MSADA, One McKinley Square, Sixth Floor, Boston, MA 02109

auto M a s s a c h u s e t t s

D

E

A

L

E

R

FIRST CLASS MAIL US POSTAGE PAID BOSTON, MA PERMIT NO. 216

October 2016 • Vol. 28 No. 10

The official publication of the Massachusetts State Automobile Dealers Association, Inc

R a isi n g our V oices

Ma s s a c h u s e t t s

auto D

S ta f f D i r e c t o r y Robert O’Koniewski, Esq. Executive Vice President rokoniewski@msada.org Jean Fabrizio Director of Administration jfabrizio@msada.org Peter Brennan, Esq. Staff Attorney pbrennan@msada.org Jorge Bernal Administrative Assistant/ Membership Coordinator jbernal@msada.org Auto Dealer MAgazine Robert O’Koniewski, Esq. Executive Editor Tom Nash Editorial Coordinator nashtc@gmail.com Subscriptions provided annually to Massachusetts member dealers. All address changes should be submitted to: MSADA by e-mail: mguerra@msada.org Postmaster: Send address change to: One McKinley Square, Sixth Floor Boston, MA 02109 Auto Dealer is published by the Massachusetts State Automobile Dealers Association, Inc. to provide information about the Bay State auto retail industry and news of MSADA and its membership.

Ad Directory Blum Shapiro 21 Boston Herald 32 Ethos Group 2 Leader Auto Resources 22 Lynnway Auto Auction 23 Nancy Phillips 21 O’Connor & Drew, P.C. 31 Reynolds & Reynolds 24 Southern Auto Auction 20 ADVERTISING RATES Inquire for multiple-insertion discounts or full Media Kit. E-mail jfabrizio@msada.org Quarter Page: $450 Half Page: $700 Full Page: $1,400

Back Cover: $1,800 Inside Front: $1,700 Inside Back: $1,600

E

A

L

E

R

The official publication of the Massachusetts State Automobile Dealers Association, Inc

Ta b l e o f C o n t e n t s

4 6 10 11 12 14 15

From the President: Looking to November THE ROUNDUP: Election Season’s End Nears LEGISLATIVE SCORECARD TROUBLESHOOTNG: Drug Testing in the Age of Legal Marijuana AUTO OUTLOOK ACCOUNTING: October is National Cyber Security Awareness Month LEGAL: Some Employment Law Lessons from the 2016 Presidential Election Campaign

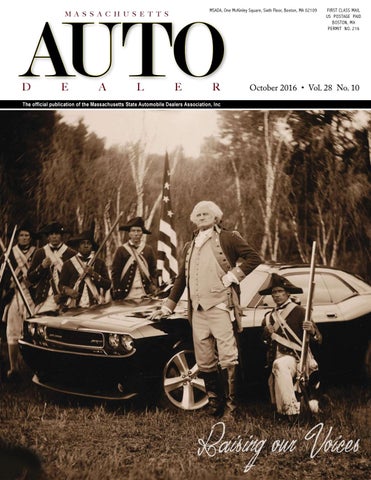

16 Cover Story: Raising Our Voices

19 20 25 26 29

DEALER SERVICES: Bad Hiring Practices Are Bad Business NEWS From Around the Horn Truck Corner: Help Truck Dealers’ Families After Floods and Hurricane nada Market Beat nada update: Working Toward Fairness Join us on Twitter at @MassAutoDealers www.msada.org Massachusetts Auto Dealer OCTOBER 2016

4

from the President

MSADA

Looking to November Our fate as dealers remains linked with all levels of government.

By Scott Dube, MSADA President A

s Election Day nears, we all need to go out and vote, and remember how much more it takes to be active participants in our democracy. Hundreds upon hundreds of bills get filed through the State House, Congress, and your local City or Town Hall every year. It’s an unfathomable amount of information to keep track of, and frankly most legislators can barely keep track of their own initiatives. That is why it is important to have friends, or as close to friends as you can ever truly have, in politics. But not playing the game is not an option. If we do not engage in the issues being brought to their attention, if we do not bring our own needs into the spotlight, someone else is simply going to have an easier time making our lives difficult. The franchised automotive industry needs to ensure that we have legislators who remember who we are, what we stand for, and how large of an impact we have on our Commonwealth. That we make up 20 percent of the retail economy in this state is usually enough to make those unaware perk their ears up. As Massachusetts continues to climb out of the hole of the 2008 recession, local dealerships are businesses that are easy for any legislator to support. Our dealerships require no public investment and reap jobs and tax revenue for all involved. Election time is a critically important event in our calendar, because it gives MSADA a chance to show our legislators and other elected officials that the issues they are confronting are not in a vacuum. Every bill or ordinance they put forward and every vote they take has the chance to impact our businesses -- positively or negatively. Those consequences are much more stark than they realize. Franchised auto dealerships employ more than 25,000 people in Massachusetts, and we cover every part of the state. We represent a large and quantifiable part of their constituencies, and their agendas hit or help us in ways that we have to make sure they understand. The bottom line is, they know the difference we make in their local economy when we show them the numbers. The Teslas and AutoZones of the world cannot make the same case that we can, and they do not provide the constituency that we do. Lawmakers can often be reasoned with, and a lot of times the flashy issue of the day simply needs proper illumination from a local economics perspective. So as Election Day nears, I encourage you to vote, but I also encourage you to reach out to your local representatives. They need to hear from us more often, so they can put faces to numbers. If you haven’t already done so this year, I also encourage you to donate to our state New Car Dealer Political Action Committee. It’s a key way of keeping our agenda on the table, and it only takes a few minutes. Contact Executive Vice President Robert O’Koniewski at (617) 451-1051 or rokoniewski@msada.org. t

OCTOBER 2016

Massachusetts Auto Dealer www.msada.org

Msada Board Barnstable County

Brad Tracy, Tracy Volkswagen

Berkshire County

Brian Bedard, Bedard Brothers Auto Sales

Bristol County

Richard Mastria, Mastria Auto Group

Essex County

William DeLuca III, Woodworth Motors John Hartman, Ira Motor Group

Franklin County

Jay Dillon, Dillon Chevrolet

Hampden County

Jeb Balise, Balise Auto Group

Hampshire County

Bryan Burke, Burke Chevrolet

Middlesex County

Chris Connolly, Jr., Herb Connolly Motors Scott Dube, Bill Dube Hyundai Frank Hanenberger, MetroWest Subaru

Norfolk County

Jack Madden, Jr., Jack Madden Ford Charles Tufankjian, Toyota Scion of Braintree

Plymouth County

Christine Alicandro, Marty’s Buick GMC Isuzu

Suffolk County

Robert Boch, Expressway Toyota

Worcester County

Steven Sewell, Westboro Mitsubishi Steve Salvadore, Salvadore Auto

Medium/Heavy-Duty Truck Dealer Director-at-Large [Open]

Immediate Past President James G. Boyle, Tuck’s Trucks

NADA Director

Don Sudbay, Jr., Sudbay Motors

Officers

President, Scott Dube Vice President, Chris Connolly, Jr. Treasurer, Jack Madden, Jr. Clerk, Charles Tufankjian

Associate Members

MSADA A ssociate M ember D irectory ADESA Jack Neshe (508) 626-7000 Albin, Randall & Bennett Barton D. Haag (207) 772-1981 American Fidelity Assurance Co. Dan Clements (616) 450-1871 American Tire Distributors Pamela LaFleur (774) 307-0707 AutoAlert Don Corinna (505) 304-3040 Auto Auction of New England Steven DeLuca (603) 437-5700 Auto/Mate Dealership Systems Troy Potter (877) 340-2677 Bank of America Merrill Lynch Dan Duda and Nancy Price (781) 534-8543 Bellavia Blatt Andron & Crossett, PC Leonard A. Bellavia, Esq (516) 873-3000 Blum Shapiro John D. Spatcher (860) 561-4000 Boston Globe Mary Kelly and Tom Drislane (617) 929-8373 Burns & Levinson LLP Paul Marshall Harris (617) 345-3854 Capital Automotive Real Estate Services Willie Beck (703) 394-1323 Cars.com Heidi Allen (312) 601-5376 CDK Global Chris Wong (847) 407-3187 Construction Management & Builders, Inc. Nicole Mitsakis (781) 246-9400 CVR John Alviggi (267) 419-3261 Dealer Creative Glenn Anderson (919) 247-6658 Dealerdocx Brad Bass (978) 766-9000 Dealermine Inc. Carl Bowen (401)-742-1959 DealerTrack Ernest Lattimer (516) 547-2242 Downey & Company Paul McGovern (781) 849-3100 Ethos Group, Inc. Drew Spring (617) 694-9761 F & I Resources Jason Bayko (508) 624-4344 Federated Insurance Matt Johnson (606) 923-6350 First Citizens Federal Credit Union Joe Ender (508) 979-4728

