Digitisation:

proo

data

ALSO IN THIS ISSUE: ERMA FIRST solutions | Carbon capture | Lubricant race | Electrification doubts MAY/JUNE 2024 Vol. 105 Issue 1221 Learn more today www.eagle.org/sustainability

MEPC 81: Well to Wake debate

Future

fing

Ammonia: Market ramps up Methanol: Going mainstream

14

Dutch know-how for US cableship project

Kalypso Offshore Energy has signed a letter of intent with Royal IHC to develop the first US-flag, Jones Act compliant cable layer to serve the offshore wind market

37 Wärtsilä fulfills largest Chinese methanol newbuild order

Wärtsilä is to supply methanol fuelled auxiliary engines for five new container vessels for COSCO Shipping Lines and seven new container vessels for Orient Overseas Container Line

37 Thordon rudder bearing for research ship

The 77.1m Ocean Endeavour, operated by marine survey company, Gardline, was fitted with the SXL rudder bearing at UK Docks Marine Services’ Teesside drydock

8

Leader Briefing Cathrine Kristiseter Marti has been appointed chief executive officer at Vard Group AS, with effect from 1 June 2024

44

Design for Performance

BIO-UV Group has equipped a first of its kind cargo sailboat with a state-of-the-art ballast water treatment system

46

Ship Description

David Tinsley looks at the P&O Liberte which is setting new standards on the Dover-Calais run

50

50 Years Ago

The June 1974 issue of The Motorship charted the growth of the offshore oil industry

10 ERMA first sets sights on emissions reduction

Greek solutions provider ERMA FIRST has launched a number of sustainable future-proof solutions to help ship owners to decarbonise

24 Future proofing shipping against the next crisis

Captain Steve Bomgardner of Pole Star Global, argues that leveraging digitisation and using data to transform the experience of crew members is key

34 MAN readies for pilot testing of its first ammonia engine

This year, MAN Energy Solutions will conduct full-scale ammonia engine tests and ready its first commercial design

40 Lubricants adapt with changing fuels

As the speed of new fuel development ramps up, the challenge for lubricant manufacturers is to stay ahead

42 Doubts over deepsea vessel electrification

Cost and unawareness of application cases is creating hesitance amongst deepsea vessel owners considering greater electrification

The Motorship’s Propulsion and Future Fuels Conference will take place this year in Hamburg, Germany. Stay in touch at propulsionconference.com

Social Media Linkedin Facebook Twitter YouTube Online motorship.com

Latest news

Comment & analysis

Industry database 5 Events Weekly E-News Sign up for FREE at: www.motorship.com/enews For the latest news and analysis go to www.motorship.com MAY/JUNE 2024 | 3 CONTENTS MAY/JUNE 2024 NEWS FEATURES 4 8

5

5

5

46

REGULARS

10 ThMthi’PlidFtF

VIEWPOINT

DAVID STEVENSON | Editor dstevenson@motorship.com

A well to wake-up call for shipping industry?

Japan’s IHI Power Systems had been falsifying fuel consumption data for at least 20 year and perhaps more alarmingly, its own internal investigation at the end of last month found some marine engines could be in violation of IMO regulations on nitrogen oxide emissions.

Oh dear, this mess will take time to sort out as ship owners who bought engines from IHI may face reputational damage but also expensive retrofits, if the malfeasance is such that emission levels are breached. The lawyers are going to be kept busy, that’s for sure.

To suggest that the IHI episode is the marine world’s very own Volkswagen-gate has been seized upon by other journalists, some citing historic cases to imply that engine data deceit is somehow endemic in the industry. A quick way to compare Volkswagen’s infamous “defeat device” diesel emissions scandal of 2015 to ICI is look at the reaction of the financial markets, the numbers never lie. Following Volkswagen’s transgressions, the company lost about half its value in two months. IHI Global’s parent company saw its share price dip by around 8% following the news and has since made that back up.

The real shame about this incident is if it overshadows all the great work engine manufacturers have been doing to produce cleaner, more efficient units. Regarding the quest to reduce emissions, in this issue alone we look at the progress of ammonia, the growth in popularity of methanol and battery use for deepsea vessels as well as the evolving regulatory maritime framework surrounding pollutants.

On page 39 you can read about MAN Energy Solutions, funnily enough owned by Volkswagen, as it continues to engage in what some might call “mission impossible”, to build a working onboard carbon capture system. The sheer logistics involved in this developing tech seem unfeasible but where’s there a will, there will hopefully be a way. We also cover the company’s progress with its testing of a new 60 bore ammonia engine, being built ironically enough in Japan.

We look at the regulatory framework in which these innovations are occurring in the issue, including March’s MEPC 81 meeting in which a well to wake approach to emissions was underlined as the best approach. But looking at the whole lifecycle of a fuel raises important questions for seemingly green fuels such as ammonia as they can be made in a number of a ways, varying from clean to quite dirty methods. The devil is in the detail it seems for this holistic approach to viewing emissions.

Elsewhere we feature an interview with Christian Berg, managing director of Amogy Norway on the potential of ammonia for long haul voyages and hear from Captain Steve Bomgardner, vice president of shipping & offshore at Pole Star Global about how digitalisation and data can be used to protect the crews and ships alike from future crises.

Finally, ahead of this year’s Posidonia event, we hear from Greece-based ERMA FIRST as the BWTS provider seeks to aid ship owners with emissions reduction through a number of initiatives.

Dutch know-how for US cableship project

New York-based start-up Kalypso Offshore Energy has signed a letter of intent with Royal IHC of the Netherlands for the development of what would be the first US-flag, Jones Actcompliant cable layer to serve the offshore wind market.

Under Jones Act requirements, construction will be undertaken in the USA, leveraging Royal IHC’s design, engineering and shipbuilding know-how as a leading light in vessels and technology for the offshore energy and dredging sectors.

The envisaged newbuild, to be delivered in 2028, is of some 115m length overall and features a dual-lane cable installation system and a 5,000t cable transportation capacity in two carousels. The turntables are dimensioned to load up to 100km of cable for wind farm arrays and connections to the onshore network.

The vessel will fill a gap in US fleet capabilities. Besides installation work in the emergent US offshore renewables business, the diesel-electric cableship is also to be equipped for repair and maintenance tasks.

The preliminary agreement signals the first step in a partnership between Kalypso and Royal IHC, which will collaborate to finalise the contractual, engineering and construction details for the project.

The proposed vessel employs a forward bridge and accommodation arrangement, with all offshore operations effected from the aft working

deck. The two lay lines over the stern sheaves will be fed from the two below-deck carousels, offering identical 2,500t storage capacities. The design includes a dedicated, enclosed cable splicing area for cable joints and repairs.

Handling wherewithal includes an active heave compensated, 100t knuckle boom crane offset on the starboard quarter for installation and construction assignments, and a jet trencher. There will also be provision for a work-class remote operated vehicle (ROV) with a 1,000m umbilical and associated launch and retrieval gear.

The newbuild is to be of DP2 dynamic positioning standard, and powered to ensure transits at 10 knots’ cruising speed, up to a maximum 12 knots. Four primary gensets, each rated at approximately 2,300ekW, supplemented by an energy storage system of some 1,500ekW equivalence, will feed all shipboard consumers.

The main propulsion units in the draft specification are two nozzled, azimuthing thrusters of 2,500kW apiece, complemented in position holding, track keeping and otherwise precision handling mode by two 1,400kW bow tunnel thrusters and a 1,500kW retractable azimuthing thruster in the foreship. Consideration has been given in the design and engineering for optional or future use of methanol fuel in the prime movers.

NEWS REVIEW 4 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

Credit: Royal IHC

8 Jones Act cable layer for the US offshore wind market

ONE CALL +31 343 432 509 QUALIFIED STERN SEAL & PROPULSION SERVICE info@aegirmarine.com aegirmarine.com The Netherlands | China Namibia | UAE | Australia Singapore | Panama USA | Turkey | Greece POSIDONIA GREECE 3 - 7 JUNE BOOTH: 4.32 PHILMARINE, PHILIPPINES 19 - 21 JUNE BOOTH: 137 SMM HAMBURG 3 - 6 SEPTEMBER BOOTH: A1.438 LET’S MEET

smm-hamburg.com the leading international maritime trade fair driving the maritime transition 3 – 6 sept 2024 hamburg facebook.com/SMMfair youtube.com/SMMfair linkedin.com/company/smmfair smm-hamburg.com/news buy a ticket or redeem your invitation smm-hamburg.com/ ticket

Wärtsilä fulfills largest Chinese methanol newbuild order

Wärtsilä is to supply methanolfuelled auxiliary engines for five new container vessels for COSCO Shipping Lines and seven new container vessels for Orient Overseas Container Line.

