Market Study Calumet Country Club Redevelopment 2136 175th Street Homewood, Cook County, Illinois 60430 Report Date: 09-13-2022 FOR: JLL Construction Services, Inc. Mr. Jerry Lewis President 2532 W. Warren Blvd., Suite A Chicago, Illinois 60612 Valbridge Property Advisors | Chicago 566 W. Lake Street, Suite 240 Chicago, Illinois 60661 312-288-8687 phone Valbridge File Number: 312-929-4216 fax IL01-22-0116-000 valbridge.com

09-13-2022

Mr. Jerry Lewis President

JLL Construction Services, Inc.

2532 W. Warren Blvd., Suite A

Chicago, Illinois 60612

RE: Appraisal Report

Calumet Country Club Redevelopment

2136 175th Street

Homewood, Cook County, Illinois 60430

Dear Mr. Lewis:

In accordance with your request, we have performed a market study of the above referenced property. This market study sets forth the pertinent data gathered, the techniques employed, and the reasoning leading to our value opinions. This letter of transmittal does not constitute an appraisal report and the rationale behind the value opinion(s) reported cannot be adequately understood without the accompanying appraisal report.

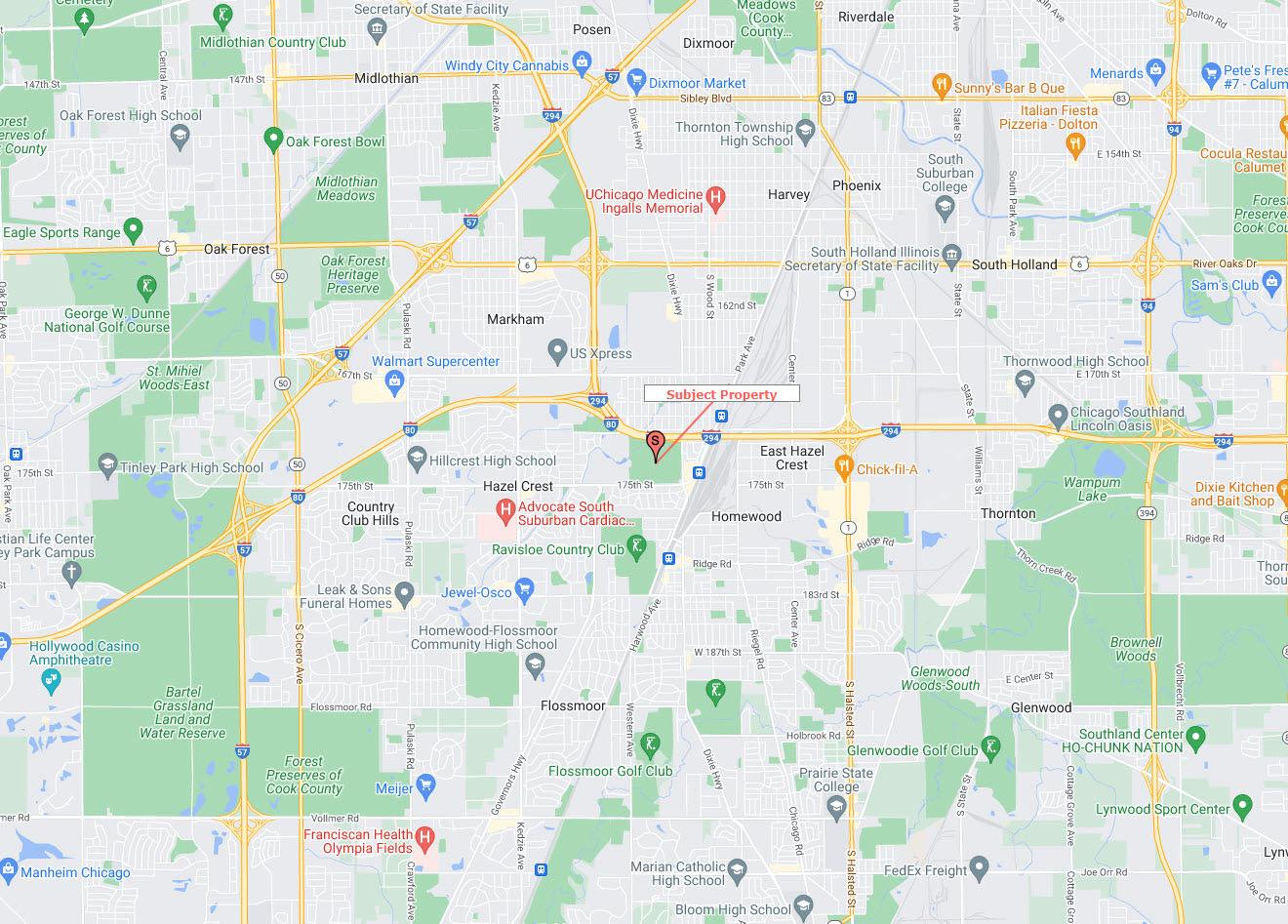

The subject property, as referenced above, is located on the northwest corner of 175th Street and Dixie Highway, just south of I-80 and is further identified as tax parcel number(s) 29-30-300-005,103 and -102. The subject site is a 128.36000-acre or 5,591,362-square-foot parcel. The subject property consists of a 128.36-acre parcel of land that is currently occupied with the Calumet Country Club. The Calumet Country Club is a private 18-hole championship golf course. The property is improved with various structures, including:

• An approximately 31,500 square foot, two-story clubhouse

• An approximately 1,240 square foot, single-story locker room and swimming pool building

• An approximately 275 square foot, single-story halfway house

• An approximately 5,940 square foot, single-story storage building

• An approximately 4,900 square foot, single-story maintenance building

• A pump house

The subject property is located in a commercial/residential area formerly in Homewood, Cook County, Illinois. However, in April of 2021, by direction of the owner, the Homewood Village Board approved disconnecting the property from the village. Therefore, a majority of the property currently is located in unincorporated Cook County, with a small portion at the northwest corner of 175th Street and Dixie Highway falling with the village boundaries of Hazel Crest. Currently, the property is under review for potential redevelopment with proposed uses to include industrial, retail, commercial, residential condos, hotel, training facility, recreational land and aquaponics along with a

© 2022 VALBRIDGE PROPERTY ADVISORS | Chicago

W. Lake Street, Suite 240

Illinois 60661

phone 312-929-4216 fax valbridge.com

566

Chicago,

312-288-8687

dog park and walking trails. More specifically, the proposed development will feature an indoor waterpark and a state of the art sporting complex. Other tenants may include a fresh market farm stand, per groomer, UPS Store, Bamenda Coffee shop and more. The mixed-use industrial plans will also include the introduction of Factory Town and Warehousing. This inclusion will provide continuous support and growth for the proposed retail tenants. This is all pending re-zoning to a mixed-use industrial district either within Cook County or re-annexation into the neighboring village of Hazel Crest. The subject property is bound on the north by Interstate 80/294, on the east by Dixie Highway, on the south by 175th Street, and on the west by The Lanco Group of Companies and Community Care Systems, Inc.

Valbridge has reviewed the property and the associated client provided documentation, zoning applications and other public files associated with the use on the property, in addition to local regulations and planning practice. Please note that this market study is a general overview of high level economic, demographic and property level statistics for the local area and PMA along with the proposed components of the subject property development. Given the scope of the current assignment, a detailed marketability/feasibility study on the proposed development was not conducted. If such a study is required, it will be conducted under a separate engagement.

We developed our analyses, opinions, and conclusions and prepared this report in conformity with the Uniform Standards of Professional Appraisal Practice (USPAP) of the Appraisal Foundation; the Code of Professional Ethics and Standards of Professional Appraisal Practice of the Appraisal Institute; and the requirements of our client as we understand them.

The client in this assignment is JLL Construction Services, Inc. and the intended users of this report are Jerry Lewis of JLL Construction Services, Inc., his development team and legal counsel and no others. The sole intended use is to complete a narrative market study on various planned land uses slated for the subject for internal asset management purposes. The value opinions reported herein are subject to the definitions, assumptions, limiting conditions, and certifications contained in this report.

The findings and conclusions are further contingent upon the following extraordinary assumptions and/or hypothetical conditions, the use of which might have affected the assignment results:

Extraordinary Assumptions:

This appraisal is predicated on the extraordinary assumption that hazardous substances do not exist at the subject property. The appraiser, however, is not qualified to detect such substances, including the existence of urea-formaldehyde insulation, radon gas, foam and asbestos insulation, lead paint or other potentially hazardous material that may affect the value of the property. Additionally, no soil survey has been furnished, and it is assumed that no surface or subsurface contaminants are present. No responsibility is assumed for any such conditions, nor for any expertise or engineering knowledge required to discover them.

It is assumed that the information provided to us by the owner and city/county officials is accurate. Any deviation from how this information was represented to us could result in a change in opinion of value.

Mr. Jerry Lewis JLL Construction Services, Inc. Page 2 © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago

The use of these extraordinary assumptions may have affected the assignment results. Furthermore, we reserve the right to change our opinions of value on a time and material basis, should any information contrary to the assumptions described herein and which affects the value and/or marketability of the subject property arise.

Hypothetical Conditions:

None pertaining to this assignment

Respectfully submitted, Valbridge Property Advisors | Chicago

Anthony S. Mulé, MAI, CCIM Managing Director and Principal Illinois License 553.002360 amule@valbridge.com

Gary K. DeClark, MAI, CRE, FRICS, R/W-AC Senior Managing Director and Principal Illinois License 553.000218 gdeclark@valbridge.com

JLL

Inc. Page 3 © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago

Mr. Jerry Lewis

Construction Services,

CALUMET COUNTRY CLUB REDEVELOPMENT TABLE OF CONTENTS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page i

Cover Page Letter of Transmittal Table of Contents ....................................................................................................................................................................... i Summary of Salient Facts ....................................................................................................................................................... ii Aerial and Front Views ............................. iii Location Map ............................................................................................................................................................................. iv Introduction ................................................................................................................................................................................. 1 Scope of Work ............................................................................................................................................................................ 5 Regional and Market Area Analysis.................................................................................................................................... 6 City and Neighborhood Analysis ..................................................................................................................................... 20 Site Description ....................................................................................................................................................................... 27 Improvements Description ................................................................................................................................................. 41 Market Analysis ....................................................................................................................................................................... 55 Highest and Best Use .......................................................................................................................................................... 227 Final Conclusions and Analysis ....................................................................................................................................... 229 General Assumptions and Limiting Conditions ........................................................................................................ 233 Certification – Anthony S. Mule, MAI, CCIM .............................................................................................................. 238 Certification – Gary K. DeClark, MAI, CRE, FRICS, R/W-AC ................................................................................... 239 Addenda .................................................................................................................................................................................. 240 Additional Subject Photographs ................................................................................................................................ 241 CCC TIF Redevelopment Revenue Assumption ................................................................................................... 242 Glossary ............................................................................................................................................................................... 243 Qualifications..................................................................................................................................................................... 250 Valbridge Property Advisors Information / Office Locations ......................................................................... 256

Table of Contents

Summary of Salient Facts

Property Identification

Property NameFormer Calumet Country Club - Land Market Study

Property Address2136 175th Street

Homewood, Cook County, Illinois 60430

Latitude & Longitude41.574557, -87.670261

Census Tract8284.01

Tax Parcel Numbers29-30-300-005 & -103

Property OwnersW&E Ventures, LLC

Site

ZoningPublic Land and Open Space (PL-2)

FEMA Flood Map No. 17031C0733J

Flood ZoneZone X

Gross Land Area128.360 acres

Usable Land Area128.360 acres

Valuation Opinions

Highest & Best Use - As VacantIndustrial and commercial

Reasonable Exposure Time6 to 12 months

Reasonable Marketing Time6 to 12 months

CALUMET COUNTRY CLUB REDEVELOPMENT SUMMARY OF SALIENT FACTS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page ii