Fisher Phillips LLP John Donovan (404) 240-4236 Joe Ambash (617) 532-9320 Gulf State Financial Services Bob Lowery (713) 302-5547 GW Marketing Services Gordon Wisbach (857) 404-404-0226 Harbor First Ron Scolamiero (617) 500-4080 Hireology Kevin Baumgart (773) 220-6035 Huntington National Bank John J. Marchand (781) 326-0823 JM&A Group Jose Ruiz (617) 259-0527 John W. Furrh Associates Inc. Kristin Perkins (508) 824-4939 Key Bank Mark Flibotte (617) 385-6232 KPA Rob Stansbury (484) 326-9765 Leader Auto Resources, Inc. Chuck August (518) 364-8723 Lynnway Auto Auction Jim Lamb (781) 596-8500 M & T Bank John Federici (508) 699-3576 Management Developers, Inc. Dale Boch (617) 312-2100 Micorp Dealer Services Frank Salkovitz (508) 832-9816 Mid-State Insurance Agency James Pietro (508) 791-5566 Mintz Levin Kurt Steinkrauss (617) 542-6000 Murtha Cullina Thomas Vangel (617) 457-4000 Nancy Phillips Associates, Inc. Nancy Phillips (603) 658-0004 Northeast Dealer Services Jim Schaffer (781) 255-6399 O’Connor & Drew, P.C. Kevin Carnes (617) 471-1120 Performance Management Group, Inc. Mark Puccio (508) 393-1400 PreOwned Auto Logistics Anthony Parente (877) 542-1955 ProActive Leadership Group Bill Napolitano (774) 254-0383 Quik Video Jack Gardner (617) 221-5502

R.L. Tennant Insurance Agency, Inc. Walter F. Tennant (617) 969-1300 Reflex Lighting Daryl Swanson (617) 269-4510 Resources Management Group J. Gregory Hoffman (800) 761-4546 Reynolds & Reynolds Marc Appel (413) 537-1336 Robinson Donovan Madden & Barry, P.C. James F. Martin, Esq. (413) 732-2301 Samet & Company John J. Czyzewski (617) 731-1222 Santander Richard Anderson (401) 432-0749 Schlossberg & Associates, LLC Michael O’Neil, Esq. (781) 848-5028 Sentry Insurance Company Eric Stiles (715) 346-7096 Shepherd & Goldstein CPA Ron Masiello (508) 757-3311 Silverman Advisors, PC Scott Silverman (781) 591-2886 Southern Auto Auction Tom Munson (860) 292-7500 SPIFFIT Sean Ugrin (303) 862-8655 Sprague Energy Timothy Teevens (800) 828-9427 SunTrust Bank Michael Walsh (617) 345-6567 Target Dealer Services Andrew Boli (508) 564-5050 TD Auto Finance BethAnn Durepo (603) 490-9615 TD Bank Michael M. Lefebvre (413) 748-8272 TrueCar Pat Watson (803) 360-6094 US Bank Vincent Gaglia (716) 649-0581 Wells Fargo Dealer Services Christopher Peck (508) 314-1283 Wicked Local Media Massachusetts Jay Pelland (508) 626-4334 Zurich American Insurance Company Steven Megee (774) 210-0092

www.msada.org Massachusetts Auto Dealer OCTOBER 2016

5

6

The Roundup

Election Season’s End Nears By Robert O’Koniewski, Esq. MSADA Executive Vice President Follow us on Twitter - @MassAutoDealers As the adage goes, “Elections have consequences.” And those in the retail auto industry certainly know that first-hand, especially as operating a business has become exceedingly more difficult over the last decade. On Election Day, November 8, voters across our country will be heading to the polls to mark their preferences for any number of federal, state, county, and local offices. Many voters have already exercised their right to vote, being residents of states with early voting laws, including us here in Massachusetts. At the national level, we have well-defined distinctions identifying the personalities, policy positions, personal and educational experiences, work histories, intellects, and other behavioral intangibles of the standard bearers of the two main political parties: Republican businessman Donald J. Trump and Democrat Hillary R. Clinton, a former U.S. Senator and U.S Secretary of State. We even have two minor party candidates getting a sniff from a good number of voters: former GOP governor of New Mexico, Gary Johnson, now running as a Libertarian with our former governor, William Weld, as his vice presidential running mate; and Green Party candidate Jill Stein, who, also, has a Massachusetts connection, having run for governor, in 2002 and 2010, and other offices as the Massachusetts Green Party nominee. On issues ranging from economic policy, taxes, our growing national debt (not abating as it hits $20 trillion), the U.S. Supreme Court nominations, law and order, criminal justice reforms, foreign policy and our country’s role in the world, the chasm separating the two main candidates, as well as their respective political parties, in OCTOBER 2016

Massachusetts Auto Dealer www.msada.org

their proposals and perspectives is vast and deep. There really are well-defined choices for voters to consider. During the current White House administration, the retail auto industry has been buffeted by extreme economic headwinds flowing from a devastating economic recession, which included banking disruptions and two auto manufacturer bankruptcies, as well as a growing regulatory burden (e.g. CFPB, Obamacare, etc.), buttressed by the highest number of annual car and truck sales in our history as the national economy attempts to put the recession behind it and push itself past 1-2% rate of growth in our Gross Domestic Product. We have seen up close and personal the overwhelming surge in government’s demands and controls on business operations. On one hand, those in government treat the business community as a financial piñata in the hunt for more revenues from those perceived to be not paying their fair share. On the other hand, the small business community has become a regulatory punching bag, crushed under the weight of a flurry of intrusive blows in the form of hundreds of thousands of pages of new laws and regulations designed to punish those for being job creators and revenue producers. As we have written previously, and as you see in our cover story this month, we at your association are always active with our legislators, whether they are seated on Beacon Hill or Capitol Hill, to ensure that our message is properly articulated, regardless the issue at hand. Government always will try to tell you how you need to run your business. To cede any ground in the give-and-take of policy formulation and implementation would be fatal.

MSADA Before stepping into the voting booth on November 8 (or even before if voting early), one needs to think long and hard as to which candidate provides the best path, especially with the appointment of judges necessary to protect a pro-growth agenda, to righting our national ship and implementing policies to deliver true substantive economic growth, including for the shrinking, economic unsteady middle class, and re-invigorate our stature and presence on the global stage. The stronger we are, the safer we will be. Our next president will have daunting challenges to face on any number of national and international fronts. To not participate, minimally, as a voter in the process of selecting our next Commander in Chief, as some elected officials have suggested, irresponsibly, goes against the very grain of everything we were taught in civics class. As an individual one has the power and ability through the electoral process to use one’s vote to support the people one wants to oversee our government for us, created by us. Too many men and women in our armed services have paid the ultimate price over our 240 years of independence to casually toss that vote away.

Voting Rules for November 8 On Tuesday, November 8, the polls will be open from 7:00 a.m. until 8:00 p.m. This may seem like a long span, but commuting times can impact a citizen’s ability to get to the polls either when they open or before they close. State law makes an accommodation for the time your employees may need to vote. Under Massachusetts law (MGL Chapter 149, Section 178), an employer must give an employee up to two hours off to vote if the employee requests it. The employee does not have to be paid for this time but should be allowed a two-hour absence after the opening of the polls in the employee’s voting precinct. For information on elections in your community, including early voting times, go to the Massachusetts Secretary of State’s website, www.sec.state.ma.us.

Veterans’ Day (Friday, Nov. 11) Pay Rules Reminder • A dealership that operates on Veterans’ Day is required to pay most employees at time and one-half their regular rate so long as work is actually performed on the holiday. • An employer may not require an employee to work on this holiday nor may it punish or penalize an employee for choosing not to work. • If the dealership is going to be open prior to 1:00 p.m. on the day, a local permit is required.