The order for three 8-cylinder and two 6-cylinder Wärtsilä 32M engines per vessel represents the Chinese maritime sector’s largest order to date for methanolfuelled newbuilds.

“With decarbonisation a major priority for the maritime industry, sustainable fuels, such as methanol, will play a vital role in helping shipping to reduce its greenhouse gas emissions,” said Roger Holm, president of Wärtsilä Marine and executive vice president at Wärtsilä Corporation.

“Wärtsilä continues to make strong investments in developing new fuel flexible technologies and products which enable the industry’s transition towards greener fuels.”

In addition to the engines, the newbuilds will be equipped with selective catalytic reduction exhaust cleaning systems and alternators supplied through Wärtsilä’s joint venture company, CWEC (Shanghai).

The OOCL’s 24,000 teu ships are to be built at the Nantong COSCO KHI Ship Engineering yard, and the COSCO Shipping

8 The Wärtsilä 32M methanolfuelled engine has received type approval certificates from several classification societies around the world

Lines’ 24,000 teu ships at the Dalian COSCO KHI Ship Engineering yard. The vessels are expected to begin commercial operations in 2026.

Thordon rudder bearing for research ship

Thordon Bearings has fitted the rudder bearing for a research ship bound for environmentallysensitive environments.

The 77.1m Ocean Endeavour, operated by marine survey company, Gardline, was fitted with the SXL rudder bearing at UK Docks Marine Services’ Teesside drydock.

“The lead time and price we offer for our SXL solutions are two major benefits for ship owners and

OSV certification

the yards carrying out refit work,” said Neil McDonald, Thordon Bearings’ regional manager, Northern Europe & Africa.

“A like-for-like bronze bush replacement would have taken twelve weeks for the part to be delivered and would have been very expensive. We were able to get the SXL material to the yard in a matter of days and for significantly less. It’s also a better product.”

Schottel propulsion

The order was secured by Bruntons Propellers, Thordon’s new authorised distributor in the UK.

The Ocean Endeavour, which runs a pair of Ruston 8RKCM main engines driving a single four-bladed CP propeller, was previously fitted with a bronze rudder bearing. This required replacement due to age-related wear and tear.

ClassNK approval

Meyer Turku’s turnover up for last three years

Meyer Turku Group’s turnover increased by 10.6% in 2023, with profitability expected to improve further with new ships under construction..

The company’s turnover was €1.43 billion - meaning that both the yard’s turnover and the number of personnel there have been growing for three consecutive years.

“The cruise industry has recovered to the pre-corona level, even beyond it, and there is demand for our high-quality products. We constantly make large financial investments in sustainable development, which is a key competitive factor for us and a natural part of the high-quality shipbuilding that we are known for,” said Tim Meyer, CEO, Meyer Turku.

”It has been exceptional times building the most complex cruise ship in the world. Icon of the Seas has made huge success on the market. With the continuation of the Icon series, our cost efficiency improves, leading to more profitable ships vessel by vessel. So we remain optimistic about the future.”

Like most yards, rising financing costs added to the covid pandemic and the war in Ukraine heavily affected financial results in 2023. But still, Meyer Turku has made remarkable contributions required for the green transition.

BRIEFS

Safety training

DNV has presented Australian green tech company, Fortescue with class and statutory certificates for its dual-fuelled ammonia-powered offshore supply vessel. This marks the culmination of a project beginning in 2021, when DNV was engaged by Fortescue to work on the feasibility study and ‘Fuel ready (Ammonia)’ notation for the Green Pioneer’s conversion. DNV’s Technology Qualification process provided the assurance framework.

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions evasion ‘‘

Four new Damen ASD stock tugs are to be equipped with Schottel RudderPropellers type SRP 270. The compact 1810-series tugs have a length of just 18.25 metres and a beam of 10.23 metres. Each has a bollard pull of 30 tonnes. “Damen has designed the 1810 series with a specific focus on sustainability,” explained Siebe Cieraad, product portfolio manager tugs at Damen. The 1810 design features an electric power generation system.

ClassNK has issued a type approval certificate for the Condition Based Maintenance (CBM) management software SVESSEL CBM developed by Samsung Heavy Industries (SHI). “CBM technology represents a paradigm shift in maintenance practices, empowering us to predict and prevent equipment failures before they occur,” said Dr Dong Yeon Lee, executive vice president/director of Ship & Offshore Research Institute, SHI.

Ocean Technologies Group has created an e-learning module on ammonia safety. To produce the title, ITG brought on board working groups such as The Nautical Institute and the Just Transition Task Force. The module covers the known risk and their mitigations when using ammonia as a fuel and includes topics such as onboard storage, how to deal with a fire involving ammonia and what to do if there is an accidental leak.

NEWS REVIEW For the latest news and analysis go to www.motorship.com MAY/JUNE 2024 | 7

Credit: Wärtsilä

VARD BRINGS IN NEW CEO AND SECURES NAVAL CONTRACT

Cathrine Kristiseter Marti has been appointed chief executive officer at Vard Group AS, with effect from 1 June 2024. Marti replaces the current ceo, Alberto Maestrini, who will retain his position as chairman of the board

Maestrini will continue to lead the Offshore and Special Vessels business in Fincantieri within which Vard sits and will continue to support Vard’s integration in the wider Fincantieri Group.

Cathrine Kristiseter Marti will become the new CEO of Vard from 1 June 2024.

Cathrine Marti comes from the position as CEO of Ulstein Group and has extensive industry experience from 25 years within maritime related industries.

”I am honoured and proud to take over the responsibility as CEO and I am confident, that together with the competent and engaged colleagues in Vard, we will continue to grow as a trusted player in the shipbuilding industry and create long term value for the shareholder,” she said.

Military and other contracts

Last month, Vard and parent company Fincantieri built on their experience and expertise in the construction of naval vessels to present the next generation of military vessels dubbed the Vard Resilience series. The company said the move was done to accommodate a new geopolitical and technological world which requires both knowledge and experience.

Based on the Norwegian Navy's input, the company aims to design and develop new marine vessels designed to protect Norway. Vard is afforded high security clearance as it

owns several large capacity shipyards in the country, commissioning and outfitting the military vessels.

Vard has a long history with naval vessels, most recently with the construction of the three Coast Guard ships in the Jan Mayen class for the Norwegian Coast Guard. The company also has extensive experience with classified procurements and physical security, information management as well as personnel security.

To answer the Norwegian Navy’s demands for the new vessels, Vard has developed the Vard Resilience series with a design aimed to meet the request for standardisation, modularisation, adaptation to the customer's needs and purpose of the vessel, and a long service life.

Vard focuses on using a large proportion of domestic Norwegian suppliers with service networks in Norway and good access and short lead times for spare parts. This is important in terms of local and national value creation, but also important when it comes to security and emergency preparedness in case of conflict.

Vard also signed a three-year agreement with valves, actuation and instrumentation supplier W&O, a global maritime instrument provider last month. Under the agreement’s terms, W&O will provide technical support to Vard as well its products to the company’s bases in Norway, Romania and Vietnam.

LEADER 8 | MAY/JUNE 2024For the latest news and analysis go to www.motorship.com

8 Cathrine Kristiseter Marti, incoming Vard CEO

We’re enabling long-term sustainability

Balancing decarbonization, availability, and economics is a challenge for energy-intensive sectors like power generation, shipping, and most effective ways to achieve net-zero targets. Our experts convert your conventional fuel engines into dual fuel systems that can also run on green e-fuels. By upgrading existing engines and turbomachinery, we balance ecology and economy, and give your business a long, clean future.

www.man-es.com

future-proof

with

ERMA FIRST SETS SIGHTS ON EMISSIONS REDUCTION

European BWTS provider ERMA FIRST is expanding its portfolio of sustainable solutions to help ship owners cut emissions in line with looming decarbonisation targets, according to its co-founder & managing director, Konstantinos Stampedakis

Greek solutions provider ERMA FIRST has launched a number of sustainable future-proof solutions with the aim of helping ship owners to decarbonise their operations over the next 15 to 20 years.

