Spring in Cullman is a season of renewal, growth and fresh opportunities . The days are longer, the flowers are blooming and there’s a renewed sense of possibility in the air. Just like we plant gardens in the South, knowing the harvest will come, the choices we make today — whether in business, family or finances — shape our futures.

This month’s "Invest" issue is all about pouring into what matters most — our community, our fam ilies and our financial well-being. Within these pages, you’ll find insight from Tonya Palmer of Palmer Law Firm on protecting your legacy, and Edward Jones on building a secure future. We’re also excited to introduce new faces to the magazine — Corbin M. Ellard with Merrill Lynch, White Pine Designscapes and White Pine Hydroseed — each bringing something fresh and valuable to Cullman.

As we step into this season of new beginnings, let’s take time to invest wisely — in relationships, in our hometown and in the dreams we want to grow. Wishing you a season of growth and good investments, MISSY GURLEY, PUBLISHER

April 2025

PUBLISHER

Missy Gurley | missy.gurley@citylifestyle.com

EDITORIAL COORDINATOR

Wendy Sack | wendy.sack@citylifestyle.com

CONTRIBUTING PHOTOGRAPHERS

Lisa Jones Photography

Samantha Southerland Photography

CEO Steven Schowengerdt

COO Matthew Perry

CRO Jamie Pentz

CTO Ajay Krishnan

VP OF OPERATIONS Janeane Thompson

VP OF SALES Andrew Leaders

AD DESIGNER Mary Albers

LAYOUT DESIGNER Kelsey Ragain

QUALITY CONTROL SPECIALIST Brandy Thomas

Learn how to start your own publication at citylifestyle.com/franchise.

Proverbs 3:5-6

WHERE

1: Congratulations to Alice Ann Kontegeorge for winning Miss Southerner at Cullman High 2: A fun ribbing cutting with the Cullman Chamber of Commerce and 1st Behavioral Health 3: Dr. Rebekah Lloyd and Kathy Sims at the ribbon cutting for 1st Step Behavioral Health 4: Our favorite Cullman Savings Bank drive-thru teller Lisa Alexander stopped at Seven Daughters Scoops. 5: The cutest first customers of Cullman Savings Bank’s Valentine Ice Cream Giveaway 6: Robin Oberry, Robin Parson and sweet friends enjoying Seven Daughters Scoops 7: Rebekah Lloyd and Missy Gurley at Seven Daughters Scoops - thank you Cullman Saving Bank!

8: Karma’s and Jubilee Owners Katie and Jacob Fine at their ribbon cutting. 9: Let’s Go Camping! Second Century League Fundraiser 2025! All proceeds went to Cullman County DHR. 10: Dr. Rebekah Lloyd - friend and local author. Check out her books on Amazon! 11: Jubilee Coffee and Wine Bar’s ribbon cutting - so much fun! 12: Donna and Keith Lann, owners of Guthrie’s Chicken at Second Century League Fundraiser 2025! 13: Mimi Weir, Donna Lann, Rachel Hickman and Rachel Eidson at Second Century League Fundraiser 2025! 14: We are loving the new 7 Brew in Cullman!

Cullman City Lifestyle is proud to welcome Corbin Ellard of Merrill Lynch – Harty Carpenter Group to our business community! Specializing in wealth management, retirement planning and investment strategies, Ellard provides personalized financial guidance to help individuals and businesses build a secure future. Now serving Cullman, he’s ready to assist with expert financial solutions tailored to your goals. Call 205-326-9713 to get started!

Scan to read more

White Pine Designscapes is now serving Cullman, bringing expert landscape design, hardscaping and outdoor living transformations to your home or business. From elegant patios and fire pits to stunning garden designs and retaining walls, they specialize in crafting beautiful, functional outdoor spaces. Whether you're enhancing curb appeal or creating your dream backyard, White Pine Designscapes delivers top-quality craftsmanship and creative solutions. Ready to elevate your outdoor space? Call 256-590-9459 or visit www.facebook.com/whitepinedesignscapes.

