Managing Director

Shankar Shivaprasad

Co-founder & CEO

Shashank M

Chief Editor

Ujal Nair

Assistant Editor

Kevin Thomas

Laura Edwards

Head of Operation

James

Head of Production

Tom Hanks

Head of Research

Catherine D’Souza

Head of Media Sales

John Smith

Advertising Contact Info@wboutlook.com

Content Managers

Sathya Narayana B

Madhulika Pandey

Amith Raj S

Business Developers

Daisy Cooper, Mark Cooper, Justin Wong, Elena Davis, Eric Thomson

Graphic Designer

Chandan R

Video Editor

C Gidieon Sam Issac

Accounts Manager

Steve Smith

Office Address

32 Pekin St #05-01

Singapore 048762

Phone: +65 86159608

Is 2024 more aspirational for consumers than 2023?

The 2023 economy has been widely influenced by several geopolitical tensions across the Middle East and the East European regions. 2024 seems to be a continuation of the same with new strains on global peace and trading activities. With several elections on the agenda for some of the biggest economic powerhouses in the world, political observers are keeping their vigil on the new policies being drafted by the incumbents and the next government.

For World Business Outlook, 2024 marks another ambitious year for the introduction of new faces, new brands, new disruptors to our global business diaspora. The nominations for World Business Outlook Awards 2024 has opened up for Banking, Finance, Real Estate, Mining, Healthcare, Education, Forex Brokers, Online traders and more such sectors from across the globe. This event would set a networking platform for the investors, startups, top government bureaucrats and for some of the most well-established industrialists.

This edition would give you a glimpse of the various sectors across the globe and could help you make the right investment decisions for 2024. The Editorial Team is grateful to the contributions of BigBoss in a special feature article that talks about their prominence in the field of online forex trading.

The cover story focuses on consumer behaviour in the pre-pandemic and post-pandemic conditions today. It’s an interesting take on the inter-relationship between the economy and the purchasing patterns of the consumers. This is something that is very much visible in the real estate sector that is heavily influenced by the GDP, the per capita income, inflation rates, interest rates and more. We invite you to study these pages and share your valuable opinions about the same through our social media pages.

Be sure to check out our website at www.worldbusinessoutlook.com

Connect with us on Facebook: www.facebook.com/WBOutook

Twitter : https://twitter.com/wboutlook Instagram: https://instagram.com/wboutlook

https://www.linkedin.com/company/world-business-outlook

https://www.youtube.com/@worldbusinessoutlook908

From the humble beginnings of brick-sized mobile phones to the sleek and sophisticated smartphones of today, the mobile industry has undergone a remarkable transformation. Yet, amidst this sea of change, a new contender has emerged, all set to revolutionise the way we think about mobile devices: Foldable smartphones.

Imagine a world where your smartphone seamlessly transforms into a compact device that fits snugly in your pocket to a larger-than-life canvas that unfolds to reveal endless possibilities. This is the promise of foldable smartphones, a game-changer in the mobile industry.

Birth and evolution of the foldable smartphone:

Initial foldable smartphone prototypes date back to the early 2010s. But it wasn’t until recently that improvements in manufacturing techniques and display technology made these foldables a feasible product for the mainstream market. If we recount, the Motorola Razr was one of the first flippable phones in

the world, and it was the company’s humble attempt to reduce the phones to a pocketable size. Polymer Vision created a vision in 2006 that featured a rollable idea and a foldable gadget known as ‘Readius’. In 2008, Samsung introduced the AMOLED Kyocera and debuted the Echo, a dual-touchscreen Android phone with a 3.5-inch display. The manufacturer was considerably ahead of its time. ZTE debuted the AXON M nearly a decade later, in 2017. Huwaei also ventured with foldable MATEX. It had a 6.8-inch screen front display. It was now XIAOMI’s turn to venture into the foldable smartphone arena with its MI Mix Fold, which unfortunately suffered lacklustre reviews.

Samsung’s reign of dominance: Samsung has long been a dominant player, known for pushing the boundaries of innovation and setting new standards for excellence. Samsung grabbed headlines in 2019 with the launch of the Galaxy Fold, the world’s first commercially available foldable smartphone. Building

on the success of the Galaxy Fold, Samsung further solidified its presence in the foldable smartphone market with the introduction of the Galaxy Z series in 2020. These were the first-generation phones with an ‘infinity flex display’ that folded vertically. The second generation of the series was rolled out later that year in September, followed by the third and fourth in 2021 and 2022, respectively. The latest fifth-generation model, the Samsung Galaxy Fold/Flip 5, which was unveiled in 2023, is a high-end phone that boasts of a thinner, lighter, and huge display. It is considered to be one of the best foldables in the market. With the use of ultrathin glass (UTG) and its unique hinge mechanism, Samsung has established itself as the undisputed leader for the foldable smartphone market.

Other major players in the market: Jumping on the bandwagon are major smartphone producers, Huawei, Motorola, Xiaomi, and Oppo, each fighting for a spot in the ever-expanding smartphone market with their flagship models. Huwaei made significant advancements with its MATE X series, launched in 2019. Subsequently, they came up with improved variations, MATE Xs, MATE X2, and the latest MATE X3, which is only exclusive to the Chinese market. However, due to the USA trade restriction, it faced challenges in sales and marketing. Motorola made a victorious comeback to the foldable smartphone market with its iconic Razr series, which was expected to be launched in late 2023.

Oppo became the latest entrant in the segment with the Oppo Find N Flip, which is still awaited in the global market. The highlights revealed its exquisite specification and attracted eager techies to get a hands-on experience of the novelty. And then there’s Xiaomi, the Chinese tech giant known for its disruptive approach to innovation. With Mi Mix Fold, launched in 2021, Xiaomi ventured into the foldable smartphone ring, showcasing its ability to push the boundaries of conventional design and engineering. Mi Mix, with its svelt and classy looks, garnered huge attention but failed to appeal to the masses.

In the last few years, the foldable smartphones market has expanded significantly. According to recent market research, the foldable smartphone market size is estimated to be around USD 28 billion in 2024, with projections indicating a staggering growth trajectory to reach nearly USD 60 billion by 2029, reflecting a strong CAGR (compound annual growth rate) of 17.13 percent during the forecast period. The reports also suggest that the smartphone industry will experience remarkable overall growth of 84 percent this year. One of the major reasons for this exponential rise is the escalating demand for innovative consumer electronics, particularly in the entertainment and gaming sectors. The advent of 5G technology has also aided this proliferation, offering manufacturers the opportunity to increase their market presence by leveraging on the growing demand for high-speed connectivity. Moreover, these smartphones have intensified the competition in the industry, with major

OEMs looking for a larger market share. This competition has spurred innovation and expedited the speed of technical developments, benefiting consumers with a wider range of options and improved features.

Future

The slow sales of these phones haven’t deterred these manufacturers from coming up with continued upgradation and innovative functionality. Foldables are very sought-after, even though they are not mass-market devices. The rise in demand for foldable smartphones is paving the way for a new era of innovation and excitement in the tech industry. As these devices become more accessible and budget-friendly, they will undoubtedly reshape the way we communicate, work, and play. The potential for innovation in this sector is unlimited. By combining the portability of a smartphone with the productivity of a tablet, foldable devices offer users the best of both worlds. One thing is certain: the rise of foldable smartphones is just the beginning. With each new version, these devices will continue to improve, becoming more versatile and useful in our daily lives.

- Blog by Madhulika Pandey

Our global industry is classified into 3 sector structures – cyclical, defensive and sensitive. Industries that come under the Sensitive group are the Industrials, Infotech, Energy and Communication services. In the defensive sector group, we have consumer staples, energy, healthcare, communication services, utilities and real estate. The defensive sector group are the kind of sectors that are always in demand at the stock market regardless of how the economy is doing. The sensitive sectors have a very mild correlation to the business cycles of the economy. For this article, our focus would

remain on the third group, i.e. the cyclical sector group. This group comprises of companies that are easily affected by the strength of the economy. It grows well when the economy is enjoying its bull run. However, as the bear claws back at the stock market, this sector is the one that is affected the most. The sectors included in this group are – Financials, Technology, Real Estate and Consumer Discretionary. For this article, we are going to focus on the Consumer Discretionary sector to better understand consumer behaviours today.

