FOREX. INDICES. COMMODITIES. www.gomarkets.com Trading CFDs carries significant risks and is not suitable for everyone. You should ensure you fully understand the risks involved and seek independent advice if necessary. Before you make any decision in relation to a financial product you should obtain and review our Target Market Determination, Product Disclosure Statement, Financial Services Guide and other CFD legal documents. *International Business Magazine Awards 2022

.......Note From EDITORIAL Welcome

As we enter 2024 with a fresh perspective on the real estate and investment sector scenario from the MENA region, this magazine edition could help you make the right business decisions. International Business Magazine enters this new year with a new confidence after the grand success of its International Business Magazine Awards 2023 held in Dubai.

We approached this edition intending to lay the foundation for all the new decisions for 2024. Our main highlight story behind the cover page is the disruption and widespread popularity of BaaS across the Asian and European banking industry. This article will give you a peek into the role of IT companies and their upcoming strategies for the financial world across the globe. Also, we contributed our outlook towards the tourism industry in the MENA region and a few latest updates on the corporate events.

We recommend you flip the pages to learn more about sustainable fuel in aviation, the performance of the credit market since 2022, some of the milestones in MENA region’s banking sector, and some of the notable trends in FMCG and Technology for 2023.

We hope this magazine edition will prove to be a worthwhile investment for you.

Director Shashank M

& CEO Shankar V Shivaprasad

Editor Shankar V Shivaprasad Editor Ujal Nair Assistant Editors Medhaj Nair, Tamanna Shaikh, Amith Raj

of Production Shank Mendez

of Research

Watson

of Media Sales

Grey

Sales Manager

contact

Managers: Daniel Edwards, Sumana Shankar, Ana Watson

Development

Morgan, Alisha Taylor, Jane Sanders, James Smith, Jason Brown, David Johnson, Stella Grace, John Davis, Nancy Miller, Alex Milo Graphic Designer Chandan R Video Editor C GIDIEON SAM ISSAC Account Manager Agnes Wong Registered Adddress: Sharjah Media City (Shams), Al Messaned City, Al Bataeh, Sharjah, United Arab Emirates, P.O. Box: 515000 Office Address: Suite No 502, Al Tawhidi 1 Building, Floor 5, Khalid Bin Al Waleed Road, Bur Dubai, Dubai, UAE. Email: info@intlbm.com Phone: +971 55 686 6713 Connect with us on Twitter: @ibmag_magazine, Facebook:@intlbm and Instagram: @intlbm LinkedIn: @international-business-magazine Be sure to check out our website at www.intlbm.com

Managing

Co-Founder

Chief

Head

Head

Sara

Head

Charles

Media

Chris Young Advertising

chris@intlbm.com Content

Business

Leo

14

The Ultimate Playbook: Unleashing Profit Potential in 2024’s Investment Chessboard

Demystifying the New Tax Law in Saudi Arabia

22

26

A Recap of MENA’s monumental Banking and Finance milestones in 2023

32

Performance Report of Credit Market in 2022 to 2023

Game of Drones: The Future of Urban Development Modern Banking Customers set BaaS for Fintechs in 2024 NBK and Zain inks agreement with KFAS to launch a Digital Program 40 08 Cover Story 50

MENA Tourism could rise like a Phoenix in 2024

The tourism industry in the Middle East and North Africa (MENA) region has been hit hard by the COVID-19 pandemic. However, recent forecasts and reports indicate that the region is on track for a strong recovery. As we move into 2024, there is hope & optimism about MENA tourism recovering from the pre-pandemic levels seen in 2019.

The fastest-recovering travel market in 2022

In 2022, the Middle East emerged as the fastestrecovering travel market globally. As per reports, the region’s tourism sector outperformed the Americas, Asia Pacific, and Europe, achieving nearly 86 percent of its 2019 levels. This impressive recovery continued in 2023 and is also expected in 2024, as highlighted by the Global Business Travel Association (GBTA). The GBTA’s annual forecast predicted that business travel in the

Middle East and Africa will reach 86% of pre-pandemic levels in 2023, signalling a strong rebound in the region.

The HSBC’s August report stated that the Middle East has achieved a “total recovery” in terms of tourist arrivals in the first quarter of 2023. This milestone demonstrates the region’s ability to attract visitors and regain its position as a top tourist destination. In the first three months of 2023, the number of tourist arrivals in the Middle East increased by 15 percent compared to 2019 levels, showcasing the resilience and appeal of the region’s tourism offerings. According to the Airports Council International World, the Middle East’s air passenger traffic was about 96 percent of pre-COVID levels in 2023, handling an estimated 394 million travellers. This growth trajectory is expected to continue, with passenger volumes fully recovering

Representational Image 06 Tourism

in 2024, reaching a projected 400 million travelers, or about 105.4 percent of 2019 levels.

In Saudi Arabia, the travel and tourism industry’s contribution to the GDP is projected to reach nearly SAR 635 billion, representing 17 percent of the total economy, as per estimates. The forecast reveals that travel and tourism employment is also expected to double over the next 10 years leading to millions of jobs. These projections are part of the Vision 2030 plan laid out by the Saudi Arabian government.

Factors driving MENA’s tourism recovery

One of the major determinants in the revival of MENA tourism has been the successful rollout of vaccination campaigns in key markets such as the UAE and Israel. The government has been actively working to vaccinate the population, & following stringent health protocols to provide a safer environment for locals and visitors alike. Additionally, a renewed focus on digital transformation played a pivotal role in attracting and engaging tourists. Advanced booking systems, virtual experiences, and seamless digital communication are enhancing the overall travel experience. Moreover, the number of foreign visitors visiting Saudi Arabia has seen quite an increase, with 5.8 million from the 2019 level. In 2023, during the time of Hajj, the Muslim pilgrimage to Mecca, the country welcomed a larger number of tourists. Because of the pandemic, the Mecca pilgrimage saw a huge decline in 2020–2022. But the number significantly increased to more than 200 percent last year. Few of the major destinations in the Middle East saw a strong rebound, where footfall doubled, especially Qatar, the host of the 2022 FIFA World Cup. Besides, the increased economic activity, driven by the rising price of crude oil, has fueled the recovery of the business travel sector, further boosting the overall tourism industry in the region.

Overcoming obstacles

Although the MENA region is on track for a strong recovery, there are still challenges that need to be addressed. The ongoing uncertainty surrounding the global economic environment, including inflation and

energy prices, is posing quite a challenge. These factors can impact travel costs and consumer spending patterns, influencing the pace of recovery. Additionally, the conflict between Russia and Ukraine poses geopolitical risks that may affect travel patterns and international relations, potentially impacting the tourism industry in the MENA region. If we look at the positive outlook, countries are putting their best foot forward to leverage the opportunity of restructuring the MENA region as the most desired tourist destination across the world. From realising the importance of sustainable tourism to minimising the environmental impact of tourism, preserving the culture, and supporting local communities. The adoption of advanced technology such as digital health passes, contactless payment services, and online booking platforms has facilitated a safe and efficient travel experience. This improved operational efficiency in the tourism sector, playing a crucial role in recovering from the wrath of covid 19.

Towards the brighter side

The road to recovery post-COVID seemed like an uphill task but wasn’t impossible. The growth in the tourism sector of the MENA region has shown just that. The gradual easing of travel restrictions, the acceleration of vaccination campaigns, and the surge in demand for travel are among the major factors fueling the region’s tourism recovery. As the region continues to overcome challenges posed by the pandemic, the implementation of effective strategies, digital transformation, diversification of offerings, collaborative efforts, and targeted marketing, will prove to be beneficial in long term. MENA region will continue to be the host of major events, conferences, summits, and exhibitions to showcase the region’s capabilities, which will attract international visitors and promote economic growth. With a renewed emphasis on safety, innovation, and sustainability, MENA is poised to welcome travelers back to its world-class hospitality, fascinating landscapes, and rich cultural heritage, restoring the vibrancy of its tourism sector to pre-2019 levels.

