Sponsors:

Supporters:

visit: coastlink.co.uk

contact: +44 1329 825335

email: info@coastlink.co.uk

#Coastlink

APRIL

2024

25 TO The

sustainable

Hotel

Amsterdam, The

promotion

short sea feeder shipping

sustainable intermodal

logistics networks through the ports that support the sector.

Nick Lambert,

Director, NLA International Ltd

Hosted by:

Port of Amsterdam

The Netherlands 24

short sea shipping &

logistics network Conference Handbook

Jakarta

Netherlands A neutral pan-European network dedicated to the

of

plus the

and

Chairman:

Co-Founder &

Gold

Sponsor

Media partners: GREENPORT INSIGHT FOR PORT EXECUTIVES MOTORSHIP MARINE TECHNOLOGY THE

t: (+44) 1329 825 335 e: sales@portstrategy.com www.portstrategy.com Contact us today PORTSTRATEGY INSIGHT FOR PORT EXECUTIVES MAGAZINE RECIPIENTS DECISION MAKERS PAGEVIEWS PER MONTH 14,000 72% 28,300 Reach industry professionals with Port Strategy

your business to the right audience in the right place at the right time. Engage with our international audience of decision makers and buyers. The Port Strategy multi-media platforms offer our commercial partners a wide range of opportunities for campaign delivery. We provide bespoke marketing packages with quantifiable ROI. Port Strategy’s valued content is dedicated to the international ports and terminals business and is delivered through multiple channels.

Promote

Welcome to the Coastlink 2024 Conference - we are delighted to meet you all.

I am pleased to welcome you to our 2024 venue, Hotel Jakarta Amsterdam, one of the first energy-neutral hotels in The Netherlands. Built on the former location where ships left for Jakarta, the hotel boasts an energy-neutral status in addition to an indoor subtropical garden. I am sure that this impressive building will add to your Coastlink experience and overall enjoyment of the event.

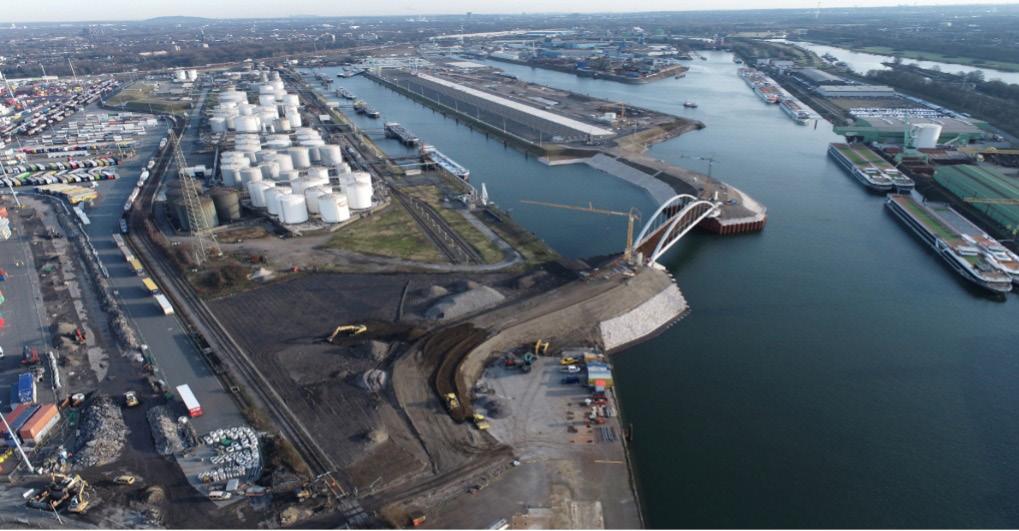

Firstly, I would like to extend our sincere thanks to the Port of Amsterdam for hosting this year’s event including both the technical visit aboard the ‘Het Wapen van Amsterdam’ and the conference dinner.

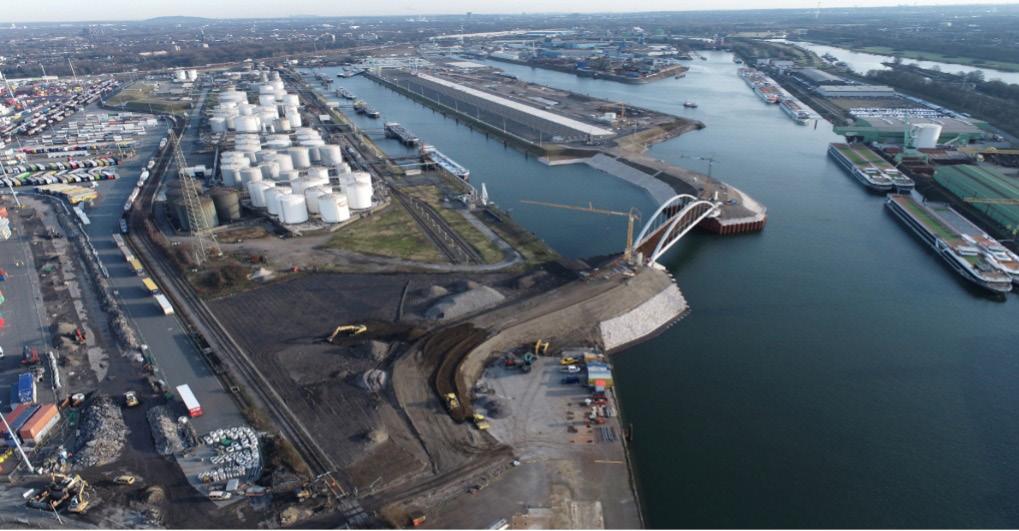

As the fourth largest port in Northwest Europe, the Port of Amsterdam is a leading player in the international world of transport and logistics, and is historically characterised by a strong energy cluster. During the technical visit, delegates will enjoy a tour through the Amsterdam port area, providing an unrivalled opportunity to see firsthand the dynamic metropolitan hub. I am sure that you will find the tour insightful, whilst also enjoying the Evening Drinks Reception aboard.

The strategic and central location within Europe makes the port region widely accessible and ensures excellent connections to the major European market. With an annual cargo turnover of more than 80 million tonnes and a total economic added value of EUR 7.2 billion, the port economy in the North Sea Canal Area (NCSA) makes a strong contribution to the Amsterdam metropolitan region. I am also delighted to confirm that Dorine Bosman, Chief Investment Officer at the Port of Amsterdam will be delivering the welcome address.

The 22nd Coastlink remains focussed on the vital role of short sea and feeder shipping and the intermodal transport networks that support the sector. Over the 2-days we will cover pertinent topics with a varied and diverse programme including: Advancing supply chain resilience with modal shift, Smart operations - Digitalisation, Automation, & Innovation Ports - Enabling the Energy Transition, Green corridors - collaboration to drive sustainable growth and Short Sea Shipping - how the market is adapting.

I am also so pleased that our esteemed chairman Nick Lambert, Co-Founder and Director at NLA International returns to Coastlink for the third year in a row. I know that Nick and our moderators will promote active debate and discussion throughout the event, whilst introducing you to our schedule of expert speakers. I hope that you enjoy the sessions and the networking opportunities on offer.

I would like to give a sincere thank you to The Port of Bilbao for being our Gold Sponsor, to Royal HaskoningDHV for also sponsoring, and to all the supporters and speakers who have helped to make Coastlink 2024 possible. Last, but not least, to you, our delegates for joining this year’s conference where we hope you will meet, discuss, and develop key partnerships that will help build a sustainable future.

On behalf of the Coastlink team I hope that you enjoy the Conference. We look forward to meeting you all throughout the 2 days.

Marianne Rasmussen-Coulling Events Director

Marianne Rasmussen-Coulling Events Director

Mercator Media Welcome 3

Amsterdam, your global hub for fuels

Thanks to its central location and good hinterland connections by land, rail and water, the port of Amsterdam is a world class hub for fuel storage and distribution. Together with our partners in the port we are making the transition to sustainable energy and fuels. We are continuously investing in high-quality fuel storage and infrastructure. With an increased focus on attracting alternative fuel producers, constructing hydrogen pipeline connections, and making use of the available CO2 sources.

Please scan QR code for more info.

Dear Delegate,

Coincidentally and appropriately, I’m enjoying the fabulous snow-clad views of the Norwegian fjords from 9 deck of the M/S Havila Castor enroute to Tromso as I apply pen to paper (or fingers to keyboard) welcoming you to the programme for Coastlink 2024. What better background to ponder the challenges and opportunities of operating short sea shipping routes and logistics networks in complex sea spaces such as the North Sea, Baltic, English Channel and the approaches to northwest Europe?

Commissioned two years ago, the Havila Castor is a very modern LNG and battery hybrid platform reflecting the evolution of ship design in tackling the global concern about shipping emissions. On passage from Bergen, we’ve seen numerous wind and fish farms, one of Ocean Infinity’s new autonomous survey ships in the approaches to Alesund and witnessed the remarkable technologies and processes that support and enable Norway’s sophisticated maritime and coastal infrastructure and communities. It is an obviously national, holistic approach to obtaining socio-economic benefit from the resources of the coastal zone whilst minimising impact on the marine environment. The ship’s approach is also holistic, building on the LNG hybrid propulsion system to include waste recycling of all kinds, table service restaurants (thus reducing waste from conventional food buffets) and describing passengers as ‘eco-travellers’ who can chose environmentally sustainable cabin services and so forth.

So, contrary to the prevailing view that ports and shipping are behind other industry sectors such as aviation and agriculture, here is clear evidence that maritime has world leading technologies and leadership; it can change and is changing. I will happily argue that the Coastlink community has been in the vanguard of these developments over the past five years and has influenced the debate. Our agenda for CL24 is no exception, demonstrating a commitment to environmentally sensitive, regenerative and sustainable port and shipping operations. I therefore look forward to reviewing the short sea market drivers and the potential for the short sea fleet to enable a modal shift in global logistics, addressing the need for green, sustainable end-to-end supply chains in our Day One topics followed by a discussion of the role of ports in driving and supporting the transition to net zero emissions energy solutions on Day Two.

