N 011 54° "44'

N 011 54° "44'

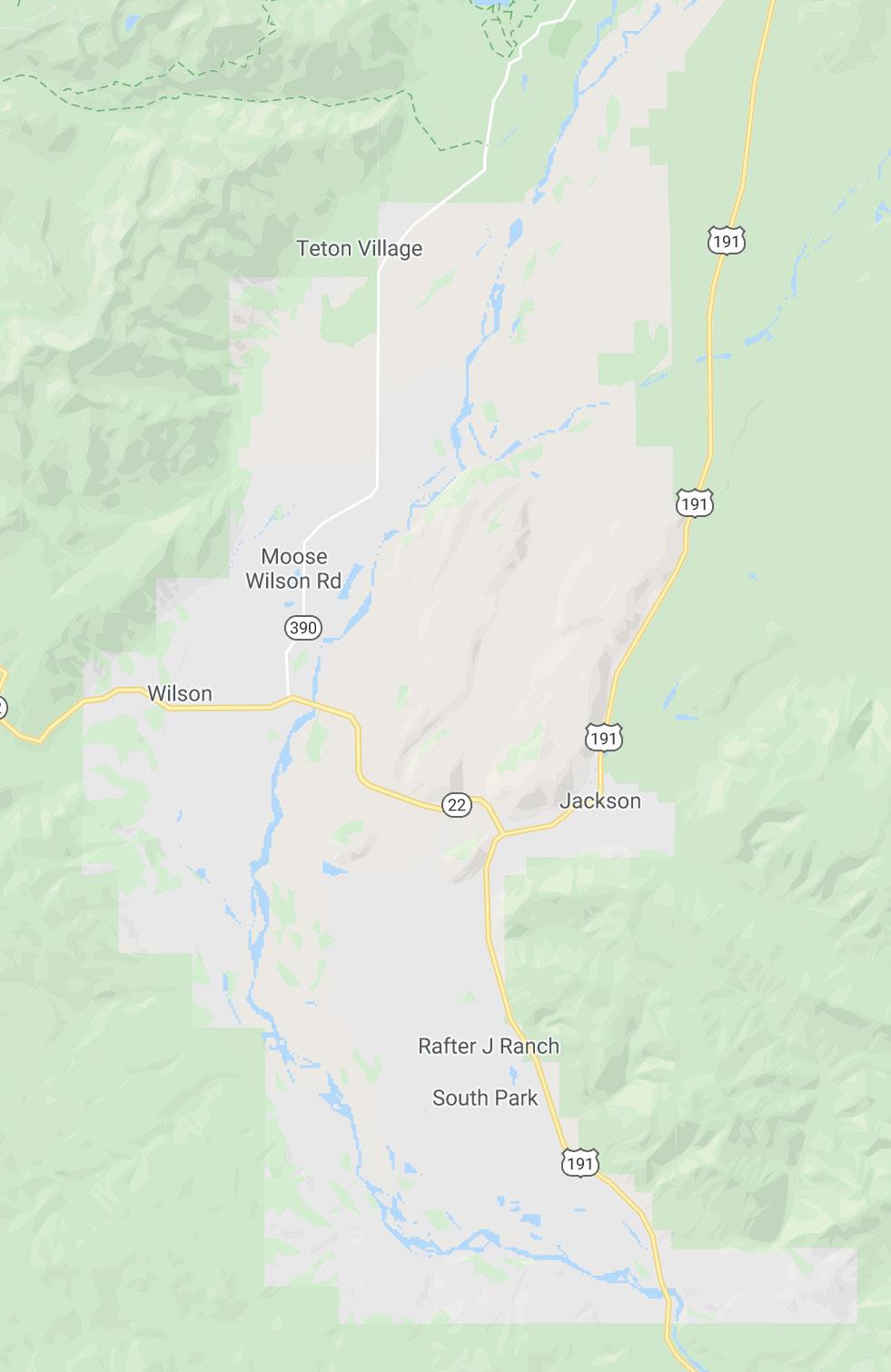

In the second quarter of 2024 the overall market brought intriguing developments in Jackson Hole’s real estate market. The overall market saw 125 total transactions, a 13% decrease when compared to Q2 of 2023. However, the single-family home segment saw an increase. These transactions totaled $603 million, an 11% decrease. At the time of this report there are 302 active listings, and 45 pending listings, increasing by 8% and 18% respectively.

In the single-family home market, there has been a 10% increase in transactions, totaling 65, yet the total dollar volume has declined by 5% to $319.7 million. Despite a 10% decrease in the median sale price to $2.9 million, inventory has risen by 19%, with a significant 46% of transactions being cash sales. This speaks to more activity in the lower priced segment of the single-family home market.

