50 Years at the Forefront of New York City’s Real Estate Industry Managing Member Michael E. Lefkowitz and Founder Gary M. Rosenberg

In shifting markets, we’re taking the long view, so you can seize the moment — now and for years to come.

EDITORIAL

Editor

Debra Hazel

Associate Editor

Alex Baumbusch

Director of Communications and Marketing

Penelope Herrera

Director of

Newsletter Division

Cheri Phillips

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Serena Bhullar

Cover Photography

Rosenberg & Estis

Jared Antin

Andy Birch

Frank DeLucia

Ran Eliasaf

Kris Kiser

Andrew Schwartz

George Shea

Carol A. Sigmond

Stephen Smith

Technology Consultant

Joshua Fried

Distribution

Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Serena Bhullar

Editors

Alexandra Baumbusch

Natalia Finnis-Smart

Debra Hazel

Penelope Herrera

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306

New York, NY 10123 212-840-MANN (6266)

For 50 years, R&E's attorneys have been instrumental in driving the firm's success, helping R&E achieve remarkable milestones and putting the firm at the forefront of the real estate industry.

Welcome, 2025, and welcome back, readers!

I hope you’ve enjoyed the holidays and a bit of time off. We’re back in full swing, and I’m thrilled to start the year with a cover feature on a law firm that continues to evolve with the times and its clients.

Rosenberg & Estis is celebrating its 50th anniversary this year, but also is celebrating a new division, adding a practice dedicated to distressed assets on top of its work in every other aspect of real estate law. The firm has worked with small and major landlords, helping to create case law that affects us all. It’s a fascinating read.

It’s also a pleasure to see the many events that took place as 2024 came to a close, especially those that help those in need. We’re proud to feature Children’s Happy Faces Foundation, American Friends of Rabin Medical Center and Town Title Insurance Agency’s fundraisers, as well as events that help to educate us and honor us.

January is always a time for resolutions, and this year, we at Mann Publications will renew our annual resolution: to provide you with the information you need and want to help you do business better, in our magazines and news wires. Please let us know how we can help you.

Happy New Year!

“Foresight is not about predicting the future, it’s about minimizing surprise.” — Karl Schroeder

It’s a new year, with new opportunities in real estate.

The annual PwC/Urban Land Institute report on “Emerging Trends in Real Estate,” offers a snapshot of how the organization’s members feel the year is going to play out. As you’ll see in our summary, one of the most appealing sectors — data centers — is also one of the most difficult to build because of its intense need for power and water for cooling. It will be fascinating to see how builders meet this challenge as we need ever more cloud storage for routine and complicated tasks.

Meanwhile, Jared Antin of Elegran/Forbes Global lets us know why Manhattan’s residential real estate prices are cointinuing to rise, and Stephen Smith tells us how various technologies can make our homes smarter and healthier. Also check out our columnists, who share their expertise on financing trends, energy standards, the importance of mixed-use and more.

This year looks to be one of massive change, and we’ll be here to tell you what’s happening and why. I’m looking forward to your suggestions and contributions.

Zetlin & De Chiara LLP, one of the country’s leading law firms, has built a reputation on counseling clients through complex issues. Whether negotiating a contract, resolving a dispute, or providing guidance to navigate the construction process, Zetlin & De Chiara is recognized as a “go-to firm for construction.”

Photos by Brooke Alexander

Over 450 leaders of New York’s and America’s real estate, finance and technology industries joined together at The Plaza Hotel in New York City for the American Friends of Rabin Medical Center (AFRMC) 24th Annual Gala to support saving lives in Israel at Rabin Medical Center, the country’s premier hospital.

The Yitzhak Rabin Corporate & Civic Responsibility Leadership Award was presented to Bank of America, represented by Sheri Bronstein. Robert J. Sorin, a partner at Fried Frank, was honored with the Yitzhak Rabin Lifetime Real Estate & Legal Leadership Award and the Yitzhak Rabin Lifetime Real Estate Leadership Award was given to Bruce E. Mosler, chairman, global brokerage of Cushman & Wakefield. Honorees were recognized for their “outstanding leadership in their fields and for being trusted partners, loyal friends and exemplary philanthropists.”

AFRMC Gala Chairs Scott Rechler, Shari Redstone, Orly Avidan, Gary Jacob, Mitti Liebersohn, Mitchell Moinian, Wendy Mosler, Mitchell Rudin, John Santora, Stephen Siegel, Harrison Sitomer and Glen Weiss contributed to the event’s success in raising critical funds for Israel’s Rabin Medical Center’s Emergency Rehabilitation Department for wounded Israeli soldiers and civilians. Since October 7, 2023, the hospital has been treating countless casualties — including returned hostages, children and women — and is one of the only hospitals in Israel with a rehabilitation program dedicated specifically for recovering war casualties.

Guest presenter Shari Redstone (chair, Paramount Global and president and CEO, National Amusements) introduced the 13th Prime Minister of Israel, Naftali Bennett, who once again joined Gala Master of Ceremonies – her seventh year – Magalie Laguerre-Wilkinson, vice president of news programming at Nickelodeon News, in a fireside chat. Bennett spoke of his recent visit to Israel’s Rabin Medical Center and how he wished that the country would “respond the way Rabin Medical Center did — with a sense of community and collective purpose to help others.”

At the end of the evening, RXR CEO Scott Rechler presented a gift of thanks to Bennett, and AFRMC Executive Director Joshua Plaut announced three Rabin Medical Exchange Fellowships to be named after the evening’s honorees.

by Jill Lotenberg and Howard Wechsler

The Children’s Happy Faces Foundation had a special day at its yearly charity golf and tennis experience, held at Sleepy Hollow Country Club in Briarcliff Manor, New York, and Fenway Golf Club in Scarsdale, New York to benefit Ronald McDonald House New York. Golfers at Sleepy Hollow, overlooking the Hudson River, were greeted with a bluegrass band and omelets. In total, 230 golfers and tennis players and an additional 200 donors gathered for dinner at the Mansion of Sleepy Hollow Country Club, enjoying live music by the Parker Reilly Band and the American Bombshells.

“The continued support from the New York real estate industry that directly benefits Ronald McDonald House New York is truly remarkable,” said David Lipson, CEO and founding member of Children’s Happy Faces Foundation and senior managing director of Century Management Services Inc., the event’s chairman. “For 45 years, Ronald McDonald House New York has provided needed support for the children and their families, with an incredible staff and dedicated volunteers offing daily programs for the children and their families. It’s truly their home away from home — the house that love and hope built on the Upper East Side of Manhattan, centrally located near the finest hospitals in the world, ensuring that families can be with their children while undergoing care. It is wonderful to see such an outpouring of love and support from so many.”

This vital fundraiser was supported by several notable organizations. The Title Sponsor was The Barry Family Foundation. The Platinum Sponsor was the Andrew & Abby May Family Foundation. Gold Sponsors were Century Management Services Inc., Efficient Combustion & Cooling Corp., Morgan Stanley, National Cooperative Bank and Spring Scaffolding LLC.

Silver Sponsors were Bargold Storage Systems, JAD Corporation, C.A.C. Industries and Skyline Restoration. Bronze Sponsors were Daniels Norelli Cecere & Tavel PC and Dial-ABug Pest Control. Brass Sponsors were Mann Publications, New York Plumbing & Heating Corp. and Schwartz Sladkus Reich Greenberg & Atlas.

“We are grateful to the Children’s Happy Faces Foundation and all who have partnered with us to bring this year’s golf outing to life,” said Ruth C. Browne, president and CEO of Ronald McDonald House New York. “The funds raised for this event are critically important in supporting our families as they experience the most difficult fight of their lives.”

Children’s Happy Faces Foundation’s mission is to assist the families of sick children during the difficult and challenging times they face. Over a 17-year period, the foundation has raised a total of $10 million.

Town Title Agency hosted its Ninth Annual Town Title Golf Outing, presented by the Town Title Foundation, at the prestigious Ridgewood Country Club, in Paramus, New Jersey. With its renowned 27-hole private golf course and a clubhouse designed by A.W. Tillinghast and Clifford Wendehack, Ridgewood Country Club gave attendees a day of exceptional golfing in a stunning setting.

