B SI SS24e u n

“Change will not come if we wait for some other person, or if we wait for some other time. We are the ones we have been waiting for. We are the change that we seek.” – Barack Obama

At Ishmael Yamson & Associates, we take

immense pride in hos�ng the annual Business Roundtable ‒ it is our way of making a meaningful impact and driving posi�ve changeinourcountryandtheAfricancon�nent.

Building the content for this magazine was quite a seamless process as we had a clear understanding of the message we intended to convey to readers. The magazine is enriched by the contribu�ons of trailblazerswhohavesharedexcep�onalinsights.

In recent years, our economy has encountered numerous challenges that are obvious to everyone. As argued by many, Ghana possesses an abundance of natural resources that have been touted as sufficient to help the country meet its needs Leaders have over the years also a�empted strategic efforts to capitalize on the poten�al of diverseindustriessuchasagribusiness,culture,arts and tourism, and the use of technology Although progress has been made, our ul�mate objec�ve of mee�ng the needs of the ci�zens and providing themwithbasicneedsremainsawork-in-progress.

Whatcouldbethereasonforthesetback?

We have failed as a country to establish sustainable ini�a�ves that are able to endure in the long run. Countless promising ini�a�ves have fallen through the cracks over the years, o�en due to changes in government and other unforeseen circumstances.

As the world finds itself in unprecedented �mes, there is a crucial need to build a more sustainable economy

Agriculture has long been the backbone of Ghana's economy, accoun�ng for a significant por�on of employment and contribu�ng to food security Its importancecanthereforenot beoverstated.Ghana can capture more value within the value chain by processing agricultural products and promo�ng agro-industrial ac�vi�es The promo�on of sustainable farming prac�ces and the adop�on of technology in agriculture can also contribute to environmental sustainability and resilience in the faceofclimatechange.

By adop�ng modern agricultural prac�ces, improving access to finance and markets, and suppor�ng small-scale farmers, we are confident thatGhanacanboostitseconomicproduc�vity.

Ghana is now able to a�ract a growing number of interna�onal tourists This not only generates revenue but also creates employment opportuni�es, par�cularly in the hospitality and crea�vesectors‒anindica�onthatourrichcultural

heritage presents a wealth of opportuni�es for economic growth, job crea�onandenhancingthecountry'simageontheglobalstage.

Investments in infrastructure, coupled with effec�ve marke�ng strategies, can showcase the beauty and diversity of Ghana's cultural tapestry Collabora�ons between the public and private sectors, as well as engagement with local communi�es, are similarly key to harnessing the poten�al of our African heritage and transforming it into sustainablewealthcrea�on.

Technology has become an indispensable tool for driving economic growth and development, and our tech sector con�nues to show promising growth. From improving access to educa�on and healthcare to enhancing efficiency in governance and business opera�ons, ICT plays a transforma�ve role in shaping the economy Access to affordable internet connec�vity and the development of digital skills are therefore cri�cal in ensuring that all segments of society can par�cipateinthedigitalrevolu�on.

Ghana can unlock immense poten�al across various sectors by harnessing the power of Informa�on and Communica�on Technology (ICT). We need to therefore create an enabling environment that encourages innova�on and entrepreneurship in the tech sector to fosterthegrowthoflocaltalentanda�ractmoreforeigninvestments.

In conclusion the adop�on of ICT, leveraging Ghana's African heritage, and priori�zing agribusiness are key strategies for building a sustainable economy By expanding internet access, fostering innova�on in the tech sector, promo�ng tourism, and inves�ng in agribusiness, Ghana can achieve economic diversifica�on, create employment opportuni�es, and improve the overall well-being of its ci�zens. These efforts will contribute to Ghana's development goals and posi�on the country as a leader in sustainable economic growth in Africa. Let us seize this opportunity to be the change we seek and drive posi�vetransforma�onforgenera�onstocome.

by Winnifred Adjei-Mireku & Juliana Essel AckomISHMAEL YAMSON AND ASSOCIATES is a management

consul�ng prac�ce which applies two core specialisa�ons; in business and organiza�onal transforma�on, and leadership development, to help clientscreateandunleashvalueforsustainedgrowth. In the face of the current global and local challenges that confront businesses and organiza�ons, we believe our essen�al focus as partners, is to help our clients thrive and unearth the unique capabili�es that can propel them into outstanding organisa�ons, occupying market leadershipoverthelongterm.

The firm draws on the extensive management and business experience of a stable of competent and experienced consultants and associates in designing and execu�ng all programmes, leading projects and strategy implementa�on in the areas of Corporate Strategy, Organisa�onal Restructuring, Process and Systems reviewsandBrandDevelopment.

WeWillWalkWithYou.

PASSIONANDFOCUS

We focus on implemen�ng three impera�ves for public and private sector organisa�ons with a range of services asfollows:

• DevelopingStrategy

1. VisioningandStrategydefini�on: Wehelpcompanies and organisa�ons define their vision and strategies, and translate Strategy into Ac�on to create great, prosperouscompaniesonasustainablebasis.

2. Developing Brands and Channels: We work with the opera�ons and sales teams to help businesses to discover, formulate, and implement powerful consumer, shopper, and trade insights to guide brand visionandstrategydevelopment.

• DevelopingEfficientandEffec�veBusinesses

1. Organisa�onal Reviews & Change Management: We help organisa�ons first to align their structures, people, values, and behaviours to their vision, strategies, and plans; second, we collaborate with them to design the right management systems and processes, which support the delivery of organisa�onalgoals.

2. Governance Arrangements and Systems & Process review: We help organisa�ons to align their governance framework and opera�onal processes

and systems to drive produc�vity and innova�on and the delivery of strategy We work with leaders in organisa�ons to review and streamline their opera�ons to provide the right pla�orm for efficiency andproduc�vitygains.

3. Corporate Services: We offer bou�que consultancy services on capacity building including recruitment, training and development, reten�on and pension planning.

• DevelopingPeople

1 Coaching and Mentoring: We provide interac�ve processes for managers and supervisors to solve performance problems or develop capabili�es. The process relies on person-to-person collabora�on to support the individuals in three areas; technical help, personaldevelopmentandindividualchallenges.

2 Management Educa�on: We bring leading-edge management thinking and a deep understanding of trendsshapingorganisa�ons.

Weserveawidevarietyofclients,including:

1.Localandforeigninvestors.

2.Privatesectororganisa�ons.

3.Publicsectororganisa�onsincluding ministries,departments,andagencies.

4.Non-Profitandnon-governmentalorganisa�ons.

We offer exclusive business training and development programmes on client-specific basis to individual companies and organiza�ons, and also for the general corporate community – businesses in both the private and public sectors. These programmes can be accessed inthree(3)ways:

1. Companies and organiza�ons can register their execu�ves to par�cipate in our adver�sed public programmesonspecificsubjectareas.

2. Companies can request to run any of our programmes in-house. Such arrangements require a minimum number of par�cipants depending on the selected programme.

3. Special programmes can be designed and run for organiza�ons and companies on a need-specific basis. The design of such programmes will be based onabrieffromtheorganiza�onorcompany

In 2014, when we first launched the Ishmael Yamson & Associates Business Roundtable, our purpose was to help develop strong founda�ons on which to build much more robust economies in Ghana and Africa We decided therefore to focus on issues of economic growth, governance, and leadership, and how these must drive and shape Ghana's efforts towards building a fast growing, sustainable and resilient framework for wealth crea�on, especially as Ghana had discovered oil and begun producing crude oil and gas in commercial quan��es in 2011. Suddenly signs of the Dutch disease were beginningtoemerge,andthatwasaworrytous.

In the fourteen (14) years since 2010 Ghana's economic growth has been inconsistent, with high growth rates between 2010 and 2013, low growth rates between 2014 and 2016, high growth rates in 2017 and 2018, a crash to 0.51% growth in 2020 following the covid-19 disrup�ons, a recovery in 2021 of 5.36% and a sharp decline in 2022 to 3.5%. The forecast for 2023is1.5%.

This clearly is an economy without resilience and sustainability It is an economy which is overly dependent on a very narrow commodity export base but highly import driven, o�en dri�ed around by global economic developments. Sadly, for instance, even with Ghana's enormous arable land, the country is the most dependent on food importsinAfrica.

To my mind, two factors have accounted for this dismal and inconsistent economic performance;

poor governance and leadership without conscienceandpurpose.

Issues of leadership and governance in Ghana have been discussed extensively because of the impact they have had on the performance of the economy and the country's ability to create wealth on a widespread basis. The only period that Ghana has witnessed real economic transforma�on was under the leadership of Dr. Kwame Nkrumah, who had a clear purpose to build an industrial economy, a clear agenda to build Ghana's economic and social infrastructure and a clear understanding of how to build resilience and sustainability into Ghana's economy And he was in power for only nine (9) years!

