Get Real Values from Actual Deals

No Guessing. No Extrapolation.

When it comes to valuing M&A transactions in the middle market, no other source provides the level of quality and granularity as GF Data.

GF Data provides the most reliable data on private-equity sponsored M&A transactions with enterprise values of $10 million – $500 million.

Uncover proprietary transactional information provided by an established pool of private equity groups on a blind and confidential basis. Obtain accurate and up-to-date information to value and assess middle-market businesses.

To learn more about subscribing or contributing, scan the code or contact bdunn@acg.org.

GFData.com

Finessing the Funnel

When you talk to business development executives, you inevitably end up discussing “the funnel”: that ratio of opportunities that firms look at compared to how many result in an investment. Sellers, buyers and intermediaries are all thinking about how their time is best spent and how they can get to the right deals quicker.

In our second annual installment of Business Development Professionals to Watch, some of the most successful players in the field discuss which strategies work for them. In light of weakening market fundamentals, some firms say they are seeing less deal flow from investment banks. Others think financial advisors are running more targeted processes: going to a short list of prospects they think will be more likely to bid or buy. This increasingly means buyers need to get in front of sellers early and often to make sure they are not missing out on quality opportunities.

Several private equity firms now say they are running on a “thematic investing” platform, which involves identifying sectors or subsectors they think will be fruitful for the next several years and using their networks, existing portfolio companies and their management teams to find deals or add-ons in those areas. Many are relying on Grata and other search engines to narrow down the opportunity set more effectively. Technology also comes into play with business development professionals using sophisticated CRM systems to track deals they looked at in the past. They can evaluate which worked or didn’t work—and why—to try to use past experience as a guide for where to focus their efforts in the future.

Some of the brightest stars in middle-market business development across private equity, corporate development and investment banking share these tips and more on pgs. 38-67. Katie Oswald, managing director in business development at Crossplane Capital, who was featured in last year’s BD list, also talks about the expanding demands of the BD role in her In Perspective column on pg. 12. And our feature story on pg. 68 discusses the nuances of sifting for quality late-stage startups at a time when many are getting hit hard by market headwinds. Read on for more tips and tricks of the trade. //

On the Road Again

With the pandemic increasingly receding into the rearview mirror, my colleagues and clients have gone back to our normal travel schedules, and I expect business travel to be even more robust this year. Getting back on the road has shown just how much people in the industry miss traveling and networking in person. While virtual events and Zoom still have their place, they are no match for face-to-face meetings and breaking bread over a meal with clients.

To that end, we’re excited about many networking opportunities at ACG this year. The newly rebranded DealMAX conference will take place at the ARIA Resort & Casino in Las Vegas in May. Many Capital Connection events across the country will also offer dealmakers and service providers a chance to link up in person.

This issue of Middle Market DealMaker focuses on business development, highlighting some of the standout BD professionals of 2022 and underlining strategies that work to bring in deals and new business. In-person meetings and conferences are especially important for the business development function.

While dealmaking is expected to slow down this year, it won’t grind to a complete halt when there is so much money sitting on the sidelines at private equity firms. According to PitchBook, there is $1.2 trillion of private equity dry powder available to put to work. We’ll definitely continue to see deals getting done, but at a time of high interest rates and deepening inflation, they might be financed with more cash than leverage.

A slight slowdown might also be a welcome change, as 2021 and part of 2022 were still very busy. Private equity executives, investment bankers and service providers oversaw an overwhelming amount of activity in the past two years, so a slight breather could be due.

A challenging environment can also prove to be a boon for networking, as people need to get out there more and make connections when deals are hard to find. In-person meetings will be even more valuable when the path to closing transactions might be lined with roadblocks. I look forward to seeing some of you on the road in 2023 and continuing to get deals done despite market headwinds. //

MIDDLE MARKET DEALMAKER // WINTER 2023 EDITION

PRESIDENT AND CEO

Thomas Bohn, CAE, MBA tbohn@acg.org

VICE PRESIDENT, ACG MEDIA

Jackie D’Antonio jdantonio@acg.org

CONTENT DIRECTOR

Kathryn Mulligan kmulligan@acg.org

SENIOR EDITOR Anastasia Donde adonde@acg.org

DIGITAL EDITOR

Carolyn Vallejo cvallejo@acg.org

ART DIRECTOR, ACG MEDIA

Michelle McAvoy mmcavoy@acg.org

CHIEF REVENUE OFFICER

Harry Nikpour hnikpour@acg.org

SENIOR DIRECTOR, STRATEGIC DEVELOPMENT

Kaitlyn Gregorio kgregorio@acg.org

68

Learn about the private equity, investment banking and corporate development professionals you need to know in 2023, including their proudest accomplishment in 2022, their goals for this year and the best career advice they’ve received.

IN THE

FOREST

Sky-high valuations for late-stage startups in recent years have drawn unicorn hunters from all corners of the investing universe, including private equity and growth equity funds. Yet as the dynamics in the venture capital market have shifted, PE and growth investors are treading carefully in search of high-quality businesses—and hoping their owners are willing to sell.

Association for Corporate Growth membership@acg.org www.acg.org

Copyright 2023 Middle Market Growth® and Association for Corporate Growth, Inc.® All rights reserved.

Printed in the United States of America.

ISSN 2475-921X (print)

ISSN 2475-9228 (online)

Amp up your network at

The M&A Conference that Totally Rocks

DealMAX (The Conference Formerly Known as InterGrowth) connects our community in ways that generate seismic outcomes. In 2022, attendees made nearly 10 new meaningful connections on average with 3+ deals sourced per person.

In 2023, we’re taking this mission to the nth degree and maximizing your experience even further.

By harnessing the power of the entire M&A community, bringing in electrifying live entertainment, and giving you powerful opportunities to connect, DealMAX will absolutely rock your dealmaking world.

P RESENTED BY

P RESENTED BY

WHAT IS YOUR DEAL?

Expand your network and fast-track your goals with ACG Membership

ACG Members represent the most active and engaged professionals within the middle market.

They embody ACG’s mission of driving middle-market growth by carrying out their own missions: to source and close deals, to grow their own organizations, to win business, and to continue developing their own careers.

And we help make it happen. When you join ACG as a member, you gain access to the exclusive network and benefit from the connections that ACG actively facilitates.

Does this sound like you? Are you among the middle-market’s foremost, deal-making, business-growing, investment-finding, ladder-climbing, acquisition-targeting, talent-sourcing, hand-shaking, professionals?

Do you aspire to be?

If so, we encourage you to join ACG as a member and take advantage of the following benefits:

� Invitations to Member-Only Events - Collaborate with other ACG members and benefit from expert panels and industry insights. (Some events are just for fun.)

� Member-Only Discounts for just about all ACG-hosted events, including InterGrowth: the premier dealmaking conference in the middle market.

� Access to – and a presence – within the ACG Member Directory: Search for and connect with fellow ACG members with our exclusive directory of middle-market professionals.

� A Subscription to Middle Market Growth® Magazine: Keep up to date on news, trends, best practices and thought leadership in the middle market.

� ACG JobSource® - Post or search for a job on ACG’s job board.

� Earn your MMP via ACG’s Middle-Market Professional Certification Program at a discounted rate.

� Member-Only Offers courtesy of ACG’s Partners

75% of ACG Members do deals with other members

75% of ACG Members do deals with other members

Trend Watch

THE LATEST IN DEALS, FUNDRAISING AND PEOPLE MOVES IN THE MIDDLE MARKET

DEAL ROUNDUP

M&A trends from the fourth quarter signal an expected slowdown.

IN PERSPECTIVE: PRIVATE EQUITY

Crossplane Capital’s Katie Oswald on how the PE business development profession has evolved.

14 16 20

IN PERSPECTIVE: INVESTMENT BANKING

Stout's Eric Welsch discusses guiding investors through challenges and opportunities.

FOCUS ON FUNDRAISING

Why continuation funds have staying power.

ON THE MOVE

Recent hires and promotions among middle-market investors and advisors.

Our Middle Market Multiples report published in December offered data and perspectives from sources pointing to slower deal activity in 2023 because of worsening market conditions. The last quarter of 2022 already showed some of that expected slowdown— with sponsors seeing less deal flow from banks, lenders being increasingly cautious about which loans they take on, auctions taking longer to close and companies being more meticulous about getting their house in order before going to market.

