The Investment Issue

FINANCE + LEGAL SERVICES

SMART INVESTMENTS: BUILDING WEALTH FOR YOUR FAMILY’S FUTURE

EDUCATION

RAISING FINANCIALLY SAVVY KIDS: TEACHING THE NEXT GENERATION ABOUT WEALTH

APRIL 2025

FINANCE + LEGAL SERVICES

SMART INVESTMENTS: BUILDING WEALTH FOR YOUR FAMILY’S FUTURE

RAISING FINANCIALLY SAVVY KIDS: TEACHING THE NEXT GENERATION ABOUT WEALTH

APRIL 2025

Dear Readers,

April is all about investments—not just financial, but also the ones we make in friendships, creativity, and belief in one another.

For our cover this month, I knew exactly who to bank on when we needed a beautiful, meaningful design for our April issue. I reached out to my dear friend Stephanie Wehrmeister, the founder of Night Sky Paperie. Our friendship goes back to high school when we both worked after-school jobs at Target on N. Main Street in Walnut Creek. We sat at the same desk in the back of the store, and if I ever came in after Stephanie, I knew my workspace would be covered in her doodles. We developed a close bond and shared countless adventures as teens and young adults, and she became family—so much so that she and my mom formed their own special bond. After college, Stephanie spent years in the corporate world at Wells Fargo before leaving to follow her artistic passion. Now, she creates stunning paper goods and art, and I couldn’t be more honored to showcase her work on our cover.

This issue also highlights an incredible investment in people—one made with Merrill Lynch Financial Advisor Omar Chyou. I first met Omar before this magazine even existed, during a time when Walnut Creek City Lifestyle was just a vision. While we discussed business, our conversation quickly drifted into an engaging, lively chat about everything under the sun. He became one of my first believers, supporters, and, ultimately, an advertiser. This issue features his insights on smart financial investments, but to me, his story is a testament to the power of investing in relationships and ideas.

As you explore this month’s features, I invite you to think about the investments you’re making—in your future, your passions, and your community. Whether it’s a financial strategy, a leap into a creative endeavor, or simply showing up for a friend, these are the things that truly shape our lives.

Here’s to making investments that matter.

With gratitude,

LAUREL KELLAM, PUBLISHER @WALNUTCREEKCITYLIFESTYLE

April 2025

PUBLISHER

Laurel Kellam | laurel.kellam@citylifestyle.com

EDITOR

Hema Sivanandam

hema.sivanandam@citylifestyle.com

EDITORIAL COORDINATOR

Jennifer Starbuck | jennifer.starbuck@citylifestyle.com

CONTRIBUTING WRITERS

Lindsey Hickman, Julie Brown Patton, Crystal Long

CONTRIBUTING PHOTOGRAPHER

Albena Ilieva

CEO Steven Schowengerdt

COO Matthew Perry

CRO Jamie Pentz

CTO Ajay Krishnan

VP OF OPERATIONS Janeane Thompson

VP OF SALES Andrew Leaders

AD DESIGNER Matthew Endersbe

LAYOUT DESIGNER Kelsi Southard

QUALITY CONTROL SPECIALIST Marina Campbell

At Diablo Subaru, we care deeply about our community and are committed to keeping our neighborhoods vibrant and healthy now and for generations to come. Trees are vital to this effort — they provide oxygen, cool our community, filter water, clean the air, prevent flooding, and improve health.

Every year, the U.S. loses 36 million trees due to age, disease, infestation, and extreme weather. This loss negatively impacts both the environment and public health.

Subaru and retailers like us are proud to partner with the Arbor Day Foundation to help address this problem. Each spring as part of our Subaru Loves the Earth initiative, Diablo Subaru is providing and distributing 100 mature, regionally appropriate trees that will benefit communities for generations. Anyone, regardless of owning a Subaru, can reserve a tree free of charge.

Together, we are growing a greener, healthier Walnut Creek for generations to come.

