For The Cannabis PROFESSIONAL

What you need to know about REITs

For The Cannabis PROFESSIONAL

What you need to know about REITs

How this executive transformed a family-run business into a modern-day global powerhouse

Super Seed or Gangster Villain?

HOW TO REAP THE REWARDS FROM THIS YEAR'S

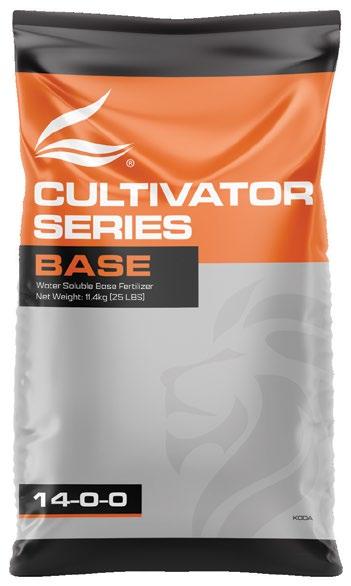

Enhance cannabinoids, terpenoids, and yields at an unbeatable price with cutting-edge water-soluble powders.

The ONLY 3-part water-soluble powder that hits the vital, phase-specific shift of your cannabis so it can reach its true genetic potential

Complete nutrition with enhanced triple chelation of iron, manganese, zinc, magnesium, and sulfur for increased cannabinoids and terpenoids and superior yields

A seamless and hassle-free transition from any other 3-part powder

Highly soluble nutrients optimize plant absorption, fostering robust growth and maximizing crop yields

With 14 inputs, our plant nutrition is more comprehensive than competitors with 5-8 inputs. Coupled with 8th-generation chelation technology, growers often report better results at 2.5 EC compared to the 3.0 EC they were previously running with other brands

No dyes, 100% mineral inputs

Fresh and accessible nutrients: The middle mylar layer, a metalized polyester, preserves freshness, and the zip-top closure simplifies access and storage of your nutrients

Triple-layer protection:

Three layers of durable material in each bag protect nutrients from moisture, light exposure, and pests

ENHANCED TRIPLE CHELATED TECHNOLOGY FOR:

Faster nutrient absorption

Optimized plant growth and development

Increased nutrient utilization

Increased cannabinoid and terpene levels

Heavier yields

LEARN MORE

News, data, trends, forecasts, and other tidbits worth knowing.

Brands and regulators are deploying covert agents to get the goods on dispensary operations.

Mother Earth Wellness has made a big impression in the country’s smallest state.

Something bugging your grow? Here’s how to bring pests under control.

Despite inherent risks, REITs offer several benefits real-estate equity doesn’t.

A three-step strategy can help companies limit exposure and mitigate risk.

Enhance your brand’s appeal to dispensary buyers with these tips from a retail pro.

Nail these five digital best practices for e-commerce success.

He may be only thirty-one years old, but Royal Queen Seeds’ president is a seasoned international operator with aggressive growth plans for his family’s business.

Have we discovered a new Eden or unearthed the roots of dystopia?

By Jack Gorsline

Editorial Director KATHEE BREWER

editorial@inc-media.com

Creative Director ANGELA DERASMO

Digital Editor Jeff Hale

Contributing Writers Alain Vo, Alisha Holloway PhD, Allison Zervopoulos, Anthony Coniglio, Christopher Jones, Dan Mondello, Danny Reed, Dan Serard, David Kooi, David Sandelman, Gary Allen, Henry Baskerville Esq., Howard Sykes, Jay Virdi, Jess Phillips, Kim Prince, Kris Krane, Kyle Sherman, Lance C. Lambert, Laura Bianchi Esq., Marc Beginin Esq., Michael Mejer, Rachel Gillette Esq., Rachel Goldman, Randy Reed, Richard Proud, Robert T. Hoban Esq., Ruth Rauls Esq., Ryan Hurley Esq., Scott Johnson Esq., Shane Johnson MD, Sue Dehnam, Taylor Engle, Terrence White

Artists/Photographers Christine Bishop, Steve Hedberg, Mike Rosati

Digital Strategist Dexter Nelson

Circulation Manager Faith Roberts

ADVERTISING SALES & CLIENT SERVICES

BRANDI MESTA

Senior Account Executive Brandi@inc-media.com (424) 703-3198

BUSINESS OFFICES

Chief Executive Darren Roberts

Tech Architect Travis Abeyta

Accounting

Diane Sarmiento, Brittany Gambrell

Subscriptions subscribe.mgmagazine.com

Back Issues

store.mgmagazine.com

Mailing Address

mg Magazine

23055 Sherman Way, Box 5069

West Hills, CA 91308

(310) 421-1860 hello@inc-media.com

MEG CASHEL

Account Manager Meg@inc-media.com (424) 246-8912

mg Magazine: For The Cannabis Professional Vol.10, No.10 (ISSN 2379-1659) is published monthly by Incunabulum LLC, located at 23055 Sherman Way, No. 5069, West Hills CA 91308. Periodicals Postage Paid at Las Vegas Post Office and additional mailing locations. POSTMASTER: Send all UAA to CFS. NON-POSTAL AND MILITARY FACILITIES: Send address corrections to mg Magazine, 23055 Sherman Way, No. 5069, West Hills CA 91308.

mg is printed in the USA and all rights are reserved. © 2024 by Incunabulum LLC. mg considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur; consequently, readers using this information do so at their own risk. Each business opportunity and/or investment inherently contains criteria understanding that the publisher is not rendering legal or financial advice. Neither Incunabulum LLC nor its employees accept any responsibility whatsoever for contributors’ activities or content provided. All letters sent to mg Magazine will be treated as unconditionally assigned for publication, copyright purposes, and use in any publication or brochure and are subject to mg’s unrestricted right to edit and comment.

ANTHONY CONIGLIO

President, CEO, and board of directors member Anthony Coniglio oversees NewLake Capital Partners Inc.’s portfolio of internally managed investments. A real estate investment trust, New Lake provides capital to state-licensed operators through sale-leaseback transactions, third-party purchases, and build-tosuit projects. NewLake.com

JAY VIRDI

As chief sales officer for specialty practices at global insurance brokerage Hub International, Jay Virdi connects clients with a team of experts to achieve their goals while reducing risks in a highly scrutinized industry. He is a Chartered Insurance Professional under the Insurance Institute of Canada. HubInternational.com

A returned citizen, Terrence White works to correct the disproportionate impact of criminalization on marginalized communities. He founded and serves as CEO for Monko, a luxury cannabis experience in the heart of Washington, D.C. He also owns the cultivation brand Pleasant Wellness. Monko.co

A serial entrepreneur, Dan Mondello cofounded and serves as CEO for Rank Really High, an e-commerce services provider specializing in website development and digital marketing. The company counts Cookies among its more than 400 dispensary clients nationwide. RankReallyHigh.com

It never ceases to amaze me how young some of the executives in this industry are. Shai Ramsahai is one example. He wasn’t yet thirty when he was named president of Royal Queen Seeds, and in the two years since, he’s steered the Barcelona-based company through major expansions in Thailand and the United States and brokered an exclusive deal with Tyson 2.0. More big moves are on the horizon. (Psst! Don’t tell anyone, but Royal Queen is seeking new partnerships with U.S. companies.)

Seeds seem to be trending lately. One of the topics we’ve heard quite a bit about is F1 hybrid seeds, which some bold futurists suggest could change the complexion of the cultivation sector within ten years. F1 hybrid seeds have been used extensively in food agriculture for decades, but our industry is just beginning to discover them. Growers have mixed feelings about whether they’re a viable alternative to clones. You can read more about that in this issue.

Elsewhere among these pages, we take a look at biological pest control, cannabis-focused real estate investment trusts, trending cultivation tools, and the underappreciated value of covert operatives in retail.

At mg Magazine, we learn something new every day. It’s not only our job but also our responsibility to provide platforms where expertise can be shared, ideas can be fueled, and success can be celebrated. We are grateful to our advertising partners, contributors, and the industry at large for granting us this privilege.