Two types of products and services exist in the market. There are those that consumers need daily and then there are those that are not necessary for survival. The consumer discretionary sector comprises the latter part. It includes fast food, specialty food, furniture and appliances, automobiles, travel and certain luxury services and products.

As per a report, from September 2010 to 2022, the consumer discretionary sector has had a CAGR of around 14 percent with a standard deviation of around 15 percent. Analyzing the performance of the sector, we see that at the MSCI World Consumer Discretionary Index, the value of the portfolio decreased from USD 27,150 in March 2019 to USD 23,857 in March 2020. However, after the global rollout of the COVID-19 vaccinations, this value shot up by almost 100 percent to USD 43,215 in 2021 and moderate growth in 2022 to reach USD 43,982. This same performance is echoed at S&P Global 1200 with the valuation of the sector dipping to USD 2,623.44 in March 2020 from USD 3,373.62 in March 2019. However, in 2023, hostile macroeconomic conditions increased the risk factor of the consumer discretionary sector.

In 2023, most companies in the sector showed signs of a weak growth trajectory due to the growing scepticism among investors. Investments for 2023 in the sector were badly affected due to rising inflations and a grim macroeconomic outlook. Several companies in the consumer discretionary sector have shrunk their yearly estimates for 2024 as well. Another shocking revelation is the fact that in the US, the healthcare and the consumer discretionary sectors together accounted for half of the bankruptcy filings in the private sector. This is also the same period (2022-23) when consumer staples (daily necessary products and services) saw one of its greatest quarter-over-quarter increases.

Automobiles are one of the biggest GDP contributors in most parts of the world. transport and logistics are essential for our daily lives and the automotive industry thrives on the demand for ‘delivering by road as promised on the phone’. In most developing nations, a two-wheeler (preferably a small capacity one) is seen as a household necessity to meet the daily errands and the office commute needs in a densely populated city. However, with an exception for a few cities in Asia, a two-wheeler is seen as the best choice for last-mile

connectivity in the transport and logistics sector. As mentioned earlier, the automotive industry has a big share in the overall GDP of a country as it breeds several other industries such as the steel, aluminium, rubber, plastic, electronics and others. This is one sector that enjoys the most during an economic uptick and at the same time suffers the most during a negative macroeconomic outlook. Simply put, we observe high sales figures when the economy is doing well. Subsequently, we see a heavy rush in the public transport system when the economy is down. The commercial vehicle segment is another indicator of the health of the market. More trucks are plying on the roads when everybody is doing good business and vice-versa. We can understand the past year’s performance of the consumer discretionary sector by studying the Indian two-wheeler segment.

The Indian two-wheeler industry is the biggest by volume in the world. The OEMs (Original Equipment Manufacturers) have a vast portfolio ranging from 80cc engines to 800cc engines. They also have highend big-capacity motorcycles assembled in India. Of the lot, the 100cc to 200cc capacity two-wheelers are considered to cater to the commuter segment, essential for daily needs with frugal running costs at a pocketfriendly sticker price. These are the alternatives people choose over the jam-packed public transport system. Above 200cc till 300cc, we see premium commuter segments that cater to the office-going mass as well as to those who prefer a casual weekend ride around the hills or the beach. After 300cc is where the Indian two-wheeler market reserves its innovative top-class lot. This is the segment where most of the products are packed to the brim with best-in-class technology and accessories to deliver world-class performance and give the rider the feeling of luxury and premiumness. This is a characteristic of the South Asian two-wheeler market. This is the segment where the bikes are priced close to some of the entry-level family cars. That’s why, OEMs try to make their 300cc portfolio as premium as possible. In India, buyers need to be convinced that even though they are buying this bike due to their own discretionary choice, it needs to appear value for

money in front of their family members. So, if a buyer is looking for a bike/scooter for the general commute to the office for a quick errand to the local shops, or even for the monthly grocery stock-ups, he/she would stop at the 200cc segment. This becomes the prime mode of transport for most of the middle-class people.

The Indian 300cc-500cc segment is where most of the Indian OEMs have placed their flagship models. The fact that we have seen a majority of the new launches in this segment in the past 2 years, says a lot about the rising per capita income of the people of India. However, the sales charts carry a different story here.

In 2018, the sales of the motorcycles in the 300-500cc segment reported a decline. This was attributed to the new emission norms that were implemented by the Indian government which led to decreased demand for the older bikes and sluggish production. At the same time, the new bikes that adhered to the new emission standards came with a high asking price. This brought down the sales performance even further. The lack of stocks and the high selling prices continued to dissuade people from the 300-500cc segment in 2019. In the same period, we saw EVs catching the fancy of the masses across the nation. By the end of 2019, new models in the 300-500cc segment gained traction. With the beginning of the pandemic in 2020, most of the productions had either stopped or partially operational. Interestingly, it was during this period that we saw a rise in demand for low-budget cars that came at almost the same price as a high-end 500cc bike. It was the time when people became more considerate about their family’s safety. However, this did not deter some of the manufacturers from launching new models in the 300-500cc segment. They also brought updates to some of their older models to meet the new emission standards. This bore some fruit in 2021 when most of the people received vaccinations and people started venturing out of the government-imposed lockdowns. India saw a sharp rise for the 350cc segment bikes that were capable enough for long tours without being too demanding on the wallet. Since 2021 also witnessed a

sharp rise in fuel prices, India saw an exodus of demand for environment-friendly electric two-wheelers for their household errands and daily office commutes. In 2022, the threats of massive layoffs and a looming depression in the market again brought down the demand for bikes in the 300-500cc segment. However, India maintained its strong exports for these segments with some of the newly launched models performing exceptionally well in the developed markets. 2023 proved to be a comeback for this segment. It seemed like people were holding their savings or amassing the capital to get their hands on the best value-for-money offers. The 300-500cc segment saw a 3.7 percent growth in total domestic

sales. Incidentally, this was also the year when almost every Indian OEM had something fresh and innovative to offer in the segment.

Even though this segment went through a huge devaluation during the dreaded COVID-19 pandemic period, it regained quite a bit in 2023. Unlike other sectors, every one of the new two-wheeler launches enjoyed healthy bookings at the time of the launch itself, in 2023. This also coincides with the fact that India showcased a sharp rise in its per capita income in 2023 while becoming one of the few Asian nations to post a 7+% GDP growth. The high inflation rate and the

high fuel prices kept the demand for electric vehicles up. This shows that Indian consumers, like most Asian consumers, are very price-conscious and give great importance to value-for-money products and services. The premium two-wheeler segment saw a spike in its sales charts only after the macroeconomic conditions improved. Despite the high unemployment rate in India, a steady recovery of the rural economy pushed for a significant demand for sub-200cc vehicles.

With several geopolitical tensions still rampant across the globe, very few countries seem to be making any

positive strides in their overall financial conditions. Many exporting majors like India, China, Bangladesh, and Vietnam are deeply affected by the new skirmishes in the Red Sea. The European market is grappling with a new wave of price hikes and inflations due to these new tensions. 2024 is also the year of many new political changes with elections happening in some of the major economies. With such political ambiguity, experts believe that consumers could resort to lower-priced brands or value-based substitute products, especially in the FMCG, food and beverages and clothing sectors.

Protecting your priceless digital assets is more important than ever in the current digital era. Data breaches and cyberattacks are growing more frequent, and the repercussions may be disastrous for both individuals and companies. Purchasing cyber insurance is one practical approach to safeguarding your digital assets. Despite being a tiny and emerging sector, cyber insurance is a crucial component of financial security. It is essential to have a fundamental grasp of the cyber insurance market, including its scale, potential sources of risk capital, and pricing. This blog will give you a thorough understanding of what cyber insurance is, as well as market insights and information on the size and scope of the cyber insurance market.