This year, all net proceeds from the golf outing benefited three extraordinary programs at Hackensack University Medical Center, including the Inserra Diabetes Research Institute, Tackle Kids Cancer at the Children’s Cancer Institute at the Joseph M. Sanzari Children’s Hospital and the Caryl and Jim Kourgelis Foundation for

Behavioral Health. These programs are dedicated to pioneering research, providing cutting-edge treatment and offering compassionate care in their respective fields.

Town Title Agency is a full-service title insurance agency founded in 2002. It is the agent for Chicago Title Insurance Company, First American Title Insurance Company and Stewart Title Insurance.

The Town Title Foundation is a 501(c)(3) nonprofit organization supporting local communities. Its mission includes providing financial aid to the healthcare community, fostering small businesses, supporting local organizations and enhancing educational systems.

The Schack Real Estate Club held its second annual Schack Student Summit at the Rosenthal Pavilion at the Kimmel Center for University Life at 60 Washington Square South. The exciting day was filled with insightful panels, fireside chats and networking opportunities with top professionals from the real estate industry. This summit is designed to provide students with the chance to learn from and engage with leading experts across various sectors as they share their experiences, offer valuable insights and discuss the latest trends, shaping the future of real estate.

Speakers included Peter Lewis from Wharton Equity Partners, Robert Verrone from Iron Hound, Doug Harmon from Newmark, Miki Naftali from the Naftali Group, Kevin Maloney from PMG and NYU Schack Alumni who generously shared their time and insights.

The Real Estate Board of New York hosted its Annual Commercial Holiday Luncheon at The Metropolitan Club in New York City. More than 200 professionals attended the annual event, which gathers the trade organization’s members working in office and retail leasing, development, investment sales and other sectors of the business.

Following a lively cocktail hour, guests enjoyed a lunch featuring remarks by REBNY COO Sandhya Espitia, followed by a fireside chat between Blackstone Global Co-Head of Real Estate Kathleen McCarthy and Commercial Observer Executive Editor Cathy Cunningham. REBNY’s Most Promising Commercial Salesperson of the Year Award (Rookie of the Year) was announced at the luncheon and presented to Cooper Katz of ABS Partners Real Estate and Claire Koeppel of Newmark. Created in 1996 and selected by REBNY’s Commercial Board, this award recognizes current and potential professional achievement as well as high character and ethical professional behavior.

$995/YEAR

$995/YEAR MEMBERSHIP

Be a part of the who’s who in real estate while listening to guest speakers, enjoying an assortment of food and drinks and having a good time.

Be a part of the who’s who in real estate while listening to guest speakers, enjoying an assortment of food and drinks and having a good time.

Be a part of the who’s who in real estate while listening to guest speakers, enjoying an assortment of food and drinks and having a good time.

Be a part of the who’s who in real estate while listening to guest speakers, enjoying an assortment of food and drinks and having a good time.

A space where members can meet, connect, and work together to help real estate prosper more than ever

A space where members can meet, connect, and work togethertohelprealestateprospermorethanever

A space where members can meet, connect, and work togethertohelprealestateprospermorethanever

A space where members can meet, connect, and work togethertohelprealestateprospermorethanever

We hope you see the vision of filling NYC with an abundance of success

WehopeyouseethevisionoffillingNYC withanabundance ofsuccess

WehopeyouseethevisionoffillingNYC withanabundance ofsuccess

WehopeyouseethevisionoffillingNYCwithanabundance ofsuccess

In a transaction arranged by CBRE, Kozusko Harris Duncan LLP (KHD), an international law practice representing highly successful individuals, private businesses and family offices, has inked a 14,701-square-foot office lease at 575 Madison Ave. The law firm will expand its operations already at the property and will relocate from the 24th floor, where it occupies 8,629 square feet, to part of the 12th floor of the owneroccupied, 25-story office tower.

CBRE’s Chris Mansfield, Zac Price and Tara Rhodes represented KHD. The CBRE team of William Hooks, David Hollander, Gregg Rothkin, Bradley Auerbach and Maxwell Tarter are exclusive leasing agents for the property.

“We are thrilled to have negotiated a new lease that allows KHD to expand its footprint in the property as it continues to grow its client base,” said Price. “575 Madison Ave. offered very attractive economics for a building so well located. Ownership has done an excellent job modernizing the building and we appreciated collaborating with ownership to achieve such a great outcome for KHD.”

The building, located on the corner of 57th Street and Madison Avenue, has completed a renovation, including a new lobby and amenity center.

ZCG, a privately held merchant bank in the midst of a strategic global expansion, has leased the entire 16,849-square-foot 16th floor at 430 Park Ave., announced JLL, which represented ownership. The 19-story, Class A office property occupies an entire city block between East 55th and East 56th Streets.

The company will relocate from 1330 Avenue of the Americas, where it occupied 10,000 square feet, in the second quarter of 2025 after its turnkey space has been fully built out by ownership.

“Our new office at 430 Park Ave. reflects ZCG’s commitment to New York as a key hub for our global operations,” said James Zenni, founder, president and CEO of ZCG. “As we continue to expand our team and presence worldwide, this location will support our ongoing growth and our ability to deliver excellence for our partners and investors.”

430 Park Ave. was repositioned in 2002 as a Class A office property by current ownership — a joint venture of Oestreicher Properties, Midwood Investment & Management and Marx Realty — and serves as home to a high-profile roster of corporate and financial tenants, including SK Capital Partners, H.C. Wainwright and Withers.

Ownership recently retained architectural firms MdeAS Architects and Vocon to design new base building improvements that will include a new lobby and entrance on Park Avenue, where net effective rents have continued to climb post-pandemic.

“Vacancy on Park Avenue has been falling as the flight to quality continues among tenants seeking proximity to regional transit,” said JLL Executive Managing Director Clark Finney. “With its institutional, hands-on ownership, 430 Park Ave. is well positioned to meet persistent demand for Class A office space in this prime Manhattan location.”

Finney, along with JLL Vice Chairman Frank Doyle, Managing Director Randy Abend and Senior Vice President Robin Olinyk represented ownership in the lease with ZCG. The tenant was represented by Josh Berger and Sam Matayev of Norman Bobrow & Company Inc.

The Jewish Museum 26th Annual Most Amazing New York Art & Design Tour

Brilliant Earth Group Inc., a specialist in ethically sourced fine jewelry, has opened its first street-level showroom in New York City at 255 Elizabeth St. in Nolita. The company now has four retail locations in the New York Metropolitan area.

The floorplan includes a jewelry try-on bar, offering customers a handson shopping experience, and includes dedicated private spaces for the company’s one-on-one bridal and fine jewelry appointments. Brilliant Earth’s engagement rings will be available for customers interested in immediate purchases, alongside design-your-own pieces.

“We are committed to serving our customers where they live and shop, ensuring that our personalized and joyful shopping experience is always within reach,” said Beth Gerstein, co-founder and CEO. “Opening our doors in this vibrant Nolita neighborhood, particularly during the holiday season, is an exciting step forward for us, and we look forward to serving this dynamic community.”

The opening of the Nolita showroom provides customers in the greater New York Metropolitan area with two convenient options in Manhattan, along with additional locations in Brooklyn and at the Roosevelt Field Mall on Long Island.

“This new location is an important milestone in our brand’s evolution,”

said Chief Brand Officer Pam Catlett. “We’re delighted to bring our distinct bridal, wedding and fine jewelry collections to more consumers. We are thrilled to be in this vital New York City neighborhood that’s always been a center of style and self-expression.”

UJA-Federation of New York’s Hospitality Division Honors Ian Schrager

Dalfen Industrial has signed a 96,000-square-foot lease with HVAC equipment company Cooper & Hunter at its recently completed Midpoint Miami Logistics Center in Hialeah, Fla. Cushman & Wakefield negotiated on behalf of the landlord.

