BUILDING THROUGH YOUR OWN CASH FLOW: NECTAR’S KEY TO MULTIFAMILY SUCCESS

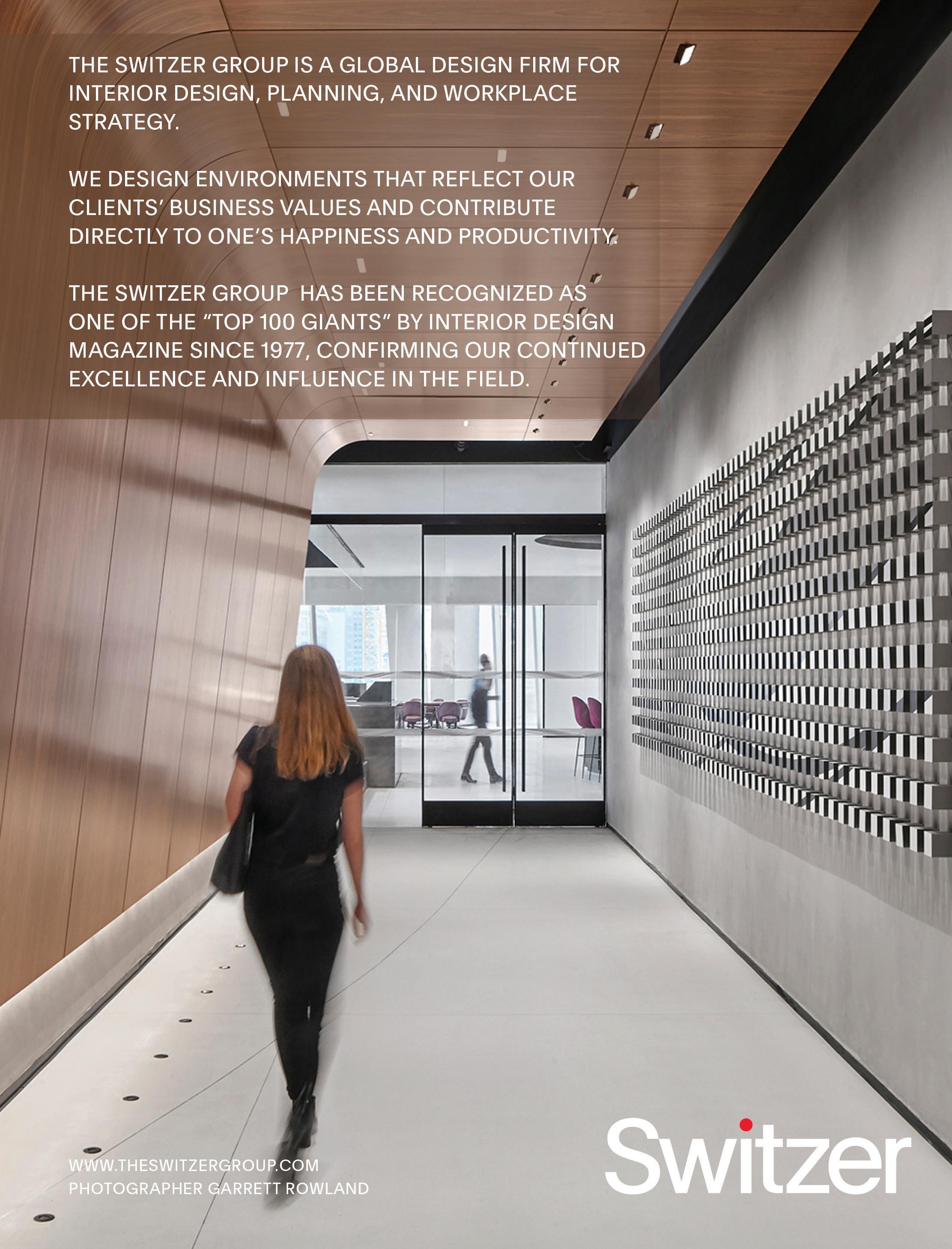

BOUTIQUE OFFICES: THRIVING IN SOUTH FLORIDA AN UPSCALE VIBE FOR THE BRONX

BUILDING THROUGH YOUR OWN CASH FLOW: NECTAR’S KEY TO MULTIFAMILY SUCCESS

BOUTIQUE OFFICES: THRIVING IN SOUTH FLORIDA AN UPSCALE VIBE FOR THE BRONX

With our deep insight and experience, where others see challenges, we see opportunities.

Hempstead Golf & Country Club | Hempstead, NY MONDAY, AUGUST 5, 2024

The Seawane Club | Hewlett Harbor, NY

Rockaway Hunting Club | Lawrence, NY

Sunrise Day Camp–Long Island is the world’s first full-summer day camp for children with cancer and their siblings, provided completely free of charge

Sunrise Day Camp–Long Island is a proud member of the Sunrise Association, whose mission is to bring back the joys of childhood to children with cancer and their siblings worldwide. Sunrise accomplishes this through the creation and oversight of welcoming, inclusive summer day camps, year-round programs and in-hospital recreational activities, all offered free of charge. Sunrise Day Camp–Long Island is a program of the Friedberg JCC, a beneficiary agency of UJA-Federation of New York.

646.597.6171

dhandler@handler-re.com

646.597.6179

rfarley@handler-re.com

kgalin@handler-re.com

Meridian’s national dominance in multifamily financing gives us a unique vantage point from which to approach markets on our clients’ behalf. By leveraging our 30+ year relationships and depth of experience, we are able to see what others can’t and produce exceptional outcomes — especially in turbulent markets. Remain informed and be agile with Meridian.

EDITORIAL

Editor

Debra Hazel

Associate Editor

Alex Baumbusch

Director of Communications and Marketing

Penelope Herrera

Director of

Newsletter Division

Cheri Phillips

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Serena Bhullar

Graphic Designer

Madi McCreesh

Cover Photography

Greg Kuhn

Giray Boran

Frank DeLucia

Raffaele Di Censo

Shaun Keegan

Merilee Kern

Kris Kiser

Robert Sasloff

Carol A. Sigmond

BUSINESS

Technology Consultant

Joshua Fried

Distribution

Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Serena Bhullar

Madi McCreesh

Editors

Alexandra Baumbusch

Debra Hazel

Penelope Herrera

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827 Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306 New York, NY 10123 212-840-MANN (6266)

Welcome to our Multifamily Issue, with an especially pertinent cover story on Lighthouse Living, which is developing multifamily properties for the way we live today—larger spaces, with just the right combination of amenities for its users.

Every decade, there is a generational talent who comes along in the real estate industry. Meet David Mann who has built an empire from scratch that is developing around the Tri-state area and has expanded to Green ville, South Carolina. He has already completed fifteen projects, with two more that are currently in construction. His development plans in the Southeast region of the United States are also under way. Each one of his projects is very special to him.

David, 45 years old, has dominated the market by thinking outside of the box. It is imperative that you read this story to learn what he has accomplished. To fully appreciate his story, simply pick up the phone and call him or email him, as he is a pleasure to speak with and is very engaging.

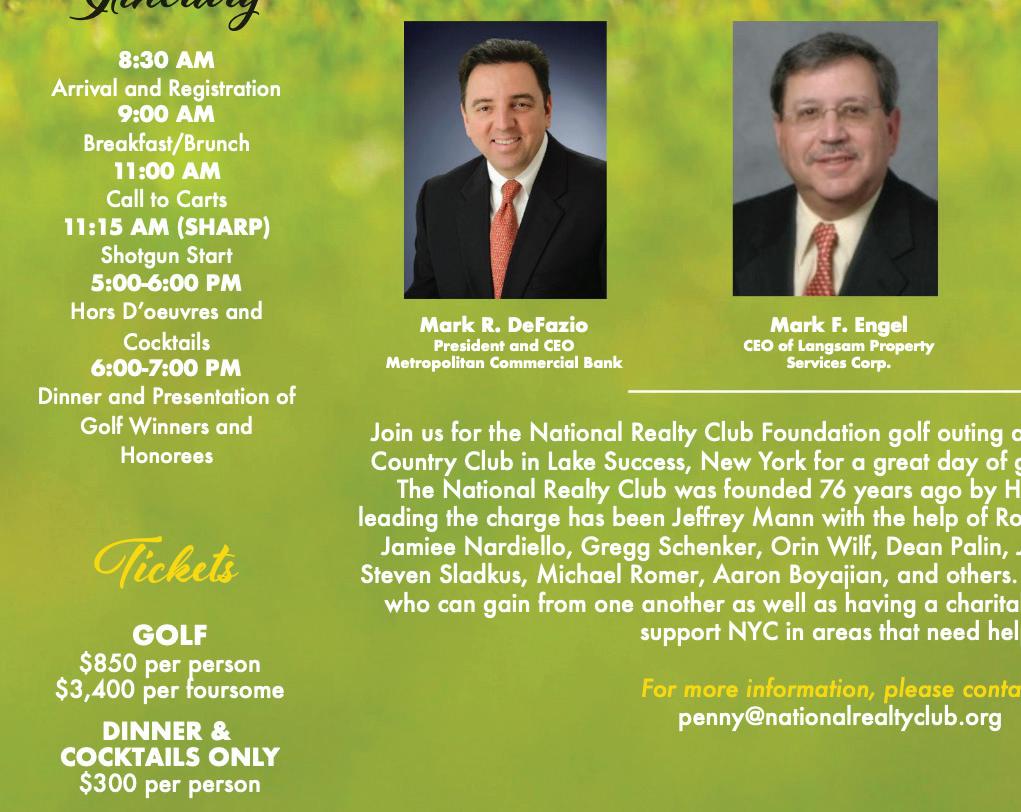

I also know that we’re still dealing with the August heat, but it’s also time to look ahead to our autumn National Realty Club Foundation Golf Outing, set for October 7 at the Fresh Meadow Country Club. We’re delighted to be honoring Mark R. DeFazio, president, CEO and a founder of Metropolitan Bank Holding Corp. and Metropolitan Commercial Bank and Daniel Vitulli, a part ner in Marcum LLP’s New York Office and national partner-incharge of its real estate group. Our Humanitarian Award will be given to Mark F. Engel, CEO of Langsam Property Services Corp. It’s always a great day, and raises funds for the NRC Foundation, which supports causes that benefit all New Yorkers. Thanks to our Gold Committee Co-chairs Bob Knakal of BK Real Estate Advisors and Jaimee Nardiello of Zetlin & Chiara LLP for all the efforts. For more information, please contact me or Penny Herrera at pherrera@nationalrealtyclub.org.

