3D Printing and Printed Materials in 2020: A Challenging Year But Fascinating Times Ahead, Reports IDTechEx

UNICEF Cryptocurrency

Fund announces its largest investment of startups in developing and emerging economies

NEW LAW ISSUED ON CONTRACTS, WAREHOUSE MANAGEMENT IN DUBAI GOVERNMENT

The Swedish AI company, Artificial Solutions, moves fully to SaaS and initiates restructuring program of sales and services to accelerate growth

24

AFOMA to Enable Social Impact with Decentralized e-Commerce

30 60 46

Bayut celebrates the successful female leaders in UAE real estate ahead of Emirati Women’s Day

BofA Launches CrossBorder Payment Tracker, Expands SWIFT gpi Support to 140+ Currencies

BOSTON, Dec. 15, 2020 /PRNewswire/ -- Although 3D printing as a technology has been around for several decades, it has made serious headway into factories, homes, and offices since the patents for the fused deposition modeling (FDM) printing process expired in 2009. In the years have that followed, 3D modeling has become increasingly popular – in homes for hobbyists and in industry, particularly for prototyping and the early phases of

product development. But in 2020, the landscape began to change once more.

Although the COVID-19 pandemic has interrupted the 3D printing sector and its end users (such as printing bureaus), new directions of travel have nonetheless emerged. Some opportunities have even been directly prompted by the pandemic.

In late 2019/early 2020, health systems in much of the world went onto a war footing as the COVID-19 pandemic took hold. Demand for PPE and medical peripherals like filters and swabs went through the roof, but 3D printing was well placed to respond –and it did. Italian company Isinnova developed a 3D-printed connector, the Charlotte valve, which could be used to fit a commercial snorkeling mask to CPAP machine; this was swiftly followed by 3D-printed swabs and personalized 3D-printed face masks. Even emergency dwellings to isolate quarantined patients were printed. All of these were gratefully received but highlighted an issue that continues to plague the sector: a lack of regulatory control and standardization within 3D printing as a whole made it difficult for printed medical devices to gain the approvals required for use as medical devices. This, in turn, limited the extent to which they could be used.

However, the expanding range of materials used in printing, along with the experience granted

by COVID-19, has alerted many people to the potential of 3D printing in healthcare. In particular, the ability to produce specialist, customized items on demand is attractive because it reduces waste and inventory throughout the supply chain. While traditional plastic filaments may be of limited use, given their fragility and issues around infection control, the increasing use of metal and bioprinting is opening up a world of possibilities.

COVID-19 has also shown the advantages of 3D printing in terms of speed, customization, and increasing versatility, along with reliable production (if one printer in a bureau breaks, there will be several others than can quickly take on its work – this is generally not the case in traditional manufacturing). Sales of industrial-scale printers plummeted as the world went into lockdown, but printer manufacturers may be comforted by a growing number of applications in the longer term. Meanwhile, sales of home printers soared as people stuck at home sought hobbies to pass the time.

Printing with plastics has been less dominant in 2020, but this is not the end for traditional filaments (powders have been less affected), and IDTechEx foresees a rebound in due course. Meanwhile, the 3D sector as a whole is shifting, and in particular, more companies are integrating 3D printing into general manufacturing processes as well as prototyping. This calls for a wider range of printing materials and printers, depending on the components or processes involved.

A key market driver is sustainability, with several consumable firms investigating bio-sourced materials – not merely to enhance biocompatibility in medical or research settings but also to produce ‘greener’ biodegradable end products, including packaging.

While plastics are widely acceptable for prototyping, the same is not true for all components or end products, so newer materials are of interest to all concerned. The world market for metal components, for example, is worth trillions of dollars each year, and 3D printing meets many end-users’ requirements for customizable, decentralized production.

Thus, 2020 has seen interest in metal additive manufacturing, in particular with aluminum alloys and steel. Titanium, Cobalt-chrome, and other emerging variants are particularly used for medical printing due to longevity and biocompatibility requirements. Some companies have now produced and protected proprietary consumables, such as liquid metal, as production scales up. The increasing appetite for new printing materials coincides with the development of printers that can create larger items, and together these are meeting the diverse and growing demands of multiple sectors for 3D printed products.

Then there is the exciting field of composites that are gaining notable traction. IDTechEx has seen an increasing number of players, demonstrations, and partnerships expanding from the 2019 news surrounding Markforged and Desktop Metal. The most notable announcement being the $48.5m Series B funding raised by Arris Composites. However, any growth may not be immediate, thanks to the influence of COVID-19.

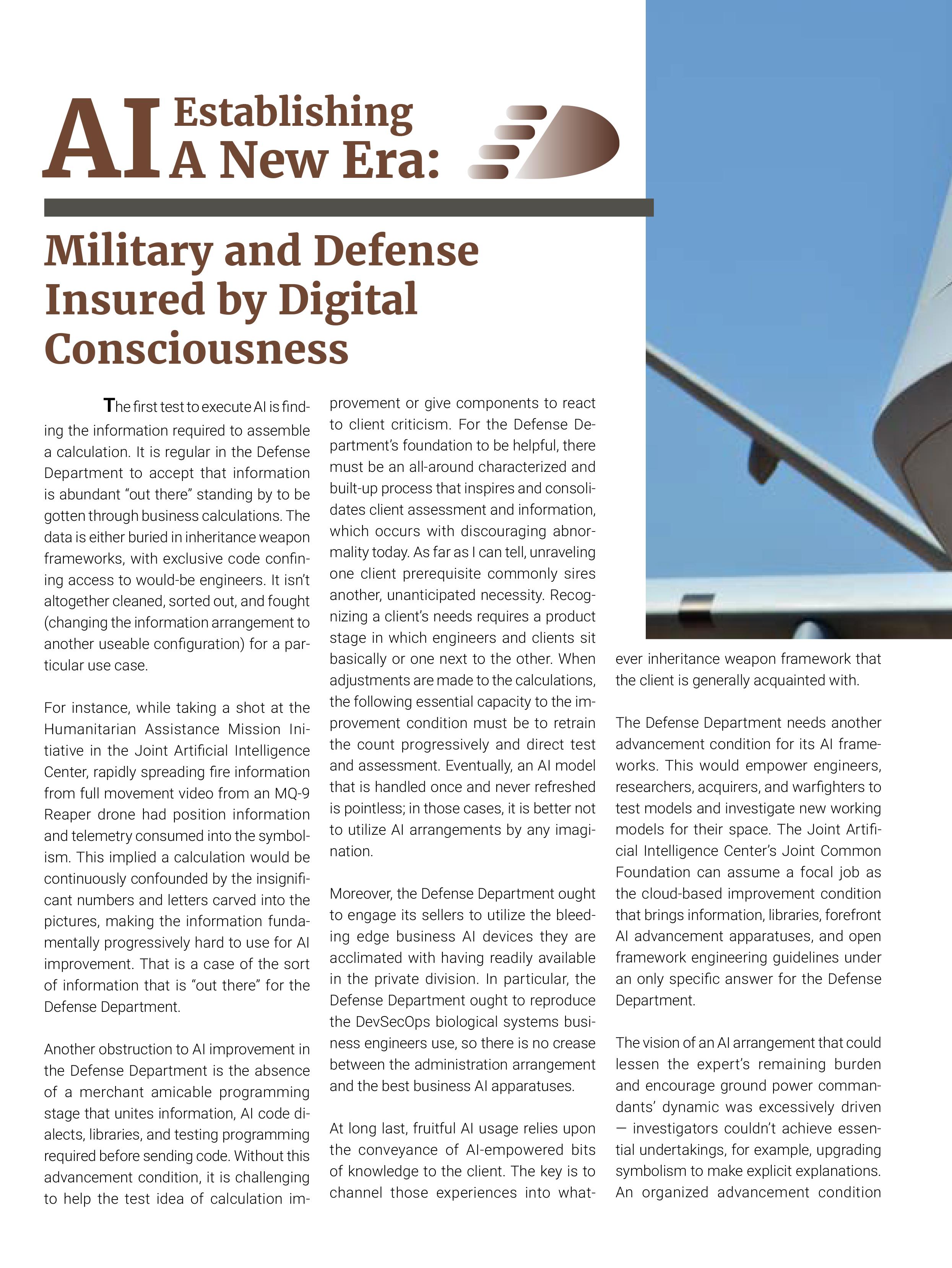

Aerospace is an important market for 3D printing, especially with metal, and many commercial airliners now have printed components and have been looking for more. An increasing number of appropriate printing materials (primarily alloys) have come to market, and both 3D printing technologies and materials have now evolved to the point that alloy proportion and composition can be varied across the component, and larger components can be printed.