KATHEE BREWER EDITORIAL DIRECTOR

The e-commerce experiences consumers find most frustrating.

NEW YORK — Shortly after reporting a net loss of $21.8 million for the second quarter, publicly traded multistate operator Ascend Wellness Holdings Inc. terminated its chief executive officer and chief financial officer. The company characterized the move as part of an effort to “align its operations with long-term strategic goals and financial priorities.”

John Hart served the company as CEO from May 2023 until August 2024. In his place, Ascend’s board of directors appointed Seventh Avenue Investments President and Chief Investment Officer Samuel Brill, who has served on the Ascend board since May 2023.

The board also tapped Ascend Chief Accounting Officer Roman Nemchenko to replace CFO Mark Cassebaum, who had been in his position for about eleven

months. Nemchenko, who has been with the company for four and a half years, led Ascend through its initial public offering in 2021.

The restructuring also included appointing Ascend co-founder and director Francis Perullo president.

According to a prepared statement, Perullo “led the company from inception to more than half a billion dollars in revenue over the past five years.”

“We are confident this hands-on leadership team … will guide Ascend through this next phase of growth,” said Abner Kurtin, co-founder and executive chair of the board of directors. “The leadership changes come as part of a broader effort to realign our strategy and address recent performance challenges. We are confident the changes will bring our focus back to the basics with an emphasis on the fundamentals and will position [Ascend] for future success.”

29% promo codes not applied in shopping cart

26% excessive scrolling required to complete purchase

26% search results included out-of-stock products

23% insufficient info in product descriptions

(Source: Digital Commerce 360 / Bizrate Insights survey)

LEMOYNE, Pa. — Retailers may want to adjust their merchandise mix and sales approaches in light of a new multigenerational survey of cannabis consumers. Conducted by Sanctuary Wellness in May and released in September, the survey reveals a divide between age-related demographics.

According to the report, 72 percent of American adults have tried cannabis, and nearly 33 percent are current users. Most consume weekly or more often. Members of Generation X, whose favorite product format is flower, consume most frequently, with

89 percent partaking at least weekly. Eighty-four percent of baby boomers, who prefer edibles, admitted they partake at least weekly. Millennials and Gen Z, tied at 73 percent each for at-least-weekly use, prefer edibles and flower, respectively.

According to the survey, the top five reasons Americans use cannabis are stress relief, relaxation, enjoyment, coping with anxiety or depression, and help with sleep issues.

One-third of Gen Z reported using cannabis to address boredom, while another third consume to enhance their enjoyment of events. Brands able to tap into Gen Z’s desire to replace a mundane existence with an extraordinary Instagram-worthy experience stand to build lasting relationships with the industry’s fastest-growing consumer segment.

While edibles are the most popular product format among millennials at 68 percent, this demographic leads the industry in vaping at 53 percent. Brands without both product categories may want to consider a marketing partnership or product collaboration to appeal to the majority of millennials, who purchase from adult-use dispensaries.

Although nearly nine in ten Gen X consumers use cannabis at least once a week, only 48 percent of them shop at dispensaries, the lowest percentage among all age groups. Licensed shops targeting Gen X customers should implement and optimize loyalty programs and collaborate with local brands to incentivize repeat visits from these frequent consumers.

Boomers are frequent cannabis users, as well, with more than eight in ten reporting weekly use. They’re also the most likely to hold a medical marijuana card, and 95 percent of cardholders included in the survey said their quality of life has improved since they began consuming cannabis. Brands and budtenders who can find compelling ways to communicate the effectiveness of products like edibles for seniors can establish themselves as trusted providers.

For the survey, researchers collected responses from 1,017 American adults aged 18–78 with an even respondent distribution across generational cohorts. Nearly 45 percent were men, 54 percent were women, and 2 percent were non-binary or preferred not to reveal their gender identity.

Hiring platform Vangst acquired GreenForce, a temporary staffing agency serving the industry in Oregon and Arizona, for an undisclosed sum. GreenForce founder Ryan Rosenfeld was named chief business officer at Vangst, where he will focus on regional and national expansion. The deal marked Vangst’s second acquisition of 2024.

A joint venture (JV) between privately held operators Mint and Shango acquired The Cannabist Company’s Florida subsidiary for $5 million. The deal included fourteen dispensaries, two cultivation-and-manufacturing facilities, licenses, and inventory. The JV plans to expand its holdings to thirty-five dispensaries, all operating under the Mint banner.

Organigram Holdings Inc. closed the second of three tranches of a C$124.6-million (about US$92 million) follow-on strategic equity investment by BT DE Investments Inc., a wholly owned subsidiary of British American Tobacco plc. Gross proceeds from the transaction totaled about USD$31 million. The companies expect the third tranche to close in February.

WASHINGTON – Moving cannabis from Schedule I to Schedule III under the Controlled Substances Act (CSA) would do little to improve banking access for state-legal cannabis businesses, according to the latest Congressional Research Service (CRS) report about the effects of potential federal rescheduling.

While reclassifying the plant would provide some benefits for the industry—like removing certain federal tax burdens—cannabis would remain federally illegal. As a result, financial institutions would face the same legal risks under regulations implemented to combat money laundering.

“Rescheduling would have no effect on state recreational marijuana laws, because recreational marijuana activities would remain unlawful under federal law,” the report states. “For medical marijuana regimes, Schedule III drugs,

Powered by

unlike those on Schedule I, can be lawfully dispensed by prescription—but only if they are approved by the Food and Drug Administration (FDA).”

The FDA has not approved cannabis as a prescription drug. If the agency were to change its position, manufacturers, distributors, and sellers would need to register with the Drug Enforcement Administration and follow strict rules for Schedule III substances, including CSA mandates for safeguarding, recordkeeping, and reporting. Patients would need a prescription from a medical professional. But, as the CRS report points out, current state regulations do not match these federal mandates.

According to the report, the House and Senate hold the power to mitigate the risks financial institutions face when providing services to cannabis businesses. In September 2023, the Senate Banking Committee passed the Secure and Fair Enforcement Regulation Banking Act out of committee, and the House has passed versions of the very similar Secure and

Recent studies have shown that up to 60% of consumers aged 25-34 are replacing alcohol consumption with cannabis.

Health and wellness concerns are among the reasons for this shift, which may also explain why edibles are a preferred delivery method.

Using BLAZE Insights, we found a 7.5% increase in edible sales from January - July 2023 to January - July 2024. Additionally, there was a 3.2% increase in revenue.

While these numbers may not seem substantial, they do indicate the beginning of a trend in this category.

Fair Enforcement Banking Act seven times, but so far nothing has reached the president’s desk.

Both bills would protect depository institutions from legal liability under the Bank Secrecy Act and anti-moneylaundering laws. In addition to treating cannabis income as revenue collected from a lawful source, the banking acts would protect the Federal National Mortgage Association, Federal Home Loan Mortgage Corporation, and other federal agencies providing mortgage loans, guarantees, and insurance programs to industry insiders.

The acts also would require the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) to develop new regulations and guidelines for suspicious activity reports (SARs). To date, FinCEN has received more than 410,000 cannabis-related SARs from about 680 financial institutions. Additionally, the bills would limit federal regulators’ ability to encourage financial institutions to close customer accounts based on “reputational risks” associated with state-legal operations.

Recommendations:

Treat your customers with Halloween-themed product bundles

An increasing number of brands, retailers, and regulators are employing covert operatives to help them get honest feedback.

BY TAYLOR ENGLE

Traditional consumer packaged goods companies have relied on “secret shopper” programs since the 1970s to collect valuable feedback about consumer satisfaction with brands and services in brick-and-mortar settings. According to the U.S. Bureau of Labor Statistics, thousands of people across the United States are employed as mystery shoppers as part of what has become a multibilliondollar industry. But in the highly regulated cannabis industry, much more than customer satisfaction can be at stake.