1-6: Walnut Creek City Lifestyle magazine hosted a networking and appreciation session for our partners at Brioche de Paris in downtown Walnut Creek. 7: Care for your pet’s health and well-being by vaccinating them. Joybound offers free, monthly pet vaccination clinics at various locations in Contra Costa County!

Coliseum Dental is revolutionizing implant dentistry with Yomi, the first and only FDA-cleared AI robotic system for dental implants. This cutting-edge technology enhances precision, efficiency, and patient comfort, ensuring minimally invasive and highly accurate implant placement. Whether you're restoring a single tooth or a full smile, Coliseum Dental’s advanced approach delivers unmatched results. Experience the future of dental implants today—schedule your consultation and discover the next level of precision in implant dentistry!

From small repairs to full renova tions, Mr. Handyman, serving Walnut Creek and San Ramon Valley, is your trusted partner for home improve ment. As part of the neighborly fam ily, they offer expert craftsmanship, dependable service, and a hassle-free experience for all handyman jobs and general contracting needs. Whether fixing, remodeling, or maintaining, they’ve got you covered. Call (925) 4144567 today and let the pros handle it!

Mobility Matters, a nonprofit dedi cated to serving homebound seniors and veterans, is seeking volunteer driv ers to provide essential transportation for medical appointments and grocery trips. With just three hours of your time, you can make a lasting impact by helping members of the community maintain their independence. Flexible volunteer opportunities are avail able. Every ride makes a difference. Visit mobilitymatterscc.com/

Realtor Yelena Vayn Reflects On Juggling Real Estate Career And Home Remodel As First-Time Homeowner

Bay Area Realtor Yelena Vayn practices what she preaches to clients. While house hunting in 2024, she and her husband, Igor Sydorenko, fell in love with the character and views from their 1950s-built home in Walnut Creek. But they knew it needed work, TLC, and updates.

“I often tell clients that buying a home is just the first step. Figuring out how to make it yours is the real journey. Now, I’m living that journey myself,” she reveals about having her own home remodeled. “There’s no right or wrong answer regarding trade-offs between buying a move-in-ready home versus taking on renovations. It all depends on what works for anyone’s lifestyle, budget, and vision.”

Yelena says she’s guided clients through renovations before, for selling or investment purposes, or after buying, but going through with it firsthand "has been a whole different experience.”

She recommends that new homebuyers focus on cosmetic renovations, such as fresh paint, new flooring, and touches that make houses feel cleaner and renewed. Larger projects, like landscaping and structural changes, can be handled in phases over time.

“My biggest surprise was how quickly small projects add up! While fixing one thing, we typically uncovered more to fix in the process,” she says.

However, going through the renovation process herself now has made her an even stronger advocate for clients. “I understand firsthand the emotions, decisions, and challenges that come with buying a home and balancing long-term goals,” she says.

Whether buying, selling, or remodeling, Yelena states having a plan, the right team, and a little patience makes all the difference.

This Keller Williams Realtor believes homes are more than just places to live: they’re reflections of lifestyles. “That’s exactly why we chose Walnut Creek. We sensed it offers the perfect balance of nature, community, and convenience. From gorgeous hiking trails and the super fun, vibrant downtown to peaceful neighborhoods and a strong sense of community, it truly felt like the ideal place to plant our roots and create a home we truly love,” she states.

“I often tell clients that buying a home is just the first step. Figuring out how to make it yours is the real journey.”

She suggests considering a few tips before starting renovations sometimes, even simple things like cabinet handles and paint choices can shift budgets. She also encourages everyone to test paint colors on a larger wall section before committing to one, just to see how it looks in different lighting conditions and how it interacts with existing room elements. Sometimes, one project leads to another, and then suddenly, entire spaces need to be rethought, or previously unknown problems are uncovered.

