Investment is more than just a financial term—it’s a mindset, a commitment to dedicating time, energy, and resources toward something we believe will create lasting value. Whether it’s investing in our community, relationships, health, or financial future, each choice we make has the power to shape a better tomorrow.

One of the most rewarding investments we can make is in the place we call home. Supporting local businesses, participating in community initiatives, and volunteering our time strengthens the fabric of our town, creating a thriving environment for all. On a more personal level, investing in the people around us— our family, friends, and neighbors—builds meaningful connections that enrich our lives in ways that go far beyond material wealth.

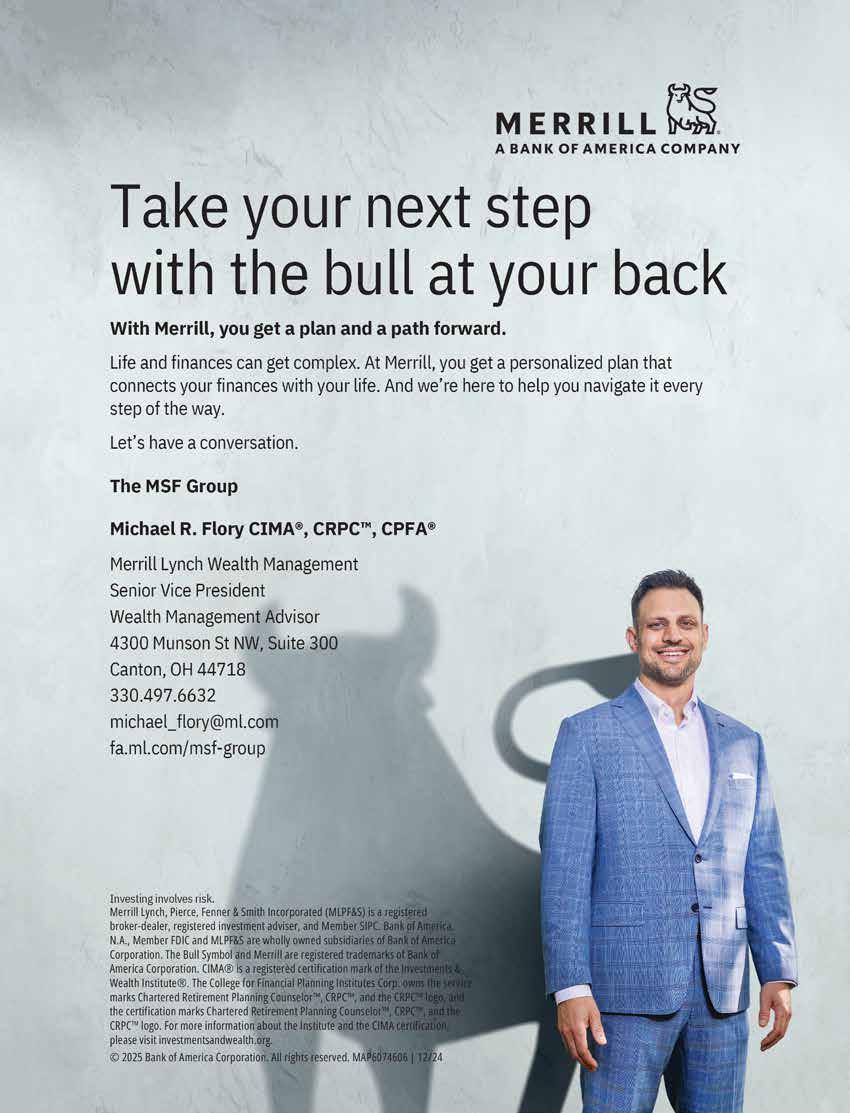

This month’s issue highlights the many ways we can invest in ourselves and our surroundings. Infinity Homes Remodeling shares how transforming your home is an investment in happiness and well-being. Michael Flory provides valuable insights into retirement spending, ensuring financial security for the years ahead. And Canton Regency showcases how investing in a supportive and enriching lifestyle benefits our senior community.

We also celebrate the power of collective giving in our City Scene feature, highlighting the Wind Chime Ball hosted by the Josette Beddell Memorial Foundation. This event raises crucial funds and awareness in the fight against cancer, reminding us of the profound impact we can have when we come together for a cause.