In 2024, regulators in multiple states are using secret-shopper-like programs to oversee retail compliance issues like packaging and labeling. In March, Acting Massachusetts Cannabis Control Commission (MCCC) Chairperson Ava Callendar Concepcion spoke about her team’s effort to “ramp up” the state’s mystery shopper program to make sure businesses conform with measures implemented to protect consumers.

“It’s making sure that labeling is accurate, that potency levels are being described accurately, to make sure that what is being displayed for consumers and the information being relied on is accurate,” Concepcion said.

In Massachusetts, regulators can authorize an employee or other agent to pose as a customer

and purchase regulated products from dispensaries for any investigative purposes consistent with state laws, including “testing for compliance with laboratory-testing standards and identification-check requirements.”

Oklahoma lawmakers instituted a similar program in 2022 after passing House Bill 3971, which allows the Oklahoma Medical Marijuana Authority (OMMA) to employ secret shoppers for the purpose of conducting compliance inspections at licensed dispensaries. Under the program, OMMA sends undercover shoppers to at least fifty dispensaries each year to purchase products for lab testing.

Colorado’s Marijuana Enforcement Division rolled out its secret shopping program in 2014. The program primarily sends underage individuals to licensed recreational and medical dispensaries to ensure businesses are complying with age-verification laws. Data for 2022 showed underage secret shoppers were able to purchase regulated products only 1 percent of the time. That’s an improvement of 5 percent over 2016, when 6 percent of underage shoppers were successful.

Secret shopping may not be universally required, but it’s an easy way to avoid costly compliance mistakes while getting first-hand knowledge about the experiences customers actually have when engaging with products, brands, or services in person.

“Secret shopping is a method all brands should be utilizing,” said Muhammad “Muha” Garawi, co-founder and chief revenue and marketing officer at multistate operator Muha Meds. “You’ll learn so much about how your products are doing first-hand. You’ll also get to see which trends are performing well in the market so you can understand what adjustments you need to make to assist sell-through, budtender education, and brandimage maintenance.”

The practice also helps brands understand how their dispensary partners are pushing their products when brand representatives aren’t around to assist on the sales floor.

“When we refer to ‘secret shoppers,’ we’re usually sending our own employees out to dispensaries versus hiring external shoppers,” said Timeless Chief Operating Officer Shawn Williams. “Since we’re a third-party brand, it’s unlikely the budtenders selling our products would know we work for Timeless. One of the benefits of that is, we can covertly do a quality assessment to see how cartridges look and taste, and also check out how the packaging looks to ensure it meets our standards and consistency across states.”

“There isn’t an unsuccessful example of secret shopping, because the knowledge you gain from each experience is worth it, whether you hear exactly what you were hoping to hear about your brand or product or the budtender isn’t too familiar with you,” Williams said. “And if it’s the latter, take that time to educate them and potentially improve things on your end.”

At best, stores that fail to prepare for secret shopping risk reputational damage among consumers and partners and loss of consumer traffic (which often results in loss of revenue). Those consequences are serious enough,

For Williams, secret shopping is a unique way to understand whether the brand’s budtender education is working. Timeless also receives real feedback about its products directly from budtenders, instead of the overly diplomatic responses typically collected by surveys.

Muha Meds’ Garawi takes a similar approach to uncovering the truth.

“I like to play dumb and ask questions like, ‘Does this help you sleep?’ or ‘What’s the difference between diamonds and live resin?’” he said. “This helps gauge the knowledge of the budtenders selling your product. I’m looking to see how accurately they answer these questions, how heavily they recommend our brand, and what their feedback sounds like for our brand and/or similar brands.”

From there, Garawi likes to get more specific, asking sales-focused questions like “Which vape brand is performing best for you right now?” or “Do you sell more flower or vapes?” This helps him understand what sell-through looks like, seek out potential gaps his brand might be able to fill, and understand the marketing tactics leading to success or failure.

Secret shopping is a method all brands should be utilizing.

—MUHA GARAWI co-founder, Muha Meds

but if the covert operative works for a state or local regulatory body, ramifications can be much more severe, including additional training mandates, loss of licenses, or—in extreme cases—criminal prosecution.

The most obvious risk of a compliance infraction is a significant financial penalty. In California, compliance fines run up to $5,000 per violation for licensed individuals or $30,000 per violation if the operation is unlicensed. However, penalties vary widely across states with other statutes and ordinances to consider in different cities and counties. In Auguest, the MCCC’s website listed only four enforcement actions in 2024, all of which entailed multi-year investigations.

While a dispensary sales floor rarely has a secret shopper actively looking for costly compliance errors, employees always should assume someone important is watching. At the end of the day, every customer’s experience is consequential.

Housed in a reclaimed nineteenth-century machine shop, Mother Earth Wellness draws connoisseurs from across New England.

Located just off Interstate 95 in Pawtucket, Rhode Island, Mother Earth Wellness is doing its part to define the connoisseur experience for New England’s cannabis consumers. With a sleek design, top-shelf products, and the only dispensary drive-thru window on the East Coast, the one-of-a-kind shop attracts everyone from the cannacurious to sophisticated shoppers from across the region by providing an experience that is both luxurious and convenient.

We change our inventory multiple times a day. That’s why people come to us.”

—Joe Pakuris

Stepping into Mother Earth is like entering a meticulously designed sanctuary. Despite its industrial history, the space feels both modern and warm. The dispensary reclaimed a historic mill building that originally housed the Narragansett Machine Company, which opened in 1890. Co-owner Eddie Keegan and his team accepted the challenge of transforming the cavernous space into a retail environment without obscuring the abundant vintage charm. The result of their efforts is a stunning blend of past and present—a dispensary that boasts more than 1,000 square feet of custom-fabricated marble countertops, high-end antique lighting fixtures, and natural wood ceilings.

Keegan, who also co-owns the Kitchen & Countertop Center of New England located nearby, brought his design expertise into the careful interiors choices at Mother Earth. His vision for the dispensary was clear: create a space that feels sophisticated yet approachable; minimal yet functional.

“Eddie installed everything himself,” said co-owner and Chief Executive Officer Joe Pakuris. “He cut and fabricated all the tile and countertops and worked with our carpenters to build all the displays.

“We wanted classy but comfortable,” Pakuris continued. “When you walk in, you’re in a nice, well-lit space, but it’s just really relaxed and easy on the eye. We wanted it to be an experience.”

All these crazy little things we’ve done have made this place what it is today. There’s nothing else like it.”

—Joe Pakuris

One of the most striking features of the dispensary is the fully functioning waterfall that serves as the centerpiece of the retail floor. This isn’t just any waterfall, though. The eye-catching feature is surrounded by seventy-five cannabis strains, each flower meticulously displayed for customers to see, smell, and even puff before making a purchase. The attention to detail creates a unique-in-theregion, immersive sensory experience for customers.

Hands-on innovation is clearly at the heart of Mother Earth Wellness, and perhaps this is most evident in the store’s drive-thru, which Pakuris brought to life after thinking about the location’s proximity to I-95. Inspired by the convenience of a Dunkin’ Donuts shop, the drivethru isn’t just a novelty; it’s a game-changer for the local industry, allowing customers to order cannabis as easily as they would a cup of coffee. Equipped with a digital menu that changes daily, the three-lane setup has the capacity to queue up to seventy-five cars at a time, ensuring customers

can enjoy a quick and efficient experience even during peak hours. Drive-thru customers may choose from a variety of options, whether they’re pre-ordering online and simply picking up their purchase or making selections on the spot.

The entire process is seamless, from placing an order to picking up the purchase, and takes just three to seven minutes. The approach is particularly appealing to people on the go, whether they’re local residents or travelers just passing through.

Pakuris is particularly proud of the drive-thru. “I had the idea as soon as I got the dispensary license,” he said. “As soon as the retail end was working, I had in the back of my mind that I wanted to do a drive-thru, so I began working on it.”