The advantages of 3D printing for aerospace lie in saving weight (which in turn saves huge amounts in fuel costs), reducing the buy-to-fly ratio, or in customizable, on-demand, and decentralized manufacture. For similar reasons, automotive is another key market for 3D printing.

Binder jetting has continued to gather attention across 2020, Desktop Metal has undergone a merger and is live on the New York Stock Exchange, raising even more funding, GE Additive announced more partnerships, including Sandvik, and HP announced more users. However, aerospace has

been devastated by the COVID-19 pandemic, and automotive has also suffered. With vaccination programs now being rolled out, the speed at which both sectors recover will have knock-on effects for makers of 3D printing materials and for printing bureaus. Clearly, both of these will affect the consumables market.

Without a doubt, 2020 has been challenging for 3D printing and consumables as it has been for many sectors, but there is plenty left to play for. More and more companies are finding uses for additive manufacturing, and the technology is maturing beyond product development and into mainstream manufacturing. The demand for metal prints is such that metal printing materials look set to equal or overtake plastics and resin, and new players are entering the field, while bio-inks are at a much earlier stage of development but show great potential. However, despite the influx of new products, plastics have a long-term future and are likely to bounce back from 2020 levels as the market and technologies mature.

Fund announces its largest investment of startups in developing and emerging economies

Among the awardees are companies expanding work to use their technologies to mitigate the hardships of COVID-19 on children and youth

New York, 19 June 2020 – Eight technology companies in developing and emerging economies will receive investment from the UNICEF Cryptocurrency Fund (CryptoFund) to solve local and global challenges.

The CryptoFund will invest 125 ETH each in the eight companies – from seven countries – to develop prototypes, pilot, or scale their technologies over six months: Afinidata, Avyantra, Cireha, Ideasis, OS City, StaTwig, Somleng and Utopic.

All investees have previously received up to $100,000 from UNICEF’s Innovation Fund and are now receiving cryptocurrency to continue the development of their open-source and digital public goods.

Within the scope of their technology, several investees are working to mitigate the hardships of COVID-19 on children and youth around the world.

They are collaborating with national governments and local partners to send vital messages on COVID-19, track the effectiveness of rice delivery to vulnerable communities, improve children’s literacy through remote learning, treat pandemic and isolation-related anxieties, and other vital solutions.

“We are seeing the digital world come at us more quickly than we could have imagined – and UNICEF must be able to use all of the tools of this new world to help children today and tomorrow,” says Chris Fabian, Senior Adviser, co-Lead, UNICEF Ventures.

“The transfer of these funds – to eight companies in seven countries around the world – took less than 20 minutes and cost us less than $20. Almost instant global movement of value, fees of less than 0.00009% of the total amount transferred, and realtime transparency for our donors and supporters are the types of tools we are excited about.”

Afinidata (Guatemala) is further developing its AI-based app to provide parents with personalized early childhood educational activities.

Avyantra (India) is expanding the functionality of its health app which uses data science to support frontline health workers in the early diagnosis of neonatal sepsis.

Cireha (Argentina) is scaling the reach of its accessible app in three countries to help more children with speech impairments communicate using symbols.

Ideasis (Turkey) is transitioning its exposure therapy tool from VR to WebVR to address anxieties and phobias from users’ homes. They will develop new therapy scenarios to address COVID-19 and isolation-related disorders.

OS City (Mexico) is issuing blockchain-based government assets, heading towards issuing 1,000 blockchain IDs to allocate children’s educational diplomas.

StaTwig (India) is piloting its blockchain-based app by partnering with the Government of India to track and improve the delivery of rice and support their effort to secure food for millions living in poverty – a need amplified by the onset of COVID-19.

Somleng (Cambodia) is scaling its low-cost Interactive Voice Response platform by partnering with the Government of Cambodia to send vital information about COVID-19.

Utopic (Chile) is transitioning its learning game from VR to WebVR and empowering educators to assess, track, and help improve children’s reading skills from their homes during COVID-19 containment measures and beyond.

Selected from almost 40 startups that have graduated from the UNICEF Innovation Fund, these eight companies have undergone technical evaluations, quality assessments of their open-source tech solutions, evidence of impact and more. They join three other grantees that received the Fund’s first cryptocurrency investment last year.

Besides funding, investees receive business growth mentorship, product, and technical assistance, opensource and UX and UI development, access to experts and partners, as well as opportunities to showcase their solutions.

The UNICEF Innovation Fund and CryptoFund currently have an open call for blockchain solutions to apply for funding (up to $100,000 and cryptocurrency combined) and mentorship.

Abu Dhabi Ports, part of ADQ – one of the region’s largest holding companies with a broad portfolio of major enterprises spanning key sectors of Abu Dhabi’s diversified economy, today announced another step in its drive to enhance the emirate’s rank as an international hub for trade and logistics with the acquisition of MICCO Logistics.

With the integration of MICCO as part of Abu Dhabi Ports Logistics, the Group’s logistical arm is setting itself apart from the competition. Abu Dhabi Ports Logistics leverages MICCO’s experience and capabilities as the emirate’s first provider of endto-end logistics solutions.

Thanks to the powerful combination of MICCO’s international and regional logistics solutions, its large and diversified transportation fleet, and a network of temperature-controlled warehouses, along with the Group’s extensive multi cargo

handling and industrial zone capacity, Abu Dhabi Ports is in a unique position to serve its customers along every segment of the supply chain.

The added capacity enables the organisation to manage all customer touch points including: sourcing; PO management; international freight handling through Project, Commercial, and Contract Logistics; customs clearance; stevedoring; local, regional, and international transportation; Airline Road Feeder Services; and, storage, order fulfilment and handling solutions via its strategically located network of distribution centres.

Abu Dhabi Ports’ enhanced logistics portfolio will ensure that it remains the leading provider of logistics services for the energy sector, while at the same time it expands its value offer to other strategic sectors including retail, e-fulfilment, FMCG and pharmaceutical/healthcare.

H.E. Khalifa Sultan Al Suwaidi, Vice Chairman of Abu Dhabi Ports and Chief Investment Officer at ADQ, commented: “We are collaborating with Abu Dhabi Ports to transform its logistics arm into one of the largest, most capable and most cost-efficient providers of fully integrated and holistic logistics solutions in the UAE and beyond. This reflects ADQ’s key role in stimulating economic development and growth through our logistics cluster while further strengthening Abu Dhabi Ports’ strategic position as a leading provider of integrated port and industrial zone services, and a facilitator of global maritime trade and logistics.”

Captain Mohamed Juma Al Shamisi, Group CEO, Abu Dhabi Ports, said: “The acquisition of MICCO is a critical step in our emirate’s journey to establish itself as a leading hub within the global trade and supply chains.

“The combined advantage of both organisations means that Abu Dhabi Ports will be able to compete on the regional and global stage as a provider of holistic logistics solutions, enhancing what we offer to both existing and prospective customers, while at the same time furthering our contribution to Abu Dhabi’s non-oil GDP and the government’s diversification efforts.”

Robert Sutton, Head of Abu Dhabi Ports Logistics Cluster, said: “Aligning directly with Abu Dhabi Ports’ growth strategy, the integration of MICCO has enabled us as an organisation to both enhance our service offering, while also meet the needs of a broader global market.

“Our greatly expanded capacity to deliver a wide spectrum of services across the entire supply

chain has also opened doors for us to target new opportunities in segments that have been traditionally underserved, including FMCG and healthcare. With the addition of MICCO, we are truly connecting the world with the Gulf and beyond.”

Founded in 1978, MICCO Logistics is one of the first local freight forwarders established in Abu Dhabi and one of the first businesses to offer consolidated freight services to the emirate’s oil and gas industry.