In the context of risk management, “cyber insurance” refers to a specific kind of coverage that shields businesses and individuals from the financial consequences of cyber-related incidents and data breaches. Because cyberattacks are becoming more frequent and sophisticated, obtaining cyber insurance is becoming essential to protecting an organisation’s reputation and financial viability. This insurance can cover a number of things, such as public relations services, legal costs, data restoration, and even monetary losses from company disruption. When properly implemented, a cyber insurance policy can help organisations transfer and manage the risks related to cyberattacks. However, to make sure the policy meets the unique needs of a business and offers sufficient coverage, due diligence is required.

The global cyber insurance market size was estimated at USD 13.33 bln in 2022 and is projected to grow from USD 16.66 bln in 2023 to USD 84.62 bln by 2030, exhibiting a CAGR of 26.1% during the forecast period. The market has witnessed substantial rate rises and re-underwriting to bring profitability back in under two years. These actions were a response to increased ransomware activity that caused loss ratios in previous years to decline. According to a report, malware incidents rose in 2022 for the first time since 2018, reaching 5.5 bln attacks — a 2% increase year over year.

The adoption of remote work by both individuals and corporations was greatly influenced by the Covid-19 pandemic. Cybercriminals viewed this as a chance to profit from the situation. As a result, ransomware, phishing, and mail spam increased during the pandemic era. According to a threat analysis, throughout the pandemic, there were about twenty lakh exploitation incidents, in addition to over one lakh malware and botnet occurrences across the globe.

During this time, the insurance sector saw tremendous growth, which enhanced e-commerce and an organisation’s digital capabilities. The demand for technological innovation, the developing workspace paradigm, the rise in cybersecurity threats, and the growing usage of public clouds by businesses have all had a beneficial impact on the growth of the cyber insurance industry.

Global cryptocurrency ownership has been increasing quickly. Multi-million dollar hacks target extremely volatile cryptocurrencies, causing investors to lose millions and the industry to lose billions. Companies have been investing in insurance coverage to counter these threat risks to address the volatility of cryptocurrency. Over time, this is anticipated to have a favourable impact on market growth. Cyberattacks are affecting a number of areas, most notably healthcare, education, banking, and finance. There is a greater chance of a data breach as online banking and digital payments have become more popular. Cyber insurance provides broad protection to mitigate the effects of a cyberattack.

The five major regions that make up the cyber insurance industry are Asia-Pacific, Europe, the Middle East and Africa, and North America. The market in North America is expected to reach USD 4.89 billion in 2022 and increase at a CAGR of 25.4% from 2023 to 2030.

Significant growth is anticipated in the Asia-Pacific. The nations where cyberattacks have increased the most in the Asia-Pacific region are Malaysia, Singapore, Indonesia, and Japan. According to research, the demand for insurance rose by more than 80% in the Asia-Pacific region.

Europe gained recognition as a result of its evolving insurance regulations, which raised demand for insurance services. There was a spike in DDoS attacks under 1Gbps in South America. As a result, the insurance company increased both their clientele and the range of products they offered locally. Finally, due to an increase in worldwide ransomware claims in 2023, cyber insurance rates in the MEA region grew. Because there is more capacity available in the Middle East, there are still more players entering the MEA cyber insurance market, which encourages competition among insurers and guarantees the best terms and conditions.

It is becoming increasingly clear that cyber insurance is necessary in today’s digitally dependent society. Businesses and individuals need to protect their interests and assets in light of the growing threat of cyberattacks and the possible financial consequences they may have. Cyber insurance is an essential line of defence against the expenses associated with data breaches, cyberattacks, and other cyber events. This coverage helps with the mitigation and recovery process in addition to covering the monetary damages brought on by these occurrences. It provides financial stability and peace of mind in an environment where even the strongest cybersecurity safeguards can be compromised in the workplace. Organisations and individuals can proactively manage the risks connected with cyber threats and ensure financial security and crisis management skills by purchasing a comprehensive cyber insurance policy.

- Blog by Tamanna Shaikh

A positive leadership style is mostly dependent on authentic leadership. A trustworthy leader is one who has a reputation for being transparent and unambiguous. Financial communication serves as the foundation for any organisation in this regard. It alludes to the various financial messages that a business sends to its stakeholders. The necessity for transparency between financial professionals and the general public has only grown in significance as we move towards development and the convergence of many industries. We will emphasise the role of financial communication and its effectiveness in fostering positive relationships in the finance sector.

The Enron scandal is a classic case of firms hiding information from stakeholders about their operations and influencing board member decisions. As per reports the financial records were manipulated and remained opaque for its key stakeholders and partners. This led to the eventual bankruptcy and several litigations against one of the biggest energy firms in the US. Nonetheless, when it comes to investment strategy or capital flight decisions, financial communication is a crucial narrative that aids board members in their decision-making. If and only if transparency reporting

is untarnished, investors can use such data to make hedging decisions that mitigate investing strategy under a risk-reward scenario.

There is more to financial communications than just banks. The ecosystem consists of people who want financial transparency from businesses. Financial strategy, which addresses capital inflow and revenue management of a business, is the foundation of financial communication. Open and honest communication makes it easier to collaborate with investors and is crucial to a company’s ability to secure funding.

An important component of strategic business communication is investor relations and financial communication. Investors are not just a source of capital for businesses; they also have an impact on company strategy through their ability to supply market insights or, in the case of activist shareholders, influence and promote strategic initiatives within the governance structure. Therefore, establishing rapport and mutual understanding with the financial community should be a top concern for all businesses.

The perception of a corporation is shaped by a variety of non-financial factors, including the organisation’s

governance, corporate social responsibility, reputation, brand, integrity of its management, and strategy coherence, all of which contribute to communication financing.

The organisations have realised how critical it is to incorporate ESG initiatives into investment and commercial plans in order to reassure investors that ESG is now considered an integral part of business strategy rather than a stand-alone workstream. In order to ascertain the company’s financial performance, ESG relies on non-financial performance metrics. It serves as a key signal for investors when deciding whether to purchase or sell a company’s stock.

In today’s environment, investors want greater openness from businesses when it comes to how they manage their environmental effects, board governance, community involvement, and commitment to moral principles. In order to address this and inform investors, analysts, and shareholders, the company’s adherence to ESG principles must also be communicated through its financial disclosures. Many businesses have looked to financial communications during the pandemic to assist in informing staff members about the company’s

future prospects. Financial communications have changed to meet these new demands, just as society has adjusted to a new normal.

One underrated yet important factor that most businesses overlook is giving the hiring and training of investor relations and corporate communicators top priority. This influences how a company’s story is told through its financial standing, potential for expansion, and adherence to ESG principles. Businesses may optimise their capacity to strategically engage investors and cultivate enduring relationships with shareholders by allocating resources towards the acquisition of appropriate personnel and experience.

Companies can stand out in an increasingly competitive marketplace and draw in more discerning investors and job seekers by using a deliberate and planned approach to strategic communications. Dealing with business-critical scenarios or exercises, such as investor targeting, developing investor relations (IR) policies, acquisitions, post-merger integration, initial public offerings (IPOs), crisis communications, and executive positioning, is also essential. Investor relations

specialists are vital in bridging the divide between a business, potential investors, and current shareholders in this dynamic environment. Their job is to tell investors about financial performance, strategy, and outlook. To do this, they need to be able to navigate an industry that is filled with complexity and effectively communicate multifaceted financial information. Given the speed at which regulations are changing in this field, investing in thorough IR (investor relations) training can be very beneficial.

When barriers between audiences dissolve, it also means having the guts to communicate across a wider variety of channels. Social media’s ascent and

the ease with which information is now accessible have dismantled boundaries between shareholders, clients, staff, partners, and other stakeholders. An effective, comprehensive, and tried-and-true integrated communication strategy is needed in these high-stress information times. It should permeate every aspect of the firm and influence all that it says. A sound financial communications strategy should not only guarantee that the company’s information is distributed as needed by the authorities but also openly and honestly report on all of the company’s activities to all of its stakeholders. As a result, financial communication plays a crucial role in the ever-evolving landscape.