Mother Earth Wellness isn’t just for casual cannabis users. The dispensary has become a destination for serious connoisseurs who seek out exclusive products. The shop

has built a reputation for offering high-quality flower that is grown locally by forty craft cultivators. Each of the cultivators operates in a space covering less than 10,000 square feet, which allows for a “small-batch” experience. The contrast with products in nearby states like Massachusetts and Maine—where large-scale production sometimes takes precedence over the artisanal approach—is unmistakable and plays to Mother Earth’s regional benefit.

“Our flower is always fresh,” Pakuris said. “We change our inventory multiple times a day. That’s why people come to us: They know they’re getting the best.”

He also said the freshness factor has attracted a loyal customer base that spans Rhode Island, Massachusetts, Connecticut, and beyond. Locals and tourists alike are willing to travel significant distances to shop at Mother Earth, according to Pakuris, because they know they can find products that aren’t available anywhere else, like the shop’s proprietary strains.

“We have people from all over New England who come to Mother Earth Wellness just because they can buy our Super Orange Soda in pre-roll form infused with oil,

and then they can buy that same Super Orange Soda in flower, a full-spectrum vape, and in edible form,” he said.

Mother Earth also offers homemade edibles crafted on the premises with the same attention-to-detail.

“We individually wrap every single gummy we manufacture; we don’t just throw them in a tin,” Pakuris said. “We wrap every cookie, every chocolate, so when you get a bag, the stuff doesn’t all melt together. And if you’re going out, you can just take one without having to bring the whole bag with you. All these crazy little things we’ve done have made this place what it is today. There’s nothing else like it.”

The dispensary serves approximately 2,000 customers a day—a testament to its popularity and the quality of its service and products. The robust loyalty program doesn’t hurt, either: Regular customers earn 5 percent cash back on their purchases, a perk that keeps them returning.

Inside the dispensary, customers enjoy multiple ways to shop. They may browse the displays, interact with knowledgeable budtenders, or use self-service kiosks to place their orders. The kiosks are particularly popular with customers who prefer to take their time exploring the menu and making their selections at their own pace, according to Pakuris. Once an order is placed, it’s ready for pickup in three minutes or less, ensuring even those who opt for the in-store experience can enjoy a quick, efficient transaction.

Because the owners and staff are attuned to the desires of their customers, Mother Earth Wellness soon will extend its hours of operation until 1 a.m. on Thursdays, Fridays, and Saturdays, catering to customers who work shifts and those from nearby institutions of higher education who prefer to shop in the middle of the night.

BY KURT KINNEMAN

Any home gardener can tell you ladybugs are beneficial pests. But while having a healthy Coccinellidae population is hardly a bad thing, it’s far from the most effective pest-management strategy in a commercial setting. In fact, ladybugs are known to “farm” aphids—which can decimate a cannabis crop—making sure to stockpile their favorite sap-sucking insects so they have a constant supply of food.

On the other hand, predators like Aphidius colemani, a parasitic wasp, can wipe out aphid colonies in greenhouses and commercial fields. These beneficial bugs lay eggs in aphid nymphs and let their larvae consume any problematic pests from the inside.

Just like the bugs themselves, insect- and pestmanagement programs can eat into profits. While cultivation facilities should consider both chemical

and biological pest control when developing operating procedures that will help them reduce the chance of infestations, determining the most cost-effective method is an ongoing challenge. Using scouting techniques to monitor pest populations provides critical information about the most appropriate action to prevent and cure pest infestations.

Always use serious predators to target serious pest problems instead of relying on generalists like ladybugs. Identify your pest and hire their best enemy to eliminate the infestation.

“When building a cannabis crop-protection program, I typically focus on biological control agents (BCAs) for control over pests such as two-spotted spider mites, aphids, thrips, and certain kinds of caterpillars,” said Daniel Graham-Boire, cannabis technical advisor at

agricultural supply company BFG. “For diseases, we rely on a group of biorational pesticides that either block infection or actively fight against pathogenic agents. By utilizing a combination of BCA and biorational tools, we can safely and effectively control pests and diseases in cannabis production.”

The cost of biological predators varies greatly due to shipping and supply limitations. Generally, enough insects to cover about 1,000 square feet of application area costs between $50 and $100. Most predatory insects are available for purchase in their adult and egg or larval forms.

When purchased in adult form, biological controls are delivered in packets or sachets with a limited food source. The small bags are designed to hang from the canopy or rest on top of grow media. As soon as they are added to the grow, the predators immediately leave the sachet or packet to hunt for a new food supply.

When purchased in egg or larval form, the insects arrive in small biodegradable egg structures. They can be placed directly on top of the growing media, where the eggs will hatch and go to work. It is important to have an adequate environment for the eggs and larvae; maintaining a temperature of 75 degrees and humidity of 50 percent works well for most biological controls.

Insects should be applied every two to three weeks throughout the growth cycle. Beneficial bugs can be applied during any stage. Assuming a twelve-week cycle, cultivators can expect to spend $200 to $400 purchasing biological controls for a 1,000-square-foot grow. In addition to the cost of bugs, cultivators should plan for one to two hours of labor for each deployment.

If you prefer pesticides to siccing beneficial pests on destructive ones, biological agents, horticultural oils, and synthesized chemicals each require different applicators for spraying. As a result, operators need to consider the cost of tools, maintenance, and storage. Worker training for spraying is another critical component to ensure pesticides are mixed at the correct application rates while adhering to strict worker safety guidelines.

Some pesticides, such as PyGanic and Venerate, have a reentry interval to consider. After these chemicals are sprayed, staff members must stay out of the area until the interval time has passed unless they wear protective clothing and gear. Such restrictions can lead to significant scheduling issues at cultivation facilities of all sizes.

Pesticide concentrates range from $50 a quart to $200 a gallon depending on brand and ingredients, and application rates can vary dramatically depending on the severity of infestation and targeted pest. Cultivators should expect to spend about $1 to $10 for enough concentrate to cover a 1,000-square-foot space. The associated labor will be about two to four hours per application. In an ideal setting, pest

Amblyseius andersoni are especially good for controlling two-spotted spider mites (TSSM), but they’re also effective against thrip infesations. Andersoni are reliable generalist predators, meaning they feed on more than one species. However, as generalists, they are less aggressive than more specialized predators.

Deploy Amblyseius swirskii for TSSM and thrip control, especially when dealing with thrips. Swirskii are more specialized than andersoni While swirskii actively hunt and eat soft-bodied pests like thrips, they feed on only the larvae and eggs of spider mites.

Amblyseius californicus are specialists for TSSM but do not have a habit of eating thrips.

Phytoseiulus persimilis are the ultimate predators for controlling TSSM, because they co-evolved with the non-insect pests. They can help gowers stay ahead of the biological arms race.

Deploy Aphidius ervi to gain control over cannabis aphids. In less than one second, this vigorous parasite examines an aphid, determines if it’s been parasitized, and stabs it with its ovipositor to lay eggs if the host is suitable food for its young.

Aphidius colemani, which are slender, dark parasitic wasps, work just like their ervi counterparts and often hunt smaller insects. Sic them on green peach aphids or greenflies.

Chrysoperla species (green lacewings) are a good choice for knocking down clusters of aphids that develop on the stems and undersides of fan leaves. The larvae of these delicate green bugs are small, fast, and aggressive predators capable of eating about 100 aphids during their lifespan.

prevention applications should happen once or twice weekly, stopping after the second or third week of flowering. For a twelve-week growth cycle, between seven and fourteen applications would be required, necessitating fourteen to fifty-six hours of labor.

Attacking an infestation often requires both pesticides and beneficial insects. Pesticides can provide knockdown power, eliminating numerous pests in one sweep. After the pest population has been reduced, beneficial bugs can be introduced to help eliminate the remaining targeted pest colony. For severe infestations, additional rounds of pestcontrol application may be required.

When pesticides are used in conjunction with beneficial bugs, care must be taken to monitor the populations of predators and prey to avoid the potential consequences of friendly fire. Pesticides do not discriminate between good bugs and bad bugs.