- Blog by Madhulika Pandey

07 Tourism

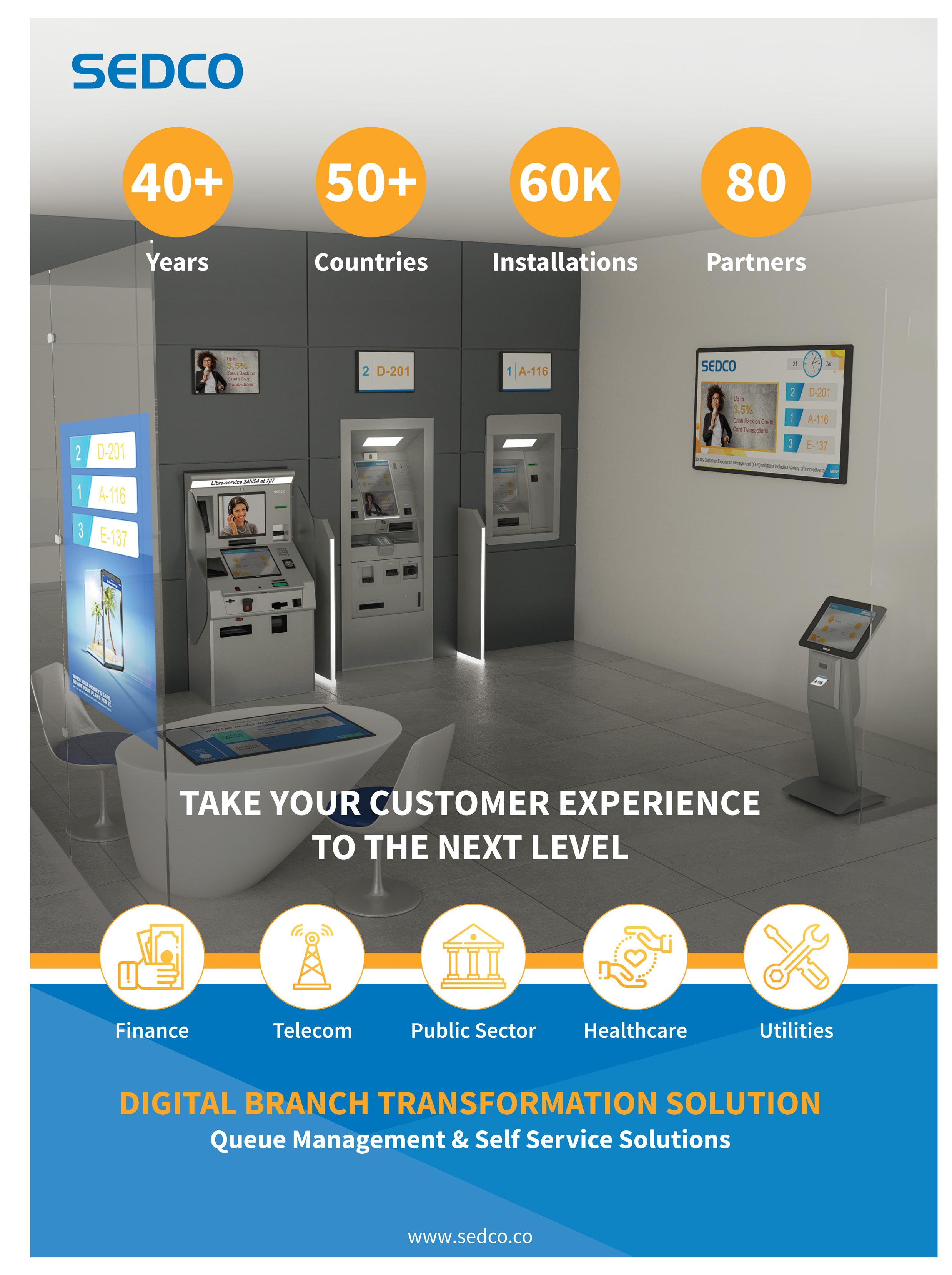

Modern Banking Customers set BaaS for Fintechs in 2024

Before the global penetration of the internet in the financial world, banks were largely focused on credit facilitation and being a safe keeper of private deposits. With the internet bringing the world closer, digitalization became the new buzzword in the banking sector in the first decade of the 21st century. It was an obvious and swift realization for the sector that without digitalization, the cost of globalisation would be too high with conventional brick-and-mortar and paper filing systems.

In the quest to expand the markets and embrace newer technologies for efficient operations, banks started incorporating IT companies. The IT companies, while assisting in the incorporation of the core banking

operations faced several regulatory restrictions, which hindered the overall onboarding process. As soon as the IT companies procured the licenses to carry out the financial transactions, it led to the birth of several fintech companies. Thus, Banking as a Service (BaaS) came into practice. In BaaS, a licensed institution like a bank provides access to its financial system to a non-banking entity like an IT company for banking and financing-related activities. In other words, it is an end-to-end approach for third-party companies to collaborate with banks through APIs (Application Programming Interface) and deliver financial services.

Plugging IT in Core Banking

The idea of BaaS arose from the need for breaking

08 Cover story

Representational Image

down the banking process and automating them or offloading or outsourcing them to reliable third-party ventures. Today BaaS service providers are mainly plug-and-play software. This way, several startups that provide services in insurance, retail, securities and international transactions could come together to form a bank. Taking a glimpse into the future, Japan already has a fully operational bank that has no branches, is completely digital and has roughly around 100-150 employees.

One of the prime reasons for non-commitment to digital technologies in the banking system has been the lack of a strong redundant security system for the data. However, due to rampant innovations by

several fintech companies, BaaS has become the most trending platform for banks and financial institutions. It also opened a whole new opportunity for non-financial institutions to play a role in the global financial industry.

The need for a robust and dependable IT infrastructure led to the advent of several IT major brands becoming the preferred partners for some of the biggest banks in the world. BaaS became the preferred choice for online payments especially on non-banking platforms.

Today, BaaS is seen as the go-to option for personal loans, payment processes, wealth management, credit and debit card onboarding processes, updation and monitoring of regulatory compliances about taxation and more.

09 Cover story

Banking on the Next Fintech Disruption

As per reports, the BaaS solutions will provide around USD 5 trillion opportunities to e-commerce companies and other retailers. This comes to 70 per cent of growth in the next 3 years for the adoption of BaaS solutions. There are other reports that estimate that the BaaS market could reach USD 5.32 billion in 2024. With a CAGR of 26.60 percent, it is expected to reach USD 14.72 billion.

The benefits of BaaS for the non-banking finance corporation are quite evident from above. However, banks are currently investing heavily in BaaS platforms,

mainly as a customer retention strategy. Through BaaS, a bank’s customer could explore several payment options making it a smooth online experience for shopping or bill payments. The biggest benefit, however, has been the third-party applications where a third-party company incorporates the Application Programming Interface (API) services for the traditional banks and BaaS providers for their financial products and services. The third-party benefactors incorporate BaaS as a software layer in their operations. NBFC, Fintech startups and other financial companies customize the BaaS layer platforms for a smooth user interface. Furthermore, tech companies with banking

10 Cover story Representational Image

licenses are turning their BaaS layer platforms into BaaP (Banking as a Platform). This way the IT company with a strong IT infrastructure and a valid banking license are providing a plug and play style services for the banking needs of any commercial entity. For a retailer in, let’s say, the FMCG sector, this reduces the payment complexities and leverages credit, savings management, investments, user data storage and management and more without the involvement of the banks.

We spoke to Jeremy Mah, the CEO and Founder of NeuXP, a Malaysia-based financial app that provides

a complete and highly integrated financial and lifestyle services ecosystem that complements the lifestyle needs of its users beyond borders. According to him, “Most of the businesses, especially the traditional ones, still have their IT infrastructure deployed on-premise while the newer ones especially startups are having their infrastructure over the cloud.”

As per a market study, the market for BaaS providers is set to grow by over 50 percent per year in the upcoming five years. SME and corporate banking activities are going to be the major sectors for BaaS. Currently, governments across the globe are transforming their

11 Cover story

12 Cover story

Representational Image

regulations on banking from macro-level to microlevel processing. The biggest challenge to digital transformation in almost all sectors has been accountability and modern financial entities are seeking accountability at a nano level. This has made the entire compliance protocol even more complex. Even though blockchain seems to showcase a significant promise it is still at a nascent stage. The whole idea of decentralisation does not seem to be finding much admiration among the bureaucracy.

The main challenge to the harmonious relationship between a bank and an IT company is the difference of interest. While banks are concerned about adhering to compliances and registering profits in the books, the fintechs concentrate widely on delivering the best customer experience. This explains why more and more banks are investing heavily in their IT infrastructure. Subsequently, many IT ventures are also seeking banking licenses of their own. The moral – banks are developing their own BaaS and BaaS providers are establishing their banking operations.

- Blog by Ujal Nair

13 Cover story

The Ultimate Playbook: Unleashing Profit Potential in 2024’s Investment Chessboard

The year 2023 saw major upticks and slowdowns from the Asian market. While India made a surprise rebound in investment, due to the positive resilience from the Dalal Street, China experienced slow growth rate due to ongoing geopolitical tensions. 2023 saw the rise of domination of the Big 7 stocks at S&P 500 while the West and the MENA region remained anxious over the possibilities of the Middle East conflagration.

When considering investment strategies for 2024, it is crucial to approach the task with a professional and informed mindset. A shifting global landscape and emerging market trends present both challenges

Representational Image

and opportunities for investors. It is crucial to identify and take advantage of new trends in this dynamic environment when making major investment choices. Let’s navigate into some of the investment strategies for a post-pandemic economy in 2024.

From Boom to Bust: Top Strategies to Thrive in 2024!

According to the predictions in 2024, the Federal Reserve will keep interest rates elevated for a brief period of time. Stock prices and interest rates have an inverse relationship, meaning as interest rates rise, stock prices tend to move lower. The ultimate question is: what should investors be aware of in 2024. The upcoming

14 Investment

US Presidential Election in 2024 will likely affect the investment markets as certain reports claim- ‘The S&P traded positive in each six-month period before a Presidential Election, except 2008. Here are some of the trends worth looking into to plan all of your financial objectives:

1. Invest in Emerging Markets: Tap into Future Growth

Emerging markets offer unique investment opportunities for those willing to embrace growth potential. Countries like China, India, and Brazil are experiencing rapid economic growth, leading to new business prospects. Investing in emerging markets is a strategic move that can potentially yield significant financial gains for investors. One can take advantage of the rising middle class, increasing consumer demand, and favourable government policies. These economies, often characterised by rapid growth and expanding consumer bases, offer a plethora of untapped opportunities for individuals looking to diversify their investment portfolios. By allocating resources to these promising regions, investors can tap into future growth and reap the rewards of a burgeoning market.

However, it is important to approach such investments with a professional mindset, conducting in-depth research and analysis to identify the most promising prospects. Careful consideration of factors such as political stability, economic policies, and regulatory frameworks is crucial to mitigate risks and maximise returns. Additionally, staying attuned to market trends and employing a long-term perspective will help investors navigate the inherent volatility of emerging markets. With the right approach and an eye for growth potential, investing in these dynamic landscapes can be a rewarding endeavour for professionals seeking to optimise their financial portfolios.

2. Real Estate Investment Trusts (REITs): Enjoy Passive Income

Real Estate Investment Trusts (REITs) have become increasingly popular among investors seeking passive income. These investment vehicles offer individuals the opportunity to invest in a diversified portfolio of

income-generating real estate properties, such as commercial buildings, apartments, and shopping centres, without the hassle of direct property ownership. The professional tone of voice in this context emphasises the credibility and expertise surrounding REITs as a viable option for those looking to generate passive income from real estate. REITs allow investors to enjoy regular dividend payments, which are typically higher than those from traditional stocks and bonds. Moreover, these investments are managed by teams of experienced professionals who oversee property acquisitions, management, and leasing activities on behalf of shareholders. With a professional approach to investing, REITs offer a compelling solution for those seeking to diversify their investment portfolios and enjoy a steady stream of income with minimal effort.