CALUMET COUNTRY CLUB REDEVELOPMENT AERIAL AND FRONT VIEWS

Aerial and Front Views

AERIAL VIEW FRONT VIEW

© 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page iii

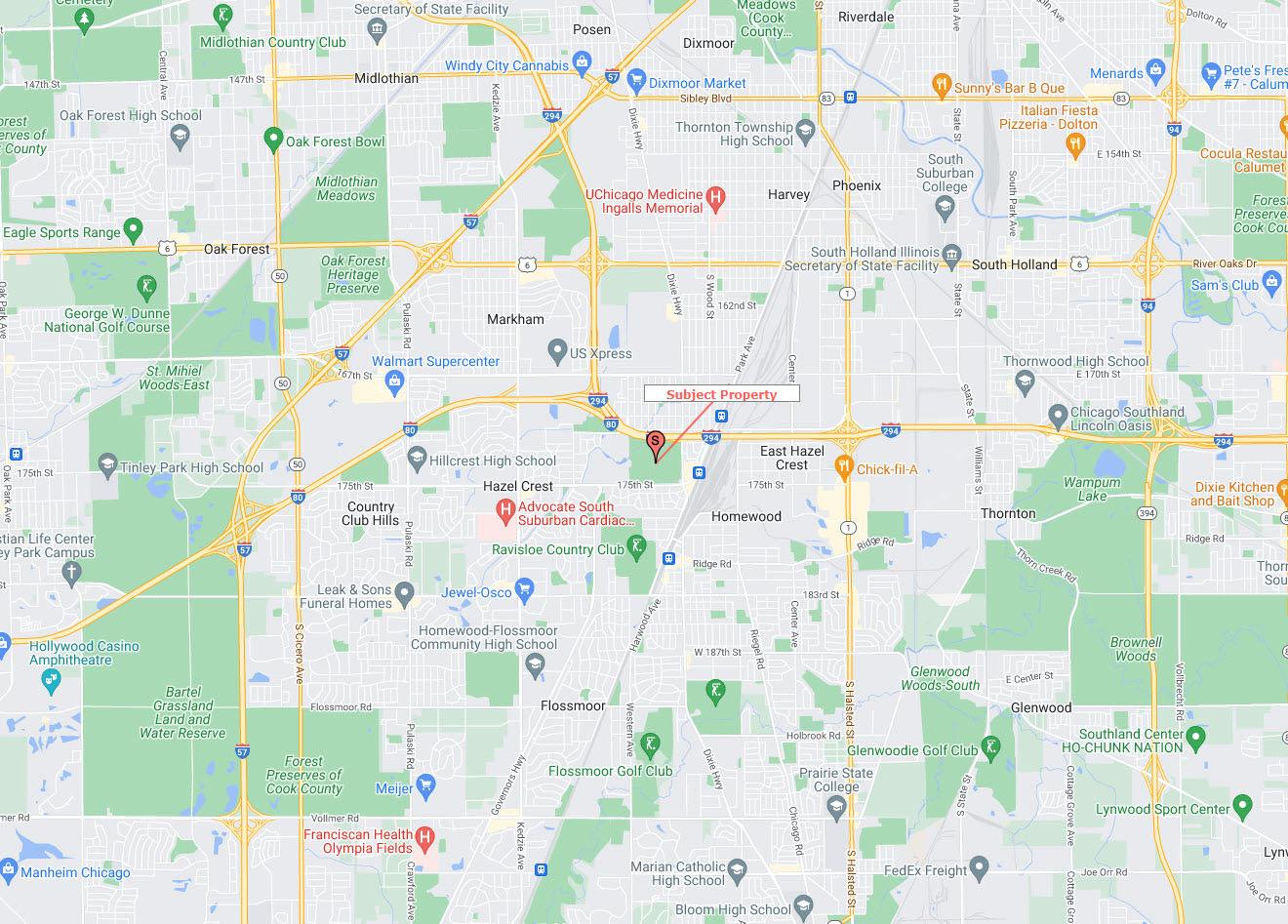

Location Map

CALUMET COUNTRY CLUB REDEVELOPMENT LOCATION MAP © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page iv

Introduction

Client and Intended Users of the Appraisal

The client in this assignment is JLL Construction Services, Inc. and the sole intended users of this report are Jerry Lewis of JLL Construction Services, Inc., his development team and legal counsel. Under no circumstances shall any of the following parties be entitled to use or rely on the market study appraisal or this appraisal report:

i. The borrower(s) on any loans or financing relating to or secured by the subject property,

ii. Any guarantor(s) of such loans or financing; or

iii. Principals, shareholders, investors, members or partners in such borrower(s) or guarantors.

Intended Use of the Appraisal

The sole intended use of this report is to complete a narrative market study on various planned land uses slated for the subject for internal asset management purposes. The purpose of this assignment is to provide the Client with solid market intelligence useful to their decision-making regarding the redevelopment of this property.

Real Estate Identification

The subject property is located at 2136 175th Street, Homewood, Cook County, Illinois 60430. The subject property is further identified by the tax parcel number 29-30-300-005, -103 and -102.

Legal Description

A copy of the legal description was found from the deed of the prior sale which is included in the Addenda.

Use of Real Estate as of the Effective Date of Value

As of the effective date of value, the subject was a country club/golf course property.

Use of Real Estate as Reflected in this Appraisal

The opinion of value for the subject as is reflects use as a mixed-use industrial, commercial and residential redevelopment project.

Ownership of the Property

According to a title policy, title to the subject property is vested in W&E Ventures, LLC.

History of the Property

Ownership of the subject property has changed within the past three years. The current owner acquired the subject property on 10-20-2020 for a recorded consideration of $3,300,000. The grantor was CCC Investors, LLC according to Cook County public records. This does not include the gas station parcel along the northwest corner of Dixie Highway and 175th Street. The recording number was 2031917096. We have considered and analyzed the known history of the subject in the development of our opinions and conclusions.

CALUMET COUNTRY CLUB REDEVELOPMENT INTRODUCTION © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 1

Analysis of Listings/Offers/Contracts

The subject property is not offered for sale on the open market.

Type and Definition of Value

The appraisal problem is to develop an opinion of the market value of the subject property. “Market Value,” as used in this appraisal, is defined as “the most probable price that a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus.” Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby:

Buyer and seller are typically motivated.

Both parties are well informed or well advised, each acting in what they consider their own best interests;

A reasonable time is allowed for exposure in the open market;

Payment is made in terms of cash in U.S. dollars or in terms of financial arrangements comparable thereto; and

The price represents the normal consideration for the property sold unaffected by special or creative financing or sale concessions granted by anyone associated with the sale.”1

The value conclusions apply to the value of the subject property under the market conditions presumed on the effective date of value. Please refer to the Glossary in the Addenda section for additional definitions of terms used in this report.

Underlying Assumptions and Limiting Conditions

The conclusions reached in a market analysis are inherently subjective and should not be relied upon as a determinative predictor of results that will actually occur in the marketplace. Thus, a market study is not a substitute for management's ultimate decision-making responsibilities. There can be no assurance that the estimates made, or assumptions employed in preparing this report will in fact be realized or that other methods or assumptions might not be appropriate. The conclusions expressed in this report are as of the date of this report, and an analysis conducted as of another date may require different conclusions. The actual results achieved will depend on a variety of factors including the performance of management, the impact of changes in general and local economic conditions and the absence of material changes in the regulatory or competitive environment. Reference is made to the statement of Underlying Assumptions and Limiting Conditions that can be found in the Addenda of this analysis and area incorporated in this report.

Neither all nor any part of the content of this report, especially any conclusions as to market study, the identity of the analysts, or any reference to Valbridge Property Advisors shall be disseminated through advertising media, public relations media, news media or any other means of communication other than for this specific document without the prior written consent of the firm. Consent has been granted to JLL Construction Services, Inc. and its designees.

1 Source: Code of Federal Regulations, Title 12, Banks and Banking, Part 722.2-Definitions

CALUMET COUNTRY CLUB REDEVELOPMENT INTRODUCTION © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 2

Date of Report

The date of this report is 09-13-2022.

List of Items Requested but Not Provided

All requested information was provided

Assignment Issues

None

Assumptions and Conditions of the Appraisal

This appraisal assignment and the opinions reported herein are subject to the General Assumptions and Limiting Conditions contained in the report and the following extraordinary assumptions and/or hypothetical conditions, the use of which might have affected the assignment results.

Extraordinary Assumptions

This appraisal is predicated on the extraordinary assumption that hazardous substances do not exist at the subject property. The appraiser, however, is not qualified to detect such substances, including the existence of urea-formaldehyde insulation, radon gas, foam and asbestos insulation, lead paint or other potentially hazardous material that may affect the value of the property. Additionally, no soil survey has been furnished, and it is assumed that no surface or subsurface contaminants are present. No responsibility is assumed for any such conditions, nor for any expertise or engineering knowledge required to discover them.

It is assumed that the information provided to us by the owner and city/county officials is accurate. Any deviation from how this information was represented to us could result in a change in opinion of value.

The use of these extraordinary assumptions may have affected the assignment results. Furthermore, we reserve the right to change our opinions of value on a time and material basis, should any information contrary to the assumptions described herein and which affects the value and/or marketability of the subject property arise.

Hypothetical Conditions

None pertaining to this assignment

Researchers for the Analysis

The principal-in-charge of this assignment has been Gary K. DeClark, MAI, CRE, FRICS, R/W-AC, Senior Managing Director. He has over 40 years of appraisal, valuation, real estate development, finance and consulting experience. Most relevant to this assignment, DeClark has successfully completed feasibility assessments for commercial opportunities throughout the Chicagoland area and the Midwest.

Anthony S. Mule, MAI, CCIM is a Managing Director with Valbridge Property Advisors | Chicago and has 15 years of consulting and appraisal experience for various commercial real estate property types. Mulé has completed numerous assignment concentrated in the Chicago Metropolitan area along with various parts of the Midwest and is familiar with hotel and multifamily characteristics in these markets.

CALUMET COUNTRY CLUB REDEVELOPMENT INTRODUCTION © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 3

Additional information on the firm and directors are found in the Addenda at the end of this study.

CALUMET COUNTRY CLUB REDEVELOPMENT INTRODUCTION © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 4

Scope of Work

The elements addressed in the Scope of Work are (1) the extent to which the subject property is identified, (2) the extent to which the subject property is inspected, (3) the type and extent of data researched, (4) the type and extent of analysis applied, (5) the type of appraisal report prepared, and (6) the inclusion or exclusion of items of non-realty in the development of the value opinion. These items are discussed as below.

Extent to Which the Property Was Identified

The three components of the property identification are summarized as follows:

Legal Characteristics - The subject was legally identified via various client documents and Cook County public records.

Economic Characteristics - Economic characteristics of the subject property were identified via market participant surveys, our company database, and/or third party sources, talking with city and county officials, real estate brokers, appraisers, and local property owners, CoStar, MRED, Crexi, STDB and ESRI, as well as a comparison to properties with similar locational and physical characteristics.

Physical Characteristics - The subject was physically identified via an appraisal inspection that consisted of exterior observations of land.

Extent to Which the Property Was Inspected

We inspected the subject on 06-07-2022. The improvements were not measured during the course of the inspection.

Type and Extent of Data Researched

We researched and analyzed: (1) market area data, (2) property-specific market data, (3) zoning and land-use data, and (4) current data on comparable listings and transactions. We also interviewed people familiar with the subject market/property type.

Appraisal Conformity and Report Type

We developed our analyses, opinions, and conclusions and prepared this report in conformity with the Uniform Standards of Professional Appraisal Practice (USPAP) of the Appraisal Foundation; the Code of Professional Ethics and Standards of Professional Appraisal Practice of the Appraisal Institute; and the requirements of our client as we understand them. This is an Appraisal Report as defined by the Uniform Standards of Professional Appraisal Practice under Standards Rule 2-2a.

CALUMET COUNTRY CLUB REDEVELOPMENT SCOPE OF WORK © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 5

Regional and Market Area Analysis

Market Definition

The dynamic nature of economic relationships within a market area has a direct bearing on real estate values and the long-term quality of a real estate investment. In the market, the value of a property is not based on the price paid for it in the past or the cost of its creation, but on what buyers and sellers perceive it will provide in the future. Consequently, the attitude of the market toward a property within a specific neighborhood or market area reflects the probable future trend of that area.

Since real estate is an immobile asset, economic trends affecting its location quality in relation to other competing properties within its market area will also have a direct effect on its value as an investment. To accurately reflect such influences, it is necessary to examine the past and probable future trends, which may affect the economic structure of the market and evaluate their impact on the market potential of the subject. This section of the report is designed to isolate and examine the discernible economic trends in the region, which influence and create value for the subject property.

