JUNE 2024

Skilled nursing is facing down another headwind that could lead to the closure of hundreds, if not thousands, of facilities. That is the minimum staffing mandate as issued by CMS. However, a strategic and wellfounded lawsuit filed by AHCA could help kill the regulation.

See article at right

REITs As Lenders

With a shortage of debt and lenders in the wake of higher interest rates, healthcare REITs are poised to fill the debt capital vacuum. They had started before the pandemic, too. And who is leading the way in volume? You guessed it, Welltower.

See article at right

Skilled Nursing Acquisitions.............Page 5

Seniors Housing Acquisitions...........Page 8

Agency Loans...................................Page 14

Conventional Loans.........................Page 15

Bond Financings..............................Page 17

Management Transitions.................Page 18

People on the Move.........................Page 23

Skilled Nursing Faces Down Staffing Mandate

AHCA’s Lawsuit May Kill the Mandate Once and For All

The skilled nursing sector continues to confound many in the industry. The pandemic briefly sounded the death knell for the industry, especially with the political and media response to early deaths in nursing homes and a trend toward health care in the home. However, government payors, lenders, and other post-acute care providers recognized the importance of the asset type in the continuum of care and did not let the industry fail through a series of aid packages, reimbursement rate increases and a little grace. The tireless work of the thousands of skilled nursing staff that kept the doors open and continuously provided care in distressed conditions played a role too. Some operators are even thriving now, maximizing their billings through case mixes and proper patient coding and enjoying needed rate increases in their respective states.

Many others are struggling with labor costs or shortages, low census, inflationary expenses and low reimbursement rates in their respective

continued on page 2

REITs As The New Lenders

The Search for Yield Has Led Some to be Lenders

Anyone trying to buy, build or refinance a seniors housing property knows how difficult the mortgage lending market has been, and continues to be. This means availability as well as pricing, not to mention other terms. Despite being four years out from the beginning of the pandemic, and more than three years from the bottom for seniors housing, the lending market is still tepid, with some lenders still “in business” in name only.

Visit us Online: www.seniorcareinvestor.com

Time usually solves many problems, but some people are now asking how much more time does the sector need to fully recover? The answer is not easy, because there are the haves and the have nots, and then you have to define recovery. Is it to pre-pandemic occupancy levels (we say no), or pre pre-pandemic levels (we say yes)? Many senior living providers have already surpassed the former and are pushing toward the latter. And then, what about margins? They have been harder to expand because cost

continued on page 20

Inside the World of Senior Care Mergers, Acquisitions and Finance Since 1948 VOLUME 36 | ISSUE 6

SeniorCare_Inv

continued from page 1

states. Plenty of bankruptcies, premature retirements and exits of numerous smaller owner/operators, mom & pops and even some bigger players are evidence of the struggles. And the threat of a minimum staffing ratio, which was finalized by Centers for Medicare and Medicaid Services (CMS) on May 10, could put hundreds or thousands of facilities out of business, if it is implemented.

What is interesting is that few actually believe that the minimum staffing ratio, which would mandate a minimum of 3.48 hours per resident per day (HPRD) of total staffing with specific allocations for registered nurses (RN) and nurse aides plus a requirement to have an RN onsite 24/7, would ever be implemented as it currently stands.

Most dealmakers we have asked have commented that it

Inside the World of Senior Care Mergers, Acquisitions and Finance Since 1948

ISSN#: 1075-9107

Published Monthly by: Irving Levin Associates LLC P.O. Box 1117, New Canaan, CT 06840

Phone: 203-846-6800 Fax: 203-846-8300 info@seniorcareinvestor.com www.seniorcareinvestor.com

Managing Editor: Benjamin Swett

Editor-at-Large: Stephen M. Monroe Research Analyst: Stephanie Mallozzi Advertising: Cristina Blazek-Hearty

©2024 Irving Levin Associates LLC. All rights reserved. Reproduction or quotation in whole or part without permission is forbidden.

This publication is not a complete analysis of every material fact regarding any company, industry or security. Opinions expressed are subject to change without notice. Statements of fact have been obtained from sources considered reliable but no representation is made as to their completeness or accuracy.

POSTMASTER: Please send address changes to The SeniorCare Investor, P.O. Box 1117, New Canaan, CT 06840.

has not factored into investment decisions, prices or loan amounts (that they’ve seen). And our pulse survey asking “How much do you expect the minimum staffing mandate (as it currently stands) to impact buyer demand for skilled nursing facilities,” revealed that 71% of respondents said it would have “somewhat” of an impact, followed by 22% saying “not at all” and only 7% believing the mandate would have a “significant” impact on buyer demand. Asking how the mandate would impact lenders’ ability to lend for skilled nursing facilities brought a little more caution, with 64% saying “somewhat,” 15% saying “not at all” and 21% saying “significantly.”

The chances of the rule going forward already hinge on the 2024 presidential election, with a Trump Administration likely tabling the regulatory change. Call that a 50-50 chance, at this point in the election cycle, felonies and all.

Now, the rule has even less of a chance of surviving after the American Health Care Association (AHCA) filed a lawsuit on May 23 against the U.S. Department of Health and Human Services (HHS) and CMS for “exceeding their statutory authority and arbitrarily and capriciously issuing the Minimum Staffing Standards for Long-Term Care Facilities final rule.” Most in the industry would agree on the seeming unseriousness of the rule, with the rushed nature of it, the lack of supporting evidence for a “onesize-fits-all” minimum staffing ratio improving quality of care, and the conspicuous absence of LPNs in the original version of the rule.

The ratio increasing from 3.0 hours of nursing care per resident day to 3.48 hours after the comment period (with near-universal decrying from multiple healthcare sectors) also smacks of a political decision in an election year, not one based on evidence nor one derived in good faith. Scott Tittle, Managing Director and Head of Government Relations and External Affairs at VIUM Capital, seemed to agree, telling us, “This is a political play by the Biden Administration and will not result in improved quality in any direction.”

Tittle is talking the talk but also walking the walk, having taken our call from Washington, D.C. just before heading to Capitol Hill to help advocate for the skilled nursing industry and educate lawmakers on the costs of the

The SeniorCare Investor 2 www.seniorcareinvestor.com

regulation. He discussed his thoughts on the regulation, the strategy behind the lawsuit and the chances of its success.

Importantly, the AHCA was joined by the Texas Health Care Association and several five-star Texas skilled nursing facilities in filing the lawsuit in the Northern District of Texas. Clearly, Texas was a key part of the legal strategy for numerous reasons. First, the state is more conservative and business-friendly than most. There are also a few precedents in the Northern District that make it a favorable environment to review the complaint. At the appellate level, the Fifth U.S Circuit Court of Appeals and even the U.S. Supreme Court would likely agree with the AHCA that HHS and CMS exceeded their statutory authority based on the composition of the respective courts and more recent precedents challenging judicial deference to administrative policy making.

Tittle added that, “maybe more specifically, Texas is a state which if this rule is implemented and becomes fully final … will have to hire more nurses on average than other states. So, it will be impacted the hardest, especially on the 24-hour nurse rule.” It’s estimated that operators in Texas would need to hire nearly 2,600 RNs and 7,900 nurse aides to satisfy the rule, or a 46% increase in RNs and 28% increase in aides. The Texas SNF plaintiffs were also chosen specifically, “because they are five-star operators, and it’s a demonstration that this rule will absolutely impact even the best of the best all across the country.”

AHCA helped its case by securing Paul Clement as its lead lawyer. Clement is “one of the most brilliant constitutional administrative law minds in the country, a former Solicitor General for President W. Bush, and has argued a number of cases in front of the Supreme Court.” He will have solid legal grounds to demonstrate how CMS exceeded its statutory authority in modifying a federal law unilaterally and did so in an arbitrary or capricious way. “You look at the fact that there is longstanding, internal discussion at CMS on a federal minimum staffing ratio for skilled nursing facilities, and that its own internal position over many years has been that a one-size-fits-all approach just won’t work.” Tittle believes that CMS also only nominally included LPNs in the final version of the

rule, without recognizing the critical role that LPNs play in each building.

More recently, CMS’ own independent research study indicated that there was no minimum staffing threshold that would improve quality at all. In fact, they couldn’t recommend any level of staffing that would improve quality. And yet, they charged ahead.

Tittle pointed out that the industry has not said they’re against new staffing ratios but that the issue should lie with the states, as it currently does in approximately 30 states. “Market to market, region to region. Looking at labor markets in each state. The numbers that CMS chose are unreasonable and cannot be met, especially in this current labor environment. The staff isn’t there and there’s no funding.”