Yelena advises first-time remodelers to set a budget and add 20% or more for unexpected costs. Be flexible with timelines, as even well-planned projects can take longer than expected. It is also important to pick battles wisely, as some updates are worth the investment, while others are purely cosmetic. Renovations can be disruptive so one should expect stress as it's part of the process.

Some of the spring 2025 home remodeling trends Yelena has noticed include a shift away from cool gray aesthetics to warmer tones, natural wood finishes, and layered, inviting textures.

“More buyers are valuing the connection to nature. So indoor-outdoor living is a priority, whether it’s patios, pergolas, outdoor kitchens or fire pits, people are making the most of their yards,” she says.

Big kitchen islands with seating are still a top request. “Open-concept layouts are evolving not just about space, but about creating friendly, functional areas.”

Energy efficiency is also popular, with solar panels, well-insulated windows, and upgraded HVAC systems.

Statement bathrooms are also becoming a real design feature, Yelena concludes. “Some custom homes have a completely unique look for every bathroom, with bold tile, floating vanities, and custom spas.”

She also believes that kitchens and bathrooms still are spaces that yield the highest return on investment.

650.701.5422

YelenaVayn.com

Ensure your assets are protected and your wishes honored with a solid estate plan.

Having a solid estate plan is the key to securing a future for you and your family. Three cornerstones of solid estate planning are creating a will or trust to ensure your assets are distributed according to your wishes, having powers of attorney so that someone else has the authority to make decisions on your behalf if you are unable to do so, and making sure beneficiary designations are named on your financial accounts. These three things will ensure that your estate proceeds smoothly and minimize confusion or disputes.

Wills and trusts are documents that outline an individual’s wishes after they pass. They are similar as they both allow an individual to specify who will receive their assets, but they differ on how they are executed. A will goes into effect after an individual’s death, at which point their assets are distributed according to the probate process and the

instructions laid out in the will. A trust, however, is a legal entity that holds an individual’s assets during their lifetime and distributes them according to the instructions in the trust upon the individual’s death. Trusts remain private and do not have to go through probate. One can have a trust in addition to or instead of a will. However, the will and trust should not have conflicting terms.

ARTICLE BY NATHAN PASTOR | PHOTOGRAPHY BY AIKA CARDIN PHOTOGRAPHY

A power of attorney is a legally binding estate document that grants someone else authority to make critical decisions on your behalf if you lack the capacity to do so. There are two different types of powers of attorney: financial and medical. A financial power of attorney allows someone else to handle your finances if you cannot do so yourself, while a medical power of attorney gives someone else the authority to make medical decisions on your behalf when you cannot communicate your wishes. A medical power of attorney is critical if you are in a coma and a decision has to be made regarding life support. Everyone age 18 and over should have a medical power of attorney.

Beneficiary designations are often used in conjunction with a will or trust. They specify who will inherit any assets that do not pass by way of the will or trust. Life insurance policies and retirement accounts typically have beneficiary designations that overrule what is laid out in a will or trust.

One common mistake people make when setting up their estate plan is failing to properly fund their trust by titling assets into the name of their trust. Another common mistake is failing to keep an estate plan up to date. For example, one may forget to update their beneficiary designations after having children or getting divorced. Because relationships and family dynamics change over time, failing to update one’s estate plan can result in assets going to people that the individual no longer wants them to go to. It is important to consult with an experienced estate planning attorney who can guide you through the process and help you avoid mistakes.