Do You Want to Increase Your Profits by $370K? Hireology Webinar – November 2, 11 AM All dealerships want to drive additional profitability to their stores, but many are missing how the people side of their business could help them add to the bottom line. In a study created for DrivingSales, Hireology found that dealerships who build a strong employment brand and utilize a data driven hiring process see a staggering profit increase. In fact, a 55-employee store that reduces their turnover could see an additional $370,000 in profit each year. In a brief but impactful 20-minute webinar, Hireology will touch on the study and what your dealership can do to obtain similar results. Attend this webinar and walk away with: • Comprehensive knowledge of Hireology’s groundbreaking study; • Innovative ways to build an employment brand; and • How much profit your store could add back with this formula. Register for the webinar at: http://resources.hireology.com/msada-webinarnovember-2016.

DrivingSales Seminar on Friday, Nov. 18, 9:00 a.m. – Noon, Crowne Plaza Hotel, Newton Your MSADA is hosting Jared Hamilton and Ron Henson of DrivingSales for a special complimentary event for our

members. Hamilton, Founder and CEO of DrivingSales, and Henson, Director of Operations University and Data, will discuss recent research on how to build the perfect sales team. Dealers are being pushed from two sides: Customers demand better buying experiences, while dealers struggle to find quality salespeople and retain them. Hear how dealers have been able to decrease their turnover from the industry standard 72% to 27% while increasing their close ratios. Things you’ll learn: • How changing customer expectations have shifted the way we must sale; • What companies have done inside and outside our industry to address a fundamental shift in buyer experience; • Why improving sales is the key to optimizing your performance. DrivingSales University is the industry leader in modern showroom, customer experience, and dealership operations training. DrivingSales offers over 800 classes that teach everything from how to answer the telephone to advanced SEO, mobile marketing practices and analytics. DrivingSales excels in dealership performance assessments, custom learning to meet dealership needs, and guiding each learner on the training they need the most in order to succeed. More specific event details and registration materials will be sent to you shortly. Be on the lookout for the opportunity to improve your dealership operations – compliments of your MSADA.

Federal Appeals Court Rules CFPB Structure Unconstitutional On October 11 the U.S. Court of Appeals for the District of Columbia Circuit ruled that the structure of the Consumer Financial Protection Bureau (CFPB) is unconstitutional. In its ruling, the court found that the current structure of the agency gives too much power to the director of the agency, currently Richard Cordray, without appropriate checks and balances. The court did not shut down the CFPB, but ordered that the agency be

www.msada.org Massachusetts Auto Dealer OCTOBER 2016

7

8

The Roundup restructured so that the director could be removed by the President at will. Under the current agency structure, the director can only be removed by the President “for cause”. “To remedy the constitutional flaw, we follow the Supreme Court’s precedents … and simply sever the statute’s unconstitutional for-cause provision from the remainder of the statute,” wrote Judge Brett Kavanaugh in the court’s 110-page majority opinion. “With the for-cause provision severed, the President now will have the power to remove the director at will, and to supervise and direct the director. The CFPB therefore will continue to operate and to perform its many duties, but will do so as an executive agency akin to other executive agencies headed by a single person, such as the Department of Justice and the Department of the Treasury.” The ruling was the result of a case in which the CFPB had fined mortgage lender PHH Corporation $109 million dollars for allegedly accepting kickbacks from mortgage insurers. As a result of the ruling, the fine against PHH was thrown out. The ruling is expected to be appealed.

Reminder – New Federal “White Collar” OT, Minimum Wage Exemption Rules Take Effect December 1 [We provided this information previously in our MSADA Legal Bulletin #25 on June 1, which was prepared by attorney Joe Ambash of Fisher & Phillips, our advisor on labor and employment issues.] The U.S Department of Labor (DOL) finally released the anxiously awaited revised regulations affecting certain kinds of employees who may be treated as exempt from the federal Fair Labor Standards Act’s (FLSA) overtime and minimum-wage requirements. These rules will take effect on December 1, 2016. If you currently consider any of your employees to be exempt “white collar” em-

OCTOBER 2016

ployees, you might have to make some sweeping changes. In brief, the following changes will be made in DOL’s definitions of executive, administrative, professional, computer-employee, and highly compensated exemptions under the FLSA’s Section 13(a)(1): • The minimum salary threshold is increasing to $913 per week, which annualizes to $47,476 (up from $455 per week, or $23,660 per year). DOL says that this figure is set at the 40th percentile of data representing what it calls “earnings of full-time salaried workers” in the lowest-wage Census region (currently the South). • This amount will now be “updated” every three years (meaning that it will likely increase with each “update”), beginning on January 1, 2020. DOL will announce these changes 150 days in advance. • Employers will be able to satisfy up to 10% of this new threshold through nondiscretionary bonuses and other incentive payments, including commissions, provided that the payments are made at least quarterly. This crediting will not be permitted as to the salaries paid to employees treated as exempt “highly compensated” ones. • The total-annual-compensation threshold for the “highly compensated employee” exemption will increase from $100,000 to $134,004 (which will also be “updated” every three years). DOL says that this figure is set at the 90th percentile of data representing what it calls “earnings of full-time salaried workers” nationally. These rules will become effective on December 1, 2016, which is considerably later than had been thought. Unless this date is postponed, by that time you must have done what is necessary to continue to rely upon one or more of these exemptions (or another exemption) as to each affected employee, or you must forgo exempt status as to any employee who no longer satisfies all of the requirements.

Massachusetts Auto Dealer www.msada.org

The Bottom Line 1. Essentially, DOL is doubling the current salary threshold. This is likely intended to both reduce the proportion of exempt workers sharply while increasing the compensation of many who will remain exempt, rather than engaging in the fundamentally definitional process called for under the FLSA. As we have said previously, manipulating exemption requirements to “give employees a raise” has never been an authorized or legitimate pursuit. 2. For the first time in these exemptions’ more-than-75-year history, DOL will publish what amounts to an automatic “update” to the minimum salary threshold. This departs from the prior DOL practice of engaging in what should instead ultimately be a qualitative evaluation that also takes into account a variety of non-numerical considerations. 3. DOL did not change any of the exemptions’ requirements as they relate to the kinds or amounts of work necessary to sustain exempt status (commonly known as the “duties test”). Of course, DOL had asked for comments directed to whether there should be a strict morethan-50% requirement for exempt work. The agency apparently decided that this was not necessary in light of the fact that “the number of workers for whom employers must apply the duties test is reduced” by virtue of the salary increase alone. What Should You Do Now? • analyze whether the requirements for the “white collar” exemptions you have been relying upon are met; • evaluate what might be changed about one or more jobs so that the incumbents may be treated as exempt in the future; • consider the possible application of alternative FLSA exemptions; and • develop FLSA-compliant pay plans for employees who have been treated as exempt but who no longer will be. DOL has provided extensive commentary explaining its rationale for the revised provisions.

MSADA FTC Charges SoCal Auto Group with Using Deceptive and Unfair Sales and Financing Tactics On September 29 the Federal Trade Commission (FTC) announced it has charged nine Los Angeles-area auto dealerships and their owners with using a wide range of deceptive and unfair sales and financing practices. The FTC’s action filed in the U.S. District Court for the Central District of California seeks to end these practices and return money to consumers. This is the FTC’s first action against an auto dealer for “yo-yo” financing tactics: using deception or other unlawful pressure tactics to coerce consumers who have signed contracts and driven off the dealership lots into accepting a different deal. The FTC also alleges that the defendants packed extra, unauthorized charges for “add-ons,” or aftermarket products and services, into car deals financed by consumers. According to the FTC’s complaint, the defendants entice consumers, particularly financially distressed and nonEnglish speaking consumers, into their dealerships with print, internet, radio and television ads that make an array of misleading claims, including that vehicles are generally available for the advertised terms and that consumers can buy vehicles for low prices, finance with low monthly payments, or make low down payments. Other allegedly misleading claims include that consumers can finance the purchase of vehicles – when in fact they are lease offers – and that the defendants will pay off consumers’ tradein vehicles, despite the fact that consumers ultimately are responsible for paying off any amount owed on the trade-in. The FTC also alleges that the defendants use phony online reviews to tout their dealerships and discredit negative reviews that highlighted their unlawful practices. They and their employees or agents allegedly post positive, five-star online reviews that purport to be from objective or independent reviewers without disclosing their relationship to the dealerships.

