11 minute read

Cover Story

PRINT IS

Advertisement

HERE TO STAY

Canon and ME Printer ME Printing Industry Market Study 2020 identifies opportunities and challenges of regional printing industry post Covid-19

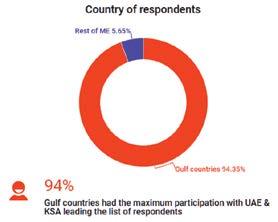

The ME Printing Industry Market Study 2020 conducted jointly by Canon and ME Printer, attempts to unveil the opportunities, challenges and market trends in the regional printing industry and more specifically the Gulf region. This includes UAE, Saudi Arabia, Oman, Kuwait, Qatar and Bahrain.

During a webinar hosted by Canon ME and ME Printer magazine on Tuesday, August 25, 2020 the results of the joint study and an indepth overview of the print market and the current state of the industry during COVID-19 were revealed.

Included Sunil Pandita, Director of Production, United Printing & Publishing; Alex Jahanbani, Editor of ME Printer; and Ayman Aly, Senior Marketing Manager, Canon Middle East

The industry-first study also supports print service providers looking to implement an informed and sustainable business strategy based on their customers’ requirements in a post-COVID world.

Shadi Bakhour, B2B Business Unit Director, Canon Middle East, said: “With the onset of the pandemic and the lockdown, we knew that there is going to be an impact on the print. There was already a change in motion with the natural progression brought forth by digital trends and new print sectors emerging, but we believe the change was accelerated by COVID-19 and put the industry on a path where transformation was now a necessity. Our objective is to support the print industry in the region, and conducting the Canon ME Printing Industry Market Study 2020 early on allows businesses and stakeholders in the sector to make solid strategic decisions and capitalise on the opportunities that are now available based on these new insights.”

METHODOLOGY

The report was based on responses to an online survey conducted by ME Printer on behalf of Canon, between June and July 2020. The survey was sent to printing presses, service providers and key industry stakeholders, and brand owners.

ME Printer asked survey respondents a series of questions in order to gain a better understanding of the current market conditions for the print industry and the demand for print services today.

Dramatic shock

Most of the industries have suffered a dramatic shock with demand and business confidence decimated due to Covid-19 and print industry is no different. The print industry is facing lot of challenges including non-availability of financing options, major competition from online media, crowded marketplace in the offset printing space etc. Gaining insight into and delivering the right investment decisions can be challenging, but it is a process and the more input and information, the better. Ensuring you have the right business model that delivers profitability and sustainability is something that needs to be looked at again as the economy starts recovering after months of lockdown across the world due to the COVID-19 pandemic

The printing industry also needs to look at options for process improvements, which can open up new opportunities. Additional challenges that call for a revised review of your business model include:

Business Environment: It is profoundly more complex and industry conventional boundaries are fading. Technology is bringing competition into your backyard and you have the opportunity to similarly follow.

Competition: Today the basis of competition is increasingly based on capabilities and knowledge.

Value Creation: The valueadded potential of many businesses is shifting toward knowledge, systemic innovation, and service-based activities.

Extended Enterprise: Virtual integration, partnerships, strategic alliances and joint ventures, part of the extended enterprise, are becoming common parts of competitive strategies. Companies that get investment right will inevitably capture the most profitable opportunities, clients and markets. Companies that don’t will be left to compete on unfavorable terms and smaller returns.

With this research, Canon and ME Printer hope to provide you with a better understanding of cumulative trends impacting the print industry. There are many common issues faced by organisations across the industry, clearly some organisations are dealing with these challenges better than others.

Key Findings (print service providers)

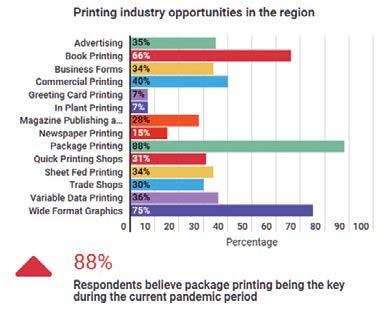

. Packaging sector is showing the stabilizing effect in the printing and packaging arena.

