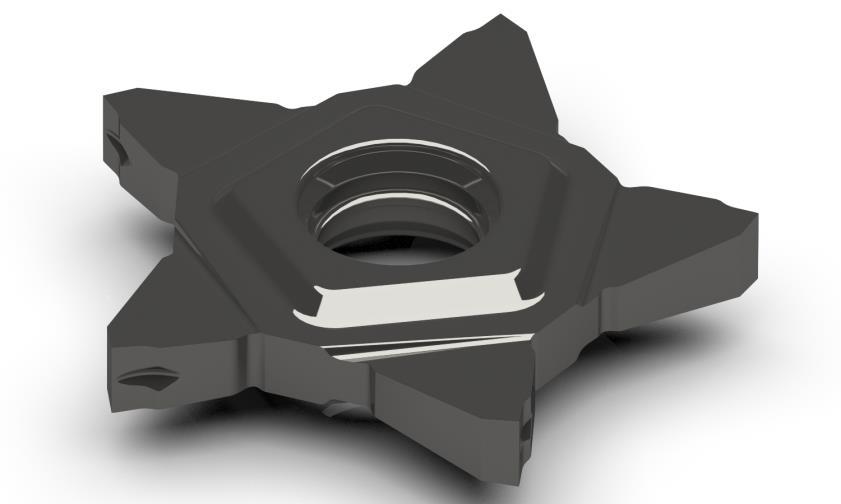

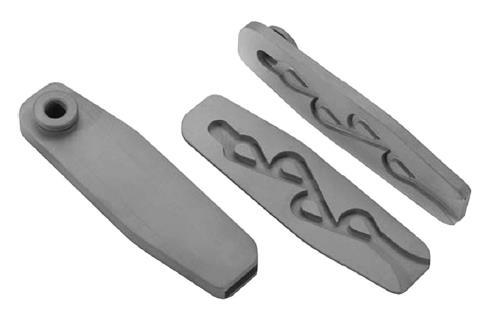

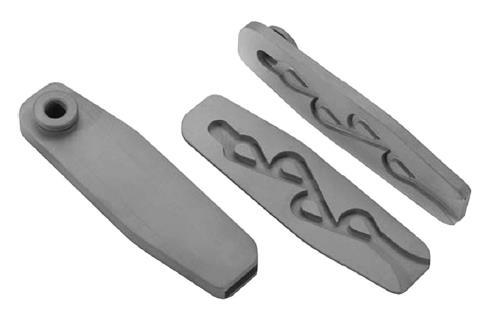

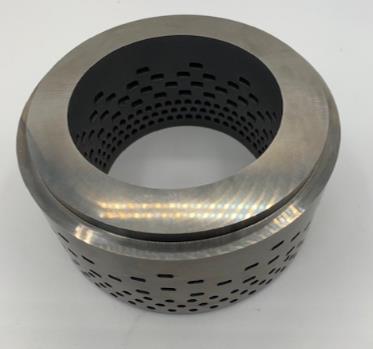

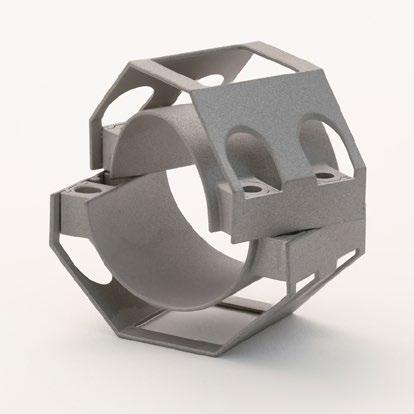

Cover image

A Powder Metallurgy bedplate insert (Courtesy Hyundai Motor/ Korea Sintered Metal/Höganäs Korea)

Find out more at www.riotinto.com Our materials, your life

Rio Tinto Metal Powders (RTMP) is committed to finding better ways to provide the materials the world needs now and in the future.

As a producer of iron and steel powders at our plant located in Quebec, Canada, RTMP is a key supplier to the automotive industry, which is undergoing a transition towards electrification. RTMP is contributing to the development of new Soft Magnetic Composite (SMC) materials for electric components, from pump assemblies to small electric motors in e-bikes and EV’s to support the energy transition. Together, we can create a better life for the generations to come.

Metal Powders www.qmp-powders.com

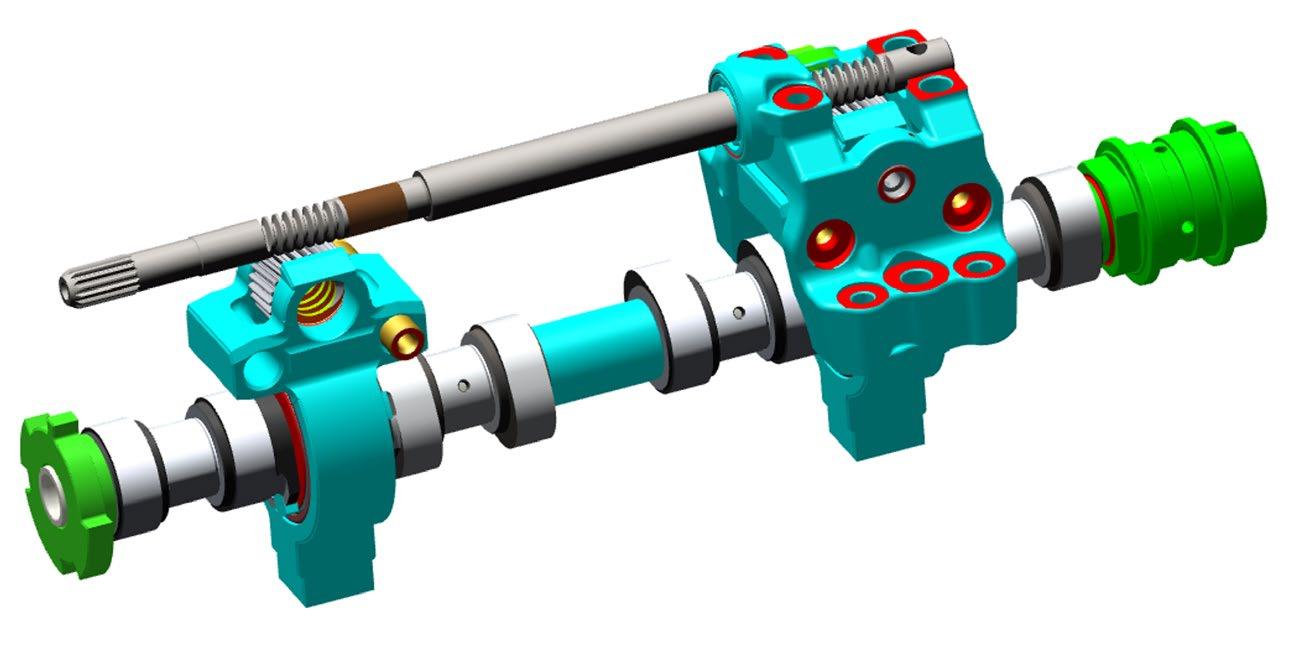

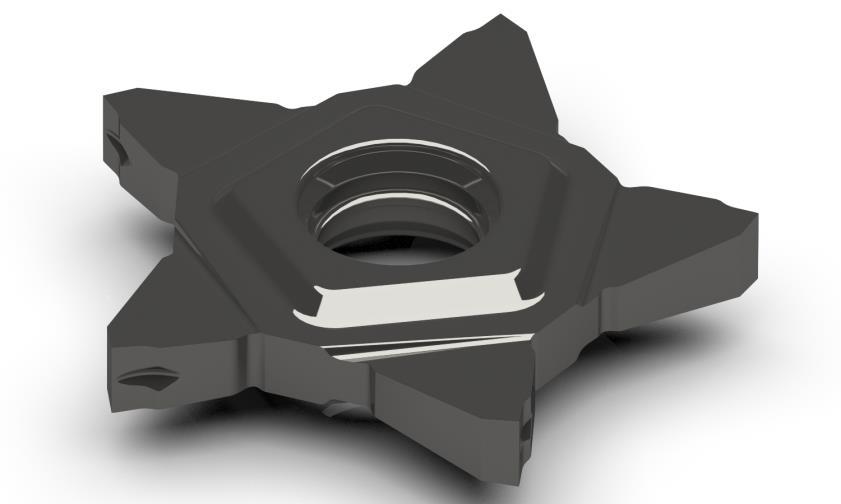

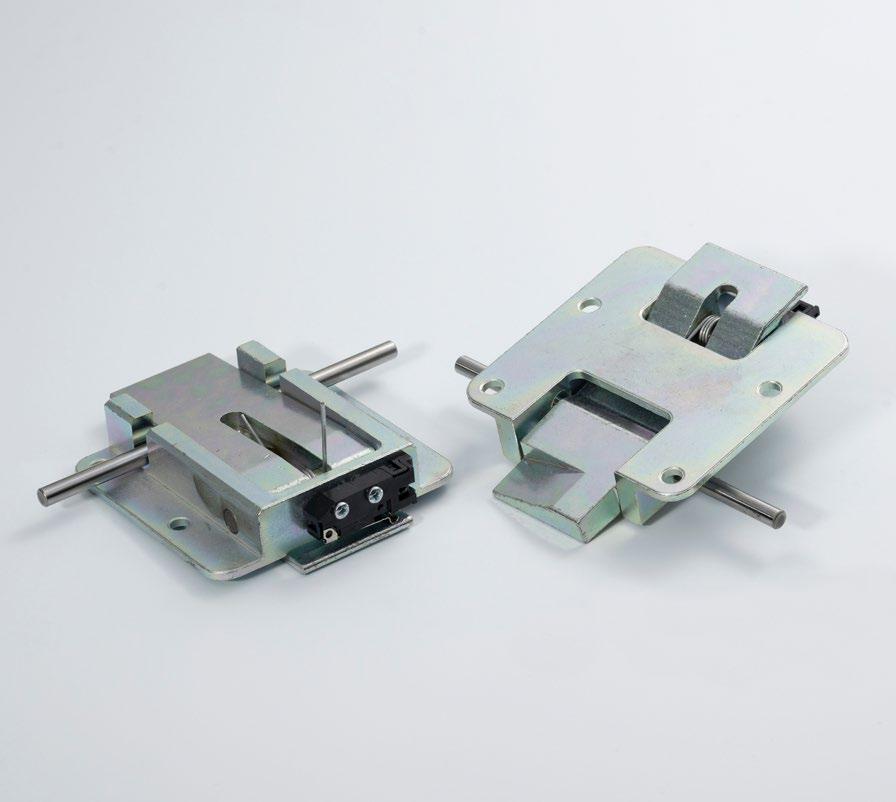

53 Collaboration drives success for PM: New Hyundai Motor applications developed with Korea Sintered Metal Co. and Höganäs AB

Despite the shift towards electrification, the further development and optimisation of internal combustion engines (ICEs) is still necessary in order to meet society’s diversified transportation needs. As it has done in the past, Powder Metallurgy is able to deliver the innovative solutions that are required for a new generation of engines.

