KNOCK, KNOCK

80 TH SHOW SPECIAL

SEE PAGE 6

LANDLORD INVESTOR LANDLORD | PROPERTY | INVESTMENT 71ST EDITION | 2023 Find us on...

A warm welcome to the 71ST Edition of Landlord Investor Magazine.

Avery warm welcome to the 71st edition of Landlord Investor Magazine. It’s great to see the sunshine again and I hope I find you well. I'll cut to the chase as there's one subject dominating all conversations in the PRS at present. The long-awaited and much discussed Renter's Reform Bill has finally been published, but with precise detail a little thin on the ground we’ve all been trying to decode what it actually means for the landlord and property investor community. With so many questions our 80th show (yes 80th show) at Old Billingsgate on July 4 hopes to provide some insight. Reaching our 80th show is an incredible achievement and our goal since day one has been to provide an unrivalled platform that educates, connects, and empowers property investors and landlords. See page 6 for full details of what's in store. Back to this issue, we have some fantastic content covering everything from the economic outlook for the rest of 2023, to the boom in co-living spaces, remortgage options and investing in the North East. As always, thank you for reading and I hope to see you at our London Show on July 4th. Wishing you the very best on your property investor journey and don't forget to register if you'd like to attend our summer show on the 4th.

Show Update Knock, Knock. Change is Knocking.

Investment Economic Outlook for 2023: Is there cause for concern?

Investment Co-Living Housing Is Booming –Are you in it yet?

Investment

Why the north east delivers for property investors at all stages of the investment cycle

Investment Facing Your Remortgage: What Are Your Options?

Strategic Spotlight TitleSplit.com

Online Property Spotlight Griffin Property Co.

Investment Spotlight Reloc8 Em

Room Rental Spotlight Cloudrooms

Search landlordinvestmentshow on:

LANDLORD INVESTOR MAGAZINE

Editor Tracey Hanbury

Design

Marc Riley

Photography

Design

Marc Riley

Photography

Aneesa Dawoojee

Printing

IOP Marketing

PLEASE NOTE: Statements and opinions expressed in articles, reviews and other materials herein are those of the authors and not the editors and publishers of LI Magazine. The content of this publication does not under any circumstances constitute investment or legal advice. While every care has been taken in the compilation of this publication and every attempt made to present up-to-date and accurate information, we cannot guarantee that inaccuracies will not occur. LIS Media, Tenants History Limited and our contributors will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through the promoted links. Published by LIS Media, 27 Stafford Road, Croydon CR0 4NG. www.landlordinvestmentshow.co.uk | info@landlordinvestmentshow.co.uk

TH

IN THIS ISSUE 18

06 22 12 16 24 28 32 34

TRACEY HANBURY CO-FOUNDER / DIRECTOR

Team: Donegal GAA

Song: Galway Girl, Steve Earle

Film: Dirty Dancing

Food: Indian

Likes: A busy show - can’t beat it

Dislikes: Rudeness

Fave thing about LIS: Building client relationships

STEVE HANBURY CO-FOUNDER / DIRECTOR

Team: Crystal Palace

Song: Plastic Dreams, Jaydee (Original)

Film: Goodfellas

Food: Indian

Likes: Team meetings in the pub

Dislikes: Bad manners

Fave thing about LIS: Show day (as anything can happen)

KIERAN MCCORMACK SALES DIRECTOR

Team: Manchester United

Song: Bonkers, Dizze Rascal

Film: American Gangster

Food: Indian

Likes: Family time, Man Utd, golf (not necessarily in that order)

Dislikes: Tinned sweetcorn

Fave thing about LIS: No day is the same (hence the song choice)

CHARLOTTE DYE HEAD OF CLIENT RELATIONS & OPERATIONS

Team: Spurs

Song: The view from the afternoon, Arctic Monkeys

Film: E.T

Food: Chinese

Likes: Anything four legged and furry

Dislikes: Clowns and Spiders

Fave thing about LIS: Office cuddles with Ollie

ALICIA CELA HEAD OF ACCOUNTS

Team: Barcelona FC

Song: Hotel California, The Eagles

Film: Shawshank Redemption

Food: Anything Spanish (I'm very biased lol)

Likes: Cooking great food

Dislikes: Liars. Oh, and liver (can't stand it)

Fave thing about LIS: Socialising with the whole team

MARC RILEY CREATIVE DIRECTOR

Team: Letterkenny Gaels

Song: What’s going on, Marvin Gaye

Film: Anything by the Coen Brothers

Food: Sea

Likes: Clean typography

Dislikes: Paywalls and clickbait

Fave thing about LIS: The website

BEN PAYNE SALES EXECUTIVE

Team: Manchester United

Song: Brown eyed girl, Van Morrison

Film: Meet the Parents

Food: Italian

Likes: Hitting a nice drive on the fairway (not!)

Dislikes: Salad

Fave thing about LIS: Meeting new clients and building rapport

OLLIE HANBURY ENTERTAINMENT & SECURITY MANAGER

Team: Crystal Palace

Song: Who let the dogs out

Film: 101 Dalmatians

Food: Roast Dinners

Likes: Walkies

Dislikes: Poo in bags left on branches

Fave thing about LIS: Getting all the attention

SUBSCRIBE FREE TO LANDLORD INVESTOR MAGAZINE ONCE MORE UNTO THE [ DIGITAL ] BREACH LANDLORD INVESTOR LANDLORD PROPERTY INVESTMENT 2021 Find us on... Buy-to-let vs BuildTwo sides of the same coin Opportunity Knocks Once more unto the (digital) breach Why landlords should let to families on benefits BUT ARE LIVE EVENTS NOW BACK ON THE HORIZON? SEE PAGE 6 WRITTEN BY INDUSTRY IN THIS ISSUE... Down, But Not Quite Closed Down technology take the strain What do do if I'm a student landlord? landlords during the pandemic triggered opportunity LANDLORD INVESTOR LANDLORD PROPERTY INVESTMENT 55 EDITION 2020 LANDLORD SURVIVAL GUIDE III & Taxation IN THIS ISSUE...

Meet the team

INTERESTED IN ADVERTISING? FIND OUT MORE 04 LANDLORD INVESTOR 71ST EDITION

WWW.LANDLORDINVESTMENTSHOW.CO.UK Join our morning panel debate Navigating PRS Sea Change hosted by

Russell Quirk

TRACEY HANBURY EDITOR & SHOW FOUNDER

KNOCK, KNOCK.

SHOW UPDATE

06 LANDLORD INVESTOR 71ST EDITION

Reaching 80 shows is quite a milestone and given 2023 also marks our 10th year we are particularly excited about July 4th event. Reform may be on the horizon but our commitment to supporting the property investor community remains steadfast. Since day one the goal of our shows and media has been to provide an unrivalled platform that educates, connects, and empowers property investors and landlords, and as anticipation of the Renters Reform Bill looms it serves as a crucial platform to learn more about impending changes, engage in meaningful conversations, and explore opportunities in the evolving rental market. With the industry's future at stake, our shows stand as a beacon of support for landlords and property professionals alike.

Embracing Change

Change is inevitable, and the private rental market is no exception. The Bill is poised to bring significant transformations, with the aim of improving tenants' rights, increasing security of tenure, and addressing issues such as excessive rent hikes and substandard living conditions. It’s being described by many as the biggest shake-up of the PRS in 30 years, but now it’s been made public what does it really mean for landlords?

