LUXURY MARKET TRENDS

HAPPY FALL!

The luxury market has continued to experience an intensity adjustment this autumn across most of the John L. Scott network. Unsold inventory has grown in many markets within the luxury price ranges as the days on market have trended higher than we previously saw during those frenzied months of the past couple years.

The month of October will have the greatest selection of luxury properties available until next March. Looking ahead, the number of listings will dwindle as fewer people choose to list their homes and the “winter cleanup” of sellers taking their homes off the market over the holidays and then reposition to bring them back on the market after the first of the year.

It’s ok to buy and sell within the same market timing. It comes down to your individual situation and what is right for you. Contact your John L. Scott Luxury Specialist to review market charts and trends that will help you make an informed decision.

J. Lennox Scott Chairman and CEO John L. Scott Real Estate

EXCEPTIONAL HOMES

BY JOHN L. SCOTT

Exceptional Homes is John L. Scott’s luxury real estate brand. Together with our luxury broker associates, our global partners at Luxury Portfolio International, and our support staff, we strive to provide concierge-level service by putting clients first.

We can ensure you that we are here for you and your family. The real estate market is fast-paced and ever changing, but what hasn’t changed, is our commitment to exceed your expectations when you are ready to buy or sell your home.

ON THE COVER: OFFERED AT $3,390,000 | JOHNLSCOTT.COM/56063

ON THE RIGHT: OFFERED AT $2,798,000 | JOHNLSCOTT.COM/27290

YOUR

Luxury

LIVE

WE ARE GLOBAL

John L. Scott is a founding member of the international organization Leading Real Estate Companies of the World®.

Founded in 1931, JLS operates over 100 offices with over 3,000 agents throughout WA, OR, ID & CA

A global community of over 565 real estate companies awarded membership based on rigorous standards for service and performance

BY THE NUMBERS

Member Firms

of applicants to this network are turned down

John L. Scott’s luxury brand, providing our agents with tools and data to help each and every client live their luxury

The luxury division of LeadingRE & the largest global network of the most powerful, independent luxury firms