In addition to the deceptive advertising and marketing allegations, the FTC has charged that several financing tactics of the defendants are deceptive and unfair. As part of the sales and financing process, the defendants offer add-ons such as extended warranties, guaranteed auto protection (GAP), and maintenance or service plans. The FTC alleges the defendants have violated the FTC Act by charging some consumers for add-ons without their consent or falsely claiming the products were required or were free. And according to the complaint, in some instances after the consumers have signed contracts, the defendants falsely represent that consumers are required to sign a new contract with different terms. In other instances, the defendants tell consumers who have completed finance contracts that the contracts are cancelled and falsely represent that the defendants are permitted to keep consumers’ down payments or tradeins. When consumers request compliance with the terms of the contract or refuse the defendants’ demands, the defendants, in some instances, have falsely represented that consumers will be liable for legal action, including lawsuits, repossession, or criminal arrest for a stolen vehicle. The FTC’s complaint also charges the defendants with violating the Truth In Lending Act and Regulation Z, and the Consumer Leasing Act and Regulation M, for failing to clearly disclose required credit information and lease information in their advertising. The Commission vote authorizing the filing of the complaint against the Sage Auto Group defendants was 2-1.

2017 Auto Show, Dealer Summit & Charity Gala Circle the dates now – MSADA’s 60th edition of the New England International Auto Show will run January 12-16, 2017, at the Boston Convention and Exposition Center in South Boston. In order to celebrate our Auto Show, dealers, their families, and key employees are invited to attend on Friday, Januwww.msada.org

ary 13, our Twentieth Annual Auto Show Charity Gala at the BCEC, from 5:00 p.m. to 10:00 p.m. The Gala benefits our Charitable Foundation’s Automotive Technician Scholarship Program. Prior to the Charity Gala we will conduct the Dealer Summit at the BCEC from 1:00 p.m. to 5:00 p.m., at which we will have several speakers discuss ongoing events in our industry.

NADA Louisiana Flood Relief Efforts In August thousands of dealership employees and their families suffered devastating losses in the recent Louisiana floods. The need for financial assistance is great and will last for many weeks, if not months. The NADA Foundation’s Emergency Relief Fund helps dealership families after natural disasters, and NADA announced several weeks ago that the Foundation would seek to raise $2 million for new-car dealership families displaced by the flooding in Louisiana. Initial estimates indicate that more than 1,500 dealership families from new car dealerships in Baton Rouge and surrounding areas have been flooded out of their homes and desperately need financial assistance. Because of the severity of the flooding and lack of insurance (affected areas were not in flood zones), the vast number of relief applicants will qualify for a $1,500 check from the Foundation. To fill the expected gap between what’s needed and what’s on hand (about $325,000 is currently available), NADA President Peter Welch initiated a nationwide fundraising campaign. All relief efforts will run through the NADA Fund. NADA has asked dealers across the country to consider making a taxdeductible donation to the emergency relief fund. You can donate online at www.nada.org/emergencyrelief or send a check, payable to NADCF Emergency Fund, to NADCF, 8400 Westpark Drive, Tysons, VA, 22102. t

Massachusetts Auto Dealer OCTOBER 2016

9

MSADA MSADA

10

OCTOBER 2016

Massachusetts Auto Dealer www.msada.org

MSADA

Troubleshooting

Drug Testing in the Age of Legal Marijuana By Peter Brennan, Esq.

MSADA Staff Attorney Drug testing of prospective or current employees is already a complicated issue for employers. Federal laws must be complied with, and an employee’s right to privacy must be balanced against the employer’s interest in employing only drugfree employees. In Massachusetts, the issue could become cloudier in the near future, as the Commonwealth votes on a ballot question on November 8 to legalize the sale and consumption of marijuana by adults over 21 years of age, essentially regulating marijuana in a manner similar to alcohol. Massachusetts is one of five states voting to “legalize it” this year (Arizona, California, Maine and Nevada are the others). Another four states are voting to legalize medicinal marijuana, which is legal in roughly half of the country already, including Massachusetts. This is in addition to the four states, Alaska, Colorado, Oregon and Washington, which already have legalized the commercial sale and use of marijuana. Anecdotally, dealerships across the country are having more and more trouble finding potential employees that don’t test positive for THC, the principal psychoactive constituent of marijuana, during preemployment screening. A colleague from Oklahoma recently shared a story about a dealership client that went through nineteen applicants for an opening before finding one that didn’t test positive for THC. Several factors have likely contributed to this uptick: States that share a border

with states in which marijuana has been legalized have seen an increase in availability and usage. Nebraska and Oklahoma filed a lawsuit against Colorado in the U.S. Supreme Court in order to overturn Colorado’s law based on the overflow impact to their states, but the Supreme Court denied the challenge. THC is also relatively easy to screen for, as it can stay in a person’s system at a level detectable by a hair or urine drug test for up to three months, depending on factors including frequency of use and body fat composition. Comparatively, opioids, amphetamines, and cocaine are all undetectable through a urine screening within 2-4 days, although hair testing may detect use of these substances for upwards of three months. Federally, marijuana remains listed in Schedule I of the Controlled Substances Act. Private employers who have contracts with the federal government exceeding $100,000 are subject to the Drug Free Workplace Act of 1988, which does not require the drug testing of employees but does require employers to sponsor a drug awareness program, among other conditions. Interestingly, if a prospective employee tests positive for marijuana, the Drug Free Workplace Act does not prevent an employer subject to the Act from employing the person. Stricter hiring regulations apply to safety-sensitive jobs subject to the jurisdiction of the Department of Transportation (DOT) and the Federal Motor Carrier Safety Administration (FMCSA). For example, employers are required to test applicants for positions that require a Commercial Driver’s License (CDL). Employees holding safety-sensitive positions subject to DOT jurisdiction, including CDL holders, are also subject to postaccident testing, testing when returning to duty, testing when there is a reasonable suspicion of drug use, and random testing throughout the year. Massachusetts law does not have a statute governing drug testing of prospective www.msada.org

or current employees, but litigants have invoked the Massachusetts privacy law in lawsuits to test the legality of employer drug testing programs. The law states, in pertinent part, that “a person shall have a right against unreasonable, substantial, or serious interference with his privacy. The superior court shall have the jurisdiction in equity to enforce such right and in connection therewith to award damages.” (M.G.L. c. 214, § 1B). In cases brought by employees that have challenged an employer’s drug testing program, Massachusetts courts have balanced the employee’s right to privacy against the employer’s interest in maintaining a drug-free workplace. Generally, if an employee’s duties require anything that could jeopardize the safety of the employee or others then pre-employment and random drug tests have been upheld. Safety-sensitive dealership positions would include, but are not limited to, any position that requires the operation of a dealership vehicle or heavy machinery. Where drug testing is not required, or employing someone that tests positive for marijuana is not prohibited, employers can (a) forego testing or (b) still consider for employment an applicant that tests positive for marijuana. A positive test does not have to be an automatic disqualifier, but the dealer should speak to the applicant regarding the applicant’s frequency of usage and the dealer’s zero tolerance policy for drugs in the workplace. The dealer must also ensure that, if a positive test is not an automatic disqualifier, minority and other protected class candidates are not rejected for positive tests without any other justifiable basis. t If you require any additional information on these wage and hour issues please contact Robert O’Koniewski, MSADA Executive Vice President, rokoniewski@ msada.org or Peter Brennan, MSADA Staff Attorney, pbrennan@msada.org or by phone at (617) 451-1051.

Massachusetts Auto Dealer OCTOBER 2016

11

12

AUTO OUTLOOK

OCTOBER 2016

Massachusetts Auto Dealer www.msada.org

MSADA

www.msada.org

Massachusetts Auto Dealer OCTOBER 2016

13

14

Accounting

MSADA

October is National Cyber Security Awareness Month tive actions companies need to take are low cost or even free. Most breaches occur not with a hacker working technical magic breaking into a firewall but with a careless employee clicking a link or O’Connor & downloading a file that he should not. Drew, P.C. Educating your employees on the safe use of internet and email and how to identify phishing attempts is critical. The corrective actions may also include imNick DeLena is a Senior Manager at OCD Tech, O’Connor & Drew’s IT Audit & Security proving password security, locking comDivision. OCD Tech helps auto dealers identiputer rooms, and protecting wireless netfy, understand, and prioritize IT security risks. works. Many organizations already have He can be reached at ndelena@ocd-tech.com. the tools needed to secure themselves; they just do not use them. The Massachusetts data privacy law, National Cyber Security Awareness 201 CMR 17.00, which came into effect Month was created in 2004 as a means in March 2010, requires of drawing attention to the all companies handling growing importance - and personally identifiable risk - that computing has information (PII) have introduced in the conduct a written information of our daily lives and the security policy (WISP) running of our businesses. that should be reviewed Most recently, Yahoo! anand tested at least announced that 500 million nually. This is an opusernames and passwords portunity for companies were stolen from their to evaluate whether or systems. It is a staggernot they have sufficient ing number that represents protections in place on almost 1/12th of the ennot just the PII they tire population of Earth. process and store but Though Yahoo!’s breach also on their broader inis one of the biggest to frastructure. date, they are not alone. The lesson here is Many other organizations, you cannot improve including the IRS, UC The lesson here is you cannot what you do not meaBerkeley, Wendy’s, and sure. National Cyber Verizon, have experienced improve what you do not measure. Security Awareness significant breaches this Month is an opporyear. The National Cytunity for companies ber Security Alliance has through what’s inside, looking for things to think about cyber security, engage an compiled the following statistics: they can sell. When the same happens to independent firm, and have their people, • Almost 50 percent of small businesses your company, how will you fare? Will processes, and technology assessed. Not have experienced a cyber attack; your employees know what to do when doing so could literally mean the end of • More than 70 percent of attacks target something goes wrong? your business. small businesses; t The good news is most of the correc• More than 75 percent of employees

