Looking into the crystal ball, we see major challenges ahead for the European ports sector. Today’s business models are being eroded and new realities await. It is important to recognise the changes underway and to build a strategic vision that offers continued health in what looks to be much more complex and difficult circumstances

“The only constant is change” is an appropriate remark to lay at Europe’s door.

Taking the macro picture, it is already clear that the world is no longer Eurocentric and that it will not be so in the future. This is underlined in the report, Global Trends to 2030: Challenges and Choices for Europe compiled by European Strategy and Policy Analysis System (ESPAS). It foresees, “Europeans will be fewer, older, and relatively poorer while much of the rest of the world is rising.” It further anticipates that even if European Union member states pool their resources, “Europe will remain outspent on security and defence. And as a global power is being redefined by rapid technological progress.” Europeans, the argument goes, lag behind China and the USA on emerging technologies and innovations.

Seismic changes indeed with the seeds of this change already seen to be in place. A situation that some believe is, in broad terms, mirrored in the European ports sector.

Today, we can see that Asia – Europe trade is slowing, impacting both container gateway and transshipment activities. Equally, the traditional link between GDP and trade growth has visibly weakened. Slower deepsea growth, increased emphasis on intra-regional trade and increased volatility overall are lining up as the new primary influences in the container sector with slower growth the dominant outcome. A scenario that promises to be challenging when it comes to making investment decisions and achieving a satisfactory return on investment.

There is also the prospect of increased emphasis on meeting new environmental requirements with greater regulation providing a catalyst to this. This too promises to have cost implications and is expected to further erode profit potential.

The scale of change is expected to deliver a shift away from existing port structures – one result of which may be the requirement for a greater level of public sector support.

Some may point to new business opportunities in the area of new clean fuels/energy hubs but with many European ports facing realities such as land only being available for these sort of activities at premium prices this is not a straightforward alternative.

By 2034 signs are that we will see a European ports sector that has undergone major structural changes, which requires new business models in order to operate effectively while operating in a market which is largely mature and typically features a more restrained trade development climate.

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: Andrew Penfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; Ben Hackett; Peter de Langen; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production

David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Media Sales Manager: Arrate Landera alandera@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published bi-monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com

Register and subscribe at www.portstrategy.com

1 year’s digital subscription with online access £244.00

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

Europe –A New Reality Structural Changes Underway

Challenging Times in Europe Port Performance Assessed

Turbulent Times Box Port Challenges

Congestion Looms West Med Space Pressure

Fending Off Competition San Antonio Megaproject

OMT Game Changer Onne Progress

Bold Decisions Required Coastlink Conference Takeaways

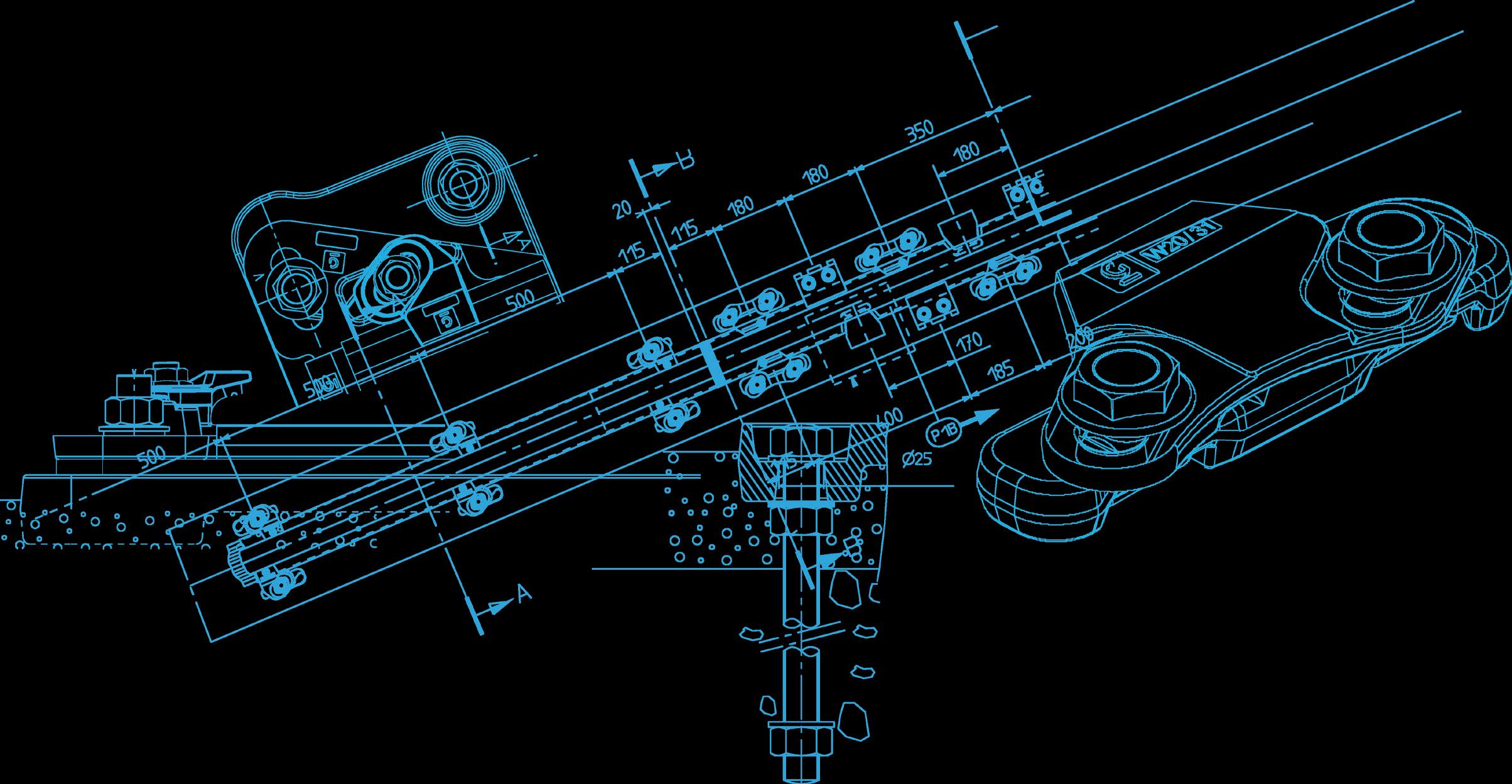

Safe Mooring Systems Supporting Efficient Operations

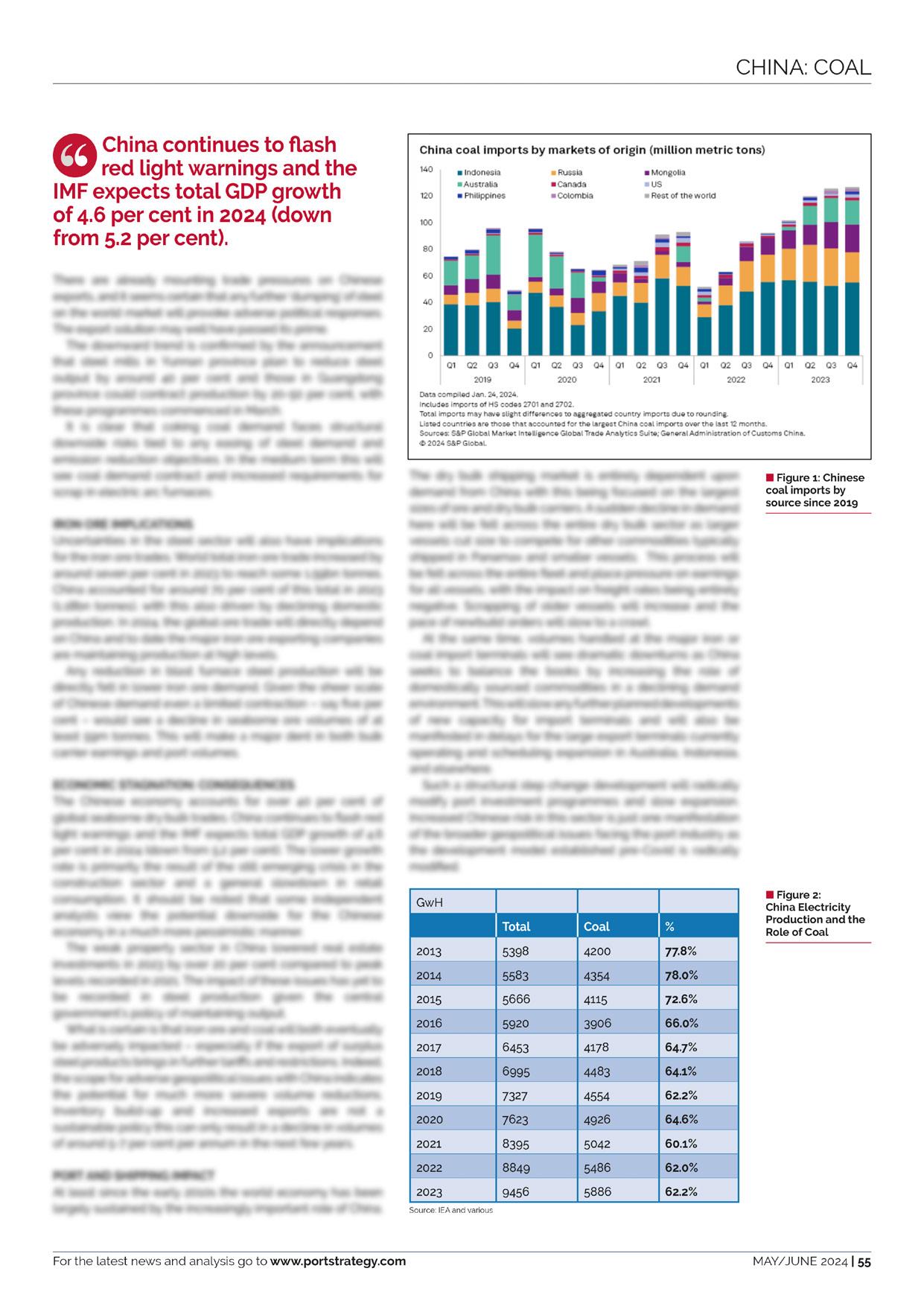

China Coal Demand Heading South?