Although year-end data wasn’t yet available at the time of writing, several investors and advisors say the end of the year showed less activity than usual. How bad things are getting depends on who you talk to. Investment bankers are often optimistic about deal flow because M&A is their bread and butter, while private equity firms are being selective and mostly focusing on addons. Lenders are especially cautious in this environment to avoid deals that could result in defaults.

“Bankers tend to focus on continued market strength while private equity is talking about a readjustment on pricing,” says Bob Goldsmith, founder and president at Northern Edge Advisors, a New York-based lower middle-market investment bank.

Still, several mid-market firms announced deals in December. Wind Point Partners’ Smart Care bought refrigeration company Refrigeration Anytime, while Cornell Capital’s Ingenovis Health acquired Springboard Healthcare, a healthcare staffing business. Gryphon Investors-backed Right Time also bought a Canadian HVAC business, Dunn Heating and Air Conditioning, in December.

Many firms transacting today are

DEALMAKING IN THE YEAR AHEAD

Deal activity at the end of 2022 pointed to an expected slowdown, as investors focused on bright spots and took longer to scrutinize companies

BY ANASTASIA DONDEsticking to the sectors they know best, companies that might be more resilient in a downturn and, increasingly, smaller deals and add-ons.

“We were funding a few deals at year-end, but it’s less than we thought we would, as a slowing economy and higher financing costs took hold,” says Art Penn, founder at private credit firm PennantPark. “We’re in the careful and cautious camp—not putting it all into the market right now. This environment is going to last a while, so it necessitates careful deployment.”

Buyer and Seller Motivations

Bankers noted that owners of smaller, founder-run companies might still be motivated to sell, especially if they’ve been through several bear markets.

“Just because they can’t get the highest price, doesn’t mean they won’t sell. This is about individual people’s lives and needs. Some people need to retire. There are different drivers than in the public market,” Goldsmith says.

“There are a lot of founders who have been through a number of recessions and events who don’t want to go through another one,” agrees Stephen Rossi, managing director and co-founder of investment banking services at Palm Tree, who oversees the firm’s middle-market investment banking arm out of Los Angeles.

From the buyer perspective, private equity firms are scrutinizing deals. “They want to have more visibility on how the company will perform in a downturn,” says Goldsmith. “Lenders

also want your numbers lined up. The info has to be readily available, sometimes on a monthly basis as opposed to quarterly.”

Extending the timeline for launching and running an auction could prove to be a smart strategy in this environment, sources say. Companies have more time to do quality of earnings work and can show a longer period of performance through a recession.

Palm Tree’s Rossi says he hasn’t seen as much of a slowdown in middlemarket M&A, but there is a huge gap from one term sheet to another and deals are taking longer to close. “It’s taking longer to find the right partner at the best terms and price,” he says.

Several sources noted that while 2021 was very busy and many firms were rushing to get deals closed at the end of the year, the slower pace at the end of 2022 could be a welcome change. Bankers said in 2021 that they were telling some companies to wait to launch until 2022, so they would have more time to put materials together.

The mindset at the end of 2022 was a bit different than the year prior, with fewer deals in the market, ample time for prep work and more opportunity to get everything in order before launching a process. “In 2021, there was a blizzard. Last year, from the third quarter through the end of the year, it’s been kind of moderate, a lot of add-on acquisitions,” says PennantPark’s Penn.

Some companies are waiting on the sidelines for market conditions to improve, but Palm Tree wants to launch sooner, before market conditions worsen. “We’re in a recessionary and inflationary environment, and those concerns will continue to be a drag on availability and cost of leverage, and valuations,” Rossi says. But he’d rather start the auction process. Most transactions take six to nine months to close nowadays. That gives investors a longer time frame to get comfortable

with a company and its performance through a macro downturn.

Sector Trends

PennantPark is continuing to focus on its core sectors, especially defense and government services that could see more activity from the new defense spending bill that will raise salaries for service members and authorize military aid for Ukraine and Taiwan. Home maintenance and healthcare will continue to be strong, Penn says, while he’s more cautious about the consumer sector.

Palm Tree’s Rossi cites healthcare, technology and business services as areas with strong tailwinds. “Those sectors tend to be where the flight to quality is going. Some areas of concern are companies related to consumer buying trends or those with large international supply chains, especially from Asia,” Rossi says.

Despite the negativity toward consumer deals in this market, investors are still cherry-picking companies in the sector. Palm Tree closed a consumer services deal right before Christmas. “It was a great company with good cash flow, and we were able to get past investors’ knee-jerk concerns around the consumer industry,” says Rossi about the company, which he couldn’t yet name. “The particular sectors where this business plays tend to be recession-resistant, but there were a lot of groups that said, ‘Because it’s consumer, I just can’t touch it right now.’”

New Water Capital also didn’t shy away from the consumer sector. The Boca Raton, Florida-based private equity firm invested last year in Klosterman Baking, a Cincinnatibased bakery that makes a variety of breads, donuts and other products. The company is a fourth-generation family business, whose owners wanted to cash out, says Jason Neimark, managing partner at New

Water Capital. “The company needed to bolster its systems and processes and improve its management bench,” he adds. New Water Capital stepped in with those services and brought in a new CEO previously with Custom Made Meals, a food business that New Water Capital used to own. “It’s consumer nondiscretionary, recessionresistant and had good growth but also operational challenges that can be tackled,” Neimark says.

New Water focuses on special situations, deep value investing, carveouts, transitions and turnarounds: areas where the firm still sees a lot of opportunity, especially now. In the lower middle market, the firm often looks at small businesses that don’t have sophisticated processes or systems in place and could use an operational upgrade that an investor can bring to the table. “Sometimes they’re just run by the family checkbook,” Neimark says.

In December, New Water’s portfolio company LUXIT Group acquired a lighting manufacturing facility in Tennessee from Proper Group International. “The facility adds multicolor injection molding, anti-fog, and hard coating and assembly capabilities in a strategic location close to many of LUXIT’s customers,” a press release from the firm said. The asset was sold out of a large restructuring situation where the sale helped Proper Group’s lenders get the most value, says Neimark. Going forward, New Water is focusing on the OEM auto space, industrial technology and other manufacturing and consumer businesses.

“We have a saying that you can fix a bad business, but you can’t fix a bad industry,” Neimark says, so the firm targets areas where it believes fundamentals are still sound, despite market headwinds. //

PRIVATE EQUITY

Over the past decade, an increasing number of private equity firms have introduced the full-time business development role. Executive search firm BraddockMatthews estimates that the number of private equity BD professionals in the U.S. has increased by more than 300% since 2016. The BD role serves as the face of a private equity firm among intermediaries, including sell-side advisors, accountants, attorneys and other sources of deal flow.

While the core of the BD professional’s responsibilities remains the same—to fill a firm’s pipeline with actionable investment opportunities—the role has evolved significantly over the past decade, and the expectations of the position continue to expand.

The deal landscape in the middle market has never been more competitive, as the number of private equity players grows, technological advancements make the dealmaking process more efficient and the trend of smaller sell-side processes emerges. Simultaneously, there is a growing number of investment bankers, brokers and other sell-side advisors.

Business Development Goes Next Level

To effectively stay top of mind with the hundreds of relevant intermediaries, business development professionals must network creatively, differentiate their firms and build meaningful, long-lasting relationships. The best BD professionals utilize comprehensive knowledge of their firms’ portfolio companies, operating experience and strategic capabilities to effectively position their teams for inclusion in competitive sell-side processes. Finally, BD professionals must screen thousands of investment opportunities each year to ensure their investment team’s time and resources are utilized efficiently.

Sourcing Differentiation

BY KATIE OSWALD, MANAGING DIRECTOR, BUSINESS DEVELOPMENT, CROSSPLANE CAPITAL

BY KATIE OSWALD, MANAGING DIRECTOR, BUSINESS DEVELOPMENT, CROSSPLANE CAPITAL

All BD private equity professionals use conferences, in-office meetings, Zoom meetings, calls and city trips to develop and maintain strong intermediary relationships. The most efficient BD professionals utilize technology and datadriven CRM systems to understand where their time is spent most effectively, maximizing the probability of sourcing success.

