Spotlight on Senior Care M&A

Fifth Edition

Spotlight on Senior Care M&A 2001-2023 | Fifth Edition The SeniorCare Investor Inside the World of Senior Care Mergers, Acquisitions and Finance Since 1948

SPOTLIGHT ON SENIOR CARE M&A

2001-2023 | FIFTH EDITION

ISSN: 2688-383X (print) | 2688-3848 (online)

ISBN: 978-1-970078-44-2

Published by: Irving Levin Associates, LLC P.O. Box 1117 New Canaan, CT 06840 Phone (203) 846-6800 | Fax (203) 846-8300 info@levinassociates.com

Managing Editor: Advertising:

Benjamin Swett

Cristina Blazek-Hearty

© 2023 Irving Levin Associates, LLC

All rights reserved. Reproduction or quotation in whole or part without permission is forbidden. First Class Postage is paid at New Canaan, CT.

This publication is not a complete analysis of every material fact regarding any company, industry or security. Opinions expressed are subject to change without notice. Statements of fact have been obtained from sources considered reliable but no representation is made as to their completeness or accuracy.

POSTMASTER: Send address changes to Irving Levin Associates, LLC P.O. Box 1117, New Canaan, CT 06840

Irving Levin Associates Publications and Services

Subscriptions & Memberships

Long-Term Care: LevinPro LTC

LevinPro LTC News

The SeniorCare Investor

Health Care: LevinPro HC

Introduction ............................................................................................... 6 Long-Term Care ....................................................................................... 8 Skilled Nursing Market 10 Independent/Assisted Living Market ................................................ 14 Independent Living Market .................................................................. 15 Assisted Living Market 22 Contents Spotlight on Senior Care M&A 2001-2023 | Fifth Edition

The senior care industry has taken a lot of punches in the last couple of decades but is still poised to see enormous growth in the 2020s. That is because the demographic tailwinds, even if most senior care properties are still years away from actually caring for baby boomers en masse, outweigh the numerous headwinds in the eyes of many investors. However, the COVID-19 pandemic posed a greater threat to the senior care industry than any other shock of the 21st century, so far, including the Great Recession and the period of severe overdevelopment in the mid-2010s.

The virus targeted the sick, frail and elderly, then admission bans caused census and cash flow to plummet at properties across the country. Plus, when seniors were finally allowed to make the move into a senior care facility, they were obviously older but usually frailer, and thus lengths of stay declined.

Then, a staffing crisis unlike ever before hit the industry. Temporary staffing agencies attempted to fill the gap while charging companies exorbitant costs and poaching their existing staff with the promise of higher marginal pay increases and more schedule flexibility. So, senior care providers had to significantly raise wages across the board to attract and retain staff, usually without the revenue increases to compensate for them.

Not helping the expense issue was inflation hitting the country, which saw costs for food, supplies, fuel and other items rise for facilities. Wages saw even more upward pressure as a result, too. Many seniors housing communities were able to use inflation as an excuse to raise rents as much as 6%, 8% or 12%. But, it was mostly the higher-end communities that could pass along those costs to their residents without a massive hit to their occupancies. Government reimbursement-dependent SNFs had no such luck.

But then, interest rates soared to combat inflation, and the cost to build, buy and own senior care facilities rose with the cost of debt and equity. Owners with floating-rate debt saw their capital costs soar, and properties that even could qualify for agency debt based on their trailing operating performance then faced refinancing at a higher-than-initially-expected interest rate. So properties bought and built under the assumption of a 3% fixed-rate, permanent mortgage now would deliver a lower return to their investors. That sent many potential buyers to the sidelines, waiting for interest rates to fall. At the same time, sellers took some time to accept the valuation realties based on those new capital cost assumptions, leaving bid-ask spreads way too wide for numerous transactions to close.

All of these factors led M&A to fall off its record pace of 2022, and leaves the industry in an uncertain position going forward.

Ben Swett

About the Editor

Ben Swett is the Managing Editor of The SeniorCare Investor, The Senior Care Acquisition Report and the LevinPro LTC & HC products at Irving Levin Associates. Since joining the company in 2014, he has reported on the senior care M&A, finance, and development markets. He has a BA in History from Hamilton College and an MBA in Finance from UConn. Contact Information:

Spotlight on Senior Care M&A | Fifth Edition | 2023 6 www.seniorcareinvestor.com

Introduction

The seniors housing and care merger and acquisition market has grown tremendously since the turn of the century in terms of deal and dollar volume but faces its toughest challenge to date.

Editorial@levinassociates.com 203-846-6800 www.levinassociates.com

informational

news

in-depth

intelligence

care and health care

More

and

Introducing LevinPro Gain an

edge with focused

briefs, expert analysis, and

deals

spanning long-term

industries. Learn

Long-term care

health care deals, data, news and insights

Long-Term Care

The number of mergers and acquisitions steadily increased throughout the 2010s in the seniors housing and care industry, until the pandemic led to an understandable drop in M&A activity. Dealmaking quickly rebounded to record highs in 2021 and 2022, but the current operating environment faces many headwinds, and capital markets issues have hit investors hard.

Investor interest in the senior care sectors has boomed since the Great Recession, rising steadily from 89 publicly announced transactions in 2009 to a then-high of 365 deals in 2015, according to statistics from LevinPro LTC. After a couple of years of lower activity, deal making took off again in 2018, reaching 435 deals (a 41% increase over the 308 transactions announced in 2017) and peaking at 457 deals in 2019. Including transactions that were confidentially disclosed or took place off market, that total would be even higher.

The buying frenzy had to come to an end, but no one could have predicted how it actually did. The first confirmed case of COVID-19 was announced early in the first quarter of 2020 (January 21st, officially), and investors halted much of their activity by the end of the first quarter and through Q3:20. COVID-19 raged through the population (especially the frail and elderly), lockdowns forced providers to shut their doors,

unemployment soared, political uncertainty persisted through the summer and fall, and much was still unknown about the virus or the prospect for vaccines.

The M&A market rebounded quickly, resulting in 361 deals in 2020, which was the fourth-highest deal total ever at the time, before buyers announced 457 deals in 2021 (the second-highest annual total ever). On an annualized basis, the first half of 2022 was the peak of M&A activity in seniors housing and care, when the 294 publicly announced transactions in the first half of 2022 annualized came to 588 deals, which would have been an annual record by nearly 100. But then interest rates started to rise, slowing acquisition demand and lowering prices. Calendar-year 2022 cooled from that pace, ending with 548 deals announced in the year (a record), followed by just 219 deals in the first half of 2023. When annualized, that total of 438 deals barely surpasses 2018’s total of 435 transactions.