Enjoy the last bits of summer and see you next month!

“One pound of learning requires 10 pounds of common sense to apply it.” -Persian proverb

by

From financing considerations, to property performance metrics, today’s real estate business is inundated with both challenges and opportunities.

PKF O’Connor Davies has decades of experience working with a variety of assets including industrial, office and residential sites. Our experience in this complex field gives us the expertise to deliver strategic advice that drives real value.

With the PKF O’Connor Davies Real Estate Team, our clients know greater service, know greater insights, Know Greater Value.

Edward O’Connor, Partner 201.712.9800 eoconnor@pkfod.com

Overall, New York City is a city of renters — according to nyc.gov, nearly seven in 10 (69%) of New Yorkers rent their homes, more than double the percentage of Americans (34%) who don’t own. So, it makes sense to focus on multifamily, a critical sector in real estate. And it was a real pleasure to speak with David Mann about how Lighthouse Living is reinventing the rental experience by offering larger units with just the right kinds of amenities just outside the city. These are not your grandfather’s apartments.

David Mann isn’t alone. Around the city and the country, multifamily developments are focused on bringing amenities and, more importantly, a sense of community. Our friend Merilee Kern shows how Urban Living is creating that community through programs and events. And look at what The Bronx Vibe is bringing to the Grand Concourse area.

Also check out what our columnists and contributors have to say about new electrical needs, real estate bankruptcy and more.

Enjoy the last days of summer and see you next month!

Photos by Steven Lipofsky

Kramer Levin’s Real Estate and Land Use groups recently hosted their annual spring cocktail reception at the Bryant Park Grill Patio, convening New York’s leading owners and developers, private equity funds, sponsors, lenders, family offices, REITs, investors and major non-profits. Kramer Levin welcomed more than 250 guests for a chance to network with each other under an open-air tent.

“What a terrific evening. I was thrilled with how many of our clients and colleagues were able to join us,” said Jay Neveloff, a partner and chair of the Real Estate Group at Kramer Levin. “As the real estate markets continue to recalibrate and reenergize from the rapid economic change and disruption of the past few years, this gathering gave us all a chance to pause and reflect, not only on where we are today but also on the welcomed economic indicators we see coming.”

Kramer Levin’s legal services cover every aspect of real estate and land use law, from acquisitions and sales, joint ventures, entitlements, financings, development and conversions, to bespoke, hybrid leasing transactions, condominium work, workouts, restructurings air rights deals and historic preservation.

The law firm’s attorneys and their clients stand at the forefront of many significant real estate developments and projects across New York and throughout the United States, it noted.

“This was another wonderful Kramer Levin event; as in previous years, we felt great friendship, energy and enthusiasm for the future of New York City,” said Land Use Co-chair Elise Wagner. “Land use and real estate are twin engines that drive our city’s economy, and this event brings people together to network, build productive relationships and eventually work together to make New York an even greater place.”

PHOTOS BY MICHAEL PRIEST

More than 300 New York real estate professionals attended Jewish National Fund-USA’s annual Leonard Litwin New York City Real Estate Tree of Life Gala at Gustavino’s in Manhattan to honor two industry leaders for their invaluable leadership and philanthropic endeavors.

Chaired by Glen Weiss of Vornado Realty Trust, the annual real estate reception honored Tree of Life Award recipient Neil J. Goldmacher, chairman, National Tenant Representation at Newmark. Goldmacher joined the firm in 1995 as a senior managing director and became a principal in 2000.

Previously associated with Williams Real Estate Co., Goldmacher is a dedicated philanthropist and long-time supporter of Jewish National Fund-USA, the leading philanthropic organization for the land and people of Israel.

Scott Nadler, vice president of lending at CrossCountry Mortgage LLC, was the recipient of the Gregory A. Davis Leadership Award. The latter recognizes

young philanthropists between the ages of 22 and 40.

Nadler has been ranked in the top 1% of mortgage originators nationally nine years in a row. Philanthropically, he is a co-founder of Jewish National FundUSA’s New York Real Estate Cabinet and is on the organization’s Housing Development Fund Task Force, which removes red tape and speeds up the development of housing sites in Israel’s Negev and Galilee.

Special guests included Alon Davidi, the mayor of the southern Israeli city of Sderot, and four residents of Hamas-ravaged Kibbutz Be’eri. As survivors of the October 7 attacks on their kibbutz, the representatives were in the United States to raise awareness about the realities on the ground in Israel, raise funds to rebuild their community and expedite the hostages’ return.

David R. Greenbaum of Vornado Realty Trust and Jeffrey E. Levine of Douglaston Development served as the event’s honorary chairs.

“Diversity creates profitability. Diversity creates success. Diversity improves our economy and diversity improves our society and REAP embodies all of that,” said REAP Chair Michael Kercheval at the NY/NJ/CT Silver Jubilee event. The gala celebrated 25 years of diversifying the talent pipeline in commercial real estate since the founding of Project REAP (Real Estate Associate Program) in 1998.

Kercheval, a supporter of REAP since its inception and the retired CEO and president of ICSC, remained upbeat about the future, despite recent curtailing of DEI initiatives.

“Today we face some major challenges in our industry and in the economy. It is very, very troubling,” he said. “We can stand up and continue to push that mission. We’re creating opportunities and we’re training. We’re opening doors and we’re supporting people for a lifetime of career success in real estate. We’re going to continue to make a difference.”

Katrina Rainey, Esq., a REAP 2006 alum and secretary of the REAP board, and now a site acquisition director with Microsoft, relayed how the organization has helped build her career from Day One. Recruited to create and launch McDonald’s property management program shortly after completing the REAP Academy, she has continued to maximize her REAP network, which helped her transition into her current position.

“REAP has been an amazing opportunity to help propel my career in not only teaching me the language of commercial real estate but also networking skills,”

said Rainey.

NY/NJ/CT REAPer of the Year Randall Powell, REAP 2019 alum and co-founder, principal and CEO of his own firm, Infinite Horizons LLC, praised and thanked REAP, saying, “I am forever grateful for the transformative impact REAP has had on my professional journey. REAP has been an amazing platform for myself and my organization, and it is these endeavors and the vision of people that come together to support and teach each other like yourselves that give us an opportunity to grow our businesses and become substantial in this marketplace.”

G. Lamont Blackstone, acting executive director of REAP, called out the most toxic critics of DEI as impeded by an “antebellum” way of thinking, an outdated mindset that fails to grasp present-day urgencies and realities.

Said Blackstone, “Diversity is not a threat, it is simply an effort to expand the talent pool of this nation.”

The program was followed by networking with fare provided by NY/NJ/CT Silver Jubilee Event Champion ICSC and other sponsors.

Denham Wolf was the Early Investor Level Sponsor; Greystone and Monge Capital were the Investor Level Sponsors and IREM (Institute of Real Estate Management), Grow America and All Renovation Construction (founded and led by REAP 2017 alum and board member Allan Suarez) were the Jubilee supporters.

PHOTOS BY ANCHIN

Anchin announced the 2024 Construction and Design Awards winners at its 14th awards ceremony, held at the prestigious Elsie Ballroom in New York City. The event, held in collaboration with the New York Building Congress, the American Council of Engineering Companies of New York and the Subcontractors Trade Association, highlighted industry excellence, innovation, MWBE empowerment and leadership.

The ceremony celebrated achievements and provided a platform for networking and forming valuable industry connections. Attendees were encouraged to engage with one another, share knowledge and foster collaborations that could lead to future partnerships and projects.

Keynote speaker Greg A. Kelly, P.E., president and CEO of STV, provided insightful reflections on real estate’s current state and future and societal impacts, saying, “We are all bound by a common purpose, and that purpose is why we are here — to enact changes that positively affect our community. … Despite challenges such as inflation, legislation like the Infrastructure Bill, the CHIPS Act and the Inflation Reduction Act have catalyzed our industry, emphasizing the importance of public and private investment and partnership.”

The MWBE Empowerment Award was presented to Civic Builders and Holt

Construction for honored for their exceptional growth, creativity and leadership, setting new industry standards and paving the way for future innovation. Curtis Partition and JB&B were celebrated with the Innovation-Driven Excellence Award for their bold visions and cutting-edge technology, redefining the boundaries of design and construction.

Pioneering Industry Leadership Awards were given to Syska Hennessy Group and Shawmut Design and Construction for their leadership in economic development, community engagement, technological advancement and commitment to sustainability and DE&I principles. The Rising Star Award was presented to Kings Capital Construction.

In the opening address, Phil Ross, Anchin’s Architecture, Engineering and Construction partner, highlighted the critical role of innovation and collaboration in advancing the industry, focusing on sustainability and integrating new technologies.

“Congratulations to all our deserving winners and a heartfelt thank you to our esteemed judges for their thorough evaluation,” Ross said. “Your collective contributions continue to fortify our industry, propelling us towards a future distinguished by innovation, inclusivity and exemplary leadership.”

As part of its 50-year anniversary celebration, Rosenberg & Estis P.C. welcomed members of the Metropolitan Black Bar Association (MBBA) as host of its inaugural “Elevate & Empower: Black Real Estate Development Symposium” at the firm’s offices at 733 Third Ave.

