Projects Review

As we announced within our last newsletter, Marshall White Projects recently celebrated its first decade of operations.

Now we’re also very pleased to announce that both Mr. Liam Adey and Ms. Kierra Hagedorn have recently joined the current group of Marshall White Directors.

Kierra’s stellar rise since June 2010, started at the front desk at our Hawthorn office, then an EA for a leading residential sales team and in 2017 became a highly respected Projects sales person and Projects team leader. And then there’s Liam … we rarely single out directors for individual praise and so we’re not about to start with Liam.

The brittle state of the building industry certainly had a detrimental impact on this years – March quarter. So much so, that we felt it prudent to announced on the front page of our Projects website the fundamental difference between buying off the plan from a developer and engaging a volume builder - you can read the article here. For the majority of our off the plan purchasers, the line between the two has becomes increasingly blurry.

REA tell us that an average off the plan buyers journey will range from three to six months. With buyers now acclimatizing to a higher (normal) interest rate, the Australian aspiration to own property slowly resurfaces. Off the plan Inquiry as risen to consistently over 550 email inquiries a week for our suite of new projects. This now exceeds pre pandemic numbers.

Many projects in the marketplace today are pioneering prices. Not because they can, but because if they don’t then the project doesn’t get out of the ground. Slowly the buying market becomes acclimatised to these new rates and so then having to pay what’s required.

It’s the empty nester market that’s already made their money within their family home following an unprecedented decade of capital growth pre-COVID. A continued lack of alternatives then brings them back to the negotiation table after an abridged buying journey.

Professional couples went AWOL during the first quarter of 2023,

with an understandable anxiety around ten consecutive rate rises and for their ability to continue to quality for finance after a eighteen month construction period. Projects, big and small, are now being taken back off the shelf and are now preparing to launch sometime in 2023. Launch times have delayed however owing to a developers increased diligence around build costs. If there’s been one lesson that has stood out above all others from our time with COVID, it’s to lock in construction costs before selling commences. An increasing number of projects we take to the market this year will already have a builder under contract , giving another layer of certainty to a nervous buying public.

Undoubtedly construction funders, lead by the banks have become increasingly more risk adverse when it comes to vetting a developers FESO and a preferred builder. Moneys more expensive (where isn’t it I hear you ask) and whilst most funders claim to be open for business, it’s still often very much dependent on a pre existing relationship.

The benefits of the off shore boarders opening are slowly taking effect, with us having transacted more FIRB deals during the first quarter of 2023 than the entire 24 months leading up to COVID. This is despite the obscene impost paid for a FIRB application.

So we continue on, there are already signs that this years residential Spring market will be extremely active as investors (33% of total market) and owner occupiers again pop their heads up and start to move on with their life. This is rarely good news for project sales, as over 80% of off the plan buyers will consider an established alternative to off the plan if available. So, don’t delay, time's running out to launch in 2023.

If you’re ready to talk to us, then we’re ready to listen.

Mark

Dayman - DirectorT 85642387 M 0409 342 462

mark.dayman@marshallwhite.com.au

Leonard Teplin - DirectorT 85642318 M 0402 431 657

leonard.teplin@marshallwhite.com.au

Known for his ability to create sales at the highest level, over the last decade Ross has been involved in some of Melbourne’s most iconic and successful off the plan residential developments.

With his unwavering client-centred focus on selling Melbourne’s most luxurious off-the-plan residences, Ross Hams is recognised industry-wide as the go to agent for some of Australia’s largest public and private companies.

Outside of Real Estate, family and sport are Ross’ driving forces. Ross, a former gym owner, and lawyer wife Jo have three beautiful children, and they are all sports and fitness fanatics. Basketball is number one sport at the Hams’ Warrandyte family home, and Ross plays, supports and coaches his kids’ teams and is an avid fan of SE Melbourne Phoenix and the LA Lakers

Part of the project development team at Marshall White, Ranko’s natural positive energy and enthusiasm and ability to relate to people from all walks of life has been invaluable. His genuine integrity and service style quickly makes clients feel at ease.

With over twenty years of real estate experience, Ranko has a proven track record of achieving outstanding sales results in the industry. During this time period, Ranko has seen substantial change in the real estate profession but his professional approach to every facet of every transaction hasn’t wavered. Balance has always been and continues to be crucial to Ranko’s consistency throughout his career. Away from the office he spends time with his son and family and he is dedicated to keeping fit and physically active.