Spotlight on Senior Care M&A | Fifth Edition | 2023 8 www.seniorcareinvestor.com

The size of deals also dropped with the rise in interest rates, and buyers were not willing to make big bets and sellers were less willing to divest large portfolios when values were low. Dollar volume plummeted in the first half of 2023 to $2.73 billion, which annualized would be the lowest total spend, based on disclosed prices, since 2009. And the 20% drop in deal activity from 2022 to annualized 2023’s total was exceeded by the 62% drop in dollar volume in the same period.

There were no mega deals (over $500 million) announced in 2023, either. The largest with a disclosed price was Axium Infrastructure and Optima Living’s $326.6 million acquisition of seven high-end retirement communities in Alberta, Canada. The largest recorded price in the United States in the first half of 2023 was the $136 million acquisition of eight assisted living communities in Pennsylvania (7) and Michigan previously owned by Persimmon Ventures and Big Bay Ventures. An undisclosed Northeast-based owner was the buyer. To put that in perspective, there were 14 publicly disclosed prices above that mark in 2021 and 27 more in 2022. Including confidential prices, there were several more in each year.

Nearly all industries have seen a dearth of mega deals because of the difficult debt markets, which has meant far less dollar volume and less transaction fees for the bigger investment banks. But within senior care, the change was more pronounced in the

seniors housing market. The skilled nursing sector, meanwhile, has continued to see numerous, large portfolio deals (although nothing approaching $500 million or $1 billion), as buyers in that space believe they can more easily turn around operations through better referrals, patient coding and new contracts with often-related ancillary service businesses. And skilled nursing buyers have had a larger stable of lenders willing to deploy capital at decent leverage because of the believed operational strength of their operating partners and in their ability to increase revenues significantly.

In the last several years, only one transaction is in the top-10 since 2001, based on purchase price, which was the 2021 sale of DigitalBridge Group’s healthcare assets for $3.21 billion. The portfolio consists of 53 managed seniors housing communities (4,756 units and 69.4% occupied in Q1:2021, on average), 106 managed MOBs (3.8 million square feet and 82.6% occupied as of March 31, 2021), 65 triple-net leased seniors housing communities (3,534 units and 70.8% occupied in Q4:20, on average), 83 triple-net skilled nursing facilities (9,723 beds and 68.2% occupied in Q4) and nine triple-net hospitals.

Among the post-pandemic, mega deals, REITs were buyers in two of these. In June 2021, Welltower (NYSE: WELL) announced the acquisition of Holiday Retirement’s owned portfolio of 86 independent living

@SeniorCare_Inv 9 21st CENTURY

communities for $1.58 billion, or just about $152,000 per unit. That was another portfolio acquired “below replacement cost,” which was a common theme post pandemic. Shortly after, Ventas (NYSE: VTR) bought New Senior Investment Group (NYSE: SNR) for $2.3 billion, including assumed debt of $1.5 billion, or about $185,400 per unit.

Another June 2021 deal signified the market had really turned a corner from the depths of the pandemic. In that transaction, Harrison Street Real Estate Capital paid $1.2 billion for 24 senior living communities located in California (23) and Nevada (1). The price point was one of the highest ever for a portfolio of that size, at $546,700 per unit, and certainly the highest in the previous two years.

One of the reasons for the high price was that half the portfolio averages four years in age and the other half of the properties were recently built or are under construction. New usually translates into a high price, especially in the California market. The seller of 12 properties was Healthpeak Properties (NYSE: PEAK), which spent two years divesting several billion dollars of senior living assets, and Gallaher Companies for the other 12. Oakmont Management Group managed all 24. But the fact that Harrison Street would pay that high of a price, and in a $1.2 billion transaction,

showed a lot of confidence in the market, and in the future.

Skilled Nursing Market

The strength of the skilled nursing market, from a valuation perspective, surprised many in the immediate wake of the pandemic. That is because facilities were often caring for the sickest and frailest populations who were especially vulnerable to the coronavirus, they received a lot of negative attention in the early days of the pandemic because of outbreaks and higher numbers of patient deaths, and saw census plunge due to lack of elective surgeries and home health options (most of which were/are inappropriate for patients that require skilled nursing care). Many proclaimed the death of the industry.

However, with the return of elective surgeries, strong referral relationships that filled beds and the lingering benefits of the PDPM (Patient Driven Payment Model) rule change at the end of 2019, investors still saw a huge opportunity for profit in the skilled nursing industry. Investors that could wrap around ancillary services such as therapy, staffing or food services that benefitted from an increased patient population could earn revenues not just from the facilities themselves, adding to their appeal. Bidding wars ensued

Spotlight on Senior Care M&A | Fifth Edition | 2023 10 www.seniorcareinvestor.com

among investors trying to increase their bed counts, which pushed up prices for skilled nursing facilities to levels never seen before.

Before this opportunity was noticed, the skilled nursing sector’s average price per bed did drop 14% from $93,000 in 2019 to $79,700 in 2020. We had seen larger percentage declines in the past, most recently an 18% decline from the $99,200 per bed average price in 2016 to $81,355 per bed in 2017. Considering the circumstances of 2020, there could have been a steeper fall in average price, with the sale of many ailing facilities by highly motivated owners. Plus, federal and state aid programs prevented many owners from having to sell, leading investment demand for SNFs to outpace supply of facilities available for sale.

That trend was only exacerbated throughout 2021 and into 2022, when the average price per bed rose to $88,500 in the four quarters ended June 2021, to $98,000 in calendar year 2021 and to $118,600 in the four quarters ended June 2022. It settled at $114,200 for calendar year 2022, which was a record by some 15% from the next-highest average in 2016.

The sale of Stonerise Healthcare’s 17 skilled nursing facilities in West Virginia was emblematic of the new market, with an estimated price of more than $315,000 per bed. For a variety of factors, the deal stands out among all the rest, with its geographic concentration, favorable reimbursement environment in West Virginia, relatively young age, high quality facilities and ancillary businesses.

But the hyperactive bidding process and aggressive valuations seen in that deal did become almost standard in the industry in 2021 and most of 2022. Interest rates had risen and squeezed the spreads of other real estate sectors like seniors housing and multifamily, leading investors in search of yield to the SNF business, where cap rates have traditionally stuck between 12% and 13.5% in good economic times and bad.

However, sustained high interest rates finally began

to eat into SNF valuations in 2023, as lenders pulled back from the market or pushed back on pricing. The operating risks, let alone the capital costs, were just too high to justify the kind of value that the market was consistently seeing. As such, the average price per bed for skilled nursing facilities in the four quarters ended June 2023 dropped 6.5% to $106,800.