While the disrup�ve military interven�ons of the 60s, 70s and 80s created major setbacks for the

economy, it is even more true that poor governance and poor leadership have aggravated the difficul�es facing the Ghanaian economy. There is no administra�on that has not been accused of serious economic mismanagement, greed, and corrup�on And regre�ably our democracy has itself become a vic�m of the greed and corrup�on that have captured our leadershipinGhana.

The recent report- Understanding How Dirty Money Fuels Campaign Funding in Ghana- An Exploratory Study, Commission by Adam Smith Interna�onal and prepared by William Nyarko and Kojo Pumpuni Asante of CDD- Ghana, clearly demonstrates how Ghana's poli�cs has been captured by dirty money and excluded many capable and visionary young people from ac�vely par�cipa�ng in the poli�cs of the country This is due to the prohibi�ve cost of running for public office as the young men and women are normally unable to raise those funds. The example of the destruc�on caused by State-capture in South Africa, should make it clear to Ghanaians that any f o r m o f c a p t u r e i s d a n g e r o u s a n d counterproduc�ve, and we must as a na�on fight it.

A�er sixty-six (66) years of independence from colonial rule, which we o�en blame as the cause of our backwardness and lack of development, Ghana is currently a highly and unsustainably indebted and poor country Many thousands of educated and capable young men and women

cannot find jobs and are leaving our shores in drovesforhopeelsewhere,hopetheycannotfind inGhana.

Governance and government are meaningless if they do not create growth. Good governance and good leadership cannot be separated from Ghana's effort to create a wealthy, prosperous country The two are inseparable, and Ghana must make every effort to embed them in its governanceculture.

But even in the midst of this deep crisis, I believe that a return to prudent economic management, an embrace of good governance, and aggressive fight against greed and corrup�on are possible. What remains is our ability and determina�on as a people to reject purposeless and rudderless leadership and elect leaders who can perform and who have integrity to lead our economic and socialtransforma�on.

The Ishmael Yamson & Associates Business Roundtable started this Journey ten (10) years ago and it is our inten�on to con�nue on this path. We therefore invite you to join us, as Ghana embarks on a new journey to create an enabling economic and social environment in which its ci�zens are empowered and feel proud to be Ghanaians.

This presenta�on on Wealth Crea�on as the 4thHorizon forGhana's Growthisintended to seed a review of the op�ons Ghana has to create an economic transforma�on and interrogate some ideas and op�ons best suited fo r t h e r e c o v e r y, d e v e l o p m e n t a n d transforma�on of Ghana's economy. A transforma�on that moves finance, people, jobs in selected sectors from low to high produc�vity andasustainedresilientgrowthtrajectory.

We have always assumed that if we produce more, we will earn more revenue and with more revenue, be able to look a�er our economy and ci�zens much be�er. But the proof of 66 years of

MICHAEL HARRY YAMSON MANAGING PARTNER, IY&Aindependence is that more revenue does not necessarily lead to sustainable development that creates resilient wealth The ques�on then becomes why we have allowed this false paradigm - that revenue equals development equalswealth-tostandforsolong.

If we look at agriculture in the last seven decades, we have paid much a�en�on to produc�on. However, private and public investments in technology, related sciences, agriproduct branding, commercialising value-added agriproducts, and developing global markets for the services and know-how built through the agriculture and agribusiness value chains, have been insignificant and not sustained Consequently, agribusiness remains a daun�ng exercise and therefore a low priority in alloca�ng resources.Thisisinstarkcontrasttothestrategies successfully employed by Thailand, Indonesia, VietnamandMalaysiawhousedagriproductsand tourism to power economic transforma�ons

Largely, revenues from cocoa exports, for example, have not gone into crea�ng new industries, rather, apart from the alloca�ons to scholarships, , the billions of dollars Ghana has earned from expor�ng cocoa have been spent paying for recurrent expenditure and in some cases on bare-faced corrup�on. Li�le wonder that the sector has failed to drive Ghana's development.

Where do we find new ways to create industries from the agricultural supply chains, in planta�ons, in storage, in value addi�on, in branding, marke�ng our food to the rest of the world and export market development? These have the poten�al to turn revenue into new industry-building investments that generate stable, be�er-paid jobs and medium-term wealth. Though mature, agribusiness could s�ll be a source of long-term wealth. It is possible to maximise the residual value, earn significant surpluses and seed long-term growth in new industries.

The story of our heritage and crea�ve industries is not much different. Revenues are mostly spent on low-value-adding ac�vi�es, employing few people in the sector and maintaining structures. Very li�le has been invested in crea�ve industries that help us tell our story be�er to a global audience and generate profits in the process. I giveyoutheexampleofTheLionKing.Thestoryof Lion King originates from Southern Africa. Yet the story has been told to a global audience and commercialised by Hollywood. Hollywood has earned billions from films, merchandise, games, theatre products, and anima�ons Southern Africa saw li�le of that money and the creators of the theme song earned no royal�es. So, what stories do we have that we can tell be�er using different formats that can fetch us billions in revenues beyond invi�ng people to visit Ghana? We can create new industries allied to the original baseheritageandcrea�veeconomy.

Now considering ICT, Ghana sits in the West African sub-region where we s�ll have one of the best educa�onal systems. We have the poten�al to leverage the brain power of our academia and students, par�cularly in the rela�vely new areas

of ICT and technology. Yet, students from across the region who graduate from places like Ashesi University, having developed ICT and technology solu�ons for Africa and the world, leave yearly without the opportunity to register and build their ideas into businesses in Ghana. Today, we are dependent on solu�ons created outside our region based on the needs of other socie�es and cultures. All governments have overtaxed and inhibited the growth of ICT and technology industries rather than incuba�ng technology firms and ICT solu�ons relevant to the needs of our market, the daily reali�es of our ci�zens and solving global problems. It will be be�er to untax technology and demand that firms heavily reinvest their profits to s�mulate new technology industries.

My view is that rather than pursue revenue as an end in itself, it is even more important to decide how we will invest revenue in new spheres of high-value enterprise to generate stable, highquality revenue streams that bring resilience to the economy I agree with the view that Wealth Crea�on means a sustainable acquisi�on and accumula�on of resources to compe��vely generate relevant output and financial flows to a�ain na�onal development goals that fulfil the needs of ci�zens without compromising the ability of future genera�ons to meet their own needsii. This sort of Wealth Crea�on indelibly improvesthequalityoflifeforallci�zens.

Post-pandemic and debt default, there is an openingtoresettheeconomy.

Embracing Wealth Crea�on as the development model for Ghana is right for many reasons, includingtherecogni�onthat:

1. the days of one-size-fits-all solu�ons and expor�ng unprocessed cocoa, metals and fish; and li�le processed and illegal �mber are no longer viable in the new global economic p a ra d i g m G h a n a s h o u l d e m b ra c e differen�ated paths to its wealth crea�on goals and the managers of the economy must implement customised wealth crea�on strategiesforselectedindustries.

2. to remain relevant and compe��ve in global markets requires a diversified reservoir of intellectual property, patents, innova�on, and value-addi�onthatis'Made-in-Ghana'.

3. sustainable profits and savings determine the pace of investments in human capital developments and innova�ons to create new anchor technologies that will maximise the speed, scale and longevity of economic transforma�on.

To paraphrase Dr Seyram Kawor of the UCC, “no country borrows to develop. Borrowingmust only supplement a country's own accumula�on of its own resources and revenues.” Therefore, amid global vola�lity, a fluctua�ng Cedi, vanishing domes�c savings and investments, and emp�ed na�onal reserves, we have to step back and urgently

(1) priori�se crea�ng resilient wealth with robustbufferstocontainmajorshocks.

(2) determine a new vision for wealth crea�on and

(3) decide how to achieve material i m p r o v e m e n t a n d q u a l i t a � v e transforma�on for the benefit of ci�zens nowandintothefuture.

Letmeexplainwhy.

As in Africa and the developing world, Ghana's economy straddles centuries of economic revolu�on from the mechanisa�on of agriculture, the development of industry, the rise of services, and the knowledge economy powered by communica�ons, ar�ficial intelligence, nanotechnology and biosciences Ghana's economy is integrated with the global economy through global trade and financial markets and the intertwining of our economy with these powerful economic systems opens up new opportuni�es for growth and wealth crea�on. Ghana has an opportunity in the coming decades to harmonise all four revolu�ons to accelerate economic transforma�on and wealth crea�on. There is no be�er �me than now when we have been presented with the “historic opportunity to

dosowiththeAfricaFreeTradeCon�nentalArea” toquotetheWorldBank.

