Dear Readers,

As the days grow longer and spring is in full swing, it’s the perfect time to reflect on growth— whether it’s in our gardens, our relationships, or within ourselves. In our April issue, we’re exploring a theme that’s all about investing in what truly matters.

When we think of “investing,” we often focus on money, but it’s so much more than that. It’s about dedicating time and energy to the things that enrich our lives—the people we love, the activities that bring us joy, and the dreams we want to make a reality. We also want to remind you that investing in our community matters too. Supporting local businesses, volunteering, or simply spreading kindness helps create a stronger, more connected place to call home.

As we embrace the season of growth, let’s think about how we can invest in the things that bring us the most joy, meaning, and connection. After all, the best investments are the ones that shape our lives and the lives of those around us.

Thank you for being part of our community. We hope this issue encourages you to take a step back and think about where your energy and time are best spent— because in the end, those are the investments that will truly pay off.

Wishing you a season of growth and opportunity,

STACY LEACH, EDITOR @PORTERCITYLIFESTYLE

April 2025

PUBLISHER

Rachel Burk | rachel.burk@citylifestyle.com

EDITOR

Stacy Leach | stacy.leach@citylifestyle.com

ACCOUNT MANAGER

Jamie Allgood | jamie.allgood@citylifestyle.com

CONTRIBUTING WRITERS

Rachel Burk, Amber Dobyns, and Stacy Leach

CONTRIBUTING PHOTOGRAPHERS

Fireheart Photography and Tyler Jones

CEO Steven Schowengerdt

COO Matthew Perry

CRO Jamie Pentz

CTO Ajay Krishnan

VP OF OPERATIONS Janeane Thompson

VP OF SALES Andrew Leaders

AD DESIGNER Mary Albers

LAYOUT DESIGNER Jamie Housh

QUALITY CONTROL SPECIALIST Megan Cagle

Learn how to start your own publication at citylifestyle.com/franchise.

“It gives me great pleasure to announce that there are still banks, like The MINT National Bank, that continue to provide a sense of security in this insecure world,”

- Karen Dorway, president

of BauerFinancial.

The MINT National Bank, Kingwood’s only hometown bank, is proud to announce being awarded a 5-star rating by Bauer Financial, a leading independent evaluator of bank financial health.

This prestigious rating signifies exceptional performance and positions The MINT National Bank among the strongest financial institutions in the country.

359-6468

1: Take your kids to The Krafty Shack for fun, hands-on creativity, and artistic exploration! 2: Porter High School seniors signed autographs for EMCSA kiddos—celebrating baseball and community together! 3: Commissioner Gray dedicates “The Sergeant Stacey Baumgartner Memorial Highway” in Honor of fallen Police Sergeant. 4: RFPD’s 12th Annual Awards & Appreciation Dinner Celebrates 50 Years of service and dedication. 5: PCL, Dan Crenshaw, and Creg Mixon at the first Greater EMC Chamber Elected Officials’ Reception. 6: PCL proudly sponsored Mardi Gras Casino Night! If you missed it, join us next year! 7: The Spanish Trail Riders traveled through Bull Sallas Park, continuing their journey to the HLSR.

Want to be seen in the magazine?

Habitat for Humanity of Montgomery County, TX (Habitat MCTX) announces the appointment of three new board members: William Dean, Real Estate Project Manager at Amoco Corporation; Bryant Lach, Senior Vice President at JLL; and Taylor White, Petroleum Engineer at Ovintiv USA. Their seasoned expertise will support Habitat MCTX’s mission to provide safe, affordable housing. Executive Director, Vicki Johnson, and Board President, Charles Merdian, welcome their leadership and dedication.