To cultivate relationships with the most relevant advisors, BD professionals are hosting specialized, more intimate events that foster true connection. These smaller gatherings are more memorable and enjoyable. This past October, I hosted a group of 30 advisors from across the country for a pickleball tournament in Dallas with the Crossplane Capital team, and I plan to host similar events in the future.

When it comes to add-on acquisitions, business development professionals are smart to develop relationships with portfolio company management teams. These executives are intimately knowledgeable of their competitors and often already possess relationships with potential add-on targets. In my experience, conversations with prospects can span several months, if not years. I track these ongoing discussions and provide insight and updates to the investment team on a regular basis.

Portfolio Company Knowledge

The most effective business development professional possesses in-depth knowledge of his or her firm’s portfolio companies. This includes both current and past portfolio companies and can include the careers and experience of the investment professionals and operating partners prior to their private equity roles.

The BD professional’s ability to speak in-depth about a firm’s experience through current and past portfolio companies, as well as prior operating experience, is crucial during discussions with advisors, who seek firms with relevant experience and capabilities for their sell-side clients.

For example, my role includes conveying the track record of the Crossplane Capital team, which has decades of collective experience transforming industrial companies

as senior executives, operational improvement consultants, strategy consultants and restructuring advisors. That experience enables us to drive value at lower middle-market companies that are looking for an operationally oriented partner.

Conveying a firm’s unique expertise is especially important for investment opportunities that are brought to market in smaller, more targeted processes. A private equity firm must have an angle on the opportunity to be considered in these scenarios.

The ability of the business development professional to speak comprehensively about portfolio companies helps develop strong relationships with advisors, who appreciate the chance to get smart on a firm’s portfolio companies years in advance of potentially pitching for a sell-side mandate. As the Crossplane Capital portfolio has expanded into 31 investments, including eight platforms and 23 add-on acquisitions, my conversations with advisors focus heavily on trends we are seeing at our companies and our plans for growth, both organically and through acquisitions.

Filtering the Funnel

The best business development professionals not only source a high number of actionable investment opportunities through their networks but also serve as the initial strategic screen for these opportunities to ensure that the

time and resources of their investment teams are allocated efficiently.

To determine which opportunities are most relevant, a BD professional must utilize a clear grasp of his or her firm’s investment mandate beyond just size, industry focus and transaction dynamics. In my role as the first reviewer of opportunities, to assess whether a company is a good fit for our fund, I evaluate market share, industry niche, customer concentration, pricing power, commodity risks, value creation opportunities and other criteria. Collectively, this process screens out most companies. In a typical year, I will source over 1,000 opportunities but will screen out over three-quarters of these companies. Roughly onefourth of the total opportunities I review will be presented at our weekly investment team meeting. This is not necessarily because the opportunities sourced are bad investments, but rather because they are not a fit for Crossplane’s specific mandate and our strategic and operational strengths.

In the years to come, the most effective business development professionals will continue to network creatively, building strong relationships with relevant intermediaries. They will utilize comprehensive knowledge of their firms’ portfolio companies and operating experience, and they will add value to their investment teams by efficiently screening thousands of investment opportunities each year. //

KATIE OSWALD is the managing director of business development for Crossplane Capital, a private equity firm based in Dallas investing control equity in industrial business services, niche manufacturing and valueadded distribution businesses. She focuses on sourcing and evaluating new investment opportunities and supporting portfolio companies with their growth initiatives.

The role has evolved significantly over the past decade, and the expectations of the position continue to expand.

INVESTMENT BANKING In Perspective

A Q&A with Stout’s Eric Welsch

Stout’s head of financial sponsors discusses guiding private equity clients through turbulent times

Q: How is the opportunity set for 2023 shaping up so far?

A: After 2021’s near-perfect capital market conditions shaped a year characterized by exceptionally favorable M&A and financing dynamics, we found that 2022 was characterized by disruption across many dimensions of the capital markets due to inflation, labor market constraints, rising rates, supply chain issues and broader geopolitical factors. The resulting volatility and uncertainty caused many business owners to pause to take stock of their own outlook and risk appetites, and to explore the nuances of buyer and seller expectations in a lower valuation environment partially impacted by less robust debt financing. Stout’s bankers have been focused on helping our clients properly assess their options and market conditions. As 2023 has begun, we are thoughtfully bringing several new opportunities to market and are in advanced discussions about many others.

Q: Which sectors do you expect will be more attractive this year and why?

A: I’ll call out two sectors of focus at Stout where we expect robust activity in 2023 and beyond. The first is in home healthcare, an area of expertise for us (led by John Calcagnini) that is attractive for private equity as it presents a lower-cost treatment setting compared with extended acute care hospital stays or longterm care settings like skilled nursing. Patients generally prefer to be at home, and providers with home health models can increasingly serve this growing demand. We are active with companies that utilize statesupported family caregiver models for the Medicaid population; skilled home care companies that provide

higher acuity services; and private pay agencies.

Another area of strong activity for us that is attractive to private equity is auto aftermarket (led by Steve Rathbone). Growth is being driven in part by the increasing average age of vehicles on the road in the U.S., which in turn spurs demand for parts, repair and collision services, and wheel and tire replacement. Greater complexity and technological advancement in vehicles are also stimulating the need for more specialized and sophisticated collision, repair and maintenance services, benefiting scaled providers. E-commerce within the auto aftermarket space also continues to lead the sector from an overall growth rate perspective.

We are working with a variety of companies and sponsors across both home health and auto aftermarket as private equity firms seek opportunities to back innovators and consolidators in these growing and highly fragmented markets.

Q: What are you hearing from financial sponsors about their sentiment and willingness to do deals in the current environment?

A: Most financial sponsors we work with are eager to find unique, differentiated investment opportunities. There’s been much discussion over the years about the growing reserves of dry powder in private equity. And that’s certainly a factor supporting deal appetite. However, history and hindsight also tell us that some of the best private equity investments (and fund vintages) date to periods of economic disruption like the one we are in now. Sponsors know this and are focused on trying to not only pursue the best deals, but also on working with bankers to uncover hidden opportunities and strategic situations that might require more creativity. That doesn’t mean investors aren’t

going to be disciplined in sale processes. In fact, it’s quite the opposite. We believe most private equity investors are leaning into their areas of past success and experience to find differentiated new investment opportunities. Similarly, with regard to exits, financial sponsors holding high-quality businesses will continue to have strong opportunities to sell.

Growing businesses that are winning based on differentiation, scale and consolidation opportunities are usually better positioned for success. Because private equity takes a relatively long-term view on creating value, paying up for great companies despite over-equitization and higher borrowing costs today still makes a lot of sense. For any given business, there are almost always several larger sponsors that see opportunity to back those businesses for the next four to six years to create even more value.

Q: What’s next for Stout’s financial sponsors group?

A: Since I joined Stout in 2022, our leadership team and I have been focused on hiring senior, experienced investment bankers into our financial sponsors group to lead and orchestrate strategic relationships with our priority sponsor clients. Our vision is to have a team of FSG bankers who are accomplished dealmakers acting as key trusted advisors to their sponsor clients and portfolio companies

while working closely with our industry, product and capital markets bankers. This seamless collaboration across our broader investment banking team, as well as with our experts in our valuation advisory and transaction advisory businesses, will enable us to deliver a uniquely committed partnership experience to our clients.

Q: What’s your advice to younger people starting out in investment banking?

A: First off, be deliberate about the people you choose to work with and with whom you align yourself. Try to surround yourself with colleagues, clients and mentors who have positive energy and demonstrate good intentions in their work and interactions with others. Nurture those relationships and friendships, and find ways to build your career progression around them.

Secondly, obtain robust and varied deal experience across a variety of M&A transaction types, industries and across the capital markets, including the debt and equity capital, private capital and fundraising markets. It’s important to have a thorough understanding of how these financial markets fit together and impact M&A, especially in volatile periods like the one we’re in now.