3. The Rise of Fintech

Investment in financial services and fintech has become an increasingly attractive option for savvy investors seeking modern and technologicallydriven opportunities. With the rapid advancements in artificial intelligence, blockchain technology, and mobile banking, the financial services sector has experienced a significant transformation. As a result, investors are drawn towards fintech companies that offer innovative solutions that improve efficiency, convenience, and transparency. Additionally, this sector offers opportunities for diversification, as fintech encompasses various subsectors, including payment processing, robo-advisory services, and online lending. Investment in financial services offers individuals the chance to be a part of the digital revolution in finance, thus reaping the benefits from this sector. Representational Image

15 Investment

Representational Image 16 Investment

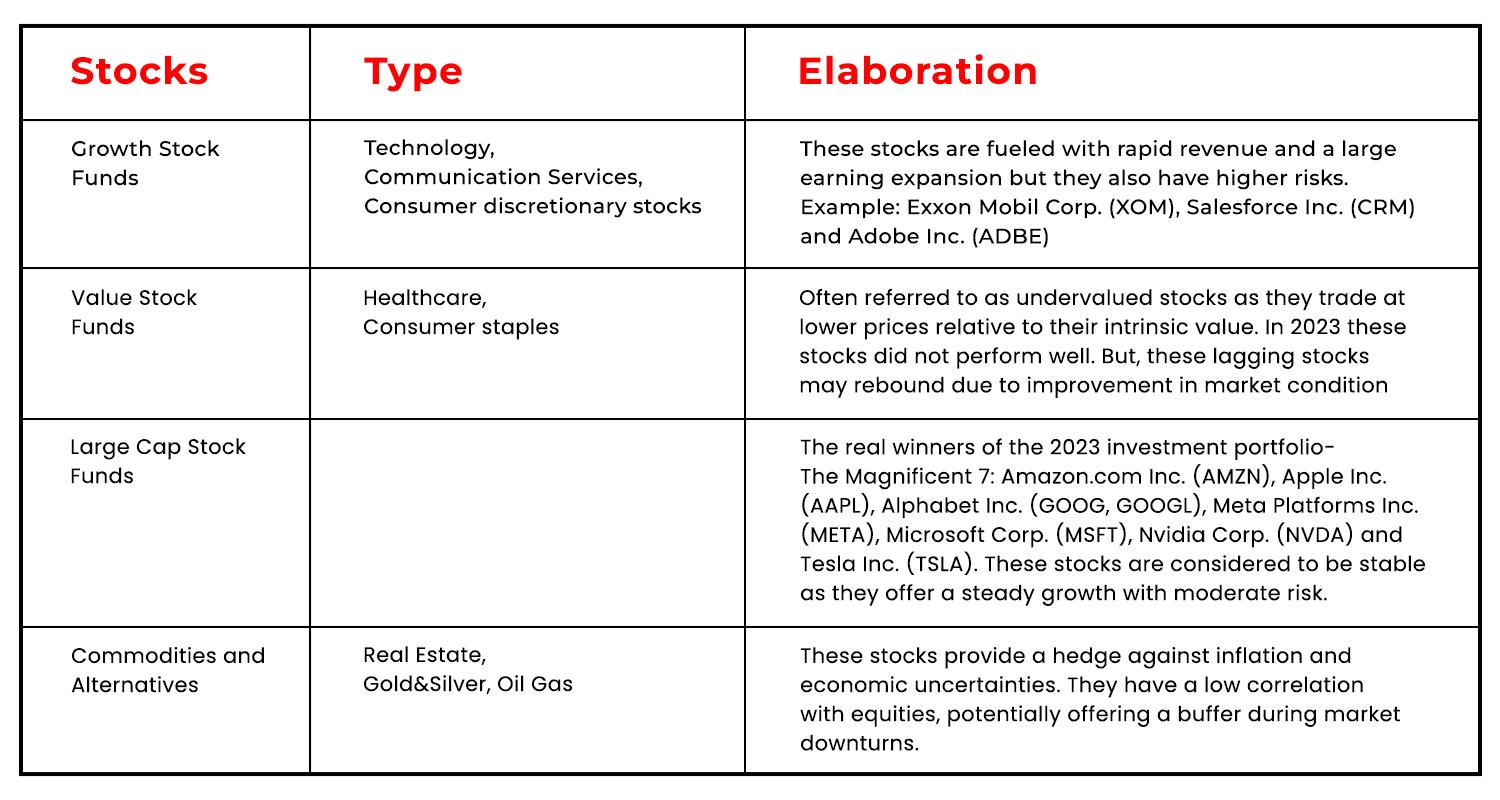

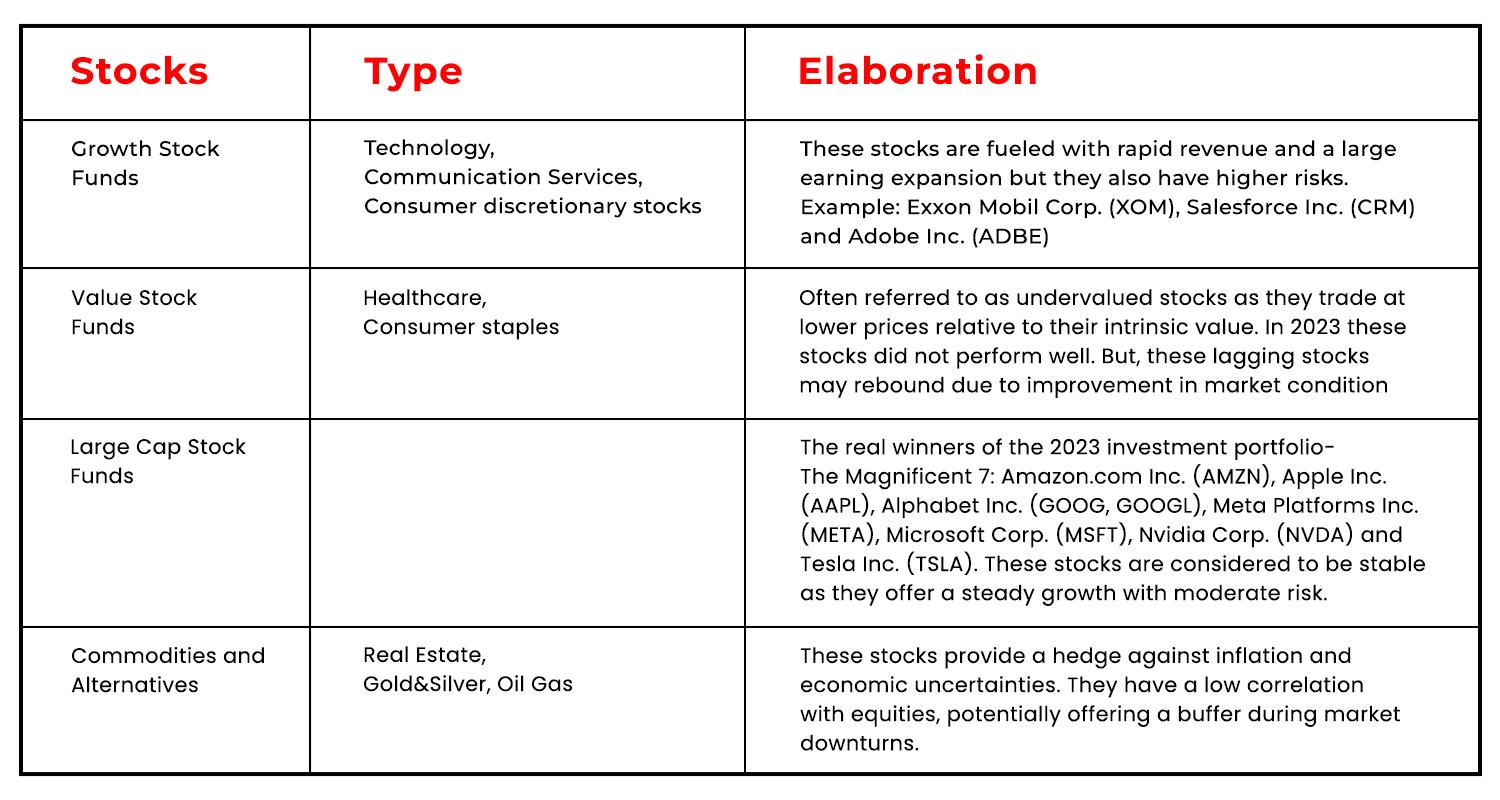

4. Investment in assets/stock market

Distributing your investments among a variety of asset types is a good start. The question arises how to identify

what assets and stocks to be invested in. Listed below are some of them for a better understanding.

An additional tip- hold onto the cash portfolio as cash was the king in 2023. We are unaware when ‘Black Swan Events’ may arise, example COVID. It is necessary to have cash as it maintains liquidity.

5. Technology and Investment: Embrace the Future

The most attractive company vertical to invest in is the technology sector. Particularly in the areas of machine learning and artificial intelligence, they have grown exponentially. Automation, data analysis, and decisionmaking algorithms driven by AI can help firms improve productivity, simplify operations, and respond to client requests more quickly and efficiently. The e-commerce sector has experienced unprecedented growth due to the spike in online purchasing, which is also advantageous for investors. In the realm of technology, cybersecurity is rapidly gaining ground. The likelihood of cyberattacks and data breaches typically increases as technology develops. As a result, stronger cybersecurity measures are becoming increasingly necessary. The need for creative cybersecurity solutions will probably only increase as businesses work to protect their digital assets and comply with increasingly stringent rules.

According to some reports, global investments in startups using quantum technology reached a record high in 2022—roughly USD 2 billion. In the last two years, 70 percent of all start-up investments made in quantum technology since 2001 have poured into the sector, a sign of investor faith in the technologies’ potential for future commercial success. Considering all of this, investing in technology is a good idea.

A Way Ahead

It is critical to take into account a variety of investment techniques and make appropriate annual plans. Some strategies to diversify the investment portfolio include investing in emerging markets for future growth, exploring Real Estate Investment Trusts (REITs) for passive income, considering the rise of fintech for technologically-driven opportunities, and embracing the future by investing in the technology sector. Additionally, diversifying investments among different asset types and holding onto a cash portfolio can provide stability and liquidity.

