For a sustainable tomorrow

Höganäs AB commits to reduce absolute scope 1 and 2 GHG emissions 51% by 2030 from a 2018 base year.* Höganäs AB also commits to reduce absolute scope 3 GHG emissions from purchased goods and services, upstream transportation and distribution, and business travel 30% within the same timeframe.

*The target boundary includes land-related emissions and removals from bioenergy feedstocks.

Our climate tagret is validated by Science Based Targets initiative.

For more info scan the QR Code

www.hoganas.com

Publisher & Editorial Offices

Inovar Communications Ltd

11 Park Plaza

Battlefield Enterprise Park Shrewsbury SY1 3AF United Kingdom

Tel: +44 (0)1743 469909 www.pm-review.com

Managing Director & Editor

Nick Williams, nick@inovar-communications.com

Group News Editor

Paul Whittaker, paul@inovar-communications.com

Advertising Sales Director

Jon Craxford, jon@inovar-communications.com Tel: +44 (0)207 1939 749

Assistant News Editor

Charlie Hopson-VandenBos charlie@inovar-communications.com

Editorial Assistants

Amelia Gregory, amelia@inovar-communications.com Emma Lawn, emma@inovar-communications.com

Consulting Editor

Dr David Whittaker

Technical Consultant

Dr Martin McMahon

Digital Marketer

Mulltisa Moung, mulltisa@inovar-communications.com

Production Manager

Hugo Ribeiro, hugo@inovar-communications.com

Operations & Partnerships Manager

Merryl Le Roux, merryl@inovar-communications.com

Office & Accounts Manager

Jo Sheffield, jo@inovar-communications.com

Subscriptions

PM Review is published on a quarterly basis. It is available as a free electronic publication or as a paid print subscription. The annual subscription charge is £150.00 including shipping.

Accuracy of contents

Whilst every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions or for any consequences arising there from. Inovar Communications Ltd cannot be held responsible for views or claims expressed by contributors or advertisers, which are not necessarily those of the publisher.

Advertisements

Although all advertising material is expected to conform to ethical standards, inclusion in this publication does not constitute a guarantee or endorsement of the quality or value of such product or of the claims made by its manufacturer.

Reproduction, storage and usage

Single photocopies of articles may be made for personal use in accordance with national copyright laws. All rights reserved. Except as outlined above, no part of this publication may be reproduced or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner.

Design and production

Inovar Communications Ltd.

ISSN: 2050-9693 (PRINT)

ISSN: 2050-9707 (ONLINE)

© 2024 Inovar Communications Ltd.

Different visions for the future of PM at World PM2024

As at every PM World Congress, the informal exchange of views, whether in the exhibition hall or at social events, provides invaluable insight into PM companies’ fears and aspirations.

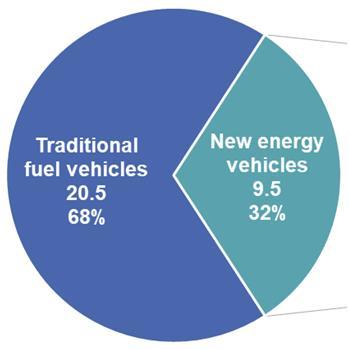

What set this PM2024 event apart from previous years were the diverging views on PM’s future. The trajectory of the automotive industry – PM’s most significant consumer – was at the heart of many discussions. It became clear that the future development of PM is, to some extent, beyond the industry’s control, influenced by the unpredictable shifts within the automotive industry.

Official policy amongst governments may dictate an acceleration towards Electric Vehicle (EV) adoption, but this often seems to conflict with consumer demands. This contrast places significant pressure on Western automotive companies; future government policies are uncertain, and such companies contend with the heat from the rapid rise of China’s automotive industry.

However, as highlighted in the three articles in this issue, there are paths forward. There are promising opportunities for using PM technologies in EVs and hybrids, particularly in magnetic materials. Beyond the automotive sector, more diversified markets do exist for conventional PM parts. PM stands to benefit from regional growth hot spots, notably in India, where the demand for region-specific transportation solutions is rich in opportunity.

The PM2024 mantra, “Make a better world with PM,” captures the PM industry’s potential to drive change and embrace the evolving global demands of both industries and societies.

Nick Williams Managing Director, PM Review

Cover image Koenigsegg’s Regera hybrid supercar features three SMC motors from YASA (Courtesy Koenigsegg)

Our materials, your life

Rio Tinto Metal Powders (RTMP) is committed to finding better ways to provide the materials the world needs now and in the future.

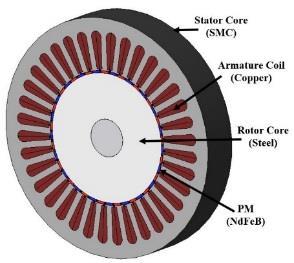

As a producer of iron and steel powders at our plant located in Quebec, Canada, RTMP is a key supplier to the automotive industry, which is undergoing a transition towards electrification. RTMP is contributing to the development of new Soft Magnetic Composite (SMC) materials for electric components, from pump assemblies to small electric motors in e-bikes and EV’s to support the energy transition. Together, we can create a better life for the generations to come.

Find out more at www.riotinto.com

49 Powder Metallurgy: Discover innovative technologies meeting the demands of vehicle electrification

Vehicle Electrification is transforming the PM industry, providing new opportunities as Battery Electric Vehicles and Hybrid Electric Vehicles continue to gain market share.

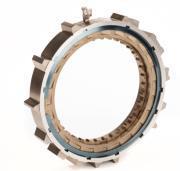

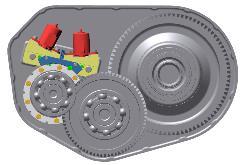

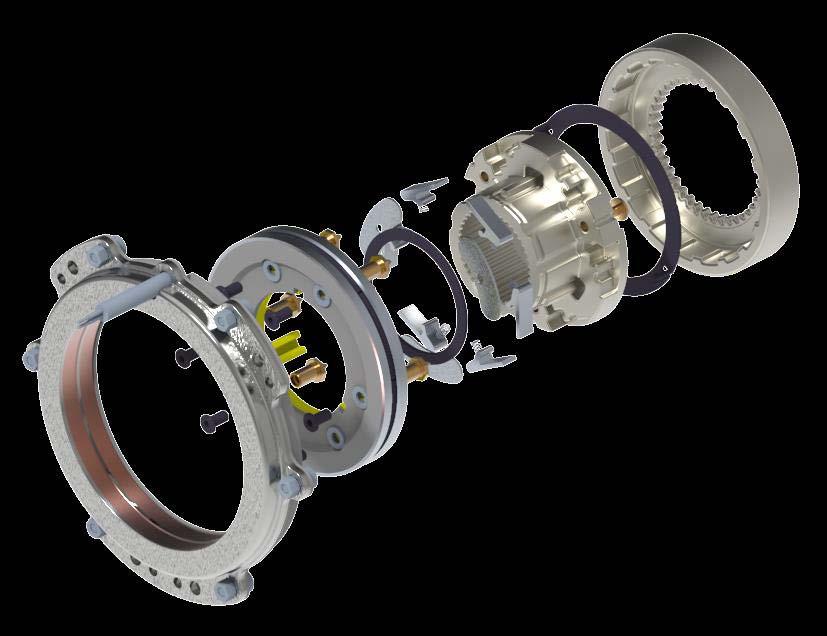

At MPIF’s PowderMet2024 conference, a series of Special Interest Sessions delved into the innovative PM technologies used to meet current demands. Advances in Soft Magnetic Composites, PM permanent magnets, new electric motor designs, and evolving drivetrain mechanisms are discussed. Bernard North gives a comprehensive analysis of how industry leaders are adapting to these changes and explores the implications for future PM applications in the rapidly evolving automotive sector. >>>

65 Gevorkyan a.s.: Europe’s fastgrowing Powder Metallurgy company achieving success through a diversified customer base

Slovakia’s Gevorkyan a.s., founded in 1996 by Artur Gevorkyan, has grown into one of the fastest growing Powder Metallurgy companies in Europe. With a diverse product portfolio and a broad range of powder-based technologies, the company has proven itself to be highly adaptable and resilient during economic challenges.

Dr Georg Schlieper visited the company for PM Review and reports on its extraordinary journey, culminating in a recent expansion following a successful IPO in 2022. >>>

Experience the power of performance, the spark of innovation, and the strength of partnership

Performance:

As a global leader in powders, pastes, and granules, we excel in materials like Aluminum, Copper, Titanium, and more. Our precision manufacturing ensures superior product attributes tailored to your requirements.

Innovation:

Utilizing state-of-the-art research and development alongside cutting-edge technologies, we provide tailored solutions for PM and additive manufacturing. Our emphasis on materials and process advancements positions us as industry leaders in quality, service, and operational excellence.

Partnership:

Count on us as your trusted development and production ally. Our expertise in metal powders and alloys ensures top-tier materials for critical applications, empowering industries worldwide.

At Kymera International, we’re not just a powder provider; we’re your strategic partner in the world of specialty material solutions and additive manufacturing. Contact us today to revolutionize your projects