Personally, I’ve always believed that some of the best investments are the ones that don’t come with a dollar sign. The time spent with loved ones, the effort put into personal growth, and the energy devoted to making a difference—these are the investments that pay the greatest dividends. Whether it’s a heartfelt conversation, lending a helping hand, or taking that first step toward a dream, these moments shape our legacy.

No matter how you choose to invest—be it in your home, your future, or the people you cherish—I hope this issue inspires you to pursue what brings the greatest fulfillment. Here’s to making meaningful investments that enrich our lives and community.

Warmly,

NICOLE CERTO, PUBLISHER

PUBLISHER

Nicole Certo | nicole.certo@citylifestyle.com

CONTRIBUTING WRITER

Christian Williams

CONTRIBUTING PHOTOGRAPHER

Alexa P Artistry

CEO Steven Schowengerdt

COO Matthew Perry

CRO Jamie Pentz

CTO Ajay Krishnan

April 2025 Visit our Instagram

VP OF OPERATIONS Janeane Thompson

VP OF SALES Andrew Leaders

AD DESIGNER Josh Govero

LAYOUT DESIGNER Kelsi Southard

QUALITY

Learn how to start your own publication at citylifestyle.com/franchise.

Y O UR

DO YOU HAVE A RETIREMENT SPENDING PLAN?

ARTICLE BY MICHAEL R. FLORY | PHOTOGRAPHY PROVIDED

PL A N

You have worked hard, saved and invested, now what?

Saving and investing are just the first steps in retirement planning — creating a strategy to draw down that money is the next challenge. These tips from Bank of America can help.

You have worked hard, saved and invested — all with the goal of having enough to live the retirement life you want. As the day approaches, you may be thinking, “Now what?” How much of your savings can you afford to spend if you want that money to last as long as you live? Which accounts should you consider drawing from first: your 401(k), IRA or your taxable accounts?

You may have heard broad guidelines about the “right” amount to withdraw each year and the optimal order for tapping your accounts. While these rules of thumb contain kernels of truth, they generally gloss over the fact that everybody’s

retirement is different — and much too important to be guided by a formula. “You need to come up with a plan for drawing down your income that is based on your own unique priorities and goals,” says Ben Storey, director, Retirement Research & Insights, Bank of America.

As you consider how you will create a retirement income, start with these questions:

1. HOW

According to one oft-quoted rule of thumb, retirees should tap 4% of their savings annually. But that rough guideline does not consider variables such as the age at which you retire and how your income needs will change. “The younger you are when you retire, the lower the percentage you will be able to spend each year if you want your savings to last,” Storey says.

Your withdrawal rate is in some ways a reflection of your confidence that your investments will continue to grow. If you are comfortable investing more aggressively, you might decide to take a little more income each year. If you prefer less risk, you might opt for a lower withdrawal rate. It is important to remember that investing involves risk. There is the potential for losing money when investing in securities.

Other factors may come into play. Some years you might withdraw more for a long-cherished goal like travel. Or you might have healthcare needs that dictate a higher spending rate. Your plans should be flexible enough to accommodate a variety of needs.

The conventional wisdom goes that you should withdraw from your taxable accounts first, then tax-deferred, then tax-free. That is because the money you take from a taxable account (such as a brokerage account) is likely to be taxed at the rate for capital gains or qualified dividends, which varies depending on your tax bracket. It is generally a lower rate than what you would pay on ordinary income from 401(k) plans, traditional IRAs and other tax-deferred savings. “Tapping taxable accounts first gives the other accounts the potential to continue growing, shielded from current taxes,” Storey says.

Even if you are not ready to start withdrawing funds from your traditional IRAs and qualified retirement plans, the government generally requires you to do so once you reach age 73. The amounts of these required minimum distributions, or RMDs, will vary from year to year, depending on your retirement account value and your age. Failing to take an RMD, or taking too little, can result in costly additional taxes. An exception may apply if you are still working. Review your employer’s plan highlights and talk with your tax advisor about your situation. Roth IRAs and, as of 2024, Roth 401(k)s do not have RMDs, so you can keep money in your account for your lifetime.