There also came a point in the pandemic when these problems started to adversely affect the older, mostlyMedicaid facilities, or facilities in states with a higher percentage of Medicare Advantage enrollees. Stagnant census and lower quality mixes will make paying for higher labor costs a tough ask. So, the difference in price between stabilized and non-stabilized facilities may grow in 2023.

Quality and case mix will continue to be a major factor in SNF values too, with the introduction of the PDPM reimbursement rule change in October 2019 rewarding those facilities with more medically complex Medicare patients. CMS has also announced significant reimbursement rate increases for its traditional Medicare patients, staving off a downward rate readjustment to account for inflationary and labor issues.

For two decades, skilled nursing cap rates have continued their general downward trend. However, they did not compress to the degree that seniors housing communities had experienced and largely stayed between 12.0% and 13.5%. The sector maintained that consistency amid more volatile interest rate changes and global economic trends.

During the Great Recession, the sector saw a moderate increase in cap rate, rising from 12.1% in 2007 to 12.9% in 2008 and peaking at 13.1% in 2010. Other real estate classes were not so lucky. In the years afterward, the consistently high yields that skilled nursing offered drew investors to the sector, helping compress the average cap rate to around 12.0%. Incredibly low interest rates after the Great Recession and abundant capital also contributed to the cap rate compression, but not nearly as much on the seniors housing side.

@SeniorCare_Inv 11 21st CENTURY

sponsored

Spotlight on the Seniors Housing & Care M&A Market

Erik Howard – Executive Managing Director | Capital Funding Group

Although the number of lenders and availability of capital has fluctuated in the M&A market, Capital Funding Group (CFG) continues to lead the industry with its one-stop-shop offerings and entrepreneurial approach to lending. CFG takes on client challenges and goals as its own and executes creative lending solutions to help grow client businesses. CFG’s Erik Howard speaks to industry trends and how CFG helps clients reach their goals and makes a positive impact on the healthcare industry.

1. What are the latest trends you are seeing with long-term care industry M&A transactions? What do you anticipate going into 2024?

Although 2022 was a record M&A year, as the industry recovered from COVID, there was a slowdown in transactions in H1 2023. However, it started to accelerate towards the end of Q2. Rising interest rates and a tightening of liquidity in the banking sector impacted volumes, but we are starting to see borrowers adjust to the new normal and expect that to continue into 2024.

We view disruptions in the market as opportunities for us and our clients, which is why we have continued to lend to the skilled nursing and senior housing sectors despite economic turbulence. We focus on wellcapitalized sponsors with expertise in the industry and on assets where we believe the long-term intrinsic value of the properties will weather any short-term economic turbulence.

2. How has CFG been able to help its clients in a uniquely challenging lending environment?

With respect to existing bridge loans, our focus has been converting floating rate bridge debt into longterm, fixed rate permanent financing with HUD. While HUD rates have increased significantly over the last year and a half, the relative increase has not been nearly as steep as short-term benchmarks, such as SOFR, and we can help refinance in the future.

Consequently, the gap between interest expense associated with bridge loans and permanent financing is the largest we have seen in some time. Given our flexible capital, we get creative in solving for shortfalls on HUD takeouts to ease the burden of rising rates for our clients.

Flexible capital is in large part how we continue to support and lead the M&A markets over the last year. With our one-stop-shop loan offerings, we have the capability to provide subordinate debt, mezzanine loans, and other private credit instruments, which allow us to fill the void left in the capital structure with senior lenders largely dialing back their risk appetite.

3. This is CFG’s 30th anniversary as a company – please reflect on what you think this says about your brand?

It’s all about longevity. We have been an unwavering supporter of the healthcare industry for 30 years,

Spotlight on Senior Care M&A | Fifth Edition | 2023 12 www.seniorcareinvestor.com

content

through all sorts of different headwinds and cycles. During the 2008 financial crisis, we adapted to the staggering lending market and acquired a bank to continue supporting our clients. And again, during the COVID-19 pandemic, we reaffirmed our commitment by closing more than $3 billion in bridge loans. We intend to continue our resilient approach during this challenging interest rate and capital markets climate.

We approach client relationships with the same theme, keeping all portfolio management and servicing functions in-house, so there is a continuity of service the industry expects and receives from CFG.

4. What sets CFG apart from other healthcare lenders in the space?

We’re not your typical lender and our commitment to the industry goes beyond the norm. We are strong supporters of organizations such as AHCA/NCAL, NIC, and actively work with HUD, Congress and state healthcare associations to champion the industry and help develop solutions.

Redefining what it means to give back, our owner, Jack Dwyer, founded Dwyer Workforce Development (DWD) in 2021. An innovative 501(c)(3), DWD provides individuals who lack opportunity with free

21st CENTURY

Visit CapFundInc.com or call 410.342.3155 CAPITAL FUNDING, LLC AND CAPITAL FINANACE, LLC ARE WHOLLY-OWNED SUBSIDIARIES OF CFG BANK. MEMBER FINRA/SIPC In H1 2023, we executed Our Numbers Speak For Themselves $411 MM in Financing 27 Transactions Celebrating 30 years leading the industry.

Then, the risk of owning and operating a skilled nursing facility shot up as COVID-19 cases and deaths rose across the country, unfortunately all too often in the facilities themselves. And the average cap rate followed, increasing 50 basis points from 12.2% in 2019 to 12.7% in 2020. But then came 2021, when the average skilled nursing cap rate fell out of the standard 12.0%-13.5% range to 11.3%.

The four quarters ended June 2022 showed a further decline in the average cap rate to 11.1%, which is the lowest average cap rate ever on record as the frenzied bidding environment that pushed prices up also pushed cap rates down. This drop came despite the rise of interest rates in the first half of 2022, further highlighting the strong buyer demand and many observers’ confusion. It rebounded to an average of 11.4% in calendar year 2022 and to 11.7% in the four quarters ended June 2023.

However, it must be noted that the average cap rate reflects the SNFs sold during the year, and the financials used to calculate each cap rate. Because of the stress on the sector, there were many struggling SNFs that sold in 2021 and 2022 with negative trailing EBITDA and thus negative cap rates not included in the average. Facilities with little positive cash flow that yield very small cap rates would also not be in-

cluded in our calculations, since they were not “cap rate” deals but rather “per-bed” deals. This happens every year but was only exaggerated in the last two years. There were simply so few stabilized deals, with market cap rates, that the average cap rate is not totally representative of the recent M&A market.