Lastly, look for windows to create entrepreneurial opportunities alongside professional friends and partners when they present themselves. Don’t be afraid of taking risks and trying new things when you can leverage your capabilities, professional relationships and create clear value for yourself and other key stakeholders.

ERIC WELSCH is a managing director and head of financial sponsors in the investment banking group at Stout. He has over 20 years of experience in investment banking and capital markets.

PE investors are leaning into areas of past success and experience to find differentiated new investment opportunities.

IN IT FOR THE LONG HAUL

Continuation funds are here to stay.

catch on, the continuation fund is a way for LPs to keep supporting them.

BY KAREN SCHWARTZThis investment structure has gained a foothold as a tool for private equity general partners to release their investors from commitments if they’re interested in moving on, or it can provide more exposure to familiar assets for those that want to stay. The vehicle is usually set up by a GP to house one or more investments from a previous fund that the PE firm is not ready to sell. The GP can then roll existing limited partners into the new structure or find new investors.

For a fund with an underperforming asset, a continuation vehicle provides an alternative to selling during volatile market conditions. Meanwhile, for companies in growth markets with strong assets that are just starting to

ECP, Zenyth Partners, QHP Capital and Waud Capital Partners are among the fund managers that closed continuation funds in 2022, taking advantage of the market appetite for this type of investment. Of that set, ECP’s raise was the largest, with $1.6 billion in capital commitments. ECP in June 2022 announced that the fund had signed an agreement to acquire a portion of power company Calpine Corp., along with a consortium of investors from its funds ECP III and ECP IV.

If market conditions worsen this year and LPs have less capital to deploy, continuation funds can offer a way for investors to stick with names they like. “I think they’re going to be completely relevant,” says Jeff

Continuation funds are extending the runway for companies that might not be ripe for an exit, especially as market conditions get choppier

Edwards, partner at Raleigh, North Carolina-based private equity firm QHP Capital, which in November announced a single asset continuation fund backing global contract research organization Catalyst Clinical Research. “They’re an extra tool for the industry to use,” he adds. And if the global economy goes through a recession, he says these funds can balance investors’ needs for liquidity without forcing GPs to sell in an arbitrarily low valuation environment.

Gaining Momentum

The use of continuation funds has dramatically increased in the last few years, though they have been around for about a decade, says Peter Laybourn, a partner with law firm Ropes & Gray’s asset management practice. The firm was involved in $110 billion worth of continuation fund transactions on the LP and GP sides in 2021, according to Laybourn. The firm advised QHP and ArcLight Capital Partners on the formation of their continuation funds.

The standard holding period for private equity is often five to seven years; continuation funds started out as a tool for sponsors to manage assets they couldn’t easily unload after that time frame. Continuation funds offered a way to return capital to LPs or move assets to be able to liquidate an existing fund.

In both single- and multi-asset continuation funds, companies are moved from legacy funds to give sponsors another exit opportunity and a broader market for capital. “In particular, lots of the sponsors we have been speaking to over the years have expressed a real desire in holding a specific asset for a longer period of time, controlling an asset because they think it will continue to perform well,” Laybourn says. “You may have other sponsors willing to take over the asset, but there’s a lot of appeal

to having the sponsor that knows the asset, that has generated attractive returns, manage the asset.”

Lots of money has pooled into funds that are designated to participate in continuation vehicles, he says, adding that sponsors are increasingly raising dedicated pools of capital for this purpose.

“For the secondary fund making the investment in the continuation vehicle, they know which asset they’re acquiring,” Laybourn explains. “The potential for better economics is there and management fees are usually lower than you’d see in a blind pool private equity fund, so there’s some economic incentive to do these direct deals versus direct deals with a blind pool.”

Setting Up Shop

With many constituents to satisfy, the amount of work necessary to execute a continuation vehicle makes it a less attractive option for some firms than raising a blind pool. “I was surprised how difficult it is, but the investors that do these said it was very easy. I don’t have any plans to do another one anytime soon, but it is a structure that is available to us,” says Edwards.

Edwards also acknowledges that, when viewed from an LP standpoint, continuation funds raise concerns about conflicts of interest that GPs should take seriously. “You can’t just say, ‘We’re going to go create a continuation fund’ and get someone

to put capital in the fund and buy the fund,” he says.

The consent of LP advisory committees is key to mitigating conflicts of interest. LPs need to be consulted every step of the way, Ropes & Gray’s Laybourn adds. “There’s a healthy dynamic that keeps some checks and balances on it,” he says. “The existing investors or advisory committee will have to provide consent to do the transaction. They’ll give the sponsor some real-time feedback on what they think about it.”

QHP Capital’s recent continuation fund is primarily made up of new capital, although most current investors rolled over into the fund. Some LPs that had available capital increased their stakes, while others rolled what they could, Edwards says: “When you’re in Q3 or Q4 of a funding year, allocations are spoken for.”

It’s unusual for such a high number of investors to opt into a continuation fund, as many LPs want to take their money off the table and allocate it elsewhere, Edwards notes. “People must really like the asset or believe in what you can do with it,” he adds. His firm used a placement agent as part of its process, though it was speaking with investors that were already involved with multiple continuation vehicles. “I think we have a very global footprint, so our investors see the churn of these vehicles so often that they’ve gotten quick at looking at them and underwriting,” he says.

Weighing the Options

Sponsors with continuation vehicles have more time and capital to maximize value for investors, explains Mark Boyagi, a partner in Kirkland & Ellis’ Investment Funds Group. In 2022, Kirkland’s secondaries practice advised on more than $100 billion in deal volume, including transactions for Wind Point Partners, Trinity Hunt Partners, Waud Capital Partners and Vance Street Capital.

At its best, a continuation fund deal is an ‘everybody wins’ kind of transaction.

MARK BOYAGI, Partner, Kirkland & Ellis

2022 Highlights: Continuation Funds

“From a sponsor perspective, you don’t want to sell a crown jewel asset to a third party if you believe there’s room for significant additional growth and you’re best placed to realize it over an extended hold period,” says Boyagi. “At the same time, LPs are subject to their own internal drivers, and so offering them an option to lock in gains at an attractive price can carry a lot of value. At its best, a continuation fund deal is an ‘everybody wins’ kind of transaction.”

In most cases, LPs elect to sell instead of taking part of the continuation fund, adds Boyagi. “Sell rates at the moment are high, which I think is a reflection of macro conditions and the desire for liquidity among LPs,” says Boyagi.

Changing market conditions could slow deal flow in the short term, says

QHP’s Edwards, since in a downturn, it takes time for prices to fall in the private markets. “You may have a period where fewer deals are being done because investors and sponsors may not be willing to take a reduced price for an asset, especially when you have market conditions that could turn right around,” he says. That means sponsors with single-asset continuation vehicles might be more likely to wait to lock in the desired return for investors, if they can.

There’s a difference of opinion at present between secondary buyers and GPs on valuation, Boyagi explains: “There’s been a bit of a staring contest in the last six to eight months between the buy-side and the sell-side on these deals. I think it’s a temporary phenomenon—the underlying rationale for these transactions isn’t

going anywhere, whether you’re a GP, a secondary buyer or an existing LP.”

In the first half of 2022, before macro conditions worsened, there was movement back toward multiasset deals, he says, largely because of secondary fund LPs’ desire for diversification. Single-asset deals are still getting done, just not with 2021’s frequency.

In any case, Boyagi points out that GPs overall remain incentivized to do deals, LPs want the transactions to be offered to them for accelerated liquidity, and secondary buyers are dedicating pools of capital to it: “We think it is just going to continue to grow.” //

Six Leading Practices for a Successful Post-Merger Integration

Are you resourced for an efficient and effective post-merger integration?

Few mid-sized companies are equipped with all the people, processes, and technology integral to achieving valuable post-close results — not to mention, the ability to handle data, applications, and infrastructure to integrate the new company and drive the multiples you’re expecting.

Depending on the scope and scale of the transaction, what happens from Day 1 to Day 120 can vary greatly. A wellexecuted and communicated plan for that critical transition period can help reduce delays, unnecessary costs, and longterm unfavorable consequences. For a smoother handoff from the deal team to the integration team, think about these six priorities when planning the days following the close:

1. Document everything and assume nothing. Memorialize the value creation strategy. What is the integration approach? Where is the value? And what’s the timeframe to realize this value? When these factors are defined, the integration team can set the right priorities and repeatedly communicate those priorities throughout the early integration phase.

