FEATURE STORY:

MANUFACTURING WORKERS ARE LOOKING FOR LEADERSHIP TO TAKE THESE 4

ACTIONS

PAGE 12

MANUFACTURING TIDBITS: SMALL SCALE MANUFACTURERS ARE KEY TO REVIVE DOWNTOWNS PAGE

ENERGY OUTLOOK

PAGE 32

GRAPHENE OUTLOOK: WHAT OBJECT HAS LENGTH, WIDTH, AND NO THICKNESS? PAGE 42

Brought to you by www.jacketmediaco.com The Manufacturing & Business Podcast Network LISTEN TO OUR PODCASTS AT: OUR PODCASTS: APRIL ISM PMI: 47.1% Released May 1st -The Full Executive Summary Report On Business - Page 16 [ RESILIENCE AND EVOLUTION: A SUMMARY OF DELOITTE’S 2023 OIL & GAS INDUSTRY OUTLOOK

14

OUTLOOK PAGE 26 PAGE 8

ASIA

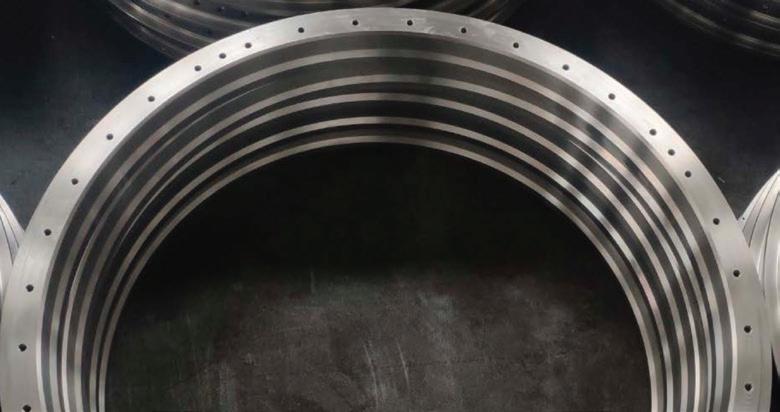

3 Manufacturing Outlook /May 2023 Forging Deliveries Got You Down? How About 8-10 Weeks? U.S. (973) 276-5000 Toll Free (800) 600-9290 Canada (416) 363-2244 STEELFORGE.COM • SALES@STEELFORGE.COM ISO 9001/AS 9100D Registered ALLOY • CARBON • STAINLESS • TOOL STEEL • NICKEL • ALUMINUM • TITANIUM

4 Manufacturing Outlook /May 2023 © 2023 Jacket Media Co. No part of this publication may be reproduced or used in any form without the prior written permission of the publisher. Manufacturing Outlook is a registered trademark of Jacket Media Co. Publisher LEWIS A WEISS Editor in Chief TIM GRADY Creative Director CRAIG ROVERE Contributing Writers ROYCE LOWE JESSICA BARON CHRIS KUEHL CHRIS ANDERSON CHRISTINE CASATI KEN FANGER KERRI JORDAN Production Manager LINDA HOPLER Advertising ADVERTISE@MFGTALKRADIO.COM Editorial Office JACKET MEDIA CO. 75 LANE ROAD FAIRFIELD, NJ 07004 (973) 808-8300 TABLE OF CONTENTS Moving Forward by Lewis A. Weiss PUBLISHER’S STATEMENT 5 The Challenge Of U.S.-China Trade Relations: Countering Predatory Influences While Managing Healthy Trade Ties by Christine Casati ASIA OUTLOOK 26 Ford Fights Back by Royce Lowe AUTOMOTIVE OUTLOOK Airbus Expands in China by Royce Lowe AEROSPACE OUTLOOK 30 Keeping Down E.V. Energy Costs by Royce Lowe ENERGY OUTLOOK 32 Global Performance Improving by Royce Lowe MANUFACTURING OUTLOOK 6 Policy Matters: Creating Cybersecurity Policies that Won’t Weigh Employees Down by Ken Fanger CYBER SECURITY OUTLOOK 38 ISSUES OUTLOOK 40 India on the Up and Up by Royce Lowe GRAPHENE OUTLOOK 42 What Object Has Length, Width, and No Thickness? MATERIALS OUTLOOK 34 U.S. Tariffs on Russian Aluminum by Royce Lowe Open call for... Contributing Writers for new and existing content. Let’s start a conversation –Contact us at info@jacketmediaco.com ISM MANUFACTURING REPORT ON BUSINESS 16 The Manufacturing PMI is 47.1% 8 COVER STORY: RESILIENCE AND EVOLUTION: A SUMMARY OF DELOITTE’S 2023 OIL & GAS INDUSTRY OUTLOOK FEATURE STORY: by Jessica Baron Manufacturing Workers are Looking for Leadership to Take These 4 Actions by Kerrie Jordan Small Scale Manufacturers Are Key To Revive Downtowns by Illana Pruess MANUFACTURING TIDBITS 12 14 36 NORTH AMERICAN OUTLOOK • UNITED STATES • CANADA • MEXICO 20 by Dr. Chris Kuehl The Elephant in the Room Africa’s Journey To Urbanville by Royce Lowe AFRICA OUTLOOK 22 TRY OUR SUBSCRIPTION FOR FREE Strength and Growth Continue by Chris Anderson EUROZONE OUTLOOK 25

Moving Forward…

We’ve heard enough. Recession, recession, recession, yada, yada, yada…it’s like a Seinfeld routine. Let’s focus on the nearterm future. First quarter GDP came in at 1.1% growth. The U.S. GDP for 2022 was 425.46 trillion, so 1.1% growth is more than 250 billion dollars. The U.S. has averaged 3.13% growth year-over-year since 1948, despite the occasional recession.

“Current-dollar GDP increased 9.2%, or $2.15 trillion, in 2022 to a level of $25.46 trillion, compared with an increase of 10.7 % or $2.25 trillion, in 2021.” -- Bureau of Economic Analysis, U.S. Government.

Manufacturing purchasing is softer because manufacturers are burning off excess inventory purchased during the latest boom. This has caused a bit of a raw material demand slump. We expect that to continue in most sectors through the second quarter and into Q3 2023. By then, unless the economy has weakened considerably, manufacturers’ inventory levels will be too low, and purchasing demand will rise. Forecasts of GDP for 2023 range between 1.0 and 2.5% growth – hardly a recession.

The University of Michigan Consumer Sentiment Index unexpectedly rose to 63.5 in April of 2023 from 62.0 in March. Inflation is cooling but not yet down to 2% or less, as price increases soften in most sectors of both manufacturing and services. The consumer continues to buy because unemployment is at 3.5%, with few signs of a dramatic rise. Although major corporations are adjusting headcounts downward to respond to reorganizations, new efficiencies, or adverse market conditions in their sector, overall employment conditions remain solid. Manufacturing, in particular, continues to hang on to skilled employees who were difficult to find and expensive to train, and are more likely to weather the year than dramatically reduce headcount unless market demand were to retreat significantly.

Feeling better yet? Short of an awful “Black Swan” event, the U.S. economy continues to expand modestly but earnestly. And the reconfiguration of supply chains by astute supply chain managers and staff has removed much of the volatility from previous sourcing. We continue to see jobs and strategic industries returning to America, such as microprocessor chip manufacturing from design through production to domestic supply. Much of this capacity will come online in 2024.

We expect similar progress in solar panel research, development, and manufacturing in the U.S. China is the dominant supplier. Although it was hit with tariffs, it maneuvered around them by doing assembly in other Southeast Asian countries. Key to U.S. production will be innovations in panel components, and this month we introduce a new Outlook section in Manufacturing Outlook called Graphene Outlook. Spoiler Alert – that article is worth the read, so I’m not going to give anything away here.

Manufacturing Outlook continues to grow its subscriber base rapidly as the only industrial publication discussing forwardlooking, forward-thinking topics relevant to the manufacturing industry, from raw material suppliers to industrial buyers of assemblies and component parts, as well as consumers of retail goods. So, although the mainstream media makes its living from doom, gloom, and negative commentary, Manufacturing Outlook presents the upbeat side of a hope-filled future.

Be sure to subscribe at www.manufacturingoutlook.com. n

Lewis A. Weiss, Publisher Contact laweiss@mfgtalkradio.com

Lewis A. Weiss, Publisher Contact laweiss@mfgtalkradio.com

for comments, suggestions and ideas and guest requests for MFGTALKRADIO.COM podcast or any of our podcasts.