The group’s recent developments have focused on energysaving devices (ESDs) including a unique modular propeller boss cap fin (BCF) to cut ships’ fuel consumption, an alternative maritime power (AMP) system to connect them to shorebased electricity in ports, and onboard carbon capture and storage (OCCS) solutions to capture their emissions at sea.

Collaboration key to decarbonisation

ERMA FIRST was established in 2009 as an offshoot of marine technology developer EPE – Environmental Protection Engineering – which has been in operation since 1977. While most competitors are now abandoning the ballast water treatment systems (BWTS) market, ERMA FIRST retains its commitment to providing industry leading BWTS.

Its solutions are fully certified by IMO, USCG, China, and Korea, and the combination of flexibility on installation and highly competitive OPEX has established ERMA FIRST as one of the leading BWTS makers worldwide, with systems on 3,800 vessels by the end of 2024.

Collaborating with owners is also characteristic of ERMA FIRST’s position on ESDs and emissions, in the knowledge that alternative green fuels will be the eventual solution to maritime decarbonisation. However, for the next 15 to 20 years, the majority of vessels will continue to burn fossil fuels while facing increasing challenges to cut emissions from regulations such as the CII, EEXI, and EU ETS. Decarbonisation

targets for 2030, 2040, and finally 2050 are eminently achievable if all stakeholders act sooner rather than later, utilising technologies that deliver operational improvements, reducing fuel consumption and vessel emissions which are available today.

Despite slow progress in ports introducing facilities to connect ships to shoreside electricity and offload captured and stored carbon, ERMA FIRST emphasises the importance of investing in existing technologies that can support compliance with approaching decarbonisation targets.

Custom-made and cost-effective

Owners can immediately cut fuel consumption and emissions by two to three per cent by fitting a BCF. Installed at the hub of a ship’s propeller, a BCF utilises water swirl while its fins catch and absorb the rotating water force. This weakens the propeller hub vortex, boosts thrust, improves propulsion efficiency, and, ultimately, reduces energy loss.

However, the efficacy of off-the-shelf BCFs is limited, and given the variety of propeller and ship types and sizes, it is prohibitively expensive to design bespoke solutions for individual vessels.

With an innovative modular design, ERMA FIRST FLEXCAP overcomes this issue. Through the combination of various fins, caps, and flanges, at least 22 different models are possible. The angle of the fins and the selection of the cap can be adjusted based on a specific vessel’s needs, giving a bespoke propeller cap – resulting in a modular design that minimises cost and makes it possible to achieve a return on investment within a year.

REGIONAL FOCUS 10 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

8 ERMA FIRST Blue Connect, alternative maritime power solution for high and low voltage shore connections

Decarbonisation targets for 2030, 2040 and 2050 are eminently achievable if all stakeholders act

Solutions in port and at sea

ERMA FIRST’s efforts to help ship owners meet looming maritime decarbonisation targets cover operations in port and at sea.

Emissions restrictions in ports are gaining traction, with some Californian ports already requiring berthed container, reefer, and cruise ships to draw 80% of their power needs from a shore-based source. These rules will also apply to car carriers and tankers from 2025 and 2027, respectively.

In Europe, the ‘Fit for 55’ legislative package includes proposals for ports to introduce cold-ironing infrastructure for passenger and container ships of over 5,000 gross tonnage by 1 January 2030. China already requires vessels on international voyages to use AMP if they are equipped to do so.

ERMA FIRST BLUE CONNECT is an AMP system allowing ships to connect to a port’s shoreside grid to run onboard services, systems, and equipment. Meeting all latest international standards for cabling and connections, the solution enables a ship to switch off its diesel generators to reduce both emissions and noise in port.

BLUE CONNECT is recognised as an energy-saving device by world-leading classification society DNV and has received approval in principle (AiP) from Bureau Veritas. The system’s first installation is scheduled for autumn 2024, with ERMA FIRST having received orders for six to eight more units to be delivered by the end of the year.

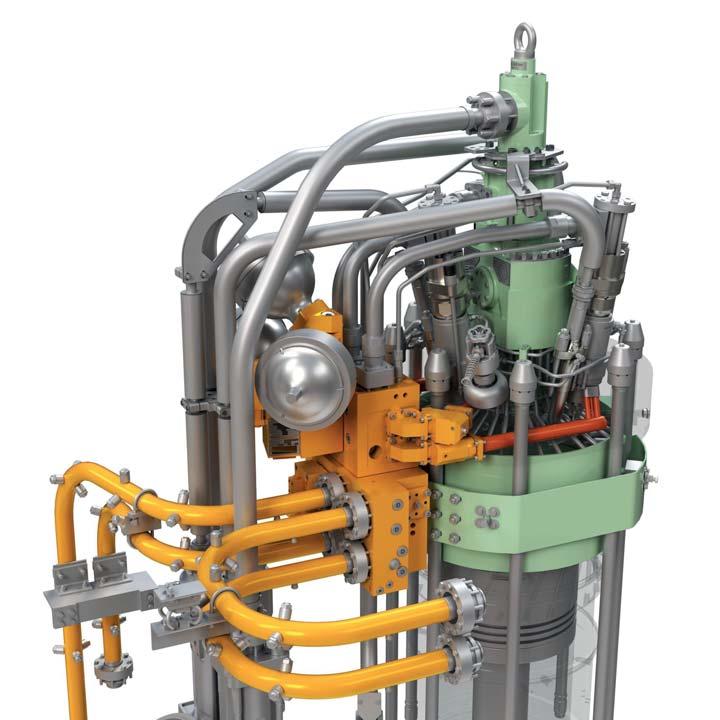

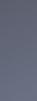

At sea, the company’s focus has been on OCCS as a means of reducing carbon dioxide emissions, with two versions of the same system – ERMA FIRST CARBON FIT – currently under development.

The larger, amine absorption version is designed for deepsea ships and uses well-established technology to absorb CO2 from flue gas, store it in a liquid state, and thereby reduce its volume – a necessity for long-distance voyages. The technology has secured AiP from DNV and Lloyd’s Register.

Aimed at shortsea vessels, the simpler, calcium hydroxidebased version uses an organic alkali to absorb CO2 from flue gas in a specially designed reactor. The resultant dehydrated calcium carbonate slurry is then stored on board until its disposal at authorised facilities.

ERMA FIRST is aiming to install pilot units in August 2024, and with clients indicating their intent to place orders, commercial sales are expected to follow from the second half of 2025.

Under normal operating conditions, OCCS systems are expected to cut emissions by 15% to 30%.

A broader commitment

Beyond its ongoing research and development investments, ERMA FIRST recently demonstrated a broader commitment to the environment by joining the EU Mission Charter to ‘Restore our Ocean and Waters by 2030’, which aims to “protect and restore the health of our ocean and waters through research and innovation, citizen engagement and blue investments”.

ERMA FIRST’s signing of the Charter builds on its involvement in local sustainability initiatives.

In 2023, the company collaborated with HELMEPA –Hellenic Marine Environment Protection Association – on events in May and November, mobilising volunteers to remove waste and debris from beaches in Piraeus, Greece. Both projects aligned with EU ‘Mission Ocean and Waters Actions’ definitions, with the second event also notable for involving the IADYS ‘Jellyfishbot’ in clean-up operations. In an earlier initiative, ERMA FIRST brought the community together to clean Votsalakia beach in 2021.

By organising and leading these events, ERMA FIRST directly contributed to objectives 1 and 2 of the Mission Charter: to “protect and restore marine and freshwater ecosystems and biodiversity” and to “prevent and eliminate pollution of our ocean, seas and waters”. Furthermore, by calling on the assistance of the local community, the company used one of two Mission ‘enablers’ – “public mobilisation and engagement”.