Personable, positive and hardworking, Liam strives toward helping people achieve their off the plan purchasing requirements.

Maintaining open channels of communication, Liam easily develops a natural rapport with his buyers. Liam finds the development industry to be incredibly rewarding as it revolves around making connections with people and perfectly suits his positive mindset. Combined with his strict time management, perfectionist nature and a refined attention to detail, Liam is well suited to his role at Marshall White projects.

Active by nature and a big believer in the value of physical fitness and a healthy social life, Liam divides his free time between playing basketball, spending time with his friends and supporting his beloved Hawks.

A driven and compassionate Partner, Kierra has grown a stellar reputation for outstanding results and exceptional customer service. Kierra’s process-driven approach and excellent communication skills complement an innate attention to detail and genuine care for each person she encounters.

A firm believer in spending as much time as necessary to gain a comprehensive understanding of what her clients seek in a new home, she is well-positioned to achieve tailored outcomes. Kierra relishes the opportunity to forge strong relationships and connections with clients and colleagues alike. Having spent several years of her career as an integral part of Australia’s top performing real estate team helping with over 800 sales and settlements, Kierra has an enviable depth of knowledge of the real estate industry.

Ross Hams Director

Ranko Cvjeticanin Director

Liam Adey Director

Kierra Hagedorn Director

Ross Hams Director

Ranko Cvjeticanin Director

Liam Adey Director

Kierra Hagedorn Director

Up until recent years, open-plan living had been the epitome of modern residential design for as long as current generations could remember. This was all well and good while families spent the majority of their days living busy lives out and about –at work, school, socialising and the like – reconvening at home in the evenings only to debrief and rest. Open-plan living areas lent themselves well to this way of life.

With kitchen, living and dining programmes melded into one cohesive space, such a layout enabled families to make the most of the precious little time spent with one another at home – cooking, eating, working, studying, and unwinding together, all at once.

The advent of COVID-19, however, has changed all that. By now we’re all too aware that dining tables do not serve well as workspaces. Spending any more than a couple of hours hunched over a laptop at an island bench only creates mess, leads to poor posture, and diminishes productivity. One of the most prevalent shifts we’ve seen in the residential market, that can be directly attributed to the pandemic, is the renaissance of the dedicated study space. Even for clients who don’t necessarily work from home full-time, the rise of flexible work arrangements and WFH in general is driving an increase in the value of incorporating home offices into residential programmes as a provision for future resale.

Although the home office is not a new concept, the resurgence in its popularity post-pandemic goes against the grain of its traditional form. Historically, we think of a residential study as a room anchored by one grand desk, and perhaps ornamented with a book wall and a couple of occasional chairs to accommodate visitors; an elitist type space that was traditionally a nice-to-have rather than a requirement. These days, however, we are thinking of them as much more utilitarian spaces that often need to accommodate dual workstations. As designers, we are approaching these spaces quite differently to before, with an emphasis on pragmatic details such as built-in-desks, cable management, ergonomics, and acoustics – considerations that have historically not been front-of-mind in residential design.

This newfound interest in dedicated study spaces is just as prevalent in the multi-residential market as it is in the private residential market. Rondure House – a boutique multi-residential development we designed for Above Zero – has been a testament to this. Designed pre-pandemic, in 2019, the project launched to market in 2020. One of the most valuable amenities of the building turned out to be the 14 privately-titled ‘Vault’ spaces that surround the communal bar and lounge, situated on the ground floor.

Originally conceived as additional storage space for each of the building’s 14 apartments, the concept of the ‘Vaults’ took on a life of its own as the pandemic

unfolded, with many of the clients buying into the building opting to fit their Vaults out as private offices or creative spaces that act as an extension of their apartments; a place for WFH that allows them to maintain a boundary between work and home. As a result, the ground floor communal areas of Rondure House have become something akin to a co-working space for residents of the building; they each have their own private office space (a.k.a. ‘Vault’), but are able to come together and socialise in the central bar/lounge at the end of a day’s work, much like they could in a co-working environment.

Another shift we’re seeing in the multi-residential sector is the transition from an investor-oriented market to an owner-occupier market. For the last 10 years or so, this shift has been driven by the growing number of ‘downsizers’ and ‘rightsizers’ in the market. However, with traditional stand-alone houses becoming increasingly unaffordable, and the pandemic serving as a catalyst for the rise of the ‘15-minute-city’, many first home buyers are looking at alternative housing product typologies, such as apartments. As a result, apartments are becoming larger, and more considered in relation to solar orientation, natural ventilation, biophilic design, and communal amenities.