Independent/Assisted Living Market

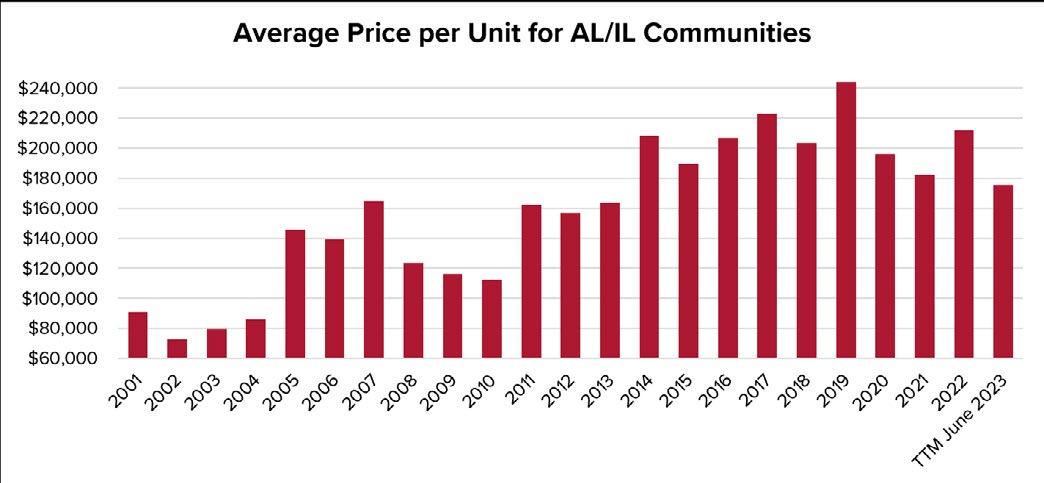

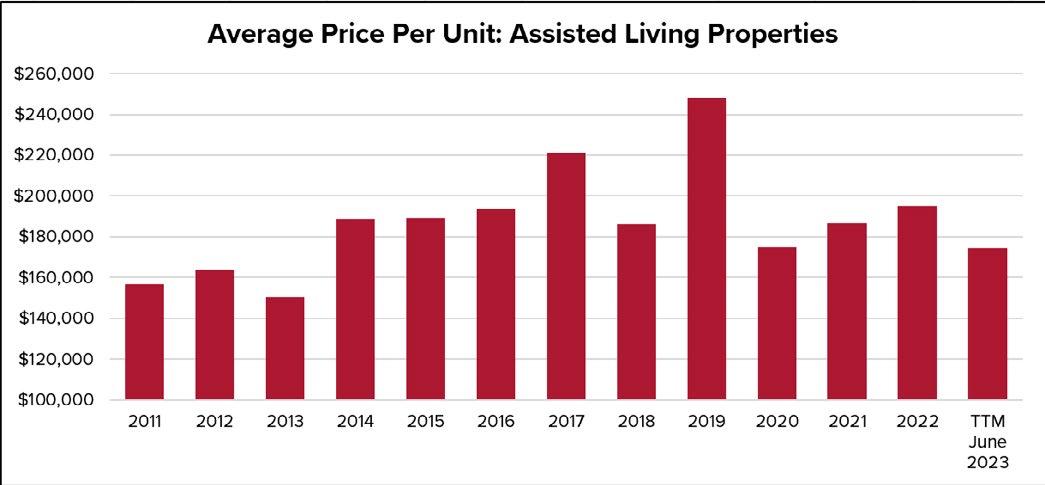

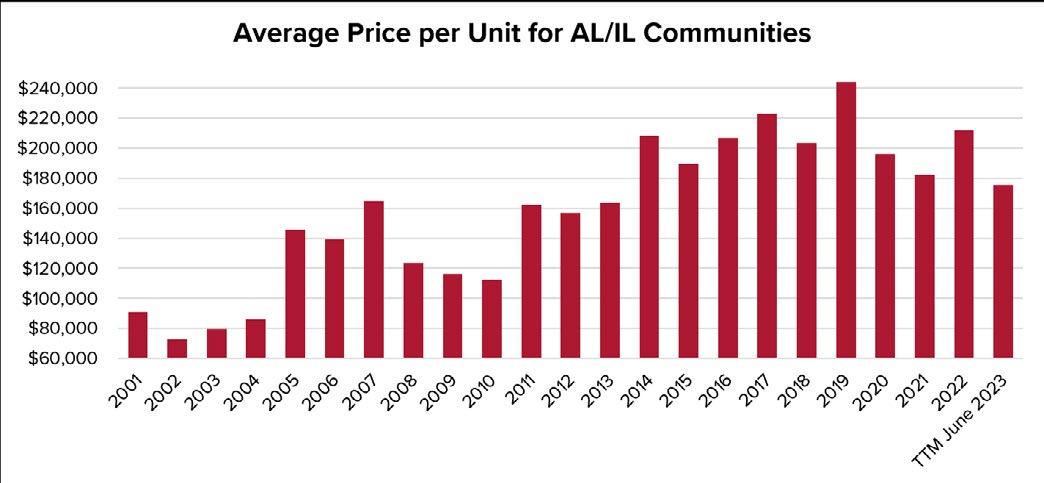

After the average price per unit for seniors housing communities (including independent living, assisted living and memory care) rose 20% from 2018 to an all-time peak of $244,200 per unit in 2019, the market readjusted, dropping the average price per unit by 20% to $196,000 per unit in 2020 and another 7% to $182,300 per unit in 2021.

Prices rebounded in 2022, averaging $211,800 per unit. Improvements in occupancy across the board likely contributed to the bump in values, but a few more owners of high-quality communities were also tempted off the M&A sidelines knowing that their well-performing properties would command a significant premium in a market flooded with struggling operations. However, as the market soured in 2023, the average price per unit for the four quarters ended June 2023 dropped to $175,600, the lowest average since 2013.

Spotlight on Senior Care M&A | Fifth Edition | 2023 14 www.seniorcareinvestor.com

Since the turn of the century, assisted living communities have accounted for the majority of sales and of dollar volume in the overall seniors housing market, and 2021 was yet again no exception, with assisted living representing close to three of every five seniors housing properties sold. The sector was clearly affected by the pandemic, ensuing lockdowns and inflation, more so than independent living.

Prior to the pandemic, the AL sector also faced serious labor problems, both the scarcity and cost of it, which only worsened in 2020 and more so in 2021 and 2022. As in the skilled nursing market, the newer, high-quality communities with their higher monthly rents had more financial flexibility to weather the storm, leaving the older, traditional assisted living communities to watch their occupancy and cash flow drop, all while trying to retain an overworked staff.