REGIONAL FOCUS For the latest news and analysis go to www.motorship.com MAY/JUNE 2024 | 11

8 ERMA FIRST Flexcap installation in place

‘‘

8 ERMA FIRST Flexcap improves propulsion efficiency and reduces emissions by weakening the propeller hub vortex

GHG DISCUSSIONS CONTINUE TO DOMINATE MEPC TALKS

For MEPC 81, held in March this year, it was clear that the main focus would be on progressing the revised GHG strategy agreed at the preceding meeting in July 2023, writes Malcolm Latarche

Building on the initial 2018 strategy, the 2023 revised strategy’s more ambitious targets include a 20% reduction in emissions by 2030, a 70% reduction by 2040 (compared to 2008 levels), and the ultimate goal of achieving net-zero emissions by 2050. The figures would be calculated on a well to wake basis and not the tank to wake method that has been used up to date.

However, the target dates were not set in stone with actual wordings saying ‘close to’ which could indicate a measure of drift is being prepared for. In addition, provisos such as the targets would apply for transport work as an average across international shipping suggesting that different ship types or regions would have different levels. There was also a commitment to ensure an uptake of alternative zero and near-zero GHG fuels by 2030, as well as indicative checkpoints for 2030 and 2040.

These targets were to be met by introduction of so-called mid-term measures (the short term measures of a revised EEDI and the introduction of the EEXI and CII having already been agreed and introduced by the beginning of 2023). The strategy envisages the mid-term measures to be in place by 2027 and effective in 2028 in advance of the adoption of the next revision of the GHG strategy scheduled for MEPC 88 in 2028.

MEPC 81 was therefore focussing on identifying the candidate mid-term measures as well as considering how to address industry concerns over identified flaws in the CII. It was also taking forward the work of the Intersessional

Working Group on Reduction of greenhouse gas (GHG) Emissions from Ships (ISWG-GHG 16) which took place the week before.

Following MEPC 81, there were many reports from various industry and NGO bodies welcoming what was said to be a gathering consensus on candidate measures for the Net Zero framework although the statement from the IMO was seemingly less confident. It said, “MEPC 81 agreed on an illustration of a possible draft outline of an “IMO net-zero framework” and went on to say that “The possible draft outline for the IMO net-zero framework will be used as a starting point to consolidate the different proposals into a possible common structure, to support further discussions, with the understanding that this outline would not prejudge any possible future changes to it as deliberations progress”.

At this juncture, there is agreement that there would be two elements to the framework’ a technical goal-based marine fuel standard regulating the phased reduction of the marine fuel’s GHG intensity commonly referred to as GFI; and an economic element to incentivise the transition to netzero. However, there are various opposing views as to what the final outcome would be in either measure.

In a recent DNV podcast, (https://www.dnv.com/expert-story/ maritime-impact/Defining-IMOs-greenhouse-gas-regulationsan-update-from-MEPC-81/?utm_campaign=MA_24Q2_GLOB_ ART_Ind_539_Podcast_MEPC81&utm_medium=email&utm_ source=Eloqua) Eirik Nyhus, Director Environment for Maritime set out that there are numerous proposals on the table and while two

REGULATION 12 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

8 Opening of the 81st session of the IMO Marine Environment Protection Committee (MEPC)

of the technical measures seem to enjoy more support there is no overall consensus.

Interestingly both of these proposals allow for pooling arrangements for fleet operators. That is a position also supported by industry bodies such as the World Shipping Council which included it in its own paper submitted to MEPC 81. WCS’s argument is that pooling will allow companies to invest in innovative zero emission technologies and count the GHG impact across a fleet of ships. It said in its paper, “A flexible approach to pooling will enable investments that would not be feasible if each and every vessel must perform at the same level at the same time and will help smaller carriers transition more efficiently”.

On economic measures, Nyhus noted in his podcast that views are divergent and there are deep splits. One proposal that would put a price of $150 per tonne of CO2 emitted would effectively add $450 per tonne to the price of bunker fuel. The argument that this allows for a level playing field is countered by those that say it would penalise developing countries.

Support for the $150 levy has grown especially among smaller states and Caribbean countries but a number of other states led by China believe the pooling will provide both a technical and economic measure and that there is therefore no need for a fixed levy. The question of how any levy should be used is another contentious issue. For some states it is simply a revenue generating exercise, others believe its purpose is to advance technologies while some see it as a means to compensate early movers on alternative fuels.

With such divergent views it is clear further work is needed before an agreement can be reached. Detractors of the IMO often colour it as a cumbersome body but that is inevitable as the ultimate decision depends upon almost 200 individual member states reaching an agreement that all can support. Governments of those states will have their own issues to contend with, not least the impact increasing transport costs will have on consumer prices.

There is of course nothing to prevent individual states or even groupings of states from introducing their own rules on GHG and other emissions with regards to ships calling at their ports or flying their flags. The EU has already gone down this route and Norway was the first country to take action against NOx emissions with its NOx levy and NOx fund to incentivise reduction measures for individual ships. If more nations were to do this, it would complicate matters for operators but that would not be unique in the history of maritime trade.

Two related agenda items were discussed, and both will feature strongly in the debates over the adoption of technical

Roadmap for future debates

Assuming that progress is not derailed by disagreement among member state delegates, the following series of meetings and target dates have been pencilled in.

5 MEPC 81 (Spring 2024) - Interim report on Comprehensive impact assessment of the basket of candidate mid-term measures/ Finalisation of basket of measures

5 MEPC 82 (Autumn 2024) - Finalised report on Comprehensive impact assessment of the basket of candidate mid-term measures

and financial elements. These include the relatively new development of onboard carbon capture and the fuel Life Cycle Analysis (LCA) whereby the emissions from well to tank will be determined.

Onboard carbon capture systems (CCS) were initially proposed to the industry some years ago but at the time thought impractical due to the impact of weight of captured gases on ships’ cargo capacity. Since conventional oil fuels produce 3.5 times the weight of CO2 compared to fuel burned, every tonne of bunkers would mean the sacrifice of 2.5 tonnes cargo carrying capacity.

Nevertheless, some CCS have been developed and are already in operation. Depending on how the captured emissions are handled after discharge, credit should be given for emissions saved. It was agreed to establish a Correspondence Group that will further consider issues related to onboard carbon capture and develop a work plan on the development of a regulatory framework for the use of onboard carbon capture systems with the exception of matters related to accounting of CO2 captured onboard ships and submit a written report to MEPC 83.

There has been much discussion on the GHG intensity of different fuels in recent years. The focus concerns that while some fuels produce higher amounts of GHG than others when used on a ship, the production, storage and delivery processes of other fuels means the overall GHG emissions of those fuels could actually be higher.

Initial guidelines on lifecycle analysis (LCA) of GHG

5 MEPC 83 (Spring 2025) - Review of the short-term measure to be completed by 1 January 2026

5 MEPC 84 (Spring 2026) - Approval of measures / Review of the short-term measure (EEXI and CII) to be completed by 1 January 2026

5 Extraordinary one or two-day MEPC (six months after MEPC 83 in Autumn 2025)Adoption of measures

5 MEPC 85 (Autumn 2026)

5 16 months after adoption of measures (2027) - Entry into force of measures

5 MEPC 86 (Summer 2027) - Initiate the review of the 2023 IMO GHG Strategy

5 MEPC 87 (Spring 2028)

5 MEPC 88 (Autumn 2028) - Finalization of the review of the 2023 IMO GHG Strategy with a view to adoption of the 2028 IMO Strategy on reduction of GHG emissions from ships.

REGULATION For the latest news and analysis go to www.motorship.com MAY/JUNE 2024 | 13

8 Chair of MEPC 81 Mr Harry Conway of Liberia

intensity of fuels LCA were adopted at MEPC 80. MEPC *1 adopted Resolution MEPC.391(81), 2024 Guidelines on life cycle GHG intensity of marine fuels (2024 LCA Guidelines), which incorporates draft amendments proposed by an LCA Correspondence Group. Furthermore, as the issues investigated at the Correspondence Group were diverse and required expertise, it was agreed to newly establish a Working Group on the Life Cycle GHG Intensity of Marine Fuels under GESAMP to pursue discussions along with its Terms of Reference.

To progress the issues going forward MEPC 81 established a number of intersessional working groups including:

5 A GESAMP Working Group on Life Cycle GHG Intensity of Marine Fuels (GESAMP-LCA WG);

5 Fifth GHG Expert Workshop on the further development of the basket of mid-term measures (GHG-EW 5) which will hold a two-day expert workshop in July;

5 ISWG-GHG 17 (23-27 September 2024);

5 Correspondence group on LCA (to submit a report to MEPC 83 in April 2025).

New ECAs and more Discussions on GHG and related measures were extensive but not the only items on the agenda which also included new NOx ECAs, shortcomings of NOx control technologies, further work on the Life Cycle Analysis of marine fuel GHG intensity, Ballast Water Convention review, ballast water treatment systems approvals and issues around challenging water quality, use of ballast tanks for grey water storage, amendments to MARPOL amongst others.