In this article, Hak-Soo, Kim, Hyundai Motors, reports on a collaborative project between Hyundai Motor Company and Korea Sintered Metal Co. that resulted in the development of two innovative new PM automotive applications. >>>

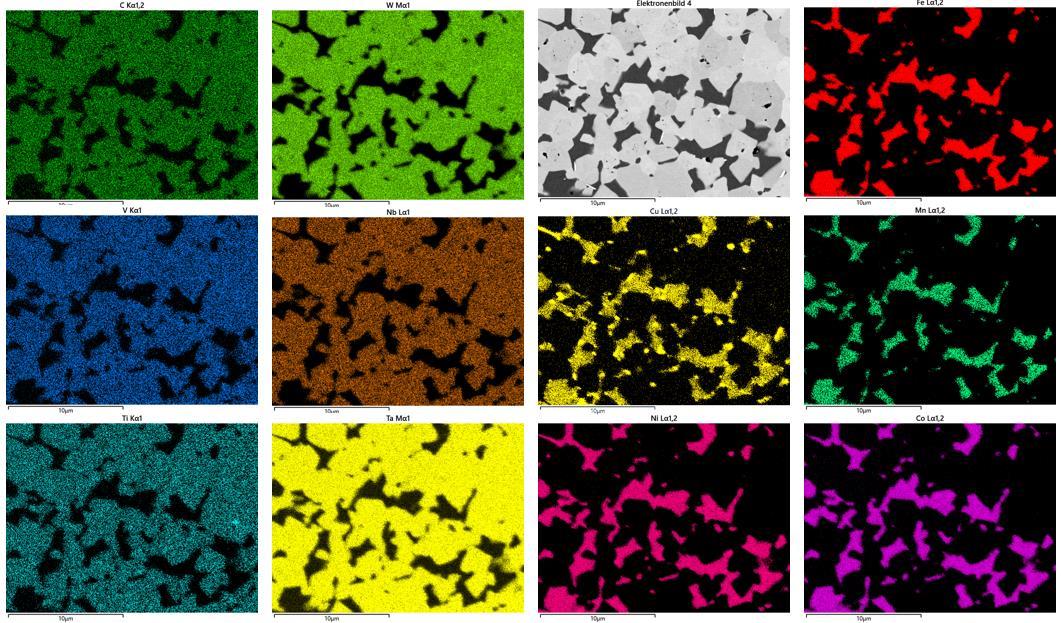

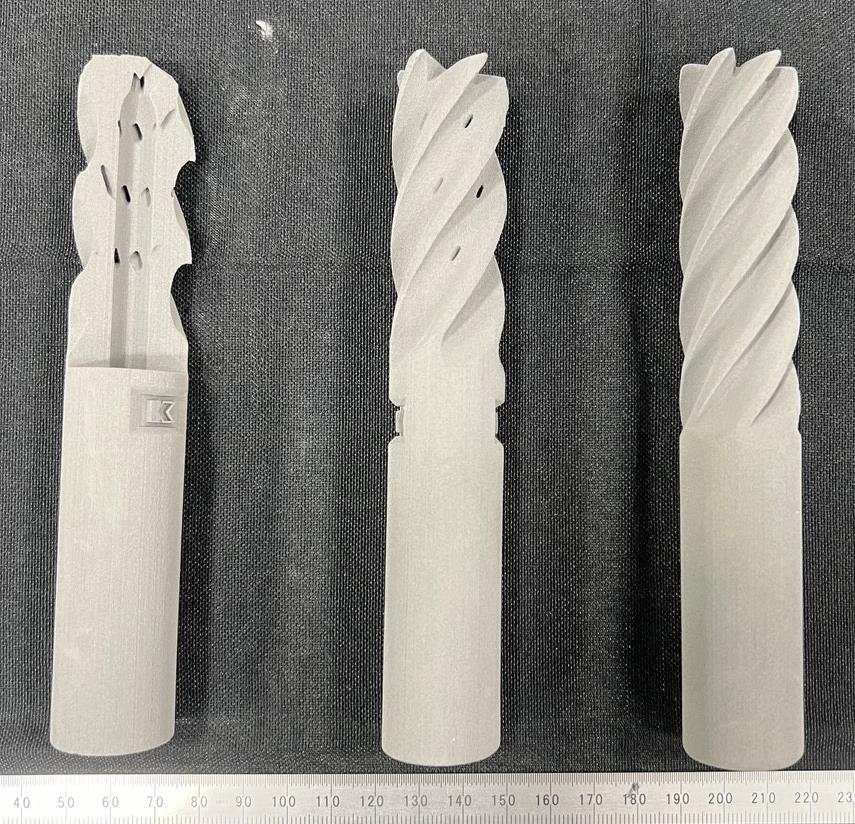

63 PowderMet2024 and AMPM2024 report: Cemented Carbides brought into focus in Pittsburgh

The fact that a high proportion of North America’s Powder Metallurgy structural parts and cemented carbide industries are located close to Pittsburgh, the host city for this year’s PowderMet2024 and AMPM2024 conferences, ensured a good turnout for the organiser, the Metal Powder Industries Federation (MPIF).

In the following report, Bernard North shares his overall impressions of the event and reports in detail on a particularly well-attended Carbide Forum, in which developments in the $20 billion cemented carbide industry were presented by a very knowledgeable panel of presenters. >>>

Experience the power of performance, the spark of innovation, and the strength of partnership

Performance:

As a global leader in powders, pastes, and granules, we excel in materials like Aluminum, Copper, Titanium, and more. Our precision manufacturing ensures superior product attributes tailored to your requirements.

Innovation:

Utilizing state-of-the-art research and development alongside cutting-edge technologies, we provide tailored solutions for PM and additive manufacturing. Our emphasis on materials and process advancements positions us as industry leaders in quality, service, and operational excellence.

Partnership:

Count on us as your trusted development and production ally. Our expertise in metal powders and alloys ensures top-tier materials for critical applications, empowering industries worldwide.

At Kymera International, we’re not just a powder provider; we’re your strategic partner in the world of specialty material solutions and additive manufacturing. Contact us today to revolutionize your projects

www.kymerainternational.com

info@kymerainternational.com

79

Powder Metallurgy shines in the MPIF’s 2024 Design Excellence Awards competition

The annual Powder Metallurgy Design Excellence Awards competition, organised by the Metal Powder Industries Federation (MPIF), is an opportunity for PM part producers to showcase the capabilities of the full range of metal powder-based technologies to a global audience.

This year’s winners were announced at a special ceremony at the International Conference on Powder Metallurgy & Particulate Materials (PowderMet2024), held in Pittsburgh from June 16-19. This report reviews the winners in the conventional Press and Sinter PM category. >>>

85 PowderMet2024: The state of the Powder Metallurgy industry in North America

A highlight of the Metal Powder Industries Federation’s annual International Conference on Powder Metallurgy & Particulate Materials (PowderMet) is the ‘State of the PM Industry’ presentation, in which key industry data are presented alongside analysis of the performance of PM in major markets. This year’s presentation was delivered by Michael Stucky, president of the MPIF and Business Unit Director at Norwood Medical. Stucky’s presentation, published here in full, brings the current challenges facing PM into focus, as well as highlighting opportunities for growth. >>>

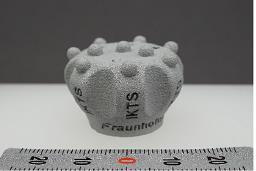

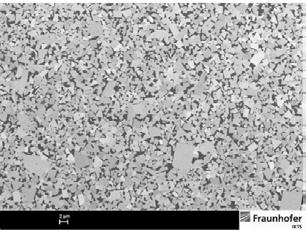

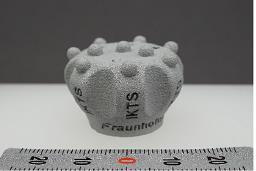

93 The wire that makes the powder: TGTi’s development of titanium wire feedstock for plasma atomisation

When it comes to titanium powder production for Additive Manufacturing, Metal Injection Moulding and other advanced production processes, plasma gas atomisation is regarded as a gold standard – particularly for demanding applications in the aerospace and medical sectors. The quality of the wire feedstock that is used in the process, of course, directly impacts the quality of the powder that comes out. In this article, Jiangsu Tiangong Technology (TGTi) shares insights into its production processes, its rise to becoming a market leader, and its goal of meeting the needs of the international community. >>>

Advertisers’ index & buyer’s guide

Our advertisers’ index and buyer’s guide serves as a convenient guide to suppliers across the PM supply chain. In the digital edition of PM Review magazine, available at www.pm-review.com, simply click on a company name to view its advert, or on the company’s weblink to go directly to its website.

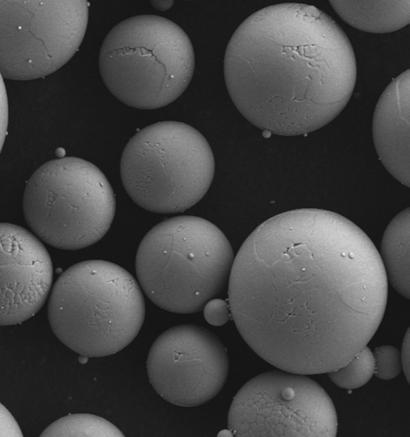

● GAS AND ULTRASONIC ATOMIZERS FOR SPHERICAL POWDERS WITHOUT ANY SATELLITES for LPBF, MIM, Binder Jetting and other Additive Manufacturing applications. High purity, sphericity and wide range of reproducible particle size distribution.

● WATER ATOMIZERS FOR MORE IRREGULAR POWDERS ideal for recycling/re ning process, press & sinter process and others.

● AIR CLASSIFIERS FOR THE PRECISE SEPARATION OF METAL POWDERS into ne and coarse powder fractions especially in the range < 25 µm

● MAXIMUM PURITY BY OXIDATION-FREE PROCESSING

● ALL SYSTEMS DESIGNED FOR EASY HANDLING AND CLEANING, QUICK ALLOY CHANGE WITH MINIMUM CROSS CONTAMINATION

● FOR A WIDE RANGE OF METALS AND FOR SMALL TO MEDIUM AMOUNTS

To submit news for inclusion in Powder Metallurgy Review contact Paul Whittaker at paul@inovar-communications.com

IDEX to acquire Mott Corporation for $1 billion

IDEX Corporation, Northbrook, Illinois, USA, announced in July that it has entered into a definitive agreement to acquire Mott Corporation, headquartered in Farmington, Connecticut, USA, and its subsidiaries for cash consideration of $1 billion, subject to customary adjustments.

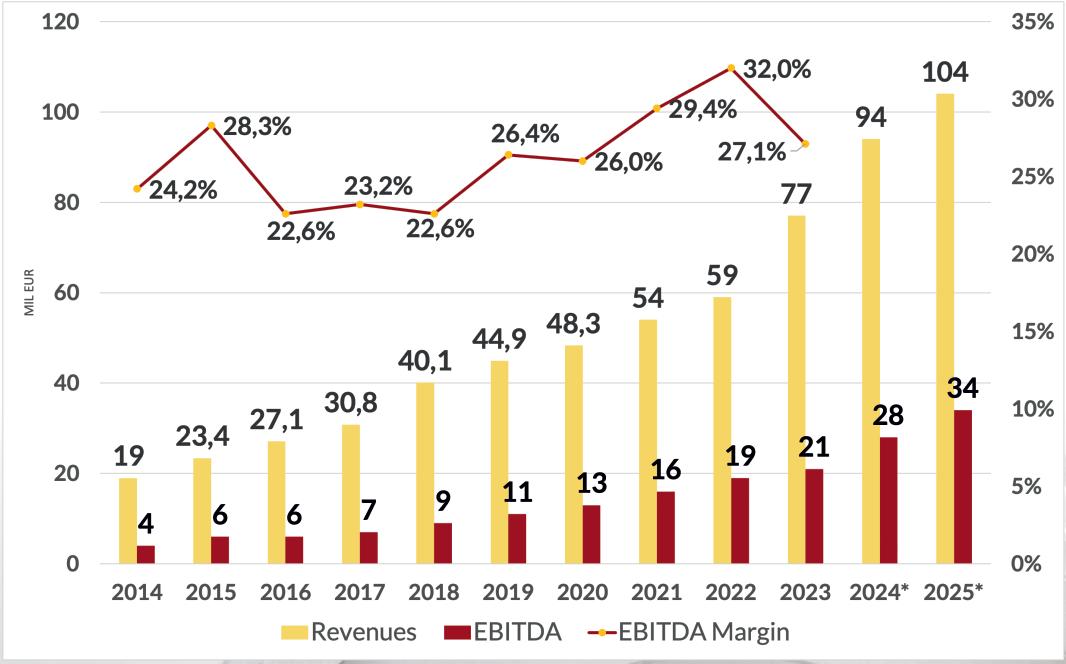

When adjusted for the present value of expected tax benefits of approximately $100 million, the net transaction value is approximately $900 million. This represents approximately 19x Mott’s forecasted full-year 2024 EBITDA and a mid-teens multiple based on forecasted 2025 EBITDA. The transaction is expected to be accretive to adjusted earnings per share in fiscal year 2026.

