A unique opportunity for investors and developers in the heart of Riyadh, Saudi Arabia, a G20 capital city

A unique opportunity for investors and developers in the heart of Riyadh, Saudi Arabia, a G20 capital city

WELCOME to MIPIM, an opportunity to turbocharge your business with face-to-face meetings, networking and market insights in an extraordinary melting pot that we are proud to curate. This year, we have dubbed the event MIPIM: The Global Urban Festival, to reflect the depth and diversity of the MIPIM community. Real estate is always the sum of its human parts — from investors to end-users — and has a notable social role.

Real estate has an environmental impact too, and for that reason, MIPIM 2024 is our most sustainable exhibition to date, distinguished by four main engagements to make MIPIM cleaner, greener, more diverse and more equitable. These themes include waste minimisation, carbon reduction, social impact and diversity, equity and inclusion. Issues like diversity and accessibility are at the heart of property’s human dimension and are themes we will explore both with dedicated sessions and the launch of MIPIM Challengers, our next-generation initiative. Some 16 professionals under the age of 30 have been carefully selected to participate at MIPIM as MIPIM Challengers, providing them with a platform to influence decision-makers and industry leaders.

MIPIM will host five stages in total. Our Road to Zero area showcases exhibitors who are at the forefront of environmental change, with an exciting programme of conferences reflecting this vital theme. The Leaders’ Perspective Stage is focused on forecasts from those making waves in the industry, while The Asset Class Stage looks at the main asset classes to gain insight into the direction of the market. The Geo

Nicolas Kozubek MIPIM DirectorFocus Stage examines specific local markets, while the Make It Happen Stage will feature conversations about operational excellence and practical solutions to address current market issues. Our keynote speaker, meanwhile, continues the responsible leadership theme. Former Prime Minister of Finland (2019-2023) Sanna Marin will open our exciting four-day programme today with her unique insights. On Thursday, meanwhile, we will be handing out awards for some of the most visionary and sustainable projects in the world at the MIPIM Awards. Investment is always a core element of MIPIM, with over one third of our delegates from the investor community. As global macroeconomic headwinds continue, MIPIM 2024 promises to be a crucial occasion for public and private stakeholders to secure vital capital investment to support building and regeneration projects. The continued popularity of our Re-Invest Summit, attended by the world’s leading investors, underscores MIPIM’s critical role as the premier venue for discussing the latest trends, strategies and opportunities. We are glad you are a part of the MIPIM movement and look forward to supporting your big wins at this year’s event.

ROMA TRASTEVERE • ROMA TIBURTINA • TORINO LINGOTTO TORINO PORTA SUSA • VARESE VOGHERA • NAPOLI CAMPI FLEGREI NAPOLI PORTA EST

COME VISIT

FS SISTEMI URBANI

AT STAND R9. N

15.10

Sanna Marin is the former Prime Minister of Finland (20192023) and the leader of the Finnish Social Democratic Party. Appointed at the age of 34, Marin served as the youngest Prime Minister of the world when taking office in 2019. In 2015, Marin was elected to Parliament on her first run, where she was a member of the Grand Committee, Legal Affairs Committee and Environment Committee. She has also served as Chair of the Social Democratic Party since 2020. Marin’s government has been considered one of the most successful in handling the COVID-19 pandemic, especially in terms of lost lives and economical damage caused by the pandemic. Following the Russian invasion of Ukraine, Marin led her country through the most swift NATO accession process in the whole history of the alliance. Marin now specialises in topics of geopolitics, strategic autonomy, climate change and female leadership.

Macroeconomics, architecture, UK opportunities, resilience, Japanese timber buildings, German investment, living assets, geopolitical impacts, ESG trends, Italian development, hospitality outlook

Infrastructure: Smart investment strategies in Southern European real assets

Development:

Dozens of innovative projects breaking ground around the globe

All the session details, expert speakers, conferences and events, to help you plan your time at MIPIM and make the most of the latest research, insights and debate

Klara Geywitz, Germany’s Federal Minister for Housing, Urban Development and Building, joined a stellar line-up of speakers at the Housing Matters! event on Monday at MIPIM (see page 7)

Métropole francophone des Amériques

PROGRAMMATION

Conférence

Innovation :

Réfection abritée de façades - Étude de cas

Présentée par

Mercredi 13 mars, 14 h

Cocktail réseautage Montréal / Québec

Mercredi 13 mars, 16 h 30

STAND P-1.K2

Conférence Investissement :

Opportunités d’investissements à Montréal

Présentée par

Jeudi 14 mars, 15 h

Partenaire média

Photo : Loïc Romer

Photo : Loïc Romer

‘A housing crisis is a reality’

REAL ESTATE professionals must “ask themselves some questions” about “the vertical of housing” in the face of changing lifestyles, increasing urbanisation of populations, and the lack of access to homes felt by so many, a MIPIM speaker and co-living expert has said.

In a packed Grand Auditorium at the start of a one-day conference on housing yesterday, Gui Perdrix’s comments set the scene for sessions on the challenges and opportunities within the residential sector.

On stage with Perdrix at the Housing Matters! event was MIPIM director Nicolas Kozubek, who noted that last year’s residential-focused MIPIM had identified worrying trends within housing and that more serious implications were now being realised widely across the industry.

