RTA completes 45% of roads and bridges leading to Dubai Hills Mall

The construction of the AED780 million project is coordinated with Emaar

Abu Dhabi Exports Office Joins Dubai Exports to Host Digital International Trade Forum to ...

Etisalat Digital’s new blockchain platform aims to stop trade finance losses

Dubai cruise sector posts record increase in tourist numbers Dubai FDI’s Global Promotional Investment Team announces preparations for investment mission to China

Dubai Exports announced they will co-host the UAE’s major virtual international buyers forum in the COVID-19 era in partnership with Abu Dhabi Exports Office (ADEX) and Etihad Credit Insurance (ECI) in a unified effort to boost the emirate’s export economy and increase foreign business to drive economic recovery for Dubai businesses.

The announcement of the forum which will be held on July 21st, 2020 was made in conjunction with the signing of a new Memorandum of Understanding between ADEX, the UAE-wide export financing entity founded by Abu Dhabi Fund for Development

and Dubai Exports, an agency of Dubai Economic Department (DED), which specializes in developing and promoting the growth of the Dubai’s economy through the development and promotion of exports and industry.

The MOU, signed by Eng. Saed Al Awadi, CEO of Dubai Exports, and Mr. Saeed Al Dhaheri, Acting Director General of ADEX, represents a commitment to collaborate on a range of strategic initiatives and data sharing to strengthen, unite and increase access to the broad range of financial and support services available to Dubai exporters.

The inaugural activation of the partnership will be a digital education forum bringing together leading exporters from across the Dubai business community with international buyers from around the world. Dubai Exports is activating on-theground resources from its 24 international offices to invite buyers to join in the UAE’s first significant international trade promotion event since the global lockdown.

Participating companies will learn about the full range of financial support services, buyers credit facilities available through ADEX and credit insurance available through ECI to stimulate transactions with foreign buyers of made in the UAE goods and services.

Eng. Saed Al Awadi said: “We are leveraging the full resources of the UAE national export community to help ensure Dubai exporters and their foreign buyers keep goods and services flowing across our borders to continue to stimulate economic recovery and long-term growth. Through Dubai Exports, we have the access and resources to bring buyers from around the world together with our leading export companies. Through ADEX, we have highly competitive, world-class direct and indirect financing products that can help make transactions happen efficiently and effectively on behalf of both our exporters and their foreign buyers.”

Mr. Saeed Al Dhaheri said: “The UAE has invested in building an incredibly comprehensive and powerful network of strategic financial products and services as well as support entities that together effectively increase access to international markets around the world and greater strengthen the competitive positioning of exporters across the world. This international buyers forum is among many initiatives ADEX is undertaking to deliver on our commitment to work with partners across our national export community to ensure our business

leaders know how to access and most effectively leverage the power of ADEX and the entire export support network to enter new markets, expand their businesses and drive a robust, growing UAE export economy.”

In the MOU, ADEX and Dubai Exports will work together to support exporters to diversify the export markets for local businesses by introducing them to the facilities provided by the corporation. Starting with the international buyers forum, these joint activities aim to increase awareness of how to access and most effectively use the full suite of financial products and services available through ADEX to help UAE companies safely enter new international markets and drive export growth.

ADEX was established in 2019 by ADFD with a mandate to drive diversification and growth of the UAE export economy. ADEX provides direct financing and credit guarantees to overseas buyers from the public and private sectors seeking to import goods and services from UAE companies. ADEX funding and guarantees are designed to support national businesses across the UAE in all non-crude oil sectors. ADEX has allocated AED 550 million ($150 million) in funding for qualifying export transactions of national companies.

Through its direct funding program, ADEX provides loans to qualifying foreign buyers of UAE goods and services with payment made directly from ADEX to the UAE exporter, reducing their risk of delayed or non-payment.

Abu Dhabi Exports Office (ADEX) and the Sharjah Chamber of Commerce and Industry (SCCI) are partnering together on a strategic initiative to help boost exports from one of the leading manufacturing hubs in the region that provides a significant contribution to the UAE’s GDP.

ADEX, the UAE-wide export financing entity founded by Abu Dhabi Fund for Development (ADFD), and SCCI, represented by the Sharjah Exports Development Centre (SEDC), signed a memorandum of understanding today (MoU) to partner together to support marketing and promotion of the emirate as a strategic international trade partner while empowering SCCI members to explore new international export markets and business growth opportunities by tapping into the unique suite of financial products and services provided by ADEX.

The signing ceremony was held in the presence of His Excellency Abdullah Sultan Al Owais, Chairman,

SCCI, His Excellency Mohammed Saif Al Suwaidi, Director General, ADFD, and Abdul Aziz Shattaf, SCCI Assistant Director General, Members Services Sector and Director of Sharjah Exports Development Center, while the MoU was signed by His Excellency Mohammad Ahmed Amin Al-Awadi, SCCI Director General, and Mr. Saeed Al Dhaheri, Acting Director General of ADEX.

With the support of ADEX, Sharjah manufacturing and business leaders can access new sources of funding to directly finance transactions with overseas buyers and increase export business as the UAE and international markets continue to open up after the COVID-19 lockdowns.

As one of the first joint activities, ADEX and SCCI are preparing to host a special online education workshop for all export companies in Sharjah. The workshop will help SCCI companies better understand how to access AED 550 million (USD $150 million) in ADEX funding allocated to directly

support national exports in non-crude oil sectors in order to expand their export business.

Welcoming the signing, His Excellency Abdullah Sultan Al Owais said: “This partnership is part of SCCI’s effort to cooperate with government entities like ADEX that can support our national companies with innovative new models that better enable them to develop their businesses and diversify their export markets, thus contributing to the economic performance of the Emirate of Sharjah and its business community. Working with ADEX, we will promote the advantages of investing in the UAE and in Sharjah by highlighting the emirate’s attractive environment and the innovative facilities and services provided by SCCI and our UAE government partners.”

Said His Excellency Mohammed Saif Al Suwaidi:

“Sharjah has long served as a strategically important economic centre in the UAE and a major contributor to the national export economy. Through our partnership with SCCI, ADEX can play a key role in the short-term supporting Sharjah companies in their recovery from the current economic challenges. But more importantly, this is a long-term partnership to help continue to expand the Sharjah economy and contribute to our national economic diversification strategy.”

ADEX provides direct financing and credit guarantees to overseas buyers from the public and private sectors seeking to import goods and services from UAE companies. Financing is provided in the form of direct loans to overseas buyers from UAE companies as well as payment guarantees to financial institutions for loans offered to their buyers for procurement of goods and services from UAE companies.

international markets. While the loans are made to the overseas buyer, upon successful delivery of goods or services ADEX makes payment direct to the UAE exporter, eliminating payment delays and risk of non-payment. ADEX funding and guarantees are available to national businesses across the UAE in all non-crude oil sectors.

ADEX and SCCI are working on developing a mechanism that will drive the planning and implementation of joint export market development projects. The mechanism will provide easy access for Sharjah business community to approach ADEX and avail their services. This is expected to enhance the competitiveness of the commercial enterprises operating in Sharjah and empower them to develop their businesses, thereby reinforcing the emirate’s position as a distinctive export destination to the regional and Middle East markets.

Mr. Saeed Al Dhaheri said: “ADEX provides highly valuable strategic products and services for UAE companies to be more competitive and attractive as business partners in the global marketplace. It’s important that we work closely with the Sharjah Chamber to ensure its members understand how to most effectively leverage ADEX as a strategic partner that can add value to their overseas buyers. Working together with SCCI, we will continue to ensure that Sharjah is strongly positioned to play an important role building our nation’s future economy.”

Funding export transactions through ADEX enables companies to safely and securely enter new

The ADEX/SCCI joint webinar will provide Sharjah business leaders with detailed background on specific ADEX products and services immediately available to companies and how to work with the entities financial services support team to qualify and apply for export funding support. Sharjah exporters wanting to participate in the joint ADEX/ SCCI webinar to learn more about how to access ADEX support can contact SCCI directly for details.