www.kymerainternational.com

info@kymerainternational.com

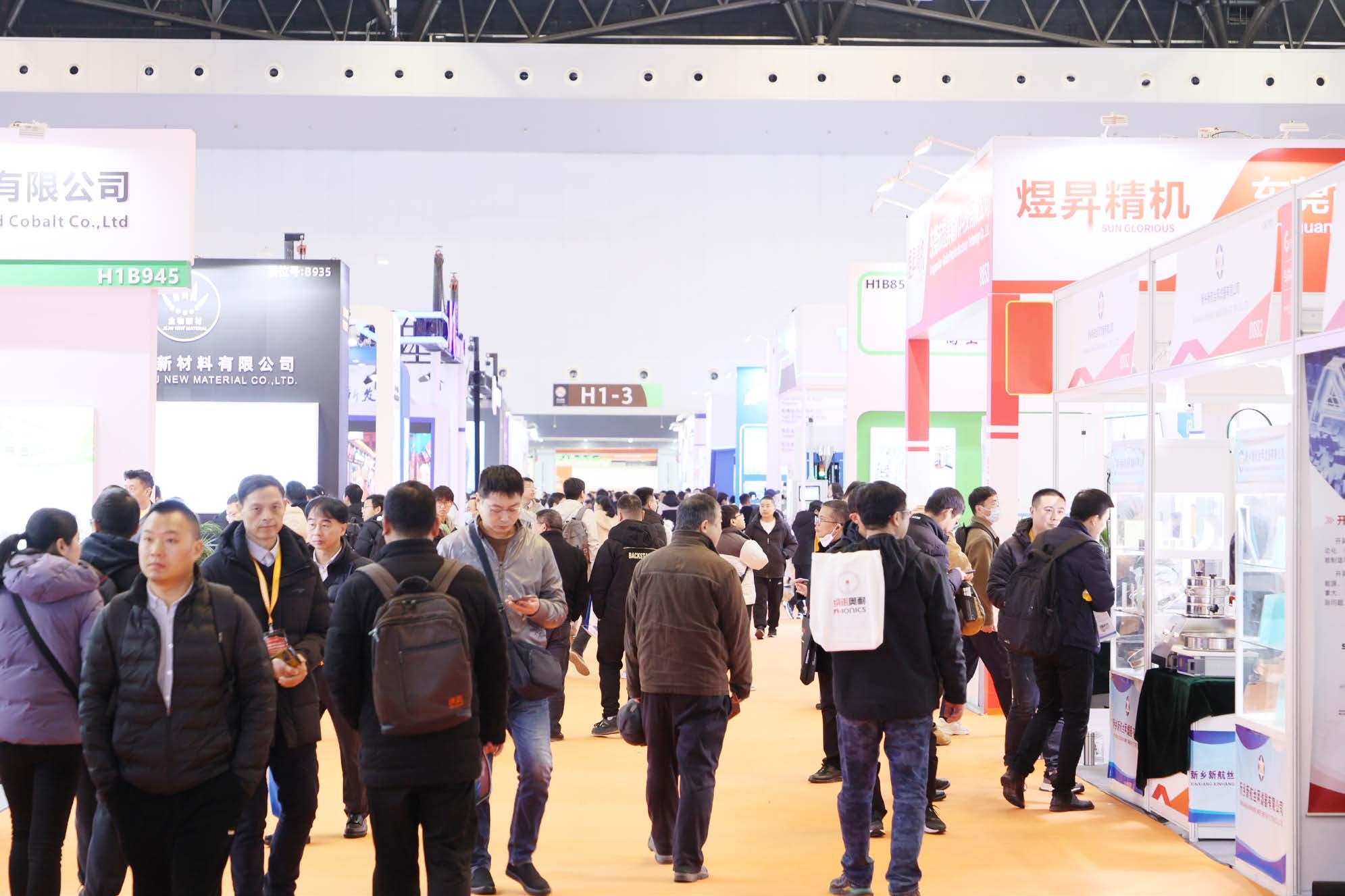

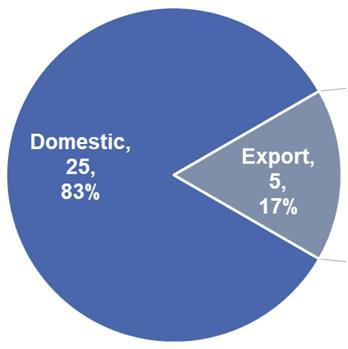

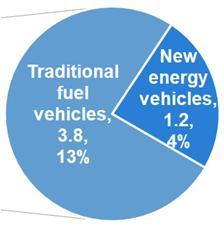

75 Powder Metallurgy in Asia: A status update from the World PM2024 Congress, Yokohama

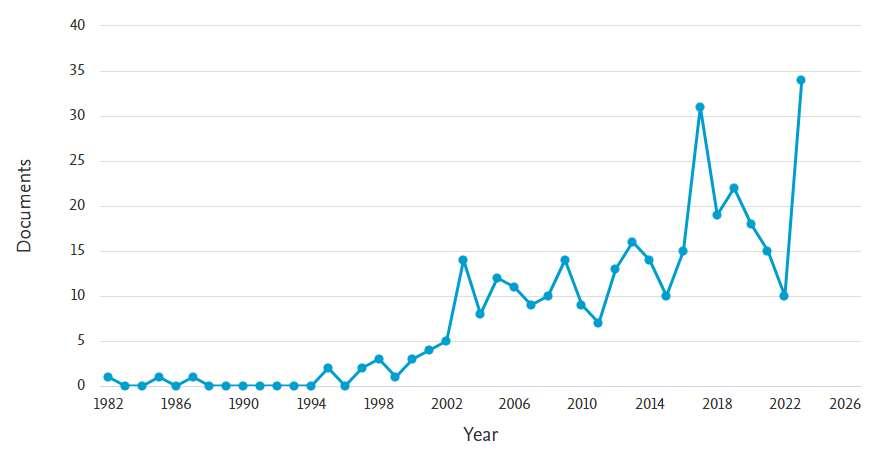

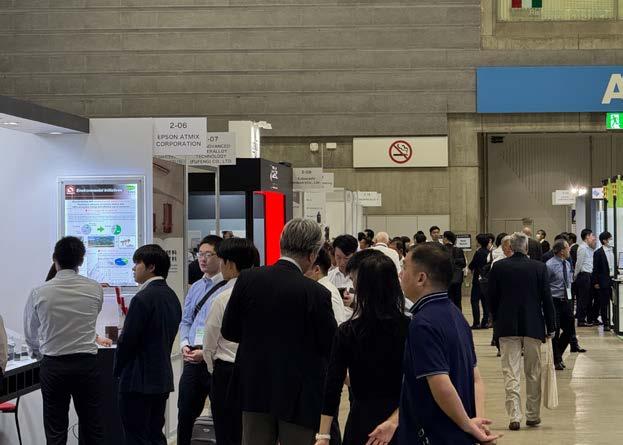

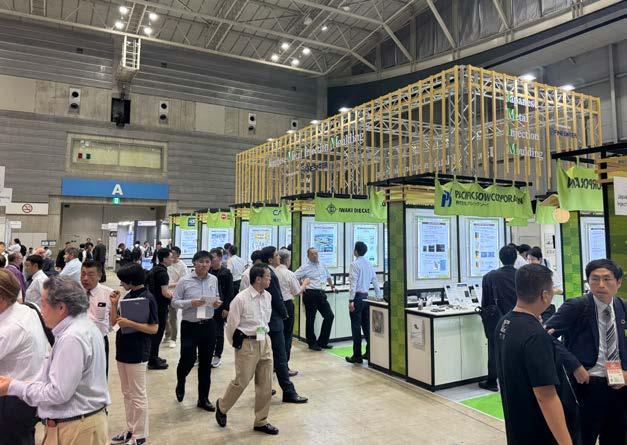

The Powder Metallurgy World Congress series has long been a cornerstone event for the PM industry, offering a vital platform for global collaboration and innovation.

Following disruptions caused by COVID-19, World PM2024 marked the series’ successful return, attracting nearly 800 delegates and offering a comprehensive technical programme. The event also highlighted the Powder Metallurgy industry’s resilience amidst significant ongoing challenges.

Here, Nick Williams reports on the status of Powder Metallurgy in Asia as presented during the Plenary Session, including market trends, regional growth potential, and opportunities for Powder Metallurgy in an evolving global landscape. >>>

Our advertisers’ index and buyer’s guide serves as a convenient guide to suppliers across the PM supply chain.

In the digital edition of PM Review magazine, available at www.pm-review.com, simply click on a company name to view its advert, or on the company’s weblink to go directly to its website.

● GAS AND ULTRASONIC ATOMIZERS FOR SPHERICAL POWDERS WITHOUT ANY SATELLITES for LPBF, MIM, Binder Jetting and other Additive Manufacturing applications. High purity, sphericity and wide range of reproducible particle size distribution.

● WATER ATOMIZERS FOR MORE IRREGULAR POWDERS ideal for recycling/re ning process, press & sinter process and others.

● AIR CLASSIFIERS FOR THE PRECISE SEPARATION OF METAL POWDERS into ne and coarse powder fractions especially in the range < 25 µm

● MAXIMUM PURITY BY OXIDATION-FREE PROCESSING

● ALL SYSTEMS DESIGNED FOR EASY HANDLING AND CLEANING, QUICK ALLOY CHANGE WITH MINIMUM CROSS CONTAMINATION

● FOR A WIDE RANGE OF METALS AND FOR SMALL TO MEDIUM AMOUNTS

To submit news for inclusion in Powder Metallurgy Review contact Paul Whittaker at paul@inovar-communications.com

GKN Hoeganaes and First Phosphate collaborate to supply EV battery cathode materials

GKN Hoeganaes, a division of GKN Powder Metallurgy, based in Cinnaminson, New Jersey, USA, has announced a strategic collaboration with First Phosphate, a mineral development company located in Saguenay-Lac-SaintJean, Canada. The partnership is intended to help establish a North American supply chain for lithium iron phosphate (LFP) batteries, a critical component for the electric vehicle (EV) and energy storage industries.

The partnership follows GKN Hoeganaes’ successful integration of First Phosphate’s magnetite into its proprietary Ancorsteel melting process. This process has led to the development of a high-purity iron powder, which serves as a precursor to lithium iron phosphate cathode active material, necessary for the production of LFP batteries. These batteries are growing in popularity due to their cost-effectiveness, safety and stable raw material availability.

In support of this growing demand, the collaboration marks one of the first substantial efforts to establish a North American production line for LFP battery components, helping reduce dependency on international supply chains.

“Partnering with First Phosphate enables us to contribute our advanced iron powder

technology to a rapidly growing industry that is focused on clean and efficient energy storage solutions,” said Matthias Voss, president at GKN Hoeganaes. “This collaboration underscores our commitment to fostering a local supply chain for LFP batteries, addressing both sustainability and technological innovation.”

First Phosphate is set to integrate high-purity Ancorsteel into its upcoming iron phosphate precursor (FP pCAM) and lithium iron phosphate cathode active material (LFP CAM) Saguenay-Lac-St-Jean production facility, with ambitions to reach 400,000 tonnes per annum by 2032. Supporting this vision, GKN Hoeganaes is prepared to scale its Gallatin, Tennessee, opera -

tions – already recognised as the world’s largest steel atomising plant – and will be providing its research and development facilities in Cinnaminson, New Jersey, for process enhancement and optimisation.

“Working with GKN Hoeganaes to bring Ancorsteel to the market is a vital step in advancing our mission to create a sustainable and locally sourced LFP battery supply chain,” said John Passalacqua, CEO at First Phosphate. “This partnership combines our high-quality phosphate resources with GKN Hoeganaes’ expertise in iron powder production, setting the stage for a robust North American battery ecosystem.”

The newly developed Ancorsteel material is composed of sustainable North American iron scrap and magnetite, aligning with non-FEOC standards for domestic production. www.gknpm.com www.firstphosphate.com

GKN Hoeganaes produces metal powder for battery applications at its Powder Production Center in Gallatin, Tennessee, (left), with R&D undertaken at its Powder Innovation Center in Cinnaminson, New Jersey (Courtesy GKN Hoeganaes)

Neo secures US$50 million for sintered magnets facility in Europe

Neo Performance Materials Inc, headquartered in Toronto, Canada, has entered into a loan agreement with Export Development Canada (EDC) for a US$50 million credit facility to finance the ongoing construction of its sintered magnets plant in Narva, Estonia.