Independent Living Market

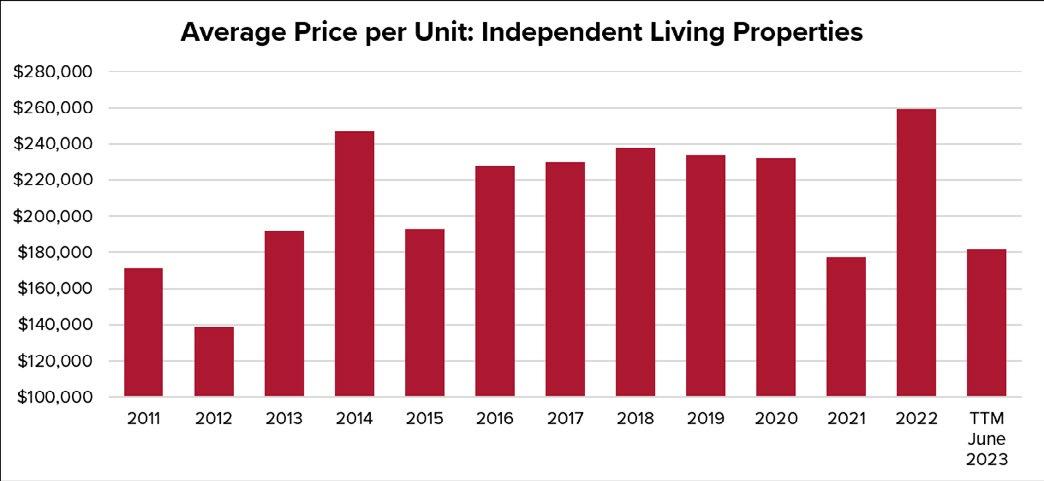

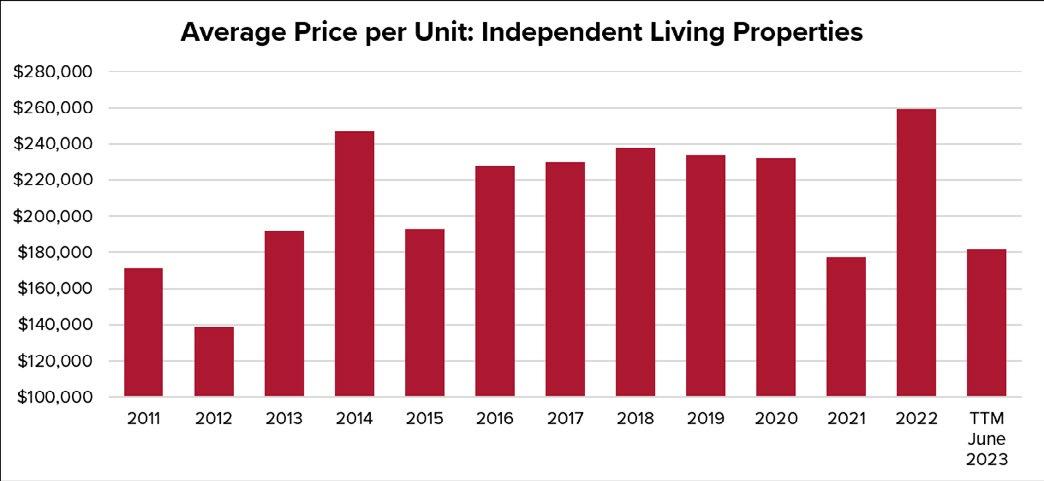

Being a much smaller market compared with assisted living, the independent living sector is prone to more wild swings in its average price per unit, and one or several large transactions with especially high or low prices can have an outsized impact on the average. There was some remarkable stability in the average price in the years leading up to the pandemic, when

the average price hovered between $228,200 per unit and $238,100 per unit, which was possibly a reflection of the sector’s more stable operating environment. However, a few high- or low-priced sales can sway the average price, and the sector experienced a significant 24% drop in 2021 to $177,400 per unit followed by a 46% increase in 2022 to $259,400 per unit. So far in 2023, in the four quarters ended in June, the average is sitting much lower at $181,500 per unit.

Proponents of independent living touted its durability during the pandemic, especially relative to the assisted living market, since it required fewer staff, catered to a younger, healthier population and did not suffer from the effects of overdevelopment. The sector’s average occupancy hovered around the healthy level of 90.0% just before the pandemic, so it had a larger census cushion to absorb the impacts of COVID-19. That strong occupancy also gave these communities more flexibility to charge higher rents, resulting in surer financial footing going into the pandemic as well. Independent living is also a lot closer to attracting the oncoming baby boomers, since the average move-in age is theoretically lower than assisted living.

However, occupancy has been slower to rebound across the sector, and the burgeoning active adult

@SeniorCare_Inv 15 21st CENTURY

sponsored content

Experience Matters

Colleen Blumenthal, MAI - COO | HealthTrust, LLC.

Capital markets have tightened throughout the year as the Federal Reserve has increased the federal funds rate. For many appraisers, investors, lenders, and operators, a federal funds rate in excess of 5.00% is the highest seen in their careers.

The broader economy influences the cycle of all real estate, including seniors housing and care properties. A real estate investment is generally long-term, held for years, and illiquid unlike stocks, bonds, and similar assets. Generally speaking, when the economy expands, real estate is developed and leased, both of which incur needs for capital. When the economy overheats, the Federal Reserve will take measures to tighten supply of money, as it has since Q1 2022. Economic cycles have influenced broader real estate cycles in the 1990s and 2000s as shown:

Presently, there is only one data source that can track the performance of seniors housing and care properties during this same period, and, in fact, since the last time the federal funds rate was 6.00%: HealthTrust.

Our team of professionals have seen it all and are uniquely qualified to assess what current market conditions mean for valuations of properties in our industry. How much will seniors housing cap rates expand? Why are skilled nursing values rising despite the increased cost of capital? Where will margins normalize? When you have tough questions, call HealthTrust.

Spotlight on Senior Care M&A | Fifth Edition | 2023 16 www.seniorcareinvestor.com

Services: Valuation | Consulting | Litigation | Feasibility | Tax | Transaction Support Management & Clinical Assessments | Asset Management Offices: Boston | Denver | Los Angeles | Sarasota 941-363-7500 | healthtrust.com

HealthTrust Asset Management

The HealthTrust Asset Management platform provides companies with a single pane of glass to organize, visualize, map and analyze their data for better decision making. It’s your data, organized.

Organize

Your entire portfolio organized into a universal chart of accounts and mapped by seasoned professionals.

Visualize

Easily perform variance analysis with an array of custom views and filters, all tailored to your organization.

Map Analyze

Integrated mapping to provide location-based awareness of your assets in your markets.

Robust analytics for creating charts and graphs for deeper insight into performance and trending.

@SeniorCare_Inv 17 21st CENTURY

HEALTH TRUST Find out more at healthtrust.com

sector, which is not a subsector of IL, may be poaching some of IL’s younger potential residents. Once in active adult, it is possible those residents will bypass independent living services and go straight into assisted living or skilled nursing, as needed. Because active adult communities come with fewer services, they typically charge lower rents than independent living. But they usually still offer activities and a better social life than if the seniors just stayed at home, which is a big selling point for independent living.