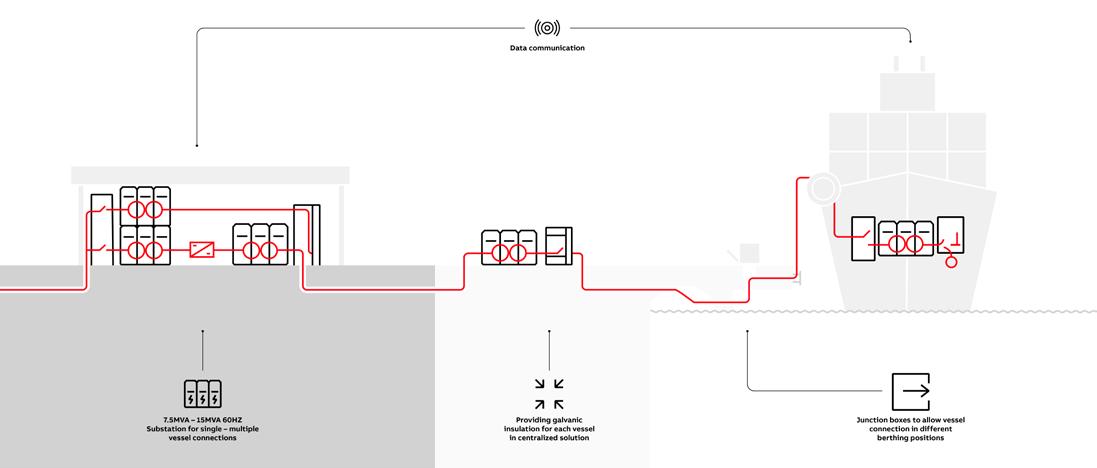

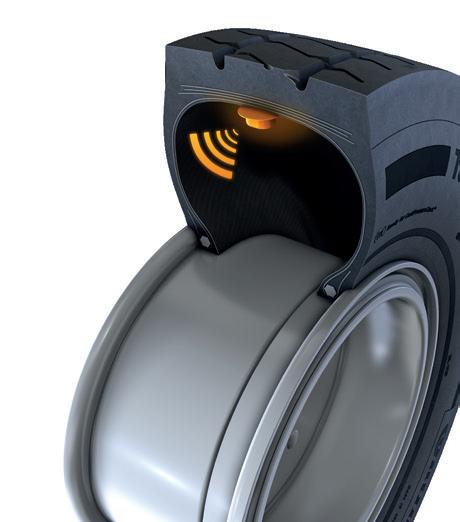

Charge for Shore Power Momentum, but Obstacles Exist 61 Reefer Monitoring Big Data, Algorithms & AI

X Ray Visions System Take-Up Builds

excellent connectivity throughout the region.

This new port is strategically located 120km south of Manila and only 9km west of Batangas City. It will become the leading international gateway for shippers based in the CALABARZON region (Cavite, Laguna, Batangas, Rizal, and Quezon), which is one of the Philippines’ fastest-growing regions, reaching a 5.2 percent growth rate in 2023, according to latest figures from the Philippine Statistics Authority. The region’s GDP represents 15% of the Philippines’ total.

Christian R. Gonzalez, ICTSI Executive Vice President, notes: “We are building a world-class facility that will unlock a wave of economic benefits for the region and the country. It will create new employment opportunities,

n The new container terminal in Bauan, Philippines, being developed by ICTSI will eventually offer an annual capacity of up to two million TEU and solidify Southern Luzon’s position as a key player in global trade

improve the quality of life for our host communities and the industries located around the terminal, and solidify Southern Luzon’s position as a key player in global trade.”

Gonzalez adds that this new terminal complements ICTSI’s strategy of providing a national network of ports with ICTSI’s brand of operational synergy that would further improve the country’s supply chain and competitiveness in global trade.

ICTSI runs a geographically diverse portfolio across six continents and 19 countries, with 32 terminals employing over 19,000 people.

n India and Iran have agreed a 10-year deal over the development and management of the Port of Chabahar. Located on Iran’s south-eastern coast along the Gulf of Oman, the port will be developed by India to support shipment of goods to Iran, Afghanistan, and Central Asian nations, bypassing the key competing Pakistan ports of Karachi and Gwadar. Continuing US sanctions on Iran have reportedly slowed the port’s development to-date

Minimize the risk of downtime and damages with Fogmaker’s fire suppression system!

The Fogmaker fire suppression system is tailormade for each type of material handling equipment.

High-pressure water-based mist chokes fires quickly and cools the area to prevent reignition. Fogmaker’s system is automatic, independent of electricity, and always ready!

Allegations of corruption relating to the granting of port terminal contracts, building permits and a beach concession have surfaced in the Port of Genoa, Italy. Two parties have been arrested in conjunction with the investigation, Paolo Emilio Signorini, former head of the Port of Genoa Authority and Aldo Spinelli, a major stakeholder in terminal facilities in the port of Genoa and also well known for his former role as owner of the professional football clubs Genoa and Livorno.

The Spinelli Group’s involvement in the port of Genoa includes operation of the Genoa Port Terminal, a container handling facility, and involvement in Terminal Rinfuse, originally a dry bulk handling facility. In 2015

UK-based investment firm iCON Infrastructure acquired a 45% stake in Lighthouse Italy Srl, the holding company for the Spinelli Group, which has been owned 100% by the Spinelli family since it was set up by Aldo Spinelli in 1963. In September 2022 liner operator Hapag Lloyd closed a deal to take a 49% stake in the Spinelli Group.

The Prosecutor’s office accuses Aldo Spinelli of paying bribes amounting to €75,000 to Paolo Emilio Signorini over a three year period to “obtain favours and resolutions” including the extension of the concession period for Terminal Rinfuse which

served to significantly increase its asset value. For his part Spinelli has claimed the legitimacy of his donations stating that these were made not just to a single party but everyone. Roberto Spinelli, Aldo’s son, is also in the frame for corruption charges relating to dealings with the Regional Governor John Toti.

It is understood that the Spinelli Group has made comprehensive changes to its Board including a new President and CEO while legal proceedings continue.

Aldo and Roberto Spinelli and the other involved parties remain under house arrest at the time of writing.

The dispute surrounding a new container terminal development in Colon Container Port (PCCP), Panama, which has seen China’s Landbridge Group ousted from the project due to alleged failure to meet contractual commitments, is hotting up.

The dispute is the subject of international arbitration but the latest development is that the Landbridge Group, a Chinese conglomerate with links to the Chinese Communist Party and the People’s Liberation Army, is now seeking to halt what it has described as a “sham arbitration process.” It has moved to request a US Court to issue an injunction as part of a broader claim that the arbitration is a fraudulent attempt to expropriate its investment in the new Colon terminal.

This latest move is seen as a

Contship Italia Group has reaffirmed Eurokai’s continued commitment to La Spezia Container Terminal (LSCT) through provision of an additional US$53 million investment in the facility, in addition to the already allocated US$266 million for the Ravano extension. To be undertaken in the next two years, the priority will be to enhance the Fornelli quay and purchase new equipment to improve competitiveness.

step that could influence future arbitration proceedings and the overall approach to resolving disputes arising from international investments. The Colon terminal project was 40% developed at the time Landbridge was ousted from it. Overall it is estimated to be a US1.4 billion project.

The Panama Maritime Authority revoked Landbridge’s concession

The U.S. Department of Transportation’s Federal Highway Administration (FHWA) has confirmed provision of US$7.1 million for port improvements in Louisiana. The Port of New Orleans will use this funding towards the purchase of new, all-electric heavy and light duty trucks to replace diesel vehicles currently in use, while also upgrading electrical infrastructure and evaluating new emissions-reducing equipment to improve air quality.

The European Parliament has confirmed an update to the TEN-T Regulation Agreement which acknowledges the value of strengthened synergies between the Trans-European Transport Network (TEN-T) and the Trans-European Energy Network. Regulatory updates recognise the need for infrastructure that facilitates carbon capture and storage deployment.

The move has a ground swell of support including lobbying from organisations such as Clean Air Task Force (CATF) and Bellona directed at including a reference to the role of diverse transport modes in transporting captured carbon to storage – thereby hastening decarbonisation measures for industry across Europe.

Both the EU Industrial Carbon Management Strategy and 2040 Climate Target Communication identify the key role of carbon capture and storage (CCS) in European industrial decarbonisation, halting millions of tonnes of CO2 from entering the atmosphere.

n Colon Container Port, the focus of a legal battle that could have significant implications for arbitration processes

in June 2021 and following this MSC partnered with Notarc Management Group, a global advisory, investment and management-consulting firm with a subsidiary in Panama, to finish the construction.