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 6

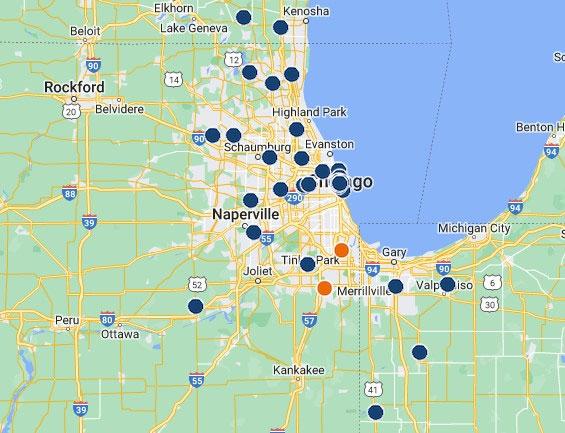

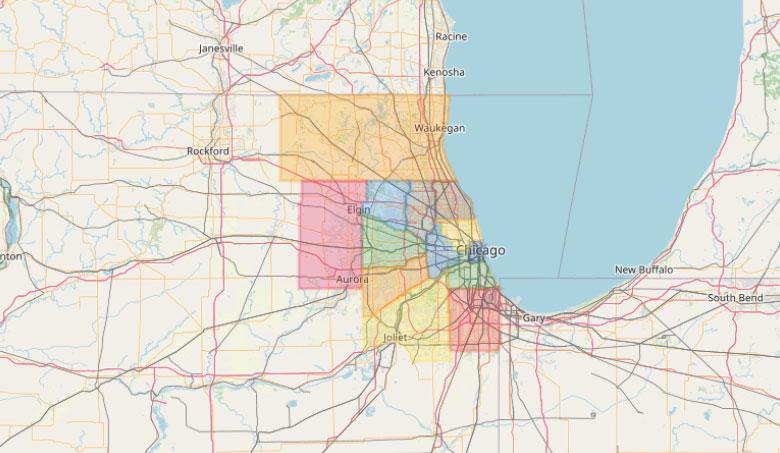

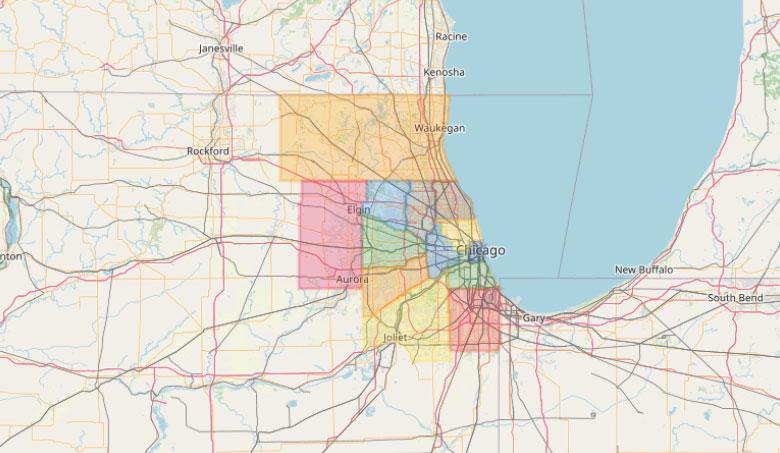

REGIONAL MAP

The subject is located in Homewood, in Cook County. It is part of the Chicago-Naperville-Arlington Heights, IL MSA. As defined by the U.S. Bureau of the Census, the Chicago “Primary Metropolitan Statistical Area” (PMSA) covers nine Illinois counties. However, in relation to the region’s principal growth and economic activity the metropolitan area is usually considered to consist of six Illinois counties of Cook, DuPage, Kane, Lake, McHenry and Will, exclusive of outlying DeKalb, Grundy and Kendall counties. This area includes the City of Chicago and 272 suburban communities and includes 75 miles of Lake Michigan shoreline. These six counties, in conjunction with the City of Chicago, form an interlocking economic structure.

Geographic Location

The subject property is located in the geographic area generally referred to as the Chicago metropolitan area, which is centrally located in the Midwestern United States. Other major metropolitan areas in the region include Milwaukee, Wisconsin (90-miles north), Indianapolis, Indiana (185-miles southeast) and Detroit, Michigan (279-miles east).

The standards for statistical areas are defined on the federal level by the Office of Management and Budget. Recent changes to these standards by the OMB resulted in new area configurations and new names to identify them. The Chicago metropolitan area, formerly known as the Chicago Metropolitan Statistical Area, is now identified as the Chicago-Naperville-Joliet, IL-IN-WI Metropolitan Statistical Area. The primary area within this new MSA is now referenced as the Chicago-Naperville-Joliet, IL Metropolitan Division. (For ease of reference, this report retains the term “Chicago MSA,” but it will refer to the Chicago-Naperville-Joliet, IL-IN-WI Metropolitan Statistical Area. “Chicago MD” is used to refer to the Chicago-Naperville-Joliet, IL Metropolitan Division. Additionally, combined with the neighboring Metropolitan Statistical Areas including the Michigan City-La Porte, IN MSA to the east and Kankakee-Bradley, IL MSA to the south, the ChicagoNaperville-Joliet, IL-IN-WI MSA is a part of the larger Chicago-Naperville-Michigan City, IL-IN-WI Combined Statistical Area (CSA).

Chicago-Naperville-Joliet, IL MD

Cook, DeKalb, DuPage, Grundy, Kane, Kendall, McHenry, and Will

Chicago-Naperville-Joliet, IL-IN-WI MSA

Gary, IN MD

Jasper, Lake, Newton, and Porter

Lake (IL) and Kenosha (WI) Kankakee-Bradley,

Lake County-Kenosha County, IL-WI MD

Source: Executive Office of the President of the United States, Office of Management and Budget

The Chicago-Naperville-Joliet, IL Metropolitan Division consists of eight counties in northeastern Illinois. These eight counties are Cook, DeKalb, DuPage, Grundy, Kane, Kendall, McHenry and Will. Also included within the MSA are the counties found in the Gary, IN Metropolitan Division which are

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 7

Metropolitan Statistical Area (MSA)Metropolitan Divisions (MD)Counties

MSA-Kankakee

MSA-LaPorte

CITY, IL-IN-WI CSA DEFINITIONS

IL

Michigan City-La Porte, IN

CHICAGO-NAPERVILLE-MICHIGAN

Japser, Lake (IN), Newton, and Porter as well as the counties found in the Lake County-Kenosha County, IL-WI which are Lake (IL) and Kenosha. The Michigan City-La Porte, IN MSA and KankakeeBradley, IL MSA consist solely of LaPorte and Kankakee Counties respectively.

Overview

The City of Chicago is located on the shores of freshwater Lake Michigan and is the third most populous city in the United States. As of the 2021 census-estimate, Chicago has a population of 2,700,000, which makes it the most populous city in both the state of Illinois and the Midwestern United States. It is the county seat of Cook County, the second most populous county in the U.S. Chicago is the principal city of the Chicago metropolitan area, which is often referred to as "Chicagoland." The Chicago metropolitan area has nearly 10 million people, is the third largest in the United States, the fourth largest in North America, and the third largest metropolitan area in the world by land area.

The city of Chicago is part of the Chicago-Naperville-Arlington Heights, IL MSA. As defined by the U.S. Bureau of the Census, the Chicago “Primary Metropolitan Statistical Area” (PMSA) covers nine Illinois counties. However, in relation to the region’s principal growth and economic activity the metropolitan area is usually considered to consist of six Illinois counties of Cook, DuPage, Kane, Lake, McHenry and Will, exclusive of outlying DeKalb, Grundy and Kendall counties. This area includes the City of Chicago and 272 suburban communities and includes 75 miles of Lake Michigan shoreline. These six counties, in conjunction with the City of Chicago, form an interlocking economic structure.

In 2022, Chicago is amongst the top 10 most visited cities in the United States not far behind San Francisco, Las Vegas, and New York City. Landmarks in the city include Millennium Park, Navy Pier, the Magnificent Mile, the Art Institute of Chicago, Museum Campus, the Willis (Sears) Tower, the Museum of Science and Industry, and Lincoln Park Zoo. Chicago's culture includes the visual arts, literature, film, theater, comedy (especially improvisational comedy), and food. Chicago is also well known for their music, particularly jazz, blues, soul, hip-hop, gospel, and electronic dance music including house music. Of the area's many colleges and universities, the University of Chicago, Northwestern University, and the University of Illinois at Chicago are classified as "highest research" doctoral universities and located within the city’s limits.

The Chicago region is economically diversified and has a healthy balance between financial services, manufacturing, wholesale and retail trade, transportation, and health care industries. Its assets include a central location served by an extensive air, rail and highway network which allows for a viable central-city downtown district accessible by several forms of public transportation.

Chicago remains a mature economy with a large manufacturing base. Though the MSA’s economy is exposed to periodic distressed in the manufacturing industry, it is somewhat shielded by the diversity of the overall manufacturing base. As such, manufacturing conditions are generally solid with a majority of the area’s companies experiencing order growth. Demand for capital goods, such as machine tools, is robust, and steelmakers are seeing improved conditions, all of which is favorable for manufacturing.

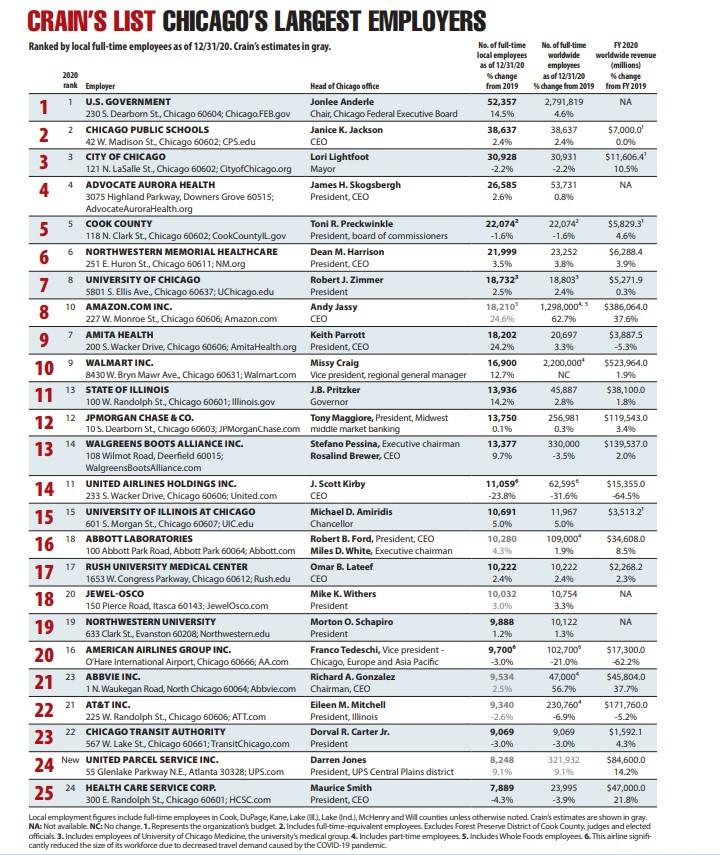

Several Fortune 500 industrial or service companies are located in the metropolitan area. According to Economy.com, current employment is 3.74 million which is projected to increase to 3.87 million by 2022. The Northeastern Illinois Planning Commission (NIPC) projects that employment will grow to

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 8

5.56 million by 2030. The region is the third largest retail market in the U.S. and is a national and international tourism center. Conventions, trade shows and sales meetings bring in about 4.5 million visitors each year.

In addition to corporate headquarter presence, Chicago is the nation’s second most important financial center and the world leader in commodities with the Chicago Board of Trade, the Chicago Board Options Exchange, the Chicago Mercantile Exchange, and the Chicago Stock Exchange all located within the city. Chicago is the national leader in stock options trading, currency trading, currency futures and interest rate futures. The complex financial activity associated with this volume of trading along with the Midwest’s expanding role in world trade has created a solid base for growth in the financial community.

Chicago remains a mature economy with a fairly large manufacturing base. Though the MSA’s economy is exposed to periodic distressed in the manufacturing industry, it is somewhat shielded by the diversity of the overall manufacturing base. As such, manufacturing conditions are generally solid with a majority of the area’s companies experiencing order growth. Demand for capital goods, such as machine tools, is robust and steelmakers are seeing improved conditions, all of which is favorable for manufacturing.

