REBNY ON 2025:

James Whelan, President, Real Estate Board of New York

James Whelan, President, Real Estate Board of New York

In shifting markets, we’re taking the long view, so you can seize the moment — now and for years to come.

EDITORIAL

Editor

Debra Hazel

Director of Communications and Marketing

Penelope Herrera

Director of Newsletter Division

Cheri Phillips

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Serena Bhullar

Associate Graphic

Designer

Caroline Thomas

Cover Photography

Jill Lotenberg/REBNY

CONTRIBUTORS

Phillip J. Consalvo

Frank DeLucia

Merilee Kern

Kris Kiser

Greg Papeika

Stuart Saft

James F. Schnars

Dan Sharplin

Carol A. Sigmond

Stephen Smith

Scott Spector

Steve Tishco

Brian Turner

BUSINESS

Technology Consultant

Eric Loh

Distribution Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Serena Bhullar

Caroline Thomas

Editors

Natalia Finnis-Smart

Debra Hazel

Penelope Herrera

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827 Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306 New York, NY 10123 212-840-MANN (6266)

For 50 years, R&E's attorneys have been instrumental in driving the firm's success, helping R&E achieve remarkable milestones and putting the firm at the forefront of the real estate industry.

Meridian’s national dominance in multifamily financing gives us a unique vantage point from which to approach markets on our clients’ behalf. By leveraging our 30+ year relationships and depth of experience, we are able to see what others can’t and produce exceptional outcomes — especially in turbulent markets. Remain informed and be agile with Meridian.

For more than 125 years, in good times, in bad times, in all times, the New York City real estate industry has had one constant to rely on: the Real Estate Board of New York. Whether it is supplying critical data to help us benchmark transactions, hosting networking events including last month’s amazing gala or lobbying our public officials to strengthen real estate, REBNY never stops working to make us and our business better.

REBNY is, simply, the voice of our industry, and we’re thrilled to feature that voice on our cover this month.

Speaking of galas, as you’ll see in these pages, the industry was back to full celebrations of the holidays and the new year.

And at the National Realty Club (NRC), we’re kicking off a new year of Fireside Chats with my dear friend, our very first Mann Report cover subject and industry icon Bob Knakal who will be discussing “Reinventing Real Estate” — and no one is better qualified to do so. At his new company, BK Real Estate Advisors, Bob is blending new technologies with old-fashioned industry knowledge and dealmaking to change how real estate is bought and sold. Join us on March 3 from 5:30 p.m. to 7:30 p.m. at the spectacular, newly renovated Versa on the seventh floor of the Renaissance Hotel (218 West 35th St.)

The event is free for NRC members, $200 for nonmembers. For more information about the event or the NRC, email Penny Herrera at penny@ nationalrealtyclub.com.

See you next month!

“Cooperation is the thorough conviction that nobody can get there unless everybody gets there.” — Virginia Burden

Ongoing

Strictly

Sayings become cliches because there’s an element of truth to them, and this issue epitomizes the statement that “Great minds think alike.”

We’re blessed to have extraordinary contributors share their experience and expertise with us, and this month has a couple discussing the growing importance of “accessory dwelling units,” small, fully equipped homes built near a primary residence. These mini-homes are providing an income stream, or much-needed housing for older generations or young adults.

Merilee Kern’s interview with Maxable’s Paul Dashevsky and Jon Grishpul offers a guide to why and how to build in this format, while our Commercial Corner interviewee, Robert Wasmund of Ascent Developer Solutions, discusses financing. Given today’s housing shortage around the country, it’s a trend to be watched.

Elsewhere, our friends at Ditchik & Ditchik remind us that the deadline for most property owners to protest their New York Tax Commission assessments is March 1, among other deadlines. And if you’re craving the sun by now (who isn’t in February?), check out our feature on Naples, Florida.

Thanks to all the great minds who continue to enlighten us.

Photos by Brooke Alexander

Law firm Fried Frank’s Real Estate Department hosted its annual Real Estate Holiday Party at Cipriani 42nd Street. The party, which aims to show the firm’s appreciation to its valued lawyers, clients and friends in the real estate industry, welcomed over 900 guests.

CREW New York held its annual Holiday Party at The Lotos Club, featuring a celebration of CREW New York’s 2024 Member Recognition awards and the announcement of this year’s Past Presidents’ Scholarship recipients.

CREW New York’s Member Recognition awards honored esteemed professionals who have made a significant impact on the association and the commercial real estate industry as a whole. This year’s categories recognized three influential members for their commitment, contributions and service and one company for their dedicated support and empowerment of CREW New York.

Star of the Year was Robin Landow, principal, Landow and Landow Architects. She is a CREW New York board member and chair of the Career Advancement committee, overseeing the Mentorship Program, CREW Careers and the philanthropic activities including the Holiday Party’s toy drive in collaboration with Toys for Tots and hygiene kit drives for Women in Need.

Also Star of the Year was Kenne Shepherd, founding principal, Kenne Shepherd Interior Design Architecture. Shepherd has been a CREW New York member for 24 years and currently serves as a board member and chair of the Programs committee. She has been a driving force behind CREW New York’s signature events including the monthly luncheons, summer Leading Ladies of Real Estate series and tours of landmark buildings across New York City.

Named Rising Star was Andrea Palacios, assistant vice president, Santander Bank. She joined CREW New York as a past presidents’ scholarship recipient and now serves on both the Career Advancement and Young Professionals committees.

Sponsor of the Year was Akerman, a longtime supporter and Silver Sponsor of CREW New York. It hosts CREW New York’s signature Leading Ladies of Real Estate series each summer that highlight trailblazing women from around the commercial real estate industry.

The night also included the announcement of the 2024 Past Presidents’ Scholarship recipients: Joane Kim, Columbia University GSAPP; Christine Kim, Columbia Business School; Jessie Pan, Columbia University GSAPP, Miki Ji, NYU Schack Institute of Real Estate and Katy Lepeturin, Columbia Business School

Photos courtesy of Louis Gilbert Photography

Project REAP (Real Estate Associate Program) celebrated its DC Silver Jubilee at Skyline 609, honoring its 25th anniversary. Launched in Washington, D.C., REAP has graduated 275 Fellows from the greater Washington area and over 2,000 alumni nationwide.

The event also introduced REAP newly appointed Executive Director Taneshia Nash Laird. Nash Laird, most recently the inaugural president and CEO of the Greater Roxbury Arts & Cultural Center, is the former president and CEO of Newark Symphony Hall, the cofounder of the entertainment venue MIST Harlem and was a New Jersey municipal and state economic development official.

“She’s an entrepreneur, she’s a steward, she’s a mentor, she’s a mom of two teenaged girls, and she’s an amazing leader,” said REAP Chair of the Board Michael Kercheval.

The event also honored Buwa Binitie, founder and CEO of the Dumas Collective and a REAP alumnus in 2005, as DC REAPer of the Year, voted on by an overwhelming majority of area alumni.

Nash Laird praised Binitie’s commitment to “creating and preserving affordable and workforce housing,” noting that he and his team at Dumas Collective have closed over $2.3 billion in financing, resulting in over 8,000 workforce and affordable units through unconventional real estate transactions that utilize low income housing tax credits, New Market tax credits, tax exempt bonds and other forms of alternate financing.

“I can’t thank REAP enough for giving me an opportunity to live my dream. This recognition is more important than any … I’ve ever received because this is where I started,” Binitie said. “You can’t be what you don’t see.”

REAP Founder Mike Bush, president of The Minority Resource and an adjunct professor in urban development at Georgetown University, also was honored at the event.

Photos by Stefan Klapko

The Met Council welcomed more than 500 attendees at this year’s Annual Benefit who gathered to celebrate the vital assistance Met Council provides to over 325,000 New Yorkers in need each year. In 2024, Met Council is especially proud to have distributed nearly two million pounds of food each month, provided emergency support to the more than 1,000 families facing domestic violence and secured over 20 million dollars in SNAP funding for its clients.

