breaking the bull: inflation’s effect on cre

LIVE. WORK. PLAY: THE CONTINUED EVOLUTION OF THE RETAIL LANDSCAPE

UNDERSTANDING INFLATION: THE PROS &

LIVE. WORK. PLAY: THE CONTINUED EVOLUTION OF THE RETAIL LANDSCAPE

UNDERSTANDING INFLATION: THE PROS &

BY LUC WHITLOCK & NABIL AWADA

BY LUC WHITLOCK & NABIL AWADA

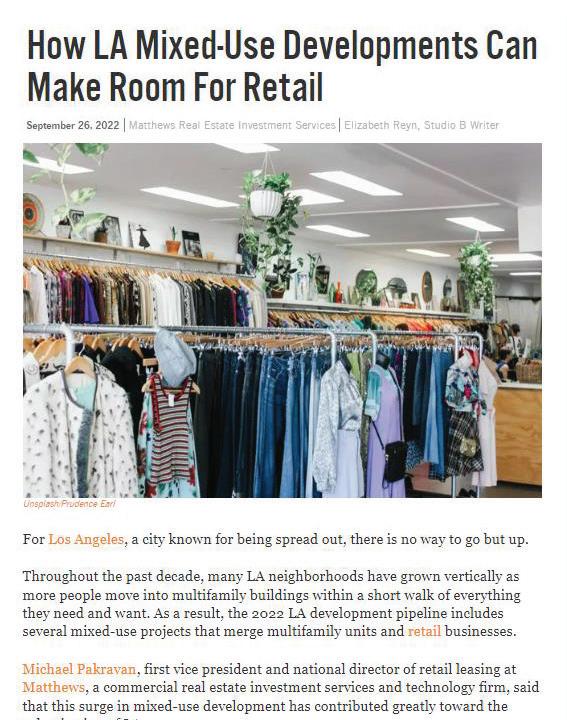

Los Angeles has been painted in a bad light for the last few years – from the eviction moratorium to continuous COVID-19 restrictions, homelessness issues, development costs, California exodus, and more, the market has received its fair share of bad press. Despite the news, Los Angeles continues to attract investors seeking opportunities. To illustrate this, the Los Angeles multifamily market achieved $14.4 billion in sales in the last 12 months; this compares to $3.7 billion in Austin, TX, $4.6 billion in San Diego, and $5.4 billion in Las Vegas. The most comparable market is Phoenix which recorded a whopping $16.9 billion in sales over the last 12-month period, but the vacancy rate stands at 7.9 percent, compared to Los Angeles’ 3.4 percent. Here are five fundamentals that drive the Los Angeles multifamily market and why it is still a top market to invest capital in.

The biggest Achilles heel for Los Angeles is land availability and, thus, the housing shortage. With the ocean on one side, the desert on the other, and steep hills in between, there isn’t a lot of land left to develop. The land is more valuable than any other market in the United States and is therefore priced at a premium. As of 2021, Los Angeles is ranked as the third hottest market for increasing land values. Even small parcels of land in Los Angeles nowadays cost a pretty penny, according to a recent Realtor.com report which analyzed how underdeveloped property prices have risen since the onset of COVID-19.

In Los Angeles, the average price per square foot soared 67 percent year-over-year, most notably in the city’s outer regions, which were once considered relatively affordable. The current price per square foot of a multifamily building in Los Angeles is $457.42. Faced with a severe housing shortage and geography challenges, land value in Los Angeles isn’t expected to fall. Land costs account for nearly 17 percent of a multifamily development, compared to two percent in other markets. As Mark Twain once said, “buy land; they’re not making it anymore.”

Despite these obstacles, the development pipeline in Los Angeles is robust as developers target infill locations and redevelopment opportunities. The percentage of properties under construction represents 2.6 percent of existing inventory as of September 2022. Looking at construction levels, Downtown Los Angeles, Burbank, Greater Inglewood, and Woodland Hills have the most apartment units under construction. Multifamily construction projects are typically Class A properties as they are the only developments that pencil out in current market conditions. Developers find it increasingly hard to build

in Los Angeles due to high costs of land, expensive rent, the ongoing threat of rent control, eviction moratoriums, local zoning ordinances and restrictions, and difficulty acquiring permits, labor, and materials.