I also much anticipate welcoming you all to the Port of Amsterdam which is, of course, a fabulous example of a technologically advanced port and intermodal logistics operation. Thank you in advance to our delegates, our sponsors (Port of Amsterdam, Bilbao Port and Royal HaskoningDHV), our supporters (British Ports Association, Workboats Association, Logistics UK, BIMCO, UK Chamber of Shipping and the UK Major Ports Group) and (not to be forgotten!) the Mercator Media team. It will be great to see everyone and I’ve no doubt that we’ll have a meaningful debate!

Nick Lambert Co-Founder & Director, NLA International Ltd

Nick Lambert Co-Founder & Director, NLA International Ltd

Chairman’s Welcome 5

A warm welcome to Amsterdam

Dear Coastlink 2024 participants,

On behalf of Port of Amsterdam, it is my distinct pleasure to extend a warm welcome to all participants of the Coastlink Conference 2024.

As we gather in this vibrant city, known for its rich maritime heritage and dynamic port infrastructure, we recognize the importance of collaboration within an international network of renowned experts, allowing for high-level discussions on the latest trends and developments in our industry.

Short sea shipping, with its inherent advantages in cost-effectiveness, environmental sustainability, and congestion mitigation, presents a compelling opportunity to unlock new opportunities for trade and connectivity across Europe. As we navigate the complexities of global trade dynamics, the potential for short sea shipping to serve as a vital link in the multimodal transport chain is significant.

Our port communities serve as indispensable enablers in facilitating the energy transition towards a more sustainable future. From shore power infrastructure and modern bunkering facilities to import of renewable energy carriers and carbon-neutral port operations, ports play a pivotal role in advancing the transition towards cleaner and more sustainable future.

The Coastlink Conference covers all these relevant topics, igniting discussions on the emerging opportunities for short sea shipping, enhancing supply chain resilience and harnessing the transformative power of ports in facilitating the energy transition.

For several years, Port of Amsterdam is part of this unique network of experts from the maritime and logistics industry. We are therefore proud to host this year’s conference in our home port. On behalf of our entire team, I would like to sincerely thank Mercator Media Ltd. for putting tireless efforts in the organization and planning of this year’s conference.

Once again, welcome to the Coastlink Conference 2024 in Amsterdam. May our collective efforts during the next two days lead to lasting partnerships and meaningful outcomes that propel the maritime industry forward.

Warm regards,

Dorine Bosman Chief Investment Officer Port of Amsterdam

Dorine Bosman Chief Investment Officer Port of Amsterdam

Sponsor Welcome 6

Host

DORINE BOSMAN

Chief Investment Officer, Port

DORINE BOSMAN

Chief Investment Officer, Port

of Amsterdam

BIOGRAPHY

Dorine Bosman joined the Port of Amsterdam board in October 2021. As Chief Investment Officer, Bosman provides direction in boosting Amsterdam as a sustainable European seaport and in stimulating and accelerating the energy transition, circular activities and industries, to reduce CO2 emissions in the port and in the region.

Within Port of Amsterdam, Bosman is responsible for infrastructure, maintenance, environmental management, innovations and commercial participations.

Bosman joined Port of Amsterdam after a career in the offshore energy sector – both oil & gas and renewables. Bosman held several technical and commercial positions in the Upstream business, including positions as Vice President Social Performance, and Vice President Offshore Wind for the Shell Group of companies.

Boman likes to work on the touch points of disciplines, finding value in working interfaces and fostering collaboration and integration. Bosman holds an MSc in geophysics from Delft University, and graduated with distinction from the Partnership Brokering Accreditation Scheme (pbas). Dorine is a former board member of the Australian CO2 Cooperative Research Centre and of the UK.

Sponsor Welcome 7

Host

ANDIMA ORMAETXE

Director - Operations, Commercial, Logistics and Strategy, Port of Bilbao

BIOGRAPHY

Andima Ormaetxe has been the Director - Operations, Commercial, Logistics and Strategy at the Port of Bilbao Authority since 2018.

He is a member of the Board of Directors of several Dry Ports and Intermodal Platforms such as Azuqueca de Henares (Guadalajara), Coslada (Madrid), Villafria (Burgos), CSP Iberian Zaragoza Terminal and Sibport.

He is also a member of the Board of Directors of Deposito Franco de Bilbao as well as a member of the Shipping Council Port of Bilbao.

He has held management positions in companies such as ‘Maritima Candina’, ‘Berge Maritima Bilbao’, and ’Agencia Perez y Cia’.

n Degree in Nautical Science

n Merchant Navy Officer

n Masters Degree in Maritime-Port Business Management - University of Deusto

n MBA - University of Basque Country

n Management positions in companies such as ‘Maritima Candina’, ‘Berge Maritima Bilbao’, and ’Agencia Perez y Cia’.

n 2018 to present - Port of Bilbao Authority currently holding the position of DirectorOperations, Commercial, Logistics and Strategy.

Gold Sponsor Address 8

Contents 9 Contents Day 1 3 Opening & Keynote Addresses Session 1 - Emerging Opportunities for Short Sea Shipping –How is the market adapting to economic & market pressures to sustain future growth 10 Session 1.1: Panel Discussion – Green corridors – collaboration to drive sustainable growth .......................................................................................................... 28 Session 2 - Advancing Supply Chain Resilience & Embracing the Benefits Of Modal Shift....................................................................................................................... 35 Session 3 - Ports As Enablers – Facilitating the Energy Transition for Shipping & the Supply Chain ............................................................................. 58 Session 3.1: Panel Discussion – Shore Power – Overcoming the barriers to infrastructure and delivery .................................................................................. 73 Session 3.2: Panel Discussion – Smart operations & logisticsWhat’s next in Digitalisation, Automation and Innovation to drive efficiency? 81

Emerging opportunities for short sea shipping – how is the market adapting to economic & market pressures to sustain future growth

SESSION 1 10

JOHAN-PAUL VERSCHUURE

Senior Port & Transport Economist & Director of Rebel Ports and Logistics

BIOGRAPHY

Johan-Paul Verschuure is a senior port & transport economist and director at Rebel Ports and Logistics. He has extensive experience with market studies and business case development in the port and shipping sector, in particular in the shortsea domain. He combines a technical background as a port engineer with financial economic expertise for developing business cases from a commercial, technical, and financial point of view.

In the shortsea domain he has particular experience in Northwest Europe and the UK. Recent studies in the shortsea domain he was involved in include the shortsea strategy for the port of Amsterdam, shortsea market study for Zeebrugge, Brexit Impact study for ABP, transaction support for a shortsea container terminal in Rotterdam, shortsea fleet analysis North Sea operators and port pricing analysis for the shortsea domain in Northwest Europe. In addition, he carried out studies on the supply of shore-power in the shortsea domain and looking at supporting the uptake of low carbon fuels in the Netherlands.

Before joining Rebel, He has been with WSP Maritime for almost 4 years where he was a Technical Director based in London, being responsible for the contents of the business cases which are delivered by the team. Prior to this position, he gained experience with Royal HaskoningDHV and Ocean Shipping Consultants for over 8 years, part of which being based in London.

1 - Keynote Presentation 11

Session

Shortsea its revival will need a revival in public support

Shortsea its revival will need a revival in public support

For a long time ‘globalisation’ was dominating the headlines. Stories were focused on increased shares of deepsea trade, growing Asian trade and outsourcing of production. This resulted in closing down shortsea terminals and limited investments in the sector – ports and shipping. And then protectionism, trade wars, geopolitical tension happened. Add to this Covid and an increased focus on sustainable and social responsible trade and the shortsea sector is back making waves.

Shortsea Share on the rise

For a long time ‘globalisation’ was dominating the headlines. Stories were focused on increased shares of deepsea trade, growing Asian trade and outsourcing of production. This resulted in closing down shortsea terminals and limited investments in the sector – ports and shipping. And then protectionism, trade wars, geopolitical tension happened. Add to this Covid and an increased focus on sustainable and social responsible trade and the shortsea sector is back making waves.

Shortsea Share on the rise

Container volumes across the board dropped as a consequence of the sanctions on Russian trades, slowing macro-economic conditions and poor export performance in particular. Looking at the North-West European range volumes are roughly back at 2016 levels. In particular the last two years have been surprising. It is unprecedented that such a decrease in volumes happens without a major or deep economic recession.

Container volumes across the board dropped as a consequence of the sanctions on Russian trades, slowing macro-economic conditions and poor export performance in particular. Looking at the North-West European range volumes are roughly back at 2016 levels. In particular the last two years have been surprising. It is unprecedented that such a decrease in volumes happens without a major or deep economic recession.

Source port authorities, statistical offices, Rebel

Source port authorities, statistical offices, Rebel

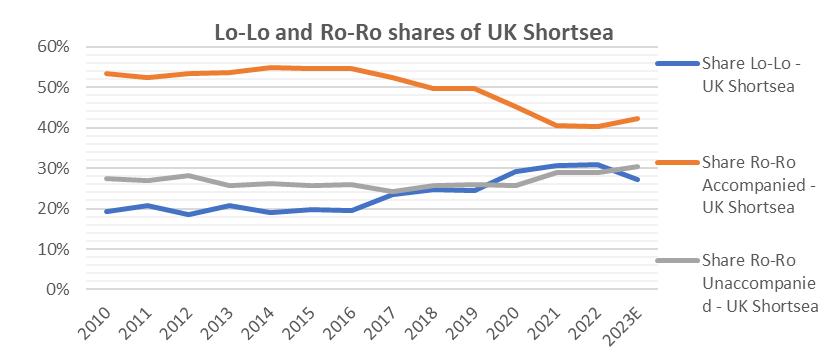

When zooming in on the shortsea trade the picture is actually different in several ways. First of all last two years were more positive for shortsea than for deepsea trades. This even when accounting for large Russian volumes dropping out form the shortsea Lo-Lo sector. In Port of Rotterdam roughly 6% of the volumes were going to/coming from Russia. However, accompanied and unaccompanied Ro-ro traffic fared much better, compensating for most of this decline. This trend is expected to continue.