One of the night’s highlights was a stunning sculpture: an apple crafted from 3,496 tuna cans, commissioned from DeSimone Consulting Engineers. Each can symbolizes acts of kindness that nourish and uplift the lives of our neighbors in need. Following the event, the cans will be distributed to nearly 3,000 Holocaust survivors as part of Met Council’s weekly food packages. The evening was made even more memorable by the incredible entertainment of Josh Beckerman, the Foodie Magician, who captivated attendees with his unique blend of humor, magic and culinary charm.

During its program, Met Council honored Michelle and Adi Chugh with the Community Leadership Award, inspired by Adi’s moving message of three life maxims to live by. Additionally, Ben Gershenfeld was recognized with the Young Leadership Award, representing the next generation of changemakers.

The benefit also drew over 30 elected and appointed officials, including New York Attorney General Letitia James and New York State Comptroller Tom DiNapoli, along with philanthropists and community leaders — all united in their commitment to combating poverty.

The New York Apartment Association (NYAA) held its first annual cocktail party at the Tribeca Rooftop. NYAA was formed in 2024 by merging the Community Housing Improvement Program (CHIP) and the Rent Stabilization Association (RSA). NYAA launched in September 2024 as a means for the industry to have a unified, singular voice to advocate for better housing policy that will incentivize growth and make abundant housing possible.

More than 600 industry experts, members and leaders came together to network and build community within the industry. In an often-fraught political landscape for real estate, this event provides an opportunity for members and industry professionals to connect and converse..

The 57th Annual NYU Conference on Capital Markets in Real Estate, hosted by the NYU School of Professional Studies Schack Institute of Real Estate, brought together commercial real estate industry icons and up-and-coming leaders to explore how the improving macroeconomic sentiment and shifts in the global economy will shape opportunities and risks in real estate capital markets moving into 2025.

“Capital markets are the lifeblood of the global real estate market, and for 57 years, the NYU SPS Annual Conference on Capital Markets in Real Estate has been the foremost and most enduring thought leadership forum for the global real estate capital markets,” said conference co-host Marc Norman, Larry & Klara Silverstein chair in real estate development and investment, and associate dean of the NYU SPS Schack Institute of Real Estate. “This year’s speakers and panelists shared their insights and perspectives on the recent infrastructure boom, financing for sustainable workforce housing, the capital markets for alternative real estate assets, global equity investments and the next generation of leaders shaping the industry, among other topics.”

This year’s NYU Conference on Capital Markets in Real Estate also celebrated the 25th Anniversary of the event’s most popular session, the annual Golden Apple Panel, which highlightspioneering leaders who continue to shape the sector. These leaders have faced challenges and seized opportunities with resilience and foresight.

The 2024 edition of this panel, moderated by Robert S. Blumenthal ’80, featured Jeff Blau of Related Companies, Marty Burger of Infinite Global Real Estate Partners, MaryAnne Gilmartin of MAG Partners, Scott Rechler of RXR and William C. Rudin of Rudin.

The discussion explored key trends, shared insights on today’s most pressing issues and discussed how long-standing principles are being challenged and redefined in response to new market demands with this group of industry visionaries

We are constantly upgrading our approach and methods to save our clients time and money by delivering the most progressive services and tools in the industry.

Why? To always increase the value of our buildings and enhance the lifestyles for our residents.

Large to small, we tailor all our services to meet the unique needs of each of our clients. A total commitment to quality service is what has made Century one of the most trusted management companies in New York for over 40 years.

Connect with our expert team today to find out how we can help. OUR EXPERTISE AT A GLANCE Residential Property Management

Financial Management

Risk Management

Residential Sales & Rentals

Coop and Condo Conversions

Construction Coordination

Project Management

Taking its first office in New York City, IGI Global Scientific Publishing has signed for 4,000 square feet at 250 Broadway, a 648,000-squarefoot office property in Lower Manhattan, announced AmTrust RE. AmTrust’s Anne Holker and the CBRE team of Brad Gerla, Michael Rizzo and Alex Benisatto represented the landlord in the transaction, while the tenant was represented by Aaron Winston of Newmark.

IGI Global Scientific Publishing is an international academic publisher of scientific research books, journals and encyclopedias with a focus on business and management; science, technical and medical and education and social sciences.

“With interest rates falling and other positive economic indicators, we’ve seen strong leasing activity over the past few months across our New York City office portfolio,” said Jonathan Bennett, AmTrust’s president. “Companies are coalescing around the idea that a postCOVID-19 world requires a highly designed, well-located office setting that is easily accessible to workers and positions them for professional success. As a well-regarded academic publisher, IGI Global Scientific Publishing is an exciting new addition to our tenant roster. Their move to 250 Broadway is additional proof of the success we’ve had at elevating this office property for premier local and national commercial tenants.”

The building is located directly across the street from City Hall Park

and is home to several law firms, New York City Council, New York City Housing Authority, New York State Assembly and New York State Senate. Originally constructed in 1962, the property has received significant capital improvements in recent years, including major upgrades to the lobby, elevators and other common areas.

Nordstrom Inc. has signed a definitive agreement under which Erik, Pete and Jamie Nordstrom, other members of the Nordstrom family and El Puerto de Liverpool, S.A.B. de C.V. will acquire all of the outstanding common shares of Nordstrom not already beneficially owned by the Nordstrom family and Liverpool. The all-cash transaction is valued at approximately $6.25 billion on an enterprise basis. Following the close of the transaction, the Nordstrom family will have a majority ownership stake in the company.

Under the terms of the agreement, Nordstrom common shareholders will receive $24.25 in cash for each share of Nordstrom common stock they hold. In addition, the board intends to authorize a special dividend of up to $0.25 per share immediately prior to and contingent on the close of the transaction. Nordstrom will become a private company.

“For over a century, Nordstrom has operated with a foundational principle of helping customers feel good and look their best,” said Erik Nordstrom, CEO of Nordstrom. “We look forward to working with our teams to ensure Nordstrom thrives long into the future.”

“Nordstrom is one of the worldwide leaders in department store retailing, and we’re thrilled to be investing in a company that has meaningfully shaped the industry for nearly 125 years,” said Graciano F. Guichard G., executive chairman of Liverpool.

The transaction is expected to close in the first half of 2025. It will be financed through a combination of rollover equity by the Nordstrom family and Liverpool, cash commitments by Liverpool, up to $450 million in borrowings under a new $1.2 billion ABL bank financing, and company cash on hand. Following the closing of the transaction, Nordstrom will be owned 50.1% by the Nordstrom family and 49.9% by Liverpool.

Morgan Stanley & Co. LLC and Centerview Partners LLC are acting as

$6.25B

financial advisors to the special committee, and Sidley Austin LLP and Perkins Coie LLP are acting as legal counsel to the special committee. Moelis & Company LLC is acting as financial advisor and Wilmer Cutler Pickering Hale and Dorr LLP, Lane Powell PC and Davis Wright Tremaine LLP are acting as legal counsel to the Nordstrom family. J.P. Morgan Securities LLC is acting as financial advisor and Simpson Thacher & Bartlett LLP and Galicia Abogados S.C. are acting as legal counsel to Liverpool.

JCPenney and SPARC Group have combined to form a new organization, Catalyst Brands, creating an unmatched portfolio of six retail banners.

Catalyst Brands brings together SPARC Group’s brands Aéropostale, Brooks Brothers, Eddie Bauer, Lucky Brand and Nautica with JCPenney and its exclusive private brands, including Stafford, Arizona and Liz Claiborne. Catalyst Brands, which has served over 60 million customers over the past three years, boasts more than $9 billion of revenue, 1,800 store locations and 60,000 employees.

The combined Catalyst Brands organization is a joint venture formed in an all-equity transaction between JCPenney and SPARC Group, with shareholders Simon Property Group, Brookfield Corporation, Authentic Brands Group and Shein. In addition, Catalyst Brands has sold the U.S. operations of Reebok and is exploring strategic options for the operations of Forever 21.

