Timing the market

LOOKING BACK TO MOVE FORWARD

WHERE TO FIND OPPORTUNITIES IN THE CURRENT ECONOMY

THE YEAR OF THE SHOPPING CENTER

TM SPRING/SUMMER 2023

FEATURED articles THE YEAR OF THE SHOPPING CENTER How the Sector Found Its Footing 32 LOOKING BACK TO MOVE FORWARD How the Great Financial Crisis Compares to Today’s Market 07 MARKETS TO WATCH Where to Find Opportunities in the Current Economy 16

52 HOSPITALITY SUCCESS IN 2023 56 MIDWEST SPOTLIGHT A Look at Multifamily Performance 64 INCREASING PROPERTY VALUE OF SELF-STORAGE FACILITIES 68 THE ROAD TO RECOVERY A Capital Markets Overview 74 MOM-AND-POP Top Leasing Trends to Watch 80 THE FUTURE OF MEDTAIL Trends Transforming Healthcare 84 HOW TO CAPITALIZE IN A DOWN MARKET 07 LOOKING BACK TO MOVE FORWARD How the Great Financial Crisis Compares to Today’s Market 16 MARKETS TO WATCH Where to Find Opportunities in the Current Economy 28 WHAT’S BEHIND THE RECENT DECLINE IN APARTMENT RENTS? 32 THE YEAR OF THE SHOPPING CENTER How the Sector Found Its Footing 38 SECURING STABILITY Why Invest in Government Tenants 43 INDUSTRIAL DEVELOPMENT Movement in the Markets 49 CONTRARIAN APPROACH What. Why. How. TABLE OF CONTENTS

Contributors

Executives

Kyle Matthews

David Harrington

Raddie Zlatkov

Duerk Brewer

Sean Clancy

Paul Mudrich

Featured Agents

Adam Feldman

Austin McLeod

Brian Brady

Catherine Lueckel

Clark Finney

Publications

Kaylee Stock

Lauren Huling

Leanne Jenkins

Lori Valencia

Matt Fitzgerald

Bill Pedersen

Cliff Carnes

Michael Pakravan

Ben Snyder

Daniel Withers

Maxx Bauman

Hutt Cooke

Chuck Evans

Laura Gonzales

Andrew Gross

Keegan Mulcahy

Bob Osbrink

Kurt Sauer

L.B. Sierra

David Treadwell

Matthew Wallace

J. A. Charles Wright

Corey Selenski

Devon Dykstra

DeWitt Goss

Finley Askin

Gene Mello

Design

Erica Ragland

Marina Rubio

Brooke Farris

Alfonso Lomeli

Harrison Auerbach

Hunter Reynolds

Jacob Friedman

Kate Dockery

Matt LoPiccolo

Michael Federico

Mitchell Glasson

Ryan Kawai Sanchez

Thomas Wilkinson

Explore the mindsets, mentality, and motivations of people who have achieved the pinnacle of success in their respective professions.

Listen, Watch, Subscribe Scan to visit website

8 | SPRING/SUMMER 2023

10 | SPRING/SUMMER 2023

MATTHEWS™ | 11

12 | SPRING/SUMMER 2023

MATTHEWS™ | 13

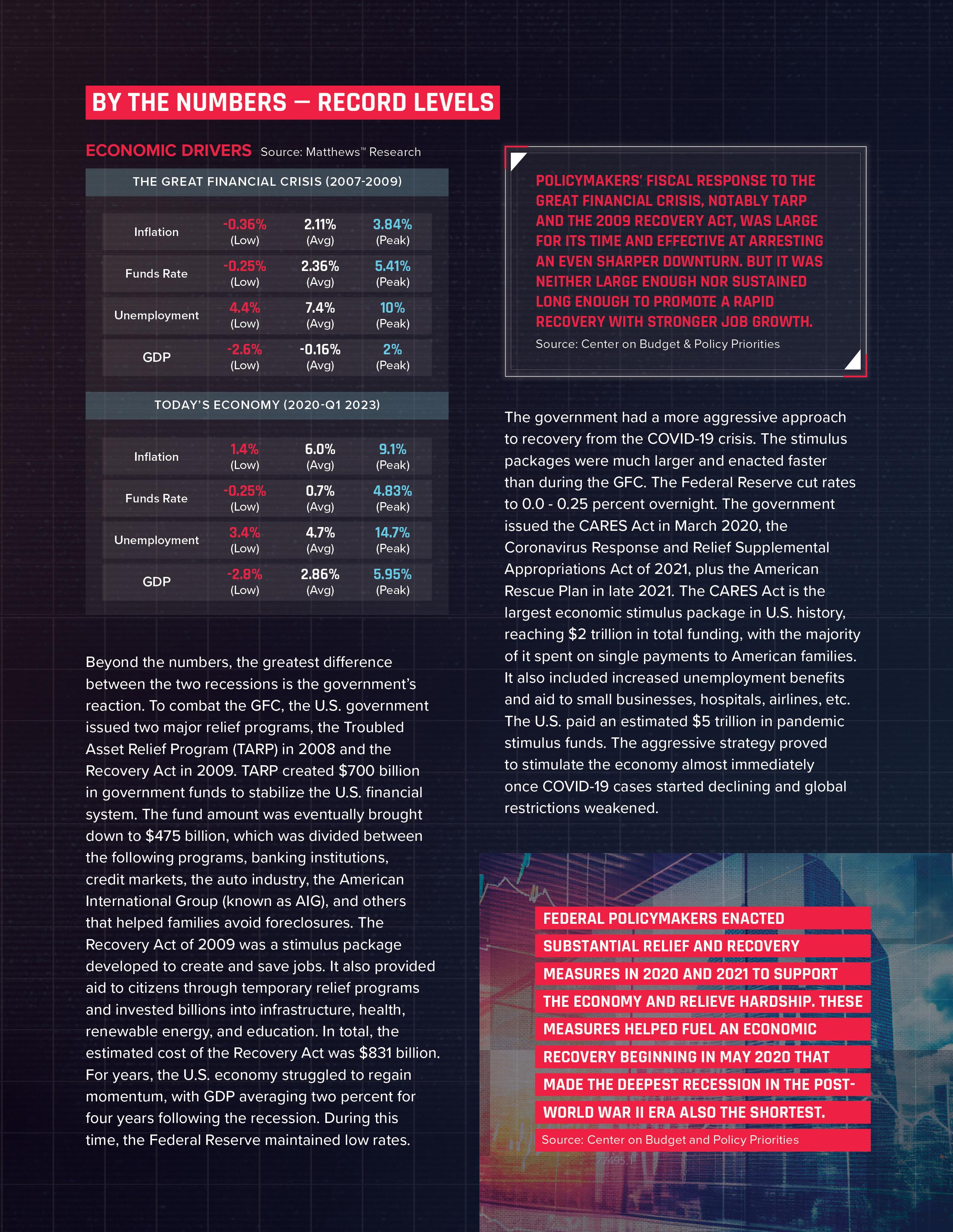

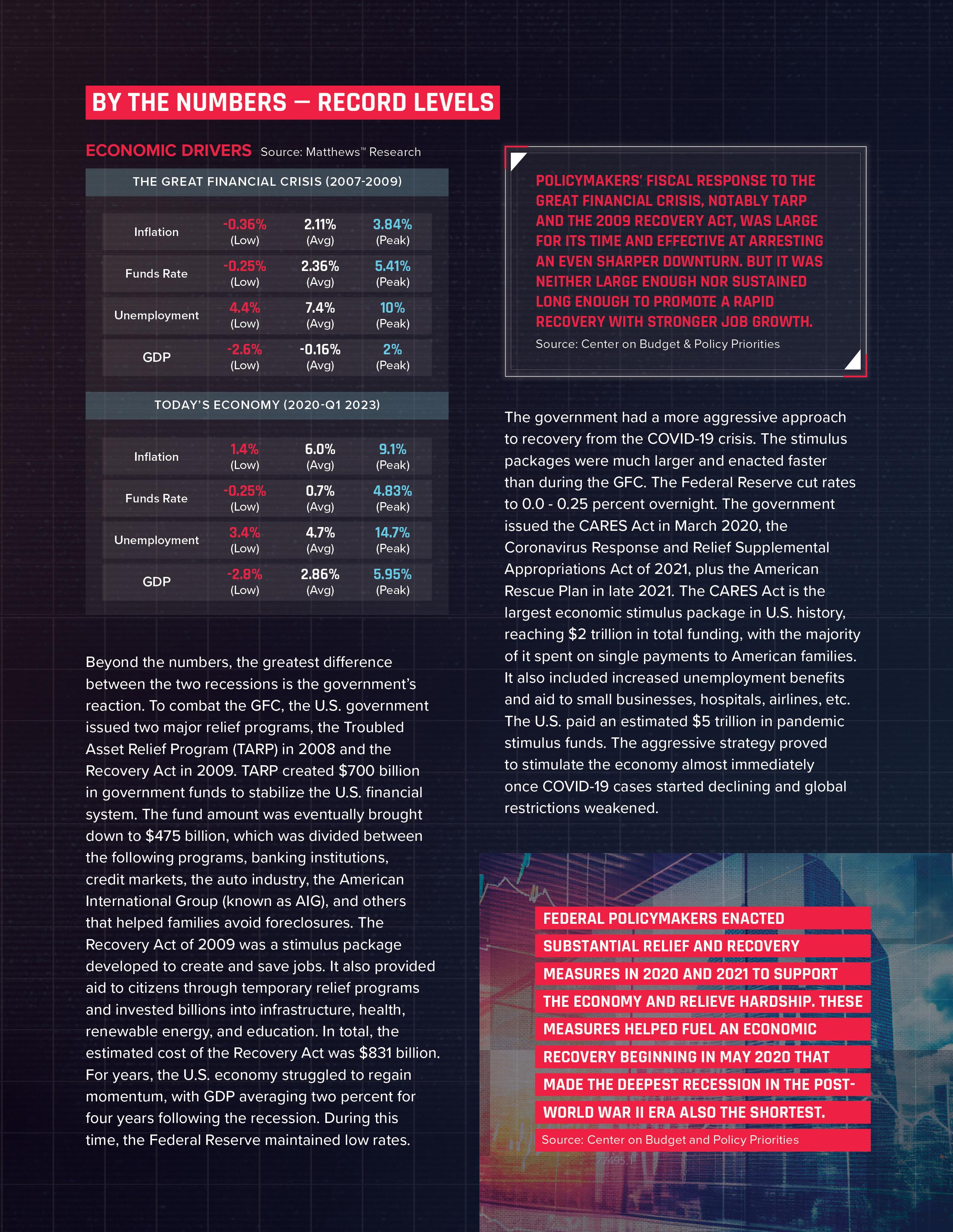

Investors entered 2023 on uncertain footing, facing a different investment landscape compared to the start of the previous year. The front-loaded nature of real estate growth in 2022 decreased as economic growth and supply shocks drove inflation to record levels. Today’s commercial real estate landscape presents some challenges (and opportunities) for investors trying to navigate the uncertainty.

THE FACTORS THAT DETERMINE WHERE TO PLANT CAPITAL

Overall, markets across the U.S. are down as transaction activity decreased, with investors pausing to reassess the risks they face and underwrite appropriately. While it is clear that sentiment is weak, this pause in activity has provided some real estate professionals with time to reposition their portfolios to ride out the current slump and plan for another period of sustained growth and strong returns, and others with opportunities to buy at discounted prices.

This report highlights the markets investors are targeting now and, in the future, based on factors such as population growth, economic growth, job growth, affordability, and real estate market conditions. These factors are only a selection of the growing number of inputs that drive asset performance in certain markets despite an increasingly complex investment environment. These outlooks will largely be dictated by inflation and how the Fed responds throughout 2023. The big six markets – Chicago, Boston, Los Angeles, New York City, San Francisco, and Washington, D.C. – are facing a more pronounced inflationary cycle due to already inflated prices than the rest of the nation. Higher interest rates amid the spike in the cost of living are expected to weaken demand in these markets, pushing investors to explore options outside the big six mentioned above.