By Nick DeLena

OCTOBER 2016

leave their computers unsecured; • As much as 60 percent of hacked small and medium-sized businesses go out of business in the following six months. As alarming as these numbers are, most companies are still not investing the amount of time and effort required to secure their organization’s IT infrastructure. Often, especially with auto dealers, IT is outsourced or handled by a part-time resource, and dealers assume everything else is handled by the DMS vendor. Most companies hit with data breaches are targets of convenience; hackers do the equivalent of walking down a residential street looking for unlocked car doors, eventually finding one and rummaging

Massachusetts Auto Dealer www.msada.org

Legal

MSADA

By Joseph W. Ambash and Jeffrey A. Fritz

Some Employment Law Lessons from the 2016 Presidential Election Campaign No one is likely to dispute that the 2016 election cycle has been a wild ride and one of the most bizarre election cycles of the modern age. Politics aside, employers can glean some valuable lessons from the candidates’ trials, tribulations, and missteps along the way. The following are just a few.

able hostile work environment. Employers should (1) not tolerate any “locker room talk” at all, (2) encourage employees to report any comments they find offensive, (3) promptly and appropriately investigate any such reports, and (4) promptly and appropriately discipline any offending employees.

Locker Room Talk

WikiLeaks and Hot Mics

As you likely know, one nominee has attempted to justify some lewd comments he made a number of years ago in a private conversation by dismissing them as mere “locker room talk.” Whether that defense is a viable or effective one in the political arena is open to debate and remains to be seen; nonetheless, employers should know it is not a viable or effective defense to discrimination or harassment claims. And even a little “locker room talk”—about sex, race, national origin, or any other protected status—can be very costly for employers. Indeed, state and federal law prohibits employers from taking adverse action against employees because of any of their protected statuses. If one of your managers, for example, engages in “locker room talk” about an employee’s protected status and later (legitimately) decides to terminate that employee for poor performance, the employee may file a charge with the Massachusetts Commission Against Discrimination and/or the U.S. Equal Employment Opportunities Commission, regardless of the merits. The employee could claim the manager’s “locker room talk” shows he fired the employee not because of his performance but because of his protected status. “Locker room talk” also could lead to claims of discriminatory and illegal harassment, even between heterosexual males. While one or two comments alone are not likely to amount to an actionable hostile work environment, they very well may be enough to cause a disgruntled employee to file an administrative charge and/or lawsuit. And “locker room talk” that pervades the workplace may, in fact, create an action-

That politicians have had different public and private personas, or said one thing to certain segments of the electorate and another to others, likely comes as no surprise to most people. While the existence of the internet, 24-hour-a-day cable news, and surreptitious email hacks have exposed that facet of political life for certain nominees, the fact of the matter is that, for years, employers’ communications have been susceptible to disclosure (and exploitation by plaintiff’s attorneys) in litigation, unless protected by the attorneyclient or some other privilege. Accordingly, you should ensure your managers know they need to be very careful about (1) what they write in emails, text messages, and instant messages, and (2) how they write it. They need to understand and appreciate that their electronic communications may be scrutinized and picked apart in litigation, and they very well may be called upon to explain or account for them in a deposition and, ultimately, in front of a judge or jury. You should ensure your managers understand that inappropriate, hasty, or thoughtless comments in electronic communications can lead to liability for your dealership as well as, potentially, for themselves.

know what Aleppo was, rather than trying to wing it. Both the criticism and the praise of this candidate offer valuable lessons for employers. Indeed, in a typical discriminatory discharge claim, the employer invariably is called to answer the central question: “Why did you fire the employee?” While an employer can fire its at-will employees for any reason, and no reason at all, so long as it is not for an illegal reason, the employer must be able to answer that question, and answer it well. But employers should not wing it. Nor should they rely on speculation, assumptions, possible misunderstandings, or faulty investigations in making such decisions. Prior to taking any adverse action, employers candidly should assess what, if any, important or material facts they do not know and then take appropriate steps to learn and confirm them. While employers certainly may rely on their subjective assessments in making employment decisions, the more they can ground any adverse actions in objective and verified fact, the easier they typically are to defend. Regardless of who wins the election, things are not likely to get much easier for employers, especially here in Massachusetts. When in doubt, consider consulting an attorney. t

What is Aleppo? About a month or so back, a candidate was asked what he would do about Aleppo, to which he responded: “What is Aleppo?” Many criticized the candidate for not knowing the name of the widely-reported city at the center of the Syrian conflict. Some others, however, praised him for his (refreshingly apolitical) admission that he did not

Joe Ambash is the Managing Partner and Jeff Fritz is counsel at Fisher & Phillips, LLP, a national labor and employment firm representing hundreds of dealerships in Massachusetts and nationally. They may be reached at (617) 722-0044.

www.msada.org Massachusetts Auto Dealer OCTOBER 2016

15

16

Cover Story

Ra isin g our V oices

While lawmakers on Capitol Hill are often at odds with any number of interest groups, dealerships have a strong advantage when pushing back against onerous policies. Every legislator has a dealership in their district, and none of their decisions are made in a vacuum. OCTOBER 2016

Dealers unite on Capitol Hill to advocate for fair policies. By Tom Nash

Every September, the National Automobile Dealers Association offers a reminder of the scope of dealerships’ impact by bringing in franchise owners from across the country to visit their representatives and senators. This year, on September 20-21, MSADA Vice President Chris Connolly (Herb Connolly Auto Group), NADA Director Don Sudbay (Sudbay Motor Group), and Board Clerk Charles Tufankjian (Toyota of Braintree) made the trip alongside Executive Vice President Robert O’Koniewski, legislative agent Jim Hurrell, and staff attorney Peter Brennan. Given Sudbay’s work in making sure Massachusetts dealers are in the picture when considering national affairs, he says maintaining one-on-one relationships with legislators is a key part of working with a sometimes hostile legislative environment. “They are always cordial even if they may not always agree

Massachusetts Auto Dealer www.msada.org

MSADA MSADA with you,” he says. “But in other ways they will be there when we need them.” The MSADA met with Rep. Stephen Lynch (D-South Boston), Rep. William Keating (D-Bourne), Rep. Michael Capuano (D-Somerville), Rep. Seth Moulton (D-Peabody), and staff for Rep. Jim McGovern (D-Worcester), Rep. Katherine Clark (D-Melrose), and Rep. Niki Tsongas (D-Lowell). With more than 300 dealer-legislator meetings taking place, NADA singled out three priority issues where congressional action could have an enormous impact on dealer across the country.

Issue: CFPB Reform In 2013, the Consumer Financial Protection Bureau (CFPB) issued guidance that threatens to eliminate a dealer’s flexibility to discount auto loans in the showroom. The CFPB is attempting to change the $1 trillion auto loan market and limit market competition without prior public comment or analyzing the impact of its guidance on consumers. The CFPB’s actions will raise the cost of credit car buyers and push otherwise-creditworthy consumers out of

guidance without considering the consumer impact. S.2663, the “Reforming CFPB Indirect Auto Financing Guidance Act,” was introduced by Sen. Jerry Moran (R-Kansas) in March. The Senate Banking Committee held two hearings on the CFPB where support for keeping auto loans affordable was highlighted. On April 7, NADA submitted testimony to the committee supporting S.2663. This bill is identical to H.R.1737, which overwhelming passed the House in November 2015 by a veto-proof vote of 332-96, including 88 Democrats. Massachusetts Reps. Tsongas and Keating voted “yes,” while the other seven Massachusetts House members voted “no.”