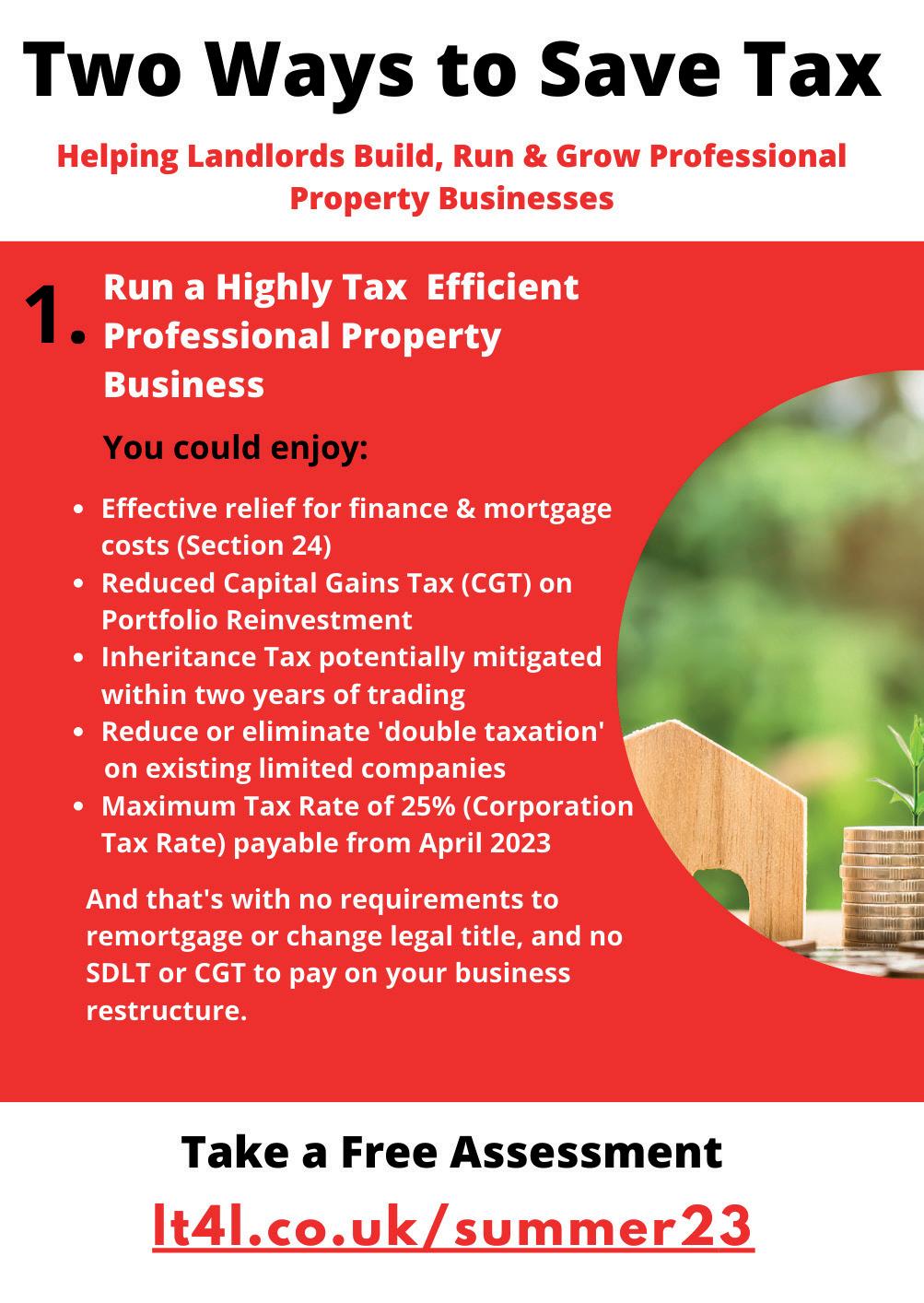

Our morning panel debate (10:15), hosted by property expert Russell Quirk aims to deal with these issues headon with Navigating PRS Sea Change - Charting a course through the storms and Icebergs of a transforming sector. The panel of industry experts includes Chris Bailey (Less Tax 4 Landlords), Ben Beadle (NRLA), Carly Jermyn (Woodstock Legal Services), and Paul

Shamplina (Total Landlord Insurance). Amidst current uncertainties, this is a vital event for anyone with an interest in the above.

We continue the theme of change with our mid-morning panel debate (11:30)

- Alternative Investment Strategies: From HMO to Holiday Lets, where next for your money? The afternoon session (14:30) features the Mennie Talks Podcast Live with Simon Jordan, where HJ Collection CEO, Reece Mennie, discusses everything from property investment to buying Crystal Palace Football Club with serial entrepreneur Simon Jordan.

Networking and Collaboration

By facilitating a platform for making connections our events cultivate an environment of support and collaboration. Attendees can share experiences, learn from one another's challenges and successes, and collectively explore strategies to thrive in the evolving rental market. Such

networking opportunities enable landlords to stay abreast of industry developments, exchange best practices, and build a robust network of contacts. Now, more than ever, it is essential for stakeholders to come together, share insights, and explore innovative approaches and as the Renters Reform Bill looms on the horizon the National Landlord Investment Show assumes a critical role in the rental market.

Secure your place now

With 100+ exhibitors, 50+ expert seminars and 3 panel sessions the National Landlord Investment Show remains the go-to event for seasoned and aspiring landlords, Investors and property professionals. At the time of publishing, tickets are already going like hotcakes. You can find out more and reserve your free show tickets at www. landlordinvestmentshow.co.uk/04-julylondon. I look forward to seeing you there.

SHOW UPDATE

The sound of change may be heard knocking, but the key to surviving any significant shift is adaptation. With our 80th show on July 4 we aim to help our audience steer a course through choppy waters.

Since day one the goal of our shows and media has been to provide an unrivalled platform that educates, connects, and empowers property investors and landlords.

TH 07 LANDLORD INVESTOR 71ST EDITION

NAVIGATING PRS SEA CHANGE

CHARTING A COURSE THROUGH THE STORMS AND ICEBERGS OF A TRANSFORMING SECTOR

The National Landlord Investment Show presents the Reece Mennie Podcast Live with Simon Jordan.