With a modern ground fleet comprised of more than 350 prime movers with diversified fleet of trailers, specialised storage facilities, MICCO’s diverse portfolio of logistics solutions includes freight management in Project, Contract, and Commercial Logistics, multi-modal transport, warehousing and distribution, stevedoring, as well as road feeder services for the aviation segment.

As the first logistics company to establish its presence in the Khalifa Industrial Zone Abu Dhabi (KIZAD), MICCO’s distribution centre includes several temperature-controlled warehousing services that are ideally suited for storing sensitive cargo for extended periods.

The state-of-the-art Warehouse Management Systems and highly advanced GPS systems add to the technical excellence extended within the supply chain.

In his capacity as the Ruler of Dubai, Vice President and Prime Minister of the UAE, His Highness Sheikh Mohammed bin Rashid Al Maktoum has issued Law No. (12) of 2020 on Contracts and Warehouse Management in Dubai Government.

The Law will help set standards for regulating procurement processes of government entities in line with the vision of Dubai Government.

It aims to develop an efficient system for government organisations to further raise the quality of their procurement and warehouse management.

The Law also seeks to foster integrity, transparency and equal opportunities among suppliers and provide a legal framework for automating the procurement and warehouse management operations of government entities as part of achieving Dubai’s smart transformation objectives.

The new legislation outlines the responsibilities of Dubai’s Department of Finance, the Smart Dubai Government Establishment and all units responsible for inventory management in government entities.

The Department of Finance is tasked with creating guidelines for the governance of procurement, and asset and inventory management, as well as drafting policies and decisions related to unified procurement processes.

The Smart Dubai Government Establishment is tasked with coordinating with public entities to create a unified online government system to manage contracts and inventory; developing associated systems and programmes; ensuring

proper operations, maintenance, updates and supervision of the system; and monitoring compliance of government entities with the system.

The Law stipulates the creation of a ‘Central Registry of Suppliers’ as part of the government’s unified online system for managing contracts and inventory.

Furthermore, the Director-General of each government entity is authorised to create an ‘Inventory and Valuation Committee’ to manage inventory and assets.

The Law does not apply to commitments made by government procurement departments to projects and programmes supported by the government, especially those relating to small and medium enterprises registered under the Hamdan bin Mohammed Programme for youth projects, which is covered by Law No. (23) of 2009 on the Mohammed Bin Rashid Establishment for SME Development.

Law No. (12) of 2020 annuls Law No. (6) of 1997 on Contracts of Government Departments in the Emirate of Dubai, and its amendments. The Law also annuls any clause in any other legislation that may contradict its provisions.

The Law will be effective from January 1, 2021 and will be published in the Official Gazette.

Estonia and the United Arab Emirates are co-hosting a virtual conference Global Business Summit on 16 December, 2020. The aim of the event is to bring together private and public sectors to accelerate digital transformation in the fight against COVID-19.

Global Business Summit is bringing the world’s governments and businesses together to share some of the world’s best digital solutions, which can help confront the complex challenges posed by the pandemic. The sectors featured are health, education, e-governance, cyber security, food technology, smart mobility and logistics, finance and manufacturing.

Foreign Minister of Estonia, Urmas Reinsalu expressed hope that the event will inspire countries and business sectors globally to boost efforts in digitalisation. “The year 2020 has proven beyond expectations that we need strong digital infrastructures now more than ever before. Estonia has long-standing experience in this field, and our experience has shown that public and private sectors must work together in order to achieve scalable and successful digital transformation,” said Reinsalu.

H.H. Sheikh Abdullah bin Zayed Al Nahyan, Minister of Foreign Affairs and International Cooperation underlined: “Countries equipped with the essential resources and capacities, and a firm commitment to promoting innovation and advanced technology have demonstrated their ability to overcome

challenges affecting countries and peoples unequally throughout the COVID-19 pandemic”.

Moreover, His Highness said: “Through a collaborative approach between the public and private sectors, our solutions must prioritize the welfare of all—regardless of geography or ideology—to uplift all members of the international community”. His Highness added: “Practical digital responses to complex issues are the way of the future, and the UAE is honored today to partner with the Republic of Estonia in outlining a roadmap of global cooperation in this critical field to the benefit of humankind.”

Countries exhibiting their best digitalisation practices at the event include Estonia, the United Arab Emirates, Germany, France, Finland, Austria, Poland, Russia, Turkey, Latvia and many others. Over 30 countries have stepped up to share their digital innovations that are making a difference in their countries. Additionally, inspiring keynote speakers will be featured as well. The event can be publicly streamed at https://globalbusinesssummit.online/. The updated list of speakers will be available on the website as well.

Artificial Solutions® (SSME:ASAI), the leading specialist in enterprise conversational AI, today announced its new SaaS strategy, re-shaping its market offering to modular conversational AI solutions. The company is also restructuring its organization to better serve the quickly maturing AI market to increase growth and reduce the run rate operating costs net after investments with approximately 35 MSEK on an annual basis.

“Enabling brands to deliver customer experiences as quickly and efficiently as possible is paramount in this digital age,” said Per Ottosson, CEO at Artificial Solutions. “We are adamant in empowering developers with a modern SaaS platform where integrators or brands can realize time-to-value much faster in all our 36 languages and dialects. Our existing customers will benefit from an even faster innovation than before.”

“The changes allow us to revamp our delivery model which enables a streamlining of the organization. As a result, we will require less functions and staff. This has effects in our legacy organization in the UK but also in other countries. This will provide us speed but also reset our cost baseline to approximately 35 MSEK lower cost per year,” said Per Ottosson.

Transformation cost of 6 MSEK is expected in Q4 2020 and Q1 2021. The reduction of the net operating costs will have a positive impact on cash flow from today with full run rate impact from second part of Q1 2021.

As the phases of the COVID-19 pandemic progress, clients across geographies are pressured towards faster digitalization and are now resetting their strategies. With the new SaaS model, customers and partners will be able to:

Lower the total cost of ownership of Conversational AI-implementations

Teneo solutions can be built in half the time versus building with current Conversational AI-solutions, and scale much faster.

Artificial Solutions hybrid language model reduces the need for expensive training data and can enable rapid deployment of multi-language solutions.

Enable rapid prototyping and shorter release cycles

Teneo as development platform and conversational engine solves common pain points within Conversational AI, by rapid prototyping and shortening of the release cycles for market leading conversational bots or virtual agents.

Improve productivity

Artificial Solutions enables accelerated cloud-based API services. The close engagements with clients such as Skoda and Swisscom have been instrumental in setting the new strategy.

Teneo offers the most powerful conversational data insights toolkit available on the market.

All new functionality is available as of today both to the benefit of existing customers and customers of other bot platforms.

With the new go to market strategy, Artificial Solutions addresses a larger part of the Conversational AI market, projected to reach USD 16.2 billion by 2024 (Fortune Business Insights).

“Conversational bots and virtual assistants are today widely deployed, with Teneo our customers can add the today dearly needed AI powered customer support services and omni channel deployments,” continued Per Ottosson. “Having a cloud-based Teneo at the core of their deployments, enterprises can get a faster ROI in their existing conversational AI-investments.”

The shift to a SaaS model will require an internal restructuring to better respond to the demand now emerging. Our software delivery model will continuously improve and provide value to all clients at the same time.

Artificial Solutions believes that Teneo is ideally placed to deliver the combination of Conversational AI capabilities and enterprise features that the market demands in the new world learning to live with the impact of Covid-19.

All new functionality is available as of today both to the benefit of existing customers and customers of other bot platforms.

In implementation of the directives of His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, the UAE has announced that it will invest US$10 billion with the Indonesia’s sovereign wealth fund – Indonesia Investment Authority.

Investments will focus on strategic sectors in Indonesia, including infrastructure, roads, ports, tourism, agriculture, and other promising sectors that have potential for growth and can contribute to growth as well as economic and social progress.

Joko Widodo, President of Indonesia, last month announced the members of the Indonesia Investment Authority’s Board of Supervisors and Board of Directors, which was formed under the Omnibus Job Creation Law passed in October 2020.

The setting up of the board is considered a turning point in the governance and development of the investment system in Indonesia. The Indonesian sovereign fund aims to implement strategic projects that support national development, including the development of infrastructure and the construction of the new capital in Kalimantan.