Sometime down the road as their resident population ages, active adult communities could begin to add IL-like features, such as communal dining and laundry services and even certain care options. That could have ramifications across the entire seniors housing spectrum.

On the other hand, the rise of active adult could also prove to be a boon for other seniors housing sectors, including IL, since it gets those elderly adults out of

Spotlight on Senior Care M&A | Fifth Edition | 2023 18 www.seniorcareinvestor.com

their homes, a major barrier to moving into seniors housing anyway, and out living among their peers, another major draw to seniors housing communities.

In the four quarters ended June 2023, there has been a dearth of major independent living acquisitions, as buyers shunned the sector in favor of the more need-based assisted living or popular skilled nursing sectors. The largest deal of 2022 totaled $650 million, but the details of the transaction were confidential. So, the next-biggest deal based on price in 2022 or 2023 was Welltower’s acquisition of three communities in Washington State for $244 million, or $349,000 per unit. Welltower and Cogir bought the communities in a 90-10 joint venture, with Cogir operating them going forward. The acquisition was expected to generate an unlevered IRR in the high single-digit range. The lack of big deals reveals that investors were not confident to make large bets on the independent living space, or that seller expectations in price did not fall accordingly with the rise in capital costs.

Comparing the two main seniors housing sectors, assisted living beating independent living in terms of average price per unit in 2019 was an interesting phenomenon, but it was repeated in 2021. However, independent living communities regained the top

position in 2022 and the four quarters ended June 2023, the latter by a relatively narrow margin. A handful of high-quality, high-priced deals in this small sector helped maintain a higher average price per unit. However, far more struggling assisted living communities sold during the four-quarter period, leading to the continued drop in average assisted living prices.

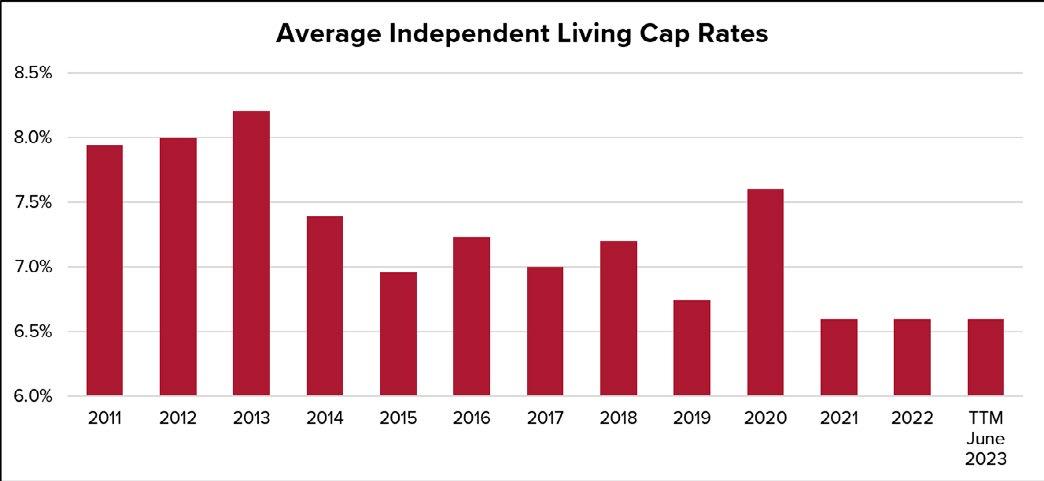

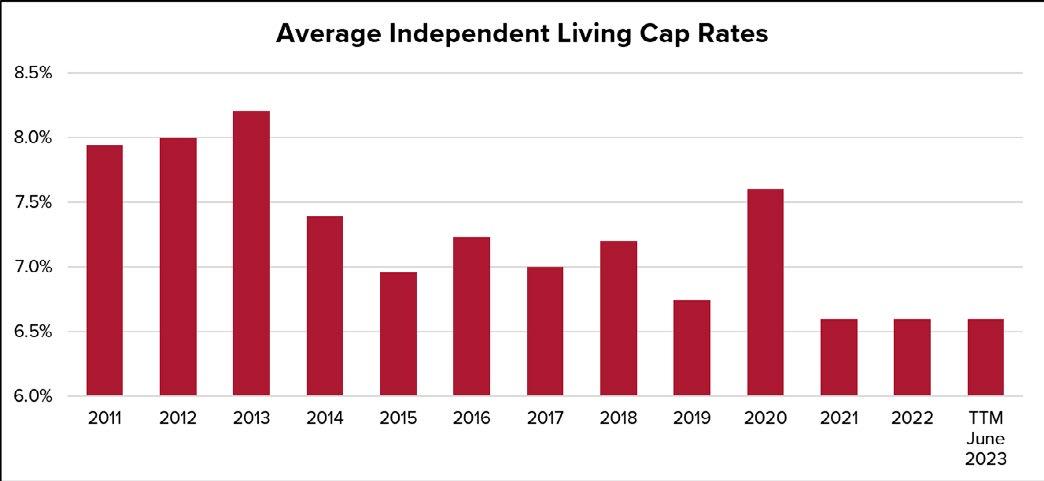

The small size of the IL market can yield wild swings in the average cap rate, including swings that sometimes may seem antithetical to how the market was actually valued during the year. However in the period from 2021 to June 30, 2023, the cap rate has remained remarkably steady despite soaring capital costs, staying at 6.6% the entire time. That does not leave much room for error when a long-term mortgage from Fannie Mae or Freddie Mac carries a 5.5% interest rate, or when acquisition debt far surpasses 6.6%. With those terms and in this current market, most IL investors probably are not using the cap rate when valuing their purchases.

The lack of movement in cap rate is not emblematic of the typical IL community that sold in the most recent four-quarter period, however, because logic and history dictate that as the price for properties falls, the cap rate correspondingly rises. But a 30% decrease in average price per unit from 2022 to the four quarters

@SeniorCare_Inv 19 21st CENTURY

sponsored content

PROUDLY SERVING THE HEALTHCARE REAL ESTATE INDUSTRY

About Us

Oxford Finance LLC provides capital for growth and development to life sciences and healthcare services companies worldwide.

We have remained a leader in the lending industry because of our financial strength and commitment to be fair, flexible and responsive to the changing needs of our clients.