16 | SPRING/SUMMER 2023

The Top Three

ALL EYES ARE ON THE SOUTH

It’s important to note that the markets mentioned are primarily located along the Sunbelt, with Northern New Jersey as an outlier. Following the pandemicinduced changes on what aspects are essential for business operations and residents, population and rapid economic growth along the Sunbelt increased. The Sunbelt holds approximately 50 percent of the national population (326 million), which is expected to rise to about 55 percent by 2030. From the affordable nature of the markets across the region to tax-friendliness and quality of life, the Sunbelt’s markets are expected to grow faster than any others in the nation.

Nashville Dallas-Fort Worth Atlanta

Nashville is ranked at the top of the markets to watch list as it holds one of the strongest office-job markets in the nation and benefits from expanding industrial, automotive, and healthcare industries. Several large corporations have announced headquarters relocations or expansion plans to the market for its businessfriendly environment.

Dallas-Fort Worth took the number-two spot as many investors witnessed the fastgrowing market’s ability to balance the continuous supply with corresponding absorption. Compared to other markets, DFW makes a point to adequately expand infrastructure alongside real estate development, the failure to do this is an impediment to growth.

Dubbed “The New York of the South,” Atlanta is poised to experience the most population growth in 2023, according to the National Association of Realtors. Atlanta’s metro area population increased by 1.55 percent in 2023 from 2022 and 1.73 percent in 2021 versus 2020.

MATTHEWS™ | 17

AN IN-DEPTH LOOK AT THE MARKETS

NASHVILLE TENNESSEE

Nashville has made monumental strides in growth, including population, construction, and employment. Household formation has more than doubled the national average, partly due to the numerous significant universities that call the metro home. Additionally, millennials account for a majority of the population growth, thanks to the ever-expanding job market.

"The quality of life that Nashville provides is a principal cause as to why people are moving here. There is a much lower cost of living compared to larger coastal markets, and wages continue to grow. Nashville attracts and produces talented workers, and large companies like Oracle and Amazon recognize that. These large companies are moving high-paying jobs to the market, bringing in talent while maintaining a strong quality of life for their employees."

HUTT COOKE

Nashville Market Leader

The developers and investors interested in Nashville provide insight into the market’s trajectory. Buyers continue to make their way to the area, but with a

different regularity than in 2021 and early 2022. Rising rates have impacted local deal flow in the market, but that hasn’t stopped the flight toward quality. All sectors of CRE are seeking top-quality assets, introducing the under-construction pipeline with spec builds and build-to-suits, with other projects waiting in the wings.

The industrial market continues to flourish from above historical norms, benefiting from the national logistics boom occurring since the onset of the pandemic. Nashville’s geographic position allows companies based here to reach over half the country’s population in roughly a day’s drive, helping the market attract third-party logistics firms, e-commerce companies, and retailers.

Over the past several years, the above-average economic and population growth has helped boost Nashville’s retail market, allowing property owners to raise rents briskly. In fact, Nashville’s retail rents have increased at one of the fastest rates in the country over the past 12 months, with annual rent growth coming in at an impressive 7.8 percent.

18 | SPRING/SUMMER 2023

DALLAS-FORT WORTH TEXAS

Many experts deem DFW as one of the best markets for overall real estate prospects. Over time, the economic fabric of DFW has become more diversified, with a global reach that resembles that of a big six market. Employment growth is expected to outperform the national benchmark over the next five years. Meanwhile, household incomes continue to rise. Over recent years, median household incomes have grown about four percent annually and are now tracking near $80,000.

"The Dallas-Fort Worth market is a top performer for several reasons. First, it has a strong and diverse economy, with major industries ranging from healthcare and finance to technology and logistics. This diversity helps to mitigate the impact of economic downturns in any one sector.

The market also benefits from its central location in the United States, making it a hub for transportation and distribution. This has led to a thriving logistics industry, with major companies such as FedEx and UPS having significant operations in the area.

Another factor contributing to the strength of the DFW market is its relatively affordable cost of living and business-friendly environment. Finally, the DFW market has seen significant population growth in recent years, with projections indicating continued growth in the future. This growth has fueled demand for housing, commercial real estate, and other services, contributing to the overall strength of the market."

ANDREW GROSS Dallas Market Leader

Robust economic underpinnings have fostered a healthy commercial real estate market. Outperforming demand and rent growth across all CRE sectors have driven interest from investors, pushing sales volume and asset pricing higher. The most substantial shift in growth on record occurred over the past two years. While investors remain keen on the long-run structural advantages of DFW, deal volume was curbed by rising interest rates, which have weighed on investor sentiment. Despite this, continuous supply and leading absorption levels make DFW one of the country’s fastest-growing and balanced markets.

Development within the multifamily market is strong, tracing robust population growth in the region. The trend runs counter to several other major Sunbelt markets whose pipelines are starting to settle after swelling the past two years. Healthy job growth and continuous in-migration are two primary drivers of apartment demand in the metroplex. Since 2010, the market has added about 200,000 new multifamily units, growing its inventory by 33 percent, the most among major markets in the country. The DFW industrial market is also undergoing a massive expansion, as developers can work quickly, thanks to abundant and relatively cheap land. The metroplex is in an excellent position due in part to its central location in the U.S., excellent highway and rail networks, and world-class airports.

MATTHEWS™ | 19

ATLANTA GEORGIA

In recent years, the Southeast has transformed into a hot spot for population and business growth, positioning its real estate to be one of the best performing in the country. The transitionary growth has reached beyond well-known metros and into secondary cities across the market, helping commercial real estate accomplish record-level investment activity. In 2023, the market has downshifted slightly after a record run of tightening vacancies and escalating leasing activity.

Few retail markets, for both owners and tenants, are enjoying success like Atlanta. Space is absorbed quickly, investment demand is present, rent growth is healthy, and pricing power remains with landlords. Interest rate hikes, inflation, and rising debt costs haven’t deterred investors from buying in Atlanta, primarily centers with high-profile national

retailers with good credit. Tenants are still willing to pay higher rents in well-located centers near Atlanta’s varied pockets of strong buying power, growing neighborhoods, and recovering office markets. Unanchored strip center cap rates were up 74 basis points, while the cap rates for groceryanchored centers have risen by 50 basis points as investors flock to those investments. Retail vacancy decreased to the lowest figure in Atlanta’s history, 3.5 percent, after almost 2.8 million square feet were absorbed in 2022, twice as much as in 2021.

Atlanta remains one of the country’s least expensive major industrial markets, commanding significant rent increases but still discounted compared to other large West and East Coast distribution markets. In the multifamily sector, absorption is flat across an inventory nearing 500,000 market-rate units.

20 | SPRING/SUMMER 2023

AUSTIN

The expansive Austin market remains a top market for people to work and live. It is home to a booming tech industry and plentiful employment opportunities, attracting many young professionals. Even with employers, particularly in the tech sector, cutting back on labor costs, the economy continues to add jobs and grow at an annual rate of 4.2 percent. Since 2010, the market has experienced over 25 percent growth in population, with 120 to 150 people moving to the capital daily. Austin has a hefty development pipeline across multiple CRE sectors to accommodate population growth, boasting the third-largest construction pipeline in the country. However, many professionals anticipate supply-side risk as these deliveries become available.

While the Austin market has not been immune to softening in demand, the multifamily sector is still outperforming many other markets nationwide, thanks in part to the resilient labor market. Annual multifamily net absorption as a share of inventory leads the nation’s largest 50 markets, with roughly 6,700 units absorbed within the last 12 months.

Further, the market has approximately 15.6 percent of the market’s existing inventory underway, equivalent to around 42,000 units.

Again, motivated by a lower cost of doing business, access to a growing talent pool, and one of the fastest-growing populations in the country, industrial users continue to make Austin a destination for their relocation or expansion plans. Approximately 17.5 million square feet of space is currently under construction, primarily speculative development.

Austin hasn’t reached the end of the runway yet in terms of expansion. The market is facing its fair share of growing pains as the rapid-fire population continues, resulting in limited land availability, price increases, affordability concerns, and infrastructure challenges. Austin won’t be slowing its roll any time soon as creative developments, redevelopments, and relocations continue to pop up.

MATTHEWS™ | 21

TEXAS

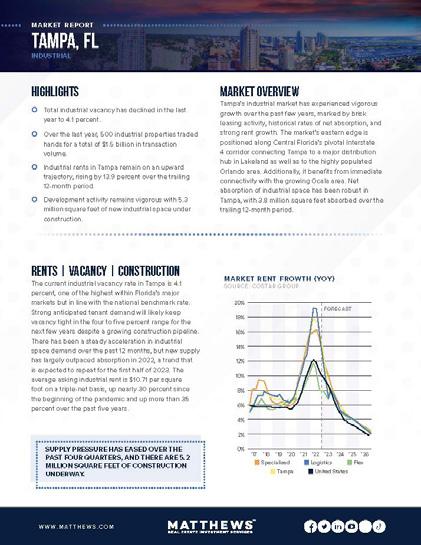

TAMPA/ST. PETERSBURG FLORIDA

Tampa’s economy has been quite strong in recent years, and its labor market remains one of the strongest in Florida. Job growth has been the market’s biggest success story over the past decade, but population growth has been equally impressive. Oxford economics predicts a population gain on average of one percent from 2022 to 2026. The market, however, doesn’t come without its fair share of challenges, including a below-average medium-income level of $65,000, which trails the U.S. average by 10 percent. Despite this, the market has many factors to help offset the large spread, including no state income tax and one of the nation’s most affordable housing markets.

“It seems like every day you hear Tampa being mentioned in the news. From being named one of Time Magazine’s top 50 “World’s Greatest Places” or hearing national and global corporations being bullish on the Tampa market, Tampa has certainly seen its fair share of recognition. Despite some market headwinds, the commercial real estate market continues to see impressive activity in all facets of the market.”

L.B. SIERRA, Tampa Market Leader

Retail, multifamily, and industrial have experienced vigorous growth over the past few years. Unprecedented levels of multifamily demand have fueled rent growth by roughly 25 percent through the beginning of 2022, but following a recent significant supply wave, the apartment vacancy rate has increased to 7.5 percent. Tampa’s industrial market has seen historical net absorption rates and strong rent growth. The sector is in a great position as Tampa connects to major distribution hubs throughout Florida.

RALEIGH/DURHAM NORTH CAROLINA

In 2022, the Raleigh/Durham market was ranked the fourth fastest-growing city in the U.S., according to the Kenan Institute’s report known as the American Growth Project. The growth is attributed to increases in employment, with companies moving into and hiring from the area. The market is known for its “research triangle,” a powerhouse for biotech, technology, life sciences, manufacturing, and finance, even amid possible cuts in the industry nationwide. This created growth in itself, but with that growth, a rising cost of living followed, pushing many to rent instead of buy. Over the past decade, Raleigh has gained more than 260,000 residents, nearly tripling the national growth rate, according to Carolina Demographic. In the next 15 years, the region expects to expand by another 125,000 residents.

Underpinned by the growth, Raleigh/Durham’s commercial real estate is reaping the same benefits. Retail rents have increased across all asset types at rates well above the national levels, though rent growth may have peaked in late 2022, and moderation is expected for the rest of 2023. Vacancies remain incredibly tight at just 2.5 percent and an availability rate of just 3.4 percent. Growth is robust for power centers, grocery stores, and other necessity-based retailers. A significant trend across the industry is properties being purchased for redevelopment purposes into higher uses. New construction is expanding south and east into outlying communities.

