RED SEA: DON’T OVERPLAY THE ISSUES

EGYPT: PRIVATE SECTOR $ POUR IN

BUENOS AIRES: WHAT NEXT?

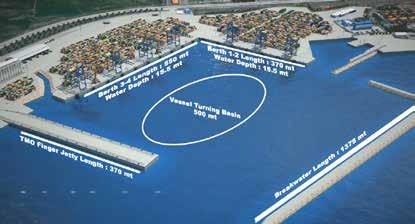

PREPARING FOR COASTLINK

JANUARY/FEBRUARY 2024 VOL 1024 ISSUE 1 portstrategy.com Hydrogen Equipment Trials | Beware Data Scraping | Engine Innovation Builds

MIKE MUNDY

MIKE MUNDY

2024 Promises an Interesting Cocktail of Coverage

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: Andrew Penfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; Ben Hackett; Peter de Langen; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING

t +44 1329 825335 f +44 1329 550192

How much do we believe all the ‘noise’ surrounding the Red Sea Crisis? In true PS analytical style, we drill down into the facts and come up with a fresh take on the foreseeable economic impact. This edition of PS also contains a strong focus on investment hotspots and addresses a number of other issues of the moment, not the least of which is dealing with the so-called dark fleet and what the future holds for Buenos Aires, a long-running controversial subject!

Welcome to 2024 where PS has a lot lined up for you via the magazine, online and at various industry meets.

Geopolitical events are to the fore – ‘mad Vlad’, as the UK’s Sun newspaper aptly names President Putin, continues to wage his war of aggression against Ukraine, which to me, and doubtless many of you, seems to lack any meaningful purpose other than some flawed dream to rebuild the Soviet Union. Definitely ‘nuts stuff’ and the product of a deranged mind but nevertheless very important to react against for a number of fundamental reasons – not least to stop the contagion of Putin’s thinking spreading and to provide stability in the food and energy markets.

Clearly, the International Maritime Organization (IMO) agrees – our review of IMO’s latest thinking, on p54 highlights newly appointed Secretary-General, Arsenio Dominguez referencing the so-called dark fleet and calling on “Member States to uphold their responsibilities when it comes to implementing regulations.” The view is very clear that Member States are seen to have a role to play in conjunction with vessels evading safety conventions and operating without proper insurance cover, while breaking international sanctions to carry, for example, Russian, Iranian or Venezuelan oil cargoes.

The Red Sea crisis also comes into IMO’s focus – with the emphasis placed on the safety of seafarers.

We too add some interesting dimensions to this subject, Ben Hackett, regular writer of our Economist column, highlights how quickly much of the shipping sector has acted to avoid the threats in the Red Sea and how some ports will benefit from the introduction of more vessels using the Cape of Good Hope route. In key respects, he dubs the event, “a storm in a teacup.” Andrew Penfold, in the article Don’t Overplay the Issues, drills down into the economic impact of the crisis and suggests that there is too much ‘noise’ in this respect, in both the container and bulk shipping sectors, and that proper analysis suggests a limited impact.

In terms of port investment, there is a big story to tell in Egypt (p26), a positive story in Turkey along its Mediterranean coast where the ports of LimakPort Iskenderun and Mersin are strongly pursuing positive development after the problems posed by the major earthquake in the area (p28) and, admittedly on less of a positive note, we look at what the future holds for container operations in Buenos Aires under the new Milei Government (p40).

Looking ahead I would like to highlight the Safe Mooring Seminar PS is running in conjunction with Through Transport Club on 28 March in London. All critical aspects of safe berthing will be examined in this important day seminar. I hope to see you there and that generally PS keeps you well informed, in advance of your needs, in 2024.

Media Sales Manager: Arrate Landera alandera@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published bi-monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com Register and subscribe at www.portstrategy.com

1 year’s digital subscription with online access £244.00

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

©Mercator Media Limited 2024. ISSN 1740-2638 (print) ISSN 2633-4232 (online). Port Strategy is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 3

PORTSTRATEGY INSIGHT FOR PORT EXECUTIVES

VIEWPOINT

11

13

13

19

19

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 5 Social Media links LinkedIn PortStrategy portstrategy YouTube The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operationalenvir challenges. Stay in touch at greenport.com Join leading port executives in Athens, Greece from 14-16 October 2019 www.greenport.com/congress Online portstrategy.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Weekly E-News Sign up for FREEat: www.portstrategy.com/enews CONTENTS JANUARY/FEBRUARY 2024 is a proud support of Greenport and GreenPort Congress GreenPort magazine is a business information resource on how best to meet the environmental and CSR demands in marine ports and terminals. Sign up at greenport.com The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operational environmental challenges. Stay in touch at greenport.com Social Media links LinkedIn PortStrategy portstrategy YouTube The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operationalenvir challenges. Stay in touch at greenport.com Join leading port executives in Athens, Greece from 14-16 October 2019 www.greenport.com/congress Online portstrategy.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Weekly E-News Sign up for FREEat: www.portstrategy.com/enews Social Media links LinkedIn PortStrategy portstrategy YouTube The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operationalenvironmental challenges. Stay in touch at greenport.com Join leading port executives in Athens, Greece from 14-16 October 2019 www.greenport.com/congress analysis www.portstrategy.com/enews

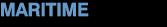

the cover Due to the Red Sea Crisis and vessels rerouting round the Cape of Good Hope, Suez Canal Container Traffic has dropped to its lowest levels since the 2021 blockage. Depending on how long the crisis continues this can have a serious impact on Egypt’s GDP, two per cent of which is attributed to the Canal. On a more positive note private sector dollars are pouring into boosting the country’s container terminal capacity – p26. NEWS FEATURE ARTICLES REGULARS 21 The New Yorker Red Sea Trigger to Intermodal? 21 The Analyst ‘Whole New Space to Occupy’ 23 The Economist Storm in a Teacup 23 The Strategist ESPO: “No Time to Lose” 54 Postscript Shadow Fleet Targeted 24 Don’t Overplay the Issues The Real Cost of the Red Sea Crisis 26 Private Sector $ Pour In Egypt Container Port Development 28 Down But Not Out Iskenderun Bounces Back 31 Privatisations Up and Downs Ownership Challenges in Greece 32 Hydrogen Equipment Trials Put to the Test in Valencia 35 ETS: Complex and Changing Potential to Cheat? 37 Beware Data Scraping Problems Identified 38 Bulk Shipping Outlook Shape of Things to Come 40 Buenos Aires: What Next? Still a Lack of Direction 41 Ro-Ro Terminal Bonanza Auto Trade Catalyst 42 Paranagua Prospects Bright Investment Pays Off 44 Preparing for Coastlink Amsterdam Talks 46 Data and Decarbonisation Reachstacker Design Trends 48 Engine Innovation Builds Race for Reduced Emissions JANUARY/FEBRUARY 2024 VOL 1024 ISSUE portstrategy.com Hydrogen Equipment Trials Beware Data Scraping Engine Innovation Builds EGYPT: PRIVATE SECTOR $ POUR IN RED SEA: DON’T OVERPLAY THE ISSUES BUENOS AIRES: WHAT NEXT? PREPARING FOR COASTLINK

Transforming Iloilo ICTSI Signs Concession

Rail Tender Valenci Rail Boost

Deals for RightShip Sudeste and Napier

Durres Powers On Volume Builds

On

17

17

19

11

East CT Gears UP Spending Big in Colombo

Konecranes Order TOS for Verbrugge Int.

Alicante Joins Party Integrates with PACECO POSEIDON

Up and Running Truck App for HHLA

PLA Upgrade VTS Contract Award

Hydrogen RTG First Kobe Mitsui Terminal Trial

Kalmar Demerger As Orders Roll In

15

15

17

17

Brand Refresh & Ambitions Konecranes “Moves What Matters”

Coal Transshipment System Bedeschi Deal

ICTSI CONCESSION BRINGS TRANSFORMATION TO ILOILO PORT…

International Container Terminal Services Inc. (ICTSI), reports the award of a new concession in the Philippines and commencement of works on the upgrade of its Rio Brasil Terminal in Brazil.

The Philippine Ports Authority (PPA) has awarded ICTSI a new 25-year concession contract to develop and operate the Commercial Port Complex (ICPC) in Western Visayas. This decision represents a significant step forward in transforming ICPC into a modern and efficient gateway for the region.

Visayas Container Terminal (VCT), the future name of the facility after handover to ICTSI – is a critical gateway for trade in the Western Visayas. However, capacity efficiency constraints have hampered its full potential. ICTSI’s involvement aims to tackle these challenges head-on, unlocking the port’s economic potential.

VCT has 627m of operational quay and 20ha of land for container and general cargo storage, warehousing, and other cargo-handling activities. Upon signing of the contract, ICTSI will focus on improving terminal productivity and service quality

by investing in the development and rehabilitation of the terminal infrastructure and the deployment of modern cargohandling equipment.