Inventory

550

4,600 Offices Worldwide Total

$58 BILLION

80%

GLOBAL LUXURY

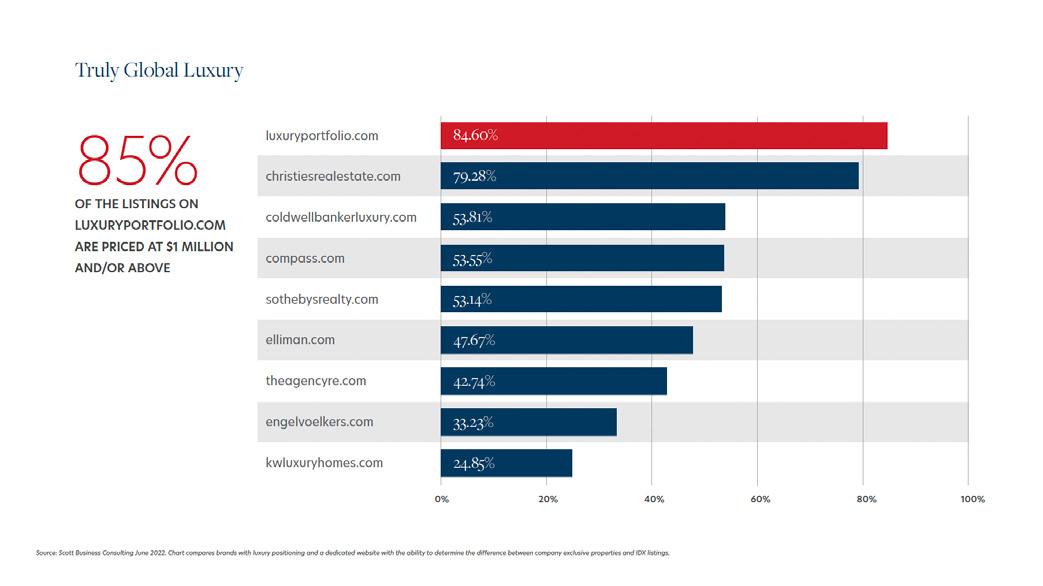

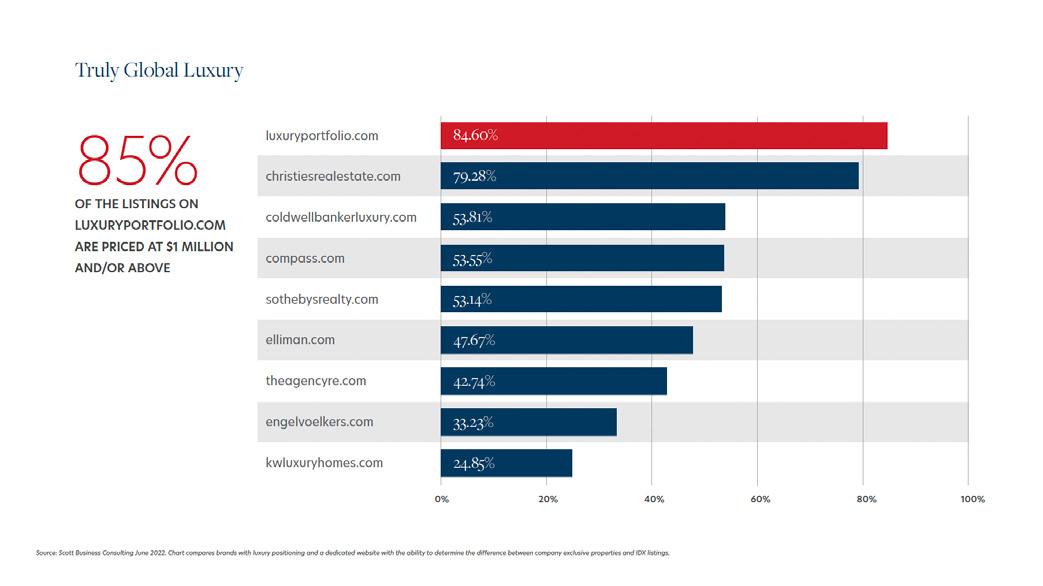

Associates Worldwide 6 Continents with Member Companies 130,000 Average Property $2.6 MILLION 85% 84.60% 79.28% 53.81% 53.55% 53.14% 47.67% 42.74% 33.23% 24.85% TRULY

JOHN L. SCOTT LUXURY SPECIALISTS SCHOLARS OF THE MARKET

Curious about luxury trends in your neighborhood? See what some of our real estate specialists had to say about the luxury market in their area.

Q3 2022 validated the need for “best in class pricing and turn-key properties with beautiful finishes.”

AMY KANE Lake Oswego, OR

Homes that do not meet both criteria are sitting on the market longer and if the seller is motivated, prices are being lowered.

The challenge for sellers is to focus on what is happening now. Data from 6 months ago is not applicable when pricing for this market.

There are still many buyers in the market, they are just taking their time making choices. Not every offer has to be cash to be accepted.

Buyers with strong jumbo and conventional loan commitments are now able to buy as opposed to 2021 when cash was king.

Luxury buyers are looking for pristine homes with state-of-the-art kitchens and baths.

Younger buyers are focused on sustainability components in homes.

BEN PRIDGEON Issaquah, WA

Q3 2022 will go down as a dynamic period of adjustment with interest rates trending higher throughout the quarter and early June marking a noticeable turning point in percent of new listings pending within 7 days on market. Luxury home buyers are experiencing more flexible terms transactionally with contingencies returning to the process and longer market times working in their favor.

DANIELLE

SNOW Bend, OR

There are several buyers lingering around in our area, renting and in a seeing/wait mode. The crazy market of first quarter has softened since mid-May with the rise of interest rates. The market has returned to a more normal cycle with sellers not getting top dollar and buyers having more leverage in their negotiating. As we head into fall, serious sellers will have to adjust their pricing if they want to accomplish a sale. Buyers can be more savvy in their negotiating and reap some benefits. Still a win/win for all concerned.

MARTIN WEISS

Sammamish, WA

Sammamish, WA

The luxury market on the Eastside saw increasing inventory and softening prices in Q3. This shift in the market is due to rising interest rates affecting affordability and shrinking the potential pool of would-be luxury buyers. It should be noted we are still seeing elevated sales activity and below-normal inventory compared to historical norms. Buyers have potential opportunity for contingencies, sellers’ concessions, and negotiation. Sellers have challenges with diminished buyer pool and affordability makes pricing strategy, presentation strategy, and marketing strategy more important.