“What everybody is calling a housing crisis was already nascent a year ago,” he said. “Now it’s a reality in the mainstream.”

Kozubek said city dwellers in developed countries were suffering the most as a result of high housing costs and lack of development to keep track with demand.

He called on the industry to work more jointly and collaboratively to deliver more housing, and for more “cross-sector” co-operation between “key stakeholders”.

He warned that there needed to be more strategic and innovative thinking in the way housing development was planned out, with solutions that were as “creative as possible”.

Kozubek and Perdrix’s opening chat led into a session entitled Understanding The Current Housing Landscape, hosted by Kelsea Crawford, chief executive of Paris-based architecture and design studio, Cutwork. Joining her on stage were Olivier Durix, executive vice-president of offers and clients at Bouygues Immobilier; Sonia Lavadinho, founder and chief executive of Bfluid; and Michal Mlynár UN Assistant Secretary-General and acting executive director of UN-Habitat.

On the subject of need for housing globally, Mlynár highlighted the desperate plight suffered by a huge proportion of the world’s population. He pointed to the fact that approximately 2.8 billion people currently live without adequate housing around the world, with another 1.1 billion estimated to live in slums.

“This challenge is certainly not only for developing countries,” he said. Though it is well beyond what is currently deliverable, Mlynár said that in order to meet the demand for adequate housing around the world, some 96,000 new homes would need to be built every single day.

European Distribution Centre for Levi Strauss & Co. with 73,000 m² GFA Warehouse with fully automated intralogistics and high-quality office space

Cradle to Cradle optimized, LEED Platinum & Well Platinum certified 30,000 m²/3.5 MWp solar panels and geothermal energy system

Comprehensive initiatives to achieve whole life carbon positivity

Fusion of sustainability, functionality and aesthetics

THE NEED for emergency housing will be among the chief challenges of the coming decade, “requiring an innovative and sustainable approach to meet the growing demand for shelter and efficient construction”, according to Patrick Coulombel, co-founder of the Architectes de l’Urgence (Emergency Architects) foundation. Citing “global warming, natural disasters and refugee migrations”, Coulombel said that “adaptive solutions” would come to the fore amid the need to “quickly rehouse thousands of people while respecting the constraints of preserving resources and integrating risks into construction”.

International organisation Architectes de l’Urgence was founded to help people in distress, prioritising a return to decent living condi-

tions as soon as possible in cases of disaster. Since its creation in 2001, emergency architect teams have intervened in more than 30 countries, working on reconstruction, erecting houses, and building schools and other essential infrastructure. Coulombel noted that climate risks and geopolitical factors had increased the rate of such displacements around the world.

Yet he also acknowledged the complexities of creating solutions in a world of limited resources.

“How can technical and budgetary constraints be reconciled with a sustainable development approach, while integrating the re-use of materials and the involvement of beneficiaries?” he asked.

“Collaboration between international architects, NGOs and companies and industrialists present

at MIPIM is essential to meet this challenge. Together, they must rethink emergency construction in a context of dwindling resources and the need for sustainability,” Coulombel added.

“Investments in education, vocational training and the creation of economic opportunities are key to reducing incentives to migrate, while access to water and energy is crucial to stabilising populations in developing regions.

“By combining these three approaches — investment in education and the economy, access to basic resources, and the use of sustainable materials — it is possible to address the challenges linked to migration, population stabilisation and construction economics. This is how we can shape a more balanced and prosperous future for all.”

T HE REAL estate industry may have “stronger, vintage years” ahead as more attractive opportunities to invest in a broad range of assets emerge, the head of a major European investment firm has said.

Annette Kröger, PIMCO Prime Real Estate’s European chief executive, has said that the firm she runs is gearing up to capitalise on the increasing opportunities in the markets, particularly those within real estate debt and equity. She said: “In particular, an active approach to lending and real estate debt, with opportunities chosen on a select, disciplined basis, will be key to successfully navigating the year ahead.

“Equity investments could be very targeted, reflecting the vintage and value opportunities that will

become increasingly apparent.”

Kröger accepted that there is a need to remain “prepared for un-

PIMCO’s Annette Kröger

PIMCO’s Annette Kröger

certain markets, given the wider macro-economic and geopolitical environment”, but said that the outlook was looking more positive as 2024 goes on. She said various sectors and sub-sectors were presenting opportunities which PIMCO, formerly known as Allianz Real Estate, is following with interest.

“In terms of equity, opportunistic and distressed markets are showing opportunities though we also anticipate core and core+ segments to become appealing for those with dry powder as we move into a new cycle and possibly stronger, vintage years,” she said.

“Despite the sector uncertainty over the past two years, we believe that some elements of the market have remained consistently strong, relatively speaking. Highly

specialised strategies with secular tailwinds such as data centres, for instance, have weathered well.”

Kröger said that real estate assets, particularly those within the office sector, were benefiting from a marked return to on-site working and greater desire for personal and social interaction.

“We are seeing a renaissance in face-to-face interaction post-COVID. Much as many corporates and businesses are evolving with regards to work-from-home — with a renewed focus and energy on attracting employees back into the office — events such as MIPIM remind us of the power of relationships and the importance of connecting in real life.”