Construction of the new facility began in 2023, and is reported to be progressing on time and on budget at an estimated cost of US$75 million. The facility has obtained significant

support, including a grant of up to US$20 million (€18.7 million) from the European Union’s Just Transition Fund (JTF) in 2022. As of the first half of 2024, Neo has capitalised US$24.9 million since the project’s inception. The remaining estimated cost of US$50.1 million (prior to the JTF grant) is anticipated to be spent through the end of 2024 and into 2025.

The Estonian facility is strategically located near Neo’s existing rare earth separation plant. Phase One of the

Kymera International secures $775M for debt refinancing and acquisitions

Kymera International, a specialty materials company headquartered in Raleigh, North Carolina, USA, has received a private credit loan of $775 million to refinance its existing debt and provide capital for add-on acquisitions, including its recent acquisition of Fiven, reports PitchBook, a financial data and software provider.

According to market sources, HPS provided the entirety of the facility and syndicated a small portion of the debt to other lenders. The facility included a term loan as well

as a delayed-draw term loan. The company also has a separate AssetBased Lending (ABL) facility held by KeyBanc and M&T.

Piper Sandler and Goldman Sachs served as financial advisors on the transaction, which was reported to have been dual tracked between the syndicated market and the private credit market.

“When you have a good credit like Kymera, with a history of growth and strong free cash flow conversion, you have financing options. Private credit has raised so much capital that it

new facility’s operations is expected to produce 2,000 metric tons per year, with plans for future growth to support the growing use of sintered magnets.

“Neo is pleased to have EDC’s support to advance our new sintered magnets manufacturing facility. Strategically located in Estonia to support the mid-to-downstream integration with our Silmet rare earth separation facility, this manufacturing facility will be Neo’s first to produce madein-EU rare earth magnets for electric vehicle traction motors. It will service the growing demand for localised, parallel supply chains, shaping the future of EV manufacturing in Europe and North America,” said Rahim Suleman, Neo President and Chief Executive Officer.

The loan will be advanced in two tranches of US$25 million and will mature five years from the date of each instalment, with repayment of principal beginning in two years. The outstanding principal amount carries an interest rate equal to the secured overnight financing rate, as administered by the Federal Reserve Bank of New York, plus an applicable margin.

Several of Neo’s subsidiaries, including the entity that owns the Narva project, are expected to provide guarantees and/or security in favour of EDC.

www.neomaterials.com

does create a viable alternative to the syndicated market, a dynamic that benefits the issuers,” Adam Shebitz, Palladium’s Head of Industrials, told PitchBook LCD.

Palladium first invested in Kymera in 2018, and since the buyout, the company’s EBITDA has reportedly tripled.

The company announced its agreement to acquire silicon carbide developer Fiven from OpenGate Capital on June 4.

“Given the fact that Kymera had an acquisition under LOI, we wanted a timely close and we wanted to avoid market flex on terms,” added Shebitz.

www.kymerainternational.com

The rare earth sintered magnet manufacturing facility is located close to Neo’s existing rare earth separation facility and began construction in 2023 (Courtesy Neo Performance Materials)

Press Systems for Shaping Magnets & Magnetic Materials

AM 4 AM funding round to expand facilities and boost powder production

AM 4 AM, a producer of metal powders for Additive Manufacturing based in Foetz, Luxembourg, has announced the successful completion of a €1.3 million seed funding round. The round was led by Luxembourg Space Sector Development, EIT RawMaterials, and further supported by the Young Innovative Enterprise initiative from the Ministry of Economy of Luxembourg.

AM 4 AM announced that the €1.3 million investment will fund the expansion of its facilities, as well as enhance its production and product development capabilities. The company aims to install a complete powder development platform in its facility by the end of the year to meet the growing demand for high-performance materials.

“With this funding, AM 4 AM is entering a new phase in its development. The future infrastructures we will put in place will allow us to enhance production capacity, broaden our product portfolio, and accelerate our innovation efforts,” stated Maxime Delmée, CEO and founder of AM 4 AM. “The 3D printing market is expanding rapidly, yet there remains a shortage of suitable

Höganäs introduces

metal materials. With HiperAL, our high-performance aluminium, we’ve demonstrated a groundbreaking ability to provide metals with the required properties, meeting the demands of this growing sector.”

From its founding in 2019, AM 4 AM has pioneered an innovative technology for powder modification using cold plasma. This technology is said to enhance the properties of materials when additively manufactured, with the company’s flagship product, HiperAL, reported to be one of the strongest aluminium alloys on the market.

“It’s a real pleasure to see AM 4 AM continuing to grow and succeed from Luxembourg! After taking part in Fit 4 Start in 2022, the company continued its successful development from the Technoport in Foetz. Now, by leveraging the Young Innovative Enterprise scheme, AM 4 AM is set to expand and scale its operations internationally,” said Sven Baltes, Manager of Start-up Relations at Luxinnovation.

The Luxembourg Space Sector Development Fund, under the oversight of the Luxembourg government and satellite connectivity solutions

Starmix

Nova for optimised compaction

Höganäs AB, headquartered in Höganäs, Sweden, has launched Starmix Nova, a new bonded mix solution said to offer high apparent density and good filling performance, without the use of metal stearates.

Starmix Nova is reported to enable more efficient compaction in terms of productivity, quality and sustainability. Its high apparent density reduces filling height and allows for compact tool design.

The solution enables the compaction of larger and more geometrically

complex components as well as the compaction of components with narrow sections. It also improves density distribution.

The fillability performance also reduces the green scrap rate by minimising weight scatter and dimension deviations, cracks and edge defects. Additionally, the improved lubricity extends tool life while the zinc-free lubricant ensures clean burn-off with no residues in the sintering furnace. Both ejection properties and density can be further improved

AM 4 AM has announced the successful completion of a €1.3 million seed funding round. The company plans to expand its facilities and enhance its production and product development capabilities (Courtesy AM 4 AM)

provider SES, is intended to support the fund’s mission of bolstering Luxembourg’s space ecosystem. AM 4 AM’s powders, with their high strength, are well-suited to use in Additive Manufacturing intended for space.

Speaking about the investment, Bernd Schäfer, CEO and Managing Director of EIT RawMaterials, said, “Companies like AM 4 AM who work on advancing raw materials play a crucial role in the future of the European economy and its sustainability. EIT RawMaterials’ focus on innovation and AM 4 AM’s mission show perfect synergies, and I’m excited that we are part of this journey.” www.am-4-am.com

Starmix Nova is a bonded mix solution developed for improved compaction (Courtesy Höganäs)

by applying warm die compaction (60-80°C). Starmix Nova can be utilised to either increase the green density by decreasing the lubricant content or to improve the ejection process.

www.hoganas.com

6K closes $82 million funding round, names Saurabh Ullal as CEO

6K Inc, located in North Andover, Massachusetts, USA, announced that it has raised $82 million as part of its Series E funding round. The capital is expected to enable the company to scale up production for battery cathode active materials (CAM) and expansion for producing Additive Manufacturing metal powders.

In addition to the funding round, 6K announced that Dr Saurabh Ullal has assumed the role of CEO, replacing Dr Aaron Bent. The company has also appointed LaunchCapital’s Chief Investment Officer Bill McCullen as chairman of the board, with Volta’s CEO Dr Jeff Chamberlain and auto industry veteran Beda Bolzenius also joining the board.

“Thanks to Aaron, 6K is wellpositioned today as a leader for sustainable, critical material produc -

tion for lithium-ion batteries and additive manufacturing. Saurabh’s expertise in technology and operations ensures the company’s scaling strategy while meeting the material specifications and reliability levels customers demand,” McCullen stated.

“The $82 million raised underscores the confidence investors have in 6K, the UniMelt platform, and the leadership team.”

Incoming board member Beda Bolzenius has over thirty years of experience in leadership roles across the global automotive industry in Germany, United States, Mexico, South Africa, China, and Japan. Beda has an automotive technical background with operational experience in engineering, manufacturing, logistics, and supply chain management. He served as CEO of global manu -

facturer Marelli and held leadership positions in market-leading companies such as Bosch and Johnson Controls. He is expected to bring corporate, operational and automotive industry insights to his role on the board.

Dr Chamberlain is the CEO of Volta Energy Technologies, LLC, a venture capital firm launched out of Argonne National Laboratory. Chamberlain has a long record of industrial product R&D and commercialisation in energy, integrated circuit, and water treatment technology.

In addition to these activities, Chamberlain spent ten years leading energy storage initiatives at Argonne National Laboratory. In collaboration with the US Department of Energy, he led the effort to successfully transfer advanced battery technology from Argonne to organisations such as LG Chem, BASF, General Motors, Toda Kogyo, and General Electric. www.6KInc.com

United Grinding acquires GF Machining Solutions

United Grinding Group, based in Miamisburg, Ohio, USA, has signed an agreement with Georg Fischer AG, Schaffhausen, Switzerland, to acquire its division GF Machining Solutions (GFMS), based in Biel, Switzerland. The move is expected to strengthen United Grinding’s

GF Machining Solutions offers a range of tooling for PM presses under its System 3R brand (Courtesy GF Machining Solutions)

market position and serve its global customers with more comprehensive solutions. The transaction is valued between US$714–737 million (CHF 630-650 million) and is expected to close in Q1/Q2 2025, subject to regulatory approvals.

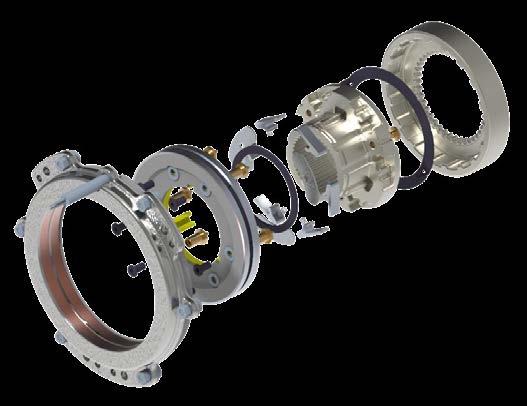

GF Machining Solutions provides solutions for manufacturers of precision parts and tools and mould and die makers. Its portfolio includes machines for milling, eroding, laser texturing, laser micromachining and Additive Manufacturing. The group currently employs around 3,500 people at over forty global locations. Through its System 3R brand, GFMS provides a range of tooling for the Powder Metallurgy industry. When producing punches and dies, the tooling reduces setup times and is said to improve accuracy and quality with fewer rejections. When used in the powder compaction press, setup times are also drastically reduced, with improved accuracy and quality of parts.

For metal Additive Manufacturing, GFMS partners with 3D Systems to offer a range of machines. These include the DMP Flex/Factory 350 and DMP Factory 500.