Demand for e-commerce and other distribution operations is strong, particularly towards the western side of the metro. The market’s robust pipeline will likely cause a further rise in the vacancy rate, though it is expected to stay below the region’s historical average. Investors have shown strong interest in Durham, and sales volume is near an alltime high, despite current market conditions.

22 | SPRING/SUMMER 2023

MIAMI/FT. LAUDERDALE FLORIDA

South Florida has always been highly dependent on tourism but has evolved, and Miami now ranks as one of the world’s top cities. South Florida’s high rankings and growing population have spurred the startup network for tech and new businesses in Miami and Fort Lauderdale. Oxford Economics forecasts that Miami will see job growth of 1.2 percent in 2023. The luxury single-family housing market is a significant driver for the growth seen in both metros, translating into immense development in commercial real estate.

"The South Florida commercial market is a top performer nationwide as it continues to benefit from the migration of people, companies, and significant wealth from other parts of the country as well as internationally. What makes South Florida an enticing market is not just the massive population and job growth, but also the high volume of real estate assets with attractive returns and safety for the capital of domestic and international investors. The lack of income tax, high tourism and robust consumer spending will continue to keep South Florida among the top commercial markets across the country. As such, it is poised for

Fort Lauderdale Associate Market Leader

The retail market has seen 1.7 million square feet delivered over the past three years, and there are currently 590,000 square feet underway.

The industrial market has delivered 13.2 million square feet or a cumulative inventory expansion of 5.3 percent over the past three years. The multifamily market has delivered 12,000 units over the past three years or a cumulative inventory expansion of 9.9 percent from 2022 to 2023. There are also 13,000 multifamily units currently underway, representing the largest under-construction pipeline in over three years. Retail rents rose 10.7 percent on an annual rate during the first quarter of 2023 and have posted an average yearly gain of 6.5 percent over the past three years. Industrial rents in Miami rose 17.3 percent and Fort Lauderdale 16.4 percent annually during Q1 2023.

In the office space, the average square footage leased has increased from 500 square feet to 2,500 square feet due to the migration of out-of-state firms to the region. Trends such as co-working office spaces have also played a significant role in filling tenant demand.

With South Florida’s industrial, office, and retail sectors holding steady, growth is expected in 2023. In 2022, Blackstone invested $1.3 billion into industrial properties in Miami-Dade County, an indicator that South Florida’s commercial real estate market will continue to perform in 2023. Additionally, Prologis acquired $1.1 billion worth of industrial properties, pushing asking rents to record highs in the county.

continued growth and success in the future."

DEVON DYKSTRA

MATTHEWS™ | 23

PHOENIX ARIZONA

The Phoenix MSA has a population of approximately 4.95 million, a slight increase from the previous year of over 4.6 million. In addition to the population growth, a diversifying economy, relative affordability, and business-friendly regulation have strengthened Phoenix’s value proposition. These characteristics attract more than 200 people to the market daily. Phoenix remains one of the nation’s best-performing markets for employment growth recording more than 75,000 job additions in 2022. As Phoenix continues to boom, many out-of-state investors, particularly from California, have expanded their portfolios due to proximity, higher yields, and stronger cap rates.

"The growth of The Valley is similar to the "Path of Progress" that occurred in Southern California in the 1980s and 1990s. Los Angeles got expensive and crowded, which pushed its growth to Orange County. As Orange County grew, the Inland Empire became a desired location for businesses and homeownership. As Southern California experiences high taxes and restrictions on development, the "path" is now into Arizona, particularly the Greater Phoenix market. This is the beginning of this growth pattern and should keep Arizona's economy expanding for decades."

BOB OSBRINK

Phoenix Market Leader

Multifamily supply is outpacing demand, as absorption moderated and construction activity ramped up, causing vacancies to rapidly increase. As a result, annual rent growth has turned negative and concession usage has increased. However, the long-term outlook for fundamentals is positive due to Phoenix having the country's strongest employment and household growth and low levels of singlefamily inventory.

The retail market conditions are the tightest they’ve been in recent memory. The MSA may be approaching a supply-constrained market, not because demand is slowing but because retailers are struggling to find space. The construction pipeline remains muted as construction costs are higher and financing for speculative construction is constricted. These dynamics support healthy rent growth; market rents have risen 7.7 percent over the past 12 months. In the industrial sector, the market faces one of the most aggressive construction pipelines in the U.S., with 45.6 million square feet scheduled to be delivered in 2023. This underlying demand is driven by Phoenix’s strong momentum in various industrial-related sectors. Plus, The Valley plays a crucial role in national supply chains, boasting a rapidly expanding consumer base and advanced manufacturing industries.

24 | SPRING/SUMMER 2023

CHARLOTTE NORTH CAROLINA

Nicknamed the Queen City, this rapidly growing Sunbelt market is attractive to many professionals and developing businesses. The market has witnessed massive inbound migration, averaging nearly 100 new people moving to Charlotte each day, and the population is projected to grow by 50 percent by 2030. The area’s robust economy, lower cost of living, and businessfriendly government drive the steadily increasing population. Charlotte is a global hub for businesses with thriving healthcare and financial services. The market is home to the headquarters of three of the nation’s six largest banks – Bank of America, Wells Fargo, and Truist. The relative strength of the financial industry bolstered the market economy through the most recent economic downturn. But, of course, there is a lot more to Charlotte than just business.

Charlotte’s commercial real estate marketplace draws investors and tenants across the county. It is bolstered by demographic tailwinds that bring in new residents with greater education and higher incomes, further fueling economic activity in the region. Charlotte’s apartment inventory is expanding fast, and the market’s construction pipeline, on a percentage basis, remains in the top 10 among U.S. metros. There are currently 30,000 units under construction, representing 14.4 percent of the existing inventory. However, the supply surge led to a slowdown in rent growth heading through early 2023. The industrial market has seen great success due to its proximity to major markets and recent investments in infrastructure. The market expanded its industrial inventory by more than 15 percent. The retail market saw bolstered consumer spending. A recently released census report shows that Charlotte’s market grew by 1.2 percent, making it the seventh-fastest growing large metro in the county, levering the brick-andmortar retail space despite economic uncertainty and the shift to online shopping.

MATTHEWS™ | 25

NORTHERN NEW JERSEY

The Southern and Western portions of the U.S. have been the focus of demographic shifts in the country. Still, the Northeast also sees promising migration numbers, especially in the Northern part of New Jersey. Despite New Jersey being ranked as one of the top outbound states of 2022 due to a high cost of living, the northern portion of the state is among the most popular destinations for renters and has one of the strongest industrial markets in the nation. Like many suburban markets throughout the U.S., the metro has benefitted from robust demand due to residents relocating from more densely populated areas, like New York.

The Northern New Jersey multifamily market sees record-high occupancy rates, gross deliveries, asking rents, and asset pricing. A primary driver is the high home prices and surge in mortgage rates, pushing more would-be buyers toward the apartment rental market. According to a recent Yardi RentCafe analysis, North Jersey is the most competitive rental market in the U.S., outpacing the Sunbelt. North Jersey outranked many other major markets regarding the number of days apartments were vacant, occupancy percentage,

KEY TAKEAWAYS

number of prospective renters competing for a given apartment, percentage of lease renewals, and share of new apartments completed.

Northern New Jersey has also performed remarkably well as the growth of e-commerce and retail distribution networks boosted the need for more logistics space. Already strong, fundamentals were accompanied by increasing cargo volume to the port of New York and New Jersey, helping to propel the metro into the national limelight as importers increasingly sought out the East Coast as a more stable alternative to California Ports. In addition, the population’s enormous purchasing power made Northern New Jersey’s logistical demand necessary as the market boasts one of the strongest retail markets in the country. The retail market has attracted interest from owners and tenants due to the stable consumer base with some of the nation’s highest average incomes. In addition, retailers are right-sizing their spaces and building their logistics network to accommodate shopper preferences gravitating to buy online and pick up instore business models.

Numerous dynamics, on both macro and micro levels, are affecting the short-term and long-term outlook for CRE markets. Fast-growing and business-friendly secondary markets are pushing through an economic slowdown and are prime for CRE investment. Real estate professionals are more willing to consider markets outside the big six, and the perpetual search for new opportunities ensures constant flux in how markets are viewed over time.

26 | SPRING/SUMMER 2023

NEW JERSEY

FROM FUNDING TO CLOSE, THE MATTHEWS™ PLATFORM PROVIDES A ONE-STOP-SHOP.

CAPITAL MARKETS

A FULL SUITE OF CAPITAL SOLUTIONS TO SOLVE EVERY REAL ESTATE FUNDING NEED. MATTHEWS™

WHAT’S BEHIND THE RECENT DECLINE IN APARTMENT

RENTS?

HOW MUCH HAS RENT FALLEN FROM LAST YEAR?

ACCORDING TO RECENT DATA PROVIDED BY APARTMENT LIST, RENTERS WITH NEW LEASES IN JANUARY 2023 PAID A MEDIAN RENT THAT WAS 3.5% LOWER THAN THE AUGUST 2022 RATE, HEAVILY ATTRIBUTED TO THE RECORD NUMBER OF MULTIFAMILY UNITS DELIVERED.

National year-over-year rent growth has noticeably declined, standing at three percent as of March 2023, making it the lowest rent growth level since April 2021. Rents began dropping in September 2022 and proceeded to fall for the next five months until the slight increase seen in February 2023.

The national median rental rate for January 2023 was $1,942, slightly lower than December 2022’s median rental rate of $1,978 and the lowest since February 2022. Rental prices began rising in mid-2021, first surpassing $2,000 in May 2022 and peaking at $2,053 in August 2022.

BY DANIEL WITHERS & ADAM FELDMAN

Rising interest rates, inflation, and recession worries have caused a dramatic shift throughout the multifamily market. After surging from mid-2021 through the first half of 2022, apartment rents are falling in almost every major U.S. metropolitan area. Experts predict this slowdown to continue until year-end 2023 due to supply additions outstripping mediocre demand. However, positive monthly rent growth during seasonality highs could reverse this yearover-year trend.

The national rent index did experience an increase of 0.3 percent for February 2023, ending the fivemonth decline in the rent growth period. However, this minuscule increase does not negate the fact that year-over-year rent growth is seeing a steady decline, and experts do not foresee any noteworthy rent increases in the following months.

