2024 Budget First Reading and Public Hearing

Board of Commissioners Meeting – June 1, 2023

Cathy Ball, City Manager

Board of Commissioners Meeting – June 1, 2023

Cathy Ball, City Manager

• New Towne Acres Elementary

• Safer and secure building

• Additional capacity

• $40 million project total

• $5.4 million for roadway improvements

• $3.6 million for capital equipment

• $30.8 million in Police & Fire

• Body-worn cameras and radios, $475k

• Downtown cameras, $265k

• Funding to JCDA for security at John Sevier, $120k

• Comp and class study, $1.34 million

TCRS Hybrid, $436k

Pay plan adjustment of 3% and Merit adjustment of 2%, $2.54 million

• $5.2 million in funding to over 10 community partners

• $400k addition to EMS and $250k addition to 911 for salary increases and recruitment

• New partnership with the Child Advocacy Center

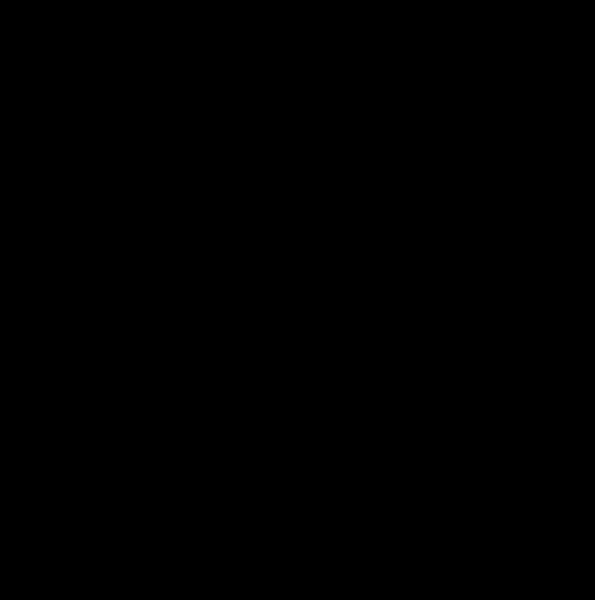

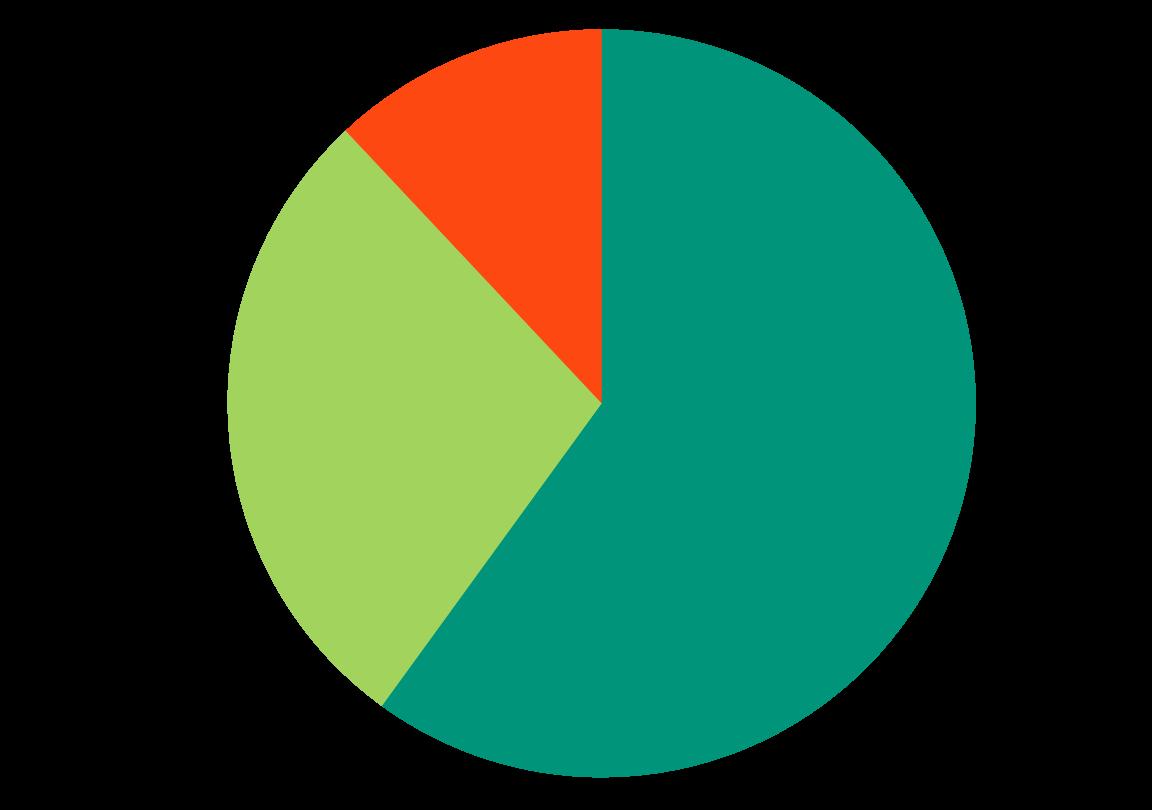

Parks & Rec/Seniors/Golf: 11%

Quasi-Governmental: 9%

Student Transportation: 3%

Other: 1%

Fire: 17%

General Government: 18%

Police: 20%

Public Works: 20%

Million

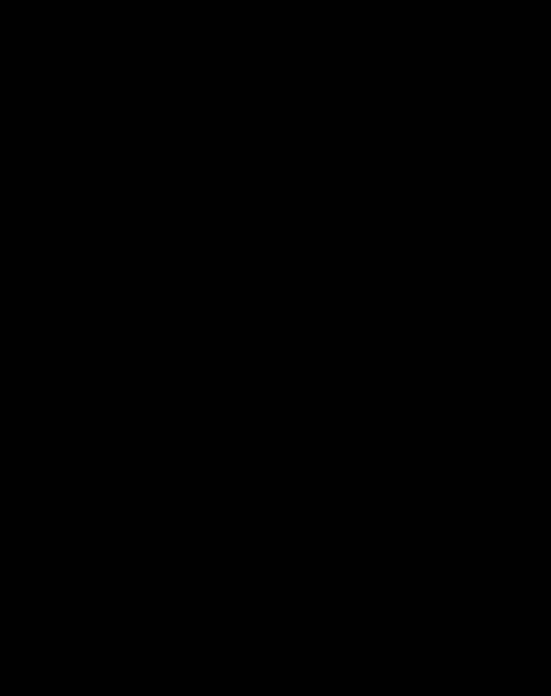

Other Revenue: 7%

Intergovernmental: 12%

Other Local Taxes: 15%

Property Tax : 37%

Local Option Sales Tax: 29%

FY 24: 5% increase over FY 23 projected

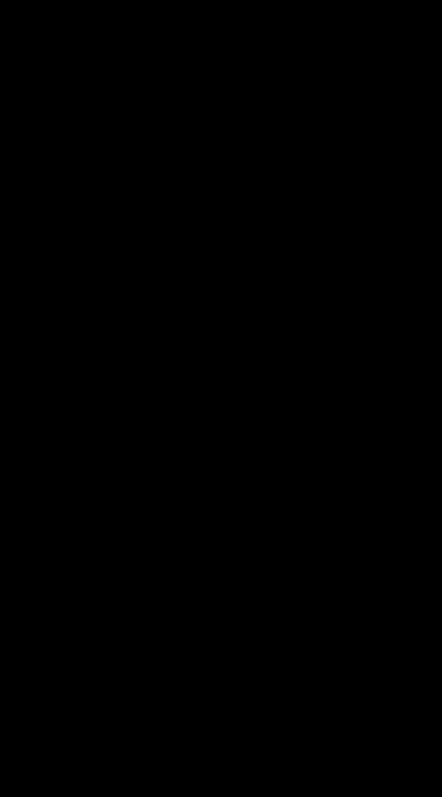

• Raise city property tax by 25¢

• Johnson City – Washington Co.

$1.73 -> $1.98

• Johnson City – Carter/Sullivan Co.

$1.55 -> $1.80

• Tax on a $200,000 home will increase by $10.42 per month

• Construction of a new Towne Acres Elementary

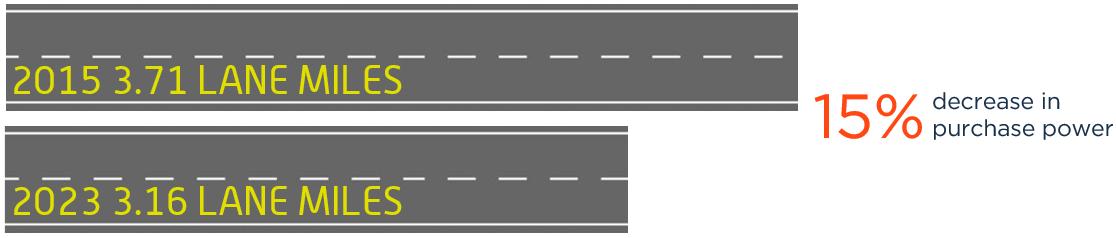

$1.5 million annually for roadway improvements • $650k annually for partnering emergency response services