Issue: Overbroad Recalls

The legislators are always cordial even if they may not always agree with you. But in other ways they will be there when we need them.

Bills introduced by Rep. Jan Schakowsky (D-Illinois) and Sen. Richard Blumenthal (D-Connecticut) would prohibit dealers from selling or wholesaling a used vehicle that is subject to an open recall, despite the fact that the majority of vehicle recalls do not require the drastic step of grounding. Because of a shortage of recall parts, it often takes months

the auto credit market. to repair recalled vehicles. Enacting NADA supports legislation, H.R.1181/S.900 would diminish S.2663/H.R.1737, that would rethe average value of a consumer’s peal the flawed 2013 CFPB guidrecalled vehicle by $1,210, accordance and allow the CFPB to reissue ing to a J.D. Power study, prompt-Don Sudbay it under a transparent review proing dealerships to pay significantly NADA Director cess. The current guidance is based less for trade-ins with open recalls, on faulty research, such as estimatif they accept them at all. Lowering ing a customer’s ethnic background based on last name and zip trade-in values would immediately hurt auto buyers by reducing code. the down payment a consumer could use to buy a newer car. A nonpartisan study of the CFPB’s methodology found that Also, since the bills do not regulate private sales, recalled it was prone to significant errors, and that the CFPB knew of vehicles would be pushed into the unregulated private market, these flaws yet failed to correct them. The bills also require the making it less likely that the consumer will get the manufacbureau to consider the cost and effect of new auto guidance turer remedy for the vehicle. These bills also would ground on consumers, since the CFPB admitted that it issued its 2013 vehicles for such minor compliance matters as a misprint in www.msada.org

Massachusetts Auto Dealer OCTOBER 2016

17

18

RAISING OUR VOICES an owner’s manual. With other transportation legislation pending, an amendment by Sen. Blumenthal that was identical to S.900 was rejected by the Senate Commerce Committee in July 2015. NADA urged Congress to focus on legislation that increases recall completion rates and oppose bills that would diminish the value of millions of customer trade-ins. MSADA Vice President Chris Connolly says the laws Congress should pass with respect to recalls relate to equitable treatment across the industry. With the Takata airbag recall continuing to grow, dealers are facing widely differing treatment from manufacturers. “I hate to say it, but there should be a law,” Connolly says. “Dealers need to be protected going forward. We need to recognize what are life threatening recalls and what are just open recalls that must be disclosed.”

Issue: LIFO and Advertising Expenses LIFO (last in, first out) is a longstanding inventory accounting method used by businesses to help mitigate rising inventory costs. Similarly, advertising has been considered an ordinary business expense for more than 100 years. Repealing the use of LIFO and limiting advertising deductibility would take working

OCTOBER 2016

capital away from dealerships that could otherwise be used to create jobs. Although the recently released House Republican Tax Blueprint maintains LIFO, it is silent on the treatment of inventory, LIFO reserves, and advertising expenses. Provisions to repeal LIFO and limit advertising have been in previous tax reform bills and may be added to a 2017 tax bill, if Congress and the new incoming administration decide to tackle tax reform. NADA urged Congress to ensure that any changes in the tax treatment of LIFO and advertising deductibility do not hurt small business.

How to Get Heard Coming away from the conference, O’Koniewksi says it’s imperative for all dealers to do whatever they can to foster a relationship with their legislators in Washington. “MSADA sends a contingent of dealers to DC to advocate on everyone’s behalf, but we do need all the help we can get,” O’Koniewski says. “Dealers can best tell their own stories. Legislators need to remember how important dealers are in their communities, and that message needs to come from their constituents.” But whether in a Washington office or a dealer’s store, for Tufankjian developing a relationship with representatives means getting more than rehearsed answers or blank stares when he does make contact. The important thing is making the effort. “We should all know our representatives,” Tufankjian says. “I feel like if I needed something, I can pick up the phone and call and they know who we are. That personal contact means a lot.” For more information about what you can do to keep in contact with your representative, contact rokoniewski@msada.org. t

Massachusetts Auto Dealer www.msada.org

DEALER SERVICES

MSADA

Bad Hiring Practices Are Bad Business By Rob Sneed

Rob Sneed is a development rep and motivator for Ethos Group Consulting Services and the author of various articles in the automotive industry. franchised an

Ethos Group

automotive

integrated

program

provides

dealerships of

propriately vet each candidate. The dealership cannot allow hiring to be rushed. Structure a process that ensures potential hires have the skills necessary to be successful prior to making them any kind of offer. Taking time with each step of the hiring process also shows candidates that the dealership does not invite every applicant to be part of the team. A carefully considered offer demonstrates to the candidate that he or she will not be thought of as “just another employee”.

with

results-driven

income-development services, comprehensive training, robust recruiting and industry-

Finding the right people for the right positions can be a challenge for automobile dealers. While many other industries have adopted hiring processes to match candidates to a position prior to hire, the automobile industry often confuses a willing applicant with a qualified, able one. Dealership management often has a desperate need to fill a position, which leads to desperate hires. The dealership then wastes time, energy, and resources trying to develop the skills of individuals who likely should have never been hired for their positions.

Power of the Process Ethos Group has recruited tens of thousands of highly qualified candidates for our dealership clients nationwide. We have earned a reputation as a company that attracts top talent, because we successfully place candidates in a workplace where they can be most successful. Our experience has taught us that the key to effective recruiting is to constantly and efficiently pursue qualified candidates while, at the same time, maximizing each step of the hiring process. The following four items are vital to designing and implementing an effective hiring process.

1. Slow Your Roll A successful hiring process requires dealership management to take the time to ap-

2. Conduct Multiple Interviews A quality hiring process does not have to be lengthy or complicated, but it does need to be focused. Insist that qualified candidates are interviewed a minimum of three times before extending an offer. Structure the process to allow your team to conduct multiple interviews during one visit. This allows the dealership to interview each candidate efficiently and thoroughly while eliminating the candidate’s need to return to the dealership for multiple interviews. It is also important that a different interviewer conduct each interview. The dealership will gain different perspectives on the applicant’s qualifications and will also create accountability for the candidate’s success if hired.

3. Ask the Right Questions The purpose of an interview is to determine whether a candidate is qualified for the position. Interviews should be both efficient and in-depth. In today’s highly competitive market for top talent, the dealership needs to ask questions to determine the candidate’s competency and capacity for growth and development. Ask non-traditional interview questions that require the applicant to think quickly and communicate clearly. Ask questions to reveal character and “trainability” rather than questions that simply reveal existing skills. These types of questions will provide the insight to determine a candidate’s work ethic, thought processes, communication style, and other strengths and weaknesses. www.msada.org

4. Change the Focus

Each interview should have a slightly different focus. Multiple interviews provide little value unless each round adds new insight into the professionalism, ability, and desire of the applicant. The first interview should be introductory in nature and give the interviewer the opportunity to engage the candidate in a way that reveals their work ethic and desire for the position. Ask questions about the candidate’s work history, and explore details of notable accomplishments, looking for both consistencies and inconsistencies in their story. Identify key strengths and weaknesses that can be evaluated in detail in subsequent interviews. The second interview should focus on evaluating the candidate’s core competencies. For example, if the applicant seeks a position in sales or on the service drive, ask questions to reveal the applicant’s ability to communicate clearly and show empathy. The third interview should focus on the applicant’s character. Character-focused questions will ensure that the dealership hires someone able to handle the day-to-day stress of working in a dealership. Ask questions that reveal instances when the candidate overcame adversity or broke through a barrier. While it is important that the interviewer remain professional, it is acceptable to allow the applicant to describe personal challenges and how these challenges have equipped the applicant for the position. High value should be given to individuals with a great attitude, core competencies, and the desire to learn new skills.