Marc Rosen, formerly the chief executive officer of JCPenney, has become CEO of Catalyst Brands. Michelle Wlazlo, formerly the chief merchandising and supply chain officer of JCPenney, has been promoted to brand CEO of JCPenney. Natalie Levy continues her role as brand CEO of Aéropostale, Lucky Brand and Nautica and Ken Ohashi will continue leading Brooks Brothers and has assumed responsibility of Eddie Bauer in his new role as brand CEO of both. Kevin Harper, formerly an executive with Walmart, will join Catalyst

Brands as chief operating officer. Marisa Thalberg, formerly the consulting chief marketing and brand officer of JCPenney, has become the chief customer and marketing officer of Catalyst Brands.

Catalyst Brands is headquartered in Plano, Texas with offices in New York, Los Angeles and Seattle.

In the largest CMBS loan ever issued for a single office asset, Tishman Speyer successfully completed a $3.5 billion refinancing of the Rockefeller Center campus.

Bank of America and Wells Fargo served as co-lead managers on the five-year Single Asset Single Borrower (SASB) loan with a fixed interest rate of 6.2265%. The proceeds will be used to pay off Rockefeller Center’s previous 20-year, $1.7 billion CMBS loan and additional mezzanine financing set to mature in May 2025, and fund reserves for contractual leasing costs.

The 7.3 million-square-foot campus encompasses workspaces, multilevel retail, popular attractions, private event spaces and dining options, as well as dynamic open spaces including the new 24,000-square-foot park atop Radio City Music Hall. Rockefeller Center is co-owned by Henry Crown & Co., the Crown family’s Chicago-based investment fund, and Tishman Speyer.

“We are proud of our stewardship of Rockefeller Center,” said Tishman Speyer CEO Rob Speyer. “The lending market’s overwhelming response speaks volumes about the success of our redevelopment and their confidence in top performing assets.”

The massive refinancing has been secured as Tishman Speyer’s comprehensive redevelopment of the renowned 13-building campus nears completion.

Tishman Speyer’s capital improvement program, inspired by the Center’s original plans and history, has restored the intent of the Channel Gardens and Rink areas as grand and welcoming entrance points for the public. The company has opened the lower-level

passageways surrounding the Rink, creating a light-filled space that prioritizes efficient pedestrian flow and easing access to skating and public art in the center of campus.

The Rink Level is now home to marquee restaurants from celebrated independent chefs, including Le Rock, 5 Acres, Jupiter, Lodi, Naro, Pebble Bar, Smith & Mills and others. Tishman Speyer has similarly pursued a retail transformation at the Center, reinvigorating its offerings with distinctive shops helmed by local entrepreneurs alongside global brands, including Lego, Banana Republic, Anthropologie, Michael Kors, Catbird, FAO Schwarz and Nintendo.

Rockefeller Center is currently 93% leased.

Christie’s International Real Estate Group announced the newest addition to its New Jersey division: The Highland Group, based in Westfield, N.J. This dynamic team marks another significant milestone in Christie’s continued expansion and market leadership across the state, the firm said.

With over 20 years of collective real estate experience and more than $100 million in sales, The Highland Group will represent the Christie’s brand in Westfield and throughout New Jersey. Launched in June 2023, its team of nine agents brings extensive expertise, deep local knowledge and valuable connections to their new role. The team members, previously with Keller Williams, include Amelia Sarrazin, Erin McMahon, Lindsay Kaup, Matt Jarecki, Megan Brown, Sandra Bliwise, Suzanne McMahon, Todd Mitchell and Katelynn Whitlock Leemhuis.

The Highland Group has teamed up with renowned local artist Ricardo Roig to co-launch a Christie’s brand boutique at Roig Studio, located at 245 East Broad St. in downtown Westfield. This unique partnership offers a collaborative space where real estate and art come together.

As part of their commitment to community engagement, Christie’s and Roig plan to host a series of exclusive monthly events in the shared gallery space. These events, open to both agents and Westfield residents, will include wine tastings, curated shopping experiences and art auctions benefiting local charities, among others, further solidifying Christie’s presence in the community.

“We are thrilled to welcome The Highland Group to the Christie’s family. Each of the nine agents brings a wealth of experience and a proven track record of success. We couldn’t think of a better team to represent

Christie’s in Westfield,” said Alex Ristovic, regional vice president at Christie’s International Real Estate Group New Jersey. “We look forward to seeing The Highland Group thrive and engage deeply with the local community.”

Coldwell Banker Warburg (CBW), the brokerage that has served New York luxury real estate for more than 100 years, is opening an outpost in Brooklyn. The new space will be located in the borough’s DUMBO neighborhood, and feature an industrial, open-concept design within a Two Trees Management co-working space.

“As we continue to grow, it’s clear that we need to expand our existing footprint in Brooklyn to help our agents meet the demands of its fastpaced market. Brooklyn isn’t just a borough; it’s a lifestyle, a vibe, and we’re here to bring our experience and network to this amazing community at exactly the right time,” said Kevelyn Guzman, regional vice president at Coldwell Banker Warburg. “We’re ready to continue to serve Brooklyn’s unique needs with the same expertise and personalized touch that define our work in Manhattan. With this office as our home base, we look forward to forging new relationships, serving our clients and expanding our role in building Brooklyn’s ongoing story.”

The Brooklyn office will serve as a satellite location next to CBW’s main operations in Manhattan, with an existing team supporting its growth and operations. It will also have a dedicated creative area for agents and brokers, allowing them to access resources for media production and personal branding outside of Manhattan.

“Agents and their clients are consistently choosing Coldwell Banker to leverage our strong support, service and resonance in the market, and the Brooklyn market is no exception,” said Kamini Lane, president and CEO of Coldwell Banker Realty. “We congratulate Coldwell Banker

RICHARD SIMON, ESQ. | PARTNER

CHAIR, BANKING AND FINANCIAL SERVICES

JEFFREY ROSENTHAL, ESQ. | PARTNER CHAIR, BANKRUPTCY AND CREDITORS RIGHTS

Since 1930, Mandelbaum Barrett PC has prioritized providing clients with proactive legal protection spanning over 30 practice areas:

Alternative

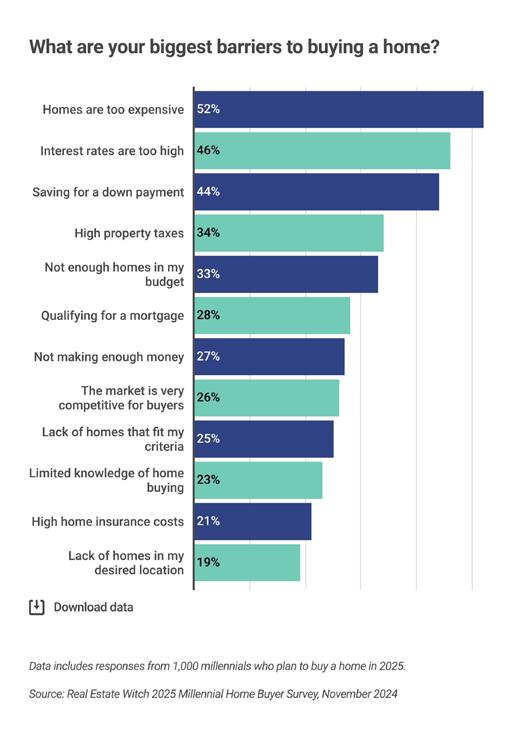

Banking

Just 21% of millennials believe their generation can afford homes, a sharp decline from the 52% who felt the same in 2024, according to new research from Real Estate Witch, an online publication owned by Clever Real Estate that connects readers with expert real estate advice. The result — many potential buyers will overlook some problems that would have disqualified a home not that long ago.

The median U.S. home price hovers around $420,000, but 68% of 2025 millennial homebuyers plan to purchase a home that costs less than $400,000. In comparison, just 57% of millennials planned to spend less than $400,000 in 2024.

Nearly all (96%) of millennial home buyers have concerns about purchasing a home, the survey said, with 44% worried about finding an affordable home — up from 35% in 2024.

Nearly all millennials (97%) face barriers to homeownership, with financial challenges topping the list: 52% cite high home prices, 48% point to high interest rates and 44% struggle to save for a down payment.

As a result, nearly half of millennials (41%) said that they would buy a home with asbestos or pests, such as mice, cockroaches and spiders, while 57% would make an offer on a fixer-upper.