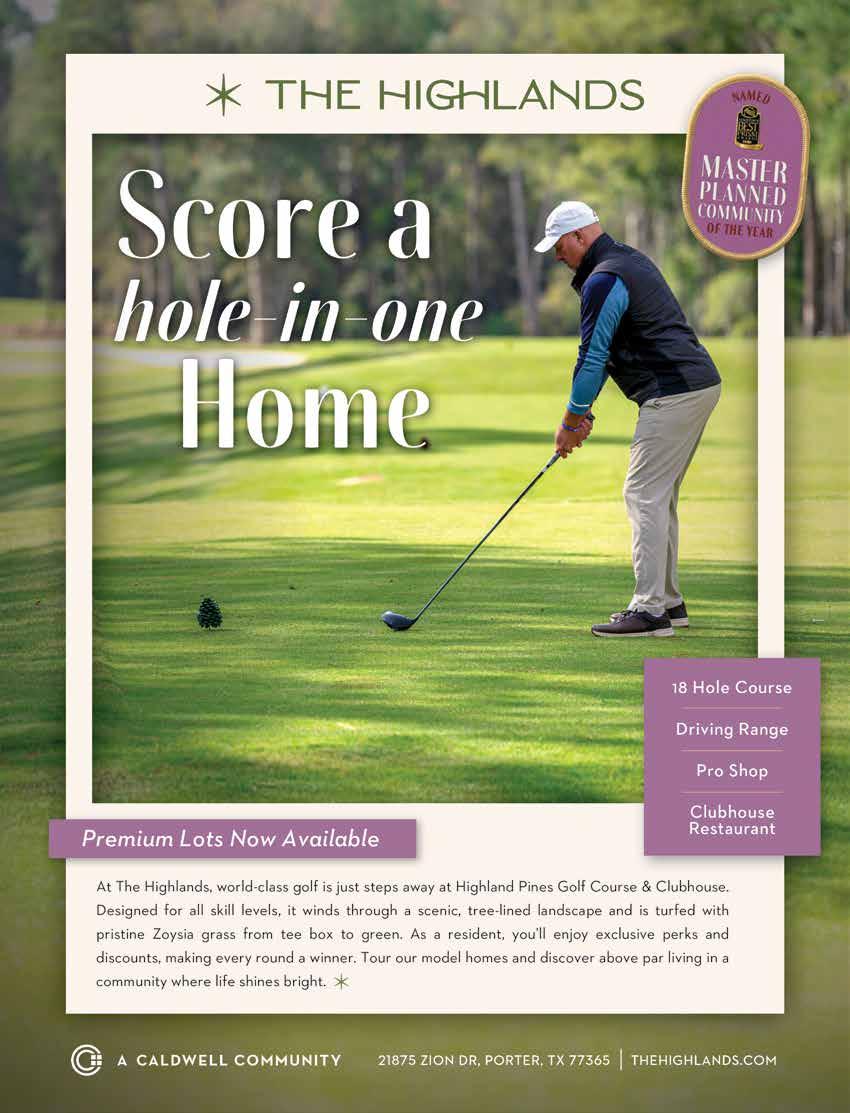

We’re excited to share that we’ve officially broken ground on The Hideaway, our brand-new amenity center designed exclusively for our 55+ residents in The Highlands! This future retreat will offer a perfect blend of relaxation, recreation, and community, providing a welcoming space for residents to connect, unwind, and enjoy a vibrant lifestyle. Stay tuned for more updates!

Looking for expert chiropractic care? Meet Dr. L. Robert Taylor, our skilled Associate Chiropractor at New Leaf Chiropractic. A 1997 graduate of Texas Chiropractic College, Dr. Taylor offers exceptional adjustments and clear communication. Text 325-896-5090 to schedule your appointment today!

A diverse financial portfolio is key, and there are many different routes to diversify. One opportunity is in real estate. A successful investment portfolio starts with the right properties—but securing them isn’t always easy. Navigating government regulations and restrictive bank financing can make real estate deals feel out of reach for investors, whether they’re first-time buyers, seasoned flippers, or commercial developers. The Joslin family saw this struggle firsthand through their ventures, Joslin Development Group and Joslin Construction. Instead of letting difficulties slow them down, they took action. What began as financing their own projects soon expanded into funding opportunities for other Texas investors, leading to the creation of Joslin Financial Group—a family-owned lending firm built to help investors turn challenges into opportunities. Every investment journey comes with its fair share of trials, but Joslin Financial Group believes that each obstacle is simply an opportunity in disguise. Finding the right property at the right time is only part of the equation—securing the necessary funding can often be the biggest hurdle, especially when traditional lenders are slow to approve or unwilling to take on risk. That’s where Joslin Financial Group steps in. As a family-owned, private money lender, they specialize in supporting investors and developers ready to make a tangible impact in their communities. By taking a personalized approach, they work closely with clients to understand their goals, identify flexible terms tailored to their unique needs, and simplify the lending process. With a straightforward one-page application and a commitment to efficiency, Joslin Financial Group helps investors move forward with confidence, often closing deals in just 30 days.