The lack of adequate land has led to the chronic housing shortage, and investors are drawn to the increasingly valuable opportunities in the market.

Sunny weather, expansive mountains and beaches, and an endless trove of career opportunities have always drawn young people to Los Angeles. But members of Gen Z are claiming a growing share of apartments in California compared to other generations. They represent more than one-quarter of active renters in Los Angeles. Many of them seek to live out their Hollywood dreams. In fact, 30 percent of Los Angeles Gen Zers are drawn to online fame. Resources also say that Los Angeles is one of the healthiest cities in America in terms of lifestyle. After two years of a pandemic-related stint in health, Gen Z has made healthy living a top priority, making Los Angeles a prime city for the healthconscious generation.

The roughly 67 million Americans born between 1997 and 2012 just entering the workforce, starting college, or graduating high school – have impacted the market. Experts have predicted that Gen Z will become the economy’s main drivers for budding entrepreneurs, advocates, artists, and tech experts. It’s fair to say the cities to which Gen Z flock will benefit not only from the influx of new residents but also set that city up for long-term success.

Real estate is never just about real estate. It’s also government policy, financial markets and new technologies that are changing the way we do business. At The Real Deal, we cover it all so you can stay one step ahead to make smarter decisions.

GlobeSt.com

GlobeSt.com’s trusted and independent team of experts provides commercial real estate owners, investors, developers, brokers and finance professionals with comprehensive coverage, analysis and best practices necessary to innovate and build their businesses. We celebrate those that are adapting and succeeding in new ways, translate the impact of macro issues, local market trends and emerging technologies into digestible, shareable information that can be immediately put into real-life practice.

GlobeSt. Real Estate Forum magazine is a must-read for the nation’s leading decision makers in all segments of the commercial property industry. Each issue delivers in-depth analysis of the latest market conditions, insightful case studies, company profiles, interviews with innovative thinkers, demographic trends – everything you need to know to make smart business decisions.

GlobeSt.’s event portfolio delivers a combination of local market commercial real estate forums and national forums designed to tackle some of the most challenging real estate opportunities across sectors such as Healthcare, Apartments, Net Lease and Industrial.

Through our real estate brands, GlobeSt. reaches nearly 300,000 CRE professionals across all markets, sectors and business disciplines. Our unique print/online/events integrated business model allows us to deeply understand the dynamic real estate industry and the evolving needs of our audience.

GlobeSt.’s suite of publications and events covers the entire commercial real estate ecosystem, providing our users with a 360-degree view of their industry. Punctuated by well-researched and incisive news and analysis, and bolstered by insightful thought leadership, innovative ways to access information, exclusive events, and pragmatic tools for implementing new strategies, GlobeSt.’s real estate industry capabilities are uniquely focused on giving our readers a competitive edge in their business initiatives. Visit us online at GlobeSt.com

NM HC ’ s meetings

NM HC ’ s meetings

br i ng toget her sen ior execut ives from t he nat ion’s leadi ng mu lt i fa m i ly fir ms for h igh level network i ng , act iona ble busi ness i ntelligence a nd t hought provok i ng discussions .

br i ng toget her sen ior exec ut ives from t he nat ion’s lead i ng mu lt i fa m i ly fir m s for h igh level network i ng , act iona ble busi nes s i ntel ligence a nd t hought provok i ng discussions

This information has been produced by Matthews™ solely for information purposes and the information contained has been obtained from public sources believed to be reliable. While we do not doubt their accuracy, we have not verified such information. No guarantee, warranty or representation, expressed or implied, is made as to the accuracy or completeness of any information contained and Matthews™ shall not be liable to any reader or third party in any way. This information is not intended to be a complete description of the markets or developments to which it refers. All rights to the material are reserved and cannot be reproduced without prior written consent of Matthews™.