A recent Victorian Civil and Administrative Tribunal (VCAT) decision has raised red flags for property developers who undertake capital raisings. The decision increases the risk that as a result of such raisings, equity interests acquired by unrelated investors in development entities may be aggregated under the landholder regime. This aggregation of interests may trigger a significant stamp duty liability, for which the developer and investors will be jointly liable.

The landholder regime, which was introduced

1 July 2012 and replaces the former land rich regime, operates to impose duty on the acquisition of certain interests in entities that own land in Victoria. The provisions were introduced as an anti-avoidance measure, to deter artificial schemes whereby people would acquire interests in land holding entities as a means to acquire the underlying land, rather than a direct land acquisition which would otherwise attract duty.

A person will make a ‘relevant acquisition’ in a landholder entity if:

• the person acquires an interest that is itself a ‘significant interest’ (that is, upon the winding up of the entity, the person would be entitled to 50% or more of the property distributed in the case of a private company, or 20% or more of the property distributed in the case of a private unit trust scheme); or

• when the interests acquired by the person and any other person in an associated transaction are aggregated, these total interests together amount to a ‘significant interest.’

An associated transaction includes any transaction where multiple and unrelated investors obtain an interest in a landholder, where all those transactions

are deemed to form collectively ‘one arrangement.’ As a result, duty is assessed on the aggregated amount of the interests acquired in a landholder.

Accordingly, individual acquisitions that are below the ‘significant interest’ threshold (that is, 50% or 20%) can be aggregated with other interests acquired by any person in an ‘associated transaction.’ If the State Revenue Office (SRO) considers that there has been an associated transaction, this can result in unanticipated duty liabilities, particularly where all individual acquisitions are wholly independent.

Landholder duty is calculated based on the deemed percentage acquisition of the underlying land. This is determined by multiplying the unencumbered value of all Victorian land holdings of the landholder, by the percentage interest acquired in the entity. The acquirer will be liable to landholder duty at the same rates applying to land transfers.

Creek Pty Ltd

Commissioner of State Revenue involved 18 investors who acquired shares in a landholding company.

The company sought to raise equity funding from investors with respect to its development project at Diamond Creek, known as ‘Diamond Grove.’ The company initially issued an Information Memorandum which was marketed by a property research group with a large database through which it could promote projects.

The company subsequently issued 1,800,000 shares at a price of $1 per share to 18 investors, with investment parcels ranging from $50,000 to $200,000. The Commissioner of State Revenue (Commissioner) issued a landholder assessment to the company for $160,600 calculated on the aggregated interests acquired in the company by all of the investors

Before VCAT, the Commissioner successfully argued that the subscription for shares in the company by the 18 separate investors were to be aggregated, as the separate acquisitions formed substantially one arrangement. This was despite the fact that the investors were unrelated to each other, and the Information Memorandum had been marketed broadly to a database. As noted on behalf of the company, there was no identifiable connection between the investors, ‘save that they each responded to the offer.’ Further, while the transactions were interdependent, this was for the purpose of meeting the only requirement that the target investment would be reached. Judge Michael Macnamara, Vice President of VCAT, concluded there was a clear unity of purpose, to raise equity via the capital raising activity with respect to the company. Further, while the shareholders were not acquainted with each other, they did have a unity of purpose in becoming shareholders in the company. In doing so, they bound themselves to the terms of a share offer and to the terms of a constitution.

In the course of the judgment, Judge Macnamara considered Revenue Ruling DA.057 (the Ruling), which provides guidance on how the Commissioner will apply the aggregation rules to acquisitions in landholders.

The decision has implications for any capital raising activities conducted by landholding entities, where the total interests acquired by investors as a result of those capital raisings equal to, or exceed, the landholder duty thresholds (i.e. 50% for private companies and 20% for unit trust schemes).

In our opinion, the decision is problematic because the facts of the case support the view that the acquisitions are not associated transactions, and should not be aggregated. In particular:

• the Information Memorandum and share offer were not confined in their circulation or limited to a specific group; they widely distributed via a broad database;

• the various investors made their decisions independently; no application was conditional upon the investment by other identified parties; and

• while each investor was bound by the constitution (the ‘statutory contract’), every landholder would be governed by such a document, hence it will exist in all cases. Accordingly, the existence of the constitution cannot, in itself, be a significant factor supporting aggregation.