2. Prioritize consistent communication between key players. The right hand needs to know what the left hand is doing. That does not mean constant meetings between every member of the M&A team, but the moving pieces — e.g., M&A leaders, operations personnel, and the finance team — must regularly sync with each other. Set an early expectation for communication cadence.

3. Agree on the ultimate goal. Is the goal of the transaction an absorption, a mere holding, or a true integration? Agreement on the end game can create a solid common strategy, quiet the noise around non-priorities for the near term, and universally define what success looks like in 0 –90 days, 90 – 120 days, and beyond.

Written by: Amy Moore CLA Principal4. Realistically assess team skills and what’s missing. In smaller companies, everyone on the integration team has a day job, and few have the experience or bandwidth to handle one-time tasks and niche elements of M&A. For most companies, it’s the first time they’ve been through such a transaction and the learning curve is steep. If you don’t have time for training or to do the job efficiently, consider contracting outside talent that regularly handles these types of transactions.

5. Make the target visible. What do new stakeholders expect to see in terms of reporting? In order to keep stakeholders properly informed, the integration team needs operations diligence and a plan for data amalgamation.

6. Understand (and respect) the culture. Every transaction will affect people — employees, customers, partners, and suppliers. Recognize the impact, plan for it, and communicate what you know when you know it. Focus on value creation for each audience.

As early as possible, right-size the project team with a collaborator who understands the nuances of the middle market, has nimble processes, a broad range of knowledge and expertise, and — most importantly — the ability to execute.

For more information on post-close transaction strategies, contact Amy Moore at amy.moore@CLAconnect.com or 781-402-6346.

The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting, investment, or tax advice or opinion provided by CliftonLarsonAllen LLP (CLA) to the reader. CLA is an independent network member of CLA Global. See CLAglobal.com/disclaimer. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor.

REBECCA O’CONNELL

Rebecca O’Connell was appointed to executive vice president and New York City metro market executive at Citizens Bank.

O’Connell has more than 25 years of experience as a banking executive and senior management consultant.

Before joining Citizens, she was managing director-region head, NYC metro, Long Island, in the apparel industry group at JPMorgan Chase.

She previously held roles of increasing responsibility with Bank of America as senior vice president, global commercial banker and director and working capital advisor, northeast region.

DAVE SHEPHARD

Seattle-based lower middle-market private equity firm Rainier Partners hired Dave Shephard as director of portfolio operations.

Before Rainier, Shephard worked at Bain & Co., where he managed teams focused on private equity due diligence and strategic challenges for leading companies across the consumer, technology and industrial sectors.

Before that, Shephard served as a combat arms officer in the U.S. Army where he held a wide variety of strategic, operational and leadership positions.

DAVID PRENDERGAST

New York-based private equity firm Enhanced Healthcare Partners named David Prendergast to principal, head of business development.

Prendergast joined EHP in 2019 and was vice president of business development before his promotion. Prior to EHP, Prendergast served as vice president of business development at Waud Capital and as a vice president at Great Point Partners. Before that, he worked as an associate at Summit Partners.

Maryland-based private equity firm FVLCRUM Funds hired Jason Lee as vice president. He will focus on managing FVLCRUM’s legacy portfolio and provide due diligence and portfolio company support for the current fund.

Lee recently worked as a managing partner at First Alta Management. He held several titles there, including interim chief financial officer and board member of Spineloop, a medical device company, and strategic adviser of Pure Vita, a tech-enabled medical supply company.

He also served as managing director of Muirfield Management Group, a Los Angeles-based family office, where he was responsible for joint venture partnerships investments and growth strategies across a broad spectrum of industries and verticals.

MICHAEL NELSON AND DAVID GAU

Chicago-based family investment firm Pritzker

Private Capital (PPC) named Michael Nelson as managing partner and David Gau as chief operating officer. The duo replaces Paul Carbone, a co-founder, president and management partner, who is stepping down from day-to-day management of the firm.

Nelson was previously head of investing at PPC where he led the sourcing and execution of new partnership opportunities with growth-focused middle-market businesses in the firm’s core sectors. In his new role, he will continue to lead PPC’s investing efforts and will oversee the firm’s investing and partner relations teams.

Gau was partner and head of operations before his promotion. He will continue leading PPC’s team of operating professionals and will oversee the firm’s internal operations team.

Nelson joined Pritzker Private Capital in 2012. Prior to that, he was a managing director at Chicago-based middle-market private equity firm Wind Point Partners, where he led investments in the specialty manufacturing and packaging sectors. Gau joined PPC in 2014. Before that, he was the chief executive officer of Intersystems, a manufacturer of material handling equipment for agricultural and industrial applications.

MATTHEW HUDSON AND SPENCER LIPPMAN

Global investment bank Houlihan Lokey hired Matthew Hudson and Spencer Lippman as managing directors in its business services group.

Hudson is leading a dedicated sector coverage team in Baltimore, while Lippman is based in the Houston office.

Before joining Houlihan Lokey, Hudson was a managing director and head of rental services investment banking at Oppenheimer & Co. He was also a director at CIBC World Markets and vice president at FBR Capital Markets. Before that, he worked as an associate at Deutsche Bank.

Prior to joining Houlihan Lokey, Lippman was the managing director in the rental services investment banking group at Oppenheimer & Co. Before Oppenheimer, he was an associate at Genesis Capital and an analyst at Silverton Capital Corp.

Before joining Piper Sandler, he was a managing director, covering the automotive aftermarket industry at Lazard for more than 10 years. He started as an associate at Lazard and was promoted several times, eventually holding the managing director title when he left.

Prior to Lazard, he was an associate customer account manager at Epicor Software and a national account representative at Black Box Network Services.

JAMES REILLY Investment bank Piper Sandler hired James “Jim” Reilly as a managing director. He will co-lead investment banking coverage of the vehicle aftermarket space in the Minneapolis office.DOUGLAS PALMER AND THIEN VAN TRAN

Tysons, Virginia-based middle-market investment banking firm Ascend Capital Group appointed Douglas “DJ” Palmer to managing director and Thien Van Tran to director.

Palmer has worked in global M&A, corporate strategy, private equity and investment banking for about 15 years.

At Ascend, he’s held many titles, including director and vice president. He’s currently an official member of Forbes Financial Council. Prior to Ascend, he worked as an investment banking associate at District Capital Partners, as an investment banking associate and investment banking analyst at Evergreen Advisors, as a senior associate and associate at PricewaterhouseCoopers and as a financial analyst at Deloitte.

Van Tran has spent 10 years focusing on M&A, capital raising, corporate finance and investment banking at a variety of firms.

Prior to Ascend, Van Tran was vice president in investment banking at Evergreen Advisors and a management associate at Regions Bank. He began his career as a mechanical engineer at the Space and Naval Warfare Center.

DAVID BROWN

David Brown recently joined investment bank Raymond James as managing director and head of strategic limited partner relationships. For more than 20 years, Brown has worked with private fund sponsors and limited partners.

Before joining Raymond James, he spent eight years with Moelis & Co.’s private fund advisory business, serving as the head of North American distribution. He was also the co-head of private equity and real estate advisory at Greenhill & Co.

Prior to Greenhill, he worked in the private funds marketing team at Lehman Brothers and as head of public funds distribution at New York Life Investment Management.

SHARI YOUNG LEWIS

Chicago-based private equity firm Cresset Partners hired Shari Young Lewis as a managing director in the private funds group. She is focusing on private equity funds and co-investments across buyout, platform buy-and-build and other control-oriented strategies.

Before joining Cresset, Lewis was a partner in the private equity practice at Aon Investments. She focused on buyout, growth equity, venture capital, private credit and infrastructure investments.

She is an Illinois Growth and Innovation Fund council member and she’s on the Midwest Steering Committee for the Women’s Association of Venture and Equity. She’s also an active member of the Private Equity Women’s Investor Network and serves on the board of directors for the Little Giraffe Foundation.