“Mott’s business fits the IDEX sweet spot of highly engineered, configurable mission-critical components focused on scalable select applications. The addition of Mott represents an important step in our evolution, as we continue building our differentiated capabilities in applied materials technologies. Mott brings advanced technical and application expertise that will expand our capabilities in highvalue end markets and open new organic growth opportunities. Our focus on driving profitable growth through the enterprise-wide application of 80/20 is expected to yield material benefits,” said Eric D Ashleman, Chief Executive Officer and President of IDEX.

“The addition of Mott supports our strategy to deliver longterm, compounding value to our customers, employees, and shareholders, which includes targeted inorganic growth funded by strong cash flow generation. With shared cultural values, including a deep passion for solving customer challenges through technical capabilities and innovative solutions, our great teams combine to offer meaningful go-to-market opportunities. We look forward to welcoming the over 500 Mott employees to IDEX,” Ashleman continued.

In 2024, Mott is expected to generate approximately $200 million of revenue, with an EBITDA margin in the low 20s. Mott will join IDEX’s Health & Science Technologies segment. The transaction will be funded through a combination of cash on hand, borrowings from

IDEX’s current credit facility, and potential debt issuance.

“We’re excited to join an industry leader with a strong record of helping customers solve their toughest problems. Mott brings applied material science, chemistry, and application expertise, an additive and complementary customer base, and a growing pipeline of opportunities. When combined with the scale of IDEX, industry-leading positions, and deep technological know-how, this will yield meaningful synergies and benefits. Our culture and capabilities align with IDEX, and our employees will add tremendous value to the company, just as they’ve driven Mott’s growth for generations,” stated Boris Levin, president and Chief Executive Officer of Mott.

The deal is expected to close by the end of the third quarter of 2024, subject to regulatory approvals and customary closing conditions.

www.idexcorp.com

www.mottcorp.com

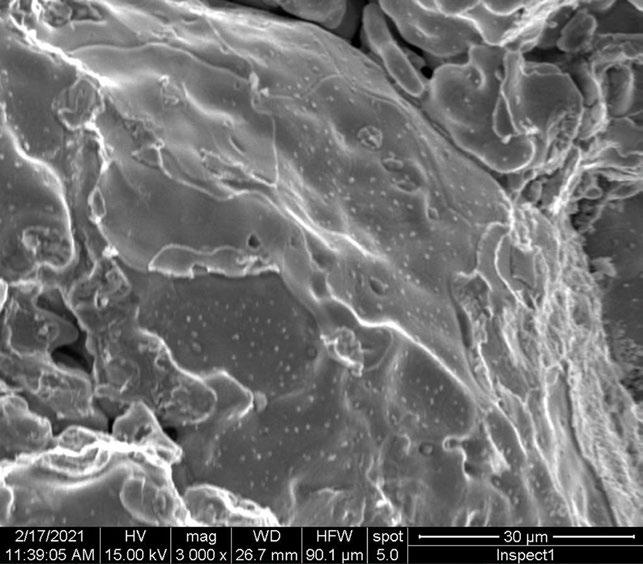

Mott Corporation produces a range of sintered filters, amongst other products (Courtesy Mott Corporation)

Dowlais considers sale of GKN Powder Metallurgy business

Dowlais Group plc, the UK-based parent company of GKN Automotive and GKN Powder Metallurgy, has published its half year 2024 results. In the report, the company confirmed it has commenced a strategic review of the Powder Metallurgy business, as it eyes a potential sale of the division.

GKN Powder Metallurgy noted a good start to the year, with adjusted revenues growing by 0.2%, ahead of the market, while adjusted operating profit increased by 6.0%, resulting in an adjusted operating margin expansion of 50 bps, to 9.5%.

The company stated that proactive management of the cost base had enabled GKN Powder Metallurgy to offset inflationary increases through operational efficiencies. This led to restructuring activities continuing in the first half of the year, with one site closed in the US and another set to close by the end of the year. The location of the second site closure was not stated, but this was expected to further optimise the manufacturing footprint, Dowlais stated.

It was added that GKN Powder Metallurgy continued to advance its EV transition, winning new EV-specific contracts and identifying additional growth areas for propulsion-agnostic products.

For the group as a whole, Dowlais reported adjusted revenue of £2,571 million for the six months ending June 30, 2024, a reduction of 5.1% on the prior year, said to be driven by weakness in the ePowertrain product line of the Automotive business.

Driveline, China and Powder Metallurgy, totalling more than 75% of the group’s revenues, were reported to be performing above their markets.

The group posted adjusted operating profit of £151 million, including £7 million of operating losses from Hydrogen operations, a decline of 9.0% compared to the prior year, said to be driven by lower volumes.

“In this challenging market environment, we focused on what we can control and took several decisive actions to mitigate the impact from lower volume as well as unlock value from our portfolio,” stated Liam Butterworth, Chief Executive Officer.

Gevorkyan reports acquisition of Altha PM’s customers and production of PM parts for SKF Group

Gevorkyan, headquartered in Vlkanová, Slovakia, has reported on its recent agreement with Poland’s Altha Powder Metallurgy and the ongoing transfer of PM part production from Sweden’s SKF Group to Gevorkyan’s manufacturing plant in Vlklanová.

In April 2024, an agreement between Gevorkyan and Altha Powder Metallurgy, a division of Altha Group based in Radom, Poland, resulted in the acquisition of customers for whom Altha PM was no longer able to serve. The deal did not involve the

purchase of any shares in Altha PM – rather, Gevorkyan has taken over the portfolio for a number of its customers and is transferring production of the related products to its manufacturing plant in Vlklanová. The company added that it has since negotiated new and more favourable terms of cooperation with Altha PM’s customers.

Gevorkyan is currently negotiating with the Polish company regarding the purchase of certain assets, including machinery. If they reach an agreement, the machinery

Liam Butterworth, Dowlais CEO, has announced a strategic review of GKN Powder Metallurgy (Courtesy Dowlais Group)

“First, we implemented a relentless focus on cost control, limiting the impact on adjusted operating profit and mitigated the margin decline to 30 bps. Second, we initiated a comprehensive programme of commercial recovery initiatives with our customers which, together with the ongoing restructuring programmes and performance initiatives, will limit the impact from expected lower revenues in the second half of the year. Finally, today’s announcement of a strategic review of Powder Metallurgy and the disposal of our Hydrogen operations underscores our commitment to unlocking value from our portfolio and delivering shareholder returns,” Butterworth concluded. www.gknpm.com

would be transferred to Gevorkyan’s plant in Vlkanová to further increase its production capacity.

Gevorkyan also announced that it is continuing to produce Powder Metallurgy parts for Sweden’s SKF Group.

SKF group is one of the largest bearing and seal manufacturers in the world, present in 130 countries. In 2023, it employed over 40,000 people and generated sales of €8.5 billion.

Having established itself as a stable and reliable supplier, SKF Group has entrusted Gevorkyan with the production of several PM components that the group previously produced itself, opting for outsourcing rather than opening a larger plant.

www.gevorkyan.sk

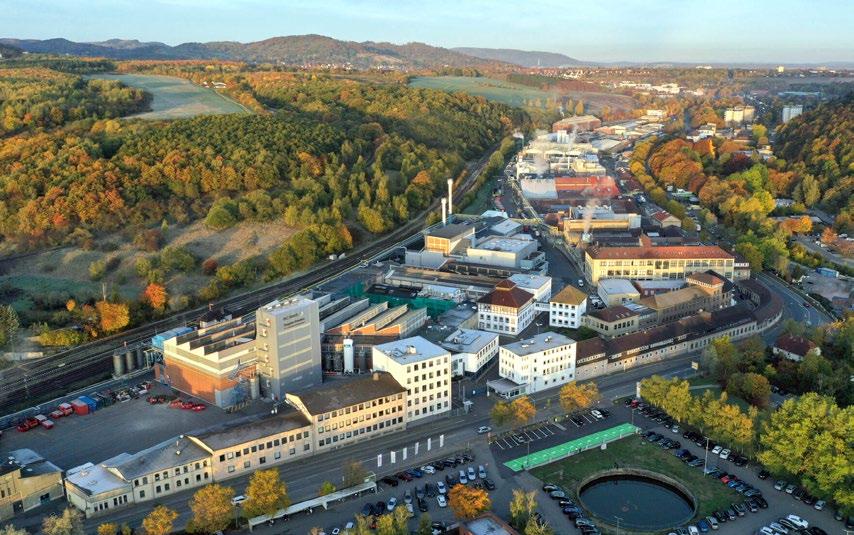

HC Starck Tungsten to be sold to Mitsubishi Materials Corporation

Masan High-Tech (MHT) Materials Group, headquartered in Ho Chi Minh City, Vietnam, parent company of HC Starck Tungsten, has signed a binding agreement with Mitsubishi Materials Corporation Group (MMC), Tokyo, Japan, for the sale of all

shares in HC Starck Holding GmbH. MMC, which operates its own site for the recovery and processing of tungsten as well as the manufacturing of tungstenbased tools, is a long-standing customer of the Goslar-based

China unveils new rare earth regulations to protect domestic supply

China has unveiled a list of rare earth regulations that are aimed at protecting supplies for national security purposes, reports Reuters These regulations encompass rules governing the mining, smelting, and trading of critical materials used in the production of items ranging from magnets in electric vehicles (EVs) to consumer electronics.

The regulations, issued by the State Council, announced that rare earth resources belong to the state, and the government will oversee the development of the rare earths industry. In recent years, China has become the world’s dominant producer of the seventeen minerals, accounting for nearly 90% of global refined output.

China’s global industrial significance is such that the European Union has set ambitious 2030 targets for domestic production of crucial minerals, particularly rare earths. This is in line with the green transition as rare earths are used in permanent magnets powering motors in electric vehicles and wind energy. The law came into force in May to support this initiative. The demand for rare earths in the EU is projected to increase sixfold by 2030 and sevenfold by 2050.

The new Chinese regulations, which will take effect on October 1 st, state that the State Council will establish a rare earth product traceability information system. Under this system, enterprises

company. It acquired a 10% stake in MHT in 2020, shortly after the latter took over HCS from the former HC Stark Group.

As a result of the acquisition, MMC Group will have tungsten operations in four major markets: Japan, Europe, North America and China.

MMC stated that Japan New Metals Co, Ltd (a wholly owned subsidiary of MMC) and HC Starck will work together to create synergies and increase corporate value by strengthening R&D capabilities and promoting cross-selling, as well as developing a global tungsten recycling business.

Dr Hady Seyeda, CEO of HCS, stated, “We know and appreciate Mitsubishi Materials as a longstanding customer and as an investor whose activities in Japan perfectly complement our global presence. Following the signing of the agreement, we will now focus on discussing the relevant strategic and operational issues and taking the appropriate steps.”

www.masanhightechmaterials.com www.mmc.co.jp www.hcstarck.com

involved in rare earth mining, smelting and separation, as well as the export of rare earth products, will need to establish a product flow record system and accurately record the flow of products when entering them into the traceability system.

Last year, China imposed restrictions on the export of germanium and gallium, which are used in chip-making, in order to protect national security and interests. Additionally, China banned the export of technology used to produce rare earth magnets and placed restrictions on technology used for the extraction and separation of rare earths.