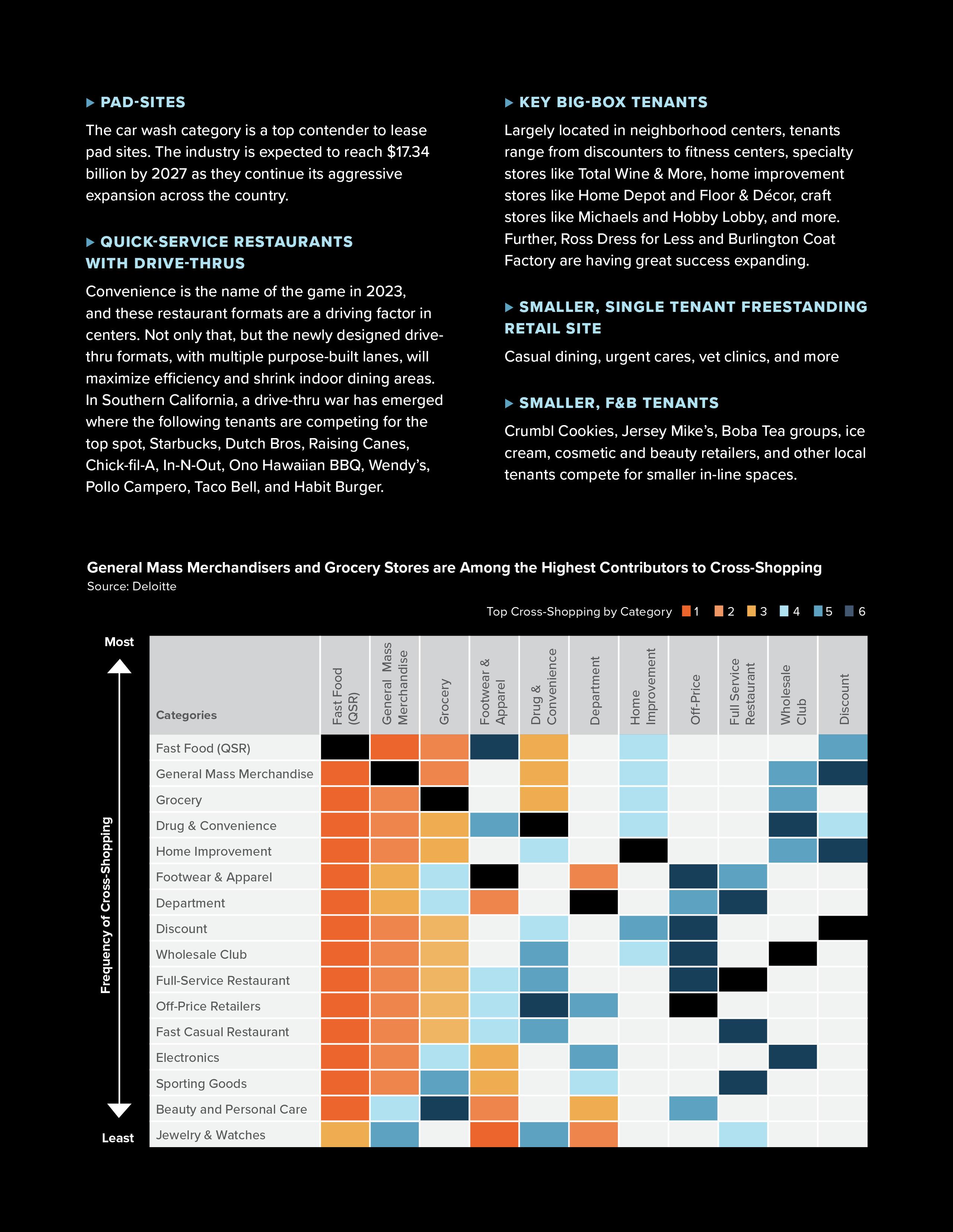

YOY CHANGE IN NATIONAL RENT INDEX Source: Apartment List Rent Estimates 2018 2019 2020 2021 2022 2023 20% -5% 0% 5% 15% 10% Start of COVID-19 Pandemic 28 | SPRING/SUMMER 2023

EVERY MAJOR URBAN AREA IN THE COUNTRY HAS EXPERIENCED A FALL IN APARTMENT RENTALS SINCE THE SUMMER OF 2022, INCLUDING SEATTLE, SAN FRANCISCO, SAN JOSE, AND NEW YORK.

U.S. METRO AREAS WITH SLOWEST RENT GROWTH

THE VACANCY INDEX HIT ITS HIGHEST LEVEL IN TWO YEARS IN MARCH 2023, STANDING AT 6.4%.

Source: Apartment List

The San Francisco metro saw the most significant rent reduction in the country during the first year of the pandemic and has been the slowest market to recover since then. San Jose and San Francisco are the only two major metro areas where the median rent is less than it was during the onset of COVID-19. Several urban, densely-populated submarkets in the San Francisco Bay area are rebounding at an even slower rate.

Over the past 12 months, some markets that had been booming have now quickly cooled off, according to Apartment List data. Metros, including Las Vegas and Phoenix, have seen the sharpest rent declines despite both cities being among the top 10 in terms of pandemic-era rent growth.