Nathan Pastor is a certified specialist in trusts and estates. Get started on estate planning today. Visit Pastor Law Group, PC at NathanPastor.com

New Office in Walnut Creek - Rossmoor Area

Medical, Surgical, Cosmetic Dermatology

Skin Cancer Diagnosis and Treatment

Mohs Surgery & Reconstruction | NonSurgical Skin Cancer Radiation

G Lift (mini facelift) | Eyelid Lifts | Neck and Body Liposuction

NonInvasive Body Contouring | Lasers for Wrinkles | Lasers for Red & Dark Spots

Acne Scar Treatment | Injectables | Liquid Facelift | Botox & Dysport

Dr. Hayes B. Gladstone, MD

Double Board Certified, Dermatology/ Dermatologic Surgery

Fellowship Trained, Cosmetic Surgery

Former Director/Professor, Dermatologic Surgery Stanford University

Dr. Daniel Wall, MD

Board Certified Dermatologist

Medical, Surgical, Cosmetic Dermatology San Francisco Giants Dermatologist

Jaclyn Ballin, PA-C

Certified Dermatology

Physician Assistant

Walnut Creek (Tice Valley Plaza)

Call or Text: (925) 427-7000 | 1808 Tice Valley Blvd, Walnut Creek, CA 94595

Hours: Tuesday - Thursday: 9:00am-6:00pm, Friday 9:45am - 1:00pm

Call or Text: (925) 837-6000 | 3860 Blackhawk Rd #140, Danville, CA 94506

Hours: Monday - Friday: 9:00am-6:00pm

HOW TO TEACH SMART MONEY HABITS EARLY

ARTICLE BY NEALE GODFREY

PHOTOGRAPHY PROVIDED BY NEALE GODFREY

photo

Even in these challenging times when we are so distracted, we need to keep parenting. And it's more important than ever to ensure we are the parents we want to be. Why? Because if we don't set our kids up for success, we set them up for failure.

It's not easy to teach money lessons you may not have learned. And because of this, you may unknowingly support the "I want, I want" syndrome. You dole out $20 here and $20 there because, "Hey, they are just kids." You are actually fostering entitlement.

There is nothing that we use more constantly than money. Even if you are not spending it, your mortgage or credit card interest rates are ticking, and your electric bill is adding up. If you are not making money decisions based on knowledge, you're making them based on ignorance. Why would we pass this legacy on to our kids?

Work-for-Pay

This concept may raise a few eyebrows. I think young children should go on the family payroll. Allowance should be in the form of payment for work for specific age-appropriate household chores. I start really young for two reasons:

1) Research shows that children experience the greatest brain growth between birth and age five. They learn abstract and hardto-grasp languages. So, if our children learn the most at a young age and form their patterns and habits, why wouldn't we start teaching them this important life skill when they are young?

2) At this young age, kids think we are really smart, and they want to do everything we do. By the time they are teens, we get "really stupid," and any lesson may seem like more "blah, blah, blah."

There are two types of chores within a household:

Citizen-of-the-Household Chores – brushing their teeth, going to bed on time, and returning toys to the toy box, for example, are part of good behavior. You can make a chart, write down each chore, and put a sticker for each accomplishment.

If you are not making money decisions based on knowledge, you're making them based on ignorance.

Work-for-Pay Chores – where they receive money. These include chores such as sorting out laundry and recyclables and setting the table (except for the knives). You model the chores and help them until they can do them on their own. Write down each chore on a chore chart. They should do about three to four chores a few days a week. Payday, with real coins, should be a consistent ritual. It's important that they make the connection between real and digital money. Pay them their age each week, so a three-year-old, for example, gets three dollars a week.

CONTINUED >

Budgeting is another habit to learn. Help your kids to count out their money into four clear plastic jars or envelopes. Here is how it gets divided:

• Charity Jar—10%: You are teaching them the value of giving to others. You pick the charity with them. It could be as simple as putting coins in the jar to support the local animal shelter.

• Quick Cash—30%: This is for instant gratification. They worked hard and should be able to make some impulse purchases. But when the money is gone, it's gone. No more nagging at the grocery store; they need to use their Quick Cash

• Medium-Term Savings—30%: They will set a monthly goal to save up for something larger, like a sticker book. This way, they will learn the benefits of savings and avoid instant gratification.

• Long-Term Savings—30%: If possible, open a real bank account in a physical bank and explain how a bank works. As they grow older, you can go all digital. But for now, you don't want them to think that digital money is just another video game.