UAE Trade Connect says losses through duplicated invoices could be between AED500mln and 1bln annually

A new blockchain technology which could prevent losses in trade finance of up to 1 billion dirhams annually has gone live in the UAE.

The new platform has the capability to prevent duplicate invoices, whether submitted through error or fraud.

UAE Trade Connect (UTC), a collaboration between Etisalat Digital, the Central Bank of the UAE as well as seven other banks and Avanza Innovations, will initially use this technology including artificial intelligence to block suspicious or dubious invoices in trade finance. Other initiatives will be launched on the platform later.

Asked about the scale of the issue being addressed by the technology, a statement from Etisalat Digital said: “Statistics are not generally available because banks’ risk mitigation processes are activated to prevent losses.

“However even if duplication and fraudulent invoices represent 1-2 percent of the financed value this would mean something between AED 500 million to AED 1 billion of potentially invalid invoices being presented to UAE banks annually.”

For now, the platform will be used to prevent the same invoice from being paid twice, whether it has been submitted through error or deliberate fraud.

The initiative is the first of its kind in the Gulf region, although similar technology is already in use in Singapore and Hong Kong.

The banks involved in the launch are Commercial Bank International (CBI), Commercial Bank of Dubai (CBD), Emirates NBD, First Abu Dhabi Bank (FAB), Mashreq Bank, National Bank of Fujairah (NBF), and RAKBANK, but there are ambitions to take the scheme nationwide.

At a press conference to mark the commercial launch of the platform, Zulqarnain Javaid, CEO of UTC outlined the potential of the platform: “The system will evolve so that it can handle financial crime risk, which includes trade-based money laundering and sanction busting, and later on, we hope that we will be able to take this platform towards e-invoicing. Electronic invoicing is about digitising invoicing and we will have to work with multiple stakeholders inside and outside the banks.”

He added: “Later on, we hope to be able to develop bills of lathing on a digital basis. This will be a very big change because it involves, port authorities, customs, governments, international players, freight forwarders and logistics companies.

Atif Raza, head of sales and advisory, international and transaction banking at participating bank, CBD, said: “We were targeting to thread together all the banks operating from this part of the world with an effort to avoid double financing done through duplicate invoices.”

He added: “I think it has all the merits to become a nationwide platform for all the banks operating from this part of the world.”

New AWS Region expands cloud pioneer’s global footprint, enabling customers to innovate faster and run workloads from data centers located in the Middle East

Hyper scale infrastructure includes three Availability Zones and connects the Middle East to AWS’s global network to power the region’s push for digital transformation

Tens of thousands of customers and partners across the Middle East are already innovating on AWS, including Al Tayer Group, Anghami, Aramex, Bahrain Bourse, Bahrain iGA, Careem, Classera, Dubizzle, Emirates NBD, Fetchr, Flydubai, Hassan Allam, Mawdoo3.com, MBC Group, Opensooq, OSN, Seera Group, Union Insurance, Virgin Middle East, and many more

SEATTLE--(BUSINESS WIRE)--Jul. 30, 2019-- Amazon Web Services, Inc. (AWS), an Amazon.com company (NASDAQ:AMZN), today announced the opening of the AWS Middle East (Bahrain) Region. With this launch, AWS now spans 69 Availability Zones within 22 geographic regions around the world, and has announced plans for nine more Availability Zones across three more AWS Regions in Indonesia, Italy, and South Africa. Starting today, developers, startups, and enterprises, as well as government, education, and non-profit organizations can run their applications and serve end-users from data centers located in the Middle East, as well as leverage advanced technologies from the world’s leading cloud, to drive innovation. Customers can get started today

“The cloud has the chance to unlock digital transformation in the Middle East,” said Andy Jassy, CEO, Amazon Web Services. “Today, we are launching advanced and secure technology infrastructure that matches the scale of our other AWS Regions around the world and are already seeing strong demand in the Middle East for AWS technologies like artificial intelligence and machine learning, data analytics, IoT, and much more. We are excited to see how our cloud technology will provide new ways for governments to better engage with citizens, for enterprises to innovate for their next phase of growth, and for entrepreneurs to build businesses and compete on a global scale.”

The new AWS Middle East (Bahrain) Region offers three Availability Zones at launch. AWS Regions are composed of Availability Zones, which each comprise at least one data center and are located in separate and distinct geographic locations with enough distance to significantly reduce the risk of a single event impacting business continuity, yet near enough to provide low latency for high availability applications. Each Availability Zone has independent power, cooling, and physical security and is connected via redundant, ultralow-latency networks. AWS customers focused on high availability can design their applications to run in multiple Availability Zones to achieve even greater fault-tolerance.AWS infrastructure Regions meet the highest levels of security, compliance, and data protection.

Customers and APN Partners welcome the new AWS Middle East (Bahrain) Region

Millions of active customers are using AWS each month in over 190 countries around the world, including tens of thousands of customers in the Middle East and North Africa (MENA). Startups like Alef Education, Almentor, Altibbi, Anghami, Bayt. com, BitOasis, Babil Games, Bey2ollak, Boutiqaat, Careem, Classera, Clicksco, Crowd Analyzer, Dubizzle, EKar, Elephantsocial, Fetchr, Fish.me, Haraj, Health at Hand, Jeeny, Little Thinking Minds, Maestro Pizza, Mawdoo3.com, Mrsool, Naseej, Ngwa, Opensooq, Property Finder, Sarwa, Souqalmal, StarzPlay, Tajawal, ToDoorStep, Ureed, Vezeeta, and Yallacompare are building their businesses on top of AWS, enabling them to scale rapidly and expand around the world. Enterprises across the region are moving to AWS to become more agile and innovate, and include Al Jouf Cement, Al Tayer Group, Arab Banking Corporation (Bank ABC), Aramex, Bahrain Bourse, Bank Al-Etihad, Batelco, Emirates NBD, Flydubai, Gulf News, Hassan Allam, Lulu International Exchange, MBC Group, OSN, Seera Group, Union Insurance, Virgin Middle East, and many more. Public sector organizations, including Government of Bahrain’s Ministries, such as the Ministry of Education, Ministry of Finance, Ministry of Information Affairs, Ministry of Labor and Social Development, and Bahrain iGA, as well as other public sector organizations such as Bahrain Polytechnic, Communications and Information

Technology Regulatory Authority of Kuwait (CITRA), Mumtalakat, Paris Sorbonne AD, Tamkeen, University of Bahrain, and many more are also using AWS to drive cost savings, accelerate innovation, and better serve the citizens of the region.

Emirates NBD is a United Arab Emirates (UAE) based enterprise that is working with AWS to build an Artificial Intelligence-enabled bank of the future. Emirates NBD is a leading banking Group in the Middle East, with total assets of AED 537.8 Billion, as of June 30, 2019. The Group has a significant retail banking presence in the UAE and is a participant in the global digital banking industry. The bank is utilizing AWS’s artificial intelligence and machine learning services, data analytics, and natural language processing technologies to better engage with customers and simplify banking. Abdulla Qassem, Group Chief Operating Officer, Emirates NBD, said, “Emirates NBD has been collaborating with AWS and taking advantage of AWS’s technologies and innovation practices to develop personalized, real-time banking experiences. The new AWS Middle East Region will allow us to further experiment and enhance our solutions as we continue to realize our vision of being the region’s most innovative financial services organization that is making banking more easy and intuitive for customers.”

Well established family businesses in the Middle East are also moving to AWS to become more agile and innovate. Saudi Arabia’s Abdul Latif Jameel is one of the most respected family-owned businesses across the Middle East, North Africa, Turkey, and over 30 countries worldwide, with diversified interests in major sectors including transportation, energy and environmental services, financial services, land and real estate, and many other industries. Faisal Alsamannoudi, Vice Chairman, Abdul Latif Jameel Commercial Development Company Ltd., said, “We welcome the opening of the AWS Middle East Region and see it as a real opportunity to bring more efficiency and innovation to our business, in a secure way. We started our AWS journey with Abdul Latif Jameel Commercial Development Company, in Jeddah, by migrating critical HR management systems covering seven different companies –a process that took us less than one month and brought savings up to 60 percent, compared to our previous solution. With AWS, we are becoming more agile and able to innovate quickly across different lines of business, including S:mile express delivery brand, and CarHub on-demand vehicle care services.”