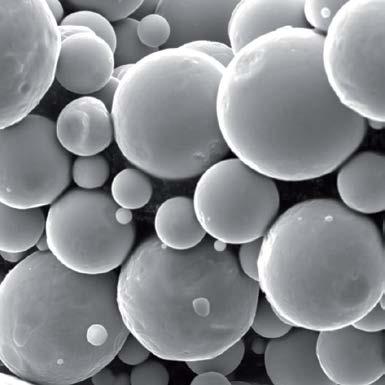

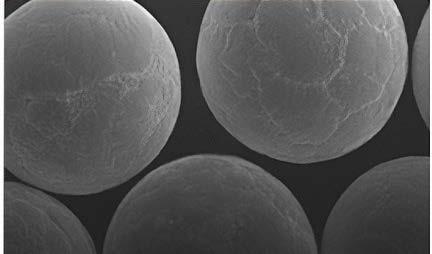

Sandvik launches Osprey HWTS 50 hot-work tool steel powder

Sweden’s Sandvik AB has introduced Osprey HWTS 50, a hot-work tool steel powder designed for enhanced manufacturability. Primarily developed for Laser Beam Powder Bed Fusion (PBF-LB) Additive Manufacturing, it is also well-suited for Hot Isostatic Pressing (HIP) and Metal Injection Moulding (MIM).

The tempering and thermal fatigue resistance, as well as thermal conductivity of Osprey HWTS 50, are improved when compared with conventional H-class hot work tool steels. These advanced properties are intended to effectively address many common

challenges in hot-work applications within general engineering, stated Sandvik.

Osprey HWTS 50 also improves the processability in PBF-LB, lowering the susceptibility of cold cracking compared with conventional H-class hot work tool steels. Typical applications include highpressure die casting dies, injection moulds, and hot forming tools. The chemical composition is tailored for improved hot hardness at temperatures exceeding 600°C. It is characterised by lower carbon content compared with those of medium carbon hot work tool steels

The DMP Flex 350 enables the efficient production of very dense, pure metal parts and includes improved gas flow technology for improved uniform part quality across the entire build area. The DMP Factory 500 is a workflow-optimised metal Additive Manufacturing machine that produces parts of up to 500 x 500 x 500 mm in size. Engineered using 3D Systems’ metal additive technology along with GF Machining Solutions’ technical and industrial knowledge, the DMP 500 incorporates precision System 3R clamping systems.

United Grinding is one of the world’s leading manufacturers of grinding, eroding, laser, and measuring machines, as well as machine tools for Additive Manufacturing. The company employs around 2,000 people at over twenty locations.

United Grinding’s majority shareholder is Patinex AG, a Swiss holding company. Through its Mägerle, Blohm, Jung, Studer, Schaudt, Mikrosa, Walter, EWAG, and IRPD brands and competence centres in America and Asia, the company offers a large product portfolio and a full range of services for the production of highprecision components. www.grinding.com www.gfms.com

and modifications to the carbide forming elements. This is to ensure a comparable or even enhanced tempering resistance despite lower carbon wt.%.

The thermal conductivity of Osprey HWTS 50 is higher compared to medium carbon tool steels over a wide temperature range.

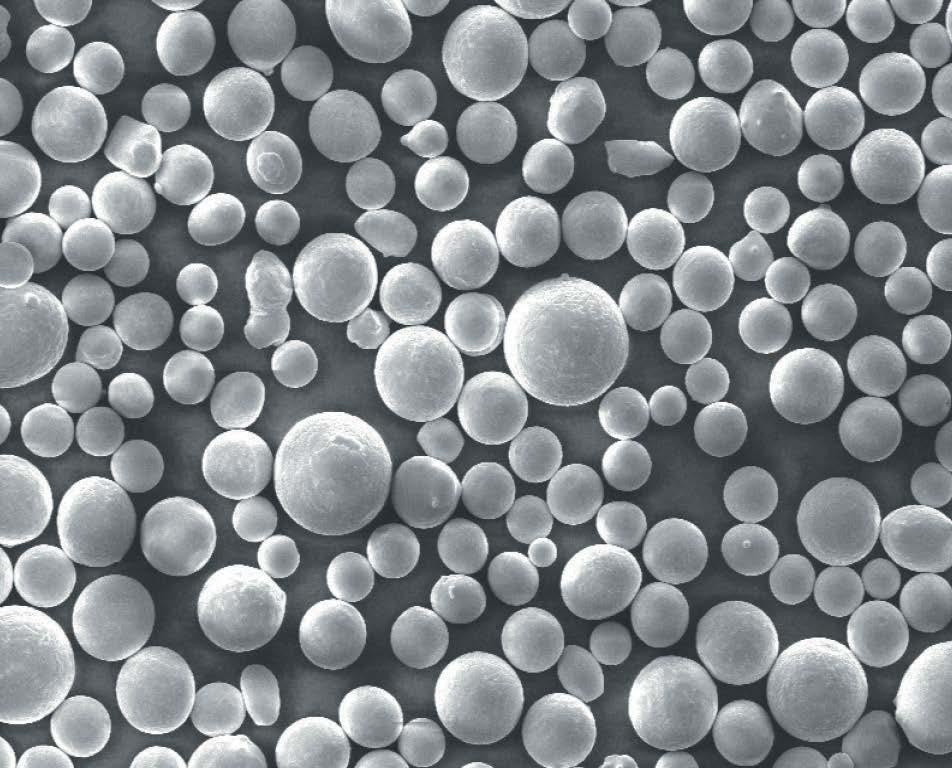

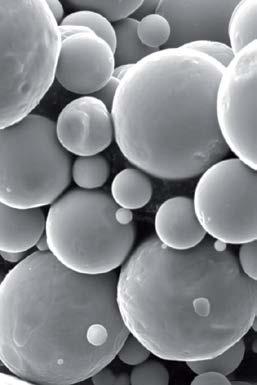

Osprey HWTS 50 metal powder is manufactured by either induction melting under Vacuum Inert Gas Atomisation or melting under argon prior to Inert Gas Atomisation. This produces a powder with a spherical morphology, which provides good flow characteristics and high packing density. In addition, the powder has a low oxygen content and low impurity levels.

www.metalpowder.sandvik

A SOLID LINE OF THINKING: SINTERING WITH A SOLID INFILTRANT

SOLIDIFY YOUR CASE FOR ULTRA INFILTRANT

There’s a solid line of thinking in the copper infiltration of ferrous PM parts and it can change the way you do business. Ultra Infiltrant is a wrought, homogeneous copper-based alloy that offers significant benefits over powder form copper infiltrants. Benefits like less waste, improved productivity, reduced erosion, no adherent residue and increased strength and hardness values. Benefits that affect your production line and ultimately your bottom line. Ultra Infiltrant is available in single and multi-turn wire rings, straight-length slugs, or other configurations to accommodate virtually any automated process. Ultra Infiltrant was designed for copper infiltration of ferrous PM parts in today’s cost competitive manufacturing environments, where the handling of fragile green infiltrant slugs is difficult and can lead to excessive waste. Additionally, it performs well in nitrogen-hydrogen based atmospheres so widely used in sintering operations globally.

SOLIDIFY YOUR INFILTRATION PROCESS FOR ULTRA INFILTRANT

Less waste, easier production, superior product: what more is there? Ultra Infiltrant revolutionizes the PM industry by eliminating all the negatives associated with infiltrant powders and improving on the process as a whole. The net result? How about overwhelmed customers and a boost to your bottom line? That’s what Ultra Infiltrant offers, so put it to work and get started on a solid line of thinking.

ORNL and NETL develop alloy for crackfree, lightweight turbine blades

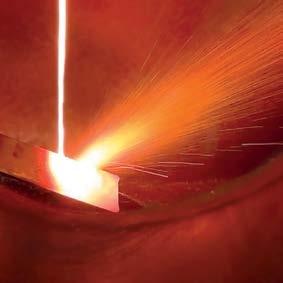

Researchers at Oak Ridge National Laboratory (ORNL), Tennessee, USA, and the US National Energy Technology Laboratory (NETL), have developed and additively manufactured a light, crack-free alloy capable of operating at temperatures above 1,316ºC (2,400ºF) without melting.

LE-237i-2023.ps

T:\MISC\ADS\LE-237\LE-237i-2023.cdr

The alloy combines seven elements in a niobium-rich, complex

Thursday, February 23, 2023 8:16:40 AM

Color profile: Disabled

concentrated alloy whose melting point is at least 48% higher than the nickel and cobalt superalloys previously developed by ORNL. Researchers fine-tuned the electron beam melting process to make test parts from the novel alloy.

“No one has been able to develop and print alloys with such a high melting temperature and low density without cracks before,” said

ORNL’s Saket Thapliyal. “This is significant. We’re making something lighter that can hold its structural integrity at ultra-high temperatures.”

The new alloy’s light weight and ability to withstand such high temperatures could enable additively manufactured turbine blades to better handle extreme temperatures, reducing the carbon footprint of gas turbine engines like those found in aeroplanes.

www.ornl.gov www.netl.doe.gov

AMES reduces environmental impact of Tamarite facility with photovoltaic installation

AMES Sintered Metallic Components, Barcelona, Spain, has announced the installation of a photovoltaic system at its Tamarite facility. The installation consists of 1,125 modules and six 100 kW power inverters.

This move is expected to generate over 937,000 kWh of energy annually, with Ames announcing it plans to reduce CO 2 emissions by around 187,000 kg per year.

AMES Tamarite manufactures a range of Powder Metallurgy gears and mechanical sintered components. Finishing processes include treatments such as case hardening, carbonitriding, induction hardening and steam treatment.