There were two new ECAs (emission control areas) approved; one in Canada and one in Norway. Since the initial applications were submitted at previous MEPC meetings there was little question of these not being approved. The Canadian Arctic ECA will impose a fuel sulphur limit of 0.1% and Tier III NOx limits will apply to ships constructed (keel laying date) on or after 1 January 2025, and which will be operating in the Canadian Arctic ECA. This new ECA would have the added benefit of partially addressing concerns around black carbon emission in the Arctic region. Also approved was Norway’s proposal for a Norwegian

Sea ECA which, if adopted by MEPC 82, would become effective on 1 March 2026. For NOx Tier III to apply to a ship the building contract would need to be placed after 1 March 2026, or if no building contract a keel laying date on or after 1 September 2026. For other newbuildings already ordered the ECA would apply if delivery occurs after 1 March 2030.

Ballast and other developments

The BWT convention is now being monitored in what is called the ‘experience building phase’ where identified weaknesses and contradictions are addressed. MEPC 81 accepted the recommendations of the Correspondence Group with regard to changes already identified as needed and re-established the Correspondence Group on Review of the BWM Convention to prepare draft text for amendments to provisions of the Convention and to associated instruments, and for new provisions and/or instruments with a view to submit a report to MEPC 83.

Interim guidance on ballast management for ships operating in challenging water quality was adopted and work continues on developing a comprehensive set of guidelines to apply to ships, administration and ports. Guidance for temporary storage of treated sewage and grey water in ballast tanks, necessary when reception facilities at ports is inadequate, was approved. The guidance sets out the standards such as for flushing tanks after temporary storage and for implementing the relevant procedures in Ballast Water Management Plans. Discussion on ballast water treatment (BWT) saw four systems given new type approval and one using an active substance granted Basic Approval.

There were a number of other issues on the agenda and the meeting adopted resolutions relating to reporting of containers lost at sea, recommendations on the carriage of plastic pellets as cargo in containers, and endorsement of a Draft Action Plan for reduction of underwater noise from commercial shipping and an agreement to include an agenda item on the topic for MEPC 82.

A small number of matters including proposed amendments to the 2021 Guidelines for Exhaust Gas Cleaning Systems with regards to nitrates, were held over due to lack of time or for requiring further input.

REGULATION 14 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

8 MEPC

81

The NPT propeller from Stone

Marine Propulsion

A FUEL’S LIFE CYCLE – FROM WELL TO WAKE

With the IMO having accepted the principle of using well to wake rather than tank to wake as the future basis for determining GHG emissions from marine fuels, the difficult process of putting that into practice is now underway

There are few within the shipowning and operating fraternity who do not accept that although fossil fuels will continue to be dominant in the short to mid-term, lower emitting alternatives will play an increasing role going forward. At one point in the 2000s it seemed that fuel cells might be the way forward, but development soon stagnated, and LNG was being actively promoted at many levels.

Moving forward, even LNG came under fire for its GHG emissions as the reduction in CO2 was often accompanied by methane slip sending an even more potent GHG into the atmosphere. Most recently the focus has been on alternative fuels such as methanol and ammonia with the latter being backed because it is essentially carbon-free. According to projections in the Fourth IMO GHG Study 2020, about 64% of the total amount of CO2 reduction from shipping in 2050 will be achieved using alternative low/zero-carbon fuels.

But while methanol and ammonia may produce less GHG emissions when burned on board ship, their production is in many cases highly energy intensive. The result is more emissions released in their production, transport and storage than for conventional fossil fuels. Therefore, any advantage in burning ‘cleaner’ fuels on ships would be lost because of the emissions involved prior to bunkering.

The irony of this was not lost upon bodies such as SEA-LNG or the Methanol Institute and five years before MEPC 80 in 2023 they and others were advocating that the IMO should take a more holistic view of emissions. That was precisely what happened at MEPC 80 when along with the more ambitious targets for decarbonisation agreed that it would be measured on the basis of well to wake and not tank to wake.

The decision was not spontaneously taken at MEPC 80 as a working group had been busy on producing the guidelines for the new measure published as RESOLUTION MEPC.376(80) GUIDELINES ON LIFE CYCLE GHG INTENSITY OF MARINE FUELS (LCA GUIDELINES) just after MEPC 80.

Announcing the document the IMO said, “the levels of ambition and indicative checkpoints should take into account the well-to-wake GHG emissions of marine fuels as addressed in the Guidelines on lifecycle GHG intensity of marine fuels (LCA guidelines) with the overall objective of

reducing GHG emissions within the boundaries of the energy system of international shipping and preventing a shift of emissions to other sectors”.

The 2023 guidelines – a 60 page document – is just the first step in a major task that the IMO has set itself. While it is a simple task to measure the tank to wake emissions, the same is not true of the well to tank element.

With a wide variety of fuels expected to be available and multiple means of producing each one calculating a GHG emission figure for a fuel that is acceptable to all is an impossible task. Ammonia for example can be produced from coal, natural gas oil and by chemical processes combining nitrogen and hydrogen. The power needed for the processes also needs to be taken into account; will it be provided by ‘dirty’ coal, hydroelectric, wind or solar? And what about the emissions produced from transporting it?

The methodology employed by the IMO in the guidelines draws upon ISO 14044:2006 (Environmental management — Lifecycle assessment — Requirements and guidelines.) and ISO 14040:2006 (Environmental management — Lifecycle assessment — Principles and framework). But there is still debate over whether there should be an aggregate standard for each fuel or whether each batch of fuel should be considered as unique.

The arguments around the suitability and formulae used for calculating the EEDI ratings of ships were a hot topic in the period up to 2013 and the numerous amendments since look likely to be dwarfed once the LCA formulae become clearer

No less than eight papers offering opinion were presented to the ISWG-GHG 16 meeting that preceded MEPC 81 with consequent amendments being made to the 2023 guidelines. The new draft LCA guidelines were approved at MEPC 81 and will be published as RESOLUTION MEPC.391(81). The updated guidelines include revised calculations for default emission factors; updated appendix 4 on template for wellto-tank default emission factor submission; and new appendix 5 template for Tank-to-Wake emission factors.

Despite approving the revised guidelines, MEPC 81 agreed that further development of the LCA framework will be discussed at ISWG-GHG 17 in September 2024.

REGULATION 16 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

8 NYK and Hitachi Zosen Corporation have proposed the development of N2O reactor for an ammonia-fueled ship

Fuel Gas Systems

We support the industry in reaching their sustainability targets and moving towards a greener future.

Clean Fuel for the Future

INNOVATIVE AND EFFICIENT FUEL GAS SYSTEMS

As a leading contractor for the design and construction of fuel gas systems in the Maritime and Offshore industry, TGE Marine is your partner for any LNG-, Ethane-, LPG-, Ammonia (NH3), alternative, and future fuel requirements to aid the decarbonisation of the shipping industry.

Our methods work on reducing Green-House-Gas (GHG) emissions and decreasing operational expenditure for owners and operators.

AMMONIA FUEL SYSTEMS will play a strong role in the decarbonisation of shipping.

THE GAS EXPERTS

Innovations for Greener Shipping

Maritime

© provided by Crowley

Corporation

ON A MISSION TO UNLOCK AMMONIA’S POTENTIAL

The Motorship speaks to Christian Berg, managing director, Amogy Norway, about why ammonia has a integral role as a long-distance energy carrier

Amogy is on a mission to build technology that unlocks ammonia’s potential as a clean energy source, thus accelerating the global journey to Net Zero and sustaining future generations.

“As a carbon-free hydrogen carrier, ammonia as a fuel is truly a no-brainer,” says Christian Berg, managing director, Amogy Norway.

“With advancing technology nearing commercial viability, it’s no surprise that ammonia is gaining traction as a pivotal enabler of the clean energy transition. Beyond its carbonfree chemistry, its energy density and existing infrastructure further bolster its appeal.”