Allianz Real Estate was renamed as PIMCO Prime Real Estate in January last year, a little over two years after parent company PIMCO assumed overall control of the firm.

THE ISLAND of Malta is rich with opportunities for real estate buyers seeking prime residential and tourism properties, the head of the country’s property investment body has said.

Investors are being invited to meet with members of the Property Malta Foundation at MIPIM, led by chairperson Sandro Chetcuti, to learn about the great potential the Mediterranean country offers. Chetcuti said that an “exceptional” post-pandemic recovery combined with high economic growth rates and low unemployment makes Malta one of the jewels in European real estate investment. “This is happening in one of the smallest EU countries, smack in the middle of the crystalline Mediterranean,

with 300 days of sunshine and a history, architectural and cultural heritage spanning seven millennia,” he said. “The country boasts a cosmopolitan lifestyle, extensive connectivity by air and is sixth in ICT adoption in Europe.”

Malta is becoming increasingly attractive to “investors, top-tier professionals and managers and highnet-worth individuals” both for property acquisitions and as a place to live and work, Chetcuti added.

“I am here to lead a delegation of property developers, estate agents and property owners interested in selling residential and commercial properties to foreigners. We assist them to promote the sale of local developments, apartments, luxury villas, authentic houses of character

on an international level.

“Our task is to position Malta as a leading destination of choice for those interested in purchasing property of substantial value right in the middle of the Mediterranean.”

Chetcuti acknowledged that tough conditions both before and since COVID have negatively affected investor confidence across the board, but that Malta’s status as a “gem with many facets” made it unique as a European destination.

“Economically, politically and financially, we are living through uncertain times. Wars and geopolitical turbulence close to home and faraway, the aftermath of a global pandemic, inflation and higher transportation costs are

only a few of the factors fuelling this trend,” he said. “I am proud to say that despite our size, the value of property has historically and consistently been on the increase, without ever experiencing a dip.”

THE CITY of Rome is back at MIPIM at a “pivotal moment of opportunities and events” making the city ripe for investment, according to Rome’s Mayor, Roberto Gualtieri. “Rome is experiencing an extraordinary period of change and modernisation, that is not merely the sum of thousands of ongoing building sites, but a precise plan to stop talking about problems, and start solving them,” he said.

The Mayor added that Rome was “once again becoming a centre of attraction on a par with the world’s other great cities, thanks to a development strategy bringing together the main institutional, financial and industrial players”.

Gualtieri noted that the scale of the city’s redevelopment was

what made this phase of activity so exciting. “In Rome urban regeneration processes could affect 11 sq km of land by 2050, bringing more than 4 million sq m of

buildings back into use,” he said, estimating an added value of some €22bn to the city, “with a further €40bn in social and economic benefits for citizens”. On

top of this, he said that Rome was investing some €3bn in improving its public transport network, as well as a €300m spend to make Rome more inclusive, plus “interventions in digitalisation, the circular economy and 5G to make a more modern city”. He said: “The changes that we are making are not only radical, but fair, appealing to all neighbourhoods and citizens — with major investments from Piazza Pia to Tor Bella Monaca — to make the city grow together.”

Gualtieri concluded: “I want to send a clear message: Rome is at MIPIM in Cannes because it wants to tell the story of the impressive transformation project that is now under way.

“We are committed to ensuring that, over the next 10 years, Rome becomes a city that is more welcoming, more sustainable, more efficient and where it is easier and cheaper to invest. And we won’t stop!”

Rome Mayor Roberto Gualtieri

Magnum Estate, a leading developer in Bali, is building the cutting-edge Magnum Resort Sanur – the most extensive and promising project on the island in the ultra-luxury segment.

Nestled along the pristine shores of the Indian Ocean, Magnum Resort Sanur defines ultra-luxury living. Beyond its enchanting views and resort ambiance, residents of this exclusive complex enjoy access to 8,000 m² of premium facilities, five-star service, and hospitality that rivals the world’s finest hotels.

Magnum Resort Sanur offers 156 luxurious one- and two-bedroom apartments, starting from 101 m². With classic layouts, designer furniture, high-tech appliances, and premium-class plumbing, every detail is designed for a comfortable living experience.

Every unit comes equipped with a Smart Home system, allowing residents to effortlessly control all apartment amenities using voice commands or their smartphones. For those on the upper floors, there’s an exclusive perk – a private terrace jacuzzi with a panoramic view of the ocean.

Magnum Resort Sanur is not just a residential complex; it’s a true resort offering its residents:

• A scenic restaurant with a fusion menu.

• Moon rooftop lounge with ocean and Mount Agung views.

• State-of-the-art fitness center.

• Spa with a hammam and sauna.

• Yoga platform.

• Children’s play area.

• Co-working space with high-speed internet.

Additionally, residents and guests can enjoy a private beach, exclusive beach club, water motorcycles, and a yacht.

The complex is nestled in the heart of Sanur’s resort area, now Bali’s thriving hub for development. Here, the expansive Icon Bali shopping and entertainment complex is taking shape, along with the worldclass Bali International Hospital. Within walking distance, residents enjoy access to all essential conveniences, including a plethora of restaurants, cafes, shops, entertainment venues, childcare facilities, a golf course, and other vital amenities.