2022 Q3 LUXURY MARKET TRENDS

PUGET SOUND

the third quarter of 2022, luxury sales activity in

West Bellevue and Mercer Island has experienced an intensity adjustment after the frenzy which began in 2020. Fewer listings have come on the market and buyers have been able to take their time before making an offer.

2022 Q3 LUXURY MARKET TRENDS Q3 2022 Q3 2021 % Change Number of Sales 881 1,150 -23.3% Total Dollar Volume $1,422,780,700 $1,825,030,628 -22.0% Average Sales Price $1,614,961 $1,586,983 1.8% Median Sales Price $1,375,000 $1,361,500 1.0% Average Days on Market 41 42 -2.3% Sold / List Price % 100.0% 105.2% -4.9% Average Price per SQFT $599 $605 -1.0% Quarter-end inventory 537 239 125.0% SEATTLE THIRD QUARTER HIGHLIGHTS In

Seattle,

The data is for single family residences over $1M in MLS areas 140, 380, 390, 700, 710. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. OFFERED AT $1,799,950 | JOHNLSCOTT.COM/12294

Over the last three months, active inventory has ticked upward in West Bellevue bringing some relief to luxury buyers. As the intensity of the market continued to adjust, combined with the seasonality and higher inventory in the late summer, buyers will find more options before the cooldown during the final months of the year.

Q3 2022 Q3 2021 % Change Number of Sales 46 115 -60.0% Total Dollar Volume $232,697,300 $488,793,250 -52.3% Average Sales Price $5,058,637 $4,250,376 19.0% Median Sales Price $3,275,000 $3,400,000 -3.6% Average Days on Market 60 54 11.1% Sold / List Price % 93.70% 101.50% -7.6% Average Price per SQFT $1,273 $1,158 9.9% Quarter-end inventory 73 25 192.0% WEST BELLEVUE SOLD | JOHNLSCOTT.COM/57451

The data is for single family residences over $1M in MLS area 520. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed.

The number of active listings has continued its upward trend over the last several months on Mercer Island, where inventory was scarce earlier this year. As we head into the winter cleanup season, inventory is still at a low level. This is providing buyers with a greater selection of homes closer to market price.

2022 Q3 LUXURY MARKET TRENDS MERCER ISLAND Q3 2022 Q3 2021 % Change Number of Sales 60 113 -46.9% Total Dollar Volume $186,185,150 $357,683,541 -47.9% Average Sales Price $3,103,086 $3,165,341 -1.9% Median Sales Price $2,429,000 $2,425,000 0.1% Average Days on Market 52 41 26.8% Sold / List Price % 98.30% 104.10% -5.5% Average Price per SQFT $881 $855 3.0% Quarter-end inventory 45 16 181.0% PENDING | JOHNLSCOTT.COM/36147

The data is for single family residences over $1M in MLS area 510. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed.

EASTSIDE PENDING | JOHNLSCOTT.COM/33484 Q3 2022 Q3 2021 % Change Number of Sales 1,287 1,967 -34.5% Total Dollar Volume $2,470,741,873 $3,810,660,961 -35.2% Average Sales Price $1,919,768 $1,937,296 -0.9% Median Sales Price $1,562,000 $1,560,000 0.1% Average Days on Market 60 46 30.4% Sold / List Price % 97.0% 106.9% -9.3% Average Price per SQFT $646 $645 0.1% Quarter-end inventory 848 197 330.0% The data is for single family residences over $1M in MLS areas 500, 530, 540, 550, 560, 600. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. 30.4% DAYS ON MARKET 0.9% AVERAGE SALES PRICE

2022 Q3 LUXURY MARKET TRENDS KING COUNTY CONDO SOLD | JOHNLSCOTT.COM/59581 Q3 2022 Q3 2021 % Change Number of Sales 153 198 -22.7% Total Dollar Volume $242,771,461 $304,401,928 -20.2% Average Sales Price $1,586,742 $1,537,383 3.2% Median Sales Price $1,350,000 $1,302,500 3.6% Average Days on Market 52 66 -21.2% Sold / List Price % 97.6% 100.1% -2.5% Average Price per SQFT $827 $848 -2.6% Quarter-end inventory 174 108 61.0% The data is for condominiums over $1M in King County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. 22.7% NUMBER OF SALES 21.2% AVERAGE DAYS ON MARKET