Rebel Ports & Logistics NL bv

Expressing the share of shortsea trades as the overall traffic through ports or as share of the gateway traffic only, the reverse in fortune since the covid pandemic is clear. In the aftermath of the Brexit referendum, very low mainline shipping rates and with globalisation dominating the headlines, shortsea’s traffic declined. However the last three years has seen the share rising again.

Wijnhaven 23

3011 WH Rotterdam

The Netherlands

+31 10 275 59 95 info.rpl@rebelgroup.com www.rebelgroup.com

Session 1 - Conference Paper

12

Favourable Winds

Favourable Winds

Session 1 - Conference Paper

The shortsea sector is enjoying favourable winds when excluding the sanctioned Russian volumes The first month of 2024 were extending the positive trend started late 2023 with growth again for a range of months. This is expected to continue the coming year with the destocking process slowing down and reversing to its longer term trend.

The shortsea sector is enjoying favourable winds when excluding the sanctioned Russian volumes. The first month of 2024 were extending the positive trend started late 2023 with growth again for a range of months. This is expected to continue the coming year with the destocking process slowing down and reversing to its longer term trend.

And there can be even further upside surprises. Global supply chains keep struggling in the fragile geopolitical context, further highlighting the case for more resilient and shorter supply chains. However, although trade protectionism with in particular China could push more shippers to more local supply chain solutions, alternatives in South East Asia may provide a cushion for global supply chains. Also cost advantages of outsourcing keep being attractive to reconsider. The net direction of these forces has to be seen.

And there can be even further upside surprises. Global supply chains keep struggling in the fragile geopolitical context, further highlighting the case for more resilient and shorter supply chains. However, although trade protectionism with in particular China could push more shippers to more local supply chain solutions, alternatives in South East Asia may provide a cushion for global supply chains. Also cost advantages of outsourcing keep being attractive to reconsider. The net direction of these forces has to be seen.

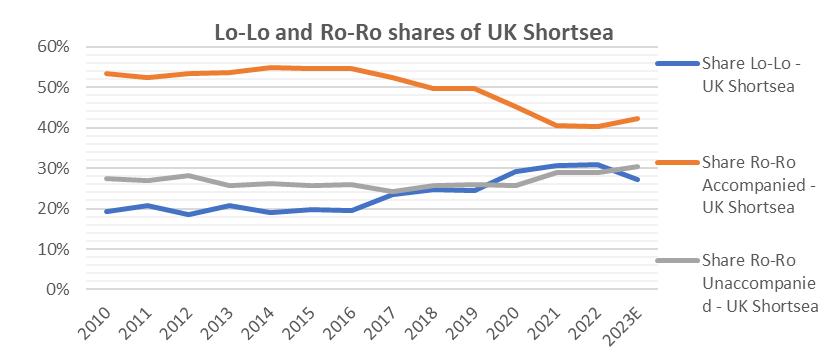

UK-European trade has shown resilience after the first negative post-Brexit reaction. With smoother customs procedures and slowly warming trade relationships again, there may even be upside potential for the intra-European trade. After the 2016 referendum UK shortsea trdae volumes declined. In the slowing macro-economic conditions and struggles which the deepsea segment is experiencing, the shortsea sector stable performance stands out. More remarkable is the shift in modality in the UK trades. The decline in popularity of accompanied trades since 2016 is clear, driving up the Lo-Lo and unaccompanied Ro-Ro sector and therefore the port requirements for storage facilities on both side of the North Sea.

UK-European trade has shown resilience after the first negative post-Brexit reaction. With smoother customs procedures and slowly warming trade relationships again, there may even be upside potential for the intra-European trade. After the 2016 referendum UK shortsea trdae volumes declined. In the slowing macro-economic conditions and struggles which the deepsea segment is experiencing, the shortsea sector stable performance stands out. More remarkable is the shift in modality in the UK trades. The decline in popularity of accompanied trades since 2016 is clear, driving up the Lo-Lo and unaccompanied Ro-Ro sector and therefore the port requirements for storage facilities on both side of the North Sea.

Source: Uk Department for Trade, Rebel

Supporting policy coming in place

The reversal in popularity of shortsea trades is due to the fact that shortsea trades seem the right mode of traffic for the current time:

First of all policy makers in Europe will prefer Intra-European trades over other trades. They result in less dependency on foreign production (in particular favourable for strategic products), result in employment and there are less concerns on production circumstances and/or pollution when the trade stays within Europe. However also the shipper seems to realise that the low cost production concept results in supply chain risks. Naturally the logistic issues during the global pandemic clearly highlighted the vulnerabilities in this regard.

Less often advocated are the sustainability benefits of shortsea trades over the deepsea ones and over direct trucking. Global supply chains reduce the visilibity of what is happening in the supply chains. With the shipping sector being more scrutinised on social and environmental responsibility shippers have an increased preference for more local production. When CSRD requirements for large shippers will come into effect, it will require them to report on the impact of their sourcing and supply chains.

13

rising again.

Secondly maritime transport results in the lowest emissions per container per mile transported. Shipping cargoes rather than trucking them all the way reduces the environmental impact. The introduction of the ETS system to both trucking and shipping later this decade will make distribution over local shortsea ports preferable. The sector will need to do its best to increase flexibility, visibility and journey times to match that of road transport as much as possible. Naturally putting more containers on shortsea vessels will result in less road congestion –a large problem around major cities such as London. North West European ports are well positioned to take over this land bridge function. Introducing carbon pricing will cause shifts in both the balance between the all-trucking routes and shortsea shipping, but will also change the competitive position between ports and terminals. Terminals closer to the end market will be more competitive in the direct hinterland and thereby fragmenting the market more, though the impact depends greatly on the carbon price. However, in particular options with long distance trucking will feel the costs of emission taxation as long as the vehicles are not electric.

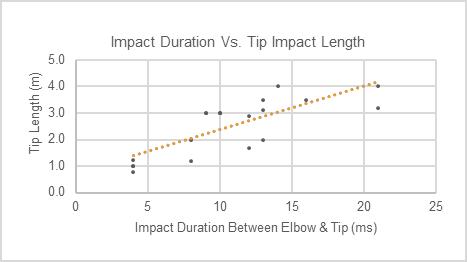

Change in competitive cost position of shortsea terminals in Rotterdam to Hull when introducing carbon pricing

Source: Rebel

Source: Rebel

Promising, but...

Promising, but…

Despite the positive noises from a strategic, trade policy and geopolitical context, the sector faces challenges to realise its potential. Most important hurdles are the ageing fleet, low levels of digitisation/transparency and pressure on port capacity. The latter can be attributed to both lower investment levels the past decade, but also less possibilities to expand. Increasing investment levels remains difficult in a sector in which margins are relatively thin and which is dominated by a larger number of liners. A pity with regard to the low margins is that a lot of the benefits of shortsea trade are economic or environmental in nature. Monetising these benefits is difficult for private market players, but the EU and national governments can play an important role in this.

Despite the positive noises from a strategic, trade policy and geopolitical context, the sector faces challenges to realise its potential. Most important hurdles are the ageing fleet, low levels of digitisation/transparency and pressure on port capacity. The latter can be attributed to both lower investment levels the past decade, but also less possibilities to expand. Increasing investment levels remains difficult in a sector in which margins are relatively thin and which is dominated by a larger number of liners. A pity with regard to the low margins is that a lot of the benefits of shortsea trade are economic or environmental in nature. Monetising these benefits is difficult for private market players, but the EU and national governments can play an important role in this.

Table 1 Average age of shortsea container fleet calling in ZARA range (shortsea up until 3,000 TEU typically)

Source: Rebel

14

Session 1 - Conference Paper

4/5

TEU Vessels Depl Capacity Average of Age 0 - 500 30 8,385 21 500 - 1000 105 83,926 19 1000 - 1500 53 62,673 13 1500 - 2000 19 33,116 14 2000 - 3000 6 14,830 20 3000 - 4000 7 24,383 11 4000 - 5500 3 14,397 13 223 241,710

Source: Rebel

The second big problem is the competition for space in ports which threatens the ability for the shortsea sector to grow. With most port authorities lining up for the energy transition and a more circular economy, there is a large competition for space. In many places there will be very limited possibilities the next decade for developing large new shortsea terminals. Deepsea terminals will not provide a solution for this problem as the nature of the shortsea business and size of vessels and containers are significantly different from the deepsea sector. Rather than adding terminals, there is an increasing pressure to squeeze out more capacity from the same footprint. The energy density of ammonia and hydrogen is such that the storage space will be a factor 2 to even 5 more for the same imported amount of energy. On top of this additional safety margins will need to be implemented. Considering the vast sizes of the liquid bulk terminals in North West Europe, it is not hard to imagine the pressure on space in ports in the future. In ports where this trade-off is strongest, concession fees are likely to increase in the near future. Also as port authorities will struggle to finance the large reinvestments involved in the energy transition.

On top of this, ports and shipping gets more scrutiny from the public for its environmental footprint. Despite being the greenest mode of transport on a per mile basis, getting the permits for realising new port capacity is increasingly difficult. Also increasing negative sentiment towards industrial complexes and ability to file objections to permitting have its implecation on development lead times. With longer permitting processes and frequent delays, utilisation rates in the European and UK port sector will increase. As a consequence the sector will be more vulnerable for fluctuations and congestion at terminals. We all remember from recent events what that can lead into.

Shortsea needs some breathing space

The shortsea sector is back in the spot light with the share of shortsea trade in (North West European) ports to rise. Port demand is on the up and more favourable drivers for further growth are on the horizon and policy supporting the shift in broader terms. Both the ageing fleet and highly utilised terminals need fresh investments to keep pace with the growth in demand. These investments are difficult to realise as a result of an increasing competition for space and complexity of monetising some benefits of shortsea trade. The one thing which should be easiest to change it to make the permitting and realising port developments easier with policy and even subsidy support to unlock environmental gains. Governments should do more to facilitate the growth in the shortsea sector and put it higher on the agenda. However, so far ‘short’ in shortsea stands for that the sector got the “short end of the stick”.