On the other hand, we have all witnessed worldwide economic disrup�ons since 2020, and the slide of Ghana's economy into an unprecedented economic abyss that we are beginning to understand began as early as 2018. The ongoing collapse and uncertainty generated con�nue to spook financial markets, slow investment and ul�mately economic ac�vity into the medium term Perversely, if the global recovery con�nues to strengthen and as policies to frame the new global economic order are normalised, an emerging economy such as Ghana, can expect the process to expose its economy to external shocks and adverse spillovers, even as we strive to remain a viable player in key global economic systems – unless we build a more robust economy Just as Winston Churchill advised, we should not waste this crisis. Itisanopportunitytoremodeltheeconomy.

Three major developments are predicted between now and 2040 in the November 2021 World Bank Country Economic Memorandum �tled Ghana Rising: Accelera�ng Economic Transforma�on and Crea�ng Jobs; (a) Ghana's popula�on will rise to 45 million (b) six in every ten people will be less than 30 years old, and (c) about 10 million young Ghanaians will join the labour force and must be gainfully engaged. It notes that "Ghana faces an acute challenge of genera�ng more and be�er jobs and has a 'missing middle' of employment in midproduc�vity sectors". However, all is not lost. The report further acknowledged that Ghana has all it takes to con�nue being an economic development star if it takes the right steps to nurture growth and job crea�on despite the debilita�ng effect of the pandemic. And I will add even more cri�cally restoring prudent economic management. Specifically, the World Bank highlighted;

(1) macroeconomicstability,

(2) financialsectordevelopment,

(3) technologicaltransforma�on,

(4) fosteringgreaterglobalintegra�on, and I will addasakeypoint,

(5) restoring a robust governance architecture to underpinthefourpriori�es

In the Post-World War II process of wealth crea�on, sub- Saharan Africa along with parts of the Middle East, the former Communist-Socialist bloc and La�n America lost ground in various degrees to the winners like France, Germany, Japan, South Korea, Taiwan, Singapore, and Hong Kong, and then, Malaysia, Thailand, Indonesia, and Chinaiii. Some heavily-endowed na�ons and regions mismanaged their blessingsiv whilst countries with precious li�le became adept at sustainably acquiring and accumula�ng resources and improving the lives of their people indelibly We know where Ghana fits in this picture.

Let us step briefly into 1957 to hear Victor Adams' describe the hope and op�mism for a be�er future when church bells rang across the city of Accra to signal the birth of modern Ghana, to the e-newsle�er UN Africa Renewal. He was in his home village of Shiashi, a suburb of the Ghanaian capital. Shiashi had no electricity, roads or piped water There were only eight mud houses in the en�re village. Shiashi and its surrounding areas have since been transformed but signs of underdevelopment s�ll abound, including poor sanita�on, unpaved roads and makeshi� homes. In a way, the story of Shiashi reflects Ghana's uneven economic and social development over the years. A middle school student at the �me of independence, Mr Adams said, "Our country could have done be�er." Many Ghanaians share thatsen�ment.

Ghana requires a new economic model to translate resources and revenues into resilient WealthCrea�on.

Ghana cannot create wealth by just earning more money If that were untrue we would be rich from over 100 years of cocoa, bauxite and gold exports alone. The economy needs a new paradigm where we consciously reserve por�ons of our

earnings to invest in a con�nuous process of resource accumula�on designed to create parallel streams of income through private industry and human capital investments. It cannot be a short-term ac�vity Secondly, wealth crea�on should have a clear intent to generate and distribute opportuni�es across all stages of priori�sed value chains. This clarity is crucial for the quality of outcomes from the alloca�ons of resources:

(1) for human and capital investments to produceabiggereconomy,

(2) to transform Ghana into a technology and innova�on-driveneconomy

(3) tosupportdomes�cindustrialgrowth,and

(4) tosustain,resilientlong-termGDPgrowth. Ghana as a developing country ought to be aggressive about developing opportuni�es through policy-making to a�ract investments We must support innova�on and produc�vity solu�ons that will enable the economy to generate wealth by a�rac�ng the spending and investments of both local and global consumers and investors. The “if we build it, they will come” approach of the Emirates is proof posi�ve of the success of pursuing wealth crea�on as a na�onal objec�ve.

For too long greed and corrup�on, self-interest, poli�cal longevity, the desire for aggrandising , power and social relevance have been the main obstacles undermining wealth crea�on in Ghana. These mo�va�ons end with the erosion of the well-being of ci�zens. Unfortunately, commentary on intangible sources of wealth like the environment, innova�on, intellectual assets, social order etcetera are underplayed and remain elusive in economic and sociological literature. And we dare not look to na�onal glory and honour for inspira�on. Yet, these are what should strengthen the extent to which we produce sustainedeconomicwealthandgrowth.

Some�mes being a late bloomer has its advantages. Once the consensus bakes in, Ghana

will have a fresh canvas on which to define how to straddle the economic revolu�ons in agriculture, industry, services and the new knowledge industriesandvaluechains.

(1) The first horizon should aim to shi� the core of na�onal revenues to agribusiness by rapidly expanding the scale, quality and performance of deriva�ve industries that either add value to or innovate around previously raw or lightly processed agricultural products. It should shi� targeted investments to increase their efficiency and produc�vity. The same logic should apply to value-added cultural exports, tourism productsandotherbasicexports.

(2) The second horizon is the phase for selec�ng and resourcing emerging technological and innova�onindustrieswhichshouldbeatthe core of the New Ghana economy. A successful strategy will create self-funding growth from entrepreneurial ventures that will generate substan�al broad and longterm economic opportuni�es very quickly in thetransforma�oncycle.

The transi�on to technology and innova�on driven industries requires three major shi�s in culture,mind-setandfocusasfollows:

● THESHIFTINCULTURE

Ÿ SharetheVisionandCultureoftheFuture

Ÿ Clearly define the strategic direc�on of the economy and society and get everyone deeply mo�vated by and commi�ed to the journey to transformlives;notjustchangelifestyles.

Ÿ Highlight the new na�onal values and end the culture of seeing the na�on's tolerance for mediocre leaders as infinite and embrace a meritocracy Demand changed behaviours to undergird the transforma�on agenda in terms of personal responsibility and being accountable.

Ÿ Build the right habits to be a self-sufficient economy. Emphasise sound economic principles such as modera�ng consumerism and disciplined work-ethic, building compe��ve advantage across industries, low

debt,andbuyingMade-in-Ghana.

● THE SHIFT IN MIND-SET – STEP OUT. STAND OUT

Ÿ Develop Ghana Inc. as an economic philosophy founded on discipline, keeping high standards, andintegrity;theprotec�onofindividualrights, property rights, and the environment; and the supremacyoftheruleoflaw.

Ÿ Build ecosystems to promote trade and rela�onships that reinforce our development andgrowthplans.

Ÿ Intensify partnerships in markets and knowledge that enable the economy to u�lise natural and human resources more efficiently andeffec�velythanbefore.

Ÿ Break from the socioeconomic and poli�cal norms in the African region. Ar�culate a bold, standout vision about what life, work and leisureintheNewGhanaeconomywillbelike.

Ÿ Increase the savings rate in the economy and make genera�onal investments in mul�ple, long-term income flows; and break the false beliefthatfinancialsuccessispossiblewithouta disciplined focus on raising the rates of savings, (re)inves�ng, and increasing the levels of financial literacy and business skills. Ergo, put wealth crea�on above borrowing and crea�ng unsustainabledebt.

Ÿ Concentrate government spending on na�onal priori�es and human resources founded on broad consensus, not poli�cal ini�a�ves and schemes that drive the cost of government but do not create value; do not waste na�onal resources on short-term projects and conspicuousconsump�oningovernment.

Ÿ Decide more strategically, whose money to use for what. Leverage the geopoli�cs of today Blend the resources of private investors with those of emerging economies, the IMF and World Bank, China, India and the West in seeking financing to invest in skills, physical infrastructure, and business development LearntoGAMEandstopbeingPLAYERS.

(3) The third and farthest-looking horizon of wealth crea�on, targets how to elongate long-term growth by leveraging exploratory investmentsinR&D;anddeployingstrategies and technologies to establish new agribusinesses, crea�ve, heritage, knowledge and technological industries to secure five long-term fundamentals in the NewGhanaeconomy,namely:

1. Job crea�on through the radical transforma�on of the core sectors and transi�oning of labour with new skills into new industries with higher produc�vity –especially innova�on, ICT and business services. These more socially and geographically mobile workers also expand domes�c trade, urbanisa�on, and connec�vity.