We consider it would have been appropriate for VCAT to view the Information Memorandum and share offer as being analogous to public offers or

prospectuses, which the Commissioner has accepted in his Ruling ought not to be aggregated. Arguably, the Information Memorandum and share offer are essentially indistinguishable from a public offer, and it would have been within the purpose and intent of the aggregation provisions to permit the concession to apply to capital raisings that are akin to public offers and prospectuses.

Given the judge’s comments that there is no provision in the Duties Act “which could authorise the Commissioner to offer this concession” as set out in the Ruling, it is uncertain if the SRO will continue to apply this concession to exclude genuine public offers from aggregation.

Where a liability to landholder duty arises in the context of capital raisings, the company and investors are jointly and severally liable to pay such duty. The Commissioner will typically issue the assessment directly to the company (or unit trust scheme). The landholder will need to assess if it can recoup those costs on a pro rata basis from its investors. It may be necessary to include a mechanism in the transaction documents whereby the entity can recover any potential duty liability from its investors. In terms of project costings, it would be prudent to factor in potential landholder duty costs.

Developers may alternatively consider other structures through which investors can contribute capital rather than via equity subscriptions. For example, investors could loan start-up funds to developers via development agreements. Such contributions would provide developers with capital, while ensuring lenders do not have any interests in the landholder as shareholders or unit holders. However, care would need to be taken with respect to the economic entitlement provisions.

Written by Giancarlo Romano, Principal Lawyer at Best Hooper Lawyers | gromano@besthooper.com.au | 03 9691 0220

Written by Giancarlo Romano, Principal Lawyer at Best Hooper Lawyers | gromano@besthooper.com.au | 03 9691 0220

Recently, our Dominic Scally and Eli Morrison were involved in cases for developers seeking planning approval for multistorey apartment buildings in the cities of Kingston and Bayside. In one matter, the Victorian Civil and Administrative Tribunal (VCAT) requested further information from our client for its proposed apartment development in Brighton to show alternative additional communal open space options. In response, an option put forward has been for provision of communal space within the front setback of the site. In this scenario, an often-underutilised option is the use of roof terraces. In the current context, it is not yet known what the Tribunal’s opinion will be on this, however what is known is that, more than ever before,

developers need to be conscious that the decision maker will consider open space, and alternative additional open space options, when assessing residential amenity for apartment developments.

The Victorian Planning Schemes at Clause 55.07 and standards B36 and B37 include communal open space objectives such as meeting the recreation and amenity needs of residents, ensuring that communal open space is accessible, functional, and is easily maintained, and ensuring that communal open space is integrated with the layout of the development and enhances resident amenity.

A common topic that continues to emerge for our developer clients is the provision of communal open space and where to locate it.

Standard B36 provides open space should be:

• Landscaped.

• Accessible to all residents.

• A useable size, shape and dimension.

• Capable of efficient management (ie, by Body Corporate).

Be located to:

• Provide passive surveillance opportunities, where appropriate.

• Provide outlook for as many dwellings as practicable.

• Avoid overlooking into habitable rooms and private open space of new dwellings.

• Minimise noise impacts to new and existing dwellings.

Standard B37 provides that solar access to communal outdoor open space should be:

• Located on the north side of a building, if appropriate.

• At least 50 per cent or 125 square metres, whichever is the lesser, of the primary communal outdoor open space should receive a minimum of two hours of sunlight between 9am and 3pm on 21 June.

In addition to the primary communal open space of 30sqm, additional areas may be both indoor and outdoors and consist of multiple separate areas of communal open space. It is therefore a matter for the developer and design team to explore where to locate communal space, having regard to factors such as allowing solar access into the space and tailoring the space to the needs and demographic of the prospective purchaser.

For example, purchasers may want sunny AM/ PM indoor/outdoor reading nooks or a vegetable garden instead; think “Nightingale” not-for-profit apartments providing social and financial benefits for its residents.

In urbanised denser environments such as Bayside, there is an increasing demand to utilise developable land to its full opportunity whilst keeping in mind site sensitivities such as the amenity of neighbouring properties. Given the qualifier on managing noise, in our opinion, roof terraces are an excellent option and allow for a greater development yield.

But there is no correct answer and VCAT is grappling with it.

If you are a developer and are seeking expert legal advice for approval of an apartment building, please do not hesitate to contact our planning group for assistance

This article is general in nature, should you wish to seek expert legal advice please contact us.