The UAE and Indonesia enjoy strong political, economic and cultural ties. Official diplomatic relations between the two countries began in 1976, with the Indonesian embassy in Abu Dhabi opening on October 28, 1978. The UAE embassy in Jakarta was inaugurated in 1991, following a historic visit by the late Sheikh Zayed bin Sultan Al Nahyan to Indonesia in 1990.

Relations between the two countries have witnessed tremendous growth in recent years with an increase in mutual visits at the level of top leadership and senior officials, most notably the visit by Indonesian President Joko Widodo in September 2015 to the UAE, and the visit by His Highness Sheikh Mohamed bin Zayed Al Nahyan to Indonesia in July 2019.

The two countries signed several agreements and cooperation deals. The two sides recently concluded the UAE-Indonesia Week 2021, during which several cooperation agreements were signed relating to ports, logistics, strategic and defence industries, energy, tourism, the creative economy and mangrove farms. In terms of trade and economic ties, there was remarkable growth, with the volume of trade exchange reaching about US$3.7 billion.

Moderated by Fibha Ahmed, the Sales Director for Bayut and dubizzle Property, the webinar brought together noteworthy female leaders from the UAE’s property market, to engage in a meaningful discussion on how women in the country’s real estate sector had to instantly pivot in the face of unprecedented market upheavals and changes brought on by the global COVID-19 pandemic

Dubai: Bayut, the region’s leading property portal, hosted a high-profile webinar as part of its popular online series, The State of Real Estate, focusing on the role and contributions made by women in the real estate sector ahead of the Emirati Women’s Day celebrations in the city.

Moderated by Fibha Ahmed, the Sales Director for Bayut and dubizzle Property, the webinar brought together noteworthy female leaders from the UAE’s property market, to engage in a meaningful discussion on how women in the country’s real estate sector had to instantly pivot in the face of unprecedented market upheavals and changes brought on by the global COVID-19

pandemic. The three guests; Safura Abasniya, General Manager & Partner at Aston Pearl Real Estate; Zeina Khoury, CEO at High Mark Real Estate; and Katie Savage, Director at The Urban Nest, spoke about the challenges they had to face and overcome in the past few months.

The session also highlighted the important contributions made by women towards UAE’s growth across key business sectors and emphasised the importance of gender diversity in the real estate market, emulating the UAE government’s equal opportunity goals through its workforce and initiatives.

All three of the leaders, who are also working mothers, narrated the challenges of maintaining work-life balance in the face of work from home routines and accommodating their children’s needs during lockdown.

Crediting their success during this challenging time to the support from their families along with self-discipline and time management, the trio also shared their experiences of using this period to re-educate themselves and upskill according to the needs of the market. They also highlighted the supportive environment the UAE government offers for women of all nationalities to thrive and flourish as entrepreneurs and leaders in the UAE.

Their observations tied in with the Emirati Women’s Day theme for this year — ‘Preparing for the next 50 years: Women are the support of the nation.’ The panellists were also happy to note that female investors accounted for a sizable portion of the real estate transactions in the city and have also been actively using their financial independence to support the needs of the economy. As per the latest data released by DLD, the second quarter of 2020 saw 1,781 women finalising nearly 2,000 deals worth AED 2.6 billion, while the statistics for the

entire first half of 2020 show 4,536 women investors invested a total of AED 6.6 billion over 5,000 deals. This cements female investors’ status as seasoned and significant contributors in the sector.

Bayut as an organisation has always been on the forefront in championing workplace diversity and gender equality, providing equal opportunities for women as part of its successful business model. Nearly 40% of Bayut’s employees are women, and almost 50% of the top management positions at Bayut are held by strong, female leaders. Sahar Khan as Bayut’s Director of Marketing, Mahvish Bari as the Director of Industry Marketing, Fibha Ahmed in the role of Sales Director, Melissa Denham as the HR Manager, and Suzanne Gandy as HR Director, have lead the company with a well-rounded and strategic approach that has propelled Bayut’s success in a short time.

Haider Ali Khan, CEO of Bayut, said: “Our female employees have played an indispensable part in building the company and the brand. In my professional and personal life, I never cease to be amazed by the ability of women to wear many hats and juggle their responsibilities while bringing a valuable, nurturing facet to everything they undertake.

“On the occasion of Emirati Women’s Day, it is also important to highlight and respect the achievements made by Emirati women in the UAE, whose remarkable success under the country’s stellar leadership is something that countries across the world should emulate and embrace. I look forward to seeing more women entering the UAE’s workforce, making a difference, adding value, creating impact and driving success stories. I firmly believe that there is no gender and limit to success, and women in the UAE and around the world are a testament to that.”

Islamic finance assets stand at US$2.88 trillion in 2020 and are expected to grow to US$3.69 trillion by 2024. Shaima Hasan, Senior Proposition Manager within the Refinitiv Islamic finance division, explains.

Refinitiv and the Islamic Corporation for the Development of the Private Sector (ICD) release 2020 Report forecasting that global Islamic finance assets are expected to hit $3.69 trillion in 2024.

Malaysia, Indonesia, Bahrain, UAE and Saudi Arabia ranked as the top five developed countries globally in Islamic Finance.

Islamic finance assets increased 14 percent to US$2.88 trillion in 2019, the highest recorded growth for the industry since the global financial crisis.

The Islamic finance industry saw double-digit growth of 14 percent with a total of $US2.88 trillion in assets by the end of 2019, despite the expected volatility due to sustained low oil prices and the approaching coronavirus pandemic.

According to the Islamic Development Report 2020, the strong growth in industry assets was driven by continued growth in Islamic banking assets, which account for most of the industry’s assets.

In addition, the growth was also impacted by the elevated levels of sukuk issuance in the traditional markets in the GCC and Southeast Asia, besides the impact of the growing global popularity of Green and ESG sukuk which have continued to 2020.

In collaboration with the Islamic Corporation for the Development of the Private Sector (ICD), the

private sector development arm of the Islamic Development Bank (IDB), the global Islamic Finance Development Indicator (IFDI) provides the industry’s various stakeholders with a detailed analysis of the key factors driving growth in the Islamic finance industry.

It is the definitive barometer of the state of the Islamic finance industry in 2020, with rankings provided for 135 countries around the world.

It draws on five indicators considered to be the main drivers of development in the industry. By measuring changes in these indicators over time and across countries, the IFDI provides a vital tool in guiding policy within the industry.

The IFDI evaluates the strength of the ecosystem behind the industry’s overall development as well as the size and growth of the different Islamic finance sectors within the many countries where it has a presence.

The report also provides a detailed look at the current state of the industry based on the Islamic Finance Development Indicator (IFDI) which considers five key indicators in the development of Islamic finance: Quantitative Development; Knowledge; Governance; Corporate Social Responsibility; and Awareness.

Gain access to an exclusive Islamic finance database including over 1,400 Islamic financial institutions data covering $2.5 trillion Islamic finance assets, with the Islamic Finance Development Indicator (IFDI).

The outlook for the Islamic finance industry is uncertain while the COVID-19 pandemic remains, despite the rapid growth in digital solutions.

Despite the strong expansion seen in 2019, industry growth is forecast to slow to the single digits, reaching US$3.69 trillion by 2024, as the world attempts to deal with the Coronavirus pandemic that erupted on a global scale in the first quarter of 2020.

reported losses or a drop-in profit caused by a Covid-related increase in loan impairments.

In addition, governments and multilateral organizations have introduced a stream of wideranging measures to defend their economies and societies.

These include some extremely large government stimulus packages that have stretched fiscal deficits to the limit.

Central banks are turning to debt to shore up their fiscal positions and sukuk are proving an increasingly popular choice of instrument.

Meanwhile, Islamic financial institutions have been responding to the crisis by stepping up their digital services and using Islamic social finance instruments to support those who are struggling financially due to the crisis.

The impact of the coronavirus on Islamic finance is analyzed in the report not just in terms of the different sectors of the industry but also covers the disruption to the industry’s supporting ecosystem such as education. To learn more, access the full ICD Refinitiv Islamic Finance Development Report.

However, despite that, the pandemic has been a game changer as several Islamic financial institutions have moved to offer their products via digital platforms in order to better serve their locked-down customers, thereby speeding the advance of technology within Islamic finance.