He points out that globally, over 200 low-carbon ammonia facilities are in the planning stages, with the US Gulf Coast emerging as a significant hub.

Because of these advantages, there’s a growing consensus among policymakers, energy firms, infrastructure investors, and industrial players alike that ammonia will play a central role as a long-distance energy carrier.

Founded in 2020 by four MIT PhD alumni, Amogy aims to enable the decarbonisation of the hard-to-abate sectors, such as shipping, power generation and heavy-duty transportation, with its ammonia-based, carbon-free, high energy-density power solution.

The system

Amogy’s system is characterised by its scalability, modularity and tailored design, specifically engineered to meet the distinctive requirements of maritime applications.

Within maritime shipping, Amogy’s power solution caters to various vessel types, including offshore, cargo and special purpose vessels.

“We believe ammonia is an optimal fuel choice to drive decarbonisation within this sector,” says Mr Berg.

“Our ammonia-to-electrical power system seamlessly converts ammonia into carbon-free electrical power at the point of use. By harnessing cutting-edge ammonia cracking technology, we achieve ultra-efficient conversion without combusting the ammonia.”

The Amogy Powerpack is a modular system which enables supplementary modules to be integrated to deliver more sizable Powerpacks.

Amogy has already received Approval-In-Principle (AiP) from Lloyd’s Register for the system.

It is currently working toward achieving type approval from multiple classification societies, including DNV, Lloyd’s Register and the American Bureau of Shipping.

Additionally, Amogy is working with the US Coast Guard to confirm powerpack regulatory compliance. These efforts will

ALTERNATIVE FUELS 18 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

8 Amogy has created The NH3 Kraken tug as a capability demonstration for its technology

Credit: Amogy

There’s a growing consensus among policymakers, energy

rms, infrastructure investors, and industrial players alike that ammonia will play a central role as a long-distance energy carrier ‘‘

identify potential hazards and operational risks associated with using ammonia as a fuel and ensure appropriate safety measures are incorporated into the product design.

Commercialisation

Mr Berg says that Amogy’s recent partnership with Green Ships and the operational expertise of Bourbon Horizon represents a crucial milestone in Amogy’s mission to decarbonise the maritime sector.

Land-side, Amogy is currently conducting full-scale tests of its ammonia cracking power systems in Stord, Norway.

The company started flowing gas and performed ignition testing last month and will proceed in the coming days and weeks to ramp up and verify full 200 kW reforming capabilities.

It has also recently signed other commercial contracts with Terox and Hanwha Ocean. These pilot projects signify a shift towards commercialisation of Amogy’s technology.

“This focus on commercialisation is present as we focus on getting our facility up and running in Houston, first for larger scale testing of our system and eventually for assembly of our first commercial products,” adds Mr Berg.

It’s exciting times for Amogy and for the ammonia market as a whole.

Mr Berg says the company will continue to collaborate with clean ammonia procurers and developers of bunkering facilities to accelerate the development of the global value chain for clean ammonia moving forward.

r the design lectrical power

“The partnership signifies confidence in our ammonia-topower technology as a viable solution for the industry’s urgent decarbonisation needs,” he says.

Green Ships’s cutting-edge 82m ePSV design notably integrates Amogy’s pioneering ammonia-to-electrical power system as its primary propulsion method, setting a new standard for carbon-free maritime operations.

This groundbreaking approach aligns with stringent DNV regulations and underscores a commitment to surpassing the maritime sector’s environmental targets.

In addition, Amogy has created The NH3 Kraken tug as a capability demonstration for its own technology, which is almost ready to sail.

As the world’s-first ammonia-powered, carbon-free tugboat, its demonstration will mark a significant milestone not just for Amogy, but for the entire maritime sector.

Mr Berg says that showcasing the viability, e safety of ammonia as an alternative fuel is paramount, especially to its commercialisation.

“The vessel sets the stage for substantial investment in ammonia and positions the maritime industry to embrace a cleaner, more sustainable future,” he says.

DNV surpassing tug as a ology, which is , carbon-free sector. efficiency and investment in y to embrace a chain for clean ammonia forward

Establishing an alternative fuels training hub

The Maritime and Port Authority of Singapore (MPA) has inked an agreement to develop a Maritime Energy Training Facility (METF) on the operation of ships powered by alternative fuel systems.

A Letter of Intent (LOI) was signed between Amogy, a provider of ammonia-topower solutions, the MPA and 22 partners, including international organisations, engine makers, classification societies, trade associations and institutes of higher learning at Singapore Maritime Week 2024.

“We are thrilled to embark on this exciting and important project in partnership with the Maritime and Port Authority of Singapore and other esteemed collaborators,” said Seonghoon Woo, CEO at Amogy.

“This initiative showcases Singapore’s leadership in driving sustainable maritime solutions and underscores our commitment

to advancing ammonia as a clean energy source for maritime shipping and equipping the global maritime workforce with the necessary skills to navigate the future of shipping.”

Training recommendation

The establishment of a training facility follows a recommendation put forth by the Tripartite Advisory Panel, formed in early 2023. This panel aims to identify emerging and future skills and competencies needed to build the maritime workforce of the future.

This METF will be a decentralised facility based in Singapore, utilising the various partners’ assets and training technologies to train global seafarers in the use, manning, and operation of vessels powered by zero or near-zero emission technologies.

With hundreds of crew changes conducted

daily in Singapore, the METF’s establishment is strategically positioned to support vessel operators and ship management companies with their crew training needs as part of their crew change arrangements.

This approach is expected to result in significant time and training cost savings for the shipping community. When fully operational, the METF is anticipated to benefit around 10,000 maritime personnel, including seafarers, frow now to the 2030s.

Amogy provides carbon-free energy solutions to decarbonise hard-to-abate sectors such as maritime, power generation and heavy industry.

Its ammonia cracking technology is a mature and scalable method for splitting liquid ammonia, generating electrical power in combination with hydrogen fuel cells at five times the energy density of lithium batteries.

ALTERNATIVE FUELS For the latest news and analysis go to www.motorship.com MAY/JUNE 2024 | 19

Christian Berg, managing director,

fi

Christian Berg direc Amogy Norway

Credit: Amogy

AMMONIA GAINS MOMENTUM DESPITE CONCERNS

Strong demand is driving development but emissions issues remain, writes

René Sejer Laursen, ABS director – fuels & technology, global sustainability

Demand for ammonia is being transformed by the energy transition. Until recently used as an input for fertiliser and chemical products, new markets for green and blue ammonia are emerging, replacing coal in power generation, in green steel production and as a marine fuel.

Today some 200m tonnes per annum is produced worldwide with 20m tpa transported in LPG carriers. The scale of the emerging and potential demand will see these figures rise; how quickly this can be achieved will determine its take-up within shipping.

The interest in ammonia stems both from its zero emissions when used as fuel and because its production isn’t dependent on biogenic carbon sources. As the global economy transitions away from fossil based fuels, biogenic carbon – from captured CO2, electrolysis and even waste sources – will be subject to increasing competition from different industries.

Biogenic carbon will increasingly replace fossil-based carbon in many of the products in use today in industry and consumer goods. Competition from the energy and aviation sectors will inevitably lead to increased prices but production capacity will need to come from industrial sources rather than biomass harvested for this purpose.

The rise of ammonia also creates potential for green

hydrogen as a fuel. But because Ammonia is significantly cheaper to transport over long distances – and considering the loss of energy when hydrogen is turned into ammonia via the Harbor Bosch process – it seems likely that a majority of hydrogen will be produced by cracking green ammonia at the location where the hydrogen will be consumed.

Ammonia production

To realise large-scale production of green ammonia to serve new markets, its production capacity, along with that of renewable electricity and green hydrogen, will need to grow tremendously. The current global installed capacity of wind and solar farms and especially the electrolysers needed to produce the necessary green hydrogen for ammonia production, are dwarfed by the required capacity needed.

Renewable electricity for electrolysis will need to be produced at locations around the globe that have favorable conditions for wind and solar energy generation and also have large land areas available. Those locations tend to be in remote areas; locations such as Western Australia, Chile, West Africa, Oman and Saudi Arabia are the areas that are expected to dominate production. Ammonia needs to be shipped from these locations to demand centres, in the first instance North/East Asia and Europe.