R&E Associate Shakiva Pierre, along with Jerome Frierson, director of housing team for Bronx Defenders, moderated a panel discussion with Leleah James, vice president of community engagement at Related Affordable; Josiane Lysius, associate broker at Corcoran Group; Kenneth Morrison, managing member and principal, Lemor Development Group; Malcolm Punter, president, Harlem Congregations for Community Improvement Inc. and Craig Livingston, managing partner at Exact Capital.

“Rosenberg & Estis has grown, evolved and diversified over its 50 years serving New York’s real estate industry and we are proud to host this inaugural symposium on behalf of the MBBA,” said Managing Member Michael Lefkowitz. “With a 1% vacancy, it is clear New York does not have enough housing, especially workforce housing. Our speakers offered tremendous insight into ways the real estate industry can adapt and change in the same way the city has to provide homes for everyone who wants to live here.”

The MBBA is a unified, citywide association of Black and other minority lawyers in the New York metropolitan area, with members in all five boroughs. In further celebration of its 40th year as New York’s largest unified Black bar association, MBBA’s roundtable discussion focused on leveraging real estate development to empower the Black community. Topics included past, present and future development initiatives, perspectives on community engagement and strategies for increasing Black representation in real estate development.

“Real estate creates jobs, stimulates economic growth and generates wealth,” said Pierre, who serves as MBBA co-chair, real estate law section. “Open fo-

rums like the MBBA Symposium provide an ideal platform for sharing information that can increase Black representation in the process and we are thankful to Rosenberg & Estis for their ongoing support.”

Enso, a tire technology company that makes better tires for electric vehicles (EVs), has signed a Letter of Interest (LOI) with the ExportImport Bank of the United States (U.S. EXIM Bank) to establish a carbon-neutral tire factory in America. Potential factory locations include Colorado, Nevada, Texas and Georgia, with other states in consideration.

U.S.-based technology partners Rockwell, global sustainable development firm Arup and U.S.-based investors 8090 Industries and Galway Sustainable Capital are supporting Enso.

The first-of-its-kind tire factory will be carbon-neutral without purchased offsets, utilizing carbon-neutral raw materials, building materials and 100% renewable energy. In its first phase, the factory will produce five million EV tires by 2027 and create 600 jobs, rising to 2,400 jobs when built out to full production capacity of 20 million tires — 8% of America’s total annual tire market. The Enso technology campus will integrate research and development with production under one roof.

“The U.S. is the best place for Enso to establish its first carbon-neutral tire factory. With strong regulatory support and a significant market opportunity, we are committed to bringing our innovative, low-emission, low-cost tires to American consumers,” said Enso CEO Gunnlaugur Erlendsson. “This factory will make tires more affordable, reduce tire pollution, create great jobs and drive sustainability in the U.S. tire industry.”

The U.S. regulatory environment strongly supports Enso’s move to America. Initiatives such as the Inflation Reduction Act have transformed the automotive sector and enabled more ambitious EPA (Environment Protection Act) emissions standards, paving the way for similar advancements in the tire industry.

Programs such as the California Energy Commission’s (CEC)

Replacement Tire Efficiency Program and the California Environmental Protection Agency’s (CalEPA) efforts to control toxic chemicals such as 6PPD in tires align with ENSO’s goals, by setting out minimum efficiency and environmental standards for both new and aftermarket tires.

Currently, the majority of tires sold in the U.S. are imported. This factory will help reduce America’s reliance on imports.

Enso’s tires already increase EV range by 10% and reduce particulate matter emissions by 35%, the company said. By producing fewer, longer-lasting tires with better technology, Enso aims to cut tire pollution, which is responsible for six million tons of particulate matter emitted globally each year and icontributes to ocean microplastic pollution and air pollution.

The company has committed to completely phasing out all fossil fuelbased raw materials from its products by 2030, replacing them with bio-based renewable and low-carbon alternatives.

The Square, Hines’ flexible workplace platform, will open its first New York City location at 205 Hudson in Hudson Square this summer. This marks The Square’s sixth location globally, with additional locations in Washington, D.C., Houston, Salt Lake City and Mexico City. Taking over the former WeWork space, The Square in New York City will occupy nearly 63,000 square feet.

205 Hudson is part of the Hudson Square Properties portfolio, a joint venture of Trinity Church Wall Street, Norges Bank Investment Management and Hines, consisting of 13 office buildings across approximately six million square feet of commercial space.

“There is a universal shift towards greater flexibility, across small businesses to large enterprises, and we are leading the way in redefining new products that cater to our clients’ needs beyond traditional long-term leases,” said Annie Draper, director of workplace services at Hines. “As the office model continues to transform in today’s dynamic world of work, and with each company operating in different ways, the demand for a diverse array of workspace options becomes increasingly essential.”

Designed for the modern occupier, The Square will offer on-demand meeting rooms and office space at 205 Hudson that are bookable by the hour, day, week or month. Spaces include Enterprise suites, large, fully customizable for suites of teams of 25 and more with

private offices, meeting rooms and amenity spaces; private offices and flex suites for teams from one to 25 and on-demand meeting rooms and office spaces. Members gain access to common spaces, private phone booths, state-of-the-art technology, as wel as food and beverage services.

The Square at 205 Hudson can accommodate over 700 people spread across offices and suites, including 12 conference rooms that can be booked by non-members. Members will have access to building amenities across the Hudson Square portfolio, including an expansive rooftop with views of Manhattan, and lounge and event spaces. They will also gain access to The Square’s network of collaboration and office spaces.

AT AGGRESSIVE ENERGY we’re striving to power New York and beyond with affordable fuel, oil, biofuels, natural gas and electricity. In addition to competitive pricing, we’re committed to our customers and have been offering reliable energy service for more than 30 years. As a leading energy supplier throughout the northeast, we promise to uphold our premium service while doing what’s right for our environment and our economy.

Our knowledgeable professionals, experienced in all aspects of the industry, are ready to advise you on your energy needs. For more information, call us at 888.836.9222 or visit our website at www.AggressiveEnergy.com

Tredway, an affordable and mixed-income real estate developer that builds and preserves high-quality, high-opportunity housing, and ELH Mgmt LLC announced the acquisition of a seven-building portfolio in Brooklyn’s Fort Greene neighborhood.

Concurrent with the acquisition, Tredway has extended the affordability of the properties for another 40 years, ensuring all 193 homes will serve low-income households earning no more than 50% of area median income. An additional 30% of the homes will be reserved for formerly homeless individuals and families.

“The tremendous changes we’ve seen in Fort Greene over the past decade have unfortunately made it difficult for longtime residents to remain in the community they pioneered,” said Will Blodgett, CEO and founder of Tredway. “By locking in affordability for elderly and vulnerable residents, we hope the preservation of Greene Clermont Houses and Tri-Block Houses Apartments serves as a bulwark against displacement and an example of the socio-economic diversity that makes New York City so great.”

Tredway and ELH are investing more than $10 million to renovate the portfolio, which has been largely untouched since it was built. The cornerstone of the preservation is a 97-unit, elderly-designated, midrise building located at 80 Greene Ave. Built in 1982, Greene Clermont Houses is home to longtime residents of Fort Greene who will benefit from critical aging-in-place retrofits aimed at enhancing residents’ quality of life.

A redesigned indoor and outdoor community space and a new wellness center will allow on-site vaccination and nursing services and include office space for a resident services coordinator. Jericho Project, a nonprofit, has been retained to provide social services with an emphasis on housing retention and stabilization, as well as ageappropriate programming.

Collectively known as Tri-Block Houses Apartments, the remaining buildings are located at 36 Fort Greene Place, 56 Fort Greene Place, 35 St. Felix St., 42 St. Felix St., 51 St. Felix St. and 221-225 Ashland Place. Apartments will receive new bathrooms, kitchens, lighting and flooring, while lobbies and commons areas will be refreshed for the first time in over 40 years.

The project is being financed with a $97 million Freddie Mac loan from Wells Fargo. The total development cost is estimated to be $110 million. The sale was brokered by Affordable Housing Advisors.

Vornado Realty Trust celebrated the completed transformation of a portion of West 33rd Street into Plaza33, a permanent pedestrian plaza in the heart of the Penn District.

Developed through a public-private partnership with the NYC Department of Transportation, the 1/3-acre promenade boasts mature trees, lush landscaping, circular stone benches and colorful chairs and tables. Sitting directly above Penn Station’s new LIRR Concourse, Plaza33 is an oasis for the surrounding neighborhood and a new connection to transit, nearby amenities, office buildings and over 70 food and beverage offerings.

Plaza33 is the centerpiece of a $65 million project by Vornado to make the streetscape around Penn Station safer, greener, more accessible and more pedestrian-friendly. In addition to the plaza, Vornado has partnered with the New York CIty Department of Transportation to replace one-half mile of concrete sidewalks across the District with distinctive Petit Granit stone pavers, and to double the width of the crowded Seventh Avenue sidewalks that border Penn Station, the nation’s busiest transit hub.

The Plaza features 16,000 square feet of reclaimed public space for pedestrians; five mature October Glory maple trees; a connection to the newly renovated East Plaza at Penn 1, the recently completed

grand entrance to Penn Station’s all-new LIRR Concourse and the new ADA-compliant Amtrak entrance at 32nd Street; special programming provided through the 34th Street Partnership and new food and beverage offerings in adjacent retail space curated by Vornado that serve a wide range of budgets and tastes, including Roberta’s Pizza, Los Tacos No. 1 and Anita Gelato.

Lendlease, LMXD (an affiliate of L+M Development Partners) and Daiwa House Texas Inc. announced the official completion of Claremont Hall, designed by Robert A.M. Stern Architects (RAMSA). Located at 100 Claremont Ave. in Morningside Heights, Manhattan, Claremont Hall features 165 condominiums including one- to four-bedroom residences within the Union Theological Seminary (UTS) campus.