These new rules raise concerns that limitations on rare earth supplies could further escalate tensions with the West, especially the United States.

www.reuters.com

Mitsubishi Materials Corporation Group will acquire all shares in H C Starck Holding GmbH (Courtesy H C Starck Holding GmbH)

A SOLID LINE OF THINKING: SINTERING WITH A SOLID INFILTRANT

SOLIDIFY YOUR CASE FOR ULTRA INFILTRANT

There’s a solid line of thinking in the copper infiltration of ferrous PM parts and it can change the way you do business. Ultra Infiltrant is a wrought, homogeneous copper-based alloy that offers significant benefits over powder form copper infiltrants. Benefits like less waste, improved productivity, reduced erosion, no adherent residue and increased strength and hardness values. Benefits that affect your production line and ultimately your bottom line. Ultra Infiltrant is available in single and multi-turn wire rings, straight-length slugs, or other configurations to accommodate virtually any automated process. Ultra Infiltrant was designed for copper infiltration of ferrous PM parts in today’s cost competitive manufacturing environments, where the handling of fragile green infiltrant slugs is difficult and can lead to excessive waste. Additionally, it performs well in nitrogen-hydrogen based atmospheres so widely used in sintering operations globally.

SOLIDIFY YOUR INFILTRATION PROCESS FOR ULTRA INFILTRANT

Less waste, easier production, superior product: what more is there? Ultra Infiltrant revolutionizes the PM industry by eliminating all the negatives associated with infiltrant powders and improving on the process as a whole. The net result? How about overwhelmed customers and a boost to your bottom line? That’s what Ultra Infiltrant offers, so put it to work and get started on a solid line of thinking.

Levine Leichtman Capital Partners acquires NSL Analytical Services

Levine Leichtman Capital Partners, headquartered in Los Angeles, California, USA, has announced that it has acquired NSL Analytical Services, Inc, based in Cleveland, Ohio, in partnership with its management.

NSL, founded in 1945, is a materials testing provider serving a diverse client base across highly regulated and technologically advanced end markets, including aerospace and defence, advanced materials, and electronics. NSL’s experienced chemists, metallurgists and technicians are experts in testing a wide range of materials and finished components, serving the recurring and non-discretionary testing needs of clients throughout the US and the world.

Levine Leichtman Capital Partners has acquired NSL Analytical Services in partnership with its management (Courtesy NSL Analytical Services)

“We are thrilled to partner with NSL, a leader in the materials testing and analysis sector,” stated Matthew Frankel, Managing Partner at LLCP.

“NSL has established itself as a trusted partner for a loyal client base across numerous high-performance industries. We are excited to work with the NSL team to broaden the company’s testing capabilities and geographic footprint through both organic initiatives and strategic acquisitions.”

“Our new partnership with LLCP will further guide and fuel NSL’s growth in support of the critical quality assurance testing our team delivers to clients world-wide,”

CEO Ron Wesel shared. “In an everincreasing technology-driven world, NSL’s material testing capabilities provide the confidence and security demanded by traditional and evolving production methods such as AM.” www.nslanalytical.com www.llcp.com

October 14-16,2024 - Columbus Convention Center

Established in Barcelona, We are the biggest manufacturer of mesh belts for sintering furnaces with global presence around the globe

Seco/Warwick expands USA furnace manufacturing operations

Seco/Warwick Group, headquartered in Swiebodzin, Poland, has announced plans to expand its operations in the USA. The group, parent company of Seco/Vacuum and Seco/Warwick USA, has committed to expanding its manufacturing capacity in Pennsylvania by relocating a portion of its manufacturing, and a metallurgical lab for vacuum furnaces, from Poland to Crawford County.

In support of the expansion plans, the government of Pennsylvania has awarded the company a $2 million package of matching fund grants from the Department of Community and Economic Development through its Redevelopment Assistance Capital Program (RACP). The primary use and intent of the RACP fund is for reimbursement of eligible construction costs which Seco/Warwick Group companies will match on a 1:1 basis.

Seco/Vacuum manufactures heat-treating furnaces specialised for heat-treatment processes that must be conducted inside a vacuum chamber to prevent contamination from atmospheric gases. Seco/Warwick USA manufactures atmosphere heat-treatment furnaces, aluminium melting furnaces and controlled aluminium brazing (CAB) furnaces.

The expanded facility will benefit the community as well as the heat-treatment equipment manufacturer’s customers. The company will begin upfitting their nowempty factory floor in the Crawford Business Park, which itself was recently redeveloped from the long-abandoned American Viscose Corporation’s synthetic textile mill in Meadville, Pennsylvania, USA.

At its peak in the 1950s, the mill employed nearly half of Meadville. After many decades of operation, the mill closed in 1986. Beginning in 1989, the Crawford County Redevelopment Authority, the predecessor to today’s Economic Progress Alliance of Crawford County, invested in cleaning, remodelling, and subdividing the millionsquare-foot plant into more than fifty smaller commercial and industrial spaces.

The added capabilities look to improve the company’s response to its North American customers’ needs, not only through manufacturing but also through the addition of parts, service, and training capacity. At the same time, the new facility will require an expanded staff, at both entrylevel and skilled positions, providing new opportunities to workers in Meadville and the surrounding communities.

“We look forward to working with our local partners including the City of Meadville, the Economic Progress Alliance of Crawford County (EPACC), the Workforce and Economic Development Network (WEDnet), and the Pennsylvania Department of Community and Economic Development (DCED) to make this expansion happen,” said Piotr Zawistowski, SECO/VACUUM President, Managing Director.

www.secovacusa.com

Meet the all new LAUFFER E- CELL

Powder Press System with integrated automation

Powder Press System with integrated Automation:

• Fully integrated ejection press system with robot-based parts handling

• One LAUFFER control unit for the complete press cell

• State of the art drive technology for highly energy efficiency

• Unmatched press precision

• IoT ready

LAUFFER GmbH & Co. KG

Industriestr. 101, 72160 Horb, Germany T +49 7451 902-0 F +49 7451 902-100 E lau er.pressen@lau er.de W www.lau er.de

Maschinenfabrik

Osterwalder delivers its first 1000kN multi-plate servo electric press

Osterwalder AG, Lyss, Switzerland, reports that it delivered its first 1,000 kN servo-electric multi-plate press, the OPP 1000, in July 2024. The press is said to use a unique combination of the servo electric main-drives, hydraulic plate-drives for the powder transfer phase and CNC controlled mechanical stops.

“Around 2015 it became clear to us that the future of powder pressing is electric. These presses have only advantages: more precision, reduced energy consumption, reduced noise, reduced maintenance costs, etc. With the latest developments in electro-mobility and micro-mobility, it also became clear that, after the successful launch of the OPP 2000 (Osterwalder’s 2000 kN press) in 2018 and the OPP 5000 (Osterwalder’s 5000 kN press) in 2022, the next one will be smaller again,” commented Rolf Graf, owner and CEO.

“This press is not only the latest of the new multi-plate product-line, it is also the most mature press Osterwalder has made,” stated David Benczur, Global Head of Sales Iron Powder. “The structure is based on the successful design of the previous hydraulic presses of the same size, the Control System is derived of larger OPP presses, and it operates with the latest version of our wellknown HMI. But it also includes some new tricks, for example a kinetic energy battery that reduces the peak-currents.”

Osterwalder launched the world’s first CNC-controlled powder press in 1989. The OPP 1000 is the latest member of the multi-plate series.

“Our discussions with our customers conclude usually on short returns on investment (ROI), typically within one to three years, sometimes even comparing to already amortised used presses. High stroke-rates

Neo Performance Materials sells Quapaw rare metals facility

Neo Performance Materials Inc, headquartered in Toronto, Canada, has announced that it has entered into an agreement to sell its equity ownership interest in Neo Rare Metals, LLC, Quapaw, Oklahoma, USA, to Kevin Reading, the current General Manager and co-founder of the facility. The transaction is said to continue Neo’s drive to simplify its business globally, by focusing on portfolio assets that reflect the company’s scale and growth ambitions in a competitive global business environment.

Reading has agreed to purchase Neo’s 80% equity interest in the Quapaw location in consideration for an aggregate cash purchase price equal to $1.4 million plus cash on closing, subject to normal closing adjustments, which represents a 9.0x multiple of trailing

twelve months of the EBITDA of the facility.

The transaction is part of Neo’s operational transformation and production optimisation commitment to simplify global operations. It includes a five-year agreement for the purchase by Quapaw of gallium and indium from the company’s recycling facility in Peterborough, Ontario, as well as for the processing and transfer of gallium scrap to the company’s Peterborough recycling facility.

“We continue Neo’s global transformation and optimisation of our asset base. The sale of the Quapaw facility back to its founder is an exciting opportunity for both of us to benefit in the long-term. I look forward to our continued partnership with the entrepreneurial owner-operator team at Quapaw. Mr Reading has

Osterwalder offers a range of multi-plate presses (Courtesy Osterwalder AG)

play a role of course, but precision, reliability and also short set-up and learn-in times for the work force are equally important to maximise good parts produced continuously week after week.”

www.osterwalder.com

always been a valued partner and great business leader. We are excited for Kevin, the team at Quapaw and for the continued growth opportunities for this facility as a focused entity,” stated Rahim Suleman, president and Chief Executive Officer of Neo.

“We are thrilled to purchase back the business we founded as we look to grow operations in Quapaw, Oklahoma,” shared Kevin Reading, General Manager of Quapaw. “Our relationship with Neo over the years has led this facility to improvements in health and safety initiatives that has truly made us a better facility. Our strong management team will continue to work closely with our Neo partners to ensure that together, we can meet the needs of both facilities and our customers’ needs.” The transaction is subject to customary conditions to closing and is expected to close in the third quarter of 2024. www.neomaterials.com

A remarkable milestone

A quarter of a century. We could have only accomplished this by forging solid partnerships, friendships and collaborations build on trust, integrity and commitment.

DSH Technologies is the GO-TO support team for helping to process metal powder parts and materials. Real world solutions to real world problems, we can help solve technical, process and engineering related issues.

• Remote or In-Person process support

• Toll Debind and Sinter Services – “You Print It, You Mold It – We Debind & Sinter It”

• In person facility walk through, process evaluation, and education programs For the past twenty five years, DSH is the only source for the best process support, toll processing and educational resource for your MIM and Metal AM applications.