Edward Mahony of our office recently appeared at the Victorian Civil and Administrative Tribunal (VCAT) before Deputy President Bisucci regarding a technical point on what determines a Council ‘decision’ for an appeal under Section 77 of the Planning and Environment Act 1989 (Vic) (P&E Act).

Written by Giancarlo Romano, Principal Lawyer at Best Hooper Lawyers | gromano@besthooper.com.au | 03 9691 0220

Written by Giancarlo Romano, Principal Lawyer at Best Hooper Lawyers | gromano@besthooper.com.au | 03 9691 0220

which the application is refused and state whether the grounds were those of the responsible authority or a determining referral authority We submitted that as the Council did not give the Notice of Refusal to the Applicant until after the appeal, the failure appeal was appropriately made at the time it was filed.

Our client filed an application with VCAT under Section 79 of the P&E Act against the City of Greater Geelong’s failure to grant a planning permit within the 60 statutory day timeframe (‘Failure appeal’). Council raised a preliminary question of law stating that our client should have filed the appeal under Section 77, on the basis that it had made a ‘decision’ to refuse a permit on the planning permit application at an internal Council meeting the day prior to our client filing the appeal with VCAT. Our client had no knowledge that this meeting had occurred at the time of filing its appeal.

Our office argued that the ‘decision’ made at this Council meeting, is not a ‘decision’ for the purpose of Section 77. In making this submission, we relied upon the words of Section 65 of the Act which states: Refusal of permit:

• The responsible authority must give the applicant and each person who objected under section 57, a notice in the prescribed form of its decision to refuse to grant a permit

• The notice must set out the specific grounds on

We also submitted that at a practical level, an Applicant would be disadvantaged if the Council’s submission that a ‘decision’ for the purpose of Section 77 could be a decision that is not conveyed to an Applicant in the form of a Notice of Refusal. If Council delayed issuing such a Notice of Refusal, it would arguably result in the Applicant having no appeal rights against Council.

The Tribunal accepted our submission that the application for review was properly made under section 79 of the Act. The Member noted ‘to rely upon the date of the decision of a council made at a meeting, which was not given to the relevant persons, would defeat the certainty created by the various provisions in the PE Act and PE Regulations’. In coming to this determination, Deputy President Bisucci placed emphasis on the requirement of Section 65 that Council must give the notice in the prescribed form (Notice of Refusal) and that the decision is made when the notice is issued.

A similar scenario occurred in the VCAT decision of Klados v Banyule CC (Costs) [2017] VCAT 1397, where it was determined that just because an authorised delegate of Council makes a determination/finalises their position on an application, does not mean that the Council’s ‘decision’ has been made for the purpose of Section 77 of the Act. Rather, it is the date of the Notice of Refusal.

Travelling on a bus down the main street of Newcastle (NSW) a few years back, I sat behind a couple of locals who were doing it tough and looked like they had done some rough sleeping. They were discussing accommodation options as we passed various establishments. One pub was $100 a night, another was $110.

At that time, I was lucky enough to be renting a small studio apartment in Circular Quay with harbour views for $460 per week.

"The comparison was salient in that a property with one of the world’s most iconic outlooks was effectively 35% cheaper than what was being charged nightly for the most basic of accommodation in a regional city. This anomaly highlighted the difference in the economics between the short-term and long-term rental market."

However, technology is rapidly removing the barriers between the markets for short-term and long-term residential accommodation.

Platforms such as Airbnb have made it possible for landlords, who would otherwise have only considered the option of long-term rentals, to offer their properties to the more lucrative short-term market. Estimates suggest there are more than 200,000 properties available via short-term rental platforms in Australia.

Undoubtedly short-term rental technology platforms offer convenience and efficiency to both the landlord and tenant and may contribute to the economy’s aggregate income by boosting our capacity to service foreign tourists.

Tougher regulation of short-term renting may be inevitable, which could have significant implications for property related investments.

However, these platforms have some downsides as well. Most notably, rental affordability is likely to be negatively impacted by a shift in properties away from long-term rental markets.

The current rental crisis, which has long-term rental vacancy rates of just 1.0% nationally, is likely to be attributed at least in part to the growth in the popularity of short-term rentals.

"This historically low vacancy rate belies the fact that Australia has come through a period of unusually low population growth at a time when residential construction has been high. In fact, the 1 million new dwellings completed in the 5-years to December 2019 (just prior to the COVID crisis) was some 41% above the longerterm average level of dwelling completions."