The data is for single family residences over $750k in MLS areas 100, 110, 120, 130, 140, 300, 310, 320, 330, 340, 350, 360, 380, 390, 700, 710. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. Q3 2022 Q3 2021 % Change Number of Sales 641 723 -11.3% Total Dollar Volume $638,392,609 $684,361,590 -6.7% Average Sales Price $995,932 $946,558 5.2% Median Sales Price $899,995 $860,000 4.7% Average Days on Market 26 15 73.3% Sold / List Price % 98.9% 103.3% -4.3% Average Price per SQFT $349 $319 9.4% Quarter-end inventory 485 234 107.0% OFFERED AT $1,100,000 | JOHNLSCOTT.COM/25909 SOUTH KING COUNTY IN Q3, WE SAW A 11.3% DECREASE IN SALES FOR SOUTH KING COUNTY

THE AVERAGE DAYS ON MARKET INCREASED BY 20.0% IN Q3 IN PIERCE COUNTY

2022 Q3 LUXURY MARKET TRENDS Q3 2022 Q3 2021 % Change Number of Sales 692 671 3.1% Total Dollar Volume $720,511,591 $668,625,339 7.8% Average Sales Price $1,041,202 $996,461 4.5% Median Sales Price $899,950 $885,000 1.7% Average Days on Market 24 20 20.0% Sold / List Price % 98.9% 102.7% -3.7% Average Price per SQFT $344 $321 7.0% Quarter-end inventory 539 285 89.0% PIERCE COUNTY The data is for single family residences over $750k in Pierce County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed.

OFFERED AT $1,679,000 | JOHNLSCOTT.COM/26468

OVERALL, THE AVERAGE PRICE PER SQUARE FOOT DECREASED 3.4% IN KITSAP COUNTY

The data is for single family residences over $750k in Kitsap County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. Q3 2022 Q3 2021 % Change Number of Sales 261 290 -10.0% Total Dollar Volume $314,471,009 $362,439,602 -13.2% Average Sales Price $1,204,870 $1,249,792 -3.6% Median Sales Price $1,000,000 $994,500 0.6% Average Days on Market 27 16 68.8% Sold / List Price % 100.2% 105.8% -5.4% Average Price per SQFT $423 $438 -3.4% Quarter-end inventory 214 93 130.0% OFFERED AT $1,149,000 | JOHNLSCOTT.COM/12947

KITSAP COUNTY

BAINBRIDGE ISLAND

The demand for the island lifestyle on Bainbridge Island remains strong, even as we see a continued intensity adjustment. Buyers have seen some relief as active inventory has increased, yet in several price ranges the pending sales have continued to outpace the new listings coming on the market. As such, Bainbridge Island inventory is still at a shortage up to $3M based on buyer demand.

New listings will inevitably slow in the coming months as we close out the year with fewer people putting their homes on the market during the holiday season which can be a great time to list a property with reduced competition.

2022 Q3 LUXURY MARKET TRENDS Q3 2022 Q3 2021 % Change Number of Sales 71 96 -26.0% Total Dollar Volume $124,807,398 $169,470,533 -26.4% Average Sales Price $1,757,851 $1,765,318 -0.4% Median Sales Price $1,565,000 $1,597,500 -2.0% Average Days on Market 42 36 16.6% Sold / List Price % 100.9% 108.2% -6.7% Average Price per SQFT $596 $581 2.6% Quarter-end inventory 39 10 290.0% The data is for single family residences over $1M in MLS area 170. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed.

OFFERED AT $1,849,000 | JOHNLSCOTT.COM/11536

The data is for single family residences over $750k in Snohomish County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. Q3 2022 Q3 2021 % Change Number of Sales 1,362 1,633 -16.6% Total Dollar Volume $1,436,763,895 $1,621,229,334 -11.4% Average Sales Price $1,054,893 $992,792 6.3% Median Sales Price $962,423 $902,500 6.6% Average Days on Market 24 10 140.0% Sold / List Price % 98.4% 105.5% -6.8% Average Price per SQFT $406 $394 2.9% Quarter-end inventory 856 335 156.0% Q3 SAW A 140.0% INCREASE IN DAYS ON MARKET IN SNOHOMISH COUNTY PENDING | JOHNLSCOTT.COM/47300 SNOHOMISH COUNTY

