MEPC 81: Mid-term measures

Blowdown: Methane slip focus

Near-sea electrification: First world problems

Ammonia tests: Lubmarine insights

ALSO IN THIS ISSUE: ABS’ view on data | MEPC81 BWTS update | Holy Boss cap | Nuclear future

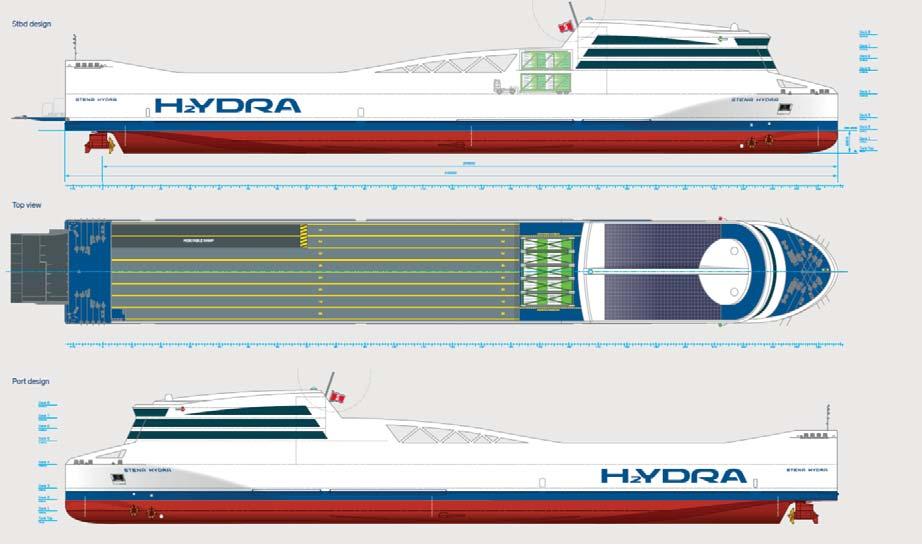

A New Milestone in Liquefied Hydrogen Transport

MARCH/APRIL 2024 Vol. 105 Issue 1220

CONTENTS MARCH/APRIL 2024

NEWS

5 6

15 First Evergreen CCS Retrofit

Evergreen’s Ever Top has become the world’s first Neopanamax to be retrofitted with a CCS system, after a SMDERI CCS system was installed at Huarun Dadong Dockyard Co., Ltd. (HRDD).

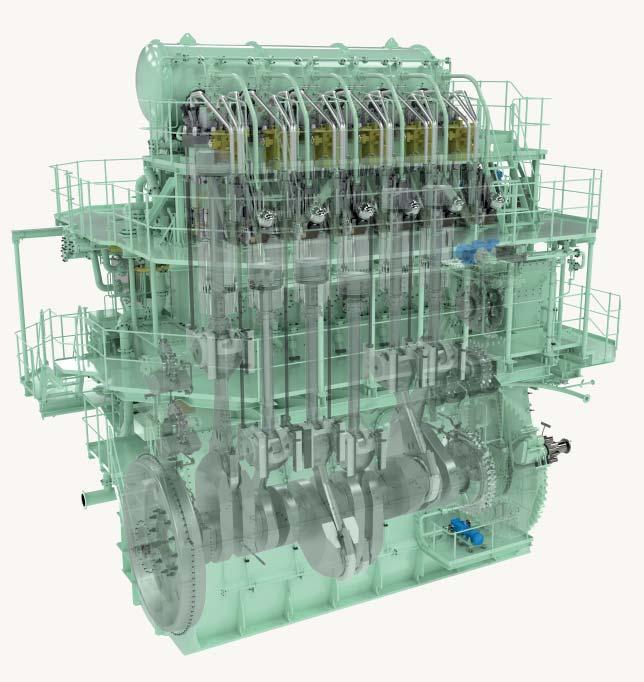

35 First G45 type with an EGR bypass

MAN ES licensee Mitsui has successfully delivered the first MAN B&W G45 type to feature an EGR bypass.

38 Mid-term

matters

Discussions about potential carbon levies as well as fuel standards will continue in September 2024, after ISGW-GHG considers the outcome of the Comprehensive Impact Assessment.

42 REGULARS

6 Leader Briefing

Updated Marine Vessel Rules include new functional requirements and a risk-based methodology to accommodate the latest technology, writes Dan Cronin, VP Class Standards & Software at ABS.

40 Design for Performance

Utilising holes in a boss cap can eliminate propeller hub vortex cavitation and reduce associated propeller efficiency losses, Dr Batuhan Aktas of EcoMarine Innovations tells The Motorship.

FEATURES

18

14 Methane slip focus on blowdown

Engine makers have ongoing work underway to reduce methane slip, including tackling emissions from blowdown, Wendy Laursen writes.

16 Emissions data CHEK

The CHEK project’s analysis of the emissions reduction potential that multiple energy saving technologies offer a Kamsarmax bulk carrier paves the way for more accurate ESG reporting.

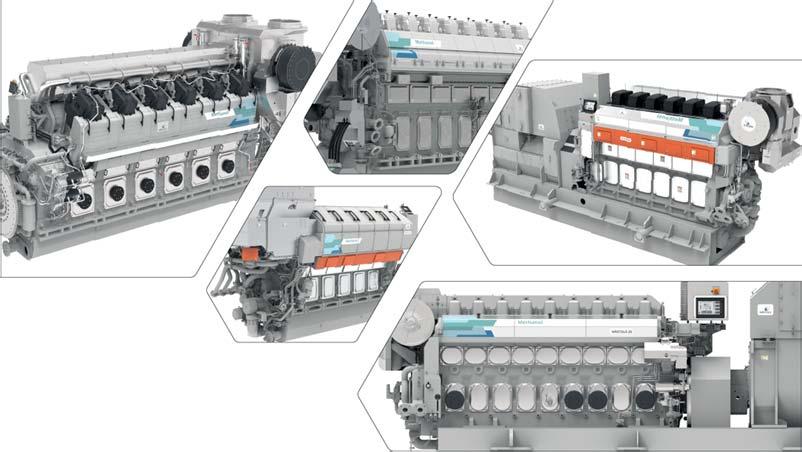

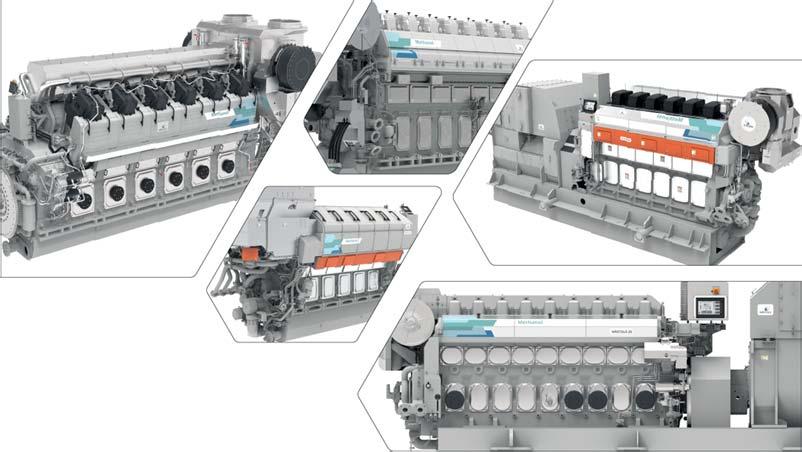

20 Resisting siren calls

Despite technical advances, high upfront capital costs and battery energy density constraints mean alternative fuels and ICEs remain the path to decarbonising deep-sea vessels.

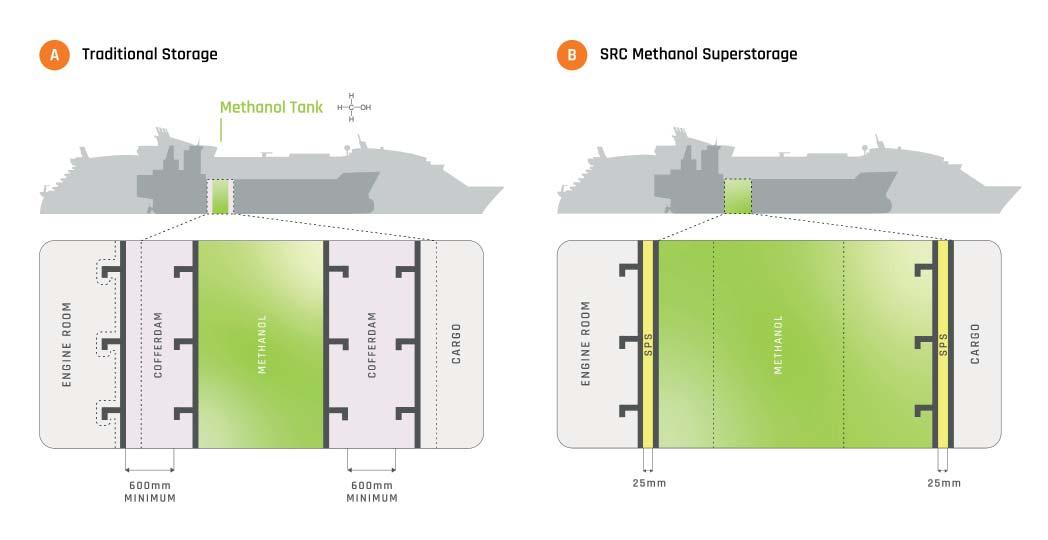

28 Methanol concerns move to pricing

The solutions available for methanolfuelled 4-stroke engines and retrofit packages are growing, but there are still concerns about their financial viability.

30 Lubmarine’s ammonia test results

5

5

5

5

42 Ship Description

A new generation of hybrid 5,400dwt coasters will lower CO2 emissions per cargo unit by as much as 50%, according to its Nordic owners.

Dr Olivier Denizart, Technical Manager at Lubmarine, shares some of the key findings from Lubmarine’s latest R&D projects on future fuels including an NH3-fuelled engine.

Social Media Linkedin Facebook Twitter YouTube Online motorship.com

Latest news

Comment & analysis

Industry database

Events Weekly E-News Sign up for FREE at: www.motorship.com/enews For the latest news and analysis go to www.motorship.com MARCH/APRIL 2024 | 3

will take place this year in Hamburg, Germany. Stay in touch at propulsionconference.com

The Motorship’s Propulsion and Future Fuels Conference

ThMthi’PlidFtF

VIEWPOINT

NICK EDSTROM | Editor nedstrom@motorship.com

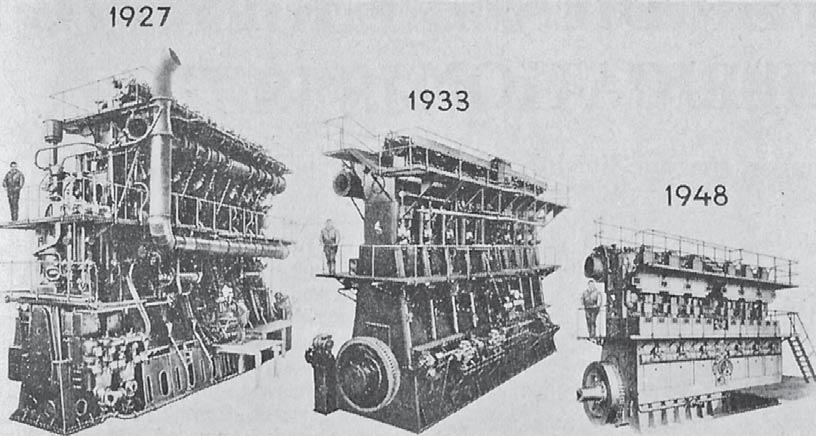

Thank You For The Music

One of the first things that I was told when I started at The Motorship in December 2018 was battery hybridisation was unlikely to become widely adopted within the deep-sea shipping sector. The technological barriers to uptake were simply too established, ranging from the weight of the battery systems themselves all the way through to questions about charge/discharge rates and battery cell longevity.