While these guidelines offer a starting point, Storey says, “it is helpful to have some flexibility in the way your income might be taxed.” For example, if you fall in a higher-than-usual tax bracket one year — you sold a business at a profit, say — you might like to have the option to draw federal (and potentially state and local) tax-free income from a Roth account.

You can begin receiving Social Security retirement benefits as early as age 62 but waiting to claim until your full retirement age (66 or 67, depending on the year you were born) or even age 70 will give you a larger monthly payment and future survivor benefits for your spouse may be greater. But, Storey notes, “after considering all of their options, some people might decide not to wait.”

If you have a health condition that could limit your life span, for instance, it could make sense to start collecting Social Security income immediately after carefully considering how spousal survivor benefits may be impacted.

As you work out a retirement income plan, “it is important to work with your financial advisor and your tax advisor to know all your options,” Storey says. “You can get a general idea from rules of thumb, but you are different from anyone else, and your personal situation needs to be factored into any thoughtful decision.”

For further information or questions, please call Michael Flory at Merrill Lynch at the Canton office. He can be reached at 330-497-6632 or email at michael_flory@ml.com

Investing involves risk. There is always the potential of losing money when you invest in securities.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

This material should be regarded as educational information on Social Security and is not intended to provide specific advice. If you have questions regarding your particular situation, you should contact the Social Security Administration and/or your legal advisors.

Banking products are provided by Bank of America, N.A., Member FDIC, and a wholly owned subsidiary of Bank of America Corporation ("BofA Corp.").

Merrill Lynch, Pierce, Fenner & Smith Incorporated ("MLPF&S" or "Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of BofA Corp.

MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp.

Investment products: Are Not FDIC Insured. Are Not Bank Guaranteed. May Lose Value

Working out of Massillon, Ohio, Brian, along with his sister Nicole and his daughter Tori, with assistance from their lifelong friend Jason, Infinity Homes & Remodeling is here to allow you to invest in your happiness and allow for you to achieve that goal of wanting to turn your house into your home. While this business is 1st generation-owned, it is backed by generational knowledge of fathers, uncles, grandfathers, and great-grandfathers who have worked along the East Coast in businesses that have long existed today. Since the COVID-19 pandemic, people have taken a good look at their homes and how they are styled, realizing that being home more and more allowed ideas of change to fester. They began to get back into projects that they’d put off for so long, becoming more active in investing time and money into getting those remodeling/ redesigning projects completed. Infinity Homes & Remodeling is there to assist and help you achieve those goals. Specializing in remodeling kitchens, bathrooms, basements, and more, they work with you every step of the way. Starting with meeting with the customer and discussing what they’re looking for, budget, and setting

project dates, they ensure that your investment will lead to you coming home and feeling happy about your new home. However, suppose you’re unsure what you want in your remodel. In that case, luckily, Infinity Homes & Remodeling has plenty of images from past projects, as well as inspirational photos on Pinterest and Houzz. They show customers to give them ideas and allow customers to create vision boards.

Infinity Homes & Remodeling wants customers to be able to invest their happiness into their projects, but what exactly does that mean? According to Brian and his own experiences, he believes that “it’s fixing something that customers have always disliked or that they feel is outdated in their house.” For example, when it comes to a kitchen remodel, you’ll want to change the flow, and for that, the layout of the entire kitchen will need to be remodeled and not just the current layout being updated. “I pinch myself every time I walk into my kitchen, wondering why I didn't do this sooner,” says Brian. Infinity Homes & Remodel wishes to bring your investment and that same happiness into the remodel. Allowing the flow and feeling of entering your new home.

Working within an hour of their location, Infinity Homes & Remodeling, along with their experienced subcontractors and suppliers in many areas of the remodeling scene, are here to ensure that you can end your work day, wake up, or simply sit around a newly remodeled home or section of your home and know that your happiness has been entrusted and invested properly and efficiently.

For more information regarding Infinity Homes & Remodeling, please visit www.infinityhomesremodeling.com to view their previous projects, learn more about their services, and meet the team.