Surprisingly, more millennials would prefer buying near a cemetery (34%) or railroad track (26%) than near their ex (25%), while 60% wouldn’t consider a home near their in-laws.

About 74% of millennials believe high interest rates make now a bad time

to buy a home, but 76% say they would be enticed to buy if rates fall in 2025.Over half (56%) would offer over asking price, though that figure has dropped from 79% in 2024.

Two in three (67%) of millennials regret not buying a home when prices were lower, and 32% expect to max out their budgets in 2025.

Nearly half of millennials (45%) think their generation faces the greatest challenges in affording homes, with 33% blaming boomers for being most responsible for the affordable housing crisis.

Pretium, a specialized investment firm with over $55 billion in assets under management, has secured $550 million in equity commitments from a diversified group of existing and new institutional investors to originate up to $5 billion in loans to homebuilders to create new and renovate existing stock across the United States.

The fund’s investment will consist of residential transition loans to facilitate the renovation of aged houses for homeownership with conventional mortgages; vertical construction loans on single family for-sale communities and build-to-rent communities and horizontal infrastructure loans to land developers/lot bankers.

“The success of this fund reflects the strength of our brand as a leading investor in residential real estate. It underscores the significant opportunity we see to help increase housing supply across the U.S. by filling the void left by regional banks in real estate lending,” said Jonathan Pruzan, co-president of Pretium. “Through this fund, Pretium will provide capital to homebuilders so that they can add critically needed inventory to the housing market.”

The fund will use the unique data and analytics capabilities of Pretium’s five residential real estate operating companies to make informed and timely credit decisions on residential housing projects across highgrowth markets in the United States. Additionally, the fund will utilize Pretium’s operating companies, including Anchor Loans, to directly originate and service loans for private homebuilders and developers, who previously relied on regional banks to fund their growth. On a leveraged basis, the fund has committed $650 million of capital to date to investment opportunities.

“By providing bespoke debt capital solutions, we’re supporting private homebuilders who are underserved by traditional financial institutions, and we are facilitating new housing supply,” said Josh Pristaw, Pretium’s head of real estate. “This fund will support the construction of approximately 12,000 new homes in key markets, meaningfully increasing housing availability in regions experiencing the most acute shortages.”

Kirkland & Ellis LLP served as legal counsel to Pretium on these investment vehicles.

Michael Baker International, a global provider of engineering, planning and consulting services, announced that the firm’s portfolio company, Akela Engineering and Consulting, is now fully merged into Michael Baker’s Sustainable and Resilient Solutions (SRS) business vertical. The SRS vertical encompasses the firm’s current mechanical, eectrical and plumbing (MEP), structural engineering, telecommunications, cybersecurity, fire protection and architectural services.

The merging of Akela, a national MEP+ firm with deep expertise in California, into Michael Baker offers clients holistic, smart and resilient building solutions across market sectors, the firm said. The action strengthens Michael Baker’s position as it focuses on growing private sector work in San Diego and the Southern California region as well as nationally, with the broader SRS team.

The firm plans to expand in sectors including Industrial, Defense OEMs, Aerospace, Data Centers, Semiconductors, Life Sciences, Energy Transition, Higher Education and Healthcare.

“With growth in the MEP space continuing to accelerate, concentrating our Akela and SRS teams into one cohesive entity strengthens our ability to expand our client base and position ourselves to deliver complex smart and resilient buildings, something only a full-service engineering firm can do well,” said Pankaj Duggal, president, Sustainable and Resilient Solutions at Michael Baker International. “The merger will continue to strengthen our competitive position in the growing MEP engineering and consulting market since acquiring and

uniting Michael Wall Engineering and DEC Engineers in 2022 to form Akela. This combined team also allows us to offer our clients access to even more expertise and services as we support their businesses and enables us to create and embrace new opportunities that enhance our pursuit of larger, more complex MEP projects.”

Home Value Lock, a market value insurance product for homebuyers, has been made available through Century 21’s Select Real Estate. The Sacramento, Calif.-area real estate group will provide clients the option to benefit from market value protection for their new home at no additional cost.

“We want to offer our homebuyers additional confidence in market values through this coverage,” said Select Group CEO Dan Jacuzzi. “Providing a product like this further demonstrates the meaningful benefit of working with Century 21 Select Real Estate professionals when you purchase a home.”

Home Value Lock Insurance, which was launched inn 2024 in Northern California, protects the first 10% of the purchase price of a home against a scenario where the market value has gone down when it gets resold. The product, which is fully licensed and regulated in the state of California, is the first of its kind to hit the marketplace.

“Homebuyers deserve some protection against unexpected housing market drops like what we saw during the 2008 Financial Crisis,” said Evan Weston, director of sales for OMT Insurance Services, which distributes Home Value Lock. “Outside of massive recessions, localized events like wildfires can have an impact on prices. Our coverage is designed to give the homebuyer some peace of mind, particularly in the first few years of homeownership, that the market value of their home is protected.”

Home Value Lock will be offered to Century 21 Select Real Estate’s homebuyers as a closing gift for those who have used a mortgage to finance their purchase. Availability will be across the greater Sacramento area but subject to the terms of coverage.

Accounting, tax and advisory firm PKF O’Connor Davies has opened a new office in Fort Lauderdale, Fla. The office, located at 200 East Las Olas Blvd. in the city’s downtown financial district, offers 5,000 square feet of office space and convenient, on-site amenities.

“As our work in southeast Florida continues to grow, the opening of our Fort Lauderdale office strengthens our market position and provides the necessary operating support to further scale our work in the region,” said Kevin J. Keane, executive chairman at PKF O’Connor Davies. “We look forward to joining Fort Lauderdale’s thriving business community and welcoming new and existing clients to our state-of-the-art space.”

With 23 offices in the U.S. and India, PKF O’Connor Davies’ new location enhances its ability to support the evolving needs of domestic and international clients through comprehensive offerings, including accounting and assurance, tax, business consulting, technology and cybersecurity, private client and outsourced services, the firm said. The office’s numerous amenities, including a designated meeting space and café, further enable the organization’s client-centric focus and strengthen its ability to serve as a trusted, valued advisor.

“The opening of our Fort Lauderdale office marks an exciting new chapter. Well-positioned to build up our client base, we remain steadfast

in our commitment to delivering the value, service and expertise that have fueled our growth,” said Rachel DiDio, partner-in-charge of PKF O’Connor Davies’ Fort Lauderdale office. “From quality workspaces and the latest technological tools to downtown views and easy access to one of the city’s major thoroughfares, I’m confident our team and clients will greatly benefit from all that this office has to offer.”

The New York State Energy Research and Development Authority (NYSERDA) announced more than $29 million has been awarded through Round XIV of the Regional Economic Development Council (REDC) Initiative to 15 innovative projects that will reduce statewide carbon emissions. The projects, seven of which are located in disadvantaged communities, were selected by NYSERDA to participate in the Building Cleaner Communities Competition or Commercial and Industrial Carbon Challenge program and will advance community and economic development across New York State.

The Commercial and Industrial (C&I) Carbon Challenge is a competitive program that provides funding to large energy users such as manufacturers, colleges, universities, health care facilities and office building owners in New York State to implement clean energy projects that reduce carbon emissions. Projects may utilize a combination of energy or manufacturing process efficiency strategies, carbon capture technology, low-carbon fuel utilization, renewable generation or energy storage.

NYSERDA awarded $14.1 million for five projects located in the Finger Lakes, North Country, New York City and Western New York including: Kraft Heinz Company’s equipment electrification, more efficient heating and installation of on-site thermal storage technology in Lowville; American Rock Salt Co.’s shift to using an electric continuous miner as an alternative method of extraction in Mount Morris; Red-Rochester’s elimination of vented waste steam, installing three solar PV arrays and replacing centrifugal air compressors with state-of-the-art machines in Rochester; EME Consulting Engineering and Architecture Group’s design and development of the largest geothermal heating and cooling system in the Northeast for Fordham University’s Rose Hill Campus in the Bronx and Skyven Technologies’ plan with Lactalis to install an efficient, electrified heat system capable of reaching high temperatures at their plant in Buffalo, N.Y.