Midpoint Miami Logistics Center is a recently completed, Class A development totaling 300,000 square feet. This development is located in the NW Medley industrial submarket of Dade County with close access to the Florida Turnpike, Interstate 75 and West Okeechobee (Hwy. 27). It is also within 11 miles of Miami International Airport and 20 miles of the Port of Miami.

Wayne Ramoski, Skylar Stein and Ivana Leitner Perez of Cushman & Wakefield represented Dalfen Industrial in the lease transaction, while Cooper & Hunter (operating under the name Comfortside) was represented by Cook Commercial Realty.

“We are pleased to welcome Comfortside to our Midpoint Miami Logistics Center,” said Tyler McElroy, Dalfen Industrial’s Florida market officer. “This strategic ‘last mile’ location will provide Comfortside with an ideal location for their immediate Miami distribution needs.”

Dalfen Industrial owns and operates 1.5 million square feet of industrial property in South Florida.

Century 21 Real Estate is expanding its international presence with signings of three new Master Franchise Agreements in Greece, India and the United Arab Emirates (UAE), tapping into the growing markets in each of these countries.

Antonios Kallas and his two sons, Yannis and Athanasios, will oversee the development of the Century 21 network in Greece, further expanding its current base of operations of three offices and 50 independent agents. According to Global Property Guide, Greece is experiencing strong housing market trends including increased demand from foreign homebuyers, more residential construction activity and continued economic growth.

“Our affiliation with Century 21 Real Estate in Greece marks a significant milestone for both our company and the real estate industry in the region,” said Antonios Kallas. “This new venture reflects our commitment to bringing world-class real estate services and innovative practices to the Greek market, building on the strong foundation and global reputation of the Century 21 brand.”

Charles Tarbey, owner of Century 21 Australia/New Zealand, will oversee the new Master Franchise Agreements in India and the UAE.

Global Property Guide data indicates residential property sales in the UAE are expected to increase by nearly 18% over the next five years, from $390 billion in 2024 to $460 billion in 2029. Among the primary drivers of growth is a surge in demand for luxury properties due to an increase in high-net-worth individuals seeking investment opportunities.

He recognized an opportunity to leverage existing connections between

his current markets and these new countries, which will support the expansion of the Century 21 brand in all four regions.

“Over recent years, many hard-working people from India and the UAE have made Australia and New Zealand their home,” explained Tarbey. “Securing the rights to operate Century 21 India and Century 21 United Arab Emirates will allow us to directly support this growing relationship by establishing a direct business relationship that will support the high level of interest in property ownership across all of these two countries.”

India’s real estate market outlook is also strong, with stable mortgage interest rates serving as the main drivers. In addition, increasing demand (particularly for high-value properties) and a surge in new development is contributing to a growing real estate market.

Corcoran Group LLC announced its first Mexican franchise with the launch of Corcoran The Baja Real Estate Co. Owned and led by Blake Harrington, the brokerage will serve clients throughout the greater Cabo San Lucas area.

“Cabo San Lucas is a vibrant destination and a global leader in tourism, luxury, and culture — the perfect market for the Corcoran® brand’s expansion into Mexico,” said Pamela Liebman, president and CEO of The Corcoran Group. “With Blake’s extensive experience and his resounding influence within the local market, we’re excited to grow our global presence and showcase everything the Corcoran brand has to offer both consumers and real estate professionals throughout Cabo.”

Harrington has been a leader in the luxury Cabo San Lucas real estate market since co-founding REmexico Real Estate in 2010. Following the success of REmexico Real Estate, Harrington moved on to become vice president at Snell Real Estate, a Baja California Sur brokerage, where he led the company in surpassing $1 billion in sales volume.

Cabo San Lucas draws interest from both domestic and international consumers with its blend of luxury resorts, pristine beaches and vibrant nightlife. Nestled at the southern tip of the Baja Peninsula, Cabo offers a thriving tourism economy and world-class development opportunities, with residential real estate options ranging from convenient beachfront condominiums to custom estates in private communities.

The area is renowned for its top-tier golf courses, bustling tourism

corridor, sprawling beaches and numerous outdoor activities, generating high-demand for vacation homes, investment properties and primary residences for those interested in living the resort life all year long.

With an international airport and easy access to major U.S. cities, Cabo continues to be a dynamic hub for consumers seeking leisure and real estate development.

In addition to Harrington, Corcoran The Baja Real Estate Company is comprised of a boutique team of agents and support staff, and will operate out of their newly established office, located at Calle Boulevard Mijares No. 32 in San Jose del Cabo, Baja California Sur, Mexico.

Photo via PRNewswire

Florida’s housing market in October reported higher inventory levels (active listings) and easing statewide median prices compared to a year ago, according to Florida Realtors’ housing data.

“With more inventory available now and home price increases slowing, it’s a positive sign for homebuyers, who are seeing more opportunities to enter the market,” said 2024 Florida Realtors President Gia Arvin, broker-owner with Matchmaker Realty in Gainesville. “Mortgage interest rates are lower than they were a year ago, too, which helps boost affordability.”

In October, closed sales of existing single-family homes statewide totaled 18,671, down 5.6% year-over-year; existing condo-townhouse sales totaled 6,499, down 19.9% over October 2023, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations.

The statewide median sales price for single-family existing homes in October was $415,000, up 1.2% from $410,000 one year earlier. For condo-townhouse units, the median price was $315,000, down 2.2% from $321,990 in October 2023.

According to Florida Realtors Chief Economist Brad O’Connor, Hurricane Milton caused significant coastal damage in Florida, from Tampa Bay down well to the south along the Gulf Coast. While inland areas were spared from catastrophic winds due to Milton’s weakening ahead of making landfall on October 9, 2024, the storm still caused widespread

corridor, including in the Orlando area.

On the supply side of the market, Florida had a 4.7-month supply of single-family existing homes last month, up 34.3% year-over-year. For condo-townhouse units, the state had a 7.7-month supply in October, up 67.4% year-over-year.

Related Group and Integra Investments have broken ground on The St. Regis Residences, Miami (The Residences), the residential tower rising at 1809 Brickell Ave. on the Biscayne Bay waterfront in Miami’s South Brickell neighborhood. Featuring 152 bespoke residences — including penthouses, sky villas and two exclusive stand-alone garden villas — the project offers the timeless elegance and celebrated five-star services that define the St. Regis brand.

Coastal Construction is overseeing construction, and completion is expected in 2027.

“The groundbreaking for The St. Regis Residences, Miami marks a pivotal step in bringing an unparalleled luxury experience to one of South Florida’s most dynamic urban neighborhoods,” said Nick Pérez, president of Related’s condominium division. “With each milestone, we’re transforming the Downtown Miami skyline, introducing a level of sophistication and service that only the St. Regis brand can deliver.”

Architecture is by Robert A.M. Stern Architects (RAMSA) and interiors are by Rockwell Group. This striking property represents the first residential development in South Florida for RAMSA, which drew inspiration from the elegant aesthetic of golden-age ocean liners at sea, merged with the modern allure of skyscrapers.

“We’re proud to bring the St. Regis name to a premier site on the South Brickell waterfront,” said Nelson Stabile, principal at Integra. “Upon completion, this extraordinary property will offer buyers an elevated lifestyle unmatched in the area, blending hospitality-driven services with exceptional views and ease of access to the best of Downtown Miami.”

The amenities package comprises more than 50,000 square feet of indoor and outdoor spaces, including a professional-grade fitness center with a Pilates and yoga studio, a full-size pickleball court, a private marina, a world-class spa and holistic wellness center and an indoor lap pool. Signature butler services complete the lifestyle experience, including deliveries to residences, an on-premises house car, shoeshine service and other personal arrangements. Park-like grounds surround the building, with landscaping designed by the Swiss design firm Enea Garden Design.

Related Realty is the exclusive sales and marketing partner for The Residences.

StorageMart and Manhattan Mini Storage Third Party Management announced the onboarding of a new facility located at 41 East 21st St. that will operate under the Manhattan Mini Storage brand, adding to its growing portfolio in Manhattan. This additional self-storage facility, developed and owned by Mequity Companies, will be managed under StorageMart and Manhattan Mini Storage Third Party Management program.