He pointed to more reasonable approaches in states like Florida and Virginia, where minimum staffing ratios can work when they’re done in collaboration with the industry and regulators, with appropriate funding attached to it. The rule could cost $6 billion to the industry, or about $400,000 per SNF per year, and possibly more. When asked “If a minimum staffing mandate is implemented, would it be accompanied by a commensurate increase in federal and state funding,” none of our pulse survey respondents said “Yes, covering all increased staffing costs.” No surprise there. Half of respondents said “Yes, but only partially covering costs,” followed by 29% saying “Yes, but barely covering costs.” The remainder (21%) said “Not at all.”

The survey also asked, “What will be considered a “healthy” operating margin (using EBITDAR after management fee) for SNFs in two years?” Among the four options, the responses were: 20% margin (0% of respondents), 15-19% margin (38%), 10-14% margin (38%) and 5-9% margin (24%). That may very well be lower than historically “healthy” operating margins, but the absolute level of cash flow matters more to operators and owners, too.

The industry is already starkly divided between the winners and losers on a cash flow basis, and many of the “losers” (plus some facilities that are currently doing

VOLUME 36 | ISSUE 6 SeniorCare_Inv 3

fine) would close under the new mandate. In addition, Tittle believes that those that will survive will have to modify their own internal staffing charts to attempt to meet the requirements of the rule. That means letting go other key staff that aren’t required by the rule. “So, the quality of care of existing facilities is going to be impacted significantly.”

Beyond the lawsuit, which stands an excellent chance of stopping the regulation, there is significant, bipartisan interest in Congress to intervene. By and large, all Republicans would support such a measure, plus some key Democrats, like Montana Senator Jon Tester, who is in a tough reelection fight and represents a rural state that could have difficulty finding the necessary nursing staff. This being an election year, no major legislation stands a chance of passing between now and November, but an opportunity lies in the lame duck period.

The Congressional Review Act, which is a hard-stop legislative action often used in the lame duck following a presidential election or a change in the control of

Congress, would only require a simple majority by both the House and Senate to pass a resolution to undo an action done by an agency. If the Biden Administration were to win, the President would still have to sign the resolution, and with his backing of the unions, that seems unlikely of him. A two-thirds majority in either chamber to overturn a veto also sounds unrealistic at this stage. “But it would be a pretty strong message if the House and Senate were to pass a Congressional Review Act appeal.”

Otherwise, with the Congressional Budget Office showing a significant cost to the federal government to implement the regulation, a bill repealing the rule could be attached to any bill that has already gone through several stages in both the House and Senate that the administration must sign, for example to keep the government open, and that would be another potential pathway, legislatively. Don’t you love how the sausage gets made?

Adding to pressure against the regulation is the nearuniversal opposition to it by other healthcare associations like the American Hospital Association and within

The SeniorCare Investor 4 www.seniorcareinvestor.com CHICAGO | 630.858.2501 ST. LOUIS | 314.961.0070 WWW.SLIBINC.COM CONFIDENTIALITY COMMITMENT CREDIBILITY WE GET DEALS DONE. LET US GO TO WORK FOR YOU!

sectors like home health and assisted living. “Everyone understands that the long-term care, post-acute sectors are all largely hiring from the same labor pool. And if this regulation were to go into effect for skilled nursing, the staff would have to come from somewhere, so people are going to start getting hired away from other components of health care, including hospitals, unfortunately.”

As far as a timeline of events with the regulation (as it currently stands) and the lawsuit, indications are that it could be early 2025 by the time we see a hearing or a judgement. Tittle noted that there are some legal scholars suggesting there could be an injunction filed much earlier to pause the implementation of the rule, pending the outcome of the case, as early as this summer. And the first prong of the rule would impact urban facilities in two years and rural ones in three years. So, there is time, and the rule would be phased in, with exceptions too (albeit, extremely limited). But in the meantime, we have a presidential election that could make the whole issue moot. Alas, it is not a single-issue election.

In the meantime, “the best thing that operators can do right now is to do what 500 or 600 people are here today, which is get to D.C., meet with your member of Congress, meet with their staff, meet with the district staff in your communities so they really understand how significant this regulation will be, what costs are associated with it, the staffing challenges, the quality of care impact. This is going to be a ‘grassroots and grasstops’ advocacy approach until we have some relief on Capitol Hill or in the Courts.”

With so little certainty surrounding the implementation of the rule, investor interest continues nearly unabated within skilled nursing. You would not suspect there was a looming, industry-devastating regulatory change with the sustained, high valuations paid for skilled nursing facilities today. After prices rose to record-highs in the immediate aftermath of the pandemic, from $98,000 per bed in 2021 to $114,200 per bed in 2022, which was the first time the average price per bed surpassed $100,000, the debt markets eventually started to affect SNF sales, with fewer lenders and more stringent terms. As a result, the average price per bed fell by 14.5% to $97,700 in

2023, but that is still higher than its pre-pandemic level.

When asked where they thought skilled nursing prices would go in the next 12 months, 50% of survey respondents said they would “stay the same,” while 36% believed they would increase between 1% and 10%, on average. Only 14% thought that SNF prices would decline between 1% and 10%, on average. No one believed there would be movement in the average SNF price beyond 10%, up or down.

Of course, this is an average, and facilities that have benefited, or are set to benefit, from generous reimbursement rate increases in their respective states can command a premium on the M&A market. Conversely, with diminished profitability and prospects in other states, those facilities will sell at a discount, by and large. By our survey, some of the top states that people would invest in SNFs, Massachusetts, Indiana, Florida and West Virginia came up the most consistently, with Delaware and Virginia getting a few nods. For the states not to invest in, the responses were a little more consolidated around Illinois, California and Texas, with others pointing out Connecticut, New York, Massachusetts and Kentucky as no-go’s. There are certainly states where it is tough to succeed, but anyone can fail anywhere. That is even more true with a one-size-fits-all minimum staffing mandate not accompanied with the appropriate labor pool or funding, so reach out to your Congressman today.

SKILLED NURSING ACQUISITIONS

At the time of publishing, we are closing in on 60 publicly announced transactions in the month of May, currently at 58 deals. In all likelihood, we will reach that figure, which, albeit not a record, is close to a historic monthly high. We have been saying that despite the difficulties in the capital markets and the near-constant obstacles facing dealmakers in closing a transaction these days, plenty of motivated sellers (motivated by maturing debt, sinking operations or retirement) combined with plenty of opportunistic, deep-pocketed buyers have produced near-record M&A activity. It also helps that many deals that would have normally been large portfolio sales have been broken up into three, four or five separate

VOLUME 36 | ISSUE 6 SeniorCare_Inv 5

transactions, helping to inflate the pure transaction count. Nevertheless, we are on track for 600+ transactions in 2024. And the higher number of transactions means more debt negotiations in this difficult capital market.

Amid the challenges confronting the skilled nursing facilities, including evolving regulatory landscapes, persistent staffing shortages and reimbursement uncertainties, transactions persist in this sector too, showcasing its resilience (and opportunity).

Evans Senior Investments arranged one of the larger deals of the month with the sale of a Connecticut skilled nursing portfolio comprising eight skilled nursing facilities in the Hartford MSA. The transaction, executed on behalf of a West Coast-based REIT, later revealed to be Summit Healthcare REIT, amounted to $60.0 million, or $54,000 per bed, for the real estate only. The existing operator, iCare Health Network, was chosen as the buyer.

The facilities include Touchpoints at Manchester (Manchester), Westside Care Center (Manchester), Trinity Hill Care Center (Hartford), Chelsea Place Care Center (Hartford), Silver Springs Care Center (Meriden), Touchpoints at Bloomfield (Bloomfield), Touchpoints at Chestnut (East Windsor) and Fresh River Healthcare (East Windsor). The facilities were built between 1966 and 1990 and feature a total of 1,106 beds. When thinking of the aging of the inventory in the United States, note that these were all built 35 to 55 years ago. The

portfolio has an average four-star CMS rating across all eight facilities. During marketing, the portfolio’s average census was 90%. Additionally, there was anticipation of a large Medicaid rate increase that would take effect in July.

ESI conducted a confidential marketing process, procuring over 10 offers in under a month. There was a competitive bidding environment, which ultimately added substantial value to the closing price. The transaction closed within four months of ESI’s marketing campaign. The sale of the portfolio was subject to a triple net lease with the existing operator, with an additional 8.5 years remaining and two five-year renewal options.

In another portfolio transaction, Blueprint was engaged

by Birchwood Healthcare Partners, a Chicago-based private investor and owner/operator, in its sale of its eastern Oklahoma skilled nursing portfolio. The regionally clustered portfolio comprises seven facilities that total 561 beds. It benefited from the recent Medicaid rate increases and steady census rebounds. There was attractive assumable HUD debt on select facilities, and improved performance tracking towards historical highs.