DREW MOLINARI, NICK STONE AND LISA VULIC

Cleveland-based private equity firm Cyprium Partners promoted Drew Molinari and Nick Stone to partner and Lisa Vulic to chief financial officer and chief compliance officer.

Molinari joined Cyprium Partners in 2008 and has more than 18 years of experience in mergers and acquisitions and private equity. Before joining Cyprium, he was associate, corporate development, at Agilysys and an analyst at Brown Gibbons Lang.

Stone has been with Cyprium since 2007, leading the firm’s origination and marketing activities since 2016. He’s held various titles at Cyprium, including managing director, director and principal. Before joining Cyprium, he was a director at Key Principal Partners.

Vulic joined the firm in 2004 and has held various positions since then, including senior accountant and controller. Before Cyprium, she was a senior accountant at Key Principal Partners, corporate tax analyst at Ceres Group and tax compliance specialist at Ernst & Young.

LOUISE HUSIN

Palo Alto, California-based private equity firm

HGGC named Louise Husin as chief talent officer, a newly created position.

She will manage all aspects of talent acquisition, talent management and development, organizational planning and employee engagement and will oversee HGGC’s diversity, equity and inclusion initiatives.

For more than two decades, Husin has worked for major companies and private investment firms in talent management, recruiting, leadership development, DEI and C-suite hiring.

Before HGGC, she worked at private investment firm Freemont Group, where she was the chief people officer. She also held roles as the human resources director at BlackRock, human resources manager at Williams-Sonoma and human resources manager at Bechtel Corp.

Easily

navigate your portfolio’s health care spending

UnitedHealthcare’s dedicated private equity team can help to lower your portfolio’s health care costs with tools like:

Group buying power

Aggregated purchasing leverages the buying power of all your portfolio companies for competitive pricing

Portfolio trend management

Sophisticated analytics provide enhanced reporting on client portfolios and reveal opportunities to improve strategies in your health plan

Seamless national network

Take advantage of our large provider network of 1.5M+ physicians and health care professionals and over 6,200 hospitals to support growing companies and offer a consistent member experience1

Designated, responsive team

Get on-call, personalized service from experienced professionals who understand your business and can guide you toward a solution

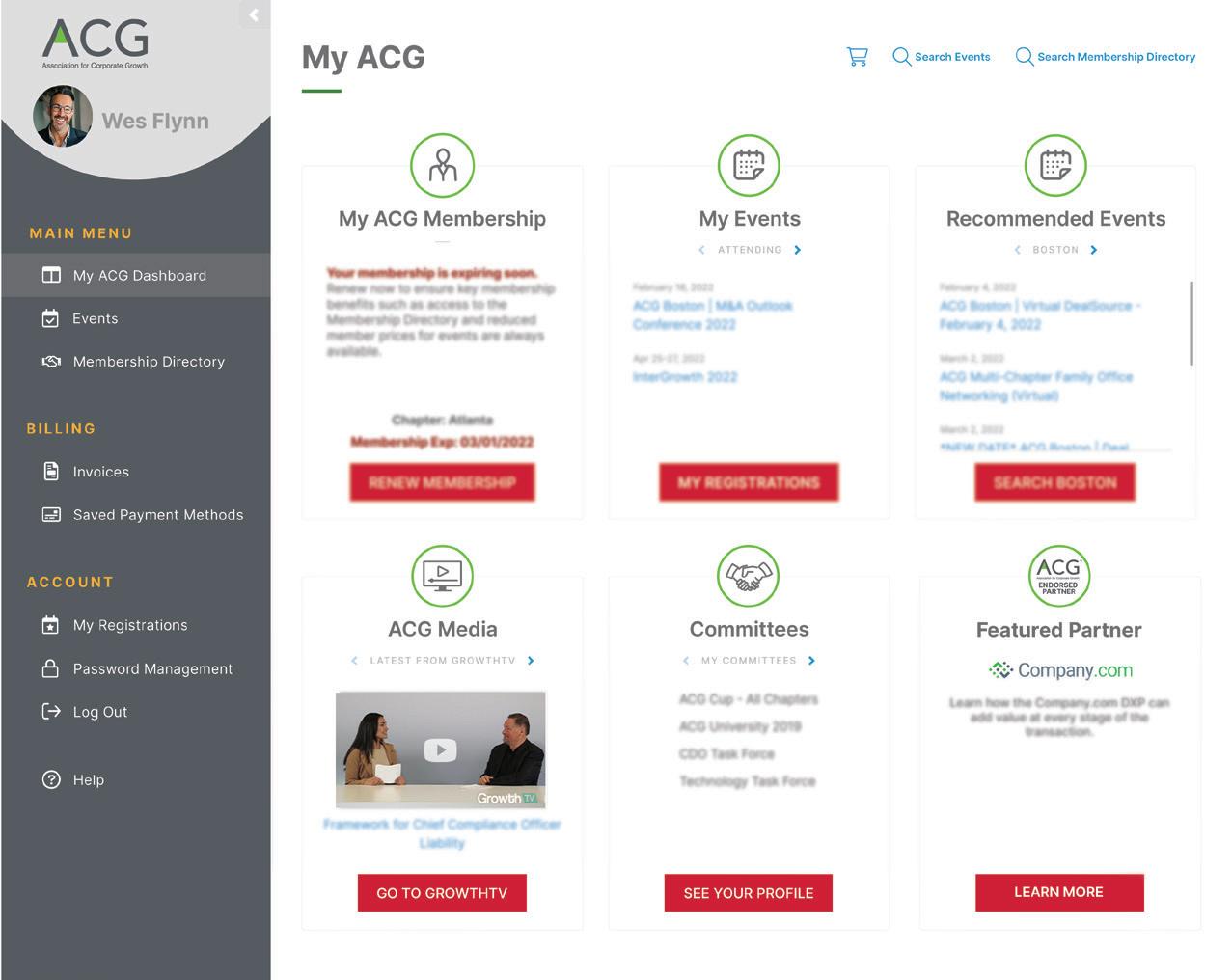

Introducing The New My ACG

ACG has partnered with Company.com to bring you a sparkling new interface.

Everyone with an ACG log-in can enjoy the new experience, complete with a fresh design and new features to help you grow.

With the power of your fully completed profile, the new system:

Showcases specific events you’d be interested in – across the ACG chapter network in your area and beyond.

Presents relevant industry insights according to your job, industry, and goals.

Create

Matches you with ACG partners, resources, and special offers that would be helpful for you and your business.

Offers a revamped Member Directory, helping you search for and connect with ACG members across the entire member network. (Available for ACG members only.)

Company.com is one of ACG’s Endorsed Partners. For more information on Company.com and how they can help your organization improve its user experience, visit acg.company.com. To learn more about ACG’s Endorsed Partner Program, contact Ben Greenwood at bgreenwood@acg.org.

your free log-in today or access your existing account, and let the power of ACG go to work for you.

What’s Next

EMERGING INDUSTRIES AND TRENDS IN DEAL SOURCING

28

NEXT TARGET

A pet wellness business leader makes the case for the industry’s resilience and why recession fears shouldn’t hold back investors.

32

BEHIND THE DATA

Grata’s Nevin Raj details how business development professionals can engage with prospects in a more personalized way.

34

ON THE HORIZON

Findings from GF Data offer insight into the current challenging environment, and how private equity transactions compare to those led by family offices.

36

ON THE HORIZON

Experts from Troutman Pepper outline five innovative approaches to evaluating privacy and cybersecurity aspects of a deal efficiently and effectively.

PUTTING THE PET CATEGORY’S

REPUTATION TO THE TEST

Pet food and at-home testing kits are among the retail categories expected to prove resilient through a downturn

BY CAROLYN VALLEJO

BY CAROLYN VALLEJO

Pets have become members of our families, a culture shift that has owners seeking gourmet food, premium toys and advanced health and wellness care. With more U.S. households than ever welcoming a cat or dog, spending in the pet category has reached new heights.

Historically, the pet industry has been seen as recession-proof. But with inflation and recession concerns mounting, will pet owners’ insistence on spending more for higher-end products and services continue in today’s environment?

“There are a lot of nuances in the question,” says Dave Shephard, director of portfolio operations at middlemarket private equity firm Rainier Partners. He adds that, broadly speaking, the current economic climate will indeed impact the pet retail market. “But it will be felt harder in certain categories than others.”

