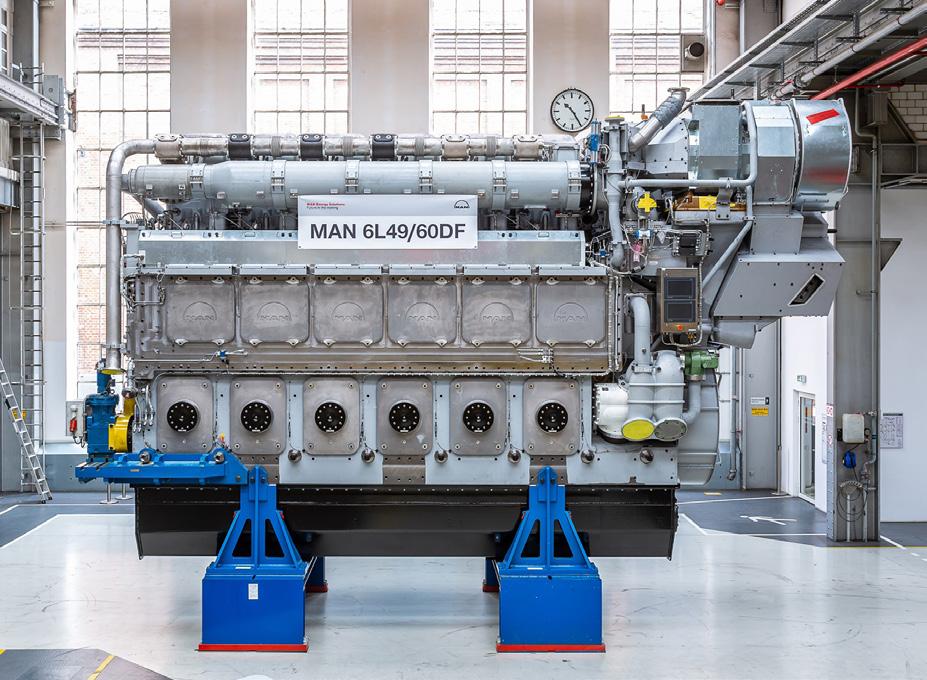

The new MAN 49/60DF

Best fuel costs and long-term compliance Today’s marine propulsion choices are significantly influenced by fuel costs and decarbonization requirements. These factors have driven the development of the MAN 49/60DF. It sets a benchmark in efficiency to keep fuel costs and CO2 emissions low. The built-in flexibility of a dual fuel engine, its low methane emissions and high efficiency ensure multiple paths for long-term emissions compliance. Based on this state-of-the-art engine platform, MAN Energy Solutions plans options ready for future fuels.

WinGD’s engine control system has been granted SP1 type approval by DNV, in line with IACS UR E27 technical system requirements.

The EU agreed to allocate 20 million ETS allowances (EUR1.5 billion) to maritime projects under the Innovation Fund.

Kongsberg Maritime’s new Direct Trunk Support (DTS) system aims to boost rudder performance, promising improved manoeuvring, propulsion performance and weight savings.

Chinese yards have regained primacy in the newbuilding market, and are eyeing expansion into higher-value niches, writes David Tinsley.

As Azipod systems celebrate a milestone, Marcus Högblom, Head of Passenger Segment, Global Marine Propulsion Sales, ABB Marine & Ports sees new opportunities ahead.

GTT’s three-tank LNG tanker design will make it possible to reduce the daily boil-off rate, Wendy Laursen hears.

MAN Energy Solutions’ latest dual-fuel four-stroke engine, the 49/60DF, is its most powerful dual-fuel four-stroke engine yet, exceeding even the larger 51/60DF, thanks to its electronics.

A high-level discussion at PFF 2022 assessed the implications of the upcoming introduction of onshore power system requirements across the EU’s Core TEN-T ports by 2030.

The 43rd Propulsion and Future Fuels Conference underlined the pace of advances in alternative fuel developments and fuel efficiency.

Japan’s Tsuneishi Shipbuilding has delivered the first of a new design of bulk carrier that offers a substantial uplift in cargo capacity within the Kamsarmax category, writes David Tinsley.

Although Maersk plans to shutter TradeLens in Q1 2023, new applications for blockchain technology are likely to emerge for the digital technology.

propulsionconference.com

The Motorship’s Propulsion & Future Fuels Conference will take place on 17-19 November 2020 in Hamburg, Germany. Stay in touch at propulsionconference.com

The Motorship’s Propulsion and Future Fuels Conference will take place this year in Hamburg, Germany. Stay in touch at propulsionconference.com

I was struck by two observations during the Onshore Power System (OPS) high-level panel discussion during this year’s 43rd Motorship Propulsion and Future Fuels conference.

The decision to accelerate the requirement to introduce OPS installations at the EU’s Core TEN-T ports is likely to require significant investments within the ports themselves, and upon the electricity network providers themselves within EU member states. The sums involved are hardly trivial: the European Commission itself believes that the final bill could exceed EUR7bn.

However, the larger challenge would appear to be that early adopting port authorities themselves are finding it difficult to develop a compelling business case to encourage vessel operators to make use of cold ironing.

One significant barrier to adoption is the higher cost of electricity than diesel fuel. This problem is likely to disappear or at least be muddied once the IMO introduces its market-based measures (or economic instruments).

But the larger issue that still perplexes me is how the ports themselves and the electricity companies will handle the continuing uncertainty about electricity demand from shipping going forward.

Just as we have discussed the difference between digitalisation development lead times and engine development cycles previously, we should be aware that electricity infrastructure investments make ship lead times appear extremely brief.

If the EU wishes to compel the majority of container vessels and passenger vessels to make use of OPS facilities with Core TEN-T ports by 2030, one wonders whether the ports have begun to liaise with the local grids around ensuring stable electricity supplies will be available by then.

I suspect that the confidence interval surrounding the size of the expected electricity draw that the ports of Gothenburg, Amsterdam or Marghera can expect to see in December 2030 is likely to be quite significant.

Of course, similar concerns can be made about the sizing of alternative fuel bunkering infrastructure. The size of the investment requirements to develop bunkering infrastructure for alternative fuel dwarfs the EU’s OPS investment requirements. ABS tentatively estimated that the cost could reach USD30bn per annum over the coming 20 years or so.

The only place where such large investments can be raised is likely to be the financial markets. However, bankers and financiers tend to favour clarity, and clear data, and are unlikely to invest significant sums into projects that have significant question marks attached to them.

While I appreciate that the above is likely to be a statement of the obvious for many readers, I should stress that the academic theories underlying associated with decarbonisation of the energy markets put regulations before markets and prices. This reflects the origins of environmental economic theory in the complex world of (stationary) energy markets and national regulation.

In a boost to UK shipbuilding prospects, the British-led Team Resolute consortium has been chosen by the Ministry of Defence as preferred bidder for three Royal Fleet Auxiliary(RFA) support vessels, writes David Tinsley. The award presages a return to ship construction by Harland & Wolff(H&W) at Belfast, after a gap of two decades, albeit drawing on overseas technological know-how.

The series of 216m newbuilds, with the power to operate at speeds up to 19 knots, will have a primary role as replenishment vessels, supplying stores, munitions, spares and equipment to warships at sea.

Team Resolute, comprised of H&W, ship designer BMT, and the new UK arm of Spain’s largest shipbuilder Navantia, has won the bidding round in the face of competition from three other groups. A production contract, valued at £1.6bn($1.9bn)(before inflation), is set to be authorised by the spring of 2023. However, under what has proved to be a long drawn-out competition, building of the first ship will not start before 2025 and the final vessel in the programme is not expected to be operational until 2032.

The majority of the blocks and modules for the ships will be constructed at H&W’s yards in Belfast and Appledore, with components also being sourced from the group’s fabrication sites in Scotland at Methil and Arnish. There will also be significant input from Spain, whereby Navantia’s Puerto Real yard at Cadiz will undertake some of the building work, while the organisation will also provide

technology transfer and skills know-how to Belfast. Final assembly for all three vessels will take place at Belfast.