5 Manufacturing Outlook /May 2023

PUBLISHER’S STATEMENT FOLLOW US: TRY OUR SUBSCRIPTION FOR FREE

MANUFACTURING OUTLOOK

GLOBAL PERFORMANCE MAINLY IMPROVING THROUGH SERVICES. INPUT PRICES AND SUPPLIER DELIVERIES ON ENCOURAGING TRENDS.

By: Royce Lowe

Data from ASIS, the Armada Strategic Intelligence System report, suggests that manufacturing industrial production will show a very slight overall contraction through 2023, whose second half will show a recovery after a similar contraction in the first half of the year. Primary metals are forecast to strengthen in 2023

with a stronger mid-year recovery followed by stabilization through the end of the year and into 2024. Inventories of the major non-ferrous metals are lower than for decades. If usage improves as thought, this will push prices higher than expected. A strong start to 2024 is anticipated. Fabricated metals will see a contraction in

2023’s first two quarters, followed by growth in Q3 and a final contraction to see out the year. Some weakening in early 2024 is likely.

The automotive sector is looking healthy, with good growth seen through 2023. Aerospace looks generally healthy through 2023 and 2024,

6 Manufacturing Outlook /May 2023 MANUFACTURING OUTLOOK

continued

with good demand and, hopefully, a good supply chain. Computer and electronic products are looking better towards year-end. Electrical and Appliances will likely show contraction throughout 2023. The machinery sector will suffer a lack of demand through mid-2024.

The Global Steel Users PMI for March showed a marginal decrease in operating conditions across all monitored regions (U.S., Asia, and Europe). There was a second improvement in delivery times, and output price inflation was at a 29-month low. New orders fell in all three regions, as did export orders. Employment levels fell in March, for the first time since November 2022.

The March Global Aluminium Users PMI™ data signaled a sharp reversal in fortunes among aluminum-using manufacturers in March, as the boost provided by the reopening of the Chinese economy receded sharply. Global output and new orders fell back into contraction territory, albeit at marginal rates, while purchasing activity stagnated. As output and new orders fell, firms took the opportunity to work through backlogs at the quickest rate for 33 months. More positively, there was a sustained shortening in suppliers’ delivery times, which contributed to a further easing in average cost burdens. As such, the rate of input price inflation eased to the lowest for seven months, which allowed firms to raise selling prices at the softest rate since October 2020.

Global copper-using firms registered a sharp slowdown in new order growth during March. Growth wholly reflected a sustained yet slower

increase in Asia, while firms in both the U.S. and Europe saw incoming orders fall at a solid pace. Demand was partly offset by a renewed contraction in export orders that was the fastest for three months and driven by the first reduction in Asia since December. All three regions saw increases in employment in March, with the best performance coming from Europe.

Global demand for manufactured goods fell for the ninth month running, with the rate of contraction being the weakest during the sequence. International trade in goods fell for the 13th straight month. The service sector’s new export business rose at its quickest pace in over a year. The global composite PMI rose by 1.3 points to 53.4 in March, a nine-month high for the series. New orders and employment also strengthened. A wide disparity remains between the performance of the manufacturing and service sectors, with the latter moving ahead on its way to a sustained recovery while manufacturing remains relatively lackluster. The latest survey shows still-modest demand and rising inventories.

The Economist Intelligence Unit, in its Global Economic Outlook for 2023, forecasts a low risk of recession for 2023, with an economic rebound in the second half of 2023, continuing into 2024. There are those, too, who say a recession in the U.S. is either inevitable or is already here. If not, it will be by Q3 this year. Overall, the predictions call for no more than a mild recession.

Other predictions are saying the U.S. unemployment rate will be 6.5% to 7% by early 2024. Global growth

will be 2%, with stagnating growth in Europe and the U.S. Global growth of 2.5% is expected in 2024, with a rebound in the Eurozone and the U.S. and still high growth in China. China’s estimate of its own growth in 2023 is 5%, and The Economist’s is 5.7%. Both the U.S. and Europe are forecast to grow at 0.7% this year.

The global manufacturing economy is suffering from a lack of demand due in large part to a lack of consumer confidence or a downright inability to “consume.” The U.S. inflation figure for mid-April was 5.2%, down from February’s 6.0%, and probably largely due to a drop in oil prices. Interest rates will continue to rise until inflation is licked. The performance of the service sector is what is keeping the global economy’s head above water. The latest monthly manufacturing PMI figures show declines in Japan, China, the Eurozone, the U.K., and Canada. The U.S. climbed but is still in contraction. India is the anomaly, with its March PMI increasing from 55.3 to 56.4. Employment has stayed high in just about all regions, but unfortunately, this has gone along with a lack of skills in some cases.

Overall, a recession isn’t a foregone conclusion. It is more of an ‘if’ than a ‘when’, and even then, it is difficult to predict its depth and length.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

7 Manufacturing Outlook /May 2023 MANUFACTURING OUTLOOK

Resilience and Evolution: A Summary of Deloitte’s 2023 Oil & Gas Industry Outlook

8 Manufacturing Outlook /May 2023 continued COVER STORY

A shift is taking place in the oil and gas (O&G) industry as the world grapples with the urgency of transitioning to cleaner energy, macroeconomic uncertainties, and geopolitical tensions.

Deloitte’s 2023 Oil and Gas Industry Outlook provides an analysis of the industry’s performance and future trends according to insights from a survey of 100 U.S. industry executives and other senior leaders in five specific industry segments: exploration and production, oilfield services, midstream, petroleum refining and marketing, and integrated O&G and new energy companies.

The following is an Executive Summary of the Deloitte’s report presented by Manufacturing Outlook

The Oil & Gas Industry’s

Trilemma

The industry faces the challenge of having to achieve three simultaneous objectives:

1) Maintaining energy affordability for consumers while investing in new technology and compliance requirements;

2) Ensuring a reliable and uninterrupted supply of energy by continually exploring and extracting resources, maintaining robust infrastructure, and managing geopolitical risks;

3) The increasingly urgent need to transition to cleaner energy sources, which requires significant investment in renewable energy, carbon capture technologies, and other methods to reduce greenhouse gas emissions.

Maintaining Healthy Balance Sheets

The executives surveyed highlighted the industry’s fiscal prudence and strong balance sheets, which are the result of a disciplined approach to investments, an emphasis on shareholder returns, and the leveraging of operational efficiencies.

However, this cautious stance on investment, particularly in hydrocarbon-based resources, is creating supply-demand tension. The executives acknowledged this tension could lead to price spikes and supply shortages, underlining the industry’s ability to maintain energy supply stability in the transition to cleaner energy sources.

The Transition to Clean Energy

The oil and gas industry is respond-

9 Manufacturing Outlook /May 2023 continued COVER STORY

200” Max O.D. 6” Min O.D. To 80,000 lbs. TOLL FREE IN THE U.S. 800.600.9290 - 973.276.5000 - CANADA: 416.363.2244 - INFO@STEELFORGE.COM - STEELFORGE.COM

ing to global climate concerns by increasing clean energy investments by an average of 12% annually since 2020, making significant investments in clean energy technologies; carbon capture, utilization, and storage (CCUS); and renewables. But while Europe and the U.S. are spearheading this transition with policies incentivizing these investments, it is not yet mirrored in actual capital allocation.

According to Deloitte’s survey, the oil and gas industry has significantly changed its policies and investment trends. Now, they see natural gas as a clean energy option, but only if they can reduce emissions.

The Role of Natural Gas

These developments have been accompanied by a rise in the production and certification of low-carbon nat-

ural gas and lower-carbon liquefied natural gas (LNG).

The Downstream Response to Shifting Energy Demands

In 2023, the industry will need to balance challenges against the urgency of energy security and climate goals.

Challenges include regulatory lag and current supply chain constraints that could hamper the deployment of necessary infrastructure and technologies. Furthermore, a massive grid expansion is required to handle the increase in electrification and renewable energy.

However, significant cash flows from record profits in 2022 provide some optimism.

High oil prices, robust demand, and low inventory levels drove petroleum product prices to record levels in the first half of 2022. Despite uncertainty in demand and volatile prices, refiners adjusted their strategies to include high-margin petroleum and chemical products and repurposed infrastructure for clean energy options such as renewable diesel.

Renewable diesel emerged as a prominent focus in the report, signaling the industry’s evolving priorities in the energy transition. Over half of the downstream executives (54%) identified renewable diesel as the low-carbon fuel with the most substantial growth prospects in the next three years.