SENIORS AT CANTON REGENCY

SENIOR LIVING ENJOY NEXT CHAPTER IN LIFE

ARTICLE PROVIDED PHOTOGRAPHY BY ALEXA P ARTISTRY

When you think of senior living, many images—and sometimes myths—come to mind. But Lisa Massey, Executive Director of Canton Regency Senior Living, offers a comparison that resonates with many of the staff and residents in the community: it feels like a vibrant university campus.

“The minute you walk in, you feel the life,” Massey says. “There is a large, welcoming atrium entrance, and you notice residents going about their business— some headed to exercise classes, others traveling down a hall for coffee at the café, some moving to the chapel for a service, and others just lounging by the fireplace or in other comfortable nooks, catching up on their reading or chatting with neighbors.”

Since opening more than 30 years ago, the 232-apartment Canton Regency Senior Living has provided seniors in Jackson Township and Stark County with a continuum of housing options, including independent living, assisted living for those who need a little support with daily activities, and specialized dementia care. The community even offers short-term stays for individuals recovering from an injury or surgery.

“THE MINUTE YOU WALK IN, YOU FEEL THE LIFE.”

What makes Canton Regency much like a college campus is its lively environment—a place designed to foster a sense of community, provide amenities, encourage new friendships, and promote social engagement. Similarities include:

• Community & Social Life – Canton Regency offers a vibrant social environment with clubs, group activities, and communal spaces where residents connect.

• Health & Wellness Support – The most popular offerings at Canton Regency are the health and wellness programs. The community partners with an

experienced vendor to deliver a mix of programs that promote flexibility, aerobics, balance, and function.

• Amenities & Services – Canton Regency provides residents with an excellent dining facility, fitness center, library, and daily programs focused on lifelong learning—much like a university.

• Housing – The community features private apartments, studios, and common areas, including outdoor spaces, gardens, and a courtyard.

• Planned Activities & Events – Residents enjoy vibrant social and activity calendars, with classes, lectures, live entertainment, and excursions, including a

grand annual party to coincide with Pro Football Hall of Fame festivities.

• Transportation & Walkability – Canton Regency supports residents with transportation services, walkable paths, and connections to local Canton life.

Two years ago, Canton Regency underwent a multi-million-dollar renovation to modernize the campus. The independent living option offers residents a choice of one-bedroom, two-bedroom, and studio apartments. Residents love leaving homeownership duties behind, enjoying three meals a day in a restaurant-style venue, and having free time to pursue hobbies and passions. As one couple remarked, “It’s like living on a cruise ship every day.”

Assisted living residents have a choice of one-bedroom, two-bedroom, and studio apartments and receive support with activities of daily living, medication management, and more from professional caregivers. “Since I moved here, I have gotten a lot stronger through the programs available,” says resident Karen Myers.

Residents in specialized memory care residences receive professional, resident-centered care in a safe, loving environment. They also enjoy purposeful activities and personal attention tailored to the stages of memory loss.

Massey, who has been the executive director at Canton Regency for three years, is surrounded by an experienced team— some with decades of expertise in senior living. In fact, Receptionist Wanda Marshall has anchored the front desk with a friendly face for almost 30 years. “It’s this depth and breadth of experience that helps set Canton Regency apart,” says Massey.

ARTICLE BY ANGELA BROOCKERD

PHOTOGRAPHY BY

JANIE JONES

Boost your health by adding a generous serving of fresh greens to your daily diet. While both cooked and raw vegetables offer health benefits, consuming them raw often provides the most nutrients. Raw greens are rich in fiber, antioxidants, and essential vitamins, helping to lower inflammation and reduce the risk of disease.

Dandelion greens are a nutritious and easy addition to any meal, perfect for salads or cooked dishes. They are rich in vitamins A, C, K, chlorophyll, and fiber, making them a great choice for digestion and overall health. Their light flavor and texture enhance salads and sandwiches.

Broccoli is often hailed as a nutritional powerhouse, packed with a variety of vitamins and minerals that support overall health. Known for being high in vitamins A, C, and K, it also contains important minerals like potassium, iron, and calcium. In addition, it’s a rich source of beta-carotene, flavonoids, and fiber. Whether raw or cooked, broccoli is an excellent choice for immune system support, making it one of the most nutrient-dense vegetables available.