While the total impact of the pandemic on the industry cannot be measured quantitatively before the end of 2020, at the time of writing, several Islamic financial institutions including Islamic banks had

Although Islamic FinTech had already been making headlines in recent years, digital-based financial institutions have become much more popular during the pandemic, just as digital solutions have leapt ahead in other economic sectors around the world.

OneBlinc announced today the launch of its new debit card, powered by the Mastercard network, which offers fair financing options to the over 22% of U.S. households that are unbanked or underbanked –according to a report by the Federal Reserve. Alongside this new debit card offering, OneBlinc is also debuting its free OneBlinc checking account service.

OneBlinc, the disruptive fintech that drew industry attention in 2019 by offering instant loans to poorcredit individuals through its proprietary scoring algorithms, has since expanded its portfolio of fair financing products, including salary advances and overdraft protection. Today’s announcement is the next step in the company’s mission to elevate the underserved, while giving them access to the latest in payment technologies. Even more, these new offerings can help customers better manage their finances, as debit cards provide an easy way to track and control money.

The fully digital OneBlinc Mastercard co-branded debit card product includes popular features such as contactless payments, as well as no overdraft

fees and no required minimum balance. Customers can also load salary advances and loans from OneBlinc on the card and use it for common expenses like automatic bill payments.

“We want to make access to the latest financial technology more democratized, especially among the Black and Latinx communities, who make up a disproportionate amount of the unbanked and underbanked U.S. population,” said Fabio Torelli, CEO and Co-Founder of OneBlinc. “We are excited to tap Mastercard’s technology and solutions to provide our loyal customers with products that help them rebuild credit and better manage their money — with access to emergency funds when needed.”

OneBlinc’s services are tailored for those working in the public sector, providing quick lines of credit for people who work hard but who need an extra boost to cover expenses — without predatory fees and interest rates from traditional quick loan providers.

The fintech continues to grow, maximizing its footprint to reach some of the most underserved communities in the U.S., including underbanked Black, Latinx and American Indian populations. In just three years, OneBlinc has raised more than $40 million in debt and equity funding.

Initially, the OneBlinc checking accounts and corresponding Mastercard debit cards are available to the more than 20,000 OneBlinc customers nationwide; customers can apply for an account and manage their loans at www.oneblinc. com. As it grows, OneBlinc wants to expand the offer to all 15 million public sector employees.

OneBlinc, a tech-enabled financial platform, provides easy-to-pay financial products and offers the opportunity to rebuild credit, as well as education and finance-related services to help people up their money game, avoiding abusive fees and predatory rates. OneBlinc serves customers across the U.S. and is working to become the destination online bank for public sector employees, offering customized solutions for this specialized market of 15 million people. OneBlinc doesn’t rely on credit scores, but instead uses technology to assess the applicant’s creditworthiness. By offering an array of fair and affordable credit solutions, OneBlinc believes that providing access to socially responsible credit and developing financially savvy citizens can improve people’s lives and society. The company plans to expand into mobile banking offerings and develop a resource hub for financial education later this year.

Category leaders Coinbase, Fold, Shakepay and Bakkt have all leveraged Marqeta to build cutting edge card solutions that drive new engagement through crypto spend and rewards cards.

Marqeta (NASDAQ: MQ), the global modern card issuing platform, announced today that it is powering cryptocurrency spending and rewards products for Coinbase, Fold, Shakepay and Bakkt, with the company seeing rising interest in new card products in this rapidly evolving category.

Use of cryptocurrencies has grown considerably in the United States, with data from the Gemini Exchange estimating that 14% of the US currently owns some form of crypto. As a category leader in modern card issuing, Marqeta has opened up new applications of its platform, to allow cryptocurrency to be spent at the point of sale, or allow consumers to earn rewards in cryptocurrency from debit and credit card spending. According to research from Cornerstone Advisors, 68% of cryptocurrency owners are very interested in Bitcoin based debit or credit-card based rewards.

“Coinbase set out to allow our customers to seamlessly spend cryptocurrency anywhere, and Marqeta enabled us to turn our vision of a cryptobacked debit card into reality,” said Muneeb Imtiaz, Product Manager leading Card at Coinbase. “Marqeta’s flexible APIs and Gateway JIT Funding feature facilitates the creation of customizable debit cards and oversees transaction approvals, allowing our customers fast access to their currencies. The Marqeta team brought a vast amount of payments experience to the table and

worked hand in hand with us every step of the way.”

“Fold was looking to bring a unique feature set to market: a card that could deliver gamified bitcoin rewards while incentivizing responsible spending and saving habits. We are proud to have a payments partner like Marqeta to help us navigate this,” said Will Reeves, CEO of Fold. “Marqeta’s open APIs are extremely flexible and its technology is best-inclass, helping us bridge the worlds of digital assets and traditional banking - all the while building out a truly modern consumer experience.”

Marqeta’s cutting edge Just-in-Time Funding innovation allows cryptocurrency wallets to build out card products, making authorization decisions at the point of sale based on a user’s available cryptocurrency balance. Marqeta’s open APIs allow its customers to build customizable experiences, easily integrating with other apps and offering visibility and transparency through real-time notifications and monitoring powered by webhooks. Marqeta innovations like instant issuance allow cards to be immediately deployed

into digital wallets, and its ATM network integrations and direct deposit and ACH capabilities allows crypto innovators to build out a well-rounded digital banking experience. Through its ecosystem of partners, such as Deserve, Marqeta will also be

able to introduce unique features for its customers issuing credit cards, such as credit limits that can be adjusted according to a consumer’s cryptocurrency balance.

These unique features of Marqeta’s modern card issuing platform have been leveraged by several customers in recent months to launch innovative new products allowing customers to either earn, or spend cryptocurrency at the point of sale:

Bakkt launched its Visa Debit Card, which allows customers to spend Bitcoin and cash balances from their Bakkt accounts, anywhere Apple Pay or Google Pay are accepted.

Coinbase launched its Visa Debit Card, which allows users to spend their cryptocurrency balances anywhere Visa debit cards are accepted and earn additional crypto rewards on eligible purchases.

Fold launched its Bitcoin cashback debit card, which offers Bitcoin rewards through a gamified experience that emphasizes healthy financial habits.

Montreal-based Shakepay announced its new Visa Card, which is currently available for beta access as a virtual card and allows customers to spend Canadian dollars at physical and virtual merchants and earn Bitcoin rewards on every purchase.

“To see such an impressive list of innovators turn to Marqeta to build out new crypto cards and reward programs shows the flexibility of our modern card issuing platform and our unique modern architecture, which can support entirely new card constructs and power their launch at scale,” said Randy Kern, Chief Technology Officer at Marqeta. “This is one of the bleeding edges of innovation in fintech and these new cards are providing even more points of access to and utility for cryptocurrencies. We’re excited to see that our platform can help these companies build out full service digital banking capabilities alongside the card itself.”

TORONTO--(BUSINESS WIRE)--The GDA Group, a financial institution focused on disruptive technology, is launching a new Global Family Office Wealth Network to connect families and institutional investors with exponential thinkers powering the future of industry using disruptive technologies. The GDA group is the parent corporation of GDA Capital and Secure Digital Markets — a capital markets firm focused on merchant banking for digital assets and a trading platform which has completed over 2 billion dollars in over the counter (OTC) digital assets transactions respectively.

The GDA Group, a financial institution focused on disruptive technology, is launching a new Global Family Office Wealth Network to connect families and institutional investors with exponential thinkers powering the future of industry using disruptive technologies. The GDA group is the parent corporation of GDA Capital and Secure Digital Markets — a capital markets firm focused on merchant banking for digital assets, and a trading platform with over 2 billion dollars in over the counter (OTC) digital asset transactions respectively.

The first initiative held by the Global Family Office Wealth Network is the Global Family Office Summit, a quarterly event happening on October 20th that is bringing together innovative asset managers,

more traditional family offices and private equity firms, global regulators and unicorn disruptors to discuss technology that is changing the world. This first Global Family Office Summit is accessible by zoom and is also the first gathering of private wealth that is taking place in the metaverse at the Crypto Convention Centre in Decentraland.