The marketing process resulted in multiple competing offers and rounds of bidding. Birchwood selected a familiar Missouri-based provider as the ultimate buyer. There were bifurcated closings upon final HUD approval for the loan assumptions. Michael Segal, Ben Firestone and Daniel Waldhorn handled the transaction.

Blueprint was additionally brought on to facilitate the sale of an inpatient transitional care facility, Las Cruces Post Acute and Rehab. Built in 2017, the facility features 50 beds and is in Las Cruces, New Mexico. It’s located within two miles of three short-term acute care hospitals that offer quality Medicare referral opportunities. Trailing EBITDAR was approaching $745,000 at the time of marketing. Amy Sitzman and Giancarlo Riso handled the transaction. Multiple offers were received, with Blueprint ultimately advising the client to move forward with an owner/operator representing strong execution certainty. Blueprint had transacted with the buyer previously in New Mexico. The deal closed about 120 days after LOI execution

April showers apparently brought The Ensign Group (NASDAQ: ENSG) acquisitions this May, as the publicly traded provider announced eight separate deals, including four where its captive REIT Standard Bearer Healthcare REIT acquired the real estate. Two of the deals in Kansas and Arizona involved seniors housing sales handled by Senior Living Investment Brokerage (see page 8).

Ensign and Standard Bearer also acquired the operations and real estate, respectively, of Spencer Post Acute Rehabilitation Center, an 82-bed skilled nursing facility in Spencer, Iowa, South Davis Specialty Care, a 95-bed SNF in Bountiful, Utah, and Western Peaks Specialty Hospital,

The SeniorCare Investor 6 www.seniorcareinvestor.com

a 43-bed LTACH also in Bountiful, Utah.

On the same day, Ensign announced that its affiliates acquired the operations of Creekview Health and Rehabilitation, a 78-bed SNF in Knoxville, Tennessee, Foothills Transitional Care and Rehabilitation, a 135-bed SNF in Maryville, Tennessee, and Midlothian Healthcare Center, a 120-bed SNF in Midlothian, Texas. The three transactions were all subject to long-term, triple net leases.

In a separate SLIB transaction, Daniel Geraghty and Bradley Clousing were engaged by a regional owner/ operator in its divestment of a senior care facility in Arkansas. The seller was looking to consolidate its portfolio and exit the skilled nursing industry. The buyer is a regional-based owner adding to its portfolio throughout the state.

Built in 1990, Indian Rock Village comprises 121 skilled nursing, assisted living and independent living beds/ units. There are 28 independent living units, 38 assisted living units and 55 skilled nursing beds. The facility is wellmaintained and in excellent condition. It overlooks Geers Gerry Lake and spans 83,825 square feet in Fairfield Bay, Arkansas. No financial details were disclosed.

A skilled nursing facility in Tennessee that was struggling to maintain debt service and other loan obligations sold with the help of Laca Wong-Hammond and Isabel Carta of Lument Securities serving as exclusive financial advisor to the seller. Located in Rocky Top, about 25 miles from Knoxville, Summit View of Rocky Top is a 117-bed skilled nursing facility that offers short-term rehab and traditional nursing care, along with an 18-bed behavioral health hospital. It also carried an attractive, assumable loan. Like many facilities, it had experienced financial and operational difficulties since the pandemic, and so the local owner/operator engaged Lument Securities and Lument’s asset management team to find an outcome that benefitted all parties.

A competitive marketing process garnered significant interest before Core LTC Services, a private long-term care operator based in Tennessee, emerged as the buyer.

VOLUME 36 | ISSUE 6 SeniorCare_Inv 7 www.locustpointcapital.com Don Kelly (941) 961-0277 dkelly@locustpointcapital.com Dan Contardi (732) 580-5564 dcontardi@locustpointcapital.com Red Bank, NJ Miami, FL Balance Sheet Lender Senior Mortgage Loans, Subordinate Loans, Mezzanine Loans, and Preferred Equity Investments for acquisitions, refinancings, recapitalizations, and new construction of seniors housing and care facilities Relationship Approach, Execution Focus

Lument also suggested an interim manager change with a group that would fund working capital and provide financial relief to the owner, which Core LTC was able to do. The transaction structure included the loan assumption, but the terms of the sale were not disclosed. The seller exited the industry as a result of the deal.

Lease-to-purchase arrangements present advantageous opportunities within the prevailing interest rate and lending environment. They enable prospective buyers to establish themselves within the community and improve operations, pursuing more suitable financing in the future. Sellers simultaneously benefit, as they can hand over operational responsibilities while potentially securing a more favorable sales price compared to an immediate sale.

Nick Stahler and Austin Diamond of the Knapp-Stahler Group at Marcus & Millichap facilitated a lease-withpurchase-option transaction for a dually certified, 120-bed skilled nursing facility in the Dallas-Fort Worth area. The pair was also able to negotiate $500,000 of key money from the incoming operator for the landlord, a rarity in Texas deals. That was possible because at 10 years of age, the facility was performing well and represented decent lease coverage on day one. The SNF was 74% occupied and operated at a strong 12% margin with a 4% management fee.

Stahler and Diamond obtained several offers culminating in a full asking lease rate, purchase option that starts in year three of the lease, and the key money. Ultimately, the new operator was selected due to its regional presence in the state as well as its national coverage as a publicly traded operator. The owner/landlord is a private, regional owner/operator in the Dallas-Fort Worth area.

Marcus & Millichap was also brought on to facilitate the sale of a skilled nursing facility in Northern Wisconsin. Aspen Health & Rehab is a skilled nursing facility featuring 86 beds in South Range, Wisconsin. Ray Giannini, Justin Knapp and Nick Stahler of Marcus & Millichap handled the transaction. No additional details were disclosed.

Lastly, Ziegler announced its involvement in the divestment of a senior care facility. The facility comprises

80+ skilled nursing and assisted living beds in Washburn County, Wisconsin. The seller was a 501(c)(3) not-forprofit organization serving elderly and disabled people across the Upper Midwest. The buyer was a local owner/ operator. Nick Glaisner handled the transaction. No additional details were disclosed.

SENIORS HOUSING ACQUISITIONS

Similar to the skilled nursing world, the seniors housing sector also faces headwinds, such as rising expenses, however, deals continue to make it across the finish line at a near-record clip. In The Ensign Group’s recent slew of acquisition announcements, it was revealed that the provider was the buyer in two transactions that were handled by Senior Living Investment Brokerage. First, Nick Cacciabando, Jeff Binder and Ryan Saul were engaged by a local owner in its divestment of its only senior care facility.

Hillside Village of De Soto, located in De Soto, Kansas, offers assisted living and skilled nursing services, comprising 65 units (38 AL, 27 SNF) and is licensed for 95 beds (46 AL, 49 SNF). The SNF portion was built in 1970, and the AL portion in 2003. Operations were solid, with EBITDAR hovering around $648,000 on $5.6 million of revenues. And there is room for improvement with occupancy, which stood at 79%.

The real estate was acquired by a subsidiary of Standard Bearer Healthcare REIT, Ensign’s captive real estate company, and the acquisition was effective May 1. The purchase price came to $6.5 million, or $100,000 per unit and $68,400 per bed, with a 10.0% cap rate. Gateway Healthcare, LLC, Ensign’s Kansas-based subsidiary, will take over operations.

Ensign also announced its purchase of North Chandler Place in Chandler, Arizona. Built in 1966 with additions made in 2002 and 2007, the community consists of 198 units and 230 beds of independent living (119 units), assisted living/memory care (45 units) and skilled nursing (66 beds). A group of investors decided to divest the asset in order to reinvest the proceeds in other core assets in the portfolios. Ensign will invest in capital improvements, but no financial details were

The SeniorCare Investor 8 www.seniorcareinvestor.com

disclosed. Standard Bearer also acquired the real estate of the campus, and Bandera Healthcare LLC, Ensign’s Arizona-based subsidiary, took over operations. Jason Punzel, Brad Goodsell, Cacciabando and Saul handled the transaction.

SLIB also facilitated the sale of three memory care communities in two separate transactions. First was the sale of two standalone memory care communities in Quincy and Centralia, Illinois. The seller was a regional developer/owner/operator while the buyer was an Illinois-based owner/operator with an existing presence in the state. It has experience with the Supportive Living Program and intends to focus on increasing occupancy to be the premiere affordable option in the market.

The communities were constructed in 2019 and 2017, respectively, and are in excellent condition. The Quincy community consists of 56 units and is one of less than 20 communities in the state licensed as Supportive Living Dementia Care Setting. It benefited from a significant rate increase on January 1. The Centralia community

consists of 16 units with 22 beds. Both communities saw large improvements in occupancy and performance since emerging from the pandemic and currently operate at a stabilized level.