The Port of Portland has confirmed that it intends to continue providing marine container shipping services at Terminal 6. The port took over operations in 2018 following ICTSI exiting the facility but has struggled to attract container services. However, Tina Kotek, Oregon Governor, has included critical items in the 2025-2027 biennial bud get to support the facility, notably terminal development funding support

The revised TEN-T regulation sends a positive signal for the large-scale deployment of carbon capture and storage in Europe by acknowledging multiple modalities can be employed for CO2 transport.

Under earlier regulations, only CO2 transport via pipeline had access to administrative support and funding.

Cambodia Canal

Plans are proceeding in Cambodia to develop a canal that will reduce reliance on Vietnamese ports. Supported by Chinese backing, the scheme entails the construction of the 180-kilometre Funan Techo Canal which will run from the Takeo Canal of the Mekong River right through to merging with the Ta Hing Canal of the Bassac River in Koh Thom District. Project cost is US$1.7 billion.

Serious questions have surfaced regarding the award to Adani Ports of the concession to operate the Dar es Salaam Container Terminal, Tanzania International Container Terminal

News of the award emerged back in February, via filings with Tanzania’s Fair Competition Commission (FCC), the nation’s anti-trust body. There has been no official announcement by the Tanzania Ports Authority (TPA) and it is understood that the acquisition is still subject to

The big question is though will the FCC do a proper job, in line with its remit, or will this simply be a process that is quietly seen through the necessary gates and the news announced at a time of

What is the reason for this scepticism? Well, apart from where Tanzania sits in Transparency International’s 2023 with a score of 40 (highly corrupt, an all-time high for the country), analysis of the process that the TPA adhered to in order to select an investor for TICTS highlights

Three cornerstones of a best practice tender process for a container terminal, and indeed other port terminal facilities, are: Marketing the Opportunity on

Heavily promoting the opportunity on a global basis to maximise investor interest and announce a formal process for the submission of Expressions

A Comprehensive EOI Process to Maximise Investor Interest & Optimise Selection

Structuring the EOI process so that it provides a clear framework for submissions giving adequate time for the issuing body to check that organisations comply with the qualifying criteria – relevant experience record, financial strength, performance capabilities etc. Following this, announcement of candidates to go through to participate in the formal bid process.

The Bid Process

Modern-day structures call for both a technical and financial submission – with points

gained for both elements, and the highest combination of points emerging as the winner. Again, a clear and well organised framework for submission is a fundamental requirement together with adequate time to fully understand how the terminal functions, the market served and to plan the best solutions.

It is apparent that there were serious shortcomings on the part of the TPA with regard to all three of these fundamentals.

Feedback from interested parties indicates that:

Marketing of the Request For Quote (RFQ)/Request For Proposal (RFP) related to the TICTS opportunity was only advertised in a local newspaper – no international coverage.

The EOI process/RFQ was unclear – specifically the submission criteria were not clear.

The Bid Process was rushed and queries were answered in a haphazard manner.

Add all this up and experience suggests a ‘game was in play’ or

to put it more succinctly that the winner had already been decided.

There is no logical reason whatsoever to not advertise such an important opportunity, one that can make a significant contribution to the country’s economic wellbeing, on a local basis.

Equally, lack of proper structure to the RFQ and RFP processes basically suggests the creation of ‘landmines’ via which interested parties will fail in the bid process. Similarly, another strong signal of this is rushing the RFP submission – what useful purpose does this serve in the context of a multi-million-dollar investment? It is a long way away from best practice in such bid situations as set out in such distinguished works as the World Bank’s Port Reform Tool Kit.

If any further evidence is required of what looks to be a controversial process then consider two further factors:

In the limited process that was operated for the RFP submission; after the submission of bids some

bidders were requested to submit clarifications but not all bidders received the email request from the TPA, only to be subsequently disqualified for not submitting information.

Last but by no means least, East Africa Gateway Limited is the Adani company acquiring TICTS and tellingly listed among its founding directors is Nazir Karamagi, a politician and former Minister in the Tanzanian government. How is this not a serious conflict of interest?

It will be interesting to see what the FCC decides with regard to the award to Adani. How can it possibly not take into account these obvious flaws and the detrimental effect they will surely have on the economic health of Tanzania? Let’s see if self-interest on the part of a few rules over benefit to the country as whole.

Building from a one-country operation at the Port of Manila in the Philippines, ICTSI has pressed forward across 35 years. On six continents, currently in 19 countries, we continue developing ports that deliver transformative benefits.

All across our operations, we work closely with our business and government partners, with our clients and host communities: to keep building momentum where it matters, in and through ports that keep driving sustainable growth.

Port Skills and Safety Ltd (PSS) is calling on the UK Ports industry to improve data recording relating to near-misses and incidents.

PSS has completed a pilot data project to understand if AI can provide what it defines as “better root cause analysis” of port information to obtain better insight into safety risks.

PSS highlighted that more than 33,000 records were uploaded as part of this pilot project, which included almost 10,000 incident reports and 1000 near miss reports – the remaining records were classified as observations.

However, one of the main findings of the pilot programme was that in a high number of cases, the incident report contained only very brief information and a limited amount of useful data.

Debbie Cavaldoro, CEO, PSS, elaborates: “PSS has been promoting the recording of incident and near miss data for many years. But without the context of how that data can be used, it is difficult to fully understand what data should be recorded. If more detailed records are kept, including basic notes taken at the time of the incident, then ability of AI to identify root causes for near

misses and observations, will allow the port sector to learn lessons much more effectively and address the root causes most likely to be the cause of incidents in the future.”

PSS has confirmed it is intending to take the results of this initial project forward by encouraging more ports to take part, and crucially, to retain more of the data that arises from observations, near misses and incidents, so that the true value of computer learning, data analysis, and artificial intelligence can be realised.

PSS is the UK’s professional

n Forth Ports is one of five UK-based port groups working with Port Skills and Safety Ltd to improve data recording and analysis relating to near-misses and incidents through greater use of AI

safety and skills membership organisation for ports and has been collecting statistics on incidents and near misses in UK ports for more than ten years. Working with PSS member Comet; data, including first responder’s reports, investigations, and safety observations was collected from five ports, Bristol Port Company, Forth Ports, Peel Ports, Hutchison Ports and the Port of Blyth.

Port and terminal operator, Eurogate, has confirmed a new groundbreaking partnership with Prodevelop that will see a Digital TwinSim developed for the Eurogate Container Terminal in Hamburg, Germany.

Prodevelop is using its expertise in Internet of Things (IoT) and Big Data projects to implement what it regards as “revolutionary” solutions in generating a digital twin of processes and equipment, transforming operations and maintenance at this facility.

Patrick Jandt, Head of IT, Eurogate, explains how the process is developing: “As we approach the key stage of the TwinSim project, leveraging big data to visualise current operations in real-time and predict future scenarios, our collaboration with Prodevelop

stands as a cornerstone in our digital transformation journey.”

Eurogate has also confirmed that there is a focus on Industry 4.0 technologies, which will support seamless integration of terminal equipment into a unified view, thereby helping better optimise operations for enhanced efficiency and productivity.

The operator adds that pivotal

n Eurogate, has confirmed a new “groundbreaking partnership” with Prodevelop that will see a Digital TwinSim developed for the Eurogate Container Terminal

to the project is Prodevelop’s establishment of a Data Lake and innovative methods that better integrate IoT data from the physical layer with Terminal Operating System (TOS) systems.

PreGate for Holt Advent eModal (AeM) has confirmed that Packer Avenue Marine Terminal, operated by Greenwich Terminals LLC and a part of Holt Logistics Corp., has expanded its use of AeM’s eModal Community Portal with the deployment of PreGate at the Port of Philadelphia. This allows truckers and shippers to schedule appointments in advance to facilitate a more efficient entry and exit process.

Harbor Lab, the maritime software company modernising outdated accounting practices across the shipping industry, has raised US$16 million to help it streamline port call cost management processes. The company’s platform optimises the port cost management process for shipping companies, thereby enabling a single individual to oversee disbursements for up to 50 vessels vs today’s ratio of 1 to 6 ships. Harbor Lab further states shipping companies can reduce the margin of error from 20% to just 3% per port call.

‘Live Position’ has been launched by Hapag Lloyd. Representing the shipping line’s first dry container tracking option, this new platform offers full transparency on the location of shipments, from the start of transportation through to arrival at destination. The shipping line says key features include a user-friendly interface and easy-touse search functionality by container, booking number, or in batches and is flexible enough to make adjustments in real time.

Welcome to stand B30 and celebrate with us!

Rotterdam Ahoy Centre, 11-13 June 2024

The Port of Gothenburg has launched a new platform, dubbed ‘Digital Port Call’ to provide faster, safer, more efficient and sustainable ship calling processes.

This new vessel arrival initiative represents a new comprehensive digitalisation process, as Fredrik Rauer, Manager Port Control, Gothenburg Port Authority, explains noting that from the departure of a vessel from its previous port until it arrives at the Port of Gothenburg, large amounts of information need to be communicated between up to 120 different parties. These must all be actors who need to be synchronised, including

The Quantum Delta NL programme consortium of Port of Rotterdam Authority, Q*Bird, Single Quantum, Cisco, Eurofiber, Portbase, Intermax and InnovationQuarter have built a scalable quantum internet connection in the port of Rotterdam. After a successful trial, this new communication system hopes to improve the security of seagoing vessels that visit the port and deliver security against the threat of quantum computers.

shipping companies, terminals, tugboats, pilots, boatmen, and traffic planners.”

He elaborates: “With our Digital Port Call platform, all necessary information can be collected and processed into a common situational awareness that provides data-driven decision support throughout the call process. This provides better predictability and opportunities for more efficient resource planning, while any disruptions can be detected and addressed early.”