The rapid development of electrification in the automotive sector has driven a number of advances in associated sectors, including battery cell technologies. These advances have led to steady improvements in the performance of battery cell installations, which in turn is likely to transform the cost-benefit calculus involved in integrating such systems on board vessels.

It is a mark of how fast technology has developed over the intervening period that CIMAC will be conducting a survey of its members to gauge attitudes towards the relative advantages and disadvantages of introducing large scale Energy Storage Systems onto deep-sea vessels.

We address the issue in a number of features in this month’s issue, comparing the relatively slow penetration of ESS systems in larger vessels’ propulsion packages with the faster pace of evolution in the near-sea and short-sea ferry segments.

One recurring criticism of hybridisation technologies is that they will introduce significantly greater complexity into onboard systems. However, the roll-out of autonomous and semi-autonomous navigation – we include reviews of several of such projects in this month’s issue – will transform the complexity of onboard systems. (I have postulated that this will have knock on effects on the operational lifespan of vessels, as higher upfront costs will encourage longer amortisation periods, quite apart from the improved insight into vessel wear and tear offered by digitalisation tools).

All Change

This issue will be the last issue of The Motorship that I will have the pleasure of editing. After just over five years, one pandemic and one of the most sustained periods of technological change in the industry since the Industrial Revolution, it is time for someone else to take over the reins.

This means that I will miss the growth of methanol fuelled shipping in a number of different commercial segments in 2024, as well as the upcoming addition of ammonia to the range of fuels upon which vessels are operating in both the 2-stroke and 4-stroke markets. To say nothing of the propulsion sector.

I will be leaving the maritime industry and returning to the world of market reporting, with a focus on renewable fuels. I very much hope to remain engaged with the maritime industry, not just because of its importance to all the market transitions that are occurring, but also because I have made so many friends and excellent contacts over the past few years.

From a personal perspective, it has been very rewarding to meet, get to know and report on the work of highly capable, intelligent people who are struggling to resolve challenges for the first time. The term ‘hard to abate’ doesn’t really capture the scale of the endeavour you are all engaged in. It has been a tremendous privilege.

Fjord1 to operate four autonomous ferries on domestic service

Fjord1, the Norwegian domestic ferry operator, has signed a contract with the Norwegian Road Administration to operate four autonomous, electric ferry nnewbuildings on the crossing between Lavik and Oppedal, the company said in a statement.

The four vessels, which will have a length of 120 m, will be able to carry 399 passengers and 120 cars and they will be built at the Tersan shipyard in Türkiye. All four ferries are scheduled for delivery in the first half of 2026 and the contract to operate them will take effect on 1 September.

The contract covers eight years from 2026 and it includes an option to extend it by a further three years. A total of 23 different functions will be automated from 2027, starting with docking and undocking and later on, including autonomous navigation. The crossing on which the vessels will operate is 5.6 km and it will take 20 minutes.

The ferries have been designed by Fosnavag based HAV Design, which has so far designed 18 electric ferries for Fjord1, including the now ordered ships. The autonomous ferries differ from other vessels HAV Design has produced for Fjord1 in that the systems onboard must be simpler, so that they can be easily monitored and controlled from a station ashore, said Jan Magne Goksøyr, Vice President Sales at HAV Design.

Autonomous but not unmanned “It is important too note that these vessels will be autonomous, but they will not be unmanned. The Norwegian flag has made no openings for carrying passengers

on an unmanned vessel. The captain can lean back, but he cannot leave the ship, Goksøyr told The Motorship.

Norway has been a leader in the development of electric ferries and as the country has lots of green hydro power and several domestic ferry services, there are good prospects for future orders for electric ferries in the country. As batteries get smaller and smarter, the outlook for these vessels is encouraging elsewhere as well, provided that the electricity they use has been provided from green sources, Goksøyr pointed out.

The Tersan Shipyard that will build the four Fjord1 ferries has also built the four 15,800 gross ton ferries that Havila Kystruten operates on the long coastal run between Bergen and Kirkenes along the west coast of Norway.

In December 2023, Tersan bought the Havyard Leirvik Shipyard in. Norway in a move that it said would strengthen its position in northern Europe. “We have already been collaborating with Havyard Leirvik on project base cases, although such collaboration had been only to some extent it has always worked well and showed promising signs for a potential more expanded partnership,” said Ahmet Paksu, vice chairman of the Tersan board, in a statement.

“By combining our expertise and resources with those of Havyard Leirvik Shipyard, we will be able to strengthen our position in the global shipbuilding industry,” he concluded.

NEWS REVIEW 4 | MARCH/APRIL 2024 For the latest news and analysis go to www.motorship.com

8 Fjord 1 autonomous ferries

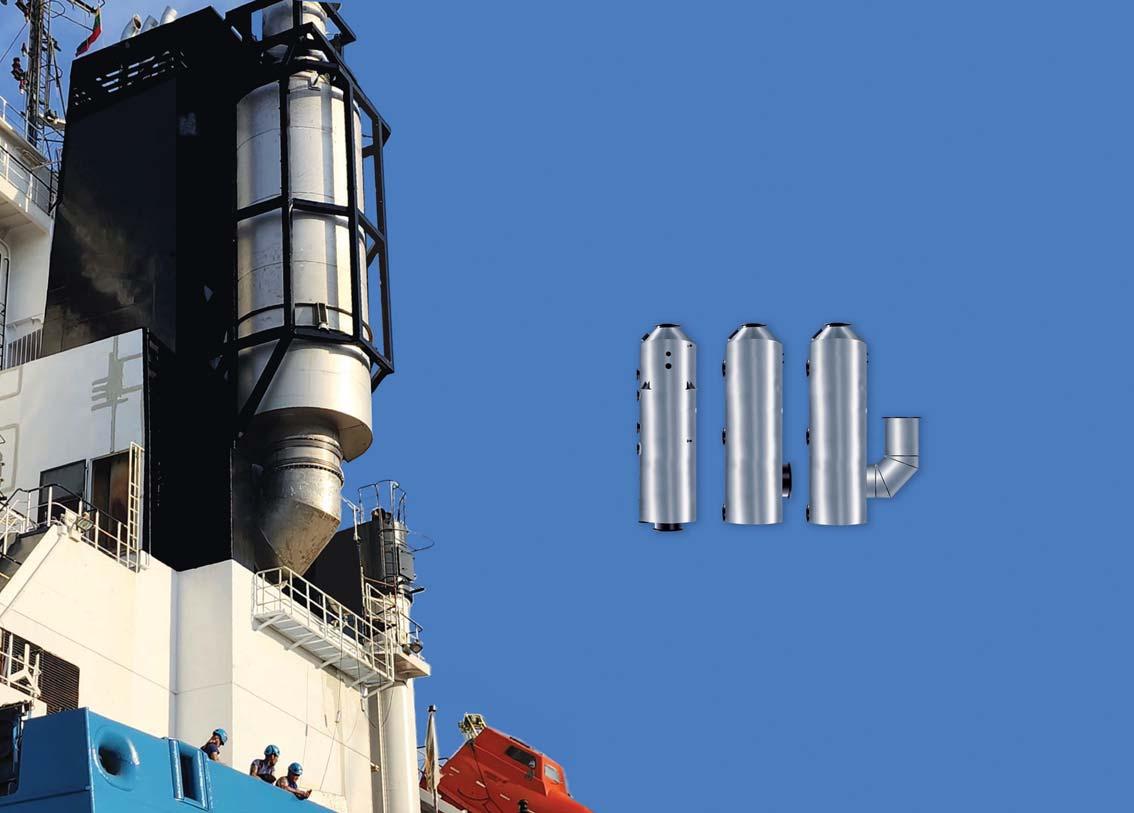

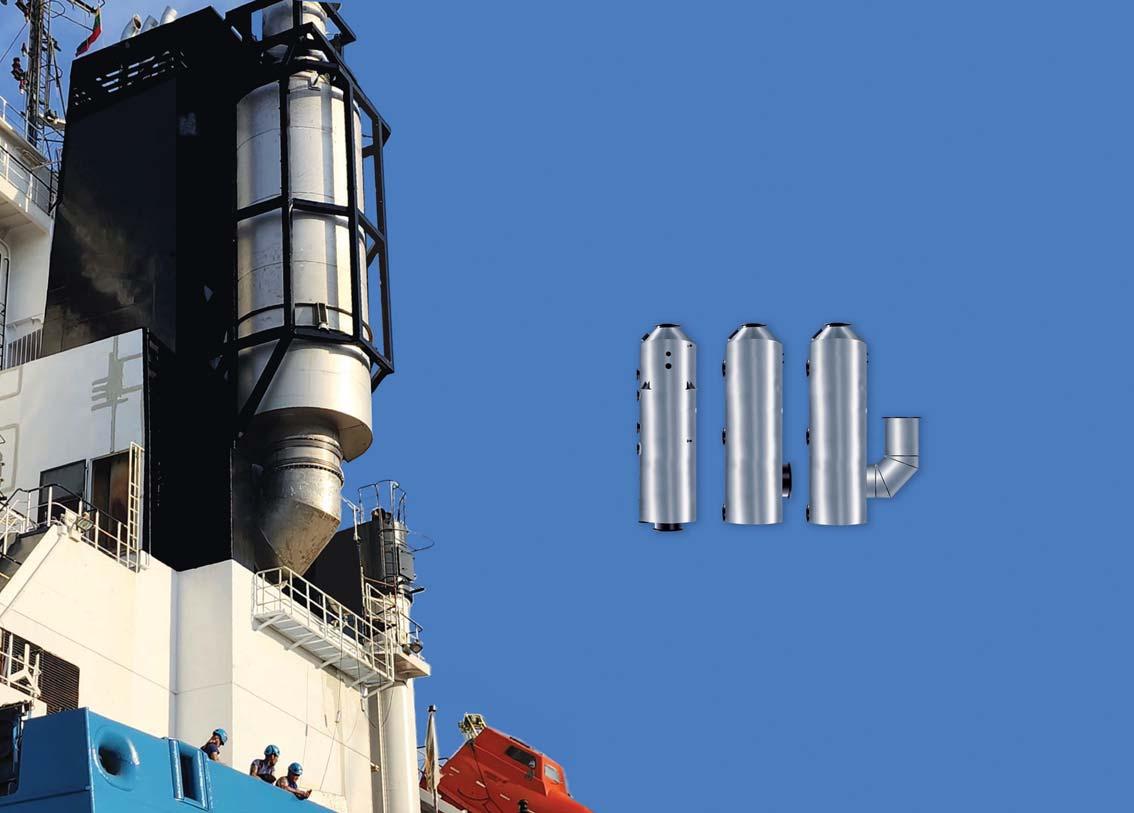

Ever Top, a Neopanamax container vessel owned by Taiwanese liner operator Evergreen, has been awarded a SCCS-Full class notation by ClassNK, signifying that the vessel is equipped with an onboard CO2 capture and storage (CCS) system.

The vessel is the world’s first Neopanamax container vessel to be retrofitted with a CCS system. The CCS system, designed and developed by Shanghai Marine Diesel Engine Research Institute (SMDERI), were installed at Huarun Dadong Dockyard Co., Ltd. (HRDD).