Former Senator Franklin Drilon, a native of Iloilo, and long-term supporter of the port, outlined the importance of this decision: “With its impressive track record, ICTSI is well-positioned to efficiently manage the ports and address the longstanding congestion issues plaguing our ports, which have deterred potential investors.

The decision to partner with ICTSI is a significant step forward in transforming VCT into a modern, world-class port facility and accommodating more domestic and international shipments. This

will position Iloilo as a key driver of economic progress in the Philippines.”

Christian R. Gonzalez, Executive Vice President, ICTSI, notes: “We are elated and grateful to be entrusted with the redevelopment of the Iloilo Port. We recognise the port’s pivotal role in driving Iloilo’s economic and social growth. Our comprehensive proposal outlines significant investments in infrastructure upgrades, cargo-handling equipment, and operational efficiency measures, all aimed at transforming the Iloilo Port into a premier gateway.”

…AND UPGRADES RIO BRASIL TERMINAL

Also on ICTSI’s agenda, is the upgrade of its Rio Brasil Terminal spanning major structural modernisation and expansion works.

The expansion works involve a

Gantrex buys Liftcom

Gantrex Group, a company supported by Argos Wityu, has acquired Liftcom, as it continues to grow and expand its Port Crane Services (PCS) capabilities. Integrating Liftcom will reinforce the competitive position of Gantrex in the Dutch market and within Rotterdam, a port with over 100 ship-to-shore cranes and 300-yard machines spread over multiple terminals. This latest deal is expected to double turnover by 2026.

new methodology that uses moveable metal panels that are fabricated on site and a state-ofthe-art geo-positioning system (GNSS) for landing the foundation piles. On average, each section of

Port Auctions Coming

The National Water Transportation Agency (ANTAQ) in Brazil is planning to hold 19 port auctions in 2024, which is expected to generate approximately R$11.7bn in investments. Eduardo Nery, Director, ANTAQ, says that the initiatives include 16 concessions developed by the federal government (R$8.2bn in value) and three projects in Paranaguá, Paraná, where administration is decentralised, (expected to raise R$3.5bn in investments).

a planned new quay involves use of 380m3 of concrete. A total of 12 phases of development space are due to be created during Q1 2024 and once completed there will be an additional 6000m2 of new dock.

JAXPORT Deal Done

South-eastern US-based JAXPORT has approved a 30-year agreement with US marine terminal and logistics company Enstructure for the lease and development of 79-acres of waterfront land at the port’s Talleyrand Marine Terminal. Enstructure will develop a mixed-use facility from late 2025 when incumbent tenant, Southeast Toyota Distributors, relocates to the Blount Island Marine Terminal.

Port of Valencia Tenders Third Rail Line

The Port Authority of Valencia (PAV) is tendering to double track and construct a third railway line connecting the Poniente and Levante terminal facilities in the Port of Valencia. The tender has been confirmed for an amount of €12 million ($13 million), with a completion period of 18 months.

Once operational, the new line will allow the access of 750m-long freight trains to the Levante Railway Terminal on double mixed track and eliminate the singletrack section existing at present.

This expansion project aims to provide improved access to the APM Terminal’s container terminal while also accommodating more trains inside the port, facilitating convoys to the upcoming rail highway and also accessing Valencia Terminal Europa (VTE). .

This development is part of Valenciaport’s railway strategy, which is encouraging greater use of railroads, and which has seen train-handling cargo rise in recent years. Currently a total of eight per cent of all freight enters/ leaves Valencia’s port network via rail.

In another new development, the port of Valencia and Valencia Terminal Europa have signed an agreement governing the construction, operation, and maintenance of a new photovoltaic infrastructure.

BRIEFS

RNLI Marks 200

A 200-year photo history of the Royal National Lifeboat Institution (RNLI), timed for the RNLI’s 200th anniversary on March 4, 2024 is being released. The commemorative publication, 200 Years of Lifesaving at Sea is noted as offering “over 100 fascinating images….. to the brave folk who sailed and continue to sail towards danger, rather than away from it.” To date the RNLI has saved over 144,000 lives.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 7 PORT & TERMINAL NEWS

8 Artist’s rendition of ICTSI’s vision for the Visayas Container Terminal

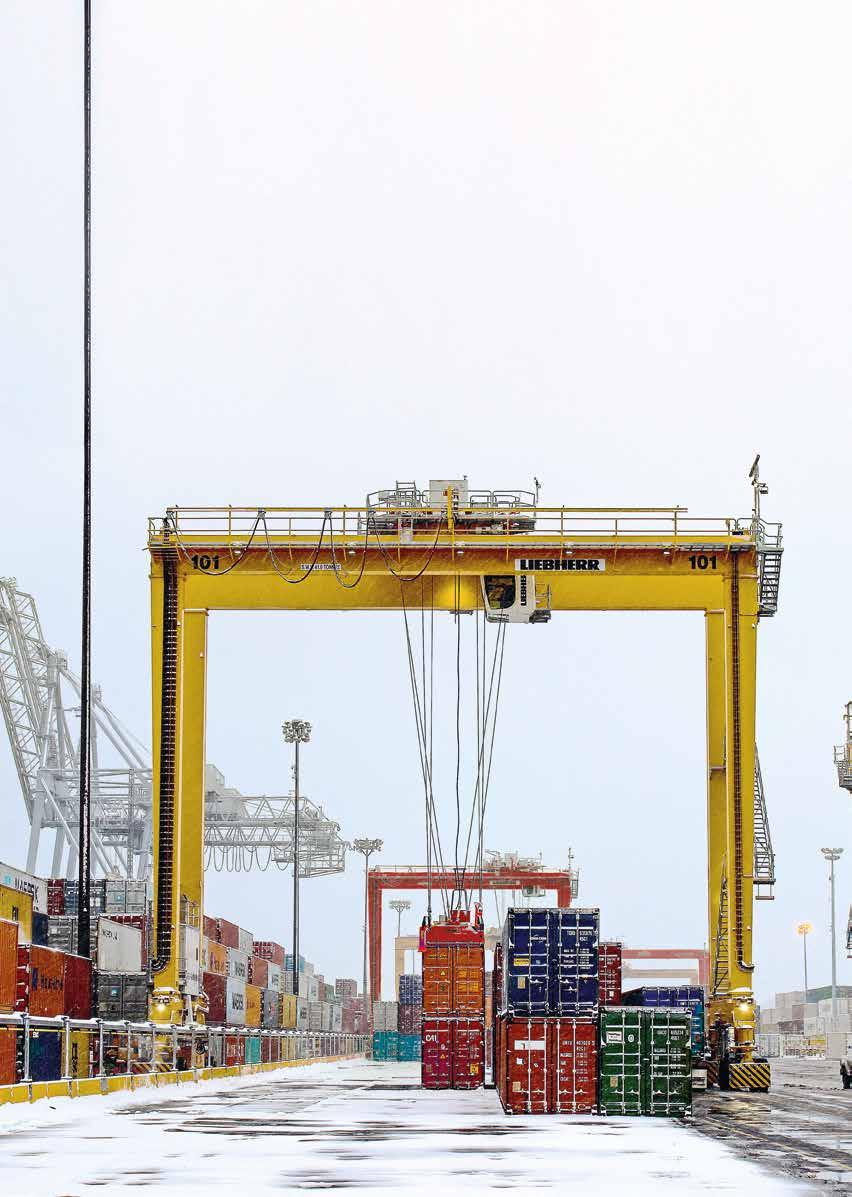

Any colour, but always green.

Electric RTGs, available with busbar or cable reeling drum and hybrid machines with Liduro energy management are ideal for reducing your carbon footprint.

www.liebherr.com

Liebherr Container Cranes Ltd.

Liebherr Container Cranes Ltd.

RIGHTSHIP SECURES TWO NEW PROJECTS

Leading environmental, social and governance (ESG) focused digital maritime platform specialist, RightShip, has confirmed two new port deals. The first is for Itaguai, Brazil, with the second deal for Napier Port, New Zealand.

The new partnership with Port of Sudeste, located in Itaguai, Rio de Janeiro, will see the port start utilising RightShip’s Maritime Emissions Portal (MEP), in what represents a first for the Latin American region.

MEP is a unique digital solution that combines AIS vessel movement data with RightShip’s vessel insights. Its primary objective is to calculate ships’ emissions and identify areas of opportunity to reduce environmental impact. MEP, according to Rightship, provides crucial support and access to unparalleled maritime datasets. This helps ports and terminals to effectively measure and manage their emissions, thereby supporting decarbonisation strategies that align with global, regional, and national targets.