OVERALL, THE NUMBER OF SALES DECREASED BY 17.9% IN ISLAND COUNTY

2022 Q3 LUXURY MARKET TRENDS Q3 2022 Q3 2021 % Change Number of Sales 119 145 -17.9% Total Dollar Volume $125,670,342 $173,041,371 -27.4% Average Sales Price $1,056,053 $1,193,389 -11.5% Median Sales Price $925,000 $940,000 -1.6% Average Days on Market 21 21 N/A Sold / List Price % 98.3% 104.4% -5.8% Average Price per SQFT $426 $428 -0.3% Quarter-end inventory 133 48 177.0% ISLAND COUNTY The data is for single family residences over $750k in Island County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed.

OFFERED AT $1,375,000 | JOHNLSCOTT.COM/72310

LUXURY WATERFRONT

LAKE WASHINGTON

Q3 2022 Q3 2021 % Change

Number of Sales 28 52 -46.2%

Total Dollar Volume $186,163,000 $276,280,910 -32.6%

Average Sales Price $6,648,679 $5,313,094 25.1%

Median Sales Price $3,697,500 $3,612,500 2.4%

Average Days on Market 27 34 -20.6%

Sold / List Price % 92.6% 97.4% -4.9%

Average Price per SQFT $1,650 $1,588 3.9%

Quarter-end inventory 35 22 59.0%

LAKE SAMMAMISH

Q3 2022 Q3 2021 % Change

Number of Sales 27 28 -3.6%

Total Dollar Volume $70,353,326 $76,562,401 -8.1%

Average Sales Price $2,605,679 $2,734,371 -4.7%

Median Sales Price $2,100,000 $2,197,500 -4.4%

Average Days on Market 26 16 62.5%

Sold / List Price % 98.0% 103.0% -4.9%

Average Price per SQFT $793 $846 -6.3%

Quarter-end inventory 17 8 113.0%

KING COUNTY

Q3 2022 Q3 2021 % Change

Number of Sales 121 193 -37.3%

Total Dollar Volume $390,273,774 $597,533,186 -34.7%

Average Sales Price $3,225,403 $3,096,027 4.2%

Median Sales Price $2,040,000 $2,095,000 -2.6%

Average Days on Market 24 20 20.0%

Sold / List Price % 95.8% 100.6% -4.8%

Average Price per SQFT $986 $1,027 -4.0%

Quarter-end inventory

68 93.0%

The

131

data is for waterfront single family residences and condos over $1M. Lake Washington is MLS areas 510, 520, 380, 390, 710. Lake Sammamish is MLS areas 530, 540. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed.

2022 Q3 LUXURY MARKET TRENDS PENDING | JOHNLSCOTT.COM/12553

FEATURED LUXURY LISTINGS

at this custom-built home on over 3.5 picturesque acres. Sprawling interior features 6 beds, 2 offices, media/flex room, and themed playroom. Immaculate remodeled kitchen boasts Tuscan detailed backsplash, Miele appliances, a spacious walk-in pantry, and quartz countertops. Capacious primary suite with private balcony is perfect for enjoying the spectacular Oregon sunset. Workshop/studio, attached 3-bay garage, RV Parking, and storage shed offer plenty of storage and space throughout. Built to roam outdoors with new decking, built-in firepit, children’s 2-story playhouse, wooded trail, and pasture views. Easy access to Highway 26, Portland Hi-Tech Corridor, and Pumpkin Ridge Golf Course around the corner.

NORTH PLAINS, OR | $1,675,000 | JOHNLSCOTT.COM/44526 16401 NW PUMPKIN RIDGE RD, NORTH PLAINS, OR 97133 Marvel

NATALIE QUANDT (503) 536.5782 nataliequandt@johnlscott.com

custom built modern home, featuring incredible architectural details and elevated finishes that will inspire you. Methodically built with no expense spared. Striking western lake and mountain views from both levels with walls of floor to ceiling windows to capitalize on the stunning sunsets. The great room is one of many with built in rift cut white oak cabinetry that blends seamlessly into the luxury appointed chef’s kitchen. La Cantina glass pocket door extends great room indoor-outdoor entertainment. Lower level can accommodate extended stays with private entrance, family room, kitchenette and 2nd laundry. Striking with very well thought out details this home will leave a lasting impression on all who visit!