In addition, ‘Digital Port Call’ also enables just-in-time arrivals for vessels. By receiving a “digital queue ticket” well in advance of

Icom UK has launched its new, innovative, IP-M60 Hybrid Marine VHF/LTE radio. This product combines the reliability of traditional VHF communications with the versatility of 4G LTE connectivity providing users with communication covering both land and sea. This means the IP-M60 can be used offshore, in ports, on rivers, in container ports, harbour authorities and anywhere maritime and business communications are required.

Peel Ports Group has confirmed a new strategic partnership with Awake.AI to leverage AI-based solutions for berth planning and prediction.

The company explains that this collaboration is seeking to integrate Awake.AI’s innovative technologies into relevant systems by facilitating the sharing of situational awareness regarding port calls among end users.

Awake.AI’s Berth Planning and Prediction solutions are targeting significant improvements in port operations by increases in utilisation rates and reductions in both turnaround times and emissions.

arrival, vessels avoid rushing into the port area for a favourable slot time. Instead, it can adjust to a more eco-friendly and cost effective speed during the sailing from the previous port so that upon arrival in the Gothenburg port area, it can proceed directly to a pre-assigned quay.

When calculating the total reduction in anchorage and berth time, the Port of Gothenburg expects a decrease of 6000 tons of CO2 emissions in the port area per year thanks to the conditions created by the new platform.

A new joint initiative has been launched to digitally connect the maritime and inland port community by platform operators, Portbase and RheinPorts. The aim is to optimise the flow of data between the ports in the Netherlands and the inland ports on the Rhine through seamless exchange of data, import and export process optimisation, improvements in planning and the simplification of information to stakeholders.

Georgios Krystallis, Business Improvement Manager at Peel Ports – South East Ports, commenting on the partnership with Awake.AI underlines: “Their innovative solutions can be instrumental in revolutionising our operations, enhancing efficiency, and driving sustainable growth……on this journey of progress.”

UK-based Peel Ports handles around 70 million tons of cargo across its portfolio of eight facilities, which includes Liverpool, London Medway, Heysham, Clydeport and Dublin.

Global Shipping Business Network (GSBN) has added Philippines-based International Container Terminal Services Inc. (ICTSI), Westports (malaysia) and Portbase (Rotterdam) to its membership network digitalising container shipping and trade activities.Cosco Shipping, Cosco Ports, SIPG, Hutchison Ports and Hapag-Lloyd are members of the non-profit group targeting paperless global trade.

Flexible cables are essential for efficient energy supply and data transmission, especially in dynamic applications like cranes Prysmian’s state-of-the-art German engineering ensures these cables are perfectly tailored to specific conditions, preventing downtime and guaranteeing smooth operations With our comprehensive product and service solutions, we help systems operate efficiently and sustainably

With nearly 140 years of experience, a global presence, and a dedication to innovation and sustainability, we are driving the energy transition forward

Product Solutions for every application

Our extensive product portfolio covers all crane and hoist applications, including LV/MV Reeling, Spreader, Festoon, Chain, and Shore Connection cables These products are engineered to withstand the toughest mechanical and environmental conditions, ensuring reliable performance even under extreme stress We also offer hybrid cables that integrate power, data, control, and fiber optic elements in a single, efficient solution

Quality Assurance

Our rigorous testing and development processes ensure the highest quality and durability of our products Through comprehensive testing, such as torsion, cold flexibility, rolling, walk and chain tests, we simulate realworld conditions to enhance product longevity and reliability

Service Capabilities

Prysmian offers a range of services, including cable termination, on-site repairs, and custom configurations to streamline installation and boost efficiency Our expert teams can quickly repair and restore damaged cables, extending their lifespan and reducing waste, which directly supports our sustainability goals

Prysmian’s commitment to innovation, sustainability, and quality makes us the leader in advanced cable solutions for crane applications. Join us in driving the global transition to sustainable energy with cables designed to meet and exceed the toughest demands.

KEY PRODUCTS

PROTOLON MV reeling cables

Perfect for mobile equipment with high energy demands, offering durability and reliability

CORDAFLEX LV reeling cables

Designed for high mechanical stress applications, providing unmatched flexibility and resistance to torsion and abrasion

RONDOFLEX cables

Ideal for festoon systems, offering superior flexibility and minimal maintenance

SPREADERFLEX cables

Engineered for vertical applications with high mechanical stress and speed, ensuring robust performance

INNOVATIVE SOLUTIONS FOR THE ENERGY CHANGE

CORDAFLEX(SMK-200)

optimized design and cost attractive for electrified rubber-tired gantries (ERTGs)

SPREADERFLEX cables setting new lead-free standards for environmental performance

PROTOLON(SC) Shore Connection cables facilitate cleaner energy supply to ships in ports, supporting diesel-free operations and improving air quality in harbors

More info about our products

MEET US AT TOC EUROPE 11 - 13 JUNE AHOY ROTTERDAM BOOTH B32

US President, Joe Biden has confirmed plans to impose tariffs of 25% on a wide range of goods manufactured in China during 2024, including ship-to-shore (STS) container cranes, electric vehicle (EV) batteries, computer chips and medical products.

These increased tariff rates are part of a broader strategy by the US to seek to “safeguard” American workers, companies, and supply chains.

Yet the timing is pertinent, coming during heightened security concerns for US ports and alleged potential cybersecurity threats connected with port equipment developed and manufactured in China.

A major supplier of STS cranes to the US (and, indeed, on a global basis) is Shanghai Zhenhua Heavy Industries (ZPMC). This is a company with reported close ties to the Chinese Communist Party (CCP) and, therefore, the national government. As a result, ZPMC faces security challenges in the US with fears that its equipment

Crane systems supplier PACECO Corp., has confirmed a new pilot programme at Yusen Terminals Inc (YTI) in the Port of Los Angeles for the world’s first hydrogen fuel cell powered rubber-tyred gantry (RTG).

The new unit, known as a H2-ZE RTG Transtainer Crane, has been developed in collaboration with MITSUI E&S and with funding from the Japanese New Energy and Industrial Technology Development Organization (NEDO). It commenced operations in mid-May 2024.

The new design RTG runs 100% on fuel-cell hydrogen technology,

The Port Authority of Guam (PAG) has approved the procurement of up to three new cranes. The acquisition of these new Ship-to-Shore cranes comprises the first new cranes that the port will procure in its 48 years of autonomy. All previous cranes have been sourced as secondhand equipment, previously owned and operated by other US ports. The current units are 40 years of age and need replacing by 2029.

n The Biden Administration is imposing 25% tariffs on STS container cranes manufactured in China as US security concerns rise in conjunction with such units

can play a role in terms of spying and espionage.

The decision to impose tariffs follows an Executive Order issued by the Biden administration in

February 2024 that includes improvements in maritime cybersecurity and strengthening supply chains. A key part of this initiative is the provision of

US$20bn to help facilitate STS crane manufacturing domestically in the US spanning new units and the replacement of existing Chinese-built cranes.

representing an unprecedented first for terminal operations, offering the ability to achieve zero emissions with large container cranes without connecting to the electric grid.

The fuel-cell power pack (FCPP), an efficient power system replacing a typical diesel genset, was designed and built by MITSUI E&S in Oita, Japan, with hydrogen being provided by Toyota Tsusho for the project.

JF Fendercare Deal James Fisher Fendercare (JF Fendercare) has confirmed a new contract to supply bespoke fixed cell fenders and bollards in Singapore, as part of consolidating terminal container activities and improving levels of efficiency and sustainability. This deal is a component of a project entailing the reclamation of 387ha of land, provision of 23m of deep water and 8.6km of quay wall with overall project completion in Q1 2027.

Modification of existing conventional diesel RTGs is possible to achieve zero emissions with the FCPP system.

A typical diesel-powered RTG crane emits the carbon dioxide equivalent of burning over 400 barrels of oil per year, while the H2-ZE RTG Transtainer Crane emits nothing. This pilot project is scheduled to operate over the next four years at YTI Initially, the crane will operate

OneStop Deal OneStop has confirmed it is partnering with DP World to drive innovation and efficiency at DP World’s new state-of-the-art container park at Fisherman Island, Port of Brisbane. The facility will use OneStop’s Depot Operating System, OneStop Modal, to ensure fast and reliable container transactions, with OneStop’s Vehicle Booking System (VBS) further expediting traffic flow management.

for 16 hours per day and will perform at the same efficiency level as a conventional dieselpowered or hybrid rubber tyred gantry crane. In addition to emissions reduction, the crane offers reduced noise pollution for port workers, both those operating the machine and those in close proximity to it.

Cavotec has signed a new service agreement with the Port of Salalah, Oman. Cavotec previously installed 32 automated, MoorMaster vacuum mooring units at this major container port. However, the aim of this new arrangement is to support the port’s efficiency and throughput by minimising downtime and ensuring continuous operation of essential equipment. Cavotec currently works in 30 different countries.

A new automated gate system has been launched at P&O Ferries in Europoort, in collaboration with port technologies supplier Surikat.

As a result of the Fast Gate solution being placed into operation, P&O Ferries is expecting to see improved efficiencies in data management and customer services for freight operations involving both road and rail activities.

Surikat has confirmed that Fast Gate features include:

Handling all gate processes for rail, plus accompanied & unaccompanied freight.

New electronic signage at the freight gate to provide clear and easy-to-follow instructions for drivers.

A Visy camera portal that will analyse all vehicles entering and exiting the terminal, for both road and rail traffic, providing ANPR (automatic number plate recognition), vehicle measurement and a full 360-degree capture of the vehicle and unit condition.