The formal contract award to Team Resolute will also trigger a £77m($92m) investment in shipyard infrastructure, creating jobs and strengthening the capability to attract future export and domestic shipbuilding and offshore orders to the Northern Ireland yard. Although H&W, under previous ownership, delivered its last commercial vessel in 2003, the yard has maintained a presence in heavy engineering, steel and offshore fabrication, renewables, shiprepair and refurbishment, and business development has accelerated since the 2019 takeover by InfraStrata, now trading as Harland &Wolff Holdings.

The newbuilds, designated fleet solid support ships(FSS), will have cargo space for 9,000m2 of supplies and stores. They will have a beam of 34.5m and will be the longest vessels deployed by the civilian-crewed RFA, and will have some commonality with the 201m Tide-class fleet tankers.

Four of the latter were constructed by Daewoo Shipbuilding & Marine Engineering to BMT’s Aegir design and commissioned between 2017 and 2019.

The RFA series constitutes one of the key projects listed under the 30-year “pipeline” of work for naval and other governmentowned vessels contained in the revised National Shipbuilding Strategy, published in March 2022.

Windcat has ordered a series of hydrogen-powered commissioning service operation vessels (CSOVs) from Damen Shipyards.

The Elevation Series CSOVs have been designed by Damen Shipyards in cooperation with Windcat and CMB.TECH. The vessels are 87 metres long, 20 metres wide, can accommodate 120 people on board and will be powered by hydrogen. Initially, two vessels have been ordered with options for further vessels. The series will be delivered from 2025.

The CSOVs will be built at Ha Long Shipyard, Vietnam, and will be delivered to Windcat Offshore, a new business unit within Windcat, which will focus on offshore energy commissioning

and services.

A CSOV is a vessel that remains in an offshore wind farm for an extended period of up to 30 days, providing maintenance materials and housing technicians in hotel-style accommodation.

To significantly reduce the vessels’ CO2 footprint, Windcat and CMB.TECH, will provide the same dual fuel hydrogen technology for the Elevation Series as on board the Hydrocat, the world’s first hydrogen powered crew transfer vessel.

Kongsberg Maritime has launched a new Direct Trunk Support (DTS) system which aims to boost rudder performance.

The new system transfers the manoeuvring forces from the rudder through the headbox and the steering gear deck directly into the hull structure, promising improved manoeuvring, propulsion performance and weight savings.

“Today, replacement and modernisation of propulsion and manoeuvring systems are key drivers for newbuilds and aftermarket sales,” said Andreas Malmkvist, SVP Propeller & Shaftline Systems, Kongsberg.

WinGD has become the first marine engine designer to gain cybersecurity type approval for its engine control system. DNV has granted WinGD Control Electronics (WiCE) an SP1 type approval, aligning with IACS UR E27 technical system requirements. The approval demonstrates that WiCE meets the IEC62443 standard including software authenticity verification, and backup functionality.

“For Kongsberg, DTS is a significant opportunity to cover a larger market and provide

The EU’s on-going negotiations on the EU ETS for maritime has resulted in an agreement that at least 20 million ETS allowances “(EUR1.5 billion at current prices) will be allocated to maritime projects under the Innovation Fund. The provisional deal is subject to an overall agreement on the ETS revision. The agreement includes all GHGs and outlines steps towards a life cycle perspective, which will include GHG emissions from marine fuel production.

customers with a long-term solution to help them meet their goals.”

The DTS rudder has no upper size limit and works for vessels of any size, from container ships to fishing vessels, and in any segment, from naval ships to superyachts.

It eliminates the radial forces and bending moment transferred from the rudder blade to the steering gear. This is accomplished with an extended pipe integrated into the rudder trunk. This means that the rudder stock (torque shaft) in the DTS system only transfers torque and axial loads.

Some of the most important

ClassNK has issued an AiP for a dual-fuel hydrogen/diesel genset. The technology was designed for a 160,000m3 LH2 carrier developed by KHI. It will be able to use boiloff gas from the ship’s LH2 cargo tanks as the main fuel. ClassNK has already issued AiPs for the vessel’s integrated design, containment and cargo handling systems, and DF main boilers.

benefits of the new DTS system come in the design phase of a ship. The improved load distribution gives ship designer more flexibility in the aft ship design, which enables a lower positioned steering gear deck. This gives greater storage capacity to any vessel.

The DTS system also gives ship owners the option to choose smaller steering gear, since the DTS system only transfers torque load.

The improvement in load distribution allows more freedom in the design of the rudder blade. Higher aspect ratios and slimmer, full-spade rudder designs are possible, which improves the overall performance of the vessel.

ABS launches SaaS unit ABS has launched ABS Wavesight, a new maritime software as a service (SaaS) company.

Wavesight integrates My Digital Fleet, an AI-driven analytics and performance visualization platform, with Nautical Systems, the fleet management system. The platform aims to offer greater visibility into fleet assets.

8

Added-value

In 2021, China regained its position as the world’s biggest shipbuilder, overtaking South Korea for the first time since 2017. Results from the first nine months of 2022 not only keep China on course to retain the top slot but put it to the fore in a number of sectors. For example, Chinese yards booked more than half the contracts awarded for containerships in excess of 10,000TEU capacity, and logged the preponderance of new work involving deep-sea vehicle carriers, a sector that has seen heavy investment this year.

Moreover, the advance to higher value-added tonnage has been underscored this year by China State Shipbuilding Corporation (CSSC) having secured orders for the largest number of LNG carrier newbuilds placed so far this year with any single organisation worldwide. CSSC has assigned most construction to the group’s Hudong-Zhonghua Shipbuilding.

Brokers are forecasting a downturn for 2023 in demand in major areas of the international market that are significant for Chinese yards, specifically bulkers, containerships, large tankers and also LNG carriers. Should such a decline materialise, and notwithstanding the fundamental importance of export work to the industry in China, the country’s own, ever-expanding trade and energy requirements provide a solid domestic platform for Chinese shipbuilding capacity utilisation. The national mercantile marine is growing on all fronts, and its development will be met wholly by recourse to home yards.

Furthermore, and going hand-in-hand with the country’s rise as a superpower, the shipbuilding industry has fundamental strategic as well as economic importance, as the cradle for the huge build-up of the Chinese Navy.

A national champion is born Consolidation is a theme pervading shipbuilding worldwide, and the grand-scale amalgamation effected by China’s two state-controlled groups appears to have given the industry new strength. Greeted with trepidation by South Korea and Japan, and with a surprising lack of response from Europe, a Chinese behemoth was created in 2019 through the remerger after 20 years of China State Shipbuilding Corporatio n(CSSC) and China Shipbuilding Industry Co(CSIC). Over half the nation’s shipbuilding industry was vested in the two government-owned conglomerates, and the successor organisation continues under the CSSC banner.

The Chinese initiative had ostensibly been spurred by the prospect of the creation of a potent new South Korean force through Hyundai Heavy Industries Holdings’ planned acquisition of DSME – a move which, however, was subsequently thwarted on anti-competition grounds by the European Commission.

container liners, each of 24,000TEU capacity. Worth nearly $2.9bn in monetary terms, the project has added technological and commercial significance in its specification of methanol dual-fuel propulsion. COSCO companies already had 34 boxship newbuilds booked with domestic yards, and the latest project extends the workloads at Dalian Cosco KHI Ship Engineering (DACKS) and Nantong Cosco KHI Engineering (NACKS) by five and seven ultra-large vessels, respectively.

LNG carrier investment has been a major feature of the newbuild market this year and China’s shipbuilding industry has made considerable inroads into the sector. Although South Korea’s three largest groups collectively still lead the field, Hudong-Zhonghua has the single largest concentration of LNGC orders worldwide. Moreover, such has been the broader Chinese success in penetrating the market that the contract inflow is more distributed than before, whereby five Chinese builders are engaged in LNGC construction rather than three hitherto.

HZD builds LNG carrier momentum

Hudong-Zhonghua, which has the longest track record in the field, having completed the first Chinese-built LNG tanker in 2008, has landed three ordering tranches this year arising from Qatar’s planned boost to LNG production and exports through its North Field development scheme. An initial contract signed during April with Mitsui OSK Lines (MOL) embracing four 174,000m3 newbuilds, to be run under longterm charter to QatarEnergy, was followed in November by a second MOL deal spanning three vessels, for delivery in 2027.