SHOW UPDATE 08 LANDLORD INVESTOR 71ST EDITION

Hosted by Russel Quirk

Carly Jermyn Woodstock Legal Services

Ben Beadle NRLA

Paul Shamplina Total Landlord Insurance

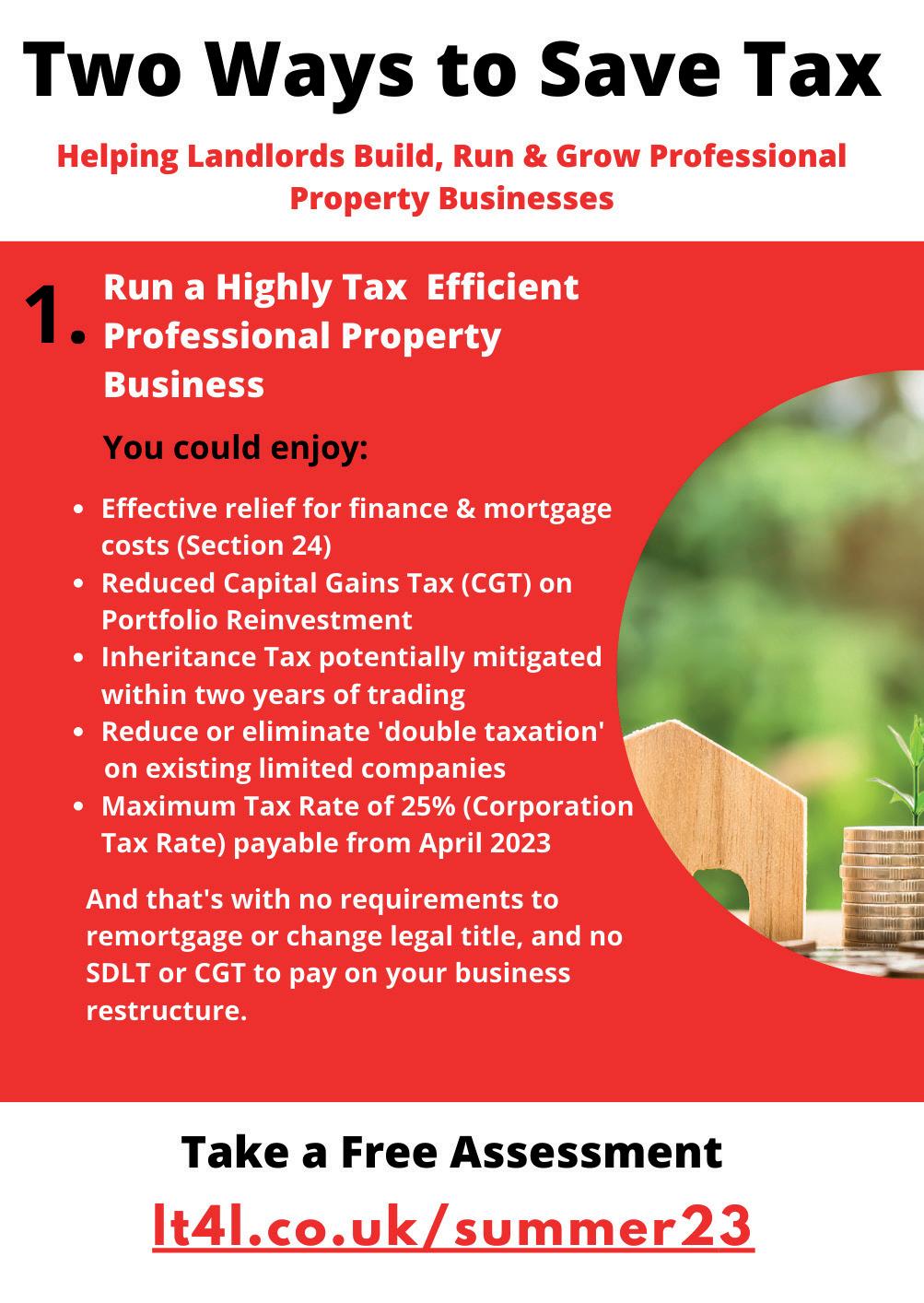

Chris Bailey Less Tax 4 Landlords

Russell Quirk Property Expert

Panel debate sponsored by Less Tax 4 Landlords

SHOW UPDATE CO-SPONSOR MEDIA PARTNER CO-SPONSOR SHOW SPONSOR THANK YOU TO OUR 4 JULY SHOW SPONSORS AND PARTNERS FROM HMO TO HOLIDAY LETS, WHERE NEXT FOR YOUR MONEY?

ALTERNATIVE INVESTMENT STRATEGIES

Ashish Saraff Novyy

propertyCEO Kane

Ben Duncan Host & Stay

Ritchie Clapson

Andrews The VIP Room

Hosted by Ritchie Clapson

REECE MENNIE FOUNDER & CEO, HJ COLLECTION

REECE MENNIE FOUNDER & CEO, HJ COLLECTION

ECONOMIC OUTLOOK FOR 2023: IS THERE CAUSE FOR CONCERN?

INVESTMENT | HJ COLLECTION

12 LANDLORD INVESTOR 71ST EDITION

While no economic analysis currently makes for comfortable reading, it’s important to remember that some of the World’s biggest and most iconic brands have been born out of periods of economic turmoil and although these periods are certainly challenging, they also present many opportunities for growth.

So, what is the current economic outlook for 2023? And what should investors consider when reviewing new opportunities?

Changing Analysis

Rewind to late 2022 and economic analysts, financial institutions and even Government representatives were reporting the likelihood of a long and painful recession, with inflation rates seemingly out of control and the Bank of England predicting a peak base rate in excess of 6%.

Despite this bleak prediction, the UK economy has proven itself to be more resilient than previously thought, with Bank of England Governor, Andrew Bailey, revealing in early February 2023 that the tide has started to turn on inflation and any recession will be much shallower than once thought.

Furthermore, the same report also revealed that the Bank of England base rate is now likely to peak at 4.5%, at least 1.5% lower than anticipated, with rates forecast to fall by the end of 2023installing cautious optimism for the year ahead.

Property Market Predictions

With the rising base rate directly impacting mortgage rates, property

professionals have predicted a drop in the value of both residential and commercial properties UK wide.

However, where some experts have predicted a hefty 20% decrease, others believe the reduction in property value will be minimal and, in some locations with high buyer demand, there will even be an increase - albeit a small one.

While a drop in the property market may result in a decline in current portfolio value, it also presents an opportunity to acquire new sites or development opportunities at more attractive rates.

Here, taking the time to research the property and its potential for return will be key to success – where location, local infrastructure and investment, rental or resale demand and material and build costs should all be taken into consideration.

Despite increasing supply chain costs and reducing property values, it’s important to remember that the demand for housing remains incredibly high - with the latest report commissioned by the NHF and Crisis from Heriot-Watt University identifying a need for 145,000 new affordable homes to be built each year to 2031 in order to meet current levels.

As such, it is unlikely that the UK will experience a housing crash similar to that in the 2008/09 recession, with build incentives and property demand across both the private and public sector keeping such a downturn at bay.

In recognising this, HJ Collection is focused on acquiring 10 – 15 additional sites during 2023, delivering quality but affordable homes to those who

need them in key locations across the UK, while increasing GDV and resulting business growth by 40%.

Aside from highlighting confidence in the market, this approach showcases the importance of attitude and mindset during periods of fiscal uncertainty, where those who retreat from business and investment activities will ultimately experience a decline as a result.

Mindset = Success

The Office for National Statistics have reported that the UK economy showed zero growth in Q4 2022, with GDP declining by 0.5% in December. While this trend is forecast to continue during 2023, the UK economic outlook is not as bleak as once thought, with the property market likely to hold its nerve and more.

However, in any period of economic downturn, the business and investment community always divide into two: Those who ‘go dark’, retreat and focus on maintaining operations Vs those who push forwards, take risks, and commit to growth.

History has taught us time and again that it is the latter group who come out on top, and it will be the same for business leaders, entrepreneurs and investors operating in the current economic climate.

This means there is a choice to make: To stop, retreat out of fear and accept zero growth over the next 12 months or push forward with business and investment opportunities, accepting that it may be more challenging but that there is still opportunity for progression.

Ultimately, the choice is yours…

INVESTMENT | HJ COLLECTION 13 LANDLORD INVESTOR 71ST EDITION

The latest report from the International Monetary Fund [IMF] has predicted that the UK economy will shrink during 2023 as every other major economy is forecast to grow - with the impact of COVID-19, continued inflation and political turbulence caused by Brexit and the conflict in Ukraine taking the brunt of the blame.

G E T T O K N O W U S

" A d o m i n a t i n g d e v e l o p e r w i t h a r o o t e d p u r p o s e t o c o n t r i b u t e t o e a s i n g t h e h o u s i n g s h o r t a g e t h r o u g h g r e e n e r p u r p o s e s . "

H J C o l l e c t i o n a r e a s p e c i a l i s t d e v e l o p e r f o c u s i n g o n P e r m i t t e d D e v e l o p m e n t R i g h t s a n d h a v e b e e n r e v o l u t i o n i s i n g t h e d e v e l o p m e n t s e c t o r . W i t h h u g e U K a n d W o r l d w i d e i n v e s t o r s u p p o r t , i n c l u d i n g s u c c e s s f u l j o i n t v e n t u r e p a r t n e r s h i p s , H J C o l l e c t i o n a r e a b l e t o p r o v i d e a m a n a g e d p o r t f o l i o c o m p r i s i n g o f m u l t i p l e c o n t r a c t o r s a n d d e v e l o p e r s n a t i o n w i d e .

Up to 11% passive returns pa

Fixed-term

Fixed-returns

No fees

FCA-regulated security trustee

UK asset-backed

W W W . H J C O L L E C T I O N . C O . U K

WE ARE A REVOLUTIONARY UK PROPERTY DEVELOPER THAT IS HERE FOR YOU TODAY TO ELEVATE TOMORROW.

AVERAGE UPLIFT TOTAL GDV 46% £76m TOTAL UNITS 650+

CO-LIVING HOUSING IS BOOMING –ARE YOU IN IT YET?