A self-service kiosk providing a multi-language user interface for drivers to gate-in and out of the terminal automatically, or to check in for a sailing.

An automated barrier system for swift entry and exit of the terminal.

“We are excited to introduce Surikat’s automated gate solution at Europoort, offering a streamlined and customer-centric approach to freight operations,” says Alex Cork, P&O Ferries, adding, “This system not only enhances our operational efficiency but also prioritises the convenience and safety of our valued customers.”

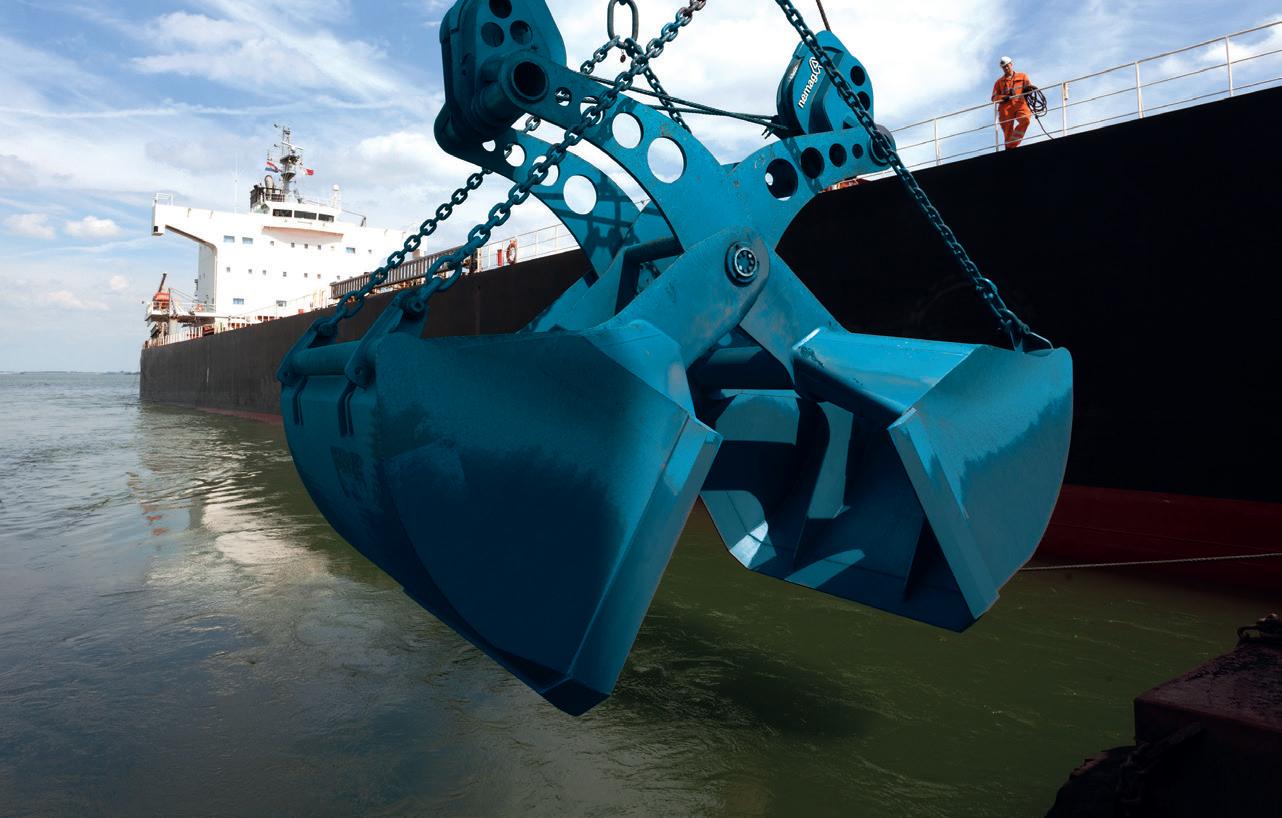

Bruks Siwertell has launched a new radar-based anticollision system, which enables supervised, semi-automatic unloading and a further option of digital hatch visualisation.

The use of radar offers distinct advantages in dry bulk handling. Even in challenging environmental conditions such as dust, fog, and snow, it is able to provide a very effective mechanism for digital

image generation, meaning it is possible to see the hatch and the material inside, with top, side, and overall views available.

This means that the operator can also see the distances in meters to the hatch coaming and the depth of the bulk material in the hold, making it much easier to make operational decisions in either manual or semi-automatic modes.

“Digital advances are offering new levels of operational insight, and safety improvements, including the efficiency advantages of being able to run the ship unloader or loader in a semi-automatic mode when our anti-collision systems are in us,” explains Krister Holmberg, Manager Electrical Systems, Bruks Siwertell.

UNIT53 Inc. has extended its product line with the addition of a 53ft dry safety container, designed to offer the highest standards of cargo security and developed with sustainability in mind.

Available for the North American domestic US market, including Canada and Mexico, the 53ft lockable safety container has

been designed in response to the ten-year high in cargo theft. Safety features include solid doors, reinforced with safety pins and plates to provide an extra layer of protection against theft and tampering, and lashing rings that allow the stable stacking of cargo during transit.

Optional tracking by Traxens/ Hoopo enables clients to trace

their cargo at any point in the shipping process, from loading through to final destination.

In addition, UNIT53’s dry safety container can be fitted with an internal locking system to provide verifiable evidence of a secured load, key for obligatory compliance with U.S. Food & Drug Administration’s Food Safety Modernization Act (FSMA).

Kalmar, part of Cargotec, has concluded an agreement with Uniport Srl. to supply three TR618i heavy terminal tractors. The order was booked in Cargotec’s Q2 2024 order intake, and the machines are scheduled to be delivered during Q4 2024. These new units will come with cabin air suspension, an optional feature to increase comfort for operators during shifts. Uniport is located in the Port of Livorno, northwest Italy.

The Port of Long Beach has broken ground on its new truck charging station, which is to be managed by Forum Mobility. The facility, set to open during Autumn 2024, is being built to meet what the port says is accelerating demand for heavy-duty electric truck use, as part of its drive towards ensuring zero emissions for drayage haulage by 2035. This new facility will offer 19 dual-port chargers and six singledispenser chargers capable of charging 44 heavy-duty electric trucks simultaneously in about 90 minutes.

(SFT) has delivered four Parallel Motion Fenders to Thunderer Jetty, located on the banks of the River Thames in Dagenham, East London, Each of the four sets consists of two cone fenders SPC 1100 mounted back-to-back, to allow for twice the energy absorption and large closed box steel panels (2250 x 9930 mm). The project scope also included two more Fender Panels (2100 x 9930 mm) and eight sets of Bollards with various capacities.

UNIT45, worldwide market leader in 45ft containers, concentrates exclusively on the development, construction, financing and delivery of 45ft pallet wide containers for European shortsea/intermodal transport operators.

Transporting more with fewer movements, all handled with the same infrastructure as used for 40ft containers.

Achieve efficiency on all levels of environment and infrastructure. Reduce your transport costs and carbon footprint.

Start your intermodal journey with UNIT45 and contact us today for a suitable offer!

Click here to read article on Port Strategy online

Click here to read article on Port Strategy online

WE ARE THE EXCLUSIVE DEALER FOR SEVERAL TRIPLE A BRANDS IN THE PORT EQUIPMENT INDUSTRY. OUR CLOSE CONNECTIONS WORK TO YOUR BENEFIT: YOU HAVE ACCESS TO SHORT SUPPLY LINES AND A WIDE RANGE OF PRODUCTS. WHETHER YOU’RE BUYING, LEASING OR RENTING, GPE OFFERS DIFFERENT FINANCING OPTIONS. THANKS TO OUR NETWORK OF LOGISTICS EXPERTS, YOU’RE ALWAYS SURE YOUR MACHINE WILL ARRIVE PUNCTUALLY, NO MATTER WHERE IN THE WORLD YOU NEED IT.

Click here to read article on Port Strategy online

Click here to read article on Port Strategy online

The trajectory of European ports is changing – fundamental structural changes are underway. Andrew Penfold identifies the catalysts to change and paints a picture of the port sector 10 years on

The development of demand at European ports has been characterised by fairly steady expansion, with this linked to general economic growth and (for containers especially) a period of globalisation driven primarily by China. As is considered by A J Keyes in the accompanying articles, there is now a clear step-change in demand and, as the Covid crisis recedes, and its immediate fall-out is digested (a demand collapse followed by recovery), it’s clear that significant changes are underway. A simple reliance on increased demand to fund large scale port investment now looks increasingly misplaced. So how will the tension between investment and economic returns be squared?

What is going on in the market and what will the major ports look like in five- or ten-years’ time? Essentially, major ports are facing pressures from two key sources. On the one hand, macro- economics is shifting the ground on which port investment is predicated and – at the same time – changes at the regulatory level are also forcing shifts in the sector. How these forces will interact, and modernisation and expansion still be delivered on a profitable basis, will be the main driver of future port development in the major European ports. Since the early 1990s the emphasis on investment in the North Continent has been for providing increased capacity for containerisation, with a focus on market share considerations. With demand recording year-on-year increases this rising tide served to ‘lift all boats’ with increased volumes invariably justifying the pace of expansion. The rapid shift to larger

vessels also resulted in investment being focused on the largest capacity terminals for both gateway and transshipment activities.

The European Seaport Organisation (ESPO) has suggested that European ports will require investment of at least Euro 80bn within ten years. How this can be profitably delivered in a climate of slower growth is far from clear.