Adjacent to the complex lies the island’s longest waterfront promenade, spanning 5.5 kilometers – an ideal setting for leisurely strolls and moments of meditation. This unique spot in Bali boasts a wave-free sea, inviting for a refreshing dip, and 7 kilometers of picturesque beaches with pristine sands and a gentle water entry – a tempting invitation for residents and guests to indulge in swimming and sunbathing.

Beyond providing a comfortable lifestyle in Bali’s premier resort, Magnum Resort Sanur offers a compelling investment opportunity.

• Robust demand: The demand for elite real estate rentals in Sanur remains consistently high throughout the year, ensuring a steady passive income of 12% annually.

• Investment growth: Analysts project a substantial increase in square meter prices within the first five years post-complex completion. Investing now, starting at $5,000 per square meter, could yield over 50% profit upon apartment resale.

• Limited availability: The number of apartments in Magnum Resort Sanur is limited, making it nearly impossible to acquire real estate here after the complex is completed.

Magnum Resort Sanur stands out as a distinctive offering in Bali’s real estate market with significant profit potential. Its prime oceanfront location, premium facilities, unparalleled service, and robust investment returns position this complex as the new standard for luxurious living in Bali.

THE PRIME Minister of Thailand, Srettha Thavisin, is attending MIPIM for the first time to highlight Thailand’s potential as a “good place to live in and invest in”. Also the country’s Minister for Finance, Prime Minister Thavisin will be joined by working groups from a range of sectors, including the Thailand Convention and Exhibition Bureau (TCEB) in the Ministry of Foreign Affairs, as well as the public relations department (PRD), which has co-organised the exhibition Thailand Unveiled: Harmonising Liveability For Life – Why Thailand?. This explores Thailand’s excellent reputation for being a liveable country that is worth investing in, as part of the

project to promote Thailand’s image and publicise it internationally.

On its MIPIM debut, the PRD plans to present important strategic opportunities, such as

Bangkok, Chiang Mai, Phuket, Chonburi and Rayong, to attract investors from around the world through multimedia messages conveying the unique -

ness and elegance of Thailand. The department said it expected to further develop relations with government officials and executives from companies in countries including the UK, the United Arab Emirates, Germany and Saudi Arabia, among others, who would potentially be interested in visiting and investing in Thailand still further.

The Prime Minister is scheduled to attend MIPIM today, March 12, and will deliver a speech on the topic Better Infrastructure In An Age Of Risk, Scarcity And Emergency, on the Leaders’ Perspective Stage at 11.10.

While in France the Prime Minister is also scheduled to pay a courtesy visit and speak with Emmanuel Macron, President of the French Republic, as well as having bilateral talks with business leaders and executives of worldclass companies.

THE LONDON investment market is likely in a “buying year” as confidence returns and take-up rates continue to rise, a senior UK real estate expert has said.

Dominic Amey, principal and managing director of capital markets at Avison Young UK, has said that conversations with clients and prospective clients with an interest in London show that investors are approaching 2024 with a more positive approach than recent years, and that an increase in cross-border investment is likely to follow.

He said: “Early year conversations indicate that many investors see 2024 as a buying year. I’m active with several investors who have been waiting years to get into London and see this as the right time.”

“Private investors will be preva -

lent, investing directly or via investment managers.”

Amey’s comments reflect wider sentiments suggesting a return to confidence across the real estate investment market. This follows several years of reduced investment volumes since a string of economic shocks, starting with the COVID pandemic in 2020.

Amey said: “2023 saw below half the long-term average investment volume, and I expect this year to be more like 60% to 70% of long-term average volumes.”

But Amey warned that key underlying negative trends are likely to remain in 2024, including difficulties in obtaining debt to drive investment deals.

“Cash will remain king, as debt markets will still be tricky,” he said.

THE DEVELOPMENT agency responsible for the Brussels region, citydev.brussels, will share a broad slate of opportunities with real estate players at this year’s MIPIM. In a session on Wednesday, March 13, dubbed The Productive And Inclusive City – From Idea To Reality, the public body expects to discuss some of the topics of the moment, according to Benjamin Cadranel, CEO of citydev.brussels.

“The session will highlight the challenges encountered between the conceptualisation of a project and its realisation,” Cadranel said. “We decided to use two of our recently inaugurated projects as examples and to openly, critically and constructively discuss all the contingencies associated with their development with the archi-

tects of these projects and international experts.”

2024 marks an important milestone for citydev.brussels, as the agency celebrates its 50th birthday. Cadranel added: “This anniversary is an opportunity to celebrate the solid foundations of our institution, its expertise in complex projects, and the immense potential that this entails for our future projects.

“An anniversary is also a perfect occasion to look to the future. Of course, it’s risky to predict what the challenges of urban planning will be when citydev.brussels celebrates its one-hundredth birthday, but I’m convinced that we will have equipped our institution with the means, expertise and credit required to optimise our impact on

After a flat period in terms of sales and occupancy in 2022, Amey said that last year London experienced a “surge” in take-up for office space, a trend which he said is likely to continue this year.

He said: “Companies that had perhaps extended existing leases, or served lease breaks in favour of working from home, were keen to get back to the office — many seeking best-in-class space to attract their staff back in.

“I’m sure clients will seek clarity on whether this level of demand is likely to continue throughout 2024.”