ClassNK reviewed the system components and the installation plan, aligning with its comprehensive “Guidelines for Shipboard CO2 Capture and Storage Systems.” The risk

MAN Energy Solutions has announced the production of a 3.9m diameter Cluster 5 Double Layer SCR (Selective Catalytic Reduction) catalytic converter for MITSUI E&S Co., Ltd. The SCR unit - the largest the company has ever builtcomes ammonia-ready.

The 3,900 mm diameter Cluster 5 Double Layer has a total weight of 28 metric tons, and will shortly be available for series production. The quality of the product was confirmed during the final inspection by MAN Energy Solutions and MITSUI E&S. Following a successful water-pressure test, the component was subsequently shipped from Dalian, China to Tamano, Japan.

Dr. Daniel Struckmeier, Head of Sales & License Turbochargers &

NH3 AFSS launched

FIRST EVERGREEN CCS RETROFIT

assessment through Hazard Identification (HAZID) and the onsite installation process were also examined.

The retrofit installation of SMDERI’s amine-based CCS system on board the EVER TOP extends the history of

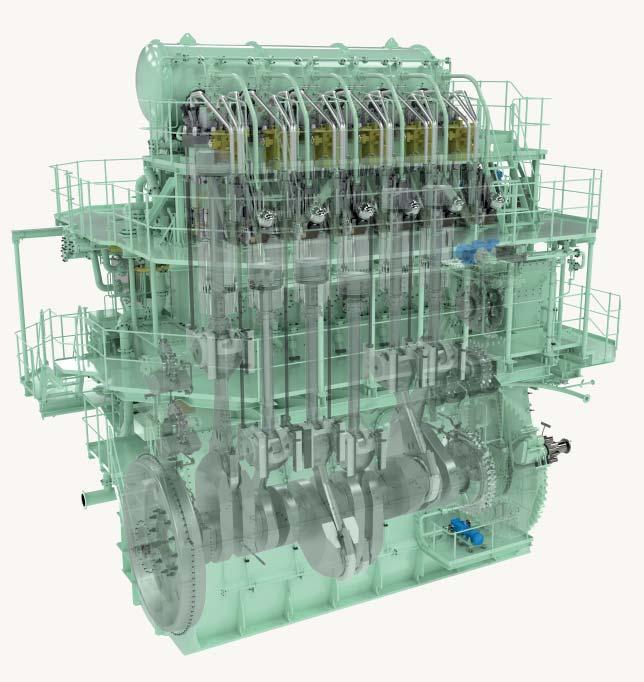

8 The MAN B&W S90ME-C engine on board Evergreen’s Ever Top container vessel was retrofitted with a SMDERI onboard CCS unit at Huarun Dadong Dockyard Co., Ltd

cooperation between SMDERI and MAN Energy Solutions in CCS applications. Ever Top is equipped with a MAN B&W 11S90ME-C9 main mover.

The Motorship previously reported that SMDERI had received a first order for an onboard CCS system in connection with an order for 12 x 82,000 dwt Kamsarmax vessels at Jiangsu New Hantong Ship Heavy Industry in April 2024. The Kamsarmax vessels have been specified with MAN B&W 6G50ME-C9.6 main movers.

Largest MAN ES SCR for Mitsui E&S

Exhaust Gas Treatment APAC, said: “As the very first SCR for an ammonia engine anywhere in the world, this is a historic moment.

As the largest, high-pressure SCR we have ever built, this marks a new milestone for our business. The new equipment also passed

Mitsui H2-fuelled Test

its Factory Acceptance Test without any major issues and I congratulate everyone involved in this groundbreaking project.”

MAN SCR (selective catalytic

Green Corridor Nears

reduction) control systems are integrated into the overall engine-control system and adapted to the fuel-injection system and turbocharger, enhancing the efficiency and reliability of the entire system. Up to 2.5 g/kWh of fuel-oil consumption can be saved thanks to the integration of MAN SCR and optimised control strategies compared to the use of an SCR system provided by a third-party supplier. Besides reducing NOx emissions by up to 90%, they also deliver IMO Tier III compliance and increased efficiency in respect to fuel and urea consumption.

BRIEFS

EGR bypass for G45

Wärtsilä Gas Solutions launched a commercial Ammonia Fuel Supply System (AFSS) for ships able to operate with ammonia fuel in late February. The groundbreaking solution is available for both liquid and gaseous fuel. The announcement follows the news that the first NH3 fuel supply systems will be installed on two new gas carriers being built at Hyundai Mipo Dockyards (HMD) in South Korea.

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions evasion

Mitsui E&S completed the successful first running of a large bore 2-stroke test engine on hydrogen at its Tamano Plant in Japan. The successful combustion was performed on one of the cylinders of a modified MAN B&W two-stroke 4S50ME-T type in October 2023. The test was successful at 100% load operation, with promising data regarding an absence of hydrogen leakage from the gas supply equipment. The gas supply system was developed by Mitsui.

A new green shipping corridor is set to be established between Singapore and Australia, following the agreement of an MoU between the two nations on 5 March. Both countries have undertaken to work with interested partners to develop zero or near-zero fuel supply chains. The deal is expected to have implications for international iron ore, thermal and coking coal, and bauxite and alumina supply chains.

MAN ES licensee Mitsui has successfully delivered the first MAN B&W G45 type to feature an EGR bypass. The Makita-built 6G45ME-C9.7-EGRBP will be the first of its type worldwide to feature EGR bypass, which allows the engine to match EGR operation to engine load to deliver the required NOx emissions reduction. The first reference with Accelleron’s A255-L turbocharger will be deployed on a 40,000 DWT bulk carrier for Japanese shipyard.

NEWS REVIEW For the latest news and analysis go to www.motorship.com MARCH/APRIL 2024 | 5

‘‘

8 The Cluster 5 Double Layer has a diameter of 3,900 mm and a total weight of 28 metric tons

RISK-BASED CLASS RULES

NEEDED FOR MARINE SECTOR

Updated Marine Vessel Rules include new functional requirements and a risk-based methodology to accommodate the latest technology, writes

An increasingly complex, digitalised maritime industry is challenging designers, shipyards and vendors to deliver the kind of vessels that can safely navigate the transition to a low carbon, high efficiency operating environment. With new technologies enabling innovative approaches to design and performance across all types of vessels, the industry wants to know that class rules are keeping pace with developments.

The emergence of a goal-based approach from the International Maritime Organization (IMO) signaled a seachange in the way regulators could develop criteria that could be applied to any technical solution, rather than the traditional prescriptive approach.

The exponential growth in technology development that we expect over the next decade and beyond has enabled designers and builders to accommodate more and more advanced technology within their concepts. Class and others have been mindful of the need for a clear pathway to understanding the risks attached to new technologies, whether for assets or the humans that work with them.

In particular, the technologies of decarbonisation that are novel and innovative, demand a fresh approach that enables shipping to achieve a safer and more sustainable energy transition.

The rate of technology development is challenging to an industry which is often incorrectly labelled as slow and resistant to change. Owners and operators are looking to move quickly to cut emissions and maintain a competitive edge. This necessitates a requirement structure that applies a risk-based approach to class rules, which helps by quickly and efficiently identifying unintended safety consequences of employing new technology onboard their vessels, thereby allowing owners and operators to make fleet-wide decisions with speed and confidence.

In response to growing demands for a framework that can enable innovation, ABS has updated the Marine Vessel Rules and introduced new Rules for Alternative Arrangements, Novel Concepts and New Technologies applying functional requirements, developed in accordance with the guidance in IMO Circular 1394, and risk-based methods to designs that do not have established Rules.

This approach is aligned with the IMO process for alternative arrangements. ABS has received positive feedback from flag Administrations who also face the challenge of evaluating new ideas against regulations that were often written with a speci technical solution in mind. By following the IMO framework and leveraging predefined functional requirements, the process of obtaining both class and flag approval of alternative designs will be far more efficient.

g, to provide a process for ular 1394, and risk-based ve established Rules. he

s who also face ideas with a specific wing IMO

Dan Cronin, ABS

a lighter vessel, equipment to handle new fuels, or a new vessel type that operates in a manner not seen before.

The updated ABS Rules enable shipowners to integrate new technology knowing that they have been through a riskbased process as part of a comprehensive ABS Class review. At the C-suite level, the enhanced rules create an environment to explore the impact of incorporating advanced digitalization capabilities and new decarbonization technology into a fleet.

For shipyards and technical personnel, the Rules provide a series of pre-defined objectives and functional criteria. ABS working with other stakeholders can determine the acceptability of the new technology and identify risks to existing systems. With approval times reduced by as much as half for the adoption of new technology, project managers can make fleet-wide decisions with speed and confidence.

ABS prescriptive Rules remain in place for conventional designs, technologies and arrangements that follow the traditional approval process.

The Rule enhancements are a result of a multi-year collaboration with industry, shipyards, shipowners, equipment manufacturers, designers and regulators. Over 600 ABS clients took time to provide feedback through ABS Technical Committees, questionnaires, and other avenues.

In addition to the request for a framework adaptable to new technology, two other important requests were to provide easier access and to improve the clarity of the existing Rules.

To meet those requests, ABS has also released Rule Manager 2.0, an intuitive application that allows users to quickly search and access content across the suite of ABS Rules and Guides. This follows the 2023 launch of the industry’s only Custom Rule Book application, a powerful tool which allows users to instantly create tailored rules sets for their specific vessel or project. Rule Manager 2.0 will also be available to MyFreedom™ Portal subscribers which will allow more personalization and content.

Commentary and updated text simplify class requirements, reducing interruptions during survey and plan review by clearly describing what is required for compliance. New figures have been added to explain complex technical content more easily.

The new Rules and approach can address any innovative idea that does not have de requirements. Some examples may be the incorporation of new materials for

ing both class signs will be far an address ave fined may be for gp wh images and ha technical content more progressive vessel includ craft and h

ABS will progressively release updated Rules for popular vessel types including offshore units, barges, high speed craft and light high speed naval craft.

8 Dan Cronin, VP Class Standards & Software at ABS

8 Dan Cronin, VP Class Standards & Software at ABS

The updated ABS Rules are built to adapt to a new and rapidly changing technological world, creating clarity around complex topics and simplifying access to the information the industry needs. By enhancing ABS Rules with risk-based requirements and strengthening the technical content to account for compatibility with objectives, functional requirements and prescriptive criteria, ABS has created a robust infrastructure to enable the innovation and technology to support our clients and the wider maritime industry’s evolving decarbonization and digital ambitions.

The c clarity aroun access to the AB and strengthe compatib a ro innovation an and the decarb

LEADER BRIEFING

6 | MARCH/APRIL 2024For the latest news and analysis go to www.motorship.com

MID-TERM MEASURE DEBATE WILL DOMINATE RUNUP TO MEPC82

The 81st meeting of the IMO’s Marine Environment Protection Committee (MEPC) in London on 18 to 22 March 2024 was held the week after the Intersessional Working Group on the reduction of Green House Gases (ISWG-GHG 16)

Decisions about the final shape of mid-term measures to improve the economics of operating on fuels with lower greenhouse gas emission (GHG) profiles were delayed until ISWG-GHG 17, which is expected to be held the week before MEPC 82 in late September 2024

The working group meeting will take into account feedback from a two-day workshop into the findings of an IMO commissioned Comprehensive Impact Assessment, to assess the impact of potential mid-term measures on states, as well as individual trades.