Another regional enterprise moving to AWS is Al Tayer Group, one of the largest privately held family-run conglomerates in the MENA region. Al Tayer Group has interests in automobile sales and services, luxury and lifestyle retail, and hospitality. Headquartered in the UAE, the group operates in 12 countries in the Middle East and manages over 200 stores. Mohamed Al Fayed, Senior Vice President of OmniChannel, Al Tayer Retail, said, “Today’s news from AWS is fantastic as we continue accelerating our cloud adoption. Using AWS, we were able to become more agile and reliably launched five e-commerce platforms, such as Mamas & Papas, Nisnass.com, and Ounass alongside Android and iOS apps, all within a year. We rely on several AWS managed database services such as Amazon

Aurora, where we were able to cut costs by 40 percent, while increasing performance by four times, compared with proprietary database technologies. We also leverage AWS spot instances to reduce operational cost by 79 percent. We see great potential to improve our business even further with the new AWS Middle East Region, which will enable us to serve our end customers with even lower latency.”

Government organizations are also working with AWS to lower costs and better serve citizens in the region. The Bahrain Information & eGovernment Authority (iGA) is responsible for ICT procurement for the Bahrain government and is leading the government’s migration project to support the country’s Cloud First policy. iGA’s Chief Executive Mohammed Ali AlQaed said, “Bahrain is committed to becoming a country in the cloud and we will be able to accelerate our journey with the launch of the AWS Region in Bahrain. By December of this year, we will have 30 percent of all 72 government entities migrated to AWS and by June 2020, we expect to have most government data centers shut down, while the rest are minimized allowing us to focus resources on projects that benefit our citizens and dramatically improve the overall availability and durability of government applications and data.” An example of a government entity that turned to the agility and speed of AWS is Bahrain’s National Bureau of Revenue (NBR), who needed to quickly and efficiently launch the country’s Value Added Tax (VAT) system. Rana Faqihi, Assistant Undersecretary for Development and Revenue Policies at Bahrain Ministry of Finance, said, “The National Bureau of Revenue needed a solution that would enable a seamless VAT rollout, without delays and with the highest levels of security. By launching SAP S/4 Hana on AWS, the NBR was able to go to market in just under two months while lowering costs by 40 percent. Eliminating the need to manage IT infrastructure allowed us to focus on

successfully reaching an important milestone in Bahrain’s economic development. The launch of the new AWS Region in Bahrain is allowing public and private sector organizations to realize the full potential of the cloud.”

Another government body in the Middle East welcoming the new AWS infrastructure Region is the Communication and Information Technology Regulatory Authority (CITRA), Kuwait’s regulator responsible for the country’s IT sector and technology adoption in the government. Salem Muthib Al-Athainah, Chairman and CEO of CITRA, said, “We welcome the launch of the new AWS Middle East Region as an important step in bringing reliable and secure cloud computing technologies closer to end users in the Middle East. This launch underlines the important location of the Middle East as a center to the global data movement worldwide. The presence of the AWS Middle East Region opens up new prospects for companies and government organizations to serve customers in the region, contributing to the enhancement of infrastructure, digitization, connectivity, and customer experience. Our significant work with AWS supports CITRA’s strategy of transforming Kuwait into a regional ICT hub, and the digitization of the Kuwaiti economy, and we look forward to continue to build on that while leveraging the new AWS Middle East Region in Bahrain.”

The most well-known and fastest growing businesses in the Middle East are also choosing AWS to launch and grow. Careem, the leading technology platform for the region, started working with AWS in 2012 to help it scale fast and wide across 14 countries in under seven years. Today, Careem hosts 33 million customers and one million drivers on its platform, and has expanded its services to offer on demand deliveries as well its original core business, ride hailing. Magnus Olsson, Chief Experience Officer and co-founder of Careem, said:

“When we started building Careem, we knew that the ability to scale fast, and in a secure and reliable way, would be critical to our long term success. As one of AWS’s early adopters in the region, we have grown with them. Thanks to AWS, we have been able to focus our efforts on geographical and new vertical expansion and to innovate new technologies and services. With the opening of the new AWS Middle East Region, we will now be able to benefit from data centers with lower latency in the region. AWS’s commitment to our region shows the enormous potential of the local technology scene and will be instrumental to the success of the new wave of startups to come. We look forward to having them as a strong contributor to the Middle East tech ecosystem.”

A rapidly growing startup using AWS is Classera, one of the leading education companies in the Middle East and at the forefront of using cloud technology to rethink education services. Classera co-founder and CTO Mohammad Alashmawi said, “We understood the power of the cloud in our early days, and have relied on AWS since 2010 to grow into a trusted education platform that is currently used by over 2 million people in more than 12 countries. As we revolutionize the e-learning ecosystem, we are developing smart solutions that leverage AWS data analytics and machine learning services to bring personalized and highly engaging learning experiences to students. Thousands of schools and organizations across the Middle East rely on the Classera platform as a core pillar of their learning, teaching, and training process. We have peace of mind that AWS gives us the performance, reliability, and security that we require to deliver our services. It’s very exciting to have AWS launching a Region in the Middle East. This brings us, and other startups in the region, a competitive edge as we have greater access to the most advanced technologies in the world today.”

AWS Partner Network (APN) Partners also welcomed the arrival of the AWS Middle East (Bahrain) Region. The APN includes tens of thousands of Independent Software Vendors (ISV) and Systems Integrators (SI) around the world. APN Partners build innovative solutions and services on AWS and the APN helps by providing business, technical, marketing, and go-to-market support. Partner Network (APN) Consulting and Technology Partners in the Middle East helping customers to migrate to the cloud include Adfolks, Al Moayyed Computers, Batelco, Citrus Technology, Cloudnexa, Computer World, Du, Ejada, Ellucian, Fortecloud, Infonas, Integra Technologies, Kaar Technologies, Kalaam Telecom, Kloudr, Kuwaitnet, Nournet, Redington, Tamkeen

(Saudi), Thinglogix, Zain, Zero and one, and many others as well as global APN members such as Accenture, Capgemini, Cognizant, Deloitte, DXC Technology, TCS, and Wipro. Global ISVs such as F5, Fortinet, Palo Alto Networks, SAP, Splunk, Trend Micro, VMWare, and many others are already using AWS to deliver their software to customers around the world and will serve their customers in the Middle East from the AWS Middle East (Bahrain) Region at launch. Customers can also easily find, trial, deploy, and buy software solutions for AWS on the AWS Marketplace. For the full list of the members of the AWS Partner Network, please visit: https://aws. amazon.com/partners/.

The new AWS Middle East (Bahrain) Region adds to the infrastructure investments AWS has been making across the Middle East, to provide customers with advanced and secure cloud technologies. Today, AWS is also launching a new AWS Direct Connect location in Bahrain, which is the first to be operated by AWS, joining the two AWS Direct Connect locations and two Amazon CloudFront Edge locations in the UAE that launched in 2018. AWS Direct Connect makes it easy for customers to establish a dedicated private network connection between AWS and their data center, office, or colocation environment. Amazon CloudFront gives customers an improved experience for their end users, including faster content delivery and added cybersecurity protection.

To support the growth in cloud adoption across the region, AWS has made significant investments in education, training, and certification programs to

help those interested in the latest cloud computing technologies, best practices, and architectures, to advance their technical skills and further support Middle East organizations in their digital transformation. AWS offers instructor-led training programs for customers and partners, as well as general public training events such as AWS Summits, AWSome Days, Immersion Days, and Game Days as well as over 500 free online training courses. To help drive diversity in the tech industry, AWS has also extended its global ‘We Power Tech’ program to the region, providing events and free training courses to support technology skills development for women in the Middle East.

For students and educators, the AWS Educateand AWS Academy programs are providing free resources to accelerate cloud-related learning and preparing today’s students in the Middle East for the jobs of the future.