Session 1 - Conference Paper 15 Table 1 Average age of shortsea container fleet calling in ZARA range (shortsea up until 3,000 TEU typically) TEU Vessels Depl Capacity Average of Age 0 - 500 30 8,385 21 500 - 1000 105 83,926 19 1000 - 1500 53 62,673 13 1500 - 2000 19 33,116 14 2000 - 3000 6 14,830 20 3000 - 4000 7 24,383 11 4000 - 5500 3 14,397 13 223 241,710

KARI-PEKKA LAAKSONEN

Group CEO, Samskip

KARI-PEKKA LAAKSONEN

Group CEO, Samskip

BIOGRAPHY

Kari-Pekka Laaksonen is responsible for reinforcing the company’s strategy of aligning its sustainable logistics services more closely with the business objectives of its customer base. He is dedicated to ensuring the unique balance of delivering scale economies through Samskip’s shortsea, rail, barge and trucking network while maintaining the privately owned culture that responds to opportunities quickly and decisively.

Samskip is a global logistics company offering transport and related services by land, sea, rail and air with a particular focus on cost-efficient, reliable and environmentally friendly transport. With an annual turnover of over EUR 900 million, Samskip is one of the larger European transport companies, with offices in more than 24 countries. We consider sustainability to be one of the fundamentals of doing business as it stands for the long‐term continuity of our business, and of society as a whole. The company has truly committed to reduce the carbon density of its activities in the coming years by creating and offering low-to-zero transport services.

1 - Keynote Presentation 16

Session

SABINE KILPER Senior Research Analyst, Toepfer Transport GmbH

SABINE KILPER Senior Research Analyst, Toepfer Transport GmbH

BIOGRAPHY

Sabine Kilper is a shipping expert with profound experience over more than 30 years in the multipurpose (MPP) / heavy lift and general cargo segment through various positions in chartering and research with recognized ship owners, ship brokers and ship operators. Since 2021 Sabine has been dedicated to the short sea shipping market, undertaking analysis of the short sea fleet, newbuilding activities and the publication of short sea shipping reports and relevant market index.

Current duties and responsibilities

n market analysis in the field of MPP and short sea shipping

n research and publication of the monthly Toepfer Transport Short Sea Shipping Report, the Toepfer Transport Short Sea Index (TSI) as well as bespoke research products.

17

Session 1 - Speaker

The European Short Sea Market

1. INTRODUCTION

In 2022, almost 60 per cent of all cargo shipped from or to the EU was short sea cargo.1 Short sea ships are thus an essential component of Europe’s logistical transport system. They have been developed over centuries and until today offer a fast, cost- and energy-efficient way of carrying imported and exported cargoes from and to every corner of the European continent. However, short sea shipping is currently facing huge challenges. For one thing, global climate goals and European Union (EU) directives are asking for significant reductions in greenhouse gas (GHG) emissions, which is putting increasing pressure on shipping companies to take action. Also, a large part of the short sea fleet is too old to transition to energy-efficient operations. About 53 per cent of the short sea fleet is more than 20 years old with a significant part needing to be replaced in the next 10 to 15 years.

The circumstances are not exactly ideal. The strong need for new fuel-efficient vessels has come at a time when newbuilding prices are high, there is limited shipyard capacity, and the dampened economic outlook is threating to lower cargo volumes and earnings.

This paper provides insights into the current state of the short sea fleet, the short sea shipping market as well as the development of the kind of new designs that are needed to adapt to the requirements for environmentally friendly, sustainable growth in European short sea trades.

2. SHORT SEA MARKET ENVIRONMENT

The European short sea market is fragmented with a multitude of owners and operators transporting goods from various regions across the continent. The ships they use range in designs from the 40-year-old vintage models - high construction quality, high fuel consumption and still riding the waves of the rough North Sea - to the small number of state-of-the-art creations from pioneers in ship design and zero-emissions fuel systems that are slowly entering the market.

Europe is a global leader when it comes to setting decarbonization regulations. The European ‘Green Deal’ calls for net-zero GHG-emissions by 2050. And, since 1 January 2024, the EU Emissions Trading System (EU ETS) requires shipping companies to surrender their GHG emissions allowances for vessels above 5000 gross tonnage (GT) that trade in European waters, which is increasing voyage related costs.

At the same time, major industries in Europe appear to be struggling with the new normal brought about by having turned away from cheap (Russian) gas and fossil fuels. Those fuels were a vital part of Europe’s economic strength, enabling it to deal cost-effectively with high export quotas and a steady flow of cargo. According to the European Central Bank (ECB), the annual average real gross domestic product (GDP) growth is expected to be only 0.6 per cent in 2024 - in March 2024 it revised the figure downwards by 0.2 percentage points from its December 2023 projections.2

The short sea market is thus navigating a fragile environment. While it is more stable and less volatile than other shipping segments, thanks generally to the large variety of goods and opportunities available, it still has a number of challenges to resolve.

1 See: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Maritime_transport_statistics_-_ short_sea_shipping_of_goods

2 See: https://www.ecb.europa.eu/pub/projections/html/ecb.projections202403_ecbstaff~f2f2d34d5a. en.html#toc2

- Conference Paper

Session 1

18

3. SHORT SEA FLEET

a. Short Sea Fleet Definition

Toepfer Transport defines the short sea fleet as:

n general cargo vessels / mini bulkers

n built in 1980 or later

n gearless or geared up to 99 mt combined

n a minimum 1,000 tons deadweight tons (dwt)

n a maximum 9,999 tons dwt

n owned or managed by a stakeholder from Europe, including the Mediterranean and the Black Seas.

b. Trading Fleet

The European short sea trading fleet has grown from 3,037 vessels in Q1 2024 to 3,054 ships, equalling 14,516.710 dwt in April 2024 (average age: 24.45 years !). This corresponds to a 0.9 per cent increase in deadweight. Looking at it annually, there has been 4.1 per cent deadweight growth since April 2023, when there were 2,974 ships, equalling 13,950,155 dwt.

1 - Trading short sea fleet

c. Short Sea Fleet Age Structure

Currently, about 53 per cent of the fleet is 20 years old or older and about 28 per cent of the fleet is at least 30 years old. More than 8 per cent of the vessels still trading in Europe have reached an age of 40 years and beyond.

Table 2 - Fleet age distribution

19

Session 1 - Conference Paper

Trading Short Sea Fleet by dwt ranges DWAT range No. of Ships DWAT cum. DWAT rel. trading Avg. Age 1000-1999 204 316.997 2,18% 36,24 2000-2999 339 856.928 5,90% 29,81 3000-3999 793 2.747.319 18,93% 27,64 4000-4999 504 2.265.560 15,66% 23,95 5000-5999 386 2.070.108 14,26% 20,25 6000-6999 283 1.814.665 12,50% 21,23 7000-7999 224 1.680.764 11,58% 18,88 8000-8999 233 1.934.979 13,33% 14,58 9000-10000 88 829.390 5,71% 19,84 Total 3,054 14,516.710 100,00% 24,45 Fleet Age Distribution (trading) Age No. of Ships DWAT cum. DWAT rel. trading 0-4 179 1.131.266 7,79% 5-9 91 541.479 3,73% 10-14 350 1.988.386 13,70% 15-19 582 3.221.110 22,19% 20-24 314 1.543.264 10,63% 25-29 430 2.084.333 14,36% 30-34 367 1.580.251 10,89% 35-40 367 1.224.433 8,43% 40-43 281 977.609 6,73% 44 62 224.579 1,55% Total fleet 3,054 14,516.710 100,00%

Table

Session 1 - Conference Paper

20

PAPER Toepfer Transport – Short Sea Shipping Coastlink 2024 4

Graph 1 - Fleet distribution by year of delivery

Graph 1 - Fleet distribution by year of delivery

Session 1 - Conference Paper

Short Sea Orderbook

d. Short Sea Orderbook

Demand for newbuilt vessels was strong in 2023 and the orderbook is continuing to grow steadily. It currently stands at 194 vessels or 7.69 per cent of the trading fleet (compared with the October 2021 level of 4.42 per cent). We are expecting a steady influx of newly delivered vessels to the market primarily in the first half of 2024, though some of these are delayed 2023 deliveries. Altogether, 60 ships are slated for delivery in the first half of 2024, 27 of which have already launched from shipyards in the Netherlands, China and India (data as of March 2024).

Demand for newbuilt vessels was strong in 2023 and the orderbook is continuing to grow steadily. It currently stands at 216 vessels or 8.55 per cent of the trading fleet (compared with the October 2021 level of 4.42 per cent). We are expecting a steady influx of newly delivered vessels to the market primarily in Q1 2024, though some of these are delayed 2023 deliveries. Altogether, 60 ships are slated for delivery in the first half of 2024, 27 of which have already launched from shipyards in the Netherlands, China and India.

e.