StorageMart is a provider of self storage solutions with a presence across the continental United States, Canada and United Kingdom.

“Adding this facility to the Manhattan Mini Storage family is an exciting opportunity for us and for our partner, Mequity Companies,” said Herby Bowman, vice president of Third Party Management at StorageMart and Manhattan Mini Storage. “Our focus is on maximizing facility performance and enhancing service standards to match the exceptional reputation of Manhattan Mini Storage within the New York market.”

The facility offers 2,103 units and 65,165 net rentable square feet, providing convenient storage solutions tailored to both individuals and businesses in the Flatiron District. Designed with the needs of the community in mind, the facility includes entirely interior climatecontrolled units and a large, enclosed pull-in loading bay.

“Manhattan Mini Storage is the most dominant and recognizable storage brand in Manhattan and their portfolio performance has been outstanding,” said Mequity CEO Bill Marsh. “These factors compelled us to make the switch. The StorageMart team has done a great job on the transition.”

The StorageMart and Manhattan Mini Storage Third Party Management program is designed to provide self-storage owners and developers with operational, marketing and revenue management services.

Broad Street Realty has inaugurated a 2.4 MW(dc) rooftop solar project at its Cromwell Shopping Center in Glen Burnie, Maryland. The 233,000-square-foot shopping center is hosting the solar project, which produces enough electricity to power over 1,000 homes in BG&E service territory in Maryland. The ballasted racking system is covered by 4,380 solar panels.

“We are excited to be partnering with Centennial and MEI to decarbonize the Cromwell Shopping Center, advancing our goal to reduce emissions throughout Broad Street’s portfolio supporting our ESG initiatives,” said Michael Jacoby, Broad Street Chairman and CEO.

Centennial Generating Company developed the project, which was built by Halo, a solar engineering contractor; AccelDev served as development capital financing. The project will be owned and operated by Madison Energy Infrastructure (MEI).

“The solar project at Cromwell Shopping Center demonstrates how commercial real estate owners can implement solar projects with a clear and measurable benefit to their bottom line while achieving sustainability targets,” said David John Frenkil, founder and managing principal of Centennial.

“We’re committed to delivering long-term value to our partners and customers with projects like these,” added Richard Walsh, CEO of Madison.

National construction management firm Shawmut Design and Construction has acquired full-service hotel renovation contractor First Finish, a partnership that combines expertise in large, complex hotel projects with expertise in fast-track, luxury interiors.

Based in Columbia, Md., First Finish is known for combining quality and speed through nimbleness, creativity and efficiency. Among its recently completed and ongoing projects are the W South Beach, Four Seasons Resort Palm Beach, The Shelborne by Proper in Miami Beach and Sonesta Los Angeles Airport.

“The joining of First Finish with Shawmut creates an offering that is unique to the market, creating an all-in-one solution for clients,” said Les Hiscoe, CEO of Shawmut. “We pride ourselves on our commitment to excellence — in client service, execution, safety and people. In First Finish, we see a company that shares this commitment.”

With current pent-up demand for refreshed rooms and amenities — particularly in the New York, Los Angeles, South Florida and Boston markets — this partnership combines the specialties of each firm to provide a more strategic analysis of an overall project, bringing value with a holistic view that identifies and solves challenges upfront. While most full-scale hotel renovations require two contractors or more, Shawmut and First Finish provide one team that can execute structural, infrastructure, public space and room work cost-effectively, the firms said.

“We’ve grown to where we are today thanks to our specialty expertise, market knowledge, and deep understanding of our clients and their needs,” said David Burman, president and founder of First Finish. “By becoming part of Shawmut, we can grow and scale with existing clients and add larger, more complex work to our resume. The cultural synergy and complementary skillsets with Shawmut create one incredibly strong, all-encompassing expert team.”

First Finish will continue to pursue its own projects in addition to its pursuits with Shawmut, and Burman will retain his position as First Finish president. All First Finish employees will become part of Shawmut, a 100% employee-owned company.

Shawmut’s portfolio of hotel work spans four decades, with projects including The Peninsula New York, Soho Warehouse, Hotel AKA Brickell, InterContinental New York Barclay, Nobu Ryokan, Four Seasons Hotel Westlake Village, Hilton Fort Lauderdale Marina event center and The Langham, Boston.

FMI Capital Advisors served as financial advisor and Venable LLP served as legal counsel to First Finish. Chartwell Financial Advisory served as financial advisor and Blank Rome LLP served as legal counsel to Shawmut.

Building materials solutions provider CRH announced the acquisition of Dutra Materials in San Rafael, California. This acquisition expands CRH’s Americas Materials Solutions business and enhances its ability to provide integrated solutions to customers in northern California.

“Following our entry into the state of California earlier [in 2024] via the acquisitions of BoDean Company and Northgate Ready Mix, we are excited to expand our presence in California and further enhance our ability to provide integrated solutions to customers in this attractive market,” said Scott Parson, president, Americas Materials Solutions, CRH, in the announcement.

Dutra Materials complements CRH’s Americas Materials Solutions business in the western U.S., bringing additional strategic aggregate reserves and asphalt production capabilities to service the northern California construction market.

“The construction market in California is one of the largest in the United States and presents CRH with attractive opportunities for continued growth. As North America’s leading integrated supplier of aggregates, asphalt and ready mixed concrete, we look forward to helping build, connect and improve Northern California and serving customers with

our unique combination of building materials, products and solutions,” Parson added.

Janover Inc., an AI-enabled platform connecting the commercial real estate industry, has launched an advanced AI voice tool designed to engage clients with seamless, natural conversation while performing complex, real-time CRM operations.

Currently in internal use and soon available for licensing, this tool will make high-level interactions effortlessly across phone, email and text while autonomously integrated with Hubspot, Janover said.

“This AI tool is more than just a voice on the other end of the line,” said Blake Janover, CEO of Janover. “It’s a sophisticated system that understands the nuances of commercial real estate and human conversation and can respond in real-time, making interactions feel as authentic as speaking with a professional with answers that are simply more comprehensive and faster.”

Key features include authentic human-like conversations, deep expertise in commercial property finance, optimization for sales conversions, integration with SMS, e-mail and voice for seamless cross-channel conversation abd integration with HubSpot.

“We’re bringing a level of sophistication that feels simple,” said Steve Schwartz, vice president of innovation at Janover. “It combines advanced conversational depth with seamless multi-channel functionality. This isn’t just an AI; it’s an adaptive partner that integrates perfectly into existing workflows and enhances our teams’ capabilities.”

As part of its early release, Janover is using the AI voice inside its business and plans to release it for licensing for the commercial real estate sector in the immediate future.

Vend Park, a provider of AI-powered parking technology solutions, has announced an integration with Cove, a platform that modernizes property operations and tenant experience for real estate owners and operators. This collaboration aims to create a unified experience by linking Cove’s visitor management module with Vend’s advanced parking technology, enhancing the way properties manage visitors, parking and tenant interactions.

“Our goal is to help real estate owners and operators deliver exceptional experiences, and this collaboration ensures that parking is as easy and accessible as possible for everyone,” said Karan Singhal, chief technology officer at Vend.

The new integration offers features that the companies said enhance convenience and efficiency for property owners, tenants and visitors. When tenants invite visitors to a building through Cove, they can now issue a Vend parking validation as part of the visitor invitation workflow. This allows tenants to either fully or partially cover parking session costs based on the validations configured in Vend, ensuring a frictionless experience for visitors.

Permissions are synced between Vend and Cove, allowing tenants to provide appropriate parking validation types based on their access level. Only authorized employees can create parking validations for visitors, ensuring control over parking resources. Vend parking details and validations are automatically included in Cove’s visitor emails, offering clear instructions for visitors on how to access the building and ensuring a smooth entry experience. In addition, pre-registered visitor vehicles will be automatically recognized using Vend’s License Plate Recognition (LPR) system at the entrance and exit, with parking validations applied instantly. This automation reduces hassle for visitors and guarantees a seamless parking experience.