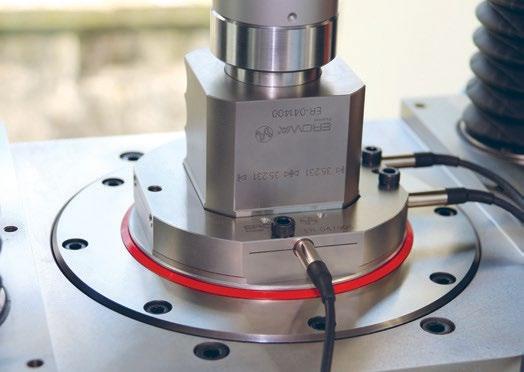

Tooling for Powder Compacting Technology

• Simple, quick set-up • High accuracy • Low scrap rate • Maximal machine utilization

Increased productivity

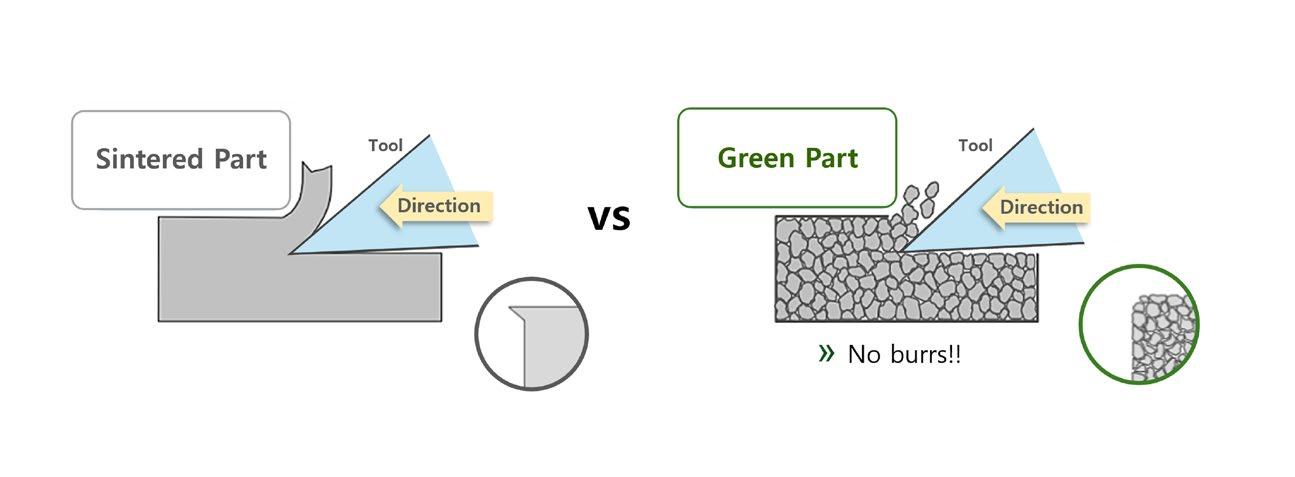

Ametek SMP launches new High Green Strength Stainless Steel Powders for Powder Metallurgy

Ametek Specialty Metal Products (SMP), Collegeville, Pennsylvania, USA, has announced the launch of its new ‘High Green Strength Stainless Steel Powders’, suitable for a wide range of automotive and industrial Powder Metallurgy parts.

The new High Green Strength Powders consistently provide a 50% or greater improvement in green strength in 300 and 400 series stainless steel grades relative to powders mixed with standard EBS wax. This enhancement is said to have minimal impact on sintered density, dimensional change, and other properties.

Manufactured using advanced water atomisation technology, the High Green Strength Powders are reported to reduce part damage during die ejection and part transfer, leading to more efficient processing and lower manufacturing costs.

www.ametekmetals.com

Plansee and Ceratizit open shared office in Singapore

Plansee, headquartered in Reutte, Austria, and Ceratizit, part of the Plansee Group and headquartered in Mamer, Luxembourg, have announced the official opening of their new shared office at the German Centre, Singapore. The event was attended by guests and key partners.

The new office is designed to foster collaboration and efficiency, supporting the companies’ mission to drive sustainable growth and deliver value to their customers in the expanding Southeast Asian markets.

Alexander Tautermann, Director – Marketing & Sales, Plansee, stated, “Ten years ago, Plansee started our own sales office in Southeast Asia. I am delighted that we can celebrate the ten-year anniversary together with the announcement of a very close cooperation between Plansee and the Ceratizt Group. Our shared office in Singapore is a testament to the strong partnership between both companies in this very important region. It will serve as a hub for our mutual cooperation and be our centre of excellence, allowing us to better serve our customers and achieve our strategic goals.”

Andreas Fritz, President – Asia Pacific, Ceratizit Group, added, “This new office represents our commitment to expanding our footprint in Southeast Asia and delivering superior support and services to our customers in the region. We look forward to leveraging this space to drive innovation and strengthen our market presence.”

www.plansee.com | www.ceratizit.com

IperionX reports first successful HAMR titanium furnace production run

IperionX, based in Charlotte, North Carolina, USA, has announced the successful commissioning of its commercial-scale Hydrogen-Assist Metallothermic Reduction (HAMR) furnace. This marks the first titanium de-oxygenation production run at the Titanium Manufacturing Campus in Virginia, USA.

“The IperionX team delivered an important technological and commercial milestone for the global titanium industry,” stated Anastasios (Taso) Arima, IperionX CEO.

“Over the last two years, we have successfully operated our pilot titanium production facility in Utah, producing high performance titanium products for customers and - importantly – delivering first revenues for our company. Today,

we demonstrated that our HAMR technology works at commercial scale. We successfully increased the furnace production capacity by ~60x and produced high performance titanium that exceeds industry quality standards,” continued Arima.

IperionX’s proprietary HAMR technology offers a range of competitive advantages, including lower operating temperatures, reduced energy consumption, enhanced process efficiency, and accelerated production cycles – all achieved with lower capital investment intensity.

Produced entirely from 100% scrap titanium (Ti6Al4V alloy, Grade 5 titanium), quality assessments confirmed a large reduction in

oxygen levels from 3.42% to below 0.07%, exceeding the ASTM standard requirement of 0.2% for Grade 5 titanium.

Over the coming months, IperionX will commission and optimise the supporting process equipment to achieve full system production capacity in Virginia, with end-to-end system operations expected in late 2024.

“IperionX plans to expand the capacity of its Titanium Manufacturing Campus by adding modular, low-risk and low-cost HAMR furnaces. IperionX aims to be a leading US titanium producer of +10,000 metric tons per annum by 2030. Our goal is to re-shore the full titanium supply chain to the United States, at lower costs for our customers, and deliver the most sustainable titanium products on the market,” Arima concluded. www.iperionx.com

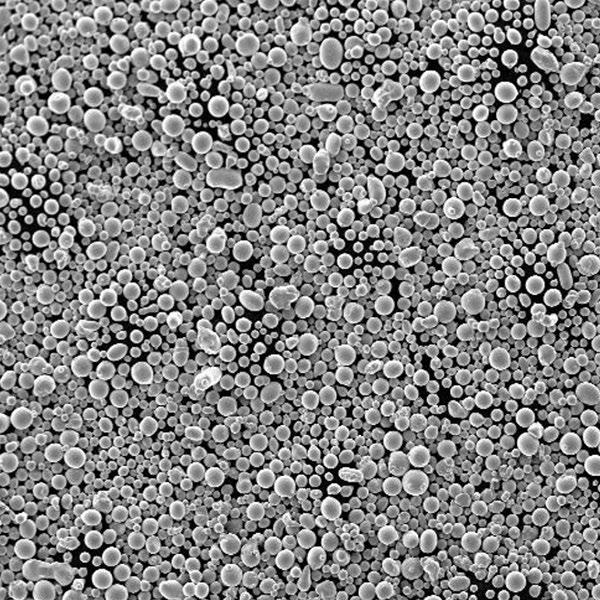

KBM adds IMR’s aluminium powders to its online marketplace

IMR Metal Powder Technologies, Velden am Wörthersee, Austria, has finalised its agreement with KBM Advanced Materials, LLC, based in Fairfield, Ohio, USA, for sale and distribution of IMR’s aluminium powders through KBM’s metal powder distribution network.

IMR has been a provider of industrial metals, semi-finished products, and chemical products for over thirty years, marketing its products globally. There will now be a dedicated stock of IMR material at KBM’s warehouse in Ohio, providing access to producers of aluminium parts.

IMR primarily produces aluminium alloy powder for the Additive Manufacturing industry. It partners in the development and production of customer-specific powders for Laser Beam Powder Bed Fusion (PBF-LB), Direct Energy Deposition (DED), and other processing technologies.

Thomas Rimmer, IMR CEO, stated, “By offering our aluminium alloy powders on the platform of KBM, our US customers now have access to their products on short-term notice which supports their inventory management optimisation as well as fast response to new business opportunities in a still evolving and

Metal Powder Group names new Technical Director

Metal Powder Group, Stockholm, Sweden, has named Rajiv Tandon as its new Technical Director. Tandon is an experienced technologist, noted as having a deep understanding of metal powder processing, specifically in process development,

powder production, and powder metal characterisation.

“I am pleased to have Rajiv joining us at Metal Powder Group,” stated Greg Chirieleison, Group CEO. “He brings a wealth of powder processing experience and will ensure our customers receive topquality tech support and engineering assistance. I look forward to seeing the innovations and improvements he will bring to our family of companies.”

sometimes difficult to predict market environment. The availability of IMR’s products to the US AM community from a local warehouse with the expert service of KBM were the main reasons for moving into this exciting opportunity.”

KBM offers products and services to AM powder consumers in the USA and Canada. Its business model results in KBM having large amounts of stock available for order at any given time, allowing customers to order and receive metal powder quickly and efficiently. KBM is reputedly North America’s largest marketplace for metal powders, allowing customers access to a variety of alloys and producers. It also offers transparent pricing and access to a variety of producers.

Kevin Kemper, KBM CEO, shared, “KBM is excited to partner with IMR to increase accessibility of their metal powders in North America. On-demand availability of products differentiates producers into those that can ship product when consumers need it and those that have a lead time. Our e-commerce solution features an easy-to-use interface, secure online transactions, detailed product information, pricing transparency, and the ability to ship products within a day of purchase. We want it to be easy and efficient for part producers to procure the raw materials they need to be successful. IMR is a strong and exciting addition to our offering.”

www.kbmadvanced.com www.imr-metalle.com

Tandon has previously held positions at Phillips Metal Injection Moulding, Parmatech, Amulaire Thermal Technology, Magnesium Elektron Powders, Luxfer Magtech, and Chemalloy. He holds a Bachelors Degree in Metallurgical Engineering from the Indian Institute of Technology, Kanpur, and a PhD in Engineering Science and Mechanics from Penn State University, USA. www.metalpowdergroup.com

IMR Metal Powder Technologies produces a range of metal powders, including aluminium powder (Courtesy IMR Metal Powder Technologies)

POWDER METAL SOLUTIONS

The transformation of the Automotive Industry toward electrification is driving the Powder Metal world to innovations related to the production of components that had never been produced before.

The result can be observed in the recent production of powder metal parts with full density and helical gears with angles up to 45°, which is a decisive goal for the Press&Sinter technology.

In addition, besides the Automotive industry, even companies involved in different industries have the opportunity to take advantage from these new techologies to enter new sectors. Follow SACMI in its journey towards electrification.

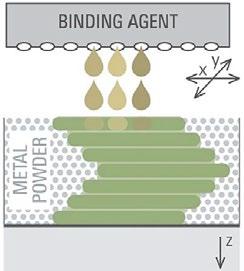

Desktop Metal launches PureSinter sintering furnace

Desktop Metal, Inc, headquartered in Burlington, Massachusetts, USA, has announced the launch of its PureSinter furnace. Capable of debinding and sintering metal parts created via Binder Jetting (BJT) Additive Manufacturing, the new furnace is also suitable for parts produced using traditional Metal Injection Moulding (MIM) and Press and Sinter Powder Metallurgy (PM) methods.

In development for more than five years, PureSinter features hot walls that prevent contamination buildup and an airtight processing environment to enable efficient waste exit and high levels of purity.

Contamination can be caused by hydrocarbons and other waste emitted by the powdered metal parts, explains Desktop Metal. This builds up on walls and other surfaces inside the furnace and can cause undesirable chemical reactions and furnace reliability.

PureSinter has undergone extensive testing and is reported to show little to no contamination or buildup inside the furnace, even after hundreds of runs.

“Rather than trying to simply mitigate the factors that lead to poor performance in an all-in-one debinding and sintering furnace, we have eliminated them with an innovative all-new design,” stated Ric Fulop, founder and CEO of Desktop Metal. “This is the first product from Desktop Metal aimed at manufacturers using both Additive Manufacturing and traditional manufacturing methods.”

“We have put the PureSinter through a prolonged period of testing to rigorously verify our new design, and it has exceeded all expectations. PureSinter is an exemplary demonstration of the innovation for which Desktop Metal and our engineers are known. We believe this furnace will revolutionise sinter-based AM and the traditional furnace industry.”