SLOWEST METRO-LEVEL RENT GROWTH

U.S. METRO AREAS WITH HIGHEST RENT GROWTH

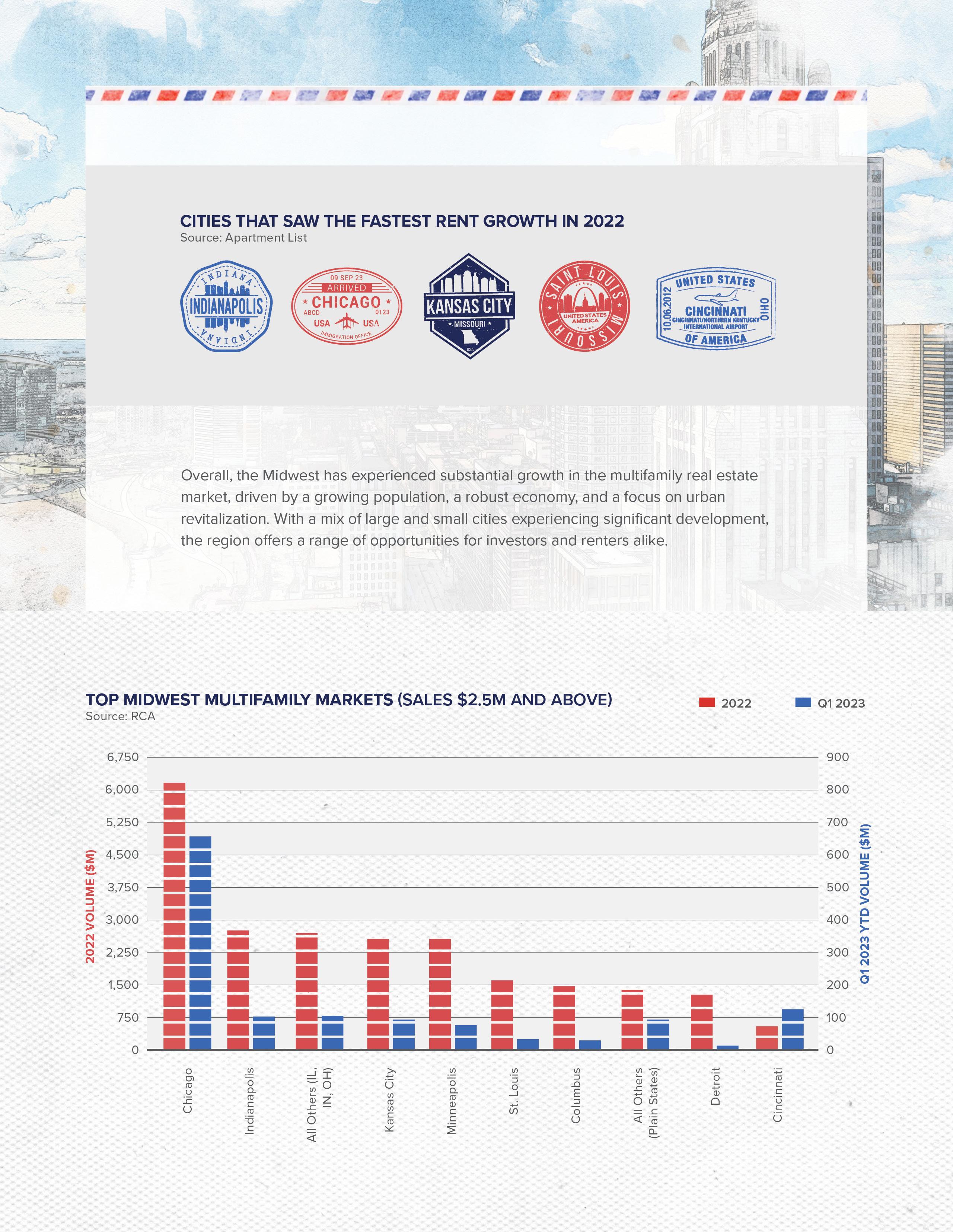

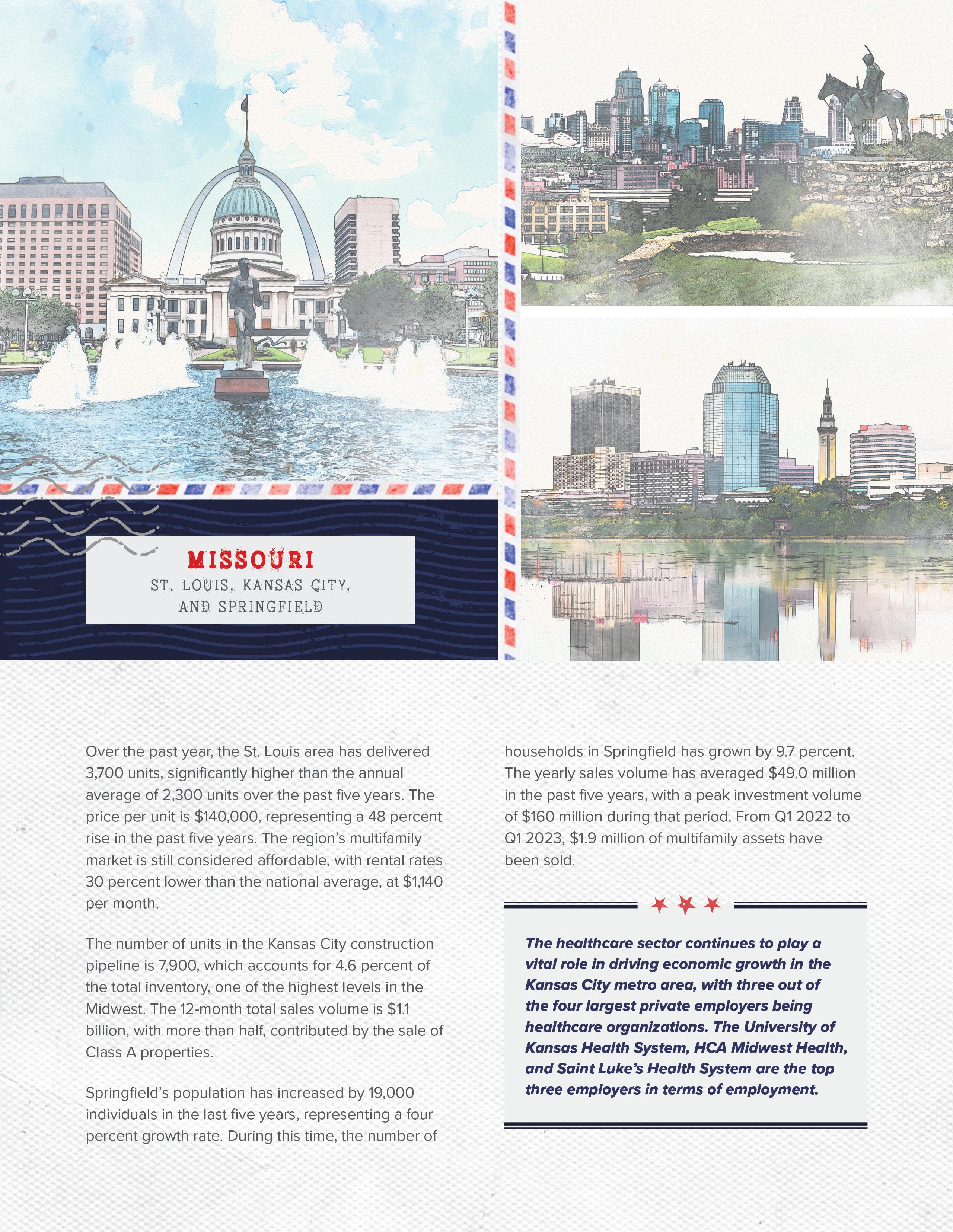

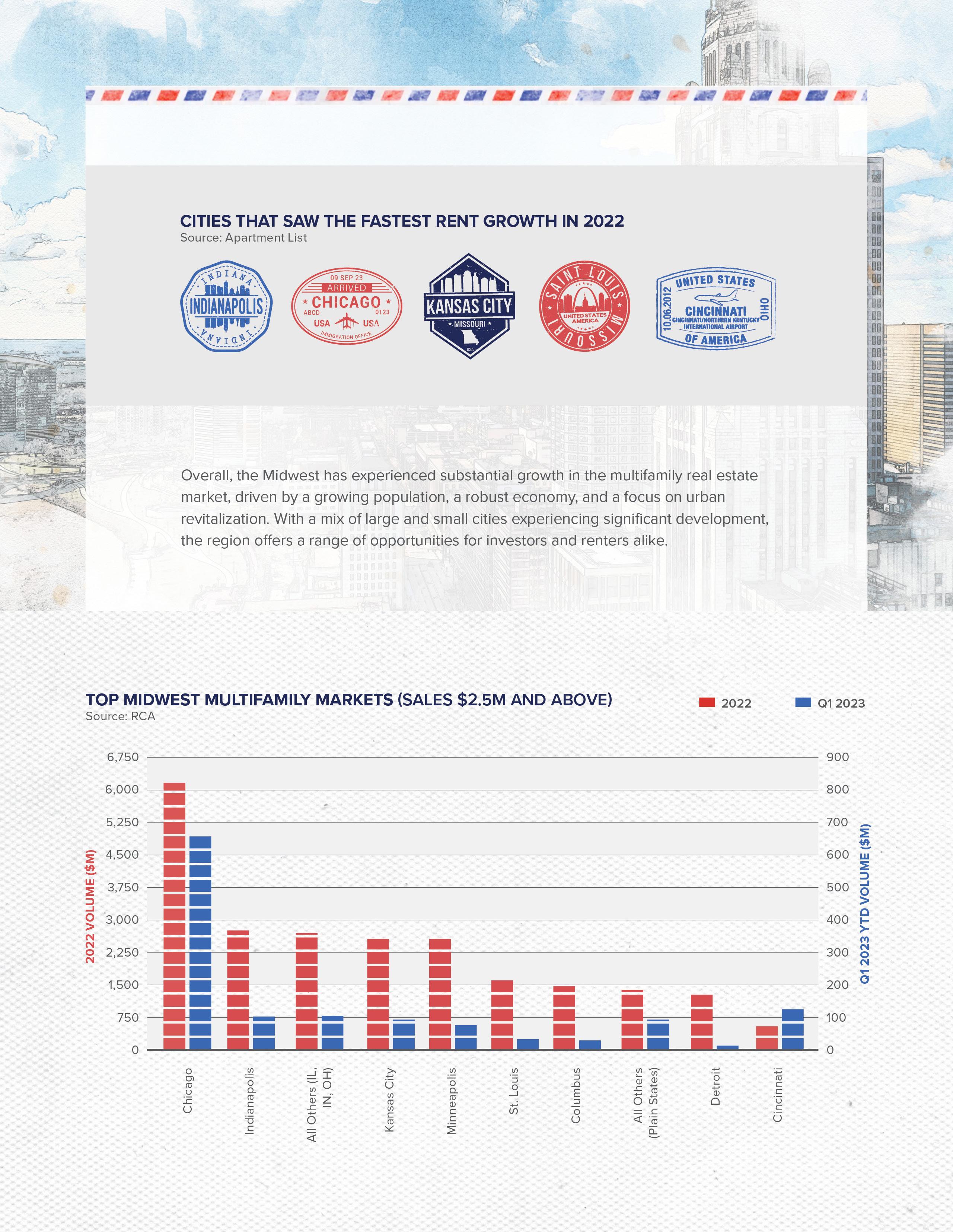

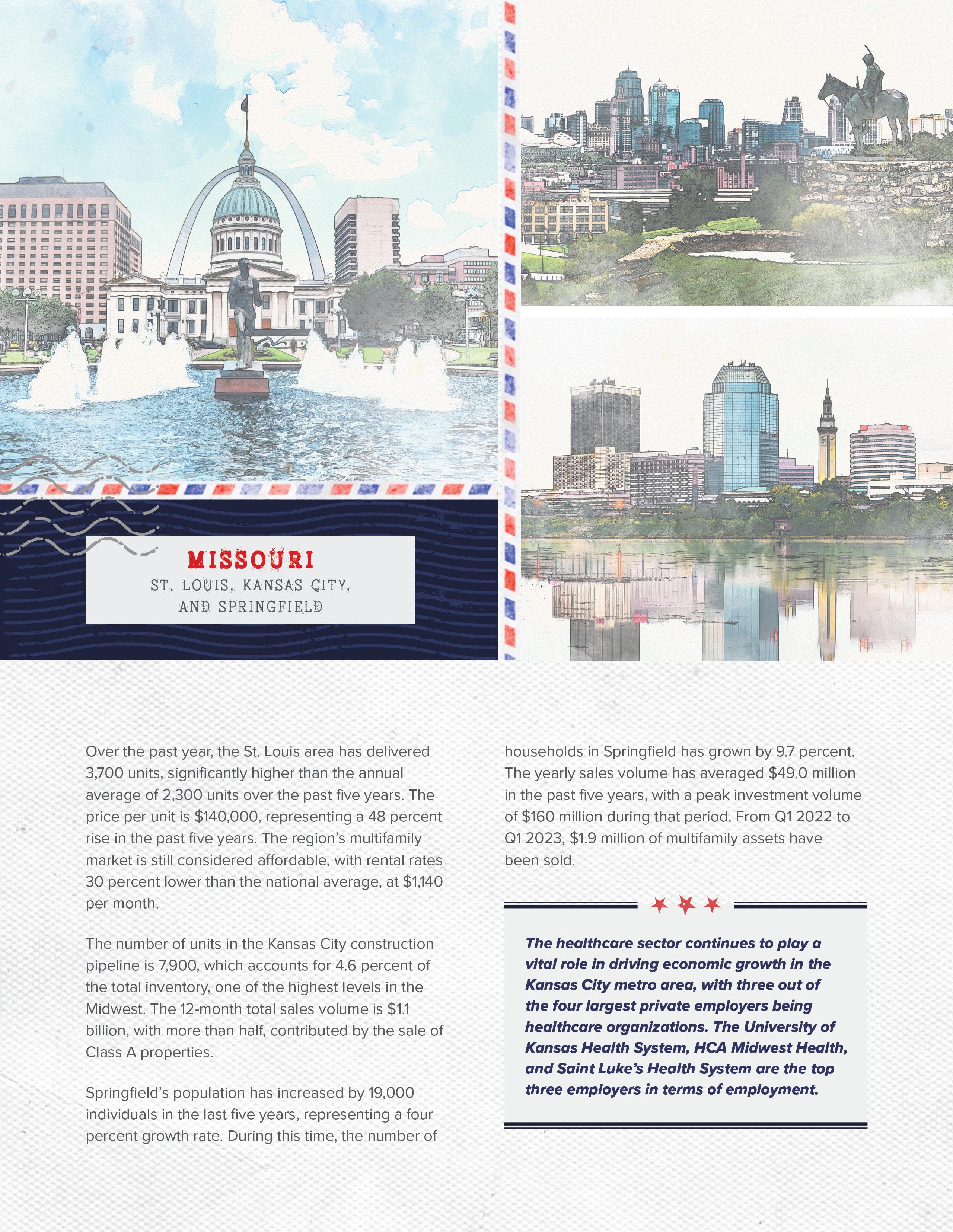

According to Apartment List, the Midwest region boasts the top three metros with the fastest yearover-year rent growth. Chicago takes the lead with a 6.3 percent increase, followed closely by Indianapolis at 6.2 percent and Cincinnati at six percent. The Sunbelt has experienced a surge in rental prices of over 30 percent in the last two and a half years, making the Midwest markets the last affordable option for renters. For coastal markets, Los Angeles is still drawing investors as it is one of the few California metros to see annual rent gains and is known for its resiliency.

Although some metros are performing well yearover-year, rent growth is moderate compared to 2021 and 2022 due to a cooldown in the rental market. For instance, no large metro has seen rental rates increase over the last six months.

FASTEST METRO-LEVEL RENT GROWTH

Source: Apartment List Rent Estimates

Rank Over Past 12 Months

Source: Apartment List Rent Estimates Rank Over Past 12 Months #1 Phoenix (-3%)

#1 Chicago (+6%)

MATTHEWS™ | 29

FOR THE FIRST TIME SINCE THE PANDEMIC’S EARLY BEGINNINGS, PROPERTY OWNERS MAY BE THE ONES COMPETING FOR RENTERS RATHER THAN THE OTHER WAY AROUND.

#3

New

#6 San

Salt

#2 Las Vegas (-3%)

Sacramento (-3%) #4

Orleans (-1%) #5 Riverside (-1%)

Francisco (-1%) #7 Detroit (0%) #8

Lake City (0%) #9 Atlanta (0%) #10 Memphis (+1%)

#2

#3

#4

#5

#6

*Among 52 CBSAs with Population > 1 Million #7

Indianapolis (+6%)

Cincinnati (+6%)

Louisville (+6%)

Boston (+6%)

Columbus (+6%)

Oklahoma City (+6%) #8 Kansas City (+6%) #9 Hartford (+5%) #10 St. Louis

(+5%)

*Among 52 CBSAs with Population > 1 Million

MAJOR DRIVERS BEHIND RENT DECREASES

The cost of rent was 10.1 percent higher in 2021 compared to 2020. In 2022, rent increased five times the pace of 2020 rent growth. Overall, the last two years of rent growth were unprecedented and not expected to last long term. Essentially, the deceleration of rents was bound to happen as the rapid growth was unsustainable.

These decreasing rents are also a result of landlords succumbing to increased vacancy rates since renters cannot afford the higher rent. Landlords are realizing that having expensive rent limits the renter pool and hurts profitability as renters are priced out of the market, increasing the number of vacant units. Other factors within the apartment industry, including increased cost of living, new supply, and demand below seasonal averages, significantly contribute to these price slowdowns.

NEW MULTIFAMILY SUPPLY

According to CoStar Group data, a record 959,000 multifamily units were under construction at the end of 2022, and projections for 2023 new deliveries are 507,000 units. In the fourth quarter of 2022, the top five most active investment multifamily markets were New York City, Atlanta, Los Angeles, Phoenix, and Washington, D.C. Each were among the top 10 in combined net deliveries in 2021 and 2022.

The new supply within the apartment sector will give renters more options, making it challenging for landlords to raise rents at the pace seen in early 2022. According to RealPage, the proportion of apartment residents who extended their leases fell to 52 percent in January, the lowest level for that month since January 2018. More and more renters are finding better options elsewhere, leading owners to head back to the drawing board.

MULTIFAMILY REMAINS A TOP INVESTMENT PICK

Multifamily continues to be a top asset type for investors, even with the fall in rent growth. With national sales volume of $197 billion from Q1 2022 to Q1 2023, trending above the historical average of $87.9 billion, the asset has proven resilient even in low-demand times. This increase in sales volume is from the record investment activity seen at the beginning of 2022. The influx of supply has weakened demand, but the need for housing will never cease. As some generations look to downsize and other generations are priced out of the housing market, demand and supply will balance.

February’s 0.3 percent hike has put an end to the five-month string of rent decreases. Nevertheless, even if demand keeps improving, the heavy development pipeline should restrain rent growth from surging. Rent growth is expected to moderate by the last two quarters of 2023. It is advised that investors look towards markets that are still seeing positive rent growth and growing populations.

DANIEL WITHERS

daniel.withers@matthews.com

(818) 923-6107

ADAM FELDMAN

adam.feldman@matthews.com

(818) 923-6112

THE MORE UNITS ADDED AND THE STRONGER THE CONSTRUCTION PIPELINE, THE SLOWER RENT WILL GROW DUE TO THE SUPPLY AND DEMAND IMBALANCE.