This interest is likely to initially be most marked for “best-in-class” London office assets, chiefly The City and the West End, where Avison Young UK anticipates “strong rental growth” of between 5% and 10% in the next 12 months.

Avison Young UK is based in London but is active in numerous markets throughout the EMEA region, the US, Canada and Central America.

the Brussels Region’s development.” MIPIM will also see citydev.brussels flanked by the Brussels-Capital Region and colleagues from the public institutions responsible for territorial development at the Belgian Pavilion.

“This will be an opportunity to discuss the development of urban planning in the Belgian and European capital with national and international players.

“We will also be presenting our Business Review with the Société du Logement de la Région Bruxelloise and the Société d’Aménagement Urbain, which has become a recurring event for professionals in the sector keen to find out about and prepare for the public contracts that will be put out to tender in the months to come,” he said.

citydev.brussels’ Benjamin Cadranel

citydev.brussels’ Benjamin Cadranel

THE ANNUAL ritual of hundreds of delegates taking to two wheels and cycling to MIPIM was as popular as ever this year, with multiple teams arriving with smiles aplenty despite the miles in the saddle.

As in previous years, Club Peloton from the UK was a major presence. According to CEO Nick Hanmer, the club’s Cycle to MIPIM event is an opportunity for members to network while at the same time raising money for charity.

“We use cycling as a platform for events both on and off the bike that bring together a love for the sport and the opportunity to network while raising money to transform the lives of young people,” he said. “Cycle to MIPIM is our longest-running flagship ride, giving property-industry professionals the opportunity to complete either seven or four days on the bike together, building stronger and more meaningful working relationships as they cycle from London or Auxerre to Cannes. The friendly and interactive atmosphere builds camaraderie very quickly and forms the core of the Club Peloton ethos.”

Over the years, Club Peloton has raised huge amounts of money, Hanmer added. “Since our first outing in 2006, Club Peloton has made grants totalling £4.5m (€5.28m) to fund a variety of projects,” he said. “[That ranges] from recruiting families for 1,150 children waiting longer than 18 months to find adoptive homes to assisting 500 families with post-adoption support, awarding 800 bikes, tandems and adapted trikes to children and young people

affected by cancer and tackling the root causes of violent street crime through 18 amazing projects.”

Les Cycles de l’Immobilier association, which this year had almost 300 members taking part in the ride to Cannes, has similar motivations, according to its president, Sébastien Masson.

“The campaign aims to break the million-euro barrier in eight years, with a target of €250,000 in donations for this year,” he said. “The goal? To raise funds that will then be distributed to three associations: Architectes Solidaires, BlancheVLM and Imagine for Margo.”

He added: “This sporting challenge, in keeping with our experts’ passion for real estate, affirms the values that unite all of us: cohesion, solidarity, endurance and perseverance. Real estate professionals know how to invest themselves selflessly to help improve the daily lives of people in need.”

The finishing line also played host to the REcycle Club, which brings

together cyclists from Belgium and Luxembourg and raises funds for Cycle for Hope, a philanthropic organisation that supports children fighting cancer and their families. “This year the raised funds will go to the CHL Hospital in Luxembourg and Cliniques Universitaires: Institut du Roi Albert II in Brussels,” said club organiser Jean Leclercq. “Our efforts will contribute to providing specialised equipment for those children fighting cancer to ensure they receive the care they deserve.”

Club Peloton takes a well-earned break (top)

Les Cycles de l’Immobilier association on the road (middle)

Club Peloton takes a well-earned break (top)

Les Cycles de l’Immobilier association on the road (middle)