Higher long-term rents, due to properties increasingly being diverted to the short-term market, is not only a social problem but is also contributing to inflation. Rents have a 6% weight in the Consumer Price Index. Rental increases of the magnitude currently being experienced can have a material impact on inflation and therefore indirectly lead to higher interest rates and lower house purchase affordability.

From an overall economic efficiency perspective, it could also be argued that the accommodation needs of those seeking short-term rental accommodation are better served by custom-built and managed hotel and tourist facilities, rather than standard residential housing stock.

Hotels are generally run with higher occupancy rates and lower floor space and land footprints per occupant than the “cottage industry” approach of the short-term rental platforms. As such, the call on the economy’s scarce resources and infrastructure is lowered via tourists using fit-for-purpose tourist accommodations.

Many who have experienced the encroachment of short-term rentals in their own neighbourhoods would also argue there is a loss of “community” and local area custodianship when long-term residents are replaced by short-term renters.

In 2019, the Mayor of Paris, Anne Hidalgo, suggested short-term rentals threatened to turn the city into an “open-air museum”.

"Although not sitting neatly within its regulatory bailiwick, the prospect of curbing short-term rental activity may become increasingly compelling for the Commonwealth Government."

There is unlikely to be any other supply-side reform that could so quickly address the dual policy objectives of lowering inflation and addressing rental affordability. With National Cabinet possibly having all mainland State Labor Governments from March 25th, the potential for centralised coordinated housing policy has never been greater.

The Reserve Bank’s reference to rental costs in their Statement following the March Board meeting was notable as it highlighted an area of inflation that is outside of its control – and therefore implies other policy levers need to be engaged. In fact, higher interest rates are likely to add to rental inflation as landlords pass on the cost of higher interest rates. Increasingly, it would seem, there will be pressure on the Commonwealth Government to act to address inflation.

"Opponents of increased regulation may argue that the efficiency of the free market is being compromised by an attempt to restrict the use of short-term rentals. However, the need for zoning of land for specific purposes is well accepted."

It could be argued that short-term rentals are more akin to a commercial activity, which is incompatible with land zoned “residential” where there is an implicit expectation that this is land set aside for the population to “reside”.

At a time when residential property prices are already under stress, regulatory risks associated with shortterm rentals should be a consideration for residential property investors. Any new restrictions could trigger the need for some landlords to sell their properties. Risks extend to other investment categories as well.

A question that should be asked of any manager of a mortgage fund or private credit fund holding residential loan assets is “what percentage of their fund is backed by short-term rental income streams?”.

There could be a fundamental difference in the credit quality of an owner-occupied residential loan vis-àvisa a loan backed by a short-term rental property. This difference in credit quality is unlikely to be currently reflected in the return offered to investors.

Analysis conducted for Livewire suggests the great Australian dream is now even more out of reach than previously thought.

At the best of times, buying a first property is hard. For many Australians, (Livewire staff included), scraping together the savings to compile a 10% mortgage deposit is an almost insurmountable challenge.. And that's before servicing interest repayments are even considered.

Now, add to this problem, the 350 basis points worth of rate hikes from the Reserve Bank in less than 12 months..... and it's no wonder that mortgage stress is at record levels and refinancing in January was the highest on record.

The rate hikes, and the expectation of their impact on mortgage stress, have led to the steepest price

falls in modern times, with the CoreLogic five-capital-city metric falling by more than nine percent year-on-year.

Normally, this should mean that home buyers get an easier entry point into the market. But these aren't normal times and the Reserve Bank is not hiking in a normal environment.

So it's led us to ask a pertinent question:

"Is Australian property actually less affordable now than before the pandemic?"

Property affordability has fallen 39% in a year. But are the seeds for the next rally being sown right now?

The answer to this question is the subject of this wire. We'll also tackle the other question many homeowners have on their minds - is this all Reserve Bank Governor Philip Lowe's fault?

The experiment:

To answer the key question, we asked the team at Yard Home Loans to work out the change in borrowing capacity between March 2020, just before the first RBA rate rise, and today.

Several assumptions were used, plenty of which will be described in the table below. In all cases, the following was applied.

• 80% LVR

• The borrower rate is 2.25% + cash rate.

• APRA buffer of 3%, which changes over time

With that said, these are the results of our experiment. Of course, this isn't the case for everyone but it's an illustration of how borrowing capacity has changed in the last three years.

The data was provided by Toby Boswell from Yard Home Loans.

*Case 1: Single 30-year old with no dependents, earning a full-time $90,000 wage with $25,000 in HECS debt to pay off.