Wide format graphics, book printing and commercial printing. Sheet-Fed digital printing are other areas which look promising . printing & packing industry feels that Covid-19 has had moderate to significant impact on their business. Still they feel there would be opportunities in KSA and UAE once the

COVID-19 phase is over . Significant numbers of

Businesses (64%) wants to diversify into new areas of printing & packaging with 30% respondents planning

Investment in machinery in the near future The joint Canon and ME Printer webinar concluded with a panel discussion with the participation of Sunil Pandita, Director ProductionUnited Printing & Publishing, Alex Jahanbani, Editor ME Printer and Ayman Aly,Senior Marketing Manager- Canon Middle East

. Non-existent financing options remains one of the top business challenge for the business . Packaging, labels, security printing and cut-sheet digital print are the major job segments to witness growth . Cloud-enabled workflow services were adding value to the overall workflow according to printers using workflow for estimation, print management using workflow tools help in controlling costs and adding value. . Financial support to purchase new digital equipment, access to printing/graphics templates and free software libraries are major factors cited by small local print service providers limiting their plans to move more towards digital printing equipment.

Despite sharp decrease in demand for printing still a large portion of all types of information is printed. The web is now more dominant than ever but print still matters and this is the essence of this survey. Among all sectors of printing, packaging reigns supreme. The findings of this survey in general and the graph in this slide in particular are more or less attuned to global graphic arts trends, except perhaps commercial printing which boasts more opportunities in our region

comparing to developed western countries. According to a recent report published by Smithers Pira in 2020 print for packaging is valued at almost $447 billion, with print output of 11.4 trillion A4 prints equivalent. There are huge untapped opportunities for digital printing to penetrate packaging and label printing market.

Next stop is digital inkjet printing which is an essential part of large format printing. Based on figures presented by Smithers Pira. In 2020 Inkjet printing market is valued at $80.4 billion, which is equivalent to 932 billion A4 prints. Smithers Pira forecasts this growth will continue post Covid pandemic. Printers and converters will spend $3.9 billion on new inkjet equipment, up from $2.9 billion in 2015.

There is no doubt that Covid -19 has shaken our industry to the core and we all are trying to adjust to new realities. For signs and graphics industry, COVID-19 has posed a major challenge, but there are also opportunities. Governments and health authorities are using videos and graphics to promote social distancing and how to properly wash your hands. Floor stickers, billboards and other large format printing material have been used for this cause. Also, interactive shop signs and restaurant touchless menus also creates opportunities

for large format printing.

It seems that large format printing will be able to recover quickly. On the other hand, the services and products that signs and graphics offer to public is very valuable and sometimes lifesaving.

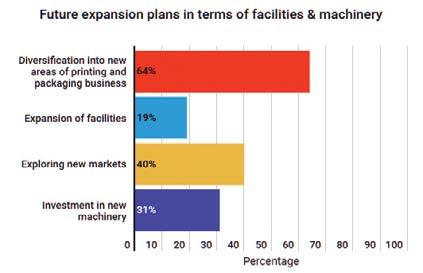

In terms of expansion plans of machinery and facilities, 64% of respondents want to diversify into new areas of printing & packaging. 40% of participants want to explore new markets to cover the reduction in demand due to the pandemic. Investment in machinery is planned in the near future according to 30% of the respondents.

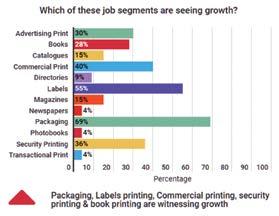

Packaging, labels, Commercial printing, security printing and book printing are the major job segments that will witness growth and respondents view this as their main revenue streams

No surprises here. The demand for packaging and labels is growing and will increase. Security printing is also promising. However, the commercial printing is also encouraging and should not be overlooked.

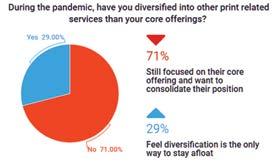

We are not seeing much diversification into other print related services yet. 71% of respondents are still focused on their core offering and want to consolidate their position, 29% feel diversification is the only way to stay afloat in this pandemic hit market.

Traditionally commercial printers were keen to diversify and become a one stop shop for their customers. Commercial printers are now offering a wide range of products and added value services including graphic design, web to print and fulfillment, database management. Many offset printers are also using digital equipment for short run printing and other services. For commercial printer, diversification meant adding services and products which complements their core offering. Covid pandemic strengthened this strategy and they prefer not to get out of their comfort zone for time being. On the other hand, some printers also feel they have to shift to other more profitable printing activities including packaging and label printing.