While ISWG-GHG agreed to develop a goal-based marine fuel standard regulating the phased reduction of marine fuel’s GHG intensity as part of the basket of mid-term measures, there was less consensus upon whether an economic element should be introduced independently or integrated into the goal-based marine fuel standard.

Proposals for more sophisticated flexible compliance strategies also divided committee members, with some delegations raising concerns that countries without the experience of operating in complex trading markets may be disadvantaged.

The Working Group also noted the wide support for using the existing IMO instruments for reporting and verification requirements while also noting the necessity to develop additional tools, such as a central registry.

This focus on improving the consistency and reliability of DCS data quality was seen elsewhere: the MEPC requested the IMO Secretariat review the IMO DCS to assess its suitability for the implementation and enforcement of regulatory GHG measures.

MEPC 81 also adopted amendments to add granularity to fuel consumption data which must be reported by ships of 5,000 GT or above, as well as information related to attained CII. These amendments, amongst other things, give guidance on the methodology for recording fuel consumption per consumer as well as how to record when a ship is under way/ not underway for the purpose of data recording to the DCS.

Significant progress was made in the development of a life cycle GHG assessment (LCA) framework, and the MEPC adopted the 2024 Guidelines on Life Cycle GHG Intensity of Marine Fuels (2024 LCA Guidelines) (MEPC.391(81)).

As previously noted by The Motorship, this will lead to ever deeper scrutiny of emission factors related to upstream fuel production and onboard fuel consumption. (The 30 year or 100 year methane emission timeframe problem). The Committee’s decision to embed onboard carbon capture and storage technologies in the development of LCA boundaries suggests that onboard CCS will become an important technology for improving the environmental footprint of conventional fuels over the intervening period.

The ISWG-GHG expressed a wish to re-examine the reduction trajectory imposed by accepting the ambitions in MEPC.377(80) once the fuel standard enters into force, rather than accept a straight line reduction between a 20%

reduction by 2030, a 70% reduction by 2040 and net zero by 2050. The focus of discussions on technical discussions about the correct base line to use indicates the contribution of highly skilled shipping economists. They will be fully engaged in the months ahead, as the terms of reference of a Fifth IMO GHG Study will be put before MEPC 82 in October 2024.

Timelines

It is worth noting that ISWG-GHG plans to reach a recommendation on the preferred mid-term economic and technical measure at its ISWG-GHG 17 meeting in September 2024, which will be considered and potentially recommended for adoption at MEPC 82 in October 2023. The approval of the measure will subsequently occur at MEPC 84 in April 2025.

This timeframe is unexceptional, but the highly politicised nature of the topics under discussion within individual IMO member states raises the risk that political transitions after national election results, or alterations to the orientation of European Commission political appointees may well alter negotiating positions.

Leaving aside potential alterations to the political environment in the USA and the European Union, several technologies are likely to reach technical maturity within the next 12 months, including onboard carbon capture and storage for 2-stroke engines, ammonia-based combustion and potentially hydrogen-based combustion.

Despite their technical maturity, the adoption of these technologies and their necessary (negative and positive) supply chain infrastructures more broadly will rely upon the introduction of relevant economic tools.

8 Expect MEPC 82 to approve the terms of reference of a Fifth IMO GHG Study in October 2024

REGULATION 8 | MARCH/APRIL 2024 For the latest news and analysis go to www.motorship.com

Motorship Issue for Motorship HalfPg 2024 outlines indd 1 3/17/24 10:27 PM For Marine Decarbonization; The Answer is CO2 Mineralization. * Unique and innovative technology for economical CO2 capturing from ships * Customized design based on the CO2 capture rate optimized for each ship’s operating data. Please contact sales@hiairkorea.co.kr

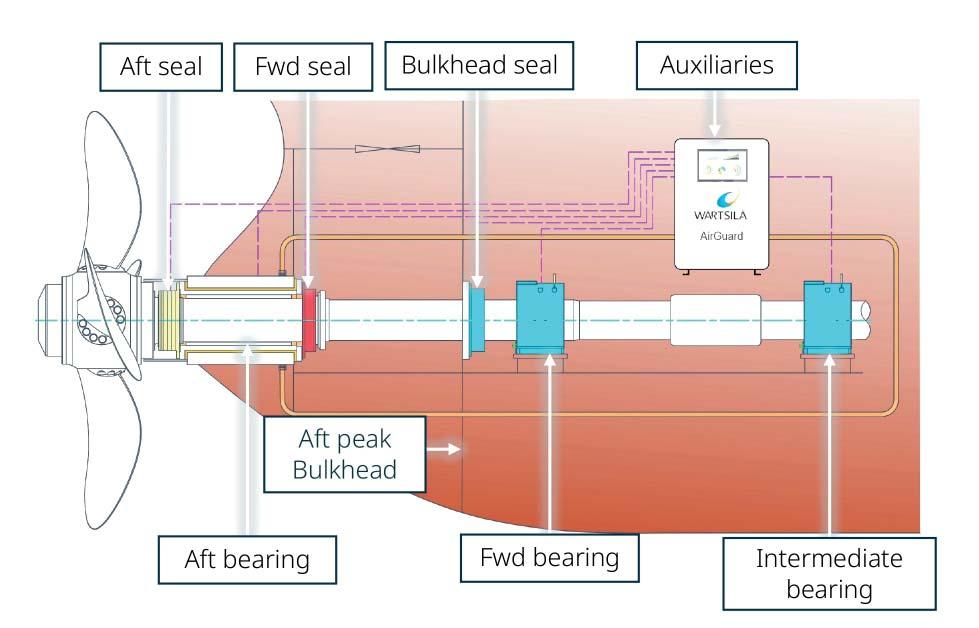

BACK TO THE FuTube: WÄRTSILÄ CHECKS BEARING

Wärtsilä starts afresh to plan its shaft line strategy, Paul Gunton reports

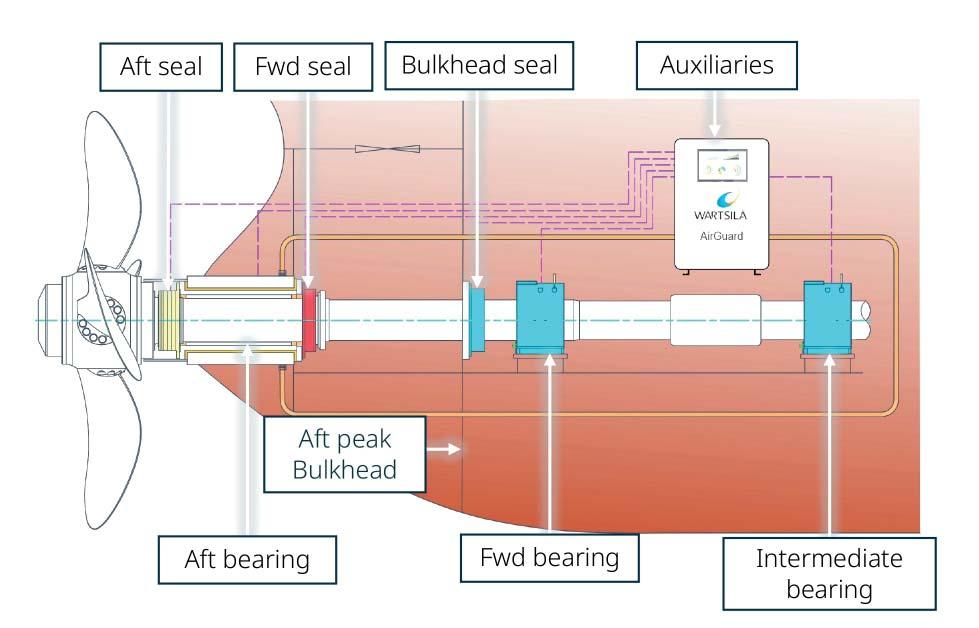

Thomas Pauly has an important job: he is a General Manager at Wärtsilä’s Shaft Line Solutions (SLS) and is responsible for its future portfolio and market intelligence. In any company, those roles form the basis of its success but in the competitive world of shipping, where price is often the decision-driver behind technology choices, they are especially vital.

So since 2017 he has been asking some simple questions in 180 customer interviews that generated 3,800 separate pieces of information. Mr Pauly himself conducted 150 of them and the headline outcome of all this work was stark: in general, customers believe that today’s equipment is good enough.

He was speaking to a small group of invited guests, including The Motorship, in late March in the heart of SLS’ Bearing Centre in Vigo, Spain, where he summarised the research and drew two important conclusions from it. One identified what customers wanted from their seals and bearings while the other discovered where their pain points were.

foundation for all our innovations,” he said, going on to describe how Wärtsilä’s response had brought its international teams together to find solutions to address customers’ wishes and pain points in “a masterpiece of cross-collaboration”.

Those two lists were noticeably different. What customers most wanted from their seals and bearings, the survey showed, was ‘100% fail-safe [operation]; no leaks or oil spills’.

But their biggest pain point highlighted a desire that bearings should ‘handle slight shaft line bending’, which ranked only seventh on the list of what customers thought they wanted.

The variation between the two sets of priorities prompted Mr Pauly to remark that “some voices were quite loud but their pain was quite low.” And vice versa, the analysis showed.

This was not just an academic exercise. It has formed “the

This masterpiece has been dubbed ‘FuTube’, a name chosen to convey Wärtsilä’s view that it represents the future of sterntube technology. It consists of a portfolio of new and upgraded systems (see ‘Unwrapping the FuTube package’), backed up by a demonstration test rig – part-funded by an EU grant –located in its Bearing Centre.

Mr Pauly made no secret of the strategy behind its research and the creation of FuTube: it is to increase market share by persuading owners and managers to specify FuTubebased shafting and bearing systems in their vessels. At the moment, they leave that selection to yards, which generally use price to decide which manufacturer will supply these important components, he said.

“This is the brutal reality. The market is not desperately pushing for something new and there is an extremely low price level in the market,” he said, which is a problem not only for Wärtsilä but also for other suppliers, he said. “We decided we wanted to break out of this cycle.”

He summed up Wärtsilä’s route out of this circle in three ambitions, based on the pain points identified from its research: “the more it hurts, the more they value [a solution]” he said. FuTube is the result, he said, with the goals of reducing costs, making crews’ lives easier and avoiding damage.

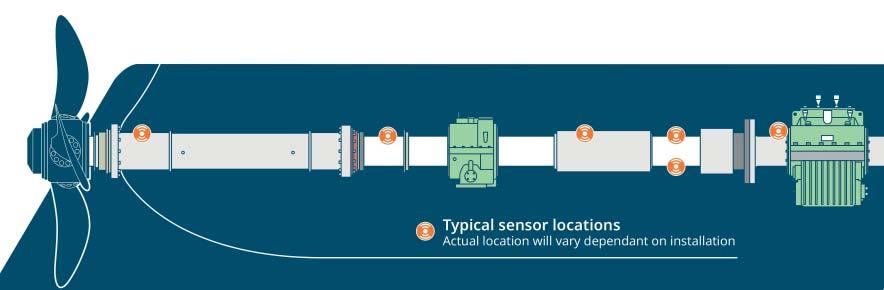

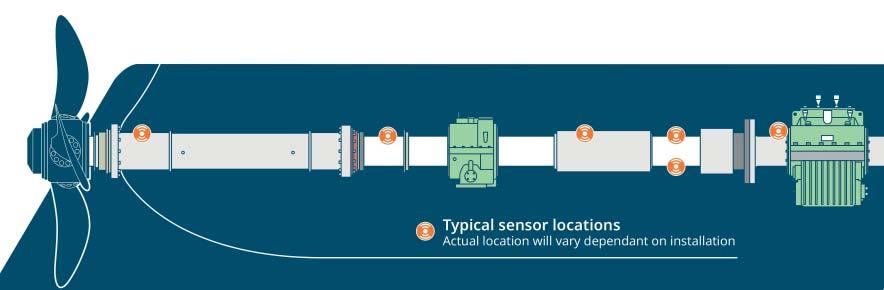

Test rig demonstrates complete FuTube family

Installed within Wärtsilä Shaft Line Solutions’ Bearing Centre in Vigo, Spain, is a practical simulation of a complete shaft line, from engine to propeller. Those two components are represented by an electric motor for the engine and a device that can replicate the vertical and horizontal forces on the shaft that would arise from a propeller in various operating modes. Everything else uses standard equipment.