AMES is able to manufacture high-density, high-performance gears using its AmesDens-A and AmesDens-C processes. The process to be used depends on the geometry and density that are required. For top-performance gears, AMES offers its SurfaDens surface densification process, which achieves an accurate tooth profile and a surface density comparable to that of a conventional wrought steel component.

www.ames-sintering.com

3D Lab secures USA and Chinese patents for its atomisation process

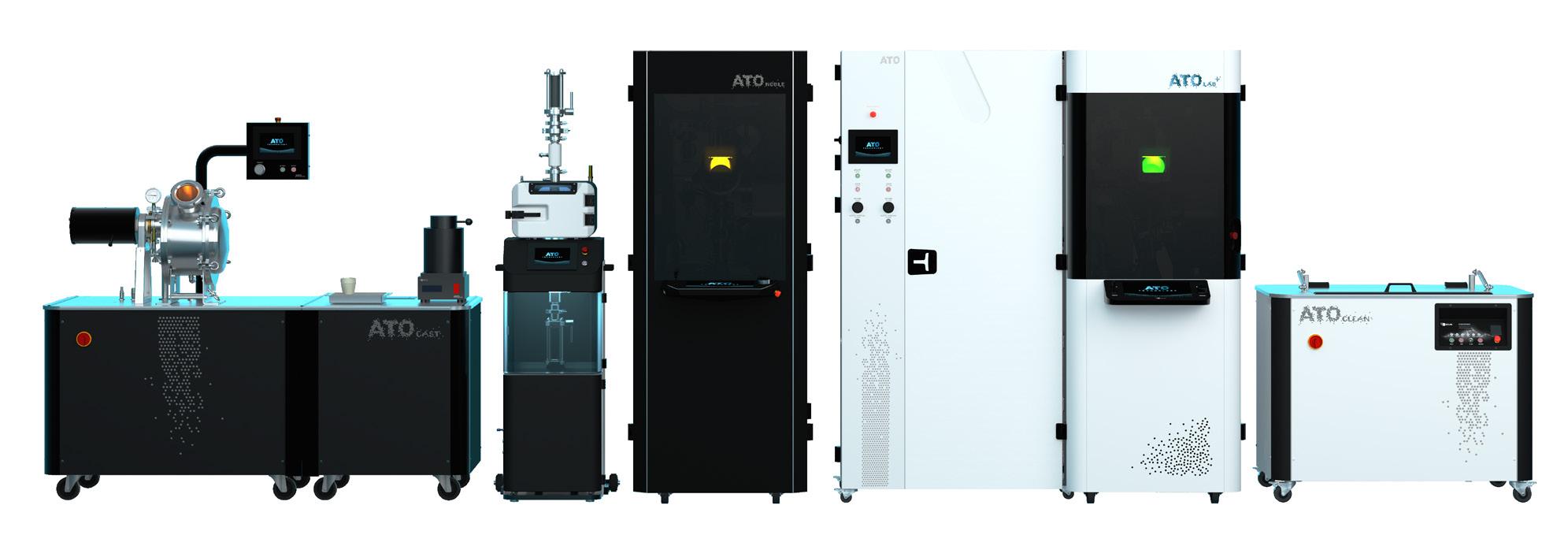

3D Lab sp zoo, based in Warsaw, Poland, has been granted a USA patent for its ‘Method and Device for Producing Heavy Metal Powders by Ultrasonic Atomization’ innovation. The company has also been granted a Chinese patent for the technology incorporated into its ATO atomisers under ‘A Method for Evacuation of Powder Produced by Ultrasonic Atomization and a Device for Implementing This Method.’

The patented technology is at the core of the company’s ATO series of ultrasonic metal atomisers. This technology is said to produce high-quality spherical metal powders with precise control over particle size, excellent flowability, and low oxygen content. These characteristics are critical for Additive Manufacturing and various industrial applications.

Commenting on the USA patent, Jakub Rozpendowski, CEO of 3D Lab, said, “We are proud to add this USA patent to our rapidly growing portfolio of global intellectual property. Our patented technologies drive our mission to provide advanced and versatile solutions for metal powder production, ensuring superior material quality and accelerating material innovations. This patent is a significant milestone in our journey, reflecting the dedication and innovative spirit of our team.”

The ATO Lab Plus is an advanced ultrasonic metal atomiser designed for lab-scale production of metal powders. Ideal for research and production environments, it enables the efficient and cost-effective production of reactive and nonreactive metal powders.

3D Lab has been granted patents for its atomisation process (Courtesy 3D Lab)

The atomiser has a modular construction, allowing for easy expansion of powder production capabilities through the use of the interchangeable modules. The device has advanced safety systems and automatic features, offering a versatile solution for producing metal powder. www.metalatomizer.com

CNPC Powder gains SCS certification for recycled aluminium and titanium powders

CNPC Powder, headquartered in Vancouver, Canada, has achieved a Certificate of Carbon Footprint for Aluminium and a Certificate of Achievement for Aluminium made from recycled materials from SCS Global Services, said to demonstrate sustainable development at scale. The company is reported to be the first manufacturer of titanium and aluminium alloy powders with production based in China to achieve SCS certification.

“Our technologies are focused on ensuring that we can sustainably scale for large applications in AM

without compromising the environment,” stated Paul Shen, CEO of CNPC Powder. “Our mission is rooted in transforming the industry by implementing eco-friendly practices and promoting the recycling and reuse of critical materials, including aluminium alloys, titanium alloy powders, and beyond. This milestone is merely the first step on our path to carbon neutrality.”

CNPC has been producing metal powders for Additive Manufacturing in China for more than a decade, over which time it has developed a proprietary Additive Manufacturing Production (AMP) technology. AMP is said to have a better composition ratio, less gas consumption and lower cost than other powder production methods, aiding the production team in achieving up to a 400% reduction in the carbon footprint of materials produced whilst tailoring properties to better suit Additive Manufacturing.

In expanding its research and development of green technologies, including refining recycling processes and enhancing product performance, CNPC has also finalised the facility expansion at its Anhui AM Campus. The additional

Höganäs celebrates 25 years of innovation and growth in North America

Höganäs in North America recently celebrated its 25 th anniversary. The event took place on October 24, 2024, at the North American headquarters in Hollsopple, Pennsylvania, USA, bringing together employees, customers, vendors, and community members to celebrate the milestone.

The anniversary celebration featured a mix of videos, guest speakers and facility tours, where

the attendees had the opportunity to discover more about the manufacturing processes and innovations at Höganäs.

“It was a true pleasure to celebrate our twenty-five-year anniversary in North America with our employees, customers, suppliers, group management and other important partners,” stated Dean Howard, Market President, North America. “Our team has built

floor space will be used for the production of 45 tons of recycled Al powder per month.

At the same time CNPC says that it has been an active participant in developing industrial standards that promote the ecological advancement of the entire Additive Manufacturing industry, including partnerships with leading local Universities and global companies in the electronics, automotive and aerospace sectors.

“Our journey to 100% recycled materials has begun with the most reactive and high-value applications, meeting rigorous aviation and automotive standards without compromising quality,” said Kathy Liu, Global Sales Manager. Currently, CNPC has a resource utilisation rate of over 90% for recycled aluminium and titanium.

By utilising recycled raw materials, CNPC states that it is contributing to both environmental sustainability and potential cost savings for customers. “Our efforts are geared toward reducing carbon emissions, lessening the impact of global warming, and setting a new standard for sustainability in the metal powder industry,” it was added. “Through sustainable practices and innovative technologies, we are committed to reducing the carbon footprint of metal manufacturing and contributing to a greener future.”

www.cnpcpowder.com

a great foundation over these years through hard work, dedication and perseverance. Everyone should be very proud of their contribution in reaching this important milestone. I look forward to continuing the journey!”

The company stated that as it marks this significant anniversary, it looks ahead with optimism and excitement. “With a clear vision, Höganäs is committed to driving positive change through material innovation and setting the stage for continued growth in the years to come.”

www.hoganas.com

CNPC has finalised the facility expansion at its Anhui campus (Courtesy CNPC)

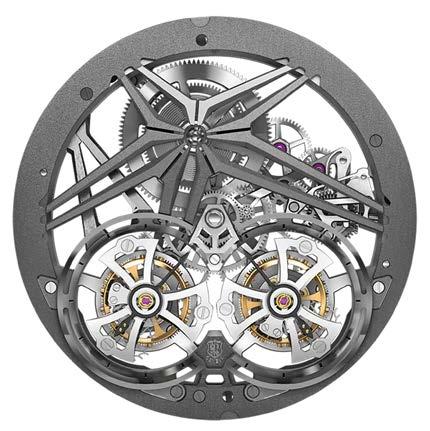

Roger Dubuis utilises Powder Metallurgy for Excalibur Double Tourbillon Cobalt watch case

Luxury watch maker Roger Dubuis, based in Geneva, Switzerland, has unveiled a limited edition of its Tourbillon watch featuring a cobalt chrome case made using Powder Metallurgy.

The Excalibur Double Tourbillon Cobalt has a 45 mm case that is reported to be produced using a Powder Metallurgy process. The use of PM gives the case a silvery-grey colour and creates a

Dubuis

completely homogeneous material without impurities.

The Roger Dubuis designers paired the alloy with cobalt-blue details to emphasise the materials used for the case.

With a limited run of just twenty-eight, the Roger Dubuis Excalibur Double Tourbillon Cobalt has a retail price of €264,585.

www.rogerdubuis.com

Sumitomo Electric’s A.L.M.T. Corp acquires Esteves Group

Sumitomo Electric Industries, Ltd, headquartered in Osaka, Japan, has announced that its wholly owned subsidiary, A.L.M.T. Corp, has completed the acquisition of all the shares of Esteves Group from Diamond Tools Group B.V., The Netherlands.

Esteves Group manufactures precision diamond tools for the wire and cable industry. Its product portfolio includes wire drawing dies, extrusion tools, and speciality tools. The company has been in existence for more than 100 years and has seven strategically located facilities in six countries in Europe, North America, and Asia.

Through this acquisition, A.L.M.T. Corp will use both companies’ diamond die product lineups, technological capabilities, sales networks, and service bases to further strengthen its global business development, including expanding sales channels in Europe and the United States.

The company added that the Esteves Group brand will continue to be used after this acquisition, and there will be no major changes to the existing service and support structure.

www.allied-material.co.jp www.sumitomoelectric.com www.estevesgroup.com

€7.3 M

An EU project coordinated by the European Powder Metallurgy Association (EPMA) has been granted €7.3 million. The funding, divided between thirteen partners under the REPTiS project, is intended to support the responsible extraction and processing of titanium and other primary raw materials for sourcing EU industrial value chains and strategic sectors. In addition to the EPMA, key participants include Ukrainian titanium producer Velta and global aerospace manufacturer GKN Aerospace.

Together, the companies are required to use the grant to demonstrate the feasibility of titanium extraction, processing, and utilisation within the EU through a partnership with Ukraine. The majority of the funding is reportedly designated for Velta and the EPMA; other recipients include companies specialising in Metal Injection Moulding and Additive Manufacturing, research centres, and universities. However, the current allocation of funding does not cover the entire €7.3 million budget.

The collaboration will focus on areas such as energy efficiency and environmental impact, titanium powder production and final product manufacturing. A life cycle assessment will be carried out from the extraction of raw materials to the final products in order to evaluate the differences between the methods used in the REPTiS project and conventional practices.

The project is funded under the EU’s Horizon Europe programme and is scheduled to run for four years, with a planned end date of August 31, 2028.

european-union.europa.eu www.epma.com www.velta.us

The Roger

Excalibur Double Tourbillon Cobalt watch features a 45 mm case made from cobalt chrome using a PM process (Courtesy Roger Dubuis)

American Isostatic Presses expands Ohio manufacturing facility

American Isostatic Presses Inc (AIP), headquartered in Columbus, Ohio, USA, has announced that it recently expanded its manufacturing operations in central Ohio.