- Blog by Tamanna Shaikh

17 Investment

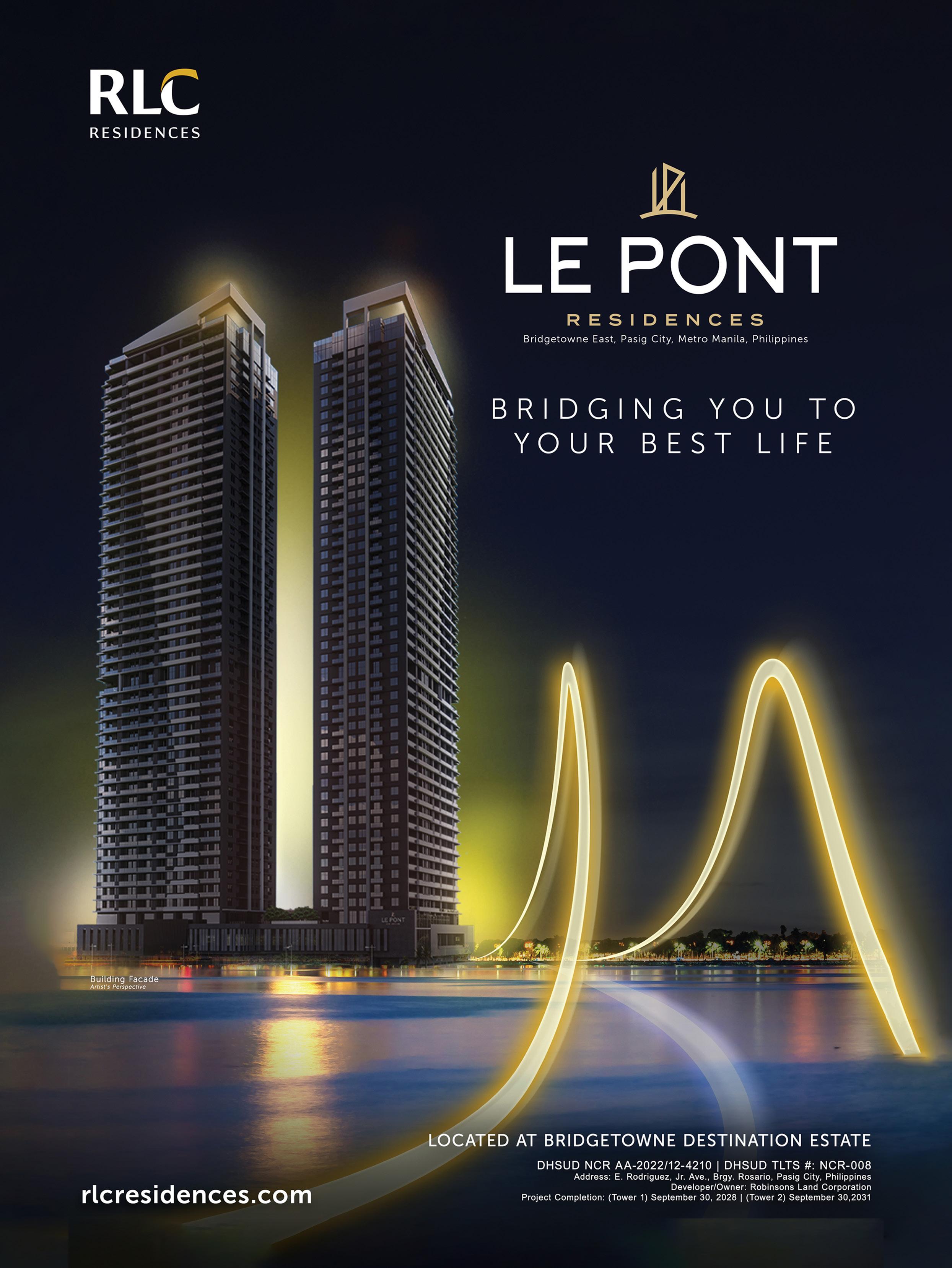

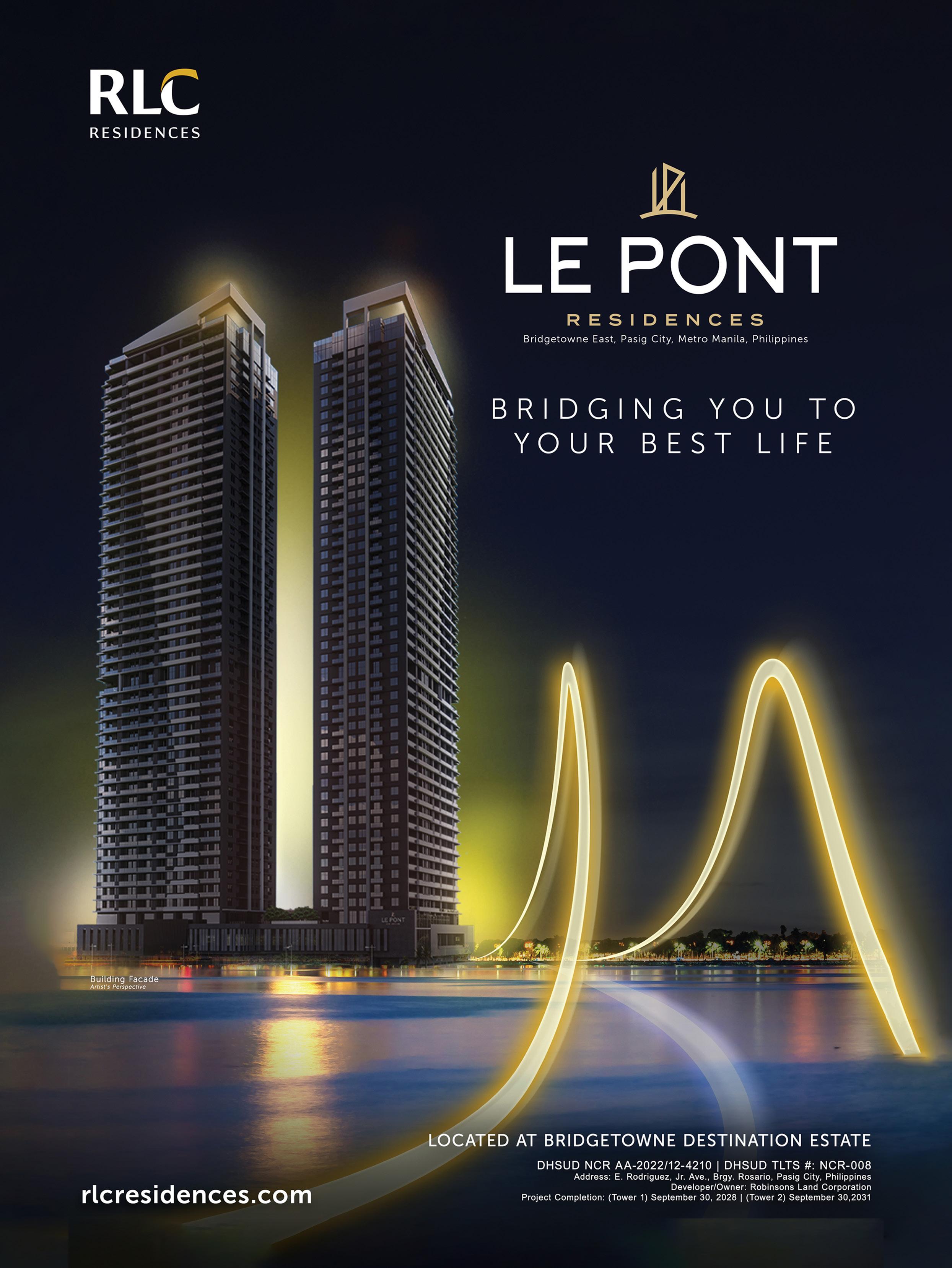

MENA Real Estate 2023 Analysis before investing in 2024

With a total market valuation of over USD 1.36 trillion, the real estate sector in the GCC region is one of the most valued markets across the GCC region. With over 50 percent of projects and valuations, Saudi Arabia is currently the most esteemed property market across the MENA region. Followed closely by the UAE, the real estate market is the top contributor to the GDP after oil-based revenue streams. Strong economic growth is the prime factor behind the strong growth of the non-hydrocarbon sectors with Saudi Arabia and the UAE being the biggest beneficiaries of the commercial property sectors. In 2023, the F&B sector, the retail sector and the commercial hubs (office spaces) saw a major recovery to inch closer to the pre-2019 levels. Funnily, most of the global residential projects are scared of revisiting the 2018 Housing Market bubble and are looking for fiscal stimulus to attract home buyers.

2023 saw the returning demand for luxury properties and the rising demand for sustainable properties along with short-term rentals. Some of the ongoing projects, such as Saudi Arabia’s USD 1 trillion futuristic city of Neom,

Dubai’s USD 25 billion downtown extension, Abu Dhabi’s USD 15 billion waterfront city of Al Maryah island, Qatar’s USD 10 billion sports city of Lusail and Kuwait’s USD 5 billion project for a new city of entertainment called Silk City, have attracted a lot of foreign investments in the MENA region and a gradual growth in demand for the off-plan property market.

Here are the 4 major outcomes of 2023 that could help you in your real estate investment decisions in 2024 in the MENA region.

Lifestyle matters

Beachfront properties, residential properties near parks and green spaces have always been a major draw for homebuyers across the globe. As per reports, Dubai saw over USD 4.91 billion in sales of such homes between January and September 2023. With the rising population of Ultra high net worth individuals and high net worth individuals in GCC and the rising influx of foreign investments, the demand for luxury real estate is bound to grow in 2024 as well in the MENA regions.

18 Real Estate

Representational Image

What makes this investment even more worthwhile is the dearth of new premium properties and the abundance of amenities and Government incentives for the existing prime properties. According to various sources, Dubai, the commercial and tourism hub of the Middle East recorded more than 100,000 new property transactions amounting to around USD 100 billion in the first nine months of 2023. UAE has revealed increase in demand across Abu Dhabi and Sharjah in 2023 due to fresh interests from new GCC investors. Abu Dhabi has been increasingly attracting Global High Net Worth buyers as the macroeconomic factors for the emirate became more favourable in 2023. As per observations, in the luxury property market, ready-to-occupy, furnished properties are always more in demand than off-plan properties as they guarantee faster returns.