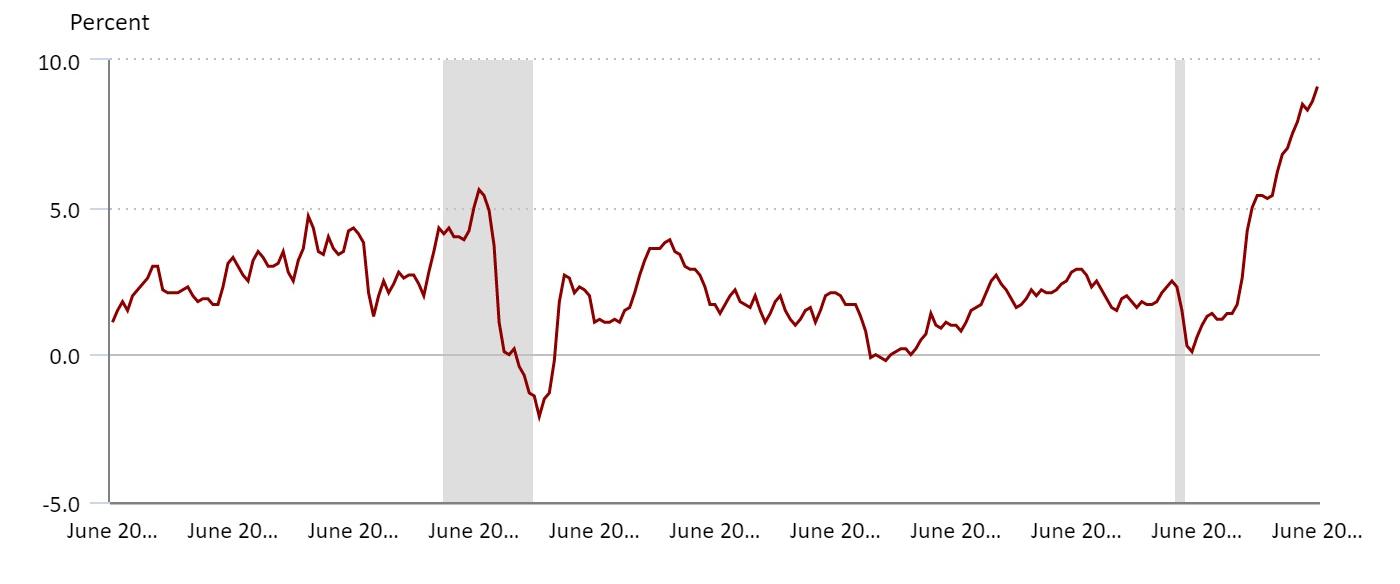

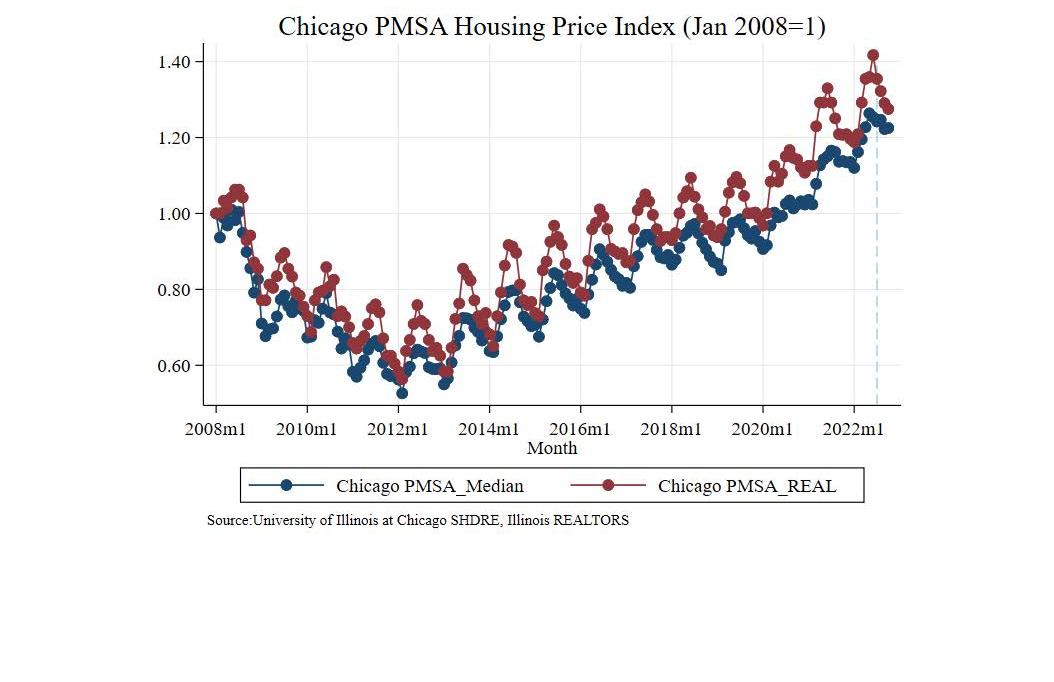

Recent Performance

Chicago is home to one of the largest and most diverse economies in the nation. Chicago's role as the international trade hub for the entire Midwest, as well as its critical place in many distribution networks, can be traced back to its geographical and infrastructural advantages, which include being the only U.S city connected to six Class 1 railroads. Chicago has recently recovered 41% of its lost jobs since the pandemic. In 2022, Chicago is expected to see a 4.4% increase and is expected to recover all lost jobs by Q1 of 2024. Looking medium term, Chicago is expected to see an average annual job growth of .3% from 2022 to 2025 which ranks 42nd of 51 metros. Since May of 2021, unemployment rates have significantly decreased in the past 12 months. One year ago today, the United States had an average unemployment rate of 5.5%. Chicago in this time had a 1% higher unemployment rate at 6.5%. in May of 2022, the United States unemployment rate is at 3.4% with Chicago’s being just above that at 4.2%. Compared to a year ago, nonfarm payroll employment increased by 249,700 jobs, with gains across nearly all major industries. The industry groups with the largest jobs increases were Leisure and Hospitality (+84,600), Professional and Business Services (+43,500), and Trade, Transportation and Utilities (+41,900). The Mining sector (-300) was the only industry

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 9

sector that reported an over-the-year decline in payroll employment. In May, total nonfarm payrolls were up 4.3 percent over-the-year in Illinois and up 4.5 percent in the nation.

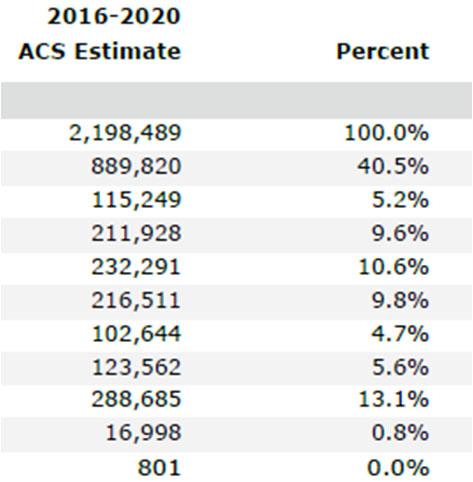

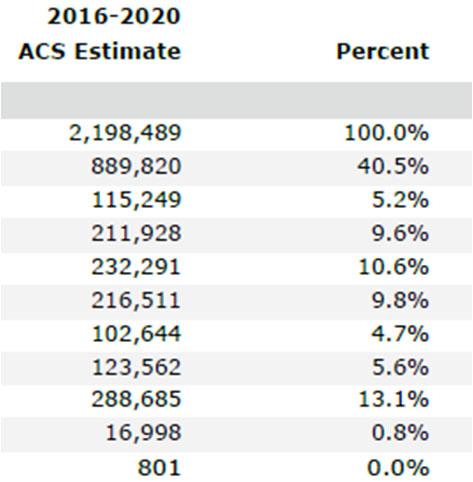

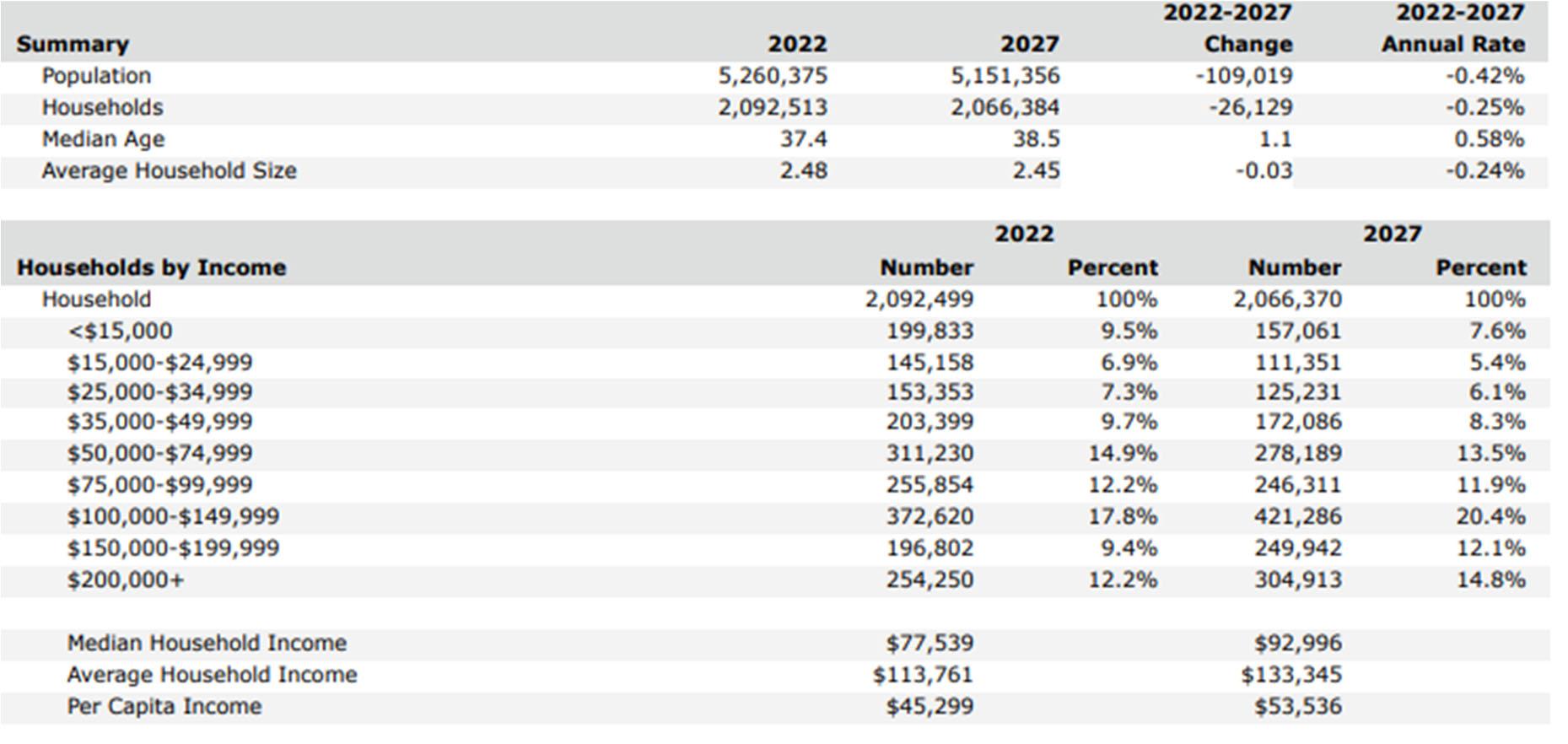

Population

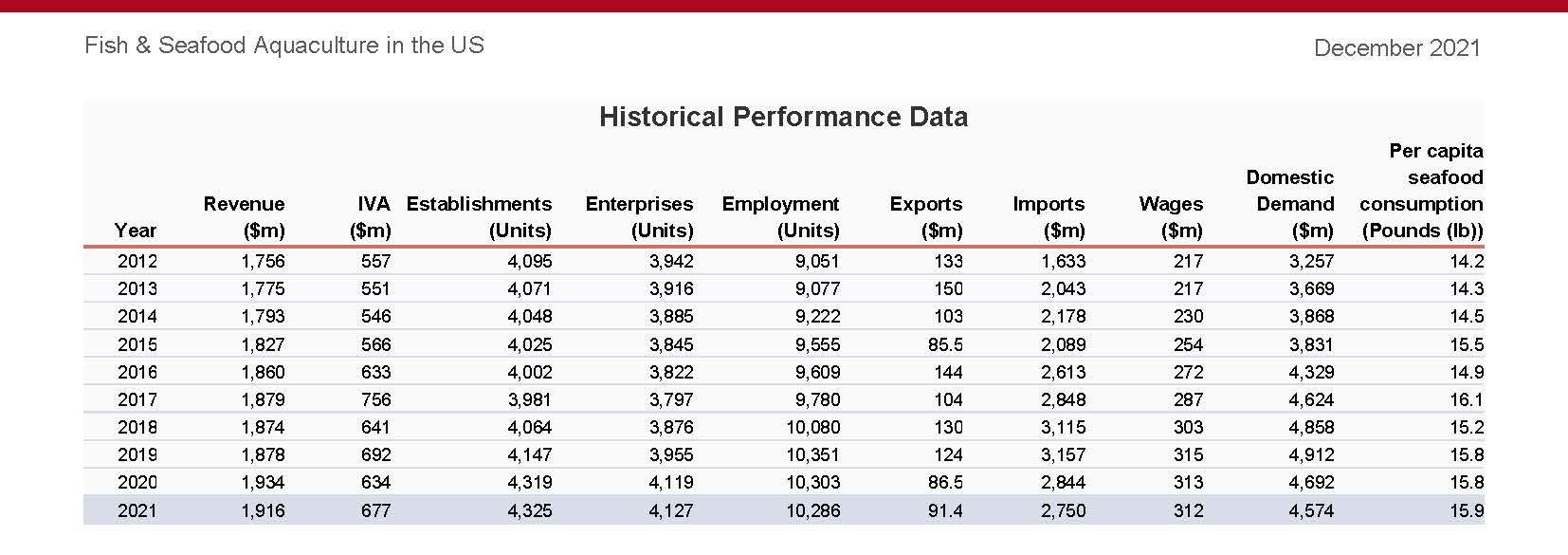

Population characteristics relative to the subject property are presented in the following table.

Although the City of Chicago’s population declined by 0.7% between 2000 and 2010, it continues to represent about one third of the region’s total population. In 2020, Chicago recorded a population of about 2.70 million people and approximately 1.081 million households residing within the city limits of Chicago. More than half the population of the state of Illinois lives in the Chicago metropolitan area.

Cook County is the most heavily populated region within the MSA with approximately 59% of the area’s population. The racial makeup of the city in 2021 was 47.7% white (33.3% non-Hispanic white), 29.2% black, 6.8% Asian, and 5.3% from two or more races. The ethnic makeup of the population is 28% Hispanic and 72% belong to non-Hispanic background. From 2016-2020, 20.3% of the population was foreign born; of this, 56.3% came from Latin America, 23.1% from Europe, 18.0% from Asia and 2.6% from other parts of the world. Chicago has the fifth highest foreign-born population in the United States.