ALTERNATIVE FUELS 20 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

8 Demand for ammonia is being transformed by the energy transition

Credit: ABS

Eminox

IMO Tier III | Stage V Inland Waterways Exhaust aftertreatment systems enquiries@eminox.com | eminox.com Technologies for a greener planet EMx Powered

delivers pioneering exhaust

reduction solutions to achieve the latest emissions standards. Our modular systems offer

and affordable solutions for diesel

alternative

zero. visit greenport.com email subscriptions@greenport.com or call +44 1329 825 335 greenport.com port and terminal professionals around the world

over to receive a trial copy of GreenPort SUBSCRIBE NOW GreenPort magazine provides key insights into environmental best practice and corporate responsibility centred around the marine ports and terminals industry. •Instant access to industry news •Expert opinion •Quarterly features •Weekly eNewsletter TO SIGN UP FOR YOUR FREE TRIAL COPY news

emissions

efficient

and

fuel powered applications for all on- and offhighway sectors. Eminox’s integrated exhaust aftertreatment system supports your journey to net

Informing

The interest in ammonia stems both from its zero emissions when used as fuel and because its production isn’t dependent on biogenic carbon sources

Current projections for the growth in global production indicate there will be enough renewable electricity to produce the volumes of green ammonia needed for the maritime fleet alone by 2040. However, because shipping will also be competing with many other industries for both the renewable electricity and green hydrogen necessary to produce ammonia, as well as with other sectors that depend on the consumption of green ammonia such as agriculture and coal fired power plants, supply is expected to be constrained.

Propulsion technology

The first tests have been performed using ammonia as fuel in combustion engines by several of the main engine manufacturers. The tests have been very promising and no showstoppers have been discovered for the use of ammonia as a combustion fuel in internal combustion engines.

Though the amount of pilot fuel and levels of NOx, NH3 slip and N2O emissions have yet to be quantified for the commercial marine engines, marine engine makers generally agree that the Diesel cycle is best suited for combustion of ammonia.

Research is ongoing for both diesel and otto cycle combustion concepts. Optimising emissions reductions is foreseen as a challenge and control of N2O and ammonia slip requires high temperature combustion which also generates high NOx levels. Tests on two-stroke engines have shown that NOx is less of a problem using the Diesel cycle combustion principle when burning ammonia. When ammonia is injected into the combustion chamber, it expands and generates a cooling effect that removes the high peak temperatures in the combustions zones that generated the high NOx.

Pilot fuel is necessary to ignite ammonia and it is also needed to keep combustion stable. For smaller four-stroke engines, 10% pilot fuel is required once engine optimisation has been completed and after the engine is in service. For large two-stroke engines using Diesel cycles, just 5% pilot fuel is required, and some engine makers expect that this amount can be further reduced.

Assessing emissions

The actual amount of NH3 and N2O emissions is therefore still to be accurately assessed, however, emissions are expected to be low, particularly for the Diesel combustion cycle. Even so, with N2O having a 20-year global warming potential (GWP) of 264 and a 100-year GWP of 265 according to IPCC 2013-ARS, the emitted levels may negate much of the CO2 benefit of using ammonia as a fuel. This remains a significant potential barrier to adoption.

Two-stroke marine engine designers have, however, found in their tests that N2O level are low - in the same range as we see for other fuels including marine diesel, LNG and methanol. Overall it seems that the Diesel combustion principle is ideal for use of ammonia since the temperature in combustion chamber hits a ‘sweet spot’ where the NOX, N2O and ammonia slip levels are recorded at a very low level. It is therefore expected that those engines will be able to operate

to IMO NOx Tier II standards without any need for an abatement system.

As of Q1 2024, the main marine engine makers have the following development plans and lead times for ammonia fuelled engines:

Two-stroke ammonia dual fuel engines covering power ranges from 5 MW to 31 MW. These engines will be available for delivery starting from Q4 2024/Q1 2025.

Four-stroke ammonia engines as dual fuel gensets engines are also becoming available. Two engine manufacturers will launch this type of engine at the end of 2024 or beginning of 2025.

Safety and exhaust treatment

Most engine designers expect that exhaust gas aftertreatment will be needed to comply with the IMO NOx Tier III standard, and all of them expect to specify Selective Catalytic Reduction (SCR) as the preferred means of cleaning the exhaust gas after it has left the combustion chamber, rather than exhaust gas recirculation (EGR) which changes the combustion conditions thereby limiting NOX formation. The EGR is reducing the amount of oxygen in the intake air, and the fear is that this will have a very negative impact on the performance of ammonia combustion, but this is still to be investigated.

In addition to main engines and gensets operating on ammonia, designs are also emerging for auxiliary engines required to complete the transition to vessels running on ammonia. Boilermakers are preparing dual fuel boilers for use with ammonia as fuel to be able to generate steam and heat from burning ammonia.

Working with ammonia onboard on a day-to-day basis requires a solution to collect ammonia vapor in a safe manner. This vapor will be released in case of a normal engine stop if the piping system needs to be purged or in case of a malfunction somewhere in the fuel supply system.

Different solutions for vapor handling are under development from several manufacturers, including water scrubber designs that can remove ammonia vapor from the purge air. In this solution, ammonia vapor is stored in dedicated tanks as a water-ammonia solution. However, this approach would require dedicated infrastructure at the port to receive and store it.

All those systems described above are being prepared for newbuilding projects for different ship types and the expectation is that we will see those systems in service by the end of 2025/beginning of 2026. We estimate that approximately 50-70 ships are under order as of April 2024.

8 René Sejer Laursen, ABS director – fuels & technology, global gustainability

ALTERNATIVE FUELS 22 | MAY/JUNE 2024For the latest news and analysis go to www.motorship.com

‘‘

Meet us at Posidonia: Hall 3, stand 3.519/6 MONITORINGEMISSION & COMPLIANCEPERFORMANCE Enhanced situational awareness and compliance reporting Holistic performance optimisation Fleet Operations Center Driving safe and sustainable shipping operations

FUTURE PROOFING SHIPPING AGAINST THE NEXT CRISIS

In this article Captain Steve Bomgardner, vice president – shipping & offshore, Pole Star Global, argues that leveraging digitisation and using data to transform the experience of crew members at every level of the on-board operation is key

Turbulence across global supply chains is nothing new. But escalating geopolitical conflict and unpredictable weather events are raising the risks for ships, crew and cargo, demanding new levels of awareness and speed of response from both masters and shipping owners.

At the same time, the maritime industry faces an array of new challenges, from crew shortages to emissions management and the evolution to green shipping.

Yet the biggest risk facing every vessel is still human interaction: Working at sea remains one of the most dangerous professions. The maritime industry has access to an extraordinary array of data resources that enable efficient tracking, security, route optimisation, a better understanding of weather and forecasting, charter party compliance, ship performance and emissions.

Data can transform vessel and crew safety. Digital systems can transform efficiency, enable highly effective preventative maintenance and eradicate tedious administrative tasks for senior crew members.

However, with the vast majority of safety incidents the result of failure to follow rules, regulations and procedures; of mistrusting or overriding information, the maritime industry needs to embrace cultural change and demonstrate the power of data to transform crew safety and well-being.

Safety first

Leveraging digitisation and using data to transform the experience of crew members at every level of the on-board

operation will rapidly embed information value within the industry and overcome the dangerous mistrust that can lead to catastrophic disasters.

Shipping companies globally are waking up to the need to improve both their data resources and the way information is being used.

There is a growing recognition of the constraints of siloed, legacy data systems and the risks to safety, efficiency and responsiveness created by a lack of trusted, real-time data. Far too many major disasters and day-to-day incidents could and should have been avoided with better, up to date data –such as the outdated weather information that led to the loss of the El Faro and crew.

Given the enormous pressure on vessels to hit deadlines and avoid delays at ports, crews will inevitably push the boundaries if there is no oversight. There is a reluctance to reroute, due to weather or conflict, given the inevitable delays and added costs. When rerouting could also further delay shore leave or even postpone the end of contract for a crew that has been at sea for up to 18 months, a desire to maintain the schedule can lead to underplaying risk assessments.