- Article by Tamanna Shaikh

Our home is a reflection of our personality, style, and aspirations. The world of interior design is constantly evolving, with new trends and ideas shaping how we decorate our homes. With a step into 2024, it’s time to explore the hottest home decor trends that will dominate the interior design world. These trends will redefine how we approach home styling, from sustainable materials to innovative colour schemes. Technology has been playing a major part in our lives, especially in the household. Smart homes are becoming increasingly popular for integrating into our everyday routine. This year, home design trends signal the approach of smart home technology, which is increasing its claws and taking over the conventional methods of home furnishing. While some people prefer the old-school way of living that feeds their nostalgia for their parent’s houses, the new generation craves tech-infused surroundings where they can control almost every device in their house with the touch of a button on their smartphones. Technology embedded with a touch of convenience and personalised living space is what they need today. Let’s dive into the top trends shaping interior design in 2024.

With the world moving towards achieving net zero emissions and other carbon-neutral practices, people are shifting their focus towards adopting sustainability, which is supposedly taking centre stage in 2024. Appliances equipped with AI, such as the bespoke refrigerator, come with technology that optimises energy by reading carbon footprints and aids in cost savings. This eco-friendly approach is particularly appealing to the environmentally conscious young generation of homeowners. The advent of ecoconscious living has given rise to various home furnishing trends that incorporate the expression of nature into homes. Today, we have the latest biophilic designs and energy-efficient appliances that track the carbon footprint. This has even boosted the popularity of rooftop solar panels. the use of natural materials for furniture and decor items such as bamboo, jute, and cork, has reduced the dependence on plastic. Upcycling, recycling, and reusing household products

is another very helpful way to manage trash and lead a sustainable lifestyle that is mindful of the planet.

The world is full of extravagant designs that are always changing and overwhelming us. Simplicity is scarce. A decade ago, when people were all showy and vocal about their surrounding space, people are now looking for a complexity-free lifestyle. The significance of simplicity has been stronger in recent years. With minimalism taking a trending space these days, from household to fashion, people are going by the mantra that less is more.

Adopting minimalism in home decor creates a serene environment by decluttering spaces, promoting mindfulness, and enhancing functionality. Simplified aesthetics prioritise quality over quantity, encouraging conscious consumption while minimising environmental effects. The minimalist design features clean lines, neutral colours, and uncluttered spaces, allowing for personal expression and calmness. Minimalist homes promote a more peaceful lifestyle by focusing on essential items and eliminating excess.

From dawn to dusk, our lives are intertwined with gadgets and devices that simplify tasks, entertain us, and even enhance our security. Technological

developments lately have infused themselves seamlessly into our lives. With ongoing trends, the demand for smart home technologies and connected devices is increasing rapidly. As per the latest report, the global smarthome market is supposed to reach 75 billion dollars by 2025. This increase can be attributed to the fact that more and more people are deviating towards incorporating smart devices into their homes. From smart video doorbells with motion sensors to smart locks that can be controlled via app, these gadgets have added an extra layer of security and provide convenience in securing our homes. Voicecontrolled virtual assistants like Amazon Alexa, Siri, and Google Home have also become major household companions, providing hands-free assistance with tasks such as playing music and controlling the lighting, temperature, and entertainment systems. These AIpowered assistants are changing the concept of home automation, becoming the hottest trend in 2024.

These new-age home furnishing trends represent more than just aesthetics; they reflect a way of life that is authentic, sustainable, and heavily reliant on technology. The development of connected devices coincided with the advent of internet technologies. The market saw tremendous growth, all thanks to the affordability of these IoT devices. At this point, creating smart homes is not a mere privilege; it is more of a necessity, as people are more focused on making their lives easier. The opportunities for improving the home experience are endless as technology advances, pointing to a future in which comfort, efficiency, and innovation coexist together. After all, home is where the heart is, and with the right furnishings, it can also be where our dreams and aspirations take flight.

- Blog by Madhulika Pandey

Technology is grappling the world with new innovations without bounds. It has become so fierce that too much has become too little. Since its beginnings, the field of computers has advanced significantly. From large, room-sized mainframes that required extensive cooling systems to fit into a data centre to compact devices that can fit into the palm of your hand, technology has undergone a remarkable transformation. One such evolution in the world of computing is the rise of edge computing. This blog will give you an overview of edge cloud technology, covering everything from its origins to the most recent developments.

Akamai launched its content delivery network (CDN) in the 1990s, thus marking the beginning of edge computing. Network nodes that cached static media closer to end users were part of the technology. Subsequently, in 1997, Nobel et al.’s “Agile application-aware adaptation for mobility” showed how many programmes, including web browsers, video players, and speech recognition software, can delegate specific tasks to strong servers (surrogates) when operating on mobile devices with limited resources. The aim was reducing the workload on the user-end computing devices and to extend the battery life of mobile devices. For instance, speech recognition technologies offered by Google, Apple, and Amazon nowadays operate on this principle. The first decentralised computer systems were created in response to the demand for more reliability, lower latency, and faster processing. By bringing processing closer to the point of data generation, these systems lessened their reliance on the constrained bandwidth and latency that come with sending data to a central data processing centre. These decentralised systems’ inception served as a precursor to edge computing as we know it today.

As suggested, several peer-to-peer (also known as distributed hash table) overlay networks were deployed in 2001 for scalable and decentralised distributed systems. These self-organising overlay networks make load balancing, object placement, and routing effective and fault-tolerant. By using these systems, we can take advantage of the network proximity of underlying physical connections on the internet to avoid long-

distance interconnections between peers. This reduces the total load on the network and enhances application latency.

Now coming to cloud computing, as it has a major influence on edge computing. It garnered attention, especially in 2006, when Amazon promoted its ‘Elastic Compute Cloud’. This paved the way for new opportunities in terms of computation, visualisation, and storage capacity. Cloud computing as a whole was not, however, the answer in every situation. The development of autonomous vehicles and the industrial IoT, for instance, has led to a growing focus on local information processing to facilitate quick decision-making.

Another term known as Cloudlet came into the picture when Satyanarayanan et al. displayed their paper ‘The case for VM-based cloudlets in mobile computing’ in 2009. The paper highlighted latency and introduced a two-tier architecture. The first tier is known as a cloud (high latency), and the second as a cloudlet (lower latency). The latter are decentralised and widely dispersed internet infrastructure components. Nearby mobile computers can leverage the compute cycles

and storage resources of those computers. Moreover, a cloudlet only stores a soft state, such as cached copies of data.

Additionally, Cisco introduced the term fog computing for dispersed cloud infrastructures in 2012. Encouraging IoT scalability—that is, the ability to manage massive IoT device counts and massive data volumes for realtime low-latency applications—was the main goal.

• T-Mobile and Google Cloud partner on edge computing and 5G, providing businesses with further opportunities to adopt digital transformation. In order to assist customers in embracing nextgeneration 5G apps and use cases, such as AR/ VR experiences, T-Mobile will integrate Google Distributed Cloud Edge (GDC Edge) with the 5G Advanced Network Solutions (ANS) suite of public, private, and hybrid 5G networks.

• VMware provides an effective transformation of business operations at the edge. With the help of the robust new VMware Edge Cloud Orchestrator, enterprises can install, configure, run, and maintain

their edge installations more securely. This tool is built upon the well-established network automation and orchestration capabilities.

• IBM and American Tower formed a partnership to expedite the implementation of a multi-cloud, hybrid computing platform at the edge. American Tower intends to add Red Hat OpenShift and IBM hybrid cloud capabilities to its ecosystem of neutral-host Access Edge Data Centres.

• An international supplier of semiconductor technologies unveiled the eBMC chip. This cuttingedge solution, created specifically for edge computing platforms, promises to improve the edge computing environment’s efficiency, security, and management capabilities.

• Essilor Luxottica and Meta Connect collaborated to create the upcoming Ray-Ban Meta smart glasses line. Along with better audio and cameras, the new glasses come with more than 150 unique combinations of bespoke frame and lens options.

Additionally, live streaming from the glasses to Facebook or Instagram is possible. By simply saying “Hey Meta,” users can communicate with Meta AI through voice commands.

As technology continues to evolve, edge computing is poised to play a pivotal role in the future of computing. Edge computing provides a scalable and flexible solution that can handle the exponential growth of IoT and the demand for real-time data analysis.