This integration will be first rolled out at Bond, George Oliver’s experiential office project in Phoenix. Bond offers a hospitality-inspired experiece with multiple amenities, now including the parking integration through Vend and Cove.

“This partnership with Vend enables us to offer a comprehensive solution that further improves the overall experience for tenants and visitors alike,” said Cove CEO Adam Segal. “By integrating visitor management and parking technology, we can deliver a more streamlined and cohesive property experience.”

This integration is now available to all joint Vend and Cove customers.

Real estate data provider PropStream announced PropStream Intelligence, an AI-driven and predictive analytics platform enhancement that it said will help find top-quality leads and harness AI and machine learning insights.

Designed to streamline and transform the lead generation process of various real estate pros, PropStream Intelligence adds an additional layer to the research process, allowing users to find the most worthwhile leads with minimal effort. PropStream Intelligence data includes property condition analysis using a strategic grading system, foreclosure factor, estimated wholesale value and a lead list.

“PropStream is embracing technological advancements in AI and machine learning to improve the accuracy and availability of real estate data so that customers can create their own leads from the millions of data combinations available to them — to help simplify and speed up informed decision-making,” said PropStream President Brian Tepfer. “Our new platform, PropStream Intelligence, is a representation of this commitment. So, whenever customers see the PropStream Intelligence icon, it lets them know they are working with intelligent curated data, giving them insights that our competitors do not offer. Furthermore,

we’re pleased to announce that all these great features are available for the same low monthly price on PropStream.”

In business since 2006, PropStream has data for over 160 million properties nationwide.

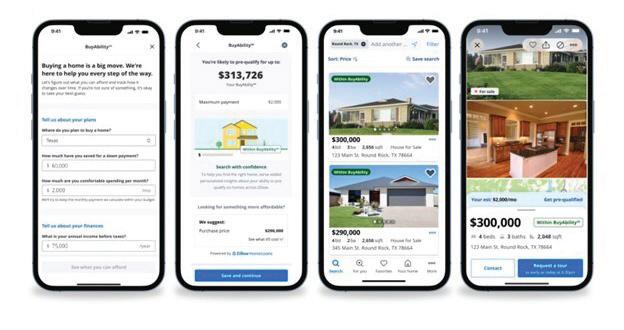

Home shoppers now have a way to instantly understand if a home on Zillow fits within their budget. BuyAbility is an affordability tool from Zillow Home Loans that gives buyers a real-time, personalized estimate of the home price and monthly payment they can afford, and their likelihood of qualifying for a loan. Instead of wasting time on homes they can’t afford, shoppers can now clearly and quickly identify homes on Zillow within their true budget.

BuyAbility is powered by real-time mortgage rates from Zillow Home Loans, and updates whenever rates move up or down or when a prospective buyer improves their credit score, their debt-to-income ratio or saves more for their down payment.

“Mortgage rates have been on a wild ride this year,” said Orphe Divounguy, a senior economist for Zillow Home Loans. “With improving inflation numbers and more balanced economic activity, mortgage rates could ease slightly heading into the new year. That will mean more affordability and more options for home shoppers. Buyers will be in a stronger position to act quickly when the right home enters their BuyAbility, bringing them one step closer to the American Dream of homeownership.”

Shoppers can access BuyAbility from the Home Loans tab on the Zillow app. They enter their basic financial information, including their income, credit score, monthly debt payments, amount saved for a down payment and the amount they’re comfortable spending each month. Within seconds, they get their BuyAbility: an estimate of the home price they are likely to qualify for and a suggested budgeted maximum price based on their desired monthly payments. When they browse Zillow, listings will be clearly tagged when they are within that shopper’s BuyAbility, providing instant clarity on whether they are likely to qualify for a loan on that home.

BuyAbility accounts for the one major factor that basic mortgage calculators neglect: the interplay between mortgage rates and a buyer’s personal financial situation. Shoppers with higher credit scores

or a lower debt-to-income ratio will qualify for a lower mortgage rate, which has a huge impact on their buying power. Assuming a 20% down payment and a fixed-rate mortgage, a median-income household would be able to afford a $380,000 home with a 7% mortgage rate. That same household could afford the monthly payments on a $420,000 home with a 6% mortgage rate.

This is particularly useful at a time when mortgage rates are changing. New Zillow research finds the share of homes that a middle-income household could comfortably afford hit a nearly two-year high in September. A household making the median U.S. income could comfortably afford 27.3% of homes listed for sale across the country. Only 22.7% of all homes listed for sale were affordable to a middleincome household when mortgage rates peaked above 7% in May.

That significant shift shows how quickly homes can go from being unaffordable to affordable in today’s market. BuyAbility gives shoppers a competitive edge by keeping them up to date on exactly what they can afford at any given time.

BuyAbility is currently available in every state but New York on the Zillow app and will be coming to desktop computers on Zillow’s website.

Real estate investment and deal management platform Dealpath has launched Dealpath Connect for Deal Acceleration with launch partners JLL and LaSalle Investment Management, connecting investment sales brokers with prospective buyers within the platform.

“[This] announcement is the culmination of over a decade of work to bring an integrated digital software and data platform to the world’s largest asset class, real estate,” said Mike Sroka, CEO and co-founder of Dealpath. “Amid changing markets, advancements in AI and increasingly complex compliance requirements, this unprecedented, integrated suite of technology will unlock enormous value for market participants on both the buy-side and sell-side.”

The real estate industry has lacked a solution to help buyers identify and track deals disseminated by brokers, leading to missed opportunities and gross inefficiency for all parties. Dealpath Connect aims to bridge the buy and sell sides of real estate transactions into a single platform.

For investment sales brokers, Dealpath Connect brings high visibility to relevant deals and cuts down transaction time by getting opportunities directly into the pipelines for buyer screening. For buyers, the platform gives them assurance that they are seeing every relevant deal from broker partners, allowing for a steady flow of new, relevant opportunities without requiring additional staffing or manual data entry.

“Our purpose-built technology, including the JLL Buyer List, which combines our proprietary data with AI to intelligently target buyers, and the JLL Investor Center, the only truly global sales listing platform, positions

us to deliver superior outcomes for our clients,” said Emilio Portes Cruz, global head of innovation of capital markets at JLL. “This direct connection of targeted listings accelerates the speed at which deals are done and surfaces more interested bidders for our clients.”

With Dealpath Connect, sell side partners are realizing more than an 80% increase in visibility of their opportunities with top institutional clients and more than a 30% increase in confidentiality agreements signed. Institutional investment managers leveraging the platform are achieving more than a 200% increase in relevant deals screened and a 30% decrease in errors in underwriting, diligence and deal execution.

Dealpath Connect for Deal Acceleration is live with JLL’s Capital Markets group and LaSalle Investment Management and rolling out globally with Dealpath clients.

The Kolter Group’s land business (Kolter Land) and Brookfield Residential’s Land development group (Brookfield Residential) have formed a strategic partnership that will provide finished residential lots and mixed-use pads to builders in the Southeast U.S.

The partnership combines Kolter’s operational strength in the Southeast with Brookfield Residential’s broad experience in real estate investments and scaling businesses. The partnership will capitalize on the Southeast’s long-term growth as well as an increasing desire among builders to place land development in the hands of expert partners, the companies said.

Jim Harvey, a 30-year veteran of residential development, will pivot from his role as president of Kolter Land to head the partnership.

“Our partnership with Brookfield Residential represents a significant milestone for Kolter Land. Our shared vision, and complementary strengths, position us to be the land developer of choice in the Southeast,” Harvey said. “We look forward to a successful collaboration that will benefit our partnership and the communities we serve.”

Kolter is a private investment firm focused on real estate development and investment and has sponsored over $29 billion of realized and inprocess residential real estate projects throughout the Southeast U.S.

Brookfield Residential specializes in land entitlement and development

to create neighborhoods and master-planned communities. The firm provides lots to third-party customers, including its own homebuilding business, and is one of the largest suppliers of lots to the homebuilding industry. It will build upon the relationships of Kolter Land, which has sold lots to the Southeast’s leading public and private builders as well as the sale of retail and multifamily parcels to other vertical developers.