SLIB’s confidential marketing process generated multiple offers, but the final purchase price was not revealed. Jeff Binder and Ryan Saul handled the transaction.

SLIB next facilitated the sale of a standalone memory care community in Alpharetta, Georgia, that benefits from strong on-site leadership and a great reputation in the local market. The seller, Insignia Senior Living, is selling its United States-based assets to focus on its core geographic markets in Puerto Rico and Latin America. Built in 1991 and renovated in 2016, Tapestry House Memory Care features 42 units across one story. The community sits on 1.93 acres in Fulton County and comprises 28,266 square feet. There were multiple offers from both regional and local buyers before a Northeastbased owner/operator, which currently owns several skilled nursing facilities in Fulton County and is looking

VOLUME 36 | ISSUE 6 SeniorCare_Inv 9 Balance Sheet Loans FHA/HUD Working Capital MidCap can make it happen visit us @ www.midcapfinancial.com 230701_Midcap_Ad_7.32x4.375_C.indd 2 7/24/23 3:41 PM

to expand its skilled nursing and assisted living portfolio throughout Georgia, paid an undisclosed sum. Daniel Geraghty and Bradley Clousing handled the transaction.

SLIB additionally facilitated the sale of an assisted living/ memory care community in Freehold, New Jersey, this month on behalf of a partnership. The partnership was between Stephanie Anderson and Steve Walling, known as SilverStone HCRE, and a private equity group located in the west. During their ownership, NOI increased significantly, enabling them to sell the community at a significant profit.

Purpose-built in 2001, Mattison Crossing at Manalapan Avenue comprises 160 units with 199 beds, and its performance was stabilized during the marketing period. The selected buyer was a publicly traded REIT with an established footprint in central New Jersey that was looking to expand its relationship with a strong Northeastbased operator. So, the REIT selected a prominent Northeast-based operator that has a New Jersey presence in addition to a well-established relationship with the REIT.

Jason Punzel, Dave Balow, Brad Goodsell and Vince Viverito handled the transaction. SLIB procured several bids from qualified national and regional buyers focused on New Jersey.

One of the largest seniors housing deals of the month was closed by Blueprint, which was engaged by a public REIT in the divestment of 12 seniors housing assets in Wisconsin. The portfolio, clustered in the Milwaukee and the Green Bay MSAs, consists of 12 communities across nine campuses totaling 279 units of assisted living and memory care. Although underperforming at the time of marketing, the portfolio was historically well-occupied and cash-flowing.

Blueprint identified Adava Care, an entrepreneurial owner/operator with an existing footprint in the Milwaukee MSA, as the buyer. Adava is eager to grow its portfolio and capitalize on the economies of scale this portfolio offers. Kyle Hallion, Lauren Nagle and Brooks Blackmon handled the transaction.

Additionally, Blueprint’s behavioral healthcare team advised a national REIT to re-tenant a vacant seniors housing asset in the Tulsa, Oklahoma MSA. The existing asset was vacant at the time of engagement and identified as a great candidate for a behavioral healthcare provider due to strong demand and referral networks for inpatient substance abuse and mental health care within the market.

So, Blueprint identified and negotiated lease and credit terms with behavioral healthcare-focused operators. Ultimately, a large regional substance abuse and inpatient mental healthcare operator was selected based on lease terms and execution capability.

In addition to identifying appealing lease terms, credit worthiness and the ability to mobilize quickly were key components of the assignment. Blueprint procured an LOI from the new tenant within one week from the commencement of the marketing effort, resulting in an executed lease soon thereafter. Andrew Sfreddo, Shane Harmon and Gunnar Raney handled the transaction.

In another transaction with a REIT seller, Helios Healthcare Advisors facilitated the purchase of two assisted living communities in Northern Louisiana on behalf of an independent investment group based in Texas and Louisiana. Savannah Court of Bastrop and Savannah Court of Minden were owned by a public REIT and operated by a regional provider under a triple-net lease. Built in the late 1990’s, both communities had a historical average occupancy of 90% and maintained positive cash flow.

Helios effectuated a cooperative operations transfer for the new tenant. A mortgage loan was secured through Texana Bank to fund the purchase, at 85% loan-to-cost and an interest rate of 7.5%, under a 25-year amortization. The transaction closed in less than 70 days from the LOI with simultaneous PSA and OTA executions. National Health Investors (NYSE: NHI) announced the sale of two communities that appear to be Savannah Court of Bastrop and Savannah Court of Minden.

Blueprint was engaged by an independent owner/

The SeniorCare Investor 10 www.seniorcareinvestor.com

operator that chose to strategically divest its 102-unit independent living community in a prominent suburb of Cleveland. Built in the late 1980s, the purposebuilt community was stabilized, cash-flowing and well occupied. Plus, there was upside through a capital deployment plan. Few of these kinds of stabilized assets are hitting the market right now, and the property received seven offers from highly credible acquirers.

The selected bidder, a private Northeast-based investor, is bringing its significant multifamily experience into the independent living sector. Blueprint, with execution support from a multifamily-focused institutional broker, guided the transaction through all aspects of negotiation and due diligence to ensure a smooth transition. Connor Doherty and Ryan Kelly handled the transaction.

Staying in the Buckeye State, Walker & Dunlop Investment Sales facilitated the sale of three separate seniors housing assets. First, W&D announced the sale of Legacy Living Florence, a 128-unit senior living community just south of Cincinnati, Ohio. Built in 2022,

Legacy Living offers independent living, assisted living and memory care. After receiving multiple offers, a REIT was selected as the buyer. Alex Vice, Joshua Jandris, Brett Gardner and W&D’s Seniors Housing Team handled the transaction.

Next, W&D facilitated the sale of Lakeview Senior Living. Built in 2008, the community comprises 125 independent living units in Lakewood, Colorado. The buyer was Livingston Street Capital. Joshua Jandris and W&D’s National Investment Sales Team handled the transaction.

Lastly, W&D Investment Sales announced the sale of American House Macedonia, a 100-unit assisted living/ memory care community in northeast Ohio. Sonida Senior Living, Inc. (NYSE: SNDA) acquired the community for $10.7 million, or $107,000 per unit, bringing the total number of its Ohio portfolio properties to 11. The community, built in 2015, experienced operational challenges due to the pandemic. Alex Vice, Joshua Jandris, Brett Gardner and W&D’s Seniors Housing Team

Delivering solutions across the continuum. Across the US.

VOLUME 36 | ISSUE 6 SeniorCare_Inv 11 Any loans or terms referenced herein are subject to receipt of a complete application, credit approval, and other conditions. This is not a commitment to lend. To view NewPoint’s complete licensing information please visit newpoint.com/licensing-disclosures. ©2024 NewPoint Real Estate Capital LLC. All rights reserved. Let us put the NewPoint platform to work for you. Visit us at NewPoint.com/healthcare. #2 HUD LEAN Lender in 2023 RECENT FINANCINGS $68.8M FHA 223(f) Refinance Skilled Nursing 300 beds | Somers, NY $10.5M FHA 223(f) Refinance Board & Care 68 beds | Tacoma, WA $24.2M FHA 223(f) Refinance Assisted Living 186 beds | Nesconset, NY $21.6M FHA 223(f) Refinance Skilled Nursing 165 beds | Monroe, GA

handled the transaction.

Representing a regional owner/operator, Evans Senior Investments successfully sold Trinity Hills of Knoxville, an 80-unit assisted living/memory care community in Knoxville, Tennessee, for $6.15 million, or $76,900 per unit. Built in 2006, the community features 66 AL and 14 MC units, all serving private pay residents. Occupancy was strong at the time of marketing, at 92%, and it stayed above 90% for more than 12 consecutive months. It also generated around $400,000 of NOI on $3.7 million of revenues, for an 11% margin.

That could be improved and offered the opportunity for a new owner to add significant value to the community. There was also assumable HUD debt on the property that increased its appeal to buyers. Evans targeted a select group of seniors housing buyers and generated several offers. Ultimately, Bourne Financial Group was selected as the buyer. Evans helped facilitate the HUD assumption, as well.

Evans also arranged the sale of an assisted living community in Denver, Colorado, representing Novellus Living in the transaction. ESI previously facilitated the sale of the community less than two years ago.

Originally built in 2002, Novellus Cherry Creek comprises 66 units and operates on a 59% private pay basis. In 2022, occupancy was in the high-70s by the time of the previous sale, but the community was losing money. However, occupancy had dropped to around 36% more recently, and cash flow remained negative, prompting Novellus to execute on a strategic redirection. That included divesting the Colorado asset to focus on its successful California and Arizona portfolios.