Port of Sudeste recently announced aims to reduce its scope one and two GHG emissions from operations by 50.4 per cent by 2033 compared to the base year 2021. With scope three emissions representing one of the main challenges for the ports and terminals sector in reaching net zero, the addition of MEP now provides Porto Sudeste with a tool to monitor and reduce these three emissions as part of its broader

8 Yilport’s Puerto Bolivar terminal in Ecuador has received four new ship-to-shore gantry cranes and one additional rubber-tyred-gantry (RTG) unit (taking the terminal’s total to 18 RTGs overall), which boosts capacity to around one million TEU per annum. The new STS cranes are supporting the Phase II expansion project, which is increasing the berth length to 1410m, of which 780m is for dedicated container activities. Operations are due to commence before the end of Q1 2024. Yilport has previously reported that its total investment in its Puerto Bolivar terminal will be in the order of US$750 million. US$150 million of this investment is being provided by way of a loan from the US International Development Finance Corporation.

decarbonisation strategy.

MEP employs an energybased modelling approach linked to UNEP and UNFCCC guidelines to calculate vessel-based emissions. Emissions are calculated in four separate operational modes across defined points of interest specified by the Port of Sudeste, making this platform a genuinely tailor-made solution for every port.

In operation since 2015, Porto Sudeste is a key Brazilian mining development. Through the port, the iron ore produced in Brazil reaches markets throughout Southeast Asia. This terminal is designed to load solid bulk iron ore, of which it can handle up to 50 million tons per year. The port is controlled by two international companies: Mubadala, a global investment company in various segments of the economy, and Trafigura, a leading multinational in the oil, metals, and mineral trade

Similarly, RightShip has

announced that it has signed a deal whereby New Zealand’s Napier Port will implement the company’s innovative RightPort risk solution. This agreement will make Napier the first port in the region to adopt this technology, which aims to enhance maritime safety and sustainability.

RightPort is a transformative digital solution that screens inbound vessels against risk-based criteria tailored to a port’s requirements. It enables ports and terminals to streamline their pre-arrival processes, reduce administrative workload, and improve communication with vessels. RightPort also connects users to a global network of ports, allowing them to access feedback reports and vessel insights from other ports and terminals.

BRIEFS

SC Ports Looks Deep

The South Carolina Ports Authority plans to deepen the ship channel leading to its North Charleston terminal to 52ft as part of its plans to expand capacity from 500,000 TEU per annum to 2.5 million TEU within the next 10 years. A request has been made to the US Army Corps of Engineers to begin a feasibility study for dredging the channel by an additional five feet.

BEST Deal for MSC

Reports in Spain are indicating that Mediterranean Shipping Co (MSC) is acquiring a 50 per cent stake in the BEST container facility in Barcelona, currently operated under longterm concession from Hutchison Ports. APM Terminals (APMT) is an operator in Barcelona, but the forthcoming end of the 2M Alliance between MSC and Maersk Line may have prompted MSC to seek alternate terminal options at the port for its own vessels. BEST is currently expanding to 3.34 million TEU capacity per annum.

Ceres Rebrand

Seattle-headquartered Carrix has announced that its recent acquisition, Ceres Terminals, is being rebranded as SSA Marine. Carrix completed the acquisition of the Ceres Terminals portfolio, consisting of operations in 18 locations, at the end of Q3 2023, for an undisclosed amount and cited the appeal of further entry into markets in the US Gulf and Atlantic as a key rationale for the deal.

ESPO Approval

The European Parliament has offi cially adopted the Berendsen report, a path to port reform – see p23.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 9 PORT & TERMINAL NEWS

8 Napier Port in New Zealand is the second port, after Port of Sudeste, in Itaguai, Brazil, that has recently signed a new deal with RightShip of Singapore for ESG focused digital maritime platform support

Protect Lives and Equipment

Minimize the risk of downtime and damages with Fogmaker’s fire suppression system!

The Fogmaker fire suppression system is tailormade for each type of material handling equipment.

High-pressure water-based mist chokes fires quickly and cools the area to prevent reignition. Fogmaker’s system is automatic, independent of electricity, and always ready!

www.fogmaker.com

Future!

PFAS-Free for the

DURRES POWERS AHEAD

Durres Container Terminal, at the Port of Durres, Albania, is capturing major new cargo volume which is being facilitated by ongoing terminal system enhancements.

Based on available information provided by the Durrës Port Authority (APD), a total of 184,017 TEU were handled in 2023, representing an increase of 38 per cent over the total recorded for 2022.

The trade itself was also balanced, with 92,100 TEU confirmed as import activity, with exports reaching 91,917 TEU. Indeed, it is export demand that has been a significant driver of this growth, with an additional 51,052 TEU exiting the terminal in 2023 compared to the same 12-month period of 2022.

It is also clear that investment in new and improved systems and improved terminal performance by the terminal’s

8 Liebherr Container Cranes ltd is supplying the new APMT Rijeka Gateway terminal with 15 electric rubber tyred gantry cranes (ERTGs) and two rail mounted gantry cranes (RMG), all of which, according to Liebherr, utilise the latest advancements in technology, allowing for seamless remote operation and control. Liebherr’s ERTGs are powered by electric busbar technology with drivein auto-connect functionality, with a mobile lithium-ion battery that helps ensure emission free operations. All the equipment uses the Liebherr Remote Operator Stations (ROS), enabling crane control from a convenient office setting, which improves safety and productivity but enables a future transition to a fully automated operation.

management company, Mariner Adriatic (part of Hili Company) is paying an important role in this uptick.

Mariner Adriatic highlights the implementation of the Navis N4Saas terminal operating system, Navis’s cloud-based solution, as a major positive step. It also reports other terminal

efficiency measures including the installation of an automated gate system and a comprehensive upgrade to the Customer Access Portal.

Serbia Targets Greece

When opening the recent Serbia-Greece business forum, Aleksandar Vucic, President of Serbia, has confirmed Serbia’s interest in securing an equity stake of between five and 10 per cent in either the port of Piraeus or Thessaloniki. He said that the aim is to support a desired growth in Serbia’s exports, especially involving automobile production and mining. It is not known whether existing investors in these ports are in favour.

CTW Connects

Eurogate Container Terminal Wilhelmshaven (CTW) is implementing Portchain Connect to simplify berth alignment processes with shipping lines. CTW is expecting to increase the quality and speed of ships berthing through digital handshakes and secure data sharing. Portchain Connect gives the terminal a real-time schedule and move count updates directly from carrier systems to allow better overall alignment.

Salalah Increases

The Port of Salalah in Oman has received the first four of 10 new ZMPC ship-to-shore (STS) cranes from China as its container terminal modernisation and expansion project gathers momentum. A further six cranes are expected during Q2 2024, replacing four lower specification units, as part of the overall increase in annual capacity from five to six million TEU by the end of Q1 2025. Crane outreach is a mammoth 75m.

East Container Terminal, Colombo, Gears Up

Container capacity at the East Container Terminal (ECT) at the Port of Colombo, Sri Lanka, is set to get a significant boost.

The Sri Lanka Ports Authority (SLPA) has confirmed that the facility is to get three new ship-to-shore (STS) gantry cranes, which are part of an order that includes 40 Automated RailMounted Gantry (ARMG) units. The total cost for the Chinesemanufactured equipment is US$282 million, which is being met solely by SLPA.

The new STS gantry cranes have an outreach of 72m, which can reach 26 containers across a vessel, with a maximum load capacity under the spreader of 65 tonnes and up to 75 tonnes using a lifting beam. The investment is part of ECT’s expansion to 2.4m TEU capacity per annum by the end 2025.

BRIEFS

Piraeus Excluded

The European Union (EU) has launched a new European Ports Alliance to combat the growing problem of drug trafficking but has excluded a major port. Piraeus was not included in the participants to launch the initiative, with this assumed to be due to its Chinese majority ownership. This new project was jointly initiated by the government of Belgium, the current (rotating) president of the EU.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 11 PORT & TERMINAL NEWS

8 The Mariner operated Durres Container Terminal has captured major new cargo volume facilitated by ongoing terminal system enhancements

Images

automated-rtg.jpg

Liebherr-ros-desks.jpg Liebherr Remote Operator Stations

Liebherr-

A cabinless Liebherr RTG LiebherrA busbar

ELEVATING LOGISTICS 50 YEARS AND BEYOND

Hammar is the world leading manufacturer of Sideloaders, self-loading vehicles for containers and more. A competetive quality solution for container logistics, special transports and terminal handling.

+ Made in Sweden since 1974, delivered to more than 122 countries world-wide

+ Lift, transport and transfer up to 50 tonnes

+ Increase safety and efficiency with grounded containers

+ One vehicle, one driver, anywhere, anytime

www.hammarlift.com | info@hammarlift.com | +46 33 29 00 00 Read our anniversary brochure https://bit.ly/H50ENG

NEW GENERATION TOS INVESTMENT BY VERBRUGGE INTERNATIONAL…

Investment is proceeding apace in state-of-the-art Terminal Operating Systems, with a number of different suppliers announcing a range of interesting developments and new agreements.