“Our combined expertise and resources will enable us to deliver highquality residential and mixed-use communities that meet the growing demand in Florida, Tennessee, Georgia and the Carolinas,” said Adrian Foley, president and CEO of Brookfield Residential.

The global Grand Hyatt hotel brand is continuing to expand its global footprint in key destinations, announcing that more than 10 Grand Hyatt hotels are expected to open through 2027 in new markets around the world.

Now available for booking, the Grand Hyatt Deer Valley marks the first hotel within the newly developed Deer Valley East Village and the debut of the brand in Utah. The hotel’s 436 luxury guestrooms, suites and residences are joined by dining options (including an après ski bar and grill), a signature bar and restaurant and coffee bistro, along with one of the largest mountainside event facilities in the U.S.

Opening in 2025 will be the Grand Hyatt Grand Cayman Resort & Spa, the first Grand Hyatt branded hotel in the Cayman Islands. The hotel will offer 382 guestrooms and over 47,000 square feet of flexible indoor and outdoor meeting spaces. Grand Hyatt The Red Sea will be the first Grand Hyatt property on Shaura Island, serving as the hub of the ambitious Red Sea Project on Saudi Arabia’s west coast and offering 430 guestrooms.

In 2026, Grand Hyatt Cancun Beach Resort will stand on the eastern part of the Yucatán Peninsula in Mexico, offering 500 guestrooms and more than 16,000 square feet of event spaces. Grand Hyatt Jaipur will mark the first Grand Hyatt hotel in the state of Rajasthan, India. The 409-guestroom hotel will offer one of the region’s largest indoor and outdoor event venues, in addition to restaurants, bars, a club lounge, outdoor and indoor pools, spa and an entertainment zone for kids, teens and adults.

Grand Hyatt Los Cabos will mark the first Grand Hyatt hotel in Mexico’s Baja California Sur, offering 300 guestrooms, in addition to over 1,200 acres of experiences located within the Oleada Pacific Living & Golf private resort community. Grand Hyatt St. Lucia will feature 345

guestrooms and debut as the first Grand Hyatt hotel in St. Lucia. The hotel will sit on the southwestern corner of the island in Sunset Bay and offer three pools, three restaurants and more than 20,000 square feet of gathering spaces.

In 2027, Grand Hyatt Bangalore, India will be located within Whitefield, a popular suburb. The 400-guestroom hotel will feature multiple restaurants abd 37,000 square feet of diverse event venues.

Additional anticipated openings include Grand Hyatt Suzhou Bay (2026), Grand Hyatt Hohhot (2027) and Grand Hyatt Yantai Laishan (2027) in China and Grand Hyatt Madinah (2027) In Saudi Arabia.

Marcus & Millichap is expanding its expanding its commercial property auction services platform with the addition of industry veterab Ian Grusd as a senior vice president. In his new role, Grusd will focus on expanding Marcus & Millichap’s national auction services team with Northeast-based clients selling properties throughout the country.

“Ian is an extremely well-respected industry leader known for his expertise and passion for commercial real estate,” said Jim Palmer, leader of Marcus & Millichap’s auction services team. “His knowledge of the auction industry, coupled with his ability to understand the needs of clients, overcome obstacles with practical, detailed and innovative solutions and support those clients as a trusted advisor make him an excellent fit for Marcus & Millichap’s Auction Services team.”

Previously, Grusd was at Ten-X, where he represented real estate investment trusts, private equity funds, institutions, syndicators and family offices in accelerated marketing and property dispositions through auction. He has over 25 years of brokerage, advisory service, asset management, ownership and receivership experience and has sourced and sold commercial real estate across all product types valued at more than $2 billion.

Grusd serves on the CCIM New York executive committee, has led SIOR New Jersey and has spoken at numerous conferences, including the Appraisal Institute, RealShare, New Jersey State Bar Association and the CCIM Institute. He also has experience as a State of New Jersey court-appointed receiver and is a State of New York Part 36 certified receiver.

When Gary M. Rosenberg founded Rosenberg & Estis P.C., in 1975 to represent New York City residential property owners, the real estate industry was very different than it is today. What was then a local industry with individual and family owners has evolved dramatically into a global asset class with large institutional players.

“In the 1970s, insurance companies were among the only institutional real estate owners, along with several family owners who had developed large portfolios of commercial properties,” said Rosenberg. “The real estate landscape is now completely different, operating as a highly sophisticated sector of international finance.”

As the industry has changed, so has R&E, growing in size and scope to offer a comprehensive suite of services for all industry members. Now, as the firm celebrates its 50th anniversary, R&E stands as the city’s leading full-service real estate law firm, while remaining the city’s foremost legal expert on the dynamics of the residential market.

The firm has 95 attorneys and has received recognitions from industry publications including the “New York Law Journal,” “Crain’s New York Business” and “Law360,” among others. In both 2018 and 2020, the firm’s Litigation team was named Real Estate Litigation Department of the Year by the “New York Law Journal.” R&E was named among the top workplaces in the city in 2023 and 2024 by “Crain’s New York,” and in 2024 by “U.S. News & World Report.”

Over its 50-year history, R&E’s litigators have represented the city’s premier owners and developers, securing dozens of major industry victories in New York State Supreme Court, the Appellate Division and the Court of Appeals. The firm’s litigation efforts have advanced the interests of all industry members, helping to create law on important regulatory issues. Its Transactional Department has helped New York’s leading developers assemble, vacate, finance and develop buildings that have transformed the city.

Among R&E’s initial clients were the Bronx Realty Advisory Board and the Community Housing Improvement Program, organizations that were largely comprised of individual owners of a small number of residential buildings. These were small operators, but they required the same level of representation as any large corporation.

While landlord/tenant work was the foundation of the firm, Rosenberg and the late Warren A. Estis made a strategic decision to broaden representation to all aspects of real estate, offering clients comprehensive resources and operating at the highest level.

“Having access to a broad range of expertise within the firm has allowed us to tackle complex, multi-faceted issues for our clients,” said Michael

BY GEORGE SHEA, SHEA COMMUNICATIONS

E. Lefkowitz, who joined R&E in 1987 and now serves as managing member and one of the heads of the firm’s transactional department. “Our strategy was simple: provide comprehensive services that are highly targeted to the New York City real estate industry.”

In the 1980s and 1990s, R&E positioned itself to provide critical services during the rebirth of the New York City office market. Notably, the firm launched a transaction practice and began working with major developers, including The Durst Organization, Vornado and The Brodsky Organization, on ground-up developments and transactions.

R&E’s depth of experience representing small landlords on tenant issues positioned it to provide critical legal services during the rise of the REITs, which were able to acquire tens of thousands of rental housing units through the efficient use of financing. When private equity entered the market, R&E had established itself as a leading firm with expertise in mid-market deals, from $25 million to $150 million.

“Larger institutions retained our firm to provide first-hand insight on regulatory issues, due diligence, compliance and other local issues,” said former Member and current Special Counsel Blaine Z. Schwadel. “These entities benefited from our history and on-the-ground experience as they acquired large portfolios of multifamily assets.”

Following 9/11, R&E began representing insurance companies as they tried to assess property damage from the terrorist attacks. The firm has continued to adapt in recent years, acting as a leader in the EB-5 space, facilitating the first and largest commercial property assessed clean energy (C-PACE) loan and helping owners and lenders work through the post-pandemic distress in the office market. R&E is now positioning itself as an industry leader in diversity, most recently hosting the inaugural symposium of the Metropolitan Black Bar Association.

“The history of the New York City real estate industry has been dominated by men, but we have worked to bring new voices into the conversation,” said Member Luise A. Barrack. “We believe that different skills and perspectives enable us to provide more effective representation.”