2. Produc�vity growth, intensified innova�on and entrepreneurship rates through domes�c firms' adop�on of digital and complementary technologies to accelerate the economic transforma�on. To enable this change, The New Ghana will require r a d i c a l l y i m p r o v e d m i c r o - l e v e l infrastructure, internet connec�vity and investmentsinawiderangeofdigitalskillsto facilitatetechnologyadop�onbyfirms.

3. Inclusive private sector development that leverages domes�c savings and financial resources to facilitate technology adop�on, innova�onandtheexpansionoflocalfirms.

4 Macro and fiscal stability, be�er natural resource management and smart, broadbased revenue mobilisa�on to generate revenues to fund reforms and economic transforma�on.

5. Long-term inclusive growth that incen�vises sustainable exploita�on of natural resources, protects the environment and minimises the impactofclimatechangeonhouseholds.

Leadership isindeedacrucialfactorinthesuccess anddevelopmentofanycountry,Ghanaincluded. It inspires and unites people, drives progress and economic growth, and makes posi�ve changes in

the lives of ci�zens happen. The underpinnings of Leadership are the Values of leaders that play a crucial role in determining the success of any country's efforts towards wealth crea�on. The values held by Ghanaian leaders will significantly impact the country's economic growth, job crea�on, and development. For Ghana to achieve sustainable and inclusive economic growth, its leaders must exorcise the wicked torments of mismanagement, corrup�on and greed; and priori�se core values, the most needed of which are:

1. Integrity: the self-confidence to act with honesty and transparency in all their dealings, whether in public or private sector roles to build trust and credibility with ci�zens,investors,andotherstakeholders.

2. Accountability: the humility to take responsibility for their ac�ons and answer to the people they serve. This means being willing to submit to tough ques�ons, admit mistakes, and take correc�ve ac�on to securethefuture.

3. Innova�on:theforethought,an�cipa�on,and adapta�on we some�mes describe as being visionary Add to that, inves�ng in research and development, entrepreneurship, and the passion to promote crea�vity that changes lives in all aspects of society and all sectors of the economy. This ecosystem enables innova�on, start-ups, and small businesses to thrive.

4. Discipline: respect for the new social norms, therule-oflawandarespectfor�me.

5. Inclusivity: inves�ng in educa�on and training for all ci�zens to ensure fair access to the benefits from economic growth for all segments of society; promo�ng gender equality, and crea�ng employment opportuni�esformarginalisedgroups.

6 Sustainability: priori�sing resilience from sustainable development prac�ces,

protec�ng natural resources, inves�ng in renewable and green energy and the longterm aspects of economic growth, when considering the impact of any policy on the environment, future genera�ons, and social cohesion. We cannot build sustainability in the New Ghana economy without building resilience in finance, supply chains, human capital,andbusinessmodels.

I set out to address five core areas that are cri�cal for us to address and interrogate as we plan to move the Ghanaian economy from the chronic crises periphery of global economic and trade systemstowardsthecoreasfollows:

1. ending the false paradigm - that revenue equalsdevelopmentequalswealth

2. selec�ng and inves�ng in new high-value enterprise that bring resilience to the economy

3. building savings to invest in private industry and human capital to create parallel streams of income, resource accumula�on and investments

4 defining how to straddle the economic revolu�ons in agriculture, industry, services andknowledgeindustries,and

5. the importance of leadership values, a�tudes and behaviours as the core underpinning for thechange.

Wealth crea�on as the 4th Horizon of Ghana's Development is a viable, credible economic objec�ve and I recommend further discourse on this.

Thank you.

Entertainment and media covers a range of sectors, some well-established in Africa and other products of the digital revolu�on heralded by mass smartphone use. Newspapers and magazines, tradi�onal television, live music, cinema, radio and street-level adver�sing remain strong on the con�nent, par�cularly in less developed markets. Yet they are no match in the long term for new industries, including video and music streaming, internet adver�sing and socialmedia.

“The entertainment sector in Africa is s�ll very much emerging and we have barely scratched the surface of what can be achieved by inves�ng in African crea�vity,” says Bright Yeoah, Co-founder of Wi-flix B.V, a strategic advisory firm specialized in the African crea�ve and sport sectors. The tech giants “know that their next billion users will come from Africa, which is why they are all inves�ng heavily in the con�nent's internet infrastructure”

Africa's youthful popula�on, growing middle class and rising internet connec�vity offer a growth opportunity for streaming services in the entertainment, arts and culture industry The con�nent's video-on-demand subscrip�ons will almost triple from 4.89 million at the end of 2021 to 13.7 million in 2027. This growth drives the revenues to more than double from US$2.1 million in 2022 to US$3.97 billion in 2027. Ne�lix and YouTube hold nearly half the market at 48%, but these global players are being confronted with the first signs of market satura�on. The interna�onal offerings aren't as a�rac�ve to Africans, since people prefer consuming local content. Hence, African streaming services such as the Wi-flix startup in Ghana, Kenya, and Nigeria grew from 300 thousand to over 1 million paid subscribers in 2021 alone. More established providers remain popular, such as IROKOTV and GloTV in Nigeria, and Showmax in

South Africa. These companies can offer large amounts oflocallymadecontentalongsidehigh-endinterna�onal offerings.

Over the last five years, Africa has become a prized territory for mul�na�onal streaming services in their ongoing ba�le for supremacy While many na�ons on the con�nent are, collec�vely speaking, an undeveloped market in this regard, Africa boasts huge poten�al for rapidgrowth.

According to a report by London-based intelligence firm Digital TV Research, streaming video on demand (SVOD) subscrip�ons in Africa, which stood at around 5.11 millionbytheendof2021,looksettotripleby2026.This has been driven by the increased connec�vity infrastructure throughout Africa, the prolifera�on of smart devices and a steadily growing, young, tech-savvy popula�on.

Streaming services, by nature, are disruptors. Their presence has already had a significant impact on movie theaters, terrestrial, and cable television markets interna�onally, and now local streaming services are staking their claim, country-by-country, across the African con�nent. We believe that local players have the edge over their interna�onal counterparts. That is because they are closer to their audience, have a greater knowledge of what they like to watch, and have deeper insightsintohowtheyconsumethatcontent.

We have learned a lot over the past two years. We looked at what the interna�onal streaming services were doing and asked – how can we disrupt the

While our audience enjoys interna�onal blockbusters, there is a vibrant entertainment culture across the con�nent that is crying out for recogni�on. Whether it is music, art, or film and television content, African people love to celebrate their local heroes and we love to consume local content Today, African streaming services like Wi-flix in Ghana, Kenya and Nigeria, and iROKOtv and GloTV in Nigeria, and Showmax in South Africa – are all providing large amounts of locally made content (alongside high-end interna�onal offerings), and their offerings are proving more popular with Africanaudiences.

Ne�lix has even taken no�ce, pledging to invest R929 million into South Africa's crea�ve industry by 2023, and has entered a collabora�on with EbonyLife to produce films for the Nigerian market Furthermore, local pla�orm owners can navigate the entertainment terrain more easily, not just being more in touch with local audiences' tastes, but also being aware of the standards and requirements of the broadcas�ng authori�es in theirregions.

Content producers and commissioners have also taken note of the appe�te for local content. According to Disrupt Africa, African content start-ups had their best funding year on record in 2020, raising a combined total of $13.9 million, almost 19 �mes the amount raised in the previous year and nearly 116 �mes what was secured in 2018. With entertainment pla�orms and start-ups seeing increased success, investors are star�ng to throw more money behind them, along with fintech, e-commerce and health ventures already in their por�olios.

From a recent so� survey conducted, It's safe to say that over 70% of Africa's youth popula�on have never been to the cinema and yet this is a con�nent with growing deep internet penetra�on of a vibrant, informed and mostly educated young people. Africa has more people of working age than the en�re world combined I understand that 41% of the global youth popula�on will live in Africa in 2030 and those numbers may double by 2050.

Africa's media and entertainment industry at a crossroad

From Instagram comedians to the telecommunica�ons giants that deliver their content, the future of media in Africaisinfizzingferment.

Trapped at home in Nairobi by the Covid-19 pandemic and, like millions around the world, feeling isolated, Elsa Majimbo started pos�ng short comedic videos to Instagram. Si�ng in bed ea�ng crisps and laughing wildly,Majimboquicklybuiltadevotedfollowing.