10 Manufacturing Outlook /May 2023

COVER STORY continued

Deloitte’s survey also indicated that the downstream sector maintains robust adaptability amid changing market dynamics. The ability to respond to price fluctuations is the primary concern for 42% of downstream executives. And over half of respondents (52%) predict healthier margins in the forthcoming year thanks to an anticipated demand resurgence for refined products and petrochemicals.

Industry executives are keenly aware of the urgency of the energy transition, with a significant majority (58%) of downstream executives committed to upscaling their investments in low-carbon fuels and circular economy solutions. This pivot aligns with stakeholder expectations for a reduced carbon footprint. However, 36% of executives name insufficient infrastructure as their primary challenge, while 29% highlight the lack of clear policy guidelines as a deterrent.

Recognizing these impediments, many in the industry are looking to

foster collaboration, with 40% of downstream executives considering partnering with external entities to hasten the transition.

Mergers and Acquisitions

In 2022, the industry experienced robust M&A activity, valued at $256 billion, a 60% increase compared to the previous year. This surge was primarily driven by consolidation in the upstream and midstream sectors.

Industry leaders predict this trend will continue, with 40% of executives surveyed indicating plans for potential M&A activities in the next year. They also cited the pursuit of operational efficiency (42%) and geographical expansion (40%) as the leading drivers for these activities.

The Oil & Gas Industry’s Resilience

Despite uncertainties, the O&G industry posted record profits in 2022, providing substantial cash flow to fund strategies in 2023. However,

regulatory lag, supply chain constraints, grid expansion, and macroeconomic headwinds could impede the industry’s energy transition.

On the positive side, significant federal funding has been allocated for hydrogen and Carbon Capture, Use, and Storage (CCUS) hubs. The development speed will depend on the permitting process and regulatory approvals.

Navigating the Path Forward

The Oil & Gas industry stands at a crucial juncture, grappling with competing demands of energy affordability, reliability, and sustainability.

Realizing these aspirations will require overcoming a range of hurdles, including infrastructure deficiencies, regulatory uncertainties, and supply chain constraints. The industry’s ability to navigate these challenges will be a defining factor in its ongoing evolution and role in the global energy future.

11 Manufacturing Outlook /May 2023

COVER STORY

Author profile: Jessica Baron is a freelance writer covering the fields of science and technology. n

Manufacturing Workers are Looking for Leadership to Take These 4 Actions

By Kerrie Jordan, VP - Product Management, Data Platform at Epicor Software

I have spent over a decade working in the manufacturing space and am grateful to have the opportunity to speak with manufacturing leaders every day. In all my conversations with successful leaders, one theme always stands out: it’s about the team. The most successful companies in this industry have leaders who value their workers and are committed to improving their experience.

But what about their employees? The past few years have seen a transformation of reorientation to work in general as the power dynamic shifts to workers and their desires from their workplace. Even while facing numerous challenges – higher regulations, supply chain issues, increased consumer demand, and the overall state of the economy – the industry is strong and resilient, experiencing

promising growth as companies move to cloud-based operations and increase their use of technology.

So, in what ways are these changes impacting the worker experience?

For our recent report on the “Voice of the Essential Manufacturing Worker,” we surveyed 600 manufacturing workers to find out their engagement levels and what they require from their leaders. Manufacturing leaders should always be looking for ways to enhance their workers’ experience, increase their engagement, and give them the necessary tools to be successful.

Here are four ways to achieve that, based on manufacturing worker feedback.

Four Actions for Manufacturing Leaders

To create more engaged workers, more streamlined operations, and a more secure future for growth, manufacturing leaders should implement the following strategies:

1. Focus on data-first manufacturing

Modern manufacturing companies are leveraging Big Data, or the data collected across their organization, to improve operations and inform decision-makers. Using analytics to gain insights from the data about where operations are working and where they need improvement is an essential part of collecting that data. Using data-informed decisions to improve

12 Manufacturing Outlook /May 2023

FEATURE STORY

continued

and streamline processes like supply chain management, forecasting, and throughput can also help workers be more engaged and productive.

Technology can not only streamline operations but also allow workers to be more efficient, effective, and happier. Factory workers are looking for companies to incorporate technology into their operations and day-today tasks. According to our report, workers would be willing to take a 10% pay cut to go to a company that puts technology first. In other words, they want to work for a company that embraces technological advances and sees the value it can provide to improving manufacturing operations and their everyday work experience. With data, software, digital applications, as well as introducing automation in your processes, you can improve the worker experience and quality while reducing costs.

2. Make sustainability a priority

Sustainability in manufacturing is critical to the company’s future in various ways. Six out of ten respondents to our survey said they would take a pay cut to work for a more sustainable factory, similar to being technology-forward.

By adopting more sustainable practices, manufacturing companies can positively impact the environment and set themselves up for growth. A recent report from HP found that workers who see their company as an industry leader in sustainability are happier, feel more cared for, are more productive, and are avid advocates of their company.

3. Provide flexible work schedules and paid time off

Expectations around work have been

changing over the past few years as workers reevaluate what they want from their careers, work/life balance, and how they want to be appreciated by their employers. Respondents to our survey all came back to two things when asked what contributed to high morale, what could create a more engaging work environment, and what they’d look for in a new employer if they left: flexible work schedules and more paid time off.

This suggests that factory workers want more work/life balance yet must adhere to rigid scheduling and don’t get much time off, which can easily lead to burnout. Morale and engagement can improve with flexible scheduling, according to a report from Gartner, and those with flexible work hours feel they achieved greater productivity as well. Manufacturing leaders should reevaluate how to alleviate workloads and allow for flexible schedules and more paid time off.

4. Continue investing in upskilling

Manufacturing companies that want to improve their operations and be a modern leader in the industry should embrace technologies such as Big Data, robotics, AI, AR, 3D printing, and more. However, with new technology and advances come the need to know how to run them. Are manufacturing companies prioritizing ensuring that their workers have the right skills for the future?

According to our report, 80% of respondents say their company is making upskilling a priority and offering it in a number of different ways. Most offer on-site and on-thejob training, while many are giving access to online learning platforms where workers can take courses and gain certifications anywhere and at any time. Many note that their company covers costs for training

programs and courses. Companies that offer upskilling aren’t just ensuring that their workers know how to operate new technologies. They’re also training them for leadership roles and upward movement.

The impacts of upskilling are many. According to Gallup, 71% of upskilled workers said their overall job satisfaction has increased, 65% say their standard of living has increased, and 69% say their overall quality of life has improved.

Modernizing Manufacturing Today

Manufacturing leaders should always be looking for ways to improve their workers’ experience. According to workers themselves, manufacturing leaders should focus on increasing their technology adoption and sustainability efforts, making upskilling a priority, and offering more flexible work schedules and paid time off.

Ultimately, happy, engaged, and skilled workers can help any company weather challenges in their industry.

Author profile. Kerrie Jordan is an accomplished technology executive serving as Vice President, Product Management, Data Platform at Epicor Software. In this role, Kerrie is responsible for steering the strategic direction of Epicor’s cloud-based solutions, ensuring their continued delivery of high-value innovation, security, and customer performance. Based in Richmond, Virginia, she brings more than ten years of extensive experience in ERP, supply chain, eCommerce, cloud computing, and product development business solutions. She can be reached at kerrie. jordan@epicor.com n

13 Manufacturing Outlook /May 2023 FEATURE STORY

Small Scale Manufacturers Are Key To Revive Downtowns

By Ilana Preuss

[Editor’s Note: Be sure to listen to Ilana’s interview on Manufacturing Talk Radio at www.mfgtalkradio. com]

Even before the Covid-19 pandemic, many cities and neighborhoods across America were suffering from economic stagnation. Today, we only need to drive through our local downtowns to see blocks of empty storefronts lining the streets. Rather than sparking an atmosphere of new opportunity, these images bring on a mood of despair and disappointment. We can change all that by bringing

small-scale manufacturers, the businesses that might be home-based or in a shared space situation today, to the brick-and-mortar world. But first, we need to understand why these storefronts are empty and what needs to be done to fill them.

Know The Economics.