*Case 2: A young married couple with two dependents, earning $100,000 and $50,000 respectively. Neither have any HECS debt remaining.

*Case 3: 60-year old couple with no dependents, $140,000 and $40,000 wages respectively. They already own an existing home ($200,000 left on mortgage) and are looking to buy an investment property attracting 4% rental yield.

**All numbers are indicative only.

Interest rates and inflation is the simple answer. After all, in the last 12 months, the average repayment for the standard $1 million loan is up by more than $1,800 per month. But in truth, a lot of other changes have been quietly taking place behind the scenes.

"Other factors such as buffer rates, increased benchmark expenses, and changes to tax have had minor impacts but have also contributed to an overall decrease in borrowing capacity from its peak at the start of 2022," Boswell noted.

CoreLogic's Head of Australian Research Eliza Owen actually goes one step further arguing every major

affordability metric has declined in the last five years. Owen puts the blame on mortgage serviceability.

"Mortgage serviceability is fast becoming the most prominent challenge in housing affordability. While our affordability metrics are a bit lagged, measures were already showing a rapid deterioration late last year," Owen said.

At the rental level, things have soured but not as much at least on the data.

"Rental affordability at the median household income level has worsened, but doesn’t look as severe as mortgage serviceability," Owen said.

Philip Ryan of Trilogy Funds pins the problem on a combination of rapidly rising rates, a lack of new housing supply, and anaemic wage growth (or in this high-inflation era, real wage losses).

"These periods of time do repeat themselves but this one will be traced to interest rates and a lack of supply," he said. "I also suspect we will continue to see this problem persist until we start to see wage growth. The one rider on that is people now have so many more opportunities to multiply their income," he added.

Ryan also has another view - Australian property was actually always unaffordable.

"If it was easy, wouldn't a lot of people have more than one house?," Ryan quizzed. "If it was really affordable, we'd all have 10 houses!"

Our man at Yard informs us that depending on circumstances and the size of the loan, a 0.25% rate hike could trim between two and four percent (2-4%) off your borrowing capability. So had the RBA started hiking interest rates earlier, could this crisis have been lessened or mitigated?

Yes and no.

"The RBA was highly stimulatory and the Government was also highly stimulatory during COVID's outbreak," Ryan noted. "In many ways, what they did was the right thing to do. Otherwise, we could have ended up with another Great Depression," he added. But they were tripped up by Governor Philip Lowe and the forward guidance which later proved to be the opposite of prescient.

"The RBA is forever trying to do its job in the rear view mirror," Ryan said. "I can understand their position being complicated and difficult but a rapid change in rates has exaggerated the problem," he added.

Ryan's base case - which in turn leans bullishsuggests the seeds for the next property boom are being sown now.

"We have reduced building activity, some builders have collapsed, and there are difficulties with trades

and council approvals. There is a real lack of product supply coming to market," Ryan said.

Ryan goes on to add that while achieving the terminal rate is important, he also believes there should be an inflection point when it comes to continually increasing rents. His view is that the next boom will occur when first home buyers decide it’s cheaper to buy than rent and when investors are drawn back into the housing market because of increased rents.

Owen is less sanguine, arguing the 'bottom' is likely going to be dependent on how fast the RBA transmission mechanism does its job.

"We are hesitant to say whether the bottomed out however, because interest rates have further to work their way through to borrowers and mortgage holders, and this dampener could be compounded by a looser labour market in 2023," she says.

As for the top markets where the buying may restart, she points to Western Australia, the Top End, and the leafy suburbs of Sydney.

"Our expectation is that regions with favourable migration trends and strong rent return, including resource-based markets across WA and the NT, will have mild declines through this cycle," Owen said.

"On the east coast, it is expected that desirable, high-end owner-occupied markets will be the first to show signs of recovery, such as the North Sydney and Hornsby market of Sydney, where large family homes have seen relatively sharp price falls, and may become appealing to buyers once interest rates stabilise," she added.