Providing More Than Monetary Value

Over the years, Oxford has been steadfast in our commitment to:

Offer Flexible Solutions – Ensuring that the loan terms, draw-down period, availability, interest rates, collateral mix and loan amounts meet the expectations and needs of our clients

Approve and Execute Transactions Quickly –Avoiding bureaucratic layers and empowering our professional team to perform a thorough screening, promptly prepare accurate loan documents and close in a timely manner

Establish Personal Relationships – Having a knowledgeable team of experts from our Business Development, Credit & Portfolio and Legal departments dedicated to individual clients from the beginning to the end of each loan transaction

Oxford Overview

• Origination of more than $11 billion in loans

• Credit facilities ranging from $5MM to $200MM

• Real estate and cash flow term loans

• Revolving credit facilities

• Headquarters in Alexandria, Virginia, with offices in California, and the greater Boston and New York City metropolitan areas

Offering Multiple Financial Products

REAL ESTATE TERM LOAN

• Bridge, mini-permanent and mezzanine

• Range from $5MM to $150MM

• Two- to five-year term

• Up to 25-year amortization period, with interest only option

• Delayed draw feature to fund additional acquisitions available in select situations

REVOLVING LINES OF CREDIT

• Asset-based

• Range from $5MM to $50MM

• Two- to five-year term

• Interest only

STRUCTURED PRODUCTS

• Customizable financing solution available to facilitate the acquisition of qualified healthcare properties

• When paired with our traditional Real Estate Term Loan, potential financing up to 95% loanto-cost available

• Buyer retains 100% of ownership

HEALTHCARE SERVICES REAL ESTATE TEAM

Trazy Maziek

Senior Managing Director, Head of

Healthcare Services

Phone: 858.750.2563

tmaziek@oxfordfinance.com

Kevin

Harbour Managing Director, Healthcare Services

Phone: 949.558.3677

kharbour@oxfordfinance.com

Richard

Russakoff Director, Healthcare Services

Phone: 424.252.2845

rrussakoff@oxfordfinance.com

Matthew

Pulley Director, Healthcare Services

Phone: 704.561.6800

mpulley@oxfordfinance.com

Spotlight on Senior Care M&A | Fifth Edition | 2023 20 www.seniorcareinvestor.com

@SeniorCare_Inv 21 21st CENTURY Bridge | Mezzanine | Revolvers oxfordfinance.com SELECT TRANSACTIONS Oxford is the principal lender or principal co-lender in each transaction. Loans made or arranged pursuant to a California Financing Law License. $38,600,000 Term Loan & Revolver Sole Lender Pennsylvania $28,000,000 Term Loan & Revolver Sole Lender Massachusetts $15,000,000 Term Loan Sole Lender California $13,500,000 Term Loan Sole Lender Wisconsin $66,900,000 Term Loan Sole Lender Louisiana $60,000,000 Term Loan & Revolver Sole Lender West Virginia $20,000,000 Revolver Sole Lender Michigan $14,250,000 Revolver Sole Lender Texas $27,500,000 Term Loan & Revolver Sole Lender Texas $15,900,000 Term Loan Sole Lender Utah $87,500,000 Term Loan Sole Lender Texas $124,750,000 Term Loan Sole Lender Maryland Undislosed Amount Term Loan & Revolver Sole Lender Maryland $58,900,000 Term Loan & Revolver Sole Lender Illinois $100,000,000 Term Loan Sole Lender Michigan

ended June 30, 2023, was met with zero change in the average cap rate. Many of those low-price deals that skewed the average price downwards likely were not for stabilized communities and thus did not come with a market cap rate.

Looking forward, there is certainly a case that more “need-based” services will rebound more quickly after the pandemic and amid economic issues, and that a “luxury” like independent living may result in potential residents deciding to stay home. Also, a drop in home values as a result of higher interest rates may not allow many seniors to feel financially secure enough to cash out and move into an IL community. On the other hand, a yearning for socialization and the convenience of living in an IL community may actually boost demand in the next several years, unless active adult communities absorb many of those residents. It is too early to tell, but some caution from investors (in the form of a slightly higher cap rate) could be warranted, even for high-quality communities.

Assisted Living Market

Assisted living has received the majority of investor attention for much of the 21st century, for good and bad. After developing a “recession-resistant” reputa-

tion, demographic-fueled enthusiasm led to a period of overbuilding in the mid-2010s and decreased occupancy as a result. Increased competition in many markets across the country exacerbated the problems caused by an already-tight labor market, with poaching of key staff an all-too-common and expensive trend. These issues hit lower-end and middle market assisted living communities more, as they could not raise rents as easily to counteract higher wages and rampant discounting. And they left the sector in a more precarious position going into 2020.

The pandemic did take a heavier toll on assisted living communities than independent living, but investor interest still targeted the higher acuity sector, since those communities accounted for three-fifths of the seniors housing communities sold in 2021 and nearly four-fifths in 2022. However, it has yet to be seen how COVID-19 and various mutations of the virus will affect future demand for community-based senior care, especially with the growth and improvement of home health care as a service. Demographics will come to the sector’s aid at some point, but likely not starting until the late-2020s.

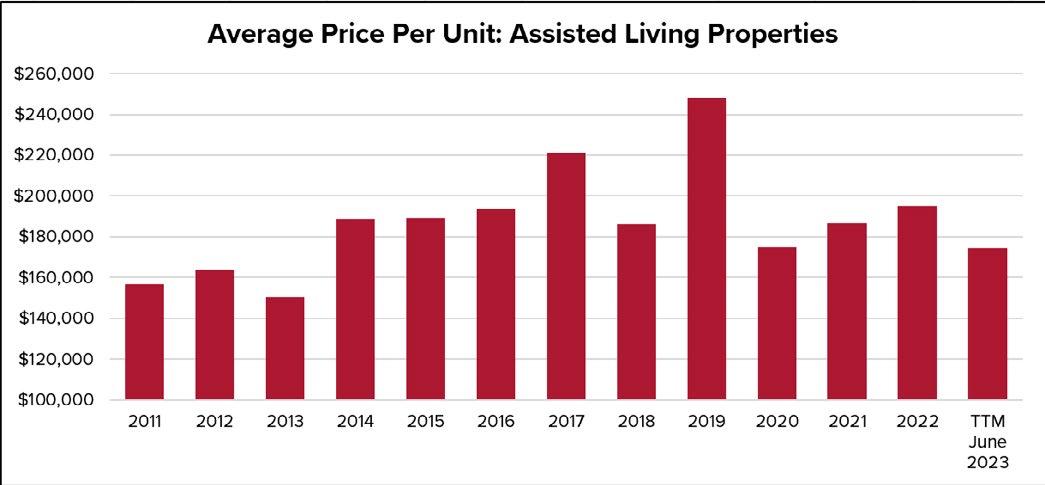

Following the pandemic, the sector’s average price remains well below the pre-pandemic high

Spotlight on Senior Care M&A | Fifth Edition | 2023 22 www.seniorcareinvestor.com

of $248,400 per unit in 2019. It plunged by 30% to $174,700 per unit in 2020 before rising a modest 7% in 2021 to $186,800 per unit. Calendar-year 2022 saw the average price per unit tick up to $195,200 as a result of another year of post-pandemic performance gains by operators and a higher share of properties sold were “A” quality communities in this sector. Those highest quality communities can charge higher rents, attract and retain staff and don’t require major capex to stay competitive, and they sell at a premium as a result.