While economics isn’t the only reason, it is the primary one. In some instances, the cost of renovating a storefront may outweigh the revenue from the market-based lease rate. If the property owner has significant income from other holdings, they may receive a tax benefit from taking

a loss on the empty storefront. Other vacancies might occur if an investment company is unwilling to rent a space for less than the advertised rate for fear of jeopardizing the underwriting by devaluing the space. There could even be the scenario of a guaranteed lease from a major national chain that will eagerly keep paying the rent on a closed store to prevent a competitor from moving in.

Learn The Logistics.

Sometimes vacancies are due to mismatches between the needs of owners, real estate developers, and prospective small businesses. If the

14 Manufacturing Outlook /May 2023

MANUFACTURING TIDBITS continued

retail space is larger than what small businesses need, property owners may not be willing to subdivide it or can’t because of code restrictions. Another may be if landlords expect tenants to pay for renovations, and prospective tenants can’t afford to do that. There are also too many examples, especially in smaller towns, of a distant neglectful owner holding on to a vacant main street property in hopes of better days ahead.

Call to Small-Scale Manufacturers

Regardless of why there are vacancies, they have a negative impact on our downtowns and neighborhood centers, depressing surrounding property values, encouraging more neglect, and suppressing the growth of nearby small businesses. That is why small-scale manufacturers need to recognize this opportunity as a win-win and contact the local government and community leaders for assistance. Small-scale manufacturers are ideally suited as tenants who can attract, sell, and service customers during heavy foot traffic days while continuing their manufacturing for online and B2B sales during slower periods. Not only do these types of small businesses get increased revenue from sales by locals and visitors, but active storefronts benefit the entire community as they generate relevancy, purpose, vim and vigor for the entire town!

Show Up

Knowing what to do is different from knowing how to do it, but there are ways to positively and productively

build bridges toward change. Some cities have adopted vacant property tax ordinances, and smaller cities have made similar regulations for abandoned homes or buildings. But tax deterrents aren’t the only solutions which is why small-scale manufacturing business owners need to become involved with local government and community leadership to bring a purposeful voice to the message that when production and retail are combined, they provide fantastic experiential retail for all people walking by, build up the local economy, and create good-paying jobs for more residents - and that is how exciting communities are made!

Small-scale manufacturers need to become involved through online forums and community organizations to participate in the debate on taxes, real estate permitting, grant, and partnership opportunities. We need to be knowledgeable so we can ask for valuable tools and changes like flexible real estate arrangements to be combined with training and mentoring to advance the prospects of emerging businesses.

It is small-scale manufacturers who have the ability to revitalize our cities and towns and reverse the trend of empty storefronts. When “hardware, hot sauce, and handbags” fill downtown spaces across the country they will grow while reviving downtowns with vibrant economies creating great places for everyone who works, lives, or is visiting there.

Author profile: Ilana Preuss is Founder & CEO of Recast City, a nationally recognized consulting firm working with smallscale manufacturing business owners, real estate developers, foundations, city planning and economic development offices, improvement districts, and mayors. They have moved ideas to action by building great places with vibrant economies. Her book Recast Your City: How to Save Your Downtown with Small-Scale Manufacturing is a must-read for all people and organizations responsible for downtown reinvestment. She can be reached by email at ilana@recastcity.com, phone 240–472–2765 and on social media on LinkedIn and Twitter @IlanaPreussb. n

15 Manufacturing Outlook /May 2023 MANUFACTURING TIDBITS

16 Manufacturing Outlook /May 2023

BREAKING NEWS ISM PMI at 47.1% for April 2023 ISM REPORT OUTLOOK APRIL 2023 47.1% PANDEMIC Released May 1st ISM PMI for the past 5 years Expanding Contracting continued

THE INSTITUTE FOR SUPPLY MANAGEMENT’S MANUFACTURING REPORT ON BUSINESS®

Economic activity in the manufacturing sector contracted in April for the sixth consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business® .

The April Manufacturing PMI® registered 47.1 percent. The New Orders Index remained in contraction territory at 45.7 percent, 1.4 percentage points higher than the figure of 44.3 percent recorded in March. The Production Index reading of 48.9 percent is a 1.1-percentage point increase compared to March’s figure of 47.8 percent. The Prices Index registered 53.2 percent, up 4 percentage points compared to the March figure of 49.2 percent. The Backlog of Orders Index registered 43.1 percent, 0.8 percentage point lower than the March reading of 43.9 percent. The Employment Index elevated into expansion territory, registering 50.2 percent, up 3.3 percentage points from March’s reading of 46.9 percent. The Supplier Deliveries Index figure of 44.6 percent is 0.2 percentage point lower than the 44.8 percent recorded in March; this is the index’s lowest reading since March 2009 (43.2 percent).

Of the six biggest manufacturing industries, two — Petroleum & Coal Products; and Transportation Equipment — registered growth in April. The five manufacturing industries that reported growth in April are: Printing & Related Support Activities; Apparel, Leather & Allied Products; Petroleum & Coal Products; Fabricated Metal Products; and Transportation Equipment. ISM

Analysis by Timothy R. Fiore, CPSM, C.P.M. Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

PMI® at 47.1% MANUFACTURING

The U.S. manufacturing sector contracted in April, as the Manufacturing PMI® registered 47.1 percent, 0.8 percentage point higher than the reading of 46.3 percent recorded in March. This is the sixth month of contraction and continuation of a downward trend that began in June 2022. Of the five subindexes that directly factor into the Manufacturing PMI®, only one (Employment) is in growth territory. Of the six biggest manufacturing industries, two (Petroleum & Coal Products; and Transportation Equipment) registered growth in April.

Manufacturing at a Glance

Commodities Reported

Commodities Up in Price: Copper (5); Diesel; Electrical Components (6); Electronic Components (3); High Density Polyethylene (HDPE); Labor — Temporary; Plastic Resins* (2); Polypropylene (3); Steel (3); Steel — Carbon; Steel — Hot Rolled (2); Steel — Stainless (3); and Steel Products (4).

Commodities Down in Price: Aluminum; Corrugate (5); Corrugated Boxes (4); Epoxy; Freight (6); Methanol; Natural Gas (5); Ocean Freight (8); Plastic Resins* (11); Steel; and Wood Pallets.

Commodities in Short Supply: Electrical Components (31); Electronic Components (29); Labor — Temporary; Plastic Resins; and Semiconductors (29).

17 Manufacturing Outlook /May 2023 ISM REPORT OUTLOOK continued 12 ISM WORLD.ORG

PMI 48.7% = Overall Economy Breakeven Line 50% = Manufacturing Economy Breakeven Line 2023 2022 2021 47.1%

INDEX Apr Index Mar Index % Point Change Direction Rate of Change Trend* (months) Manufacturing PMI® 47.1 46.3 +0.8 Contracting Slower 6 New Orders 45.7 44.3 +1.4 Contracting Slower 8 Production 48.9 47.8 +1.1 Contracting Slower 5 Employment 50.2 46.9 +3.3 Growing From Contracting 1 Supplier Deliveries 44.6 44.8 -0.2 Faster Faster 7 Inventories 46.3 47.5 -1.2 Contracting Faster 2 Customers’ Inventories 51.3 48.9 +2.4 Too High From Too Low 1 Prices 53.2 49.2 +4.0 Increasing From Decreasing 1 Backlog of Orders 43.1 43.9 -0.8 Contracting Faster 7 New Export Orders 49.8 47.6 +2.2 Contracting Slower 9 Imports 49.9 47.9 +2.0 Contracting Slower 6 Overall Economy Contracting Slower 5 Manufacturing Sector Contracting Slower 6

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies). *Number of months moving in current direction. Manufacturing ISM® Report On Business® data has been seasonally adjusted for the New Orders, Production, Employment and Inventories indexes.

Note: To view the full report, visit the ISM ® Report On Business® website at ismrob.org The number of consecutive months the commodity has been listed is indicated after each item. *Reported as both up and down in price.

INSTITUTE FOR SUPPLY MANAGEMENT® reportonbusiness

ISM® Report On Business®

New Orders

April 2023

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey Committee

ISM’s New Orders Index registered 45.7 percent. The eight manufacturing industries that reported growth in new orders in April — in the following order — are: Printing & Related Support Activities; Paper Products; Fabricated Metal Products; Nonmetallic Mineral Products; Petroleum & Coal Products; Plastics & Rubber Products; Miscellaneous Manufacturing‡; and Transportation Equipment.

The Production Index registered 48.9 percent. The 11 industries reporting growth in production during the month of April are, in order: Printing & Related Support Activities; Fabricated Metal Products; Nonmetallic Mineral Products; Primary Metals; Transportation Equipment; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing‡; Plastics & Rubber Products; Machinery; Electrical Equipment, Appliances & Components; and Computer & Electronic Products.