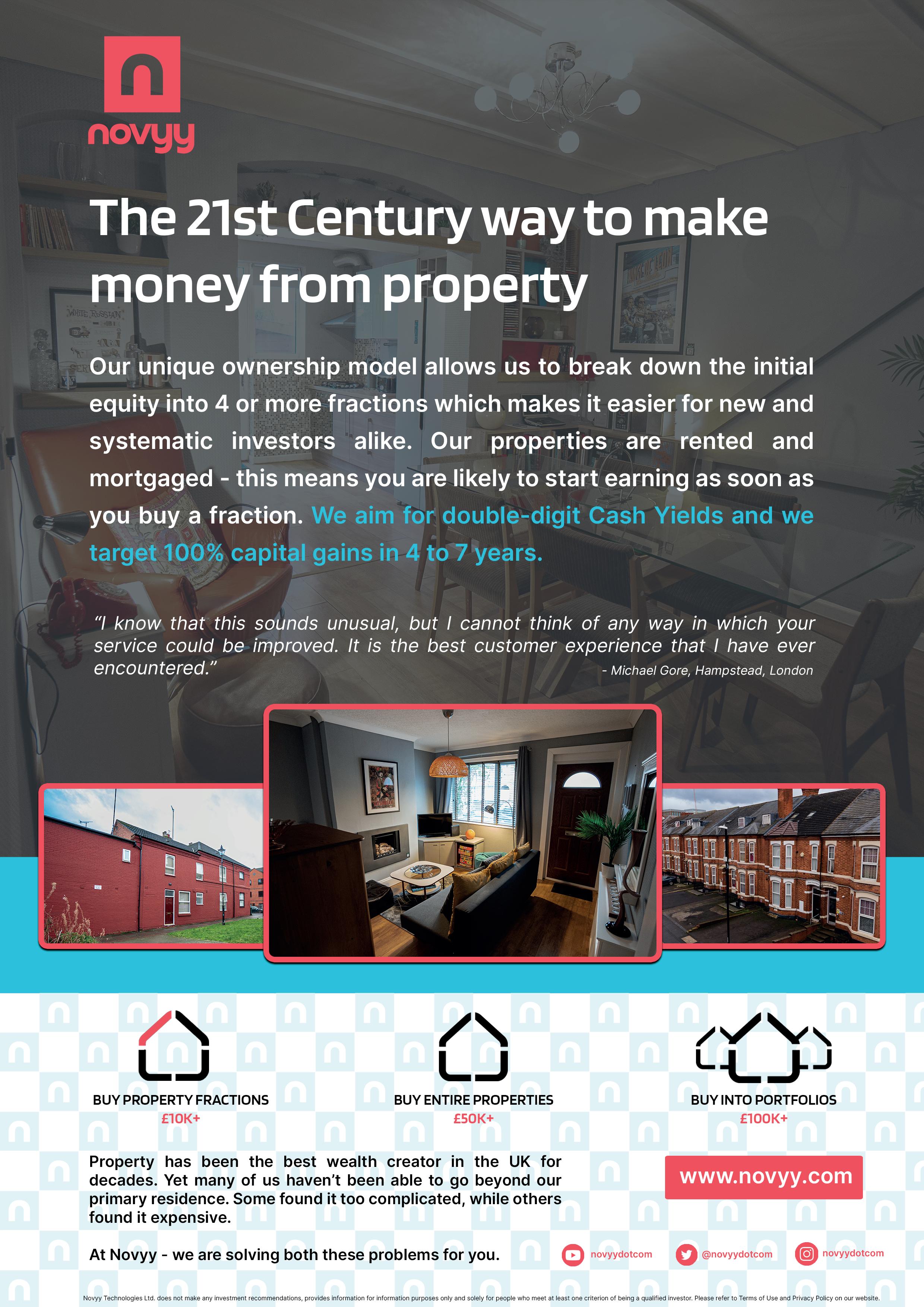

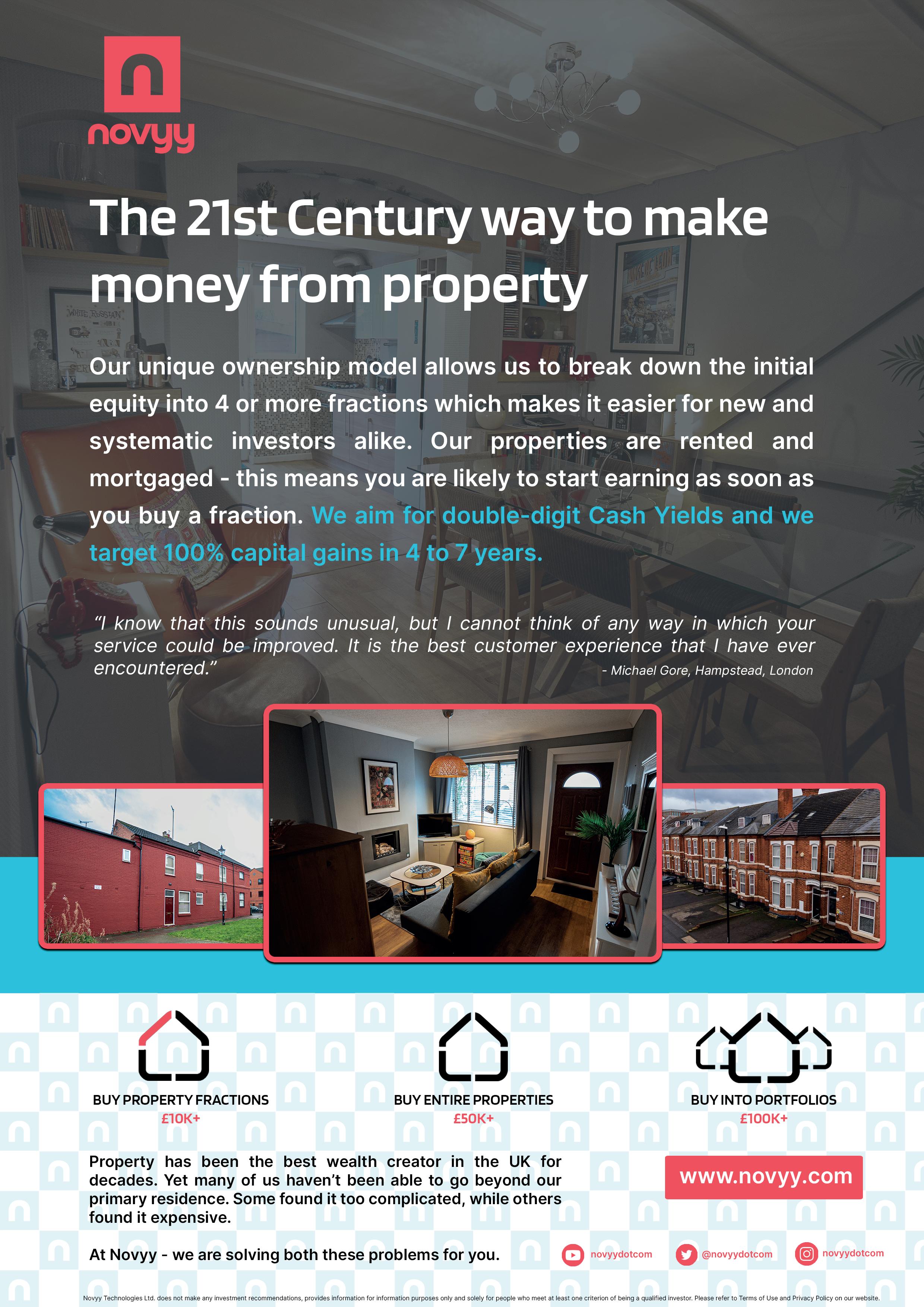

ASHISH SARAFF FOUNDER & CEO, NOVYY TECHNOLOGIES LTD

INVESTMENT | NOVYY LANDLORD INVESTOR 71ST EDITION 16

Are you in it yet?

With every asset class, one must ask for 2 important questions:

(1) Is it sustainable and

(2) How’s the risk-reward relationship?

There has been an exponential increase in demand for co-living assets from students, young professionals, and migrant workers. The students’ desire for the whole university experience since the COVID-19 pandemic questions the viability of online learning which we believe that they cannot replace the former. With limited student budgets and escalating living costs, it is difficult for students to find housing on campus, forcing them to look for alternatives such as HMOs. According to Erudera, there are currently 2.86 million active students who live in a co-living asset. On top of this, there are over 3 million young professionals between the ages of 21 and 30 living in co-living assets across the country. Quite a large market, right?