ESI took advantage of its market knowledge having previously sold the asset and conducted a confidential marketing process, targeting a select group of seniors housing buyers. Peaks Healthcare was ultimately chosen as the buyer, for an undisclosed price. The transaction closed within 130 days of hitting the market.

Evans was additionally engaged by an independent

owner/operator in its divestment of a CCRC in Shrewsbury, Massachusetts. Shrewsbury Campus is made up of three components: Southgate at Shrewsbury (senior living), Shrewsbury Nursing & Rehabilitation (skilled nursing) and Shrewsbury Medical Center (medical office buildings). ESI ran a competitive and confidential marketing process, engaging with a select group of prospective buyers. The Atlas Healthcare Group was ultimately selected as the buyer, for an undisclosed price.

Built between 1969 and 1986, Southgate and Shrewsbury Nursing total 171 independent living units, 60 assisted living units and 99 skilled nursing beds. The IL and AL units also carried a large entrance fee liability and mortgage indenture that was put in place 30 years ago. Shrewsbury Medical is made up of two medical office buildings. Built in 1970, the east office building offers five suites. Built adjacent in 1980, the west office building offers 10 suites. At the time of marketing, the campus demonstrated strong potential for continued success, with Southgate 98% occupied, Shrewsbury Nursing 70% occupied and Shrewsbury Medical 100% occupied. Prior to the pandemic, the SNF component consistently achieved an average 86% occupancy rate. No additional details were disclosed.

Haven Senior Investments facilitated the sale of two seniors housing communities in eastern Kansas that total 59 assisted living and memory care units. The purchase price was $3.4 million, or $57,600 per unit. The seller, MorningStar Care Homes, divested one of its seniors housing assets a few years ago and is now exiting the sector to retire with the divestment of these two communities.

The communities were built in the mid-90s and are located about an hour apart. They are in good shape, with not much capex needed. Both struggled during the pandemic, but were stabilized at the time of sale with around 85% average occupancy and positive cash flow. They are mostly private-pay, with some Medicaid. The cap rate was 12%, and top-line revenues were over $3.0 million. The ultimate buyer was Reflections Retirement Resort, a local, family-owned existing owner/operator that was looking to expand its portfolio with acquisitions

The SeniorCare Investor 12 www.seniorcareinvestor.com

close to its other assets. Reflections financed the deal through a local commercial loan.

Robin Gestal of Haven handled the transaction. The biggest challenge was location, as the communities are in a rural part of Kansas, making it difficult to find an operator with nearby properties.

Ziegler was engaged by Bethesda Senior Living in its sale of a stabilized, well-performing assisted living community in Grand Junction, Colorado. Bethesda is divesting this non-core asset to focus on the growth of its mission. Cornerstone Management purchased the community in conjunction with a private real estate fund. Eric Johnson handled the transaction, noting that the largest hurdle to getting it closed was location, as the community sits outside the primary markets, which limited the buyer pool.

After more than twenty years of ownership, a family owner/operator decided to sell its senior apartment community in Sacramento, California. The partnership chose to engage Rob Reis and Jon Holmquist of Marcus & Millichap to quietly market their property for sale.

Built in 1971, the 103-unit community consists entirely of one-bedroom apartments. It is a hybrid between independent living and senior apartments, as the previous owner contracted in a meal service for two to three meals per day, and had a prep kitchen, not a full commercial kitchen. Common area amenities include a community room, game room, meal plan service and exercise classes. Plus, unit amenities include hardwood floors, air conditioning and a full kitchen with dishwasher.

Rents were very low, at around $750 per month, so incoming ownership should be able to at least double them (and revenues too). The property operated at a 72% expense margin on approximately $920,000 of revenue but was fully occupied.

The buyer ended up being a regional owner/operator of workforce housing communities, but a few senior apartment communities too. They beat out a couple of other offers and paid $5.5 million, or $53,400 per unit,

THANK YOU TO ALL OF OUR CLIENTS AND LENDING PARTNERS

MERIDIAN CAPITAL GROUP’S SENIOR HOUSING AND HEALTHCARE TEAM CLOSED OVER $5 BILLION IN TRANSACTION VOLUME IN 2023

Thank you for making 2023 a successful year for our team across all of our disciplines, including debt financing, equity placement, investment sales, and advisory services. We look forward to a future of shared success together.

SENIOR HOUSING AND HEALTHCARE TEAM LEADERSHIP

ARI ADLERSTEIN

Head of Senior Housing and Healthcare

212.612.0174 aadlerstein@meridiancapital.com

JOSH SIMPSON Partner, Senior Housing and Healthcare 212.612.0243 jsimpson@meridiancapital.com

VOLUME 36 | ISSUE 6 SeniorCare_Inv 13

and have plans to invest in some needed capex before increasing rents.

Also in California (and with a purchase price), Sherman & Roylance sold two Level-3 Adult Residential Facilities (ARFs) in Fresno County representing a well-regarded, long-time owner-operator seller in the deal. Chris Minnery and Michael Belcher of S&R found a seasoned buyer eager to expand their portfolio and build upon the established legacy of care.

The two ARFs, each housing six residents, have been operating since 2003 under the management of the original owner. The facilities have consistently enjoyed 100% occupancy. They sold for $1.09 million, or $90,800 per bed. Sherman & Roylance facilitated a seamless handover process, with all residents and staff remaining on board to maintain continuity of care.

Several additional transactions closed in the month of May. At the end of the month, Newmark announced the sale of a seniors housing portfolio featuring assets spread across three states. Dubbed Project Stone, the four-community portfolio includes Class-A communities at irreplaceable locations in strong Ohio, Kentucky and Missouri submarkets. Together, they comprise 460 independent living, assisted living and memory care units.

The communities had positive leasing and operating margin trends, as well as strong recent rental and care increases. The portfolio was being offered at a discount to replacement cost, but the purchase price was not disclosed.

JLL Capital Markets arranged the sale of a Class-A seniors housing community in San Marcos, Texas. The seller was a joint venture between Bow River Capital and Investcor, and the buyer was Inspired Healthcare Capital Built in 2020, Sage Spring Senior Living comprises 90 units of assisted living and memory care. The community was stabilized at the time of sale. Jay Wagner, Rick Swartz, Aaron Rosenzweig and Dan Baker handled the transaction.

Lastly, Berkadia was engaged in the sale of two assisted living and memory care communities in the Atlanta, Georgia MSA. The communities are located in Atlanta and Marietta and total 146 units. The seller was a publicly traded REIT. Mike Garbers, Cody Tremper, Dave Fasano and Ross Sanders handled the transaction. No additional details were disclosed.

AGENCY LOANS

Cain Brothers advised FilBen Group on a $30.67 million HUD refinancing for Wallkill Realty Partners (dba Braemar at Wallkill), an assisted living community in New York. The proceeds on the loan will be used to refinance The Orange County Funding Corporation Assisted Living Residence Revenue Bonds, Series 2012, providing a long-term, fixed-rate low cost of capital to the borrower.

As a result of the refinancing, the tax-exempt public fixed-rate Series 2012 bonds were redeemed at par. In addition, the refinancing will remove any ongoing financial covenants and public disclosure requirements related to the Series 2012 bonds (for example, debt service coverage ratio and days cash on hand).

Opened in 2015, Braemar is a four-story seniors housing community in Middletown, New York (Orange County). There are 120 beds licensed as Assisted Living Residence that primarily serve private pay residents, and there are 80 Assisted Living Program beds that primarily serve Medicaid-eligible residents. Out of the 120 ALR beds, 24 are licensed as Special Needs Assisted Living Residence and are operated as memory care beds. The facility was developed and is owned/operated by various affiliates of FilBen, an experienced New York-based senior living developer that has developed over 5,000 nursing home beds and 1,400 units of private pay senior housing in the state since its founding.

Next, Dwight Capital closed $26 million in HUD financing for River Towne Center and Etowah Landing, two SNFs in Georgia. The transaction included a $17.4 million refinance for River Towne Center, a 210-bed SNF situated on five acres in Columbus, and an $8.6 million loan for Etowah Landing, a 100-bed SNF set on three acres in

The SeniorCare Investor 14 www.seniorcareinvestor.com

Rome. The HUD loans refinanced existing bridge loans provided by Dwight Mortgage Trust in December 2022. Adam Offman originated these transactions.

CONVENTIONAL LOANS

BMO Healthcare Real Estate provided $70.6 million in bridge financing to a joint venture of New Perspective Senior Living, Boldt Capital and Fengate Asset Management, for the recapitalization of two Class-A seniors housing communities. The communities total 290 units in Franklin and Waukesha, Wisconsin. Loan proceeds include capital allocated for future capital improvements and value enhancement.