Cullman City Lifestyle is excited to welcome Better Than Before Consignments to our business community! With locations in Cullman and Decatur, this upscale consignment shop offers trendy fashion, home décor and unique finds at unbeatable prices. Whether you're shopping or consigning, their expertly curated selection ensures quality and style. Visit them today and discover why they’re a local favorite! Call 256-739-3550 or visit www.btbconsignments.com.

Are you ready for retirement?

Corbin Ellard ChFC®, CPFA® and CRPC™ is a Senior Financial Advisor with Merrill Lynch in Birmingham. He is a partner of THE HARTY CARPENTER GROUP. Ellard is regarded as a Retirement Benefits Consultant.

Are you (and your finances) ready?

ARTICLE BY CORBIN ELLARD, MERRILL LYNCH PHOTOGRAPHY BY CORBIN ELLARD

Corb

, CPFA® andCRPC™

CCL: HOW MUCH SHOULD A RETIREE SPEND PER YEAR?

CE: Before deciding how much to spend each year, retirees should consider variables such as the age at which you retire, how your income needs will change and what your priorities are.

Your withdrawal rate is in some ways a reflection of your confidence that your investments will continue to grow. If you are comfortable investing more aggressively, you might decide to take a little more income each year. If you prefer less risk, you might opt for a lower withdrawal rate. It is important to remember that investing involves risk. There is the potential for losing money when investing in securities.

Other factors may come into play. Some years you might withdraw more for a long-cherished goal like travel. Or you might have health care needs that dictate a higher spending rate. Your plans should be flexible enough to accommodate a variety of needs.

Ellard advises retirees:

"Always consult your tax advisor."

"For many, the conventional wisdom goes that you withdraw from your taxable accounts first, then tax-deferred, then tax-free."

CCL: WHAT’S THE ORDER IN WHICH A RETIREE SHOULD TAP INTO THEIR RETIREMENT ACCOUNTS?

CE: For many, the conventional wisdom goes that you withdraw from your taxable accounts first, then tax-deferred, then tax-free. That is because the money you take from a taxable account (such as a brokerage account) is likely to be taxed at the rate for capital gains or qualified dividends, which varies depending on your tax bracket. It is generally a lower rate than what you would pay on ordinary income from 401(k) plans, traditional IRAs and other tax-deferred savings.

Even if you are not ready to start withdrawing funds from your traditional IRAs and qualified retirement plans, the government generally requires you to do so once you reach a certain age. The amounts of these required minimum distributions, or RMDs, will vary from year to year, depending on your retirement account value and your age. Failing to take an RMD, or taking too little, can result in costly additional taxes. An exception may apply if you are still working. Review your employer’s plan highlights and talk with your tax advisor about your situation. Roth IRAs and, as of 2024, Roth 401(k)s do not have

RMDs, so you can keep money in your account for your lifetime.

CCL: WHEN SHOULD ONE CLAIM SOCIAL SECURITY BENEFITS?

CE: You can begin receiving Social Security retirement benefits as early as age 62 but waiting to claim until your full retirement age (66 or 67, depending on the year you were born) or even age 70 will give you a larger monthly payment and future survivor benefits for your spouse may be greater. If you have a health condition that could limit your life span, for instance, it could make sense to start collecting Social Security income immediately after carefully considering how spousal survivor benefits may be impacted.

CCL: HOW SHOULD ONE PAY FOR THEIR RETIREMENT HOME?

CE: If you buy, you will need to decide whether to pay cash or finance the purchase. If you are selling another home, it may seem simplest to use the proceeds to buy the new one outright. Depending on your tax and income needs; however, it might be better to use part of the cash from the sale as a

down payment and finance the balance with a mortgage. Check with your tax advisor about your options.

CCL: CAN COST OF LIVING BE HIGHER IN A LOW-TAX STATE?

CE: Yes, look at the overall prices in the area where you are considering relocating — everything from utilities and groceries to health care costs and your car and homeowners insurance.

CCL: CAN LOW-TAX STATES MAKE UP FOR LOST REVENUE IN OTHER WAYS THAT COULD IMPACT ONE’S BUDGET?