If we take a look at the key drivers here it is clear that things are changing. Most significantly, the pace of demand growth on the major Asia-Europe trade has slowed, with this impacting on both direct volume and transshipment volumes at the major hubs. This has been driven by uncertainties with regard to reliance on China and an only partially realised switching to alternative East Asian suppliers. The Covid experience and geopolitical uncertainties underlined the move towards ‘nearshoring’ at the expense of these deepsea trades. This is a global phenomenon but has been clearly manifested in the European port market.

The link between GDP and trade growth has also changed significantly in the past few years. According to broker Clarksons, between 2010 and 2020 the global link between GDP and trade volumes was placed at 1 : 1.02, with this representing a continuation of a well-established longer term trend. Indeed, the link for containerised goods was even stronger. The corresponding figure since 2020 has been 1 : 0.66. The major market drivers – slower deepsea growth, increased emphasis on intra-regional trade and increased

n ESPO puts a figure of at least €80 billion required for port investment within the next years but in all probability this will take place against a background of a lower profitability profile for terminal operators

Governments (and their Port Authorities) will come under increasing pressure to provide the investments that will be needed to meet their new policy requirements

annual volatility – are changing, but the sector will clearly need to adjust to a period of slower growth.

This will place further pressure on the major ports but will also offer opportunities in the sector. In the period since 2020, the pace of shortsea intra-Europe trade has increased more rapidly. The previously neglected shortsea terminal market is now receiving increased attention. The pace of demand growth in the Ro-Ro and Lo-Lo (containerised) markets has increased sharply and this process is still underway. Competition between these two modes has focused primarily on cargo value and overall supply chain costs but increased emphasis on environmental issues, carbon offsets and a lack of truck drivers have made the position complex. Investment in these shortsea terminals will increasingly be driven by local trading relationships and service levels. Reliable delivery will be the key as much as overall transport costs. This represents a considerable change in perspective for both operators and investors.

As if these shifts were not enough to digest, changes at the regulatory level make the outlook even more opaque. Environmental issues are now at the centre of port development in Europe. These are primarily driven by changing rules and priorities but – considered together –these will have far-reaching impacts. Specifically:

Emissions controls will become central. Already, we are seeing moves to electrify port equipment and this will continue. At the same time regulatory requirements will insist upon the provision of shoreside power for vessels when cargo handling. There are major uncertainties in this sector with regard to standardisation, but the overall constraint will be the expense of provision of these systems.

The shift towards hydrogen and other alternative fuels will see an increase in the amount of land required for the storage and handling of these commodities. In the North Continent port markets space is at a premium so the costs of this provision will be high.

Similar considerations apply to land required for the construction and maintenance of wind farms, with this already driving up land prices in some key markets.

Carbon pricing and the push for increased intermodalism will accelerate changes in port structures with this focusing investment on facilities serving immediate markets and also emphasising the importance of barging and other modal shifts.

A combination of these and other factors will change the structure of the European port sector as the emphasis shifts from expansion to environmental efficiency. The level of compulsion is also set to increase sharply.

In the next few years port investment in Europe will be increasingly focused on meeting stricter regulatory requirements, with this entirely driven by environmental concerns. At the same time, the pace of demand growth seems certain to be significantly slower than has been the case. Indeed, recent heavy commitments in some of the major gateway ports could see a period of overcapacity as deepsea and transshipment volumes record slower growth.

In this situation, the level of profitability for terminal operators will be squeezed and this will coincide with significant investment calls. It is not clear that the established structure of port investment will survive this change. Governments (and their Port Authorities) will come under increasing pressure to provide the investments that will be needed to meet their policy requirements. In ten years’ time we can anticipate a European port sector which is less profitable and increasingly reliant on external funding to meet structural changes.

It’s far from clear that this is a positive outlook. Investors will need to factor in the impact of all of this on their profitability and asset values. This may drive away the more speculative groups as margins will become tighter and state interests exert increased control over the sector.

n Short-sea operations, spanning lo lo and ro-ro, are expected see increased activity

FOR A SUSTAINABLE PORT FUTURE

For a sustainable port future, we offer a full range of highly efficient electrified machines.

+ NO CO 2 EMISSIONS

+ LOW ENERGY CONSUMPTION

+ LESS MAINTENANCE REQUIREMENTS + REDUCED NOISE LEVEL

The Gdansk-Le Havre port range is the engine room for the North European mainland and handles a wide range of different cargoes. AJ Keyes assesses how the major facilities performed in 2023 and how 2024 has kicked off

While the ports of Le Havre, Rotterdam, Antwerp and Hamburg are known for their involvement in handling containers, the facilities in this geographic range of more than 600 nautical miles, are much more than gateway and transhipment hubs for boxes.

On the back of challenging economic developments globally, ports in this region faced a difficult 2023, which has clearly continued into 2024. So, what are the numbers behind port performance in the region and for the major ports themselves?

Figure 1 provides a summary of total cargo volumes handled for the calendar years of 2022 and 2023 for a wide range of key ports in the North European continental region between Le Havre and Gdańsk. Almost all of these main ports on this continent confirmed a drop of total performance for the 2023 period compared to the 12-months of 2022 –with the exception of Gdańsk, albeit that its volumes in 2022 were the lowest of each of the ports listed.

Table 1 provides a more detailed overview of cargo handling throughput for each of the listed ports, broken down by key types of activity, and for the full-years of 2022 and 2023, plus Q1 2023 and Q1 2024 activity (where reported).

There is a clear commonality from each of these major ports. Rotterdam regards 2023 as a year of transition, noting concerns about the “deteriorating investment climate” across several cargo sectors and pointing to a need for supportive government policies, while fellow Netherlandsbased port, Amsterdam, agrees that it was also in “full transition” as its throughput in fossil fuels declined.

…2024 is also expected to be an unpredictable year… ‘‘

Port of Rotterdam Authority

There were other similarities between the ports. The Port of Antwerp-Bruges cites “geopolitical tensions and slowing global economic growth” as driving down industrial production and trade flows, while in Hamburg the port also confirms that “geopolitical and economic challenges” impacted cargo handling demand, adding that the “declining development of the German economy and the subdued consumer sentiment” were major factors in the results for 2023.

Haropa Port, which includes the Le Havre facilities, points to a “declining global context” and national strikes for 2023 but felt it has “stayed on course” as it entered 2024.

The two major ports in the region have seen a tough start to 2024 and based on the release of Q1 figures (as available at the time of writing in early May 2024), there are clear indications of challenges being faced for the remainder of the current year.

In Rotterdam, total throughput for Q1 2024 dropped by 1.4% compared to Q1 2023, with 111.7 million tonnes falling to 110.1 million tonnes. The port authority explains that the decline is mainly due to the reduced throughput of coal, crude oil and oil products, although offset by some improvements in iron ore, scrap and LNG.

Dry bulk was down by 4.5% in the first three months of 2024 compared to Q1 2023, apparently due to lower coal volumes, with less demand for thermal coal for power generation noted. At the same time, liquid bulk throughput dropped by 3.1% to 52.6 million tonnes, a fall of 1.6 million tonnes of crude oil and mineral oil products handled. Q1 2023 was also when Russian oil products were being replaced. However, throughput of LNG, as a source of natural gas, again increased, by 3.6% to 9.1 million tonnes.

n Rotterdam is expecting 2024 to be an unpredictable year, with wider geopolitical issues impacting volume demand through regional ports

The Hamburg-Le Havre port range is the engine room for the North European mainland handles a wide range of diCerent cargoes. AJ Keyes assesses how the major facilities performed in 2023 and how 2024 has kicked oC

While the ports of Le Havre, Rotterdam, Antwerp and Hamburg are known for their involvement in handling containers, the facilities in this geographic range of more than 600 nautical are much more than gateway and transhipment hubs for boxes.

On the back of challenging economic developments globally, ports in this region faced diCicult 2023, which has clearly continued into 2024. So, what are the numbers behind performance in the region and for the major ports themselves?

Figure 1 provides a summary of total cargo volumes handled for the calendar years of 2022 2023 for a wide range of key ports in the North European continental region between Le and Gdańsk. Almost all of these main ports on this continent confirmed a drop of total performance for the 2023 period compared to the 12-months of 2022 – with the exception Gdańsk, albeit that its volumes in 2022 were the lowest of each of the ports listed.

Boudewijn Siemons, CEO & Interim COO of the Port of Rotterdam Authority provides further analysis of the Q1 results: “The throughput figures show limited imports of raw materials and exports of finished products. This tells us that European industrial production is still suffering from high energy prices and low demand from the biggest declining sectors such as construction and the processing and automotive industries. From the growth in container throughput, however, (see following article), we see the first signs that world trade is picking up. Nevertheless, these tentative signs remain highly uncertain due to rising global tensions.”

Antwerp-Bruges fared slightly better in Q1 2024. Total

Notes: Base data provided by each port/port authority and dataand.com

Notes: Base data provided by each port/port authority and dataand.com

Table 1 provides a more detailed overview of cargo handling throughput for each of the ports, broken down by key types of activity, and for the full-years of 2022 and 2023, plus and Q1 2024 activity (where reported).

cargo throughput reached 70.4 million tonnes, a rise of 2.4% compared to the same period last year. The port states that the result was achieved despite “a complex geopolitical and macroeconomic context.”