Two years on, she boasts 2.5m followers on the social media pla�orm; magazine covers; fashion campaigns; and a new home in glitzy West Hollywood. Like many African creators, from YouTubers and gamers to musicians and actors, Majimbo embodies the dizzying growth of the con�nent's entertainment and media industry

Amid rapid digital adop�on, behavioral shi�s brought about by the Covid-19 pandemic, and stagna�ng Western markets for companies such as Ne�lix, YouTube and Facebook, the path to future growth in the dynamic sectorcouldrunthroughAfrica.

As a result, Africa's fractured entertainment and media industry finds itself at a crossroad. As African consumers devote more of their �me and money to media, companies will need to be nimble. And while all agree that the sector is embarking on a period of huge expansion on the world's fastest-growing con�nent, underlying vola�lity means many companies will be le� behind.

Impressive growth in entertainment and media in Africa is being driven by the con�nent's most developed economies. South Africa, the most industrialized na�on, is also the most structured market with an established crea�ve industry and strong talent pool in film, anima�on, design, gaming and music. It even has its own streaming service, Showmax The advent of 5G technology in South Africa looks set to boost the sector even more by increasing internet speeds and lowering prices.

Nigeria,withitsenormousyoungtech-savvypopula�on,

is Africa's entertainment powerhouse, domina�ng in music,film,fashionandevenvisualarts.

MeanwhileKenya,EastAfrica'seconomicgiantandstartup hub, holds huge poten�al for entertainment and media companies. Last year Ne�lix released its first Kenyan series, a gri�y family drama called Country Queen.Highlyar�s�cGhana,too,showsgreatpoten�al.

Industry experts say smaller markets including Rwanda, Côte d'Ivoire and even Benin could also help drive growth in the sector Dakar, Senegal's capital, has established itself as a West African cultural capital and a leading sports hub. And beyond sub-Saharan Africa, Egypt,MoroccoandTunisiaareshowingstronggrowthin gaming,visualartsandanima�onrespec�vely

S�ll, markets such as Namibia and Botswana are five to six years behind the likes of South Africa, says Fakela, largelyduetothehighpriceofstreamingdataandslower digital uptake – which leave people reliant on tradi�onal media,includingnewspapersandradio.

According to mobile network industry organiza�on the GSMA, only 28% of sub-Saharan Africans were connected to the internet by the end of 2020. In some third-�er markets, Fakela says, the state s�ll has a big hold on media – though things are star�ng to change.

“The cheaper data becomes, the more you have audiences coming through,” he said. “That will create a lot more fragmenta�on, but I think it will drive down the costofmedia.”

Lora-Mungai says that Africa's entertainment industry is in the process of structuring itself. “About five years ago, governments and development financial ins�tu�ons, such as Afreximbank, the Interna�onal Finance Corpora�on, the Agence Française de Développement and its subsidiary Proparco, and the African DevelopmentBank–allthesestartedlookingseriouslyat the crea�ve sector as a source of growth and job crea�on,”shesays.

Meanwhile, improvements in internet penetra�on, smartphone ownership, online payments and mone�sa�on tools have given African creators access to the global online marketplace. During the pandemic, pla�orms such as Instagram and YouTube made mone�sa�on tools, such as mobile payments and adverts,accessibletoAfricancreators,shesays.

As a result, entertainment and media revenue has grown strongly in South Africa, Nigeria and Kenya since 2021 as all three major markets emerged from the pandemic, according to a report by global consultancy firm PwC. Yet Covid-19 also exposed fractures in the industry, with some sub-sectors benefi�ng from behavioral shi�s and others losing out. Some former niche segments, such as gaming, have become more prominent for instance, while some established sectors such as newspapers are ontheslide.

Adver�sing was hit hardest by the pandemic, but has experienced the largest rebound since, with internet adver�sing set to grow rapidly in the coming years. The PwC report claims that 79.7% of entertainment and media revenue gained in South Africa by 2026 will come from internet adver�sing, as consumers spend more and more of their �me online and adver�sers follow “I think the compe��on then in the next five to ten years is likely to be between Google and Facebook versus Ne�lix or Amazon Prime, as opposed to Ne�lix versus the local statebroadcaster,”saysFakela.

Other sectors well posi�oned for rapid growth include music and video streaming, whose revenue growth by 2026 is expected to outpace tradi�onal TV subscrip�ons in Africa's biggest markets – although TV will remain much larger. In Kenya, for instance, streaming revenue is expected to total $8.8m in 2026, while TV subscrip�on revenue will total $420m, according to PwC. Similarly, music streaming is the fastest-growing component in Nigeria's music market with the country's ar�sts, including Burna Boy and Wizkid, topping charts around theworld.

By contrast, newspapers and magazines are expected to seetheirmarketsharefall.Cinemascouldalsostrugglein the long term, amid rising streaming usage – though box office revenue in South Africa remains strong. For now, cinemas are springing up in ci�es like Dakar and Nairobi, cateringtoagrowingAfricanmiddleclass.

In the con�nent's biggest markets, a boost is coming down the track in the form of 5G (fi�h genera�on) mobile data technology, which should usher in cheaper and higher-quality lag-free streaming, cloud gaming and virtual reality. South Africa is on the brink of 5G adop�on, a�er a series of spectrum auc�ons. Nigeria heldasuccessfulspectrumauc�onin2021.

“5G is going to play a huge role because I think it will significantly reduce the costs of being connected,” says Fakela.“Iseeitasalsoaneconomicenabler,becauseyou have new businesses coming onstream as a result of faster connec�vity, and connec�vity in areas that were previouslyunderserved.”

Those that will succeed in Africa's fragmented media and entertainment industry will be those that give African consumers what they want, rather than repurposing Western content for Africa. Nowhere is that trend clearer than in streaming, where the likes of Ne�lix, Amazon Prime and Spo�fy have begun taking Africaseriously

Today, Ne�lix offers a vast content library, while Showmax has a slate of African originals and global sports coverage. Disney+ launched in South Africa last May,andhasafootholdinMorocco,Egypt,Algeria,Libya and Tunisia. Amazon Prime Video, meanwhile, launched a local service in Nigeria in August allowing customers to purchase subscrip�ons in Naira, and has established dedicated country teams for Nigeria and South Africa. Similarexpansionhasoccurredinmusicstreaming.

In turn, local companies are receiving record amounts of funding. According to Disrupt Africa, African entertainment startups recorded their best ever funding year in 2020, raising $13.9m, mostly from venture capital firms. It comes as streaming signups start to slow downinsaturatedwesternmarkets.

There is s�ll some way to go, however Streaming giants are s�ll keen to match their investments to expected returns, Lora-Mungai says, causing African creators to grumble that budgets are s�ll too low compared to elsewhere.

The ba�le between streaming giants to boost their African customer bases shows the entertainment and media industry's trajectory, which is being set by the desires of African consumers. With low barriers to entry, consumers have a huge variety of content and services

available in their price range. Companies, meanwhile, must ba�le intense compe��on and con�nual disrup�on to stay relevant. For those that do so successfully,thepay-offwillbeenormous.

The third Senior Experts Dialogue on Science, Technology and Innova�on and the African Transforma�on Agenda (SED 2016) ended in Pretoria with experts agreeing African governments need to do more to support innova�on, especially by young people intheirrespec�vecountries.

The SED 2016, a�ended by experts from 21 African countries, including representa�ves from universi�es, Member States and ci�es, sought, among other things, to help African countries iden�fy the main opportuni�es and challenges at different policy and organiza�onal levels for leveraging and maximizing the rapid rise of ci�es, including the rise of mega-ci�es on the con�nent todriveinnova�onandinven�on.

The 2016 SED was held under the theme “Ci�es as Innova�on

The three-day mee�ng, hosted by the Department of Science and Technology (DST) of the Republic of South Africa, iden�fied key elements and issues, based on local as well as interna�onal experience, that African governments, along with their interna�onal development partners, can take into account in formula�ng ac�on plans to turn their ci�es from manufacturing and trade hubs into innova�on hubs and centers.

African ci�es were already innova�ve but the sad thing was that governments were s�ll unable to close the gap betweenwhattheyspendonresearchanddevelopment and the new innova�ons that can address some of the problemsfacingAfrica'sci�es.

There is a lot happening in Africa, so much poten�al and untapped sectors that I think we can harness by going into strategic partnership. Africa is on the rise, let's support the young with the right environment and mentorshipthatwillmakeAfricaproud.

By Bright O. Yeboah, Co-Founder of Wi-Flix B.VArts, Culture and Tourism although closely intertwined are s�ll separate sectors with dis�nct roles. Each requires a separate treatment to unravel an aspect of their func�on and impact on society For coherence, this ar�cle will focus on tourism development with the tacit understanding that arts and culture are important enablers of tourism. Thus, there can´t be any meaningful development in tourism

without a meaningful development in arts and culture.