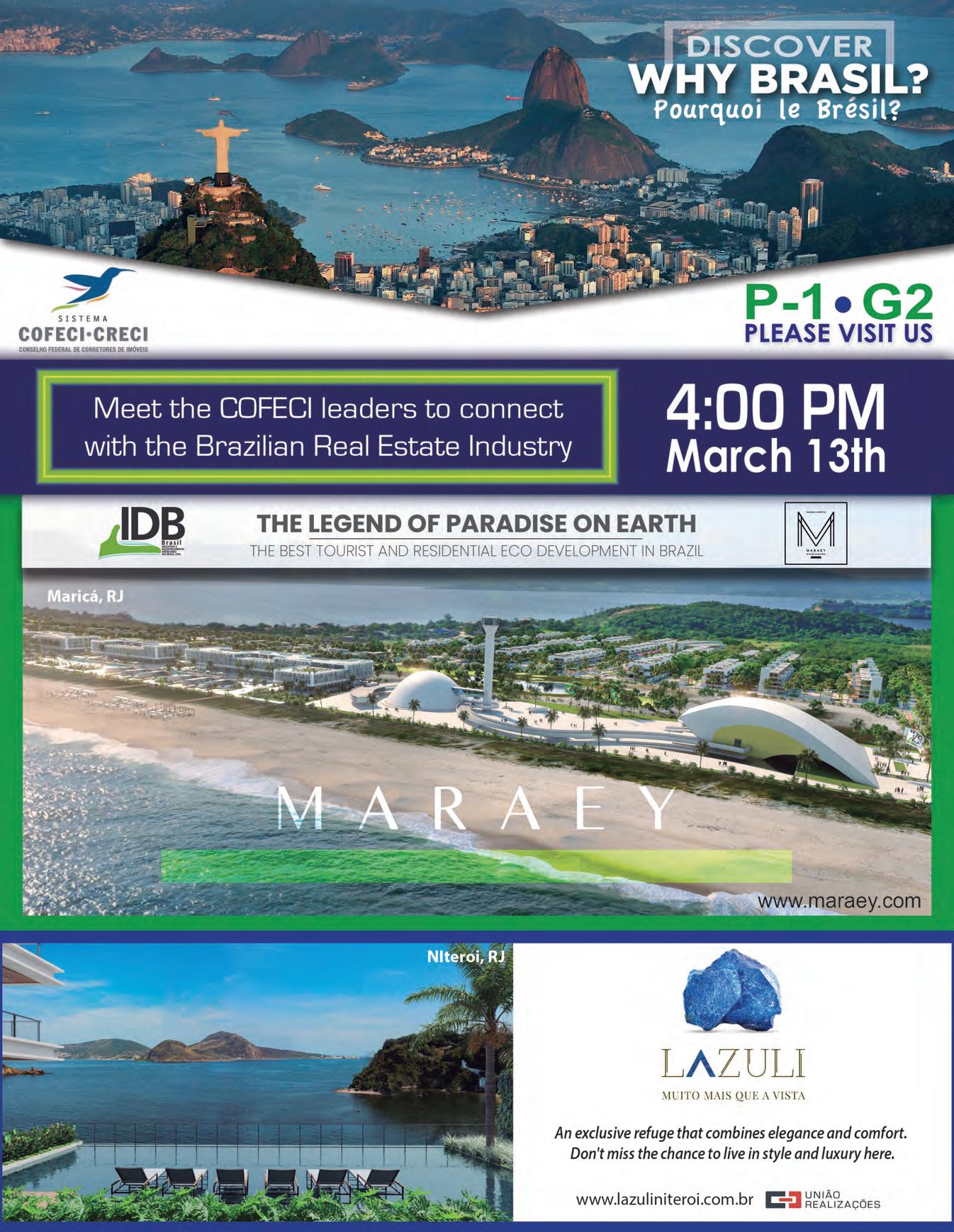

INVESTMENT opportunities across Poland are being promoted at the first-ever Polish Pavilion at this year’s MIPIM. Decision-makers from both the public and private sectors will showcase projects such as Capital Park’s Nowy Welnowiec, a multi-generational, sustainable and mixed-use neighbourhood in the northern part of Katowice.

Visitors to the pavilion will also be greeted by representatives of the Polish Association of Developers, which has 325 members from across the country active in residential, office, hotel, logistics and other sectors.

Also attending the pavilion will be Roman Skowroński, managing director of Peakside, an independent investor, real estate manager and real estate fund manager that manages assets worth approximately €1.4bn on behalf of its institutional investors from its offices in Warsaw, Prague, Frankfurt, Zug and Luxembourg.

THE LUBELSKIE Region in Poland is at MIPIM to highlight its strategic location, situated in the heart of Central and Eastern Europe, for companies that wish to operate across both eastern and western markets, according to Eliza Mazur, manager, business-support office, department of economy, at the Lubelskie Marshal Office.

The area’s main city, Lublin, is an academic centre with nine institutes of higher education, a number of technology parks, plus business incubators to support innovation and new technologies. Last year’s European Youth Capital, Lublin

offers subsidies and tax benefits for investing in the city.

One of the other major components that makes the region, and Poland, attractive for investors is the introduction of Polish Investment Zones (PSIs), which were introduced in 2018 to support new direct investments carried out across Poland by extending tax relief, previously available only in special economic zones.

“Tax exemptions under the PSI programme vary throughout Poland in connection with the sustainable development policy, and in the Lubelskie area they are available at the

maximum level — up to 70% of the eligible costs of a new direct investment can be recovered as part of the tax refund,” Mazur said.

One such example of inward investment is Panattoni, which in February handed over Panattoni Park Lublin IV. The two-building complex has a combined area of 52,000 sq m, built within the Świdnik Economic Activity Zone. Tenants include Polish food exporter Mastermedia and box specialist MM Lublin.

Currently, Poland is particuarly focused on projects connected with automation, the circular economy and R&D projects.