In more specific detail, outgoing flows of dry bulk rose by 9.7%, incoming flows fell by 24.4%, resulting in a fall of 12.1% in the dry bulk segment, with coal seeing a major decline of -68.8%. Throughput of fertilisers, the largest product category within dry bulk, recovered since Q4 2023, up by 33.9%, with demand for non-ferrous ores (+47.3%), and scrap metal (+5.7%) also higher. Lower demand from the construction sector affected throughput of sand and gravel (-12.5%) and cereals are increasingly being transported in containers rather than in bulk (hence a -43.7% drop).

For liquid bulks, growth was reported for Q1 2024 over Q1 2023 in throughput of fuel oil (+25.2%), gasoline (+12.1%) and LNG (+10%), while handling of chemicals and naphtha rose by

5.2% and 12%, respectively, despite the port authority explaining that there remained, “competitive pressure on the European chemical industry due to the high cost of energy, raw materials and labour.”

In releasing its 2023 calendar year results, the Port of Rotterdam provided a succinct summary of what was expected for 2024: “Against the backdrop of geopolitical developments and upcoming elections in several countries, 2024 is also expected to be an unpredictable year. It is all the more important in these turbulent times (for the port) to maintain a steady course and to implement plans that will further the transition.”

These words are already looking to be a reasonable synopsis of the position faced by the North European seaports industry as 2024 moves forward.

Gdańsk

Electric RTGs, available with busbar or cable reeling drum and hybrid machines with Liduro energy management are ideal for reducing your carbon footprint. www.liebherr.com

Liebherr Container Cranes Ltd.

The Le Havre-Hamburg/Gdansk port range sees some of the largest container ships in service, bringing substantial volumes to European consumers. How are these ports currently performing? AJ Keyes looks at current trends

The Westbound Asia-Europe route sees some of the biggest container ships in service bringing substantial volumes of cargo to European consumers. Add to this additional East-West transatlantic route activity and all North-South trades, then it is no surprise to note the immense scale of container port throughput in the range between Le Havre and Hamburg/Gdansk.

So, how have ports in this critical region fared during 2023 and what is expected for 2024?

Figure 1 provides a summary of the longer-term development of the major facilities between 2011 and 2023.

While there are other ports in the region, the listed facilities represent the majority of the deep-sea options and are a very good barometer for overall European development. For example, in 2011 the collective total was almost 38.4 million TEU, which had reached just over 42.6 million TEU by the end of 2023.

There have clearly been some fluctuations in this period, with the 2020 total (of around 44.1 million) impacted by the COVID-19 pandemic and 2023 seeing a decline of over 7.8% compared to 2022, representative of global economic challenges and geo-political issues (including in Ukraine and the Red Sea). Other longer-term trends include:

Rotterdam has always been the largest-volume container port, but Antwerp has closed the gap during the current decade, partly helped by Antwerp and Zeebrugge operating under one name going forward (initial agreement reached in 2021, with final ratification in Q2 2022 (to operate as the Port of Antwerp-Bruges)

The German ports of Hamburg and Bremerhaven were handling more containers at the start of the assessment period compared to the end of it

Le Havre has seen small growth, but overall throughput has remained largely consistent

Gdansk has enjoyed a successful period, although retains the lowest total throughput facility of all the ports listed

So, what are the port themselves reporting in their results?

For Rotterdam, a fall in container throughput of seven per cent to 13.4 million TEU for 2023 represents a continuation of a decline that began in 2022 and carried on for the most recent 12 calendar months.

The port authority referenced market volatility and, “lower consumption, lower production in Europe and the discontinuation of volumes to and from Russia pursuant to the sanctions,” even though port calls in this sector were up by one per cent.

A similar picture was painted in Antwerp-Bruges, with the port stating that “weak global economic growth and lower demand for commodities is impacting global demand for container transport.” This corresponds to a drop in container throughput of 7.2% for TEU traffic handled, although the port maintains that despite this position its “market share in the Hamburg - Le Havre range rose 0.6% points to 30.2% in 2023.”

In Hamburg, container throughput fell by 6.9% for 2023 compared to 2022, although it could have been worse, with the first half of the year lower by 11.7% over H1 2022.

“When we look at the development of our throughput figures, we are on the same level as our Northern European competitors and are holding our own well compared to other ports. The decline is primarily due to the difficult geopolitical and economic situation that we all are facing,” explains Axel Mattern, CEO of Port of Hamburg Marketing.

n Pursuing its strategic plan provides the development compass for the Port of AntwerpBruges in 2024

Geo-political tensions, economic uncertainty and inflation continue to linger in the background but there are some signs of recovery…

Despite the fall in containers handled, Hamburg states that it saw an increase of 14.8% in ships of 18,000TEU and above, with 272 vessels calling at the port. Other key results included growth of eight per cent (to 653,000TEU) for US trade, albeit this was still some way behind the 2.6 million TEU from China (itself a drop of 10.9% from 2022).

HAROPA Port, which includes the deep-sea facilities in Le Havre, France, states that its results for 2023 ensured that it “stays on course.” This update comes against a backdrop of 2.63 million TEU handled for 2023, versus 3.1 million TEU moving through its facilities for the comparable period one year earlier.

Clearly, 2023 represented a challenging year for almost all container ports in this key market, but how has 2024 started and what strategies are being adopted?

Rotterdam is undertaking key infrastructure and development projects in 2024 and this comes at a time when the container segment is showing a slight increase in throughput for the first time in three years. For Q1 2024, throughput was up by two per cent to 3.3 million TEU, despite the situation in the Red Sea seeing a drop of 24.5% in ship calls and Asian volumes down by 13.7% in January and February due to delays and missed sailings. A rebound of more ships arriving (up 11.5%) occurred in March, with feeder traffic to the Mediterranean up by 29% as cargo moved to this area to compensate from ships bypassing ports as they divert via the Cape of Good Hope.

Cautious economic recovery is the message from the port authority with plans for terminal expansion, improved road access in the port and better vessel access all pushing ahead this year.

APM Terminals (APMT) and Rotterdam World Gateway (RWG) are both expanding, with APMT adding two million TEU extra capacity. The completion of the quay is planned for the second half of 2024. At RWG, 45ha of terminal land and 920m of quay wall will improve capacity by 1.8 million TEU/yr. Both terminals are preparing for the use of shore power and carbon-neutral operations.

Elsewhere, the port’s Container Exchange Route (CER) went into operation in late 2023. The 17km closed road network currently connects the container terminals of Rotterdam World Gateway (RWG), the Delta terminal of Hutchison Ports ECT Rotterdam (ECT), the terminals and depots of QTerminals Kramer Rotterdam (KDD, RCT and DCS) and the State Inspection Terminal of the Customs Authority to improve security, efficiency and sustainability in the port. Finally, as more frequent and increasingly larger container vessels pass through the Yangtzekanaal to the Maasvlakte terminals, the navigable channel of the Yangtze Canal is being widened in three sub-projects. The first began in September 2023 and involves 500m of quay alongside the port entrance, with shored-powered berths established for 12 tugs. Completion is expected in early 2025.

SUSTAINABLE GROWTH KEY

March 2023 represents the best monthly throughout for containers at the Port of Antwerp-Bruges since March 2021,

GDANSK

Source: Ports, port authorities www.dataand.com

Source: Ports, port authorities www.dataand.com

Source: Ports, port authorities www.dataand.com

with almost 3.29 million TEU handled – amounting to a six per cent rise over Q1 2023.

CAPT – CAN THE ABOVE 2 CHARTS BE PLACED SIDE-BY-SIDE AND SMALLER, SO THEY TO BE ONE JOINT CHART? IF NOT, PLEASE DELETE TOP CHART

CAPT – CAN THE ABOVE 2 CHARTS BE PLACED SIDE-BY-SIDE AND SMALLER, SO THEY TO BE ONE JOINT CHART? IF NOT, PLEASE DELETE TOP CHART

These results were recorded following what the port authority described as, “economic uncertainty and inflation causing a global slowdown in demand for container transport” that ran into the beginning of 2024.

MIKE – BUT CAPT IF U CAN GET BOTH CHARTS IN IN THE LARGER SIZE THAT WOULD ALSO GOOD

MIKE – BUT CAPT IF U CAN GET BOTH CHARTS IN IN THE LARGER SIZE THAT WOULD ALSO GOOD

TEU

MARKET VOLATILITY…WEAK GROWTH

MARKET VOLATILITY…WEAK GROWTH

So, what are the port themselves reporting in their results?

So, what are the port themselves reporting in their results?

Moving forward, this major European port has a clear strategy, focussed on sustainable growth, which will see a 10year investment programme of €2.9bn on key infrastructure including a quay wall for the Europa Terminal, a new coordination centre and use of residual land on the left bank.

For Rotterdam, a fall in container throughput of seven per cent to 13.4 million TEU for 2023 represents a continuation of a decline that began in 2022 and carried on for the most recent calendar months

For Rotterdam, a fall in container throughput of seven per cent to 13.4 million TEU for 2023 represents a continuation of a decline that began in 2022 and carried on for the most recent calendar months

The port authority referenced market volatility and, “lower consumption, lower production Europe and the discontinuation of volumes to and from Russia pursuant to the sanctions” though port calls in this sector were up by one per cent.

The port authority referenced market volatility and, “lower consumption, lower production Europe and the discontinuation of volumes to and from Russia pursuant to the sanctions” though port calls in this sector were up by one per cent.

Jacques Vandermeiren, CEO, Port of Antwerp-Bruges explains further: “We had seen it coming for some time that: 2023 would not be a great year. After all, as a port, we are at the centre of economic and geopolitical challenges. But, with a powerful strategy, the merger and an efficiency exercise, we have managed to organise ourselves in good time and are even gaining market share in the Hamburg-Le Havre range. Especially in more turbulent waters, it is essential that we continue to sail in the right direction, with our strategic plan as our compass. That is what we will continue to do in 2024.”