CE: Several of the states without an individual income tax compensate by implementing a higher state sales tax or other taxes, including taxes on necessities such as gasoline, or charging more for state services such as driver’s licenses or car registrations. Those additional costs could have a real impact on your budget.

Local property taxes also vary widely — even within a state — and a state with low (or even no) income taxes may have pockets where homeowners are hit with relatively high property taxes.

CCL: HOW IS RETIREMENT INCOME TREATED DIFFERENTLY ACROSS STATES?

CE: Above certain adjusted gross income levels (plus certain modifications), you could owe federal income taxes on a portion of your Social Security benefits. But at the state level, the rules vary, with some states matching the federal approach and others exempting Social Security benefits from state income taxes (often pegged to your total income).

Another potential tax issue to explore is how your new state might treat your pension payments for income tax purposes. Among states that collect income taxes, some states may exclude all or a portion of qualifying pension income from state taxes. Always consult your tax advisor.

Investing is more than stock markets and numbers

Investing is more than stock markets and numbers. We spoke with CERTIFIED FINANCIAL PLANNER® Katie E. Brown of Edward Jones about investment considerations.

CCL: WHAT DO YOU BELIEVE THE BEST INVESTMENT SELECTIONS ARE FOR THE REST OF 2025?

KB: I get that question often. And truth be told, impactful investments are more than a given stock or mutual fund. The investments that are most impactful generally deal with time and relationships. I believe the best investments many of us can make this year would be in our families, our health, our community and our future. There are ways to do that both with and without the guidance of a financial advisor. My role when helping people make these investments is not just the particular investment choice, but also the vehicle or account that may be best leveraged.

CCL: CAN YOU ELABORATE ON INVESTMENT IN FAMILY?

KB: Be intentional when it comes to those you love. Carve out time for your spouse, children and parents. My husband and I have a set monthly date night. Our children see how important our time is together. We also have a standing family movie night with our boys. Set a time and stick to it!

Tools to leverage for actual accounts in the family space may include Educational 529s, Custodial Accounts for children so they can learn more about money before they become adults and Dependent Care Accounts if your employer provides them.

CCL: WHAT WOULD YOU ADD TO INVESTING IN HEALTH?

KB: Consistency is key to good health. Consistency and routine apply to financial health, too. If we can automate investments,

such as funding an employer plan like a 401(k), we tend to stick with it. Most investment accounts allow scheduled contributions. Look into Health Savings Accounts that can be used for medical expenses. If your medical insurance plan qualifies, you may be able to pay for expenses with pre-tax dollars. This can be beneficial for many years.

CCL: DO YOU HAVE ANY TIPS FOR HOW PEOPLE CAN HELP OUR NEIGHBORS IN CULLMAN?

KB: Explore what community means to you. Is that a charity, your church or a group of people? Then, consider their needs and how you can help. For many people, the gift of time can make a major impact. Don't discount how important your time is!

For those who think of a financial investment, consider speaking with your financial advisor and/or accountant about Donor

CONTINUED >

Advised Funds, gifting stock or other tax advantaged ways of giving. Individuals over 70.5 may be able to give directly from their retirement accounts through a Qualified Charitable Distribution. Consulting your professional is paramount.

"DO NOT FORGET TO EVALUATE YOUR INSURANCE NEEDS. THE BEST DRAFTED PLANS CAN BE BUSTED WHEN THERE IS NOTHING IN PLACE FOR TRAGEDIES LIFE CAN THROW AT US." KATIE E. BROWN

CCL: TELL US MORE ABOUT "INVESTING IN YOUR FUTURE."

KB: Invest in your future and start now! I learned this lesson early thanks to my great-grandfather and his handful of peppermints. We were allowed one candy for that very moment. Additional candies, always at least one, were to be saved for later. He always told us to do this, too, with our money. That sentiment is echoed by many great financial minds. After reading many books about investing, I stand by the idea that we should view our money in four different buckets: save part of it, invest a portion, give some of it and live off the difference.

This may sound easy, but can be hard to implement. Consider automating your savings. Review your pay schedule and set up a portion of money to automatically move from your checking to your savings. Most financial institutions can help you set this up. Take advantage of employer plans such as a 401(k). If the company offers a match on your contribution, consider investing at least that much. To take investing in your future further, explore Individual Retirement Accounts (IRAs).