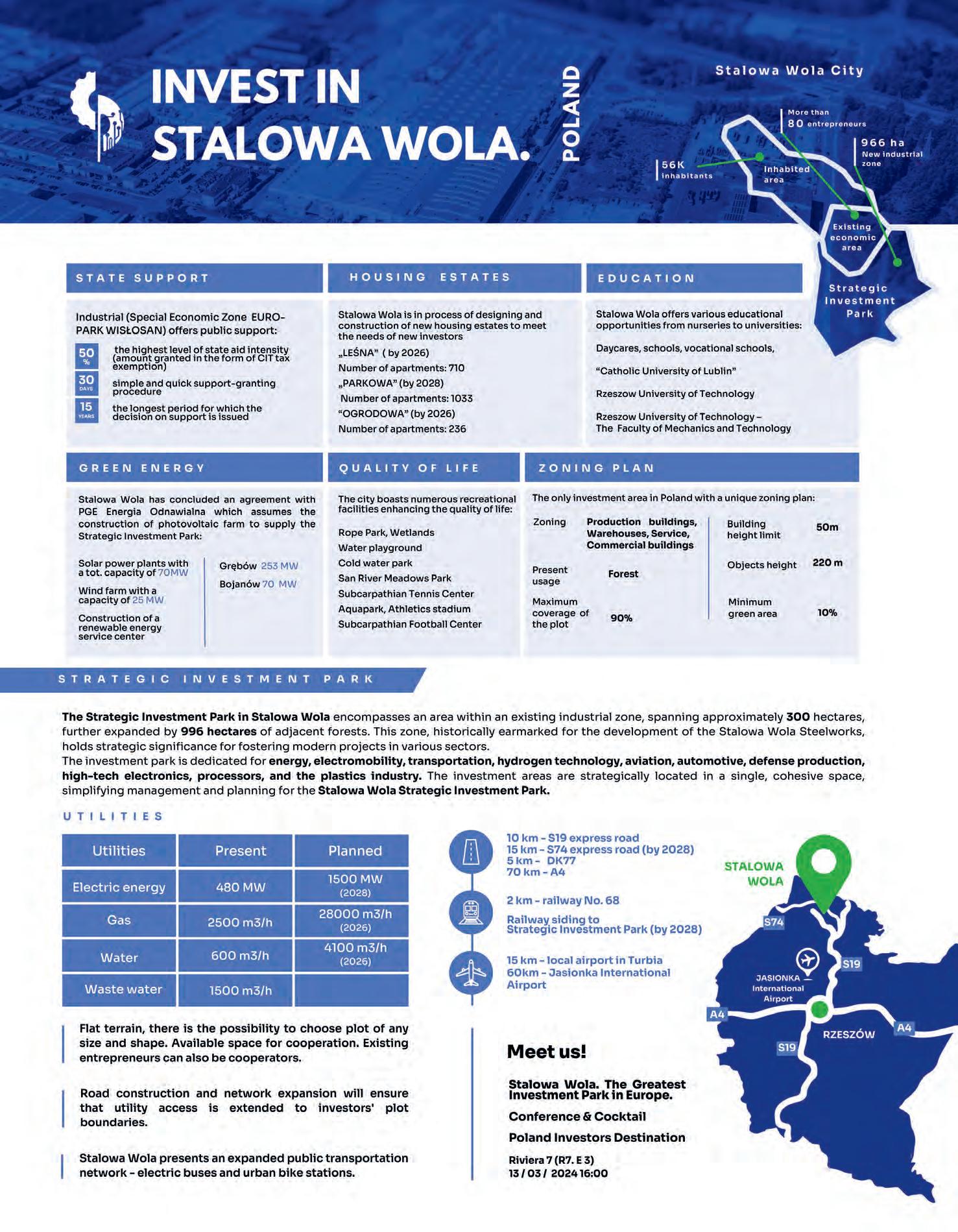

THE POLISH city of Stalowa Wola is at MIPIM showcasing its Strategic Investment Park, which spans nearly 1,000 ha and offers investors the opportunity to acquire plots of land with full access to utlilities.

Key objectives for the city include finalising the construction of road infrastructure, plus the addition of a dedicated railway siding directly linking the Strategic Investment Park area to the broader railway network.

It is also carrying out environmental initiatives aimed at transitioning the majority of the zone’s energy consumption to sustainable, green-energy sources, while

integrating small modular reactors within the city.

“Planned initiatives encompass the expansion of recreational facilities, including state-of-the-art pool complexes and the establishment of a youth sports centre,” Jacek Śledziński, business centre manager, Stalowa Wola, said.

“Our focus also extends to providing support to developers for residential construction projects. Additionally, significant investments are earmarked for the enhancement of our public transportation network, which presently relies on electric vehicles for 90% of its operations.”

The city of Stalowa Wola is showcasing its new Strategic Investment Park

Lublin is an academic centre with nine institutes of higher education

The first Polish Pavilion at MIPIM

The city of Stalowa Wola is showcasing its new Strategic Investment Park

Lublin is an academic centre with nine institutes of higher education

The first Polish Pavilion at MIPIM

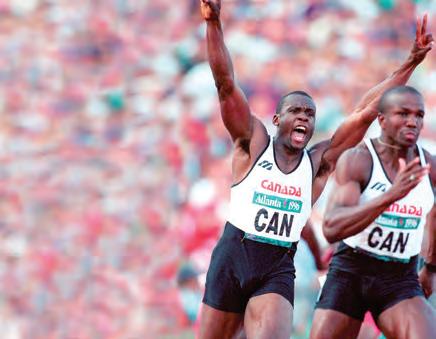

Sanna Marin is the former Prime Minister of Finland (2019-2023). Recently nominated strategic counsellor to the Tony Blair Institute, Marin became the world’s youngest Prime Minister at 34 when elected in 2019.

Marin’s government is widely regarded as one of the most successful in managing the COVID-19 pandemic, particularly in terms of minimizing both the loss of lives and the economic impact resulting from the outbreak.

Marin specialises in the topics of geopolitics, strategic autonomy, climate change, and female leadership.