ARTICLE BY AMBER DOBYNS | PHOTOGRAPHY

BY FIREHEART PHOTOGRAPHY

For over 80 years, the Joslin family has been deeply connected to East Montgomery County, not only through business but also through community involvement. Their guiding principle comes from Luke 12:48: “To whom much is given, much is expected.” Their commitment to giving back is evident in their various real estate projects and development efforts, contributing to the area’s ongoing economic growth.

As the community continues to expand, so do the opportunities for investors. Markets like Tavola West are seeing increased demand for rental homes, making single-family rental investments a strategic choice. With rising home prices and down payment requirements, leasing is becoming an attractive option for many families, creating a prime investment opportunity for those looking to generate steady income.

Successful real estate investing starts with careful planning. Researching potential markets, working with an experienced realtor such as Paige Joslin with Texcom Realty, and securing the right financing are all essential steps. In the world of real estate investment, patience, and strategic decision-making often lead to the biggest rewards.

Joslin Financial Group provides not just funding, but a partnership built on experience in investment, development, construction, and finance. Their team helps investors navigate the challenges of securing capital, ensuring they have the resources needed to grow their real estate portfolios.

Every property has a story to tell, and the team at Joslin Financial Group can help write the next chapter toward any investment goals. Whether it’s a fix and flip property, renovating or renting a home, maximizing leverage on a commercial property, or acquiring property for development or leisure purposes in a flexible and timely manner, Joslin Financial Group has it all covered. They say the best time to start investing was yesterday—the next best time is now. Contact loans@joslinfinancialgroup.com to begin your investment journey today.

f o r T e x a s R e a l E s t a t e D e v e l o p e r s &

I n v e s t o r s .

L o c a l E a s t M o n t g o m e r y C o u n t y B u s i n e s s

F o r m o r e i n f o r m a t i o n o n , F i x & F l i p ,

R e n o v a t e & R e n t , C o m m e r c i a l , o r

F a r m & R a n c h l o a n s , s h o o t u s a n

e m a i l !

l o a n s @ j o s l i n s f i n a n c i a l g r o u p . c o m

These simple, yet intentional ideas can make the best memories.

EAT DINNER TOGETHER AS A FAMILY.

This meaningful time around the table is where connections happen. Let everyone share good moments from the day or something they struggled with. Create a jar of conversation starters, exchange giggles and cook up something delicious.

CREATE SURPRISES

Everyone likes to feel special – and surprised. The littlest things make the biggest impact: A backyard picnic; a sleepover in an indoor fort; an after-school ice cream treat; a bathroom spa day.

CREATE FAMILY TRADITIONS

Build weekly or monthly traditions –movie nights with popcorn, board game marathons, a gratitude jar, evening bike rides, living room dance parties, even a family book club to discover old favorites and new reads.

EXPRESS LOVE AND GRATITUDE

In busy seasons, it’s easy to forget to let a loved one feel appreciated and thought of. Tuck a hand-written note in a lunch box or give an unexpected hug; spend time sharing what you’re thankful for about them.

KEEP GENERATIONS LINKED

Consider Sunday meals with grandparents or weekly phone calls if distance separates. Invite them to share their childhood stories and treasured memories. Start a yearly family scrapbook filled with favorite photographs and vacation souvenirs.

The Greater EMC Chamber is more than just a business network—it’s a driving force behind collaboration, advocacy, and economic growth in the community. With a mission to foster a thriving business environment, the Chamber unites companies of all sizes, from solopreneurs to major corporations, ensuring they have the resources, connections, and support needed to succeed.