Go Green to make your investment lasting

Reports suggest that the demand for sustainable commercial and residential properties has increased by 51 percent in the MENA region in 2023. Some reports indicate the sudden spurt in investments for green buildings in the MENA region due to increased awareness of long-term benefits in these properties. Property developers are working on ways to showcase the ownership value of these properties to overcome the initial high cost. Saudi Arabia, with its Neom project, is aiming to reach its net-zero targets by 2060 and other MENA countries are incorporating technological innovations to make the construction and ownership sustainable. The non-oil private economy is gradually increasing its GDP share against the hydrocarbon economy with rising stimulus from the Government bodies. With foreign entities showing interest in the new non-hydrocarbon economy of the Middle East, the green economy is opening doors to new possibilities, new projects, new employment and new markets.

Long-term investments in short-term rentals

By the third quarter of 2023, the rents for Prime, Grade A and Grade B properties have increased by 7 percent, 8.6 percent and 13 percent respectively. Reports suggest that the rental rates are set to soar in the coming years due to slow growth of new real estate projects in spite of

high demands. In the post-COVID-era, there has been a rush for longer lease commitments, especially for the furnished commercial/residential properties. While Abu Dhabi saw a major growth in new rental contracts, Dubai witnessed only a marginal decline in it. At the same time, Abu Dhabi saw a decline in rental contract renewals, while Dubai witnessed a sharp rise, especially in the retail sector. Commercially, Food & Beverage and the retail sector were the major contributors to the property rental market in GCC. While the tourism sector rejuvenates to the pre-COVID levels, the hospitality sector is attracting foreign investments again in the GCC region. As per an unofficial survey, it has been reported that the rental levels in Abu Dhabi increased by 16.9 percent and 36.8 percent in Dubai in 2023.

Dream Homes became Reality

In 2023, reports have revealed that the average apartment prices in Abu Dhabi increased by 0.9 percent while the average price of the villa reduced by 0.1 percent. During the same period, Dubai registered a 19 percent hike in residential prices. However, despite the hike, they still lie below the 2014 baselines making them a prospective investment for 2024 as well. Dubai has also registered about 47 percent hike in tenancy registrations, out of which, there was a 26.4 percent increase in renewed rental registrations and 12.1 percent decline in new rental registrations. This has been the norm that continues since the post-COVID era in 2021.

19 Real Estate

Representational Image

20 Real Estate

Representational Image

If there is a lesson that we have learnt from 2023, it is that the luxury market is going to have a good run at least in the first half of 2024 while expecting slight price corrections post April-May. It poses long-term investment opportunities and short-term gains as a hospitality portfolio. Foreign investments turned out to be a big boost for most of the big ambitious projects of many eminent property developers in the Middle East. As long as the GCC region continues its good rapport with India, China, UK and many of the Asian and Commonwealth nations, the foreign funds are bound to flow in the MENA region.

- Article

Ujal Nair 21 Real Estate

by

Demystifying the New Tax Law in Saudi Arabia

Representational Image

Many people and businesses in Saudi Arabia are uncertain about their tax responsibilities as a result of recent revisions to the country’s tax code. Reactions to the new tax law’s rollout in Saudi Arabia have been conflicting. Some fear it would negatively affect people and businesses, while others see it as an essential step towards economic transformation. People find it challenging to understand the intricacies of the law because of the abundance of false information and misconceptions around it. We will provide you with a comprehensive grasp of the main elements of Saudi Arabia’s new tax law by unravelling it in this article. Keeping up with the latest developments is crucial for both individuals and business owners to ensure legal compliance and sound financial decision-making. Let’s examine the specifics and dispel the myths surrounding Saudi Arabia’s recently passed tax legislation.

The Need to Break Boundaries

The aim of the recently enacted tax legislation is to bring Saudi Arabia’s tax laws into line with global best practices, enhance transparency, and standardise the procedures for tax and zakat regulations. This will enable the laws to be in line with the Kingdom’s Vision 2030 economic framework. The Income Tax Law Draft, which intends to reform the KSA’s income tax system now governed by the Income Tax Law, was published on October 25, 2023, by the Zakat Tax and Customs Authority (“ZATCA”) on the Istitlaa Portal. The law puts defensive mechanisms in place to prevent dealings with tax havens. The main objective of the proposed law is to make income tax more applicable to both residents and non-residents who engage in business, investment, or real estate-related operations.

Key Changes and Practical Insights

Residential Status

Since non-Saudi citizens are subject to income tax, the proposed law separates residents and nonresidents in addition to elaborating on legal and natural residents. Entities with their effective principal place of management situated in the Kingdom will also be recognised as Legal Persons, in addition to those lawfully established in Saudi Arabia. Furthermore, Natural Resident Persons are those who have their domicile in Saudi Arabia, a residence permit, and live in the Kingdom for thirty days continuous or aggregate during a 365-day period, or, in the absence of either, those who spend 183 days continuous or aggregate in the Kingdom during a tax year, or who stay for 90 days continuous or aggregate in a tax year in addition to

22 Finance

spending a total of 270 days continuous or aggregate during the last three tax years.

On these lines, it will be easier to understand who are considered to be taxable people.

Taxes

Tax w.r.t. being a Legal Person: Any legal entity that engages in any activity connected to the production of oil or hydrocarbons, natural gas investment, or any interest or units held directly or indirectly by any nonSaudi entity will be deemed taxable.

Tax w.r.t. non-resident persons: Even if a person is considered to be a non-resident and is conducting business through Permanent Establishments (PE), they are deemed to be taxable. Furthermore, nonresident natural persons who open bank accounts in the Kingdom or trade or invest in stocks of listed companies, as well as non-resident individuals who do not have a permanent establishment but nevertheless receive income from sources in Saudi Arabia, will be regarded as taxable persons.

Income sources, Exemptions, and Deductions

Under the proposed law, the majority of taxable income comes from sources inside Saudi Arabia. It provides exemptions from paying taxes on some capital gains, especially those that come from transactions involving restructuring that support the objectives of economic development. The list of deductible expenses has been expanded to include non-recoverable input VAT and real estate transaction tax, among other things. In an effort to increase accountability and transparency, the rule also places restrictions on the amount of monetary cost that can be deducted.

Changes to the ITL pertaining to WHT (withholding tax)

The ITL modifications include new provisions that modify WHT rates and exempt specific payments from WHT. This includes a 10 percent WHT on payments made to non-residents for services rendered and exclusions from listed firms’ payouts to non-resident shareholders. The proposals also suggest a 5 percent WHT on loan fees paid to connected parties. To better reflect the Kingdom’s emphasis on technological advancement, modifications to Article 16 of VAT implementing

23 Finance

Representational Image

regulation will control how costs associated with research, development, and innovation are treated.

Penalties and Compliance

The proposed bill provides for extensions under certain conditions and lowers the five-year statute of limitations for tax assessments to three years. The consequences of non-compliance have been greatly raised, particularly in the case of tax evasion, where fines can amount to 100% to 300% of the unpaid tax or Zakat. These actions demonstrate the Kingdom’s determination to uphold tax compliance.

Impact of the New Law on Saudi Arabia’s economy

The changes are a necessity for Saudi Arabia’s economic future, especially in terms of promoting both domestic and foreign investment. It is anticipated that the focus on tax compliance and transparency will increase tax receipts and improve economic stability. Here is a closer look:

On Businesses

One of the primary motivations behind the proposed changes in Saudi Arabia’s tax law is to increase government revenue. The proposed changes in the tax law are likely to have a significant impact on the business environment in Saudi Arabia with the introduction of value-added tax (VAT) and increased corporate tax rates. These measures could lead to increased costs for businesses operating in the country. However, it is important to note that the government has also announced various incentives & exemptions to support businesses in the transition period.

On Foreign Investment

Foreign direct investment (FDI) plays a crucial role in driving economic growth and development in Saudi Arabia. The proposed changes in the tax law could influence the attractiveness of the country as an investment destination. Higher corporate tax rates might make Saudi Arabia less competitive compared to other countries in the region.

On Fiscal Policy

The changes in Saudi Arabia’s tax law will have significant implications for the country’s fiscal policy. With increased revenue from non-oil sectors, the government will have more resources to invest in infrastructure development, social welfare programs, and economic diversification efforts. These measures are expected to stimulate economic growth and reduce the country’s dependence on oil.

Conclusion

The draft Income Tax Law of Saudi Arabia is a major step towards modernising the country’s tax system and bringing it into compliance with international norms. Foreign companies and investors conducting business in the Kingdom will need to carefully assess how the impending tax change will affect their activities in Saudi Arabia. This dynamic framework, which may undergo modifications after public comment, offers opportunities as well as challenges to Saudi taxpayers and foreign businesses.

- Blog by Tamanna Shaikh

24 Finance

25 Finance

Representational Image

Performance Report of Credit Market in 2022 to 2023

Despite the fact that the COVID-19 pandemic has diminished in most countries, pressure on economic growth still exists in few countries. The broader Gulf Cooperation Council (GCC) banking sector had seen a limited impact from the ongoing banking sector crisis in the US and Europe in the years 2022 to 2023. The GCC banking sector had gone through a fundamental transformation and has been on a growth trajectory. This development played an increasingly important role in the region’s overall economic global growth.

Growth in Credit Market Performance

The outlook for the GCC region has been strengthened by strong oil prices and the related improvement in non-oil activity, which has also supported the credit demand in the region. A look back into 2022 for GCClisted banks shows an upward trend of 9.9% growth in total assets and 25.3% growth in net profit. Economic growth, interest rates, and inflation, along with a change in government policies, can affect the level of the credit market in any country. It is well known that when there is an upsurge in economic growth, banks usually opt to offer more lending options but will charge

higher rates of interest. However, this also throws light on the non-performing bonds, mortgages, house/car loans, & credit cards that the banks would have to close if they did not perform well.