An average weekly rent of £100 per week from 6 million tenants presents a £600 million weekly market. However, the market is largely fragmented and needs consolidation.

The numbers will only expand each year as more new students seek accommodation in the summer before beginning their university courses in September. Young professionals around the country will always be looking for a place to live based on the relocation needs of potential work prospects. Between 2017 and 2022, international student enrollment increased from 0.45 million to 0.60 million.

What

sets co-living investments apart from the rest of the buy-to-let market?

Co-living yields are higher than vanilla buy-to-lets. While the latter can at best yield 5-6%, co-living continues to deliver 8-10% yields, with better endurance in retaining and increasing this yield over time. But running co-living assets comes with added responsibilities both in form of management & maintenance, as well as regulatory compliances.

Co-living assets like HMOs can be rented to a group of tenants under a single tenancy or be let on a room-only basis. This is the driving force behind higher rental yields. The rental yield is likely to further improve over the years as demand outruns supply.

If you are an investor or a landlord, investing in co-living assets is a no-brainer. And if you are wary of taking on the additional management hassles, you can count on us. At Novyy, we specialise in co-living assets. We continue to acquire such potential assets in university towns outside London. We source, finance, acquire, refurbish (where required) and continue to manage portfolio assets, thus offering a hassle-free investing option for our clients. Our unique ownership model is designed to relieve investors of the daily duties of landlording. Join us and kickstart your investing journey with high-performing assets in an evolving co-living market where you can safely predict multidecade incomes and cash flows from your investments.

Ashish Saraff

Co-living assets like HMOs can be rented to a group of tenants under a single tenancy or be let on a room-only basis. This is the driving force behind higher rental yields. The rental yield is likely to further improve over the years as demand outruns supply.

In recent years, co-living assets have been the greatest performing asset class in the United Kingdom. They deliver superior financial return, albeit there is more work to do than vanilla buy-to-lets. They come in various forms such as PBSA, HMOs and serviced accommodation.

INVESTMENT | NOVYY

17 LANDLORD INVESTOR 71ST EDITION

WHY THE NORTH EAST DELIVERS FOR PROPERTY INVESTORS AT ALL STAGES OF THE INVESTMENT CYCLE

INVESTMENT | HORIZON PROPERTY 18 LANDLORD INVESTOR 71ST EDITION

N S E W

Some investors want the ‘hands-off’ approach. Working with an experienced partner to guide them through the process. Managing everything including sourcing the property, arranging finance, overseeing the legal process, undertaking refurbishment works and retaining the property for management.

Others may want to build their own portfolio but need to source the relevant skills and knowledge to get started.

Alternatively, a joint venture might be the preferred approach. Though often the sums available aren’t extensive enough to take a project forward. This is where investment in the North East becomes a really compelling, viable proposition.

Traditionally, investment in the capital was the panacea for building a profitable property portfolio. However, despite house prices in London typically being the highest in the country, rental yields can be average.

Lower capital entry, higher yields and high demand is turning buyers towards regional areas to achieve maximum results.

Why the North East?

The North East of England, particularly Teesside which covers Middlesbrough, Stockton, Hartlepool, Redcar, Sunderland, Darlington and Durham, poses fresh opportunities for investors.

Here, rental yields are much higher than other parts of the UK. Private rental yields are consistently more than 7% Net. Buy smart and 8-9% is quite normal. Our own serviced

accommodation units across the region currently yield well over 13%.

So far in 2023 mortgage rates have been quite erratic due to market changes and increases with the Bank of England Base Rate. Presently clients are arranging mortgages on a 5-year fix between 4.65% & 5.99%. When calculating yields and income, this needs to be taken into consideration. It’s realistic to expect a return on capital of 10%+ on a mortgage of 75% Loan to Value forecasting.

Take property in London as an example. Many properties yield around 4%. However, the outcome isn't favourable when working with a mortgage rate of 5%.

Here in the North East, the governments’ levelling up programme, alongside projects like Teesworks; the UK’s largest and most connected industrial zone, has had a positive impact on the surrounding real estate market. Good capital appreciation is expected over the coming years despite other parts of the country seeing a downturn.

Getting the Right Support

Setting realistic expectations is a challenge for landlords. Information shared on social media or during unreliable property training courses is often shrouded in misconception and leads to unrealistic confidence.

That’s why choosing the right property investment partner is so important.

Horizon Property service the needs of property investors, at all stages of the investment cycle. We’re a high street estate agent that also source a lot of

stock that may not be on our books, actively investing ourselves in varying forms.

Our management propositions include private rental, serviced accommodation and social housing, or supported living leases.

In 2021 we expanded our wraparound sourcing and management proposition for clients wanting hands-off investment in serviced accommodation.

Today we have three distinct propositions for our clients:

Portfolio Building

Working with clients on a hands-off basis, helping them build a profitable property portfolio that we can manage.

Property Training

2-day training course programme in Middlesbrough. Aimed at clients wanting a ‘hands-on’ approach to building their portfolio. A realistic approach to getting started.

Joint Ventures

Range of options including a mechanism allowing multiple investors to joint venture with us, with investment starting at just £10,000. Similar to crowdfunding, this property bond is backed up by 1st charge security with an FCA Regulated Trustee.

Work with Horizon Property to build your portfolio, upgrade your knowledge or lend capital towards our own projects for a fixed return.

For more information please visit horizonpropertypro.co.uk

INVESTMENT | HORIZON PROPERTY 19 LANDLORD INVESTOR 71ST EDITION

The property investment market in the UK is not a ‘one size fits all’ proposition. As there are distinctive stages of the investment cycle, client needs differ greatly.

With affordable fixed fee pricing, cutting-edge technology and first-rate customer service, Hello Neighbour are a lettings one-stop-shop. Get in touch and join 1000’s of other landlords and tenants on our mission to change lettings for good. contact@hello-neighbour.com +44 (0) 20 8051 9546 hello-neighbour.com CHANGING LETTINGS FOR GOOD

Diversify your property investments and get fixed rate returns from asset classes that would normally only be available to commercial investors. Benefit from high-end and large scale residential assets or the development and trading of famous hotel brands. 01376 319 000 www.propiteercapitalplc.com VCAP Capital Ltd is a limited company (No. 10905629) registered in England and Wales whose registered office is at office Oliver’s Barn, Maldon Road, Witham, Essex. CM8 3HY. VCAP Capital Ltd is authorised and regulated in the UK by the Financial Conduct Authority (FRN: 790419). Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Invest in exclusive residential developments & branded hotels Maximise your returns today.

JENI BROWNE, SALES DIRECTOR MORTGAGES FOR BUSINESS

FACING YOUR REMORTGAGE:

WHAT ARE YOUR OPTIONS?

FINANCE | MORTGAGES FOR BUSINESS

22 LANDLORD INVESTOR 71ST EDITION

Speaking to landlords at industry shows and over the phone, it’s clear there’s real nervousness over the future of their portfolios. Lenders are charging hefty arrangement fees, and many landlords are looking at remortgaging onto interest rates almost double what they’re currently paying.

So, what are you meant to do?

Tough legislation and interest rate uncertainty is nothing new for the sector. That’s not to say it’s not challenging –more that we’ve been here before, and we’ve certainly been through worse.

Over the past eighteen months, you’ll have heard time and time again the importance of refinancing. But with the current financial uncertainty surrounding a remortgage, we're taking it back to basics:

What are the benefits and drawbacks of a remortgage, and are there other options?

A remortgage comes with lots of flexibility. For example, capital raising to help fund home improvements, a deposit on a new property, etc. Dealing with landlords on a daily basis, this is a popular option for property investors looking to reinvest in their portfolios.

And, I know I might seem biased, but I really can’t emphasise enough how helpful a whole-of-market broker can be. Not only do they take the pressure off the application, but the advice can be invaluable to your property investment journey.

Now, the drawbacks. Remortgages can take a while to complete. New mortgage documents and lender assessments have been known to slow down the application process.

It’s important to time it just right so you can fix onto your new deal as soon as your current rate ends – something a broker can certainly help with.