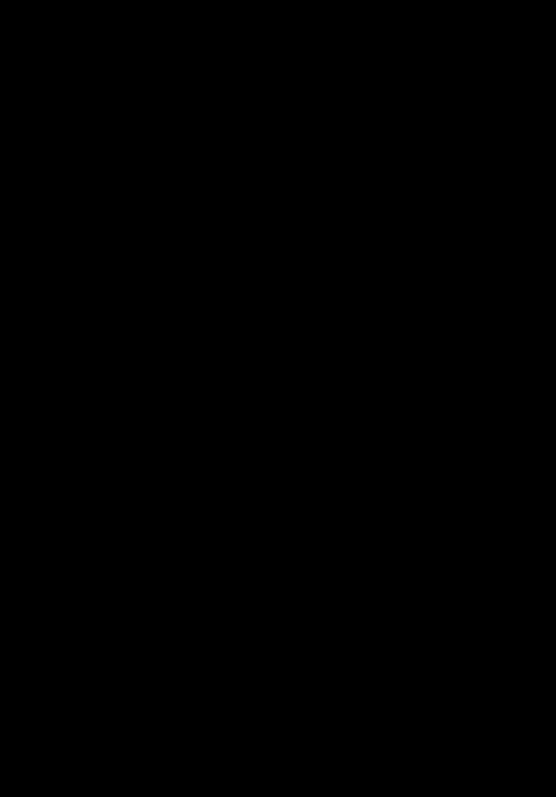

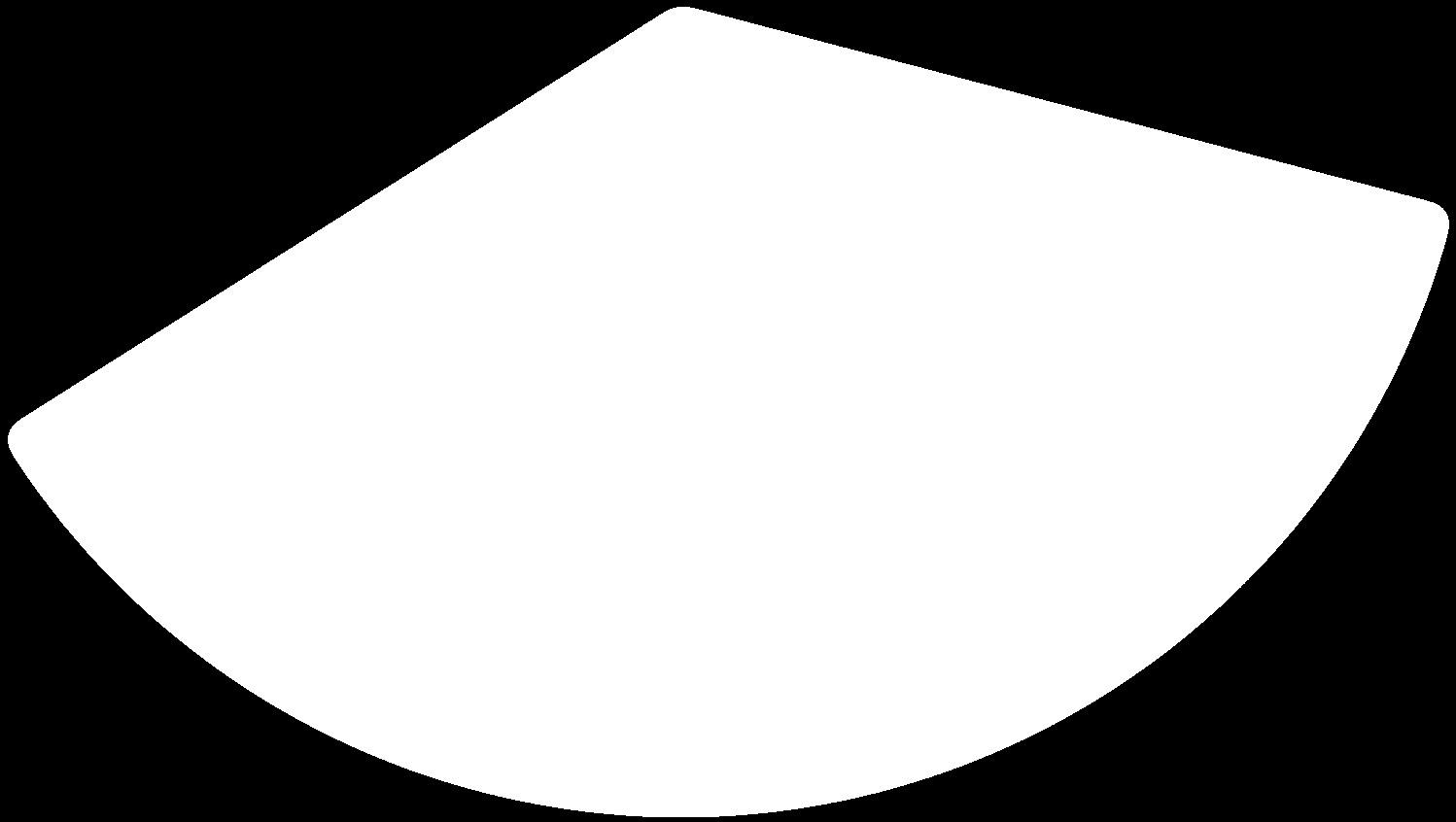

PARTNERING AGENCIES 3¢ (EMS & 911) $639,000

SCHOOLS 15¢ $3,195,000

INFRASTRUCTURE 7¢ $1,491,000

Purchasing power of $1 Million in road resurfacing from last tax increase to today

$323,984,572