This is only the beginning of establishing a healthy, lifelong relationship with money. We want our kids to understand what money can and can't do because, as parents, we never want our offspring to confuse Net Worth with Self-Worth

Neale Godfrey is a speaker and author of 28 books that empower children and parents to have healthy relationships with money. She is also the New York Times #1 Best-Selling Author of Money Doesn't Grow on Trees: A Parent's Guide to Raising Financially Responsible Children.

Spring is a season of renewal, and what better time to breathe fresh life into your home? Whether you’re preparing to sell, planning to entertain guests, or just craving a change, spring offers the perfect opportunity to revitalize your space. Ana Gonzalez of A&A Studio Staging & Design offers a few simple tweaks and a touch of creativity to help you transform your home into a welcoming haven.

Ana and Alfonso focus on timeless, neutral designs that appeal to a broad audience year-round.

1. Rearrange Furniture for a New Perspective: A simple furniture rearrangement can create a fresh feel. Try moving your living room or bedroom layout to open up the space and improve flow. Position seating near windows to let in more natural light and enjoy those beautiful spring views.

2. Declutter and Simplify: Spring is the perfect time for a deep clean and decluttering session. Clear off mantels, coffee tables, and countertops. Replace heavy or ornate decor with clean, minimalist designs. Opt for light materials and natural accents—like wood, wicker, and cotton—that reflect the season’s effortless beauty.

3. Bring the Outdoors In: Nothing says spring like the beauty of nature. Gather fresh flowers or greenery from your garden and place them in charming, mismatched vases to add a touch of eclectic flair to your home. Even small potted plants or succulents can bring a lively, fresh vibe to any space.

4. Revamp Your Patio: Don’t overlook your outdoor spaces. Fresh flowers in garden beds or planters, a fresh layer of mulch, and a little rearrangement of patio furniture can significantly enhance curb appeal. Adding small updates like a table runner or fairy lights can transform your patio into a cozy retreat.

ARTICLE BY LINDSEY HICKMAN | PHOTOGRAPHY PROVIDED BY ANA GONZALEZ

1. Throw Pillows and Blankets: Swap out heavy throws for lightweight, textured blankets in soft neutrals. Add a pop of color or floral patterns to throw pillows to instantly rejuvenate sofas and beds and evoke the season’s spirit.

2. A Potted Tree: Bring in a potted tree—whether a small indoor plant or a larger ornamental tree—to create an organic, elegant touch in

your living room. The freshness of green foliage can brighten any space and create a tranquil, nature-inspired atmosphere.

3. Sheer Curtains: Toss those heavy winter drapes and opt for light, sheer curtains, allowing spring sunshine to pour in. The soft glow they provide will help rooms feel airy and bright, creating a soft, spring-like ambiance.

Home staging is the art of preparing a home for sale by enhancing its appeal to potential buyers. Staging highlights a home’s best features by strategically placing furniture, decor, and accents while minimizing any weaknesses. The goal is to help buyers envision themselves living in the space. Staging is even considered a more cost-effective investment than reducing the price of a home that lingers on the market.

At A&A Studio Staging & Design, owners Ana Gonzalez and Alfonso Hermosillo work with a diverse range of clients, including realtors, homeowners, and property investors. Realtors rely on staging to make their listings stand out in a competitive market, while homeowners benefit from maximizing their property’s value and appeal. Property investors looking to flip homes or elevate rental properties also see significant returns with a well-staged space.

“Working with A&A Studio is a seamless, personalized experience,” opined Ana and Alfonso. “Our process begins with a consultation to assess your home’s potential, followed by a custom staging plan tailored to its unique features.” Whether clients need full staging for an empty home or a few tweaks to enhance a current space, the team ensures the process is professional and efficient.

While they tailor designs to each season, Ana and Alfonso focus on timeless, neutral designs that appeal to a broad audience yearround, boasting, “staged homes don’t just look better—they sell faster and for more money.”