However, as capital costs soared throughout 2022, owners of those highest quality communities did not see the value of selling, if buyers could not justify the prices for their well performing, “A” quality assets. Most were not in a position where they needed to sell, and so they stayed on the M&A sidelines. The properties that were selling were often in distress and owned by highly motivated sellers. As such, it was a buyer’s market in the second half of 2022 and in 2023, and the average price per unit in the fourquarter period ended June 2023 dropped by 11% to $174,300 per unit, the lowest average recorded since 2013.

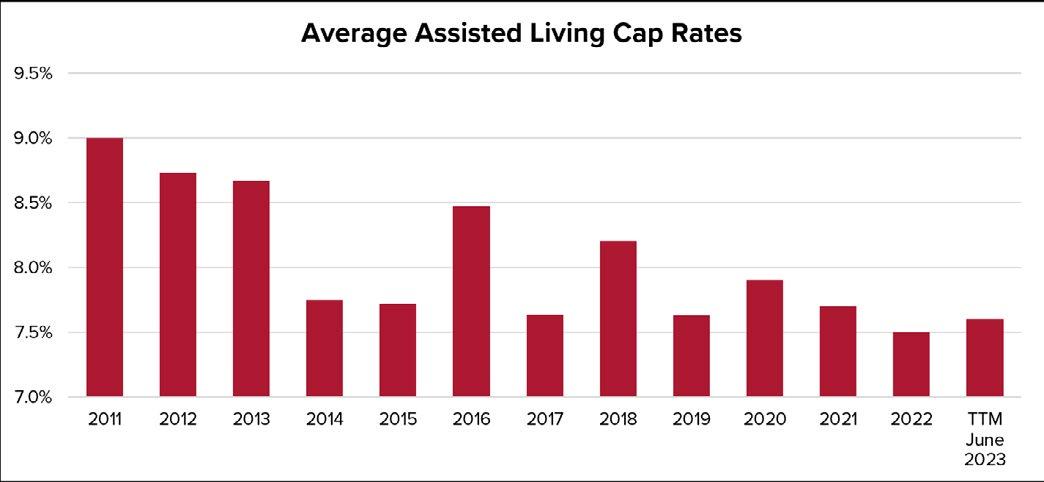

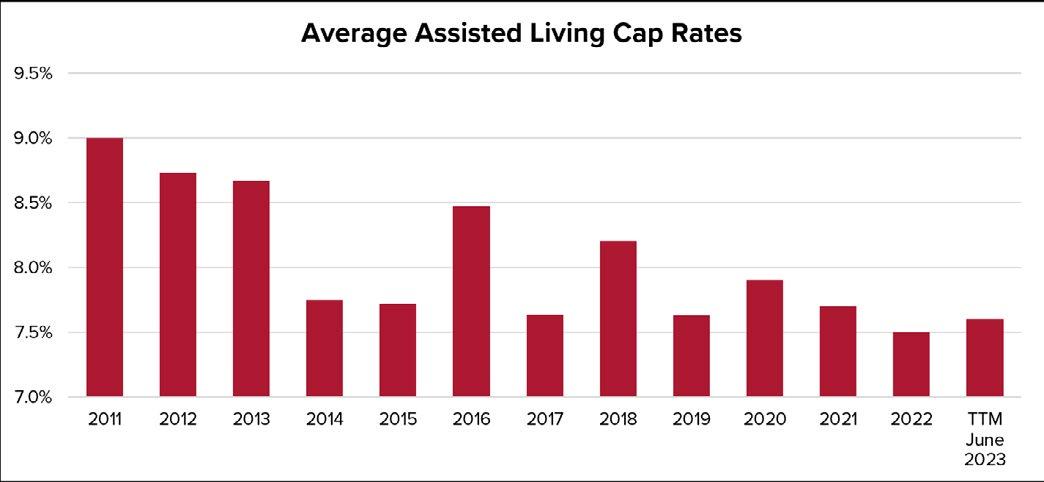

Assisted living has come a long way from the throes

of the Great Recession, when average cap rates exceeded 9%, and when 6% cap rates were nearly unheard-of. And despite the numerous risks facing the industry and the rising interest rate environment, average cap rates kept declining throughout the pandemic, from 7.9% in 2020 to 7.7% in 2021 to 7.5% in 2022. The average cap rate rose slightly to 7.6% in the four quarters ended June 2023, but the actual increase was likely higher given how high interest rates have reached. Anecdotally, investors have stated that apples to apples, assisted living cap rates have risen between 75 and 150 basis points to account for the increase in capital costs.

Overall, cap rates fell partly because there was a lower cash flow to cap, and buyers were pricing based on the near-term pick-up in census and cash flow. Even in the pandemic, there were still plenty of 6% or lower cap rate deals, as buyers clamored for the few stabilized, high-quality deals on the market. But there have been few actual “cap rate deals” involving stabilized assets. Which EBITDA period was used also affects each transaction’s cap rate, and 2022 was another volatile year for most operators and their bottom line due to inflation and staffing costs. So, the average may not be totally representative of how investors valued these communities in a post-pandemic world.

@SeniorCare_Inv 23 21st CENTURY

Spotlight on Senior Care M&A | Fifth Edition | 2023 24 www.seniorcareinvestor.com YOUR MESSAGE + OUR TARGETED AUDIENCE = SUCCESS Reach key decisions-makers in the Seniors Housing & Care and Health Care M&A industries by advertising in one of our award-winning publications. OUR 2024 MEDIA KIT IS NOW PUBLISHED / Visit levinassociates.com/advertising/ to download the 2024 media kit. Call Cristina Blazek-Hearty at (203) 295-4519 to reserve space. Don’t hesitate - Book your campaign today in: The SeniorCare Investor LevinPro HC Spotlight on Senior Care M&A The SeniorCare Investor Dealmakers Forum And more... Irving Levin Associates LLC ⋅ www.levinassociates.com P.O. Box 1117, New Canaan, CT 06840 ⋅ advertising@levinassociates.com ⋅ (203) 846-6800

Spotlight on Senior Care M&A | Fifth Edition | 2023 28 www.seniorcareinvestor.com The SeniorCare Investor Irving Levin Associates LLC P.O. Box 1117, New Canaan, CT 06840 (203) 846 - 6800 • info@levinassociates.com www.seniorcareinvestor.com