The PureSinter furnace can reach a maximum temperature of 1,420°C and is qualified for use with a variety of processing gases, including argon, nitrogen, forming gas, and air. The machine features a total of seventeen fans and a pop-out ceiling vent for active,

rapid, and consistent cooling, lowering temperatures from 1,420°C to 200°C in less than four hours and without expensive water-cooled walls.

PureSinter features a vertical furnace design, an automated thermal hood lift, touchscreen controls, and visibility inside the retort. With an oxygen-tight retort seal, and its efficient cooling system, the energy requirements are also reported to be lower than similar machines.

The new furnace is compatible with all of Desktop Metal’s metal AM machines and binders. It is also validated with fourteen metal powder and binder combinations, including stainless steels, tool steels, superalloys, and reactives. PureSinter can also process titanium with a high degree of confidence without the complex preparations which may be required with other furnaces. It was added that additional material validations are in process.

The first PureSinter furnace has been installed at FreeFORM Technologies, a metal Binder Jetting contract manufacturer based in St. Marys, Pennsylvania, and the largest owner of a fleet of twentyfour Desktop Metal AM machines, to validate new materials.

Shipments of the PureSinter furnace are slated to begin in the third quarter of 2024. www.desktopmetal.com

The PureSinter furnace is suitable for the debinding and sintering of Binder Jetting parts as well as MIM and PM parts (Courtesy Desktop Metal)

Loading the PureSinter furnace is straightforward (Courtesy Desktop Metal)

Ervin’s Amapowder metal powders now available in Europe

Ervin Metal Powders, headquartered in Ann Arbor, Michigan, USA, is now offering a range of Amapowder metal powders, suitable for Additive Manufacturing and Metal Injection Moulding, to customers in Europe through its sales office in Berlin, Germany.

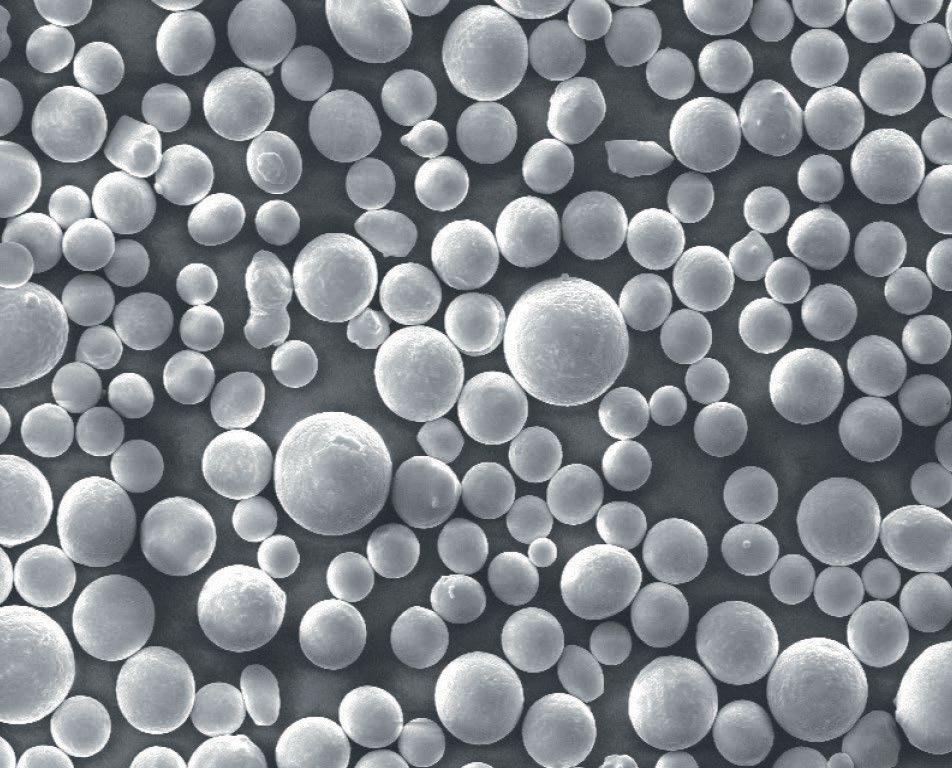

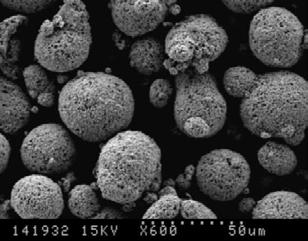

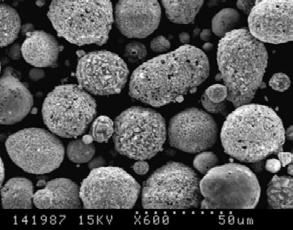

Ervin currently includes 304L, 316L and 17-4 PH stainless steel powders in the Amapowder range. The powders are produced using the company’s Rapid Solidification Rate (RSR) and Centrifugal Atomisation technology, reported to create fine-grained (nanometre-scale) and amorphous metals with uniform chemistry and a highly spherical shape. These characteristics are said to give the powders good flow and packing behaviours.

“We are delighted to be able to offer this exciting new range of prod -

ucts and are already collaborating with several Additive Manufacturing companies to help them deliver better quality and value solutions to their customers,” stated Florian Götz, Innovation Director for Ervin Europe.

Using RSR atomisation, Ervin states that it has developed a wide variety of metal powders for many industries and applications. The company has been able to collaborate with a range of industries and research professionals to advance spherical metal powder technology.

Ervin also operates several centrifugal atomisation rigs that enable it to produce both small R&D powder batches and maintain the continuous production of powders at large scales.

Amapowder is suitable for a variety of Additive Manufacturing production processes, including

Amapowder 316L is suitable for metal Additive Manufacturing and Metal Injection Moulding, as well as Hot Isostatic Pressing and thermal spray (Courtesy Ervin Metal Powders)

Laser Beam Powder Bed Fusion (PBFLB), Binder Jetting (BJT), and Directed Energy Deposition (DED). In addition to Metal Injection Moulding, it is also suited to thermal spraying and Hot Isostatic Pressing (HIP).

www.ervin.eu

UK’s Langley Holdings acquires GKN Hydrogen

Langley Holdings, based in Retford, UK, has acquired GKN Hydrogen from parent company Dowlais Group plc. Headquartered in Pfalzen, Italy, with subsidiaries in Germany and the United States, GKN Hydrogen will become part of Langley’s Power Solutions Division.

Anthony Langley, chairman and CEO, Langley Holdings, stated, “This acquisition underscores Langley Holdings’ strategic focus on sustainable energy solutions and commitment to a greener future.”

Formerly part of GKN Powder Metallurgy, the company has brought together materials science and engi -

Malvern Panalytical to acquire Micromeritics

Malvern Panalytical, part of Spectris plc, Egham, Surrey, UK, has agreed to acquire Micromeritics, headquartered in Norcross, Georgia, USA, for $630 million, plus a deferred element of up to $53 million. Micromeritics focuses on analytical instrumentation for the physical characterisation of particles, powders, and porous materials.

With the addition of Micromeritics’ suite of analytical technology, Malvern Panalytical aims to provide the broadest material characterisation offering in the market. It will offer a single suite of integrated instruments from a single manufacturer to support the entire customer workflow, thereby improving workflow efficiency and enabling deeper analytical insights.

As part of the acquisition, Terry Kelly, president and Chief Executive of Micromeritics, has agreed to join the group as Malvern Panalytical President. Kelly will be a key member of the Spectris Scientific leadership team.

Micromeritics’ technologies enable the comprehensive characterisation of particles by detailing their size, count, surface properties and behaviour, for fundamental research, product development and production quality control.

“Together, Micromeritics and Malvern Panalytical provide a unique opportunity to create a leading and highly differentiated position and a fully integrated offering in mate -

neering to create advanced metal hydride compounds. This technology captures and stores hydrogen in a solid state form at 16x the density of compressed hydrogen gas without degradation for up to thirty years, according to company literature.

Hydrogen is converted back to a gas when required by heating the hydride to 60ºC. The company has proven the system over 7,000 charge/discharge cycles with 99% efficiency.

Langley Holdings, established in 1975, is a privately owned engineering and industrial manufacturing group, principally producing capital equipment for diverse global markets. The Group operates in three principal areas: Power Solutions, Print Technologies and Other Industrials.

The Group’s operations are based in Germany, Italy, France, the UK, and Norway, with eighteen production facilities in Europe, the UK, and the USA. The group has more than ninety sales and service subsidiaries worldwide and employs around 5,500 people.

www.langleyholdings.com www.gknhydrogen.com

rial characterisation,” stated Derek Harding, current CFO at Spectris and soon-to-be president of Spectris Scientific. “Micromeritics is an excellent business with a strong track record of growth and innovation and excellent future growth prospects.”

Terry Kelly added, “Micromeritics is a world leader in particle characterisation. Our market-leading technologies are used daily in the labs of the world’s most innovative companies and institutions. Our end markets are strong and growing, and we have a robust new product pipeline. The integration with Malvern Panalytical is powerful. Together our companies will be able to unlock more answers for customers and provide expert applications and technical support that cannot be matched by any other company.”

www.malvernpanalytical.com www.micromeritics.com

Langley Holdings’ main board members Bernard Langley and William Langley (left & right) together with Guido Degen (centre), CEO of GKN Hydrogen (Courtesy Langley Holdings)

ADDING VALUE TO ADDITIVE MANUFACTURING

Bodycote provides a complete service solution for metal parts built by the additive manufacturing process, including stress relief to minimise distortion and residual stress, EDM to prepare the component for hot isostatic pressing (HIP), heat treatment or HIP to remove microporosity, and associated quality assurance testing.

Reduction in rejection rates and inspection costs

Fatigue properties on par with wrought material

Significant improvement in fatigue strength, fracture toughness, and tensile ductility

100% reduction in porosity possible

Improved machined surfaces and consistency in properties

Improved microstructure

the partner of choice for additive manufacturing

heat treatment | metal joining | hot isostatic pressing | surface technology

Kymera acquires Fiven to expand specialty materials portfolio

Kymera International, a speciality materials company headquartered in Raleigh, North Carolina, USA, has signed an agreement to acquire Fiven ASA from OpenGate Capital. The deal is expected to close following customary regulatory approvals.

With production facilities in Norway, Belgium and Brazil, as well as a global distribution network, Fiven works in the development of technically advanced silicon carbide materials for a wide range of highgrowth end markets. Through its recent R&D initiatives, Fiven has developed and marketed high-purity materials for the power electronics industries such as semiconductors and lithium-ion batteries.

“Fiven has all of the strong attributes we look for in an acquisition. They have an excellent reputation

for quality and service, are aligned with Kymera’s strategy of focusing on attractive end markets such as electronics, aerospace and defence, and have an outstanding management team and dedicated workforce,” Barton White, CEO of Kymera, commented. “We are excited to partner with Falk and his team to continue growing Fiven and capitalise on the numerous operational and commercial synergies we have already identified.”

Kymera has been owned by affiliates of Palladium Equity Partners, LLC, a middle-market private equity firm with over $3 billion in assets under management, since 2018.

“The acquisition of Fiven will accelerate Kymera’s mission to become a high-growth specialty materials and chemicals platform, and unlocks substantial organic

The acquisition of Fiven is expected to accelerate Kymera’s mission to become a high-growth specialty materials and chemicals platform (Courtesy Kymera)

growth opportunities for the combined business,” added Adam Shebitz, Partner at Palladium Equity Partners. “Altogether, Kymera is well on its way towards achieving Palladium’s investment objectives, having more than tripled in size from our initial investment, while creating a more resilient business oriented towards the industries of tomorrow.”

The terms of the transaction were not disclosed.

www.kymerainternational.com www.fiven.com

voestalpine reports solid results despite extremely difficult environment

The voestalpine Group has reported a solid result in the first quarter of the 2024/25 business year. The group’s stability was said to be attributed to its global positioning and sector diversification, despite a poor European economic environment.