Employment

ISM’s Employment Index registered 50.2 percent. Of 18 manufacturing industries, seven reported employment growth in April, in the following order: Apparel, Leather & Allied Products; Paper Products; Fabricated Metal Products; Transportation Equipment; Plastics & Rubber Products; Machinery; and Chemical Products.

Supplier Deliveries

The Supplier Deliveries Index registered 44.6 percent. Three of 18 manufacturing industries reported slower supplier deliveries in April: Textile Mills; Primary Metals; and Computer & Electronic Products.

Inventories

The Inventories Index registered 46.3 percent. Of 18 manufacturing industries, the five reporting higher inventories in April are: Printing & Related Support Activities; Textile Mills; Apparel, Leather & Allied Products; Petroleum & Coal Products; and Electrical Equipment, Appliances & Components.

18 Manufacturing Outlook /May 2023

Manufacturing PMI®

New Orders (Manufacturing) 52.7% = Census Bureau Mfg. Breakeven Line 2023 20 2022 2021 45.7%

Employment (Manufacturing) 50.4% = B.L.S. Mfg. Employment Breakeven Line 2023 2022 2021 50.2% 20 Supplier Deliveries (Manufacturing) 2023 80 2022 2021 53.1% 44.6% Inventories (Manufacturing) 44.4% = B.E.A. Overall Mfg. Inventories Breakeven Line 2023 2022 2021 46.3% Production (Manufacturing) 52.2% = Federal Reserve Board Industrial Production Breakeven Line 2023 2022 2021 48.9% 70 Production

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

ISM REPORT OUTLOOK continued

ISM® Report On Business®

Customers’ Inventories

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey Committee

ISM’s Customers’ Inventories Index registered 51.3 percent. The seven industries reporting customers’ inventories as too high in April are, in order: Apparel, Leather & Allied Products; Paper Products; Computer & Electronic Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Fabricated Metal Products; and Plastics & Rubber Products.

Prices

The ISM Prices Index registered 53.2 percent. In April, nine industries — in the following order — reported paying increased prices for raw materials: Petroleum & Coal Products; Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Plastics & Rubber Products; Machinery; Transportation Equipment; Miscellaneous Manufacturing‡; Fabricated Metal Products; and Computer & Electronic Products.

Backlog of Orders

ISM’s Backlog of Orders Index registered 43.1 percent. Three industries reported growth in order backlogs in April: Printing & Related Support Activities; Textile Mills; and Paper Products.

New Export Orders

ISM’s New Export Orders Index registered 49.8 percent. Five industries reported growth in new export orders in April: Printing & Related Support Activities; Wood Products; Paper Products; Food, Beverage & Tobacco Products; and Miscellaneous Manufacturing‡

Imports

ISM’s Imports Index registered 49.9 percent. The six industries reporting an increase in import volumes in April — in the following order — are: Printing & Related Support Activities; Textile Mills; Electrical Equipment, Appliances & Components; Miscellaneous Manufacturing‡; Food, Beverage & Tobacco Products; and Primar y Metals.

19 Manufacturing Outlook /May 2023

Manufacturing PMI®

Customer Inventories (Manufacturing) 2023 2022 2021 51.3% Backlog of Orders (Manufacturing) 2023 2022 2021 43.1% New Export Orders (Manufacturing) 2023 2022 2021 49.8 % Imports (Manufacturing) 2023 2022 2021 49.9%

Prices (Manufacturing) 52.9% = B.L.S. Producer Prices Index for Intermediate Materials Breakeven Line 2023 2022 2021 53.2%

April 2023 ISM REPORT OUTLOOK n

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

NORTH AMERICA OUTLOOK

by Dr. Chris Kuehl

by Dr. Chris Kuehl

United States Outlook

The economic forecast has resembled one of those slasher movies where there is a threat around every corner, and clueless teens are dropping right and left. Each week seems to bring a new challenge, and the media continues to feed a never-ending desire for drama. The bank crisis was depicted as the end of modern civilization and the trigger for a return of the Great Depression. On closer examination, the issue was one of a few badly run banks paying for their sins. For those that want to trust in the data and avoid the hysterical commentary, it has been frustrating as there have been as many positive developments as there have been negative ones.

A report from the Brookings/Financial Times tracker asserts that economic conditions around the world are far better than they were expected to be. Growth is expected in the U.S.,

U.K., Eurozone, Japan, and China.

The consumer has been affected by inflation, to be sure, but they are still active – especially those in the upper 30% of income earners. The estimates for GDP growth have been bouncing around over the last few weeks. A month ago, the GDP Now estimates from the Atlanta Fed were 2.6% growth and then 3.2% but in the last week that number was ratcheted down to 1.7% and most recently to 1.5%. The decline has been attributed to a slower pace of consumer spending, and that has been blamed on some adjustments in the labor market. After nearly a year of hiking interest rates in an attempt to slow the economy, the Fed is starting to see some reaction in the labor market.

signs of upward movement. The other factors that affected growth include the bank fiasco, as investors froze for over a week and millions of dollars sloshed from bank to bank as depositors tried to figure out where they could locate a safe haven.

The longer-term estimates are more encouraging – especially for manufacturing. The ongoing disenchantment with China has continued to fuel reshoring efforts. The fastest growing segment of commercial construction has been manufacturing, as new facilities are needed to accommodate the shift from China and the growth in the use of robotics and technology. The inhibitions regarding reshoring remain as they have been – worker shortage and the need to find adequate transportation for both inbound and outbound activity. In the latest ASIS matrix, there are several industrial sectors that still show solid growth

There are fewer jobs on offer, although the number of open positions remains high. There are 9.9 million openings, but that is down from 10.9 million a month ago. The rate of joblessness remains very low but has shown some continued

20 Manufacturing Outlook /May 2023 NORTH AMERICA OUTLOOK

MAY 2023

– automotive and aerospace still lead the pack. Many of the other sectors still have a reasonable outlook for the coming year but see slower growth numbers than were evident in 2022.

The Armada Strategic Intelligence System is an examination of the industrial sector as defined by the Federal Reserve’s industrial production measure. We strip out the data on utilities and mining to isolate just the manufacturing sector. Most of the sectors are going through a similar period of adjustment. There was significant inventory build in the last year as companies tried to cope with a broken supply chain. This has saddled around 70% of businesses with excess inventory levels. Until that supply is gone, there will be little reordering. That cycle usually manifests this time of year, and now it is estimated that reorders will not resume until late summer or early fall.

For the U.S., the message is still confusing. There are as many reasons to be somewhat optimistic as there are reasons to retreat. Even the big analytical organizations are providing contradictory reports. The head of the World Bank has been preaching gloom and doom at the same time that her own organization has been proclaiming better progress than expected for the world economy.

Canadian Outlook

The outlook for the Canadian economy is as mixed as it has been for the U.S. The Bank of Canada has asserted that it is sticking to the 4.5% level with the interest rate, but there have been developments in the labor market that are testing that resolve. The rate of unemployment has remained very low at 5.0%, and there has been job growth for the last four months despite the hikes. More importantly, there has been continued wage growth and that undermines the efforts of the BoC. The drivers of the Canadian economy are still intact. Commodity demand has been solid and the manufacturing sector has mirrored what has been taking place in the U.S. The strongest sector for U.S. manufacturing has been automotive, and that is also the sector in Canada that is most closely linked to the U.S.

The analysis from the Royal Bank of Canada still holds that there will be a mild recession in the middle of the year. The rate hikes tend to have a lagging impact, and most of the response will be seen in second and third quarter. It has been noted that consumer sectors are already starting to lag – the housing sector is moribund (at least for single family) and the global manufacturing numbers have

been down. That affects demand for Canadian commodities as well as the manufactured goods that go into other assemblies.

Mexican Outlook

A few months ago, the Finance Ministry in Mexico asserted that 3.0% growth was likely in 2023. Most dismissed this claim as wishful thinking but now it looks far more accurate than those more pessimistic forecasts. The economy is on pace to grow at least that fast in the first quarter and is expected to pick up speed as the year progresses. In the fourth quarter of last year, the pace fell to 0.5%, and in Q3 it was at 0.9%. The 3.1% expansion in Q1 has been attributed to recovery in all four major economic sectors for the country. Manufacturing is the number one driver and has been boosted by record levels of foreign direct investment. The FDI pace is unprecedented, and 45% of it is brand new. This is mostly attributed to the shift in supply chain options from China. Companies that still need a low labor cost environment are finding opportunities in Mexico. Tourism is making a comeback as the pandemic threat starts to ease. Remittances from the Mexican workers in the U.S. continues to be a major source of national income, and the fourth pillar is oil production. The recent hike in the per barrel price will benefit Mexico.