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 10

Population Estimated Annual % ChangeProjected Annual % Change Area 201020212010 - 2120262021 - 26 United States308,745,538333,793,1070.7%333,934,1120.0% Illinois12,830,63212,740,556-0.1%12,560,734-0.3% Chicago-Naperville-Elgin, IL-IN-WI (MSA) 9,461,1059,600,5940.1%9,486,661-0.2% Cook County5,194,6805,260,3750.1%5,151,356-0.4% Thornton township 169,278155,495 -0.8% 151,164 -0.6%

Source: ESRI (ArcGIS)

Chicago ranks as the country’s third largest city, behind New York and Los Angeles. In 1950, the city of Chicago reached a population of 3.62 million, then as time passed the population dropped by approximately 837,000 residents (a 23% decline) in the following four decades as residents and new families moved to the suburbs. In 1990, the city’s population fell below three million residents to 2.78 million, for the first time since the 1930’s. This pattern reversed itself in 2000 when an influx of young workers boosted its population by 4% to 2.9 million. Its current population of 2.78 million is approximately 3.8% below that of the 2000 census and is projected to increase to 2.83 million by 2022 primarily due to the migration of corporate headquarters and millennials along with baby boomers moving into the city.

The City of Chicago’s Central Business District has gradually expanded outside of its initial configurations within the confines of the public transit elevated train tracks that gave it its name as the “The Loop.” At present, it is generally bounded by the Chicago River on the north (300 North), and west (400 West), by Roosevelt Road on the south (1200 South) and Lake Michigan on the east.

Chicago’s economic growth has been maintained by its large employment base, healthy downtown business center, an extensive network of expressways and public transportation. The metro area also supplies two airports, and various tourists’ attractions. O’Hare international airport serviced 48,410,636 domestic and 54,024,784 international passengers in 2021. Additionally, Midway airport serviced another 15,333,690 domestic and 15,884,058 international passengers in the year 2021, a 77.3% increase from 2020.

An expanded downtown district, defined as the Central Area by the City for planning purposes, covers the area generally bounded by North Avenue (1600 North), Halsted Street (800 West), Cermak Road (2200 South) and the lake. This expanded area is roughly the equivalent to all of the community area designated by the City of Chicago as The Loop, most of the Near North Side Community area, and part of the Near South Side. The city is estimated to have an employment base of 1.42 million workers and has shown resilience in its ability to resume job growth following periods of national recessions.

Chicago’s Central Area is estimated to contain approximately 40% to 45% of the city’s total workforce. Also located within this district area the city’s dense concentration of high-rise office and apartment/condominium buildings, numerous hotels, The Art Institute, Millennium Park, Navy Pier (the city’s most visited tourist attraction), stage theaters, municipal, county and federal government offices, and the internationally known as the “Magnificent Mile” shopping district.

New and Future Developments

Chicago is a very exciting city for new developments and with the pandemic slowing down opens up more opportunities. Many projects were postponed but developers have restarted their efforts. A recent project has been Chicago’s Old Post Office. This building stood vacant for many years until recently when 601W redeveloped the building into office space. This building sits a top Ida B. Wells Drive just south of the Loop and has plans for a rooftop terrace. The renovation cost was over $800 million, and their largest tenant is Uber with 355,000 SF.

There are also five developments in the Chicago metro area that are either in-progress or completed. These are the 78, Lincoln Yards, 400 Lake Shore Drive, Willis Tower Redevelopment, and

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 11

O’Hare 21. The 78 is a project along the South Branch of the Chicago River which is being marketed as the 78th neighborhood of Chicago. This 62-acre site has sat vacant for years until Related Midwest bought the property with plans to turn the area into a mixed-use development. Related Midwest is currently in negotiations with the city for a casino to be built on the site. There are also plans for residential and retail uses as well.

The Lincoln Yards project is a new development by Sterling Bay along the North Branch of the Chicago River in between the neighborhoods of Wicker Park and Lincoln Park. This is another mixed-used development with office, residential and retail uses. There will also be ample public space and riverwalk access. 400 Lake Shore Drive which was the site of the proposed Chicago Spire. This site is adjacent to Navy Pier and the Chicago Harbor Lock, where the Chicago River meets Lake Michigan. Even though the pandemic set these projects back, there are still major development companies willing to risk millions on new projects based on the high demand that Chicago offers.

In 2017, Clayco and Turner Construction Company began construction for the reimagining and transformation of Chicago’s iconic Willies Tower. Approximately 460,000 square feet of existing space within the tower has been reconfigured. This also included 150,000 square feet of space for exclusive tenant use, including full-service fitness center, expansive tenant lounges, private event spaces, and concierge services to create a more inclusive and energetic work environment. The intended mission of the redevelopment project was to create an all-season, urban destination that brings the surrounding community together. It created a sense of place rather than a place of work. The lobby reopened in 2019 and finished construction in 2021. Some exclusive tenants include Shake Shack, Starbucks, Fifth Third Bank, Do-Rite Donuts, and Market Creations.

In 2019, the idea of O’Hare 21 came into the sight of the public with a long-term plan to progressively update certain areas of the international airport. Some focal points of the expansion would include an entirely new “global” terminal, a new satellite concourse to terminal 1, and a complete makeover of the existing terminal 5. The plan includes over 100 different plans, many of which are smaller but functional improvements, such as upgrades to parking garages, new water mains and electrical distribution systems, and refurbished underground pedestrian tunnels. At the earliest, the public shouldn’t see any major improvements until 2028 but some areas of the new terminal 5 have been refurbished and are already open to the public. The development team at O’Hare are spending more than a billion dollars on terminal 5 alone, which will be spent modernizing systems, adding 10 new gates, and more security checkpoints.

Urban core

Chicago's Revival Food Hall runs through downtown, where business/professional services will account for the bulk of the new jobs this year. There has been an explosion of tech-related hiring in the urban core, which has become the new economic engine for the metro division and enticed workers to move downtown. More talent hungry firms will join the inward migration this year. Most venture capital funding in Illinois gets funneled into Chicago, and the dollar volume of deals last year exceeded $1 billion for the first time since the dotcom bust, with half coming in the fourth quarter. The capital infusion will enable startups to hire more aggressively and support the downtown apartment market.

Construction development in the Metropolitan area has been prominent even through the pandemic years. In the year 2022 thus far, over 2.3 million SF of office space has been delivered to

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 12

the city with another 2.4 million SF expected to be delivered over the next few years. An initial 1.5 million SF at BMO Tower at 320 S Canal was 52% leased and expects banking namesake (500,000 SF), and law firm Chapman & Cutler (88,000 SF), both expected to move into their spaces in early 2023. In addition, there is 2.4 million still under construction with an availability rate of 15%. 50% of this inventory comes from the 1.2 million SF Salesforce Tower at 333 W Wolf Point Plaza in River North. Its namesake tenant agreed to occupy about 500,000 SF, while law firm Kirkland Ellis committed to almost 600,000 SF. The Hines development is projected to be over 96% occupied when it delivers to the River North Submarket in spring 2023.

Although the pandemic slowed many variables to life down, the commercial real estate industry stayed headstrong in the urban core of Chicago. In the time of July 1, 2020, to June 30, 2021, 18 commercial office/retail buildings sold in the Greater Chicago Area. The three most prominent sales included the McDonald’s Headquarters which sold for $412.5 million ($717.13/SF), Northern Trusts 1.2 million square foot office space which sold for $376 million ($311.58/SF), and Googles Fulton Market office selling for $354.8 million ($667.93/SF).

Other drivers

Other growth drivers will be less potent, however. Although Chicago does not export a lot of what it produces, weaker foreign demand will slow the ascent of transportation and warehousing. Cargo traffic through O'Hare and Midway airports softened around the turn of the year. Meanwhile, tourism is also at risk from a strong dollar, which makes it more expensive for foreigners to visit the Windy City. Overseas tourism is important because international visitors stay longer and spend more than their domestic counterparts. Finally, financial services are a lingering concern because smaller banks, which have been slow to shed problems and write down the value of their assets, will be slow to expand. Delinquency rates on commercial mortgages in Chicago are the highest among the 100 largest metro areas.

With the pandemic beginning almost two years ago today, many people have found their worth in the professional world. During the pandemic, people began learning that working from home was much more proficient, leaving employees with no interest in traveling to the office. A study by FlexJobs found that 58% of people wanted to work from home permanently, and that 38% wanted to have a hybrid work environment. We can assume that this preference will not change anytime soon knowing that people will be searching for hybrid positions as this is accepted as the new standard. This has had effect on economies in large cities like Chicago because people want to move out to the suburbs to shy away from the expensive lifestyle in the city. With the ability to

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 13

work from home, people would rather have the slower paced life with more space to live. A historical high of 96.8 million square feet of office space is currently vacant within the city limits which is about 19% of the total inventory. In quarter 1 on 2020, that number was at 20 million. The hybrid environment is bringing a change to the way people see work environments.

Fiscal

Chicago will need to get its fiscal house in order to be able to sustain the explosion of tech-related hiring downtown. Although the metro division has done more than the state to gain its fiscal footing, challenges remain. Last year the mayor won approval in the legislature for pension changes that cover nearly half of the city's workforce, narrowed the city's structural budget deficit, and reduced the rate at which it is borrowing. However, Chicago is still wrestling with general obligation and interest debt that makes it an extreme outlier among its peers, and the mayor, who has held the line on property taxes, has not ruled out a hike to help the city meet its pension obligations.

In addition, Illinois is in one of the worst debt crises the nation has ever seen. Illinois overall pension debt is 268% higher than its annual revenue due to government-workers’ pensions. It is suffering from a pension shortfall of over $111 billion with 19% of its state “budget” going towards pay for pensions while other states are around 4%. This problem came from politicians who offered generous pension benefits to government workers who in turn failed to properly fund and supply these pensions. Since pensions last for the rest of one’s life and possibly beyond, Illinois has a serious debt crisis on their hands.

Transportation

Chicago, like any big city, has its share of traffic issues and it can sometimes be very frustrating traveling through the city by car. Not to mention the scarcity of street parking and the everincreasing costs of parking garages if you're staying at a downtown hotel, and Chicago public transportation starts to look like an excellent choice for getting around. Fortunately, Chicago trains and buses are a great way to get you where you need to go.

As a result of Chicago’s strategic location, it has become a central point for all forms of transportation. Located at the junction of four interstate highways, it is the nation’s largest trucking center, offering a comprehensive motor carriage system which attracts more than 30 million tons of freight annually. Furthermore, the integrated system of interstate and arterial roadways consists of over 3,000 highway miles in combinations of tollways and expressways.

The Chicago Transit Authority (CTA) runs a network of trains and buses that service nearly every corner of the city. The trains fall under two categories: subway and elevated trains (the "L"). A quick look at a map of the Chicago train system, and you can see that it spiders out from downtown and is your best bet for getting to most of your Chicago destinations. The CTA buses fill in the gaps, running on a regular schedule on most major city streets.

Furthermore, the Chicago area is served by over 630 miles of expressway and by one of the most comprehensive and efficient public transit systems (the Regional Transportation Authority is comprised of the CTA, Metra and Pace) in the world.

The Chicago MSA has seven major Interstate highways crossing through it. However, the various

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 14

roadways are more typically known to Chicagoans not by their Interstate route numbers but rather by various given names, the vast majority of which use the suffix "Expressway" rather than "Freeway." These include Interstate 90/94 (Kennedy Expressway, northwest), Interstate 90 (the Jane Addams Memorial Tollway, Interstate 94 (Edens Expressway, north), Interstate 90/94/57 (Dan Ryan Expressway, south), Interstate 290/IL Route 53 (Eisenhower Expressway, west), Interstate 55 (Stevenson Expressway, southwest), Interstate 355 (Veterans Memorial Tollway, north/south perimeters), Interstate 88 (Ronald Reagan Memorial Tollway), Interstate 94/IL Route 394 (Bishop Ford Freeway) and the Tri-State Tollway which is comprised of Interstate 41, 80, 94 and 294. The Chicago Skyway (I-90, east) became a revenue generator in 2005 when the City of Chicago signed a $1.83 billion lease with Cintra-Macquaire Consortium to operate the roadway for 99-years.