For over 35 years, the Chamber has evolved to meet the changing needs of business owners while maintaining its welcoming, hometown feel. Members join for various reasons—brand promotion, leadership development, workforce resources, or staying informed on business-friendly policies. The Chamber creates opportunities to address these needs, including its instrumental role in establishing the East Montgomery County Improvement District (EMCID) in 1997. Since then, EMCID has driven economic development by providing community grants, incentives, and scholarships that benefit local students and businesses.

Joining the Chamber offers an opportunity to gain visibility, credibility, and a

strong support system. Monthly events, ribbon cuttings, and sponsorship opportunities allow businesses to connect with key decision-makers and potential clients. Active participation fosters trust within the community, creating lasting relationships that drive success. Some members, like Chris McIlroy of McIlroy Insurance Group, credit the Chamber with directly contributing to their business growth, while others, such as Entergy Texas, support its initiatives because of its positive impact.

Beyond networking, the Chamber provides members with exclusive industry insights, policy updates, and strategic partnerships. Events like the Annual Business Expo, Leading Ladies Luncheons, and the ‘Proud2BeEMC’ Golf Classic offer engaging ways to connect and grow. Even smaller gatherings, like ribbon cuttings, often lead to unexpected opportunities.

At its core, the Greater EMC Chamber remains committed to being member-focused, opportunity-driven, and effective in making a difference—helping businesses thrive while shaping the future of East Montgomery County.

“Joining the Chamber means gaining visibility, credibility, and a supportive network for business growth.” “

Wellness isn’t about restricting — it’s really about giving. Giving to yourself and to your body in a way that allows them both to thrive. The cool part? The things that give to your body naturally give to your mind, your hormones, your earth, your relationships, and so on — it’s all beautifully interconnected in that way.

Work in partnership with your body. Listen to it, support it, give to it, forgive it — and I promise it’ll give back. Repeat after me: I love myself as the most important and committed partner I will ever have

Eat your greens, cook at home, choose local produce and quality meats, don’t be scared of healthy fats — but also support local farmers, move in a way that makes your body and mind feel good, prioritize times of mindfulness and stillness, fuel your body in a way that is sustainable for both you and the planet, practice gratitude and empathy, give yourself grace when you lose routine, don’t try to make changes overnight, ditch the guilt, and always always be kind to yourself.