We were talking earlier about the Reserve Bank and whether specifically all the blame should be put

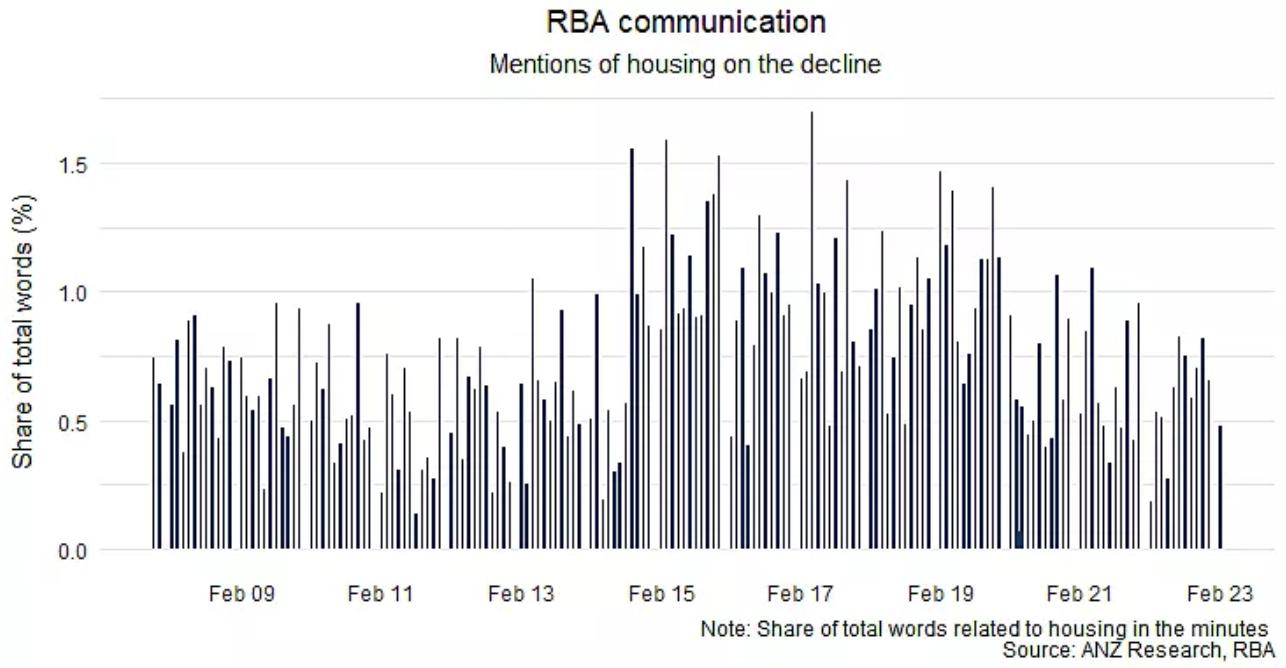

on Phil Lowe. Well, if the RBA's communication is anything to go by, perhaps not. This chart from John Bromhead at ANZ finds that mentions of housing have declined in recent years - which must go some way to explaining what the RBA is more focussed on.

If inflation comes down and the RBA reaches its terminal rate, it'll be interesting to see if these mentions tick back up.

We appreciate a number of developers have in the past successfully ran their own sales team, work exclusively through their own projects and selected channels.

With 32 % of our annual sales as a result of cross referring from one project to another, the days of a cost prohibitive data base from only one or two projects is fast disappearing.

From a project’s data base of over 280,000 and a residential data base of over 460,000 we consistently generate low cost, stress free sales that can get your project moving within the shortest possible time-frame.

Most developers and other project marketers are all doing the following to generate sales;

• Work out of a dedicated display suite

• Attempt to seek out reliable referral partners, both locally and overseas

• Commission marketing designed to attract buyers to your project

Three years ago these procedures were enough to generate sufficient pre-sales to then cover debt funding, however, we are now in a newpost covid market. Strategies with the benefits of strong relationships and front of mind market presence must be leveraged to ensure a successful outcome.

The unique initiatives we’ve put in place for every client has resulted in the successful sell out of over 242 projects and counting – make your project count by calling us today.

The start of 2023 saw Marshall White Projects celebrate our first ten year in the business of selling and marketing off the plan projects.

During this time we’ve been honoured to work with the very best in the business. We’ve also:

• Personally met with over 17,300 off the plan purchasers

• Successfully sold through 242 off the plan projects

• Assisted off the plan purchasers to own over $3.635 Billion in brand new product

Since the inception of Marshall White Projects in 2013, we've attempted to provide an insight into the ever changing world of property development b sharing the hard earnt lessons of those in the field and generous enough to share their experieces for the betterment of their peers.

Marshall White Projects has evolved as a team, maturing in a market where buyers learn to expect more than ever before, whilest developers must work harder to achieve the same reslut.

They say knowledge is power, so we invite you to click on the button below and enjoy the resource of our first publication through to today.

or process disclosed

and do not represent that the use of such information, product, or process would not infringe on privately owned rights.