At the same time, Hudong-Zhonghua won an order from an international consortium calling for five 174,000m3 carriers committed to QatarEnergy. The contractual interests involved, namely NYK Line, K Line, MISC Berhad, and China LNG Shipping, had earlier awarded seven LNGCs of the same size to Hyundai Heavy Industries, also on the strength of longterm charters to Qatar’s state energy company.

Hudong-Zhonghua has also augmented its orderbook with three LNGCs booked by MOL for long-term engagement with the privately-owned Chinese energy group ENN. Incorporating membrane-type cargo containment of around 174,000m3, the ships have been fixed through a Singapore subsidiary of ENN and will primarily transport LNG to China on commissioning during 2027 and 2028.

To the chagrin of Japanese builders, the shift by Japanese shipping groups and trading houses to source tonnage in China has gathered pace. MOL fleet development projects initiated in 2022 and entailing Chinese construction have included four Capesize bulkers and two VLCCs. LNG dual-fuel power has been nominated for each of the six ships in the programme. Production of the 210,000dwt Capesize units has been assigned to CSSC Qingdao Beihai Shipbuilding, while the 309,000dwt crude carriers will come from DACKS.

China has come to dominate the global ro-ro and ro-pax ferry construction market, in the process almost annihilating a former major source of business for European yards. Although some industry sources suggest that the uplift in newbuild costs coupled with rapidly increasing Chinese wage bills could soon see challenges to that current pre-eminence, recent contractual successes on the export front demonstrate continuing competitiveness in the sector.

In fact, on the broader ro-ro front, encompassing dedicated, deep-sea vehicle carriers, the Grimaldi Group’s October placement of an order with CMHI Jiangsu for five newbuild PCTCs of 9,000CEU capacity, plus five options, emphasises the strengths-in-depth of China’s industry. The vessels’ technological standard is implicit from a specification that

features an ammonia-ready class notation, lithium battery pack, under-hull air lubrication system, and cargo area design geared to the transport of electric vehicles.

While Chinese owners have generated only a trickle of projects in the ro-pax sector, one recent exception being the 167m newbuild arising from Chinjif’s fleet modernisation strategy, the shipbuilders’ penetration of the export market to date has been such as to attract virtually all the leading players in Europe.

The production momentum built-up in the large ro-pax ferry segment, which calls for particular capabilities in the outfitting trades, supplier network and project management, impacts on Chinese shipbuilders’ ambitions as to the international cruise vessel market. While a robust bridgehead has already been laid down through the collaboration with Fincantieri and Carnival that has yielded a programme for two high-capacity cruiseship newbuilds at Shanghai Waigaoqiao, the advance of the cruising sector in China itself has faltered through the country’s draconian measures to tackle the upsurge in Covid-19 cases.

The first of the vessels that signal China’s entry into the field of large, luxury passengership construction was launched last December. Tailored to the Chinese market, she is due to be handed over in September 2023 to CSSC Carnival Cruise Shipping. The second vessel will not be a duplication of the lead ship, but will be 17m longer at 341m, and larger in internal volume by some 6,000gt at 142,000gt, with 19 more passenger cabins for a total of 2,144. The original deal carried options for up to four further vessels.

Among the few projects of entirely domestic origination that have been taken forward to the contractual stage is that implemented by China Merchants Group, involving two 37,000gt newbuilds at CMHI (Jiangsu), specifically developed for Chinese passengers and destined to inaugurate the Shanghai Style Cruise brand.

Cruise vessels represent the next frontier Any sustained weakness in global ordering of cruise ships could have greater long-term repercussions for European yards than for China’s shipbuilding industry, given the latter’s highly diversified output, absence of high dependence on particular spheres of construction, and strong direct and indirect government backing. Although the European bastions have orders stretching as far ahead as 2028, and have succeeded in winning the very limited number of cruise vessel contracts placed since the start of the pandemic, those yards will have to confront a difficult and possibly protracted period of soaring costs in finance, materials, energy and labour, against the backcloth of reduced tonnage demand.

Whether or not a freeing-up of European capacity, and any moderation in the wage cost differential between China and Europe, will lead to a re-entry by European cruiseship building specialists into the ferry market remains to be seen. In the meantime, Finnish, Polish, Turkish and Italian yards that are not involved in cruise vessel production have scored contractual successes this year in the ro-pax domain, indicating a degree of revived competitiveness (assuming that the orders prove profitable) in a field that has increasingly become the province of Chinese shipbuilding.

But China’s ever-growing and wide-ranging capabilities, increasing technological self-reliance, overt and covert government backing, and collective industrial endeavour makes for a formidable long-term rival in any sphere of construction. A preoccupation with the environmental standard of the product offering, reflected in current deliveries and boosted R&D resourcing, bodes well for the future.

GTT has received Approvals in Principle (AiP) for its three-tank LNG tanker design from DNV and Bureau Veritas (BV).

The design reduces construction costs by negating the need for one cofferdam, one pump tower and all associated cryogenic equipment (liquid and gas domes, valves, piping, radars, etc.). The overall surface area of the containment system will be reduced by about 2,000 m², generating lower costs for the materials and vessel construction. This could also offer time-savings for shipyards.

The three-tank LNG carrier has been designed with a similar operational flexibility as the conventional four-tank LNG carrier. For instance, several solutions to discharge the cargo with the same flow rate as for the four-tank design are envisaged.

The improved ratio between the volume of LNG transported and the surface area of the cryogenic liner will make it possible to reduce the daily boil-off rate. As an example, GTT estimates that it will achieve a boil-off rate as low as 0.080% of tank volume per day with the Mark III Flex technology, compared to 0.085% of the volume per day with the LNG carriers currently in operation.

The removal of a cofferdam will lighten the hull weight, and if specific reinforcement is deemed necessary during the final design, it will not significantly increase that weight. Ship length and overall cargo capacity might be further adjusted, and the design also allows for greater choice in ballast tank location.

As GTT’s membrane systems are fully modular, they can be used unchanged for any tank dimension with local reinforcement, if required, to withstand sloshing loads. Sloshing studies undertaken by GTT at its model test facility have shown the pre-feasibility of the lengthened tank design. GTT has researched any potential challenges that could be encountered for tank length increases of up to 55%.

As the tanks are modular, there is no limitation intrinsic to GTT containment systems: the three-tank LNG carrier has been initiated for a capacity of 174,000m³ which remains the current standard. Other capacities could be developed so long as the proposed ship design meets rule requirements and the operational flexibility required by terminals. GTT is already working on other innovative concepts to address a wider range of cargo capacities.

DNV and BV have issued an approval in principle for this innovative three-tank LNG carrier design for the Mark III and NO96 technologies developed by GTT.

Tom Klungseth Østvold, Principal Engineer for DNV Maritime, said: “Three different vessel arrangements were considered in the AiP process, for which we examined the intact and damage stability requirements, as well as the ability of the membrane type containment system to sustain the increased sloshing loads associated with the increased cargo tank dimensions for each. In addition, we undertook a high-level evaluation of hull strength based on the general arrangement and midship section drawings.”

The GTT three-tank LNGC concept implies a significant increase in cargo tank length and a change in the watertight compartmentation of the hull, he said. The general vessel safety arrangement, cargo handling systems, safety systems etc. are essentially unchanged by the design

modification but would need to be adapted depending on the individual ship design.

“One of the key questions was the way the increased length of the tank shifts the sloshing resonance periods for the tanks upwards. This can increase exposure to resonant period ship motions and the sloshing impact load level in the tanks, but was addressed by GTT through detailed sloshing studies and strength evaluations of the containment systems. These studies identified an increase in sloshing impact loads compared to existing four cargo tank LNGC designs. However, GTT was able to demonstrate that this can be mitigated by the installation of the appropriate containment system reinforcement level available in the GTT product portfolio.”

Philippe Berterottière, Chairman and CEO of GTT, said: "For almost 60 years, the GTT Group has been constantly improving its technologies to offer its customers solutions that meet their requirements as well as those of the regulatory authorities. Thirty years ago, we upgraded LNG carriers from five to four tanks, and we now hope to bring the market forward with a three-tank LNG carrier. We hope to see this concept become standard in future years."

The new LNG carrier design has generated a lot of interest from shipyards, shipowners and charterers, and is particularly noteworthy, says GTT, because it reduces CAPEX while also improving performance.