To help grow the next generation of businesses in the Middle East, AWS is supporting startups across the region through the AWS Activate Program. Working with accelerators, angel investors, incubators, government organizations, & Venture Capital firms, AWS Activate provides resources to help startups launch their businesses on AWS and go global in minutes. Across the Middle East, AWS has been working with organizations such as 500 startups, Area 2071 in Abu Dhabi, BADIR in Saudi Arabia, BECO Capital, EDB in Bahrain, Flat6Labs,

For 13 years, Amazon Web Services has been the world’s most comprehensive and broadly adopted cloud platform. AWS offers over 165 fully featured services for compute, storage, databases, networking, analytics, robotics, machine learning and artificial intelligence (AI), Internet of Things (IoT), mobile, security, hybrid, virtual and augmented reality (VR and AR), media, and application development, deployment, and management from 69 Availability Zones (AZs)

Hive, MEVP, Oasis500, Seed Stars, Startupbootcamp, Techstars, and many more, providing startups with AWS credits, in-person technical support, AWS trainings, and go-to-market help.

Developers and businesses can access the AWS Middle East (Bahrain) Region beginning today. A full list of services and details on pricing is available at https://aws.amazon.com/about-aws/globalinfrastructure/regional-product-services/

within 22 geographic regions, spanning the U.S., Australia, Bahrain, Brazil, Canada, China, France, Germany, Hong Kong Special Administrative Region, India, Ireland, Japan, Korea, Singapore, Sweden, and the UK. Millions of customers—including the fastest-growing startups, largest enterprises, and leading government agencies—trust AWS to power their infrastructure, become more agile, and lower costs. To learn more about AWS, visit aws.amazon. com.

51% growth in cruise tourist footfall and 38% increase in cruise ship calls posted during 2018-19 season

DUBAI - Bolstering its position as a premier international cruise destination, Dubai concluded its 2018/2019 cruise season with a record increase of over 51 percent in cruise tourist footfall and a 38 percent increase in cruise ship calls season-on-season.

Dubai welcomed through Mina Rashid Cruise Terminal 846,176 cruise visitors via 152 ship calls during the season, compared to 558,781 visitors onboard 110 ships in 2017/2018. An additional 211 ship calls are now confirmed for the upcoming 2019/2020 season.

This growth reflects the committed joint efforts to boost the cruise sector by the Dubai Cruise Committee made up of leading industry partners; Dubais Department of Tourism and Commerce Marketing (Dubai Tourism), DP World UAE Region, operator of the Mina Rashid, Emirates Airline, The General Directorate of Residency and Foreigners Affairs Dubai, and Dubai Customs

The 2018/2019 season witnessed 14 maiden calls and welcomed leading international cruise liners such as TUI Cruises, AIDA Cruises, MSC Cruises, Costa Cruises, Pullmantur Cruises, P&O Cruises and Royal Carribean cruise line to the homeport in Dubai, all expected to return in the upcoming season. The season concluded with the departure of the Karnika, Indias first premium cruise ship from Jalesh Cruises which has recently homeported in Dubai.

Mohammed Abdul Aziz Al Mannai, CEO-P&O Marinas and Executive Director, Mina Rashid, said, “We are pleased to move in the right direction in promoting Dubai as a popular destination for international cruise tourists. As the Middle Easts premier destination for cruise operators, Mina Rashid offers a value proposition to global luxury cruise liners. It is reassuring to see the steady double-digit increase in tourist traffic at Mina Rashid each year. Central to this stellar performance is our flagship Hamdan bin Mohammed Cruise Terminal, capable of handling 14,000 passengers a day.

Commenting on the success of the 2018/2019 cruise season, Hamad Bin Mejren, Senior Vice President of Dubai Tourism, said, “The success of the 2018/2019 cruise season stands as a true testament to the robust growth of Dubais cruise industry and the citys growing appeal as a year-round must-visit destination. We are delighted to welcome leading cruise lines once again to operate regular international itineraries out of the city. We will continue to actively work with our valued network of local, regional and global partners to further highlight Dubais ease of accessibility, driven by efficient cruise terminal operations and continual enhancements that have welcomed an ever-increasing number of operators to anchor in the emirate.”

Developing Dubai’s cruise industry to its maximum potential falls in line with the Dubai Silk Road strategy prepared by the Ports, Customs and Free Zone Corporation,PCFC, in collaboration with key government entities. It comprises nine initiatives and 33 projects, which include the enhancement of the strategic and operational connection of logistics services between DP World terminals across the world.

Since its inauguration in 2014, Mina Rashids Hamdan bin Mohammed Cruise Terminal has received over 2.3 million visitors, marking a 172 percent increase towards the end of 2018. In April, Mina Rashid won the Middle Easts Leading Cruise Terminal Award for the 12th consecutive time at the World Travel Awards 2019, along with WTAs prestigious Worlds Leading Cruise Port Award for 11 years in a row since 2008.

With handling seven mega-cruise vessels at once, Mina Rashid is also currently undergoing an expansion to improve its capabilities, through a world-class recreational area that will symbolise Dubais rich cultural heritage. Due to high demand, it is also working towards providing improved berthing services for private yacht owners looking to make Dubai a home for their vessels and position the terminal as one of the worlds premier cruise tourism hubs.

The Dubai cruise season 2019/2020 is set to commence on 19 October with Mein Schiff, homeporting cruise liner carrying over 6,000 passengers.

The construction of the AED780 million project is coordinated with Emaar

Al Tayer: The project comprises the construction of 12 bridges stretching 3,700m in length and 11-22m in width

Roads and Transport Authority: HE Mattar Al Tayer, Director-General and Chairman of the Board of Executive Directors of Roads and Transport Authority (RTA), announced 45% completion of construction works on the bridges and roads leading to Dubai Hills Mall at the junction of Umm Suqeim Street and Al Khail Road.

The project is undertaken by RTA in coordination with Emaar Properties at a cost of AED780 million and is expected to be completed in the first half of 2020. The main objective of the project is to ensure the smooth flow of traffic from and to Dubai Hills Mall as well as on Umm Suqeim Street and Al Khail Road.

“The project encompasses the construction of 12 bridges spanning 3700 metres with a width varying from 11 to 22 metres in addition to ramps connecting the bridges measuring 2500 metres,” said Al Tayer.

The new bridges, which consist of four lanes in each direction, will separate the traffic from Umm Suqeim Street and Al Khail Road, leading to increase the

traffic capacity in the area. The existing four lanes of Umm Suqeim Street will be maintained in both directions to ensure a seamless vehicular flow.

“The project covers the construction of internal roads at Dubai Hills Estate to ease the movement of residents of Al Barsha South 1 and 2, and link them with new roads and bridges. Works also include the installation of traffic signals, shifting of utility lines, and landscaping,” added Al Tayer.

Dubai Hills Mall is one of the biggest destinations developed by Emaar as a joint venture with Meraas. It is an integral feature of Dubai Hills Estate and a destination that complements the development’s coveted residential and commercial community while attracting visitors from far and wide.

Featuring two million square feet of leasable space spread out over two floors, it is home to over 650 retail and F&B outlets including family entertainment offerings, a Cineplex and hypermarket.

Dubai Hills Mall is easily accessible from Downtown Dubai, Emirates Hills, Dubai Marina, Arabian Ranches and other nearby communities via Al Khail Road and Umm Suqeim Street.

- ADGM is partnering with KPMG, its FinTech ecosystem partner, to deliver the third annual FinTech Abu Dhabi Innovation Challenge. Winners will gain opportunities to scale their innovations from the UAE across to international jurisdictions

ABU DHABI, UAE, Aug. 28, 2019 /PRNewswire/ -- Abu Dhabi Global Market (ADGM), the International Financial Centre in Abu Dhabi, is pleased to launch the inaugural FinTech Abu Dhabi Awards. The awards will be decided by an independent panel of industry experts and will recognise the contributions of leading figures in the FinTech ecosystem. ADGM welcomes nominations for the FinTechAD Awards from now until 23 September across the following nine categories:

UAE FinTech of the Year

MENA FinTech of the Year

Emerging Markets Fintech of the Year

FinTech Investor of the Year

FinTech Accelerator of the Year

FinTech Corporate Innovation Programme of the Year

Emerging FinTech Talent of the Year

FinTech Leader of the Year FinTech Woman of the Year

Nominations can be done through the FinTech AD website (https://www.fintechabudhabi.com/fintechabu-dhabi-awards). Winners will be announced during the 3rd FinTech Abu Dhabi Festival taking place from 21 to 23 October, Abu Dhabi National Exhibition Centre (ADNEC), Abu Dhabi.