Ghana,afavouriteholidaydes�na�on?

It would seem the world descends on Ghana every December Thousands of holiday makers fly in to enjoy themselves in a variety of fun filled ac�vi�es.Theycomefortheconcerts,thepar�es, the tours and the general cultural emersion. Social media lights up with their comments, pictures and videos; feeding into the frenzy of a ¨DecemberinGhana¨astheplacetobe.

December is only a culmina�on of yearlong ac�vi�es as a steady stream of tourists fly into the country throughout the year Notable among the inflows are popular American celebri�es whose visits help to push the hype of des�na�on Ghana. This impression is further bolstered by a lot of interna�onal media a�en�on, whether organic or organised. Ghana o�en comes up in all sorts of publica�ons and news reports as an important touristdes�na�oninAfrica.

With so much a�en�on on the country, it is not uncommon to see social media comments from ci�zens of neighbouring countries, par�cularly Nigeria, bera�ng their governments for failing to orchestrate such excitement about their own countries. They would o�en wonder what Ghana isdoingrightthattheyaren't?

It would appear that one ini�a�ve, in recent �mes, the Ghanaian government got right was the Year of Return (YOR) implemented in 2019 to

mark the 400th anniversary of the arrival of the first enslaved Africans in America. It was a PR success which helped to spur a renewed interest in the country. The private sector took advantage to launch new programmes or intensify exis�ng ones. Major cultural and musical concerts such as Afrochella (now AfroFuture), Afrona�on and The Black Star Fes�val have all leveraged the ini�a�ve.

With all the excitement around Ghana and the many ac�vi�es and ini�a�ves promo�ng Ghana as a major tourist des�na�on in Africa, one would imagine that the country will rank high as one of the con�nent´s major tourist des�na�ons. But, it does not. Ghana does not even feature in the top 10des�na�onsinAfrica.

In the United Na�ons World Tourism Organisa�on´s 2019 rankings, the top three most visited countries in Africa were Egypt (13.0 million visitors), Morocco (12.9 million) and South Africa (10.2 million). The bo�om three were Ivory Coast (2.0 million), Kenya (1.9 million) and Botswana (1.7 million). In-between were Tunisia (9 4million), Algeria (2 4million), Zimbabwe (2 3million) and Mozambique (2 million).

In comparison, Ghana received a li�le over one million visitors in 2019 according to figures released by the Ghana Tourism Authority. In the authority´s last report for 2022, total visita�ons stood at 914,892. It is quite clear that Ghana in nowhere near the big boys when it comes to tourisminAfrica.

In the excitement following up from the Year of Return (YOR), many government officials bandied figures about that sought to create the impression of an unprecedented growth in Ghana´s tourism in order to claim as much

poli�cal dividends as possible. Official sources revealed that Ghana cashed in 1.9 billion dollars as a result of the YOR This figure was widely quoted by many interna�onal publica�ons. The amount was, however, challenged by many experts as unfounded and overexaggerated. Policy analyst Bright Simmons, wri�ng for the Africa Report in January 2020 stated that ¨the danger in eleva�ng phantom figures to the level of truth is in the complacency they can breed¨.He stressed that ¨sounding the alarm about these widely publicised and widely believed numbers is the wish to forestall such a bad outcome and to mo�vate the authori�es to see their successful marke�ng and communica�ons strategies as merely the founda�on on which to erect a truly effec�ve sales plan for Ghana´s tourism and investmentclimatepoten�al.

Bright Simmons is spot on with his observa�on that any li�le success realised so far must be seen as a founda�on to build on. For the success is indeed li�le in terms of traffic. A surgical analysis of the figures will reveal that Ghana´s tourism growth is consistent with past projec�ons and that the current ini�a�ves have not led to any drama�c increase in tourist numbers. At least not yet. At best, a few tens of thousands more visitors might be the marginal increase in visitors as a resultofrecentcampaigns.

Of course, one that does not expect marke�ng effort to bear immediate results But it is important to note that Ghana has had cycles of boom in its tourism experience followed by corresponding bursts. This will not be the first �meGhana has beeninthe spotlight.In fact,right f ro m t h e in c ep� o n o f t h e co u nt r y ´ s independence, there was great excitement around the country. Ghana was a mecca for freedom fighters and pan-Africanist Many notable black leaders such as W E. B. Du Bois,

George Padmore, Mar�n Luther King Jnr, Maya Angelou and Mohammed Ali were all here Kwame Nkrumah´s drive for a united Africa also brought in many African leaders to Ghana. One can, indeed, say that in the late 50s to early 60s, Ghanawastheplacetobe.

The overthrow of Kwame Nkrumah and the subsequent military interven�ons that followed created instability that would have affected visita�ons into the country Nonetheless, Ghana s�ll hosted one of the biggest concerts in its history, Soul to Soul, in 1971. It featured some of the most iconic American stars of the �me—James Brown, Ike, Tina Turner, Santana, Wilson Picket, among others. The Blackstar Square overflowed with tens of thousands of people who came to enjoy the once-in-life-�me experience. The concert made waves around the worldandhasalmostbecomethestaffoflegend.

Another important epoch in the �meline of Ghana´s tourism drive is the Pan African Historical Theatre Fes�val (PANAFEST) ini�ated by Efua Sutherland and launched in 1992 by then President Rawlings to encourage a reconnec�on of Africa and its diaspora For many years, PANAFEST was a big deal and a major item on the na�onal calender. It garnered a lot of interna�onal a�en�on and became an important pilgrimage for people of African descent who came in their thousands. The fes�val is s�ll on to this day, albeit without much of the luster in beganwith.

These examples are to demonstrate that there have always been moments of a�en�on and excitement around Ghana. Indeed, there is an organic pull of people, especially, the African diaspora, to Ghana because of the many enslaved people who were transported from here to the new world. And, also, the important role Ghana has played in the Pan-African struggle. Taken together, the various tourism projects launched

over the years and Ghana´s natural pull factor guaranteesacertainsteadystreamof visitorsinto the country But this has not been enough to put us up there with the big players in Africa´s tourism. The poten�al is, however, there for Ghana to leverage its posi�oning to drama�cally increase traffic into the country. For that to happen though, we need a NEW DEAL FOR GHANATOURISM

Over the years, there have been a myriad of laws, policies and ini�a�ves meant to bolster Ghana´s tourism industry. The ideas are there, the plans have been drawn and some ac�ons have been taken What is, however, missing is an overarching vision and ambi�on to connect the dotsandwhipallstakeholdersinline.

Ghana must aspire to rank within the top 10 most visited countries in Africa. It must set for itself a target to increase annual visita�ons from 1 to 5 million visitors within 10 years by leveraging a USD10billioninvestmentintothetourismsector.

Poli�cal leaders must seriously recalibrate their thinking around economic management away from the overreliance on natural resources to the crea�on of new economic value that completely transforms the tradi�onal structure of the economy.

Since independence, poli�cal ambi�on has always been to industrialise the economy as a path to prosperity Every government has pursued this elusive dream and 56 years on, we are nowhere closer to being labeled an industrialised economy. Perhaps this is so because it is not in the interest of the global capitalist world order to have an industrialised Africa. The con�nent must necessary remain at the bo�om of the pyramid feeding the industrial epicenters in the West and these days, the East—with raw materials. It is, therefore, not

surprisingthathardlyanycountryinSub-SaharanAfricacanbesaidtobeindustrialised.

For Ghana, even as we con�nue to seek industrialisa�on, how about we take compe��ve advantage of some low hanging fruits to bring in billions of dollars annually to support our economic growth? Tourism is easilywithinourreach.

We need a poli�cal leader whose ambi�on will be to transform the economy in such a way as to make tourism the number one earner If he or she succeeds, it would mean a fundamental shi� has occurred and new value has been created, and its ripple effects will be so impac�ul across the economy. New wealth wouldhavebeenbecreated.

Any meaningful transforming in Ghana´s tourism industry leading to drama�c increase in traffic will have to emerge from a new deal, from an obsessive ambi�on to transform. Without that, we will con�nue to just checktheboxesandalltheexcitementaroundbrandGhanawillnotleadtoanymeaningfulimpact.