Demolition Activities

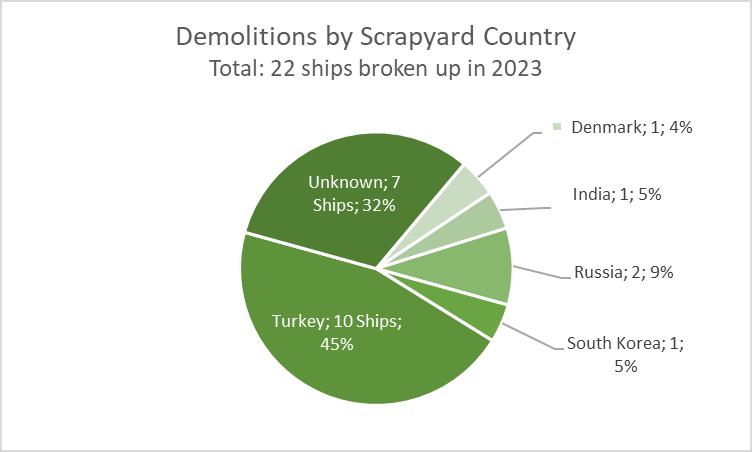

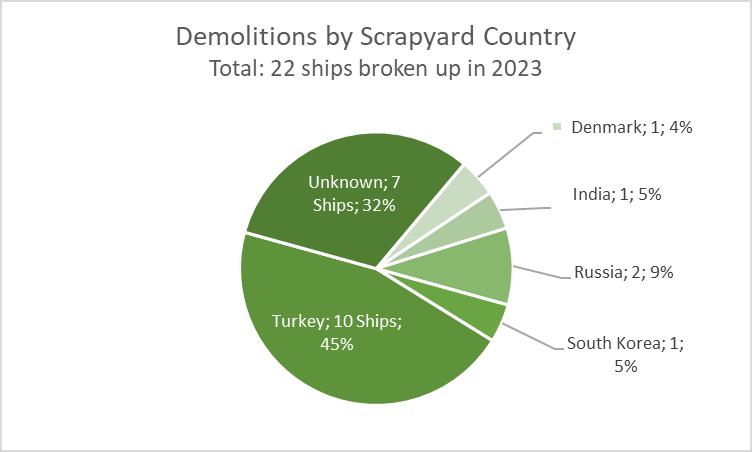

In 2023, 22 European short sea vessels representing 0.5 per cent of the trading fleet were sent to the scrapyards They were mostly Russian river-sea ships and smaller ships of under 5,000 dwt. The average age was 49 years, though the oldest was 62, having been built in Romania in 1961. The majority of demolished vessels was sent to Turkish shipyards. Other European scrapyards which are compliant according to EU Ship Recycling Regulation do not play a role yet.

e. Demolition Activities

Table 3 - The short sea orderbook

d. Demolition Activities

In 2023, 22 European short sea vessels representing 0.5 per cent of the trading fleet were sent to the scrapyards They were mostly Russian river-sea ships and smaller ships of under 5,000 dwt. The average age was 49 years, though the oldest was 62, having been built in Romania in 1961. The majority of demolished vessels was sent to Turkish shipyards. Other European scrapyards which are compliant according to EU Ship Recycling Regulation do not play a role yet.

In 2023, 22 European short sea vessels representing 0.5 per cent of the trading fleet were sent to the scrapyards. They were mostly Russian river-sea ships and smaller ships of under 5,000 dwt. The average age was 49 years, though the oldest was 62, having been built in Romania in 1961. The majority of demolished vessels was sent to Turkish shipyards. Other European scrapyards which are compliant according to EU Ship Recycling Regulation do not play a role yet.

2 - Age profile of demolished ships

21

Short Sea Orderbook by dwt ranges DWAT range No. of Ships DWAT cum. DWAT rel. trading 1000-1999 3 4.232 0,03% 2000-2999 0 0 0,02% 3000-3999 48 181.100 1,25% 4000-4999 11 48.390 0,33% 5000-5999 59 322.094 2,22% 6000-6999 15 94.500 0,65% 7000-7999 30 223.381 1,54% 8000-8999 16 134.262 0,92% 9000-10000 15 109.500 0,75% Total 194 1.117.059 7,69% PAPER Toepfer Transport – Short Sea Shipping Coastlink 2024 5

Table 3 - The short sea orderbook

hips 2023

5

Graph 3 - Scrapyard countries

Table 3 - The short sea orderbook

Graph

2023

Graph 3 - Scrapyard countries

Graph

2 - Age profile of demolished ships 2023

Graph 3 - Scrapyard countries

4. SHORT SEA MARKET

a. Short Sea Earnings – Toepfer Transport’s Short Sea Index (TSI)

The TSI represents the shortsea earnings per day in a monthly average time charter equivalent (TCE) assessment established by a panel of operators, owners and brokers for two index vessel types with the following criteria:

4. SHORT SEA MARKET

a. Short Sea Earnings – Toepfer Transport’s Short Sea Index (TSI)

TSI-35 index vessel:

n general cargo vessel or bulker

The TSI represents the monthly average time charter equivalent (TCE) assessment established by a panel of operators, owners and brokers for two index vessel types with the following criteria:

n employed in European short sea trades

TSI-35 index vessel:

n 3,200 – 3,800 dwt gearless singledecker

- general cargo vessel or bulker

n well maintained, fully workable, afloat, with all documents and class in good order

- employed in European short sea trades

- 3,200 – 3,800 dwt gearless singledecker

TSI-52 index vessel:

- well maintained, fully workable, afloat, with all documents and class in good order

n general cargo vessel or bulker

TSI-52 index vessel:

n employed in European short sea trades

- general cargo vessel or bulker

n 4,800 – 5,600 dwt gearless singledecker

- employed in European short sea trades

- 4,800 – 5,600 dwt gearless singledecker

n well maintained, fully workable, afloat, with all documents and class in good order

- well maintained, fully workable, afloat, with all documents and class in good order

b. Development of Short Sea Earnings

b. Development of Short Sea Earnings

Short sea vessel earnings, after a long period of being low in the aftermath of the 2008 Lehman crisis, picked up sharply in Q4 2021 as a consequence of pandemic-related supply chain disruptions amid high demand and overspill cargo from the container, dry bulk and multipurpose segments. TCE results have peaked in February 2022: vessels with 3,200 to 3,800 dwt reached 7.110 euros; ships with 4,800 to 5,600 dwt achieved 9,077 euros on average.

Short sea vessel earnings, after a long period of being low in the aftermath of the 2008 Lehman crisis, picked up sharply in Q4 2021 as a consequence of pandemic-related supply chain disruptions amid high demand and overspill cargo from the container, dry bulk and multipurpose segments. TCE results have peaked in February 2022: vessels with 3,200 to 3,800 dwt reached 7.110 euros; ships with 4,800 to 5,600 dwt achieved 9,077 euros on average

The last 24 months have seen a moderate market correction: rate levels reached a temporary floor in August 2023. As of March 2024, the TCEs stand at 4.843 and 6.626 euros, respectively, which are still healthy levels compared with the historical average.

The last 24 months have seen a moderate market correction: rate levels reached a temporary floor in August 2023. As of January 2024 the TCEs stand at 4 658 and 6.023 euros, respectively, which are still healthy levels compared with the historical average.

Graph 3 - TSI from October 2020 to date

Conference Paper 22

Session 1 -

October 2020

date PAPER Toepfer Transport – Short Sea Shipping Coastlink 2024 6

Graph 3 - TSI from

to

c. Sale and Purchase (S&P) Market

c. Sale and Purchase (S&P) Market

c. Sale and Purchase (S&P) Market

4 - Second hand price development of 5,000 dwt short sea vessels

Graph 4 - Second hand price development of 5,000 dwt short sea vessels

Graph 4 - Second hand price development of 5,000 dwt short sea vessels

In 2021, second hand price levels for short sea ships started to soar on the back of high demand for tonnage, profitable voyage results and scarce availability of sales candidates.

In 2021, second hand price levels for short sea ships started to soar on the back of high demand for tonnage, profitable voyage results and scarce availability of sales candidates.

In 2021, second hand price levels for short sea ships started to soar on the back of high demand for tonnage, profitable voyage results and scarce availability of sales candidates.

The last six months have seen a market correction with prices slowly decreasing though remaining on a firm level. As of March 2024, the price for a 10-year-old coaster with a deadweight of 5,000 tons built in Europe is around 6.00 million euros

The last six months have seen a market correction with prices slowly decreasing though remaining on a firm level. As of March 2024, the price for a 10-year-old coaster with a deadweight of 5,000 tons built in Europe is around 6.00 million euros.

The last six months have seen a market correction with prices slowly decreasing though remaining on a firm level. As of March 2024, the price for a 10-year-old coaster with a deadweight of 5,000 tons built in Europe is around 6.00 million euros