In the Netherlands, logistics service provider, Verbrugge International BV, has selected specialist software solutions from Konecranes across three of its locations in the country. Booked in November 2023, the new system is being implemented at both container and non-container operations during 2024 and 2025.

Verbrugge International is requesting Konecranes to simplify its port and inland terminal operations that involve handling dry bulks, general cargo, ro-ro and project cargo, in addition to containers.

The clear aim is to see better productivity and overall improved operational efficiencies, as David Trueman, Managing Director for Konecranes’ TBA Doncaster software unit in Port Solutions explains: “Konecranes’ [CommTrac and Autostore] TOS will give

Verbrugge International true multi-cargo handling capabilities for seamless management of diverse cargo types accessible from anywhere at any time. We are pleased to have Verbrugge as our first CommTrac customer in mainland Europe following our recent successes in the US, Canada and Australia.”

This new deal will also see an integration of Konecranes’ software solutions with Verbrugge’s finance systems and real-time data sources like

8 Verbrugge International BV represents the first Benelux order for Konecranes terminal software solutions for containerised and non-containerised cargo operations

weighbridges for better data visibility flow.

As the stories adjacent and below indicate, however, Verbrugge is not alone in investing in new TOS and affiliated technology. The port of Alicante, Spain, Northport, Malaysia and terminal operator Gulftainer are all busy with investments in this sector.

….AS ALICANTE JOINS THE PARTY

The Port of Alicante (Spain) has confirmed the integration of 1MillionBot Marítimo with PACECO POSEIDONs TOS (Terminal Operating System). It is a move that the port says represents a “new chapter in the efficiency and automation of container terminals.”

CPu Take Up

According to the Port of Antwerp-Bruges, 60 per cent of daily container collections from deep-sea terminals are using the new Certified Pick up (CPu) data platform. The process integrates the activities of many areas of the port community, including ship agents, terminal operators, transportation service providers (across road, rail and barge) and Customs. The port is expecting to see additional users migrate to CPu as 2024 progresses.

1MillionBot Maritime is an advanced platform for intelligent virtual assistants and has been specifically designed to adapt to the complex needs of the port logistics environment.

The port explains that the application of artificial intelligence through 1MillionBot Marítimo has

PCS for Prodevelop

The Spanish Port Authority of Avilés has selected Prodevelop to develop and maintain a new Port Community System (PCS). The Valencia-based digital transformation solution provider will take responsibility for the implementation of PCS modules covering the areas of water and power supply, fuel supply, and other vessel service requests, using a continuous improvement model, based on the Deming cycle that guarantees efficiency and adaptability.

resulted in increases in efficiency and safety because stevedores now record their operations using only their voice, thereby ensuring that there is no diversion away from critical tasks. This project received financial support through the Ports 4.0 fund of Puertos del Estado (Spanish Port System).

FAITH in AI

The FAITH project has kicked off. The initiative is targeting the development of reliable and ethical Artificial Intelligence (AI) solutions in a range of areas, including transport. Fundación Valenciaport is a partner in the project that is being co-funded by the Horizon Europe programme of the European Climate, Infrastructure, and Environment Executive Agency (CINEA). It is scheduled to develop 14 largescale pilot programmes before it ends in January 2028.

Northport, Malaysia

At Northport, Malaysia, part of the MMC Group, the company is partnering with supply-chain execution software expert, Kaleris, to implement the Navis N4 TOS to accelerate productivity, efficiencies and improve environmental benefits.

The Navis N4 system is an integral part of a solutions application that connects operational visibility to execution workflows to deliver smarter decisions, thereby resulting in faster moves for peak performance. In terms of day-to-day operations, deployment of the new TOS is part of a turnkey solution from Kaleris and will help speed vessel turnaround and minimise container re-handling at the terminal.

Gulftainer Signs With SAP

International stevedore Gulftainer is taking a step towards its digital ambition of becoming more innovative and resilient.

Peter Richards, CEO, Gulftainer notes: “We are confident that the implementation of ‘RISE with SAP’ in our business ecosystem will propel us towards new levels of efficiency, sustainability and excellence in the supply chain and logistics sectors.” The adoption of RISE with SAP will enable greater access to machine learning and robotic process automation (RPA).

BRIEFS

Sibelco Sees Green

Klaveness Digital has agreed a new deal with industrial materials specialist, Sibelco, to integrate its CargoVale emissions tracking capabilities into the company’s supply chain management network. Introduction of this system will enable Sibelco to target improved environmental sustainability and operational efficiency in its maritime logistics, while tracking greenhouse gas (GHG) emissions from maritime transport activities.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 13 DIGITAL NEWS

WE ARE THE EXCLUSIVE DEALER FOR SEVERAL TRIPLE A BRANDS IN THE PORT EQUIPMENT INDUSTRY. OUR CLOSE CONNECTIONS WORK TO YOUR BENEFIT: YOU HAVE ACCESS TO SHORT SUPPLY LINES AND A WIDE RANGE OF PRODUCTS. WHETHER YOU’RE BUYING, LEASING OR RENTING, GPE OFFERS DIFFERENT FINANCING OPTIONS.

THANKS TO OUR NETWORK OF LOGISTICS EXPERTS, YOU’RE ALWAYS SURE YOUR MACHINE WILL ARRIVE PUNCTUALLY, NO MATTER WHERE IN THE WORLD YOU NEED IT.

STRATEGY Port Policy Port Sector Reform Value & Business Strategy Public Private Partnerships (National) Port Master planning Institutional & Regulatory Change Organisational Reform & Alignment VALUATION Feasibility Business Case Value Creation & Protection Financial Modelling & Analysis Project Structuring & Packaging Risk Valuation, Allocation, Mitigation TRANSACTION Financial Solutions Transaction Strategy Transaction Management Documentation & Contracts Tendering & Negotiated Solutions FINANCE Due Diligence Project Financing Financial Structuring Procurement of Finances Investment/Divestment Merger & Acquisition MTBS is the leading international in port business solutions Unlocking value in the maritime & transport industry MTBS.NL

EXCLUSIVE DEALERSHIPS BETTER TOGETHER

Hamburg port operator, Hamburger Hafen und Logistik AG (HHLA) has commenced its transition away from conventional trucker cards to full time use of a digital application.

Developed through the company’s HHLA Next innovation unit, HHLA has introduced its Passify app at Container Terminal Tollerort.

The Passify app means truck drivers undertake identification by authenticating themselves through the new app instead of using physical plastic cards.

HHLA says the new process brings a significant advantages in terms of security and data protection, but also meets all necessary criteria to be ISPS approved.

“We have already been running the first successful tests with Passify at our terminals in Hamburg since summer 2023. The first trucking companies have already been able to test the application and provide their feedback. The switch to

HHLA PASSIFY TRUCK APP IS UP AND RUNNING

Passify that has begun at CTT will significantly increase security at our facilities in Hamburg,” explains Maren Baumgarten, who is responsible for the project at HHLA.

The Passify app is expected to be implemented at HHLA’s other

8 The transition to its new Passify app at Container Terminal Tollerort will improve efficiencies and security, according to HHLA

container terminals, Altenwerder and Burchardkai, as 2024 progresses.

CARBON MEASURING SYSTEM FROM SEA

A new Carbon Exposure solution that enables users to effectively measure and integrate their carbon exposure calculation with emissions targets has been launched.

The producer of the product is Sea, which is a technology spin-off from the Clarksons group, although it operates fully independently. The key functionalities of the Carbon Exposure solution include:

5 Voyage carbon planning: Voyages can be planned based on variables such as cargo

Harbour Lab Deal

Harbor Lab has confirmed it is collaborating with Great Eastern Shipping Co. Ltd. to optimise port cost management. The two companies said that this “pioneering” arrangement is the first time there will be an integration between a Voyage Management System (Veson) and an Accounting System (SAP). It will create efficient, seamless, end-to-end port call management processes covering from fixing to voyage end and invoice payment.

type, cargo volume, laycan, load & discharge port, ballast & laden speed, and vessel name or IMO numbers.

5 Carbon exposure intelligence: A comprehensive vessel comparison table is provided, including CII and EEOI ratings plus ballast, laden, and total CO2 emissions. Transparency in conjunction with EU ETS cost estimates is also available, alongside the Voyage EEOI, which gives the user a holistic view of the environmental impact of their voyage

APMT Haz Portal

APM Terminals (APMT) has developed a new online option to help shipping companies manage hazardous cargo documents more efficiently. Dubbed as the Hazardous Documentation Vault (HazDV), this new global tool is able to reduce the number of steps needed to execute necessary safety activity. With autocompletion and drop-down fields using standardised IMDG terminology, improvements in clarity and speed are expected.

decisions. Finally, the user will then be recommended the most environmentally friendly vessel from the comparison, in terms of CO2 emissions.