No photographs are available of the setup, so a brief description is useful for this report. The electric motor is connected via a hydraulic coupling to a 9.5m shaft which passes through an intermediate bearing and on to an EvoTube sterntube, fitted with

an IntelliSafe bearing. A conventional liptype seal is fitted at the inboard end and a Wärtsilä Airguard seal at the outboard end. Lubricating oil tanks and the various pumps – including the air pump for the aft seal are also included in the rig.

Jose Antonio Vazquez, SLS’ Technical Manager, Engineering, explained that the rig can be configured to represent any combination of components and propeller forces that a customer is contemplating and then be run for several days, following automated operating cycles, to demonstrate the various elements and collect data over a realistic length of time.

These cycles would particularly demonstrate the benefits of the IntelliSafe

8 Thomas Pauly asked customers some fundamental questions

bearing, he suggested. “We are producing a situation where the bearing should be wearing, but because it is protected by IntelliSafe, it will react and increase the oil film to avoid wear,” he told The Motorship. As well as these customer-focused demonstrations, during the two years it has been in use it has provided valuable insights that have helped its EvoTube and IntelliSafe development, in particular in comparing the ability of the cooled oil to reduce the bearing temperature quickly, compared with a conventional bearing. To perform that comparison on a ship would require it to be drydocked for components to be replaced, which would be almost impossible, he said.

THRUSTERS & PROPULSORS 10 | MARCH/APRIL 2024 For the latest news and analysis go to www.motorship.com

UNWRAPPING THE FuTube PACKAGE

Wärtsilä’s FuTube is a modular system, but each component is available separately, SLS Sales director Panu Sorvisto explained to The Motorship. “That's the beauty of it; it allows for flexibility"

Among the innovations he highlighted is an enhanced version of the company’s long-established Airguard seal, which it claims now offers a 10-year service interval. This saves operational costs, said SLS General Manager Thomas Pauly, not only because the seal does not need servicing at every five-year drydock, but checks can be carried out using a cherry-picker rather than scaffolding. This benefit alone will save 1.5 days from a typical 10-day drydock visit, he said.

This life extension has been achieved by using a new sealing material that is effectively a combination of the two products previously used; one for sealing against water and one for oil. It was developed as a result of experiments in 2020-21 specifically to find a way extend seal life and reduce repair and maintenance costs, rather than the shipyarddriven focus on the capital costs.

Forward of this seal is an EvoTube, which was launched in December 2023 and described in The Motorship that month. Its name reflects the notion that it marks an evolution from normal sterntubes, thanks to its shorter length, which contains the shaft line’s aft bearing.

‘‘

Ship crews are under a lot of pressure during a voyage and cannot be expected to be experts about shaft bearings

This is a simpler system than with a conventional longer sterntube, SLS Technical Manager, Engineering, Jose Antonio Vazquez, said. In addition, the EvoTube is about 8m shorter than a conventional sterntube, which provides an opportunity to have a shorter engineroom and create more cargo space, he noted.

Inside the EvoTube is an IntelliSafe bearing, which has been designed to address a startling statistic: in conventional sterntube arrangements 90% of shaft line breakdowns are caused by friction wear in the aft bearing. SLS sees the practical reality of this, since its workshop repairs about 200 aft bearings every year, each of which represents a ship being taken by tug to drydock for the bearing to be removed

and, quite possibly, an oil spill from the sterntube. “This is very expensive for owners and operators,” Mr Vazquez said.

Ship crews are under a lot of pressure during a voyage and cannot be expected to be experts about shaft bearings, he said, so “they should not have to care about is going on in the sterntube,” with the bearing system adapt to operational demands, he believes. This ambition led to the design ideas that lie behind the IntelliSafe bearing (see box).

Finally, a continuous shaft monitoring system monitors the entire shaft system. It is based on portable equipment that Wärtsilä has used for more than 20 years as a troubleshooting aid, but now it has been incorporated into a permanent control unit as part of the FuTube concept.

Jens Hyrup, Manager of Alignment Services at SLS, said that data from all the various sensors is stored simultaneously, so that if an event occurs, its impact would be seen in each sensor at the same time. Both raw and processed date will be retained, in separate databases. It is a complex system that generates a huge amount of data, he said, which can be exported and sent ashore for further analysis in case, for example, a class society asked to see it.

It uses proximity sensors to monitor the shafting – Mr

THRUSTERS & PROPULSORS For the latest news and analysis go to www.motorship.com MARCH/APRIL 2024 | 11

8 Sensors along the shaft line provide continuous information to the monitoring system

8 Wärtsilä’s Airguard seal now comes with a 10year service interval

Hyrup prefers these over accelerometers since those devices would be affected by background noise – and one of the critical parameters measured is bearing wear-down, which enables a prediction of a bearing’s lifetime; something that is especially relevant in water-lubricated systems.

Sensors are positioned in pairs – one making vertical measurements and the other horizontal – including one pair as close as possible to the propeller. That is straightforward to arrange in a newbuilding but not as easy in a retrofit installation, he said. Other locations include the forward seal

and regions of the shaft that have the highest mass, since that is where the highest amplitudes would be seen, for example in the event of propeller damage.

Although the IntelliSafe bearing also relies on sensors, there is no direct connection between that and the shaft monitoring system, but the shaft monitoring system will notice any performance changes as a result of the IntelliSafe’s lubrication processes. There might also be cybersecurity implications if the two systems were connected, he said, “so we tried to keep them apart.”

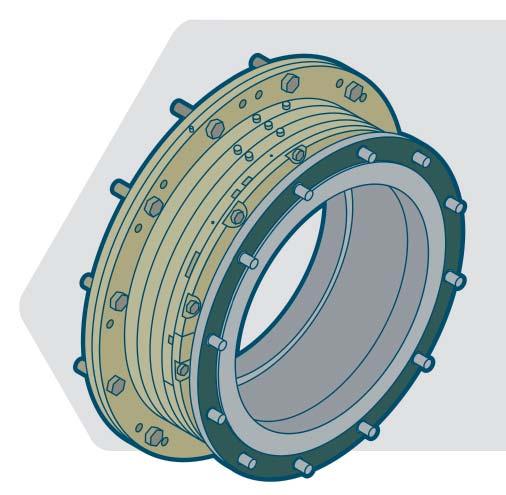

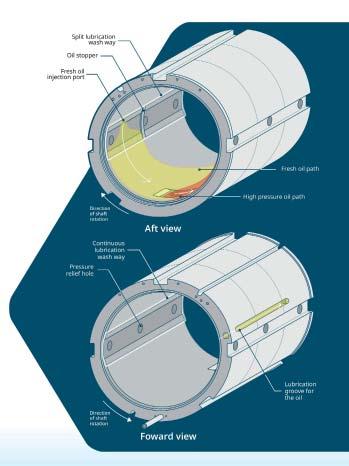

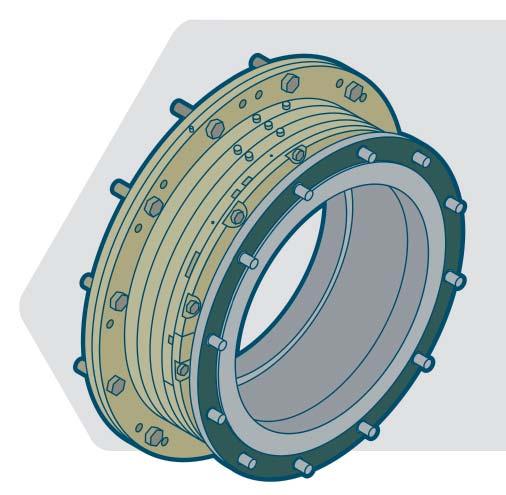

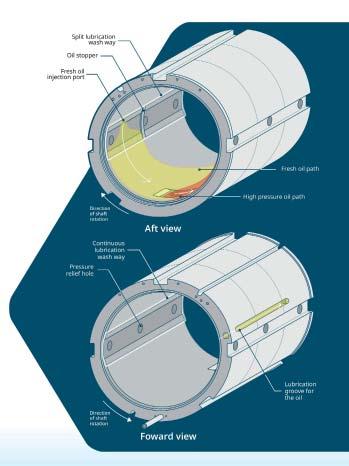

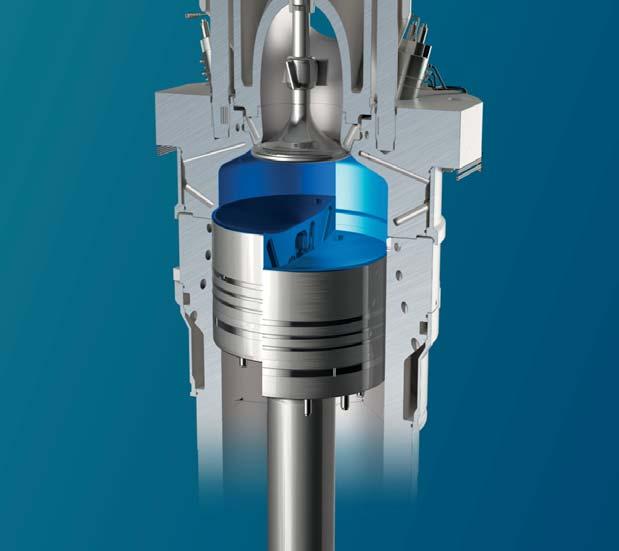

IntelliSafe is caring for bearings

Wärtsilä SLS’s IntelliSafe bearing uses sensors to provide immediate information to control oil flow in the event that there is a risk of metal-to-metal contact, which would result in expensive damage to the bearing and the shaft. SLS Technical Manager, Engineering, Jose Antonio Vazquez described a four-step development process that enables the bearing to react in real time to prevent such situations developing.

Step 1 was to include sensors within the bearing at critical places to provide information about the oil film thickness. These are typically mounted either side at the aft part the IntelliSafe bearing and provide proximity data to indicate the clearance between the shaft and bearing.

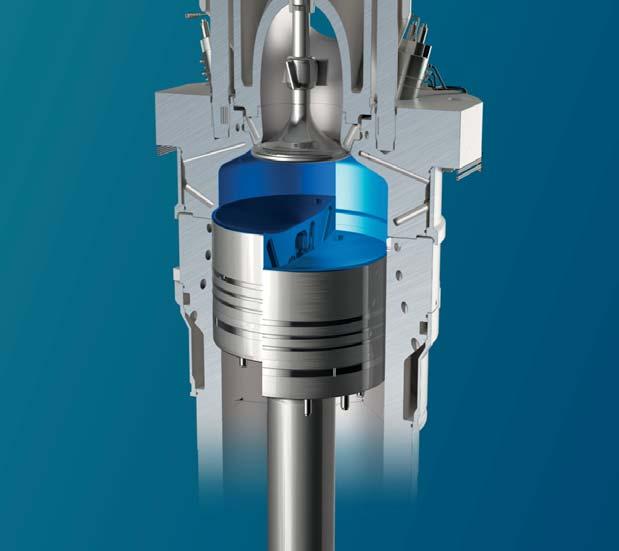

In Step 2, lubrication was improved for standard operating conditions. For example, the oil injection port is supplied with cooled oil and they are positioned so that they can provide fresh oil to the areas of the

bearing that most need it. This is achieved by arranging lubrication wash ways within the bearing to guide the oil to where it is needed, supplemented by pressure release holes to relieve any increased oil pressure.