The 41-story mixed-use building offers residents river, skyline and park views as well as proximity to the the Morningside Heights neighborhood adjacent to Columbia University. The building is available for immediate occupancy, with pricing starting at $1.195 million and residences ranging from 700 square feet to 2,765 square feet.

Each condominium features sweeping views, expansive ceiling heights, oversized windows and European white oak flooring. The kitchens, equipped with Bosch appliances, feature custom RAMSA-designed Italian cabinetry in a choice of classic Bianco or modern Grigio finish, complemented by Calacatta Laza quartz countertops and chrome fixtures and hardware. Select residences boast private outdoor terraces.

Claremont Hall’s design reflects the Gothic Revival character of the seminary campus and surrounding neighborhood. Designed by RAMSA, the building incorporates Gothic stonework at its base, connecting with the entry facade and the preserved historic campus buildings.

Crafted in collaboration with CetraRuddy Architects, amenities include a walnut-paneled library, a grand dining room, a children’s playroom, a creative maker’s space, a resident lounge with a terrace, a fitness center, convenient onsite parking and an indoor pool housed within the former refectory for seminary students and faculty. Additionally, the refectory space will be available for residents to host private events.

Detroit is the best city for real estate agents in America, while San Francisco is the worst, according to research from Clever Real Estate, a St. Louis-based real estate company.

The study ranked the 50 most-populous U.S. metros on metrics such as affordability, salary, number of agents, annual home sales, home values, commission rates and more.

Detroit emerged on top, with nearly five times as many sales per agent as the median market, the lowest competition from fellow agents, and some of the highest commission rates in the country.

Following Detroit in the top 10 are: Buffalo, New York; Kansas City, Missouri; Tampa, Florida; Richmond, Virginia; Columbus, Ohio; Jacksonville, Florida; Atlanta; Pittsburgh and Hartford, Connecticut.

Regionally, seven of the top 15 cities for real estate agents are in the Midwest, while the Northeast and South each have four. No top-ranked cities are in the West, although six of the 10 worst-performing cities are in that region.

The 10 worst cities for real estate agents are San Francisco; Austin, Texas; San Jose, California; Dallas; Milwaukee; New Orleans; Las Vegas; Phoenix; Los Angeles; and Riverside, California.

San Francisco ranks as the worst city due to high competition, the fewest sales per agent and the second-longest amount of time needed to afford a home on an agent’s salary. Notably, four of the 10 worst cities

for agents are located in California.

The study also surveyed agent earnings. Perhaps not surprisingly, agents in New York City earn the highest median salary at $103,960 per year, making it the only U.S. market with a six-figure median income. Conversely, agents in Riverside, California, earn the lowest median income at $33,510 annually.

Toll Brothers’ Toll Brothers City Living Division and Sculptor Real Estate announced that construction is complete and closings have commenced at The Rockwell. Located at the corner of 103rd Street and Broadway on Manhattan’s Upper West Side, The Rockwell offers 81 luxury condominiums and a full complement of amenities. The building was designed by Hill West with interiors by Whitehall Interiors.

Pricing ranges from $989,000 to $3.5 million.

“It’s a proud day for our team to complete this beautiful building with its brick and bronze façade – a true stand out along the Broadway corridor,” said David Von Spreckelsen, president of Toll Brothers City Living. “We’re pleased to open our doors and begin to welcome our first homeowners to The Rockwell, as well as welcome potential buyers to view our stunning model residences. With its thoughtful design, outstanding amenities, and convenient location, The Rockwell has resonated well with homebuyers and we’re now over 40% sold.”

Residences at The Rockwell feature bright living spaces with Kährs 5-inch-wide white oak flooring and open kitchens with integrated Thermador appliances and custom Poliform cabinetry and brushed nickel accents. Luce de Luna quartzite (renowned for its durability and natural beauty) comprise the kitchen backsplashes and countertops.

Amenities include a residents’ lounge with bookable dining room, a fitness studio, pet wash, music room, screening room, playroom and two separate terraces — a second-floor lounge terrace with seating nooks tucked amid verdant landscaping, and a rooftop terrace with lounge seating, outdoor dining, grilling stations and sunbathing chaises.

Co-exclusive sales and marketing is provided by

Toll Brothers City Living is the urban development division of luxury home builder Toll Brothers Inc. Since its formation in 2003, Toll Brothers City Living has completed 45 condominium buildings totaling over 7,200 residences. Sculptor is a global alternative asset management firm with approximately $32 billion in assets under management.

Despite a pandemic construction boom, the U.S. housing shortage grew to 4.5 million homes in 2022, up from 4.3 million the year before, according to a Zillow analysis. This deepening housing deficit is the root cause of the housing affordability crisis.

At its core, the housing market is driven by supply and demand. This balance reached a tipping point when the Great Recession ushered in a decade of underbuilding and millennials — the biggest generation in U.S. history — reaching the prime age for first-time home buying. The result has been worsening affordability, now exacerbated by stubbornly high mortgage rates, the company said.

“The simple fact is there are not enough homes in this country, and that’s pushing homeownership out of reach for too many families,” said Orphe Divounguy, senior economist at Zillow. “The affordability crisis extends to renters as well, with nearly half of renter households being cost burdened. Filling the housing shortage is the long-term answer to making housing more affordable. We are in a big hole, and it is going to take more than the status quo to dig ourselves out of it.”

Across the country in 2022, there were roughly 8.09 million “missing households” — individuals or families living with nonrelatives. Compare that to 3.55 million housing units that were available for rent or for sale, and there is a housing shortage of more than 4.5 million.

The pandemic-era housing frenzy sparked a construction boom, but thus far, that boom has fallen short. In 2022, 1.4 million homes were built — at the time, the best year for home construction since the early stages

of the Great Recession. However, the number of U.S. families increased by 1.8 million that year, meaning the country did not even build enough to make a place for the new families, let alone to ease deficit that has hampered housing affordability for more than a decade.

One indicator of housing affordability is how strict a region’s landuse rules are, the Zillow research showed. Those who live in highly regulated housing markets, as defined by the Wharton Residential Land Use Regulatory Index, are less likely to be able to afford the mortgage payment on a typical home in their metro, even in markets with higherthan-average incomes. This is because housing supply persistently falls short.

Founded over 30 years ago, Zetlin & De Chiara LLP is one of the nation’s leading construction law firms. Our attorneys deliver a full range of legal services centered around construction law throughout the United States and abroad.

Florida- and New York-based property management company Akam announced the acquisition of Property Management Resources (PMR) in Southern Florida, furthering the company’s footprint in the state. The financial terms of the agreement were not disclosed.

Through the acquisition, properties previously managed by PMR have access to Akam’s property management services and services including capital project management, energy services, procurement and insurance and risk management.

“For over 40 years, we have been a long-standing leader in property management, delivering exceptional service and tremendous value to our clients,” said Akam CEO Ken Greene. “We are very excited to add these dedicated professionals to our A team and provide our newest clients with the very best we have to offer.”

PMR began in 1974 as a family-run business, with a focus on dedicated and highly personalized services. The company offered complete servicing in administration, financial management and property maintenance in Palm Beach County.

“We’re proud to bring the properties we’ve served an elevated level of support and resources through Akam’s successful property management model,” said Ralph Hintz, president of PMR. “We’re confident that by becoming a part of Akam, we are adding instant value for our residents, and they’ll see those returns quickly.”

Allegra Hintz, a member of PMR’s founding family, will join Akam’s

Florida team led by Southeast Executive Vice President Kat Flores.

“Our first priority is always people — our team members and our clients,” said Flores. “We look forward to learning and growing with our new colleagues as well as bringing Akam’s hospitality-led services and solutions to customers. “We have the tools, technologies, and experts ready and willing to enhance the value, comfort, and security of each home.”

CBRE Group Inc. announced that the company plans to combine its project management business with Turner & Townsend, its majority-owned subsidiary that provides program management, cost consultancy and project management services globally.

Upon closing the transaction, CBRE will own 70% of the combined Turner & Townsend/CBRE Project Management business, with the Turner & Townsend partners holding the remaining 30%. CBRE acquired a 60% ownership interest in Turner & Townsend in November 2021. Since then, Turner & Townsend has grown revenue at a compound rate of more than 20%.

CBRE’s entire project management business, including Turner & Townsend, produced net revenue of approximately $3 billion in 2023. Since 2021, combined net revenue has grown at a double-digit annual rate with an approximately 15% net profit margin.

The net synergies derived from bringing the two businesses together are expected to generate approximately $0.15 of incremental run-rate core EPS by the end of 2027, an amount that is expected to grow.

The cost of the incremental investment in Turner & Townsend/CBRE Project Management is about $70 million, exclusive of deal costs.

“Unifying our Project Management business will create an offering that is unmatched for its scale and breadth of capabilities, with more than 20,000 employees serving clients in over 60 countries,” said Bob Sulentic, CBRE chair and chief executive officer. “Powerful secular trends, particularly increased spending on infrastructure, green energy and employee experience, are growth catalysts for this business and we are well-positioned to capitalize on this significant opportunity.”

The combined business will be led by Vincent Clancy, Turner & Townsend’s chief executive officer, who will continue to report to a board controlled by CBRE and comprised of senior executives from both CBRE and Turner & Townsend. The CBRE board intends to appoint Clancy to the board upon closing the transaction.

Turner & Townsend operates across three business segments globally: Real Estate, serving investors and occupiers across all property types, including data centers and life sciences; Infrastructure, notably transport and aviation and Energy and Natural Resources, including renewable energy, alternative fuels and liquified natural gas.

Fried Frank’s real estate department is partnering with Project Destined, a social impact platform that provides students with training in financial literacy, entrepreneurship and real estate, to launch a multiweek, virtual program on September 10, 2024, that will introduce 15 diverse undergraduate students to career opportunities in real estate law and development.