8 GTT is planning to develop a RECYCOOL concept for LNG carriers in 2023

8 The three-tank LNG carrier design is expected to reduce the daily boil-off rate by improving the ratio between the volume of LNG transported and the surface area of the cryogenic liner.

Sustainable & Smart Mobility Strategy - Ricardo Batista, Policy Officer, Directorate-General for Mobility and Transport European Commission. Development cycles towards ammonia-fuelled two-stroke engines - Dr Andreas Schmid, General Manager Technology Development, WinGD. Will “multi-fuel” propulsion engines be the solution to solve the “future fuel” uncertainty? - Rolf Stiefel, Regional Chief Executive, Bureau Veritas Marine & Offshore Economic and Ecological Considerations for Wind-Assisted Ship Propulsion Systems - Karsten Hochkirch, Head of Ship Performance Center, DNV

MAN Energy Solutions’ latest dual-fuel four-stroke engine, the 49/60DF, is its most powerful dual-fuel four-stroke engine yet, exceeding even the larger 51/60DF, thanks to its electronics. In fact, under certain conditions, it is the most efficient four-stroke dual-fuel engine on the market, MAN ES’ Sales Manager, Marine Four-Stroke, Thomas Huchatz, told The Motorship.

8 MAN Energy Solutions’ latest dual-fuel fourstroke engine, the 49/60DF, is its most powerful dual-fuel fourstroke engine yet

It is rated at 1,300kW/cyl at 600rpm – making it the most powerful engine in MAN ES’ four-stroke family – and, without its attached pumps, consumes 6,990kJ/kWh in gas mode, giving it an efficiency of 51.5%.

When the engine was formally launched during the SMM exhibition in September, MAN ES listed a number of its technical features, including the OEM’s second-generation Adaptive Combustion Control, ACC 2.0, and the latest version of its SaCoS 5000 (Safety and Control System generation 5) automation system.

These are vital not only to its initial performance but also to its future development, said Stefan Terbeck, principal technical project manager of the 49/60 engine family, in particular naming the ACC 2.0 as ‘key’ to introducing new fuels to the engine. It can operate on LNG and diesel fuel, along with “a number of more sustainable fuels including biofuel blends and synthetic natural gas,” the SMM statement said.

But it also quoted Marita Krems, Head of Four-Stroke Marine and License at MAN ES, noting that engine is making its debut “at a time where … fuels like methanol, ammonia and hydrogen are continuing their rise,” although she

acknowledged that “none [of these fuels] has established market dominance as of yet.”

Nonetheless, Terbeck indicated to The Motorship that methanol was likely to be added to the engine’s fuel options in the future while Huchatz predicted that this will be followed by ammonia and hydrogen, depending on market demands.

MAN ES has previously announced that its stationary gasfuelled engines are hydrogen-ready, capable of operating with up to 25% hydrogen in their gas fuel mix and in an announcement last November, it referenced its ACC – which was introduced about five years ago – as being instrumental for that, saying that the control system “reacts fully automatically to varying hydrogen contents in the natural gas.”

At its heart are firing pressure sensors in each engine cylinder that allow automatic cylinder pressure analysis (CPA) to be performed in real time. Now, the 49/60DF is the first engine type to be fitted with ACC 2.0 which is able to analyse combustion in each cylinder for every cycle, which is made possible by the greater calculating power of ACC 2.0 compared with the original version fitted to the 51/60DF. Terbeck had also been project manager for that engine,

which now has about 8M running hours under its belt and said that “we have seen what can be improved and put that into ACC 2.0.”

One change he mentioned is that the 49/60DF has more sensors, including for NOx, allowing closed-loop control for NOx emissions. This makes it possible to operate the engine closer to limit values rather than allowing an operating margin.

With the data gained by the CPA, Terbeck mentioned that the ACC 2.0 can control numerous combustion parameters, which reflect changing fuel properties, ambient conditions, air fuel ratio and component aging.

For example, if an engine that normally uses MGO or MDO is switched to a blend containing, say, 40% biofuel, the lower heat value will change and combustion can be delayed and the ACC 2.0 takes this into account, he explained.

The CPA will also instantly adjust for factors related to pilot fuel injection to correct the combustion parameters for best efficiency or for best dynamics so, “by having fully electronic access to our actuators, gas valves, pilot fuel valves, waste gate and gas pressure governor, we can adjust the combustion automatically to the fuel used,” he said.

This will be especially relevant for methanol, Huchatz added, because it has a lower energy density from diesel fuel. That also presents some physical challenges, since greater volumes will have to be injected into the combustion chamber.

Readers may recall a first application of SaCoS 5000 on the MAN 45/60CR engine in 2017 but it has been further refined since then. This latest version was first applied to MAN 32/44CR engines and is being introduced on the 35/44DF and other MAN four-stroke machines.

This latest version now finds its place as a vital component in the package of technologies that, together, make the 49/60DF an efficient multi-fuel power platform.

Working alongside the ACC 2.0, SaCoS 5000 helps make the new machine a ‘software engine’, Huchatz said, since it provides an improved interface between the engine and the outside world that can be used to transfer more data than before and in a higher resolution for remote analysis and support, he said.

This goes beyond the now-common practice of collecting data from onboard machinery and transferring it ashore. “This new system is technically capable having data going the other way, so that we can push data onto the engine,” he said. That opportunity could be used, for example, to ensure that the engine always has the latest combustion parameters necessary for its efficient operation. At present, these updates might only be possible when a technician visits and uploads new data directly from a laptop, for example.

“We have to convince owners that there are benefits from

this,” he said, but that is not the only constraint holding back its implementation: over-the-air updating such as this is not yet possible from a regulatory point of view so “we are talking with class societies about how this can be done,” Huchatz said.

This difficulty has arisen because hitherto an engine and its control system is class-approved as a combination of hardware, software and data. If some of that data is subsequently changed, it might have implications for emissions, for example, requiring the class society to reevaluate the set-up, Huchatz explained.

This has implications from a regulatory standpoint, Terbeck added. An engine is allocated an emission identifier related to its NOx-affecting components that, in the past, was based only on its hardware, which would not change. But once software becomes part of the system, any change – for example to the NOx-mapping – requires that this identifier should reflect that change.

Another consideration for any system that relies on data transfer is cyber security and in April this year, the International Association of Classification Societies (IACS) adopted two Unified Requirements related to cyber resilience on ships. These will be applied as mandatory to new ships contracted for construction from 1 January 2024 and the major classes have already defined different levels of cyber security beyond the requirements soon becoming mandatory, Huchatz said.

With increasing use of digital and remote software services, the risk of cyber-attacks increases, he pointed out, and protecting passwords and physical access to systems can only offer basic protection. “If you want to go to beyond Level One, you need features that only SaCoS 5000 can offer, he said.

Terbeck drew a comparison with conventional virus protection software on personal computers, which requires regular updating, but is still at risk of being bypassed.

Such traditional measures are well known in relation to IT security, where the main priority is to protect data, whereas for technical systems the focus is on their safe and secure operation, for which reactive measures such as subscriptionbased virus protection is not sufficient.

For operational technology (OT) security, when the main focus is to ensure the safety and availability of the engines and the ship, SaCoS 5000 was conceived with ‘cyber security by design’ and “’defence in depth’ in mind. “It features a builtin and fit-for-purpose layered design across separate zones using advanced network topologies comprising segregation and segmentation,” Huchatz explained.. These are fundamental features that ensure cyber security resilience and improve uptime and performance, he added.

Coinciding with MAN ES’ public launch of its new engine was an announcement that it had made a cooperation agreement with ABB to develop a next-generation, DualFuel, Electric+ (DFE+) propulsion concept for LNG carriers that will feature the 49/60DF engine and ABB’s Dynamic AC (DAC) technology.

Its aim is to offer variable-speed genset operation over the entire engine load along

with better efficiency with a significant reduction of methane slip over the entire engine map. This will help shipowners cut their carbon footprints and their fuel bills, the project partners said at the time.

Asked why the new engine is especially suitable for this project, Huchatz stressed its efficiency, but he also noted that the SaCoS 5000 control system makes the engine particularly suitable for variable-speed

operations while the ACC 2.0 optimises the engine at reduced speeds. This translates to providing effective variable speed and better efficiency to the propulsion system.