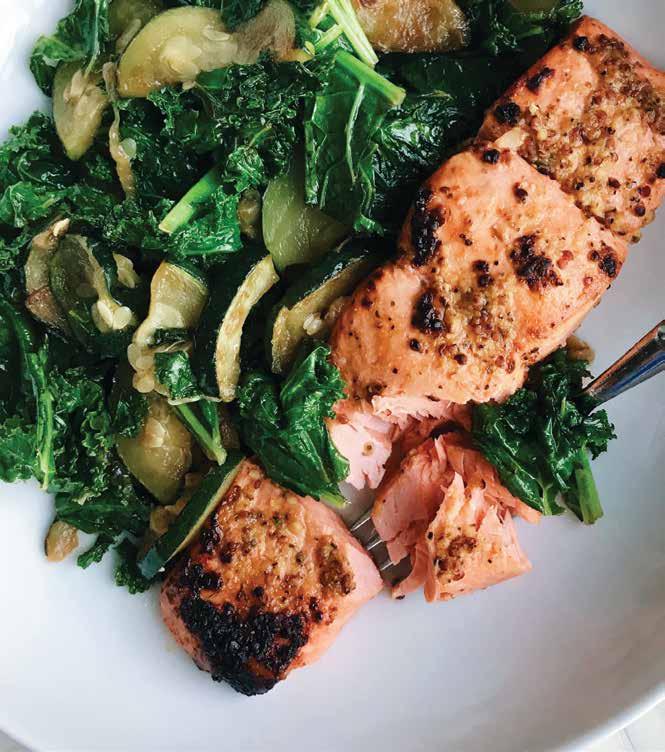

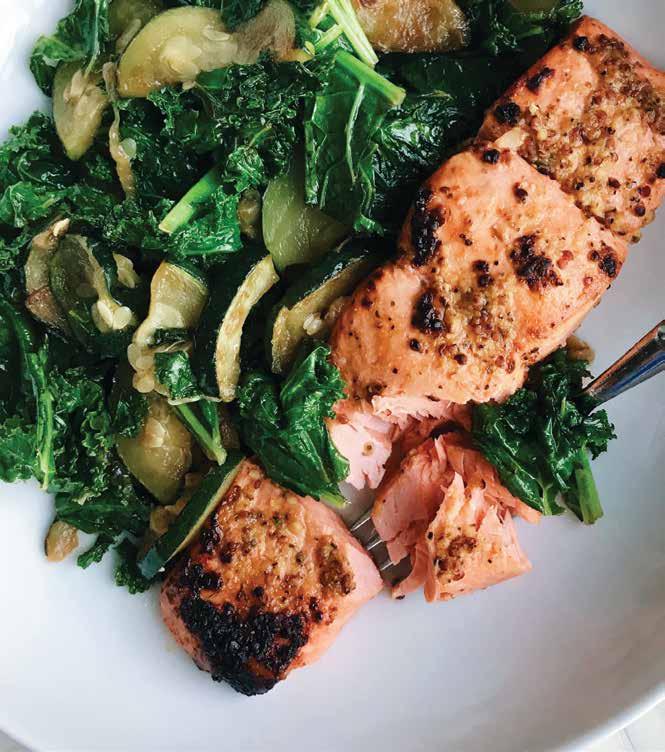

• 2 6 oz. filets of wild caught salmon

• 1 Tbsp. avocado oil

• 1 Tbsp. coconut aminos

• Zest and juice from one lemon

• 1 Tbsp. stone ground mustard

• 1 4 oz. container coconut yogurt, unsweetened

• 2 Tbsp. fresh dill, minced

• 2 Tbsp. capers, drained and minced

• Salt and freshly ground pepper, to taste

1. Marinate the salmon in the lemon juice, coconut aminos, and stone ground mustard for up to two hours.

2. Drizzle salmon with avocado oil, sprinkle with salt and ground pepper, and broil on high for five to seven minutes, until cooked to desired temperature.

3. Mix coconut cream, lemon zest, dill, capers, and ground pepper together.

4. Top salmon with coconut cream, serve with roasted or sautéed veggies, brown or cauliflower rice, or fresh greens. Enjoy!

INGREDIENTS:

• 1 head broccoli, cut into florets

• 1 medium onion, sliced

• 1 medium zucchini, sliced lengthwise, then sliced into crescents

• 1 red pepper, cored, seeded, and cut into slices

• 2 cups carrots, sliced

• 2 cups mushrooms, quartered

• 1 large boneless, skinless, pasture raised chicken breast, cut into cubes (omit to make vegan)

• 2 cans coconut cream

• 1 container curry paste or 3 tablespoons dried curry powder

• 2-4 cups bone broth, chicken stock, or vegetable stock

• 1 Tbsp. fresh ginger, minced

• 1 Tbsp. fresh garlic, minced

• 4 limes, 2 juiced and 2 quartered

• 1 cup fresh cilantro, chopped

• 2-4 Tbsp. avocado, olive, or coconut oil

• Salt and freshly ground pepper, to taste

DIRECTIONS:

1. Season the chicken with ¼ of the curry powder/paste, salt, and freshly ground pepper. Sear on medium heat in 1 tablespoon desired oil. Once browned on each side, remove from pan, and set aside.

2. Add 1 tablespoon oil and sauté the onion on medium heat until softened and translucent, roughly 2-3 minutes

3. Add the garlic, ginger, broccoli, zucchini, red pepper, carrots, and mushrooms. Sauté on medium heat for 5-7 minutes.

4. Add the chicken back in, along with the coconut cream, remaining curry powder/ paste, and broth.

5. Bring to boil, reduce to low heat, and simmer for 10-20 minutes, or until chicken is cooked through and vegetables are tender.