For more information, visit Aandastaging.com or follow @aanda.studio on Instagram.

www.studio96productions.com | studioproductions96@gmail.com

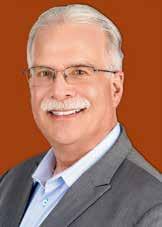

When it comes to investing, especially as a first-timer, things might get a little overwhelming. Between all the seemingly foreign financial jargon and various strategies, starting to invest might seem daunting. However, with the proper guidance, navigating the financial landscape can be empowering and rewarding. In this issue, we speak with Omar Chyou, Senior Vice President of Wealth Management at Merrill Lynch in Walnut Creek, to gain insights into investing as a first-timer.

Omar's passion for financial planning began early in life when as a college freshman, he faced an unexpected lesson in credit card debt.

"My parents helped me pay off my balance, and I quickly learned about the pitfalls of credit card debt due to the compounding interest," he recalls. This incident left a lasting impression on Omar's life. It drove him to pursue a career in financial services upon graduating to help others achieve better financial outcomes.

Omar says for many first-time investors, the fear of market downturns can create hesitation. They often get scared, not wanting to "lose more," and prematurely pull out of the market, only to reinvest later at higher prices, missing critical growth opportunities.

"These investors end up sitting on the sidelines in cash waiting for the 'right time' and end up missing the market bounce only to then reinvest at a higher price after the market has eclipsed the original value they sold their investment," says Omar.

To avoid this pitfall, Omar advises investors to have a solid financial plan with clear goals, which will enable them to remain focused on their long-term objectives and time horizons.

"This plan will guide each person to make better personal financial decisions as there

is meaning behind each action and a clearer reason to either maintain the course or make a change," says Omar.

He also stresses the importance of focusing on the big picture when investing.

"It is not just how much you make, but how much you keep," says Omar.

Omar offers a straightforward approach when asked about the best strategies for firsttime investors.

"Newer investors believe they need to time the market and buy in at the 'right time.' However, the right time is now. Get in early and let the power of compounding be an ally," says Omar. "A common adage comes to mind: 'It is not timing the market, but time in the market.'"

CONTINUED

Additionally, Omar stresses the importance of maintaining a reserve amount of cash, about six months of one's average monthly expenses, for emergencies to navigate market downturns.

"Personally, I also believe that while a younger investor should be fully invested, having a strategic amount of cash can provide

“NEWER INVESTORS BELIEVE THEY NEED TO TIME THE MARKET AND BUY IN AT THE 'RIGHT TIME.' HOWEVER, THE RIGHT TIME IS NOW. GET IN EARLY AND LET THE POWER OF COMPOUNDING BE AN ALLY,” SAYS OMAR.

benefits when markets decline and there are good opportunities to purchase," says Omar.

First-time investors should possess patience and fortitude, not be greedy, and have a specific end goal when investing.

"Steady the course during turbulent markets and don't make emotional decisions," says Omar. "Having an investment policy as part of a personal plan can be very helpful as it can serve as a reminder as to why one is invested the way they are and dissuade poor knee-jerk reactions."

Beyond his professional expertise, Omar, a Spanish speaker, actively supports organizations focused on the Latino community and is deeply engaged in local initiatives. In his personal life, he enjoys spending time with his wife and three children and embracing the great outdoors through hiking, fly fishing, snowboarding, and karting.

"I am a car enthusiast and enjoy going to races or being on a track myself," says Omar.

ARTICLE

BY

DORIS HOBBS

PHOTOGRAPHY BY RACHEL CAPIL PHOTOGRAPHY

Each year, the Diabetes Youth Families (DYF) Gala shines as a beacon of hope for children and families affected by type 1 diabetes. What began as a small organization supporting children with diabetes has since grown into a community-driven initiative that empowers those facing this lifelong condition. Since 1938, DYF has been dedicated to creating a safe space where children with diabetes and their families can connect, find inspiration, and access essential resources.