The program, titled the “Real Estate Law and Development Bridge Program,” will connect students to Fried Frank’s real estate partners and the firm’s clients, as well as provide participants with a corresponding curriculum led by graduate school professors.

The Real Estate Law and Development Bridge Program will include an Executive Speakers Series comprised of four 60-minute, live Q&Astyle panels led by partners in Fried Frank’s real estate department and the firm’s real estate clients. The series will cover topics such as “Buying and Selling Real Estate,” “Art of Land Use and Zoning,” “Financing the Transfer of Real Estate” and “Joint Ventures”. The program will also include a six-week curriculum called “Real Property Law & Development,” which will be led by graduate school professors with experience in real estate law.

“It is our duty to give back to the community and share our knowledge with the next generation of leaders,” said Jonathan L. Mechanic, partner and chairman of Fried Frank’s real estate department. “We are incredibly excited to partner with Project Destined to launch this comprehensive program that will build relationships across generations and open doors for future real estate attorneys.”

Destined has partnered with more than 250 leading firms. Fried Frank previously partnered with Project Destined in 2018 to support the launch of its successful Bronx program, which was a multiday curriculum that taught students financial literacy and leadership development through mentorship from top-tier experts in the real estate investment field, including bankers, brokers, architects, celebrities and attorneys from Fried Frank’s real estate department.

NanaWall announced that its Cero Large Panel Minimal Sliding Glass Walls have been redesigned and reimagined to offer even more architectural possibilities and capabilities for architects. NanaWall Systems designed Cero to be simple in form but engineered to perfection, producing clean, uniform and ultra-thin lines for maximum light-filled spaces that allow the inside and outside to become one whether open or closed.

“We designed Cero to offer the most pure, symmetrical and minimalist elements for architectural design — while maintaining the highest standards of engineering and technical performance,” said Ebrahim Nana, president and founder of NanaWall Systems. “For almost a decade, Cero has been the architect’s choice for creating striking, light-filled environments with maximalized sightlines in both commercial and residential applications. Our new updates will solidify that position and allow Cero to be utilized in even more designs and configurations.”

Some of the new features in Cero include panels heights up to 15 feet — more than 15% taller than the original; a new minimal sill that visually disappears with finished flooring inserts and provides barefoot friendly transitions; rails and stiles with an ultra slim and uniform 1 5/16 inches (34mm) top to bottom, side to side; glazed floor-toceiling facades into flexible openings in commercial settings and fully tested and acoustically rated minimal sliding glass walls capable of reaching sound control up to a unit STC 43. The system also offers what NanaWall calls “breathtaking design possibilities for residential projects, allowing floor-to-ceiling openings in clerestory and double height living spaces.”

An additional benefit is NanaWall’s technical support team, which

includes experienced installation managers and certified installers, who work with the architect and contractor every step ensuring precision installations.

NanaWall Cero offers multiple track and concealed carrier systems for smooth gliding with the minimal, flush and performance sill options. An integrated screen is available for configurations that slide and meet the jam. Optional automation features include a two-step safety feature with motion sensors to protect people and pets, system auto-lock and wired or wireless smart switches. The NanaWall 3D Configurator can also be used to design and test Cero configurations to produce specifications and design drawings with just seven simple steps.

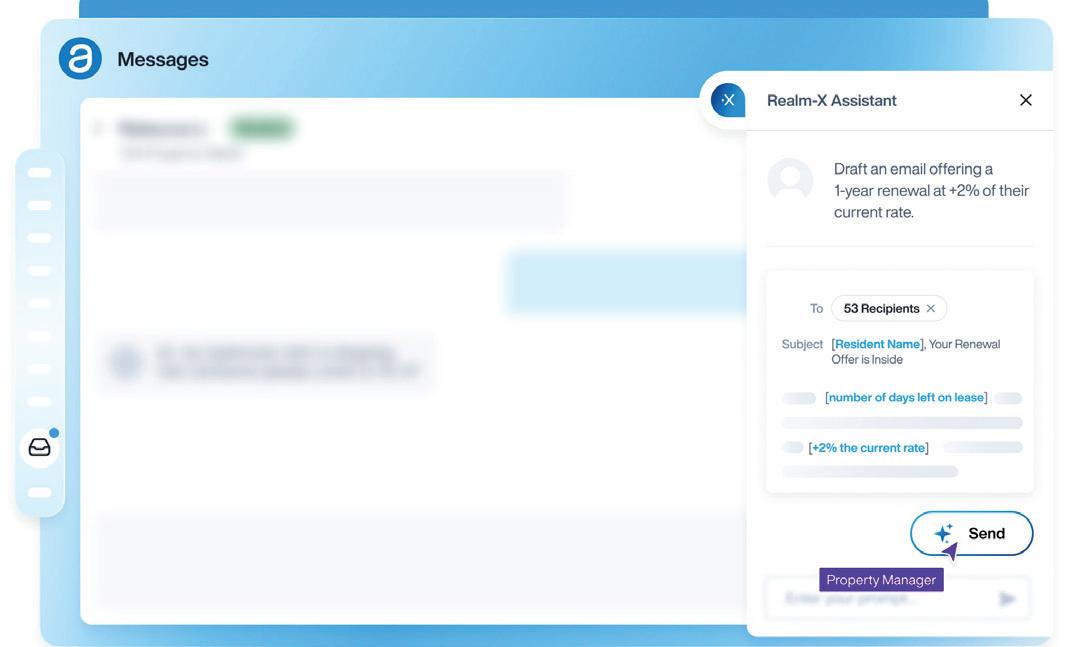

AppFolio announced a series of innovations to its AppFolio Realm-X, its embedded generative AI that provides real-time assistance by combining the latest foundation models with industry-specific context. Additional innovations include enhancements to AppFolio’s student housing and affordable housing solutions and AppFolio Stack marketplace partners.

Every AppFolio user can now access Realm-X Assistant and Realm-X Messages. These solutions give property managers and their teams a new way to experience AppFolio while achieving significant productivity gains, all within AppFolio’s one platform.

“With Realm-X, every team member is equipped with their own personal co-pilot — an additional pair of ‘hands’ to assist in managing the perpetual to-do list synonymous with property management,” said Will Moxley, senior vice president of product at AppFolio.

Realm-X Assistant is a co-pilot experience, accessible everywhere in AppFolio to get work done faster and easier. With a single prompt, Realm-X Assistant can generate reports, initiate individual and bulk tasks and automate time-consuming tasks for managing vendors, residents, properties and owners.

Realm-X Messages is a reimagined inbox that helps property managers sort through, act on and respond to routine resident communications. Realm-X Messages uses a message’s context to guide users toward appropriate steps and provide quick, clear and relevant replies with personalized details.

AppFolio also announced it is piloting Realm-X Flows, a workflow automation engine that helps users standardize their processes through workflows defined by users and automated with AI. Realm-X

Flows can be taught to complete tasks, such as rental applications, rent collection and lease renewals, tailored to each customer’s specific business needs.

For customers with student housing in their portfolios, AppFolio has introduced Flexible Leasing, offering property managers flexibility to lease units to either groups or individuals, as well as mix the two lease types within the same unit and Pre-Leasing Metrics, providing a comprehensive, real-time view of leasing performance.

For customers managing affordable housing properties or units within their portfolios, AppFolio has introduced enhanced Tenant Income Certification (TIC) support, which improves LIHTC solutions in AppFolio with fully populating, accurate TIC forms and new HUD features to recover costs.

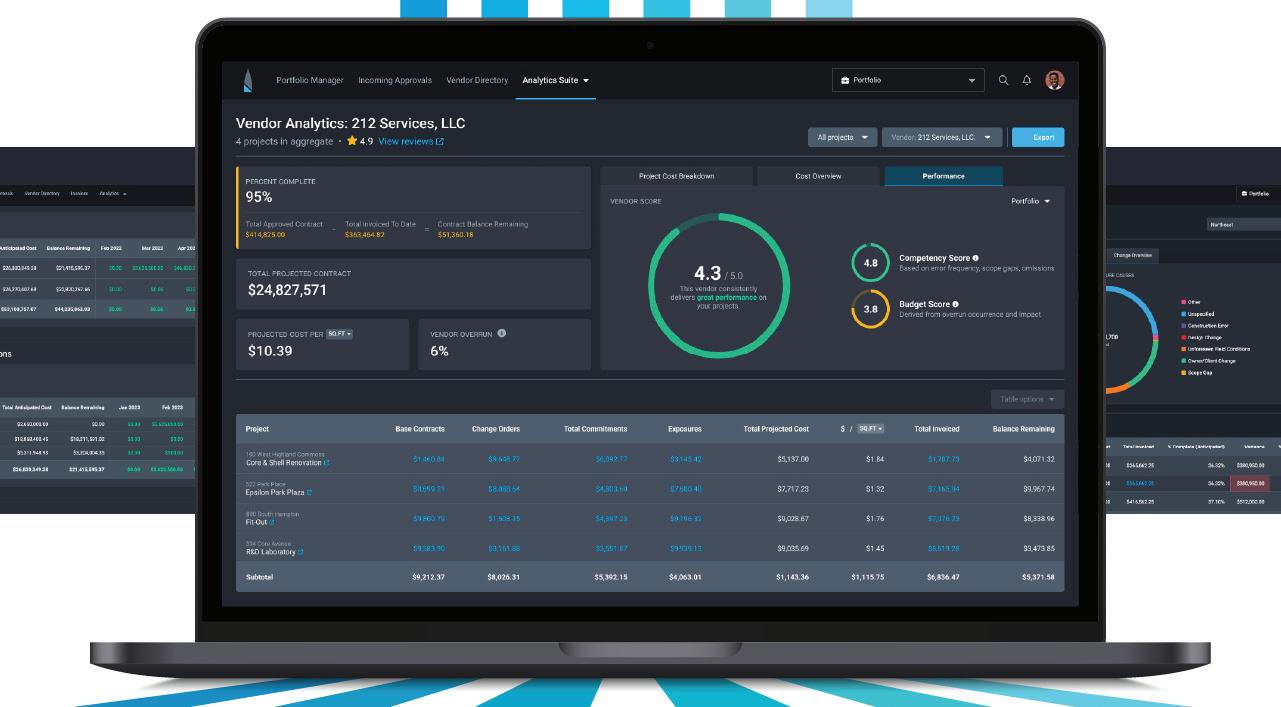

Northspyre, a real estate development platform for project delivery and capital management, launched two new products — Complex Capital Management and Portfolio Analytics Plus.