So “the electronics are key to achieving these efficiency levels,” he said. But in turn, they also contribute to a 40% reduction in methane emissions, “so developing with this new system also tackles the topic of methane emissions in four stroke dual-fuel

The like-for-like replacement of a polluting asset such as a ship, building or car might be attractive initially, but little thought is given to the carbon cost of sourcing materials for, and constructing, that replacement – the ‘embodied’ CO2. For the economics to stack up, an asset should provide enough of an operational emissions reduction to pay back its embodied CO2 costs.

In an example of this, in 2019, a new ‘Green NCAP’ rating system was launched for cars. A notable feature of the new scheme was that it incorporated the lifecycle emissions – the carbon cost of acquiring parts and making the car, as well as operating it – into the equation. An operational lifetime of 16 years and 240,000km was assumed, and as these parameters were applied, it came as a surprise to many that some petrol cars performed better, on a lifecycle basis, than electric counterparts.

One of the major concerns with the IMO’s EEXI and CII criteria for existing vessels, is that it will cause many ships to be scrapped, removing capacity which must be replaced with new tonnage.

Though welcomed as necessary by the maritime sector as a whole, shipping lines like Maersk and MSC have expressed misgivings, pointing to the disproportionate age of smaller vessels, which are necessary for efficient feeder trades.

The majors’ biggest complaint, however, is that the CII calculation in its current iteration takes into account only cargo capacity, expressed in deadweight tonnes (DWT), rather than actual cargo carried – a separate calculation known as energy efficiency operational indicator (EEOI). “It would be far better to have an operational indicator that would reward more productive ships, including based on cargo carried rather than on a theoretical value that may not correlate to transport work performed,” said MSC in a statement in October.

Speaking with The Motorship, Laxman Kumar, technical director at scrap buyer GMS, expressed concern that the EEXI and CII might lead to perverse outcomes. “Vessels will naturally be phased out of the fleet as part of a responsible ship recycling strategy, something that GMS supports,” he said. “However, serious thought needs to be given as to the rate at which older vessels are phased out of the fleet and its true benefit to emission savings, to prevent EEXI and CII leading to net-negative outcomes.

“If shipping looks beyond its 2.4% contribution to global CO2 emissions and looks more widely at the carbon contributions of a vessel along its entire value chain, disposing of older vessels, no matter how well-intentioned, may not always be the best approach.”

Globally, steelmaking is responsible for some 8% of global carbon emissions, more than double what is generated by global ship operations. According to the World Steel Association, each (long) ton of steel produced, on average, 1.85 tons of CO2. It would be possible to reduce this using

electric arc furnaces (EAFs), which can use scrap steel as a feedstock.

Unfortunately, there is neither enough scrap, nor sufficient EAFs, to go around. In Turkey, where some vessels now go to be recycled, some 84.1% of new steel is made from scrap, according to the Bureau of International Recycling. But in China, where the vast majority of ships are built, it is a different story. Only around 21% of new Chinese steel is made from scrap, and the rest, from iron ore in coal-fired blast furnaces. Further, Chinese shipyards generate their own emissions, as well. According to a recent Lloyd’s List report, a large Chinese shipyard might consume 20,000MWh, provided by a power grid in which coal plays a large part.

Replacing an older vessel with a new like-for-like one, then, with the latest efficiency upgrades including wing sails, optimised hull geometry and ducts, might yield a 30% operational CO2 emissions reduction; but it could take dozens of voyages before the CO2 cost of building a new vessel creates a return on investment.

“A newbuild bulk carrier, with a 150,000dwt capacity and a hull and machinery weight (lightweight, or LWT) of 20,000 tonnes, would require 15,400 tonnes of coal to be burned to generate enough steel for the vessel,” said Kumar. “This means that before any welding is done, the CO2 footprint of the vessel’s construction is at least 37,000 tonnes.”

Compare the U.S. Jones Act market, where instead of being built anew, sometimes ancient ships are repeatedly

8 Should demolition decisions take into account the potential embodied CO2 savings from extending the operational life of older assets?

It is only recently that the notion of ‘embodied’ CO2 emissions has come under consideration in the popular consciousness

modified to spare their owners the vast expense of building a new ship. Unfortunately, this has ended in tragedy on occasion; S.S. El Faro, originally a break-bulk vessel, was retrofitted to carry containers above the main deck and cars below, with vents for car exhaust, in one hare-brained decision, dangerously close to the waterline.

But there are other places where simply scrapping and rebuilding is not always considered the only option. At this year’s NorShipping, in Oslo, car carrier SC Connector made it into the running for the ‘Next Generation Ship Award,’ despite originally being constructed in 1997. Though it later lost out to coastal cruiseferry Havila Capella, the car carrier had been fitted with Norsepower rotor sails and a large battery pack, enough to reduce its fuel consumption by 25%.

“We pay our workers properly in Norway, and that’s why we get such good results,” Kleven sales manager retrofit, Karl Johann Barstad told The Motorship. But Mr. Barstad’s national pride aside, part of the reason why newbuilding, and not retrofit, has been regarded as a first resort for replacing tonnage is indeed cost. Labour in Chinese yards has been so cheap that there has not been sufficient spread between the cost of far eastern newbuild construction, and retrofits at yards in the West. But the economics might not stack up so handily, if embodied carbon costs were also considered.

If it’s broke, fix it

Though they have a natural advantage in low-carbon shipbuilding thanks to their abundance of renewable hydropower, Norwegian shipyards and equipment manufacturers are currently devising ways of decarbonising the process further.

Ships built in Norway tend to be specialist, and very highlyequipped. A surfeit of componentry, and the need to replace and repair it, has prompted Kongsberg to embark on a project with additive manufacturers Guaranteed, Voestalpine, Addilan and Intertek, with the aim of making additive manufacturing (AM) work well enough to create components as good as their traditionally die-forged and machined counterparts.

The aim is to be able to deliver spare parts faster and cheaper, with the added benefit of using less metal, usually steel. Wire arc additive manufacturing (WAAM), as it is known, was shown in testing to produce a component – in this case, a crank disc for a controllable pitch propeller (CPP) – equally as durable as a forged steel part.

Analysed under the microscope, the bonds between molecules in the steel were found to be nearly identical to that of a forged equivalent, Kongsberg explained. While the part did eventually require some machining and polishing to tidy up the surfaces, entailing some small amount of wasted metal, the process led to orders of magnitude less waste material than so-called ‘subtractive’ manufacturing would allow.

“We very often have to buy new parts for our customers, and we wanted to see if we could 3D-print these,” said Kongsberg’s Mette Lokna Nedreberg, manager of Material Technology. “[Forging] uses a lot of energy and has very long lead times. But if the vessel is waiting for a component, they need it immediately.”

Kongsberg also said that the process could be used to repair a cracked or otherwise damaged part, leading to even less material waste, work time, and associated carbon emissions. This would allow for existing systems to stay in use instead of being replaced, as manufacturers often will no longer carry an inventory of spare parts for deprecated machinery.

More high-tech was evident at Green Yard Kleven, which has weathered Norway’s shipbuilding drought by branching out from a shipbuilding yard to encompass shiprepair and scrapping, as well. Here, the yard is using a laser welding system to join steel plates together.

While the system can only be used to make flat surfaces at present, making it more suitable for superstructures and bulkheads than hulls, the extraordinary precision of laser welding makes it possible to create steel sheets of 5mm thickness. This would not be possible for a human welder, for whom double this thickness would be the minimum to yield a satisfactory weld. The result is a thinner sheet which cuts down on steel use, while maintaining the structural durability of its thicker counterpart.

For Green Yard Kleven, though, lasers powered by renewable energy is not even the half of it. The yard appears to be trying to change the ethos of shipbuilding entirely, to place a much greater emphasis on recycling – albeit, not in the traditional sense.

Instead of merely turning existing ships into piles of scrap steel and nautical-themed furniture, Kleven is reconditioning intact hulls and machinery, and turning them into new vessels, in a process it refers to as ‘recirculation’. In one example, the yard turned a PSV hull into an exploration yacht, the B370 Ulysses.

However outwardly environmentally-conscious Norway may be, its shipowners do not seem to be immune to wasteful attitudes, Karl Johan Barstad admitted. On hearing the first proposal to repurpose functional equipment from a scrapped ship on board a newly converted vessel, he quoted one owner as saying: “I don’t want garbage on my ship,” preferring new equipment. However, he said, when Kleven was able to demonstrate it could recondition used equipment to an asnew standard, the owner was eventually convinced to go along with it.