NATIONAL DELIVERIES & DEMOLITIONS Source: CoStar Group 160,000 100,000 140,000 120,000 ’20 ’21 ’22 ’23 Deliveries in Units 80,000 0 20,000 40,000 60,000 ’24 Forecast -20,000 Deliveries Demolished Net Deliveries 30 | SPRING/SUMMER 2023

™ WWW.MATTHEWS.COM Matthews™ is Your Resource FOR COMMERCIAL REAL ESTATE NEWS, INSIGHTS, AND UPDATES! Matthews™ Podcast To Read More

32 | SPRING/SUMMER 2023

MATTHEWS™ | 33

34 | SPRING/SUMMER 2023

MATTHEWS™ | 35

36 | SPRING/SUMMER 2023

SECURING STABILITY

WHY INVEST IN GOVERNMENT TENANTS

BY COREY SELENSKI

The U.S. government holds many hats, but for some, the government is known as a more personal entity, a tenant. Within commercial real estate lies a niche subsector — government-leased investments. These unique assets have strong credit tenancy and higher renewal rates but come with their own standards as they are directly linked to a government agency. As investors battle changes in the retail landscape and a difficult lending market, securing government tenants has gained popularity.

GSA MARKET OVERVIEW

GSA properties refer to real estate properties that are leased or owned by the U.S. General Services Administration (GSA) and used to fulfill the propertyrelated needs of various federal agencies. The GSA is responsible for managing and maintaining federal government buildings, which includes acquiring, leasing, and disposing of properties.

These government properties range from office buildings and federal prisons to warehouses and military installations. The GSA works closely with federal agencies to determine their space

requirements, leasing or purchasing properties accordingly. The agency also oversees the renovation and repair of government buildings, as well as the demolition of properties that are no longer needed.

THE GENERAL SERVICES ADMINISTRATION OWNS AND LEASES OVER 371 MILLION SQUARE FEET OF SPACE IN 8,600 BUILDINGS IN MORE THAN 2,200 COMMUNITIES NATIONWIDE.

For those buildings the GSA does not own, they rely on retail or office investors. Owners can purchase GSA-suited properties “fee simple,” meaning the land and the building is owned by the investor, but it is purchased with a government entity as the intended tenant. The GSA has leasehold rights, which results in the lease often favoring the tenant. However, because the investor is leasing to a government agency, the rent is 100 percent backed.

38 | SPRING/SUMMER 2023

WHY INVEST IN GSA TENANTS

GSA investments offer several advantages to owners that have driven the sector’s popularity over time. As retail shifts in a high operational cost environment, investors seek reliable tenants, less turnover, and higher yields.

Compared to similar single tenant net lease (STNL) assets, government-leased assets can provide yields of +500 basis points over 10 years. This is due to the steady cash flow GSA buildings incur and the strong performance of specific property types like data centers. In addition, these assets provide security and high renewal rates. GSA properties offer strong credit as the federal government backs the leases. Lenders are more likely to finance these investments in the current environment knowing the borrower will receive rent and be able to pay the loan. STNL investments aren’t as attractive as they were in previous years due to the fear their credit isn’t strong enough, making room for GSA capital. Security also comes through the tenant’s long-term leases. Experts stated that GSA-leased properties had a 14.6year lease on average due to the buildings’ purpose-built nature.

With the stability GSA real estate brings, there are also some disadvantages to being such a specialized investment. Although leases are long-term, most contracts negotiated with the GSA include an early termination clause that causes extensive underwriting obstacles. The lease renewal process is also timeconsuming compared to other NNN retail assets, as owners have to negotiate directly with government agencies, which often face delays. In addition, owners of government-leased assets need to be committed to the property management aspect of real estate investing, meaning the leases are full-service, and owners should expect to be responsible for long-term operating costs. Lastly, the U.S. government has announced several measures to consolidate and downsize its real estate footprint over the next decade in an attempt to reduce costs and environmental effects. This could cause issues for investors down the road as consolidations spur relocations and difficulties in finding replacement tenants.

GOVERNMENT AGENCIES ARE CONDUCTING

PORTFOLIO-WIDE OFFICE SPACE ANALYSES TO IDENTIFY THE MOST COST-EFFECTIVE OPPORTUNITIES — THOSE THAT BEST SUPPORT MISSION ATTAINMENT AND CUSTOMER SERVICE — TO CONSOLIDATE, DISPOSE, AND MODERNIZE THEIR PORTFOLIOS.

Source: Office of Management and Budget

MATTHEWS™ | 39

A LOOK INTO USPS INVESTMENTS

Although the United States Postal Service (USPS) is its own entity under the Executive Branch and its properties are not managed by the GSA, USPS still makes for a reliable government tenant.

The United States Postal Service has been undergoing major changes over the past few years to combat decreasing revenue predictions. In 2018, JLL took over as the real estate provider for the United States Postal Service. Previously managed by CBRE, JLL now negotiates leases on behalf of the USPS for those properties rented from private owners. The brokerage also handles the sale of postal service buildings and helps lease any unused space in USPS-owned assets. This change in providers is important for investors to note, as all lease structures, terms, and negotiations will be through the third-party brokerage on the tenant side.

During this same time, the agency rolled out new lease structures that put more responsibility on the landlord. Some major changes included lessors being made explicitly responsible for maintenance of all electrical and plumbing systems, conduit, and related “components” other than those installed by the USPS. In addition, upon lease expiration, the USPS can abandon improvements placed on the premises without the requirement of compensation to the landlord for their removal and any necessary restoration.

Another update came in 2021 when the U.S. passed Delivering for America, a 10-year plan that ensures the USPS’ financial security, streamlines operations, and invests in modern technology. A major tactic of the plan was the disbursement of $10 billion in funding to aid infrastructure and customer service and implement a new pricing authority, along with the Postal Service Reform Act. According to the American Postal Workers Union, the Postal Service Reform Act has four main goals, end the retiree health benefit pre-funding mandate, add transparency to USPS’ service issues, provide prospective Medicare integration, and guarantee six-day delivery.

Out of the four key points, the pre-fund mandate will be the biggest issue tackled. The mandate stated the postal service must pre-fund all its retirees’ health benefit liabilities 75 years ahead of time, costing $5.5 billion annually over the first 10 years. This racked up a debt of $35 billion that the USPS owed the government on unpaid portions of the liabilities, making it difficult for the postal service to put any money into upgrading infrastructure or services. After enacting the Delivering America plan, the USPS is on track to break even from 2021 to 2030. The entity was previously projected to lose $160 billion during this period.

THE

REFORM

ACT

IS

ESTIMATED TO SAVE THE USPS AT LEAST $45 BILLION OVER THE NEXT 10 YEARS.

In another attempt to modernize the USPS and reduce costs, the agency committed to implementing an electric fleet of delivery vehicles starting in 2023. Known as the Next Generation Delivery Vehicles, the USPS stated that 75 percent of its newly acquired fleet over the next five years would be electric. After 2026, all new vehicle acquisitions will be electric.

Lastly, the insurgence of e-commerce has impacted the United States Postal Service on many levels, but one that impacts landlords is its partnership with Amazon. Widely unknown, Amazon relies on the USPS for most of their “last mile” deliveries, in turn, increasing the number of incoming packages and vehicles coming on postal service property. This has caused some lessors to take steps to mitigate potential risks of non-USPS employees onsite and put policies in place to ensure operations continue without disruption.

40 | SPRING/SUMMER 2023

WHY INVEST IN USPS

USPS investments have approximately 98 percent lease renewal rates and guaranteed rent. Leases are typically structured with a five-year lease term and the option for a five-year renewal. The largest benefit of having the USPS as a long-term tenant is its specified interest in investing back into its operations and services. The entity’s ongoing commitment to securing financial security through various initiatives ensures post offices will continue to thrive in the investment sector as revenue increases, helping property values and renewal rates.

ONLY ABOUT 25% OF ALL POSTAL FACILITIES IN THE U.S. ARE OWNED BY THE UNITED STATES POSTAL SERVICE. THE REMAINING 75% ARE PRIVATELY OWNED AND LEASED TO THE USPS.

Investing in government-leased assets is a unique opportunity within the office and retail sector that provides high-level stability and occupancy. As other retail owners face the uncertainty of tenant turnover or missed payments in a volatile market, government services owners are financially backed. The specialty asset class will face some headwinds as the U.S. government looks to consolidate properties, but the efforts will also create more competition, increasing valuations.

COREY SELENSKI

corey.selenski@matthews.com (949) 945-6012

MATTHEWS™ | 41

™ WWW.MATTHEWS.COM THE INDUSTRY'S MOST COMPREHENSIVE CRE DATA SET MODERN, SIMPLIFIED, STREAMLINED UNIFIED & CENTRALIZED DEAL MANAGEMENT Matthews™ Proptech Technology Division with a. Customer-First Approach.

BY THOMAS WILKINSON & HARRISON AUERBACH

In recent years, there has been a noticeable slowdown in industrial development in several markets, while others have seen notable market growth. This growth is attributed to high industrial demand, resource availability, increased investment activity, favorable government policies, and strong demographics. Slower markets are facing the aftereffects of setbacks seen in Q4 2022, including truck tonnage and several imports declining, construction labor and material shortages, and the deceleration of e-commerce sales. However, as inflation eases, construction is anticipated to pick up again and push new developments into late 2023 and 2024.

INDUSTRIAL MARKET OVERVIEW

In 2022, 415 million square feet of industrial space was delivered. As of March 2023, 624 million square feet of new industrial supply was under construction in the U.S. and is on track to exceed completed deliveries seen in 2022, according to Costar Group. Reports conducted at the end of March 2023 state that developers in the U.S. have delivered approximately 73.4 million square feet of industrial space this year. Although a robust pipeline, the distribution is imbalanced, with major metros, especially throughout the Sunbelt region, taking on the majority of projects while others fall to the wayside.

Industrial Space Under Construction (Million Sq. Ft.)

Source: CommercialEdge

Los Angeles Cleveland Portland Bridgeport Orange County Bottom 5 Metros Dallas-Fort Worth 58.97 Top 5 Metros Inland Empire 27.67 Chicago 27.32 Houston 22.13 Phoenix 54.06 3.30 2.52 1.60 1.27 0.57 MATTHEWS™ | 43

The U.S. industrial market is expected to experience a slight downturn in Q2 2023, with net absorption slowing down in the first quarter due to caution over the economic outlook. However, there is potential for net absorption to lift in the future due to seasonality and strong retail sales.

Although U.S. industrial rent growth remains close to record highs with a 10.1 percent yearover-year increase, the quarterly gains pace has slowed in recent months. This is due to the national vacancy rate no longer decreasing as rapidly as it did in late 2021 and early 2022. Consequently, the quarterly rent growth has moderated from three percent in mid-2022 to slightly less than two percent in the first few months of 2023.

Nevertheless, the industrial market’s longerterm outlook is positive, with major metro areas picking up the slack. Rent growth is unlikely to increase in the near future, given the anticipated acceleration in new development completions for the remainder of 2023. Additionally, the opening of more than 18 electric vehicle, battery, and semiconductor plants throughout the country in 2024-2025 could generate millions of square feet of additional space for lease over that period. Increased consumer interest in EVs will continue to drive demand for manufacturing, storage, and packing facilities nationwide.

DRIVERS INFLUENCING DEVELOPMENT

One significant factor that has affected industrial development in the U.S. is the availability of natural resources. Regions with abundant natural resources, such as oil and gas reserves, have seen a surge in industrial growth. For example, states such as Texas and North Dakota have experienced rapid industrialization due to their vast oil and gas reserves.

The level of investment in infrastructure and technology is also playing a significant role in industrial development in the U.S. Regions that invest heavily in modern infrastructure, such as transportation networks, broadband, and energy systems, tend to attract more industrial development. Additionally, investments in cutting-edge technology, such as robotics and automation, can increase productivity and efficiency, making certain regions more attractive for industrial growth.