Hire the Right People The people a dealership chooses to hire are too valuable to allow shortcuts during the hiring process, because shortcuts often lead to costly mistakes. Implementing or changing a hiring process for the betterment of the organization is a key to effectively finding the right talent for the organization. After all, success almost always comes down to having the right people on your team. t

Massachusetts Auto Dealer OCTOBER 2016

19

20

NEWS from the NEWS from Around Around the Horn Horn from Around

NEWS the Horn

MSAMSAMSA-

WORCESTER

Ron Bouchard Racing Charity Donates Vans to Hope Lodge The inaugural Ron Bouchard Race for a Cure Golf Tournament raised funds to donate two new Honda Odyssey vans to Hope Lodge in Worcester in September. “The vans are a vital lifeline for cancer patients traveling daily from Hope Lodge to Worcester and Boston hospitals for cancer treatment,” said Debra Aharonian, Hope Lodge Director. “We desperately needed new vans, and we can’t thank the Bouchard family enough.” The Ron Bouchard Race for a Cure Tournament also served as a tribute to Bouchard, a noted New England NASCAR driver and auto dealer who passed away from cancer last December. The tournament, organized by the recently formed RB Racing Charity, is a non-profit serving the communities surrounding the Ron Bouchard Auto Stores that bear his name. Ron’s wife, Paula Bouchard, and their son, Chad, created the tournament and the charity. “What better way to keep Ronnie’s memory alive than to have his name on comfortable vans giving cancer patients their rides to treatment?”, said Paula Bouchard. “We remember how Ron embraced his community, his love of life, and his love for everyone close to him. Ron

OCTOBER 2016

Chad Bouchard and Paula Bouchard in front of Ron Bouchard’s Honda store in Lancaster.

is remembered for his generosity and his impact on everyone. Forming a charity in his name to give back to the community is what he would have wanted.”

Massachusetts Auto Dealer www.msada.org

NEWS from Around the Horn

MSADA

HOLYOKE

More than 300 Attend Gary Rome Hyundai Opening Gary Rome Hyundai celebrated its grand opening in early October, featuring Korean barbecue, music, and more than 300 well-wishers. The $10 million facility employs nearly 80 people on a 19-acre site that includes a car wash, state motor vehicle inspection station, and a Massachusetts Registry of Motor Vehicle office to obtain license plates. Elected officials participating included Holyoke Councilor at Large James M. Leahy, Holyoke May-

State Representative Aaron Vega, State Senator Eric Lesser, Jane and Gary Rome, and State Representative Angelo Puppolo at the Gary Rome Hyundai Ribbon Cutting and Grand Opening Celebration.

or Alex B. Morse, State Sen. Eric Lesser, State Rep. Angelo Puppolo, State Rep. Aaron M. Vega, Holyoke City Council President Kevin A. Jourdain, and Holyoke Councilor at Large Rebecca Lisi. Rome told The Springfield Republican that, after months of government hearings and permit-seeking from city boards, he wanted to hold the grand opening of the dealership to note the success of the business, which he said has increased at the new site. “We’re so excited with the result that I wanted to share the experience,” Rome said.

www.msada.org

Massachusetts Auto Dealer OCTOBER 2016

21

22

NEWS from Around the Horn DANVERS

CHELMSFORD

Honda North, Care Dimensions Raise $18K at Fundraiser

New AutoFair Location Profiled

Honda North, a member of the International Cars Ltd. family of dealerships, hosted the annual Walk for Hospice kick-off party in early October. The evening, benefitting Danvers-based Care Dimensions, drew more than 250 people to the Danvers auto dealership and raised more than $18,000 to support the Walk for Hospice at St. John’s Preparatory School in Danvers. Friends, employees, and North Shore residents sampled a variety of dishes and cocktails from numerous local restaurants participated in auctions and a raffle. The funds will help underwrite programming not covered by insurance, including grief counseling; palliative care programs for adults and children; and complementary therapies, including massage, pet, music, and Reiki. “I could have never imagined that, when we built Honda North, we’d be able to host such a terrific event as the Walk for Hospice party,” said Marshall Jespersen, dealer principal of International Cars Ltd., in a statement. “We’re so incredibly proud to partner with the team at Care Dimensions and support such a worthy cause as the Walk for Hospice.”

OCTOBER 2016

AutoFair Nissan of Chelmsford opened in mid-September after moving from its former Tewksbury location earlier this year. The Lowell Sun profiled the dealership’s move in advance of its November 14 grand opening. “It was just so cramped in Tewksbury,” General Manager Drew Hill told the paper. “We had a two-car showroom. We had 50 new cars and 60 used cars in storage down the street. It was just tough to do good business there.” The store was built on the lot of a former Sears and Party City store. Sean Fahy, president of Danvers-based Construction Management & Builders, Inc., the general contractor for the new facility, called the project “one of the most dramatic transformations of a nonauto use building to an auto dealership that we have built.” Hill told the paper that the dealership looks to hire 40 new employees in the coming months.

Massachusetts Auto Dealer www.msada.org

MSADA AUBURN

BELMONT

Herb Chambers Toyota Receives 2016 Auburn Award

Belmont Drives Electric Launches

Herb Chambers Toyota of Auburn has been selected for the 2016 Auburn Award in the “Automobile Dealers” category by the Auburn Award Program. Each year in and around the Auburn area, the Auburn Award Program identifies companies that they believe have achieved exceptional marketing success in their local community and business category. These are local companies that enhance the positive image of small business through service to their customers and our community. These exceptional companies help make the Auburn area a great place to live, work, and play. Various sources of information were gathered and analyzed to choose the winners in each category. Winners are determined based on the information gathered both internally by the Auburn Award Program and data provided by third parties. “To have our Auburn dealership recognized as a positive example in the business community is very meaningful to us,” said Herb Chambers. “Our dedicated team strives to achieve the ideals set forth in the Auburn Award Program every day, and we’re very proud to be considered among the top local companies.”

Belmont Drives Electric, a new community program sponsored by the Belmont Energy Committee, Belmont Light, and Sustainable Belmont, is an initiative designed to promote the benefits of electric vehicles. The program will also provide rebates, incentives, and free test drives to residents interested in owning an electric vehicle. Local dealerships, including Clay Nissan of Newton, Watertown Ford, Boston Volkswagen of Watertown, Herb Chambers BMW of Boston, and Mirak Chevrolet of Arlington, have partnered with the program to offer pre-negotiated deals on cars. The campaign kicked-off with two test drive events at Belmont High School in mid-October. t

www.msada.org

Massachusetts Auto Dealer OCTOBER 2016

23

MSADA

24

OCTOBER 2016

Massachusetts Auto Dealer www.msada.org

MSADA AUTO OUTLOOK

TRUCK CORNER

25

Help Truck Dealers’ Families After Floods and Hurricane Dealership employees need help after flooding in Baton Rouge and southern coast

By Steve Parker

Baltimore Potomac Truck Centers ATD Chairman

As Hurricane Matthew pummeled the southern East Coast in October, it is a terrible reminder of the devastation that violent storms and flooding can have on the people in its path. On behalf of ATD, I would like to extend our solidarity and support to all fellow truck dealers and their employees who have been affected. And let us not forget that the residents of Baton Rouge, Louisiana, also are still recovering from their own flood disaster just two months ago. ATD is ready, and I am announcing a call for help throughout the industry. On August 15, the residents of Baton Rouge woke up to the worst flood disaster in the United States since Hurricane Sandy. As much as 22 inches of rain fell in the course of two days, and more than 140,000 families were displaced in the flooding. Hundreds of our fellow dealership families were forced to evacuate their homes. Our fellow truck dealer Jodie Teuton is the ATD Kenworth Line Representative, and her dealership is located in the city. Fortunately, it did not sustain severe flood damage, but several of her employees lost everything. An estimated 60 to 80 dealerships within Baton Rouge’s flooded areas are struggling with staff shortages. Many employees cannot physically make it to the stores, and they are still dealing with the loss of their own homes or vehicles. Other truck dealers did not emerge from Hurricane Matthew unscathed, either. The tropical cyclone caused severe flooding and damages to four states in particular—Florida, Georgia, South Carolina and North Carolina. One fellow ATD dealer is suffering from a power outage at his dealerships in South Carolina. Our fellow truck dealers, their staffs, and their families need our help and they need it now. On behalf of ATD, I am asking our fellow dealers to help by making a tax-deductible contribution to the NADA Foundation’s Emergency Relief Fund today. With a $1,000 donation, you can “adopt” a truck dealership family in Baton Rouge and support their challenging time of rebuilding. Or you can contribute any amount of your choosing to those affected by the Baton Rouge or Hurricane Matthew disasters. NADA President Peter Welch has announced that NADA’s ultimate goal is to raise $2 million for the relief efforts.