The growth percentage will vary as per the lending guidelines practiced by the banks in a country. Higher interest rates did reduce some of the countries’ credit market performance in the UAE to 3% in 2023 from 8% in 2022. However, when it came to some countries in the UAE, which had performing non-oil sectors, credit market growth grew to 7% in 2023 when compared to 5% in 2022. The FIFA Cup in 2022 did make a significant impact in terms of growth revenue, as many infrastructure projects were designed and completed to make the mega event a grand success.

However, one factor was forgotten to be taken into prominence. With millennials making their entry as a prominent part of the workforce, credit markets have changed for the better. This population is ready to take risks, even if it means letting go of their cushy jobs to follow their passion or taking credit from investors to

26 Finance

become a first-time entrepreneur. So, banks, investors, and other financial institutions started investing heavily in credit programs (the issuing of new bonds) to make a mark and attract more first-time entrepreneurs since 2021.

Factors Influencing Credit Market Performance

The performance of the credit market will also change as per the government policies in the GCC, the Middle East, and African countries. In countries where commercial banks are subjected to less government intervention and foreign banks are allowed entry, the credit market has seen a steep hike. On the other hand, in countries with more public sector banks where government intervention is needed in releasing funds and the number of private or foreign banks is restricted, the credit market took a hit.

When it comes to credit market performance, small to medium businesses (SMB) are one of the main contributing factors in the economies of third-world countries. They contribute to nearly 30 percent of businesses globally and play a major part in the creation of skilled jobs and economic development. As per a survey, these SMBs play a major role in credit market performance. However, as already explained, finance is one of the main obstacles to business growth in developing countries where the release of funds is done as per government guidelines.

The Role of the World Bank in Credit Market Performance

The World Bank has taken a genuine interest in promoting the welfare of small to medium businesses and unlocking sources of revenue for needy companies. Based on their guidelines, many government banks

around the globe have designed loans that can be paid in long-term installments for small to medium businesses. This factor had immensely helped the credit market performance to improve to a higher level in the developing countries of the third world. In Ethiopia, nearly 14,000 entrepreneurs were encouraged to take loans as part of the Women Entrepreneurship Development Project. Similarly, in Bangladesh, the introduction of the credit guarantee scheme for small to medium businesses run by women has helped only a portion of the entrepreneurs. Lack of proper training and access to resources are two factors that prevent first-time entrepreneurs from taking credit from public and private banks in many countries.

Conclusion

The entire banking sector has seen rapid change in recent years. After COVID-19, many banks had to reinvent themselves with new technologies while fighting for survival against many odds, such as low interest rates and the introduction of new banks. Also, it is well known that there are two types of credit markets (the first belongs to the government and is run as per its guidelines, whereas the other is run by private financial institutions). Private institutions are seldom regulated by government policies and programs.

The credit market industry has also changed. Gone are the days when businessmen had to run around to get loans from banks. With private banking firms entering the fray in many countries, the focus is more on asset management firms. But on a global scale, the credit market was definitely in one of its best stages in the period from 2022 to 2023.

- Article by B Sathya Narayana

27 Finance

Representational Image

Sustainable aviation fuel for a greener sky

The aviation industry has long been under scrutiny for its significant contribution to global carbon emissions. With air travel becoming increasingly prevalent, it has become the fastest-growing source of greenhouse gas (GHG) emissions, driving global climate change. As other industries are making significant contributions to reducing their environmental impact, aviation’s share is expected to continue growing in the upcoming years.

In response to this situation, the aviation industry is turning its attention to sustainable aviation fuel (SAF) as a major solution for reducing its carbon footprint.

With the potential to reduce CO2 emissions by up to 80%, SAF offers a promising path towards a greener future for air travel.

The Rise of Sustainable Aviation Fuel

As the push for decarbonisation intensifies, the aviation industry is actively seeking ways to reduce its environmental impact. One of the key strategies is the adoption of sustainable aviation fuel.

So, what is SAF?

Sustainable aviation fuel is a cleaner alternative to conventional jet fuel. Unlike traditional jet fuel derived from fossil sources, it is produced from various sources such as waste oils, fats, feedstocks, and other suitable raw materials, making it a renewable and environmentally friendly alternative. It doesn’t compete with food crops or water resources, and it

28 Aviation

doesn’t contribute to deforestation. The process of manufacturing SAFs typically involves converting these feedstocks into liquid fuels that can be used to power aircraft. The SAFs can be blended at various levels, with limits ranging from 10–50% depending on the feedstock and the process of manufacture.

With the increase in demand, the production of SAF has been steadily increasing, with volumes expected to rise even further in the coming years. In 2021, somewhere between 300 and 450 million litres (approximately 80 to 118 million gallons) of SAF were produced, marking a significant increase from previous years. This upward trend is expected to continue, with the International Air

Transport Association (IATA) projecting SAF to become a primary tool for achieving net-zero emissions in the aviation industry by 2050.

The Importance of the Transition to Greener Fuel:

An aeroplane’s CO2 emissions are around 100 times higher than a bus or train ride. A return flight between London and San Francisco has a carbon footprint per economy ticket of nearly 1 tonne of CO2. These high emissions necessitate an immediate plan of action to transition to a greener option. Sustainable aviation fuel has the potential to produce cleaner combustion, leading to improved air quality around airports and in the atmosphere. SAF can lower emissions by up to

29 Aviation

Representational Image

80% compared to conventional jet fuel. This reduction is achieved through the use of renewable feedstocks and advanced manufacturing processes that minimize carbon output. By transitioning to SAF, airlines can make substantial strides towards their sustainability goals and contribute to global efforts to combat climate change.

Overcoming challenges:

Before we jump to the conclusion and state that SAF is the only carbon-free option that can be implemented, we need to address the challenges associated with it. The aviation world is still adjusting to transitioning from traditional to green fuel; there is still a long way to go. Only 2.5 percent of the total flights are currently flying,

which uses the SAF to carry out its operations. Several pacts are being signed to buy SAF, but its use is not very prevalent, as only 0.1% of total aviation fuel is in use.

So why is it not being used widely? Some of the major obstacles include the cost of production, the implementation of new technologies, and the production method. SAFs aren’t yet cost-effective with traditional jet fuel; the former is four times as expensive as the latter. The manufacturing cost at present is much higher than that of kerosene. So the only option to cut costs would be scaling up. What better example than solar energy, which once was super expensive and could be used only on satellites, but today its use is quite cosmopolitan.

30 Aviation

The Road Ahead:

Despite these challenges, the aviation industry is making strides towards a more sustainable future with the increasing adoption of sustainable aviation fuel. Governments, airlines, and industry stakeholders are recognising the need for the initiative. Major airlines and fuel suppliers have announced multiple partnerships for the trial of SAFs. Governments all around the world should incentivize the production for a more incessant use. Additionally, collaboration among airlines, fuel producers, and research institutions is essential for developing and implementing sustainable aviation fuel technologies.

The transition to sustainable aviation fuel represents a critical step in making air travel more environmentally friendly, ensuring a cleaner and more sustainable future for the aviation industry and the planet as a whole. Combined with innovative aircraft designs like the blended wing body, the industry has the potential to achieve its sustainability goals and usher in a new era of greener and more sustainable air travel. As governments, airlines, and fuel producers continue to invest in research and development, the widespread adoption of sustainable aviation fuel is within reach, bringing us closer to a carbon-neutral future for the aviation industry.

- Blog by Madhulika Pandey

31 Aviation

Representational Image

A Recap of MENA’s monumental Banking and Finance milestones in 2023

A Decade in Motion

The demand for loans has surged, resulting in a fundamental restructuring of the MENA banking system. The industry has changed in ways that affect financial stability and economic growth. One report in particular stated that the region grew year over year (YoY), with net profits rising by 30% and net assets rising by 12.2%. The strong success was also evident in the region’s banks, whose operating income increased by

18.8 percent. The loan-to-deposit ratio (LDR) has risen to 5.43%, while total deposits have climbed by 60.8%. This article will shed light on the most notable events and trends that unfolded in MENA banking and finance in 2023.

The Rise of Fintech Startups in MENA

In MENA, fintech’s are transforming the economy. This change in the provision and use of financial services represents a paradigm shift rather than merely a trend. Over 200 fintech businesses operated in the area in 2023; by 2025, that number is predicted to treble. This quick expansion is evidence of the area’s spirit of entrepreneurship. The regional fintech industry is projected to grow at a CAGR of 21.42% from 2023 to 2028, and its valuation will rise from USD 14.88 billion in 2023 to USD 39.26 billion by 2028.

MENA

Countries Embrace Cryptocurrencies

Another key moment in 2023 has been the widespread adoption of cryptocurrencies by MENA countries. Countries such as the United Arab Emirates, Saudi Arabia, and Bahrain have been at the forefront of this digital revolution. As governments and central banks recognise the potential of digital currencies, they have taken steps to create regulatory frameworks and explore the use of blockchain technology. For example, the United Arab Emirates has introduced the “Regulatory Framework for Stored Values and Electronic Payment Systems,” which provides a comprehensive legal framework for cryptocurrencies and digital assets.

32 Banking

Representational Image

According to recent studies, MENA has the sixth-largest crypto economy, with a projected USD 389.8 billion in on-chain value collected between July 2022 and June 2023. Almost 7.2% of all transactions made worldwide throughout the study period were made via this.

With the intention of creating progressive regulatory frameworks for cryptocurrencies that promote innovation while safeguarding consumers and guaranteeing the UAE’s position as a leader in the digital economy, the Abu Dhabi Global Market (ADGM) created the first regulatory framework for cryptocurrencies in history in 2018. Similar objectives were adopted by Dubai’s own Virtual Asset Regulatory Authority (VARA) in 2022. Furthermore, the crypto economy in Saudi Arabia expanded, with a YoY increase in transaction volume of 12.0%. This has made it possible for the region to see a rise in cryptocurrency investments and the creation of blockchain-based solutions.