ADGM is also pleased to collaborate with KPMG Lower Gulf (KPMG LG) on the third edition of the FinTech Abu Dhabi (FinTechAD) Innovation Challenge to deliver a strong offering of attractive prizes and direct benefits for participants. The Innovation Challenge includes 15 FinTech problem statements that represent the key challenges that financial institutions, corporates and consumers face in the United Arab Emirates (UAE) and the wider Middle East, Africa & South Asia (MEASA) region.

The winners of the FinTechAD Innovation Challenge 2019 will receive:

A fast-tracked application to the Hub71 incentive program, which includes subsidised housing, office space and health insurance in Abu Dhabi.

The right to represent Abu Dhabi and the region at the Global FinTech Hackcelerator taking place at the Singapore FinTech Festival in November 2019, where participants have access to SGD 200,000 (~AED 530,000) in funding for the development of proof-of-concept solutions.

The opportunity to co-develop proof of concept solutions with Corporate Champions in Abu Dhabi, for future deployment in Abu Dhabi, the UAE, and beyond.

Finalists will also be given an exhibition space at the FinTechAD Festival, a stipend to cover travel expenses, a fast-tracked application to the ADGM RegLab, guidance and support from ADGM and KPMG LG in deploying solutions in the MENA region, and the opportunity to explore deployment of their solutions with Corporate Champions.

Mr Richard Teng, Chief Executive Officer, Financial Services Regulatory Authority of ADGM, commented: “The FinTech Abu Dhabi Awards aim to showcase and credit the tremendous achievements made by FinTech leaders in our region. We look forward to receiving nominations and playing our part in recognising efforts in transforming the financial services’ landscape in the region.

We are also pleased to be working with KPMG LG on the third edition of the FinTech Abu Dhabi Innovation Challenge. The first two instalments of the

Mr Umair Hameed, Partner, Financial Services, KPMG LG, said: “KPMG is delighted to be a part of the FinTech Abu Dhabi Awards as part of our three-year long association with ADGM to support innovation in the UAE. This is a fantastic initiative, especially as it continues to attract growing regional and international interest. KPMG invests

FinTechAD Innovation Challenge 2019:

Applications are open until 23 September for businesses to showcase how their disruptive technologies can solve the most pressing issues and challenges facing the financial services industry in the region. Successful finalists will pitch their solutions to an audience of financial institutions, regulators, corporates, investors and

Challenge have demonstrated the transformative potential of technology to solve the pain points in the financial services industry. These solutions have been deployed to great success by leading financial institutions in the region. We are excited to announce our most compelling incentives yet for solution-providers to join us at the FinTech Abu Dhabi Festival in October. As a smart digital IFC, ADGM will continue to support innovative and new business models that meets the need of a rapidly evolving digital landscape and tap into opportunities offered by the future economy.”

heavily in technology-based solutions within its Digital & Innovation practice and has launched a number of initiatives to support this, including the KPMG Digital Village, the Autonomous Vehicle Readiness Index and Global Ignition Centres which help bring game-changing FinTech solutions to businesses.”

media at FinTech Abu Dhabi Festival 2019, the region’s flagship FinTech innovation platform.

Further details on the FinTech AD Innovation Challenge application process are available at https://www.fintechabudhabi.com/fintech-abudhabi-innovation-challenge

The first Innovation Challenge in 2017 attracted 166 FinTech startups from 39 countries who vied for the opportunity to showcase how their innovative solutions could alleviate a number of industrywide pain points experienced by financial services institutions across the Middle East, Africa and South Asia. The solutions, presented by the eleven finalists at FinTech AD 2017, highlighted FinTech’s potential to promote better outcomes in six focus areas: financial inclusion, regulatory compliance, trade finance, insurance, financial and investment

management and private capital markets. The two winners of the Challenge, FRS Labs and Silent Eight, were selected to demo their solutions at the Singapore FinTech Festival in November 2017.

The second Innovation Challenge in 2018 saw Etihad Airways, Abu Dhabi Commercial Bank, SHUAA Capital and ADGM’s Financial Services Regulatory Authority work together with leading start-ups to produce prototype solutions to tackle real business problems.

Bringing together global and local financial institutions, FinTech start-ups, investors, regulatory agencies and the business community to network, collaborate and exchange expertise and knowledge in FinTech developments in Abu Dhabi, the

wider MENA region and internationally. For more details of the ADGM’s FinTech Abu Dhabi event, visit www.fintechabudhabi.com to register interest and follow us on @FinTechAD, #FinTechAD and #InnovationChallengeAD

Winners of the FinTech Abu Dhabi Innovation Challenge will gain entry to participate in the upcoming Global FinTech Hackcelerator in Singapore. This is made possible through the close collaboration between the ADGM and the Monetary Authority of Singapore (MAS) under the bilateral Cooperation Agreement (CA) to foster closer

cooperation on developments and initiatives that nurture FinTech entrepreneurship and support innovation in financial services in both Singapore and Abu Dhabi. For more details of the Singapore event, please visit https://www.fintechfestival.sg/ global-fintech-hackcelerator.

Abu Dhabi Global Market (ADGM), an international financial centre (IFC) located in the capital city of the United Arab Emirates, opened for business on 21 October 2015. Established by a UAE Federal Decree as a broad-based financial centre, ADGM augments Abu Dhabi’s position as a global hub for business and finance and serves as a strategic link between the growing economies of the Middle East, Africa and South Asia and the rest of the world.

ADGM’s strategy is anchored by Abu Dhabi’s key strengths including private banking, wealth management, asset management and financial

innovation. Comprising three independent authorities: ADGM Courts, the Financial Services Regulatory Authority and the Registration Authority, ADGM as IFC governs the Al Maryah Island which is a designated financial free zone. It enables registered financial institutions, companies and entities to operate, innovate and success within an international regulatory framework based on Common Law. Since its inception, ADGM has been awarded the “Best IFC EMEA 2019” by CFI. co and “Financial Centre of the Year (MENA)” for three consecutive years for its initiatives and contributions to the financial and capital markets industry in the region.*

About the Global FinTech Hackcelerator

Dubai, UAE,7 June2019: The Entrepreneurship in the Middle East and North Africa2019 survey, conducted by Bayt.com, the Middle East’s leading career site, and market research agency YouGov, has found that nearly7 in10 professionals prefer to be selfemployed. Moreover,73% are currently thinking of starting a business, while only7% never thought of starting their own business.

The survey found that, if given the choice, two-thirds (69%) of UAE residents aspire to be self-employed/ have their own business. When asked about the reasons for this preference, ‘freedom to choose work-life balance’ (54%) and ‘personal fulfillment’ (42%) emerged as the top reasons. ‘Being my own boss’, ‘ability to give back to the community’ and ‘higher monetary gains’ were also cited reasons.

Those who have already started their business seem to have similar reasoning. When asked about the reasons UAE professionals have for starting their

own business, the top three answers were: more income (33%), wanting to do what they love (27%) and having a great business idea/concept (25%).

Of those who prefer to seek employment in a company, (42%) state the main reason for their preference is having a ‘regular income’ while40% said they prefer employment in order to help them learn new skills.

“Understanding the views of entrepreneurs in the MENA is essential to maximizing impact and drive growth and innovation in the economy,” said Omar Tahboub, General Manager, Bayt.com. “Not only does Bayt.com conduct surveys annually and share our learning about the opportunities and challenges of entrepreneurship for the benefit of the sector, we also work closely with startups and new businesses to ensure their talent needs are secured easily and cost-effectively during these critical early stages.”