For many children, growing up with type 1 diabetes can feel isolating. Managing insulin levels is only part of the challenge—coping with the emotional and social aspects of a chronic illness is just as significant. DYF has been a lifeline, offering educational programs, summer camps, and family retreats that help children build confidence, foster independence, and connect with others who share similar experiences. Through these initiatives, DYF provides the tools needed for children to not only manage diabetes but to thrive.

This year's DYF Gala promises to be an extraordinary evening of celebration and philanthropy. With the theme “Share the Magic” the event, which will take place on April 26th at The Ritz-Carlton in San Francisco, will bring together supporters, partners, and families dedicated to making a difference in the lives of those affected by diabetes.

One of the highlights of this year’s gala is the recognition of Nurse Jeannie Hickey as the honoree for her extraordinary contributions. Over the years, she has provided compassionate care and invaluable education to children with diabetes and their families. Her dedication to empowering parents and caregivers in managing the disease has earned her the admiration of countless individuals.

“Nurse Jeannie has been the heart and soul of our camp community,” shares DYF Camp Director

Samantha Gomez. “I first met Nurse Jeannie in 2006 as a camper, and I still remember her warm smile as she welcomed me into the medical building for the first time.”

Over the years, Samantha has found working with Jeannie an incredible journey.

“She is truly the glue that holds the medical building together, bringing comfort and positivity to everyone around her. We are beyond grateful for her unwavering dedication and the magical impact she has on our camp community,” says Samantha.

While the gala is a celebration, it also serves as a critical fundraising event. The proceeds raised will directly support DYF’s ongoing programs, ensuring that children and families continue to receive life-changing services. Funds from the event will provide scholarships for summer camps, educational retreats, and outreach initiatives that help families navigate the complexities of diabetes care.

Last year, over $280,000 was raised.

“DYF is a small but mighty organization with an 88-year history of serving youth with type 1 diabetes,” shares Marissa Clarke-Howard, Director of Development and Communications. “While we may not be as widely recognized as international diabetes nonprofits, we are a leader in our field, making a massive impact in the type 1 diabetes community.”

With a $2.5 million annual budget, DYF has a dedicated team of 11 year-round staff serving 1,500 individuals across 18 programs every year.

“The success of this gala is essential in allowing us to continue providing diabetes support. We are deeply grateful for every contribution—every dollar raised will help provide life-saving resources and care this summer,” says Marissa.

For more information about the DYF Gala, visit dyf.org/

Google Reviews:

“Dr. Hozic is an absolute gem” | “Her technique is impeccable.”

“Dr. Amela is by far the most knowledgeable, professional and overall lovely skincare provider I have ever worked with”

Walnut Creek City Lifestyle is excited to team up with Dr. Amela Hozic at Ellevi MedSpa to bring a heartfelt initiative to life—a makeover contest dedicated to celebrating the strength and resilience of women in our community. Inspired by empowerment and transformation, this contest was created to uplift a woman who has faced significant challenges and could benefit from a rejuvenating Medspa experience. Dr. Amela, known for her expertise and compassionate care, understands self-care's profound impact on confidence and overall well-being.

"Everyone deserves to feel confident, especially those who have navigated life's toughest challenges with grace and determination," says Dr. Amela.

This makeover is her way of giving back to the community and honoring those who inspire us with their resilience.

"It’s a chance to uplift a woman who has faced life’s storms and come out stronger, to remind her that she is seen, valued, and deserving of care and celebration," she says.

The makeover includes:

• Personalized medical aesthetics treatments, including facial, skincare, facial balancing, wrinkle relaxing treatments

• A personalized hair transformation

• Professional makeup application

• Eyebrow microblading by a celebrity artist If you know an extraordinary woman who deserves this life-changing opportunity, nominate her at ellevibeauty.com/ makeover. Nomination ends May 1.