2022 Q3 LUXURY MARKET TRENDS BELLEVUE, WA | $3,988,000 | JOHNLSCOTT.COM/45880 2440 KILLARNEY WAY, BELLEVUE, WA 98004 Spectacular,

LYNN DOWNING (425) 269-1136 lynndowning@johnlscott.com

EASTERN WASHINGTON & IDAHO

LUXURY

2022 Q3

MARKET TRENDS

SALES IN COEUR D’ALENE DECREASED 6.9% COMPARED WITH THE SAME PERIOD IN 2021

COEUR D’ALENE, IDAHO Q3 2022 Q3 2021 % Change Number of Sales 244 262 -6.9% Total Dollar Volume $321,390,087 $401,512,829 -20.0% Average Sales Price $1,317,172 $1,532,492 -14.1% Median Sales Price $999,369 $972,500 2.8% Average Days on Market 31 30 3.3% Sold / List Price % 95.9% 94.8% 1.1% Average Price per SQFT $427 $497 -14.1% Quarter-end inventory 441 235 88.0% The data is for single family residences over $750k in Kootenai County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. SOLD | JOHNLSCOTT.COM/22580

2022 Q3 LUXURY MARKET TRENDS SPOKANE COUNTY Q3 2022 Q3 2021 % Change Number of Sales 221 214 3.3% Total Dollar Volume $212,156,153 $204,254,678 3.9% Average Sales Price $959,983 $954,461 0.6% Median Sales Price $875,000 $868,000 0.8% Average Days on Market 25 19 31.6% Sold / List Price % 98.2% 100.5% -2.3% Average Price per SQFT $265 $238 11.4% Quarter-end inventory 252 164 54.0% The data is for single family residences over $750k in Spokane County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. PENDING | JOHNLSCOTT.COM/25104

THE NUMBER OF SALES IN SPOKANE COUNTY INCREASED 3.3% COMPARED WITH THE SAME PERIOD IN 2021

OREGON & SOUTHWEST WASHINGTON

THIRD QUARTER HIGHLIGHTS

In the third quarter of 2022, luxury sales activity in the Portland Metro area has remained steady with high demand and low inventory up to $1.5M. The area has a good amount of inventory compared to similar metro areas, which translates to great opportunities for luxury buyers.

PORTLAND METRO

Number of Sales

Total Dollar Volume

Average Sales Price $1,405,340 $1,361,584

Median Sales Price

Average Days on Market

Average Price

$1,200,000

In Lake Oswego and West Linn, luxury inventory continues to slowly build because of the intensity adjustment in the market combined with higher interest rates. In West Linn and Lake Oswego, inventory is still below pre-pandemic levels for this time of year.

LAKE OSWEGO

2022 Q3 LUXURY MARKET TRENDS Q3 2022 Q3 2021 % Change

201 208 -3.3%

$282,473,341 $283,209,564 -0.3%

3.2%

$1,200,000

N/A

52 58 -10.3% Sold / List Price % 99.0% 101.7% -2.7%

per SQFT $497 $336 48.2% Quarter-end inventory 244 145 68.0%

The data is for single family residences over $1M in Clackamas, Multnomah, Washington and Columbia Counties. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. OFFERED AT $1,300,000 | JOHNLSCOTT.COM/35513

Q3 2022 Q3 2021 % Change Number of Sales 116 163 -28.8% Total Dollar Volume $189,861,320 $277,720,723 -31.6% Average Sales Price $1,636,736 $1,703,808 -3.9% Median Sales Price $1,312,500 $1,449,995 -9.4% Average Days on Market 85 61 39.3% Sold / List Price % 100.2% 99.4% 0.8% Average Price per SQFT $572 $401 42.9% Quarter-end inventory 119 89 34.0%

SOLD

The data is for single family residences over $900k in Bend Oregon. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. Q3 2022 Q3 2021 % Change Number of Sales 407 454 -10.4% Total Dollar Volume $500,940,327 $551,620,567 -9.2% Average Sales Price $1,230,812 $1,215,023 1.3% Median Sales Price $1,045,100 $1,000,000 4.5% Average Days on Market 30 24 25.0% Sold / List Price % 98.7% 100.7% -2.0% Average Price per SQFT $489 $460 6.2% Quarter-end inventory 370 300 23.0% BEND

IN Q3, THE NUMBER OF SALES DECREASED BY 10.4% IN BEND

In the third quarter, luxury inventory in Bend has continued to increase at a slow and steady pace, yet as a desirable community inventory is still at a low level overall and 35% of new listings go under contract within the first 30 days on the market.