NADA and ATD have mobilized and prioritized the relief efforts for many emergencies and natural disasters over the years. The NADA Foundation, which serves as the philanthropic arm of our association, was established in 1975. It is involved with diverse charitable projects, such as emergency and natural disaster relief, educational and road safety grants, as well as CPR training mannequins for organizations in all 50 states. The Foundation proudly has aided in the relief efforts of dealership families who have suffered through Hurricane Katrina, Superstorm Sandy, and the plant explosion in West Texas, just to name a few. This is all made possible by the contributions from our members like you. If you have not yet contributed to the NADA Foundation, I welcome your future contribution. Thanks to the NADA Foundation’s Emergency Relief Fund, we have been able to provide critical resources for those in need after times of natural disasters just like this. Thanks to the donations of individuals, dealerships, dealer associations, and our industry partners, the foundation has distributed more than $600,000 in relief checks to 450 dealership employees who were affected in Baton Rouge. But there is still so much more to do, especially after Hurricane Matthew. The need for financial assistance is great, and it will last for many weeks to come. Truck dealers are not only the finest entrepreneurs but they also are the finest humanitarians. When fellow dealers are in jeopardy, we are there. I am proud to have made a contribution to the fund, and I ask you to join me in ATD’s relief efforts. Visit www.nada.org/EmergencyRelief to donate today or call (703) 821-7102.

www.msada.org

t Parker is chairman of ATD, a division of NADA in Tysons Corner, Virginia, which represents 1,800 heavy- and medium-duty truck dealerships. He is president of Baltimore Potomac Truck Centers in Linthicum, Maryland., which operates five fullservice commercial truck dealership locations with Mack, Volvo, and Hino Trucks franchises in Maryland and Virginia. Massachusetts Auto Dealer OCTOBER 2016

26 SEPTEMBER 2016

OCTOBER 2016

Massachusetts Auto Dealer www.msada.org

MSADA

www.msada.org

Massachusetts Auto Dealer OCTOBER 2016

27

SEPTEMBER 2016

Massachusetts Auto Dealer www.msada.org

NADA Update

By Don Sudbay

Working Toward Fairness Don Sudbay, President of Sudbay Automotive Group, represents MSADA members on the NADA Board of Directors. He welcomes your

questions

and

concerns

(donsudbayjr@sudbay.com). I have just returned from the NADA Fall Board meeting in California. While we all know that legislative and regulatory issues are so important to our industry, the issues between dealers and manufacturers are equally important. As your elected representative, I have tried to make certain that manufacturer/dealer issues are fully on the agenda. Over the last several years I have seen numerous initiatives by the manufacturers not be in the best interests of our dealer members. These include “stair-step” programs, unrealistic showroom update programs, IVC’s (instant value certificates), and now select deep discounts on certain vehicles in our inventories. All of these programs make for a confusing and misleading journey for our customers in their quest to purchase a new car or truck. I have seen examples where a dealer’s loyal customers have been forced to drive many miles to a dealership that had a “tag vehicle”. Many of these programs result in an uneven playing field for many of our dealers. I am firmly committed as your representative to address these issues. Please contact me with your concerns or questions. My email is donsudbayjr@sudbay.com and my cell number is (978) 265-3528.

Commentary: Grassroots Advocacy – Getting Involved Makes a Difference By Jeff Carlson, NADA Chairman

The National Automobile Dealers Association was formed in 1917 when a small group of auto dealers came to Washington, D.C., and successfully lobbied Congress against a proposed luxury tax on automobiles. For nearly 100 years, NADA has been advocating fiercely for new-car dealers on Capitol Hill. However, the work of NADA’s legislative and lobbying staff cannot be done alone. The nation’s 16,500 dealerships, which provided and supported more than 2.2 million private-sector jobs totaling $144 billion in employee compensation last year, need to engage and support NADA’s grassroots efforts back home in Congressional districts across the

country by building long-term relationships with elected officials. There are many members of Congress who do not understand how an auto dealership operates, despite purchasing vehicles for their families and their campaigns. When elected officials learn and understand the retail-auto industry, they become better informed about how their decisions in Washington affect the ability of dealers to invest and grow their businesses. And when future public policy issues arise, they can rely on those relationships to consult with local dealers. For information about inviting a member of Congress to your dealership, contact Patrick Calpin, NADA director of grassroots advocacy, at (202) 547-5500 or pcalpin@nada. org or visit www.nada.org/grassroots. Patrick can personally assist and connect you with your legislators along with scheduling and coordinating the visit. He can also help ensure that you are prepared with talking points and copies of NADA issue sheets to share with the legislator during the visit. As the retail-auto industry continues to grow, our grassroots dealer network continues to evolve and our level of involvement needs to be strengthened. By building these relationships with the lawmakers we elect to represent us in Congress, we can take the first step to protect and grow our businesses, much like those dealers did nearly 100 years ago.

NADA Puts Michigan Dealer Wes Lutz in Line to be 2018 Chairman NADA chose Michigan dealer Wes Lutz to be its 2017 vice chairman, putting him in line to be chairman in 2018. Lutz, owner of Extreme Chrysler-Dodge-Jeep-Ram in Jackson, Michigan, was elected by the association’s board at its Fall meeting in Rancho Mirage, California, this month. He currently leads the organization’s regulatory affairs committee. As expected, the board elected Illinois dealer and current Vice Chairman Mark Scarpelli to succeed Chairman Jeff Carlson. Scarpelli, 52, will take over in January at the NADA convention in New Orleans. Scarpelli is president of Raymond Chevrolet and Raymond Kia in Antioch, Illinois, and co-owner of Ray Chevrolet in Fox Lake, Illinois. Delaware dealer Bill Willis was re-elected as secretary. He is president of Willis Automotive Group (ChevroletBuick-Ford) in Smyrna, Delaware. Nebraska dealer Brian Hamilton will be treasurer. He is president of Midway Chevrolet-Cadillac-Buick and Midway Chrysler-DodgeJeep in Kearney as well as Beardmore Subaru.

www.msada.org

Massachusetts Auto Dealer OCTOBER 2016

29

30

MSADA

NADA Update Federal Appeals Court Finds Structure of CFPB Unconstitutional A federal appeals court this month ruled the structure of the Consumer Financial Protection Bureau is unconstitutional, setting aside a closely watched enforcement action against a mortgage lender and handing a considerable blow to the five-year-old agency. The decision by the U.S. Court of Appeals for the District of Columbia Circuit said the consumer-finance watchdog violated the Constitution’s separation of powers, because its director isn’t sufficiently answerable to the president. It rejected the idea of shutting down the CFPB, and instead said the remedy is to give the president the power to remove the agency’s director at will and to supervise and direct the director. The court also sent the enforcement action back to the CFPB for review. The CFPB, created by a Democratic Congress after the 2008 financial crisis and long-criticized by Republicans, is headed by a single director who can be removed by the president only for cause. “In light of the consistent historical practice under which independent agencies have been headed by multiple commissioners or board members, and in light of the threat to individual liberty posed by a single-Director independent agency ... We therefore hold that the CFPB is unconstitutionally structured,” the court said. The ruling by Judge Brett Kavanaugh allowed the CFPB to continue operating as an agency, but ordered a restructuring of how it operates in the executive branch.

Mark Fields Joins NADA Convention Speaker Lineup in New Orleans Mark Fields, president and CEO of Ford Motor Company, will sit down with NADA Chairman Jeff Carlson for a fireside chat during the opening general session of the 2017 NADA Convention and Expo in New Orleans on Friday, January 27. Other speakers at the NADA convention, which runs from Thursday, January 26, to Sunday, January 29 include NADA Chairman Jeff Carlson, NADA Vice Chairman Mark Scarpelli, and [ITAL] New York Times best-selling authors, comedian Jim Gaffigan and inspirational speaker Amy Purdy. Additional speakers will be announced in the coming weeks. NADA, founded in 1917, will kick off year-long events commemorating its 100-year anniversary with NADA 100 Carnival, which will be held at Mardi Gras World on Thursday, January 26. The Carnival will feature top New Orleans cuisine and musical entertainment from Foreigner, Cowboy Mouth, and jazz favorites. Admission is complimentary for NADA and ATD members, international affiliates, and registered spouses and relatives. Non-member dealers, managers, and international affiliate registration categories are required to purchase a OCTOBER 2016

ticket, which can be purchased during the online registration process. Due to limited space, Allied Industry registrants are not eligible to purchase a ticket. The four-day NADA convention includes dealer franchise meetings, workshops, a sold out Expo, and numerous networking events. NADA member dealers and managers who register online by January 20, 2017, will receive a $75 advance registration discount from the onsite rate. Hotel rooms are filling up quickly. Twenty-one hotels in NADA’s convention block have already sold out. To register, visit www.nadaconvention.org.