“With this new expansion, we look forward to continuing meeting the unique demands of our diverse customer base, ensuring highquality and comprehensive isostatic pressing solutions,” the company stated in a release.

A provider of Hot Isostatic Pressing equipment, AIP also installs every system it sells. The company reports that it has never experienced failure on the part of any of its pressure systems or subsystems.

AIP holds ASME U1, U2 and U3 code stamps, US National Board approval, and European Union PED certification. Its systems have been tested by F2 Labs for UL and CE compliance and is reputedly the only company certified by South Korea for high-pressure vessels. AIP is also in application for Chinese certification.

Beyond its Ohio headquarters, the AIP family of companies consists of Isostatic Pressing Services (IPS) in Oregon City, Oregon; Isostatic Toll Services (ITS) in Olive Branch, Mississippi; and Isostatic Toll Services Bilbao SL, Bilbao, Spain. ITS Bilbao is a collaborative effort bringing the company into the EU. www.aiphip.com

AIP has expanded its Ohio headquarters (Courtesy American Isostatic Presses)

KOMAGE begins shipping new HMI system for powder compacting presses

German press manufacturer KOMAGE Gellner Maschinenfabrik, located in Kell am See, Germany, has begun delivering its first presses featuring a new Human Machine Interface (HMI), which was unveiled at the recent Ceramitec exhibition.

The new HMI, with a modern and clean design, includes a larger visualisation panel allowing the operator to have more information available on the same page. On the hardware front, the prominent side LED strips indicate the working status of the press.

In terms of security and access control, the new HMI panel includes an RFID sensor that enables users to log in quickly. Depending on the user’s access level, some areas of

the software may be restricted. Regardless of the user, all software changes are recorded and can be audited later.

The new software has been designed as an upgrade of the current software to ensure a smooth transition for users. The main functions, such as the main structure of the software menus, the setup and programming pages, and the custom functions, remain unchanged.

A significant number of new features are available, such as the graphic simulation of the press cycle to help avoid programming errors and the oscilloscope function for fine-tuning the press cycle or troubleshooting by the customer’s maintenance team.

m4p material solutions secures funding to expand metal powder production

m4p material solutions GmbH, with operations in both Austria and Germany, has announced it has received a €3 million investment from Finindus NV and Berkau Beteiligungs GmbH. In addition to the financial backing, the investors will bring valuable connections in the metallurgical and Additive Manufacturing sectors, along with extensive experience in supporting the growth of emerging companies.

m4p specialises in advanced metal powders for industrial Additive Manufacturing. It offers a portfolio of over 160 products designed and manufactured specifically for Laser Beam Powder Bed Fusion (PBF-LB) applications and used by over 400 customers.

The company develops and produces standard alloys optimised for Additive Manufacturing as well as customised powders which are tailored to specific applications.

The additional funding will facilitate the expansion of m4p’s geographical presence into North America and Asia, the introduction of new innovative alloys for Additive Manufacturing and the support of additional AM technologies besides PBF-LB. Furthermore, m4p will deploy its fully digitised business processes, improving the supply chain and quality experience for existing and new customers.

“m4p impressed us with their strong position in their home market, which we quickly understood is due to their unwavering commitment to customer satisfaction, paired with a profound understanding of both materials and processes,” said Roel Callebaut, Senior Investment Manager at Finindus. “By seamlessly integrating flexibility with stringent contamination control of powders and minimising batch variability

KOMAGE has begun delivering presses with its new Human Machine Interface (Courtesy KOMAGE)

Another new feature is the possibility for the user to select the information seen on the main screen, with access to the new KOMConnect features also available.

www.komage.de

they empower their customers to focus on what they do best: building exceptional parts.”

Andreas Berkau, of Berkau Beteiligungs, added, “As one of m4p’s first customers, I have been able to follow the company’s development closely over the years. I have been particularly impressed by the fact that m4p has managed to build up an excellent reputation among users, service providers and machine manufacturers in recent years. I look forward to supporting m4p in the coming years with both capital and technical expertise.”

Philipp Tschertou, CEO of m4p, shared, “We are honoured to have Finindus and Andreas Berkau as new shareholders, as they bring their market knowledge and experience on top of the financial funding for further market penetration. We are looking forward to a successful and rewarding cooperation with our top class shareholder group for the benefit of our customers.”

www.metals4printing.com

GelSight and Flexxbotics partner for autonomous robotic precision inspection

Tactile intelligence technology provider GelSight, Waltham, Massachusetts, USA, has announced a partnership with Flexxbotics, Boston, a provider of scaled digital solutions for robot-driven manufacturing. This partnership will focus on providing a solution for robot-enabled non-destructive testing (NDT) with autonomous control, incorporating GelSight’s tactile sensing technology into Flexxbotics machinery. The resultant precise quality and digital thread traceability is anticipated to reduce inspection time by 40%.

“Together, GelSight and Flexxbotics provide a new level of inspection productivity, scrap reduction, and cost savings powered by tactile sensing and production robotics,” said GelSight CEO Youssef Benmokhtar. “Now, even the most challenging aspects to dimensionally measure accurately can be consistently inspected in a fraction of the time using robotics.”

Next-generation smart factories in industries where measurement accuracy is critical in tight tolerance processing often use industrial and collaborative robots to dramatically speed up inspection processes, increase throughput, and improve margins. GelSight’s technology uses 3D imaging to map surface finish and defects on any materials at the micron level.

By robot-enabling GelSight’s tactile sensing devices with Flexxbotics, users can quickly perform hundreds of precision measurements during processing on the production line, as opposed to transporting parts to utilise specialised lab equipment or relying on outside laboratory services.

Flexxbotics provides interoperable communication between the robots and GelSight devices to coordinate the entire process and connect directly with existing business systems in the plant — including the CAD/PLM, QMS, IIoT and others for closed-loop quality compliance. Geometric Dimensioning and Tolerancing (GD&T) for each part is automatically fed by Flexxbotics directly into the robot and GelSight programs, enabling critical characteristic measurement integrity with inspection results collected for nonconformance tracking and analysis. Optionally, data can transfer to quality repositories and MES systems of record.

“We believe robot-driven manufacturing is the future, and our partnership with GelSight combines some of the most advanced automated inspection capabilities on the planet with Flexxbotics production robotic orchestration for next level factory autonomy,” added Tyler Bouchard, CEO & co-founder of Flexxbotics. “Using GelSight tactile sensing to inspect during production enables robots to achieve micron-scale measurement accuracy, bringing autonomous process control with Flexxbotics to the most complex geometry parts.”

www.gelsight.com | www.flexxbotics.com

Tooling for Powder Compacting Technology

• Simple, quick set-up

• High accuracy

• Low scrap rate

• Maximal machine utilization

• Increased productivity

www.system3r.com

Upper punch with Macro

Die with Matrix

Lower punch with Macro Core rod

Continuum to open sustainable metal powder production facility in Houston

Continuum Powders has announced the grand opening of its global headquarters and manufacturing facility will take place on December 5th in Houston, Texas, USA. Reported to be North America’s largest sustainable metal powder production facility, the company will offer guests the chance to see the company’s low-carbon production methods firsthand.

The completion of the Houston facility is said to reflect the company’s commitment to environmental responsibility, with the entire building operating as a green manufacturing centre. Net-zero carbon energy partners and lowemission gas systems are integrated throughout, enabling the plant to have a very low carbon footprint.

The site is also pursuing green certification goals and is designed to maximise energy efficiency through renewable energy usage and advanced recycling initiatives.

Continuum also stated that the opening of the new facility marks a significant step forward in delivering sustainable solutions that meet the demands of a rapidly evolving industrial landscape. With increased production capacity and multiple US locations, the company is now positioned to deliver products faster at reduced shipping costs, enhancing supply chain resilience for customers.

“Our new Houston facility not only expands our production capabilities but also allows us to scale our

PyroGenesis rebrands and relocates HQ

Canada’s PyroGenesis, headquartered in Montreal, Quebec, has announced that its name has been officially changed to PyroGenesis Inc from PyroGenesis Canada Inc. Simultaneously, the French version of the company’s name has changed to PyroGènese Inc. from PyroGènese Canada Inc.

“This change to our name is a subtle but important change as it better reflects who we are and what we are doing,” stated P Peter Pascali,

President and CEO of PyroGenesis. “With sales across twenty-one countries and counting, this name change is part of an initiative to better express in all areas of communication that we are an internationally focused company with global reach.”

This name change does not involve any restructuring, change of control, or other corporate reorganisation. This decision solely pertains to a more inclusive and internationally resonant brand image. The name change does not affect the trading of the company’s shares. The shares will continue to trade on the TSX under the symbol PYR and through the OTCQX under the symbol PYRGF. The new corporate name was effec -

mission of decarbonising the manufacturing industry,” said Rob Higby, CEO of Continuum Powders. “We are committed to providing high-quality, cost-competitive metal powders while minimising environmental impact. Our technology represents a distinct advantage in the market, offering sustainable solutions that align with the needs of forwardthinking industries.”

The facility features Continuum’s proprietary Greyhound M2P (melt-topowder) plasma atomisation process, which enables the repurposing of alloyed metal waste-stream products into high-quality metal powder in a single step. By enabling a cradleto-cradle process, the platform can reduce the need for transportation, product handling, primary melting, and extensive long bar processing operations, while also minimising the environmental impact by reducing the mining of elemental metal resources.

“Houston represents a leap forward in our operational efficiency and sustainability efforts,” said Rizk Ghafari, COO of Continuum Powders. “By combining state-of-the-art technology with our commitment to decarbonisation, we are not only supporting our customers’ needs but also setting a new benchmark for responsible manufacturing in the industry.”

www.continuumpowders.com

tive on the Canadian and US capital markets as of November 11, 2024, with no change to the stock symbols. Additionally, the company announced that it has recently moved its headquarters to a larger location in downtown Montreal. The move comes as a result of the company outgrowing its previous headquarters after more than thirty years in Montreal’s historic Griffintown neighbourhood. The new office location resides in the heart of downtown and provides more modern amenities and a smarter office layout, while also providing easier access for employees and customers that use public transport.

www.pyrogenesis.com

The new Continuum Powders site is reported to be North America’s largest sustainable metal powder production facility (Courtesy Continuum Powders)

A remarkable milestone

A quarter of a century. We could have only accomplished this by forging solid partnerships, friendships and collaborations build on trust, integrity and commitment.

DSH Technologies is the GO-TO support team for helping to process metal powder parts and materials. Real world solutions to real world problems, we can help solve technical, process and engineering related issues.

• Remote or In-Person process support

• Toll Debind and Sinter Services – “You Print It, You Mold It – We Debind & Sinter It”

• In person facility walk through, process evaluation, and education programs

For the past twenty five years, DSH is the only source for the best process support, toll processing and educational resource for your MIM and Metal AM applications.