Favorable government policies, including tax incentives, regulatory streamlining, and governmentfunded research and development, can stimulate growth in specific industries and regions. Conversely, unfavorable policies, such as increased taxes and burdensome regulations, can hinder industrial growth and drive investment away from certain areas as they increase construction timelines, costing developers more money.

Regions with a growing population and a welleducated workforce tend to attract more businesses and investment, leading to higher levels of industrial growth. For example, regions such as the Pacific Northwest saw a surge in development in recent years.

44 | SPRING/SUMMER 2023

KEY TRENDS AFFECTING THE INDUSTRY

Increased Demand for Same-Day Delivery

The current-day consumer can sit on their couch, open an app on their phone, and buy a new TV for same-day delivery in under one minute. As more and more consumers purchase items for shortened delivery timelines, the demand for shallowbay centers that can complete these orders is in high demand. Shallow-bay industrial properties, primarily ranging from 50,000 to 120,000 square feet, act as both warehouse and distribution facilities, and investors’ interests are peaked. In the future, firms are expected to purchase numerous shallow-bay centers in dense metros, drifting away from traditional 300,000-square-foot fulfillment centers on the outskirts of town. Having numerous smaller, more-centralized facilities decrease timelines and allows for more imports, increasing business.

Affordability of Land

Land affordability is crucial for the development and profitability of industrial facilities in the U.S. Expensive land costs may lead to higher rental rates and hinder the industry’s growth. Conversely, affordable land enables developers to invest in more modern facilities with attractive amenities, making them more appealing to potential tenants, resulting in higher occupancy rates and profitability. Hence, developers must consider land costs carefully when selecting facility locations.

Sale-Leasebacks

In 2022, many owners utilized this strategy for industrial properties because of its stability and attractive cost. The use of a sale-leaseback has become a crucial tactic for releasing hidden value and positioning a company for future expansion. This widely used financing tool enables owner-operators to release their locked-up cash and put it to better use. The capital return is fantastic for reinvesting in the company, funding expansion and additional locations, or even paying off debt.

IN 2022, THE NUMBER OF SALE-LEASEBACK TRANSACTIONS

SURPASSED THE PREVIOUS HIGHEST LEVELS ACHIEVED IN 2019 AND 2021 BY 11%. ADDITIONALLY, THE TOTAL DOLLAR AMOUNT OF THESE TRANSACTIONS REACHED A NEW RECORD OF $31.4 BILLION.

Source: ConnectCRE

MATTHEWS™ | 45

THRIVING INDUSTRIAL MARKETS

Construction along the Sunbelt is growing exponentially, primarily in Dallas-Fort Worth (DFW) and Phoenix. DFW is currently leading the nation in development with a 59.97 million-square-foot pipeline. The DFW metro was pushed to the top of industrial markets due to the influx of logistics, e-commerce, and manufacturing firms entering the market. Amazon is also a huge contributor to the market’s growth. As a central location in the U.S., DFW has access to highway and rail networks, and top-tier airports, all of which are attractions for companies and drivers of industrial growth. Like DFW, Phoenix is a transportation hub due to its proximity to West Coast ports, a major driver for the industrial sector. Phoenix also boasts one of the largest average lot sizes compared to other cities in the U.S. According to Phoenix Business Journal, the city ranks third among U.S. cities with the most vacant land, helping developers find affordable options. A recent study by CommercialCafe also stated that Phoenix possesses 15,897 empty land plots, which amount to 53,022 acres in total. This equates to an average of 3.34 acres per plot.

Additionally, the Inland Empire is expected to grow, with net deliveries projecting 40.2 million square feet in 2023. The Inland Empire has managed to entice the largest amount of capital, making it the leading region in the country. Over one-fifth of the total industrial sales volume across the nation can be attributed to sales in this area. In Atlanta, industrial rents are rising, sitting at 7.2 percent, well over the national average of 6.9 percent. The high growth reflects Atlanta’s growing population, lack of inventory, and high demand. Along the East Coast, New Jersey recorded the second-highest sales volume among leading markets in 2022 at $149 million. The high demand for space in the Midwest can be seen in Columbus, OH, which recorded the second lowest vacancy rate nationwide at 1.7 percent.

AS OF FEBRUARY 28TH, 2023, INLAND EMPIRE HAD THE HIGHEST YEAR-OVER-YEAR SALES VOLUME IN THE ENTIRE COUNTRY, WHICH AMOUNTED TO $855 MILLION.

Source: Commercial Edge

46 | SPRING/SUMMER 2023

There are numerous regions throughout the country where the industrial market is thriving, including the Sunbelt, along the East and West coasts, and densely populated cities. Areas seeing the widest spreads include logistics hubs and port markets.

Markets with access to ports with affordable construction costs are in high demand for investors. Some regions sparking investor and large company interest include North Central Florida, North Carolina, and South Carolina. According to Commercial Search, 7.5 million square feet of industrial space were under construction in North Central Florida at the end of 2022, accounting for 16.8 percent of the total inventory. Additionally, North Carolina, specifically Charlotte, is thriving thanks to its diverse industry base, which saw a large jump in employment, rising 5.1 percent in trade and utilities in 2022. In South Carolina, industrial success can be attributed to its prime location nearby major interstates and transportation corridors, making it a desired state for hubs that transport goods.

SOME OF THE WIDEST SPREADS BETWEEN NEW LEASES AND MARKET RENT WERE IN LOS ANGELES ($7.26 MORE PER SQUARE FOOT), THE INLAND EMPIRE ($6.06), ORANGE COUNTY ($5.43), NEW JERSEY ($3.61), NASHVILLE ($3.35) AND MIAMI ($3.31).

Source: Commercial Edge

INDUSTRIAL’S FUTURE

The industrial sector continues to thrive in several markets despite supply chain disruptions and rising construction costs. Investors should expect a slowdown for the first part of the year, but deliveries and sales volume are on track to surpass 2022 numbers. Large metros that service nationwide distribution hubs will likely continue seeing development growth. Overall, industrial development is expected to overshoot demand on a national level, but not at an alarming rate.

thomas.wilkinson@matthews.com (404) 348-4945 harrison.auerbach@matthews.com (404) 445-1092 MATTHEWS™ | 47

™ WWW.MATTHEWS.COM

MATTHEWS™ | 49

50 | SPRING/SUMMER 2023

MATTHEWS™ | 51

Hospitality Success in 2023

By Mitchell Glasson, Ryan Kawai Sanchez, and Kate Dockery

Last year documented the bounce back of the decade for the hospitality sector. According to CoStar Group, 2022 ranks as the second-highest annual sales total in U.S. history, reaching $48.6 billion. The industry saw an increase in buyers, and experts predict continued demand in 2023, specifically for high-end properties that are seen as recession resistant. In addition, hospitality is receiving the green light from lenders in a tight capital market environment. Overall, the sector is experiencing its strongest Q1 start in years, and investors are intrigued.

52 | SPRING/SUMMER 2023

Demand Moves Forward

Despite high inflation, hotel demand remains strong, increasing occupancy and encouraging higher-priced room rates. The travel site Hopper reported that U.S. hotel prices averaged $212 per night in January 2023, a 54 percent increase year-over-year. This increase is likely due to the pent-up demand to travel after years of restrictions and lockdowns. Consumers don’t seem to be trimming their vacation budgets as historically seen in down markets. In fact, Q1 2023 will be the first time RevPAR will increase during a recessionary period.

In a survey of its users, Hopper found that 37% of people plan to spend more on travel in 2023 compared to 2022, while 43% of people said they plan to spend the same amount.

Although the overall hospitality market is reporting strong numbers, business hotels are struggling to gain the same momentum as leisure hotels, as remote work decreases the need for business travel. Although corporate events and group travel are increasing, the rate of recovery has been much slower than that of other hotel subsectors.

A slow development pipeline and limited deliveries also contribute to the hospitality sector’s high demand. COVID-19 weakened the already laborious and expensive timeframe for hotel construction, and now the sector is trying to play catch up. Pricey capital, fewer land sales, and expensive labor make developing large properties like hotels less appealing when other asset classes can be brought to market for much cheaper and have faster turnaround. According to CoStar Group, more than 155,000 rooms are under construction across the U.S.

HOSPITALITY

National Index YoY Change ADR $152.01 $14.15 RevPAR $91.22 $13.01

PERFORMACE Source: CoStar Group

“ “

2019 2020 2021 2022 *2023 2019 2020 2021 2022 *2023 1.29B 831.64M 1.14B 1.27B 1.30B 65.9% 43.9% 57.5% 62.7% 63.8% *Projected *Projected MATTHEWS™ | 53

HOTEL ROOM NIGHT DEMAND BY YEAR Source: CoStar Group HOTEL ROOM NIGHT OCCUPANCY BY YEAR

Source: CoStar Group

Who’s Buying?

Investors see hotels as a long-term growth option that will outweigh the near-term capital markets challenges. As other commercial real estate sectors experience cap rate compression, hotels become more attractive to buyers since they are able to reprice rooms daily, fighting the high price of inflation. This pricing flexibility isn’t seen in long-term lease assets such as offices, multifamily, industrial, and retail. So, who are hospitality’s most prominent players?

Institutional Capital

Due to the vast amount of capital needed to purchase a hospitality asset, institutional investors have dominated the space for the last five years. Although, this may change as REITs pivot strategies to account for the high-interest rate market and they most likely become more selective. VICI Properties Inc., a New York-based REIT, boasts the most transaction volume since 2018, buying over $16 billion in hospitality assets.

Private Equity

Private equity groups are becoming a well-known buyer group for the sector in recent years. These investors typically look for Class B and C properties that are underperforming or distressed with the potential for improvement, which they can acquire at a discount and then invest in to increase their value. Private equity firms may also look for hotels in attractive locations with high growth potential. Some major private equity firms buying in the sector are Blackstone Inc. and newcomer KHP Capital. Private equity firms typically hold onto their hotel investments for several years before selling them to another buyer or taking them public through an initial public offering.

What’s Next?

With increasing rates and steady demand, the hospitality sector is expected to have a highperforming 2023. As other commercial real estate property types struggle to get financing, lenders seem bullish on hotels, seeing their strong fundamentals as less risky. Consumers plan to increase or spend the same on travel and tourism in 2023, which will help hotels keep occupancy and RevPAR high. The biggest challenge facing hotels is labor shortages as help becomes increasingly difficult to find and more expensive to retain. Hotel owners must invest in their employees and guest services to succeed. High-interest rates will affect the hospitality buying pool as investors, and lenders get more selective, but increasing profit should help balance the high debt costs.

Mitchell Glasson mitchell.glasson@matthews.com (949) 432-4502 Ryan Kawai Sanchez ryan.sanchez@matthews.com (949) 287-5854 Kate Dockery kate.dockery@matthews.com (949) 873-0270 TOP BUYERS Source: CoStar Group VICI Properties Inc. Blackstone Inc. Brookfield Asset Management, Inc. MGM Resorts Host Hotels & Resorts Inc. Starwood Capital Group Gaming and Leisure Properties, Inc. Park Hotels & Resorts KSL Capital Partners Realty Income Corporation $0 $4B $8B $12B $16B 54 | SPRING/SUMMER 2023

\ ™ WWW.MATTHEWS.COM forward TOOLS THAT MOVE YOUR BUSINESS See Matthews™ Career Opportunities SHARED SERVICES PLATFORM • AGENT-FIRST INNOVATIVE TECHNOLOGY • INDUSTRY-LEADING DATA • CULTURE OF EXCELLENCE

56 | SPRING/SUMMER 2023

MATTHEWS™ | 57

58 | SPRING/SUMMER 2023

MATTHEWS™ | 59

60 | SPRING/SUMMER 2023

MATTHEWS™ | 61

62 | SPRING/SUMMER 2023

THE MATTHEWS™ 1031 EXCHANGE

Private Client Advantage Program

A step-by-step process that replaces the unknown in your exchange with the confidence that your up-leg will directly improve your investment position.