For the most resilient niches, the investment opportunity remains strong.

Testing Its RecessionProof Reputation

The number of U.S. households with pets and the amount of money owners spend on their animals have never been higher.

According to the American Society for the Prevention of Cruelty to Animals, nearly 20% of U.S. households acquired a cat or dog since March 2020, while a separate analysis from the American Pet Products Association revealed a 16% year-overyear increase on pet spend in 2021, reaching $123.6 billion.

According to Shephard, while some of the consumer spending categories that experienced a boost

during COVID have now returned to pre-pandemic levels, the increased spending on pet products and services has remained elevated.

That’s good news for pockets of the pet industry should a recession materialize. While some owners may pull back from opening up their wallets for discretionary items like premium toys, other categories remain non-negotiable.

Pet food is one of the more resilient spots in the market, Shephard says. Earlier this year, Rainier acquired Pet Food Express, an omnichannel pet food retailer that Shephard says has several advantages amid high inflation.

As an independent, regional retailer, the company can be more nimble than big box stores or directto-consumer e-commerce outfits when responding to quickly changing customer behaviors. He also points to Pet Food Express’ high-touch customer service, which enables employees to point customers toward more affordable high-quality food products.

Even as growth in pet ownership levels out, Shephard says the outlook for retail remains strong.

“I don’t think we’ll see the same growth in pet adoption or pet ownership moving forward that we saw during COVID,” notes Shephard. “However, we do think that ownership will be relatively sticky, so it has provided a really strong base of growth, and I think it will provide a fairly resilient customer segment or market over the next several years.”

Identifying Market Gaps

As pet owners demand elevated products and services, Jen Hagness, CEO of pet wellness technology startup MySimplePetLab, says the pet retail opportunity goes even further than gourmet food.

“We’re seeing a lot of growth on the

retail side of the business,” she says. “Wellness is not just about food and treats anymore. It’s about how you care for your pet.”

Founded out of a rebrand in 2019, MySimplePetLab offers at-home health test kits for pet parents to supplement pet care in between veterinary visits. Pet owners can either purchase the kit in-store or online to screen for the most common nonemergency pet ailments. They then mail samples back to MySimplePetLab and receive results within about two days.

Hagness says the company identified a major gap in the market. As owners seek higher quality care for their animals, they’re also finding that vet appointments are harder to come by, with the surge in pet ownership. “Clinics are at capacity,” she says. “Most clinics are turning patients away daily, so if you can’t get in, let’s drop a test and see what’s going on.”

The business is positioned to serve pet parents as well as vets themselves, providing test results in easy-tounderstand language for owners and standardized formats for vet clinics.

Hagness emphasizes that the company doesn’t aim to replace vet visits but to provide supplemental care for overburdened providers, while adding value for clinics by improving the overall customer experience.

Wellness is not just about food and treats anymore. It’s about how you care for your pet.

JEN HAGNESS CEO, MySimplePetLab

MySimplePetLab’s growth strategy is to fill the gap left by today’s undersupply of veterinary care, while preparing for the pet wellness landscape of tomorrow. With consumers growing more comfortable with telehealth visits and at-home testing, Hagness says they’re now demanding the same flexibility when accessing healthcare for their cats and dogs.

“What we’re seeing on the animal health side is, veterinarians are going to have to do things differently going forward,” she notes. “What got us here won’t get us there. They ultimately need to provide parents with more ways to get care that is not in-clinic.”

Moving With the Challenges

So far, Hagness says, MySimplePetLab has tested just under 50,000 kits. The company anticipates more than doubling that volume next year as it expands lab capabilities and technology.

Investors have already taken note. Earlier this year the company secured seed funding from two individual strategic investors, and in September, the business announced its $5 million Series A raise from the Companion Fund, which is dedicated to investing in pet care startups.

While about 75% of the company’s operations are currently focused on working with vet clinics to sell tests, Hagness points to retail as one of its most promising expansion opportunities, with new retail partnerships in the works.

Those collaborations also support MySimplePetLab’s expectations for industry changes ahead, with pet health and wellness predicted to shift beyond the confines of the vet’s office and into pet product stores, groomers, daycares and more. “We’re playing in animal health and in retail, and we largely think that’s going to

help cross-pollinate and create more access to care,” says Hagness.

MySimplePetLab may help usher in at-home and telehealth for pets, allowing pet parents to access vet care without having to make an in-person appointment. But some of that expansion will depend on external factors, including regulation.

Currently, rules surrounding veterinarian client-patient relationships vary state-by-state. In Oklahoma, for example, a pet owner can obtain veterinary services virtually without first seeing the vet in-person. But in California, where telemedicine regulations are among the strictest, a vet must first physically see an animal before providing telehealthcare. Even then, a vet cannot provide treatment via telehealth unless a medical condition has already been diagnosed in-person. Hagness remains confident that lawmakers will catch up to pet owners’ needs. “I think we’re going to see more connected care,” she says, “and the legislation is going to continue to evolve.”

Growth for the business will

also rely on veterinarians’ ability to embrace the evolution of their practice. Clinics will need to trust and become familiar with receiving test results from a new third party, providing care remotely and collaborating with other participants in the pet health and wellness market.

And, not least of all, growth will depend on the pet industry’s ability to live up to its recession-proof reputation. Just as Rainier’s Shephard is confident in the food retail space, Hagness remains bullish on pet healthcare technology over the next five years.

“We’re pretty optimistic on the market,” she says. “There are definitely challenges, but the reality is, you’re not going to change the way you think about caring for your pet. You might look for new solutions and services, but our pets are part of our families, so it’s our job to make those experiences as simple and approachable as we can.” //

The BD Teams Acting Like Sales Teams Are Closing More Deals

How a personalized approach can lead to more engagement with prospects

Only 9% of mass sales emails get opened, according to Gartner. Despite this fact, PE business development teams still send mass emails, customized with nothing more than an executive’s name.

There’s a better way to do cold outreach: segmenting lists and leading with unique insights. Sales teams have been experimenting with these strategies for years and found that open rates dramatically increase when an email educates the reader about their industry or addresses a challenge they face (a 14% increase globally, according to a Mailchimp report).

“Company owners have told us on many occasions that they receive numerous calls on behalf of private equity firms,” says William G. Freels

III, managing director at M&A consulting firm Andra Partners. “And the fact is that many do not want to sell their life’s business to any firm that does not understand and know their sector well.”

From the onset, BD teams face the same challenges as sales teams— encouraging a recipient to not only open and read their email but to respond to it. Executives are busy. BD professionals have approximately 11.15 seconds to answer why an executive should read their email and also respond and begin a conversation with their firm.

Hedging their bets, many firms take an easier, less personalized approach, but there’s value in engaging with targets differently.

Thematic Sourcing Fuels Segmentation

A thematic, strategic approach to M&A breaks down an investment thesis in the industrials sector into specific categories, like “manufacturers of cryogenic equipment.”

With more specific categories, BD professionals can craft emails to those business owners that highlight a firm’s expertise in their specific subsector. And that kind of value proposition can increase open rates, meetings taken and deals closed.

With a broad investment thesis like industrials, you may see 1% of 1,000 email blasts respond. With segmented

Targeted Outreach Can Increase Deal Flow by 10x

outreach, you will see your close rate improve.

Thematic sourcing does not mean sacrificing the number of opportunities in your deal pipeline. In fact, the opposite is true. If you have a more effective sourcing method, you can cover more companies at the top of your funnel.

Thematic Outreach Requires a Deal Sourcing Platform

If the results are so dramatic, why aren’t more dealmakers looking to thematic sourcing to boost deal flow? Many firms have not invested in the right tools to accomplish this kind of customized outreach.

Without the ability to search by industry (“Industrials”), by business model (“Manufacturing”) and by keyword (“Cryogenic equipment”) all in one place, BD teams cannot map campaigns effectively. You need to find these companies before you can reach out to their executives, and you cannot find these companies without a deal

sourcing platform like Grata.

There’s a new way of sourcing called deep search that incorporates industry and keyword search in the Grata platform. This deep search capability has driven a new form of BD outreach that incorporates sales teams’ secrets about how to pitch.