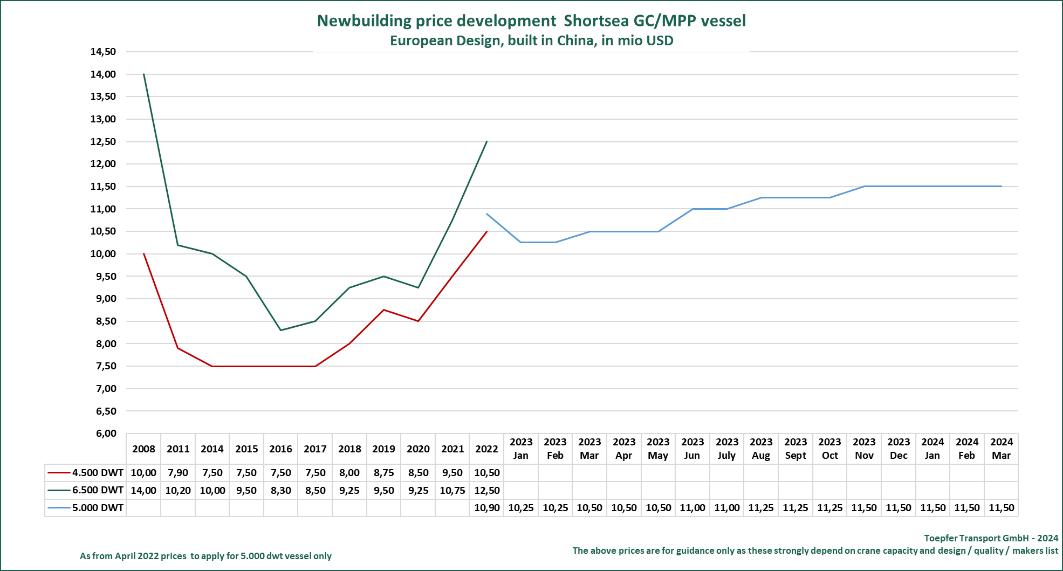

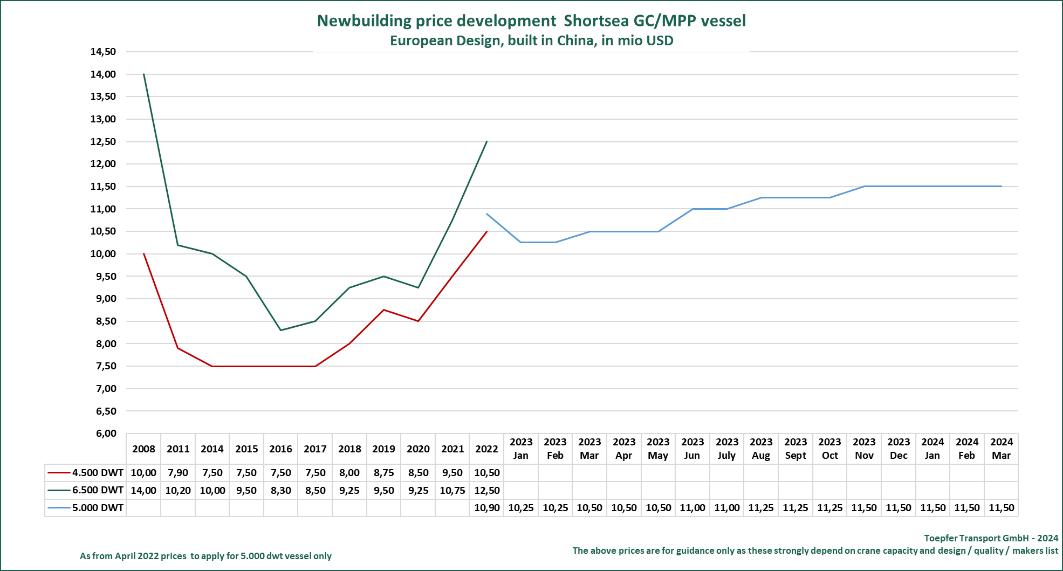

d. Development of Newbuilding Prices

d. Development of Newbuilding Prices

d. Development of Newbuilding

Graph 5 - Newbuilding price development of 5,000 dwt short sea vessels

Graph 5 - Newbuilding price development of 5,000 dwt short sea vessels

Graph 5 - Newbuilding price development of 5,000 dwt short sea vessels

High demand for new vessels, particularly from the container segment with owners reinvesting substantial profits from 2021 and 2022, and limited shipyard capacity have seen prices for newbuilt ships increase sharply over the last three years. The rising prices have been further fuelled by spiralling inflation driven by high energy and material prices in the wake of the Ukraine war despite evident market corrections in the container, bulk, MPP and short sea segments in the last 12 months. Increased equipment and labour costs are adding to the pressure on prices. With high costs, full orderbooks and low profit margins, shipyards have no reason to reduce their price level; if anything, we can expect prices to go up in the next 12 to 24 months.

High demand for new vessels, particularly from the container segment with owners reinvesting substantial profits from 2021 and 2022, and limited shipyard capacity have seen prices for newbuilt ships increase sharply over the last three years The rising prices have been further fuelled by spiralling inflation driven by high energy and material prices in the wake of the Ukraine war despite evident market corrections in the container, bulk, MPP and short sea segments in the last 12 months. Increased equipment and labour costs are adding to the pressure on prices. With high costs, full orderbooks and low profit margins, shipyards have no reason to reduce their price level; if anything, we can expect prices to go up in the next 12 to 24 months.

High demand for new vessels, particularly from the container segment with owners reinvesting substantial profits from 2021 and 2022, and limited shipyard capacity have seen prices for newbuilt ships increase sharply over the last three years The rising prices have been further fuelled by spiralling inflation driven by high energy and material prices in the wake of the Ukraine war despite evident market corrections in the container, bulk, MPP and short sea segments in the last 12 months. Increased equipment and labour costs are adding to the pressure on prices. With high costs, full orderbooks and low profit margins, shipyards have no reason to reduce their price level; if anything, we can expect prices to go up in the next 12 to 24 months.

- Conference Paper 23

Session 1

PAPER Toepfer Transport – Short Sea Shipping Coastlink 2024 7

PAPER Toepfer Transport – Short Sea Shipping Coastlink 2024 7

Graph

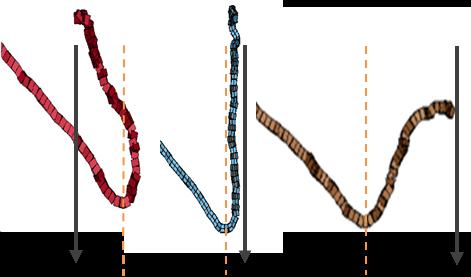

5. TYPICAL TRADITIONAL AND NEW SHORT SEA DESIGNS

In the last decade, a number of European shipyards, design houses and engineering companies have been working to address the need for more fuel-efficient short sea ships that reduce consumption and GHG emissions.

In the last decade, a number of European shipyards, design houses and engineering companies have been working to address the need for more fuel-efficient short sea ships that reduce consumption and GHG emissions.

Dutch shipyards Royal Bodewes, Ferus Smit and Damen Shipyard Group have been adapting their traditional most recognized standard designs to the new requirements. And, pioneering naval architects and design houses like Conoship International, Groot Design and Norwegian Ship Design have been working on innovative short sea ship designs that feature wind-assisted propulsion, battery solutions and alternative fuel and engine concepts

Dutch shipyards Royal Bodewes, Ferus Smit and Damen Shipyard Group have been adapting their traditional most recognized standard designs to the new requirements. And, pioneering naval architects and design houses like Conoship International, Groot Design and Norwegian Ship Design have been working on innovative short sea ship designs that feature wind-assisted propulsion, battery solutions and alternative fuel and engine concepts.

The result of these projects have been coming to the market over the past three years, with several series either under construction or already delivered to major short sea owners and operators Below we present popular designs in the two dominant size segments: 3,800 and 5,200 dwt

The result of these projects have been coming to the market over the past three years, with several series either under construction or already delivered to major short sea owners and operators. Below we present popular designs in the two dominant size segments: 3,800 and 5,200 dwt.

a. Designs of Smaller-Sized Coasters with 3.800 dwt

a. Designs of Smaller-Sized Coasters with 3.800 dwt

European short sea vessels of 3,000 to 3,999 dwt have been in heavy demand over the last 30 years. With a fleet share of 19.12 percent by deadweight or 795 ships, they represent the largest portion of the short sea fleet currently trading.

European short sea vessels of 3,000 to 3,999 dwt have been in heavy demand over the last 30 years. With a fleet share of 18.93 percent by deadweight or 793 ships, they represent the largest portion of the short sea fleet currently trading.

DAMEN CF 3850 II

DAMEN CF 3850 II

In 1999, Damen Shipyards Group began building a new standard ship series, the Combi Freighter (CF) 3850. It has a deadweight of about 3,850 tons, a grain capacity of about 5,250 cubic metres, an overall length of 88 60 metres and a beam of 12 50 metres. Up until 2013, more than 40 ships had been delivered by East European shipbuilding facilities under the umbrella of the Damen Group.

In 1999, Damen Shipyards Group began building a new standard ship series, the Combi Freighter (CF) 3850. It has a deadweight of about 3,850 tons, a grain capacity of about 5,250 cubic metres, an overall length of 88.60 metres and a beam of 12.50 metres. Up until 2013, more than 40 ships had been delivered by East European shipbuilding facilities under the umbrella of the Damen Group.

In January 2021, Damen Shipyards Yichang in China delivered the first unit of the CF 3850 II, an improved, more fuel-efficient design with an optimized hull. This marked the beginning of a new standardized shipbuilding series - more than 30 units are expected to be built by the end of 2026.3 The vessel has a deadweight of 3,800 tons, is 89.70 metres long and complies with International Maritime Organization (IMO) Tier III emission requirements.

In January 2021, Damen Cargo Vessels delivered the first unit of the CF 3850 II, an improved, more fuel-efficient design with an optimized hull. This marked the beginning of a new standardized shipbuilding series - more than 30 units are expected to be built by the end of 2026.3 The vessel has a deadweight of 3,800 tons, is 89.70 metres long and complies with International Maritime Organization (IMO) Tier III emission requirements.

Image 1 – A CF 3850 combi-freighter (source www.damen.com)

Image 1 – A CF 3850 combi-freighter (source www.damen.com)

3 See: www.damen.com

3 See: www.damen.com

Session 1 - Conference Paper 24

PAPER Toepfer Transport – Short Sea Shipping Coastlink 2024 8

TYPICAL TRADITIONAL AND NEW SHORT SEA DESIGNS

5.

Session 1 - Conference Paper

CONOSHIP CIP 3800

CONOSHIP CIP 3800

CONOSHIP CIP 3800

The vessels in the CIP 3800 series developed by Conoship International Projects (CIP) have a deadweight of 3.800 tons and a length of 89,43 metres. They are equipped with a dieselelectric propulsion system, a large-diameter propeller, optimized hull lines and a single cargo hold with high cubic capacity, which makes them ideal for carrying a varieta of heavy and light cargo. Fuel consumption is low in the CIP 3800 vessels, but they also come with the option to install VentoFoil units to reduce even further and to change the fuel type in the future.4

The vessels in the CIP 3800 series developed by Conoship International Projects (CIP), with 20 units on order, have a deadweight of 3.800 tons and a length of 89,43 metres. They are equipped with a diesel-electric propulsion system, a large-diameter propeller, optimized hull lines and a single cargo hold with high cubic capacity, which makes them ideal for carrying a variety of heavy and light cargo. Fuel consumption is low in the CIP 3800 vessels, but they also come with the option to install VentoFoil units to reduce even further and to change the fuel type in the future.4

The vessels in the CIP 3800 series developed by Conoship International Projects (CIP) have a deadweight of 3.800 tons and a length of 89,43 metres. They are equipped with a dieselelectric propulsion system, a large-diameter propeller, optimized hull lines and a single cargo hold with high cubic capacity, which makes them ideal for carrying a varieta of heavy and light cargo. Fuel consumption is low in the CIP 3800 vessels, but they also come with the option to install VentoFoil units to reduce even further and to change the fuel type in the future.4

b. Design of medium-sized coaster with 5.200 tdw

a. Design of medium-sized coaster with 5.200 tdw

Short sea vessels with a deadweight of 5,000 to 5,999 tons account for 14.26 percent of the short sea fleet or 386 ships. The size of ship is currently in the highest demand with 59 units on order.