HAROPA Port also confirms it is “continuing to invest” with €201 million being “dedicated to multimodality.” This includes construction supporting river access to Port 2000 in Le Havre, along with road and rail infrastructure improvements for Berth 11 and Berth 12, also at Port 2000, and in conjunction with MSC and TiL.

Times in 2023 for key European container ports have been challenging, but less turbulent waters seem to be on the horizon for 2024.

n Figure 1: Container Trade Development, Major Ports, in the Hamburg-Le Havre Container Port Range, 2011-2023 in ‘000

The West Mediterranean port region is seeing a surge in container demand in 2024. AJ Keyes assesses the position and asks what, or indeed where, the solution might be moving forward

Container transshipment hubs in the Western Mediterranean are currently seeing a surge in throughput demand. As a result, there are growing concerns that operational congestion may soon be faced. But what has been the cause and, more importantly, what is the solution?

Despite 2023 being a challenging year for some of the major ports in this region, there was also clear momentum gained as the year progressed. Mar Chao, President of Valenciaport (PAV), stated that there was a recovery in Q4 2023, with growth of 13.1% recorded for December 2023, 18.7% in November 2023, and almost 4.4% for October 2023 against the comparable months of 2022.

This upward trajectory continued into Q1 2024. According to PAV, for example, Asian traffic handled in the first three months of this current year reflects a rise of 23.3% over Q1 2023, with China the major commercial partner (with activity up by 36.4%).

Overall, Valencia’s total container port growth improved by 18% for Q1 2024 over Q1 2023. Further, if this level of activity is maintained as 2024 progresses then the total throughput for 2023 of 4.8 million TEU, will be surpassed and could then place the port perilously close to current capacity levels of around 5.9 million TEU.

Valencia is currently developing a new €2.5bn container terminal, which will be operated by Terminal Investment Ltd (TiL), the terminal arm of MSC. With a capacity of five million TEU planned, this facility will bring much needed additional space to the port, but the issue remains that it is not a solution coming in the near term – at least not soon enough if current growth levels are maintained.

Algeciras is unlikely to have space. The port has recorded an uptick of seven per cent over Q1 2024, which if it continues will see potential for five million TEU being reached, placing utilisation at the port towards 90%.

Tanger Med continues to rapidly increase its total throughput, the majority of which is transshipment. At the end of 2023, AP Moller Maersk completed phase two of its

million TEU expansion at APM Terminals (APMT) MedPort Tangier, Morocco. The 18ha project brings 400m of berthing and four new remote-controlled, ship-to-shore (STS) cranes. A timely Phase 3 of this project will reportedly be fully operational at the start of 2025 and increase total terminal capacity by a further one million TEU. While, however, it offers more space, it is only accessible if the capacity is not fully utilised by Maersk Line and other shipping lines are also comfortable using this facility.

There may be capacity challenges on the horizon for ports in the West Mediterranean region, following strong growth in the opening months of 2024 – is Malaga a solution?

Clearly there are challenges on the horizon for ports in the West Mediterranean region. Following a return to growth in the opening months of 2024, the threat of prolonged continuation of the Red Sea crisis brings challenges that need to be resolved.

However, the longer issues continue to impact the sailing routes via the Red Sea, the fear of dwindling breathing space for both shipping lines and port capacity will increase –especially for the West Mediterranean region where the ocean carriers are undertaking more transshipment to offset supply chain disruption.

To add further context, the Gibraltar Port Authority (GPA) states that around 60,000 vessels transit the straits on an annual, typical, basis. Of this vast total, GPA says that 20% of this activity are container vessels.

So, it is already a region seeing substantial shipping activity. Transshipment is by far the dominant activity at the

one

ports of Tanger-Med and Algeciras, (i.e. in excess of 95% of total container traffic) whereas Valenica (traditionally around 55%) and Barcelona (typically 40%) are involved in hinterland traffic, but also serve a key role supporting transshipment.

Figure 1 provides an overview of the longer-term development of the key ports included in the West Mediterranean region, namely Algeciras, Barcelona and Valencia (Spain), Tanger-Med (Morocco) and Marseilles-Fos (France).

Collectively, these ports have seen total growth of 4.8% per annum, rising from 12.99 million TEU in 2011 to 27.66 million TEU by the end of 2023.

On an individual port basis, there has been widespread long-term growth amongst these listed facilities. TangerMed has generated growth of 12.5% per annum, rising from 2.09 million TEU (2011) to 8.62 million TEU (2023). This makes the Moroccan port not only the fastest growing container facility in the West Mediterranean area, but also the largest in terms of volumes handled – and by some considerable margin in 2023. Increases at the other facilities ranged from 0.9% per annum (Valencia) to 4.1% (Barcelona), showing that every port continues to increase volumes.

For 2023, Tanger Med reports that growth over 2022 was up by 13.4% (to 8.62 million TEU) and was “equivalent to 95% of the port’s nominal capacity……accomplished four years ahead of targets.”

In its annual performance summary, the port adds: “The outstanding performance is attributed to the successful operations of terminals TC1 and TC4, managed by MaerskAPM, and the continuous development of terminal TC3, operated by Tanger Alliance (A joint venture owned by Marsa Maroc with a 50% stake, in partnership with Eurogate holding 40% and Hapag Lloyd holding 10%).”

UNFAVOURABLE COMPARISON?

So, Tanger Med has had a strong 2023 compared to other regional facilities. Container throughput at the Port of Barcelona reached 3.3 million TEU in 2023, representing a drop of seven per cent compared to 2022.

However, José Alberto Carbonell, General Manager of the Port of Barcelona, feels that there is a need to better understand the unique circumstances when explaining performance last year: “The Port of Barcelona’s throughput (in 2023) was a result of a complex international context, with an increasing number of geopolitical conflicts, low European demand and a significant cooling down of exports, in addition to the unfavourable comparison with 2022, during which we broke traffic records.”

(Morocco) and Marseilles-Fos (France).

Collectively, these ports have seen total growth of 4.8% per annum, rising from 12.99 TEU in 2011 to 27.66 million TEU by the end of 2023.

Figure 1: Development of Total Container Volumes at Major Ports in West Mediterranean Region 2011-2023, in TEU

TANGER-MED

ALGECIRAS

VALENCIA

BARCELONA

MARSEILLES-FOS

On an individual port basis, there has been widespread long-term growth amongst the facilities. Tanger-Med has generated growth of 12.5% per annum, rising from 2.09 million (2011) to 8.62 million TEU (2023). This makes the Moroccan port not only the fastest growing container facility in the West Mediterranean area, but also the largest in terms of volumes handled – and by some considerable margin in 2023. Increases at the other facilities ranged from 0.9% per annum (Valencia) to 4.1% (Barcelona), showing that every port continues increase volumes.

This is a valid point, especially in the wake of transshipment activity rebounding for the port in Q1 2024. For example, in February and March 2024, Barcelona has seen container volumes of this type increase by more than 60% compared to the comparable months of 2023. This level of growth being maintained during 2024 will place pressure on existing capacity at the port, with as much as 500,000 TEU of capacity potentially needed before the end of the current year.

Clearly, things have changed very quickly in the West Mediterranean port region.

HISTORY REPEATING ITSELF?

With a potential capacity crunch looming in the near future, and before known expansion projections come to fruition, is a return to using the Port of Malaga an option, or indeed the short-term solution?

The port has the space available; it has infrastructure and deep water because it was originally developed as a regional transshipment option, handling almost 550,000 TEU in 2008.

The port was also used by Maersk Line, until Tanger Med became an option and the shipping line gained access to its own facilities in a location immediately on major shipping routes.

How long will the Red Sea crisis last? Who knows. When the situation first occurred, sailing around Africa was an opportunity for some of the major container shipping lines to deploy available tonnage, but now the challenge is more one of finding spare container port capacity, especially for transshipment activities. For the short-term, at least, Malaga may be the congestion buster.

n Valencia recently opened bids for the construction of a new container quay at its North Terminal

n Figure 1: Development of Total Container Volumes at Major Ports in West Mediterranean Region 2011-2023, in TEU

Engage with our

We deliver bespoke marketing packages with quantifiable ROI. Maritime Journal’s valued content focuses on vessel operations and projects, both inshore and offshore, including ports and harbours and is delivered through multiple channels.

Port stakeholders want to see more momentum behind the San Antonio new port Megaproject as a path to fending off new competition. Rob Ward reports

In an unprecedented manoeuvre stake holders in the Chilean port of San Antonio are making a direct appeal to the South American country’s president, Gabriel Boric, to speed up the “Puerto Exterior [Outerport] Megaproject” that will transform the port’s current capacity, of 1.6m TEU per annum, up to 6m TEU, at a cost of around US$4BN, up from the US$3.5BN that was estimated three years ago.

The “Megaproject”- which will include two new piers, each 1730m long - has been a long time in the making and shippers and port users in San Antonio and its hinterland – which includes the country’s capital Santiago de Chile, some 75 miles and 90 minutes away up the mountain side – are getting fed up with seeing their logistics and business plans emasculated by the lack of infrastructure in San Antonio.

Leading the charge to quicken the process is Juan Armando Vicuña, President of the Cámara Chilena de la Construcción, (or Chilean Chamber for Construction) who button-holed Boric during an industry gathering last month and pushed home the point, backed up by the entire ports sector, that Chile needs to act immediately if it is to preserve the number of direct international liner calls it receives today

(predominantly to San Antonio), rather than be relegated to the status of a pure transshipment country.