Ipsen USA introduces regional Service HUBs to expand customer support

Ipsen USA, Cherry Valley, Illinois, USA, has formally launched its Service HUB model, marking a shift in how the company will deliver service and support to customers in the US. To support the rollout of the Service Hub model, Ipsen also introduced its Technical Development Center (TDC) training initiative.

Over the past two years, Ipsen has developed the regional HUB model concept under the direction of Ipsen Global CEO Geoffrey Somary. Now, led by CSO John Dykstra, the HUBs will provide services across a large portion of the American Midwest and Southeast, particularly in areas with a high density of Ipsen customers.

This move to regional service centres is intended to enable quicker response times, dedicated support teams and thorough knowledge of each customer’s facility. This more tailored response is expected to reduce customer downtime and optimise heat-treating operation performance whilst also improving the quality of life of its Field Service Engineers (FSEs).

Our powder is:

Spherical •

Free-flowing •

•

Due to the efficiency of our cuttingedge technology we can offer the lowest priced powder on the market with no compromise in quality.

D50 of 35µm for most materials

• Has high tap density •

D50 of 20µm for titanium super alloys

We process directly from: Raw elemental material

We can handle refractory and reactive alloys

Ipsen USA has formally launched its regional Service HUB model for US customers (Courtesy Ipsen USA)

The Ipsen Technical Development Center (TDC), is an initiative led by Darci Johnson, Program and Transformation Manager, and Cavan Cardenas, Technical Training Lead. The TDC is focused on training and developing new Field Service Engineers (FSEs), including the launch of the Field Service Engineer Academy, a specialised programme intended to equip new and current technicians with the skills and knowledge to best serve customers within the HUB model.

www.ipsenglobal.com

Sandvik revises AM strategy as it divests BEAMIT

Sandvik AB has announced a revised Additive Manufacturing strategy, with its focus returning to metal powder production. As a result, it has announced the decision to exit its minority stake (approximately 30%) in the Italian Additive Manufacturing service provider BEAMIT. Sandvik has been a shareholder in BEAMIT since 2019. As part of a wider strategic shift, the engineer-to-order business of DWFritz Automation (DWFritz) has also been divested.

Charges totalling approximately SEK 390 million will be accounted for in the third quarter and reported as items affecting comparability. Out of the total charges, approximately SEK 250 million relates to a capital loss, including transactional costs, from the divestment of DWFritz, and about SEK 140 million relates to a write-down of the stake in BEAMIT.

Sandvik has sold DWFritz’s engineer-to-order business to the US-based private equity firm Balmoral Funds. It bought DWFritz in 2021 to expand its ZeroTouch business. The ZeroTouch platform is a unique inspection gauging equipment that enables near-line and in-line metrology and is an important part of Sandvik’s closed-loop strategy.

www.home.sandvik

GKN PM develops high-performance Porous Transport Layers for green hydrogen production

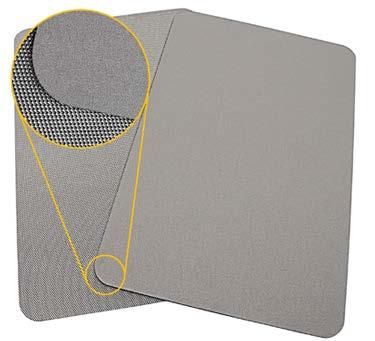

GKN Powder Metallurgy has announced the development of a new generation of high-performance, high-porous, and high-purity Porous Transport Layers (HP-PTL) for Proton Exchange Membrane (PEM) electrolysis. The solution, developed from a decade of research, is designed to improve hydrogen production by increasing efficiency and reducing overall environmental impact. By significantly reducing the required amount of catalyst materials such as iridium, GKN’s HP-PTL lowers stack costs, increasing the affordability of advanced PEM electrolysers compared to traditional solutions.

Utilising Powder Metallurgy, the HP-PTL has a highly porous structure comprised of a fine powder

layer which increases surface area connectivity. This design also reduces electrical resistance, meaning it requires a lower voltage to produce equal amounts of hydrogen, reducing energy consumption and improving the overall efficiency of electrolysis stacks.

The microstructure shows a high titanium surface in addition to a high porosity. This results in a further reduction of electrical and mass transport resistance, leading directly to a system efficiency increase of up to a reported 30% when compared to current metal sheet solutions on the market.

“Through the development of the HP-PTL, GKN Powder Metallurgy is driving the energy transition forward,” stated Stefan Zeier,

Porous Transport Layers for Proton Exchange Membrane electrolysis (Courtesy GKN Powder Metallurgy)

Senior VP Operations. “By reducing operational costs and enhancing the efficiency of PEM electrolysis, this innovation plays a crucial role in making renewable hydrogen production economically viable. As a result, it opens new possibilities for a safer, more cost-efficient future based on environmentally sustainable energy.” www.gknpm.com

Airbus and Plastometrex collaborate on standardisation of PIP mechanical test

Plastometrex, a developer of mechanical testing solutions based in Cambridge, UK, has announced a collaboration with Airbus that is intended to streamline mechanical testing processes and enhance material insights. The partnership aims to support the standardisation of PIP (Profilometry-based Indentation Plastometry), a mechanical testing technique developed and commercialised by Plastometrex.

Traditional tensile testing requires test pieces that conform to precise dimensions, which adds significant expense to testing workflows, can limit the speed of a project, and can prohibit testing in various circumstances, including where samples are small or irregularly shaped.

By comparison, PIP sample preparation is said to be simpler. The test operation is more straightforward, and the entire process can be completed in just a few minutes. Also, it can test specimens directly and at a fine scale, which unlocks the

Sumitomo

testing of small or irregularly shaped pieces and enables the extraction of more data, delivering deeper insights into material behaviour. For example, 160 PIP tests can be fitted onto a standard ASTM E8 tensile coupon, unlocking information about material homogeneity that would be obscured by the single stress-strain curve obtained when tensile testing this part.

Through PIP, Airbus will accelerate testing workflows and enable the generation of richer data, supporting innovation and advancing the highest levels of safety in aerospace engineering.

Dr Jimmy Campbell, CTO at Plastometrex, shared, “We are thrilled to collaborate with Airbus on standardising PIP. This partnership highlights the transformative potential of our technology, enabling faster, more versatile, and data-rich testing. Together, we’re setting a new standard in mechanical testing that aligns with the rigorous demands of the aerospace industry.”

reports rise in sales of Powder Metallurgy components

In its Integrated Report 2024, Sumitomo Electric Industries, Ltd, headquartered in Osaka, Japan, has reported a year-on-year rise in the sales of Powder Metallurgy components. In 2023, the company posted net sales of sintered powder metal parts at 82.9 billion yen (around $555 million), up

from 75.1 billion yen (approx $503 million) in 2022.

There was, however, a small fall reported in the category of cemented carbide tools, diamond and CBN tools, and laser optics. The company reported that in 2023, net sales for this segment totalled 110.2 billion yen (approx $738

The PLX-Benchtop by Plastometrex which uses the PIP mechanical testing technique (Courtesy Plastometrex)

This collaboration between Airbus and Plastometrex is said to mark a significant advancement in mechanical testing. It offers a streamlined, cost-effective, and data-rich complement to traditional methods. As both companies work together, this new approach looks to improve testing efficiency and deliver more detailed insights into material behaviour, benefitting aerospace projects worldwide.

www.plastometrex.com www.airbus.com

million), down from 113.1 billion yen (around $757 million) in the previous year.

In the sintered products division, Sumitomo stated that it plans to develop new products for electric vehicles and non-vehicle use applications. It also announced it will review the production structure to enhance cost-competitiveness.

Regarding the cemented-carbide tools sector, Sumitomo added that it aims to expand global sales, develop new markets such as electric vehicles, and increase market share.

Responding to the growing demand for machining in India, Sumitomo also reported that it had established a cutting tool sales company in Navi Mumbai and began operations to better serve local customers.

www.sumitomoelectric.com

Sumitomo reported a year-on-year rise in sales of Powder Metallurgy components, but slight fall in cemented carbide and diamond tools (Courtesy Sumitomo Electric Industries)

High Pressure Heat Treatment: Enhancing AM/PM reliability and performance

Reaching full density and uniform microstructures of your AM/PM components even with complex shapes with Quintus High Pressure Heat Treatment (HPHT TM) solution!

By combining Hot Isostatic Pressing with the heat treatment process in a single cycle, you can produce high-quality AM/PM parts more efficiently, achieving consistent material properties throughout the component while minimizing costs and lead times. This solution is vital for processing advanced and high-performance alloys in critical applications across aerospace, automotive, energy, and medical industries.

Find out more about Quintus HIP and HPHTTM capability on our website.

Gränges invests in post-processing line for aluminium Additive Manufacturing powders

Gränges Powder Metallurgy SAS, based in Saint-Avold, France, has invested in a new post-processing line used in the production of aluminium powders for Additive Manufacturing. The post-processing line includes ATEX-classified sieving, homogenising and packing equipment in a closed workspace to ensure the highest safety and cleanliness. The line is planned to be fully operational in the first quarter of 2025.

Gränges Powder Metallurgy has been producing high-performance Powder Metallurgy aluminium alloys by inert gas atomisation for over thirty years. The company is mainly known for the Dispal range of low-thermal expansion AlSi alloys, commonly used in the semi-conductor and precision

optics industries. As well as Dispal, standard AlSi10Mg powder and customer-specific aluminium alloys are also produced.

“The investment is a step in our ambition to become a leading producer of aluminium AM powders. With the investment, Gränges can supply large quantities of homogeneous, spherical aluminium powders with sharp powder size cuts and processed under inert gas,” said Peter Vikner, Managing Director, Gränges Powder Metallurgy. “The dedication to aluminium alloys guarantees cleanliness from crosscontamination with other alloys. It also enables synergies in raw material purchase, in processing and in R&D, ensuring that we have the right capacity, price and quality for the market.”

Gränges Powder Metallurgy has invested in a new post-processing line for the production of aluminium powders for AM (Courtesy Gränges Powder Metallurgy)

Gränges Powder Metallurgy is part of the Gränges Group, an organisation dedicated to aluminium with a total net sales in 2023 of MSEK 22,518 and an operating profit of MSEK 1,576 (€1.92 billion and €135 million, respectively). The plant in Saint-Avold, France, is dedicated to aluminium powder production and spray forming with a total capacity of 3,500 metric tonnes per year. www.granges.com

CNPC to manufacture APWorks’ Scalmalloy powder

CNPC Powder, headquartered in Vancouver, Canada, has formed a strategic alliance with APWorks GmbH, based in Taufkirchen, Germany, to manufacture and commercialise Scalmalloy, its high-performance aluminium-magnesiumscandium alloy developed for Additive Manufacturing.