Currently residing at Kleven’s yard are deck cranes, generators, thrusters and even a seismic array, which are being brought up to a modern standard in order to equip a new vessel. While this will involve replacing wear parts, hinges and so on, it also includes consulting with the OEMs to update the equipment’s firmware and software, as well. After all, over the course of 15 years, crane technology has not changed so very much.

Overdue in the eyes of many, the introduction of CII levies a scrutiny on the way existing vessels are operated, rather than just creating a standard to which new ones should be built. From the point of view of reducing shipping’s overall contribution to global carbon emissions, it represents considerable progress. But now that responsibility is being shared across the entire global fleet, revisiting the lifecycle of vessels, and including their construction and scrapping in the mix, is an obvious next step.

Years ago, says Juuso Reunamo, Design Engineer at ship designer Deltamarin, when dual-fuel LNG engines were introduced to market, they often came as new models, with, for example, new bore sizes. Today, however, the engines being developed can efficiently burn multiple fuels with minor changes. “This opens up a wide range of retrofit choices based on modular design principles,” he says.

This will be a bonus for owners of existing tonnage given that there is no “silver bullet” future fuel. Additionally, almost all new projects undertaken by Deltamarin involve energy saving options. “When considering cold ironing, batteries, solar panels and fuel cells, the electric propulsion and power plant principle starts to look lucrative,” says Reunamo. “Currently the power plant principle, where the engines are only providing electrical power, has been beneficial on ships with large hotels loads, but in future we could also see this on other ships. When considering sails, it can be that on windy day there is very little propulsion power needed from the engines and on calm days there is a big need. With the power plant principle, the number of engines in operation can be selected so that the engines can operate with good loading.”

He says fuel cells are often seen as a good future choice, but for now, in most cases, diesel engines are needed to provide reliable power with fast load acceptance, working together with or backing up other systems. “Even with battery powered vessels we usually see engines taking care of

abnormal conditions such as heavy seas or ice conditions and working as a back up for charging failures.”

A 4-stroke engine coupled with reduction gear so that engines, generators, and motors can be connected and disconnected easily, is a good solution for ships where a hybrid system is preferrable to a fully electric one. This setup would, for example, allow zero emissions operation in port if a battery was installed.

“In the future, we expect to see the uptake of alternative fuels, an increase in energy saving devices and more propulsion lines boosted or solely powered electrically. We still see the need for both 2- and 4-stroke engines, keeping in mind that the flexibility of 4-stroke engines in combination of electrification could open new opportunities for the 4-strokes,” says Reunamo.

Last year, MAN Energy Solutions reassessed the role of 4-strokes and undertook a total cost of ownership analysis for a ropax ferry sailing a specific route with a fuel cell, battery and liquefied hydrogen tank, comparing it to a hydrogen combustion engine and liquefied hydrogen tank. The comparison considered lifetime efficiency, OPEX and CAPEX and found that, even giving the fuel cell setup very favourable terms, its business case only became attractive after 19 years of operation.

That’s not the only new electrification being considered. MAN and ABB recently developed the Dual-Fuel, Electric+ (DFE+) propulsion concept for LNG carriers. The concept

The 4-stroke engine market is expanding its offering, and after meeting the needs of biofuel operation, it is now responding to the prospect of future fuels and greater electrification

features the new MAN 49/60DF engine and involves using variable-speed gensets over the entire engine load. The result is better efficiency with significant reduction of methane slip over the entire engine map.

In continuously developing its portfolio, MAN is enabling its customers to exploit synthetically manufactured, climateneutral fuels. Already today, MAN engines using power-to-X fuels such as synthetic natural gas can be operated in a climate-neutral way.

MAN launched its 49/60DF engine type earlier this year. This latest addition to its four-stroke engine portfolio, is a dual-fuel engine capable of running on LNG, diesel and heavy fuel oil as well as a number of more sustainable fuels including biofuel blends and synthetic natural gas. MAN says it sets a benchmark in terms of fuel efficiency within fourstroke engines – both in gas and diesel modes – and therefore minimises fuel costs.

The 49/60 can start in gas mode where it complies with IMO Tier III without secondary measures. In diesel mode, it complies with Tier III combined with MAN’s SCR system. Soot emissions are halved in diesel mode due to MAN’s new common rail system 2.2, while the 49/60DF’s methane emissions also greatly reduced in gas mode compared to its predecessor.

MAN plans to introduce a pure diesel engine based on the 49/60 platform in 2023 that will inherently be retrofit-ready for running on methanol and LNG should the demand arise at a later stage.

Alexander Feindt, Global Business Development Manager Marine (Four-Stroke) at MAN, says the company recognises its important role since around half of the shipping industry’s approximately 3% contribution to CO2 emissions (Scope 3) can be attributed to MAN engines due to their high market share.

The engine manufacturer is committed to pushing ahead with development of solutions for the combustion of methanol, ammonia and hydrogen, to ensure their customers can remain compliant with IMO and tougher EU regulations. The greatest “pull” from 4-stroke customers at present is for methanol. “Methane: minus 163 degrees, liquefied hydrogen: minus 253 degrees, ammonia: toxic. Methanol is the easiest to handle alternative,” says Feindt.

Methanol is also attractive from a storage perspective, as it only requires 2.5 times the storage capacity of fuel oil to maintain the same bunkering patterns. “Basically, any large cargo ship will turn into liquefied hydrogen carrier when you use liquefied hydrogen as a fuel.”

MAN anticipates offering 4-stroke methanol retrofits from 2024. Due to the modular design of MAN 4-stroke engines, retrofits are feasible for a wide range of models including the 48/60, 51/60 and 32/40. Projects are already underway with Stena and Norwegian Cruise Line.

Methanol requires adaptions of some key systems of the engine including additional, larger injectors, changes to cylinder head, piston crown and revised combustion parameters in engine electronics. Double-walled fuel piping and new detection sensors will be required, and as methanol is aggressive on seals, these may also be changed.

MAN is working on two new-engine methanol technologies: port fuel injection (PFI) expected to be available from 2024 for retrofits and integrated high pressure fuel injection expected to be available from 2026-8. PFI technology enables a solid operating range with a high methanol percentage and will be available for newly built diesel and dual fuel 4-stroke engines. The pre-mixed (Otto cycle) combustion will require a diesel pilot, with 100% MCR to be maintained in diesel mode. This engine will be able to reach IMO Tier III NOx requirements when running on methanol without an SCR system.

The high-pressure direct injection (HP-DI) Diesel cycle technology is considered the more long-term solution and suitable for near 100% methanol (along with a diesel pilot). With this technology, full power output can be achieved with the highest efficiency over the entire engine operation mode.

Despite the current popularity of methanol, MAN is committed to offering solutions for all new fuels. MAN’s hydrogen dual-fuel 4-strokes could enter the market in 2025 or shortly thereafter. MAN Cryotech has already developed and delivered a marine fuel-gas system, including storage tanks, for liquefied hydrogen.

The company continues its involvement in the AmmoniaMot project to develop a medium-speed, ammonia-fueled engine. Testing is currently at the single-cylinder stage. MAN will transfer the technology to large-bore, four-stroke engines and prepare for commercial development and production after 2025.

The recently-released Wärtsilä 25 4-stroke engine is intended to be the first Wärtsilä engine to run on ammonia. Development is currently underway with a technology concept readiness slated for 2023. The engine’s modularity is anticipated to maximise flexibility. It is already capable of operating on diesel, LNG, or on either gas or liquid carbonneutral biofuels, and the manufacturer says it can easily be upgraded to operate with future carbon-free fuels as they become available.

The engine is now available in 6L, 7L, 8L and 9L cylinder configurations. The dual-fuel version has a power output ranging from 1.9 to 3.1 MW, and the diesel version from 2.0 to 3.4 MW. The fuel gas system shares common parts with the Wärtsilä 31DF engine, and the port injection concept provides rapid response for dynamic load control and operational flexibility. Both stepless and on-off type inlet and exhaust valve timing options are available to facilitate optimisation and the use of future fuels.