In a separate transaction, BMO provided $70.0 million in bridge financing to the same joint venture for the recapitalization of three Class-A seniors housing communities. The communities total 435 units and are in suburban Milwaukee, Wisconsin (two communities), and West Fargo, North Dakota. Loan proceeds include capital allocated for future capital improvements and

value enhancements.

Next, CBRE secured financing for a seniors housing community in Tacoma, Washington, on behalf of a joint venture between Harrison Street, PMB and GenCare Lifestyle . Built in 2020, GenCare Lifestyle Tacoma at Point Ruston comprises 159 independent living, assisted living and memory care units. The community fully opened in the fourth quarter of 2020 and leased up to 90% in 36 months, averaging four net move-in’s per month. Occupancy is currently hovering around 98%. Aron Will and Tim Root secured a three-year loan for this transaction.

CBRE also arranged construction financing on behalf of a joint venture between a seniors housing owner/ operator and an institutional investor for a seniors housing community in the Washington, D.C. MSA. The community will consist of independent living, assisted living and memory care. Aron Will and Adam Mincberg secured the construction loan through a syndication of two national banks.

VOLUME 36 | ISSUE 6 SeniorCare_Inv 15

Are your 2024 business goals on track? CFG can help. As a one-stop shop lender, we create solutions tailored to meet your needs. Ready to get started? CapFundInc.com | 410.312.3155 MEMBER FINRA/SIPC

Berkadia refinanced Clarendale Clayton, a best-in-class seniors housing community in Clayton, Missouri (St. Louis MSA), that offers the full continuum of care in a high-end, resort-style setting. Opened in 2021, the 13-story property features 283 units of independent living, assisted living and memory care (195 IL, 66 AL and 20 MC).

Managing Director Austin Sacco of Berkadia Seniors Housing & Healthcare arranged financing through a national bank on behalf of the borrower, a joint venture between Harrison Street, Ryan Companies US, Inc., and Life Care Services (LCS). The $82.45 million floating rate loan (or $291,000 per unit) featured an attractive interest rate and five years of interest only.

Additionally, First Citizens Bank’s Healthcare Finance business served as lead arranger for a $260 million loan to refinance a portfolio of 12 skilled nursing facilities in Maryland that comprise over 1,500 beds. The borrower, a new client, is a Midwest-based healthcare real estate investment and management company. It invests in a variety of post-acute facilities with investments in over 24 states. At $173,000 per bed of debt, the portfolio must be performing quite well. No other details were disclosed.

Next, Live Oak Bank closed a $27.0 million refinance with a repeat client for an assisted living/memory care community, The Ridge at Lantern Crest, situated on a larger campus, Lantern Crest, in Santee, California. Lantern Crest, operated by Lantern Crest Senior Living, is a 34-acre seniors housing campus developed by The Grant Companies. It offers independent living, assisted living and memory care. Development occurred in three phases, with Phase I being The Ridge at Lantern Crest, Phase II being The Pointe at Lantern Crest and Phase III being The Plaza at Lantern Crest.

The Ridge, which opened in 2012, was originally built with 80 assisted living and memory care units. It was expanded in 2023 to include an additional 64 units. LOB had provided financing for the original community, as well as development financing for the expansion. Additionally, in 2014 The Ridge was financed via a CBRE-originated Freddie Mac loan.

The Pointe opened in 2015 and comprises 102 independent living units. In 2016, CBRE’s Aron Will, Bill Chiles and Scott Peterson arranged a refinancing on behalf of The Grant Companies for The Pointe. At the time, it was stabilized. CBRE originated a $25.0 million loan through the Freddie Mac Seller Servicer direct lending program. The 10-year, fixed-rate mortgage included 72 months of interest only.

Lastly, The Plaza comprises 113 independent living units across four stories on 3.8 acres, and opened in 2021. In 2023, CBRE arranged a refinancing for The Plaza on behalf of The Grant Companies. Will, Chiles, Matt Kuronen and Michael Cregan arranged the financing. CBRE originated a $38.35 million, 10-year loan with five years of interest only to effectuate the refinance through its Freddie Mac Optigo lending platform.

Helios Healthcare Advisors secured working capital for a Southern California assisted living provider. The working capital loan is for The Artesian, a 64-unit assisted living and memory care community in Ojai, California. It was constructed in 2020 and consists of four, 16-unit buildings that utilize a universal worker model.

A capital infusion was required to cover operating deficits until the community achieved stabilization and to reconfigure additional units to memory care as the market showed a strong demand for this. An offer from a private debt fund was procured to finance the transaction. The final product was a term loan securitized through a second deed of trust and subject to specific performance measures.

Capital Funding Group announced the closing of a bridge-to-HUD loan totaling $9.75 million on behalf of a nationally recognized borrower. The loan supports the refinancing of a 123-bed skilled nursing facility in Massachusetts. Tim Eberhardt, Craig Casagrande and Ava Julio handled the transaction.

CFG also closed a $36.2 million bridge-to-HUD loan to support the refinancing of five skilled nursing facilities in North Carolina that total 522 beds. CFG refinanced an existing loan to include two additional underleveraged

The SeniorCare Investor 16 www.seniorcareinvestor.com

facilities. Tommy Dillon originated the transaction.

This financing follow’s CFG’s closing of a bridge-to-HUD loan totaling $20 million, also on behalf of a nationally recognized borrower. The loan supported the refinancing of a 125-bed skilled nursing facility in Maryland.

Dwight Capital and its affiliate REIT, Dwight Mortgage Trust, financed $152.5 million in transactions during the first quarter of 2024. Among the transactions were a $44 million bridge loan for a 369-bed, seven-story skilled nursing facility in the Southwest U.S. The bridge loan, which closed in conjunction with a $5 million revolving line of credit, is expected to be refinanced through HUD in approximately 24 months. Adam Offman and Josh Sturm, Managing Directors of Healthcare, originated the transaction for a recurring client.

Additionally, Dwight closed a $24.6 million bridge acquisition loan for a 369-bed SNF in New Jersey, and a $15 million bridge refinance for a portfolio of three SNFs in Massachusetts. This loan was closed along with a $5 million revolver. There was also a 14.4 million bridge acquisition loan for an assisted living and skilled nursing portfolio located across Illinois, a $14 million bridge loan for two SNFs with 165 beds in Georgia, and a $4.5 million revolver for a 361-bed ALF/SNF portfolio in Ohio.

Lastly, SLR Healthcare ABL provided a $3.0 million assetbased revolving credit facility to a skilled nursing operator based in the upper Midwest. The management team has a combined 40 years of long-term care experience. It recently took over the operations of three skilled nursing facilities that total 230 beds in Iowa. Proceeds of the loan were used to provide working capital to support growth initiatives which include development of a memory care unit and expansion of a behavioral health unit. Stacy Allen handled the transaction. No additional details were disclosed.

BOND FINANCINGS

Ziegler announced the closing of BHI Senior Living’s $32.0 million Series 2024AB bank loans. BHI is a faithbased not-for-profit organization that owns and operates

10 CCRCs across Indiana, Ohio and Michigan. The Series 2024AB bonds marks BHI’s eighth financing with Ziegler since 2000.

BHI will finance two phases of new construction at Hoosier Village in Zionsville, Indiana. Hoosier intends to construct 20 independent living townhomes with 3,200 square feet each in two phases beginning in spring 2024 and another in spring 2025 for a total of 40 units. BHI currently has a waitlist with over 400 households seeking an independent living unit in the community.

Ziegler conducted a full bank search process and received multiple attractive proposals. The plan of finance was customized to leverage proceeds from the initial entrance fee pool. BHI elected to make use of the Phase I initial entrance fee pool to fund the majority of the Phase II project costs in 2025, rather than to utilize debt financing for the entire project amount.

The Series 2024A bonds consist of a $19.0 million direct placement which represents the “Permanent Debt” associated with Hoosier and it will have a seven-year commitment period. The Series 2024B bonds will consist of a variable rate drawdown loan of up to $13.0 million. This loan is considered to be “Temporary Debt” as it will be used to fund a portion of Phase II’s construction in 2025. Initial entrance fees received in Phase II will be used to pay down the Temporary Debt loan in full.

Ziegler also announced the closing of HutsonWood at Spring Hill, Inc.’s Series 2024 revenue bond anticipation notes. The notes are comprised of $14.67 million of Series 2024A tax-exempt notes sold publicly to institutional investors and $3.0 million of Series 2024B subordinate taxable notes purchased by an affiliate of the borrower.