Yet the depth of data now available to companies is not just informing efficiency and performance decisions, it is at the heart of building a safer working environment. For example, speed and fuel consumption curves are not simply monitoring engine efficiency; they can flag if the engine is not burning fuel properly. Timely use of information can not only reduce the risk of oil leak or hydrocarbon failure that could

8 Digital systems can transform efficiency, enable highly effective preventative maintenance and eradicate tedious administrative tasks for crew

MONITORING & DIGITALISATION 24 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

Credit: Pole Star Global

Leveraging digitisation and using data to transform the experience of crew members at every level of the on-board operation will rapidly embed information value within the industry and overcome the dangerous mistrust that can lead to catastrophic disasters

cause crew casualties and/or environmental disaster; but also support preventative maintenance that radically reduces the risk of engine failure, avoiding tedious and expensive delays in dry dock while the problem is fixed.

Cultural shift

However, simply collecting data is not enough to safeguard vessels and crew. The maritime industry only needs to look at the Deepwater Horizon disaster to understand that adding data alone is not enough. That was one of the most connected, data enabled vessels of its time, yet data mistrust and human interaction led to the explosion that caused the death of 11 crew and the world’s most devastating oil spill.

Today, even when crew have data, its value is often not recognised or understood. Senior crew members spend more time in meetings, creating and reviewing documentation than being hands on. Many perceive any onshore oversight of engine performance or fuel consumption as punitive rather than supportive. As a result, some perceive data and systems as a distraction and burden rather than a vital support in improving safety and efficiency.

To truly utilise joined up information, crew need a better way of interpreting multiple data feeds. They need to see how digitisation and data supports their day-to-day activity and enhances rather than detracts from core activities. Critically, there needs to be a cultural shift and a recognition that providing a central onshore team with an immediate and complete overview of onboard activity is an important second line of defence against incidents and disaster.

Crew experience

speed internet when out at sea is prohibitive and many ship owners cannot justify an investment in super connected vessels armed with sensors. That is where hardware free voyage optimisation systems can also provide a solution, delivering fleet monitoring, regulatory compliance, performance analytics and voyage optimisation in a single view. Even without dedicated hardware, both onboard crew and onshore teams have the additional insight required to boost safety and security.

Irrespective of whether the next crisis for ship owners is war, weather or another global health event, one fact is ineluctable: recruiting onboard crew is becoming difficult. With limited shore time and contracts that become ever longer, morale is a big issue on board. The job can be both mundane and high risk. Every day there is an issue, from sickness to fire, grounding or emergency response. Digitisation and information will enable ship owners and Masters to improve decision making and responsiveness but that can only be achieved by focusing on crew safety and morale to foster a trust in data.

When crew recognise that data will enhance the day-today working experience, that preventative maintenance and improved weather knowledge reduces risk, and that automated systems can remove the burden of administrative tasks, the response will be overwhelming. Reducing stress and boosting morale will improve crew performance. It will

To maximise the value of the extraordinary array of information now available to shipping companies, it is essential to change attitudes to data on board – and that can only be achieved through better education and training and, critically, the delivery of tools that truly improve the day-today working experience. Prioritising vessel safety and crew well-being is a key step in changing onboard attitudes to digitisation and data.

mean vessels move at a better pace and that cargo arrives on time and safely. Data can and must be used to safeguard shipping and create happy seafarers, supported with the information they need to respond effectively to the next crisis.

ay of it is at can g and, ay-tocrew des to den of g the cing a ed-up of an better erload cused t hich is s

For example, one person should not have the burden of deciding whether or not a sensor is faulty; of making the decision to ignore or assume a reading is false. Replacing a single isolated view of the operation with a joined-up perspective can transform onboard understanding of an evolving risk. In addition to improving vessel security, better systems can reduce the tedious administrative overload faced by senior crew members, such as automated digital permit to work systems, to enable more time to be focused on sailing the vessel and avoiding hazards. This not only improves efficiency but massively boosts morale, which is becoming a significant concern on board many vessels. Of course, data costs remain a challenge. The cost of high-

MONITORING & DIGITALISATION For the latest news and analysis go to www.motorship.com MAY/JUNE 2024 | 25

shore,

‘‘

8 There needs to be a cultural shift and a recognition that providing a central onshore team with an immediate and complete overview of onboard activity is an important second line of defence against incidents and disaster

Captain Steve Bomgardner, vice president –shipping & offshore Pole Star Global

NAVIGATING THE FUTURE: ELECTRIC SPOOLING WINCHES AND THE REVOLUTION IN MARITIME DECK OPERATIONS

by Mikael Holmberg, Segment Sales Manager, Cranes and Marine Winches, ABB

by Mikael Holmberg, Segment Sales Manager, Cranes and Marine Winches, ABB

The maritime industry is embarking on a transformation, steering away from traditional hydraulic winch mechanisms in favor of advanced electrically operated systems. The use of variable speed drives (VSDs), also known as variable frequency drives (VFDs) or, simply, of marine winch, including spooling winches, with a focus on energy

The ABB ACS880 industrial drive is setting a new standard in the vessels around the globe.

Moving from using mechanical transmission to electrical shaft transmission

Mechanical spooling winches contend with a number of operational challenges. Mechanical and hydraulic power transmission systems face require synchronisation. The physical bulk and complex nature of their mechanical transmission includes wheels, gears and chains that makes

ABB’s solution replaces the mechanical power shaft transmission with an integrated electronic synchro shaft functionality, similar to an electronic gear rather than mechanical gearing. This is made possible via the software built inside the ACS880 industrial drive that controls the motors of the main winch and spooler device. This approach allows for the electrical spooling device or motor to remain mechanically independent from the main winch, while maintaining precise synchronisation through the spooling software embedded in the drive. and mooring vessels, due to the integrated coordination between the main winch and spooler device.

strength but lack the precision needed to adequately control the rope’s tension and position. This limitation and less controlled operation can result in ‘bird nesting,’ where ropes tangle and overlap, potentially damaging both the ropes and the winch and putting the safety of the equipment and crew at risk, especially with deep sea winches that has a long rope on the drum in multilayers.

In addition, these systems, which involve chains, belts, and wheels, are large and cumbersome, requiring a lot of space. The wear and tear from their use can lead to uncontrolled spooling operations. These systems also present challenges in extreme weather conditions, such as arctic environments.

Transitioning to electric winches powered by motors and drives has the potential to revolutionise maritime deck operations, and comes with

mitigates the risk of improper spooling. The drive’s ability to control the speed of the motor allows for careful management of winch speed and torque, ensuring smooth operation and protecting the ropes from undue stress and wear.

Electric winch systems react quickly and precisely to operational commands, providing a big improvement on the slower response times that traditional mechanical transmission systems have.

By using drives, electric winch systems can match energy consumption to actual demands. This not only prevents excessive energy use, but also promotes long-term operational cost savings and a marked reduction in the associated emissions.

Tight side by side, and layer by layer for multilayer turn system on the drum

ABB has introduced a ready-made, innovative solution to address the challenges posed by traditional marine winch systems. With an

family, the ACS880, includes a dedicated a new application software designed to enhance spooling and rope guiding functions.

The key feature of this solution is a ready-made AC drive application tailored for synchronised operations between the main winch drive and

layer completely before advancing to the next, all while maintaining the

The drive-based spooling control software provides a user-friendly adjustments. Its diverse features and functionalities meet the varying needs of marine winch operations, including:

Manual and automatic modes: In manual mode, the operator manually controls the movement of the spooler to the left and right for servicing and inspection of the system. In automatic mode, the system automatically directs the spooler left and right in synchronisation with the rotation of the main drum.

Direction change logic: In automatic mode, the system can seamlessly switch the spooler’s direction from left to right using discrete input sensors, actual position feedback from sensors.

input sensors or actual position feedback, to prevent the rope from

26 | MAY/JUNE 2024 For the latest news and analysis go to www.motorship.com

ADVERTORIAL

overrunning the spooling area. This can be used in manual mode and automatic mode. If an end-limit switch sensor fails, a backup torque limit can be used to detect when the system is operating outside of its range and approaching a mechanical endpoint.

spooling to ensure ropes lay tightly side by side without gaps or permitted operating area.

Options for referencing the main drum or the line reference with various inputs, such as encoders, PLC function blocks, analog inputs, or through ABB’s high-speed drive-to-drive communication between ACS880 drives.

Scalable parameters to match the gearing ratio between the main drum and the spooler device, allowing for optimised coordination and control.

mechanisms, accommodating either unidirectional or bidirectional gear arrangements.