Leaders in investment banking are already approaching outreach this way. “By utilizing marketing and deal outreach email campaigns with targeted contacts and highly tailored messaging, we experience open rates in the 40%-50% range and click rates in the 10%-20% range,” says Patrick Nolan, president at investment bank Nolan & Associates. “We have shifted away from a mass marketing approach to our communications by coupling Grata’s data with industry-specific messaging that provides value to our network of business owners.” //

There’s a better way to do cold outreach: segmenting lists and leading with unique insights.

Investors Brace for a Bumpy Ride

While market conditions are increasingly challenging, private equity firms and family offices will still compete for high-quality assets

The state of the M&A market heading into 2023 recalled the classic movie moment when Bette Davis, as aging Broadway diva Margo Channing, turns to her timorous friends and snarls, “Fasten your seat belts—it’s going to be a bumpy night!”

We’re not there yet.

GF Data’s completed deal data through the first nine months of 2022 featured valuations remaining elevated—actually edging to recent overall highs—on deal volume down markedly year-over-year.

The third quarter was also the first period in which successive Federal Reserve interest rate increases over the course of 2022 fully permeated senior pricing on M&A transactions. Initial senior pricing for the quarter averaged 6.5%, up nearly 200 basis points over the average for the prior period. Junior capital rates showed little comparable increase.

However, what was not yet reflected in the data was movement in debt availability, as distinguished from movement in cost. We share in the general anecdotal sense of retreat in cash flow-based lending since Labor Day.

It’s not surprising that increased borrowing costs did not dampen valuations as of late last year. Let’s imagine a $6 million EBITDA business selling for $48 million. Let’s say the deal is done with 3.5x senior and no sub debt. That’s $21 million. A 200 basis point increase in borrowing cost is $420,000 in year one. Adjusting for interest deductibility, that’s about $250,000. Whatever assumptions one chooses to make about principal repayment, the present value of the added cost is a low seven-figure amount. Not a big mover in our $48 million deal.

The “bumpy night” the market is girding itself for is the combination of an icing over of leveraged finance markets, continued signs of a coming recession, lingering inflation and sundry other macroeconomic worries.

Our year-end 2022 data will be released shortly. We can provide a sneak preview and say that by year-end, these market effects did translate into long-anticipated valuation retrenchment in selected industries.

For now, we can make these observations about the state of the M&A market, perhaps as participants reach for their seat belts:

• While deal volume is down, mid-market

M&A as a market remains extraordinarily competitive. Average purchase-price multiples reached record territory through

Total Enterprise Value (TEV)/EBITDA—Buyout Transactions Only

the third quarter, and deal structures migrated to agreements that allow sellers to take chips off the table but still retain some upside, such as leveraged recapitalizations and deals with significant earnouts.

• Amid a market with more questions than answers, we decided to analyze transactions over the last several years from funded private equity groups (PEGs) versus those led by family offices and fundless sponsors (referred to as just “family offices” going forward). We found that while the old truism of family offices paying less for deals remains true, these groups have been forced to pay more in the last seven quarters than they had previously.

• Multiple increases for transactions sponsored by family offices have been far more muted over the last two years. When looking at buyout transactions only, the average purchase price for deals led by family offices reached 7.0x trailing 12-month (TTM) EBITDA through the third quarter of 2022, an increase in the third quarter, an increase of 0.2x over full-year 2021 and 0.3x over 2020, versus a multiple of 7.4x in the second quarter. This compares to a third quarter average of 8.2x for deals led by PEGs. Private equity deals averaged a half-turn higher for 2022 through the third quarter, coming in at 7.6x versus 7.5x for all of 2021 and a big jump from the 7.1x average of 2020.

• Family offices are putting in less equity on average in their transactions than their peer private equity groups. For the first three quarters of 2022, equity commitments by family offices average 45.8% for all deals and 52.4% when just platform deals are considered. This compares to an average of 51.8% and 58.6%, respectively, for PEG-backed deals.

• Family offices are also less likely to include rollover equity in platform buyouts they sponsor than PEGs. These groups employed seller rollover equity in

46.2% of deals tracked through the third quarter of 2022 on average to just over a turn of EBITDA. Meanwhile, private equity groups employed rollover equity in nearly 65% of transactions, and it amounted to 0.4x EBITDA more on average.

• And finally, family offices on average employed more debt on their transactions in 2022 through Q3 compared to private equity firms investing out of a fund. Total debt on platform transactions sponsored by family offices in the first nine months averaged 3.6x EBITDA compared to an average of 3.4x EBITDA for transactions sponsored by PEGs.

The one area where we see little difference between family offices and private equity groups is a predilection for high-performing companies with above-average financials, which we discussed in some detail in our last commentary for Middle Market Growth. (As a refresher, we make these designations based on trailing 12-month EBITDA margins and revenue growth, with some editorial judgment based on other company characteristics.)

Through the third quarter, above-average companies accounted for a record 75% of buyout transactions completed by private equity groups and displayed a pricing premium of 12% (the narrowest since we began tracking dates, through Q3).

While the totals aren’t quite as extreme with family offices (64% and 19%, respectively), it does indicate that both sets of investors are increasingly pursuing the same exceptional opportunities. //

BOB DUNN is managing director of GF Data. ANDY GREENBERG is the founder of GF Data and CEO of Greenberg Variations Capital. GF Data collects and reports on platform and add-on acquisitions completed by private equity funds and other deal sponsors in the $10 million to $250 million enterprise value range. Over the course of 2022, we extended the range to $500 million.

Teaching Active M&A Dogs New Privacy and Cybersecurity Tricks: Five New Approaches for Serial Acquirers

BY JAMES KOENIG, BRENT T. HOARD AND PETER T. WAKIYAMA, PARTNERS, TROUTMAN PEPPEROver the last few years, M&A deal flow has hit record highs, ebbed and risen again as strategic technology acquisitions have given way to selective private equity transactions. As traditional technology funding becomes more difficult to find and debt financing comes back in style, serial acquirers are trying new approaches to better assess the value of personal data and understand privacy and cybersecurity diligence, risk and post-close integration efforts. Here are five innovative approaches to save time and money on diligence, quickly rate privacy and cybersecurity risk, and develop road maps and playbooks to provide a more effective platform for sharing data, enabling analytics and maximizing data value across portfolio companies.

1. Key Pre-Term Sheet Data Points to Assess Value.

While many serial acquirers use a playbook for managing diligence, some are extending the scope of the traditional playbook to assess data issues earlier (ideally pre-term sheet or very early in diligence).

Questions to ask include: Are there restrictions on sharing and/or sales of personal information in the context of a merger or acquisition transaction? Will there be any material differences in use cases post-close? May the target use personal information for current and new product improvements and/or analytics?

The pre-term sheet questions are designed to evaluate key privacy policy terms to confirm the existence of rights that create value (e.g., transfer, sharing, secondary uses, de-identification, etc.).

2. Privacy Diligence Framework to Assess Inherent Risk.

Thorough diligence is often conducted before delivering meaningful feedback on privacy and cybersecurity risk. Some serial acquirers are using an inherent risk framework to immediately gauge privacy risk and scope the depth of privacy and cyber diligence (e.g., one version of our framework includes six areas of inherent risk that can be gauged without significant diligence).

Based on this inherent risk framework, the serial

acquirer decides whether to conduct limited, targeted or no privacy/cybersecurity diligence.

3. Using AI to Review DPAs. To reduce costs and accelerate diligence, many serial acquirers use artificial intelligence to review common, recurring structured agreements. One new application of AI is for reviewing data protection agreements (DPAs). By loading numerous DPA templates and indicating preferred templates, models and provisions, AI can provide quick, high-level reviews for problematic provisions, such as data use/rights limitations, limitation of liability and indemnification, and prioritize DPAs for in-depth review.

4. New or Updated M&A Playbook. Many M&A issues are recurring and involve post-close integration. For efficiency, we have worked with clients to develop a playbook that includes over 30 common issues across five key areas (e.g., privacy program compliance) and remediation approaches adopted by the client. The playbook includes template policies and procedures and other solutions that can be deployed as a closing condition or in post-closing integration.