HutsonWood (dba Belle Springs), is a Tennessee notfor-profit organization that will use the proceeds of the notes to acquire approximately 20 acres of land and to finance certain pre-construction development costs related to an expansion and repositioning of an existing skilled nursing and assisted living community located in Spring Hill, Tennessee. Emerald Spring Hill, Inc. (dba

VOLUME 36 | ISSUE 6 SeniorCare_Inv 17

The Reserve at Spring Hill), a Tennessee not-for-profit organization, currently operates the existing community located approximately 30 miles south of Nashville.

Upon completion of construction, the Spring Hill project will provide a full continuum of care for residents on an approximately 35-acre campus consisting of 172 independent living units, 24 assisted living units, 24 memory care units and the existing 68 skilled nursing beds. The new independent living units will consist of a mix of 112 apartments, 18 duplexes and 42 cottages. Greystone is serving as the development consultant.

It is currently anticipated that funding for the construction and other related costs will consist of approximately $186.82 million of a combination of tax-exempt and taxable revenue bonds to be issued in 2026. The plan of finance is also expected to incorporate temporary debt to be redeemed with a portion of initial entrance fees from independent living residents after establishing certain reserves and working capital amounts. The long-term debt will amortize over the anticipated economic life of the community.

This is the first step for HutsonWood as they transition to providing services in Spring Hill under an entrance feebased, CCRC model. Belle Springs faces limited CCRC competition and is in an attractive, growing primary market area.

MANAGEMENT TRANSITIONS

This month saw an uptick in operation acquisitions, which is an alternative way to expand one’s portfolio in the difficult interest rate and lending landscape that exists today.

Welltower (NYSE: WELL) caused the biggest stir, announcing that six operators would take over management of 89 independent living communities operated by Atria Senior Living. Several years ago, we had a rather heated discussion with Atria’s former CEO, John Moore, in the lobby of the hotel at the NIC fall conference. This was pre-COVID. It started with our comment that Atria was getting too big to be well managed, since no

operator in long-term care had succeeded when they had over 500 communities, and maybe even 300. He took strong exception to that concept, insisting that if you were a good manager, like Atria, you could do well no matter the size. Let’s just say, we were right, he was wrong, and the rest is becoming history. While Atria became a very good operator, a little arrogance may have slipped in as to how good, especially during tough times.

We know that Ventas (NYSE: VTR) was not happy with Atria’s performance leading up to COVID, and certainly not during COVID. Now, Welltower has decided to transition management of the 89 IL communities currently managed by Atria (and formerly managed by Holiday Retirement), to six existing operators based on geography and local strength. We have to say, this is a great move, as the new managers should be able to be better focused on operations and staffing, and maybe a different culture will help as well. In addition, Holiday always prided themselves on developing IL communities for the middle class, leaving out the bells and whistles and simply delivering a product with consistent services and food. Atria’s model, however, was always aimed at the upper end, and often the two do not mesh well, despite the effort.

Two portfolio transitions have already closed, and they include 14 communities in Texas and the southern U.S. going to Sagora Senior Living. At the time of transition, they had an average occupancy of just 73%, way below the national average for IL. The second portfolio that closed has 13 communities with an average occupancy rate of 74%, again very sub-par. These are located in Michigan, Indiana and Ohio and are now managed by StoryPoint Senior Living. With improved management and focus, census levels should increase, pushing margins up as well. This expands the relationship to 94 communities.

The two largest portfolios will be going to Cogir US and to Discovery Senior Living. Cogir will be taking over management of 20 communities in the Pacific Northwest and will expand the relationship to 45 communities. The average occupancy level is 77%. Discovery is taking over 23 communities located in California and Florida with average occupancy of 78%. While Discovery, with more

The SeniorCare Investor 18 www.seniorcareinvestor.com

than 200 communities, is approaching a size where diminishing returns often set in, we believe they have broken up the portfolios under management into smaller sizes and separate incentivized management teams. Think the Ensign (NASDAQ: ENSG) model, but in groups of properties.

Finally, Quality Senior Living (QSL) will be taking over management of 13 communities with 78% occupancy in the Southeast, and Arrow Senior Living will be managing six properties in a few Plains states with 84% occupancy. The pending transitions are all expected to be completed in the third quarter. This expands the QSL relationship to 25 communities. Welltower claims there is the potential upside of nearly $47 million in NOI upon achievement of pre-COVID occupancy and margin, and an additional $20 million beyond pre-COVID, across all six portfolios. That would be nice, if not overly optimistic on the margin side.

These 89 assets have a cost basis of $164,200 per unit at transition, and an expected $171,000 per unit after some post-transition renovations. And of course, all of this is below “replacement cost.” Welltower presented a case study of a former Holiday community that was transitioned to Oakmont Senior Living 18 months ago. Occupancy has gone from 76% to 82%, RevPOR from $5,400 to $6,236, NOI from $4.0 million to $7.2 million and NOI margin from 22% to 32%.

All very impressive, but it is Hawaii and not Indiana. It would be tough to come close to those results in the Holiday/Atria communities currently being transitioned. Regardless, the 89 communities should be performing better as the post-COVID environment gets better, but we do believe the new operators will be able to push the envelope. This will all be good for Welltower and the industry.

In other news, Welltower has increased its full-year 2024 earnings guidance, and has finally increased its dividend, the first increase since 2017. The increase, however, is a whopping 10%, much more than we had expected and been pushing for, but it shows how much the company has improved since March 2021. Oorah!

Reach key decisions-makers in the Seniors Housing & Care and Healthcare M&A industries by advertising in one of our award-winning publications.

VOLUME 36 | ISSUE 6 SeniorCare_Inv 19

YOUR MESSAGE

OUR

AUDIENCE

SUCCESS

+

TARGETED

=

DOWNLOAD OUR MEDIA KIT TODAY! WWW.LEVINASSOCIATES.COM/ADVERTISING/ Call Cristina Blazek-Hearty at (203) 295-4519 to book your campaign.

your campaign today: The SeniorCare

LevinPro HC Spotlight on Senior

SeniorCare Investor Dealmakers Forum

more... Irving Levin Associates LLC ⋅ levinassociates.com P.O. Box 1117, New Canaan, CT 06840 advertising@levinassociates.com ⋅ (203) 846-6800 & Media kit

Don’t hesitate - Book

Investor

Care M&A The

And

PACS Group (NYSE: PACS) made a big splash when it announced that subsidiaries of the company agreed to acquire the operations of 53 skilled nursing facilities and assisted living/independent living communities across eight western states: Oregon (21), Washington (19), Idaho (6), Nevada (3) and one each in Alaska, Arizona, California and Montana.

All are currently operated by Prestige and comprise 2,511 skilled nursing beds and 1,334 AL/IL units. This expands PACS’ footprint into five additional states. The acquisition of the operations is subject to customary closing conditions. PACS anticipates that the transactions will close in the third quarter.

PACS will lease 37 of the facilities from a joint venture in which it owns a 25% interest. The remaining 16 will be leased from unaffiliated third-party landlords. PACS is leasing the facilities on a traditional triple net basis, so its up-front capital outlay to do the transaction primarily consists of the approximately $15 million that it will invest in the real estate joint venture for its 25% interest.

Next, Charter Senior Living announced the addition of 13 communities to its management portfolio in Illinois and Wisconsin, all formerly managed by Cedarhurst Senior Living and owned by Diversified Healthcare Trust (NASDAQ: DHC). This announcement follows Charter’s operations acquisition of six New England-based communities for Columbia Pacific Advisors. Additionally, the company has two projects under development in Wisconsin and Kentucky. Charter’s goal is to find a path toward ownership through a joint venture in every community it operates.

Sagora Senior Living has taken over management of 17 senior living communities across Alabama, Florida, Nebraska, Oklahoma and Texas. The operator took over 14 from Atria Senior Living (as mentioned on page 18), under its Asher Point Brand. Additionally, Sagora recently opened Lynridge of Huntsville Assisted Living and Memory Care, expanding the operator’s Lynridge brand to a fourth location, and becoming the first Lynridge community in Alabama. Next, Heron Cove Assisted Living and Memory Care and Heron Point Independent Living

are in Vero Beach, Florida, less than 10 miles from The Brennity of Vero Beach, another Sagora community.

Additionally, Sinceri Senior Living announced the addition of seven new management acquisitions in the heart of the Ohio Valley. The Magnolia Springs communities are in Kentucky, Indiana and Ohio, offering assisted living and memory care.

The seven communities are Magnolia Springs Bridgewater (Carmel, IN), Magnolia Springs Southpointe (Indianapolis, IN), Magnolia Springs Loveland (Loveland, OH), Magnolia Springs Florence (Florence, KY), Magnolia Springs East (Louisville, KY), Magnolia Springs Louisville (Louisville, KY) and Magnolia Springs Lexington (Lexington, KY).