Rolls-Royce’s business unit Power Systems announced in 2021, as part of its sustainability program, that it would realign its product portfolio so that by 2030, new fuels and climatefriendly mtu technologies can save 35% greenhouse gas emissions compared to 2019. This near-term target plays a significant role in Rolls-Royce Group’s ambition to achieve net zero by 2050 at the latest.

Rolls-Royce Power Systems is evolving from an engine manufacturer to a provider of integrated sustainable solutions, offering solutions from bridge to propeller to marine customers. The Rolls-Royce business unit is also pioneering the development of methanol engines and already has hybrid propulsion systems for marine applications in its portfolio.

Next year, Rolls-Royce will release its mtu Series 2000 and 4000 marine engines for sustainable fuels. Following successful bench and field tests, Rolls-Royce will gradually be approving these engines for EN15940 synthetic diesel fuels from the beginning of 2023. These fuels include the sustainable fuels biomass-to-liquid, hydrotreated vegetable oil/renewable diesel (HVO) and power-to-liquid fuels such as e-diesel. This will enable the reduction of CO2 emissions from existing diesel engines by up to 90%, compared to the use of fossil diesel, without any changes to infrastructure.

“This means that the new generation of Series 2000 and 4000 engines, that currently account for around 85% of our sales revenues, will be qualified to run on second-generation biofuels and on e-fuels,” says Denise Kurtulus, Vice President Global Marine at Rolls-Royce Power Systems.

Future versions of the mtu Series 1163 and 8000 large marine engines, which will meet IMO Tier III standards with mtu SCR systems, are also to be approved for use with sustainable fuels.

Rolls-Royce recently signed a Memorandum of Understanding with renewable fuels producer Neste to build a strategic partnership on the implementation of sustainable fuels for diesel engines. Rolls-Royce is also investing in power-to-x production facilities.

Rolls-Royce’s service strategy for the future includes augmented reality (AR) technology that acts as an onboard digital assistant. It presents the functioning of propulsion and energy systems in an easy-to-understand way through a combination of text, animations and videos. To assist with maintenance and repair work, the AR system projects information onto physical hardware. The AR system can also show where components are located, for example sensors that have triggered an error message, and guide the user there.

“As part of our transformation into a provider of integrated sustainable solutions we strive to deliver complete propulsion and control solutions from bridge to propeller to our marine customers,” says Kurtulus. A key element of this is the automation portfolio mtu NautIQ which includes a range

of platform management and vessel control systems. The core product of the new automation portfolio is mtu NautIQ Master: a fully integrated, turnkey automation solution. Kurtulus says this makes Rolls-Royce the only propulsion manufacturer in the world to supply the electronic platform for monitoring and controlling the entire vessel.

The system can be expanded to include the Equipment Health Management (EHM) system mtu NautIQ Foresight. It monitors the technical condition of an entire ship by collecting and evaluating data from mtu and third-party components. This enables predictive maintenance before a component fails. The EHM system is currently undergoing sea trials on board of high-speed catamaran Halunder Jet.

Recent additions to the mtu NautIQ portfolio are the mtu NautIQ CoPilot, mtu NautIQ CoOperate and mtu NautIQ CoDirect products as a result of the company’s cooperation with Sea Machines Robotics, a developer of autonomous control and remote-vessel command systems. The systems offer different levels of intelligent crew support, autonomous control, and remote command capabilities.

Yanmar Power Technology increased its digital offerings earlier this year with the introduction of its proprietary SCR system with connected functionality and a dedicated management app for smartphones. The control panel of the SCR system has a USB port that can be used to connect it to a smartphone, allowing onboard information to be stored in the cloud through a dedicated application. The app also makes it possible to check performance diagnosis results and maintenance timing notifications even in shipboard environments without Internet access. Yanmar noted in August that it had received orders for over 2,200 units of its SCR system. The catalytic reactors can be used on Yanmar’s

Make the most of marketing & PR support from Seawork, Maritime Journal and our leading commercial marine magazines, in print, online, eNews and via social media.

Showcase your latest innovations in vessels, equipment and services to an international audience of over 100,000 all year on Seawork.com

Seawork & Marine Civils exhibition encompasses 12,000m2 of halls featuring 600 exhibitors and over 70 vessels and floating plant.

Features include the European Commercial Marine Awards (ECMAs) and Innovations Showcase.

The Seawork Conference programme offers opportunities to explore the challenges, changes and emerging opportunities in today’s and tomorrow’s commercial marine and workboat sector.

As we approach the deadline for ballast water treatment systems (BWTS) to be fitted the industry may be starting to breathe a sigh of relief that we are approaching the end. But, as questions remain about maintenance of systems, the ongoing supply of parts and how the convention with be enforced, it looks set that ballast water treatment will still be a hot topic even after the deadline for installation has passed, writes Samantha Fisk

It still seems that there are a lot of questions about BWTS and told some shipping crews may still be scratching their heads about the operation of these systems. A new company has launched on the market that looks to help ease the installation and operation of BWTS. Simplify Ballast is a consultancy that looks to be a bridge between crew and equipment suppliers. Mark Riggio, founder of Simplify Ballast explained that over the years that he worked in the ballast water treatment market one of the glaring problems in the market has been that crews have not understood ballast water treatment systems that have been installed on vessels, either their operation or the value of them for upcoming regulations.

The issue that he notes with this has been that BWTS have not been set up properly and especially now when systems that may have been installed but have laid dormant are now getting switched on, problems are now starting to appear. He notes that crews don’t have the necessary technical knowledge about these systems “there’s only a small knowledge of technical specs, but it takes a certain level of knowledge to operate these systems efficiently”, he explains.

Bio-UV also highlights that a particular challenge is the after sales service and commissioning requirement. 2022 has been a peak year for system installation and commissioning, and whilst it expects system acquisition to slow, commissioning will remain strong throughout 2023. As more systems are installed and enter operation, the maintenance and service market will evolve, with BWTS manufacturers delivering more after sales solutions, such as onsite support and annual performance checks. To meet market demand, the company has already increased its service network to 20 BIOSEA certified service stations around the globe. This expansion will continue across all the key maritime hubs.

The technical complicity of installation of ballast water treatment systems means that installing and setting up of systems isn’t always as simple as just ‘plug-in and play’. This is where Simplify Ballast sees that it can help shipowners with technical advice about the installation and set of BWTS.

Bio-UV also notes that there are still challenges in the market around the supply chain and component shortages. Maxime Dedeurwaerder, Business Unit Director, Bio-UV comments

that: “As a BWTS designer and manufacturer we can better overcome these challenges due to the more standardized nature of the BIO-SEA System. We have also optimised the performance and size of our UV reactors, reducing the number of components required without impacting performance.”

With more consolidation on the horizon of equipment suppliers. Riggio also questions: “What are we going to do when the market shrinks, who’s going to support the existing market/ systems?” Adding to this he asks how the industry will deal with the supply of parts, especially when it comes to the filtration screens, which have been specifically designed for the purpose of ballast water.

One notable trend that Bio-UV is also seeing is the reduction in average required flowrate. Most of the vessels that still require a BWTS installation tend to be smaller ships.

As Riggio highlights there are a number of sectors that are not enjoying the challenge of fitting and using ballast water treatment, such as mid to large vessels, high flows and chlorination systems, mainly due to the complexity of the systems and technical knowledge needed.

Another growing industry concern is the compulsory sampling test requirement, Bio-UV are advising its customers on what they need to do to ensure compliance with the new ruling. As MEPC 79 looms on the industry with a potential convention renewal, concern around how sampling and testing will be carried out. Riggio notes that compliance monitoring solutions are near approval at the IMO and that Port States are driving this legislation. What is of interest is that BEMA (Ballastwater Equipment Manufacturers Association) has been brought onboard with the IMO, signalling to the industry that this is topic is not just for the short-term but looks to be with us for some time.

Dedeurwaerder notes about the upcoming challenges that to make sure that systems stay compliant they are now also recommending that ballast tanks are kept clean so that there is no further contamination that can get into the ballast water treatment systems.

He further highlights that about the adoption of technology that last year was hard to find slots for vessels, which they are now seeing ease up. The company is now starting to see the slow switch from installation to maintenance for its systems, and for this there is a trend for remote support.