Complex Capital Management helps developers proactively monitor financial risk, track compliance and satisfy unique reporting requirements. This includes projects with complex capital stacks, including Low Income Housing Tax Credit (LIHTC) developments and deals with multiple capital partners. Portfolio Analytics Plus enables developers to make data-informed decisions by automatically benchmarking costs, as well as project and vendor performance data.

Northspyre’s Complex Capital Management solution addresses the nuances of financially intricate developments with a suite of predictive intelligence and automation tools. It also has specific applications for developers working on projects within the LIHTC space. Developers can track and forecast the allocations of each funding source throughout the lifespan of a project — a task that was historically completed manually. This tool saves teams time by automatically generating personalized financial reports and ensuring project spending meets 50% test compliance requirements set by various financial partners.

Key features of Complex Capital Management include automated source transactions by pairing sources down to the invoice and assigning multiple sources to each budget line, automatically drawing funds from the correct source when invoices come in for the associated budget item. The tool also auto-generates spending projections through the end of a project with capital source data layered in so developers can easily monitor budget progress and understand the timing of utilizing each source and when capital may run out. LIHTC

Compliance Forecast technology tracks basis-eligible budget line costs and invoices against tax-exempt sources to instantly generate detailed LIHTC reports.

Key features of Portfolio Analytics Plus include portfolio capital planning, giving executives a comprehensive view of source utilization and cash flow projections across a portfolio over a multi-year horizon.

The developer fee tool aggregates the developer fee cash flow across a portfolio, providing a holistic view of operating costs and projected income realization, while the compare feature allows users to compare projects to other projects or portfolio benchmarks using granular aggregated budget data (i.e. TAC, cost per unit, variance), including the delta between each when comparing two projects.

RentRedi, a property management software that says it simplifies the renting process for both landlords and tenants, has partnered with Home Title Lock to empower landlords to protect their rental properties from deed fraud and title theft. RentRedi landlords can purchase Home Title Lock’s TripleLock Protection, which includes monitoring, alerts and restoration services, at a discounted rate.

“Fraud has become a growing problem for rental property owners, and we are focused on providing access to cutting-edge security solutions that help our landlords and investors combat it,” said RentRedi Cofounder and CEO Ryan Barone. “Partnering with Home Title Lock provides our customers with the option to adopt a robust defense strategy specifically designed for landlords and rental property owners to protect their most valuable assets.”

TripleLock Protection has a 24/7 monitoring system that detects any changes or suspicious activities, such as unauthorized alterations to ownership documents or title transfers. Subscribers receive alerts of any changes, empowering landlords to take swift action to investigate and rectify any fraudulent activity. Landlords who fall victim to title theft or deed fraud have access to a team of restoration experts to help navigate the complexities of legal proceedings to reclaim their property rights.

“Rental investment homes and all their hard-earned equity can be too easily stolen with just a forged signature,” said Home Title Lock Vice President of Partnership Sales Chris Thompson. “RentRedi is the first property management platform to offer our TripleLock Protection

services, which provide proactive protection of rental investments through a frontline defense that gives RentRedi landlords and property owners peace of mind.”

In addition, RentRedi added an extra layer of security to its tenant screening process through a Plaid integration that provides landlords with the ability to seamlessly verify the income and assets of prospective renters, without requiring the exchange of sensitive documents.

RentRedi’s automated Tenant Income and Asset Verification feature, powered by Plaid, protects all parties by reducing the risk of fraud and providing a more accurate financial picture of applicants all in one location.

Measurabl, an ESG (environmental, social, governance) technology platform for real estate, has announced a partnership with Susteco solutions GmbH, a Bosch company focused on creating centralized access to data-driven real estate solutions. The partnership combines Measurabl’s expertise in sustainability data management with Susteco’s data-driven Ecosystem.

Successfully managing real estate requires diverse collaboration among stakeholders, yet current technology systems, including those for smart buildings, often create silos and complexity. Measurabl and Susteco share the goal of an integrated data management software and open ecosystem for the real estate industry. Both companies recognize that the sector must embrace collaboration to drastically address the growing concern of global emissions and create meaningful change.

“This partnership reaffirms our commitment to delivering detailed and accurate data management for global real estate portfolios,” said Maureen Waters, CGO of Measurabl. “By collaborating with Susteco, we will be able to provide organizations access to our platform, alongside other smart building data management tools. This means sustainability managers, asset managers, and portfolio managers are given access to a more holistic view of their buildings and portfolios. We will leverage Susteco’s technology and expertise to better serve the entirety of our customers’ portfolios.”

The Ecosystem drives sustainable innovation across a building’s lifecycle — from construction to renovations to capital investments. Real estate owners, operators and service providers can transparently record, structure and process building and consumption data as well as data from third-party providers. The platform aims to enable better decision-making, optimize operating expenses and maintain value while managing and operating real estate portfolios.

Users log into Susteco to see a profile for their building and access

different technology platforms connected to the particular building, such as Recogizer, which automatically reduces energy consumption through AI-based control of HVAC systems and EHTW Service GmbH, which specializes on waste data collection and on waste management. Customers access a digital representation of the building with all available on one single data platform, regardless of the service provider or data source, meaning more efficient monitoring and management. Measurabl will be a fully integrated ESG data and software technology partner on Susteco’s platform, the companies said.

Measurabl provides monthly and real-time sustainability reporting, compliance and real-time asset optimization measures driven by smart meter and hardware integrations provided by Susteco. Measurabl software will allow Susteco customers to access centralized ESG suite of tools including automated utility data collection, progress tracking toward sustainability targets, performance comparisons with custom peer groups, streamlined ESG voluntary and mandatory reporting, flexible and tailored ESG reports, physical climate risk insights, green certifications and capital projects.

JLL has leased over 40,000 square feet of office space in a series of transactions at 1450 Broadway, the 42-story Class A Bryant Park property owned by ZG Capital Partners, a New York-based real estate investment firm led by Bobby Zar. 1450 Broadway is represented by a JLL leasing team that includes Vice Chairman Mitchell Konsker, Executive Managing Director Greg Wang, Associate Vice President Thomas Swartz and Senior Associate Lance Yasinsky.

Leading video and ecommerce retailer QVC leased 13,357 square feet across the 19th floor in a relocation from 71 Fifth Ave. The tenant was represented by Ramsey Feher of CBRE. Kohler Ventures, a digital business subsidiary of Kohler Co., leased the entire 4,109-square-foot 40th floor of the tower to open its first New York City office. Kohler Ventures was represented by Liz Lash of CBRE.

Good Springs Capital, a private equity fund, leased the entire 4,109-square-foot 39th floor tower suite to open its first NYC office. Good Springs Capital was represented by JLL’s Evan Margolin, Daniel Posy and Ian Lipman. Longtime tenant Iconix, a fashion company that owns brands including London Fog, Mudd and Joe Boxer, consolidated its footprint to 10,124 square feet on the 22nd floor. Margolin and Lipman represented Iconix.

Kering Eyewear signed a long-term expansion and renewal to occupy the full 36th floor in addition to its existing space on the 33rd and 34th floors for a total of 12,327 square feet. Kering was represented by Cushman & Wakefield’s Deborah Van der Hayden and Joshua Cohen. Wealth data platform Masttro leased 5,851 square feet on the 20th floor in a relocation from 1407 Broadway. Sinclair Li and Connor Desimone from CBRE represented Masttro. Tech firm Good Inside leased 4,109 square feet on the 29th floor for its first NYC office and was represented by Rob

Kluge of Current RE. SG Companies, a multinational fashion brand, will relocate from 142 West 36th St. to occupy 4,677 square feet on the 9th floor. JLL’s Bill Peters and Jan la Torre represented the tenant.

The transactions follow a significant investment by ZG Capital Partners in a state-of-the-art amenity offering on the second floor of the building that will include ample conference, meeting and lounge spaces that is set to deliver Q4 2024. The 430,000-square-foot building that overlooks Times Square underwent an extensive renovation in 2012 that included a contemporary new lobby and upgraded building mechanicals.

“Ownership’s commitment to maintaining 1450 Broadway as a bestin-class office destination has resonated with forward-thinking tenants who want to offer employees a superior environment and convenient commute,” said Konsker. “With its latest investment in the building, ZG Capital has signalled its belief in the fundamental strength of the Manhattan office market.”