Additionally, the emergence of 5G networks offers the necessary infrastructure to support edge computing on a larger scale. As technology continues to progress, the future holds tremendous potential for edge computing to revolutionise industries and empower the next generation of smart devices and applications.

- Blog by Tamanna Shaikh

Artificial intelligence is becoming more and more prevalent in a variety of industries, including banking, retail, and healthcare. Consequently, this revolution is not unique to the aerospace sector. Artificial intelligence and its computational capabilities for data interpretation can simplify and expedite a wide range of tasks, including system administration, customer support, analytical procedures, and more. AI has swiftly brought in a new era of productivity and efficiency by revolutionising several parts of the manufacturing process. AI algorithms can identify discrepancies, forecast failures, and initiate repair procedures before problems arise by evaluating enormous volumes of sensor data from aircraft systems and components.

The development, production, maintenance, and support of aeroplanes, spacecraft, and rotorcraft are all encompassed within the aerospace sector. It is a highly important industry, and the success of its components depends on their extreme accuracy and dependability. As a result, the sector must continuously enhance its production procedures, lower labour expenses and error rates, keep an eye on the condition of aircraft electronics, and successfully handle safety-related concerns. All these constraints can be resolved with artificial intelligence, the catch being the algorithms should be trustworthy and reliable.

According to a particular analysis, the global aircraft artificial intelligence market is expected to generate $5.82 billion by 2028, growing at a CAGR of 43.4% between 2021 and 2028 from a 2020 valuation of $373.6 million. The dominance of the software segment, which

held three-fourths of the market share in 2020, is one of the most noteworthy trends in this industry. From 2021 to 2028, this segment is expected to develop at the fastest CAGR of 45.5%, maintaining its position as the market leader. Furthermore, with a CAGR of 45.7% over the course of the projected period, the flight operation segment is anticipated to lead in terms of revenue creation. As of 2020, North America accounted for about two-fifths of the global market, holding the greatest share of the market. But from 2021 to 2028, the Asia-Pacific area is predicted to experience the greatest CAGR of 46.0%.

Various organisations have started to use this technology for example when Swiss International Airlines started utilising AI to increase productivity, it claimed to be able to save five million Swiss francs by 2022 and optimise over half of the flights in its network. Similarly, GE Aerospace was able to monitor and analyse real-time data from aircraft engines thanks to their digital twin AI technology. By using this technique to anticipate component degradation, airlines could plan maintenance ahead of time and minimise unplanned disruptions. Another example is the cloudbased service platform Airbus Smarter Fleet, which was created by Airbus and IBM. It offers a range of solutions to Airbus clients, such as improved fuel economy, enhanced flight efficiency, and intelligent maintenance and engineering tools. The latest advancement of IBM Watson is that it can analyse massive amounts of data and find new, unidentified root causes by making correlations that a person could never find. In one case, Watson pinpointed the exact correlation between temperature and premature brake wear. This discovery

aided in the development of prognostics by aircraft manufacturers that help airlines avoid delays.

Let’s not forget Airbus’s THOR which made history as the first 3D-printed aircraft. The next iteration will have the added capability of autonomous flight, driven by artificial intelligence. If a drop in cabin pressure prevents a passenger plane’s pilots from flying, this technology might be utilised. AI would take over at this point. Boeing recently inked a deal with a tech start up in California that creates drones, artificial intelligencepowered fighter pilots, and defence-related technology. It has unquestionably reached a tipping point when big aerospace companies are utilising AI to enhance their products and services.

Generative AI is progressing significantly in the aerospace sector, particularly in the creation of images and videos. For example, engineers and designers can use it to make precise and comprehensive 3D models of aircraft parts, which will aid in the production process. Better quality control, quicker prototyping, and maybe

lower production costs are made possible by this. Moreover, pilots and crew members can benefit from virtual reality training simulations made possible by generative AI, which will increase their competency and safety. With the ability to mimic actual surroundings and situations, these simulations offer a hands-on experience without the dangers or expenses involved.

Furthermore, by employing data to create simulations of probable future malfunctions, generative AI holds promise for predictive maintenance. Pre-emptive repairs are made possible by these predictive models, extending the aircraft’s operating life and perhaps saving millions of dollars in maintenance and downtime expenses.

• Ensuring smoother takeoffs & landings- AI systems can forecast the best course for an aircraft by assessing enormous volumes of data

and taking into account variables like weather, air traffic, and airport congestion. This technology lowers expenses and its impact on the environment by improving fuel efficiency and ensuring smoother take-offs and landings.

• Aircraft maintenance & predictive analyticsAI-powered systems can identify any problems before they become serious by continuously monitoring a variety of sensors and components. Maintenance staff may schedule repairs or replacements thanks to this proactive strategy, which reduces the likelihood of unforeseen disruptions and raises aircraft reliability overall.

• Streamlining air traffic control- AI provides ways to improve controller-pilot coordination by streamlining ATC operations. Artificial intelligence (AI) can anticipate possible conflicts and recommend alternate routes by utilising machine learning algorithms. This allows for optimal traffic flow while upholding safety standards.

• Weather forecasting and avoidance- Accurate weather forecasts can be produced by AI algorithms by analysing vast volumes of historical and current meteorological data. Airlines can avoid bad weather and cut down on flight delays by using this information to inform their route decisions. It can also be integrated with flight planning.

• Improving design efficiency- AI is transforming aeroplane design by improving performance and efficiency. AI algorithms can quickly develop and assess thousands of design choices while taking into account many characteristics, including fuel efficiency, weight distribution, and aerodynamics, by automating difficult design procedures. With the use of this technology, engineers can now produce previously unthinkable levels of design optimisation, which significantly improves aeroplane performance.

• Enhancing quality control- During the production stage, artificial intelligence is vital to improving

quality control. AI-driven systems can assess real-time data from cameras and sensors to detect manufacturing flaws, guaranteeing that only the best parts are utilised in the manufacture of aeroplanes. This technology increases overall aeroplane safety by reducing the likelihood of malfunctions.

When cutting-edge technology emerges, it might cause drastic reactions in a given sector. Businesses either use the tool excessively or don’t use it at all. A balanced approach to AI is preferable. Artificial intelligence (AI) will be around to stay, so businesses must find a cautious balance and implement AI responsibly, maximising advantages, minimising hazards, and taking necessary action to address job displacement and human oversight of AI. This paves the way for a cooperative setting where people and AI collaborate to produce innovative breakthroughs in space and aviation technology.