Key Findings (Print buyers)

. The office print industry is facing immense uncertainty due to Covid-19 and it is not going to be business as usual. Hence, we wanted to understand how printing will be impacted post covid-19 in the workplace. . Device-as-a-service adoption among brand owners is only going to go up as it helps them access the latest technology, control cost & unburden IT. . Majority of marketing dollars will move towards online marketing with mobile centric contents. offline media to be optimized will be used on case to case basis. This means more focus will be on short-run ondemand printing and end of bulk printing. . Managed Print Service and its importance post Covid-19. 60% of the respondents have not evaluated the importance of

MPS . Printed marketing communication as a channel, is it still relevant even though brand owners feel that printing budgets will decrease. . Paperless trends in office post

Covid-19: It looks more like

“less paper “than paperless office. . Sustainable printing solutions going forward: Majority of brand owners feel the need to shift to sustainable printing solutions.

We wanted to understand the opportunities available going forward. Majority of respondents feel shop signage’s, floor stickers & product labels being the top 3 opportunities followed by large

poster printing, point of sale printing & POS displays in the retail printing market.

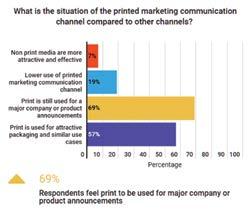

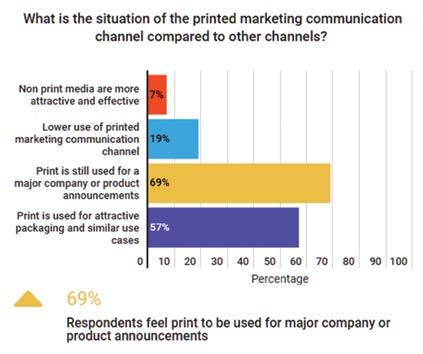

Printed marketing communication as a channel, is it still relevant. 69% of respondents feel print to be still used for major company or product announcements. 57% feel attractive packaging would be the future for print. 19% feel that print as a marketing communication channel will reduce.

Does printing play a role in brand’s success, we wanted to understand and 43% respondents feel that printing play a very important role and 40% feel it is important. 17% rate printing’s role as moderate in the success story of the brand.

The graph in this slide is an ironclad proof that printing still do matter to companies and they will use it for their day to day activities. 65% feel more marketing dollars will move towards online marketing with mobile centric contents as it is much easier to measure. 52% of respondents feel offline media will be optimized and be used on case to case basis. This means more focus will be on short-run ondemand printing and end of bulk printing.

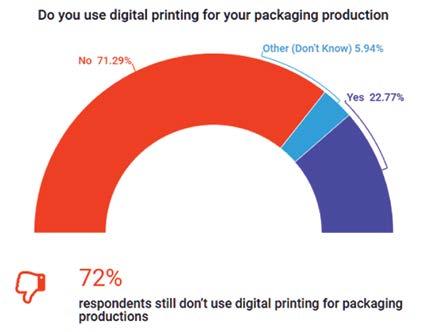

Digital printing for packaging productions: 72% respondents still don’t use digital printing for packaging productions.

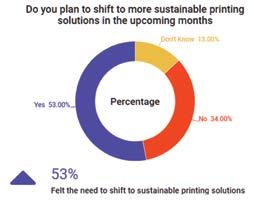

Sustainable printing solutions going forward. 53% feel the need to shift to sustainable printing solutions in the months to come whereas, 34% don’t have any plans to shift. Another 13% are still undecided.

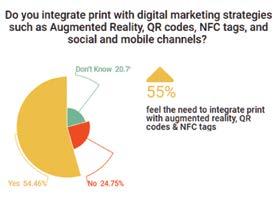

Brand owners are very serious about sustainable practices when it comes to printing and this will affect their relation with printers. Printers should take note of that. 55% of brand owners feel the need to integrate print with augmented reality, QR codes & NFC

tags. 25% of respondents don’t have any plans and another 21% are still undecided.

Conclusion

The requirement for brand enhancement/ differentiation/ customization in this competitive environment is growing hence, printed packaging is seeing attraction from the printers and we foresee investments moving in that direction.

Brand owners are still optimistic that printing of essential

documents will happen and print management & cost control using workflows will be more and more adopted by companies to cut costs and improve efficiency. With demand for long runs shrinking and short runs with variable printing gaining popularity, print vendors need to ensure better market penetration by supporting printers through offering finance solutions/device-as-a-service and helping them with necessary training/providing free templates plus access to software libraries.