Of course, at the moment, many of you will be facing higher monthly repayments once you’ve remortgaged. Yes, this is not ideal, but the alternative? Moving on to your lender’s SVR. This will likely be much more expensive than a rate you could fix into. There are competitive rates available, and lenders want to and have the appetite to lend. You may even find a deal that better suits your portfolio needs.

Now, if you don’t want to look at a remortgage, you can always choose a Product Transfer. Staying with your existing lender means no additional underwriting and a speedier process. So, if you’re already on your lender’s SVR or left it too late to remortgage, this option could be perfect for you.

However, staying with the same lender means you may miss out on a more competitive deal. You’re also more restricted with a Product Transfer, as you can’t capital raise.

These are just two of the most common options when it comes to refinancing. The benefits and drawbacks will really depend on your individual situation, but please remember you do have options.

There’s a lot of talk at the moment about whether we’ll see a ‘mass-exodus’ of landlords. Honestly, I don’t think we will. Of course, there’s a significant number selling property, but this is not the same as ‘selling up’.

We have seen clients rearranging their portfolios, prioritising their higherperforming properties. But, rental demand remains 10% higher than this time last year. This is 51% above the five-year average, and we’ve seen an annual change in rents of 9.4% across the UK. I think the yields on offer, in many cases, will balance out the higher interest-rate payments.

Landlords are an incredibly resilient group. If last year showed us anything, it’s that property investors can navigate significant challenges, yet still soldier on. Of course, things are not easy at the moment, but I’m confident that we’ll push through, and soon settle into a new normal for buy to let investment.

FINANCE | MORTGAGES FOR BUSINESS 23 LANDLORD INVESTOR 71ST EDITION

There’s no denying that landlords have had it tough lately. The Government finally published its long-awaited – and controversial - Renters’ Reform Bill, and last year’s market uncertainty (see: Trussonomics) has left many unsure about the buy to let sector altogether. And, to top it all off, we’ve had twelve consecutive Base Rate rises.

A remortgage comes with lots of flexibility. For example, capital raising to help fund home improvements, a deposit on a new property, etc. Dealing with landlords on a daily basis, this is a popular option for property investors looking to reinvest in their portfolios.

TITLESPLIT.COM

STRATEGIC SPOTLIGHT | TITLESPLIT.COM

Rachel Knight Property Investor & Title Split Coach

Harriet Dunn Property Lawyer, Consultant & Trainer

24 LANDLORD INVESTOR 71ST EDITION

STRATEGIC SPOTLIGHT

Here are just a few reasons why portfolio developers are diversifying away from HMO’s and single lets. They are securing their long-term equity and cashflow by Title Splitting apartments, commercial properties, and land.

Why is this Title Splitting so profitable?

1. High cash-flow just like an HMO from multiple tenants in the same building.

2. Individually saleable units (at any time you like once split).

3. Tenants pay their own bills saving you money.

4. Higher valuations for your individual units, than for your commercially valued HMOs and blocks. We call this the ‘Split Value’. This means you will get more of your money out of the deal every time (MIMO).

5. MIMO from Title Splits (this is so simple you will not believe it when we share how with you).

6. You can buy one unit and create many units in one go. This grows your cashflow and equity position faster.

7. Title Splitting gives you access to the highest capital growth for your properties year after year.

8. This strategy is perfect for holiday lets.

Why this strategy has been under-utilised for decades?

You may have thought about using this strategy before, but when you find a great property to work with, you suddenly find that the ‘experts’ are not available to help you.

Finding experts for this strategy is nearly impossible. You may even be told that it cannot be done, it is too expensive, why don’t you leave it until you sell it.

NOOOO this is not right! It can be done and TitleSplit.com help our clients to Title Split and make huge profits by doing so. We even introduce our clients to tried and tested power team members.

Who is TitleSplit.com?

Harriet Dunn has over 30-years’ experience as a commercial property solicitor and over 10 years’ experience training property investors how to make money from commercial property. Rachel Knight is a property developer who has been proving that Title Splits make huge profit for portfolio landlords since 2017.

Together, Harriet and Rachel formed TitleSplit.com, so that other developers can learn this very valuable strategy from people experienced in exactly how to do this.

STRATEGIC SPOTLIGHT | TITLESPLIT.COM

Harriet Dunn has over 30-years’ experience as a commercial property solicitor and over 10 years’ experience training property investors how to make money from commercial property. Rachel Knight is a property developer who has been proving that Title Splits make huge profit for portfolio landlords since 2017.

25 LANDLORD INVESTOR 71ST EDITION

Title Splitting (or splitting leasehold from freehold) is the most lucrative strategy being implemented by savvy property developers and landlords in the 2020’s.

Advice & Guidance

NICK

NEALE DIRECTOR, GRIFFIN PROPERTY CO.

ONLINE PROPERTY SPOTLIGHT

GRIFFIN PROPERTY CO.

ONLINE PROPERTY SPOTLIGHT | GRIFFIN PROPERTY CO. 28 LANDLORD INVESTOR 71ST EDITION

Specialists in Online Rental Property Lettings and Management.

With decades of experience in the online sales and lettings sectors, landlords and tenants alike can be assured that they are in capable hands with Griffin Property Co. A small, family business with an emphasis on friendly and responsive customer service, we at Griffin Property strive to provide invaluable peace of mind when navigating the rental market.

The process of letting a property can be challenging as landlords grapple with marketing, finding and vetting the perfect tenant, deposit and rent collection; all whilst complying with current regulations. Offering a smooth and efficient online service, our team seek to take the hassle and unnecessary expense out of property letting with ease and convenience.

The simplicity of the online platform allows landlords to add property details and photographs themselves and tailor their listings to their individual needs. Griffin Property also offer a range of optional add-on features such as tenancy agreements and referencing, professional photography, EPC and gas certificates and collection of rent.

Putting Landlords in Complete Control

Appointing a high street agent to manage rental properties has long been regarded as the traditional route, and while clients are generally assured of good customer service, it can come at a high price. The success of our online process demonstrates that customers do not need to pay over-the-odds for excellent marketing and the foundation of a productive relationship between landlord and tenant.

As each landlord has complete control over the content and photographs in their listings, they can be confident that their property is marketed to their tastes. Landlords can also edit their listings once they are live. Once completed, all of Griffin Property Co’s packages include listings on Rightmove, Zoopla, On the Market and Primelocation, ensuring maximum nationwide exposure.

Guaranteeing Protection of Financial and Personal Data

With cyberthreats at the forefront of public consciousness, it is crucial that companies take digital security seriously. While landlords conduct viewings themselves, Griffin Property Co’s online messaging service allows tenants and landlords to contact each other without disclosing personal information. Feedback provided by prospective tenants is also submitted to the portal and forwarded to landlords, keeping communications secure and separate unless customers choose otherwise.

Both parties can be assured that they will be legally protected, as landlords are required to provide identity verification and proof of address, and Griffin Property Co also offer credit checks and tenant referencing as an optional feature.

Fast, Professional Customer Service

For clients who have not engaged an online sales and lettings agent in the past, they may have concerns about the process. Griffin Property Co’s expertise and invaluable advice is only a phone call or email away, ensuring that clients have the utmost confidence in the process. To discuss your requirements, please fill out our online contact from, send an email to info@griffinproperty.co or call us on 0345 561 0050.

Whether you are a landlord looking to market your property and wishing to explore the packages on offer, or a tenant searching for the perfect rental property, get in touch with Griffin Property Co to find out more.

ONLINE PROPERTY SPOTLIGHT | GRIFFIN PROPERTY CO. 29 LANDLORD INVESTOR 71ST EDITION

As each landlord has complete control over the content and photographs in their listings, they can be confident that their property is marketed to their tastes. Landlords can also edit their listings once they are live.

Lay the foundations for your next property investment. propertydata.co.uk

Download Now: bit.ly/taxplan23

INVESTMENT SPOTLIGHT

RELOC8 EM

INVESTMENT SPOTLIGHT | RELOC8 EM LANDLORD INVESTOR 71ST EDITION 32

There is nothing more appealing than taking your hard-earned money and multiplying it without any extra effort. While the idea does indeed sound quite appealing, it is not as easy as it sounds.