Entrepreneurship continues to be a growing trend in MENA. Despite the usual challenges of setting up a business, the Bayt.com report indicates that entrepreneurship has become more popular than ever before. Many entrepreneurs are looking to grow their startups and establish business. Over a third of respondents have personal ambitions to grow their business further in their country of residence (35%), followed by23% who aim to become an important international player.

The top concern of respondents while setting up their own business, would be procuring finances to start (62%), the uncertainty of profit/ income (45%).

The most appealing industries for entrepreneurship in the UAE are considered to be Consumer Goods/ FMCG (11%) and IT/ Internet/ E-commerce (10%) followed by Commerce/ Trade/ Retail (10%) and Hospitality/Recreation/Entertainment (9%).

The survey shows even greater benefits of entrepreneurship for societies and the economy. The perceived image of entrepreneurs in the region is very positive – UAE respondents perceive entrepreneurs to be opportunity-driven (85%) and they help in creating new jobs (83%).

The best pieces of advice offered to budding entrepreneurs by respondents in the UAE is to not be afraid of failure and having a great business plan. Over a quarter of respondents believe that innovation is the ‘key to success’ as an entrepreneur (28%), followed by ‘being close to clients or customers’ (22%).

Kerry Mclaren at YouGov said: “Entrepreneurs are the primary source of new job creation. The ideas and innovations born in small companies and startups disrupt industries and create a stronger economy, offering greater opportunities for upward mobility. Therefore, it became imperative for us to explore upcoming entrepreneurs and what challenges they face in a new survey with Bayt.com.”

Data for the Entrepreneurship in the Middle East and North Africa2019 was collected online from May16 to27,2019. Results are based on a sample of3,331 respondents from the following countries: UAE, KSA, Kuwait, Oman, Bahrain, Lebanon, Jordan, Iraq, Palestine, Syria, Egypt, Morocco, Algeria, Tunisia, Libya, Sudan, and others.

Dubai-UAE: 16 September, 2019 – Dubai Islamic Economy Development Centre (DIEDC) today signed a memorandum of understanding (MoU) with the Dubai International Financial Centre (DIFCA), the Dubai Financial Market (DFM), and Climate Bonds Initiative (CBI) to collaborate on growing the green sukuk sector and stepping up the exchange of knowledge and expertise in the field.

The MoU signing took place at the DIFC. Signatories from the various participating entities included Abdulla Mohammed Al Awar, CEO of DIEDC, Arif Amiri, CEO of DIFC Authority, Hassan Al Serkal, Chief Operating Officer (COO) and Head of Operations Division of DFM, and Sean Kidney, CEO of Climate Bonds Initiative.

The agreement aims to promote the issuance of green sukuk in the UAE and across the world, in addition to developing the standards of certification for green sukuk along the lines of the Climate Bonds Standard and Certification Scheme.

CBI developed the Climate Bonds Standard, a set of eligibility criteria to determine whether a relevant bond can be categorised as ‘green’, thereby enabling investors to make informed decisions about the bond’s environmental credentials. Meanwhile, CBI’s Climate Bond Certification Scheme is the only accreditation mechanism for green bonds that is globally accepted. Together, the Climate Bonds Standard and Certification Scheme serve as a benchmark for all such green

certifications and comprise a robust pre- and post-issuance assurance framework.

Earlier this year, the DFM and DIFC launched the Dubai Sustainable Finance Working Group, in cooperation with 10 founding members including the Dubai Islamic Economy Development Centre. The Group is aimed at achieving the UAE’s nationally determined contributions to the UN’s Sustainable Development Goals and the strategic objectives of Dubai Plan 2021. The Group also works to develop Dubai’s financial services sector and shape a sustainable financial hub in the region, focused on environmental, social, and governance (ESG) integration, cultivating green companies and green financial instruments including green sukuk, as well as encouraging long-term responsible investment for a sustainable future.

Speaking on the MoU, Abdulla Mohammed Al Awar, CEO of DIEDC Said: “Through the MoU, DIEDC and its partners aspire to maximise the potential of the Islamic economy sectors, particularly Islamic finance, and contribute to increasing the number of businesses from the Far East that tap into these sectors.”

He added: “This agreement builds on the Centre’s vision and lays down the foundation for promoting green sukuk locally and internationally. The demand for green sukuk is steadily growing and requires an appropriate certification scheme that allows the segment to flourish.

“We are confident in our choice of partners for this important project. Our collective expertise will no doubt accelerate the growth of this market, and we invite all relevant stakeholders to come forward and contribute to this worthwhile endeavour.”

Arif Amiri, CEO of DIFC Authority, said: “Sustainable finance is fundamental to driving the future of finance in the region and across the globe. The DIFC shares a common goal with the DFM and DIEDC to build a strong and sustainable financial services sector in Dubai, the UAE and across the region. Through this collaboration, and by partnering with CBI, we are reinforcing the synergies between ESG and Islamic Finance, allowing us to lead the way in ethical financial solutions.”

For his part, Hassan Al Serkal, Chief Operating Officer (COO) and Head of Operations Division of DFM said: “As the first Islamic Shari’a-compliant exchange globally since 2007, the DFM implements numerous initiatives to strengthen Dubai’s position as the capital of Islamic economy globally in collaboration with prominent institutions in the UAE and beyond. The Green Sukuk Initiative is a significant step in the joint efforts to create favorable standards and regulations that support the development of the Islamic economy. The DFM is specifically playing an active role in this sector through its Shari’a standards on issuance and trading of shares, Sukuk as well as the investment

funds that have focused on the green financial instruments. Similarly, the DFM is promoting best practices of sustainability amongst market participants and it is looking to become the region’s leading sustainable financial market by 2025 in line with Dubai’s sustainability and green economy drive, especially that responsible investing, sustainability and environment protection are some of the key objectives of the Islamic Shari’a.”

Sean Kidney, CEO of

Initiative said: “Scaling up green sukuk is absolutely vital to meeting the climate finance challenge we all face. This agreement provides a new platform for cooperation around growing regional and global green sukuk, compatible with international standards. It signals a new phase of stakeholder cooperation to build investor confidence and market opportunities for green investment.”

According to American credit rating agency Moody’s, green bond issuance rose by 40 per cent to US$47.2 billion globally in Q1 2019, backed by strong corporate issuers. These financial instruments are structured to fund initiatives related to climate change and the environment. Also, in its report, the agency noted that around US$15.9 billion worth of green bonds were corporate, accounting for roughly a third globally. Non-financial corporate issuance contributed 17 per cent to the overall issuance, accounting for US$8.1 billion.