Bend is appealing to high-net-worth individuals from a variety of backgrounds who are looking to purchase a primary residence or second home in the city known for its fantastic outdoor recreation opportunities.

2022 Q3 LUXURY MARKET TRENDS

OFFERED AT $1,595,000 | JOHNLSCOTT.COM/49712

THE AVERAGE DAYS ON MARKET INCREASED BY 17.6% IN Q3 IN JACKSON COUNTY

The data is for single family residences over $900k in Jackson County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. Q3 2022 Q3 2021 % Change Number of Sales 94 121 -22.3% Total Dollar Volume $96,404,154 $130,986,554 -26.4% Average Sales Price $1,025,576 $1,082,534 -5.3% Median Sales Price $870,725 $901,000 -3.4% Average Days on Market 60 51 17.6% Sold / List Price % 95.2% 97.4% -2.2% Average Price per SQFT $358 $328 9.3% Quarter-end inventory 225 156 44.0% JACKSON COUNTY OFFERED AT $3,500,000 | JOHNLSCOTT.COM/70997

IN Q3 SALES INCREASED 2.9% IN CLARK COUNTY COMPARED WITH THE SAME PERIOD LAST YEAR

2022 Q3 LUXURY MARKET TRENDS Q3 2022 Q3 2021 % Change Number of Sales 433 421 2.9% Total Dollar Volume $432,995,426 $433,067,740 N/A Average Sales Price $999,989 $1,028,664 -2.8% Median Sales Price $899,000 $890,000 1.0% Average Days on Market 35 24 45.8% Sold / List Price % 99.2% 99.4% -0.2% Average Price per SQFT $414 $291 42.3% Quarter-end inventory 378 241 57.0% CLARK COUNTY The data is for single family residences over $750k in Clark County. Some John L. Scott offices are independently owned and operated. All reports presented are based on data supplied by the NWMLS, RMLS, Spokane MLS, and the Central Oregon MLS. Neither the Associations nor the MLS guarantees or is in anyway responsible for its accuracy. Data maintained by the Associations or the MLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed. OFFERED AT $995,000 | JOHNLSCOTT.COM/12926

MARHABA!

DUBAI IS BOOMING IN BUSINESS, POPULATION AND TOURISM

By LINSEY STONCHUS

By LINSEY STONCHUS

Over the past few decades, Dubai has shaped into a world-class, modern city with top-notch activities, amenities and residences.

A business hub and travel destination, its smart visa program has attracted highly successful individuals. The city, one of the United Arab Emirates, is accessible within a 10- hour flight from 80 percent of all countries worldwide, making it appealing to both out-of-towners and locals. “Dubai was recently selected as the world’s most popular destination in the Tripadvisor Travelers’ Choice Awards 2022,” says Kyp Charalambous, vice president of sales at Atlantis Dubai.

“The Emirate successfully managed a remarkable turnaround amid continuing global challenges, and it is that unwavering determination that will no doubt continue to cement Dubai’s position as the destination of choice for international travelers,” he says. In addition to the recent travel industry honor, Dubai was also considered the number one destination for city lovers, rivaling the likes of New York and London.

Both Atlantis Dubai and Five Hotels and Resorts are debuting new resorts in the coming months: Atlantis, The Royal and Five Luxe, JBR, respectively. Each resort will include high-end residences and penthouses that cater to the lavish lifestyle of Dubai.

GOLDEN DAYS

Jaydeep Anand, chief operating officer and chief financial officer of Five, attributes much of Dubai’s popularity to thoughtful planning from its leadership in infrastructure, health and safety policies that curbed the lull in growth during the worst of the pandemic, and the ease of travel from every corner of the globe.

“Dubai is a thriving, dynamic multicultural hub that stands at the forefront of entrepreneurship, invention and innovation,” Mr. Anand says. “It is a city of endless possibilities, a city of dreams, a city of the future, attracting the very best of investors, creators and artists.”

To attract those very best, the UAE offers a Golden Visa program, which awards short and long-term residency to individuals it identifies as high achievers, such as investors, entrepreneurs, scientists, humanitarians and frontline workers.