Brussels sprouts are a highly nutritious cruciferous vegetable, known for their vitamin C, K, and folate content, as well as carotenoids and fiber. These vegetables can be shaved, sliced, sautéed, boiled, or grilled, offering a range of flavors from mild to bitter, depending on preparation.

Kale is loaded with essential nutrients such as vitamins C, B6, E, K, and manganese. It contains twice as much selenium as spinach and is an excellent source of calcium. Kale’s unique properties help bind to cholesterol and lower oxalate levels, which promotes calcium absorption and makes it suitable for those prone to kidney stones. Additionally, it provides eye health benefits, thanks to lutein, and its disease-fighting properties make it a great addition to salads, smoothies, and more.

Artichokes are not only delicious but also packed with fiber, which aids in digestion. They are a great source of plant protein, potassium, and antioxidants like polyphenols. Artichokes also provide essential nutrients, including vitamins C, K, folate, magnesium, and B vitamins.

Asparagus is versatile and can be enjoyed grilled, sautéed, baked, or even raw. Packed with vitamins C, E, B, K, folate, and copper, it’s a great source of fiber. It also helps lower cholesterol and provides a variety of antioxidants that aid in healing. Asparagus is a perfect side dish that complements both light and robustly flavored meals.

Spinach is a popular green known for its mild flavor and impressive nutritional profile. Rich in vitamins A, C, K, as well as magnesium, potassium, and iron, spinach is great for overall health. It also provides antioxidants that support eye health and includes calcium for stronger bones. However, because spinach has a higher oxalate content, it should be consumed in moderation by those with a history of kidney stones.

EAT DINNER TOGETHER AS A FAMILY.

This meaningful time around the table is where connections happen. Let everyone share good moments from the day or something they struggled with. Create a jar of conversation starters, exchange giggles and cook up something delicious.

CREATE SURPRISES

Everyone likes to feel special – and surprised. The littlest things make the biggest impact: A backyard picnic; a sleepover in an indoor fort; an afterschool ice cream treat; a bathroom spa day.

CREATE FAMILY TRADITIONS

Build weekly or monthly traditions – movie nights with popcorn, board game marathons, a gratitude jar, evening bike rides, living room

dance parties, even a family book club to discover old favorites and new reads.

EXPRESS LOVE AND GRATITUDE

In busy seasons, it’s easy to forget to let a loved one feel appreciated and thought of. Tuck a hand-written note in a lunch box or give an unexpected hug; spend time sharing what you’re thankful for about them.

KEEP GENERATIONS LINKED

Consider Sunday meals with grandparents or weekly phone calls if distance separates. Invite them to share their childhood stories and treasured memories. Start a yearly family scrapbook filled with favorite photographs and vacation souvenirs.

ARTICLE BY KRISTY BELLEY

The drink that makes you look forward to TAX DAY

• 1½ oz. Gin

• ¾ oz. Dry Vermouth

• ¾ oz. Sweet Vermouth

• ¾ oz. Freshly Squeezed Orange Juice

• 2 Dashes Angastura Bitters

• Orange Twist

• Glass Type: Coupe

1.

2. Add everything to your shaker with ice.

4. Pour into your coupe.

5. Twist your orange peel again, like you did last summer.

7. Enjoy being done with taxes.

8. And a good cocktail.

The Income Tax Cocktail likely popped up during the Prohibition party scene of the 1920s. Its exact origin story remains a bit blurry, but it was definitely a hit in speakeasies.

The name? Well, it's like a cheeky nod to the idea that sipping on this cocktail might be more fun than paying actual taxes! Made with gin, sweet vermouth, orange juice, and a dash of bitters, it's like a boozy adventure for your taste buds, with hints of citrus and herbs. Despite its vintage roots, the Income Tax Cocktail still brings the party vibes, transporting you back to the roaring '20s.

THESE INVESTMENT BOOKS CAN HELP YOU STAY UP-TO-DATE ON THE LATEST FINANCIAL TRENDS

ARTICLE BY SUSAN LANIER-GRAHAM

PHOTOGRAPHY BY SIMON AND SCHUSTER

Investing in your future is critical yet complicated. While reaching out to qualified professionals is vital—whether you’re building your business, investing in your financial security, or planning for retirement—doing some of your own research is often helpful.

We checked out some of the top investment books that help you better understand how to invest in your future and build wealth.