The assemblage and development of two full-block projects in Manhattan by The Durst Organization stand out among the transformational development projects facilitated by R&E. This includes 3.5 million square feet of office space in two buildings on the block between Avenue of the Americas and Broadway and between 42nd and 43rd Streets and 1.5 million square feet of residential development in three properties encompassing the entire block between 11th and 12th avenues and between 57th and 58th Streets. R&E provided comprehensive legal services, including assemblage, litigation and financing, for both developments.

The redevelopment of the block between 42nd and 43rd Streets, which began following extensive litigation related to the 42nd Street Development Project, was transformative, not only for Times Square, but for the city. R&E managed the assemblage, acquisition and financing for the construction of 4 Times Square, the 48-story, 1.6 million-squarefoot property located on Broadway between 42nd and 43rd Streets. The firm also managed the retail leasing for the project, which was the first major new skyscraper in Times Square, and which ushered in a new era of development for 42nd Street and the surrounding areas.

R&E was also deeply involved in the complex assemblage and development of the eastern portion of the same block along Avenue of the Americas, a lengthy process that ran from the late 1980s to 2004. Notably, the assemblage of this site included the demolition of the 13story Diplomat Hotel, which was operating as a single-room occupancy (SRO) hotel at the time and required extensive efforts to vacate. R&E also assisted with the purchase of Henry Miller’s Theater, now the Stephen Sondheim Theater, helping to execute a complex plan to demolish and rebuild the landmarked theater while maintaining its façade.

At the end of the One Bryant Park assemblage, but prior to construction, New York City was paralyzed by the terrorist attacks of 9/11. This horrific episode threatened to undermine New York City’s position as the financial capital of the nation, as many banks were concerned over the loss of business continuity and began exploring alternative locations for all or part of their operations. However, R&E, working with The Durst Organization and Bank of America (BOA), obtained the assistance of the Empire State Development Corporation and the NYC Eco-

nomic Development Corporation.

This collaborative effort resulted in the establishment of BOA’s global headquarters for investment banking in a new, 50-story tower, the Bank of America Tower, or One Bryant Park. This show of faith by the bank and by The Durst Organization sent a powerful message of confidence, opening the way for others to recommit to the city at a time when many believed tall buildings would no longer be built.

To facilitate the project with New York City and New York State, The Durst Organization had to secure Bank of America’s commitment at a very early stage in the project, so early, in fact, that it was impossible to determine the building specifications or a rent for the space.

“R&E demonstrated its ingenuity by developing a complex rent formula based on building costs in the yet-to-be-designed property, enabling the two joint venture partners to sign a binding lease while the construction plans were still in a preliminary state,” said Member Richard L. Sussman. “This is the way we approach all challenges.”

R&E then led the effort to obtain a payment in lieu of taxes (PILOT) and federally subsidized Liberty Bonds for the project. R&E led the creation of the first financing that combined tax exempt Liberty Bonds and taxable financing as part of what was then the city’s largest construction loan – a total of $4.2 million.

11th Avenue to 12th Avenue, 57th Street to 58th Street

The development by The Durst Organization of the block between 11th and 12th Avenues, and between 57th and 58th streets, includes the fascinating history of the estate of Thomas Appleby, dating back

to the 1850s. Appleby had a license with the city to collect and dump fly ash into the Hudson River. As part of the agreement, he could keep any land created by this landfill effort. Over the years, this agreement led to the creation of significant parcels of land, beginning at 70th Street and running all the way down to approximately 39th Street. More than 100 years later, the estate still owns much of this property. However, the beneficiaries are not developers and hoped to generate more revenue from their land at 57th Street than they were receiving from the existing small commercial buildings.

R&E negotiated a net lease for the entire block on behalf of The Durst Organization, followed by the creation of the Helena, a 600-unit, 38-story rental tower. Following an extensive effort to rezone the block for residential use, there are now almost 2,000 units of residential housing. R&E led the construction financing and permanent loan financing as well as all of the retail leasing for the project.

R&E has a long-established reputation as a leading real estate litigation firm, defending the rights of industry members while making law on critical industry issues. In Pultz v Economakis in 2008, the firm secured a Court of Appeals ruling that the Rent Stabilization Law does not limit the number of apartments a landlord can recover for his or her own use. In 2020’s Regina Metro. Co. LLC v DHCR (New York Division of Housing & Community Renewal), the Court of Appeals ruled that retroactive application of HSTPA overcharge amendments against landlords violates due process. More recently, in Casey v Whitehouse Estates Inc. in 2023, the Court of Appeals held that DHCR’s default rent formula cannot be used where the landlord’s alleged fraud took place after the base date, and thus could not have rendered the base date rent unreliable.

The firm still vigorously represents real estate entities, honoring the legacy of Warren Estis, one of the city’s fiercest litigators, by securing groundbreaking decisions for clients despite a hostile regulatory environment.

By providing superior legal services for all elements of the industry and evolving to support its clients as they face new challenges, R&E has remained at the forefront of a changing industry. The firm’s deep history, pool of talent and its singular focus has positioned it to serve as a powerful advocate for the entire real estate community, from owners and developers to investors and lenders.

By Debra Hazel

As capital slowly becomes more affordable, look for commercial real estate transactions to pick up. The question becomes in what sectors and what markets, according to the Urban Land Institute (ULI) and PwC’s “Emerging Trends in Real Estate 2025” report.

Released at ULI’s Fall Conference, held in 2024 in Las Vegas, the report features exclusive data and insights gathered from more than 2,000 top real estate specialists, covering a broad range of real estate topics impacting the U.S. and Canadian markets, from climate change to AI. Overall, the respondents are optimistic for the year ahead, especially for some up-and-coming sectors.

“In 2025, we expect lower interest rates will reduce borrowing costs, aid in price discovery and ultimately encourage an uptick in CRE transactions,” said Angela Cain, ULI global CEO. “Sentiment is improving, although largely still erring on the side of caution, but we’re glad to see the early signs of capital markets poised for recovery, as firms look to longer-term strong fundamentals and adjust their strategy by market and property type. In this respect, a number of alternative sub-sectors are increasingly of more interest, although the need for housing and logistics continue to make these core sectors attractive.”

Industry leaders are more confident than a year ago but remain cautious, the report noted. Stability has returned to property markets, and investors are now addressing cyclical issues like oversupply and adapting to changing consumer and tenant preferences.

“While challenges persist across the real estate sector, there are signs of improvement after years of hardship,” said Andrew Alperstein, a partner with PwC’s US real estate practice. “Industry optimism has grown in the last year, though there is an understanding that recovery will be gradual. Looking ahead to 2025, firms should focus on managing short-term risks and adjust their growth strategies to succeed in this reawakening.”

One exception is the rise in demand for data centers, which is soaring due to the widespread growth of artificial intelligence, while other niche property types are also seeing strong growth.

Data Centers

Fueled by cloud storage, mobile data traffic, overall internet traffic and AI, data centers, a relatively new property type, could be one of the largest real estate sectors over the next 10 years, the port predicted. Demand is huge, but new supply is constrained, largely because of limits on electric power transmission capabilities.

As with industrial space, a previous industry darling, data center equipment requires a substantial amount of water for constant cooling, even as many areas of the U.S. experience drought. Public opposition to the noisy and visually unappealing buildings also is a factor. The result: virtually no vacant spaces in major markets and rapidly rising rents.

“Data centers have historically clustered in areas with good connectivity to fiber and near major population centers. Northern Virginia is the leading global data center market mainly because it was one of the earliest locations of the internet ecosystem, having proximity to government and military-focused users, deep fiber optic connectivity, a relative availability of land and a low risk of natural disasters. Today, approximately 70% of world internet traffic passes through data centers in the Northern Virginia region,” the report said. The vacancy rate in the region is just 0.6%.

Atlanta is the second largest market for data sectors, followed by Phoenix, Dallas/Ft. Worth and Chicago.

“Data centers are currently highly profitable for both tenants and developers/ owners. Power procurement difficulties will keep supply below demand for the near- to mid-term, ensuring that sites with power access will lease up quickly at high rates,” the report said. “Of course, if supply constraints were to materially ease, new construction would spike and rental rates and returns would likely decline. The outcome is not likely anytime soon.”