Growers should use sticky traps and maintain detailed logs on pest populations to understand which bugs are creating challenges. Having a dedicated employee scout monitoring the traps and logs is crucial for data gathering. By collecting the right data, cultivation facilities can develop a complete picture of the pests they’re battling and prepare for future mitigation and prevention.

Cultivators must make regular and honest assessments of the costs and benefits of traditional pesticides and biological controls when building standard operating producers for insect- and pest-management programs. Even with the best policies in place, determining the most cost-effective mode of action and the best timing for every situation takes a great deal of experience. Savvy growers can begin to close experience gaps with reliable historical data and employee training for scouting pests and monitoring traps. Eliminating wasted supplies and labor starts with gathering data about pests and using the information to make informed decisions.

BFG Supply

Provides an extensive range of horticultural supplies, including biological control agents for pest and disease management, and offers nationwide shipping.

Arbico Organics

A well-established supplier offering a variety of beneficial insects like lacewing eggs and larvae, ladybugs, and predatory mites. Specializes in biological control agents.

Koppert Biological Systems

A global leader in natural enemies, including predator eggs and larvae like green lacewings and parasitic wasps. Offersa wide range of products for commercial agriculture and horticulture.

Rincon-Vitova Insectaries

Offers a wide variety of beneficial insects and mites for different pest-control needs. Products are suitable for both small-scale and commercial operations.

BY ANTHONY CONIGLIO

Despite inherent risks, real estate investment trusts offer several benefits equity doesn’t.

1 2 3 4

REITs provide a diversified way to invest in the cannabis industry. By taking a stake in a broad portfolio of properties rather than relying on a single business, investors spread their risk across multiple tenants, industries, and geographic locations. This can help stabilize returns, reduce the impact of any single tenant’s execution on the overall portfolio’s performance, and minimize exposure to localized economic or regulatory challenges.

By law, REITs must distribute at least 90 percent of their taxable income to shareholders annually. This ensures that investors can enjoy regular, often predictable income, as long as the properties generate consistent rental revenue. Additionally, this income is typically more reliable than other forms of investment returns, making REITs an attractive option for income-focused investors looking for a dependable stream of dividends, even in fluctuating markets.

REITs benefit from a tax structure that avoids double taxation. The trusts generally do not pay corporate income tax (as long as they distribute 90 percent of their taxable income as dividends), leading to more favorable tax treatment compared to most other investment types. Investors pay taxes on the dividends at their individual tax rates, and in certain instances taxes may be reduced using the qualified business income deduction, further enhancing tax efficiency as an investment vehicle.

The cannabis industry is expanding, driven by increasing state legalization and growing acceptance of the plant for both medical and adult use. REITs stand to benefit from this expansion as demand for specialized real estate focused on the industry continues to rise, along with the need for cultivation and retail spaces. This growth potential can lead to increased rental income, property values, and long-term capital appreciation over time.

Real estate investment trusts (REITs) have become popular among investors seeking to diversify their portfolios and gain exposure to real estate without the hassle of direct property ownership. According to Nareit, a trade association for REITs operating in the United States, approximately 170 million Americans own the investment vehicles through their retirement plans and other funds. The investment type has grown in popularity because the vehicles enhance a diversified portfolio due to their lower correlation to equity indices, and they typically display less volatility in total return driven by quarterly dividends. In particular, a REIT’s long duration and quarterly yield are attractive to family offices and other investors seeking to generate current income and build long-term value from appreciation in the underlying real estate.

Cannabis REITs represent an emerging subsector of the $1.1-trillion market. Focused on cultivation facilities, processing space, and retail dispensaries, the subsector allows investors to tap into the growth of the marijuana market while enjoying the benefits of real-estate investment.

In addition to offering investors a dividend yield of nearly double the typical equity REIT, cannabis trusts have been growing available funds from operations, a key measure of free cash flow, at a much faster pace than the industry average.

Despite their potential, cannabis REITs remain relatively unknown and therefore underinvested by retail and institutional investors—meaning they offer a promising, untapped avenue for portfolio diversification.

REITs offer a compelling avenue for investors to gain exposure to the dynamic and rapidly expanding

cannabis industry while leveraging the stability and benefits of real-estate investments. As the industry continues to evolve and mature, REITs present unique opportunities for portfolio diversification, steady income, and potential growth. However, investors must remain vigilant about the regulatory landscape and inherent risks within the sector.

Additionally, cannabis REITs are poised to play a significant role in the future of real estate and investment. By understanding the nuances and key aspects, investors can position themselves strategically to benefit from the burgeoning market. With careful consideration and informed decisionmaking, the trusts can be a valuable addition to a well-rounded investment portfolio, offering the potential for stability, growth, and income in an emerging industry.

5 6 7 8

LEVERAGE SPECIALIZED EXPERTISE

Investing in properties within highly regulated industries requires specialized knowledge and expertise due to the unique challenges. Cannabis REITs typically employ experienced professionals who understand the nuances of cannabis real estate, ensuring properties are leased to quality tenants that can meet rental obligations over the fifteen to twenty years of the lease term.

Publicly traded REITs offer liquidity and accessibility that direct private investments often lack. Investors can easily buy and sell shares on stock exchanges, providing flexibility, lower transaction costs, and ease of entry compared to the complexities of investing directly in real estate. This accessibility allows investors to adjust their positions quickly in response to market conditions.

Cannabis REITs often offer higher dividend yields compared to traditional REITs, reflecting the higher risk associated with the industry. Investors should weigh the potential for higher returns against the inherent risks, including regulatory uncertainty, evolving legislation, market volatility, and the financial instability of some cannabis operators in this emerging industry sector.

As the industry matures, cannabis REITs may face both challenges and new opportunities. Potential changes in federal laws, shifts in market demand, evolving competition, and advancements in cannabis technology within the industry all may impact performance. Staying informed, adaptable, and proactive will be key for investors looking to capitalize on this dynamic and rapidly evolving sector.

Shai Ramsahai grew up immersed in the cannabis industry under the guidance of his father, Boy Ramsahai, who founded Royal Queen Seeds (RQS) in 2009. From an early age, the younger Ramsahai marinated in the dynamic world of the plant at industry conferences across Europe and while sitting at his father’s side during corporate meetings. The experiences laid the foundation for his ascension to the company president’s desk.

The scion of an entrepreneurial family, Royal Queen Seeds’ president is focused on international growth.

BY JACK GORSLINE

Ramsahai’s entrepreneurial streak arose early, largely out of a desire to follow in his father’s footsteps while simultaneously blazing his own trail. While attending trade shows and festivals with his dad, he often sneaked away and sold the ashtrays his father handed out as promotional items in the company’s booth. One particularly memorable day, at the age of nine, he made €800 from ashtray sales. Father and son celebrated the accomplishment with a trip to McDonald’s … before banking the rest of the windfall to fund future entrepreneurial endeavors.

Over the ensuing years, Ramsahai took on a variety of less stealthy roles within RQS, gaining hands-on experience in nearly every facet of the business. From his initial position packaging seeds in the warehouse to working as a sales representative and managing the European sales team, his professional progression provided him with an intimate understanding of the company’s inner workings.

As an adult, and with his father’s active encouragement, Ramsahai left RQS to pursue the entrepreneurial ambitions he displayed as a child.

Between 2017 and 2022, he founded and led several cannabis, CBD, and hemp ventures, achieving success by expanding the companies into global markets. His experience working at every level of RQS’s operation informed his actions and propelled him over corporate hurdles until he eventually sold Amsterdambased seeds, psychedelics, and CBD distributor SR Wholesale B.V. and European wellness brand CBD Sport. Thereafter, he found his way back to the family business, although he credits the entrepreneurial years with providing him a strong foundation for forging strategic partnerships across industries and international markets.