Author profile: Dr. Christopher Kuehl (Ph.D.) is a Managing Director of Armada Corporate Intelligence and one of the co-founders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years. He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division –Finance, Credit and International Business. n

21 Manufacturing Outlook /May 2023 NORTH AMERICA OUTLOOK

AFRICA OUTLOOK

by Royce Lowe

by Royce Lowe

Africa’s Journey To Urbanville

In 1950, Africa’s population was some 227 million. Today, with an annual growth rate since then of some 2.5% to 3.0%, it’s at 1.46 billion. In 1950, the urban population was just over 13% of the total; in 2015, the latest year for which continent-wide data is available, half the African population were city dwellers. This share is forecast to rise to over 70% by 2050.

By bringing people and companies into close contact, cities make both more productive. And even though urbanization is enriching Africans, they could be benefiting more.

African cities do not grow efficiently. This applies to really big cities, such as Lagos and Kinshasa, and towns and smaller cities where most African urbanites live. Today there are more city-dwellers in Kenya than there were in all of Africa in 1950.

The growth of Africa’s cities has, in

general, been good for people. Wages in cities are about double what they are in the countryside, according to the OECD. Urbanites work 30% more hours per week than workers in the country. Today 50% of rural Africans live within 14km of a city, which means they can more easily access public and private services that cities offer.

Urbanization is good for Africa, but not as good as it could be. As cities get bigger, the economies of scale and attendant effects can lead to higher productivity. The World Bank, however, says African cities are “too crowded, too disconnected and too costly” to take full advantage of this. The inefficiency of African cities compounds the problem of cost. They are expensive. According to the World Bank, living costs such as food, housing, and transport are some 20 to 30% higher in African cities than in other developing nations. High wages

to offset these high living costs equals less competitive industries. “Nontradable” services or construction, rather than export-oriented sectors, are what is produced in African cities. A low adult literacy rate aggravates the transition to a more productive, industrialized economy.

These negative factors do not augur well for a continent that is home to almost 20% of the world’s population. Manufacturing, and a goodly amount of Foreign Direct Investment, are essential for poverty reduction, as witnessed by those countries strong in them. If Africa is to progress significantly, it needs both.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

22 Manufacturing Outlook /May 2023 AFRICA OUTLOOK continued

MAY 2023

THE FLAGSHIP REPORTS

The Flagship Reports with Dr. Chris Kuehl is both an “Officer of the Watch” briefing of economic conditions and an Executive Briefing on specific situations impacting those conditions. Written and presented by the officers of Armada Corporate Intelligence, Dr. Kuehl lightens up the mood of sometimes distressful geoeconomic news with a bit of humor. This monthly podcast includes information from the Flagship Reports issued 3 times and week, and AISI, the Armada Strategic Intelligence System, a tool for durable goods manufacturers that dives deep into the sector each month to provide more than 95% accurate near-term forecasts.

23 Manufacturing Outlook /May 2023 AFRICA OUTLOOK

*Toll free within the U.S. * ISO9001:2015 SINCE 1994 AND AS9100D SINCE 1998 CLICK HERE FOR OUR FORGING CAPABILITIES

EUROZONE GLOBAL OUTLOOK

by Chris Anderson

by Chris Anderson

Strength and Growth Continue

Quarter 2 of 2023 will likely see a continuing slowing in the overall manufacturing scenario in the Eurozone. Metals and Mining, Construction and Machinery and Equipment are markedly trailing. Automobiles and auto parts, and transportation are showing up well. Good growth is forecast for the services sector. There is an ongoing trend to lower input prices and to improvement in suppliers’ delivery times.

We await with interest the various PMI figures for the month of April. Here is a reminder of the results for March:

· Composite, 54.1 vs 52.0 February, 10-month high

· Services PMI, 55.6 vs 52.7 February, 10-month high

· Manufacturing output index, 49.9 vs 50.1 February, 2-month low

· Manufacturing PMI, 47.1 vs 48.5 February, 4-month low.

France and Germany both showed good performance on the services side, but Germany’s manufacturing performance was at an almost three-year low. Let it be said that

expectations in the manufacturing sector remain low at the present time.

· France, flash composite, 54.0 vs 51.7 February; 10-month high

· France flash services PMI, 55.5 vs 53.1 February; 10-month high

· France, flash manufacturing output index, 46.9 vs 45.0 February; 2-month high

· France, flash manufacturing PMI, 47.9 vs 50.5 January; 4-month low

· Germany, flash composite, 52.6 vs 50.7 February; 10-month high

· Germany, flash services PMI, 53.9 vs 50.9 February; 10-month high

· Germany, flash manufacturing output index; 50.1 vs 50.2 February, 2-month low

· Germany, flash manufacturing PMI, 44.4 vs 46.3 February, 34-month low.

The Eurozone, similar to other areas of the world, is seeing Services hold up and Manufacturing weaken.

Manufacturers in the 28 countries that make up the Eurozone, like their counterparts in the U.S., are reluctant to reduce headcount when

hiring has been difficult and training expensive. Unless there is a marked decline in new orders, manufacturers will weather the current economic conditions through Q2 and into Q3. By that time, there may be clearer indications of where the economy will trend in late 2023 and into 2024.

Manufacturers continue to burn off excess inventory purchased ‘just in case’ their supply chain continued to be inconsistent before switching back to just-in-time. As the pandemic disruptions fade into history, consumer demand will drive the next manufacturing upturn in the Eurozone. So far, consumer confidence is fair as things approach summer, so the outlook remains favorable but not necessarily strong.

25 Manufacturing Outlook /May 2023

EUROZONE OUTLOOK

n

APRIL 2023

ASIA OUTLOOK

by Christine Casati

THE CHALLENGE OF USCHINA TRADE RELATIONS: COUNTERING PREDATORY INFLUENCES WHILE MANAGING HEALTHY TRADE TIES

Is China’s economic growth, and all it implies for stable supply chains and global trade, incompatible with U.S economic leadership? Has Washington’s rhetoric around tariffs, sanctions, and advanced semiconductor

export controls triggered an unnecessary strategic showdown with China? Or were these actions too long in coming? Is economic decoupling really the right answer to guarantee our national security interests? Or should the goal be to “de-risk,” as E.U. Commission President Ursula von der Leyen puts it, not to “decouple”? Which companies or technology will the U.S. or China ban next? These are the current questions dominating global economic discussions.

Economic statecraft is never easy, but not doing the work can lead to peril. China’s recent strides in military development, defense manufacturing, A.I., and signal intelligence used for spying, not to mention medical supply chain shortages in the U.S. during the pandemic, make it imperative that the U.S. map out a blueprint for a healthy and comprehensive trade policy with China, without the war rhetoric, while countering predatory influences.

26 Manufacturing Outlook /May 2023

ASIA OUTLOOK

continued

Tensions need to be defused by both sides. Otherwise, both manufacturers and consumers face ongoing uncertainty, which can result in damaging and costly decisions. At the same time, U.S. policymaking must not sabotage the profitable and mutually beneficial manufacturing investments of the U.S. and its allies in China nor make our citizens less welcome. Uncertainty and weaponizing trade policy may already have driven some multinationals, like Apple, Sony, and Adidas, to expansion elsewhere in Southeast Asia or India.

In its latest effort to define (redefine?) its economic approach toward China and to assuage its European allies who fear Washington may have grown too hawkish, the U.S. National Security Advisor Jake Sullivan, on April 27th, delivered a speech clarifying that the U.S. does not want to decouple from China. It wants to “de-risk and diversify its relationship.” While there is no doubt that the U.S. wants to reduce its reliance on China in vulnerable areas such as sourcing minerals critical to advanced manufacturing, solar energy, and electric vehicle batteries, among others, it does not want to call it “decoupling.” Janet Yellen, Secretary of the Treasury, made similar remarks in an earlier, more conciliatory speech.