6. Remove from heat and finish with lime juice.

Serve with quinoa, cauliflower rice, or add extra broth to create a healing soup. Garnish with sliced avocado, cilantro, and lime wedges.

ARTICLE BY RACHEL BURK

Money is a powerful tool, and understanding how to manage it wisely is one of life’s most valuable skills. Teaching kids about financial responsibility early on sets them up for long-term success, helping to develop habits that promote independence and smart decision-making. In today’s fast-paced world—where digital transactions, credit cards, and online shopping make spending easier than ever—financial

literacy is more important than ever. Without a solid foundation, children may grow up struggling with budgeting, impulse spending, or even debt.

By introducing money management concepts at a young age, children begin to understand the value of earning, saving, and spending wisely. When kids grasp the importance of money early on, they become better equipped to navigate financial challenges as they grow. Without proper guidance, they may struggle to achieve a healthy relationship with money. Parents play a vital role in shaping their children’s financial habits by modeling responsible behavior and providing hands-on learning experiences.

Financial responsibility also fosters patience and delayed gratification. When kids learn that saving up for something they want takes time, they develop discipline and an appreciation for goal-setting—important skills that extend beyond money management into career planning and major life decisions. Additionally, understanding fundamental concepts like budgeting and investing gives them confidence in handling their finances as they enter adulthood. By fostering financial independence from an early age, parents help their children avoid common money mistakes and build a strong foundation for financial success.

By equipping kids with fundamental money skills, they’re empowered to make informed financial choices and avoid common financial pitfalls. Here are six essential tips for teaching kids about money in a way that is engaging and age appropriate. These money skills will prepare them for a future of financial stability and independence. The earlier they learn, the better equipped they’ll be to make wise financial decisions throughout their lives.

An allowance teaches kids about earning money. Encourage them to budget by dividing their allowance into categories like saving, spending, and donating. This hands-on experience helps them understand the value of money versus the work needed to put in to obtain that money along with how to prioritize expenses.

Help kids create simple budgets. If they want a new toy, guide them through the process of saving up for it. Show them how to track spending and make choices based on their available funds. Don't forget to add in the taxes!

Provide a piggy bank or a savings account to instill the habit of saving. Match their savings contributions as an incentive, teaching them the concept of growing their money over time. This will transition into money market accounts, retirement, and other financial tools in the future.

Teach kids the difference between needs and wants. When shopping, explain how comparing prices and looking for deals can help make better purchasing decisions. This is a great initiation into teaching the concept of opportunity cost.

Kids learn by watching their parents. Demonstrate responsible money management by discussing household budgets, saving for vacations, or using coupons. Transparency in financial discussions helps normalize conversations about money.

As kids get older, introduce the concept of credit. Explain how borrowing works, why paying off debts is important, and the consequences of overspending. This knowledge will prepare them to use credit responsibly in adulthood. Credit is not limited to just cards—this lesson can transition into discussions about car loans, home mortgages, and other types of borrowing.

In the hustle of daily life, it’s easy to overlook the most important investment you can make—yourself. Selfcare isn’t just a luxury; it’s a necessity for maintaining physical, emotional, and mental well-being. Taking the time to nurture yourself through intentional care is not only about preventing burnout, but it’s also about giving yourself the tools to thrive. Just as we invest time, money, and energy into our careers, relationships, and goals, investing in self-care ensures that we have the strength, resilience, and energy to tackle those ambitions with focus and clarity. By prioritizing self-care, you are strengthening your foundation for success and happiness. Mental well-being, physical health, and personal development are all integrated, and a holistic approach to self-care brings balance to each of these areas. Investing in your self-care routine isn’t just a quick fix but a long-term commitment to living a more fulfilled life. Whether it’s setting boundaries, taking care of your body, or working on emotional resilience, each step builds toward a healthier, more grounded you. In the end, investing in yourself is one of the most rewarding and impactful choices you can make, affecting every aspect of your life, from productivity to relationships to overall happiness.

ARTICLE BY STACY LEACH

Prioritize Mental and Emotional Well-being

“Investing in yourself through self-care is not just about prevention—it’s about giving yourself the strength to thrive.”