Ramsahai’s ability to scale businesses and navigate the complexities of international sales earned his father’s trust, and the elder Ramsahai eventually handed over the reins of the business. Today, at just thirty-one years old, Shai Ramsahai oversees Barcelona-based RQS’s continuing expansion— including the development of an impressive fivestory facility in Bangkok that features a traditional storefront on the first floor, a luxurious smoking lounge and restaurant on the second, and a robust in-house cultivation operation on the third and fourth floors. Under his leadership, RQS has strengthened its position as a leading global brand with two brick-andmortar locations in Amsterdam, one in Barcelona, the Bangkok facility, and the first-ever European-owned seed bank in the United States, which opened in Eugene, Oregon, in 2023. RQS also brought to market the first F1 hybrid seeds for home-growers, launching the F1 Elite line in 2023. What’s more, earlier this year RQS partnered with Tyson 2.0 to offer consumers seeds from Mike Tyson’s handpicked favorite strains. The brand already accounts for just under 5 percent of RQS’s total revenue, and Ramsahai believes sales will increase substantially as the company widens its range of Tyson 2.0 products beyond seeds.

A blend of entrepreneurial drive and family connection is central to Ramsahai’s approach to leadership, especially as he navigates the company through choppy waters in Thailand’s cannabis industry. Earlier this year, the Southeast Asian nation flirted with a return to prohibition before settling on tightened regulations for a medical-only legal market.

Of all the different roles you’ve held at RQS—from the warehouse floor to the executive suite—which job did you enjoy most?

I’ve found all positions within Royal Queen Seeds fun and challenging. I really enjoyed my time in the warehouse, being singularly focused on processing orders with the team. But I love my job at the moment—meeting nice people, developing and executing with our great team, taking the company to the next level.

The industry’s dynamics have changed over the past five years. What changes are you seeing in your segment of the market?

We’ve seen cannabis home-grow interest explode, especially in new midwest states like Ohio—which is one of our largest markets by sales—and Minnesota. New York has seen similar growth since its home-grow regulations took effect. Internationally, Germany has been a massive and exciting market for us.

In the past five years, we’ve seen social conversations move from “Can I grow at home?” to “How do I grow the best cannabis at home?” This shift has been both exciting and challenging, as we are committed to distilling decades of experience into educational content that both newbie and expert growers can understand, ensuring they feel supported and informed.

Another consumer trend is increased demand for oldschool strains such as Northern Lights, White Widow, and Sour D. Keeping up with consumer demand for new cannabis flowers can be tricky, because the development of cannabis has a time minimum. While high THC values are one of the most important factors for U.S. cannabis seed buyers, the increasing demand for nostalgic strains may mean U.S. consumers are starting to care more about the feeling each unique strain gives them. They may also want the social aspect of cannabis consumption, and for the vast majority of consumers, old-school trains with THC percentages near or under 20 percent are the perfect go-to.

For U.S. commercial cannabis cultivators, often those strains require longer flowering times. They are worth growing, but [classic strains] may need their own growing spaces.

First, we are securing our position in our current markets by heavily investing in marketing and branding in critical global regions like the U.S. and Germany, ensuring we maintain our leadership position. Additionally, we are closely monitoring legislative developments in emerging markets that show promise, including South Africa and Brazil. We are also diversifying our product offerings while exploring opportunities to expand into unexplored verticals like flower and other “final” products [like edibles and vapes].

Existing competition is always something to consider, as is the need for more knowledge about the political and legislative context. One of our most natural moves is to expand the brand in areas it is already loved.

Take our launch in the U.S. as an example: We had been leading the [search engine results] for cannabis and helping growers from all across the States cultivate their own [plants] even before we opened our first U.S.based warehouse facility. That’s why, when people were finally able to get their RQS seeds locally, they did. It was a natural progression. We expect similar outcomes in other markets such as Colombia, Germany, Thailand, and additional U.S. locations.

RQS remains open to new and exciting partnerships with U.S. companies. American cannabis companies face challenges because [Internal Revenue Code Section] 280E taxes tie up so much of their capital. With rescheduling, we hope to see an explosion of unique, beneficial partnerships across the states.

[In December, the U.S. Drug Enforcement Administration will hold a public hearing about a proposal to move cannabis from Schedule I to Schedule III under the federal Controlled Substances Act. Rescheduling would free the regulated industry from some federal tax obligations and potentially provide other benefits, but reclassification is unlikely to occur before 2025. —Ed.]

Over the past several years, companies in our industry have had a hard time raising capital from both public markets and private sources. How has RQS managed to expand during times when capital is scarce?

Royal Queen Seeds is lucky to be a private, family-run business still. While we continue to pour money into [research and development] to develop new strains and ensure our seeds are healthy and vigorous, we don’t have the same real estate overhead that other licensed American cannabis companies have. Additionally, in the U.S. we haven’t had to spend any capital on license applications and all the hidden fees that come with that process. [Because seeds generally contain less than the federal limit of 0.3-percent THC, the U.S. Drug Enforcement Administration has acknowledged seeds are uncontrolled and federally legal, regardless of how much THC plants cultivated from the seeds develop. —Ed.]

The investors we have taken on are like family to us. Royal Queen Seeds has been profitable for years; we don’t foresee that changing.

What are your strategic priorities moving forward?

The RQS team’s efforts are centralized in our Barcelona headquarters and additional offices in key places like Eugene [Oregon] and the Netherlands, but we’re always exploring new markets and whether it would be valuable to open flagship stores. We aim to establish strong leadership in our top markets and explore new channels to reach the global community through high-impact activations. Investing in [research and development] will always be a priority to remain at the forefront of innovation for hobbyists and professional cultivators alike.

In the U.S., we continue to see more states legalizing both recreational and medical cannabis, as well as home-growing. RQS was the first European company to open a warehouse in Oregon a year and a half ago, and that made us the first European cannabis seed company to have a physical facility in the U.S. The midwest has been huge; Ohio is our largest market by sales. We have our eyes on any state looking to legalize, especially with fair and safe home-grow regulations.

Germany’s [adult-use] legalization on the first of April this year has had a tremendously positive impact on the industry and marks the beginning of a new era in the European cannabis landscape. Making indoor homegrowing legal also benefits seed banks, so of course we keep an eye on those markets.

How has RQS’s Thailand operation evolved in the wake of the regulatory upheaval the country underwent recently?

The environment in Thailand is somewhat volatile, but we are adapting to the regulations. The nice thing about Thailand is they can make cannabis legal in one day, but the negative thing is that they can make it illegal in one day, [which has] made it hard to see a future for RQS in the country at times.

At the end of July 2022, we opened the first cannabis experience in Thailand, where people can enter a store and walk through the building. We have a five-floor building; it was a huge project. Market opportunity and regulations at the time allowed us to share a true from-seed-to-harvest experience, which had been our lifelong dream: to create the perfect space to educate

consumers about the plant and its cultivation while providing the perfect atmosphere to enjoy its benefits in good company.

We will soon incorporate a medical center into the same building, which will comply with potential new government regulations.

You’ve worked with both the hemp and cannabis industries. What do you think of the current tension between the two?

Both industries share common interests in legalization, regulation, and market growth while focusing on different products and applications. However, the distinctions in tax models are currently creating some friction between them. I believe this relationship should evolve into a more cooperative partnership, with increased cross-industry innovation, co-advocacy for policy changes, and shared supply chain resources as both markets expand and mature.

RQS already offers a line of CBG-, CBN-, and THCV-dominant seeds, but do you envision the company might one day expand its catalog to include hemp-derived, non-THC products?

Even though these products have strong potential as consumer interest grows, success will depend on achieving clear regulations and social education. We are always open to expanding our product range to better adapt to our community’s needs, so we will not close that door in the future.

As an international operator, what do you consider the most undervalued international market?

Colombia’s strong legal framework, low production costs, favorable climate, and strategic location make it an undervalued market.

What about the most overvalued?

Canada is absolutely overvalued. There are intense barriers for outsiders wanting to break into the market, and the Canadian operators are well-established businesses and brands.