Efforts to Counter China’s Influence

In line with China’s continued push to influence developing countries in Africa, the Middle East, and Latin America by peddling loans, investments, and diplomacy, the U.S. has launched new counter initiatives, including a U.S.-Africa Leaders Summit in Washington in December, where Biden committed $55 billion for Africa’s development over three years. In January, Janet Yellen conducted a ten-day trip to Africa and advanced plans to expand

partnerships on conservation, climate adaptation, and access to clean energy, while announcing President Biden’s pledge of $1 billion to lead climate resilience efforts. Other U.S. leaders have visited Africa, paving the way, including Secretary of State Blinken and Climate Czar John Kerry. More recently, Vice President Kamala Harris visited three African nations in key follow-up meetings. But the U.S. is getting a late start after China began investing billions in infrastructure development, including manpower, mostly after 2010.

At the same time, the U.S. is doubling down on countering China’s dangerous influences at home. We all know about shooting down the China spy balloon after it drifted over the U.S., analyzing the balloon’s military intelligence collection capabilities. Also, the April arrest on federal charges of Chinese individuals conducting unauthorized surveillance on Chinese U.S. residents via a secret police outpost in New York City has been in the news. According to the American Enterprise Institute, this is just the “tip of the iceberg.” (4/27). The Chinese Communist Party (CCP) runs over a hundred such secret outpost overseas

through national and local public security bureaus without the knowledge of their host countries. Their job is to help PRC citizens living abroad with renewing documents. Still, they also conduct unauthorized secret police operations to track down and deport dissidents, hack websites, commit telephone fraud, and stage protests against China’s perceived enemies.

The CCP also engages in stealthy soft power influence ops across the U.S. and has the ability, through apps like TikTok, to track keystrokes, use your phone as a surveillance device, and collect biometric data. They have also established language schools, cultural associations, local newspapers and TV programs to saturate communities with the regime‘s narratives. Both the White House and Congress have teams to investigate these pervasive activities. We also know through recently leaked documents that the U.S. is conducting extensive intelligence gathering on China’s weapons development and naval activity, including an intermediate-range ballistic missile hypersonic glide vehicle, which is suspected to be able to penetrate U.S. missile defense systems.

27 Manufacturing Outlook /May 2023

continued ASIA OUTLOOK

China’s Response: Greater Risks for Foreign Businesses in China

China is showing the world that it can push back against perceived efforts by nations led by the U.S. to counter its development. The current President Xi Jinping, now in his third term, has never trusted capitalist forces and has taken steps to exert more control over the operations of foreign firms, even while his Premier Li Qiang, a close ally, warmly welcomes foreign investors into the Chinese ‘family’. Recent incidents bely Xi’s intentions. Chinese authorities recently raided the Beijing office of Mintz Group, a U.S. due diligence firm, searching for information related to suspected theft of state secrets. In April, the Shanghai office of Bain & Co., a U.S. consulting firm, was also treated to a surprise visit by authorities to question staff. The U.S. chip maker Micron has been subjected to a cybersecurity review of its imports, threatening to ban Micron altogether on national security grounds.

Additionally, China recently expanded its espionage laws to include, among other things, allowing for the search of the luggage and electronic devices of anyone suspected of espionage. (WSJ 4/28) These actions smack of Russian practices. Perhaps

Xi has been emboldened by advice from his ‘friend’ President Putin to take such steps to push back at Western Powers. Unfortunately for China, these behaviors are resulting in greater perceived risk for foreign businesses in China, with more foreign investors souring on Chinese stocks.

Emerging U.S.-China Rivalry in Emerging Technologies

On the commercial side, Chinese companies have launched their own offensives to compete with the U.S. In April, Alibaba demonstrated its new software to compete with Microsoft’s ChatGPT, called Tongyi Qianwen, which will be embedded in its smart devices and workplace messaging platform DingTalk. Such platforms like ChatGPT and DingTalk are underpinned by what is called “generative A.I. technology” and cloud computing. Many Chinese tech companies are rushing to release their versions, according to Michelle Toh of CNN. Also in April, SenseTome, the widely-respected A.I. company, launched a new suite of services in its chatbot called “SenseChat.” In March, Baidu launched its own ChatGPT-style service using a chatbot called ERNIE.

The Commercial Downside for U.S. Allies of U.S. Security Campaigns against China

There are conflicts between U.S. efforts to slow down semiconductor manufacturing in China, for example, and the trading interests of its allies. To achieve effective decoupling and build self-reliance at home re-

quires support from key Asia-Pacific trading partners, such as Japan, South Korea, and Taiwan, who are also China’s major trading partners. These allies participated greatly in developing China’s “ Factory to the World” by relocating thousands of electronic components and assembly factories to China and training the labor force. So for the U.S. to decouple from China also involves decoupling from some of these China-based operations of our allies, as well.

Impact on South Korea

After the U.S. imposed export controls on trade in chips and related equipment to China, the U.S. issued waivers to Korean companies whose operations would have been deeply affected. This year, the U.S. threatens to let those waivers expire if South Korea doesn’t align with U.S. export controls. The President of South Korea, Yoon Suk Yoel, was recently hosted by the White House for a six-day state visit the week of April 24th. The main focus of the talks was reaching a security agreement, called the Washington Agreement, which allows continued Korean reliance on U.S. nuclear forces to provide a deterrent to North Korea’s threats, rather than South Korea developing its own nuclear arsenal. There was also significant U.S. trade pressure on S.K.’s semiconductor manufacturers, mainly Samsung and S.K. Hynix, not to fill any gap in supply to China if the U.S. chips company is excluded from Chinese markets on national security grounds. While Yoon is somewhat hawkish on China, he must consider the broader picture for S.K. commercial interests. China is, after all, S.K.’s largest trading partner by far.

The U.S. has many tools in its trade kit to pressure Seoul to do its bidding.

continued

28 Manufacturing Outlook /May 2023

ASIA OUTLOOK

The Inflation Reduction Act has made it very difficult for Korean carmakers Hyundai and Kia to become eligible for U.S. tax credits for E.V.s. Even though Hyundai has built its own car plant in Georgia, creating hundreds of jobs for U.S. citizens, it still assembles cars using a majority of parts manufactured in South Korea. So far, it has failed to qualify for E.V. subsidies for sales in the U.S. If U.S. officials want Seoul to comply with

its export restrictions on semiconductors to China at the expense of its own enterprises, they should perhaps think about paving the road a bit more in favor of South Korean sales here in the U.S. to gain their cooperation against China. We know they need us. But, coercion is bad for business.

Japan has acceded to U.S. demands. In response, they have decided to invest billions in their own semiconductor manufacturing equipment industry. But they face increasing retaliation from China for not selling their equipment to China. They have also decided to go against precedent set after World War II and start investing in their own defense. They have joined AUKUS, a security pact among Australia, the U.K., and the U.S. to promote security and stability in East Asia and the Indo-Pacific.

Putting our trade allies on the spot has generated a great deal of open but often uncomfortable dialogue when the U.S. increasingly asks for their support at the expense of their own industries. As Alan Beattie of the Financial Times puts it, “ Being a U.S. ally at a time when geopolitics is leaning heavily on trade policy certainly keeps you on your toes.”

Let’s hope we don’t step on China’s toes so much that they will all end up doing what we do.

Author profile: Christine is co-founder and President of China Human Resources Group, Inc, a management consulting firm based in Princeton NJ. She has provided U.S. companies with strategic development and project implementation services for projects in China since 1986 n

29 Manufacturing Outlook /May 2023 ASIA OUTLOOK

AEROSPACE OUTLOOK

by Royce Lowe

Airbus Expands in China

Simple Flying reports that Airbus recently signed new cooperation agreements with its Chinese aviation industry partners. This partnership will next see an increase in capacity at Airbus’s Tianjin A320 final assembly line. There will further be a General Terms Agreement to allocate 160 aircraft to Chinese airlines and to increase the use of sustainable aviation fuels in regular flights.

Guillaume Faury, the CEO of Airbus, signed an agreement to increase the assembly capacity for its Airbus A320 family with a second line at its Tianjin site. The deal was made

during a recent state visit with the Tianjin Free Trade Zone Investment Company and Aviation Industry Corporation of China Ltd in the presence of Chinese President Xi Jinping and French President Emmanuel Macron. Airbus aims to produce, globally, 75 aircraft per month by the end of 2026. The original site in Tianjin, in operation since 2008, has assembled over 600 A320 aircraft since it began operations. It carries out cabin interior installation and fuselage painting. Airbus currently has four A320 final assembly sites worldwide, with four assembly lines in Hamburg

and others in Toulouse and Mobile, Alabama.