The decade has seen substantial volatility in the industry sector, beginning with a huge expansion during the pandemic as consumers shopped online, followed by slowing leasing activity in 2023/2024 as markets saw massive new high-quality supply. In the first half of 2024, net absorption declined 37% year over year. Meanwhile, new construction slowed and is likely to slow further in 2025 as a new balance is struck.

“In 2025, the new phase will merge elements of both periods: more high-quality options for customers pursuing a strategic, deliberate approach to growth that will shape the future of the supply chain,” the report said. “New demand is expected to return in 2025 with the added layer of supply chain optimization guiding growth strategies.”

Infrastructure will be critical to leasing decisions, especially access to power and water to fuel and cool the massive new technology operating in these modern facilities. This could affect previously growing markets such as California, Phoenix and Nevada.

Aging — but comparatively well off — baby boomers are fueling demand for this category, even as development activity has slowed because of constrained capital. But this provides a unique opportunity to rethink how to appeal to this group of healthier seniors compared to previous generations, the report said.

“This period of subdued development activity is the ideal time to think about what successful senior housing projects can look like in the years ahead. The future cannot be a carbon copy of the past,” the report noted. “Although scaling up successful existing models remains a viable option, the current environment presents opportunities to develop senior housing that better aligns with consumer preferences and capitalizes on real estate market trends.”

The active adult rental market, which provides lifestyle amenities, is expanding and gathering interest from developers, investors and operators. Niche operators such as Storyliving by Disney, Margaritaville and properties marketed to LGBTQ older adults also are growing. Conversions of vacant mall anchors into mixed-use developments with senior housing also are taking place.

Middle income seniors, however, may have fewer options. However, nearly half of all senior housing properties are now 25 years old or older, which could allow redevelopment to appeal to this demographic, the report observed.

Retail

Remember when online shopping was going to replace in-store retail? After a period of major store closures in the early days of the pandemic — related mostly to already weak fundamentals — demand for physical retail space rebounded well. Leasing remained strong in 2024, with restaurants, off-price

stores, groceries, fitness centers and nontraditional users such as medispas and miniature golf all taking space.

“Virtually [no one] anticipated the strength of that rebound, which has driven retail vacancy rates below levels not seen in more than a decade,’ the report said.

Open-air projects continued to attract investment, even in the current constrained environment, as investors sought stability.

“In interviews with market participants, the greatest concerns they expressed were the lack of available quality space in the market and the cost challenges that limit new development,” the report noted.

But distress is creeping back into the sector. Bankruptcies and store closures are once again on the rise, and year-over-year sales gains are largely due to inflation rather than increasing shopping. American consumers who have increasingly relied on credit cards are seeing payments balloon. The drug store category, in particular, bears watching, simply because these buildings, typically between 15,000 square feet and 18,000 square feet, are harder to fill after a closure.

Growing life sciences space supply in the core markets of Boston, San Diego and San Francisco as well as emerging areas has resulted in rising vacancy rates. By the second quarter of 2024, the sector comprised 387 million square feet of existing space, up 19% since the middle of 2020. Absorption has been strong, but hasn’t kept pace, the report said. Occupancy fell from 95.2% in the second quarter of 2022 to 89.9% in the second quarter of 2024.

But employment in the sector continues to rise (up 2% from 2022 to 2023, according to the Bureau of Labor Statistics) and as the construction pipeline works through, a greater balance could be achieved.

Multifamily may see supply glut in high-growth areas. The multifamily market in 2025 will be shaped by the issue of supply, with a wave of apartment deliveries peaking in 2024 and concerns about a supply glut in high-growth Sunbelt markets.

However, industry specialists anticipate that demand for apartments will remain strong due to job growth, favorable demographics and immigration. Rent growth has slowed in high-supply markets but remains positive in regions with limited new construction. But an increasing number of renters are cost-burdened, underscoring the need for more market-rate and affordable housing through new policies and streamlined development.

Also a factor in the housing sector is climate change, as insurance costs rise in high-risk regions. Even so, Sun Belt cities dominated the list of top 10 markets to watch, with Dallas-Fort Worth ranking first, followed by Miami, Houston, Tampa–St. Petersburg, Nashville, Orlando, Atlanta, Boston, Salt Lake City and Phoenix.

But, surprisingly the next 10 markets see a growing interest in the Snow Belt. Ranked 11th was Manhattan, which rose 20 places from 2024. Other New York area submarkets also saw a tremendous rise. Jersey City, N.J. skyrocketed 27 places to rank 19th, Brooklyn rose 14 places to rank 14th and Long Island rose 18 places to rank 20th.

“After a prolonged recovery from the COVID pandemic and ensuing brief recession, New York is getting back on track. Metro job growth continues at a steady clip, besting the nation in all but one quarter over the past three years,” the report said. “Renewed leasing activity driven by financial sector tenants — and construction slowing to a post-global financial crisis (GFC) low — is stabilizing Manhattan’s office availability rate.”

Filling out the top 20 were Raleigh/Durham (12th), San Antonio (13th), Austin (15th) Fort Lauderdale (16th), Detroit (17th) and Charlotte (18th).

RICHARD SIMON, ESQ. | PARTNER

CHAIR, BANKING AND FINANCIAL SERVICES

Since

Alternative

Appellate

Banking

Bankruptcy

JEFFREY ROSENTHAL, ESQ. | PARTNER

CHAIR, BANKRUPTCY AND CREDITORS RIGHTS

By Stephen Smith

In recent years, the concept of luxury living has undergone a significant evolution. Today’s high-end homeowners are no longer satisfied with mere opulence and creature comforts; they seek residences that actively contribute to their overall well-being that allow them to live in complete harmony with their home.

This shift has led to an exciting convergence of smart home technology and wellness features, creating living spaces that are not only luxurious but also health-enhancing.

The wellness real estate sector has experienced remarkable growth, surging from $225.2 billion in 2019 to $438.2 billion in 2023, achieving an 18.1% annual growth rate during this period. This trend reflects the growing desire for wellness features in homes, driven by an increasing awareness of their significant impact on well-being, according to the “2024 Wellness Real Estate Market Growth (20192023) and Future Developments” report from the Global Wellness Institute.

One of the most critical aspects of a healthy home environment is air quality. Modern luxury homes are now incorporating advanced air filtration systems that rival hospital-grade technology.

These systems go beyond traditional HEPA filters, utilizing multi-stage purification processes that can remove particles as small as 0.1 microns, including viruses, bacteria and volatile organic compounds (VOCs). Smart sensors continuously monitor air quality throughout the home, automatically adjusting filtration levels as needed.

Clean water is essential for health, and luxury homes are now taking water purification to new heights. Whole-home water filtration systems are now being integrated with real-time quality monitoring technology.

These systems not only purify water at every tap but they also provide homeowners with instant feedback on water quality through smartphone apps or integrated home displays. A recent survey found that 79% of Americans are concerned about their drinking water quality, highlighting the importance of such advanced purification systems.

Lighting plays a crucial role in our overall wellbeing, affecting everything from our mood to our sleep patterns. Luxury homes are now featuring sophisticated circadian lighting systems that mimic natural light patterns throughout the day.

These systems automatically adjust color, tem-

perature and intensity to support the body’s natural circadian rhythm.

In the morning, lights gradually brighten with a cool, bluish tint to promote alertness and productivity. As evening approaches, the lighting shifts to warmer, amber tones to encourage relaxation and prepare the body for sleep. Some systems even integrate with incorporated motorized shades and window treatments to optimize natural light exposure throughout the day.

Incorporated motorized shades are a sophisticated addition to modern smart homes, seamlessly integrating with the architecture to provide effortless control over natural light and privacy. Unlike traditional window coverings, these shades are built directly into the structure of the home, concealed within walls or ceilings when not in use. They operate using motorized systems, allowing for remote control via smartphone apps, voice commands or pre-set schedules.

These smart shades can be programmed to respond to various factors such as time of day, temperature or occupancy, optimizing energy efficiency and comfort. They can work in conjunction with other smart home devices, creating a cohesive automated environment.