Employment

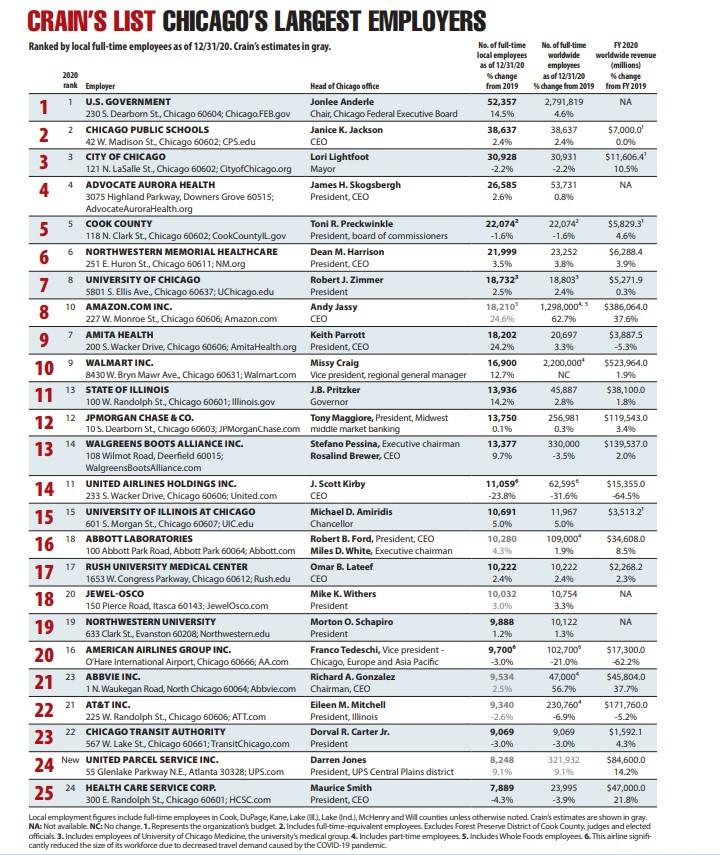

Chicago’s level of employment growth has been modest over the past several decades. Prior to the end of Great Recession, the employment gains were not evenly distributed throughout the area; the city had recently been losing jobs overall, while the suburbs had been gaining. Historically, in 1972 the city had 54% of all jobs in the metropolitan region; by 2000 the figure had fallen to 31.3%. However, it appears there once again is a migration of jobs back to city as companies search for the greatest talent pool of potential employees, primarily with regards to millennial. In 2017, for the first time ever, a majority of jobs in Chicago as a whole were located in the central area of the city. Companies like McDonald’s, Kraft Heinz, Motorola, Mondelez International and United Airlines have moved their corporate headquarters to downtown Chicago. These companies were located in the suburbs and have recognized the benefits of moving to an urban environment. Chicago’s Loop is already home to many corporations such as Boeing, Exelon, JLL, Cushman & Wakefield, Northern Trust, Hyatt and U.S. Cellular. The West Loop and Fulton Market neighborhoods have attracted many developers and companies such as Google, McDonald’s and Mondelez International. According to Crain’s List for 2022, the largest employers in the greater Chicagoland area are Government and state jobs. The leading U.S. Government positions have risen in employment by 14.5% since 2019. Second on the list is teachers and administrative workers at Chicago Public Schools. Since October of 2019, there has been a slight increase of 2.4% of hirings within the country’s third largest school district. Along with the teacher strike in October of 2019, a

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 15

separate article from NPR came out just two months prior showing the number of absences teachers had throughout the Chicago public school in 2018-2019. Upon visits to each local school, 99 majority black schools, 45 majority Hispanic, and majority 8 mixed schools reported instructor absences. The slight increase in hirings is a promising look for the future of students learning in the Chicago Public School District. Some of the more prominent changes on the Crains List for 2022 would be Amita Health and United Airlines Holdings INC. Amita Health has shown an increase of 24.2% since 2019 and will continue to grow as nurses and doctors gain more knowledge on the COVID-19 pandemic and feel safer entering health facilities. United Airlines has lost 23.8% in employment since 2019 due to the lack of travel during the pandemic. With travel becoming more prominent again, we should likely see an increase in employment within the next two years.

The top industries by percentage of employment in DuPage County according to the chart above were Manufacturing, Professional/Scientific/Tech Services and Health Care/Social Assistance.

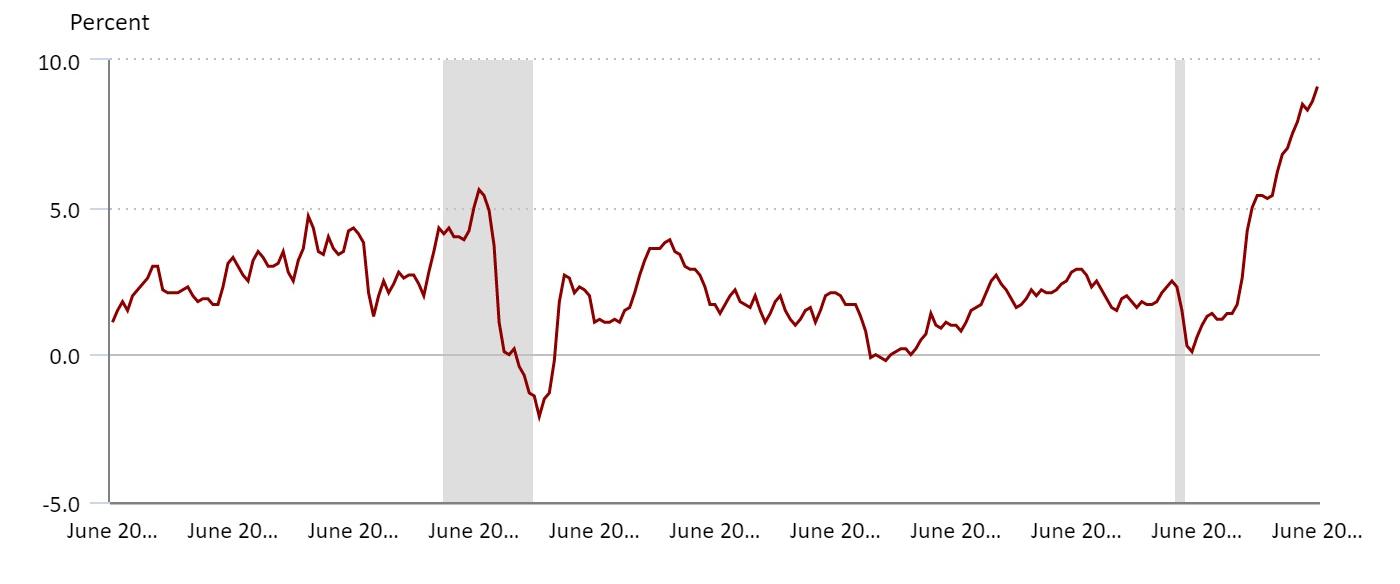

Unemployment

The following table exhibits current and past unemployment rates as obtained from the Bureau of Labor Statistics. Overall, the Region boasts one of the lowest unemployment rates for metropolitan statistical areas in the country at 4.2 percent.

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 16

2021Percent of IndustryEstimateEmployment Agriculture/Forestry/Fishing/Hunting2,9290.11% Mining/Quarrying/Oil & Gas Extraction7890.03% Construction138,0905.09% Manufacturing248,1209.15% Wholesale Trade69,4582.56% Retail Trade246,6719.09% Transportation/Warehousing225,1148.30% Utilities13,8820.51% Information48,1291.77% Finance/Insurance164,6836.07% Real Estate/Rental/Leasing58,9852.17% Professional/Scientific/Tech Services295,39010.89% Management of Companies/Enterprises2,7780.10% Admin/Support/Waste Management Services115,3184.25% Educational Services244,2909.01% Health Care/Social Assistance390,46014.40% Arts/entertainment/Recreation49,2371.82% Accommodation/Food Services173,1476.38% Other Services (excl Public Administration)125,6194.63% Public Administration99,2803.66% Total2,712,369100.0%

Employment by Industry - Cook County

Source: ESRI (ArcGIS)

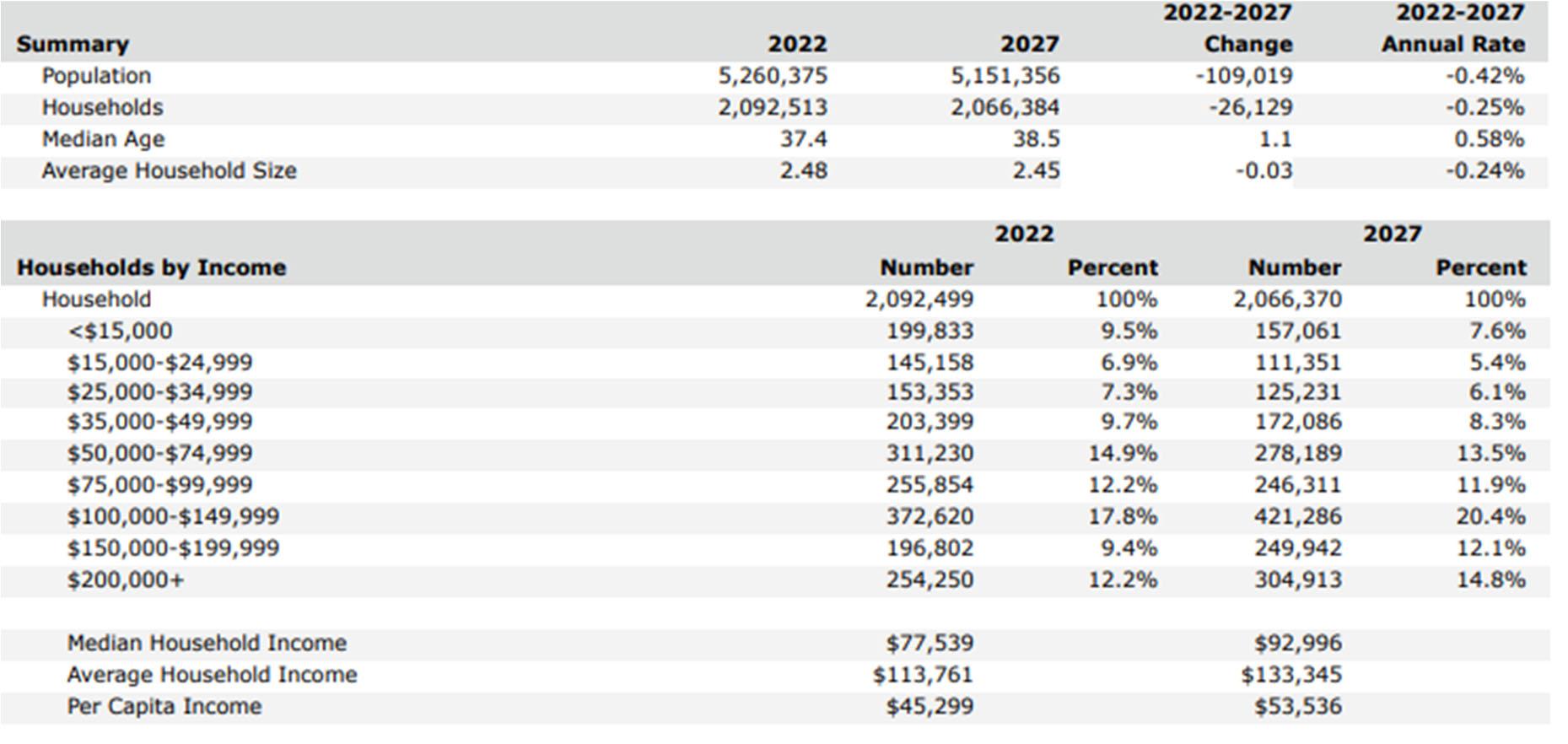

Median Household Income

Total median household income for the region is presented in the following table. Overall, the subject’s MSA and county compare favorably to the state and the country.

Education, Recreational and Cultural Amenities

Chicago is home to fifteen major public and private universities, including the highly regarded Northwestern University and University of Chicago. Other major educational institutions include University of Illinois at Chicago, which has the largest local enrollment, as well as Loyola University and DePaul University. These institutions offer a variety of undergraduate and graduate fields of study. The total enrollment of these Chicago area universities is approximately 105,000 students. Prominent MBA programs in the Chicago area include Northwestern University’s Kellogg School of Management, University of Chicago’s Graduate School of Business and DePaul University’s Kellstadt Graduate School of Business.

The surrounding area of Chicago also has a number of private liberal arts colleges and universities including North Central College, Wheaton College, Elmhurst College, North Park University, Benedictine University and Lake Forest College. Additionally, many of the major universities have established satellite campuses in the suburban areas. DePaul University has suburban campuses located in Naperville, Oak Forest, O’Hare, and Rolling Meadows. Northern Illinois University has suburban campuses in Hoffman Estates and Naperville. The Chicago area also has an extensive community college system comprised of twelve two-year colleges with a total enrollment of 145,000 students. There are also seven City Colleges of Chicago with an enrollment of over 75,000 students.