NYSERDA awarded more than $15 million for 10 projects located in the Capital District, Mid-Hudson, Mohawk Valley, New York City and Western New York including: Hawthorne Valley’s rehabilitation of four education buildings to become carbon neutral; The Schenectady Environmental Education Center’s adaptive reuse of a long-vacant building to be a net-zero facility; The Tunnel, a new high-performance mixed-use project in Port Jervis; Ulster County’s Public Safety construction of a new communications building that will incorporate ground-source heat pumps and a roof mounted solar; Chester Agricultural Center Farmwork Housing’s construction of a new mixeduse, affordable all-electric housing development that is Passive Housecertified and Hamilton College’s construction of a 41,000-square-foot computer and data science facility.

Flatiron Realty Capital LLC, a private equity firm specializing in real estate lending, announced the launch of IronLinc, an integrated system solution specifically designed to meet the needs of real estate lending professionals. Developed in-house by a dedicated team of engineers led by Chief Investment Officer and Chief Technology Officer Christopher Wolpert, the proprietary software offers a comprehensive, end-toend solution for managing deal pipelines, underwriting and customer relationship management (CRM) operations, with the goal of providing a seamless user experience.

The platform reflects Flatiron’s commitment to creating industry-leading solutions for the real estate sector by bringing every key activity into one complete ecosystem, the company said. Now operating as an independent service powered by Flatiron Realty Capital, IronLinc’s intuitive design and capabilities are aimed at simplifying and enhancing the lending process.

“We are excited to unveil IronLinc, which represents a critical step forward in transforming how the real estate lending world operates,” said Edward Ostad, founding partner. “As a private equity firm, we want to continue to create value through innovation, and IronLinc is an extension of our success in the real estate lending space.”

Among IronLinc’s applications are lead generation and CRM, loan application processing, the Iron Fund Broker Portal platform, an underwriting platform and servicing and asset management and accounting (beta). It also offers lightweight application programming interfaces that integrate with Microsoft Office tools and a flexible, front-

end design that supports rapid development and deployment, enabling tailored business solutions and partnership opportunities.

The system combines the power of Microsoft Azure and Microsoft Graph to connect with familiar business applications, enhancing productivity and workflow, and is fully cloud-oriented, ensuring secure messaging, document storage and robust database architecture.

“Our goal is to provide systems that enhance the experiences of our clients, brokers and real estate professionals, as the industry continues to experience rapid transformation brought on by AI and other new technologies,” Ostad added.

ReAlpha Tech Corp., a real estate technology company that is developing and commercializing artificial intelligence (AI) technologies, has debuted the enterprise version of its commission-free AI homebuying platform. ReAlpha Enterprise will specifically cater to corporate relocation programs. This strategic initiative targets the $25 billion employee relocation market by offering cost savings for both employers and employees.

“ReAlpha Enterprise addresses a critical market need by eliminating buy-side real estate commission expenses and bringing the entire process into one place,” said Giri Devanur, CEO of ReAlpha, in the announcement. “By leveraging our commission-free real estate platform, we aim to provide partnered companies and their employees with a seamless solution to homebuying, which many Americans identify as the most stressful life event.”

Through the elimination of traditional buy-side real estate commissions, employees can save up to 3% of the purchase price on their home. If the seller of the home has already agreed to pay the buy-side agent commission, ReAlpha will refund it to the buyer in the form of a closing cost credit, which they can use to increase their purchasing power.

“ReAlpha Enterprise goes beyond just savings by offering a complete relocation ecosystem,” Devanur said. “Our platform integrates essential services including title, mortgage and closing support, while our in-house licensed agents provide no-obligation assistance.”

Companies can deploy ReAlpha Enterprise without implementation fees or complex HR integration. The platform provides employers with

Lessen, the tech-enabled, end-to-end solution for outsourced real estate property services, announced the integration of its platforms with property management software Yardi Voyager. This integration enables Lessen to deliver streamlined on-demand services and provides seamless connectivity with the Lessen360 platform, empowering multifamily property managers to operate with greater efficiency and flexibility.

Lessen’s integration with Yardi Voyager simplifies access to its national network of over 30,000 vetted service providers, delivering on-demand solutions tailored to the unique needs of the rental housing industry. Property managers can now tap into Lessen’s trusted professionals directly from their Yardi Voyager platform for all service needs, including routine maintenance, repairs, renovations and make-readies.

“Lessen’s integration with Yardi Voyager bridges the gap between property management and service execution,” said Jay McKee, CEO of Lessen, in the announcement. “Property managers can now scale operations effortlessly, relying on our on-demand network to meet their maintenance and repair needs and backfill and support their in-house technicians when necessary.”

Lessen360, a cloud-based platform purpose-built for centralized maintenance operations, is now fully integrated with Yardi Voyager, enabling real-time synchronization of work orders and make-readies between the platforms. This allows owners to maintain a single source of truth for all operations across individual properties as well

as entire portfolios.

“Seamless data exchange is vital for creating operational efficiencies,” continued Sean Miller, chief revenue officer at Lessen. “With Lessen360’s integration into Yardi Voyager, collaboration between the platforms eliminates the need for double entry, saving property managers valuable time and freeing up onsite teams to focus on what matters most.”

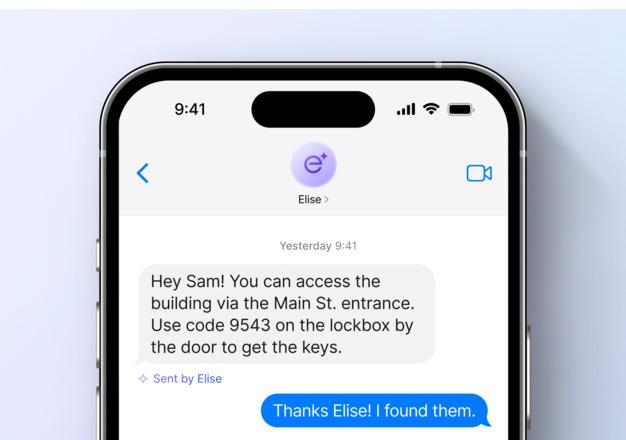

EliseAI, a provider of artificial intelligence solutions for property management, has launched AI-Guided Tours (AIGT), the first selfguided touring technology of its kind, designed to transform how leasing professionals manage property tours, the company said.

AI-Guided Tours combine convenience, advanced AI capabilities and a renter-focused approach. Powered by EliseAI’s technology, AIGT allows prospects to tour properties on their own terms — whether during evenings, weekends or any time that fits their schedule — removing barriers and maximizing leasing opportunities.

Compared to traditional self-guided tours, EliseAI’s AI-Guided Tours blends the human-like warmth of a live agent with the efficiency and scalability of AI, offering personalized support over the phone or through SMS. Elise acts as a virtual guide, answering questions, providing navigation assistance and highlighting key features, all while ensuring a secure and intuitive touring experience.

By addressing the limitations of traditional touring solutions, AIGT empowers property managers to meet renters’ rising expectations for convenience and personalization. It enhances operational efficiency by increasing tour availability, reducing staffing costs and automating routine tasks like follow-ups, ID verification and application management. Seamlessly integrated with CRM and PMS systems, AIGT transforms the leasing process into a streamlined and efficient journey that benefits both renters and property teams.

“AI-Guided Tours are setting a new standard in property management,” said Ian Weng, senior vice president of Strategy at EliseAI. “With AIGT, leasing teams can provide an exceptional touring experience while optimizing their operations and meeting the demands of today’s renters.”

With AI-Guided Tours, EliseAI continues its mission of creating AIpowered solutions to empower property management teams.

Douglaston Development and its general contracting and construction management affiliate, Levine Builders, have begun construction on 2868 Webster Ave., a 12-story, 277-unit, affordable multifamily housing development located adjacent to the New York Botanical Garden’s 250-acre grounds. It is the second phase of the two-phase, mixed-use development.