“In an extremely difficult environment, especially for European steel companies, we were able to perform very well both in steel production and in the area of downstream processing. Our high-quality steel products are highly sought after in the most technologically demanding segments, such as the rail and aerospace industries. Our strategic goal remains continued growth in high-yield markets,” stated Herbert Eibensteiner, CEO of voestalpine AG.

The rail infrastructure and aerospace sectors performed particularly strongly in the first quarter. The energy sector recorded positive demand, especially in the renewable energy segment. By contrast, the construction and mechanical engineering industries remained at a persistently low level. The ongoing weak development, particularly in the German automotive industry, led to low demand for tool steel and in the Automotive Components business segment. In contrast, demand from the automotive industry for products from voestalpine’s Steel Division was satisfactory. Demand for voestalpine’s high bay warehousing systems made from the most robust steel profiles remains strong.

At €4.1 billion, revenue in the first quarter of the business year 2024/25 was slightly below the same period in the first quarter of the business year 2023/24 (€4.4 billion).

The EBITDA operating result decreased by 16.5% year-onyear to €417 million (Q1 2023/24: €499 million). The EBITDA is influenced by negative one-off effects of €28 million from the ongoing sales process for Buderus Edelstahl.

Profit from operations (EBIT) fell by 26.7% year-onyear to €228 million (Q1 2023/24: €311 million). Earnings before taxes amounted to €189 million (Q1 2023/24: €273 million). Profit after tax fell to €150 million (Q1 2023/24: €213 million). Cash flow from operating activities increased significantly from €10 million in the previous year to €215 million.

Equity increased by 0.8% compared to the reporting date (March 31, 2024) and amounted to €7.6 billion as of June 30, 2024. Net financial debt increased by 6.3% compared to the reporting date to reach €1.8 billion as of June 30, 2024. At 23.2%, the gearing ratio (net financial debt in relation to equity) increased slightly compared to the balance sheet date (22.0%).

As of June 30, 2024, the number of employees in the voestalpine Group worldwide amounted to 51,400 (full-time equivalent), which is 0.4% more than in the previous year (51,200).

www.voestalpine.com

PM Tooling System

Amaero commissions its new atomiser ahead of schedule

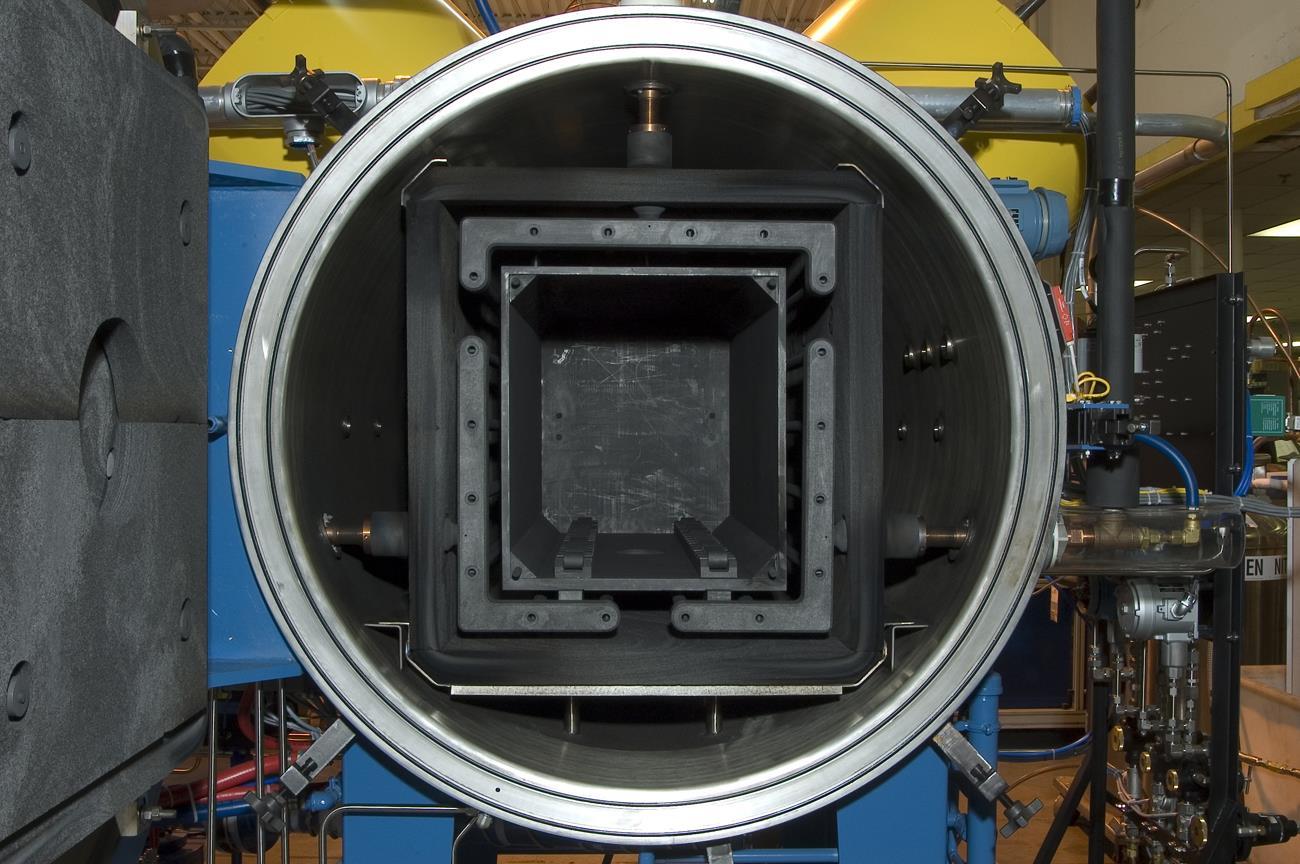

Amaero International Ltd, based in McDonald, Tennessee, USA, has announced the installation and testing of its new metal powder atomiser supplied by ALD Vacuum Technology GmbH, Hanau, Germany. The atomiser has achieved all technical specifications stipulated in the contract, and acceptance has been formally acknowledged by both parties.

“Amaero’s leadership team is relentlessly focused on execution,” stated Hank Holland, chairman and CEO. “With final acceptance and commissioning of the atomiser, we have achieved a significant milestone and we have achieved the milestone ahead of schedule.”

With this installation completed, Amaero’s technical and manufacturing team will begin work on proprietary modifications of the atomisation process and parameter optimisation.

“Given the importance of advancing priority hypersonic and strategic missile programmes from development and demonstration phases to serial production as quickly as possible and the pressure to achieve material properties and performance criteria, Additive Manufacturing plays an important role,” Holland continued. “The insertion of Additive Manufacturing in hightemperature applications is enabled by improved resiliency, scalability and responsiveness of US domestic production of C103 and speciality alloy powders. Amaero is committed to collaborating with the US government, the Department of Defense, prime defence contractors and suppliers, to address priority initiatives to re-shore strategic industrial base capabilities.”

www.ald-vt.com

www.amaeroinc.com

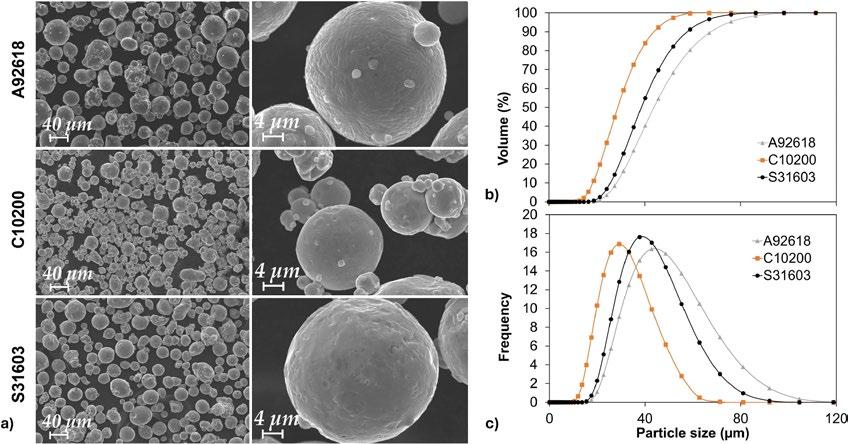

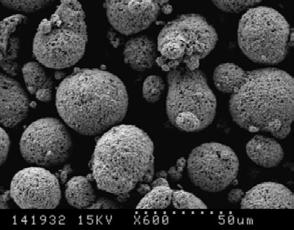

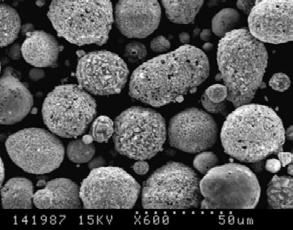

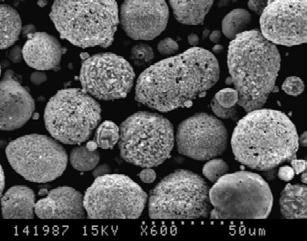

AP&C offering coarse Ti-6Al-4V powder for Additive Manufacturing

AP&C, a Colibrium Additive company, based in Québec, Canada, is now offering a coarse titanium Ti-6Al-4V (Ti64) powder suitable for Laser Beam Powder Bed Fusion (PBF-LB) Additive Manufacturing machines. The new coarse grade is reported to offer the same quality as AP&C’s finer powders, but with larger-size particles.

Ti64 is a key material for Additive Manufacturing, explains AP&C, especially in the orthopaedic industry, alongside cobalt chrome. There are also many Ti64 applications in the aerospace sector as well as in consumer goods products, so it is relatively easy to find new, niche applications for it. Ti64 has already been widely adopted by the additive community compared to other alloys, which has led to optimised parameters for this material, making it easier to find business use cases.

What is coarse Ti64?

When metal AM was first developed, the data was lacking to identify the ideal powder, continues AP&C. Therefore, the industry started with powder from more conventional technologies, such as Metal Injection Moulding. The emergent

AP&C is now offering a coarse titanium Ti-6Al-4V powder suitable for Laser Beam Powder Bed Fusion Additive Manufacturing machines (Courtesy Colibrium Additive)

PBF-LB technologies selected the 15-45 µm and 15-53 µm particle size distribution (PSD) grades.

PBF-LB technology is now the largest market for spherical Ti64 powders, reports AP&C, but by using only the finer fraction of the ‘as-produced’ PSD, coarser Ti64 powder becomes available and in need of a market. However, there is no technical reason why coarser Ti64 powder could not be used in the PBF-LB process with slight tuning on deposition parameters. Of course, larger Ti64 particles also exhibit the same quality as the finer powders, as they have been created using the same validated process. In fact, similar coarse powders are used in Electron Beam Powder Bed Fusion (PBF-EB) and Direct Energy Deposition (DED) with great results.

Academic research, and AP&C’s own internal data, have shown that using larger particles with a tuned deposition process produces highquality AM parts with comparable mechanical properties and excellent process stability. After extensive work and validations, AP&C is now commercialising a parameter for the Colibrium Additive M2 platform for coarse Ti64.

Coarse Ti64 powder is safer

Another important advantage highlighted by AP&C is that coarse Ti64 is also safer than finer powder, since the higher PSD is substantially less reactive. Powder handling, storage and reuse can be significantly simplified and local regulations for powder storage are easier to meet. For example, coarse Ti64 powder is not classified as flammable (while fine Ti64 is) and, more importantly, its minimum ignition energy is high enough that the powder is not sensitive to electrostatic discharge which can change the applicable safety controls associated with using this powder.

www.advancedpowders.com www.colibriumadditive.com

BOOTH #66

BOOTH #1-05

Miba begins construction of €12 million training centre for skilled workers and apprentices

Miba AG, headquartered in Laakirchen, Austria, is building a new €12 million training and further education centre for employees and apprentices at the Miba Campus in Laakirchen. Miba CEO F Peter Mitterbauer, numerous guests of

honour and local politicians attended the groundbreaking ceremony.