Islamic Finance Continues to Thrive

The MENA region has seen a steady increase in the use of Islamic finance, a system founded on moral and religious precepts. A greater variety of financial goods and services are now available as a result of Islamic finance’s growing popularity. A wide range of products, such as car finance, Islamic bonds, Takaful (Islamic insurance), and Shariah-compliant mortgages, are now offered by Islamic banks, insurance companies, and investment organisations.

The sector was valued at an estimated USD 3.25 trillion in 2022, according to the Islamic Financial Services Board’s (IFSB) “The Islamic Financial Services Industry (IFSI) Stability Report 2023.” Its YoY growth rate was 6.2%, and by 2025, its value is expected to reach USD 4.94 trillion. Since a large portion of the population in the MENA region is Muslim, upholding Islamic values is crucial. As a result, there has been a growing need

33 Banking Representational Image

for financial systems that adhere to these ideals. Muslims who are searching for moral substitutes for conventional financing can find what they need in Islamic finance.

The ability of Islamic finance to withstand economic downturns is one of the main reasons for its success in the MENA area. When compared to their conventional counterparts, Islamic financial institutions fared better during the 2008 global financial crisis. The emphasis on asset backing, risk-sharing, and avoiding excessive leverage, which lessens the impact of speculative bubbles, is responsible for this stability. In addition to drawing in local clients, the expansion of Islamic finance has established MENA as a major hub for Islamic financing worldwide.

Strengthening Financial Inclusion Efforts

MENA governments and financial institutions placed a strong emphasis on promoting financial inclusion. In an attempt to provide underprivileged and unbanked communities with formal financial services, efforts were made to deliver banking services to them. Certain nations have made noteworthy advancements in promoting financial inclusion.

“The Financial Sector Development Programme” was established by Saudi Arabia in order to bolster financial institutions’ ability to assist the private sector. By 2025, the percentage of non-cash transactions is expected to rise from 36% in 2019 to 70%. Consequently, there will be less reliance on cash transactions, improving financial stability.

Egypt, on the other hand, revealed its financial inclusion plan, which emphasises working with government agencies. The Egyptian Central Bank has offered programmes and initiatives to improve financial inclusion. By the end of 2021, the inclusion rates will have risen from 33% in 2017 to 56.2%. Mobile banking and digital wallets played a crucial role in bridging the gap and extending financial services to remote areas.

MENA Stock Exchanges Experience Growth

MENA stock exchanges also witnessed significant growth in 2023 as investors sought opportunities in the region’s dynamic economies. Countries like Saudi Arabia, the UAE, and Egypt saw increased market activity, with new listings and IPOs generating enthusiasm among investors. This surge in stock market activity has contributed to the overall development and maturity of MENA financial markets.

Future Outlook

The year 2023 marked several key moments in banking and finance across MENA. With the region poised for further growth and adoption of technology at large, it will play a significant role in shaping the industry. These developments will continue to drive innovation and transform the MENA banking and finance landscape in the upcoming years.

- Blog by Tamanna Shaikh

34 Banking

35 Banking Representational Image

Trends of 2023 and Predictions for MENA in 2024

Introduction

The industry of Fast-Moving Consumer Goods (FMCG) or consumer packaged goods (CPG) is one of the largest in the world. Over the years, the FMCG (FastMoving consumer goods) sector has experienced significant progress in the Middle East, owing to the region’s growing population, rising disposable incomes, urbanization, and evolving consumer preferences. As a result, the Middle East has become an attractive market for FMCG companies.

In the Middle East and North Africa (MENA) region, Egypt is reportedly having the highest total consumer spending on food and non-alcoholic beverages. Before COVID-19, the MENA region was seeing an increase in consumer demand. However, due to the pandemic, the industry underwent a major disruption. After this, the GCC countries became far more appealing to manufacturers of consumer-packaged goods, as their

governments are generally stable and supportive of business interests. Additionally, there are more than 60 free economic zones, or free zones, that offer business incentives such as tax exemptions and modern infrastructure.

MENA FMCG sector outlook

Here is a brief overview of the challenges faced by the FMCG sector in MENA. These are the main factors influencing consumer behaviour in the Middle East.

• Decreasing oil prices: Falling oil prices have pushed the Middle Eastern economies to turn towards alternative sectors such as tourism and hospitality for a steady revenue. Hence the GCC countries are increasingly investing in these alternative sectors.

• Geo-political tensions: The ongoing conflicts in the Middle Eastern region is nowhere nearing an end and this has cast a negative outlook on the region’s economies.

• Supply chain delays: Larger queues, longer delivery times, and reduced product quality and availability—are significant issues frequently experienced by regional consumers.

• High rate of inflation: Consumers are increasingly price-sensitive and actively searching for bargains. Household items are becoming more and more expensive for Middle Eastern consumers. This is one of the top three concerns for shoppers, both instore and online.

• Cost of living: Consumers across countries are concerned about their financial position to some varying degree. Around 79% of the consumers in the region are worried about their financial positions. Astonishingly, 74% of MENA consumers are in a financially worse position due to the increased cost of living, while 42% of the consumers think that it’s an economic slowdown.

• Evolving digital technology: The growth of e-commerce presents an opportunity for brands. Consumers now demand more convenience, health-oriented options, and locally sourced products. To meet these customer expectations, brands must invest in digital analytics.

FMCG

36 FMCG

Trends in the MENA FMCG sector

The outbreak of COVID-19 has resulted in significant changes in many industries and global lifestyles. The FMCG industry in the MENA region was also one of the affected sectors, but the extensive vaccination programs in the region have led to increased consumer confidence. However, the pandemic has significantly impacted consumer behaviour, and these changes are expected to persist. As a result, consumers in the area are increasingly shifting towards mobile and online shopping. Let us take a look at some of the trends in the FMCG sector in the MENA region.

• In-store shopping: Consumers in the region still prefer this mode of shopping, especially in hypermarket stores and malls that deliver a comfortable ambience. We see many supermarket stores incorporating new food and entertainment zones to ensure that the crowd comes to their mall for more than just shopping.

• Online shopping: The digital ecosystem has made the entire shopping experience more intimate. Stay tuned for new mobile apps that are going to integrated AI modules to further enhance your shopping experience, from product exploration to home delivery.

• Technology: Right from advanced robotics at the

manufacturing end to AI-based customization options for products, technology is truly inevitable in FMCG today. IoT and Augmented Reality based product recommendation systems are still at their nascent stage but 2024 could be the year of their breakthrough.

• Changing consumer habits in response to rising inflation and prices: According to a recent study, over 40% of consumers resort to using comparison sites and shopping from multiple retailers. Another 36% would either switch to buying online or from another retailer’s store, while 29% would buy a different brand altogether. Interestingly, an equal proportion of consumers (29%) would switch to retailers’ own-brand products. These figures highlight the opportunity for retailers that can resolve their supply chain issues to gain market share.

• Modern consumers are always on the lookout for promotions: More than 40% of both regional and global consumers purchase products only when they are offered at a discounted price and preferring to buy from retailers who provide better value. To cope with the current economic climate and its potential impact on the cost of living, comparison sites are utilized to find more affordable alternatives.

37 FMCG Representational Image

Predictions and Way Forward for the MENA FMCG Sector

Changing consumer preferences & market dynamics

It is the need of the hour for the FMCG sector in MENA to understand changing consumer preferences and trends and implement suitable strategies to reap the maximum benefit from the changing landscape. To succeed in e-commerce, businesses must shift their focus to growth. Analysing real-time data and embracing an omnichannel approach can help.

Some companies in the region have already begun to adapt to the environment. For instance, a prominent retail conglomerate in the region has partnered with an online grocery platform, resulting in on-demand grocery delivery services, which have led to a significant increase in the number of users. In a similar move, another Group has introduced a direct-to-consumer e-commerce portal that specializes in baby care products. This move has enabled the Group to meet the growing demand for online shopping convenience among young parents while also gaining invaluable consumer insights to customize their offerings.

Sustainability and CSR

Consumers in the MEA region is increasingly conscious of the environment and are looking to make sustainable choices when purchasing products. This includes buying products with sustainable credentials, using recyclable packaging, and using refillable containers. Consumers prefer sustainable products that are competitively priced and have clear labelling and packaging. Additionally, they are more likely to buy brands that offer personal health benefits along with benefits to the planet.

Brands must ensure that shoppers can easily find and buy environmentally friendly products by providing access to sustainability information on their product pages. The sustainability attributes of a product should be readily available to customers to facilitate their purchase decisions. Sustainability is a pressing concern for the present and future. It includes climate

38 FMCG

Representational Image

change, natural resource conservation, and global ecosystem preservation. Ensuring sustainability will be a top priority in 2024 and beyond.

The future belongs to E-commerce

E-commerce offers better prices and more products for buyers and is growing rapidly in many markets. Turkey and the Middle East stand out in particular, with Turkey’s e-commerce growth expected to continue in 2024. The UAE and Saudi Arabia are also seeing strong e-commerce growth compared to physical stores.

According to a report, Turkiye’s ecommerce market share is the highest in the MENAT region with 5.9% share in the total FMCG sales in 2022. Saudi Arabia saw a 1.7% increase in its ecommerce sales in 2022 compared to 1.2% share in 2021. The UAE’s ecommerce market share grew at an even higher rate, recording 5.7% in 2022 compared to just 3.8% in 2021. In terms of value growth percent, Turkiye saw 100% growth in online sales in 2022 compared to 2021, while its offline sales saw a 99.2% growth for the same period. The KSA ecommerce registered a staggering growth of 55% while its offline sales grew at just 5.9%. The UAE’s ecommerce market growth surpassed that of the KSA’s by recording a 62.8% growth whereas its offline sales saw a growth of 9.2% only.

Conclusion

Retailers and manufacturers must plan to develop strategies for success in the evolving marketplace beyond 2024. To achieve this, they need to figure out how consumers will react to the five emerging trends discussed above and have strategies in place to help them manage their cost-of-living challenges. Business leaders can benefit from comprehending how these underlying shifts and individual preferences are affecting consumers’ lifestyles and purchasing patterns, which will ultimately help them find new ways of engaging with customers individually.