If we want to play in the big leagues, we must bring out the big guns. There can't be any drama�c change in the fortunes of our tourism industry without a drama�c transforma�on in our tourism infrastructure, experiencesandrelatedservices.Thisrequiresmoney.Alotofit.Itwillonlytakeagovernmentwhosemajor priority is tourism to put in the kind of work geared towards a�rac�ng the colossal investments it needs to transform the sector. Leveraging a USD10 billion financing will have to come through a variety of sources: budgetary alloca�ons, foreign direct investments, tourism bonds, public-private partnerships, buildoperate-transfereeagreements,amongothers.Wherethereisawill,therewillbeaway

It is important to note that any such colossal investment will not be at the expense of the general na�onal development agenda. The things that tourism needs to thrive are also things that ci�zens need; good roads, good public transport, good sanita�on, good healthcare, good infrastructure, good public services and many others. Moreover, the dividends from massive investment into tourism will spur general economic growthtothebenefitofall.

There are many policies and ini�a�ves needed to transform the tourism sector and many of these have already been in the conversa�on for years. This ar�cle has sought to highlight what it believes is the missing link and the most important element needed for any drama�c transforma�on in Ghana´s tourism development—the ambi�on to make tourism the biggest sector of the economy and the will to see it through. We must aim at the heavens, and even if we only reach the stars, we would have s�ll made significantprogress.

Every business, no ma�er what category it

operates in, needs to have a brand and a brand strategy that are aligned with its business objec�ves That way, the process of developing and building that brand will have a well-thoughtthroughfounda�on.

Developing and building a brand involves a con�nuous process of brand development and brand building around two (2) broad pillars, thus: BrandImageandBrandIden�ty.

Under these broad pillars, a business will have to create a messaging framework that influences the manner the business communicates with the buying public and clearly informs their audiences about what value they should expect when they patronizethebusinesses'productsorservices.

Now, let's look at the main considera�ons when developingabrand.

In developing its brand image, a business will need tofocuson:

Ÿ The brand's core values – which will be the values that will guide the conduct of your business it's internal and external engagements. In essence the character of the business

Ÿ The brand's personality – represents how the business wants its audiences to perceive it. These are the emo�onal connectors that enable the business to achieve affinity with theconsumer

Ÿ User percep�on – this is the posi�on that a business occupies in the market space,

directlyrelated to the brand's equitywithin its category

In developing its brand iden�ty, a business will needtofocuson:

Ÿ Brand name & Logo – the name of the businessoritsproductorservice

Ÿ Typography – brand iden�ty elements like fonts are a key part of building a brand's iden�ty

Ÿ Colour pale�e – brand iden�ty elements like coloursarealsoakeypartofabrand'siden�ty

These are the elements that make a brand, and these are the building blocks of brand development.

Brand building involves con�nuous periodic brand ac�vi�es that feed off business and marke�ng communica�onstrategies.

Brandbuildinginvolves:

Ÿ Conduc�ngeffec�vemarketresearch

Ÿ Focusonvalueproposi�on

Ÿ Develop emo�onal connec�on with consumers

Ÿ Deliverconsistentcampaigns

Ÿ Measurementsanditera�ons

Brand development and brand building opportuni�es

The adver�sing category has been the main driver of marke�ng communica�ons in Ghana, and therefore brand development, brand building and digitalac�vi�es.

The brand development and brand building opportuni�es for businesses in the Agribusiness, Arts & Culture and ICT categories in Ghana is prac�cally the same. This is because the principles and elements of developing and building a brand for a business remain the same and can be applied acrossavariedrangeofindustries.

From my 20+ years experience in marke�ng communica�ons, the last 12 of which has been focused on the digital discipline, major branding

andrebrandingcampaignsbysomeofGhana'sClub 100 members have required the same considera�ons in brand development and brand buildingdevelopingcampaigns.

Dis�nguished brand like Unilever, Diageo, Nestle, MTN, Vodafone and SMEs like Farmerline, ExpressPay, SlidePay, GhanaPost GPS and Hubtel have all benefited from marke�ng communica�ons campaign that have helped develop and growth theirbrandandthereforetheirbusinesses.

Even media companies have leveraged their media assets to develop and build their brands. Think of companies the Joy Media, Despite group of companies,Ci�NewsGroupamongstothers.

As part of the brand building process, a business may need to remind the market of its original proposi�on by relaunch the brand emphasise an exis�ngposi�onorreclaimitsposi�on

In other cases, it may need to reposi�on itself, and this may mean a change of brand iden�ty, personality or core offering. This may require, primarily, a rebranding campaign to communicate thenewposi�oningandpersonality.

Brand campaigns are what spearhead a business's engagement with the consuming public, with the aim to occupy a favourable posi�on in the minds of theirtargetaudience.

In the realm of brand development and brand building, rebranding campaigns tend to be interes�ng and engaging An example is the Enterprise Group “Your Advantage” rebranding campaign which was precede by a cap�va�ng “Horse Invasion” teaser, complete with a pseudotrailerofafic�onalmovie.

This campaign did not only achieve its objec�ve of crea�ng synergy between the various subsidiaries, but also resulted in the stock price of the business gaining by about 23% in the month of the launch, June2014.

There are some campaigns that achieved less success. For example, AsaaseGPS was rebranded and promoted as GhanaPost GPS, based on the “Jack Where Are You?” teaser campaign This campaign ensured that the digital addressing system that was acquired by the government for Ghana Post Company was introduced to create awareness.

However, a�er the ini�al awareness drive, the campaign lost momentum as there was no followup campaigns to ac�vate and engage with the Ghanaiansociety Thiscampaignthereforefailedto leverage the full consumer journey, to achieve growthinusage.

Based on the existence of rela�vely old and strong agencies like Scanad, Ogilvy, Innova DDB, Dentsu and their track record of developing and building brands, there is, without a doubt an availability of brand development, brand building and transforma�on services that are available to Ghanaianbusinesses.

As of January 2023, 5.16 billion internet users worldwide have been recorded That is 64 4 percent of the global popula�on. Of this, 4.76 billion, or 59.4 percent of the world's popula�on, areonsocialmedia.

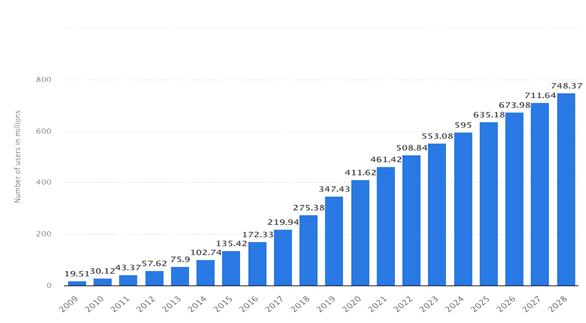

Of the 5.16 billion internet users globally, 13% of them are in Africa; and this is growing and set to reach 748+ million users by 2028.

This presents businesses in the Agribusiness, Arts and Culture, and ICT sectors, in Ghana, huge regional and global audiences to engage with, for growth.

Marketplaces like Alibaba, Jumia, Tonaton are opportuni�es for small businesses to reach global audienceswiththeirgoodsandservices.

The Technology Age is arguably the most disrup�ve age in human history, and digital technologies has democra�zed growth opportuni�esforbusinesses.

The speed with which things change due to technological advancement is mind-boggling. Becauseofthis,businessesthatareatthecu�ngedgeoftheircategorymakethemostimpact.

Digital trends like So�ware-as-a-Service (SaaS), Near Field Communica�on (NFC), eCommerce, RFID, Blockchain, eMobility, Cloud Compu�ng,

Big Data, Augmented Reality (AR), Mixed reality (MR) and Virtual Reality (VR) have impacted businessesposi�velyforgrowth.

Now let's look at some of the truly disrup�ve technologies that can be leveraged for growth by businessesintheAgribusiness,

AccordingtoRayKurzweil,computerswillachieve humanlevelsofintelligenceby2029.

The �me has come for AI, and its influence seems to have permeated every facet of business, including marke�ng communica�ons. This has led to a prolifera�on of AI-driven tools and pla�orms across the fields of finance, fintech, agribusinessandartsandculture.

In Agribusiness, a Ghanaian AI company, KaraAgro AI, has developed a tool which enables farmerstoeasilyandaccuratelydetectdiseasesin their crops using Ar�ficial Intelligence. By simply

taking a photo of the crop's leaf, the app would analyseitandtellifanydiseasesarepresent.

Farmers can detect diseases both online and offline KaraAgro AI currently has Ar�ficial Intelligence systems for detec�ng diseases in; Tomato, Maize, Sweet Pepper, Potato, Grapes, Peach,Strawberry,AppleandCherry.

The influence of AI in marke�ng communica�ons have reached dizzying propor�ons and created a lot of excitement amongst category players regardingthepossibili�es,whichseemsinfinite.

Then there is Microso�'s ChatGPT4 and Google's Bard, the two (2) front-running AI tools for marke�ngandadver�sing.