Taking care of your mental and emotional health is the first step toward overall wellness. Practices like meditation, journaling, and seeking therapy can help you manage stress and maintain a positive mindset. Investing time in these activities can boost resilience, improve emotional intelligence, and enhance your ability to navigate challenges with confidence.

Physical health is closely tied to how we feel emotionally and mentally. Regular exercise, a balanced diet, and quality sleep contribute to improved energy levels, reduced stress, and better focus. When you take care of your body, you set yourself up for success in every aspect of life, ensuring you have the strength and vitality to pursue your goals.

Boundaries are essential for maintaining a healthy work-life balance. Establishing clear limits on work hours and personal commitments can prevent burnout. By saying no when necessary and carving out time for yourself, you allow your mind and body to recharge. Whether it’s through taking vacations, enjoying hobbies, or simply resting, time away from responsibilities helps rejuvenate your spirit.

Self-care is also about growth. Investing in yourself through learning and development not only builds new skills but also boosts confidence. Whether you’re reading, taking online courses, or exploring new hobbies, continuous learning enriches your life and opens up opportunities for personal and professional growth. Investing in self-care isn’t selfish—it’s a necessary step toward living a balanced and fulfilling life.

ARTICLE BY STACY LEACH

When it comes to managing your money, where you bank matters. Credit unions like Community Resource Credit Union (CRCU) offer a member-focused approach that prioritizes people over profits. But what exactly does that mean for your financial well-being?

In this Q&A, CRCU breaks down the key benefits of banking with a credit union, how membership impacts service, and the financial products and technology that make managing your money easier than ever. Whether you’re looking for lower loan rates, better savings options, or a more personalized banking experience, CRCU is here to help.

1. WHAT ARE THE BIGGEST BENEFITS OF BANKING WITH A CREDIT UNION COMPARED TO A TRADITIONAL BANK?

At Community Resource Credit Union (CRCU), we put people before profits. Unlike traditional banks, which are owned by shareholders, CRCU is a member-owned, not-forprofit financial institution. This means that instead of maximizing shareholder returns, we focus on delivering value to our members through lower fees, competitive loan rates, and higher savings rates. We reinvest earnings into better services, technology, and community initiatives, ensuring that our members always come first. We actively support local schools, small businesses, and charitable initiatives to help strengthen the communities we serve.

2. CREDIT UNIONS ARE MEMBER-OWNED— HOW DOES THAT IMPACT THE WAY YOU SERVE YOUR CUSTOMERS?

Being a member-owned institution directly impacts how we serve our members. Every member is an owner, meaning decisions are made with their best interests in mind.

Members have a voice in the credit union’s direction and can vote for the Board of Directors, ensuring transparency and a commitment to their financial well-being. This ownership model allows CRCU to offer personalized service and tailor financial solutions that fit each member’s needs. Since we don’t have to satisfy shareholders, our earnings go directly back into offering lower loan rates, higher savings rates, and fewer fees.

3. WHAT TYPES OF LOANS AND FINANCIAL PRODUCTS DO YOU OFFER, AND HOW DO THEY COMPARE TO THOSE AT BIG BANKS?

CRCU provides a full suite of financial products designed to meet the needs of our members. From auto loans with flexible terms and low rates to mortgage and home equity loans with no hidden fees, we ensure competitive and accessible lending options. Our credit cards offer low interest rates and rewards with no annual fees, and our personal loans provide financial flexibility for a variety of needs. Business owners can also take advantage of our commercial lending options, making CRCU a one-stop financial partner for both personal and business banking.

4. HOW DOES A CREDIT UNION HELP ITS MEMBERS WITH FINANCIAL EDUCATION AND LONG-TERM FINANCIAL HEALTH?

We are committed to supporting our members’ long-term financial success through education and personalized guidance. CRCU offers free financial workshops, online learning resources, and one-on-one counseling to help members navigate everything from budgeting and credit scores to home buying and retirement planning. By providing the right tools and knowledge, we empower our members to take control of their financial futures.