For Step 3, however, the bearing has a specific high pressure oil injection port directly below the shaft to supply additional fresh oil directly below the shaft in critical conditions to prevent metal-to-metal contact. This is optimised to operate at all load and speed conditions.

A final Step 4 in the design added a hydraulic unit connected to a control box. This monitors all the sensor outputs to determine the appropriate lubrication requirements, reacting in seconds to deliver sufficient lubrication to prevent bearing damage.

8 IntelliSafe bearings provide lubrication when and where needed to avoid metal-to-metal contact

8 An EvoTube’s short length can allow more cargo capacity

THRUSTERS & PROPULSORS 12 | MARCH/APRIL 2024 For the latest news and analysis go to www.motorship.com

NEW METHODS FOR NEW MARKETS

If customers for its products are content with currently-available equipment (see ‘Back to the FuTube’), Wärtsilä has to reach two groups of customers that its innovations offer operational, as well as technical, benefits

Those groups are shipowners and shipyards: the former need to be convinced that they should specify Wärtsilä’s seals, bearings and supporting equipment, while yards must be willing to fit them in preference to whatever they might have included in their standard design specs or what they might have chosen based simply on price.

Thomas Pauly, responsible for its future portfolio and market intelligence at Wärtsilä’s Shaft Line Solutions (SLS), has played his part and identified not only what shipowners and manager think they want, but also what they actually need (see ‘Back to the FuTube’). Now, Wärtsilä needs to engage those same owners and managers and convince them that their preferences and pain points can both be satisfied by naming its equipment in their own newbuilding specifications.

This marks “a step change for the industry,” believes Matthew Bignell, International Business Development and Product Management specialist at SLS. Speaking to The Motorship, he described it as a positive approach, especially as FuTube’s modular nature means that shipowners can adopt just one element, or the full package of technologies. They are also relevant to both newbuilding and retrofit decisions, adding diversity into discussions.

He also acknowledged the value of the test rig in SLS’ bearing centre, since it allows a customer to see how their proposed set-up will behave in a typical vessel.

Even when an owner has decided to specify a particular system, that may not be the end of the story. Jens Hyrup, Manager of Alignment Services at SLS, recalled newbuilding installations in which the yard fitted a component and its sensors, but the corresponding control and monitoring cabinets were fitted by Wärtsilä after delivery. “It's not

something that the shipyard wants to include, because it's just more work for them,” he said.

SLS Sales director Panu Sorvisto agreed about the need to get yards onside. “Sometimes there is a reluctance to change … so we want to be their friend,” he said. This friendliness includes helping the yard to understand the impact of accepting a different technology from their usual spec, such as extra piping and cabling.

But, like Mr Bignell, he sees the owner as the driving force. When an owner asks for a particular design change, most yards are willing to modify their plans, he said, for a cost. “But we really have to be available to help. Then there is a lower resistance to implement it into the ship design,” he said.

Sterntube failures on the rise

Increasing numbers of vessels are suffering failures in their stern tube bearings, according to SLS Technical Manager, Engineering, Jose Antonio Vazquez and 90% of them are in the aft bearing. And he believes he knows why. “Increased pressure over operators and crews to meet targets makes them take risks,” he said.

His colleague Beatriz Garcia manages SLS’ Bearing Centre in Vigo, Spain, where many damaged bearings end up for repair. Speaking to The Motorship, she suggested that excessive speed, causing high temperatures in the bearings, is behind some of the damage that comes into the Bearing Centre, but she also reported another trend: some bearings are being sent

for repair that, in the past, might have simply been replaced, perhaps because the laser technology can complete repairs without the risk of deformation from pre-heating.

Among the tools in her centre is a patented laser system that can apply white metal to new or damaged bearing surfaces in a precisely-controlled sequence. It can work on bearings up to 4m external diameter and 2.5m long, weighing up to 10 tonnes and reliably achieves a bond strength between the new bearing surface and the bearing’s steel base of 100MPa. This has enabled the plant to win contracts for bearings to be used in nuclear power stations, for which a bond strength of at least 90MPa is demanded.

Mr Vazquez identified some operational

8 It is important to be friendly towards shipyards, says Panu Sorvisto

factors that can lead to the metal-to-metal contact that results in bearing damage. Among them is ‘hammering’, which can happen if the propeller is not fully submerged, which can happen if the ship is not fully-loaded and “the operators and crew are under pressure to deliver,” he said. This hammering can destroy the bond that secures the bearing material resulting in cracks that will force the ship into dock for repairs, incurring large costs and losses.

Shaft alignment is also critical – particularly at high speeds – otherwise bearing damage can occur and even the shaft might be damaged beyond repair because it could overheat and crack, putting the ship out of action for months, he suggested.

THRUSTERS & PROPULSORS For the latest news and analysis go to www.motorship.com MARCH/APRIL 2024 | 13

BLOWDOWN A NEW TARGET FOR METHANE SLIP REDUCTIONS

While engine makers make progress on methane slip from combustion chambers, MAN Energy Solutions is additionally targeting the blowdown of recirculated fuel when gas operation is stopped. Fuel supply system blowdown is the venting of pressurised methane from the engine and piping downstream of the gas valve train directly to the atmosphere. It is a routine procedure conducted before gas purging with nitrogen.

In a white paper titled Managing methane slip on ME-GI installations published earlier this year, the company stated it is reintroducing its already developed system which was introduced with its first design iteration of the ME-GI engine technology but which at the time never saw adequate market interest. As more focus has now come on emissions reductions, vessel owners and operators have started focusing on downstream emissions as well, posting the required demand for MAN ES to re-introduce their system in an updated version.

The gas return system has reported the capability to capture up to 95% of the gas emitted during blowdown. The gas can then be stored in a buffer tank and supplied to downstream consumers such as boilers or auxiliary engines rather than being emitted from the vent mast. The system will be offered as an optional feature for new ME-GI engines.

Currently, MAN guarantees a methane slip in the range of 0.2-0.28 g/kWh for its ME-GI engines across loads of 25-100%. Research quantifying emissions continues with the white paper providing results from two different engine sizes: 10G95ME-C10.5-GI (single engine on a container ship) and the smaller 5G70ME-C10.5-GI (twin engines on an LNG carrier).

Engine makers have ongoing work underway to reduce methane slip, including tackling emissions from blowdown Copyright:

Data was obtained from CEAS engine data reports and real engine operating profiles. Of the total exhaust emission profile, both engines displayed a methane content of 6-7%, calculated by Global Warming Potential. Looking at the overall vessel emissions, including both exhaust emissions and what is ventilated from the supply system, the dual engines LNG carrier, displayed a methane content of approximately 17%. For the container vessel, it was 11%.

MAN notes that the ME-GI provides owners with specific fuel oil consumption 7% less than that of a low-pressure twostroke engine and 32% less than a four-stroke genset.

ME-GI engine exhaust methane slip is only 16% of that from a low-pressure two-stroke engine (ME-GA) and only 6% of that of a four-stroke. Even with these merits research continues to reduce total methane slip. As engine exhaust values are already negligible, MAN has, with the latest technological offer, turned its sight towards the supply systems and vessel integration for further reductions. For the ME-GA engine, high-pressure exhaust gas recirculation is the technology of choice, and oxidation catalysts such as IMOKAT II are the choice for fourstrokes, along with optimized design features such as cylinder skip firing and reduction in crevice volumes.

Low-emission engines

Meanwhile, Wärtsilä recently introduced a new ultra-low emissions version of its Wärtsilä 31DF engine which can

further reduce methane emissions on a 50% load point by up to 56%. On a weighted average, this new technology can reduce methane emissions by 41% more than the standard Wärtsilä 31DF engine.

The new version, which is applied on one of the four engines on board Wasaline’s Aurora Botnia ferry, has already helped the Finnish-Swedish ferry operator further reduce the Aurora Botnia’s methane emissions by 10%. As part of the EU co-funded Green Ray and SeaTech projects, Wärtsilä piloted the ultra-low emissions concept onboard the Aurora Botnia with results verified through an independent study conducted in December 2022 by VTT, the Technical Research Centre of Finland.

Researchers from VTT studied methane slip from two of the Wärtsilä 31DF engines onboard – one in standard configuration and the other piloting the new combustion concept. These medium-speed 4-stroke engines have 8 cylinders, with a power of 550 kW per cylinder. Both engines were studied under five engine load conditions while the vessel operated on its normal route between Vaasa, Finland and Umeå, Sweden.

The study showed that overall methane emissions were lower than what has been reported by previous onboard

8 MAN Energy Solutions noted that it is developing a gas return system, which would enables reuse of almost the entire blowdown fuel amount, as an optional feature for ME-GI engines

TWO-STROKE ENGINES 14 | MARCH/APRIL 2024 For the latest news and analysis go to www.motorship.com

MAN ES

Wärtsilä launched the new ultra-low emissions version of the Wärtsilä 31DF engine to the commercial market last year ‘‘

studies with similar-sized low-pressure dual-fuel engines. Both engines emitted less methane at higher engine loads, especially compared to the lowest engine load of 10%. At engine loads of 50–90%, the new combustion engine produced 50–65% less methane compared to the standard engine, and at the lower loads (with higher absolute methane levels), the difference between the engines was even higher. At 10% load, the engine with the new combustion concept produced methane emission below 4 g/kWh compared to the over 12 g/kWh of the standard engine. At higher engine loads, the emissions from the new combustion concept were below 2 g/kWh.

Results also indicated that the upgraded engine technology had great potential to reduce overall emissions (including both CO2 and methane). Following the positive results, Wärtsilä launched the new ultra-low emissions version of the Wärtsilä 31DF engine to the commercial market last year.

The new engine technologies being developed will help shipowners futureproof their vessels against potentially tightening global requirements. From 2025, the FuelEU Maritime regulation will require ships calling EU ports to gradually reduce their well-to-wake greenhouse gas (GHG)

Wärtsilä’s new ultra-low emissions version of its Wärtsilä 31DF (the 10V31DF variant is pictured) has delivered methane emission reductions on a 50% load point of up to 56%.

version of its Wärtsilä (the 10V31DF variant is has of up 56%

intensity, including methane slip. The IMO is expected to introduce a goal-based marine fuel standard regulating the phased reduction of the marine fuel GHG intensity, also including methane slip, from 2027.

TWO-STROKE ENGINES For the latest news and analysis go to www.motorship.com MARCH/APRIL 2024 | 15 es. ds, At ne rd ne er. pt to ne ere ne ns ve ns ket elp ll ititildithliThIMOitdt

becker-marine-systems.com Becker Twist Rudder with bulb Your advantages: • High propulsion efficiency • Strong reliability • 24/7 support

BULKER LCA QUANTIFIES ENERGY SAVING TECHNOLOGIES

The CHEK project’s analysis of the emissions reduction potential that multiple energy saving technologies would have on a Kamsarmax bulk carrier paves the way for decarbonisation solutions and more accurate ESG reporting

Researchers from World Maritime University and Deltamarin have conducted a design-stage life cycle assessment (LCA) comparing a standard EEDI phase 2 compliant Kamsarmax bulk carrier (as baseline vessel) with an optimised design that includes multiple energy-saving technologies and operation on liquified biogas (LBG) and hydrotreated vegetable oil (HVO).