Betweenthem,these2(two)pla�ormsdeliver:

1. Data Analy�cs to analyze data to understand customer behavior and uncover trends, supplyanddemand,andtrends.

2. Analyze leads through customer data to make adver�sing recommenda�ons based on previous purchase behavior, registra�on informa�on,searchhistory,etc.

3. Smartadobjectsthatcanautoma�callycreate smart ad objects to increase interac�vity, with factors such as age, gender, geographic loca�onandinterest.

4. Op�mize ads: use Machine learning to predict the performance of adver�sing campaigns based on historical data use algorithms to op�mize ad campaigns, from ad format, posi�oning, pricing and ad content. can also track ad results and re-op�mize campaigns over�me.

5. Deep Learning: can use Deep Learning to analyze images and videos to determine appropriateandeffec�veadver�singcontent. Another instance is the integra�on of AI into socialmediamanagementtoolslikeBuffer.

In the Arts and Culture category, Spo�fy and Audiomack are examples of audio streaming pla�orms that have enabled music ar�stes to promote their works to global audiences, while mone�zingtheirtraffic.

YouTube, Google's video streaming service is another opportunity for businesses to in the Arts and Culture category to promote and. mone�ze their content. It can also be maintained as the videorepositoryforallthebrand'svideos.

In more recent �mes, social media pla�orms like Facebook and TikTok have also delivered mone�zing opportuni�es to content developers, therebypresen�ngplayerswiththespacetogrow businessesinthatsector.

Over the years, the saying that “Content is King” has con�nued to manifest in even more exci�ng and rewarding ways, and players within the Arts and Culture space con�nue to benefit from new waysofcrea�ngcontentanddistribu�ngthem.

Furthermore, a movie category disruptor like Ne�lix has open a huge door of opportunity for filmmakers and other content creators, in Ghana, toshowcasetheircontenttoaglobalaudience.

Cloud Commerce, Cloud Mobility, Cloud Marke�ng are examples of how cloud compu�ng has presented businesses with the opportunity to see goods and services online without owning any of the hardware, so�wareandtoolsrequirestorunaneBusiness.

Cloud Commerce delivers eCommerce solu�ons that provide a range of features like hyperlocal marketplaces, mul�-vendor marketplaces and payment and delivery processing pla�orm integra�ons that provides everything a business, whether small or big needs to reach wider markets, with efficiency at low costs. Examples of these players, both local and global, are Alibaba, Amazon, Jumia, Hubtel, ExpressPay, SlydePay,andTonaton.

Cloud Mobility has transformed the transport sector, with on-demand services like ride-hailing and courier. In Ghana, global players like Uber, Bolt and Yango have dominated the ride-hailing category. These companieshavealsodiversifiedintothecourierbusiness.

However, small businesses like ShaqExpress and FC Express have disrupted the courier category with the mobileapps.Therearemanyotherstart-upsandsmallbusinessesemergingfromthissector.

Cloud Marke�ng provides businesses with the marke�ng technology (also Martech) tools and pla�orms requiredtoincreasetheaudiencereachandconvertahigherrateofsalesleads,acrossmarkets.

Cloud compu�ng has become the backbone of eBusinesses, delivering low costs of opera�ons, agile development and deployment of apps and tools because of access to resources that, hitherto, was within thereachofonlyafewbigbusinesses.

Promo�ngeventsonaglobalscale

Event organizers are also taking advantage of digital transforma�on opportuni�es to deliver events to, not justlocalaudiences,butalsoglobalones.

Social media networks, as well as online publica�ons have also enabled businesses to promote these events toaudiencesthat,inyearspast,wereinaccessible.

Moreover, COVID-19 precipitated the advent of innova�on in terms of how we organized events - cue virtual events.

Ÿ There is a prolifera�on of collabora�ve and conferencing tools and pla�orms like Zoom, GoTo and BlueJeans that have brought immense benefits to businesses that are looking for alterna�ves to physicalconferencesandseminars.

EventtoolslikeEventbritecanbeleveragedtopromotebusinessevents,completewithannouncementsand �cketssales.

There are also opportuni�es for virtual conferences and seminars delivered using tools like Cvent and Bizzabo,whichcomewithexci�ngfeatureslikevirtualbooths,mee�ngroomsamongstothers.

These pla�orms and tools also have marke�ng features that enables event organizers to their events to the rightaudiences.

For businesses involved in Agribusiness, Arts and Culture, and ICT in Ghana, these present opportuni�es to reach audiences all around the globe, thereby increasing the chances of exponen�algrowth.

We cannot discuss these exci�ng opportuni�es without considering the challenges to achieving them, which is basically lack of infrastructure, mainly erra�c energy, slow bandwidth and high costofinternetdata.

This is a thorny issue at the crux of digital transforma�on in Ghana as all these tools and pla�orms indicated above will depend on the availability of the internet speeds that come with 5G.

5G is what will deliver the necessary bandwidths and speeds required to seamlessly integrate these disrup�ve tools and so�ware into rou�ne produc�vitysystems.

Needless to say that the 5G revolu�on can be accelerated by a concerted effort between government digi�za�on agencies, the NCA and mobilenetworkoperators(MNOs).

In conclusion, despite these challenges, there has been a significant growth in digital inclusion and opportuni�es for businesses in the Agribusiness, ArtsandCultureandICTtothriveandgrow

I dare say that we are at the cusp of formalizing a digital economy in Ghana, as both government and corporate ins�tu�ons embark on their own digitaltransforma�onagendas.

Therefore, it is within the space of this digital economy that businesses in Ghana will be expected to posi�on their brands, if they are to remainrelevantinthefuture.

Andtheopportuni�esareendlesslyexci�ng.

Ilearned early on the value of h a r d w o r k a n d i n d e p e n d e n c e . Concurrently, I saw a father who was fully invested in his whitecollar career as a proofreader for one of Ghana's top publishing houses at the �me. I'm the fi�h of six kids and I grew up in a big, loving family. There was barely enough money between the two of them to get by Korkor ice, as she was known to those in her supply chain (fishmongers, ice water vendors, bone shaker drivers, etc.), dealt in ice slabs at Accra's Salaga Market, as well as charcoal, grains, and other commodi�es. When she needed to find some of the stocks she traded, she would have to go far out into the countryside. Technology was far behind where we were at as a country, but she was fortunate enough to usehersister'slandlinewheneversheneededtogetin touch with any merchants or drivers. Whether my dad had been paid or not, my mom always made sure we hadfoodonthetable,helpedpayforschool,etc.

I picked up a lot of knowledge from observing her business prac�ces that has proven useful to me in my own ventures since then. I have a lot of stories to tell, but the two tasks I remember most certainly were collec�ng debts and distribu�ng goods. I take heart from her toughness and enthusiasm for selfemployment because they give me faith that I, as well, can make it as an entrepreneur. Even though she didn't see me begin this path, her pride in me has never wavered.

Once upon a �me, when I was a student ge�ng my first degree, I tagged along when Unilever Ghana Limited came to campus to talk to us Through the Na�onal Service Secretariat and the Management Trainee Program, I was able to land a posi�on with such a Fortune 500 company in the Fast-Moving Consumer Goods (FMCG) sector Because of this, I got to learn about all aspects of customer development, from enhancing our sales team's abili�es to expanding our clientele, product l i n e s , a n d c h a n n e l s o f distribu�on in the modern and tradi�onal markets of Ghana, South Africa (where I was sent on an interna�onal assignment), Kenya, Nigeria, and Ivory Coast. Three years before leaving the corporate world, I imagined myself as a successful business owner. My burning ambi�ons are to leave a las�ng impact, lower local unemployment rates, and empower local women by providing them with access tobe�eremploymentopportuni�es.

Demanding and difficult, especially as a working mother and graduate student. As I prepared to return to work a�er my maternity leave, I needed help from a caregiver, but more importantly, I needed the proper nutri�ous, affordable foods to wean my son off. Homemade Hausa Koko paste (a famous street food) was handed to me bymy aunt This was going to be our super brand someday Again, I had an experience where my sister had to shop for my niece's school supplies I found myself wondering, "Can I get someone to do this for me and deliver it to her on

campus without her packing and stressing to se�le in to school?" This seemed like a good opportunity, and I figured there had to be others in a similar boat. Originally, Chopbox Express was a web-based convenience store aimed squarely at college students away from home. The plan was to introduce packaged convenience foods, local foods, etc , a�er people becameaccustomedtoourservice.

With a plan in place beginning in August 2018, I set out to implement the changes I hoped to see in my life by the following August. On August 4, 2019, I received my first ever paying customer. Finally, in December of 2019, I made the decision to quit my posi�on as the HeadofModernTradeatUnilevertofocusonChopbox Expressfull�me.