Short sea vessels with a deadweight of 5,000 to 5,999 tons account for 20 54 percent of the short sea fleet or 377 ships. The size of ship is currently in the highest demand with 62 units on order.

Short sea vessels with a deadweight of 5,000 to 5,999 tons account for 20 54 percent of the short sea fleet or 377 ships. The size of ship is currently in the highest demand with 62 units on order.

GROOT 5200 XL

GROOT 5200 XL

GROOT 5200 XL

Groot Ship Design’s 5200XL is a versatile mini bulker that combines a large cargo hold, 1A iceclass, a modern layout and efficient powering.5 The ship has a deadweight of about 5,200 tons, a length of 89.99 metres and is optimised for low fuel consumption.

Groot Ship Design’s 5200XL is versatile mini bulker that combines a large cargo, 1A iceclass, a modern layout and efficient powering 5 The ship has a deadweight of about 5,200 tons, a length of 89 99 metres and

Groot Ship Design’s 5200XL is versatile mini bulker that combines a large cargo, 1A iceclass, a modern layout and efficient powering 5 The ship has a deadweight of about 5,200 tons, a length of 89 99 metres and is optimised for low fuel consumption

www.grootshipdesign.com)

4 See: https://www.conoship.com/2023/12/04/cip-series-the-advantages-of-conoships-new-standarddesigns/

5 See: https://www.grootshipdesign.com/posts/steelcutting-5200xl-series-commenced-1098/

4 See: https://www.conoship.com/2023/12/04/cip-series-the-advantages-of-conoships-new-standarddesigns/

5 See: https://www.grootshipdesign.com/posts/steelcutting-5200xl-series-commenced-1098/

4 See: https://www.conoship.com/2023/12/04/cip-series-the-advantages-of-conoships-new-standarddesigns/

5 See: https://www.grootshipdesign.com/posts/steelcutting-5200xl-series-commenced-1098/

25

Image 2 – A Conoship 3800 single-cargo vessel (Source www.conoship.com)

PAPER Toepfer Transport – Short Sea Shipping Coastlink 2024 9

a. Design of medium-sized coaster with 5.200 tdw

Image 2 – A Conoship 3800 single-cargo vessel (Source www.conoship.com)

Image

3 – A Groot 5200 XL mini bulker (Source www.grootshipdesign.com)

PAPER Toepfer Transport – Short Sea Shipping Coastlink 2024 9

Image 2 – A Conoship 3800 single-cargo vessel (Source www.conoship.com)

www.grootshipdesign.com)

Image 3 – A Groot 5200 XL mini bulker (Source

Image 3 – A Groot 5200 XL mini bulker (Source

SUMMARY

n After many years of very low earnings and newbuilding activities in the wake of the 2008 Lehman crisis, the last three years have seen the short sea segment attracting new investors, shipyards and operators.

n Big steps have been taken to renew the aging fleet, in view of the scant availability of second hand tonnage, the increased environmental requirements and the option to reinvest post-pandemic peak profits. The orderbook share of the trading fleet (3,054 ships) has risen from only 4.42 per cent (by deadweight) in October 2021, to 7.69 per cent as of March 2024 with 194 ships currently on order.

n We still need to replace a large portion of old coaster tonnage as almost a third of the fleet, about 28 per cent, is 30 years old or more.

n Only 0,5 per cent of the trading fleet was demolished in 2023. Scrapping activity is highly focused on Turkey at the moment, but other demolition yards will need to be used to keep up with the demand to remove the old fleet from the market.

n Innovative ship designs featuring new fuel concepts and covering the two major coaster sizes (3.800 and 5.000 dwt) have been implemented as far as possible in small but decisive steps. Expertise and willingness to build new short sea vessels is largely available.

n New designs - like the Damen’s CF 3850 II, the Conoship CIP 3800 series and the Groot 5200 XL are set to significantly reduce GHG emissions, and some can be operated with alternative fuels or wind-assisted propulsion.

n Although a market correction has taken place in the last 18 months, short sea earnings are still hovering at a healthy level to ensure reasonable returns on investments.

n Risks remain amid dampened economic outlook, geopolitical tensions, high interest rates and high costs for material and labour which are leading to elevated newbuilding prices.

n We can expect the need for green transportation solutions, fuelled by global political climate goals, GHG reduction measures like the EU ETS and the emission targets and pathways set by individual industries and cargo owners to continue to drive efforts to renew the short sea fleet.

Transforming the short sea fleet will happen only with the ongoing mutual engagement of all market stakeholders and governments. To enable sustainable growth that will benefit the environment as well as all market stakeholders also needs:

a. demolishing the overaged ships, which also requires additional demolition infrastructure and a realistic political framework to allow environmental friendly and safe scrapping;

b. governments’ funding to support research and innovative newbuilding activities;

c. cooperation between ship and cargo owners to develop business cases that makes investments in new tonnage viable for a good part of the lifecycle of a ship;

d. ongoing adaption to technical developments including retrofitting existing short sea vessels as far as possible.

26

Session 1 - Conference Paper

BOUTIQUE SALE & PURCHASE AND NEWBUILDING SHIPBROKERS

SHIPPING MARKET RESEARCH AND ANALYS IS • VESSEL VALUATIONS

Expertise and ma rket intelligence that add value to your business.

Quarterly Multipurpose Shipping Report

Monthly European Shortsea Shipping Report

Leading Market Indices (MPP/HL and Shortsea)

Tailormade Market Analysis Vessel Valuations Sale and Purchase Shipbrokers Newbuilding Shipbrokers

Toepfer Transport GmbH

Alstertor 1 • 20095 Hamburg • Germany research@toepfer-transport.com • snp@toepfer-transport.com Website: www.toepfer-transport.com

SHANGHAI

SHIPBROKERS

HAMBURG • SINGAPORE •

PASSIONATE

SINCE 1974

SESSION 1 - PANEL DISCUSSION

Green corridors –collaboration to drive sustainable growth

28

RICHARD BALLANTYNE OBE Chief Executive, British Ports Association

RICHARD BALLANTYNE OBE Chief Executive, British Ports Association

BIOGRAPHY

Richard Ballantyne joined the British Ports Association in 2007 and became the Chief Executive in 2016.

Richard has in-depth expertise in ports, transport, trade and environmental policy matters as well as a wide experience of the legislative process around the UK. He is a champion of sustainable development and is also a passionate advocate of the value of the UK ports industry both to the regions in which they are based but also as national gateways.

He is a Director of Maritime UK, a Trustee of the Merchant Navy Welfare Board charity and was previously a Director of Port Skills and Safety Ltd.

Before joining the BPA Richard spent five years at a Westminster political consultancy and was previously an MP’s researcher in the House of Commons.

Richard was also awarded an OBE in the 2022 New Year’s Honours for his services to the maritime sector.

Session 1.1 - Panel Moderator 29

JESPER CHRISTENSEN Operations Director, DFDS

JESPER CHRISTENSEN Operations Director, DFDS

We keep Europe moving through a wide range of freight services from ferry transport to complex logistics solutions

n 12,300 employees

n DKK 26.9bn revenue

n 20+ countries connected by our ferry routes and logistics solutions

DFDS has since its foundation in 1866 built a unique infrastructure of ferry routes connecting European countries with each other as well as with Türkiye. We mostly transport freight units on the routes in addition to around 5 million passengers in normal years.

We also offer logistics services rooted in the regions served by our ferry routes. They range from door-door transports of full-loads to complex solutions for major industrials.

Session 1.1 - Panellist

30

ANDIMA ORMAETXE

Director - Operations, Commercial, Logistics and Strategy, Port of Bilbao

BIOGRAPHY

Andima Ormaetxe has been the Director - Operations, Commercial, Logistics and Strategy at the Port of Bilbao Authority since 2018.

He is a member of the Board of Directors of several Dry Ports and Intermodal Platforms such as Azuqueca de Henares (Guadalajara), Coslada (Madrid), Villafria (Burgos), CSP Iberian Zaragoza Terminal and Sibport.

He is also a member of the Board of Directors of Deposito Franco de Bilbao as well as a member of the Shipping Council Port of Bilbao.

He has held management positions in companies such as ‘Maritima Candina’, ‘Berge Maritima Bilbao’, and ’Agencia Perez y Cia’.

n Degree in Nautical Science

n Merchant Navy Officer

n Masters Degree in Maritime-Port Business Management - University of Deusto

n MBA - University of Basque Country

n Management positions in companies such as ‘Maritima Candina’, ‘Berge Maritima Bilbao’, and ’Agencia Perez y Cia’.

n 2018 to present - Port of Bilbao Authority currently holding the position of DirectorOperations, Commercial, Logistics and Strategy.

Session 1.1 - Panellist 31

KATRINA ROSS

KATRINA ROSS

Policy Director, Commercial and Governance, UK Chamber of Shipping

BIOGRAPHY

Katrina Ross is Policy Director, Commercial and Governance at the UK Chamber of Shipping. Her responsibilities include tax and economics, international trade, commercial shipping policy and, in particular, green and sustainable finance. She works closely with the UK Chamber’s Environment team on policy relating to GHG/carbon pricing and sustainability reporting.

Katrina started her career in financial services, before moving into policy for the shipping industry. Katrina is a member of the Institute of Chartered Shipbrokers (MICS), with a Masters in Commercial Law (LLM). Before returning to the UK Chamber in 2023, she worked for a UKbased financial services trade body as the policy lead on green finance and tax issues.

Session 1.1 - Panellist 32

NILS MINOR

Head of Key Account Management, P&O Ferrymasters

NILS MINOR

Head of Key Account Management, P&O Ferrymasters

BIOGRAPHY

Responsible for Key Account Management within P&O Ferrymasters, a Joint Venture between Unifeeder and P&O Ferrymasters.

In 2022, P&O Ferrymasters joined forces with sister company Unifeeder, which operates Europe’s largest feeder and shortsea network. The result is a multimodal transportation engine delivering cost efficiencies, broad geographic reach, and guaranteed access to capacity on key maritime routes.