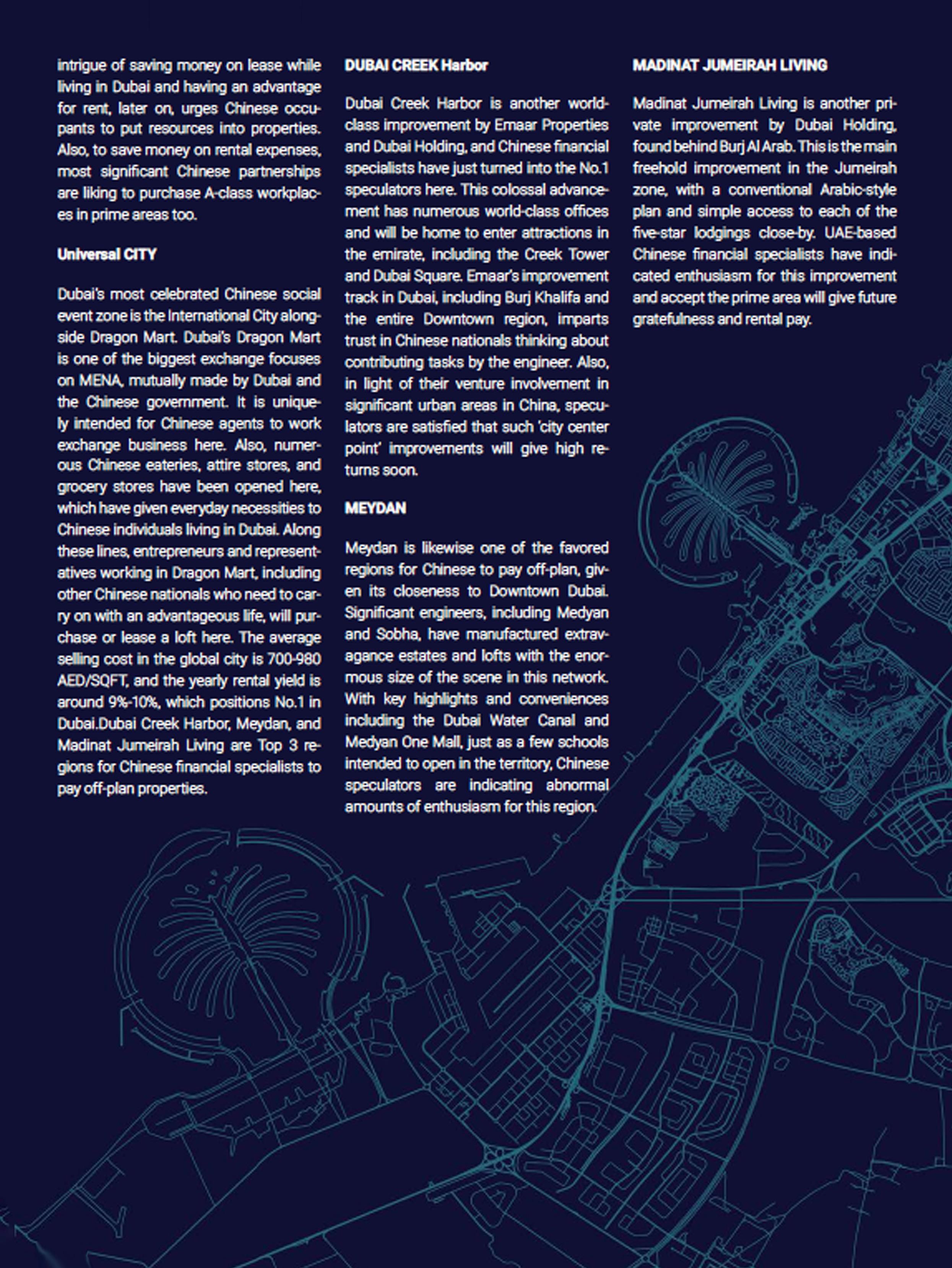

In support to the UAE’s important role as a ‘vital station along the new Silk Road’ as reflected in the latest agreement between China and the UAE valued at AED 12,486 billion, Dubai FDI, the investment development agency of Dubai Economy (DED), is set to embark on its latest investment mission to major cities in the country as part of its strategic efforts to support the global infrastructure program Belt and Road initiative. Dubai FDI will lead a delegation of government and business leaders to take part in Dubai Advantage Forum and exclusive meetings in Shanghai and Shenzhen from June 24 to 29, 2019.

The delegation will be composed of Khalid Al Boom, Deputy CEO; Ibrahim Ahli, Director of Investment Promotion Department; Nasser Al Suwaidi, Expert from Dubai FDI; Ahmad Hamza, Executive Director – Free Zone, DMCC; Shoaib DAl Rahimi, Vice-President of the Business Park, Dubai South; Imran Sheikh, Chief Investment Officer, Dubai Healthcare City Authority; Khalid Sharaf, Head of International Business Engagement at Expo 2020 Dubai; Nadimeh Mehra, Vice President – District 2020; and Michael Qu, Cargo Manager, Emirates Skycargo, in addition to other officials from these entities. They will engage in an interactive platform to discuss Dubai’s leading initiatives in facilitating foreign direct investments (FDI) through ‘Dubai Advantage Forum 2019’ in Shanghai on June 24 as well as take part in several business meetings in China on June 25. A roundtable discussion will be held in Shenzhen on June 27 followed by direct visits to major Chinese companies and business meetings on June 28.

Fahad Al Gergawi, CEO, Dubai FDI, said: “Dubai has always played an important economic hub for Asia and this role continues to evolve towards greater heights following China’s launch of the Belt and Road initiative, the new global trading highway designed to link Asia to Africa and Latin

America directly through the Middle East. With the emirate’s current strategic position as a regional base for many Chinese companies, the Dubai Government continues to engage in initiatives that would further promote the ease of doing business in the emirate for China’s public and private sector in line with its global ambition to pave the way for the new Silk Road.”

Khalid Al Boom, Deputy CEO, Dubai FDI, noted: “China maintains its leading position as Dubai’s topmost trading partner with its market value reaching AED 139 billion in 2018. The emirate’s key trading partners in China continue to enjoy lucrative opportunities market and we are keen to promote and facilitate the investment processes for leading companies in Shanghai and Shenzhen in this planned mission. Following the recent major deals which took place between UAE and China, we are confident that the forums and business meetings to be held soon in Shanghai and Shenzhen will open new opportunities for leading businesses in major sectors.”

Dubai continues to promote the emirate’s investment growth opportunities in line with the UAE’s plan to expand global leadership in key sectors such as aerospace, manufacturing, advanced technology, logistics, healthcare, financial services, life sciences, and food products and agriculture. The UAE has been a strong bilateral trade partner of China, which is its second largest trading partner, valued at AED 194,642 billion and is expected to soar up to AED 257 billion by 2020.

Following a recent agreement, a 60-million square feet ‘Traders Market’ which received AED 8,814 billion of Chinese investments will be built opposite Dubai’s Expo 2020 site, aimed at providing an international station for storing and shipping Chinese products from Jebel Ali to the world.

This market-leading initiative will facilitate faster, more secure onboarding and exchange of supporting documentation via advanced distributed technologies, including blockchain.

Dubai, UAE: Dubai International Financial Centre (DIFC), the leading international financial hub in the Middle East, Africa and South Asia (MEASA) region, together with Mashreq, a leading financial institution in the UAE, through its Corporate and Investment Banking Group, and norbloc, the leading Know Your Customer (KYC) and client onboarding fintech regionally headquartered in DIFC, announced today their strategic alliance to launch the region’s first production-ready blockchain KYC data sharing consortium in Q1 2020 to support businesses and Corporates in Dubai.

In line with the UAE Blockchain Strategy 2021, the alliance entered into a MoU in January 2019 with the strategic intent to create a first-to-market platform serving banking sector clients in the UAE. This market-leading initiative will facilitate faster, more secure onboarding and exchange of supporting documentation via advanced distributed technologies, including blockchain. The Program also outlines the creation of a Consortium Agreement to govern the mutualization of KYC efforts among future participating banks, government bodies, financial institutions as well as other licensing authorities to subscribe to the platform.

The alliance under a Tripartite Agreement has determined the optimal business framework and technical architecture to support the requirements of registered companies, financial institutions and regulators alike following a thorough and joint ‘Proof of Concept’, with the intended results further validating the positive impact of such an ecosystem. As a result, norbloc’s enterprise-grade, blockchain-powered ecosystem will be the first in the region to enable secure, customer-controlled KYC data sharing, initially between DIFC and Mashreq Bank.

By Q1 2020, companies will be able to digitally create a single KYC record (which will be authenticated with electronic ID) to simultaneously share data with their various financial institutions. This will accelerate the time required to acquire a bank account number for newly registered companies and reduce the burdensome and costly requirements of managing KYC data for already registered companies. This is in stark contrast to the status quo, whereby multiple paper-based KYC files are redundantly originated and managed in silos.

While DIFC and Mashreq Bank will serve as inaugural members, the consortium will be open to all qualified financial institutions and licensing authorities. The future vision is for the consortiumrun ecosystem to serve the greater good by improving the ease of doing business as well as uplifting customer due diligence standards in the UAE.

Particularly considering recent UAE Banks Federation (UBF) reports which have advocated for the exploration of blockchain to enhance KYC processes, there has already been strong interest in consortium membership and future members will be announced in the coming months.