EAT DINNER TOGETHER AS A FAMILY.

This meaningful time around the table is where connections happen. Let everyone share good moments from the day or something they struggled with. Create a jar of conversation starters, exchange giggles and cook up something delicious.

CREATE SURPRISES

Everyone likes to feel special – and surprised. The littlest things make the biggest impact: A backyard picnic; a sleepover in an indoor fort; an afterschool ice cream treat; a bathroom spa day.

CREATE FAMILY TRADITIONS

Build weekly or monthly traditions – movie nights with popcorn, board game marathons, a gratitude jar, evening bike rides, living room

dance parties, even a family book club to discover old favorites and new reads.

EXPRESS LOVE AND GRATITUDE

In busy seasons, it’s easy to forget to let a loved one feel appreciated and thought of. Tuck a hand-written note in a lunch box or give an unexpected hug; spend time sharing what you’re thankful for about them.

KEEP GENERATIONS LINKED

Consider Sunday meals with grandparents or weekly phone calls if distance separates. Invite them to share their childhood stories and treasured memories. Start a yearly family scrapbook filled with favorite photographs and vacation souvenirs.

Investing is something on most everyone’s minds when they think about the future. But it’s not just about financial accounts. A big investment you can make is in your property, whether a home or business. Part of that property investment is thoughtful landscaping, which can boost property value.

We spoke to Taylor Oslin of White Pine Designscapes LLC to learn a bit more about the Guntersville company and landscaping in general.

“We are a family owned landscape company founded in 2021 by Kolton Sellers and myself,” said Oslin. “I received a bachelor’s degree in landscape horticulture from Auburn University. Kolton had worked in landscaping for five-plus years before we started the company. We offer a variety of services to residential and commercial clients including landscape maintenance, lawn maintenance, hardscape installs, retaining walls, irrigation, sod installs, landscape installs, drainage solutions, seasonal color installs and hydroseeding.”

According to Oslin, adding landscaping to your home or even revamping old landscaping can increase the value of the home between 5-20%.

“Not only does landscaping add value to your home, but it also gives the homeowner the ability to create an outdoor space that caters to their needs,” she said.

ARTICLE BY WENDY SACK

PHOTOGRAPHY BY WHITE PINE DESIGNSCAPES

“Landscaping is equally as important at businesses, as adding a well-designed and planned landscape around your business can help draw in customers. Well-kept landscaping, color interest or water features are just a few of the things that could set your business apart from your competitors.”

Fun fact: BobVila.com lists lawn care and landscape maintenance as two upgrades you can make to increase home value. (www.bobvila. com/lawn-and-garden/outdoor-upgrades-add-value-to-home)

In other words, the investment is worth it.

Said Oslin, “We do our best to work with the customer and find the best solution to fit their needs.”

Find out more about White Pine Designscapes at www.facebook. com/whitepinedesignscapes or call 256-590-9459.

Estate planning is one of the most vital, yet overlooked, aspects of personal finance, says local attorney Tonya Palmer.

“Most people consider estate planning to be only for large estates or elderly individuals, but nothing could be farther from reality. It’s crucial for everyone. Estate planning isn’t just about wills and inheritance – it’s about ensuring your wishes are carried out when you can no longer make decisions for yourself and protecting your loved ones in the process,” she explained. “Without a plan, the courts will decide for you – it can take years, cost massive fees and turn ugly for those you leave behind to clean up the pieces. You have no control over who gets what you have worked so hard to obtain.”

Palmer said estate planning is especially important when you have a blended family, as the division of assets is not always cut and dry.

“No matter your social status, an estate plan is an invaluable gift to your loved ones,” she continued. “Estate planning allows you to choose who will inherit, minimize family disputes/legal battles, name your minor children’s guardian in the event of your untimely death, reduce taxes and secure your family’s financial well-being.”

Palmer’s expert advice for safeguarding assets for families, retirees and business owners?