Demolition of the site’s existing building was complete last month after the existing tenant, Cherry Valley Marketplace, moved into its newly built space in the adjacent Phase I building. Construction of the new building is slated to be complete in 2027.

“We are honored to deliver additional much-needed affordable housing for families to benefit the Bronx community,” said Jed Resnick, CEO of Douglaston Development. “We are very proud of the work completed within Phase I alongside our project and community partners, and look forward to continuing that collaboration as we advance and bring Phase II to fruition.”

Upon completion, 2868 Webster Ave. will deliver 277 affordable housing units, a mix of studios, one-, two- and three-bedroom residences available to households earning up to 70% of the area median income (AMI), with 60 of the 277 residences designated for supportive housing. Shared resident amenity spaces at the property will include laundry facilities, a fitness center, green roof and on-site parking. On-site supportive services for residents will be provided through the Jericho Project.

“We are grateful to play an integral role in bringing an essential affordable housing offering to the Bedford Park community, expanding access to quality affordable housing in the Bronx,” said Paul Finamore, chief executive officer of Levine Builders. “The celebration of this milestone is a reflection of the collective work between all the partners, and we look forward to advancing the project over the coming years.”

The project is funded by $83.4 million in tax-exempt bond financing and $17.4 million in subsidies as allocated by The New York City Housing Development Corporation (HDC). The New York City Department of Housing Preservation and Development (HPD) provided a $52.6 million subsidy under its Extremely Low- and Low-Income Affordability Program (ELLA). Wells Fargo is providing Low-Income Housing Tax Credits (LIHTC) as well as a letter of credit for the project.

Ongoing loss commercial and residential real estate losses from the Eaton and Palisades Fires in Los Angeles were estimated to be between $35 billion and $45 billion as of Thursday, January 16, reported CoreLogic, the global property information, analytics and data-enabled solutions provider.

This analysis of both residential and commercial properties accounts for both fire and smoke damage as well as demand surge, debris removal, cleanup and Additional Living Expenses (ALE). The majority of losses are to residential properties. Many of the potentially impacted properties are high-value homes, so even moderate damage from the fires or smoke could result in costly claims.

“The destruction caused by these fires is anticipated to be the most expensive in the state’s history with effects on the insurance industry that will persist into the future. This event highlights the paramount challenge for homeowners and the insurers that support them — the increasing density of homes and properties near the wildlife-urbaninterface,” said Tom Larsen, senior director of CoreLogic Insurance Solutions. “Los Angeles is a resilient community, and as they look to rebuild it will be essential to design or redesign with mitigation practices in mind, so an event of this magnitude never happens again.”

CoreLogic is supporting recovery efforts for people affected by the wildfires through a donation to the Red Cross, enabling them to prepare for, respond to and help people recover from these disasters.

The Port Authority of New York and New Jersey and JFK Millennium Partners (JMP), the company selected to build and operate the $4.2 billion Terminal 6 (T6) at John F. Kennedy International Airport, has awarded artist Jane Dickson a commission to create a bronze medallion for the arrivals plaza.

“Great works of public art are a signature part of our strategy to build new, world-class airport terminals that will create a sense of place unique to New York,” said Port Authority Executive Director Rick Cotton in the announcement. “In addition to an already extensive art program at Terminal 6, the bronze medallion to be located in the arrivals plaza will provide a fitting welcome to a city that is considered the art capital of the world.”

Dickson, who lives and works in New York City, joins 18 featured artists (including 10 others from New York) who will capture the spirit of the city with a diverse range of artworks seamlessly integrated into the terminal. The art program is led by Public Art Fund, the independent nonprofit organization dedicated to art in public spaces.

The exterior medallion, located at the arrivals plaza, will welcome visitors and will be located near a terrace with greenery. The 14-footdiameter circular medallion will be fabricated in durable cast bronze using low-relief casting techniques. Masterwork Plaques, known for its expertise in ground-based artwork, will collaborate with Dickson to translate her vision into bronze.

“As an international gateway to the city, JFK Terminal 6 will be inspiring, including when you step out the door,” said George Casey, chairman of JFK Millennium Partners and chair and CEO of Vantage Group. “Our commitment to transforming the JFK travel experience will create moments of reflection and connection throughout the terminal’s new spaces.”

Dickson frequently makes New York City her subject and has been a pioneer in the exhibition of digital public artworks in New York City. In 1982, she initiated the Public Art Fund series, “Messages to the Public,” which displayed works by artists including Keith Haring, David Hammons and Jenny Holzer on Times Square’s Spectacolor billboard.

“The art program at Terminal 6 captures the spirit of New York City as a global destination for art and culture,” said Nicholas Baume, artistic and executive director of Public Art Fund. “After experiencing the stunning works of art inside the building, arriving travelers will step outside to be greeted by Jane Dickson’s striking bronze medallion.”

Public Art Fund has worked collaboratively to develop the art program with key stakeholders including The Port Authority of New York and New Jersey and JFK Millennium Partners’ consulting architect Stanis Smith. Site-specific public art commissions drawn from New York, as well as national and international communities, will be integrated throughout the new terminal.

JFK Millennium Partners is developing Terminal 6 in two phases, with the opening of the first section expected in 2026 and construction completion in 2028.

Newmark announced that it closed the largest industrial transaction in Northern New Jersey in 2024 via the $300 million recapitalization of Fairfells Logistics Portfolio. Newmark’s Executive Managing Director Kevin Welsh, Managing Director Brian Schulz and Global Head of Industrial and Logistics Jack Fracker strategically advised The Hampshire Companies on the deal and procured the joint venture equity partner.

The Fairfalls Portfolio, totaling 1.35 million square feet of light industrial space, consists of 30 strategically located buildings with an average building size of approximately 45,000 square feet, spanning Fairfield, Little Falls, Elmwood Park and Carteret, N.J. The portfolio, which is currently 92% leased, provides critical mass and operational efficiency within the regional port-centric market, offering accessibility to major Northeast corridors and a broad user base. Most of the portfolio is concentrated in Fairfield, providing direct access to critical highways such as Interstate 80 and Route 46.

With the closing of this transaction, the firm’s Industrial Capital Markets group based in New Jersey successfully closed a combined $1.1 billion in total transaction volume in 2024.

“We are excited about the strong momentum and significant transactions the Team has executed over the last year and building upon the partnership with our clients and industrial capital markets collaborators in the Northeast,” said Welsh. “Our track record reflects the strength of our market position, and we’re looking forward to reaching even greater milestones in the year ahead.”

Northern New Jersey remains a prime location for industrial real estate, benefiting from a deep and dense labor pool, excellent regional highway infrastructure and status as a gateway to the largest metropolitan population base in the country and the ports of New York and New Jersey, the second-largest port complex in the U.S. in terms of annual TEU volume, the company added in the announcement.

The region has attracted substantial investment and interest from domestic and international investors.

BY: MANN REPORT STAFF

The Real Estate Board of New York (REBNY)’s annual gala was held this year on January 16 on Manhattan’s Far West Side. The evening was a celebration of widespread industry success and included appearances by Governor Kathy Hochul, Mayor Eric Adams, U.S. Congressmembers and dozens of electec officials.

Representing the region’s top commercial and residential owners, developers, brokers and managers, REBNY’s leadership sees the disruption of the COVID-19 pandemic not too distant in the rearview mirror and is steadfast against relenting on any progress in 2025.

“There were many positive steps forward for our industry and, in turn, the city in 2024, but we can’t take our foot off the gas now,” James Whelan, who has served as REBNY’s president since 2019, told “Mann Report” in an exclusive interview that discussed the organization’s outlook for 2025.

From reactionary residential and commercial migration to changing corporate office attendance mandates to construction cost and interest rate shocks, the pandemic was a generational disruption for the real estate industry. Five years later, the ripple effects are still being felt.

According to REBNY’s Office Building Visitation reporting, office visitations have surpassed 2019 baselines only one week since the pandemic and then only within Class A+ buildings. Despite strong demand and fundamentals, average retail asking rents along Manhattan and Brooklyn’s primary shopping corridors have still not returned to prepandemic peaks, as noted in REBNY reports.