P&O is a leading pan-European ferry and logistics group at the heart of Europe’s economy and a part of DP World, the leading provider of smart logistics solutions and enabler of the flow of trade across the globe. P&O Ferries is a major provider of freight transport and passenger travel services, sailing on eight major routes between Britain, France, Northern Ireland, the Republic of Ireland, Holland and Belgium. Its logistics business, P&O Ferrymasters, operates integrated road and rail links to countries across the continent including Italy, Poland, Germany, Spain and Romania, and facilitates the onward movement of goods to Europe from Asian countries via the Silk Road.

Session 1.1 - Panellist 33

Advancing supply chain resilience & embracing the benefits of modal shift

SESSION 2 35

Session 2 -

MARIJN MOESBERGEN

Cocoa Sourcing Lead, Cargill

BIOGRAPHY

Marijn Moesbergen is the Cocoa Sourcing Lead for Cargill’s Cocoa & Chocolate business based in Amsterdam, the Netherlands. He spent 15 years at Cargill in different commercial roles. Moving from a Commercial Management Trainee in Amsterdam to Freight Trader in Geneva, Switzerland, and back to the Netherlands to work for Cargills Grain Terminal in the Port of Amsterdam. In 2017 Marijn moved to the cocoa business and has worked for the past 6 years in the Trading & Risk Management team. Marijn is the Project Manager for the Kotug E-Pusher implementation into Cargills supply chain.

ALMAR VAN HERK

Senior Business Development Manager, KOTUG International BV

BIOGRAPHY

Almar has been fundamental in the development of the revolutionary E-Pusher Series. Having 15+ years of experience working at leading shipping company KOTUG, he jointly managed to develop a modular pusher tug capable of handling a variety of energy sources around an AC/DC switchboard. Main features of the E-Pusher Series are the usage of an Electric Vessel (EV) frame, a polyethylene (PE) floating body and the modular use of components resulting in a one-of-a-kind electric powered pusher tug. Having a background in innovation, business development and strategic positioning, Almar will present a narrative how this vessel came to life and is now sailing 100% zero emission for account of Cargill in the port of Amsterdam.

36

Keynote Presentation

Session 2 - Conference Paper

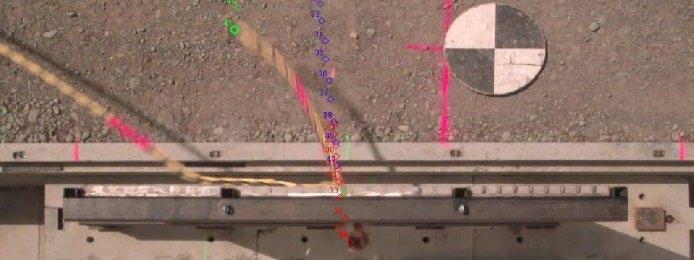

E-Pusher™ Series

COASTLINK_PAPER_08 April 2024

E-Pusher™ Series

Abstract:

Abstract:

The inland waterway industry faces significant challenges in transitioning towards sustainable energy sources while remaining competitive against vessels powered by fossil fuels. This paper explores these challenges through two main questions: "What will be the energy of the future?" and "How do we remain competitive against fossil fuel vessels?" A proposed solution is presented by the adoption of modular electric pusher tugs equipped with sw appable energy containers, offering versatility, efficiency, and environmental sustainability.

The inland waterway industry faces significant challenges in transitioning towards sustainable energy sources while remaining competitive against vessels powered by fossil fuels. This paper explores these challenges through two main questions: “What will be the energy of the future?” and “How do we remain competitive against fossil fuel vessels?” A proposed solution is presented by the adoption of modular electric pusher tugs equipped with swappable energy containers, offering versatility, efficiency, and environmental sustainability.

Introduction:

Introduction:

As the global focus shifts towards sustainable energy solutions, industries reliant on fossil fuels, including the inland waterway sector, face mounting pressure to adapt. The transition to renewable energy sources presents both opportunities and challenges. This paper addresses two primary questions: "What will power the vessels of tomorrow?" and "How can we compete against fossil fueled vessels?" A solution to these questions can be found in the adoption of the E-Pusher™ Series – a range of modular electric pusher tugs with swappable energy containers, offering adaptability, efficiency, and environmental responsibility.

As the global focus shifts towards sustainable energy solutions, industries reliant on fossil fuels, including the inland waterway sector, face mounting pressure to adapt. The transition to renewable energy sources presents both opportunities and challenges. This paper addresses two primary questions: “What will power the vessels of tomorrow?” and “How can we compete against fossil fueled vessels?” A solution to these questions can be found in the adoption of the E-Pusher™ Series – a range of modular electric pusher tugs with swappable energy containers, offering adaptability, efficiency, and environmental responsibility.

Energy of the Future:

Energy of the Future:

The first question touches upon the choice of energy sources that will power vessels in the future. While several alternatives, such as hydrogen fuel cells, batteries, and biofuels, have emerged, each comes with its own set of advantages and limitations. H ydrogen fuel cells offer zero-emission operation but face challenges related to infrastructure and cost. Batteries provide a clean energy solution but suffer from limited energy density and lengthy recharge times. Biofuels offer a potential bridge to renewable energy but raise concerns about land use and sustainability.

The first question touches upon the choice of energy sources that will power vessels in the future. While several alternatives, such as hydrogen fuel cells, batteries, and biofuels, have emerged, each comes with its own set of advantages and limitations. Hydrogen fuel cells offer zero-emission operation but face challenges related to infrastructure and cost. Batteries provide a clean energy solution but suffer from limited energy density and lengthy recharge times. Biofuels offer a potential bridge to renewable energy but raise concerns about land use and sustainability.

Managing the uncertainties surrounding the type of energy for long-term investments poses a significant risk for shippers in the maritime industry. As the landscape of sustainable energy solutions continues to evolve, shippers face the challenge of selecting the optimal energy for their vessels over the long term. The decision to invest in a particular energy infrastructure carries inherent uncertainties regarding future advancements, regulatory frameworks, and market adoption rates. Additionally, fluctuations in energy prices and availability of infrastructure could impact the cost-effectiveness and feasibility of long-term investments, further complicating decision-making processes.

Managing the uncertainties surrounding the type of energy for long-term investments poses a significant risk for shippers in the maritime industry. As the landscape of sustainable energy solutions continues to evolve, shippers face the challenge of selecting the optimal energy for their vessels over the long term. The decision to invest in a particular energy infrastructure carries inherent uncertainties regarding future advancements, regulatory frameworks, and market adoption rates. Additionally, fluctuations in energy prices and availability of infrastructure could impact the cost-effectiveness and feasibility of long-term investments, further complicating decision-making processes.

37

The E-Pusher™ design:

The E-Pusher™ design:

Session 2 - Conference Paper

To address these challenges, a range of modular electric pusher tugs equipped with swappable energy containers have been developed as a viable solution. This innovative approach combines the benefits of electric propulsion with the flexibility of modular design and energy container swapping. The pusher tug serves as the primary power unit, having a smart onboard switchboard which can handle both AC and DC power intake, and is equipped with electric motors to operate the vessel.

To address these challenges, a range of modular electric pusher tugs equipped with swappable energy containers have been developed as a viable solution. This innovative approach combines the benefits of electric propulsion with the flexibility of modular design and energy container swapping. The pusher tug serves as the primary power unit, having a smart onboard switchboard which can handle both AC and DC power intake, and is equipped with electric motors to operate the vessel.

Having the option to replace its energy units at any time, no long term commitment is required and switching to a new type of energy can be aligned with operational requirement, available infrastructure, demand and legislation.

Having the option to replace its energy units at any time, no long term commitment is required and switching to a new type of energy can be aligned with operational requirement, available infrastructure, demand and legislation.

Competitiveness

Competitiveness

An additional advantage offered by the E-Pusher™ Series lies in its substantial cost efficiencies, further mitigating risks for shippers considering long-term investments. Beyond its environmental benefits, the modular electric pusher tugs feature a streamlined construction process facilitated by a robust steel framework and Polyethylene (PE) hull design. This assembly line production approach translates to significant time and cost savings, with construction times reduced by over 50% compared to traditional methods. Moreover, the modular design allows for scalability and customization, enabling shippers to optimize vessel configurations based on specific operational requirements and budget constraints. By capitalizing on economies of scale and minimizing labor and material costs, the E-Pusher™ Series offers a compelling value proposition for shippers seeking to enhance their competitiveness while achieving sustainability goals in a competitive way against existing older generation fossil fueled vessels.

An additional advantage offered by the E-Pusher™ Series lies in its substantial cost efficiencies, further mitigating risks for shippers considering long-term investments. Beyond its environmental benefits, the modular electric pusher tugs feature a streamlined construction process facilitated by a robust steel framework and Polyethylene (PE) hull design. This assembly line production approach translates to significant time and cost savings, with construction times reduced by over 50% compared to traditional methods. Moreover, the modular design allows for scalability and customization, enabling shippers to optimize vessel configurations based on specific operational requirements and budget constraints. By capitalizing on economies of scale and minimizing la bor and material costs, the E-Pusher™ Series offers a compelling value proposition for shippers seeking to enhance their competitiveness while achieving sustainability goals in a competitive way against existing older generation fossil fueled vessels.

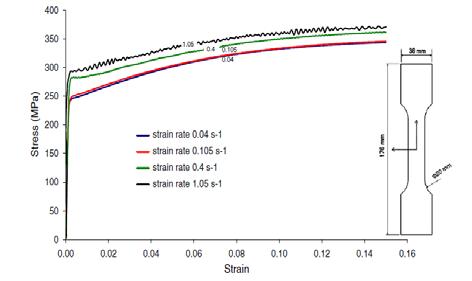

Specifications:

The E-Pusher Series comprises three models (S, M and L) ranging from 9 to 22 meters in length, with a maximum depth of 0.85 to 1.35 meters. It features variable electric propulsion up to 1,500kW able to push cargo barges of up to 6,000 dwt.

38

Session 2 - Conference Paper