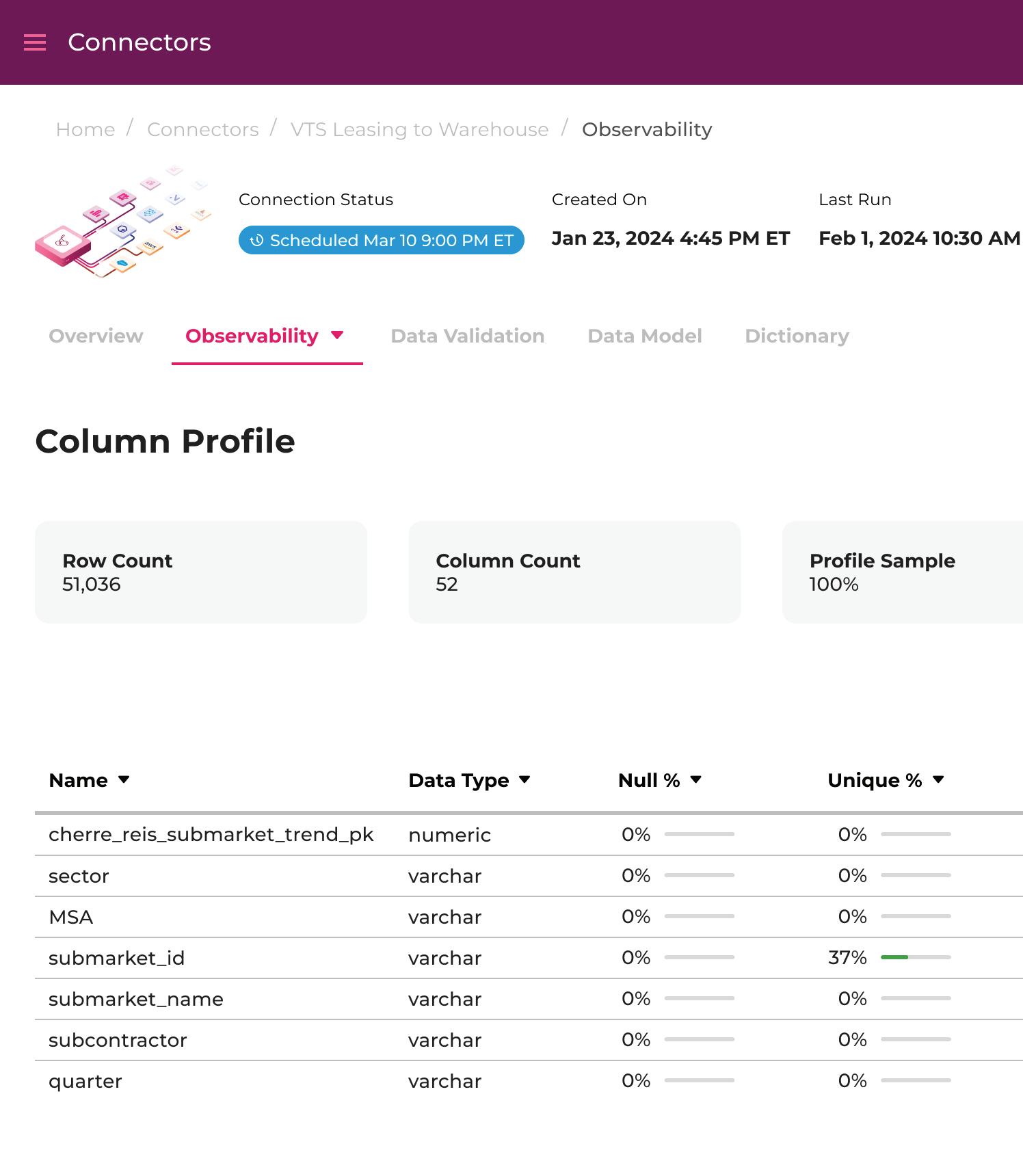

Cherre, a real estate data management platform, has released a user interface (UI) which provides visibility into Cherre’s Data Observability features, as well as enhanced data validation capabilities. The new UI also empowers clients to directly manage their data pipelines into the platform, increasing transparency into the status, completeness, delivery and transformation of their data.

Cherre’s UI includes an array of tools for users to self-manage their data pipelines and validation rules, enabling them to improve their data quality and promote confidence across the organization. These tools include: table profiling, column profiling and status monitoring which provide observability across all data moving in, through and out of Cherre; insights into data Connectors including access to the standard data model for each Connector, Connector status, data destination and available data dictionaries and data validation capabilities that allow clients to create and manage checks, alerts, and custom validation rules, as well as a standard library of tests across Connectors and the Data Submissions Portal.

“Our new UI is more than just a tool; it’s a gateway to enhanced confidence in data-driven decision-making,” said Kevin Mattice, chief product officer at Cherre. “By surfacing Cherre’s Data Observability processes and providing clients with direct access to manage their data pipelines, we are setting a new standard in real estate data management. Real estate market leaders need to feel confident in their decision making, our UI helps give them the control and transparency needed to build trust in their data.”

The new UI is now available to all Cherre Platform users.

In what will bring the largest ScreenX auditorium in the world to New Jersey, B&B Theatres will open a cinema and entertainment experience at American Dream in East Rutherford. The move marks a significant expansion of B&B Theatres’ footprint in premier entertainment destinations, complementing its operation at Mall of America and signaling its first location in the Garden State.

ScreenX, developed by CJ 4Dplex, a producer of premium film formats and cinema technologies, is the world’s first multi-projection cinema that enhances the traditional movie-going experience by seamlessly extending the screens onto the surrounding walls of the auditorium, the company said. The approach offers viewers a 270-degree panoramic viewing adventure. Through its unique presentation of key scenes and exclusive scenic elements, ScreenX immerses audiences in an unparalleled visual environment, reimagining the way movies are experienced.

The new location will be the largest ScreenX auditorium in the world, with a 80-foot-wide center screen and side walls measuring 82 feet each, boasting 242 feet of ScreenX viewing range for the moviegoer.

While the full details of the amenities and features will be unveiled at a later date, the venue will include eight screens of cutting-edge cinematic technology, multiple bowling lanes, a full redemption arcade and various food and beverage options including a restaurant and fullservice bar. The facility will offer unparalleled cinema presentations

courtesy of the latest in laser projection, wall-to-wall curved screens, and heated, leather, electric recliners in every auditorium.

“This new location underscores our commitment to providing the most immersive and enjoyable entertainment experiences possible,” said Brock Bagby, president and chief content, programming and development officer for B&B Theatres. “Our presence at the Mall of America has been a tremendous success, and we are eager to bring our unique blend of cinema and entertainment to even more guests at the American Dream.”

Affiliates of Cantor Fitzgerald L.P. and Silverstein Properties have entered into a joint venture with Turnbull Development LLC, a Charleston, South Carolina-based development firm. The venture intends to develop a mixed-use project encompassing 365 gardenstyle multifamily units across three buildings and a 40,000-square-foot medical office building in a qualified opportunity zone in Summerville, South Carolina.

The venture simultaneously closed on $54 million in construction financing from SouthState Bank to develop the project. Located at the corner of Berlin Myers Parkway and Highway 78 and strategically positioned within walking distance of Summerville’s historic downtown area, the investment is part of a 57-acre mixed-use, master-planned development known as Sawmill. The development will help the local Summerville government better respond to the growing demand for walkable, flourishing communities with convenient transit linkages, proximity to jobs and access to nearby public services and destinations.

“Sawmill will be a vibrant, region-transforming community,” said Milton Thomas, president of Turnbull Development. “We have spent the last four years developing the master plan, moving through entitlements, and working with the town of Summerville to ensure this will ultimately be one of the region’s premier mixed-use developments.”

Sawmill will be anchored by a two-story, Roper St. Francis medical office and will include a neighborhood grocery store and retail outparcels to serve residents and employees. The multifamily component will have direct access to Sawmill Branch Canal and Greenway Trail and offers on-site outdoor amenities such as a pickleball court, a dog park and a pool and clubhouse. At press time, construction of the multifamily portion was expected to commence in July 2024.

“Summerville is a desirable residential destination near Charleston that benefits from the region’s job and population growth,” said Alex Cosio, vice president, Silverstein Properties. “With preconstruction completed and financing in place, this development is positioned to further invigorate an already bustling community.”

Cantor and Silverstein launched an opportunity zone business in early 2019 to invest in, develop, redevelop, and manage a diversified portfolio of institutional quality commercial real estate assets with an emphasis on multifamily properties located in qualified opportunity zones in the United States. Their opportunity zone development portfolio includes eleven projects in various stages of development exceeding $2.2 billion in total estimated project costs.

“The proximity to Historic Downtown Summerville places the project in an enviable location with essential amenities nearby. Residents have easy access to retail, culture, recreation and dining,” said Chris Milner, CIO, real assets at Cantor Fitzgerald Asset Management. “Our partnership with Turnbull Development on this project and the location promise to have a positive impact on the community.”

Ingka Investments, the investments arm of Ingka Group, which owns the majority of Ikea stores worldwide, announced a real estate investment in 570 Fifth Avenue, being developed by Extell Development Company. The building is scheduled for tenant delivery in 2028. The result will bring an Ikea customer meeting point to the building’s prime retail space of 80,000 square feet, arranged over two large cellar levels with a corner entrance on Fifth Avenue.

The investment is another step in Ingka Group’s strategy to evolve its retail operations by adapting to urban growth and changing consumer shopping preferences. This initiative involves introducing retail formats in city centers, enhancing accessibility and convenience for customers.

“This next phase of our investment and expansion in the U.S. signals our commitment to bring Ikea closer to people in city centers,” said Javier Quiñones, CEO and chief sustainability officer, Ikea U.S. “While we are in the very early stages of planning for the Ikea location, we can promise to deliver an experience that is full of inspiration and designed to meet the home furnishing dreams of the many New Yorkers.”

Ingka Investments will hold a one-third stake in the project alongside preferred equity components and full ownership of the prime retail space where the Ikea customer meeting point will be located. Extell will hold a two-thirds stake in the project. The building is the largest development on Fifth Avenue in more than 60 years. Located at the intersection of the Plaza and Grand Central Districts, 570 Fifth Ave. will be a one million-square-foot, mixed-use commercial building, with a focus on sustainability and wellness, the tower is targeting a

minimum LEED Gold certification and will exemplify high sustainability standards and low carbon operation principles.

“We are excited to share the news of this major investment that boosts our growth strategy across the U.S., a vital market for Ingka Group,” said Peter van der Poel, managing director of Ingka Investments. “Investing in Fifth Avenue goes beyond just growing our footprint; it’s about changing the way we engage with consumers.”