Real Estate investments have always been somewhat of a scary proposition for many individuals. The reason is that many things can go wrong when you purchase property, but investing in the process of leasing property to sublet it to short-term tenants is a very reliable way to invest with a substantial ROI.

We are making your investment process as easy as it sounds

At Reloc8 EM, we offer the most convenient investment package that helps ensure a maximum return on investment. A regular Rent to Rent service requires that you handle all aspects of the property maintenance and marketing in order to have a healthy amount of ROI. When you invest with us for this purpose, we handle all aspects of this process for you to sit back and relax.

We handle the following aspects of your R2RSA investment:

• Guest relations

• Cleaning services

• Marketing services

• Maintenance services

We have the experience to ensure the highest occupancy rates

The only real worry with this investment is to have a lack of guests during the lease period. We have an outstanding 90% occupancy rate across our portfolio. This means that achieving a substantial monthly income is much easier when you are working with an experienced team that knows how to attract high-quality guests.

There are incredible results for those who sign up with us

You can expect a growth rate of around 7.2 times the value of your initial investment. We are constantly looking for ways to upgrade our efforts to help you achieve the financial security and opportunities you want in your life.

Don’t let another year of your life go by without making the life-changing decision of investing your money. It is an undeniable fact that wealth is made by making smart investment decisions. Working with Reloc8 EM ensures that you can invest wisely and without any effort or stressful situations.

Here is a rundown of the 5 most relevant reasons to invest in our services:

1. Passive income generation that ensures you don’t have to move a finger to start earning.

2. Some of the highest rental yields when compared to traditional longterm rental.

3. A more flexible and lower-risk investment for those who are hesitant and fearful.

4. Professional management that works wonders in the short-term rental market.

5. A true hands-off investment that allows you to sit back and collect passive income.

Transparency is a big deal at Reloc8 EM

We want you to feel confident that working with us means working with a reliable and trustworthy service. We will ask you to sign as a witness on all contracts between us and the landlords of the properties you lease. The goal is to ensure that you feel completely safe

and secure in your investment, not only in the financial aspect of it, but also by investing in placing your trust in what we offer.

There is no reason not to start investing this way

There isn’t a single financial entity out there that can offer an opportunity as safe, hassle-free, and massively successful as this one. This is all backed by a fully committed team that has the experience to ensure a smooth process. One that requires no effort on your side.

Visit the link below and find out how you can get started with a very accessible one-time upfront investment! www.reloc8-em.co.uk

Warning: Statements and opinions expressed in articles, reviews and other materials herein are those of the authors and not the editors and publishers of LI Magazine. The content of this publication does not under any circumstances constitute investment or legal advice and the investment strategies discussed may not be suitable for all investors. Investors should make their own investment decisions based upon their own financial objectives and financial resources and, if in any doubt, should seek advice from an investment adviser. Past performance is not a reliable indicator of future performance.

INVESTMENT SPOTLIGHT | RELOC8 EM

People all over the UK are investing in R2RSA to get outstanding results with a high ROI!

A regular Rent to Rent service requires that you handle all aspects of the property maintenance and marketing in order to have a healthy amount of ROI. When you invest with us for this purpose, we handle all aspects of this process for you to sit back and relax.

33 LANDLORD INVESTOR 71ST EDITION

CLOUDROOMS

LANDLORD INVESTOR 71ST EDITION 34

ROOM RENTAL SPOTLIGHT | CLOUDROOMS

ROOM RENTAL SPOTLIGHT

Our mission is to make property management a brilliant experience for landlords. We understand the challenges they face when renting and managing properties, and we aim to provide a hassle-free solution that maximizes their returns without all the stress and time-consuming tasks.

Renting out your property can be an incredibly timeconsuming and challenging task, leaving you feeling overwhelmed and burdened. That's where CloudRooms comes in.

We offer a hassle-free solution that allows landlords to maximise their returns whilst minimising stress.

At CloudRooms we offer three immediate benefits:

1. Our Guaranteed Rent Promise, that offers immediate financial peace of mind.

2. Our tenant verification process, which secures only the best tenants for your property.

3. Our 24/7 Support & Maintenance teams, who guarantee that your property is cleaned and your tenants are cared for.

Experts in HMO (House in Multiple Occupation) conversion

CloudRooms can transform your property into a higher-yielding HMO

asset in just seven days, at absolutely no cost to you.

Our team of experts has already successfully converted more than 100 locations into thriving HMOs, employing tried and tested best practices that comply with all council-specific regulations.

CloudRooms Online Platform

At Cloud Rooms, we leverage a stateof-the-art proprietary online platform, designed to streamline property management.

Our platform offers a comprehensive view of your CloudRoom rental income, whilst simplifying time-consuming activities, such as dealing with utilities or council taxes.

Join CloudRooms today, and let us revolutionise your property management experience.

Say 'Goodbye' to stress and uncertainty, and say 'Hello' to a hasslefree future.

Visit us at www.cloudrooms.co.uk

ROOM RENTAL SPOTLIGHT | CLOUDROOMS 35 LANDLORD INVESTOR 71ST EDITION

Our team of experts has already successfully converted more than 100 locations into thriving HMOs, employing tried and tested best practices that comply with all council-specific regulations.

GUARANTEED HIGHER RENTS FOR HMO LANDLORDS We call that the Cloudrooms Promise. You can call it real peace of mind. Cloudrooms landlords enjoy fantastic benefits: expert advice, HMO licensing support, verified tenants, guaranteed rents, higher returns and no maintenance, services or cleaning headaches. CLOUD ROOMS E: JOIN@CLOUDROOMS.CO.UK WWW.CLOUDROOMS.CO.UK/JOIN Google Reviews 4.7 “Cloudrooms has effectively and efficiently rented out my property for years now.” Emily Apple JOIN TODAY FOR A GUARANTEED £3,450* HIGHER RENT RETURN * Please visit www.cloudrooms.co.uk/termsandconditions for full details.