The condo and townhome segment has seen a 20% decrease in transactions, with only 37 sales, and a 34% drop in total dollar volume to $68.8 million. The median sale price in this segment has fallen by 33% to $1.1 million, while inventory has increased by 13%. This can be attributed to a softening of demand for condos priced between $2-$5M. However, the maximum price sold surged by 40% to $8.5 million, highlighting continued demand for high-end properties. Suggesting there is still some demand for high-end properties.

The land segment faced a 15% decrease in transactions, totaling 23, and a 3% decline in total dollar volume to $194 million. Because of more high end activity, the median sale price increased by 32% to $3.2 million, even as inventory and days on the market both decreased (12% and 18%, respectively). This implies that scarcity of available land warrants higher price tags. For example, the highest recorded transaction of Q2 2024 was a $58M guest ranch.

In summary, the overall Q2 2024 stats illustrate the market is starting to favor buyers. This is demonstrated by the increase in inventory and days on market, partnered with slight decreases in the number of transactions and listing prices of Single Family Homes and Condos and Townhomes. The correlation between these statistics suggests the time to buy is now, even though interest rates are still higher than normal. Once interest rates drop, we can expect to see competition for listings from each market segment, highlighting the importance of utlizing a buyers agent to represent a buyer’s best interest.

These trends portray a dynamic real estate landscape in Jackson Hole, characterized by shifting preferences and investor behaviors across different property types.

With many sales occurring outside of the MLS (Multiple-List Service), it is important to manually track ALL Teton County real estate sales. Typically, it is the higher-end sales that go unreported, vastly skewing the accuracy of MLS data alone. Our market report accounts for all sales, providing a comprehensive overview and deeper insight into the market.

Teton Village: 11

Racquet Club/Teton Pines: 9

West Snake North of Wilson: 10

West Snake South of Wilson: 4

Skyline Ranch to Sagebrush Drive: 15

East Gros Ventre Butte: 3

North Gros Ventre Junction: 9

Town of Jackson: 38

South of Jackson to Snake River Bridge: 21

South of Snake River Bridge to County Line: 5

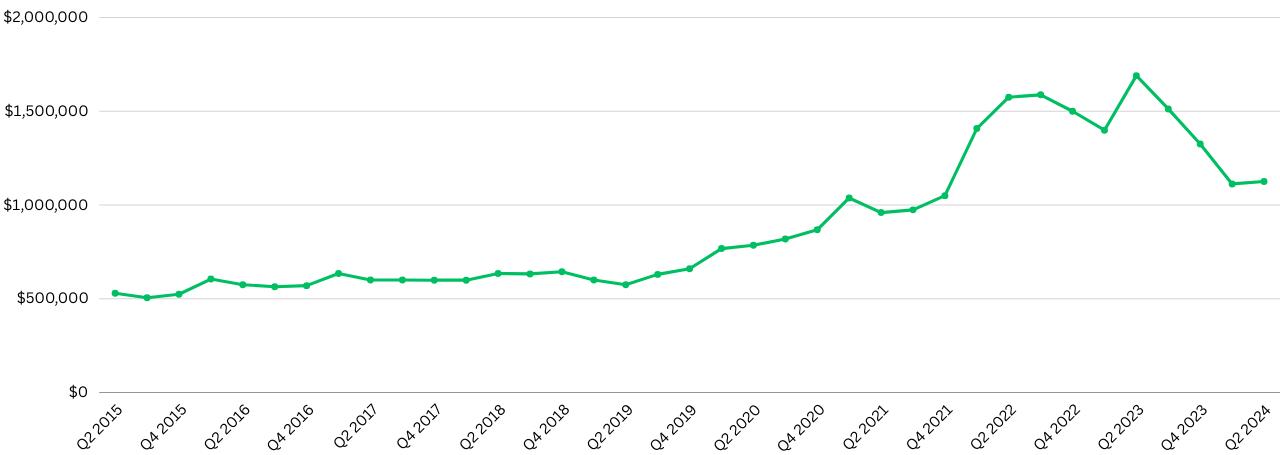

The real estate market for single-family homes in Jackson Hole, Wyoming, has seen slight shifts. With 65 transactions marking a 10% increase, activity in the market is on the rise. However, despite this uptick in transactions, the total dollar volume has decreased by 5% to $319.7 million. This decline is further reflected in the 10% decrease in the median sale price, now at $2.9 million, potentially indicating a shift toward a buyers market and a continuation of a softening of the region’s post-COVID boom market.

Interestingly, current inventory has risen by 19%, suggesting a growing supply in the market. These dynamics indicate a dynamic market environment where increased activity results from declining prices and higher availability; where buyers may finally have the upper hand when negotiating for a house.