“We’ve seen incremental growth for office visitations nearly every month of 2024 across submarkets and asset classes, and retail is trending in a positive direction, but these sectors are still not where they were pre-pandemic,” Whelan observed. “Strong office, retail and

residential activity are the legs that hold up our economy and power vibrant, resilient neighborhoods. When one leg wobbles, we are all at risk.”

REBNY’s reporting has brought public data to back up widely felt market sentiment that investments in the highest quality office designs and amenities are translating to higher leasing activity and building visitations, which drive up tax revenues for the city and foot traffic for retail business. In Q3 2024, office leasing activity was up 25% year-over-year and vacancy finally dropped for the first time in over two years.

In line with these trends, REBNY secured a significant win for the office sector in 2024 when the governor and state legislature extended the Industrial & Commercial Abatement Program (ICAP), which offers property tax abatements for commercial buildings that are modernized.

REBNY is now aggressively advocating to extend and expand the Relocation and Employment Assistance Program (REAP), which entices employers to move jobs to areas of the city with less established office hubs.

To keep the industry and city one step ahead, REBNY was a key supporter of the Adams Administration’s City of Yes zoning initiative. Passed in stages over 2024, City of Yes is the most expansive change to New York City’s Zoning Resolution since 1961 and will unlock new opportunities for housing production and economic activity across all five boroughs.

This includes expanding outdated office inventory to much needed housing, allowing for greater density in several zoning districts, eliminating costly parking mandates that challenge new development and increasing the opportunity for accessory dwelling units, town center zoning and transit-oriented development. REBNY played a key part in the legislation’s passing, giving expert testimony to public officials and rallying public support for the plan.

“With City of Yes, we now have the pathway for development in line with urban planning best practices for decades to come,” said Whelan, adding that the initiative was also key for realizing a new incentive program to support office-to-residential conversions and pathways to create more density that REBNY had advocated for in the last state budget. “Successful utilization of these zoning changes will now depend on fine tuning incentives for development to make the math work.”

The state housing deal last spring included a valuable deadline extension for projects vested under 421a, the state’s former tax incentive for the creation of new rental housing. A successor program, 485-x, was agreed upon during the same session but has been met with lukewarm enthusiasm from the industry.

Whelan said that he does not expect 485x to be as effective as its predecessor but doesn’t use that as a scapegoat for giving up on the goals set by the Mayor and Governor to create over 500,000 new units by 2030.

REBNY is also calling on state legislators to publish more data related to rent-regulated housing in 2025 to better understand the impact of recent incentives and regulations to determine where they can be improved.

Looking at REBNY’s membership, Whelan is trying to bring in new blood to the industry that is reflective of generational succession and the makeup of the city REBNY serves. This includes adding many younger members to REBNY’s executive committee and board of governors membership in 2024 and continuing to expand investment in REBNY’s social impact initiatives.

“Simply put, we need new perspectives in our industry and organization,” said Whelan. “This includes continuing investment in attracting professionals of diverse backgrounds to the

industry but also provide them the tools and mentorship to make it to the c-suite.”

To nurture diverse talent in the industry, REBNY conceived and launched the REBNY Fellows program in 2020 based on an overarching initiative led by REBNY’s Diversity Committee, which works to create professional opportunities and improve and promote the diversity of the trade association’s membership and the real estate industry at large.

The program brings in real estate professionals from diverse backgrounds for a high-impact, six-month training curriculum designed to help elevate their careers and prepare them for opportunities to increase their impact on the industry and its future. In addition to gaining networking exposure and advocacy and civic leadership training, REBNY Fellows become part of a lifelong professional network that supports their continued success. More than 100 Fellows have entered the program to date.

This past summer, REBNY partnered with the New York City Department of Youth & Community Development to place 138 talented young people in paid real estate industry internships at member firms through New York City’s Summer Youth Employment Program (SYEP). Additionally, REBNY partners with Building Skills NY to connect under-represented New Yorkers with jobs and training to create new career pathways into the construction industry.

“Real estate was by and large far too late to the game when it comes to investing in Social

Impact,” said Whelan. “While others may be in retreat on these initiatives, the message from our membership is clear: double down.”

When it comes to sustainability, REBNY members are also vocal on the need to decarbonize the built environment. Whelan believes that government must be a better partner in this area by providing a green energy grid and doing a better job of giving building owners tools to comply with regulations like Local Law 97.

Don’t Take the Basics for Granted Whelan emphasized that quality-of-life issues underly almost every issue the real estate industry faces. In 2025, REBNY plans to continue to vocalize support for public officials focused on getting crime levels back to pre-pandemic norms and advancing compassionate supportive services for those with mental health and addiction issues. The organization has also called for the state to finalize a thoughtful, long-term approach to funding the MTA, Whelan said.

“If New Yorkers can’t rely on getting to and from work, home or social activities safely and efficiently, investment will not follow,” he said.

In addition to advocacy and promoting market research, REBNY provides its members informational, technical and technological resources; networking and charitable service opportunities; qualifying and continuing education courses; professional education programs, seminars and designations; careerchanging awards; legal advice and a wide range of additional member benefits.

Nestled along the sun-drenched shores of the Gulf of Mexico, Naples, Fla., is a city that seamlessly blends luxury and community charm. With pristine beaches, world-class golf courses, high-end shopping and an eclectic cultural scene, Naples has long been a destination of choice for retirees, families and seasonal residents alike. Despite its idyllic setting, this sophisticated coastal haven has not been immune to the challenges posed by nature. In recent years, hurricanes have tested the city’s strength, yet Naples has emerged more resilient and vibrant than ever.

This is a story of growth and resiliency, illustrating how a community united by shared purpose can rebuild not only its infrastructure but also its spirit.

The real estate market in Naples serves as a prime example of the city’s ability to adapt and flourish under challenging conditions. Despite facing the dual pressures of higher interest rates and the cooldown that followed the pandemic-driven surge in sales, the market has demonstrated remarkable stability.

As of September 2024, homes in Naples are selling in an average of 70 days, significantly faster than the pre-pandemic average of 99 days. Housing inventory has stabilized, providing buyers with options while avoiding the pitfalls of oversupply. Moreover, the average sales price has seen a 9% year-over-year increase, reflecting a return to steady, historical growth trends.

Most notably, Naples has seen an uptick in cash sales, which now account for 59% of overall transactions year-to-date, and an impressive 75% of sales above $1 million. This trend underscores the area’s attractiveness to affluent buyers who value its blend of luxury and investment potential.

Naples offers a lifestyle that is as elegant as it is enriching. Boasting nearly nine miles of immaculate beaches and 40 beach access points, the city invites residents and visitors to bask in the natural beauty of the Gulf Coast.

Upscale shopping districts such as Fifth Avenue South and Waterside Shops cater to discerning tastes, while the city’s numerous high-end resorts and private yacht charters provide unparalleled opportunities for indulgence. For those seeking a cultural escape, venues like Artis—Naples and a vibrant dining scene reflect the city’s sophisticated ethos.

The real estate offerings mirror this diversity, ranging from modest condominiums in the low $200,000s to sprawling Gulf-front estates exceeding $100 million. Whether it’s a gated golf community or a waterfront property in prestigious Port Royal, Naples offers something for every lifestyle.

Resiliency in the Face of Hurricanes

Hurricanes are an inevitable part of life in coastal Florida, but the Naples community has proven its ability to weather these storms with unity and determination. The recent hurricanes, while causing some isolated flooding along the coast, largely spared inland areas. This resilience is no accident; it is the result of thoughtful planning, collaboration, and adaptation.

Property owners in Naples prioritize hurricane preparedness, from securing homes and stocking emergency supplies to reinforcing outdoor spaces. Building code enhancements, elevated construction requirements and advanced water barriers have further bolstered the area’s ability to withstand extreme weather events.

The heart of Naples’ resiliency lies in its people. Following recent hurricanes, the Southwest Florida community rallied together to support recovery efforts. From neighborhood cleanups to food drives and coordinated volunteer activities, local residents, businesses and organizations exemplified the spirit of collaboration.