EXHIBIT WITH US IN

EXHIBIT WITH US IN 2023 code to find out more

Scan

2023

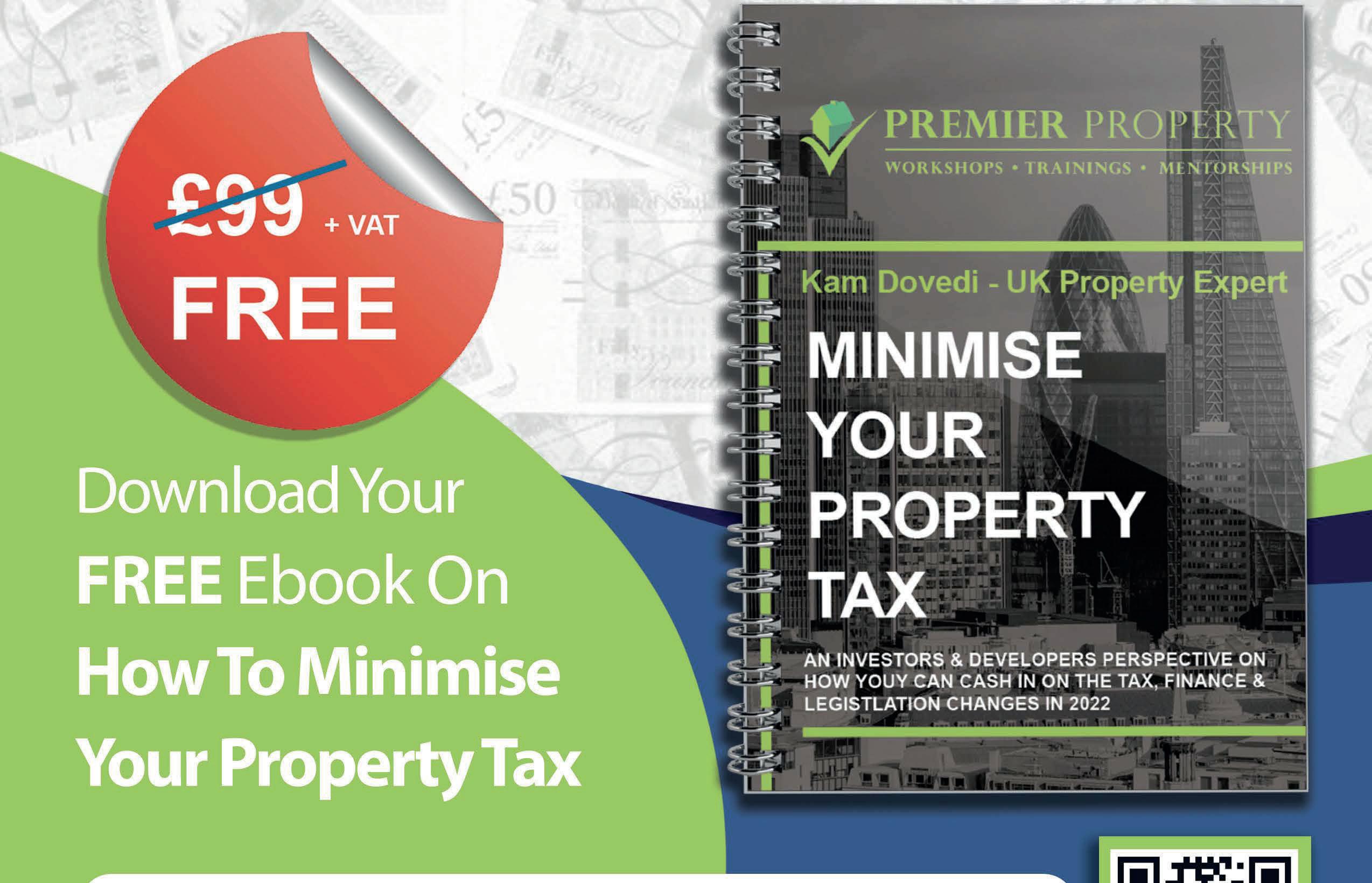

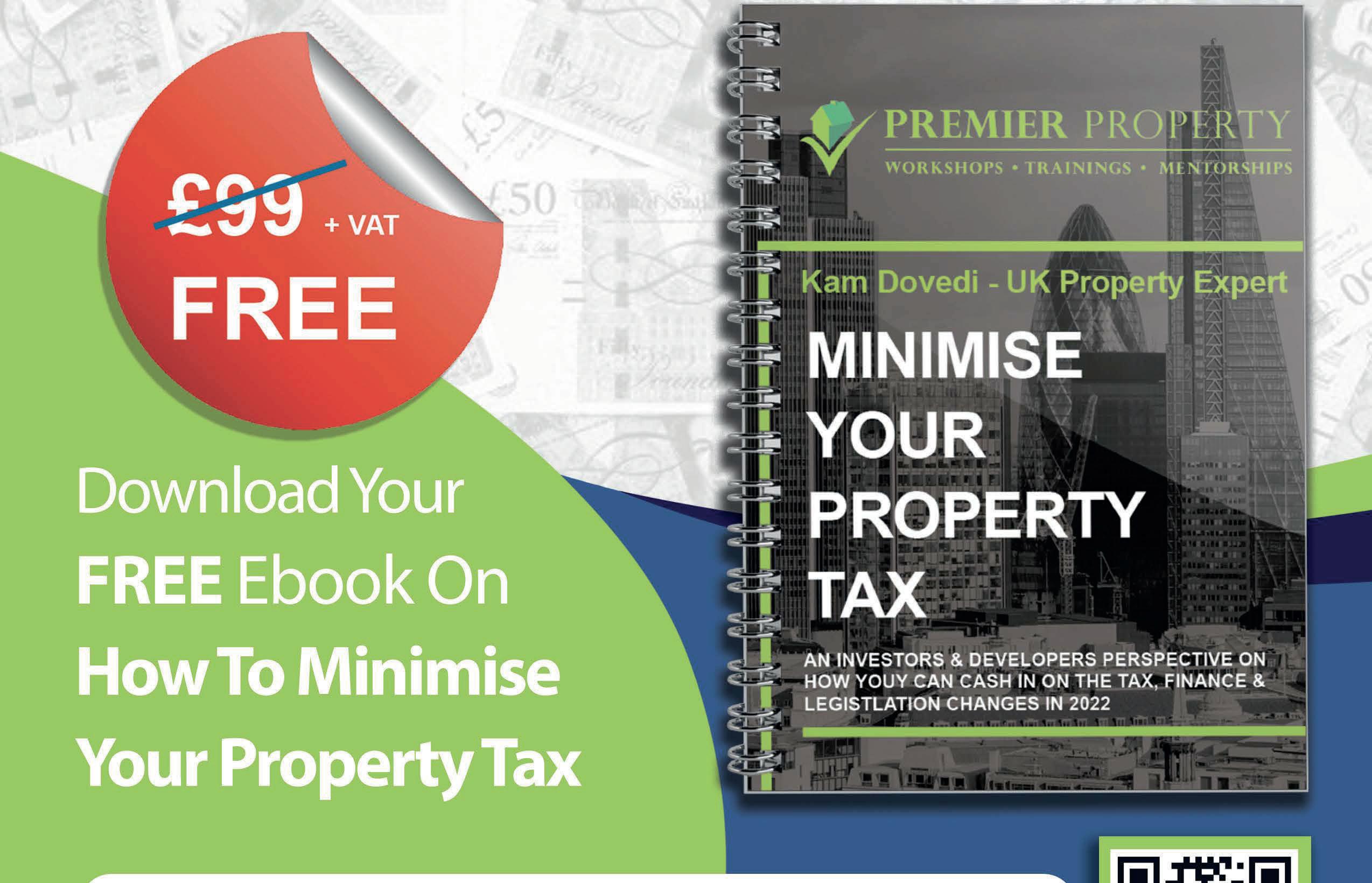

WITH OUR FULLY MANAGED SERVICE YOU’LL BE ABLE TO ENJOY YOUR HOLIDAY HOMES EARNINGS STRESS

FREE.

Our unique, flexible and millennial approach to managing and marketing your property will ensure you reach a growing global audience quickly and effectively. We know that our proven methods can increase your revenue, improve your guest satisfaction and improve the profitability of your holiday let property.

Rated exceptional by thousands of guests.

hostandstay.co.uk

Do you need a rebuild valuation for your buildings insurance?

A Reinstatement Value is what it would cost to entirely replace your property in a total loss scenario. This figure forms the basis from which your insurance premium is calculated.

Without an accurate Reinstatement Valuation, your entire buildings insurance may be inaccurate. Set it too high and you could be overpaying on your insurance premium. Too low and your insurer may not fully cover the cost of a claim in the event of a loss.

How we can help

BCH have been supporting landlords to accurately insure their investment properties since 2006. RICS regulated, BCH are experts in this field. Getting a valuation needn’t be costly or time-consuming; our remote solution, Benchmark by BCH is an eValuation service that promptly and accurately provides a Reinstatement Valuation.

Benchmark by BCH is suitable for single buildings with a maximum current sum insured of £5m and a maximum listing of Grade II. For all instructions outside these parameters we recommend an attended Reinstatement Cost Assessment.

To instruct a Benchmark eValuation of a property today, simply scan the QR code or visit bch.uk.com. Get your eValuation today Only £125 + VAT

WWW.LANDLORDINVESTMENTSHOW.CO.UK JOIN THE UK’S NUMBER ONE LANDLORD & PROPERTY INVESTMENT SHOW IN 2023 Find us on... FREE ADMISSION OLD BILLINGSGATE LONDON 4 JULY OLD BILLINGSGATE LONDON 14 MARCH OLD TRAFFORD MANCHESTER 10 OCTOBER ELSTREE DOUBLE TREE N LONDON/HERTS 27 SEPTEMBER ASTON VILLA FC BIRMINGHAM 17 MAY OLD BILLINGSGATE LONDON 1 NOVEMBER FIND OUT MORE / EXHIBITOR ENQUIRIES:

Design

Marc Riley

Photography

Design

Marc Riley

Photography

REECE MENNIE FOUNDER & CEO, HJ COLLECTION

REECE MENNIE FOUNDER & CEO, HJ COLLECTION