“We are excited about this agreement with APWorks and an impressive milestone for the company to expand our portfolio and production line with the manufacturing of an important material such as Scalmalloy,” stated Kathy Liu, General Manager of CNPC Powder. “We are also prepared for possible future joint development of new Scalmalloy formulations.”

Developed for Additive Manufacturing, Scalmalloy has a proven track record in a wide range of applications in aerospace, robotics, marine and motorsport, and is an approved material under the FIA regulations. Combining high strength with excellent ductility and processability, it is said to be an ideal material for use in highly loaded and safety-critical parts.

Jon Meyer, CEO of APWorks, added, “We see this agreement as important for the industry. CNPC has demonstrated a high level of quality control and their powder is achieving excellent results. We look forward to working with CNPC to further improve the economics and availability of Scalmalloy powder, for the benefit of the industry as a whole.”

www.cnpcpowder.com www.apworks.de

Pfeiffer Vacuum rebrands to Pfeiffer Vacuum+Fab Solutions

Pfeiffer Vacuum, a member of the global Busch Group based in Asslar, Germany, has announced a rebrand into Pfeiffer Vacuum + Fab Solutions.

Intended to reflect Pfeiffer’s comprehensive portfolio of both vacuum solutions and semiconductor fab solutions, the rebrand marks the seventieth anniversary of the company’s first major development of a turbomolecular vacuum pump.

Today, Pfeiffer is a global provider of solutions for high and ultra-high vacuum technology with a product portfolio including leak detectors, measurement and analysis devices, components, as well as vacuum chambers and systems.

“Our new logo is more than just a trademark. It tells our story, which began with the invention of the turbopump and became a global success. Our teams design and manufacture products that are used in the world’s most high-tech applications and future megatrends, exploring the frontiers of knowledge,” explained Wolfgang Ehrk, CEO of Pfeiffer. www.pfeiffer-vacuum.com

Powder engineering expertise.

GEA is a worl-leading specialist in powder engineering with exceptional patented Spray Drying Solutions. Be it a powder, a granulate or an aglomerated product, our solutions define and deliver superior quality powders to your exact specifications in the most energy-and-costefficient way.

California Nanotechnologies opens state-of-the-art spark plasma sintering facility

California Nanotechnologies Corp (Cal Nano), based in Cerritos, California, USA, has announced the commissioning of its new manufacturing facility in Santa Ana, California. The new facility is now operational and houses a large-scale MSP5 Spark Plasma Sintering (SPS) machine and cryomills.

The commission marks an important milestone in expanding its manufacturing capabilities and footprint. The expansion provides the necessary infrastructure to operate its recently purchased equip -

ment and creates additional space for potential production requirements, warehousing, and custom tooling. This infrastructure includes increased electrical current capacity, liquid nitrogen storage, and other associated upgrades.

Dr Fritsch GmbH & Co. KG, headquartered in Fellbach, Germany, supplied the new MSP5, which is the largest SPS press built by Dr Fritsch.

“We are proud to open a first-ofits-kind facility in North America, which will bring commercial access to state-of-the-art technologies and

Expansion of HIP and vacuum heat treatment capabilities at ITS Bilbao

Isostatic Toll Services Bilbao SL (ITS Bilbao), Spain, has announced that it intends to commission its fourth MEGA Hot Isostatic Pressing (HIP) unit within the next three years and, by Q2 2025, to commission a fully molybdenum vacuum heat treatment furnace from TAV. Its first heat treatment unit, the 1200 x 1600 x 1200 mm furnace will feature a maximum vacuum of 10-5 mbar, making it suitable for titanium. This additional

heat treatment capability will enable ITS Bilbao to offer a combined MEGA HIP and MEGA Heat Treatment service to its HIP customers.

ITS Bilbao ran the first cycle of its MEGA HIP unit in December 2019. While the COVID-19 pandemic followed shortly after, with its impact on the aerospace sector felt by the company, demand for toll HIP services surged again following the recovery. This increased demand

machinery for processing advanced materials,” stated CEO Eric Eyerman. “We have already started to run our first parts on the new MSP5 machine for our green steel ‘cleantech’ customer. Our mission is to help clients push the boundaries of material science and innovation, and the new equipment will allow us to execute on larger volumes, batches, and part sizes.”

Cal Nano said it expects other equipment, including multiple cryomills and a mid-sized SPS2000 machine, to come online over time.

In addition, pre- and postprocessing services and custom tooling manufacturing are becoming more important aspects of the company’s manufacturing services. To complement existing processing offerings, a molybdenum wire EDM (Electrical Discharge Machine), an advanced cutting mill, and additional machining capabilities are expected to be available at the new facility for customers who require ancillary parts and services.

All these investments have resulted in a portfolio of advanced material processing technologies across its Cerritos and Santa Ana facilities. This includes the largest SPS machine commercially available for production and R&D manufacturing services, cryomills with batch sizes ranging from 0.5 kg to 25.0+ kg, and ancillary machinery and services.

www.calnanocorp.com

prompted the company to decide, in Q1 2022, to double its existing capacity. A MEGA HIP unit, identical to the original, was commissioned in the following year.

Over the following twelve months, demand for the second unit exceeded its capacity, leading to the installation of a third MEGA HIP unit in 2024. Set to be commissioned in 2025, the unit is identical to the previous, with a Ø1088 x 2570 mm loadable zone corresponding to 2.4 m 3, and an increased maximum working pressure of up to 138 MPa (20,000 psi).

www.isostatictollservices.com

The new manufacturing facility at Cal Nano will house a Dr Fritsch MSP5 Spark Plasma Sintering machine (Courtesy Dr Fritsch)

Retech’s new Plasma Gas Atomizer will atomize reactive and refractory metals faster, cheaper, and better than ever.

Our Plasma Atomization technology not only atomizes reactive and refractory metals at unprecedented rates, but includes features that eliminate many other obstacles to cost effective atomization of titanium and other refractory metals.

• Highest Throughput in the Industry – Produces powders far faster than any other available technology

• Simplified Feedstock Preparation – Accepts elemental feedstock, scrap, sponge, recycled materials and other low-cost feed

• Retech’s Proprietary Hearth Melting Technology – Production of ultra-high purity product

• Versatile Atomization of Multiple Alloys – Suitable for any alloy that can be plasma melted

ASM secures AU$5 million government grant for Dubbo rare earth project development

Australian Strategic Materials Limited (ASM) has received an AU$5 million grant under the Australian Federal Government’s International Partnerships in Critical Minerals (IPCM) Program. The grant will be matched by ASM and used to support efforts to identify potential lower capital and shorter implementation pathways to rare earth production (RE Options Assessment and Pilot Program) at the company’s Dubbo Project in New South Wales. The RE Options Assessment and Pilot Program will be conducted as a preliminary step before the Front-End Engineering Design (FEED) services contract awarded to US-owned Bechtel Mining and Metals Inc in March 2024.

The Dubbo Project is ASM’s main critical minerals deposit, which will produce a variety of rare earth and critical mineral oxides that are essential for the global energy transition. The IPCM Program was launched in February 2024 to provide funding for critical minerals businesses to develop end-to-end supply chains with Australia’s international partners.

In a media release, Minister for Resources the Hon Madeleine King MP, said, “Government support to refine rare earths is important for our sovereign capabilities and will help our trading partners meet their economic, national security and emission reduction commitments.”

The RE Options Assessment and Pilot Program will enable ASM to identify alternative, capital-efficient and nearer-term options for producing rare earth elements at the Dubbo Project before commencing the FEED services contract and conducting an updated feasibility study on the construction and operation of the Dubbo Project. The RE Options Assessment and Pilot Program will involve engineering, sampling, metallurgical testing, and a pilot programme at ASM’s pilot facility located at ANSTO, New South Wales. ASM will collaborate with international partners DRA Global and Stantec, as well as local service providers, Mining One and Core Metallurgy, to deliver this programme. These activities are critical to ASM progressing key funding activities and making a final investment decision on the Dubbo Project, which is targeted for the first half of 2026. www.asm-au.com

Huacheng Moulding (Changshu) Co.,

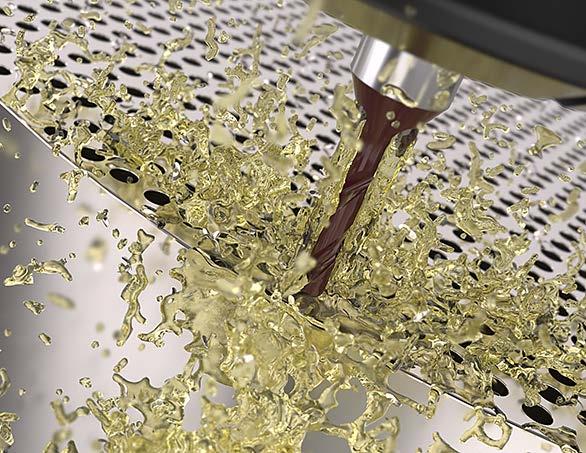

Mikron Tool unveils highperformance hardmetal tools for titanium and delicate components

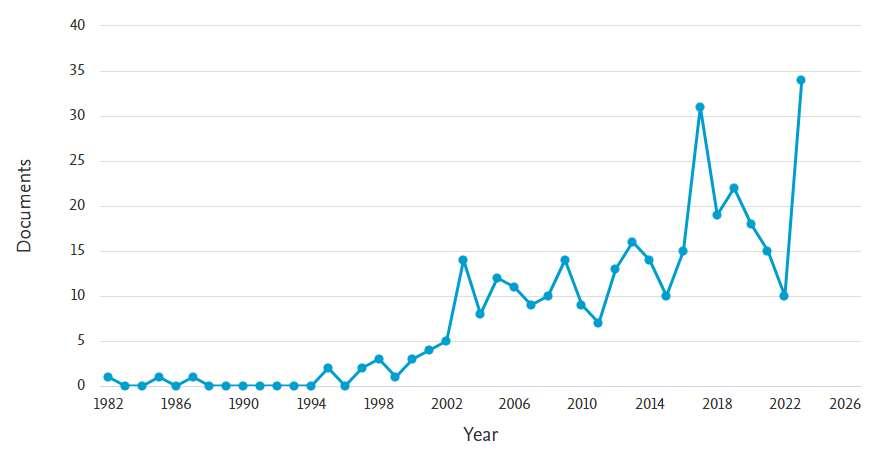

Mikron Tool, based in Agno, Switzerland, has introduced three new solid hardmetal tools. The company has added the high-performance bit CrazyDrill Titanium TN/TK for all types of titanium and two highperformance mills, CrazyMill Cool CF and CrazyMill Cool SF, specially designed for delicate components.