Arts, science, and history museums, as well as the theater, opera companies and symphony orchestras are well represented. The area’s extensive lakefront and systems of parks and open spaces (Forest Preserve Districts) provide residents with year-round recreational entertainment. Furthermore, sports are embedded within the fabric of the area. Major league franchises such as the Chicago Bears football team, the Chicago Bulls basketball team, the Chicago Cubs and White Sox

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 17

Unemployment Rates AreaYE 2017YE 2018YE 2019YE 2020YE 20212022¹ United States4.4%3.9%3.7%8.1%5.3%3.8% Illinois4.9%4.4%4.0%9.2%6.1%4.7% Chicago-Naperville-Elgin, IL-IN-WI (MSA) 4.9%4.1%3.9%9.5%6.2%4.2% Cook County, IL5.1%4.2%3.9%10.4%7.0%4.6% Source: www.bls.govdata not seasonally adjusted; ¹June - most recent for US, others lag by 1-2 mos.) Median Household Income EstimatedProjectedAnnual % Change Area202120262021 - 26 United States$62,203$67,3251.6% Illinois$76,812$89,5383.1% Chicago-Naperville-Elgin, IL-IN-WI (MSA)$83,320$100,2973.8% Cook County$77,539$92,9963.7% Thornton township$55,315$65,1873.3%

ESRI (ArcGIS)

Source:

baseball teams, and the Chicago Blackhawks hockey team call Chicago home. In addition, several minor league and college teams have a strong following as well.

The City of Chicago provides tools, resources, special programs, and education training for students, job seekers, and professionals seeking development. Provided below are links to Services, News, Alerts, and Supporting Information from all departments across the City, on topics relevant to Education and educational opportunities in Chicago.

The following table details the education attainment for the region. Thornton Township demonstrates the lower education attainment as compared to the County and MSA. However, the region demonstrates higher education attainment levels than the state and national level.

Tourism

Chicago is a very popular city for American and international tourists. According to the Illinois Office of Tourism Department of Commerce and Economic Opportunity press release dated 08-21-2020, the state received 120 million tourists in 2019. Illinois experienced tourism growth for the ninth year in a row. The U.S. Travel Association estimates that tourists spent $43.1 billion in Illinois last year. That was a 3% increase over the prior year. This helped to support over 340,000 jobs and created over $2.5 billion in state sales tax revenue. The City of Chicago accounted for around 55 million of these visitors.

The popular tourist attractions in the city include Navy Pier, Museum Campus, the Magnificent Mile, Grant Park, Millennium Park and the Willis Tower. However, the COVID-19 pandemic has put travel on hold. 2020 saw an enormous decrease in tourism much like other major US cities but there was a rebound in the summer of 2021. According to the Chicago Sun Times, “the average hotel occupancy rate on summer weekends was 71% — and it reached 85% during Lollapalooza weekend. Counting weekdays, summer capacity “topped out at” 51% overall, reaching 57.5% in July. That’s the best occupancy rate Chicago has recorded since February 2020, the month before the stay-at-home shutdown that prompted scores of major hotels to close their doors” (Spielman, 2021). This shows an upward trend coming into 2022 with the majority of the population being vaccinated and a decline of cases since the holidays.

In recent years, the Chicago Bears have been in contract with the Arlington Horse Racing Track in Arlington Heights, Illinois to purchase the track and surrounding land to redevelop the area and call it home. In July of 2022, an article came out showing the importance of sports franchises and the surrounding real estate. The Chicago Bears wouldn’t be the first to do this, but the Rams and Chargers with the construction of Sofi Stadium in Inglewood, California. Not only do these two teams call Sofi Stadium home, but they also boosted the commercial real estate market in the process.

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 18

Education Attainment Area Graduate Degree Bachelor Degree Associate Degree High School DiplomaNo Degree United States12.9%20.2%8.7%46.8%11.4% Illinois14.8%23.0%9.0%44.3%8.9% Chicago-Naperville-Elgin, IL-IN-WI (MSA)16.2%25.1%8.1%41.4%9.3% Cook County17.2%25.1%7.4%39.7%10.6% Thornton township8.1%14.7%9.4%57.2%10.6% Source: ESRI (ArcGIS)

Roughly $616 million in commercial property was sold within 1-mile of the development zone which is far more than any investment in the Inglewood area in the past three decades. The Bears plan to follow this course and begin redeveloping the 326-acre property in Arlington Heights. To counteract this move, the mayor of the city, Lori Lightfoot, is proposing a 2.2 billion remodel of the historic solider field to keep fans and tourist inside city limits. If the Chicago Bears decide to move, they would develop the 326-acre property with a stadium, retail, and living commodities. They would then own the entirety of the site and make a profit outside of the sports community.

Conclusions

In conclusion, the Chicago metropolitan area has an established history of economic stability due to its accessibility to major markets, its central location, excellent transportation facilities, and its diversified economic base. These features of the subject area are positive factors reinforcing the value of local real estate, inclusive of the subject property, over the long term with the services sector continuing to grow at a faster rate than other segments of the market.

Chicago-Joliet-Naperville has been experienced a robust economic expansion over the past several years. The public sector will continue to be a sore spot, but it will not prevent a self-sustaining expansion from taking hold, as growth in private industries broadens and strengthens. Longer term, a huge talent pool of skilled workers, world-class universities, and an airport with direct connections around the globe give Chicago an advantage over the rest of the state and other parts of the Midwest.

Chicago was facing considerable fiscal deficits prior to the pandemic, and now faces deeper challenges as its large office sector is complicated by the work-from-home trend which will hurt the office market and the CTA. It is not expected to see office employment reach the 2019 peak level until 2023. With close to 5-million SF more in office space expected by the end of 2023, this could soon change. In terms of living arrangements, people will more than likely continue to migrate out to the suburbs with the ability to now work remote. With Illinois rising tax rates, sales tax of 10.25%, and property taxes being a third higher than the national average, it’s almost a no brainer. The ultimate duration and impact that the pandemic will have on the local, regional, and national economies remains uncertain. But, Continuing through 2022, momentum is expected to increase in subsequent quarters due to pent-up demand as the pandemic becomes more controlled.

CALUMET COUNTRY CLUB REDEVELOPMENT REGIONAL AND MARKET AREA ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 19

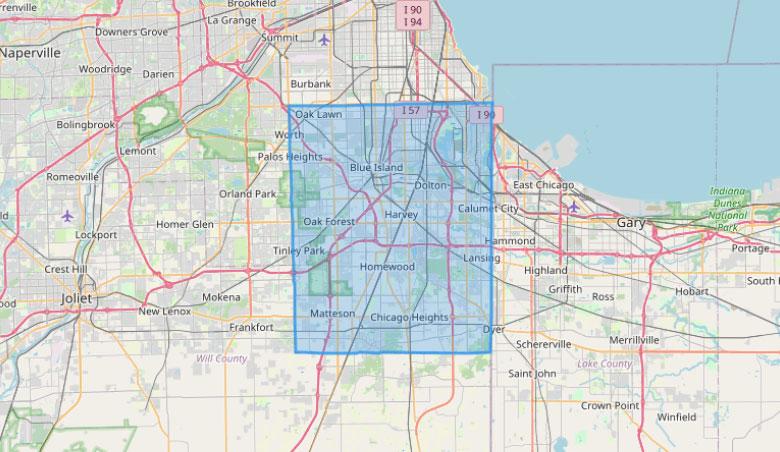

City and Neighborhood Analysis

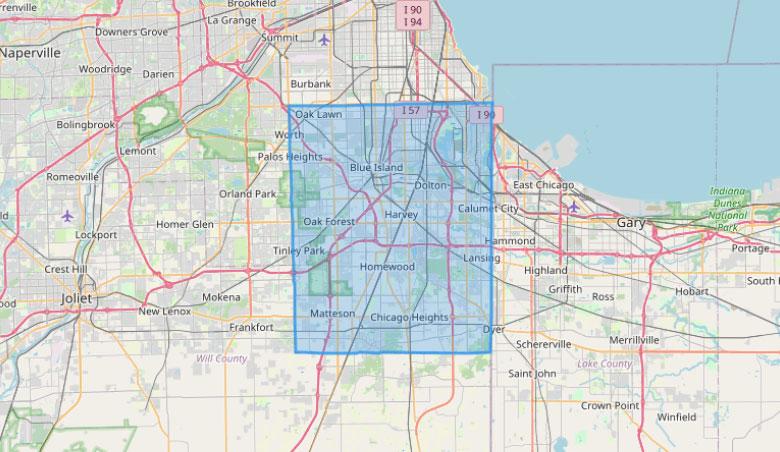

NEIGHBORHOOD MAP

Overview

The subject is located in in an unincorporated portion of Cook County, formerly within the village of Homewood in Cook County. As noted earlier, in April of 2021, by direction of the owner, the Homewood Village Board approved disconnecting the property from the village. Therefore, a majority of the property currently is located in unincorporated Cook County, with a small portion at the northwest corner of 175th Street and Dixie Highway falling with the village boundaries of Hazel Crest. For purposes of this analysis, we have provided an overview of Homewood as it most closely represents the socio economic characteristics of the subject property. Location influences from the village of Hazel Crest are also considered in this market study.

Homewood is in Chicago’s south suburbs and part of the greater Chicago MSA, about 21.5 miles south of the Chicago Loop. Surrounding communities include Hazel Crest to the west, Thornton to the east, Flossmoor to the south and Harvey to the north.

Neighborhood Location and Boundaries

The subject neighborhood is located to the north of Homewood, now within Thornton Township, Cook County, IL. The southeast corner of the site is located in Hazel Crest. The area is suburban in nature. The neighborhood is bounded by Interstate 80 to the north, Dixie Highway to the east, 183rd Street to the south, and Kedzie Avenue to the west.

CALUMET COUNTRY CLUB REDEVELOPMENT CITY AND NEIGHBORHOOD ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 20

Transportation Access

Within the immediate area of the subject property, transportation access helps define the character of its development. Major east/west traffic routes include Interstate 80, 175th Street, Ridge Road, 183rd Street and 187th Street. North/south routes include Ridge Road, Governor’s Highway and Halsted Street. Metra services Homewood with stations at Calumet, East Hazel Crest, Homewood

Amtrak Station, and Flossmoor. The commute to the Chicago Central Business District is about 20 to 40 minutes, although it may be substantially longer during peak traffic hours. Access to the area is considered good.

Road Improvements

No major road improvements are planned for the immediate area surrounding the subject property.

Neighborhood Land Use

The subject neighborhood is located in an area with primarily residential and industrial land uses. An approximate breakdown of the development in the area is as follows:

LAND USES

Like most suburbs, land uses are mixed with single family being most prominent. Other uses such as multi-family and industrial are scattered throughout as well. Support retail and office uses are primarily located along the main arteries.

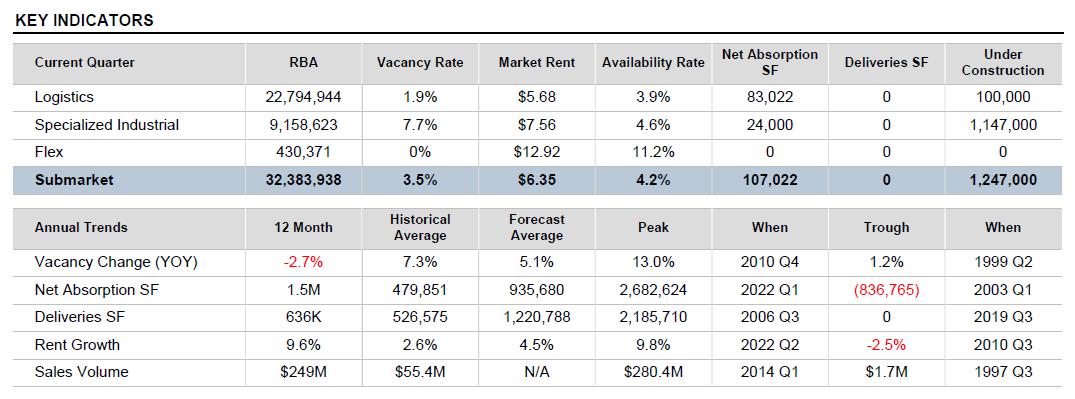

Land Use Trends

The subject property is a large part of the neighborhood which will most likely be changing from open space to industrial and retail use. Although there are plans for redevelopment of the subject parcel, there is little other new construction or change in land uses noted within proximity.

Proposed East Hazel Crest and Homewood Casino

In 2019, the Villages of East Hazel Crest and Homewood were awarded a casino bid. East Hazel Crest and Homewood joined hands on a potential casino in 2012, when they were in the running for a potential license along with Calumet City, Chicago Heights, Country Club Hills, Ford Heights and Lynwood.

The Wind Creek Casino proposed for Homewood and East Hazel Crest would cost $440 million. The proposal is for a 64,000 square-foot casino off of Interstate-80 and Halsted Street.

CALUMET COUNTRY CLUB REDEVELOPMENT CITY AND NEIGHBORHOOD ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 21

Developed 95% Residential 60% Retail 15% Office 5% Industrial 15% Vacant 5% Total 100%

Along with the casino, which would have 2,000 gaming positions — the number of gambling locations including machines and table games — the casino would have a 13,000-square-foot buffet area and 10,000-square-foot entertainment area, according to the proposal. Two hotels, each with 225 rooms, would be built.