- Article by Tamanna Shaikh

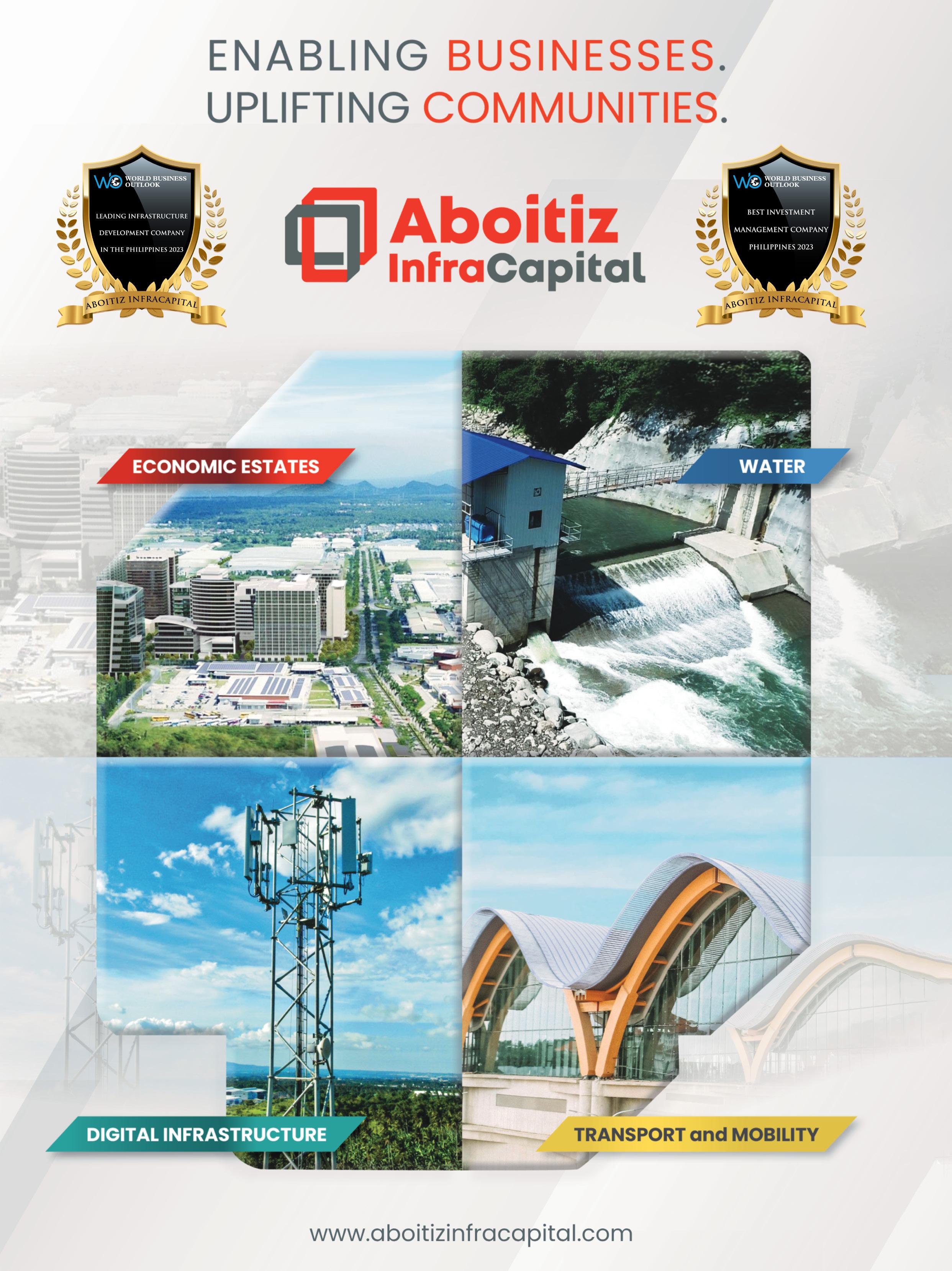

‘We focused on customer satisfaction and customers push our sales’:

Winner of the award titles Most Recommended CFD Broker and Best Cryptocurrency CFD Broker from St Vincent & The Grenadines in 2023, BigBoss is a global leader in world-class trading opportunities for the amateurs as well as the beginners. Since 2013, it has maintained its leadership as a CFD Broker in the trading industry. As the winner of the title Most Transparent Forex Trading platform in 2023, BigBoss follows the principles of continuing reform, improvement and challenges with reliability in mind.

The CEO of BigBoss, Christopher Jason, actively promotes the importance and implementation of top-class safety measures for every one of its global

traders. He spoke to World Business Outlook in an exclusive interaction to help us understand more about the various attractive incentives & benefits of being a part of BigBoss. Here is the transcript of that interaction

1. Tell us more about the BigBoss Loyalty Program, from its days of inception, its current evolution, and possibly its future iterations. BigBoss always places a high value on customer relationships and is dedicated to building long-term cooperative relationships with its clients. To show appreciation for customers who have favored our services over the years, we have launched the BigBoss Loyalty Program (BLP) in 2023. Since its introduction,

the BLP has been widely well-received. The BLP aims to maximize the benefits for our users. For example, benefits include exchanging BigBoss Points (BBP) for cash by upgrading status and increasing the BBP earned per 1 Lot traded. Furthermore, it’s possible to upgrade your BLP status using BigBossCoin (BBC), a cryptocurrency developed by BigBoss, which allows for various benefits within BigBoss. This suite of services works in synergy to strengthen the BigBoss service ecosystem. While our customers enjoy these benefits, BigBoss also expands its profits, creating a win-win relationship. In the future, we plan to continuously provide new experiences to our users.

2. According to you, how is an investment in Cryptocurrency a viable option today? How is BigBoss making it a profitable option today?

Many people have made significant profits from investing in cryptocurrencies, making it a viable investment option. However, to make it a profitable investment, it’s crucial to gain various knowledge, including an understanding of global situations, the characteristics of cryptocurrencies, and the regulations surrounding them. As cryptocurrencies have been in the spotlight for less than a decade, their prices can be highly volatile, offering the potential for high returns but also accompanying significant risks.

To become a profitable option, BigBoss has strategized around the following four keywords:

• Offering innovative services: By providing unique values to users, such as BBP and BBC, BigBoss offers attractive options to investors.

• Providing education and resources: To make investing enjoyable for users, BigBoss delivers education on trading and market analysis through blogs, columns, and newsletters.

• Enhancing security: For the safety of funds, BigBoss has implemented advanced security measures.

• Improving user experience: Aiming to optimize user experience through ease of interface use and multilingual customer support.

3. How did BigBoss remain consistent to its philosophy of ‘customer-first’ in this cut-throat CFD industry? BigBoss’s customer-first philosophy originated from the belief that “maximizing customer benefits leads to maximizing our sales.”

During the early days of BigBoss, there was a period of struggle to acquire customers and faced many difficult management challenges. It was then that the company decided to focus on the theme of “customer-first,” prioritizing on increasing the satisfaction of existing customers over acquiring new ones in its management strategy.

This shift led to existing customers spreading the word about BigBoss’s exceptional services, allowing the business to expand rapidly.

BigBoss is committed to this customer-first philosophy, ensuring a system is in place for quick and courteous responses to customer inquiries. Additionally, the company employs flexible support through social media and chat tools, enhancing customer convenience.

4. Tell us about the various initiatives taken by BigBoss to enhance its transparency and trust among its customers and partners. The effort to increase trust from customers and partners is very simple.

It’s all about “always providing what the customers want.”

There’s a dilemma that offering what maximizes customer benefits might reduce our profits. However, our business model relies on collecting a portion of the amount used by customers in FX trading as fees, meaning we don’t profit unless customers trade with BigBoss.

In terms of always providing what customers want, one example is that BigBoss has made transaction fees free for standard accounts. While transaction fees are a source of revenue for many CFD brokers, we believe customers prefer not having them. Pursuing short-term profits might lead to charging transaction fees, but our primary philosophy is to provide what customers want, hence the free transaction fees for standard accounts.

We also ensure that customer support handles withdrawal procedures quickly. Many CFD brokers allow quick deposits but take time for withdrawals, causing customers to worry if their money is being withheld. We want customers to enjoy their profits without delay, so we are careful to avoid lengthy withdrawal times.

Moreover, we have prepared a comprehensive support system to enhance customer satisfaction. Since FX is traded worldwide, issues can arise overnight due to time differences. Therefore, we ensure that support staff are available to assist with any problems at any time. Our support staff are thoroughly trained to respond

from the customer’s perspective, aiming for quick and courteous answers.

Additionally, we have enhanced our response capabilities for emergencies, such as system failures. In FX trading, where leverage is significant, system outages can lead to substantial losses. Thus, we focus on quickly identifying and resolving issues and providing appropriate responses to customers. Demonstrating a willingness to compensate for losses as much as possible helps build trust.

By thoroughly adopting a customer perspective, maintaining a strong support system, and collaborating with the industry, we have gained trust from customers and partners. We consider this trust to be the foundation of our business.

5. How has BigBoss as a Fintech organization garnered prominence in the global financial industry? Give us a brief about its current status of operation across the world.

BigBoss takes pride in being a highly trusted CFD broker worldwide, as evidenced by winning the triple crown at the World Business Outlook Awards 2023.

BigBoss has primarily focused its business expansion in Asia due to the region’s large population and many countries experiencing significant development, foreseeing further needs in the future.

Indeed, the widespread adoption of smartphones and fintech becoming more accessible have allowed our business to expand rapidly. We plan to continue our business expansion mainly in Asia, preparing to venture into Central Asia and the Middle East, regions expected to see increased needs due to their growing populations. As a globally trusted CFD broker, we aim to meet these needs.