Jean-Luc Gustave, the GDA Group’s VP in Asia, commented on the news with:

“After a strong summer that saw a significant increase in institutional participation in disruptive technology ventures, many family offices are still waiting on the sidelines. I am excited about the launch of the Global Family Office Wealth Network as this signals a clear step forward to provide educational resources and networks that can demonstrate the immense value that disruptive technology has to offer.”

Some of the participants in the Global Family Office Summit include family offices in North America, Europe and Asia, alternative asset managers with a focus on digital assets, unicorn disruptors building the next generation of technology and global regulators. More information about the event can be found at https://fowealth.global/global-familyoffice-summit/ and registration can be done on Eventbrite here.

The GDA Group is one of the first and most established blockchain firms in North America. The group, originally founded in Toronto and New York City, has expanded globally and consists of several firms focused in diverse areas of the blockchain and digital asset industries including capital markets, digital asset offerings & capital formation, asset management, trading & liquidity, consulting, development and other related services.

To date, the GDA Group has consulted Fortune 500 companies and global governments, worked on over 20 digital assets launches representing over 500 million dollars worth of capital raised and

which now total over a billion dollars of market capitalization, and have processed over two billion dollars worth of digital asset commercial transactions. The GDA Group continues to lead the industry in capital markets, advisory and trading.

Disclaimer: This press release is for informational purposes only. The information does not constitute investment advice or an offer to invest. Tokens and virtual currencies, in general, are not legal tender, in any country, and are not backed by any government as legal tender, nor should they be treated as such.

Merchants can offer digital assets in the form of NFTs on Shopify with little change to their current storefronts.

Antwerp, Belgium, October 20, 2021 --(PR.com)-

- Venly, a blockchain technology provider, announces its integration on Shopify allowing Shopify Plus merchants to create digital assets in the form non-fungible tokens (NFTs) and list them for sale. The co-developed app will leverage Polygon POS technology to reduce friction from lofty NFT minting and transaction fees.

The app is currently open to Shopify Plus businesses who can apply to become a part of Shopify’s NFT beta program and begin adding NFT products to their online storefronts and provide a check-out flow through Shopify Payments.

Tim Dierckxsens, CEO and Co-founder of Venly, said: “We’re very proud to integrate our platform with Shopify and receive merchants’ feedback after an extensive development process. We’re honored to share the same vision with Shopify to make digital

assets more mainstream and to be chosen to codevelop this app. By equipping one of the biggest web2 platforms with web3 technology, we’re taking a big step in innovating the e-commerce industry and making it future-generation proof.”

The NFT app pushes the technology boundaries and is making the blockchain based asset more accessible towards both merchants and consumers.

Unique merchants such as Miss J Alexander Crypto Couture, Avata, JG Contemporary, Creative Debuts and artists such as INSA, 2ALAS are currently utilising Venly’s new NFT app to launch their custom branded NFT stores on Shopify.

Launch dates for each merchant store will be confirmed soon.

Venly is a blockchain technology provider. It offers users of blockchain projects digital wallets to store assets with a native solution that also works on mobile devices. Venly also recently launched the Venly Market as the first-ever peer-to-peer and blockchain agnostic NFT marketplace. And with Venly’s NFTtools, blockchain games, projects, and decentralized applications can tap into an entirely new revenue stream without having experience in blockchain engineering or a complex regulatory framework.

Polygon is the leading platform for Ethereum scaling and blockchain infrastructure development with 1000+ applications hosted, ~600M total transactions processed, ~60M unique user addresses, and $5B+ in assets secured.

Will enable cryptocurrency as a funding source for digital commerce at its 26million merchants Receives conditional Bitlicense from New York State Department of Financial Services

Mainstream adoption of cryptocurrencies has traditionally been hindered by their limited utility as an instrument of exchange due to volatility, cost and speed to transact. However, the promise of advanced technological platforms offers the possibility of mainstreaming digital currencies. According to a survey by the Bank for International Settlements, one in 10 central banks – representing approximately one-fifth of the world’s population – expect to issue their own digital currencies within the next three years.

“The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access;

efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly,” said Dan Schulman, president and CEO, PayPal. “Our global reach, digital payments expertise, two-sided network, and rigorous security and compliance controls provide us with the opportunity, and the responsibility, to help facilitate the understanding, redemption and interoperability of these new instruments of exchange. We are eager to work with central banks and regulators around the world to offer our support, and to meaningfully contribute to shaping the role that digital currencies will play in the future of global finance and commerce.”

To increase consumer understanding and adoption of cryptocurrency, the company is introducing the ability to buy, hold and sell select cryptocurrencies, initially featuring Bitcoin, Ethereum, Bitcoin Cash and Litecoin, directly within the PayPal digital wallet. The service is now available to PayPal accountholders in the U.S. The company plans to expand the features to Venmo and select international markets in the first half of 2021. The service is enabled in the U.S. through a partnership with

Paxos Trust Company, a regulated provider of cryptocurrency products and services.

PayPal has also been granted a first-ofits-kind conditional Bitlicense by the New York State Department of Financial Services (NYDFS).

“NYDFS’ approval today follows our June 2020 announcement for a new framework for a conditional Bitlicense to encourage,

promote, and assist interested institutions to have a well-regulated way to access the New York virtual currency marketplace in a way that is both timely and protective of New York consumers, through partnerships with New York authorized virtual currency firms,” said Linda A. Lacewell, superintendent, NYDFS. “NYDFS will continue to encourage and support financial service providers to operate, grow, remain and expand in New York and work with innovators to enable them to germinate and test their ideas, for a dynamic and forward looking financial services sector, especially

as we work to build New York back better in the midst of this pandemic.”

As part of this offering, PayPal will provide accountholders with educational content to help them understand the cryptocurrency ecosystem, the risks and opportunities related to investing in cryptocurrency, and information on blockchain technology. There are no service fees when buying or selling cryptocurrency through December 31, 2020, and there are no fees for holding cryptocurrency in a PayPal account.

Beginning in early 2021, PayPal customers will be able to use their cryptocurrency holdings as a funding source to pay at PayPal’s 26 million merchants around the globe. Consumers will be able to instantly convert their selected cryptocurrency balance to fiat currency, with certainty of value and no incremental fees. PayPal merchants will have no additional integrations or fees, as all

transactions will be settled with fiat currency at their current PayPal rates. In effect, cryptocurrency simply becomes another funding source inside the PayPal digital wallet, adding enhanced utility to cryptocurrency holders, while addressing previous concerns surrounding volatility, cost and speed of cryptocurrency-based transactions.

In addition to providing these significant cryptocurrency services, PayPal has been exploring the potential of digital currencies through partnerships with licensed and regulated cryptocurrency platforms and with central banks around the world. For the past five years, PayPal has increased its focus and resources on exploring the next generation of digital financial services infrastructure and enhancements to digital commerce through an internal blockchainfocused research team. In 2019, PayPal Ventures, the company’s venture capital arm, invested in

TRM Labs, a company focused on helping financial institutions prevent cryptocurrency fraud and financial crime, and Cambridge Blockchain, a blockchain-based identity management and compliance software company. PayPal will continue exploring the potential of distributed ledger technologies to improve financial services and assure they are faster, more secure and less expensive. The company intends to work handin-hand with regulators, governments and central banks in this quest.

PayPal has remained at the forefront of the digital payment revolution for more than 20 years. By leveraging technology to make financial services and commerce more convenient, affordable, and secure, the PayPal platform is empowering more than 300 million consumers and merchants in more than 200 markets to join and thrive in the global economy. For more information, visit paypal.com.

This announcement contains “forward-looking” statements within the meaning of applicable securities laws. Forward-looking statements and information relate to future events and future performance and reflect, among other things, PayPal’s plans with respect to its cryptocurrency initiatives. Forward looking statements may be identified by words such as “seek”, “believe”, “plan”, “estimate”, “anticipate”, “expect”, “project”, “forecast”, or intend”, and statements that an event or result “may”” “will”, “should”, “could”, or “might” occur or be achieved and any other similar expressions.

Forward-looking statements involve risks and uncertainties which may cause actual results to differ materially from the statements made. More

information about these and other factors can be found in PayPal Holdings, Inc.’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10Q, Current Reports on Form 8-K and other filings with the Securities and Exchange Commission (the “SEC”), and its future filings with the SEC.