The study is part of the on-going CHEK project and builds on the digital twin and lifecycle modelling that has been developed throughout the project. The results showed that the future vessel could reduce energy consumption by 31.23% compared to the baseline vessel model. A significant reduction in CO2 (48.6%), NOx (88.6%), SOx (100.0%), and black carbon (94.0%) in the tank-to-wake phase was also achieved as a result of the energy-saving technologies working in synergy with the alternative fuels.

The optimised bulk carrier model used in the LCA includes WindWings technology, air lubrication system, ultrasound antifouling system, waste heat recovery, shore power and a battery utilised for spinning reserve. A hybrid 4-stroke power plant minimises the impact of fluctuating engine loads resulting from, for example, the wind-assist technology.

The study acknowledges that there is no “silver bullet” solution for decarbonisation, so multiple technologies will have to be employed synergistically, along with alternative fuels, and this will require careful evaluation using a systematic tool to ensure optimal combinations are adopted.

The LCA methodology provides an accurate and systematic tool for evaluating the environmental impacts of the new design throughout its entire lifecycle, says Mia Elg, R&D Manager at Deltamarin. The LCA framework used consists in goal and scope definition, life cycle inventory (LCI), life cycle impact assessment (LCIA), and results interpretation, and Elg says Deltamarin now has the tools and databases to provide the analysis to ships operational today or to new ship designs on a design platform capable of evaluating how multiple energy saving devices can be combined to maximise efficiency.

The CHEK project study investigated the comparative LCA of the two vessels, future vessel versus baseline vessel based on digital models and published research, thus including raw material extraction to production, operations,

maintenance and vessel disposal. It aimed to be as holistic as possible. For example, the construction phase included also transportation of material from steel mills to the shipyard and electricity consumption in the shipyard. The future vessel had higher emissions during construction and maintenance than the baseline vessel.

Elg notes that some yards in China are already providing data on their emissions, so she anticipates vessel-specific LCA accuracy will increase further yet.

The analysis incorporated realistic modelling of the ship propulsion power system including the impact of weather on typical routes. Fuel consumption estimates were obtained from a system-level energy model “DeltaKey”, where the propulsion profile is combined with the ship’s other energy consumers.

The CHEK project is targeting long-distance shipping with its evaluation of multiple decarbonisation solutions combined on a single vessel. The project, while aiming to inform both newbuild and retrofit, has specifically involved the design of a wind energy optimised bulk carrier and a hydrogen powered cruise ship.

The three-year project started in June 2021 with project partners include BAR Technologies, Cargill, Deltamarin, Lloyd’s Register, MSC, Silverstream and Wärtsilä, among others.

“This LCA study is an important new dimension to vessel design which underscores the vital importance of adopting a holistic approach to maritime sustainability that encompasses innovative technologies, alternative fuels, and a comprehensive understanding of the entire life cycle of vessels,” says Elg. “By integrating the design stage simulations of ship fuel and energy utilisation into LCA, we are able to provide environmental assessment of the emissions of the vessel from a life cycle perspective, which is more accurate than indicators such as EEDI and CII. That way our customers can know how the design will actually impact the environment.”

She anticipates the modelling to extend beyond air emissions to water emissions (water footprint), acidification, land use, biodiversity impact and others. The next articles to be published from the CHEK project, due later this year, will be an LCA of a cruise ship running on hydrogen and the digital twin stage energy modelling results.

8 The results of the CHEK project involved comparisons of the investigated the comparative LCA of two vessels, the MSC Grandiosa and Pyxis Ocean.

TWO-STROKE ENGINES 16 | MARCH/APRIL 2024 For the latest news and analysis go to www.motorship.com

VCR NARROWS GAP BETWEEN DUAL-FUEL TWO-STROKE DESIGNS

Early orders indicate that WinGD’s latest advance to its X-DF platform could answer some of the challenges associated with low-pressure dual-fuel engines

In the comparison between low-pressure and highpressure dual-fuel engines, two things stand in favour of high-pressure, Diesel-cycle concepts: better performance in diesel mode and lower methane slip when using LNG. A new technology from engine designer WinGD aims to both close that gap and improve the case further for lowpressure engines amongst those already convinced – and there are early signs that some operators are seeing the value in variable compression ratio (VCR) technology.

As reported previously, VCR is the result of a decade-long development project between WinGD and Mitsui E&S DU Co, formerly Diesel United. It enables an engine’s compression ratio to be adapted for the first time on marine engines, optimising combustion depending on fuel type, ambient conditions, engine load and other parameters. In early tests, WinGD was encouraged by efficiency improvements in Diesel mode, but in subsequent tests, improvements in both gas efficiency and methane slip abatement have been noted.

ypg

3.1%, outsized cing the uel use.

In the most recent tests, using VCR reduced fuel consumption and CO2 emissions by 7.7% when running on diesel. In LNG mode, overall GHG emissions (including CO2 and methane) were reduced by 4.6% compared to a gas consumption reduction of 3.1%, highlighting the outsized impact VCR has in reducing methane slip, beyond the emissions saved by lower fuel use.

WinGD recently reported that it has received around 40 orders for Variable Compression Ratio (VCR) technology since it was introduced in June last year. Among the orders are engines for nearly 20 LNG carriers – the biggest vessel segment for low-pressure dual-fuel engines – but also pure car and truck carriers and bulk carriers. Given the promising test results, interest could extend into the container segment as well.

According to WinGD GM Application & Technical Sales Marcel Ott those orders indicate demand from shipowners that will only rise “as methane slip is costed into ship operation through carbon pricing, and while fuel supply flexibility necessitates peak efficiency on both LNG and diesel fuels”. With several LNG carrier newbuilds expected to be con in the coming months, Ott is optimistic there will be further orders for VCR to announce shortly.

There are further factors in VCR’s favour that may make it a popular addition to X-DF. Efficiency benefits while using LNG are highest at part-load operation, WinGD claims, making it well-suited to modern operating profiles such as slow steaming, providing the largest bene loads used most often. And it retains both the capex and opex competitiveness of lowpressure engines: the hydraulic solution has no

d that it has received around 40 ession Ratio (VCR) technology June last rly 20 LNG carriers – the or ar and truck carriers and mising iner Technical that will rise sted into n and y necessitates G and diesel G confirmed Ott is er orders y rs in VCR’s opular ile eration, WinGD ted to modern slow efits at engine both titiveness of lowulic solution has no

impact on engine footprint or installation requirements and does not need additional maintenance between

impact on engine o need additio overhauls

WinGD claims that its wide consumptio benefi

WinGD claims that its own evaluation of systemwide energy consumption and emissions show the ts of deploying X-DF engines with VCR technology. On a 174,000 cbm LNG carrier with a typical operating profile, a configuration including two 5X72DF-2.2 engines with VCR outperformed not only conventional low-pressure engine systems but also high-pressure engine arrangements in terms of LNG consumption, air pollution, greenhouse gas emissions, electrical power demand for auxiliary machinery and

On a 174,00 outperfor terms of LNG demand fuel costs.

But Ott believ improving the bus LN

8 WinGD has received around 40 orders for Variable Compression Ratio (VCR) technology since it was introduced in June last year

But Ott believes VCR can go further than improving the business case for low-pressure engines in the LNG carrier segment. He says: “We’ve seen on the testbed that VCR brings ciency in line with our own highpressure single-fuel diesel X-engines. Diesel ciency is important for operators that exibility to choose between fuels, rather than using the cargo they are carrying, and we believe that VCR could tip the business case even in segments that might traditionally have opted for highpressure dual-fuel engines.”

“We’ve seen on t diesel effi pressure single-f effi is im want full flexibil rather than u and w the business c tradition dual-fue

TWO-STROKE ENGINES

18 | MARCH/APRIL 2024For the latest news and analysis go to www.motorship.com

WinGD

Copyright:

smm-hamburg.com the leading international maritime trade fair driving the maritime transition 3 – 6 sept 2024 hamburg facebook.com/SMMfair youtube.com/SMMfair linkedin.com/company/smmfair smm-hamburg.com/news see what makes SMM the #1 smm-hamburg.com/trailer

ELECTRIFICATION SPREADING INTO THE DEEP-SEA SEGMENT

Full electrification of deepsea vessels may be some time off yet, but the outlook isn’t as grim as some might suggest

Marine technology research consultancy Thetius launched its Maritime Alternative Fuels Barometer in January concluding that while batteries and shore power can support decarbonisation, deepsea shipping electrification remains unrealistic.

The Barometer measured the gaps between the shipping industry’s perception of alternative marine fuels and the reality in terms of availability, supply, technological readiness and impact on emissions. Commissioned by SEA-LNG, it was based on an analysis of market announcements, data on alternative fuels from DNV’s Alternative Fuels Insight platform, and 25 interviews with a range of maritime stakeholders.

A majority of stakeholders perceived batteries as a shortterm option and only applicable for shortsea shipping. One interviewee stated: “The technology won’t advance enough for deepsea shipping. Even electric vehicles aren’t reliable.”

Despite this, full electrification is gaining interest. CIMAC, in cooperation with the Maritime Battery Forum (MBF), is running a survey on battery use in deepsea shipping. The goal of the survey is to find out why, for what type of vessels and for what type of applications shipowners are considering batteries and if they think that full electrification is going to be an option for them in the future.

Early starters

Electric ambitions are progressing, with ferries leading the way. The battery capacity for each of Norled’s three new ferries will be approximately 8MWh, making them the ferries

with the largest battery capacity in Norway. Meanwhile, Incat Tasmania has designed the largest lightweight battery electric ship (130m in length) so far constructed in the world for delivery to its South American customer, Buquebus. The 100% battery electric ropax will have over 40MWh of battery storage, four times larger than any battery installation that has been installed anywhere in the world for the marine transport environment, says Incat.

Two electric container ships are being built by CHI (Yangzhou) for COSCO Shipping Development. The world's first 700 TEU electric container ships will have a battery capacity of over 50MWh and will sail the Yangtze River from Jiangsu to Shanghai. It is expected that each ship will reduce CO2 emissions by the equivalent to 2,035 family cars a year or 160,000 trees.

Knowledge sharing

Shaun White, the Managing Director of Foreship (UK), has been a strong supporter of maritime battery systems for a long time. He emphasises the important role advancing safety measures and establishing standards can play in addressing misconceptions that have hindered the recognised benefits of installing shipboard energy storage solutions.

“The maritime battery is often misunderstood, with many believing that a sizable battery is necessary for environmental and operational advantages, leading to cost, space, and safety concerns. Consequently, proposals for projects face difficulties in obtaining necessary approvals and moving forward with implementation.”

ELECTRIFICATION & AUTONOMY 20 | MARCH/APRIL 2024 For the latest news and analysis go to www.motorship.com

8 Bibby Marine eSOV

Credit: Yangzhou

The maritime battery retrofit market is caught in an ongoing cycle where prices do not decrease because of limited adoption, and limited adoption persists due to high prices. Foreship collaborates with owners on battery projects, conducting everything from feasibility studies, and detailed design to installation supervision. Doing so has involved working ahead of regulations to make battery systems safer, more dependable, and better designed, says White.