“At Community Resource Credit Union, you’re not just a customer— you’re an owner, and your financial success is our priority.”

5. IF SOMEONE IS CONSIDERING SWITCHING FROM A BANK TO A CREDIT UNION, WHAT SHOULD THEY KNOW ABOUT THE PROCESS?

Switching from a bank to CRCU is simple and rewarding. If you live, work, or go to school in our service areas, you’re eligible to join. Opening an account takes just minutes, and we make transferring funds and setting up direct deposits easy. Once you become a member, you gain access to better rates, lower fees, and a financial institution that genuinely cares about your success. With CRCU, you’re not just a customer—you’re part of a community-driven credit union that has been serving members for over 90 years. Visit crcu.org/welcome to learn more about becoming a member today!

APRIL 4TH

29TH Annual Rotary Golf Club Classic

Oakhurst Golf Club - 20343 Bentwood Oaks Dr., Porter, TX 77365 | 9:00 AM

Join us for the 29th Annual Golf Club Classic! All proceeds support scholarships, youth development, and community projects.

APRIL 12TH

EMCID’s Eggcellent Event & Spring Mini-Market 2025

Don Ford Stadium - 22784 Hwy. 59, Porter, TX 77365 | 9:00 AM

Everybunny who’s anybody will be at EMCID’s Eggcellent Event & Spring Mini-Market at Don Ford Stadium from 9AM - 12PM. Enjoy egg hunts by age group, shop with local vendors, and snap a photo with the Easter Bunny!

APRIL 12TH

Montgomery County Market Days

Bull Sallas Park Show Barn - 21675 McCleskey Rd., New Caney, TX 77357 9:00 AM

Join us for a weekend of open-air and indoor exploration, discovery, and celebration of local talent. Who knows, you might just find your new favorite treasure and forge lasting memories with loved ones along the way. See you at the market! Saturday - 9AM - 5PM and Sunday 10AM - 4PM

APRIL 26TH

EMC’s Buyers Group

5TH Annual Crawfish

Boil & Fish Fry

Bull Sallas Park - 21675 McCleskey Rd, New Caney, TX 77357 | 5:30 PM

It’s time for the 5th Annual All-YouCan-Eat Crawfish Boil & Fish Fry – and you DON’T want to miss it! LIMITED VIP & PRIVATE TABLES! This year, we’re capping them at 100, so rally your crew and lock in your spot. All proceeds go to support LOCAL FFA & 4-H members at the EMC & Montgomery County Fair! Claim your spot: https://emcbuyersgroup. org/2023-crawfish-boil/

APRIL 26TH

Next to Nowhere Pop-Up Market

Back Pew Brewing - 26452 Sorters McClellan Rd, Porter, TX 77365 12:00 PM

Explore cool, unique vendors offering handmade goods, vintage finds, and more. Enjoy craft brews in a laid-back atmosphere, live music, delicious food trucks, and dog-friendly vibes. With great food, live music, and awesome shopping, it’s the perfect way to spend your day. Come for the vibes, stay for the fun! 12PM - 7 PM.

MAY 2ND

Tour 18 Golf Course - 3102 FM 1960 E Humble, TX 77338 | 7:30 AM

The 14th Annual AddiShack Charity Golf Tournament is Friday, May 2nd! We are so excited for another year of golf, food, drinks and FUN all to benefit Addi’s Faith Foundation and the fight against childhood cancer. https://addisfaith.org/addishack/

Exceptional Programs for Every Age: From infants to preschoolers all the way to 5th grade, we provide a safe, nurturing, and engaging environment that sparks creativity, confidence, and growth!

Before & after school care available.

Affordable Pricing:

Infants (6wks - 22 mo): $235/week | Toddlers (23 mo - potty trained): $215/week Preschoolers (3,4,&5): $190/week | Before & After School care: $125/week

Enroll Today! Spots are filling fast— scan QR code or visit rockinghorsetx.com to schedule a tour!

21112 Royal Crossing Dr, Kingwood, TX 77339

www.rockinghorsedaycarecenters.com | 281.540.3212

Family Owned and Operated since 1971 | We are