The new 2,400 m 2 two-storey building will offer a wide range of usage options. It will include workshops for mechanical engineering training, CNC, CAM/CAD, and welding

Höganäs introduces powder-specific carbon footprint reports

Sweden’s Höganäs AB has announced that it is now able to provide product-specific carbon footprint (PCF) reports for all products with complete lifecycle assessment (LCA) models in place. The move is intended to support customers in their emissionreduction goals, and contribute to Höganäs’ long-term target of reaching net-zero emissions by 2037.

“Many of our customers already face demands from their own customers to reduce carbon dioxide emissions from the value chain (scope 3),” stated Fredrik Vinnerborg, Product Portfolio Manager. “This will become increasingly

important as many car manufacturers have set net-zero targets. Thanks to the data we provide in our PCFs, our customers gain a powerful tool to reduce their scope 3 emissions.”

Höganäs is the first metal powder producer to provide full transparency on its cradle-to-gate productspecific emissions to the market.

The PCF calculations follow the ISO 14067:2018 standard and communicate how many kg of CO 2 equivalents are emitted for every kg of metal powder produced.

Sofia Poulikidou, LCA Specialist, added, “To ensure transparency and enhance communication with customers we have created Product Carbon Footprint summary reports,

applications, as well as an automation and mechatronics laboratory.

“In order to offer our employees a training environment that corresponds to everyday work in our production facilities, we are investing in state-of-the-art machinery,” stated Mitterbauer.

The new facility, named Base 27, is seen as the next step in the company’s decades-long success in training skilled workers and apprentices.

“We have achieved a lot. Around 1,500 people have already completed a Miba apprenticeship, 25 have joined this year alone and 28 apprentices will begin their training in the autumn,” continued Mitterbauer. “With the ‘second-chance apprenticeship’ we have set up a very successful qualification programme to become skilled metal workers, which 45 people have already completed. And we offer an extensive training programme for specialists, from support when starting work at Miba to training for team or shift leaders. With ‘Base 27’ we want to take our skilled worker and apprentice training to the next level.”

Miba plans to complete the building in spring 2026.

www.miba.com

for all base powders which have LCA models in place.”

The PCFs cover all greenhouse gas emissions throughout the entire production chain, from a cradleto-gate perspective. This includes all activities, from raw material acquisition and inbound transport to energy and fuel production, as well as processing activities at Höganäs’ sites. Downstream activities, such as product distribution to customers, components manufacturing, use, and end-of-life, are excluded.

Vinnerborg continued, “We encourage our customers to reach out to their usual contact person at Höganäs to learn more about how we can support them in their sustainability journey and help reduce their scope 3 emissions with the assistance of PCFs.”

www.hoganas.com

The ground-breaking ceremony was attended by Miba CEO F Peter Mitterbauer along with guests of honour and local politicians (Courtesy Miba AG)

Global aerospace OEM to place PyroGenesis and its NexGen titanium powder on approved supplier list

PyroGenesis Canada Inc, based in Montreal, Quebec, has announced its NexGen™ Ti64 ‘coarse’ powder has been approved by a global aerospace OEM for inclusion in its approved supplier list. The client, who remains confidential for competitive reasons, will now begin the formal process of adding PyroGenesis to its internal approved supplier list for this specific powder, a process that is expected to be completed this summer.

This coarse powder has a size fraction in the range of 45-150µm and is typically used in Additive Manufacturing applications such as Electron Beam Powder Bed Fusion (PBF-LB) and Direct Energy Deposition (DED).

The qualification process – which involved extensive evaluations including quality management system review, work instructions review, and a rigorous on-site audit of Pyrogenesis’ production facility – was successfully completed over the course of several years. The final step required the company to submit samples of its powders for chemical and mechanical properties evaluation to confirm matching client specifications.

“Having our ‘coarse’ Ti64 powder accepted for addition to the approved supplier list of one of the largest aerospace companies in the world underscores the quality and reliability of our NexGen plasma atomisation process, our post-processing process, our quality assurance management process, and our quality control system,” said Massimo Dattilo, Vice President, PyroGenesis Additive. “This achievement is a testament to the hard work and dedication of our team over the past several years. We look forward to officially being added to the approved supplier list and leveraging this success.”

“This is a colossal achievement for PyroGenesis, particularly for the PyroGenesis Additive division,” said P Peter Pascali, PyroGenesis President and CEO. “While we have been confident from the outset, this notification from a global aerospace OEM is confirmation that our board’s decision to re-enter the metal powder market, with a ground-up redesign in the form of the patented NexGen plasma atomisation production system, was indeed the right one. This news is even more exciting when taken in the context of the recent announcement of a joint $415 million government/corporate aerospace initiative, to establish an aerospace innovation zone in Montreal, right in our backyard. Today’s announcement positions PyroGenesis well to also be included in one of the world’s foremost aerospace technology developments.”

www.pyrogenesis.com www.pyrogenesisadditive.com

Powder engineering expertise.

GEA is a worl-leading specialist in powder engineering with exceptional patented Spray Drying Solutions. Be it a powder, a granulate or an aglomerated product, our solutions define and deliver superior quality powders to your exact specifications in the most energy-and-costefficient way.

Neo’s new European sintered rare earth magnet subsidiary wins major EV supply contract

Neo Performance Materials, Toronto, Canada, has announced that its wholly-owned Estonian subsidiary, NPM Narva OÜ (Magnequench Sintered Magnets), has been awarded a contract to supply sintered rare earth magnets to a European Tier 1 supplier of EV traction motors. The sintered magnets will be supplied by the company’s new European rare earth magnet manufacturing facility, currently under construction in Narva, Estonia.

The new facility, scheduled for completion in 2025, is expected to be the first sintered magnet plant to come online outside of Asia. It will produce 2,000 tonnes per year of magnets in Phase 1, enough to supply approximately 1 to 1.5 million electric and hybrid vehicle traction motors. Phase 2 of the project is expected to see around 5,000 tonnes/year, enough for 4.5 million electric cars.

The volumes represented by the new supply order will be approximately 35% of Phase 1 magnet capacity, with production revenues projected for the second half of

2026 through 2033, and peak supply to the customer expected in 2029.

“We welcome this significant commercial validation from a Tier 1 EV motor manufacturer. Neo is focused on becoming the first manufacturer and supplier of made-in-EU rare earth magnets for EV traction motors. This is one more endorsement that the need for parallel, local-for-local supply chains is defining the future of the EV manufacturing transition in Europe and North America – an inflection point that is at the core of Neo’s strategy,” stated Rahim Suleman, Neo’s President and Chief Executive Officer.

The new magnet facility is located close to Neo’s existing operating rare earth separation facility and began construction in 2023. It was awarded the first Just Transition Fund grant in the European Union and gained the recognition and support of the President of the EU Commission, Ursula von der Leyen, amongst other European government and industry leaders.

Neo’s Magnequench division has supplied the automotive industry for more than two decades with rare earth magnetic materials – more than half of its sales attributed to the automotive industry (Courtesy Neo Performance Materials)

Data from Adamas Intelligence, the US Geological Survey, and customer discussions estimate that approximately 90% of sintered magnet production is concentrated in China today. The EU Critical Raw Materials Act has set targets such as 40% of rare earths material consumed annually to have been processed in the EU, 25% of rare earths magnetic materials to be sourced from recycling in the EU, and no more than 65% of rare earth magnets to be sourced from a single jurisdiction outside the EU. Similarly, the US recently announced a new 25% tariff on rare earth magnets from China in effect from 2026 onward.

Historically, Neo’s Magnequench division has supplied the automotive industry for more than two decades with rare earth magnetic materials – more than half of its sales attributed to the automotive industry. Since its founding more than three decades ago, Neo’s Magnequench has developed, manufactured, and supplied rare earth magnetic products to customers with high qualification standards in vehicle traction motor, water circulation, residential appliances, and industrial automation applications globally. www.neomaterials.com

The rare earth sintered magnet manufacturing facility is located close to Neo’s existing rare earth separation facility and began construction in 2023 (Courtesy Neo Performance Materials)

NASA selects Elementum 3D as co-exclusive licensee for GRX-810 high-temperature Additive Manufacturing alloy

Elementum 3D, based in Thornton, Colorado, USA, has announced that NASA has selected the company as one of four to produce and distribute GRX-810 alloy under a commercial co-exclusive licence. The high-temperature metal superalloy will be offered to original equipment manufacturers of airplanes and rockets, as well as the entire supply chain.

NASA’s goal of the licensing agreement is to quickly accelerate the adoption of GRX-810 to benefit US technologies, industry, and space exploration. The material is capable of creating lighter and thinner engine parts, reducing fuel burn, lowering operating costs, increasing durability, and lowering

the tolerance for failure for critical applications.

GRX-810 is an oxide dispersion strengthened (ODS) alloy that can endure higher temperatures and stress. Its strength is derived from the dispersion of tiny particles containing oxygen atoms.

The breakthrough superalloy was specifically developed for the extreme temperatures and harsh conditions of aerospace applications, including liquid rocket engine injectors, combustors, turbines, and hot-section components, capable of enduring temperatures up to 1,100 °C.

Compared to other alloys, GRX-810 can endure higher temperatures and stress up to

2,500x longer. It’s also 3.5x better at flexing before breaking and twice as resistant to oxidation damage.

Over the past nine years, Elementum 3D has gained extensive knowledge and experience in developing, commercialising, and distributing “impossible-to-print” dispersion-strengthened materials similar to GRX-810.

“We are excited to be working with Tim Smith and NASA to bring this exceptional new alloy to the commercial market,” stated Jeremy Iten, Elementum 3D Chief Technology Officer.

NASA’s investment in developing GRX-810 is said to demonstrate its dedication to advancing Additive Manufacturing. It was added that Elementum 3D, and the other co-exclusive licensees, now assume the responsibility of investing the time and resources to supply the industry with a stronger, more durable superalloy.

www.elementum3d.com

PARTICLE CHARACTERIZATION OF METAL POWDERS

Determine BET surface areas of metal powders quickly, accurately, and economically with MICROTRAC’s BELSORP MAX X Sorption Analyzer:

I The specific surface area (m²/g) is an important parameter in the evaluation of metal powders regarding their processability.

I Simultaneous measurement of up to 4 samples with high precision.

I Rapid determination of BET surface areas with up to 12 analyses per hour - perfect for quality control of fine powders with high sample throughput.

www.microtrac.com

Nabertherm celebrates 25 years of its Chinese subsidiary

Nabertherm GmbH, headquartered in Lilienthal, Germany, recently celebrated the twenty-fifth anniversary of its Chinese subsidiary. Founded in 1999, the subsidiary’s opening was regarded as a milestone in the company’s international expansion and underscored the importance of the Chinese market.

Nabertherm China’s headquarters are in Shanghai, with further sales specialists in Shenzhen, Beijing and Wuhan. Since its founding, the subsidiary is reported to have developed a reputation for high-quality industrial and laboratory furnaces, supporting customers from areas

Nabertherm offers a range of furnaces, including this retort furnace for sintering MIM components (Courtesy Nabertherm GmbH)

Continuum Powders completes rebrand from MolyWorks, names Higby as CEO

Continuum Powders, based in Los Gatos, California, USA, has announced the completion of its official rebrand from MolyWorks and the appointment of Rob Higby as the company’s Chief Executive Officer. Higby succeeds previous CEO Phil Ward, who will now assume the role of President — Asia Pacific, where he will lead Continuum’s Asia Pacific operations. Since 2020, Ward has led the organisation through customer adoption, IP development, quality systems certification and the establishment of funding partnerships.