New York City Housing Authority (NYCHA) and BFC Partners announced funding of $332.3 million for their Permanent Affordability Commitment Together (PACT) project in West Brighton, Staten Island, bringing its total capital investment in the borough to well over $1 billion. Comprised of BFC Partners; CB Emmanuel, a minorityowned business enterprise (MBE); Catholic Homes, a non-profit organization and Pinnacle City Living, the PACT partner team has converted 16 buildings to project-based Section 8 through the federal Rental Assistance Demonstration (RAD) program and will offer comprehensive renovations for over 1,300 residents.

West Brighton is NYCHA’s first PACT on Staten Island. The project will rehabilitate 574 apartments at West Brighton I and II and reactivate 24 vacant units, with 12 restored as permanently affordable residential units and 12 converted into a new senior center to serve the residents of West Brighton. Pinnacle City Living will assume day-to-day property management. Social services will be coordinated by Housing Opportunities Unlimited (HOU).

The debt was provided from Freddie Mac and the New York City Housing Development Corporation (HDC), as well as a bridge loan from Wells Fargo, historic tax credits, city subsidy and sponsor equity.

The PACT partner team formed in 2022 and has worked closely with West Brighton residents to design every aspect of the developments. The buildings will receive both interior and exterior renovations including façade restorations, roof repairs, new security installations, ventilation improvements, refurnished heating and water systems, as well as comprehensive upgrades to the bathrooms and kitchens with new applications, fixtures, countertops and more. In addition to the

residential renovations, a new senior center will be developed at 159 Alaska Street. The grounds will be revitalized by new landscaping, lighting, play equipment, seating, enlarged walkways, community gardens, as well as a dog run and screened refuse area.

“We applaud NYCHA for its first financial closing on Staten Island and are so proud to be working hand-in-hand with NYCHA and the PACT Team Partners on this transformational project,” said BFC Partners Principal Joseph Ferrara. “The significant upgrades and overhaul of building systems throughout West Brighton will improve the quality of life for both current residents and future generations of Staten Islanders.”

By Debra Hazel

If adaptability is everything, David Mann has it in spades. The CEO of Lighthouse Living trained as a journalist, then joined the fashion industry and now is building a solid portfolio of multifamily properties, using all of the skills he’s learned along the way.

With a 1.2 million-square-foot portfolio of luxury multifamily buildings in and around metropolitan New York (with a nod to the Southeast) built since 2011, he says he’s just getting started.

“I’ve turned one building to more than 14, and from being able to execute $3 million deals to $80 million deals,” Mann said. “We’re growing organically and have a whole infrastructure — from design professionals to contractors to marketing, debt providers, to capital providers. We have all the pieces of the development puzzle.”

Real estate wasn’t his first stop, however. Growing up on Long Island, Mann could have been expected to join his family’s Garment Center business — instead, he ventured off to earn a degree in journalism at the University of Wisconsin-Madison. But family duty called and after a year at the Fashion Institute of Technology, he did join one of the family businesses with his father. (David Mann’s uncle, Jeffrey Mann, is the CEO of Mann Publications.)

“I hated writing research reports. It was so mechanical; but when I discovered journalism, I had a knack for it,” he said. “I didn’t have a desire

to become a journalist, but my training allows me to write some very effective emails, presentations and investment summaries. It was useful in the Garment Center and has definitely helped my real estate career.”

After a year as an assistant salesman at one fashion label, he moved over to roles in operations and management. But the rise of internet in the early 2000s changed the industry, cutting into profits as retailers began producing their own goods.

After nine years, he came to a sudden realization — he really didn’t care for fashion design.

“There was a disconnect with the product,” he said. “I know nothing about women’s clothing.”

However, the complex process of dress manufacturing — from design to raw material procurement, engineering, sourcing the contractors to warehousing — served as preparation for the complexities of real estate development.

After speaking with lifelong friends about the opportunities in real estate, he left fashion and enrolled in NYU’s Schack Institute with especially propitious timing. Classes began just days before Lehman Brothers declared bankruptcy in 2008, sending the real estate industry into crisis as the Great Recession began.

In a way, however, he learned some powerful lessons from industry leaders on their missteps.

“Counterintuitively, it was a terrific education,” he said. But by the time Mann graduated in May 2010, newly married and expecting a child, finding employment was a challenge. Many experienced professionals who had been laid off or left the business in 2008 were also seeking jobs, at lower salaries than they would have commanded just two years previously.

“There was nothing going on, no cranes in the sky,” he recalled. “Toward the end of 2009, people saw it wasn’t the end of the world, but in 2010 no one was hiring. I was stuck with an excellent education with no job prospects. It was a frustrating time.”

He was hired in September 2010 by Michael Stern from JDS Development as a project manager for a potential 50-unit apartment building in Park Slope. But that project saw delays.

“By February, I ultimately couldn’t get the green light to start,” he said. “I was just married. My wife was eight weeks pregnant, and she said, ‘Just do it yourself.’”

Initially reluctant and days away from applying for a job at Starbucks, Mann took his knowledge, access to some capital and a relationship with a local construction manager to find a smaller development site in White Plains, New York.

“I literally walked around the city eight hours a day for three weeks, looking at all the multifamily properties,” he said. “I got to know the market and I knew I could build something as nice as the nicest project there, with amazing amenity packages.”

Multifamily appealed because of its multitude of leases, or “customers” as Mann says, a lesson from his apparel background.

“My father used to tell me, ‘You don’t only want to have 10 big clients to sell your dresses to. You need to have many customers, so if one stops buying, it won’t put you out of business,’” he said.

‘YOU DON’T ONLY WANT TO HAVE 10 BIG CLIENTS TO SELL YOUR DRESSES TO. YOU NEED TO HAVE MANY CUSTOMERS, SO IF ONE STOPS BUYING, IT WON’T PUT YOU OUT OF BUSINESS.’”

Mann found a site, broke ground in December 2011, and the project was completed in December 2012. He found his second deal in White Plains in 2011, for a 30-unit, four story building. It was at that point that he hired his first employee, and named his company Lighthouse, for the street he grew up on in Great Neck.

In some respects, the shift to real estate wasn’t that dramatic.

“Instead of building dresses, I build buildings,” he said, noting there are some similarities and some very great differences between the two industries. “In fashion, there are myriad moving parts that need to be coordinated to accomplish the objective in a precise period of time. That certainly prepared me for the environment of real estate development. But design, procurement and the level of detail in documents are very different. And if a dress falls apart, the customer just won’t buy again. If a building falls apart, people will die.”

What distinguishes Lighthouse’s projects is its apartment finishes and efficient amenity packages.

“I always had an appreciation for interior design,” he said. “Even as a kid, I’d pay attention to the design of various hotels and other people’s homes, and read architectural design magazines. I also used to help my mom lay out rooms on graph paper. Who knew I would be doing that on a much larger scale 30 years later?”

Even more important is not going overboard on amenities the tenants won’t need.

“Our philosophy is to spend more on the unit itself and make them slightly bigger than the rest of the market, while not building superfluous, unnecessary amenities,” he described. “People spend most of their time in their apartment. We offer what’s necessary — a nice lobby, coffee station, gym, maybe a roof deck or business center space if possible.”

For example, 1 DeKalb Avenue in White Plains offers tech-enabled, hospitality-like amenities, including a media wall, fully equipped fitness center and a rooftop oasis with lounge seating, barbeque grills and greenspace where the company hosts community building events.

The Duet, a boutique apartment community located in downtown White Plains, features the ButterflyMX Virtual Concierge system which connects video directly to residents’ cell phone, allowing them to provide guests entry remotely. Other amenities include a fitness studio, private club and rooftop space.

After the first two projects, more opportunities arose as financing became easier, including developments in New Jersey and Connecticut. The developments became larger, too, as properties grew from 10 units to more than 200.

But there were lessons along the way. Mann’s first developments were constructed with a modular method, with his company handling site work, the façade and the foundation. The modular company did the rest. That resulted in a number of properties needing remedial work that has since been completed. By his sixth project, and already with a team of five, he knew he needed to change his system.

“We looked at the designs and started quantifying the different materials and trades,” Mann recalled. “We saw it would be much cheaper to build conventionally. That way we could control the schedule and the quality. No more crooked light switches or wobbly toilets. Now, nine years later with a team of 20, we have very few maintenance issues.”

With each project, Lighthouse Living becomes more sophisticated and assured. In time, it jumped next door to Connecticut, opening The Westporter, with apartments and townhomes for rent – with luxury amenities including private two-car garages and dedicated indoor electric car charging. Coming soon is the Abendroth, offering 204 apartments with 25,000 square feet of ground floor retail at 169 North Main St. in Port Chester, New York.

The greatest leap came when Mann was visiting his brother, who had relocated to Greenville, South Carolina and thought he’d found a potential site. The expected culture shock never came as David found a city with nightlife and strong planning.

“We drove downtown, and I was blown away at how pretty the city was and the interconnectedness of the zoning. Clearly, that municipality put great thought into development,” he said. “I was impressed by how much the city cares about the pedestrian and the experience. They created a whole city with that live/work/play concept, not just segregating zoning uses. Greenville felt like a much larger city than it actually was. The city was vibrant and busy day and night.”

Mann was able to procure two acres in the center of the city center within two months of first visiting, and ultimately closed on the four parcels in late 2018. Challenges included moving a historic building, the home and clinic for Dr. E.E. McLaren, an African American physician who treated Black patients while white hospitals refused medical treatment to African Americans during the Jim Crow era. The clinic was moved 70 feet toward the main thoroughfare and is now a cultural museum. Paying homage to the doctor, Mann named the 10-story apartment building The McLaren. Though delayed because of the pandemic, the property includes 246 apartments and 26,000 square feet of office space.

“We are 65% occupied and hope to be stabilized by the end of the year,” Mann said.

Two more projects are in the works in Fairfield County, Connecticut, as Mann keeps an eye on opportunities in the Tri-state and Southeast. And there is more to come.