5 Carbon target tracking: The industry-first Carbon Tracker Dashboard helps users assess their expected and actual environmental performance against the company’s set targets. Intelligence and visualisation of how specific voyages contribute to emissions enables users to identify areas of improvement.

Simulator Upgrades

CM Labs has introduced key updates to its port equipment simulation training experience. The Montreal-based vendor has confirmed updates to the Reach Stacker and Empty Container Handler (ECH) packages, which include enhancing the realistic machine feel and behaviour of the machine learning experience, such as the addition of inching pedals, different camera positioning, and spreader reference lines.

PLA Upgrades Vessel Traffic Service Systems

The Port of London Authority (PLA) has confirmed it has awarded a contract to Kongsberg Norcontrol Ltd (KNC) to replace its Vessel Traffic Services (VTS) equipment.

A VTS is a key component of ensuring safety and efficiency of navigation are maintained, as well as helping to protect the environment, by ensuring operators have detailed information about traffic activity on the River Thames.

This announcement is a key part of the PLA’s Thames Vision 2050’s Marine Centre Transformation Programme that is targeting delivery of a future-proofed Port Control Centre, utilising the appropriate technology and resilience to support continued growth expectations for the cargo facilities located on the River Thames. Steven Clapperton, Director of Marine Operations, PLA, underlines: “This is a multi-million-pound scheme and will provide London VTS with state-of-the-art equipment, enhancing and improving our operational performance. It will be delivered into a brand new operations centre, ready to accommodate the expected growth of trade on the river which is forecast to rise from 55 million tonnes per year to 78 million tonnes by 2050.”

BRIEFS

PoAB Drone Update

The Port of Antwerp-Bruges’

Unmanned Aerial System Traffic Management (UTM) DronePortal is being updated by Unifly and SkeyDrone. The latest improvements include extending coverage to Bruges, plus providing optimised automated approvals, enhanced integration support with drone operations, and User Interface (UI)/User Experience (UX) enhancements. Launched in mid-2021, the drone has completed over 5000 flight authorisations.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 15 DIGITAL NEWS

Converting a conventional RTG into an electrical one (E-RTG) means to shut down the diesel generator and to power the RTG with electrical power only – the emission saving, sustainable basis for automation. This is possible with electric power solutions, including E-RTG auto-steering and positioning systems, developed by Conductix-Wampfler: Plug-In Solution, Drive-In Solution, Hybrid Solution, Full-Battery Solution and Motor Driven Cable Reel Solution with CAP - Cable Auto Plug-In.

We move your business!

www.conductix.com

We add the “E” to your RTG Electrification of Rubber Tyred Gantries

E-RTG with Drive-In L Solution and ProfiDAT® E-RTG with Motor Driven Cable Reel Solution and CAP - Cable Auto Plug-In E-RTG with ECO BatteryPack Hybrid Solution

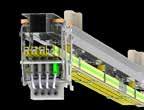

Kobe International Container Terminal (KICT), operated by Mitsui O.S.K. Lines, Ltd. has announced it is to trial the operation of a hydrogen-fuelled rubber tyred gantry (RTG) crane converted from a diesel engine powered unit.

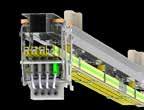

Kobe-Osaka International Port Corporation claims that this cargo handling machine is the first in the world to convert a diesel engine generator to a hydrogen engine generator. The process to move from a diesel generator to hydrogen is outlined in the schematic provided by the companies involved in this project.

Partners in this project are Kobe-Osaka International Port, Shosen Koun Co., Ltd. Mitsui Engineering & Shipbuilding Co., Ltd. iLabo Co., Ltd. (hydrogen engine manufacturer), Iwatani Corporation (hydrogen supply, transport, and fuelling) and Universal Energy Laboratory Corporation (consultants).

The development of carbon

HYDROGEN POWERED RTG TRIALS IN KOBE MITSUI TERMINAL

neutral ports (CNPs) is high on the agenda in Japan, with the aim of upgrading different

port functions to gain the benefits of decarbonisation via seeking to improve the

KALMAR DEMERGER RATIONALE EXPLAINED…

Kalmar separating from Cargotec could unlock shareholder value by allowing both companies to independently pursue sustainable and profitable growth opportunities. That is the clear message being put forward by the Cargotec board of directors.

As a result of this process, two listed companies are being created:

5 Kalmar - a technology forerunner in container handling and heavy logistics with strong market positions, geared to grow by making the industry electrified and more sustainable.

Big SLPA Spend

The Sri Lanka Ports Authority (SLPA) is receiving 12 new Ship-to-Shore (STS) gantry cranes and 40 Automated Rail-Mounted Gantry (ARMG) cranes. All equipment is being supplied directly from Chinese manufacturers and represents total spending of US$282 million by SLPA. The STS units can handle 26 containers across a ship and a maximum load capacity under the spreader of 65 tonnes.

5 Hiab - an industry pioneer in on-road load handling with a strong track record of profitable growth and attractive M&A potential.

Jaakko Eskola, Chair of the Board, Cargotec, provides further insight

into the rationale: “The planning and evaluation of the demerger has progressed well. The Board of Directors with the support of certain major shareholders, has after careful consideration decided to propose the separation

….AS NEW ORDERS ROLL IN

Kalmar has confirmed a new deal to supply Star Container Services B.V. with 12 Kalmar empty container handlers, which are scheduled to be deployed at the Rotterdam Maasvlakte terminal..

Smiths Joins METEOR

Threat detection and screening technology specialists, Smiths Detection, is to participate in an EU Horizon programme (METEOR) that is developing portable screening technology for cross-border containers. The METEOR initiative is planning to deliver a vapour based portable scanner for the non-intrusive inspection of large-volume shipments, including containers. The new technology will automatically provide fast and high-quality detection.

The company has also announced it is supplying four Kalmar reach stackers, two Kalmar empty container handlers, eight Kalmar Essential terminal tractors and the Kalmar Insight performance

PTP is Electric

Port of Tanjung Pelepas (PTP) is to acquire 48 electric rubber-tyred gantries (RTGs) from Mitsui E&S Co. Ltd. PTP, a JV between the MMC Group and APM Terminals, confirms the new e-RTG cranes are part of an equipment modernisation strategy, with delivery expected by Q3 2025. The port is aiming to reduce its emissions by 45 per cent by 2030. Currently, 85 per cent of its existing RTG fleet is already electrified.

environment through adoption of hydrogen and other clean fuel alternatives.

of Kalmar from Cargotec by means of partial demerger to increase shareholder value.”

The Demerger is subject to approval by the annual general meeting of Cargotec being held on May 30, 2024. This will then lead to a planned completion date of June 30, 2024.

management tool to longstanding Brazilian partner Super Terminais, for operations in Manaus in northern Brazil. Delivery is expected during Q3 2024.

BRIEFS

BlueBARGE is Go

The BlueBARGE project is go and with a clear focus on the design and development of an energy barge that will support anchored ships with renewable generated electricity. A key innovation of BlueBARGE is the introduction of a hybrid concept that will combine the higher energy density of lithium (Li-ion) batteries with the innovative vanadium redox flow battery (VRFB) solution, which introduces increased safety and service life.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 17 EQUIPMENT NEWS

8 – 10 October 2024

Hamburg, Germany

REGISTRATION NOW OPEN

Managing risk - building resilience - unlocking opportunities 2024 will be a pivotal year for ports and their communities. Geopolitical instability is on the rise. Physical and digital security is under threat, at sea and on shore.

Shipowners, supply chain providers and cargo owners must adapt rapidly. The energy transition towards low- and zero-carbon fuels must be balanced against national energy security concerns.

#IAPH2024 will offer attendees insights on these topics, revealing how ports – from developing and developed nations – are building secure and sustainable solutions to these shared challenges, in a deeply interconnected world. ©

Silver sponsor: Bronze sponsors:

For more information on attending, sponsoring or speaking contact the events team:

visit: worldportsconference.com contact: +44 1329 825335 or email: wpc@mercatormedia.com

#IAPH2024

Copyright of Hamburg Port Authority, Andreas Schmitd-Wiethoff

Host sponsor:

NEW BRAND IDENTITY AND AMBITIONS FOR KONECRANES AND…

Konecranes has released a new brand identity as it targets becoming a “world leader in material handling solutions.”

This news comes on the back of an updated strategy, new ambitions and financial targets, linked to revised values identified after gaining the input of thousands of employees on a global basis.

These are all noble sentiments, but what do they actually mean? Well, the company appears keen to affirm its critical role in the handling of materials and goods

essential for people, while preserving resources and reducing emissions.