Asia is home to populous nations like India and China, along with ASEAN countries experiencing notable economic growth. In these countries, the middleincome class is steadily expanding, especially in

urban areas, leading to increased interest in wealth creation and investment. The ease of access to financial services, facilitated by the widespread use of smartphones, has also been a favorable factor. Against the backdrop of Asia’s economic development and the improvement of individual financial literacy, BigBoss has been responding to customer needs by enhancing its product development capabilities and payment infrastructure, thereby steadily expanding its business.

However, outside of Asia, the foundation for offering globally viable services is not yet solid. In Western developed markets, regulatory environments are stringent, while emerging markets in the Middle East and Africa face infrastructural challenges. BigBoss considers business expansion in these regions, in addition to Asia, essential in becoming a truly global player. We are preparing various measures to understand the culture, business practices, and regulations of each region and collaborate with local partners to offer services that are both global in standard and localized.

-

Interview by Ujal Nair.

Arabsat, the leading satellite operator in the Arab world, and Aldoria, a pioneering space situational awareness company, announced at LEAP 2024, the world’s most attended tech event (Saudi Arabia), the signing of a Memorandum of Understanding (MoU) to collaborate on enhancing space safety and security.

This MoU is one of the fruitful outcomes of the 1st Space Debris Conference in Saudi Arabia held in Riyadh on February 11-12 and organized by the Saudi Space Agency. The Agency, represented by its Sector Head of Space Services, Eng. Kamal Alharbi, is fostering the development of the space economy in the Kingdom of Saudi Arabia and supports the development of capacity

and know-how in space situational awareness for the Kingdom of Saudi Arabia and the Middle East.

Arabsat, a global leader in satellite operations and the foremost provider of satellite services in the Arab world, excels in delivering a comprehensive range of solutions. From full spectrum TV and radio broadcasting to telecommunications, broadband, advanced data transmission networks, and a variety of satellite ecosystem services, Arabsat offers a seamless integration of multi-channel communication services. Additionally, they provide internet services tailored to the needs of government and commercial entities across the MENA region.

This MoU sets the stage for expanded collaboration on key strategic initiatives and potential ventures. Under this agreement, Aldoria would provide its advanced space solution to Arabsat and its member countries, enhancing their capabilities in safeguarding space assets. Furthermore, the partnership includes plans for the establishment of one of Aldoria’s sensor systems in an Arabsat member country, further strengthening space security measures in the region.

“We are particularly enthusiastic about harnessing Aldoria’s advanced solution, given their proven track

record of providing offerings to renowned satellite operators. This partnership reinforces our capability to uphold service delivery to our customers worldwide.” asserted Alhamedi Alanezi, CEO & President of Arabsat.

Romain Lucken, CEO of Aldoria added “The leadership shown by Saudi Arabia and the broader MENA region in prioritizing space safety and sustainability is remarkable. We take pride in consistently delivering our services to leading providers globally, affirming the strong market demand and our dedication to supporting industry leaders.”

Unleash live is excited to announce its participation in the Advanced Air Mobility Cooperative Research Centre (AAM CRC), a groundbreaking initiative aimed at transforming Australia’s aerospace and aviation sector. Together with over 65 leading partners and universities, we have completed Stage 1 of a 10-year innovation program focused on advancing autonomous air mobility.

The AAM CRC will serve as a pivotal research platform, leveraging the nation’s capabilities to drive the

transition towards sustainable air mobility solutions, including vertical take-off and landing aircraft, Vertiports and unmanned aerial systems. Through interdisciplinary collaboration, the CRC aims to propel Australia towards a clean, sustainable and globally competitive aerospace future.

Across key research streams – Air Vehicles, Air Operations and Ground Operations – the AAM CRC will empower stakeholders to integrate advanced aerial innovation into the national transportation system, optimising operations and fostering growth in domestic and international markets.

This submission marks a potential turning point, poised to become Australia’s largest collaborative research platform in aviation and aerospace technology. We are thrilled to be part of this journey and look forward to shaping the future of air travel.

Our participation in the AAM CRC submission underscores the transformative power of collaboration. We extend our gratitude to all partners for their invaluable contributions, laying the groundwork for realising advanced air mobility in Australia and beyond.

As we move into Stage 2, Unleash live remains committed to supporting Australia’s leadership in advanced autonomous air mobility. Together, let’s propel our nation to the forefront of innovation and shape a future where autonomous air mobility is accessible to all.

Commenting on this milestone, Unleash live CEO, Hanno Blankenstein, remarked, “This is a pivotal step towards the future of air mobility in Australia. Unleash live is proud to support this effort and together, let’s lead the way in advanced air mobility.”

Stay tuned for updates as we embark on the next phase of this transformative journey. Together, let’s soar towards a future where autonomous air mobility becomes a reality for all.

SolarEdge Technologies, Inc., a global leader in smart energy technology, announced that it has signed an agreement to invest in and partner with AMPEERS ENERGY (“AMPEERS”), a German based software start-up that designs and operates solutions for decarbonizing entire portfolios of multi-dwelling buildings and serves a broad spectrum of real estate companies across Germany and Austria.

By pairing SolarEdge’s proven solar and smart energy portfolio with the AMPEERS platform, this partnership is designed to combine technology, software and services to create a new all-inclusive photovoltaic tenant electricity solution. The offering is expected to provide real estate companies with a holistic solution for a climate-neutral building portfolio, which includes

the planning, implementation and financing options for solar and storage generation, tenant electricity billing solutions, EV charging infrastructure and new heating technologies. The solution is designed to provide landlords and tenants with the economic benefits of optimized on-site solar generation and enable a faster and simpler installation of photovoltaic and tenant electricity solutions in real estate portfolios.

The inherent benefits of SolarEdge’s advanced solar technology such as built-in safety features, maximized energy yield, design flexibility and reduced operational and maintenance costs play a key role for multidwelling buildings that typically have limited roof space and access.

SolarEdge’s investment and partnering with AMPEERS is a strategic step that aims to capitalize on legislative changes1 in tenant electricity models in Germany, and can provide a new avenue to address the multidwelling market across Europe.

Zvi Lando, CEO, SolarEdge Technologies, said: “More than half2 of the population in Germany live in multidwelling apartment buildings, most of them under a leasing contract. Until recently this meant they had less access to clean solar energy in comparison with those who own a private home. By providing holistic and smart energy solutions to real estate companies together with AMPEERS, we hope to help increase the accessibility of decarbonization and economic benefits provided by solar to more people across the country.”

Dr. Karsten Schmidt, CEO and co-founder of AMPEERS ENERGY, said:”SolarEdge stands at the forefront of smart renewable energy technologies. This collaboration is centered around a holistic approach that combines technology, software and services. We are focused on providing residential portfolios with a scalable PV tenant electricity solution, embedded into an overall carbon strategy. This comprehensive package streamlines the process for housing companies to swiftly and costeffectively adopt a climate-positive energy supply.”

The investment is subject to certain customary closing conditions and regulatory approvals and is expected to be finalized during the first half of 2024.

Visa, a global leader in digital payments, and Taulia, a SAP company, and a leading provider of working capital management solutions, have announced a new partnership to make embedded finance accessible to businesses worldwide. The collaboration will incorporate Visa’s digital payments technology into Taulia Virtual Cards, a solution that integrates with SAP enterprise resource planning (ERP) solutions and business applications for a seamless and streamlined payments experience for buyers and suppliers.

Visa and Taulia’s partnership will simplify payments across the business ecosystem by enabling virtual payment credentials to work natively across SAP business applications. Through the planned integration, Visa’s APIs will embed virtual payment credentials, acceptance and enablement solutions directly into SAP business applications. The synergies created reinforce the financial institution’s role as Issuer, and the ERP relationship to the corporate client, driving further value through embedded finance capabilities.

Corporate buyers are turning to embedded virtual card solutions to deliver a seamless payment experience, in which users can remain in their ERP or business applications to recognize mass efficiencies. The joint solution will help CFOs, procurement and accounts payable teams automate payments to suppliers, which is especially helpful for paying one-time suppliers as this eliminates the need to create full master data in the system, a process that can take weeks or even months. Suppliers will gain improved cash flow and enhanced visibility, alleviating friction across B2B transactions. This new partnership and resulting solution replace a

historically manual reconciliation process for buyers.