REITs as Lenders ...cont. from pg. 1

increases have weighed heavily even with three years of back-to-back unit rate increases in the high-single to double-digit levels. Most everyone (but not all) believed they had to follow the census increase path and then start to push margins. Given what happened from 2020 to 2021 in the first year of the pandemic, we have to agree.

While all lenders want to see census growth, it is margin growth, and cash flow growth, that will pay off their loans and provide increasing value. Obviously, this will not happen in a vacuum without census growth, but it will be necessary to get the traditional lenders back with some real volume, as opposed to the sporadic deal flow we have seen. There is no shortage of demand for capital, as the seniors housing and care M&A market is booming and may hit a record this year for transactions completed, although not for dollars spent. For dollar volume to get back to the mid-2010s levels, we will need large deals to close, and for that, we will need a lot more willing capital. Not to mention some price equilibrium, as well as confidence in the market and its direction.

Healthcare REITs are poised to fill the debt capital vacuum, and several have already started. The problem, if you must call it that, is that traditionally REITs have

The SeniorCare Investor 20 www.seniorcareinvestor.com

been long-term holders of assets, mostly a minimum of 10 years but usually 15 to 25 years. Why? They provided the capital for the long term, with escalating rents so that they could provide shareholders with an annual dividend increase even if they made no new investments.

Investors expected them to buy and hold the real estate for the long term. It provided stability to expected returns and investors wanted the annual income kick from the rent escalators. Mortgages were paid off in five to seven years, not 25 years, so investors did not know how, if or when the loan proceeds would be invested, and at what rate. This was not always the case, however.

In 1970, the Health Care Fund was founded in Lima, Ohio by Bruce Thompson (an old Choatie, which he constantly reminded us of) and Fritz Wolfe. At the time it owned just two skilled nursing facilities with a value below $800,000. It grew by buying mostly nursing homes, but also assisted living communities, psychiatric facilities and one rehab facility. But by the end of 1993, its portfolio included investments in 44 mortgage loans and seven

construction loans. They knew the lending market for nursing homes was not liquid, but they also knew they could take advantage of that, and did. By 1985, the entity changed its name to Health Care REIT, with less than $200 million in total assets, and three decades later went through another name change, to Welltower (NYSE: WELL), and the rest is history.

But it got its start by opportunistically providing capital to a sector starved for any kind of debt capital and succeeded because they understood the nature of the real estate and operations. Some of the operating expertise came from Wolfe’s founding of Health Care & Retirement Corp. in 1981, which became one of the largest and most successful nursing home chains in the country. As a side note, most HCR’s assets came to Welltower years later by way of a merger, a sale, and then a fire sale.

So, with valuation spreads continuing to be wider than market participants would like, REITs have not had an easy time finding the right acquisitions, at least at the right price. Except Welltower, which has bought more

VOLUME 36 | ISSUE 6 SeniorCare_Inv 21

nhireit.com | 615.890.9100 | Leaseback | Construction | Mezz | Joint Venture you’re unique Your Financing Solutions S hould Be Too

properties in each of the past few years than all the other healthcare REITs combined. Although they claim it is not because they have the lowest cost of capital, that certainly does help (thank you, Captain Obvious).

In the debt market, REITs have many more financing options to provide than banks and other traditional lenders, not to mention not having the regulatory burden as a lender. They can do traditional mortgage loans (and at higher LTVs), short-term acquisition loans (similar to bridge to HUD, but providing the takeout themselves with either a sale/leaseback or purchase and RIDEA structure), and mezzanine financing. They can also provide some equity, but that is not debt. The point is that REITs have access to capital and can deploy it in many ways that other “lenders” can’t. That’s a big advantage, especially in this market environment.

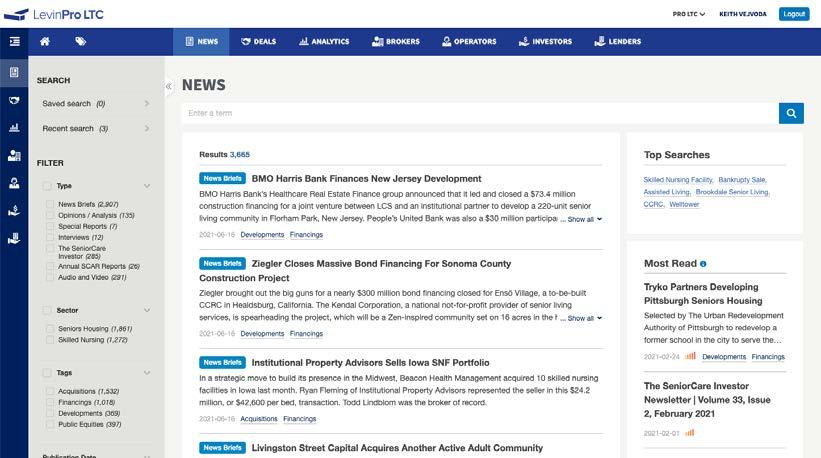

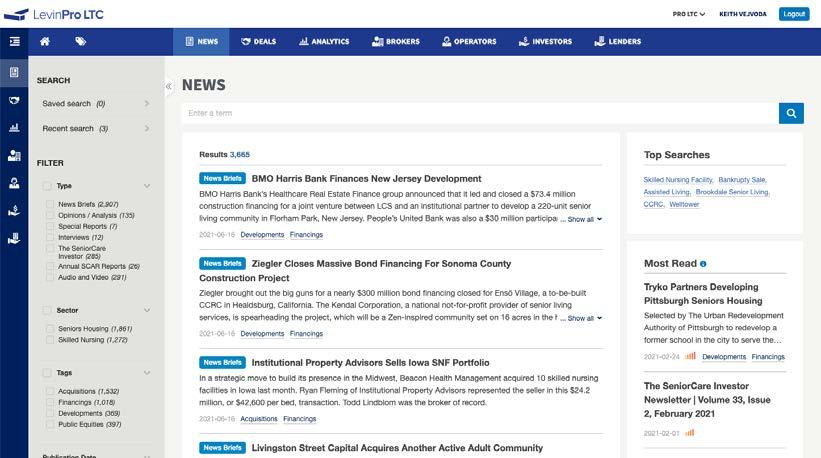

Five Years of REIT Investments. In the past five years (2019 – 2023), healthcare REITs that specialize in seniors housing have made more than $31.8 billion in investments. The vast majority is in seniors housing and care, but with a smattering of medical office and life sciences buildings. They have also divested more than $13.4 billion of assets in the same time period, mostly driven by pandemic related performance problems. This results in investments topping divestitures by a margin of 2.36 to 1.0. That means there has been significant growth despite the problems and the large volume of sales.

But it is also a tale of two different investors: Welltower, and then the rest of the REITs. It didn’t use to be this way, but the business model at Welltower seems to have changed in the past five years or so. They have become more like traders in the assets they have bought, trying to buy low and sell high, all in the name of improving shareholder returns.

Beyond that, they have just been aggressive about growth and have not been afraid to make major bets, even during the pandemic. Having the lowest cost of capital has not hurt, despite what they say. But they are very confident about their investment decisions.

We looked at the volume of acquisitions, loans and

divestitures over the past five years, grouping together CareTrust REIT (NYSE: CTRE), Diversified Healthcare Trust (NYSE: DHC), LTC Properties (NYSE: LTC), National Health Investors (NYSE: NHI), Sabra Health Care REIT (NYSE: SBRA) and Ventas (NYSE: VTR). If Welltower’s numbers had been included with the rest of the group, it would have dominated, rendering the other REITs’ numbers somewhat meaningless when combined.

When breaking out the totals above for investments and divestitures during the past five years, Welltower accounted for about 68% of all the investments, and, perhaps not coincidentally, also 68% of the divestitures. They have been dominant on the acquisition front because of their cost of capital (sorry Shankh, but it’s true), but maybe more importantly, the amount of capital they have to deploy. Obviously, they have significant lines of credit to fund acquisitions, but when you sell $9.1 billion in assets over a five-year period, that results in a lot of money that needs to be reinvested. And reinvest is what they have done.

In that five-year period, Welltower has provided more than $4.1 billion in debt financing, most of which has been for new developments. This is on top of about $17 billion of real estate acquisitions. The new development financing has mostly been active adult communities (“wellness housing”) and medical office buildings (outpatient medical).As of the first quarter, Welltower had committed about $1.8 billion to fund the development of 4,223 wellness housing units, 521 IL units, 900 AL units and 439 MC units. Approximately $543 million of this is slated for funding in the next six to 12 months to finish those projects. We suppose when there is a will, there is a way, but they have so many options as to how and when they convert the development funding to permanent funding, which is a huge advantage.