The forward-looking statements contained in this announcement speak only as of the date hereof. PayPal expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained herein to reflect any change in the expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Toronto, Canada, October 20, 2021 --(PR. com)-- Poverty eradication across developing countries, especially within sub-Saharan Africa, is not happening at a rapid pace. According to Development Aid, 2.6 people escape poverty every minute, whereas the required rate is 96 people per minute to meet the United Nations poverty eradication goals. Based on these statistics, it is a fact that Africa is not on target to meet its Sustainable Development Goal 1 – Eradicate Poverty by 2030. Contributing factors to this slow growth include: high population growth, limited digital infrastructure, lack of digital skills and most importantly, the inability to adopt pro-poor poverty reduction strategies.

One way to promote wealth creation is through digital entrepreneurship, however, Africa does far worse in this area than any other region. Contrary to expectation, digital enterprises in Africa and other developing countries on average, do not compete and scale internationally, nor do they change traditional industries such as commerce.

However, Africa and developing countries are seeing a shift towards the acquisition of new technologies in these marginalized regions, especially in Africa. In recent years, there has been a significant movement towards the expansion of mobile broadband networks, resulting in a high adoption rate of mobile devices. Other emerging technologies being rapidly adopted include cryptocurrency and e-Commerce. So, why not leverage these technologies to enable digital entrepreneurship and in doing so, create a social and humanitarian impact?

that include the unbanked and less privileged population. AFOMA will drive a decentralized social impact ecosystem. One component within this ecosystem will be a decentralized marketplace for physical and digital merchandise.

This decentralized marketplace (driven by AFOMA) will provide fair market access and the establishment of trust in commerce (through a decentralized e-Commerce and NFT marketplace), for artists and artisans (which provided a $718 billion USD market value in 2020) from developing countries, including those supported by NGOs. In doing so, AFOMA intends to bring global market exposure to their unique artisanal products.

AFOMA will empower communities across marginalized regions by funding humanitarian causes in line with the United Nations Sustainable Development Goals. AFOMA will allow for transparency and traceability through blockchain technology, for organizations (both profit and not-for-profit) involved in these social impact initiatives.

“I am excited to team up with the highly experienced professionals committed to this vision. We have a unique value proposition using digital technologies, blockchain and tokens to improve real world use cases and uplift communities across Africa and the globe.” - Eric Osuorah, Founder, AFOMA

Eric also runs AZONETA, a Canada based registered not-for-profit that undertakes humanitarian projects across sub-Saharan Africa.

AFOMA is a blockchain-based digital asset designed to bring a unique solution to how we conduct commerce. With the integration of blockchain technology and token-based models, AFOMA promises to create equitable opportunities

The AFOMA Token (OMA) will be the core component and the key success factor through which we intend to create and continuously develop a sustainable decentralized future.

IBM today at its Think Digital conference announced new services and solutions backed by a broad ecosystem of partners to help enterprises and telecommunications companies speed their transition to edge computing in the 5G era. This effort combines IBM’s experience and expertise in multicloud environments with Red Hat’s industryleading open source technology, which became part of IBM last year in one of the biggest tech acquisitions of all time.

For organizations worldwide, the rollout of wireless 5G telecommunications networks, which bring blazing speed and extremely low latency—and minimal transmission delays—to mobile data, is designed to accelerate the utility of edge computing. With new edge services, IBM Business Partners and open multicloud solutions from IBM, enterprises will be able to tap into the potential of 5G to support crucial uses like emergency response, robotic surgery or connected-vehicle safety features that benefit from the few milliseconds latency saved by not having to send workloads to a centralized cloud.

“In today’s uncertain environment, our clients are looking to differentiate themselves by creating more innovative, responsive user experiences that are adaptive and continuously available – from the data center all the way out to the edge,” said Denis Kennelly, general manager, IBM Hybrid Cloud. “IBM is helping clients unlock the full potential of edge computing and 5G with hybrid multicloud offerings that bring together Red Hat OpenShift and our industry expertise to address enterprise needs in a way no other company can.”

IBM’s new offerings run on Red Hat OpenShift, the leading enterprise Kubernetes platform that runs everywhere -- from the data center to multiple public clouds to the edge. They enable enterprises to overcome the complexity of managing workloads across a massive volume of devices from different vendors and provide telcos the agility they need to quickly deliver edge-enabled services to customers. Clients across industries can now fully realize the benefits of edge computing, including running AI and analytics at the edge to achieve insights closer to where the work is done.

New solutions include:

IBM Edge Application Manager – an autonomous management solution to enable AI, analytics and IoT enterprise workloads to be deployed and remotely managed, delivering real-time analysis and insight at scale. The solution enables the management of up to 10,000 edge nodes simultaneously by a single administrator.1 It’s the first solution to be powered by a breakthrough open source project, Open Horizon, created by IBM engineers designed to enable a single person to securely manage such a vast network of edge devices.

A portfolio of edge-enabled applications and services, including IBM Visual Insights, IBM Production Optimization, IBM Connected Manufacturing, IBM Asset Optimization, IBM Maximo Worker Insights and IBM Visual Inspector. All offer features to give clients the flexibility to deploy AI and cognitive applications and services at scale.

In addition, IBM is announcing the IBM Edge Ecosystem, through which an increasingly broad set of ISVs, GSIs and more will be helping enterprises capture the opportunities of edge computing with a variety of solutions built upon IBM’s technology. IBM is also creating the IBM Telco Network Cloud Ecosystem, bringing together a set of partners across the telecommunications industry that offer a breadth of network functionality that helps providers deploy their network cloud platforms.

These open ecosystems of equipment manufacturers, networking and IT providers and software providers include Cisco, Dell Technologies, Juniper Networks, Intel, NVIDIA, Samsung, Packet, an Equinix Company, Hazelcast, Sysdig, Turbonomic, Portworx, Humio, Indra Minsait, Eurotech, Arrow Electronics, ADLINK, Acromove, Geniatech, SmartCone, CloudHedge, Altiostar, Metaswitch, F5 Networks & ADVA as members.

IBM Telco Network Cloud Manager – a new solution offered by IBM that runs on Red Hat OpenShift to deliver intelligent automation capabilities to orchestrate virtual and container network functions in minutes. Service providers will have the ability to manage workloads on both Red Hat OpenShift and Red Hat OpenStack Platform, which will be critical as telcos increasingly look for ways to modernize their networks for greater agility and efficiency, and to provide new services today and as 5G adoption expands.

New dedicated IBM Services teams for edge computing and telco network cloud that draw on IBM’s deep expertise to help clients deliver 5G and edge-enabled solutions across all industries.

Businesses that have already been working with IBM to deploy edge computing technologies include Vodafone Business, which is working with IBM to help improve worker safety and productivity in remote locations such as oil rigs, factories, warehouses, ports and mines. Combining Vodafone Mobile Private Networks, IBM Edge Application Manager and Red Hat OpenShift, the new solution uses sensors, AI, as well as predictive and video analytics to understand and respond to incidents in milliseconds, keeping workers safe.

“At Vodafone Business, our primary focus is keeping our customers and their employees connected and safe, whether remote working or working from remote locations. Vodafone Mobile Private Networks, IBM edge computing and AI technologies enable companies to oversee operations even in the most remote locations, where rapid action can mean the difference between a near miss

and a disaster,” said Vinod Kumar, CEO, Vodafone Business.

Samsung is collaborating with IBM and telecommunications provider M1 to develop and test industry 4.0 solutions using 5G and edge computing for Singapore’s Infocomm Media Development Authority (IMDA).

“5G and edge will enable massive innovation for manufacturers, with 5G networks enabling phones and devices at the edge to deliver new AI-driven improvements to quality, productivity and safety. But the ability to achieve the scale and effectively manage the connectivity of the vast number of devices and sensors in a manufacturing environment is complex,” said KC Choi, EVP of Global B2B Sales, Samsung Electronics. “To address this challenge and enable Industry 4.0 innovation at scale, we’re collaborating to put IBM’s edge computing and AI solutions and Samsung endto-end 5G network platform and mobile devices to work. Together, we’ll deliver new 5G enabled solutions leveraging sound and video insights as well as augmented reality to uncover anomalies that can occur throughout the manufacturing process.”