“Families and retirees should have insurance policies in place to cover expenses and pay off debts,” she said. “They should also use trusts, which allow your family to bypass probate courts, ensuring faster asset distribution without public record exposure; shield assets from potential lawsuits, creditors and other financial risks; reduce estate and inheritance taxes, preserving more wealth for your loved ones; and give you the flexibility and control to dictate how and when beneficiaries receive their inheritances.”

Business owners, she said, should focus on ownership structures and succession planning, as well as trusts to protect business assets, ensure the smooth transfer of responsibility/ownership, even in the event of your incapacity, to continue to provide for your family and provide tax solutions.

Palmer advises that early adulthood is a good time to begin estate planning.

“It allows you to lay the foundation and consider tax-saving strategies. Midlife is the point in life when you should focus on protecting what you have built. Retirement age is the time to secure your future,” she said. “Don’t forget major life events, such as births, death, divorces – these should prompt a check-in and updates to your estate plan. Planning now rather than placing those difficult decisions on your loved ones, especially during times of grief and uncertainty, provides you with peace of mind knowing that you have helped to ease the burden on your family.”

Palmer Law Firm is located at 1939 Main Ave. SW in Cullman, and serves clients in and around north and central Alabama.

“We know legal matters can feel overwhelming,” she said, “but you don’t have to navigate them alone. Whether it’s estate planning, probate, family law or elder law, we’re here to help.”

Find Palmer Law Firm online at www.tcpalmerlaw.com

"Most people consider estate planning to be only for large estates or elderly individuals, but nothing could be farther from reality. It’s crucial for everyone. Estate planning isn’t just about wills and inheritance – it’s about ensuring your wishes are carried out when you can no longer make decisions for yourself and protecting your loved ones in the process."

After all this financial planning, a celebratory drink is in order! Pasquale’s Pizza & Pasta in Cullman is celebrating as well, marking its first year after re-opening under new ownership. The local staple has in fact been around since 1968, but was closed for a short time while new owners Steve and Mike Morgan made renovations.

Ingredients

• 1.5 oz. Absolut Vanilia Vanilla-Flavored Vodka

• 1 oz. Baileys Original Irish Cream Liqueur

• 0.5 oz. Licor 43

• 0.5 oz. Frangelico Hazelnut Liqueur

Re-opened Pasquale's marks first birthday

Directions

1. Add all ingredients to a shaker tin and shake vigorously for 30 seconds.

2. Strain contents into a martini glass garnished with vanilla icing topped with sprinkles.

www.pasqualescullman.com

STAY CONNECTED TO YOUR COMMUNITY

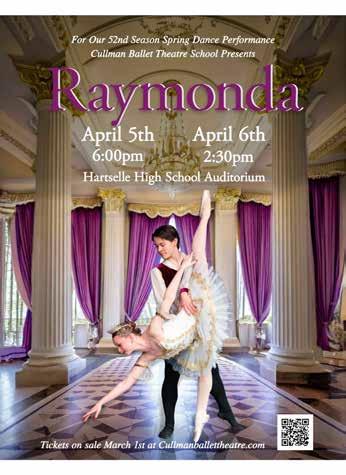

APRIL 5TH-6TH

41st Annual Bloomin' Festival

Arts and Crafts Fair

St. Bernard Prep School | 9:00 AM

More than 150 booths will be filled with artists demonstrating and exhibiting their unique work. There will also be plenty of food and live music. Special reduced admission rates are offered to festival attendees all weekend to visit the Ave Maria Grotto. Completing the weekend is the give-away of a new automobile and other valuable prizes! Visit www.bloominfestival.com for more.

APRIL 12TH

Cotton Creek Warehouse | 6:00 PM

Join us for a fun-filled evening of bingo and a silent auction to support Flourish of Cullman, Inc. Enjoy a night of entertainment, delicious food and great company while supporting a wonderful cause. Don't miss out on the excitement! Visit www.flourishofcullman.com for ticket info.

APRIL 19TH

Sportsman Lake Park | 9:00 AM

The egg hunt will start at 9 a.m. and we will not have another one, so be sure to get here early so you don't miss out on the fun! Please be sure to bring your baskets!