Anders Svensson, President and CEO, Konecranes, explains: “Our new brand promise, “Konecranes moves what matters,” summarises the significant impact we are making together with our customers and other stakeholders. We truly are shaping next-generation material handling solutions for a smarter, safer and better world.”

“Moves what matters” replaces Konecranes’ previous brand

promise, “Lifting Businesses,” which was first introduced in 2006. The company logo and “C” symbol remain, but with an updated meaning to describe its broadened role in global material handling.

“Be it the fruit on your table, the tissue paper in your house or the steel in your office building, chances are we have had a role in moving it safely, reliably and sustainably. We move what is needed where it matters most, and drive change in our industry,” Svensson confirms.

…MAJOR ORDER FOR ELDORADO BRASIL

Konecranes has confirmed successful completion of a largescale order for Eldorado Brasil’s new cellulose terminal in the Port of Santos, Brazil, with the provision of two gantry cranes and seven fork lift units. The project also included joint planning and consulting on terminal layout.

Eldorado Brasil’s new terminal in Santos is designed to process three million tons of pulp bales per annum. This equates to around 8300 tons daily, arriving to the facility by rail and truck with around 90 per cent of the cargo subsequently being exported to 45 different countries.

The seven Konecranes SMV 16-1200 C 16-ton forklifts use a special clamp designed to lift pulp bales without pallets and have several safety enhancement features including shock absorbers and safety lights and cameras. Special sensors optimise oil usage and reduce waste.

The two Konecranes gantry cranes are tailor-made with a

customised open winch, a spreader clamp for pulp bales and the option to attach a container spreader when needed. A variety of Smart Features ensure smooth and accurate movement, and braking energy is recycled. Radio controls and a Remote Operating Station (ROS) allow full crane control with maximum operator safety.

Konecranes is also providing Eldorado Brasil with TRUCONNECT ® Remote

8 Eldorado Brasil’s cellulose terminal offers a state-of-the-art digital ecosystem that brings the highest levels of efficiency and safety to lifting in the pulp and paper industry through new equipment, including a fl eet of Konecranes SMV 16-1200 C 16-ton forklifts

Monitoring, which collects near real-time diagnostics to optimize the performance, maintenance, and eco-efficiency of all the equipment. This data is available 24/7 through the online customer portal yourKONECRANES.

BEDESCHI CONFIRMS COAL TRANSSHIPMENT HANDLING SYSTEM FOR INDONESIA

Bedeschi S.p.a. has finalised a new contract for a coal transshipment system to be delivered to Indonesia.

The project scope includes two receiving hoppers with associated belt feeder extractors, one coal blending mixer, belt conveyors

and one slewing luffing telescopic ship-loader.

The system is controlled by multiple leveling sensors to monitor the quantity of coal in the hoppers and optimise the blending performances. The tailor-made equipment will be

constructed in the Guangdong district in China before subsequent delivery to Indonesia. Bedeschi is a Padova, Italy-headquartered specialist supplier of bulk handling and other systems majoring on turn-key solutions.

BRIEFS

Huisman ASCs

Netherlands-based Huisman has secured an order from Hutchison Ports ECT Rotterdam (ECT) for a series of Automated Stacking Cranes (ASCs). The new units will be welded and pre-assembled in the Czech Republic, before final assembly at its second European facility at Schiedam, in the Netherlands. Commissioning and testing will take place at the ECT Delta terminal.

Targeting Asia

Hyster-Yale Group has announced a strategic partnership with PortxGroup for exclusive distribution for Hyster® products in several important Asian countries. As a result, logistics solutions provider, PortxGroup, will be the sole Hyster dealer serving port facilities in Thailand, Malaysia, Indonesia, and South Korea.

Taylor Acquires Ferrari

Mississippi-based Taylor Group has acquired 85 per cent of the shares in CVS Ferrari. Founded in 1973, CVS manufactures mobile container handling and heavy cargo handling equipment comprising reach stackers and highcapacity forklifts. The shares are being acquired from investment company, NEIP III, and BP (formerly Battioni & Pagani).

Deeper Burgas

Cosmos Van Oord, a joint venture of Cosmos Shipping and Van Oord, has been awarded a dredging project to support the construction of a new deep-water berth at terminal BurgasWest, at the Port of Burgas. Dredging of the port area will be completed in 2024 and to a depth of 15.5m.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 19 EQUIPMENT NEWS

Sustainability without compromise

As part of our Konecranes ecolifting solutions, Konecranes Flow Drive brings concrete benefits to your everyday operations and maintains high overall productivity. It cuts down fuel consumption by up to 40% (customer proved) and it enhances the driver experience, increasing active operation time.

Dynamic at low speed, yet full power at high speed, with reduced wear and noise, it increases productivity with greater intervals between refuelling and combines full performance with ease of reach stacker driving.

www.kclifttrucks.com/ecolifting

THENEWYORKER

BARRY PARKER

In a slight re-wording of a popular aphorism, I can say with certainty that “We live in unpredictable times.” One need only watch the news about the hostilities in the Red Sea, the prices on the widely quoted container freight indices ratcheting upwards, and the multi-colored maps showing vessel diversions to understand why a new “supply chain crisis” might be looming on the horizon. Many port planners are implementing measures from exercises in “lessons learned” going back to 2021, with follow-ups into 2022.

As the trade flows are set to shift again (so it seems at the time of writing- three weeks into the New Year), it’s best to be prepared. There’s more going on than just planning for lengthier voyages. In watching the numerous webinars, You Tube broadcasts, podcasts and conference calls from logistics providers and analysts, I am sensing that potential solutions for cargo shippers

RED SEA TRIGGER TO INTERMODAL TRANSFERS?

involve routings that might necessitate intermodal transfers.

With flows from Asia to Europe the most impacted by the lengthier (and more expensive, if the indices reflect reality) voyages around Africa, some logisticians are contemplating routings across the Pacific, then overland by surface mode, and then back on vessels going trans-Atlantic into Europe. Variations on this, for higher valued items, include an airfreight leg into the States and then an ocean move across the

THEANALYST

PETER DE LANGEN

X-Press Feeders has recently decided to deploy green methanol-powered ships on its feeder network in Europe, with Evergreen committing to using X-Press Feeders services. The ships will operate out of and receive methanol in Rotterdam and serve feeder markets in Scandinavia - with plans to expand the green feeder services to other destinations in Europe once new methanol powered vessels are delivered to X-press. This decision is a first in container shipping and shows the traction of reducing the footprint of container shipping. A few aspects of the decision deserve attention.

First, the fact that the ships will be deployed serving Scandinavia & the Baltic, demonstrates again

Likewise, the “lessons learned” from the pandemic years certainly include encouraging port stakeholders to be nimbler in supporting intermodal transfers. If the hostilities and vessel diversions continue (again- at time of writing, the political and military “experts” on TV don’t see a cessation right away), and cargo interests take the suggestions of the logistics pundits to heart, then handoff s between modes could feature more prominently.

Atlantic. These may be stopgap measures; it’s impossible to predict the course of the Gaza war; a longer war could make such routings longer lasting.

The planners reading this have been there before; the need for ports to deal with surges in activity generally became apparent over the past few years. By the way, planners already knew this but 2021 and 2022 provided a jolting reminder.

Most of the initial attention throughout the marketplace (and here in this article) has been on containerised cargo flows, but movements of refined petroleum products and some petrochemical trade flows may also be impacted; shifting around to meet new realities.

Though I am hoping that the “experts” are wrong- and that the shooting stops, being prepared for changes in cargo moves is never a bad thing.

FUEL TRANSITION CREATES A ‘WHOLE NEW SPACE TO OCCUPY’

that this region is the center of gravity of clean fuel initiatives, probably because of a mix of policies and the presence of innovative companies and cargo owners willing to pay for green shipping.

Second, while one could have thought that green feeders most likely would be first deployed by the large shipping lines with dedicated feeder vessels, that has

8

not been the case. That is surprising since common feeder companies do not have direct contracts with beneficial cargo owners. X-Press feeders provides some information that suggests that the additional costs of using the green fuel between Rotterdam and the Baltic are around 100 euro per container,

while the CO2 emissions are reduced with about 268kg per container. How that bill is split between X-Press feeders, Evergreen, beneficial cargo owners and potentially others is not disclosed.