Equinix is building a reference architecture that brings the IBM Cloud Paks ecosystem to the edge of the network. With its interconnected Edge Metal infrastructure (powered by Packet bare metal technology), Red Hat OpenShift and IBM Edge Application Manager, enterprises can build edge applications once and deploy anywhere.

“Working with IBM on our Edge Metal Private Beta is a perfect example of how collaboration can enable enterprises to tap into the power of hybrid cloud for low-latency use cases,” said Zac Smith, Managing Director of Bare Metal at Equinix. “With interconnected, automated bare metal paired with edge computing and hybrid multi-cloud solutions from IBM and Red Hat, our customers can tap into a blueprint for rapid innovation at the network edge. Our Metro Edge locations will also have the advantage of enabling consolidation from the remote on-premises locations (edge-in) or migration from the cloud (cloud-out) and yet still remain close enough to where data is created and actions are taken to reduce latency, avoid bandwidth constraints, and retain a high level of operational resilience.”

Hamburg, Germany – Panasonic Avionics Corporation (Panasonic) today unveils its new Arc In-Flight Map Platform – a revolutionary 3D inflight map application and service for its NEXT and X Series in-flight entertainment and connectivity (IFEC) systems.

Arc brings a wide range of innovative new features to the traditional in-flight map application while expanding that concept into a fully integrated experience within the IFEC system, in particular by integrating it with new services from Panasonic including Loyalty (Panasonic’s personalization services), Marketplace (for onboard e-commerce), Insights (for analytics), all backed by its NEXT Cloud infrastructure.

The technology is inspired by the latest design thinking of contemporary UX and high-definition gaming experiences and enables airlines to leverage the high viewership of moving maps in-flight. Arc will be available across all in-flight displays including seatback, overhead, handset, and within mobile apps and web portals.

Gaston Sandoval, Vice President of Product Management and Marketing, says: “Moving maps have long been one of the most popular features of any in-flight entertainment system but we believe the opportunities to expand the basic map concept, and revolutionize its role in the overall inflight experience, are greatly underleveraged.

“By re-imagining the map experience based on its full potential, and integrating it as a core service of our NEXT and X Series IFEC systems, we can greatly elevate the passenger experience and the value of maps for our airline customers.

“Arc will offer everything that our airline customers have come to expect in a contemporary map application with the addition of many innovative features and tools, made possible only through our ‘Map as a Service’ approach. We believe this is one of the most exciting advances ever for in-flight maps.”

Highlights of the Arc In-Flight Map Platform include:

The industry’s first personalized maps capability – by integrating the map with Panasonic’s award-winning Loyalty personalization services, passengers can set up personalized map profiles and preferences that will appear whenever they log into the IFEC system.

New Map as a Service (MaaS) technology –including APIs that enable airlines and third parties to develop applications utilizing the Arc map engine and feature set, or to add their own content and data layers to the Arc map displays.

Wide range of map styles – from stunning satellitebased images to street views, to new and unique data visualizations.

Premium Destination and Point-of-Interest Content – through Panasonic’s exclusive relationship with the influencer-driven discovery platform provider Raleigh & Drake, and additional partners (soon to be announced).

New monetization opportunities for airlines – through integration with Panasonic’s own Marketplace e-commerce platform. In-flight sales can be directly tied to real-time flight events and status.

Integration with airline advertising and promotions – including Panasonic’s own OneMedia advertising platform. The high viewership of maps can be fully leveraged for its targeted advertising and promotional potential.

Omni-channel capability – Arc is available for all in-flight displays: seatback, overhead, handset, and within mobile apps and web portals. All map instances can dynamically utilize single data or multiple data sets, depending on their mission and audience.

Native 4K design – optimized for NEXT’s stunning 4K displays, and for ultra-definition mobile devices.

Arc Studio – an online tool and gallery service where airlines can design their own map experience, and be regularly provided with exciting new features and updated map data. Updates will range from regular maintenance data (time zone offsets, place names, borders, etc) to new features and design templates, which can all be dispatched to airline fleets utilizing NEXT Cloud.

Extensive configuration capabilities – made available to airlines through web-based Arc tools, and easily updatable utilizing NEXT Cloud.

Arc Analytics – using Panasonic’s Insights analytics services, provides the ability to track map usage, allowing for analysis and optimization of map data based on actual passenger interaction. These analytics can be used to enhance each airline’s map database set, and to enable and verify advertising and promotional impressions.

A number of new and unique features on the Arc have been developed in collaboration with FlightAware. Their market-leading services for global flight tracking will be integrated into the Arc platform to provide passengers with new ways to see air travel and the globe, including an extensive airline fleet view during their entire journey. The partnership will further explore new features based on FlightAware’s state-of-the-art predictive technology, giving passengers precise runway and gate arrival times as well as proactive information about connecting flight delays.

Matt Davis, Vice President of Sales at FlightAware, says: “We’ve been extremely impressed by the level of innovation that Panasonic Avionics is bringing to in-flight moving maps, and are thrilled to contribute

our expertise in flight tracking and provide cutting edge predictive technology to the feature set of Arc.

“We found Panasonic to be incredibly collaborative and open to new ideas, and we’re honored to work with them to enhance the experience of airline passengers worldwide. We are also grateful for their leadership as we work to understand the unique requirements of airborne map services.”

Arc has been designed and developed by Panasonic’s digital studio, Tactel AB, based in Malmö, Sweden. Acquired by Panasonic in 2015, Tactel is an award-winning UX and development firm, responsible for creating industry-leading apps and services in Scandinavia.

Panasonic is now taking orders for Arc, with deliveries available from the first quarter of 2020.

Amazon has signed an agreement to acquire Zoox, a California-based company working to design autonomous ride-hailing vehicles from the ground up. Aicha Evans, Zoox CEO, and Jesse Levinson, Zoox co-founder and CTO, will continue to lead the team as they innovate and drive towards their mission.

Amazon and Zoox are pleased to announce that we’ve signed an agreement for Amazon to acquire Zoox. Zoox is a forward-thinking team that is pioneering the future of ride-hailing by designing autonomous technology from the ground up with passengers front-of-mind. Aicha Evans, Zoox CEO, and Jesse Levinson, Zoox co-founder and CTO, will continue to lead Zoox as a standalone business as they innovate and drive towards their mission.

“Zoox is working to imagine, invent, and design a world-class autonomous ride-hailing experience,” said Jeff Wilke, Amazon’s CEO, Worldwide Consumer. “Like Amazon, Zoox is passionate about innovation and about its customers, and we’re excited to help the talented Zoox team to bring their vision to reality in the years ahead.”

“This acquisition solidifies Zoox’s impact on the autonomous driving industry,” said Aicha Evans, CEO of Zoox. “We have made great strides with our purpose-built approach to safe, autonomous

mobility, and our exceptionally talented team working every day to realize that vision. We now have an even greater opportunity to realize a fully autonomous future.”

“Since Zoox’s inception six years ago, we have been singularly focused on our ground-up approach to autonomous mobility,” said Jesse Levinson, Zoox co-founder and CTO. “Amazon’s support will markedly accelerate our path to delivering safe, clean, and enjoyable transportation to the world.”

Zoox started in 2014 with the vision of purposebuilt, zero-emissions vehicles designed for autonomous ride-hailing, along with an end-toend autonomy software stack. Zoox’s ground-up vehicle focuses on the ride-hailing customer, with tightly integrated features designed to provide a revolutionary passenger experience. Zoox’s approach to invention provides flexibility and the means to iterate rapidly to continuously deliver a superior experience for customers.

Self-Service Payment Tracker Available to Clients Using CashPro®

Bank of America, a charter member of SWIFT Global Payments Innovation (gpi), announced today the launch of a CashPro® self-service tool that allows clients to have real-time visibility into their international payments.

Accessible through the bank’s integrated platform, CashPro, the SWIFT gpi module brings to life a wealth of cross-border payment data facilitated by the SWIFT network.

=“Our payments tracking tool populates SWIFT gpi information into a view that can be read easily and acted upon immediately,” said Tom Durkin, Global Product Head for CashPro in Global Transaction Services at Bank of America.

There are a number of advantages to making payments via Bank of America’s SWIFT gpi solution. The financial institution or corporate client receives:

Visibility into lifting fees and payment charges, including foreign exchange rates.