2

BY JAY VIRDI

The cannabis industry is growing and changing at an unprecedented pace, creating immense profit potential and putting a spotlight on the array of risks for those in the arena. Companies absolutely must understand current and emerging trends if they intend to manage risk effectively while maximizing profitability. Taking a proactive riskmanagement approach is essential to help mitigate potential losses and safeguard people, property, and profitability. Here are three steps to do just that.

STEP

1

Attract and Retain the Right Talent

Attracting and retaining top talent in any industry has become more challenging. Employees now wield significant power and often are regarded as the new customers. One of the enduring effects of the COVID-19 pandemic is that they crave more flexibility in work arrangements and have reevaluated their benefit expectations.

To address these challenges, businesses should consider undertaking the following measures:

• Compare current benefit offerings with those in industries that compete for the same workers.

• Present unique and appealing options to attract and retain talent.

• Maintain effective communication to ensure employees are aware of the benefits offered.

• Leverage industry expertise to guarantee the long-term sustainability of the employee benefits program.

A multiyear strategy should include policies and procedures that consider cost management, human resources (HR) advocacy, health, and performance for employees, as well as leverage HR-benefits technology to engage everything. Employee communication is key to attaining buy-in from teammates.

Ensure Protective Controls Are Extablished

To protect your place of business, implement a multifaceted riskmanagement approach by ensuring physical, administrative, and compliance controls are in place.

Physical controls include investing in security technology (including cybersecurity), locks, gates, lighting, cameras, access controls, guards, and patrols to safeguard your physical premises and inventory.

Administrative controls center around the development of security policies, procedures, staff awareness training, deescalation techniques, threat reporting, and conflict-management programs to help safeguard your team.

Compliance controls involve the development of a system to stay organized, updated, and in compliance with state-specific regulations and licensing, including environmental considerations for cultivation and pollution concerns.

3

Review and Adjust Your Business Insurance Policy

In the United States, twenty-four states and the District of Columbia have legalized adult-use cannabis; thirtyeight states have approved marijuana for medical purposes. Though legal access to cannabis is on the rise across the country, many carriers still do not provide the coverage the industry needs because federal law maintains the use, manufacture, distribution, and sale of the substance is illegal.

A lack of experienced professionals to underwrite the risks associated with the industry is another issue. While many carriers do not underwrite in this space due to legal and reputational

risks, Business Insurance magazine recently reported “commercial insurance for cannabis operators is finally becoming easier to obtain and afford as more insurers move into the sector.” According to the publication, the supply of insurance available to the industry grows at a rate of 80–100 percent annually.

When working with one of the carriers that do write insurance for this industry, there’s a host of losses and exclusions that must be considered prior to purchasing coverage. Common losses include fire and employee theft, water damage or pollution from operations, and product-contamination recalls. Common exclusions include criminal acts and health hazards; more specifically, this includes

onsite consumption, vape, and “general” cannabis exclusions.

All operators should consider obtaining coverage to offload risk via the following policies:

• Commercial general liability.

• Management liability.

• Product liability and recall.

• Property and crop insurance

• Equipment breakdown insurance.

• Business auto insurance.

• Care, custody, and control coverage for distributors.

• Workers’ compensation.

The industry is rapidly evolving, and with that come both opportunities and risks. To achieve profitability and minimize

potential risk exposures, adopt a proactive risk-management approach that addresses the needs of your employees, protects your property, and enhances profitability. Executives also should develop a robust business continuity plan to ensure their operations can withstand unforeseen disruptions, such as product-safety lawsuits and mergers or acquisitions.

Understanding the common risks and insurance coverage exclusions, as well as staying informed about emerging trends and regulatory changes, is vital for success in this dynamic sector. By combining strategic risk management with the right insurance coverage, your

Dispensaries can use the fourth quarter to turn their entire year around with NXTeck from New Frontier Data.

When budgets must be trimmed, marketing expenses often are the first to go. Largely, that’s because it’s notoriously difficult to attribute any kind of return on investment (ROI) to marketing campaigns. Although most businesses rely on marketing to get the word out about their products and services, teams struggle to demonstrate exactly how their spend impacts the bottom line.

But what if that weren’t the case? Imagine a platform with an enormous database and advanced technology so precise it can target specific consumers at specific times, match them with a message at the moment they’re most receptive, and then follow those shoppers straight

through the sale, delivering astoundingly accurate, real-time data. Now, imagine if the platform were so confident in its ability to revolutionize campaign performance that it took a percentage of revenue instead of a fixed fee.

That platform exists: the NXTeck suite of products from New Frontier Data.

Hyper-targeted campaigns are NXTeck’s specialty. By employing advanced data analytics, machine learning, and artificial intelligence to leverage New Frontier’s thirty-eight terabytes of live data about real people, NXTeck targets, with pinpoint accuracy, precisely the consumers who are ready to buy. And, stunningly,

NXTeck’s suite solves the attribution challenge by showing—with 92–93-percent accuracy—exactly who saw the message, where they saw it, and when they subsequently walked into the store. Now that’s precision.

Unlike other platforms, NXTeck doesn’t drop clients into an arcane system that may make sense to data scientists and web wizards but often befuddles marketing pros. Instead, NXTeck’s suite of products provides clear, data-driven strategies across all media channels, including not only hyper-personalized communication like email, social media, and push notifications but also cannabis-ascendant channels such as out-of-home options and over-the-top services like Hulu, Netflix, and Amazon Prime Video. After a campaign launches, NXTeck shows clients exactly how the implementation impacts sales in the moment. Campaigns may be adjusted on the fly, allowing retailers to maximize effectiveness in real time.

Most dispensaries find native mobile marketing delivers the best engagement, according to New Frontier Data Chief Executive Officer Gary Allen, because it “meets customers where [and when] they are.” Precisely targeted programmatic advertising on the desktop is a close second, he revealed, followed by strategic out-ofhome campaigns.

“Surprisingly, rural dispensaries see amazing results from direct mail,” he said.

And those results can be breathtaking. According to Allen, NXTeck’s average client sees ROI equal to three times their spend within thirty days of a campaign’s launch. Outliers, like a major dispensary retailer in Illinois, have seen ROI soar by as much as fifty times their spend.

Allen realizes the claims are extraordinary, which is why NXTeck takes a percentage of revenue in payment instead of the more standard flat fee. By eliminating up-front fees, the platform enables dispensaries to spend their budget elsewhere while still reaping the benefits of a robust customer-acquisition engine.

“We’re here to be their ‘top of the funnel,’” he said. “I’m so confident NXTeck can transform the effectiveness of their campaigns that I’m willing to take the risk. This can be the great equalizer, especially during the fourth quarter when many are trying to make up for disappointing revenue earlier in the year.”

NXTeck’s platform is the product of more than a decade spent gathering insights from real cannabis consumers, more than 7,000 retailers, and more than 980,000 unique retail locations. The extraordinarily detailed database contains more than 60 million active

cannabis consumers, about each of whom New Frontier has an average of 649 data points. How the company acquired all that information is a closely guarded secret, but Allen said much of it is first-party facts and figures gleaned directly from consumers. In addition to maintaining a one-to-one connection with 493 million consumer devices, New Frontier conducts face-to-face interviews with large-sample groups of 5,000 statistically relevant shoppers three or four times a year. When consumers speak for themselves, the resulting insight is much more powerful than what can be provided by hypothetical models based on anonymized data alone.

“We have the data that drives results—real, measurable ROI,” Allen said. “Let us run your marketing program for the fourth quarter, and we’ll help you convert consumers you never knew existed into loyal customers.”

NXTeck’s capabilities reach far beyond advertising. The platform also can help stores manage inventory more responsively and profitably.

“One of the great things about dispensaries is you don’t get a lot of people walking in and walking out without buying anything,” Allen said, adding the average consumer visits a store two and one-half times a week. Combine that datapoint with other shopper-specific knowledge, and “we can give dispensary owners their best inventory based on the consumers who live within two to five miles. We also can tell them which products are making a profit for them.”