The company is also seeing an upturn in the offshore market that a few years ago seemed to be failing, but now seems to be making a comeback. BIO-UV Group’s maritime division and its engineering partner 3C Metal have completed the at-sea retrofit installation and commissioning of a lowflow ballast water treatment system aboard Greatship Maya.

Greatship Maya is a multipurpose offshore supply vessel operated by Greatship Global Offshore service Pte Ltd (Singapore), whose ultimate parent company is the Great Eastern Shipping Company in India.

A BIO-SEA L03-087 modular unit was successfully installed while the 4350dwt ship-maintained rig supply operations offshore Labuan, Malaysia.

Dedeurwaerder explains that: “Together, we surveyed the site, taking 3D scans of the ship’s machinery spaces to simplify pipework, electrical wiring, system integration and installation. This also revealed some space limitations which ensured we were able to design and build a ship-specific solution, allowing 3C Metal’s team to get the BWTS in place without modifying the steel structure in any way.”

All pre-installation pipework was done in parallel with the design and production of the BIO-SEA system, with 3C Metal’s facility in Johor Bahru, Malaysia, fabricating the piping, structural, hydraulic, and electrical connections needed for the project. All components were shipped to the vessel’s port of call prior to ship loading and integration. Inservice installation meant the vessel was able to continue its normal operations throughout the retrofit.

While an “L” Series BIO-SEA unit is recognised as having one of the smallest footprints of any ballast water treatment system in the market, its small size,

however, does not affect the high performance of the system, as Florian Cortes, heading technical operations for BIO-SEA by BIO-UV Group, explained.

“During preliminary work it was identified that the ship’s pumps would also be used for transferring liquids other than ballast water, such as water from drilling operations. But after studying the vessel’s different operational requirements it was found that in ballast mode, the pumps would not be required to run at their full rated capacity of 300m3/hr. 87m3/hr was sufficient. This allowed us to offer a smaller BIO-SEA system that would otherwise have been specified. This resulted in an easier integration and a more costeffective retrofit solution for the end user.”

Although afloat installations do take longer than those carried out in drydock, the arrangement shaves thousands off the total cost of a ballast water treatment retrofit project. “That’s the benefit of an in-service integration,” said Jordan Laurans, Group Operations Manager, 3C Metal. “When you consider drydock hire and the number of people involved, together with the financial losses incurred due to vessel offhire time, then an at-sea installation makes complete commercial sense. The ship continues operating.”

Greatship Maya is a DP II MPSSV built by Singapore’s Keppel Singmarine. When delivered in 2009, the vessel was one of the first to be built in accordance with the then new Special Purpose Ships Code. The vessel can store 1,140m³ of potable/fresh water, 1,140m³ of fuel oil, 1,530m³ of ballast and 1,310m³ of drill water.

Riggio highlights that “for ballast water it is only just beginning. Systems now are going to have to work”, he advises the market that “look where you’re going (sailing) and buy for the worst place that you are going to.”

The challenges around ballast water treatment are not going away soon. Whilst the deadline to have systems fitted may be close by the questions around operation and sampling still stay ever present for the market. It will be important for the industry to get this right and not just try and throw a blanket over it, otherwise as Riggio notes could ended being an expensive exercise for the industry.

8 A skid-mounted BIO-SEA modular reactorOne of the highlights of the first day of The Motorship Propulsion and Future Fuels Conference 2022 was a high-level discussion about the implications of the upcoming introduction of onshore power supply (OPS) requirements across the EU’s Core TEN-T ports by 2030.

Rather than altering the market economics to incentivise shipowners to use ‘cold ironing’, the proposal will introduce requirements for cruise vessels, passenger vessels and container vessels to begin to use shore power connections by 2030, subject to various exemptions for vessels making infrequent calls to European ports.

The panel brought together Torsten Schramm, President Maritime, DNV, Martin Kröger, the ceo of the VDR (German Shipowners’ Association), Valter Selén, a Sustainability Advisor from ESPO, and Kai-Dieter Classen, Deputy Director External Affairs at the Hamburg Port Authority (HHA).

Kai-Dieter Classen, Deputy Director External Affairs at the Hamburg Port Authority (HHA) shared the port of Hamburg’s experience as an early adopter, with the port investing over EUR100 million in the electrification of its container terminals,

One of the obstacles to extending the scope of the EU’s onshore power supply has been the difficulty in attracting investment into the development of those systems. This is partly because supply and demand relationships have yet to develop, because of the lack of demand certainty from shipowners.

Batista added that the failure to develop viable business cases for onshore power supplies until now is underlined by the lack of grid capacity even in ports that have installed OPS connections.

The slow uptake of OPS usage, outside Scandinavian countries that impose higher emissions charges for portside emissions, since 2014 has encouraged the EU to impose requirements for OPS installations, rather than rely on market forces to drive adoption.

Batista noted that the requirements are included in the Alternative Fuel Infrastructure Regulation (AFIR), the Energy Taxation Directive (which establishes taxexemptions for electricity supplied at berth) and under the ETS (where electricity is treated as zero-emission).

Batista concluded by noting that shore power projects were eligible for funding from the EU’s Connecting Europe Facility II (which closed in January 2022), and in the EU’s larger EUR672.5 billion Recovery and Resilience Facility (RRF).

Applications could be made to smaller funds dedicated to zero-emission shipping, such as the Alternative Fuels Infrastructure Facility (AFIF), and Horizon Europe’s Zero Emission Waterborne Partnership, Batista concluded.

The EU agreed to earmark at least 20 million ETS allowances (equivalent to EUR1.5 billion at current ETS carbon prices) from the EU Innovation Fund, which is financed by revenues from the EU’s Emissions Trading System, for maritime projects in late November 2022.

which is expected to be completed by 2028.

However, Classen noted that the high cost of electricity represented a barrier to adoption, with demand from customers lagging behind the installation of supply, which had been enabled by generous national grants.

The challenge of developing commercial models for OPS supply would be helped if the EU committed to extending the current tax-exempt status on electricity supplied over the longer term.

The issue of penalties was raised by Martin Kröger, who noted that there was a risk that ship operators might be declared to be non-compliant if shore power connections at the port are unavailable or not functioning as a particular issue. Batista responded that the regulations had been designed to encourage the adoption of zero-emission at berth technologies more widely, rather than narrowly focusing on OPS adoption.

The decision to apply a zero CO2 emission rating to electricity supplied via an OPS was similarly deliberate, although the regulations might allow subsequent modification to recognise the carbon footprint of the electricity generated, Batista explained.

The EU has previously estimated the cost of installing OPS systems across the Union’s TEN-T port network at over EUR7 billion by 2035.

The panellists discussed the need to invest in strengthening power supply availability and stability, and the need for national grid operators to strengthen connections to ports. The ESPO represent-ative identified issues related to the installation of electricity capacity and as well as grid infrastructure availability in TEN-T ports’ hinterlands as key areas of focus in the proposals. Selén called for the EU to include these issues in its FuelEU Maritime proposals.

More widely, there remains an absence of detailed demand-models, whether on a port-level, regional-level or national-level for OPS demand in the future. The lack of visibility about potential future demand for electricity at a port level was identified as a key vulnerability for ports seeking to attract investment into expanded grid connection capacity.

Despite rapid advances in alternative fuel developments and fuel efficiency, the 43rd Propulsion and Future Fuels Conference continued to be dominated by regulatory discussions.

At a time of unparalleled technological development within the maritime technology field, the 43rd Propulsion and Future Fuels Conference offered an opportunity for the industry to take stock of the latest technological developments in the fields of fuel efficiency and alternative fuels.

PFF also covers regulatory developments at both an EU and IMO level, as such developments play an important role in driving investment decisions.

These developments were reflected in our conference programme, with our first day opening with a high-level discussion about the implications of the upcoming introduction of OPS requirements across the EU’s Core TEN-T ports by 2030.

The opening session of our second day returned to the topics of regulatory developments relating to carbon pricing with Chris Waddington, Technical Director, ICS and Sebastian Ebbing, Technical Advisor at German Shipowners’ Association (VDR) discussing the development of proposals at the IMO for market-based measures (or economic instruments) and the evolution of EU proposals to introduce the extension of the EU Emissions Trading System. Comparing the evolution of submissions between ISWG GHG 12 and ISWG GHG 12, Waddington noted that there had been a clear movement towards a fund and reward scheme, often in combination with a separate Global Fuel Standard.