Airbus and the China National Aviation Fuel (CNAF) Group signed a Memorandum of Understanding to upgrade Chinese-European cooperation for Sustainable Aviation Fuels. The agreement covers the production, competitive application, and common standard formulation for fuel use. In September 2022, Airbus and CNAF contracted to support flights in China to operate with SAF. So far, some seventeen delivery flights and the first commercial flight have been facilitated by the two partners.

30 Manufacturing Outlook /May 2023 AEROSPACE OUTLOOK continued

2023

MAY

The aim of this new agreement is to optimize the SAF supply chain by using a mix of sources and improving SAF production to use 10% SAF by 2030.

Airbus CEO Guillaume Faury commented on the announcement, saying, “We are honored to continue our long-standing cooperation by supporting China’s civil aviation growth with our leading families of aircraft. It underpins the positive recovery momentum and prosperous outlook for the Chinese aviation market and the desire to grow sustainably with Airbus’ latest generation, eco-efficient aircraft. Airbus values its partnership with the Chinese aviation stakeholders, and we feel privileged to remain a partner of choice in shaping the future of civil aviation in China.”

Airbus also signed a General Terms of Agreement with the China Aviation Supplies Holding Company to firm up a purchase of 160 Airbus commercial aircraft. The agreement covers previously announced orders worth $17 billion. The deal includes 150 A320 aircraft and ten Airbus A350-900 widebody aircraft orders, reflecting Chinese carriers’ strong demand in all market segments.

China represents over 20% of the worldwide aircraft market. Airbus saw its first aircraft enter the Chinese market in 1985, nearly 40 years ago, when an A310 was first delivered to China Eastern Airlines. China’s air traffic is forecast to grow at a rate of 5.3% annually over the next 20 years,

significantly faster than the world average of 3.6%. This growth will lead to a demand for 8,420 passenger and freighter aircraft over the next twenty years.

We have previously mentioned China’s competing plane, the COMAC C919, which is effectively on the market. China is looking to have an annual production capacity of 150 C919s within the next five years. We will monitor the performance of the plane itself, together with progress in its production.

Boeing opened its first overseas plant, a completion and delivery center, in the middle of a trade war in 2018, some 90 miles from Shanghai. The plant does interior and exterior paintwork and other detail finishing work. The plant is a joint venture between Boeing and the Commercial Aircraft Corporation of China (COMAC).

The Outlook: The demand for commercial and fleet aircraft will remain strong through 2030 and help support component demand at subcontractors who serve aircraft manufacturing and maintenance. The industry has always had rises and falls depending on economic winds, but the long view is for strong growth over the next decade.

Author profile:Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

31 Manufacturing Outlook /May 2023 AEROSPACE OUTLOOK

MAY 2023

ENERGY OUTLOOK

Keeping Down E.V. Energy Costs

by Royce Lowe

to reduce reliance on rare earths. Model 3 and Model Y powertrains have already reduced consumption of heavy rare earths by a quarter, and Tesla’s next drive unit will include a permanent magnet motor that doesn’t use any of the materials, according to Colin Campbell, VicePresident of Powertrain Engineering. The automaker is looking to keep driving down costs, stay away from environmental and health risks, and

reduce reliance on commodities that may be susceptible to wide price swings.

Tesla recently decided to tell the world that it wants to remove rare earths from future models. This caused quite a reaction, and shares of Chinese rare-earth miners were heavily sold off at the news. At the same time, it is hoped that the announcement will spur global efforts to come up with alternatives for electric car motors that currently rely on the materials. Other carmakers, including BMW, Toyota, and General Motors, have also sought continued

China has long had control of the rare earth supply chain. This has led to unpredictable prices. Rare earths are used in magnets in everything from phones to wind turbines and fighter aircraft, and the unpredictable prices have long been a problem for the auto and the clean-energy sectors. China accounts for around two-thirds of

32 Manufacturing Outlook /May 2023 ENERGY OUTLOOK

mining and 85% of refining of the materials. The risks of relying on Beijing were highlighted in 2010 when prices spiked on China’s decision to cut exports and in 2019 and 2020 amid speculation that shipments might be limited again amid trade tensions with the U.S.

The lack of diversity in rare earth permanent magnet supply chains is “a key concern for the industry within the geopolitics of critical materials,” said Nils Backeberg, founder of Londonbased consultancy Project Blue. “Use of cheaper - though less performanceand efficiency-focused - technologies is likely to become more widespread.”

One potential alternative is ferrite magnets, a mix of iron and such materials as barium and strontium, which are more widely available and cheaper, according to William Roberts, a senior research analyst at Londonbased consultancy Rho Motion. G.M. has previously used these, and Japanbased Proterial said in December it had developed motors using ferrite magnets that performed as well as components using rare earths. Minneapolis-based Niron Magnetics,

which has partnered with Volvo Car, last year won a $17.5 million U.S. Energy Department grant to help scale up work on rare-earth free magnets that use iron nitride-based technology.

A team from the University of Cambridge and colleagues from Austria announced a new method to make tetrataenite, a possible replacement for rare-earth magnets, in a research paper published last year. It may be possible to produce tetrataenite, an iron-nickel alloy, at scale by adding phosphorus, the researchers found. Previously, making tetrataenite, whose magnetic properties approach those of rareearth magnets, in the laboratory, relied on impractical methods, they said. The researchers are hoping to work with major magnet manufacturers to determine whether tetrataenite might be suitable for highperformance magnets.

Ferrite magnets are the most likely candidate for Tesla’s innovation, according to research firm Adamas Intelligence, though the technology faces a challenge as it has traditionally come with a “significant weight or

efficiency penalty.” Existing rare earth-based motor systems also have a track record of efficiency, and demand for the materials in electric vehicles and renewable energy is forecast to surge. About $3.8 billion of magnet rare earth oxides were consumed in energy-transition-related applications in 2022, and the figure will reach more than $36 billion in 2035, Adamas forecasts.

The Outlook - As alternatives are developed by creative minds with unique approaches to problem materials or critical components, manufacturers in the U.S. (and other countries) will reduce or remove rare earths and other conflict components, defined as any element or component that is reliant upon a supply source subject to current or ongoing geopolitical, socioeconomic, strategic, or extreme cost volatility.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook n

33 Manufacturing Outlook /May 2023

ENERGY OUTLOOK

MATERIALS OUTLOOK

U.S. Tariffs on Russian Aluminum

by Royce Lowe

At the beginning of the year, nobody was sure whether the U.S. and its allies would levy sanctions against Russian aluminum over the ongoing war in Ukraine. Russia’s aluminum industry is a key part of its defense industrial base. It is also one of the world’s largest producers of the metal. The U.S. and its allies imposed several economic measures against Russia after it invaded Ukraine a year ago but did not target aluminum.

prices soaring. Hence the aluminum market was anxious about 2023.

In late February, their anxiety was answered when the U.S. announced the imposition of a 200% tariff on Russian aluminum. The 200% duty will further apply to aluminum imports from elsewhere, including Russian aluminum. The tariffs were part of a larger package of trade enforcement moves against Russian metals, minerals, and chemicals worth about $2.8 billion, announced on Russia’s invasion’s one-year anniversary. Tariffs usually lead to higher prices, but the impact of this latest action against Russian aluminum will not be as serious as it may have been. The tariffs were not as punitive as other

measures the White House considered, such as a total ban on imports of Russian aluminum and renewed sanctions on Rusal.

The tariffs are unlikely to tighten aluminum supplies in the U.S., as users have lessened their reliance on Russian aluminum since 2017. Russia, primarily through Rusal, accounted for some 11% of U.S. aluminum imports at that time. This share dipped to about 4% of import volume last year.

In 2018, the U.S. sanctioned United Co. Rusal, a major Russian aluminum producer, as a response to Russian aggression, including meddling in U.S. elections. This froze the bulk of the company’s exports, disrupted the aluminum market, and sent aluminum continued

Demand for the metal is playing a major role here, as prices of the metal on the London Metal Exchange, the international benchmark, have fallen about 30% from a year ago and remain under pressure.

34 Manufacturing Outlook /May 2023 MATERIALS OUTLOOK

MAY 2023

Global prices have been unstable since the pandemic. They began a steady climb in mid-2020, as economies slowly reopened following pandemic lockdowns and improving industrial demand. The growth of electric vehicles and renewable energy has also increased demand.