Customize a strategy TO MEET YOUR SPECIFIC FINANCIAL GOALS

Create a plan TO GET THE MOST OUT OF YOUR EXCHANGE

Improve your position THROUGH ADJUSTING DOWNTIME IN CASH FLOW

™ WWW.MATTHEWS.COM

INCREASING Property Value

OF SELF-STORAGE FACILITIES

• By Hunter Reynolds & Austin McLeod •

Consumers are seeking convenience over everything else. This evolving consumer preference has caused a dramatic shift in customer-driven operations nationwide. In particular, the selfstorage sector has seen an influx of operation adaptation as the industry works to meet consumers’ needs. Although the industry has experienced record transaction activity and consumer demand since 2021, the sector is in a time of renewal, no longer riding on the coattails of past years' success. But in an unsettled economy, how can owners increase value without increasing operating costs?

Self-Storage Demand

An owner's goal is to enhance the customer experience while increasing their bottom line. One way to do this is by introducing more technology into the business, like self-service kiosks, mobile apps, and touchless payments. The market for self-serve technology is predicted to grow significantly, particularly within self-storage.

SEASONALITY

Typically, the busiest part of the year for self-storage – also known as “leasing season” begins around April or May and ends in September or October. Last year, landlords nationwide noticed a downward trajectory in occupancy beginning in mid-September, leading owners to believe that seasonality had once again returned to the space, as opposed to the year-round trend seen in 2021 and the first half of 2022. While the COVID-19 pandemic drove self-storage demand to new highs by increasing factors such as displacement, home remodels, migration, home/office downsizing, and retirement, these factors continue to fuel consistent demand now, but at a lesser scale.

By The Numbers

Source: Storage Cafe

1.7B+ SF of U.S. self-storage space

38M+ SF delivered in 2022

52.6M SF expected to be delivered in 2023

1 Out of 9 Americans use self-storage

As the market shifts due to rising interest rates and inflation, service-based businesses that are nonnecessity services, such as self-storage, will need to find innovative ways to keep customers coming back and increase their property values.

64 | SPRING/SUMMER 2023

Valuations: What to Watch

Understanding the economic drivers that affect a property's valuation is critical. By knowing the drivers of value, owners can strategize which operational changes will positively impact cash flow and provide the highest yields long term. The market fundamentals listed below all influence the short and long-term profitability of a selfstorage investment and should be carefully considered when executing initiatives.

POPULATION GROWTH

INCREASED DEMAND: As the population continues to expand, there may be greater demand for self-storage facilities nationwide. A larger population increases the need for storage as the potential customer base widens. This is a main reason the Sunbelt states have seen significant rent growth and property appreciation in recent years.

LOCATION: As the population grows, residents are pushed to surrounding communities where new residential and commercial developments are built. Existing facilities in these areas may see increased demand, while new facilities may be built to meet this demand.

DEMOGRAPHIC TRENDS

AGE OF POPULATION: As older individuals downsize their living, the need for self-storage services rises. Also, Gen Z and millennials that opt to rent an apartment versus buying a home often times need additional storage space.

INCOME LEVELS: Income levels can impact rental rates that are able to be charged. Typically, more affluent populations can afford higher rents per square foot, leading to higher valuations in more affluent areas. Additionally, high-income areas have greater demand for premium or specialized services like boat and RV storage.

ENVIRONMENTAL CONCERNS: As more consumers become environmentally conscious, demand for eco-friendly self-storage facilities that

use less energy through Solar Panels or other avenues can increase value. Although the upfront cost of sustainable products can be high, the long-term value is typically beneficial. Oftentimes, there are also significant tax advantages for owners that implement solar panels on their facilities.

LIFESTYLE CHANGES: A trend towards minimalism and decluttering for some generations may increase the demand for selfstorage services. On the other side, Gen Z consumers prefer a maximalist lifestyle, which also pushes the need for storage.

SUPPLY STATISTICS

MARKET SATURATION: If the market is saturated with self-storage facilities, it may become increasingly difficult for existing facilities to compete with newer or better-equipped facilities. As a result, existing rental and occupancy rates may decline, ultimately leading to a lower valuation.

NEW SUPPLY: New supply being delivered in a market can sometimes oversaturate a trade area, oftentimes putting downward pressure on rental rates and occupancy across a three of fivemile trade area. If new facilities are introduced rapidly, they may capture a significant portion of the demand due to offering significant discounts or concessions, thus impacting existing facilities' rental and occupancy rates.

QUALITY: Facilities that are well-maintained, modern, and offer a range of amenities may command higher rental and occupancy rates, ultimately leading to a higher valuation.

MATTHEWS™ | 65

Reducing Operational Costs While Boosting Profit

Automating and converting to an entire self-serve operation is one of the most popular ways to reduce costs within self-storage facilities. A major reason is that automation eliminates the need for human labor and thus reduces the associated costs such as wages, benefits, and training. Additionally, selfservice operations can reduce errors and improve efficiency, in some cases, saving time and resources.

Automation can increase efficiency by allowing customers to complete tasks without staff assistance, reduce wait times, and improve service speed. This type of system can also provide customers with a more personalized experience by allowing them to customize their interactions with a business. Lastly, self-service options can be available 24/7, making it more convenient for customers to interact with a business outside of traditional business hours.

EXAMPLE OF HOW BUSINESSES SUCCESSFULLY CONVERT SELF-STORAGE FACILITIES:

Owners can invest in security cameras and lock technology, allowing customers to access their units through an app on their phones. New customers can also rent units through a kiosk on-site or even through an app, allowing this to be done completely remotely for the owner of the facility. This will reduce labor costs and attract a younger generation of customers.

These facilities can employ a range of additional strategies to increase profitability. One approach is implementing energy-efficient technology, such as LED lighting and energy-saving equipment, which can reduce utility costs and lower expenses. Using drought-tolerant landscaping and rainwater harvesting systems for storage facilities can reduce

costs. Regular maintenance and repair of equipment and facilities can also extend their lifespan, reducing the need for costly replacements.

On the other hand, marketing strategies can help to attract and retain customers, such as promotions, loyalty programs, and targeted advertising.

Overall, self-storage facilities have multiple ways to improve profitability. Implementing a combination of these strategies can help them stay competitive and meet the evolving needs of the market and their customers.

Investment opportunities in today's market, particularly in markets with positive population and job growth, are attractive for self-storage facilities. The move to self-service-based business models is only expected to grow as consumers continue to choose convenience over all else. With the increasing demand for these services, developers and investors can benefit from implementing strategies that reduce operational costs, boost profits, and cater to customers' evolving needs. By implementing these strategies, owners can keep their technology up to date, reduce operating expenses, and drive their assets up in value.

Hunter Reynolds hunter.reynolds@matthews.com (404) 380-1196 Austin McLeod austin.mcleod@matthews.com (404) 445-1093 66 | SPRING/SUMMER 2023

FULL-SERVICE REAL ESTATE SOLUTIONS

Centralized client services that foster personalization and collaboration for all our clients.

A CAPITAL MARKETS OVERVIEW

BY CLARK FINNEY

After years of low rates and liquidity, the capital markets sector has entered a constricted lending environment. The rapid increase in the funds rate adjusted the cost and availability of capital as banks tightened their lending standards. In March 2023, major banks declared bankruptcy, with some experts predicting the collapse would cause the Fed to pull back; others insist the Fed will continue increases as previously stated. With so many fluctuating fundamentals and unknown outcomes, how should investors navigate the changing market, and what opportunities lie beneath the surface?

GOING THROUGH THE CYCLE

Since the 2008 financial crisis, commercial real estate activity has undergone a number of changes and fluctuations, cycling through the real estate phases seen throughout history — recession, hyper supply, expansion, and recovery.

In the immediate aftermath of the crisis, commercial real estate markets experienced significant property value declines and a sharp reduction in investment activity due to a lack of available financing and liquidity.

However, in the years that followed, the commercial real estate market began to recover, driven in part by lower interest rates to stimulate the economy, which yielded strong economic growth, and increased demand for supply. Investment activity in the commercial real estate market rebounded by 2014, with record levels of capital flowing into the market from both domestic and foreign investors. Commercial real estate expansion also led to increased property values, with many markets seeing significant appreciation in property prices. Between 2014 and 2020, the U.S. was experiencing recovery; it was organic and fundamental — then COVID-19 happened.

YOY Change of U.S. CRE Prices

Source: International Monetary Fund

20% 10% 0% -10% -20% -30% ’06 ’07 ’08 ’09 ’10 ’11 ’12 ’13 ’14 ’15 Recession THE

68 | SPRING/SUMMER 2023

Despite the initial 90 days of lockdown in 2020, which put billions of dollars of transaction pipelines on hold, the U.S. economy's reaction of cutting rates to zero seemed to be a pragmatic and rational response to inflating the economy while it was in a state of literal lockdown. The lower rates allowed for transaction activity to continue despite higher credit spreads that were attributable to the risk of investing in an uncertain real estate market. The market did not expect these low-rate indexes to catalyze a mass migration of investor funds out of equity markets that were hit hard during the lockdown into more tangible investments like commercial real estate. Almost overnight, it appeared that professionals who had created wealth by investing their salaries into equity markets since 2008 almost cashed out their portfolios and became commercial real estate experts. The novice yet extremely active and motivated investors pooled funds and knowledge together to form groups that turned into national networks.

THE SHIFT OF CAPITAL MARKETS

The syndication model is a vital component of the current price correction experienced throughout the market today. Years of low rates, paired with pooled investor capital and $5 billion of treasury funds injected into the general population, allowed for a prolonged period of higher leverage, lower costs of debt, and the ability to grow and achieve higher rents in 2021, and early 2022. In turn, cap rates compressed, and property values increased. Between Q3 2020 and Q2 2022, nearly 50 percent of the nation's commercial real estate assets traded hands, and many of those assets exchanged hands more than once, sometimes three or four times in six quarters.

Syndicators were not the only ones staying active in this market. Naturally, other players, even institutions, saw dramatic equity increases in their property values as cap rates seemed to compress by 25 basis points every six months as the cost of funds could be as low as 2.50 percent. At some point, the music had to stop, although clearly, nobody wanted to admit it. Over the last two years, many investors' lives changed forever, and syndicator models established themselves as respected professional networks rather than think-tank forums.

This mass of active investment liquidity, paired with the lowest rate environment witnessed in the U.S. in nearly a decade synthesized the modernday syndication model investors are familiar with.

150% 100% 50% 0% -50% -100% 2018 2020 2022 2017 2019 2021 Transaction Volume YOY Change Source: RCA MATTHEWS™ | 69

THE NEXT PHASE

Welcome to the Summer of 2022! In reaction to inflation soaring up to over nine percent, a rate not seen in decades and admittedly fueled primarily by the surge in housing costs – the Federal Government moved to increase rates over time and manipulate the market to stop it in its tracks aggressively. The question now is, has this been successful? Did the Federal Reserve step up to save the American economy from its greed and ultimately create an unfixable bubble, or did it attempt to muffle a white-hot U.S. economy and potentially a new golden era of the United States? It’s unfortunate that the definition of inflation is integral to raising property values, which increases the cost of capital and creates downward pressure on rent growth, all of which is occurring in today’s market.

Net Percentage of Lenders Tightening Standards

Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices 2015 2016 2017 2018 2019 2020 2021 2022 ■ Construction ■ Commercial ■ Apartment 80% 90% 60% 70% 40% 50% 20% 10% 30% 0% -20% -10% -30% Annual

in U.S. Commercial

Source: RCA 25% 20% 15% 10% 5% 0% -5% 2018 2019 2020 2021 2022

Source:

% Change

Property Pricing

70 | SPRING/SUMMER 2023