Finally, the move involves X-Press and Evergreen as first movers, but also OCI Global, that will provide the green methanol, as well as Rotterdam as a port. The fuel transition created a whole new ‘opportunity space’ for companies and ports to occupy. OCI Global, as a relative newcomer has managed to develop a strong position as fuel supplier, while Rotterdam, as an established bunker port has managed to transition ahead of others as a bunker port for green fuels.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 21

8 The Galaxy Leader seized by Iranian-backed Houthis

Green feeders are coming

Hosted by:

Book now and save 15%

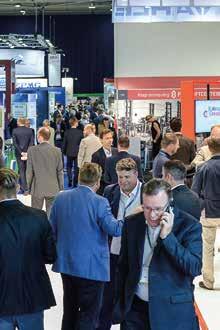

The short sea shipping and sustainable logistics network

2024 Programme and Topics

Short Sea Shipping - how the market is adapting Advancing supply chain resilience with modal shift Smart operations - Digitalisation, Automation, & Innovation

Ports - Enabling the Energy Transition

Delegate place includes 2-day conference attendance including lunch & refreshments

Technical Visit

Electronic documentation

Conference Dinner (Premium Package) Presentation download (Premium Package)

• Green corridors - collaboration to drive sustainable growth

Sponsors:

Supporters:

Gold Sponsor

Coastlink is a neutral pan-European network dedicated to the promotion of short sea shipping and intermodal transport networks. Learn from and network with international attendees representing shipping lines, ports, logistics companies, terminal operators, cargo handlers, and freight organisations.

For more information on attending, sponsoring or speaking contact the events team: visit: coastlink.co.uk contact: +44 1329 825335 or email: info@coastlink.co.uk

#Coastlink

Media partners: GREENPORT

INSIGHT FOR PORT EXECUTIVES MOTOR

MARINE TECHNOLOGY THE

SHIP

APRIL

24 25 TO

Port of Amsterdam 2024 The Netherlands

BEN HACKETT THEECONOMIST

STORM IN A TEACUP

The war in the Middle East has brought knee jerk reactions to the dangers to ships using the Red Sea, primarily bound for the Suez Canal. Is it really such a disaster?

The Houthi attacks on shipping traversing the Bab-el-Mandeb straight at the southern end of the Red Sea are being treated as a major crisis for shipping and beneficial cargo owners much in the same way that acts of piracy off the coasts of Somalia, West Africa and Indonesia were perceived in the early stages.

Shipowners, be they container, dry bulk or tanker, will always assess the risks and costs and quickly find an alternative route for destinations in Europe and the North American East Coast. The first, and quickest to react by abandoning the Suez Canal option or the Egyptian SUMED oil pipeline, were the container carriers, with an estimated 80 plus per cent opting for the Cape

of Good Hope (COGH) route, followed by the bulk carriers and most recently by the oil companies. It is all a matter of transit time, vessel supply and logistics management.

As ship owners were faced with the additional fuel cost of the COGH and loss of time they added additional capacity and extra speed to ensure that after a couple of weeks the logistics

THESTRATEGIST

MIKE MUNDY

Mid-January saw the European Sea Ports Organisation (ESPO) welcome the European Parliament’s recognition of and support for the vital role Europe’s ports play in the European economy and society. This followed the European Parliament officially adopting the Berendsen report which aims to provide the foundation stones for “building a comprehensive European Port Strategy.”

ESPO further noted that in its view, “The voted text demonstrates a good understanding of the challenges ports are facing and the high investment needs ports have to be able to play the more comprehensive and critical role they have nowadays.”

It adds: “On top of being the Union’s gateways to the world,

diversions (and clearly ‘then some’) just as freight rates had fallen to a low.

8 Some ports will benefit from the new Red Sea induced supply chain arrangements

supply chain would return to normal without the Suez passage. Fortunately (if that is the right word) with the global economy to a significant extent flat lining spare capacity has been readily available to reactivate. Ship operating companies were quick to pass on the costs of the

This then raises the question as to who suffers? Clearly not the carriers other than in the initial act of reaching the decision to divert and to find additional capacity in order to ensure that fixed day services continue for container services. Cargo owners are losers as freight rates rocketed (no pun intended). The Suez Canal Authority is another loser, having reportedly lost over 40 per cent of its revenue so far and this will increase as diversions continue. The SUMED pipeline is another loser.

Ports on the other hand will likely see additional income as more vessels are introduced to the Asia-Europe services. Industry and retailers will have to dig into their inventories for a couple of weeks until the new service networks are fully functional.

ESPO UNDERLINES “THERE IS NO TIME TO LOSE” IN IMPLEMENTATION OF NEW STRATEGY

logistic nodes and industrial clusters, Europe’s ports are hubs of energy.” And that: “As has been demonstrated over the last two years, ports play a critical role in ensuring Europe’s energy security and are at the same time facilitators and even accelerators of the energy transition. Ports,” ESPO underlines, “need large public and private investments to take on all these responsibilities and to continue to develop.”

Citing two building blocks of the new European Port Strategy ESPO highlights the merit in the proposal to review the current Foreign Direct Investment Regulation and the focus on putting the competitiveness of Europe’s ports to the forefront.

In the former context, ESPO argues that the review should, “oblige all EU Member States to

implement a foreign direct investment screening system and carry out screenings in a more harmonised manner. This,” it further emphasises, “must enhance the necessary level playing field within Europe and contribute to more legal certainty for potential investors aiming to invest in European ports.” Generally, ESPO welcomes that the report “underlines the importance of a more stable investment climate.”

A key element of boosting competitiveness is seen by ESPO as Parliament’s acknowledgment and call for support for the role of ports in energy transition and in particular developing hydrogen infrastructure in ports and speeding up permitting procedures. Equally, Parliament’s

call to avoid carbon and business leakage, avoid excessive administrative burden, boost hinterland connections and the call to provide dedicated port envelopes under the Connecting Europe Facility are seen as a beneficial outcome.

Overall, the review and downstream reform of the European ports industry as viewed by the European Parliament gets a positive vote from ESPO. It does, however, additionally make the important point that as well as generating new legislation it is important that this is implemented in a timely way just as it is important in conjunction with past relevant legislative measures where today there remains room for improvement. “There is no time to lose,” stresses ESPO.

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 23

DON’T OVERPLAY THE ISSUES!

Non-specialist headline news sources have gone overboard on the impact of the Houthi-led Red Sea crisis. Andrew Penfold takes a penetrating look at the cost impacts and other factors that will shape the outcome of any long-term loss of this routeing

Much has been made of the inflationary impact of closing the Red Sea for container and bulk transit. In reality the impact of such a long-term closure will be quite limited – although the reorganising needed will certainly have a widely disruptive impact. We should be very careful about simply accepting that such developments would push up inflation significantly and push the OECD – especially Europe – into renewed recession. This kind of background noise is very useful for retailers in their permanent quest to raise prices and improve their bottom lines.

CONTAINER COST IMPACT

Table A summarises the actual price/cost impact on a typical consumer goods shipment from Shanghai to Rotterdam – in this case a 40-foot container with a cargo of training shoes. In the middle of last year, the headline westbound rate was placed at around US$1800. The immediate impact of diversion away from the Red Sea and via the Cape was to increase freight rates to around US$3800 – certainly a very sharp increase.

However, let’s look at the actual impact on retail pricing for a pair of trainers. If a 40-foot container can load around 6500 pairs of shoes, then the actual impact of freight charges per pair of shoes will increase from 28 cents to 58 cents. If the shoes retail at around US$120 this results in a price increase of just 0.49 per cent. This is a negligible adjustment that will have no immediate impact on economic growth and inflation. Of course, this is only one commodity grouping and there will be specific, more focused, effects in some instances. However, as an example of consumer goods this is highly representative.

WHAT ABOUT BULK CARGOES?

Lower value cargoes – dry bulk, crude oil, LNG – will also be impacted. The diversion costs via the Cape need to be factored-in, although the lack of a Suez transit charge modifies the comparison. Table B looks at a typical VLCC voyage from the Persian Gulf to Rotterdam.

The voyage costs of the diversion – when fully built-up –result in an increase in costs from around US$2.3m to US$2.7m. With crude oil prices at around US$75 per barrel this equates to a CIF price increase of around 17 cents per barrel. Once again, the actual underlying cost impact for wholesale delivered commodities is very limited. The various assumptions used in this overview calculation can be adjusted or disputed but it is clear that, by itself, the cargo diversion will not induce a significant inflationary kick to the world’s economies.

NOT JUST TRANSPORT COSTS

The actual impact can be seen to be limited and the broader hype around this subject is clearly overstated but there are other considerations:

5 Increased tonne-mileage demand from the diversion will require additional shipping capacity. It is fortunate – for the container lines, at least – that the fleet of Megamax and other large vessels is passing through a period of unprecedented expansion. The tonnage will be there to absorb the longer haul lengths in this sector. Other trades are more finely balanced, and this may well result in the upturn in freight rates being sustained – although the impact should still be limited. There also remains scope to increase trading speeds

RED SEA DIVERSION: COST ANALYSIS 24 | JANUARY/FEBRUARY 2024 For the latest news and analysis go to www.portstrategy.com

8 The Bab-alMandab Strait near Yemen has now been designated a no-go area by major container lines with longer but safer routings preferred

‘‘

The Red Sea so-called crisis presents a great opportunity for wholesalers and retailers to increase their prices. Ignorance of the true position offers an open goal

to meet such short-term needs, although there will be an impact on carbon emissions from this approach.