- Blog by Amith Raj

39 FMCG

Representational Image

Game of Drones: The Future of Urban Development

The integration of drones into urban spaces is no longer a far-fetched idea; it is becoming a reality. Drones, belonging to the quadrocopter family, also known as unmanned aerial vehicles (UAVs), have the potential to revolutionize by improving urban planning, construction, and emergency response. Initially being a niche technology they were primarily used for military purposes, but now their use has become quite cosmopolitan, reshaping various industries and everyday life. These unmanned aerial vehicles soaring above our cities provide a fresh perspective and invaluable data to urban planners. By capturing high-resolution images and conducting aerial surveys, drones offer a bird’s-eye view that was once unimaginable. Drones have become a common sight

in all our major outdoor and indoor events and reports suggest that there could be almost 41 trillion drones in the air by 2043.

Regulations on Drone Usage

Drone flights, like aeroplanes, are governed by the Civil Aviation Authority. They have established clear procedures for managing drone operations and mitigating the dangers connected with their use. Recently, the UAE government created many laws to oversee its operations and designs. In a bid to enhance security measures and regulate the use of remotecontrolled drones, Saudi Arabia’s Interior Ministry has laid out certain rules in its usage. These law came to light after an incident where a drone was caught and

40 Technology

shot down flying over a residential neighborhood in proximity to the royal palace in Riyadh. It raised concerns about unauthorized use of drone near sensitive locations. The Saudi law incorporates flying permit and registration from GCAA /DCAA, flying only in the approved fly zone(Green Zone) and much more. These regulatory laws strike a balance between innovation and responsibility, ensuring a safer and regulated air space.

How Drones are Enhancing Urban Planning

Drones have revolutionized the field of urban planning by offering a faster and more efficient alternative to traditional mapping and surveying methods. These agile gadgets can cover large regions quickly and provide precise aerial pictures of city landscapes and architecture. They enable city planners to make educated decisions about land use, zoning, and infrastructure development by allowing them to access difficult-to-reach locations. They can help create 2D and 3D designs of landscapes for better local geographic information to visualise results that align properly with the plans of the cities and the architecture. The lack of precision data for proper BIM(Building Information Modeling) designs, lack of accurate road vectors, satellite imagery, time and skilled labor, can be quite a challenge. The drones, with their high quality visuals could overcome most of these challenges. Drones offer a versatile platform for monitoring various aspects of the smart city infrastructure. They can be equipped with sensors to measure air quality, noise levels, traffic flow, and other environmental parameters. By collecting and analysing this data, drones provide valuable insights for optimising urban systems and improving the overall quality of life for residents.

Smart City Revolution in MENA

The MENA region, which includes nations such as the United Arab Emirates, Saudi Arabia, and Qatar, has long been associated with affluent cities and great architecture. However, in recent years, many communities have set their eyes on a new goal: transitioning into smart cities. Driven by a drive to improve livability, sustainability, and efficiency, MENA’s

cities are embracing emerging technology to create a harmonious combination of tradition and innovation. The rise in the usage of drones is also remarkable, as more investments are being made in the production as well as the procurement of these UAVs. Middle East has been emerging as a beacon of innovation with its smart city projects, such as Masdar City in Abu Dhabi, King Abdulla Economic City in Saudi Arabia, Lusail City in Qatar, and Smart Muscat in Oman. These urban centers are more than simply urban hubs; they are living, breathing creatures that adapt and evolve to fulfill their residents’ ever-changing requirements. They aim to set a new standard for eco-friendly urban development.

Representational Image

MENA region has been putting forth its best efforts to pave the way for the cities of tomorrow. As these UAVs continue to advance, their potential impact on smart cities is limitless. However, the widespread adoption of drones in smart cities comes with its own set of challenges. One of the key obstacles is the development of robust drone networks and monitoring systems. As the number of drones in urban airspace increases, effective traffic management and integration with existing infrastructure become crucial. Regulatory frameworks must be established to ensure the safe and responsible use of drones in smart cities. Privacy concerns and public acceptance also need to be addressed to build trust and foster positive engagement with drone technology.

41 Technology

A Future called Drone City

As the concept of smart cities continues to evolve, drones are emerging as a driving force behind urban innovation. From urban planning and construction to emergency response, these unmanned aerial vehicles are revolutionizing cities’ operations. By harnessing the power of little gadgets, smart cities can enhance efficiency, reduce costs, and improve lifestyle. Actionable drones play a major role in making cities safer by connecting directly to emergency response centres. They can be useful in public safety concerns by providing real-time footage for proper law enforcement. Additionally, drones can help in crime scene preservation by remotely mapping and documenting incidents for forensic investigation. During emergencies such as fires, chemical spills, or natural disasters, drones prove to be invaluable assets. These aerial devices can fly over buildings and obstacles, generating high-resolution and 3D mapping to identify areas that have sustained damage. Live videos from drones provide real-time intelligence to help centres and rescuers, enabling swift and informed decisionmaking. Drones can also be utilized to deliver critical supplies, such as food, water, and medical resources, without putting rescue workers at risk. As technology advances, the potential applications of drones in smart cities will only continue to expand, creating a more sustainable and connected urban future.

- Blog by Madhulika Pandey

42 Technology

8 Technology Events of 2023 in MENA

Representational Images

44 Technology

Technology will always remain a game-changer. An industry will continue to get abated continuously in its own traditional ways for centuries, when out of the blue, a new technology innovation can come and change the very course of conducting or completing tasks. Technology can change the entire concept of human living, can redefine businesses/different industry sectors and offer solutions to complete complex tasks.

It is a challenge to list only the best eight technological events of 2023 in MENA, since there are many. However, our team has burned the midnight oil to collect information and selected the best among the many for your kind reference.

1. Mobile Services for Connectivity

In some parts of South Sudan, reports of noncommunication with respect to mobile services were common in remote communities and areas. However, in October 2023, a satellite broadband service provider arm of a UAE-based satellite communication organisation entered into collaboration with a startup from South Sudan to boost the telecommunication sector in the country.

2. Space Technology

In 2023, Iran made a mark in space technology by launching the ‘bio-space capsule’ into space on December 6, 2023. This country has an ambition to send astronauts into orbit within 2029 as part of its “Life in Space” program.

Saudi Arabia has always longed to become a global power in space, and on May 2023, the country made headlines by sending two of its astronauts to the International Space Station. The two astronauts are Ali AlQarni (pilot) and the first Arab woman to become an astronaut, Rayyanah Barnawi (biomedical researcher).

3. Launching of Satellite

If there is a country in MENA that achieved a significant boost in space technology other than Saudi Arabia, it is Kuwait. In January 2023, Kuwait launched its first satellite – KuwaitSat-1, thus giving a significant boost to

the country’s space program.

4. Introduction of 5G Mobile Technology in Jordan

Other than South Sudan, Jordan moved towards a remarkable milestone in mobile technology, as in February 2023, a Swedish Telecommunication company and a Jordanian mobile network company collaboratively introduced 5G technology in the country. This marks a significant positive change for businesses as they can streamline and fasten their processes due to excellent speed. The other industries which can get a boost are cloud gaming, healthcare and broadcasting services.

5. UAE

Drone technology is gathering popularity in many industries. However, when it comes to retail, global companies have tried to use drones for delivering goods, but without much success. In the year 2023, the UAE passed regulations regarding the operation of drones in the country. Prominent among them are :

Drones or any UAV should be below 5 kgs

They should be flown only in the approved area and not on private property or within 5 km of UAE airports, helicopter sites & in controlled sites.

45 Technology

Representational Image

46 Technology Representational Image

6. Türkiye & Syria

Disaster changes human lives for the worse, but it also brings to fore the very best creations in technology. When the 7.8 magnitude earthquake struck North Syria and Türkiye, the month of February in 2023, many human lives were lost and buildings collapsed. Within hours, another earthquake with nearly the same intensity struck once again, causing a huge toll on human lives and causing many to get trapped in the rumble, cutting off communication.

Companies from around the globe vied with one another to provide emergency support to citizens by various means – food packets, medical relief and technology. China & Spain provided drone technology support.

Drone Technology for relief in EarthQuake Areas

This was crucial as the images taken from drones were in the form of 2D and 3D, and provided accurate information on safe areas, dangerous zones and damaged infrastructure. Drones were also used to send small weight items such as medicine and communication equipment to those in need.

The European Union and US joined hands in providing satellite images to rehabilitation teams so that they can identify and save humans and livestock buried under the rumble.

NASA sent its popular tool FINDER (full form – Finding Individuals for Disaster Emergency Response). This tool

has the ability to identify body heat beneath 30 feet of rubble with sensors.

7. Earthquake help project for providing relief for Earthquake Infected Areas

Two engineers from Turkey, Furkan Kılıç and Eser Özvataf, designed the “Earthquake Help Project” via two social media platforms, Twitter and Discord, to mobilize tech volunteers for creating applications and portals via open-source websites. Affected persons can submit their information on these apps or portals to ask for assistance.

Chatbots to Handle Calls

Calls for relief were pouring in, and volunteers struggled to take the high influx of calls. So, the tech guys devised chatbots that can give the same answers based on the questions 24/7, thereby making the volunteers work in other areas that required human intervention.

8. High Pitch Whistle Application for Earthquake Affected Areas

Though many technologies were used, it was the highpitched whistle application that received wide acclaim. Companies designed high-pitch applications which were downloaded by the affected population on their mobile. When in need, even if the connectivity was low, they could make the siren give a high-pitched whistle which helped relief volunteers locate them with ease.

The above-mentioned are the top 8 technology events of 2023 in MENA. They had become game-changers in travel, space technology, disaster relief and mobile technology. When reading through the article, were you reminded of other technology events that had gained national and international acclaim at the same time in MENA? True, we have not included the advancement of ChatGPT and the inclusion of AI/ML in various sectors and data analytics. We have also not included health tech, even though it was a standout year for the same. We will try our best to include them in the next article.

47 Technology

- Blog by Sathya Narayana B

Representational Image

FLOOSS join forces with STC

FLOOSS to be offering an instant loan solution that rewards users for their financial aspirations. By leveraging the power of STC Pay, FLOOSS provides instant disbursement of loan funds. A seamless & efficient loan process, while also providing cash back perks.