“We are thrilled to partner globally with SAP/Taulia to embed our digital payment solutions into workflows across this impressive ecosystem,” said Alan Koenigsberg, SVP, Global Head of Large, Middle Market Segments and Working Capital Solutions at Visa. “By partnering with SAP/Taulia, we create synergies in working capital management and the enablement of a world class ERP provider. We believe that we are creating a best-in-class payments automation experience for buyers and suppliers alike, while removing cumbersome processes that take time away from the most strategic work that drives growth.”

Taulia Chief Product Officer Danielle Weinblatt said:

“Our partnership with Visa further demonstrates our commitment to delivering a customer-centric virtual card experience. Visa’s leading-edge capabilities and vast network will allow us to innovate and help our customers around the world advance on their journey with forward-thinking working capital technology.”

Halonix Technologies announce the launch of its Switchgear category, the ‘SURE MCB Series’. Engineered with precision for safety, reliability, and assurance, the SURE MCB Series is set to become the new standard in electrical circuit protection.

‘SURE MCB Series’ from Halonix, is a suite of cutting-edge circuit breakers designed for unmatched electrical safety, reliability and assurance. With features such as C-Curve operation for reliable protection against short circuits, a high-grade solenoid for consistent performance, 100 percent silver contact points for superior conductivity, and a high breaking capacity of 10Ka, these MCBs set a new standard in electrical safety. Backed by a 5-year warranty, the SURE MCB Series exemplifies Halonix’s commitment to excellence in quality and customer satisfaction.

The series offers a versatile range of products catering to residential, commercial, and industrial applications. Designed for ease of installation and user-friendly operation, the SURE MCB Series is competitively priced, ensuring accessibility for a broad spectrum of customers. Available through Halonix’s extensive distribution network and will soon be available on leading e-commerce platforms and electrical retail stores nationwide. These MCBs offer the best solutions for those who prioritise safety and quality for their premises.

Enthusiastic about the launch of the new product, Rakesh Zutshi, Managing Director, Halonix Technologies, said “We are thrilled to introduce the SURE MCB Series to the market. This launch is a testament to Halonix’s relentless pursuit of innovation and excellence in electrical safety. With its advanced features, comprehensive warranty, and diverse range, the SURE MCB Series exemplifies our commitment to providing our customers with products that ensure safety, reliability and assurance.”

Persefoni Japan G.K. announces partnership with Deloitte Tohmatsu Consulting LLC, a member of Deloitte Tohmatsu Group (Deloitte Tohmatsu), to manage clients’ carbon emissions. Persefoni and Deloitte Tohmatsu will begin a system implementation from strategic concepts to management and disclosure.

In recent years, companies have been focusing on measuring greenhouse gas emissions not simply because climate change is becoming more serious for business and personal risk, but also given the demand from investors. Investors frequently request information on a company’s ESG (Environmental, Social, and Governance) performance, making reducing Greenhouse Gas (GHG) emissions an essential component of sustainable business operations. Under these circumstances, companies are increasingly

measuring and visualizing their carbon emissions, resulting in an even stronger demand for external disclosure of environmental impact and financial risk.

The strategic partnership between Deloitte Tohmatsu & Persefoni leverages the strengths of both companies to efficiently disclose and manage emissions, develop and implement decarbonization strategies. Persefoni’s carbon accounting and management platform will streamline accurate data collection and calculation, manage carbon emissions with high transparency, and meet external requirements in anticipation of external disclosure of GHG emissions information across multiple stakeholders.

By combining Deloitte Tohmatsu’s knowledge of strategy and operational reform in these areas with

the strengths of Persefoni’s software together we enable end-to-end support from conceptualization to systematization and implementation, improving the efficiency and sophistication of corporate GHG emissions management.

A major challenge companies face when managing GHG emissions is not merely collecting their own data, but also strengthening engagement with suppliers and customers, and making medium- to long-term efforts to obtain emissions data from the supply chain. The partnership leverages Persefoni’s software to small and medium-sized enterprises to gather accurate data from their supply chain enabling them to further implement decarbonization strategies.

To further this goal, Persefoni is providing Persefoni Pro – a free guided version of its platform advancing its proprietary generative AI technology enabling small and medium-sized enterprises in the supply chain through the GHG emissions information collection, analysis, and disclosure process. This groundbreaking free solution, Persefoni Pro, was launched in the states in January 2024, and demonstrations are already being conducted with customers in Japan, where the service will commence in the summer of 2024.

Persefoni’s carbon management and accounting platform provides the technology to replace low-grade estimates with high-grade actual data, and Deloitte Tohmatsu will provide knowledge of the business design and engagement mechanisms, thereby strengthening medium- to long-term engagement throughout the supply chain while improving the sophistication and data quality of Scope 3 calculations.

“Scope 3 and Supply Chain engagement and management have historically been the largest weight of a company’s carbon footprint, and also among the most complex facets to navigate. With Persefoni Pro, we have leveraged the power of nearly five years of accomplishments with Generative AI, our excellent, global team of carbon experts, the collective knowledge base of our amazing partners, and our core enterprise

climate accounting and management software, to design a truly self-guided process for a SME that might be inexperienced at carbon accounting,” said Kentaro Kawamori, CEO and Co-founder of Persefoni. “Persefoni Pro then streamlines the communication and collection of this data up the supply chain to the customer, making what had heretofore been a complex process more accurate and materially simpler. We are excited to continue our investment in Japan by offering Persefoni Pro free to the business community here, but even more honored to combine and augment this offering by partnering with one of the most respected and experienced partners in the region, Deloitte Tohmatsu Consulting for a holistic end-to-end solution.”

The Antigua Public Utilities Authority (APUA) and Seven Seas Water Group (SSWG), a multinational provider of Water-as-a-Service® (WaaS) solutions, jointly announced the signing of a 12-year Build-OwnOperate-Transfer agreement. Seven Seas Water Group will construct two new seawater reverse osmosis (SWRO) plants, contributing a combined total of three million imperial gallons of daily drinking water production capacity to the people of Antigua. The new plants will be strategically located adjacent to the existing facilities at Ffryes Beach and Ivan Rodrigues, utilizing

some of the existing infrastructure. Implementation of the new plants will occur in two phases, with Ffryes Beach expected to commence water production within seven months of signing the agreement.

The Honourable Melford Nicholas, Minister of Information, Communication Technologies (ICT’s), Utilities, and Energy, expressed his views on this significant development, stating, “This marks a crucial enhancement of our production capacity to meet the growing demand spurred by increased tourism, cruise

ship arrivals, and economic activity on the island. Teaming up with Seven Seas ensures a quick, reliable, and cost-effective water production source, fostering a strong, local, long-term partnership. My sincere thanks to APUA General Manager Mr. Bradshaw and his team for their tremendous efforts in making this collaboration a reality. This project will be a meaningful addition to our potable water production capacity.”

APUA General Manager, John Bradshaw, emphasized the importance of addressing the need to meet increasing water demand, stating, “Climate change has led to severe droughts in Antigua, necessitating water restrictions imposed by the Authority in recent years. Despite these challenges, the Authority remains resolute in its dedication to ensuring reliable water supply to its customers. Through the expansion of

water production sources, the Government of Antigua and Barbuda, alongside APUA, has demonstrated commendable efforts and investments in adapting to this mandate.”

Henry Charrabé, CEO of Seven Seas Water Group, commented on collaborating with the Government of Antigua and APUA, stating, “We are proud and excited to have the opportunity to work with Minister Nicholas and the team at APUA and to be part of their commitment to expanding and improving the local water infrastructure. We are looking forward to increasing the Seven Seas Water Group’s network of water treatment plants by rapidly bringing them online, solidifying our position in the Americas as a reliable, long-term Water-as-aService® provider for the citizens of Antigua.”

The Asia-Pacific (APAC) banking sector faced a dynamic landscape in 2022-2023, marked by economic headwinds and varying performance across emerging markets (EMs) and developed markets (DMs). Let’s delve into the key trends and outlook for APAC banks during this period.