Constant technological development makes it critical that the maritime industry adopts safe and uniform standards, based on well-understood, industry-driven guidelines,” says White. “Safety and standardisation will be key for confidence in and the wider uptake of shipboard battery technology.”

In its first EMSA Guidance on the Safety of Battery Energy Storage Systems (BESS) on board ships, published last year, Europe’s maritime safety organisation notes: “There is no regulatory instrument at international level on the safety aspects of using batteries in ships. This important scope has been left to and evolved through the requirements of class, industry standards and codes with limited requirements and experience from…flag states.”

The strongest trend at the moment is the uptake of lithium iron phosphate (LFP) batteries in the stationary energy storage system market ‘‘

Foreship was among the stakeholders consulted on the functional requirements for risk mitigation included in the new EMSA Guidance. The resulting document goes beyond batteries and their integration, to include the design, installation, and operation of systems, says White. “This Guidance offers a significant step forward for assurance of the monitoring, management and protection of battery safety which will encourage a wider pool of owners to consider the advantages inherent in battery systems.” Recommendations cover training and operational procedures, ventilation, fire safety, systems testing and maintenance, and relevant shipboard spaces.

Foreship has also contributed to emerging maritime guidance and industry best practices for batteries, and to developing recommended standards so that battery systems are harmonised. It was one of the 21-strong group of expert organisations consulted to develop the MBF’s first Firefighting Guideline for Maritime Battery Systems Version, published in October 2023, detailing techniques, and strategies to deal with battery systems fires on board hybrid and electric ships. The company has also contributed to MBF’s Guideline to Standardisation of Containerized Maritime Battery Systems, whose publication is expected to accelerate the adoption of both fixed and swappable shipboard battery.

An optimally sized battery can have widespread positive impacts - on engine efficiency, emissions reduction and safety, in its use for peak shaving, load ramping or as spinning reserve. Batteries are a proven technology which contributes to achieving reduced emissions during ship operations while enhancing the efficiency of many alternative ship fuels and sources of power it works with, White points out.

Technology developments

Tomas Tengner, Global Product Manager, Energy Storage, ABB Marine & Ports, is working on projects where relatively small batteries are used to hybridise shaft generator systems

on deepsea cargo vessels. “We notice a trend of increased battery capacity that may enable zero emission port calls and cold ironing in ports without shore connection. We are continuously developing our onboard power and control systems to enable efficient and safe integration and usage of ever-increasing battery sizes.”

Increased cost for emissions in combination with more and more stringent regulations is driving an increased demand for low and zero-emission solutions, and batteries will be deployed wherever possible, he says, as they offer the highest system level energy efficiency.

Battery technology is developing rapidly. “The strongest trend at the moment is the uptake of lithium iron phosphate (LFP) batteries in the stationary energy storage system market,” says Tengner. “Big investments into this technology, primarily in China, have brought the cost down significantly, and LFP cells are currently offered for below 60 USD/kWh. This trend starts to merge into the marine energy storage system space, with several marine vendors launching products based on standard grid-type LFP cells.

“Looking a bit into the future, Na-ion batteries are being developed with close to the same energy density as LFP. These batteries utilise globally abundant raw materials and have the potential to further drive the cost down, enabling even larger vessels to go fully electric.

“For vessels that are weight sensitive, such as fast ferries, the solid-state batteries that are being developed around the globe by companies such as Toyota, Prologium, Solid Power and CATL to name a few, could enable full electrification of longer routes. However, this technology is

cation of longer routes However, this is still some years away, and it remains to be seen when and how it will be deployed for marine applications.”

8 After conducting an in-depth study on the potential for a fully-electric large jack-up WTIV, GustoMSC concluded implementation remains impractical until battery suppliers improve the power density of battery cells

ELECTRIFICATION & AUTONOMY For the latest news and analysis go to www.motorship.com MARCH/APRIL 2024 | 21

8 Shaun White, the Managing Director of Foreship (UK)

For deepsea vessels, high capital cost and low battery energy density is still preventive for full electrification. “Instead, biofuels and e-fuels will be used. Higher fuel costs will put more focus on energy efficiency, which can be realized by electric propulsion such as ABB’s Azipod propulsion units®, and hybrid power plants,” says Tengner.

“With energy consumption getting more expensive –either in the form of high CAPEX for batteries, or in the form of more expensive bio- or e-fuels, propulsion efficiency becomes increasingly important. ABB’s Azipod® propulsion systems and even more so our innovative ABB Dynafin™ concept that was launched last year, can significantly reduce propulsion power requirements and save valuable MWh. When considering electrification of a new vessel, the addition of energy storage to a propulsion system can often make the difference between a dead or flying business case.”

Offshore potential

Bibby Marine recently appointed Longitude Engineering for the design of a zero-emission electric service operation vessel (eSOV). The eSOV is based on Longitude Engineering’s OSD-IMT9605 design which Longitude Engineering is now developing to Approval in Principle stage. Longitude Engineering will apply a multi-disciplined engineering and marine consultancy team to work on this project, including Bibby Marine, Port of Aberdeen, ORE Catapult, Kongsberg, DNV, Shell and Liverpool John Moores University.

The vessel will be powered by a hybrid 20MWh battery system and dual-fuel methanol generators for back-up and offshore charging capability. The vessel will provide ultra-low emission support for offshore construction, operations and maintenance activities in the offshore renewables sector in the UK and elsewhere in Europe.

Damen Shipyards Group has also designed a fully electric SOV with offshore charging capabilities. The SOV 7017 E features a 15MWh LFP battery, sufficient to power the vessel during a full day of operations. Damen’s business case analysis indicates a healthy return on investment, ranging between five and 15 years, depending on the scenario.

Damen has partnered with UK-based MJR Power & Automation, a company that has developed a 4MW charger connector, sufficient for a 70-metre vessel. The company is also working on a scaled up 8MW version that will enable charging of vessels up to 90 metres in length. Charging is carried out while the vessel is in a low power DP mode, which requires less energy than the hotel load. A full charge typically requires energy produced in just a few hours by a single turbine.

For GustoMSC’s offshore construction vessel designs, offshore charging is less practical as they are installing turbines, but fast charging in port is a potential option. “Our vessels are designed to be working 24/7. Therefore, minimising any non-productive time is crucial,” says David Inman, Sales Manager at NOV-subsidiary GustoMSC.

Inman sees full electrification as an evolution. “You start with the easier ones to do. So, in our world, that means the small crew transfer vessels that come into port every three or four hours and have lower energy usage than the construction vessels.”

However, even for the larger vessels such as wind turbine installation vessels (WTIVs), return to port can potentially occur often enough to make battery charging as part of full electric power systems feasible in the foreseeable future. Even batteries installed as part of a hybrid diesel-electric system make a lot of sense, says Erwin van den Berg, Consultant / Expert Naval Architect at GustoMSC, due to the variation in load demand during the operations undertaken

by these vessels, such as dynamic positioning, jacking and crane operations. In these scenarios, batteries can provide peak shaving or spinning reserve, reliable redundancy and an attractive alternative to a genset in a diesel-electric setup.

Unlike deepsea cargo vessels, these offshore vessels are fewer in number, are more diverse and have a variety of offshore activities, making it harder to establish energy efficiency and carbon intensity index regulations that might push development faster. Battery adoption may come in association with fuel cell uptake. Fuel cells have relatively slow ramp up and ramp down performance, says van den Berg, making energy storage a necessity.

In limiting the impact on the environment of the vessels, a holistic view on vessel design is of key importance, and to do so, the company has set up the GustoMSC Energy Efficiency and emissions Quest (GEEQ) program. “The selection of fuel type, power supply systems including electrical energy recovery and storage should match the mission equipment and the type and arrangement of the vessel. And the vessel design should be matched with the demands of the foreseen operational profile and operation areas,” says van den Berg.

As part of GEEQ, GustoMSC has conducted an in-depth study on the potential for a fully-electric large jack-up WTIV but found that, with the battery systems currently on the market, the impact on the maximum elevated weight and on the deck area is such that carrying capacity and range is too much impaired for practical implementation. “We do, however, see that battery storage capacity per unit weight is expected to increase fast in the coming years. A few years from now, a battery powered WTIV might become feasible,”

ns, ng Our re, vid art he or on ne ally full re. tric rg, he ken says van den Berg.

ELECTRIFICATION & AUTONOMY 22 | MARCH/APRIL 2024For the latest news and analysis go to www.motorship.com

8 The first two 700 teu pure-electric container ships are on order for COSCO Shipping Development at CHI

8 Tomas Tengner. ABB Marine and Ports

LearnfromC-suitekeynotepanel

ErThamWaiWah ChiefSustainability Officer

TheMaritimeand PortAuthorityof Singapore(MPA)

DiscussingPortsandShipping-collaborationtoachieve2050goals

DrSanjayKuttan ChiefTechnology Officer

GlobalCentrefor Maritime Decarbonisation (GCMD)

LarsRobert Pedersen DeputySecretary General BIMCO

Sponsoredby:

Supportedby:

CaptainK. Subramaniam GeneralManager PortKlang Authority

AntonisMichail WPSPTechnical Director International Associationof Portsand Harbours(IAPH)

EvaLiu Headof Shipment Product OceaniaMarket Maersk

Programmeoutnow-Booknow

Gaininsightsfromindustryexpertson:

GreenShippingCorridors

InfrastructureDevelopment

Futuremarinelowandzero-carbonfuels

Bunkeringinfrastructure

GreenFinance

GreenTechnologies

MaritimeDigitalisation

Itisamust-attendeventforpolicymakers,portsandterminaloperators, shippingcompanies,shippersandlogisticscompanies,fuel&propulsion providers,classificationsocietiesandassociateddecarbonisationclusters.

Forfurtherinformationaboutspeaking,sponsoringorattendingasa delegate,contacttheEventsteamon: +441329825335

info@greenseascongress.com

greenseascongress.com

Mediapartners:

Mediasupporters:

#GreenPortsandShipping

A FUTURE IN THE MAKING

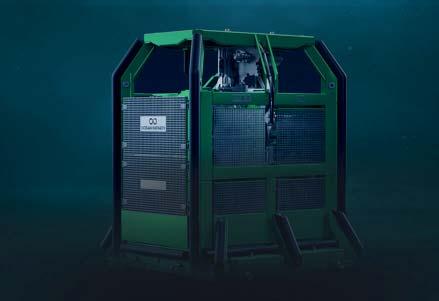

Among a clutch of companies giving effect to the concept of an unmanned ship, robotic subsea technology exponent Ocean Infinity has commissioned a flotilla of offshore vessels specifically designed for eventual remote control from ashore. writes

David Tinsley

The new 78m Armada series offers a multi-role capability, with the accent on geophysical survey, geotechnical sampling, and inspection, maintenance and repair (IMR) services.

The investment in the eight-ship class, as with the other strands of the Armada fleet development programme encompassing 21m, 35m and 85m designs, is complemented by the creation of a remote control centre (RCC) network and proprietary remote communications system.

Thus, while each vessel has a relatively small crew complement, the ground is being laid for a future wherein all operations and navigation will be handled by the onshore establishment of mariners and specialised personnel at workstations. Clearly, the project is long-term not only in vision but also in expectation of profitable returns, given the premium entailed in initially coupling crewed vessels with an infrastructure conceived for ultimate, fully remote control. Furthermore, the diesel-electric newbuilds have been engineered to facilitate adaptation over time to new fuels and lessened environmental impact.