5 There will be short term disruptions as a new equilibrium is reached and this ‘bullwhip effect’ could well see further short term increases in freight rates as a result of shortterm mismatches of supply and demand.

5 In the container sector, readjustment of transshipment strategies – for example a shift in focus from Egyptian Mediterranean ports to Algeciras/Tangiers will require reorganisation but there is sufficient available capacity to manage such moves. New opportunities will emerge such as using Nqura (South Africa) for transshipping Latin American and Caribbean containers. Equipment shortages may be a factor, with more containers required for a given trade if diverted via the Cape. Fortunately, there is an oversupply of containers at present.

5 Voyage times will be longer and, with higher interest rates there will be a negative impact on inventory costs. Even here, the actual cost impacts on a CIF basis will be limited.

5 There will be short term disruptions in the ports, but these will be insignificant in comparison with the type of chaos that was eventually managed during the Covid pandemic.

5 One of the big losers will be Egypt. It is estimated that Suez Canal revenue accounts for at lease three per cent of the country’s national income. Given the precarious position of the economy this will be a major issue.

5 In the bulk sector, specifically, there has been a rapid readjustment, with the flow of (particularly) liquid goods (oil and LNG) showing limited disruption and there has been little impact in retail petrol prices in Europe or in the broader LNG-electricity sector. This has been achieved by means of careful redeployments and adjustments in vessel speeds, the latter having been held recently at low levels. In contrast to the disruption following the (partial) sanctioning of Russian gas supplies the impact can be said to be minimal. Already we are seeing a readjustment in freight rates and vessel deployments as a new equilibrium is reached. The major shipping lines – certainly in the container sector – have

RED SEA DIVERSION: COST ANALYSIS

A: CONTAINERISED GOODS

Freight Cost Cape Diversion Impact on Shipments from China to Rotterdam

Assumptions:

40’ high cube container

Retail price per pair of trainers: USD120

Typical freight rate Shanghai to Rotterdam mid 2023 $1,800.00

Typical freight rate Shanghai to Rotterdam Jan 2024 (Cape diversion) $3,800.00

Cargo: 6500 boxes of trainers per FEU

of trainers Jan-2024 (Cape diversion) $0.58

rapidly redeployed their services and the overall impact on freight rates has been limited. It is indeed fortunate from the consumer viewpoint that the attempted hijacking of the Asia Europe container trades has coincided with a period of acute (and worsening) over-tonnaging in the container sector. With massive new capacity in the largest size ranges being introduced into the container fleet every week, the increased container tonne-milage engendered from the Cape routing has been easily absorbed. Although rates remain higher than before the disruption, there are signs of rate decline in this sector and, more importantly, renewed stability. The Covid disruption of 2022-2023 was a good training ground for large scale redeployments.

ULTIMATE IMPACT?

It’s too early to assess the ultimate impact of the Red Sea crisis but what is clear is that much hype has been generated on this subject. The direct cost impact will be limited, and the disruption impact should be manageable. It’s also clear that this presents a great opportunity for wholesalers and retailers to increase their prices. Ignorance of the true position offers an open goal for such interest groups. This is the real risk.

B: CRUDE OIL

8 Table A: The Actual Price/ Cost Impact on a Typical Consumer Goods Shipment from Shanghai to Rotterdam

For the latest news and analysis go to www.portstrategy.com JANUARY/FEBRUARY 2024 | 25

per

Freight costs per

Retail cost impact

Calculation: Freight costs

pair of trainers Mid-2023 $0.28

pair

of higher freight 0.49%

Freight Cost Cape Diversion

Persian Gulf to Rotterdam Assumptions Crude oil price FOB per barrel $75.00 Voyage length Arabian Gulf to Rotterdam via Suez - nm 6436 Voyage length Arabian Gulf to Rotterdam via Cape - nm 11169 Trading speed - 11 knots (264nm per day) Voyage duration via Suez – days 24.38 Voyage duration via Cape – days 42.31 Time Charter cost per day $37,500.00 Calculation Charter costs via Suez – USD $914,205 Charter cost via Cape – USD $1,586,506 Bunker consumption - 55 tonnes IFO per day IFO price per tonne $480.00 Bunker costs via Suez – USD $643,600.00 Bunker costs via Cape – USD $1,116,900.00 Canal charge via Suez – USD $815,000.00 Canal charge via Cape – USD $0.00 Voyage costs via Suez $2,372,804.55 Voyage costs via Cape $2,703,405.68 Freight cost via Suez per barrel - USD $1.19 Freight cost via Cape per barrel - USD $1.35 Wholesale Price Impact CIF Rotterdam via Suez per barrel - USD $76.19 CIF Rotterdam via Cape per barrel - USD $76.35 Additional wholesale cost – USD $0.17 Percentage increase 0.22%

Impact on VLCC Crude Shipments from

8 There have been several attacks on bulk carriers including a vessel belonging to Star Bulk Carriers, as per the vessel featured here

8 Table B: A typical VLCC voyage from the Persian Gulf to Rotterdam

PRIVATE SECTOR $ POUR IN

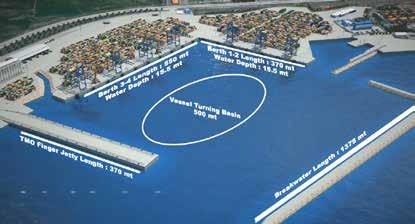

Port infrastructure development in Egypt continues to be focused on the private sector playing a big part in the country helping meet national economic goals. But is there a danger of over-capacity occurring as a result of this strategy?

Ports in Egypt are being developed to boost economic growth. There are a wide range of plans and capacity is set to be increased substantially in the short term. However, what is driving this activity, and will it ultimately meet the desired objectives?

The country has ports on two coastlines, Alexandria, Damietta, and Port Said in the Mediterranean Sea and Ain alSokhna in the Red Sea. Collectively, these facilities handle around 90 per cent of Egypt’s total trade activity, according to the Egyptian Centre for Strategic Studies (ECSS) in June 2023.

There are currently both short-term and medium-term plans in place by the Ministry of Transport in Egypt to enhance and develop container port capacity by investing in new berths, dredged navigational channels and larger storage yards. These initiatives comprise key components of the government’s “Transforming Egypt into a Global Trade Hub” report which outlines future plans across the port sector.

This aim is part of a strategic national plan, as Dean Davison, Head of Maritime Advisory, Infrata, explains: “Egypt has a clear initiative. It wants to develop its port industry as a global maritime hub and this will be achieved by leveraging its facilities to connect two coasts and in doing so link both East and West.”

Egypt has a longstanding, existing network of port facilities handling both domestic and transshipment containers, collectively seeing around 7.5 million TEU per annum.

For the domestic market – that is, cargo that is destined for or originated in Egypt – it is handled at a range of locations, including at Alexandria (Alexandria International Container Terminals (AICT), Alexandria Old Port and El Dekheila, Alexandria Container & Cargo Handling Company (ACCHCO)), Damietta and West Port Said, with transshipment also undertaken at East Port Said (Suez Canal Container Terminal - SCCT) and Ain Sokhna. Damietta also handles this traffic.

PRIVATE PLAYERS PROMINENT

International terminal operators and shipping lines are prominent in the port sector in Egypt. For example, Hutchison Ports has been operating the one million TEU per annum AICT facility at the Mediterranean Port of Alexandria since it opened in 2007.

Likewise, DP World has a 100 per cent ownership stake in El Sokhna Container Terminal, with a capacity of around 950,000 TEU per annum, while APM Terminals retains a 55 per cent share in a joint-venture that includes China Cosco Shipping (20 per cent) and the Suez Canal Authority (10.3 per cent) at the Suez Canal Container Terminal (SCCT) at Port Said by the Mediterranean entrance to the Suez Canal.

As part of the Egyptian government’s plans and strategic aims, an increase in foreign, private investment is targeting further development of container cargo-handling activities in the country.

Table 1 provides a summary of known, new, and planned developments at a range of different ports in Egypt. There are clearly a wide-range of different large-scale projects, all of which are supported by a range of private companies, with global terminal operating companies clearly leading the way.

In August 2019, Hutchison Ports signed an MOU with the Egyptian government to develop a new US$730 million terminal in the port of Abu Qir, with an estimated two million TEU capacity when fully built-out and an 18m water depth. The terminal features a 60ha yard, with a further 100ha of land exclusively reserved for yard expansion. The new facility has recently handled its first vessel, with eight ship-to-shore cranes and 35 RTGs on hand.

Also, CMA CGM is the operator of a new largescale container facility in the Port of Alexandria, at Pier 55, which will eventually see total capacity of 1.5 million TEU per annum. Construction work commenced in 2022.

HUTCHISON SPENDING TO REACH US$1.5BN