Number of Transactions

Total Dollar Volume

Minimum Price Sold

Maximum Price Sold

Average Sale Price

Median Sale Price

Average Days on Market

Pending Transactions

Inventory

174 21 134

Q2 2015 - Q2 2024

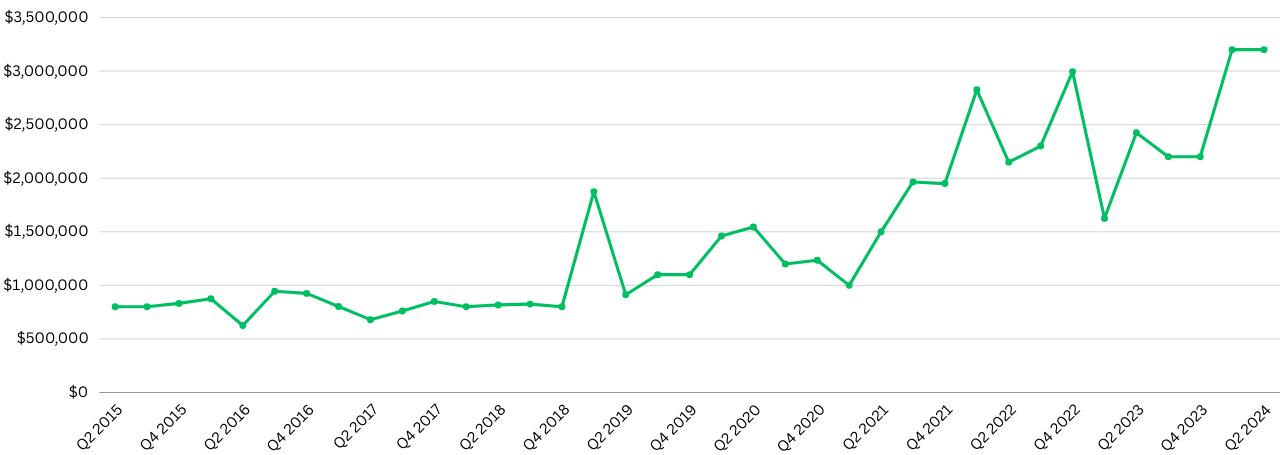

The condo and townhome market in Jackson Hole, Wyoming, has faced considerable shifts. The number of transactions has decreased by 20%, with only 37 sales recorded. This decline in activity is mirrored by a significant 34% drop in the total dollar volume, now at $68.8 million. The median sale price has also seen a notable decrease of 33%, bringing it down to $1.1 million.

Despite these downward trends, the current inventory has increased by 13%, indicating a rise in available properties. Interestingly, the maximum price sold has surged by 40%, reaching $8.5 million, suggesting there’s still interest in high-end properties. External factors, such as high interest rates, may have caused buyers to focus on finding more bang for their buck, reflected in the 10% increase of Single Family Homes sold in Q2 2024.

Number of Transactions

Total Dollar Volume

Minimum Price Sold

Maximum Price Sold

Average Sale Price

Median Sale Price

Average Days on Market

Pending Transactions

Inventory

114 13 59

Q2 2015 - Q2 2024

The land segment in Jackson Hole, Wyoming, is exhibiting a complex market landscape. With 23 transactions representing a 15% decrease, the number of land sales has declined. Despite this, the total dollar volume has only decreased by 3%, amounting to $194 million. This relatively modest dip in total volume can be attributed to the 32% increase in the median sale price, which now stands at $3.2 million.

Interestingly, the current inventory has decreased by 18%, indicating fewer available parcels for purchase. Highlighting the high-end segment of the market, a large guest ranch-style property sold for an impressive $58 million. The scarcity of available vacant land in MLS areas 1-10 causes the increase of price tags and decreases in inventory.

Number of Transactions

Total Dollar Volume

Minimum Price Sold

Maximum Price Sold

Average Sale Price

Median Sale Price

Average Days on Market

Pending Transactions

Inventory

23

217 3 60

Q2 2015 - Q2 2024

The luxury segment in Jackson Hole, Wyoming, encompassing residential and land properties priced at $5 million and above, has experienced noteworthy trends. With 24 transactions, there has been a 17% decrease in activity. Despite the drop in transactions, the total dollar volume has only declined by 8%, totaling $313.5 million.

This resilience is reflected in the 6% increase in the median sale price, which now stands at $8 million. Additionally, the current inventory has surged by 52%, indicating a significant rise in available high-end properties. These dynamics suggest a luxury market where higher prices and increased inventory present unique opportunities

Number of Transactions

Total Dollar Volume

Maximum Price Sold

Average Sale Price

Median Sale Price

Average Days on Market

Pending Transactions

Inventory

217 12 85

Median Sale Price Q2 2015 - Q2 2024

Experience the Compass Real Estate difference by working with Jackson Hole’s leading real estate experts. We are a team of trusted advisors working collaboratively to leverage our collective knowledge and expertise to deliver fundamentally different service. For us, nothing matters more than creating legacy of excellence that honors and celebrates our people and the exceptional place we call home.

To start your search of all active Jackson Hole listings, scan the QR code.