Through the UAE Blockchain KYC Platform, DIFC and Mashreq Bank have further demonstrated their commitment and leadership to adopting innovative technology and engaging pioneering fintechs, such as norbloc, with the objectives of better serving their customers and satisfying their regulatory obligations.

H.E. Abdul Aziz Al Ghurair, CEO of Mashreq Bank, said: “At Mashreq, we recognize that our corporate clients have a unique and diverse range of requirements. Therefore, a significant priority for us is to constantly tailor innovative and state-of-theart solutions that match their specific demands. In this case, investing in blockchain technology will greatly improve the customer onboarding and compliance experience, making the entire process unified as well as hassle-free. Emerging technologies such as blockchain also represents significant opportunities for banks in the UAE and wider region to create new revenue streams, which will in turn drive sustained business growth over the long-term. We are excited to initiate this blockchain KYC consortium as a testament to Mashreq’s position as the most progressive bank in the region.”

Arif Amiri, Chief Executive Officer of DIFC Authority, said: “By ensuring the consistent evolution of our world-class business environment and offering, the DIFC continues to reinforce its position as one of the most advanced financial centres in the world. This initiative provides a unique opportunity to harness innovative technology to deliver a seamless experience for both newly established and existing companies at the Centre. As we enter a new period of growth and expansion, DIFC is committed to shaping the future of finance in the MEASA region, and across the globe. It’s great to strengthen our relationship with our long-standing partners at Mashreq, while seeing norbloc, a FinTech firm that the DIFC has helped to accelerate in the region, become a true success story.”

Ahmed Abdelaal, Executive Vice President - Head of Corporate & Investment Group, Mashreq Bank: “As a leading digital bank in the UAE, Mashreq continues to identify commercial benefits for emerging technologies, specifically those that create efficiencies within our operations and enhance the banking experience for our customers. The KYC blockchain initiative exemplifies this strategy by leveraging technology that is secure, easy to integrate and automates the onboarding process for our corporate clients. A first for the region, the platform ensures the protection of customer data while offering them the convenience and flexibility of smart banking. With a launch planned for the first quarter of next year, we aim to successfully roll out this initiative to our business clients and explore the expansion of this initiative to additional segments, further building on our commitment to being the region’s most innovative bank.”

Astyanax Kanakakis, CEO of norbloc, said: “This announcement is truly a watershed moment. Our growing consortium will cultivate an ecosystem in the UAE that will set the global standard for how KYC data should be shared. It also serves as a testament to the vision of DIFC and Mashreq Bank in fostering innovation and partnership with fintech companies. Participation of such top-tier financial institutions and licensing authorities proves that all future stakeholders are able to benefit from Fides, our blockchain KYC data sharing platform, at scale. The realization of this consortium is another realworld example of the fulfilment of norbloc’s mission: to provide customers full and streamlined control of their data, reduce costs for financial institutions and foster enhanced regulatory compliance.”

The other day I noticed an interesting news title that said: “Our parents had public pension funds, we have cryptocurrencies.” I couldn’t agree more. Cryptocurrencies are our chance, this is our moment.

I’m happy to see that the interest in Vibe tokens exceeded our wildest expectations. The 5th of September is less than a month away and I’m sure that we’ll see thousands of contributors putting their ETH in to buy Vibe tokens.

As every responsible CEO, I will of course exchange a significant part of my crypto portfolio into Vibes, but I’m biased, because I believe in myself more than I believe in anything else.

So it’s important that I put myself into the shoes of unknown contributors, who will trust us with their funds. Here are five important factors I would look for when considering about taking part in Viberate’s crowdsale:

When we were raising our seed round everyone told us to emphasize our team in our presentation. So in the end our deck was around 30% about the people, working on the project. One of the investors then told us in the simplest way possible, why they invest into teams and not projects. He said: “I’d rather invest into a great team with an OK idea than into a crappy team with a great idea. You can have the best idea in the world, but can’t execute it with a bad team.”

We have the best team, everybody agrees No, really. The founders have worked together for 15 years, we’re not just business partners, we’re friends. Music has been our center focus for the whole period and we know everything there is about the music business. We are experienced managers and skilled team leaders, joined by loyal employees, who follow our vision and share our passion. We worked with big international clients such as Philip Morris, Vodafone, Hewlett-Packard and many others, who trusted us with their event management budgets. Plus, we’re cool to hang out with.

We started the project because we were lost in the flood of trends in music. New artists emerge daily and it’s hard to be on top of things, no matter how experienced you are. When you’re solving your own problems, you’ll go extra mile to nail it. We’ve always followed the rule that said: “If we want it to be good enough for clients, it first needs to be good enough for us.” The same goes for Viberate.

The ICO boom has seen some insane valuations for projects that were barely existing as an idea, scribbled on a napkin. Vasja already shared our thoughts about uncapped ICOs, but it’s not only about not having a cap, it’s also about where you set it. In order to develop all planned features we

need around $6M and then we need all the money we can get to advertise it globally. We could spend hundreds of millions on advertising, but we set our ad cap at another $6M. It’s a lot of money, but global campaigns cost much more than that. Still, it’s enough to kickstart the service and go from there.

This isn’t really an argument when you’re raising money from VC funds. But apparently it is when you’re selling tokens. Viberate already exist as an awesome service, where you can explore the world of live music, find new acts or if you’re a musician open up a profile and use it to monitor the popularity of your career. By buying Vibe tokens, you are contributing to a project that already has value and a vibrant community covering our backs. The database you see today was built with the help of over 50 thousand contributors. We achieved a lot, but that’s only the tip of an iceberg. Here’s what’s still in front of us.

The guys at Hacked.com said it best: “Live music isn’t going away, and becomes more valuable as recorded music sales continue to decline. The potential to provide disruptive services which actually benefit the industry they target is great, and even a 10% take of the industry leader in ticket sales would equate to almost a billion dollars in annual revenues.”

Recorded music is nowadays mostly a promotional tool to help drive ticket sales. For most of musicians, their primary revenue source are live shows and there’s no sign of changes here. A lot of artists are giving away their music to fans for free and hope that they will show support by attending a live show. That’s why we decided to put our focus entirely to the live music segment, because we’re sure it will only get bigger.

As the United Arab Emirates launches a new anti-money laundering system, reporting entities are required to register by the end of this week, a UAE central bank official said at a press conference in Abu Dhabi on Sunday.

The new platform (goAML) has been developed by the United Nations Office on Drugs and Crime (UNODC) for use by the UAE Central Bank’s Financial Intelligence Unit (FIU).

Reporting entities required to register on the platform by 27 June include financial institutions such as banks, finance companies and exchange houses. The goAML platform will also be used by law enforcement agencies, and designated non-financial professions such as accountants and lawyers.

Around 50 percent of 900 targeted entities have already registered on the platform, Ali Faisal Baalawi, acting head of the UAE

Central Bank’s Financial Intelligence Unit, told reporters at the conference. He said that registration began last month.

The platform (goAML) facilitates the receipt, analysis, and dissemination of illicit transactions and activity to law enforcement authorities in the UAE.

According to Baalawi, the UAE is the first country within the GCC to launch this platform, which was customised to the requirements of the UAE’s Anti-Money Laundering and Counter Terrorist Financing framework.

As for the wider MENA region, there two other countries that have already started developing goAML, Hatem Fouad Aly, the UNODC representative for the GCC region told Zawya on the sidelines of the event, without disclosing which countries.

In October last year, the UAE passed a law to combat terror financing and money laundering,

in line with the requirements of the Financial Action Task Force (FATF), which is the international organisation responsible for setting the standards for combating illicit financial transactions. The law mandated setting up a committee to assess and identify risks and the effectiveness of measures against money laundering and terror financing. (Read more here).

The Paris-based Financial Action Task Force is set to visit the United Arab Emirates to begin its latest Mutual Evaluation of the country – its first since the 2008 financial crisis – next month.

On Friday, Saudi Arabia was granted full membership of the Financial Action Task Force (FATF) in a move that is set to improve its position among foreign investors.