The casino is slated to open in the end of 2023/early 2024, with construction delayed almost a year due to COVID-19 supply chain issues and planning setbacks. The casino will be mostly on East Hazel

CALUMET

© 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 22

COUNTRY CLUB REDEVELOPMENT CITY AND NEIGHBORHOOD ANALYSIS

Subject

Crest land, with a parking garage overflowing into Homewood's property. The construction site is located off of Interstate 80 near Halsted Street and 175th Street.

A revenue sharing agreement would be in place once the casino is built, and the 2019 law that provided a south suburban license calls for the host community and 42 other south suburbs to share in 5% of revenue generated.

In this instance, with two host communities, they would keep 2% of monthly adjusted gross receipts, while another 3% would be shared among 41 other suburbs. The host communities also would get $1 of the $3 admission tax for each person entering the casino.

Wind Creek has estimated that $3 million in tax revenue would flow annually to Homewood and East Hazel Crest, and another $4 million a year to the other communities.

Demographics

The following table depicts the area demographics in Homewood within a one-, three-, and five-mile radius from the subject.

CALUMET COUNTRY CLUB REDEVELOPMENT CITY AND NEIGHBORHOOD ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 23

Neighborhood Demographics Radius (Miles)1 Mile3 Mile5 Mile Population Summary 2010 Population9,07584,364218,488 2021 Population Estimate8,57278,754204,387 2026 Population Projection8,28376,495198,461 Annual % Change (2021 - 2026)-0.7%-0.6%-0.6% Housing Unit Summary 2010 Housing Units3,52532,49282,553 % Owner Occupied68.4%67.4%68.5% % Renter Occupied23.2%23.4%22.9% 2021 Housing Units3,45831,38881,101 % Owner Occupied58.4%65.4%65.8% % Renter Occupied32.3%25.6%25.0% 2026 Housing Units3,46531,43481,269 % Owner Occupied58.7%65.2%65.3% % Renter Occupied29.5%23.7%23.4% Annual % Change (2021 - 2026)0.1%0.0%0.0% Income Summary 2021 Median Household Income Estimate$61,300$70,319$67,744 2026 Median Household Income Projection$70,634$82,895$80,262 Annual % Change2.9%3.4%3.5% 2021 Per Capita Income Estimate$31,676$34,306$32,572 2026 Per Capita Income Projection$37,760$40,539$38,620 Annual % Change3.6%3.4%3.5% Source: ESRI (ArcGIS) (Lat: 41.574557, Lon: -87.670261)

Within a three-mile radius, the reported population is 78,754 with a projected growth rate of approximately -0.6% annually. There are 31,388 housing units within that three-mile radius. The growth rate is expected to be 0.0% annually. Most of the housing is owner-occupied. Our research indicates that property values in the area are stable to increasing.

CALUMET COUNTRY CLUB REDEVELOPMENT CITY AND NEIGHBORHOOD ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 24

Within a three-mile radius, the median household income is $70,319. Looking ahead, annual household income growth is projected at 3.4% per year. The average income figures suggest that the inhabitants are within the middle income brackets.

Nuisances & External Obsolescence

Neighborhood properties have adequate levels of maintenance. No adverse or unfavorable factors were observed.

Neighborhood Life Cycle

Most neighborhoods are classified as being in one of four stages: growth, stability, decline, or renewal. Overall, the subject neighborhood is in the stability stage of its life cycle.

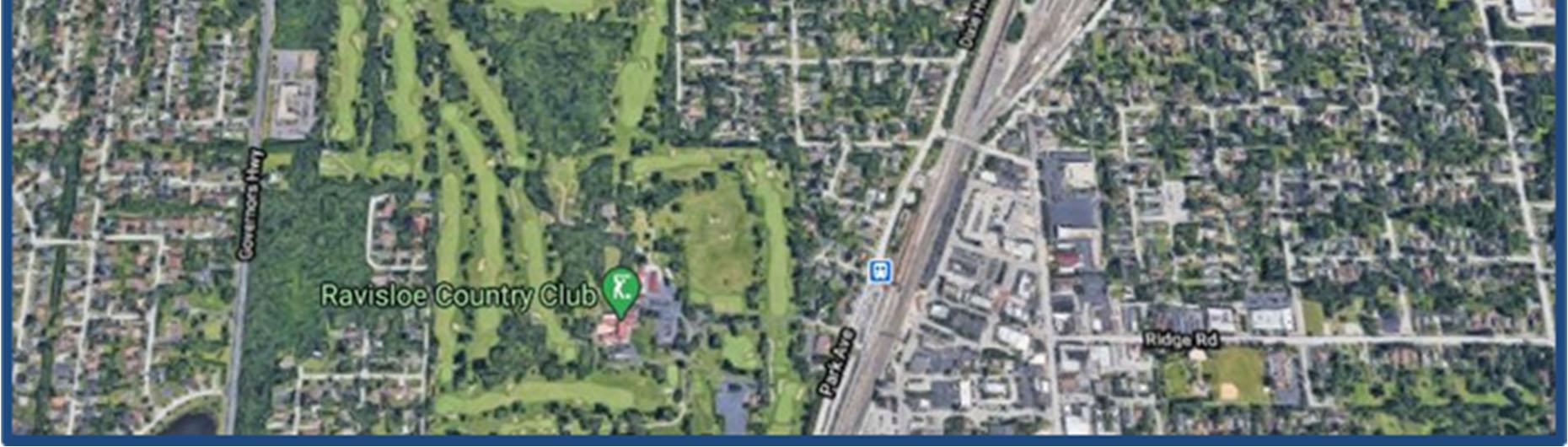

Immediate Area Uses

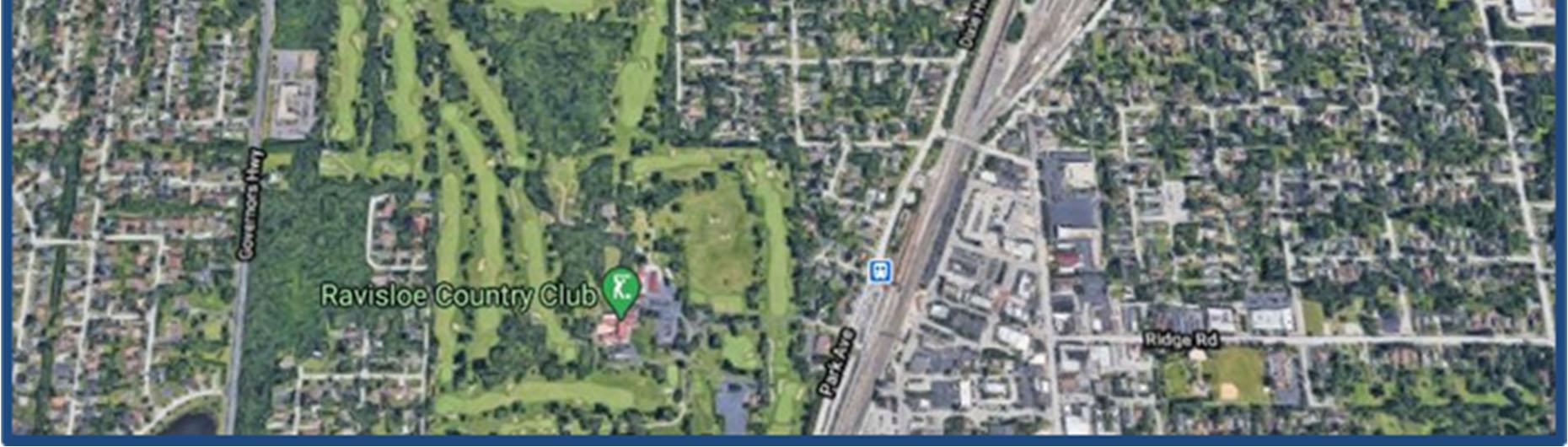

The below aerial photo exhibits the uses located in the subject’s immediate vicinity.

CALUMET COUNTRY CLUB REDEVELOPMENT CITY AND NEIGHBORHOOD ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 25

Uses along 175th Street in the vicinity of the subject are primarily residential in nature. Another golf club is located less than ¼ mile to the south of the subject, Ravisloe Country Club. To the immediate west is industrial development and established residential dwellings further west. Single family development is to the south, in between the subject and the Ravisloe Club. There are government buildings to the east, including the Hazel Crest Village Hall, as well as parking for the Calumet Metra station. The subject abuts Interstate 80 to the north, with single family development north of the highway. A drive of the neighborhood revealed that occupancies in the area are quite high. The area has remained popular with no signs of this changing into the future. As shown above, the density of uses in the area is relatively high with few vacant parcels available.

Analysis and Conclusions

The subject neighborhood is a developed suburban community which exhibits great access to local traffic linkages. Moreover, local demographics indicate a loosely defined but stable population with average income levels at the metropolitan and statewide averages. Given the surrounding population figures and access, the subject neighborhood should remain a viable commercial area for the foreseeable future.

CALUMET COUNTRY CLUB REDEVELOPMENT

AND NEIGHBORHOOD ANALYSIS © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 26

CITY

IMMEDIATE AREA USES

Source: Google Maps

Subject

Site Description

The subject site is located on the northwest corner of 175th Street and Dixie Highway, just south of I80. The characteristics of the site are summarized as follows:

Site Characteristics

Gross Land Area: 128.36000 Acres or 5,591,362 SF

Usable Land Area: 109.00000 Acres or 4,748,040 SF

Usable Land %: 84.9%

Shape: Generally Rectangular

Average Depth: 2,140.00 feet

Topography: Gently sloping

Drainage: Assumed adequate

Grade: Varies above and below street grade

Utilities: All Available

Off-Site Improvements: Asphalt paved street, curbs, gutters

Interior or Corner: Corner

Signalized Intersection: Yes - Traffic signal at the site that enhances access

Excess or Surplus Land: None

Additional Access Alley Access: None

Water or Port Access: None

Rail Access: None

Flood Zone Data

Flood Map Panel/Number: 17031C0733J

Flood Map Date: 08-19-2008

Portion in Flood Hazard Area: 0.00%

Flood Zone: Zone X

The areas of minimal flood hazard, which are the areas outside the SFHA and higher than the elevation of the 0.2-percent-annualchance flood, are labeled Zone C or Zone X (unshaded).

CALUMET COUNTRY CLUB REDEVELOPMENT SITE DESCRIPTION © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 27

Street Frontage / Access Frontage Road Primary Secondary Street Name: 175th Street Dixie Highway Street Type: Main Traffic Thoroughfare Main Traffic Thoroughfare Frontage (Linear Ft.): 2,420.00 1,790.00 Number of Curb Cuts: 1 0 Traffic Count (Cars/Day): 13600 9700

Other Site Conditions

Soil Type: Assumed adequate

Environmental Issues: A Phase I Environmental Site Assessment was conducted by ECS Midwest, LLC and dated October 12, 2020. According to this document, a 1,000-gallon gasoline UST was removed from the property on January 3rd, 1990. The Illinois EPA issued a No Further Remediation Letter on April 15, 1991, and no associated land use restrictions and/or engineering/institutional controls were placed on the property as part of site closure. Other than this historical condition, ECS revealed no evidence of environmental conditions with the property.

Easements/Encroachments: The easements are described in the Addenda.

Earthquake Zone: None

Wetlands Classification: Cherry Creek is on the northwest corner of the site. This area is subject to federal regulation. There are a number of other designated wetlands but have been determined to not be under federal regulation.

Adjacent Land Uses

North: Interstate 80

South: Single-Family Residential Neighborhood

East: Single-Family Residential Neighborhood, Retail Buildings, Calumet Metra Station

West: Industrial Buildings, Vacant Land

Site Ratings

Access: Good Visibility: Good

Zoning Designation

Zoning Jurisdiction: Village of Homewood

Zoning Classification: PL-2, Public Land and Open Space

General Plan Designation: Public Land and Open Space

Permitted Uses: A variety of uses (see exhibit)

Zoning Comments: The purpose of the PL 2 Public Land and Open Space Zoning District is to protect and maintain public properties owned by the Village, the park district, school districts, non-profit organizations, and privately-owned country clubs. The development standards provide flexibility to local government bodies, non-profit organizations, and country clubs in the use of their land while protecting surrounding uses.

CALUMET COUNTRY CLUB REDEVELOPMENT SITE DESCRIPTION © 2022 VALBRIDGE PROPERTY ADVISORS | Chicago Page 28

TIF Overview

Based on information provided to us by ownership, the intent is to secure a Cook County Class 8 incentive for the entire development, including all components. This will allow the entire development to be assessed at 10% of market value, instead of the 25% for all commercial and industrial properties in the county.

The Class 8 tax incentive promotes industrial and commercial development in areas of Cook County that are “experiencing severe economic stagnation.” An amendment to the Classification Ordinance allows property located in any of the five townships (Bloom, Bremen, Calumet, Rich and Thornton) included within the South Suburban Tax Reactivation Pilot Program and/or in an Enterprise Zone is eligible for Class 8 without any application for certification of an area. Any new construction, significant rehabilitation, or reutilization of abandoned buildings developed or reoccupied for industrial or commercial use may qualify for the Class 8.