Since September 2021, tourist visas were expanded from 30 to 60 days, with the goal of encouraging visitors to stay longer and immerse themselves in the city’s diverse offerings. Additional visas include Retire in Dubai and virtual working programs.

“Golden Visa initiatives and an extremely effective response to the pandemic are the reasons for the Emirates’ real estate industry growth,” Mr. Anand says.

“There is a keen focus on environment-friendly, people-first projects that are being encouraged by the UAE’s commitment to achieving net zero [emissions] by 2050,” he says.

Photo credit: istock.com

Photo credit: istock.com

FOOD FOR THOUGHT

Mr. Anand describes Dubai as a “dynamic melting pot of fashion, art, gastronomy, music, technology and architecture.”

Popular destinations include the Dubai Opera, Dubai Mall — the second-largest shopping mall in the world — and Museum of the Future, which explores how society, namely in Dubai, may evolve in the coming decades.

Tripadvisor’s Choice Awards 2022 also recognized Dubai as the number four destination for food lovers — unsurprising, as the city hosts “more than 12,000 restaurants and cafés that serve food and beverage drawn from the cultures of over 200 nationalities,” Mr. Charalambous says.

“Dubai’s reputation as a global gastronomy hub was further bolstered by the announcement of the launch of Michelin Guide Dubai in June,” he says.

Accordingly, exceptional dining will be found in the upcoming Atlantis, The Royal resort.

“Further enhancing the region’s culinary credentials, the property will introduce 17 restaurants to the destination, including eight by celebrity chefs such as Heston Blumenthal, Gaston Acurio and Jose Andres, as well as a world-first pool beach club by Nobu,” Mr. Charalambous says.

WHAT A WORLD

Mr. Charalambous describes the Atlantis, The Royal as “the most ultraluxury experiential resort in the world,” crafted by leading designers, architects and artists.

“Atlantis, The Royal was conceptualized as the deconstruction of the traditional sculptural towers associated with Dubai, taking the form of individual parallelogram style shapes, each offering their own bespoke experience,” he says of the building’s unique architecture.

The design lends to Atlantis’ prioritization of indoor-outdoor space. Hotel rooms and residences will feature private pools, gardens and breathtaking views.

“Each of these private pools has been carefully positioned, providing maximum frontage across the balcony, giving guests an interrupted view from inside the water,” Mr. Charalambous says. Plus, “the building’s two terraced towers step down towards one another to meet through the sky bridge, which features dramatic views of the Arabian Gulf and the breathtaking scenery of the Palm Island and Dubai skyline,” he says.

Further incorporating nature are the resort’s water features, including its Skyblaze Fountain, the region’s first fire meets water spectacle created by Wet Design, and a lobby sculpture titled Droplets, which represents ‘the first cool drop of rain in a dry desert.’

Five Luxe JBR, a prime beach property, also emphasizes experience, including lively amenities and trending biophilic design. The resort boasts 232 hotel rooms and suites, 212 lavish, serviced residences, multiple culinary and nightlife venues, ReFive Spa and an iconic social pool.

The beach property has uninterrupted sweeping sunset sea views and evenings filled with the glittering lights of the Dubai Eye.

Five has varied, homegrown, award-winning dining venues along with Dubai’s most popular rooftop destination, The Penthouse, and signature concepts such as Skyline Thursdays at The Penthouse and Bohemia on Beach by Five that are singular entertainment extravaganzas with chart-topping DJs for a global audience.

DUBAI OFFERS EVERYTHING desired of an urban center — entertainment, shopping, dining, culture and a flourishing social scene. Upcoming resorts Atlantis, The Royal and Five Luxe, JBR are expanding that scene, with nightclubs, restaurants and other amenities that appeal to tourists and locals alike, and fully lean into luxury living with their high-end finishes, art and thoughtful architecture.

“Dubai’s future, in terms of further development, is extremely bright,” Mr. Anand says.

2022 Q3 LUXURY MARKET TRENDS

Text reproduced with permission from Luxury Portfolio International and Luxury Portfolio magazine. © Luxury Portfolio International. All rights reserved.

@JLSexceptionalhomes @exceptional_homesjlsConnect with us: OFFERED AT $5,750,000 | JOHNLSCOTT.COM/10202

Sammamish, WA

Sammamish, WA

By LINSEY STONCHUS

By LINSEY STONCHUS

Photo credit: istock.com

Photo credit: istock.com