For precision merchandising to be worthwhile, though, the store must attract customers.

“Let us make you some money first,” Allen said. “Then we can do all sorts of cool things with the platform's inventory capabilities.”

He also said millions of untapped brick-and-mortar customers are wandering the streets in search of a dispensary that “fits” them. With the precise targeting offered by NXTeck’s suite of products, dispensaries can find them, attract them, and keep them.

“As we approach the end of the year, it’s time for retailers to make bold moves,” Allen said. “Cutting your marketing budget again won’t help. The only way you’re going to save your year is by filling the top of the funnel.

“As we all know, the fourth quarter is really the week of Halloween until the twenty-third of December and the week between Christmas and New Year,” he added. “Let’s get this set up now and turn your year around.”

NewFrontierData.com/nxteck-get-results

Phylos’s new Production-Ready Seeds produce superior results without clones’ drawbacks.

Genetics company Phylos Bioscience is raising the cultivation bar with its latest proprietary seed varieties, which are set for release in October. The company’s F1 hybrid seeds were developed using DNA marker-assisted selection and are designed for growers who are ready to move beyond clones. The seeds offer a range of benefits that make them stand out in the increasingly competitive genetics marketplace.

With the new F1 hybrid seed lines, Phylos is committed to replacing the industry’s reliance on clones with Production-Ready Seeds that offer clone-like uniformity, high yields, loud aroma profiles, bag appeal the market desires, and consistent THC levels—reaching 30 percent in some varieties. Clones often carry the risk of pests and diseases such as hop latent viroid (HLVd), but Phylos’s

parent breeding stock is meticulously tested before beginning hybrid seed production so the hybrid seeds start clean and grow strong, reducing the chance of crop failure and enhancing sustainability.

“Clones get infected with HLVd and become weaker over time, whereas cultivators start fresh every time they get a seed from us,” said Senior Director of Breeding Jared Reynbery.

Beyond the substantial increase in vigor, another major advantage of the new seeds is their uniform growth habit. Seed-grown plants have lacked the uniformity of clones; however, Phylos’s latest varieties exhibit consistent height, structure, and flower quality, rendering maintenance easier and allowing growers to optimize their operations without the high labor costs associated with clonal production.

Phylos’s seeds don’t just match the performance of clones—they often exceed it, according to Reynbery. Autoflower varieties are particularly popular, as they require less maintenance and have set growing cycles, increasing the number of cycles growers can produce annually and maximizing yields without expanding a facility’s footprint. Phylos also offers photosensitive seeds that thrive in indoor environments due to their stress tolerance and reduced risk of hermaphroditism.

“You shave off vegetation times with seeds versus clones,” said Amy Zents, director of cultivation at Progressive Plant Research, Phylos’s dedicated cultivation partner. “Some customers veg our seeds for one week less than they veg clones. This comes out to about a 25-percent to 30-percent time savings when you flip from clone to seed.”

At a time when cultivation businesses are grappling with falling prices and labor shortages, Phylos’s ProductionReady Seeds offer a cost-effective, sustainable alternative to clones without sacrificing quality, bag appeal, or unique and varied aromas. With new varieties released twice a year, cultivators can look forward to a growing product portfolio of improved genetics offering increased output, reduced operational costs, and improved product quality.

Phylos.bio

Some customers vegetate our seeds for one week less than they vegetate clones.”

—Amy Zents, director of cultivation, Progressive Plant Research

BY JACK

The study of genetics dates back to the nineteenth century, when Gregor Mendel, an Augustinian monk, pioneered the field. Between 1856 and 1863, Mendel’s meticulous experiments with pea plants demonstrated offspring display a combination of physical traits from both parents, thereby identifying the basic principles of genetic inheritance. Although he couldn’t figure out the “invisible factors” that determine phenotype (the observable characteristics of an organism), Mendel proved the inheritance of specific traits follows a predictable pattern through multiple generations of seed-grown plants.

IS MUCH

COMPLEX, but Mendel’s work still forms the foundation of agricultural breeding practices today. In fact, most of the commercially produced vegetables humans eat—with the ironic exception of peas—are the result of generations of scientific investigation into genetics at the DNA level, culminating in the development of stable first-generation, or F1, hybrid seeds that produce offspring phenotypically indistinguishable from the parent plants.

on nearly 80 percent of the corn and 90 percent of the soybeans grown in the country. Farmers have no legal right to grow from seeds produced by the plants they cultivate. The same is true for the home gardeners who grow some varieties of tomatoes, cucumbers, broccoli, and melons from seed.

Cannabis, like most other commercial crops, has been grown from seed for thousands of years, and seeds remain a common propagation method for outdoor growers. F1 hybrid seeds are a relatively new phenomenon in the industry, having been introduced by Royal Queen Seeds in 2016 and still not widely adopted in commercial grows.

After decades of research and development, the advantages of growing food crops from F1 hybrid seeds are well established. Produced by crosspollinating two genetically uniform parent plants, F1 hybrid seeds typically produce seedlings that exhibit “hybrid vigor”: higher survival rates, earlier flower development, higher yields, and resistance to some pests and diseases. Monsanto’s genetically modified F1 hybrid corn and soybeans are even resistant to herbicides the company manufactures. But F1 hybrid seeds also have some disadvantages in the commodity crops world, including cost and a lengthy development cycle. (It can take as many as eight years to genetically stabilize a line of parent plants.) Additionally, F1 hybrid seedlings don’t breed true to type. Many are infertile, and those that aren’t produce seeds that generate offspring with an unpredictable combination of traits from the grandparent plants. Consequently, farmers must buy new seeds every year if they hope to reproduce last year’s harvest. For some commodity crops, that has led to a virtual hostage situation in the United States: Monsanto owns and zealously protects its patents

The other common cannabis propagation method is cloning, wherein a cutting is taken or tissue is cultured from a “mother” plant and grown into an exact genetic replica of the parent. Because clones are literally a piece of the original, cloning allows for the indefinite preservation of popular strains.

Both propagation methods have their proponents. Advocates for F1 hybrid seeds say they can produce plants that are identical to their parents but stronger and faster growing. They predict F1 hybrid seeds could replace clones as the dominant cultivation modality within a decade. But not everyone is convinced. Developers of popular strains currently grown exclusively from clones worry that genetics remains an imprecise science subject to, among other things, unintended mutations that could destroy their legacy. In addition, cultivators in challenging climates say seeds may not be efficient in all environments.

Because of their shorter growth cycle, cannabis plants grown from some varieties of F1 hybrid seeds allow cultivators to grow crops in climates where traditional varieties might not thrive or the growing window is limited by shorter

seasons. F1 hybrid seedlings also can produce higher yields. For cultivators, this can result in greater efficiency: Multiple cycles and staggered harvests mean more crops can be grown on the same amount of land, which is particularly valuable in regions where space is limited and maximizing margins is crucial to profitability. In addition, because plant breeders carefully select parent plants with strong natural resistance to common pests and diseases, the need for chemical interventions like pesticides and fungicides is reduced.

And, like vegetables, cannabis F1 hybrids exhibit heterosis, or hybrid vigor. This makes them more resilient to environmental stressors such as drought and poor soil quality.

“Outdoor growers who grow from [traditional] seed often struggle with uniformity issues, [hermaphroditism], basic seed quality, and germination rates,” according to Phylos Bioscience Chief Science Officer Alisha Holloway. F1 hybrid seeds typically solve all those problems, she said.

From a cost-benefit standpoint, F1 hybrid seeds offer savings by eliminating the need to build and maintain a mother-plant room and nursery zone, freeing up valuable production space. Without a need for those areas, growers can repurpose the square footage for

production of more high-value flower. And the cost-saving benefits don’t stop there:

Growing F1 hybrid seeds also reduces pest management costs thanks to their genetic resilience. The streamlined process of F1 cultivation reduces both time and labor requirements, contributing to overall cost efficiency.

Together, these factors can enhance profitability and operational efficiency.