This unity extends to long-term planning as well. Local building associations work closely with government agencies to expedite repairs and implement new safety measures.

Meanwhile, homeowners’ associations are setting aside reserves to ensure future restoration efforts can proceed swiftly and efficiently.

In the wake of recent hurricanes, the Naples real estate market has adapted to emerging trends that emphasize both beauty and durability. There is growing interest in hurricane-resilient building technology, including true stilt homes and inland properties.

Master-planned golf course communities, which combine luxury living with inland safety, have become increasingly popular. At the same time, coastal areas are being rebuilt with stronger structures and elevated designs that adhere to the latest building codes. This balance between inland expansion and coastal restoration ensures that Naples remains an attractive destination for prospective buyers.

Looking ahead, Naples continues to capture the imagination of newcomers from across the United States. While the Midwest and New England have traditionally been the city’s primary feeder markets, residents from the Northeast and even the Western U.S. are now discovering its charms. Redevelopment efforts in already desirable beachfront areas, coupled with the construction of amenity-rich inland communities, are poised to meet this growing demand.

Naples has always had small-town charm with city sophistication, but it feels like the city is just being discovered on a broader scale.

Resiliency is not just about rebuilding structures; it’s about fostering a community that learns, adapts, and grows stronger together. Naples exemplifies this ethos, transforming challenges into opportunities for improvement. From improved building practices to collaborative recovery initiatives, the city has demonstrated its ability to thrive in the face of adversity.

For residents and visitors alike, Naples offers more than just luxury— it offers a sense of belonging and the promise of a brighter future. Its ability to balance opulence with community-focused values ensures that Naples will continue to shine as a coastal gem for years to come.

Whether it’s a Gulf-front estate or a cozy inland retreat, Naples remains a beacon of growth, resiliency and unparalleled beauty.

By James F. Schnars

By Scott Spector, AIA, Principal, Spectorgroup

As companies grow in size and team priorities evolve, leadership teams will begin to evaluate their current real estate leases and whether they are meeting or falling short of supporting company goals. The question arises: Should we renew our existing office lease and renovate the space to better suit our needs, or should we move on to bigger, greener pastures? It’s an important question for all leaders to consider. After all, one of the biggest expenditures for a company is its real estate, and you want to ensure that you are getting the most impactful results for your dollars.

At Spectorgroup, we work with our clients to navigate this challenging decision by thoroughly evaluating all factors. We help them look at the pros and cons of renovating in place and refreshing their current space, and also help research other real estate options that might be better suited to their changing organizational needs.

In a competitive real estate environment, the decision often comes down to the numbers: what are the metrics of each potential deal, and what is the client willing to sacrifice or splurge on? Of course, making the right choice goes beyond the numbers. Adopting a thoughtful approach to workplace strategy will help ensure that each organization gets the best use out of its square footage and can create an environment that fully supports its people.

Relocating or Renewing: The Basics

If a company is looking into renewing its existing lease, it involves a negotiation process. Whether it’s a short-term lease or a long-term lease, the landlord will generally provide a certain amount of tenant improvement (TI) dollars to update their space — especially if the company has been in the building for a long time.

Factors that are likely to drive this decision include whether the leadership likes their current location, what they want to achieve with a refresh and if they can get enough TI money to make it happen. If all they’re looking for is a refresh — fresh coats of paint, new carpeting, and updated furniture — and aren’t in need of an infrastructural overhaul, this may be a compelling option.

Those that are looking at relocating may receive better incentives to do so. Relocating to a new building will often cost the company more to build out, but if the landlords are seeking to attract new tenants,

they may offer a higher amount of TI dollars. On the flip side, in a challenged real estate market, the current landlord may be willing to give a better deal, particularly in an older building that is competing with newer real estate. It all comes down to how the deals pencil out.

Don’t Skip the Due Diligence Phase Navigating this decision requires involving the right consultants. In addition to an architectural team who will help you evaluate the physical conditions of any space, there are immense benefits to having savvy real estate brokers in your corner. Combining design expertise with in-depth market knowledge will help ensure you are making the right decision about what makes the most sense for your company.

The due diligence phase is almost identical whether you have your heart set on a renewal or a relocation. As an objective party, we carefully evaluate all existing building conditions and use the information we gather to inform and advise our client. In planning out any space, we consider the basic factors that will impact comfort: this includes good air conditioning for the summers, a reliable boiler for the winter and electrical capabilities that won’t create headaches down the road.

We ask questions including: Are the windows along the perimeter likely to fall apart in the next few years? Where are the existing building systems located and are they in good shape — if not, is there a program to update them? The same goes for the lobby, the elevators, the toilets. Will the tenant need to update these themselves or are they part of the overall floor that the landlord is responsible for?

For many of these items, it boils down to what the client prioritizes. We will report objectively on all factors and provide our recommendations, and then it is up to the client to decide what is the most important use of their real estate investment.

At Spectorgroup, workplace strategy is a core component of our process — starting from the initial evaluation of a space. We always start by engaging the client leadership and employee teams in a series of interactive workshops, visioning exercises and brainstorms to help us identify what elements of a space will best support their culture, brand, and team needs.

Organizations are looking at their office as more than a workspace but a destination and a brand hub. They want to create a design journey that authentically reflects their brand and helps encourage stronger collaboration between their team members. For example, if a company identifies that employee wellness is a top priority, that helps us in finding a space that allows us to maximize access to daylight and views and incorporate a range of spaces that foster inclusivity.

It can be difficult for any client when looking at a potential office as a blank slate and envisioning how it will come to life. Our job is to help our clients zero in on their needs and be able to see exactly how those needs can be addressed in a given environment.

The Question of Buildings: Old vs. New In the current real estate market, your relocation will be heavily influenced by the types of buildings you are considering. Brand-new buildings chock-full of amenities are highly desirable right now, and as demand has been satisfied we are seeing these rents driven up and TI dollars down. In order to attract new tenants, older buildings are now challenged to bring in amenities that will help them compete with the newer construction on the market.

The amenities included in a building can be a contributing factor in your decision making process. For companies that will utilize fitness centers, cafes, and bookable conference rooms, having these included in a building means that you might not need to allocate space for those amenities in your individual office square footage. Other companies find it important to have their own proprietary spaces, and are less likely to need a building that offers these perks.

The Bottom Line: What Works for Your People

While the decision to renew or relocate boils down to the metrics of the deal, it is essential to tie any decisions back to finding a space that will best serve your best asset: your employees. Encouraging employees back into the office requires thoughtful consideration of the types of spaces that will help them feel supported, productive, and happy. The answer is different for every organization that we work with.

Identify the “must-haves” of your refreshed or future space and work with your architectural consultants to ensure that the space you choose will adequately support those goals.

For our firm’s own headquarters, we negotiated a tenant improvement deal that allowed us to relocate into a 30% larger space in an older building. We were then able to invest in infrastructure changes that created a true destination for our team that encourages collaboration and celebrates our design process.

This long-standing Spectorgroup client came to us looking to refresh their existing office with a targeted, high-impact transformation. We developed thoughtful upgrades that transformed a minimalist aesthetic into a rich environment that showcases the firm’s company culture.

Photo courtesy of Merilee Kern

By Merilee Kern

The rise of the Accessory Dwelling Unit (ADU) has been nothing short of spectacular. Once a niche residential real estate concept, ADUs — often referred to as guest houses, granny flats, casitas or in-law suites — have exploded in popularity, transforming backyards across the nation. This surge in interest reflects a growing need for flexible living spaces, a desire to increase property value, a means to generate revenue and even a solution to some housing challenges.

Gone are the days of drab and cookie-cutter ADUs. Today’s designs push the boundaries of creativity, showcasing how even small spaces can be transformed into stunning, functional living environments. These modern ADUs are not just about adding square footage; they’re about enhancing lifestyles, fostering intergenerational living and creating sustainable housing options for the future.

For a deeper dive into the value, benefit and process best practices related to ADUs, I connected with Paul Dashevsky and Jon Grishpul, co-CEOs at Maxable, a national leader in resources for planning, hiring, building and managing ADU, granny flat and other tiny house projects.

How would you simply describe an ADU?