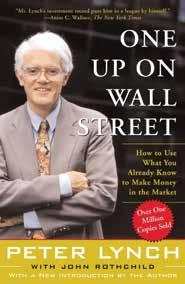

One Up On Wall Street: How to Use What You Already Know to Make Money in the Market by Peter Lynch with John Rothchild. Peter Lynch explains average investors’ advantages over professionals and how they can use these advantages to achieve financial success.

How to Invest: Navigating the Brave New World of Personal Investment, part of Economist Books, by Peter Stanyer, Masood Javaid, and Stephe Satchell. A dynamic new guide to personal investment for the era of cryptocurrencies and personal trading platforms.

Power Your Profits: How to Take Your Business from $10,000 to $10,000,000 by Susie Carder. While not a traditional book on investments, Power Your Profits helps you discover how to take your business from startup mode to the multi-million-dollar mark.

The Wealth Decision: 10 Simple Steps to Achieve Financial Freedom and Build Generational Wealth by Dominique Broadway. A roadmap for becoming a millionaire and building the foundation of generational wealth from a self-made, first-generation multimillionaire.

The Wolf of Investing: My Insider’s Playbook for Making a Fortune on Wall Street by Jordan Belfort. From the investment guru and author of The Wolf of Wall Street, this is a witty and clear-eyed guide for anyone who wants to play the stock market to their advantage and learn the secrets of a top Wall Street investor.

How to Invest: Masters on the Craft by David M. Rubenstein. This book is a master class on investing, featuring conversations with the biggest names in finance. Brought to you by the legendary cofounder of The Carlyle Group, David M. Rubenstein.

APRIL 2025

APRIL 4TH

Join us on April 4th as we Fire Up Downtown!

Downtown Canton | 5:00 PM

Whether you're a longtime attendee or experiencing Canton First Friday for the first time, we’re excited to welcome you! Each month, this vibrant event showcases the best in local talent, arts, culture, and food, creating a lively community celebration. Enjoy an unforgettable evening downtown while supporting local businesses and artists. Don’t miss out! Visit cantonfirstfriday.com for more info!

APRIL 5TH

ST. GEORGE SERBIAN CENTER 4667 Applegrove Street Northwest North Canton | 9:00 AM

Stark Vintage Market is an antique collectible and artisan market held two times a year at the St. George Serbian Center. Show hours will be 9-3. We have vendors selling a wide variety of antiques, collectibles and artisan wares from glassware to toys to jewelry to vintage clothing. Visit www.starkvintagemarket.com/ for more information. $5 admission

APRIL 5TH

Circuit

Map can be found at biastarkeco.com | 1:00 PM

Tour beautiful new homes and condos across Stark County free of charge! Explore the latest designs, gather inspiration, and find your dream home during this self-guided open house event. Don’t miss this opportunity to experience the best in modern living! April 5, 6 and 12, 13 from 1:00 - 4:00pm. For the map and more information please visit biastarkeco.com.

APRIL 12TH

Local Author Fair

Stark Library 715 Market Avenue N Canton | 2:00 PM

Local authors will be showcasing their work as well as signing & selling their books. Learn how they get ideas, perfect a writing voice, and publish their work--straight from the experts themselves! Visit starklibrary.org for more information.

APRIL 25TH

Cultural Center Theater 1001 Market Ave. N | 7:00 PM

Vocal Fusion presents "Happily Ever After...A Tribute to 100 Years of Disney Magic" Embark on a magical journey through a century of cherished stories and songs. "Happily Ever After...A Tribute to 100 Years of Disney Magic" celebrates unforgettable characters and music that have touched hearts across generations. April 25th, 26th and 27th. visit www.vocalfusion.org/tickets for more information.

APRIL 26TH

Lions Lincoln Theatre 156 Lincoln Way East Massillon | 7:30 PM

Since bursting onto the scene just three years ago, Fleetwood Gold has been setting stages ablaze, gathering a legion of devoted fans along the way. This tribute act is more than a show, it is an experience. They will take you on a musical journey through the best of Fleetwood Mac. Don't Miss it! Visit www.tickettailor.com/events/lionslincolntheatre/1340769 for tickets.

Want to be featured?