Tuesday 12 March at 15:10, Grand Auditorium

TURKISH consultancy Alkaş is attending MIPIM this year, in part, to drum up the investment required to rebuild communities, according to the company’s chairman Avi Alkaş.

“We will be joining forces with a group of real estate investors, service providers and various semi-governmental institutions,” he said. “With Turkey grappling with the aftermath of a devastating earthquake in February 2023, the urgency for investment is heightened.

“There is a need for housing projects to rehabilitate the regions affected by the earthquake in 11 provinces of Turkey, where more than 13.5 million inhabitants [were impacted]. We remain steadfast in showcasing Turkey’s resilience and investment opportunities. In the aftermath of recent

seismic events, 2024 marks the beginning of transformative initiatives for earthquake recovery and pre-emptive urban planning.”

Alkaş is also keen to highlight other opportunities in his country, not least in terms of urban regeneration and tourism. “Turkish participants are keen on exploring new developments and forging connections with leading global entities from the European and global markets,” he said. “We aim to underline that urban regeneration projects in major cities like Istanbul offer attractive opportunities for investors. Simultaneously, Turkey’s flourishing tourism industry and urban regeneration endeavours signify a growing demand for revitalising existing real estate assets.”

He added: “Turkey’s growing population, fuelled by immigration

and refugee influxes, necessitates comprehensive housing and urban development strategies. With MIPIM serving as a vital platform for Turkish investors to attract international attention and foster growth, Alkaş anticipates accelerated development and increased business opportunities in the coming year.

“Looking ahead we envision a pivotal year for Turkey amid political and economic transitions. Despite economic challenges stemming from frequent elections and currency devaluation, the real estate industry continues to innovate with long-term sales solutions.”

In addition, Alkaş said that Turkey has a leading role to play in helping other countries to rebuild.

“With Turkish construction companies ranking second globally in

investment that incorporates operational elements, will be the focus at this year’s MIPIM, according to Cristina Garcia-Peri, senior partner and head of corporate development and strategy at Madrid-based Azora.

She said that this represents a year of strategic opportunities, with a shift towards more actively managed sectors of real estate. “We will explore the potential that these sectors hold for investors looking to diversify their portfolios with real estate investments that offer more than just capital appreciation but also derive income from operational success,” she said.

“These include the hospitality sector, rented residential properties that cater to the growing demand

Azora’s Cristina Garcia-Peri

Azora’s Cristina Garcia-Peri

for flexible living options, senior living facilities that are becoming increasingly important due to demographic shifts, and data centres, which are critical in today’s digital economy.”

This year Azora, a real estate investment manager with assets under management (AUM) of €9.7bn, anticipates a continuation of repricing and distress in some specific real estate sectors, driven by market dynamics, but this should also unveil “substantial opportunities for entities equipped with robust equity positions and the backing of supportive investors”, she said.

Azora is looking to capitalise on the acquisition of assets and platforms that have experienced significant challenges, while the company believes that the living

growth and capabilities, Turkey is poised to emerge as a significant player in the international real estate arena,” he said. “Moreover, amidst global conflicts creating displaced populations and the need for new cities, Turkey stands ready to contribute to regional development alongside international investors.”

space is poised to receive a substantial boost from factors such as an ageing population, coupled with a persistent shortage of suitable housing options.

“This demographic and market reality is forecast to drive heightened institutional interest towards the rented residential and senior living sectors, with Spain positioned as a focal point for such investments. Furthermore, the hospitality sector is anticipated to continue its post-pandemic recovery trajectory, marked by positive growth indicators, including strong average daily rates and occupancy figures,” she said. “This rebound signifies a return to form for the hospitality industry, highlighting its resilience and the rekindled demand for travel and leisure experiences. Collectively, these trends underscore a year of strategic opportunities and sector growth within the real estate market, reflecting a blend of challenges and prospects for investors and operators alike.”

In honor of International Women’s Day and the incredible women in the industry, Kroll are hosting a Women’s Social event with Howden.

Join us for networking over light refreshments. You will also have the chance to learn padel with coaches from the Padel Social Club.

Tuesday, March 12, 2024

4:00 p.m. – 6:00 p.m.

Howden Beach Club. Located on the beach space in front of 22 Boulevard de la Croisette.

The event is free to attend but RSVP is required.

Meet us at MIPIM

Kroll experts from Italy, Germany, Spain and the UK will be onsite throughout the event at stand P-1.J.15 and at the Howden Beach Club.

PGIM Real Estate has acquired two prime logistics buildings in southern Milan, Italy, and finalised two major leases for logistics properties in Berlin, Germany, on behalf of its European core strategy. The Italian sheds, totalling 41,500 sq m, are located in Borgo San Giovanni.

Christine Fritz, co-portfolio manager of the European core strategy, said: “Our logistics platform has seen significant rental growth as a result of our disciplined approach to acquisitions and active asset management capabilities enabling us to activate rental value and deliver continuous income growth.

“More broadly, global investor sentiment continues to show that logistics remains highly favoured in Europe — we see a strong structural growth story in the sector for Italy, Germany and other European prime markets, with rents rising on the back of elevated e-commerce adoption and supply-chain restructuring.”

ITALIAN investor, developer and asset manager Coima has secured €50m from Italy’s sovereign wealth fund, CDP Real Asset, for the transformation of the 2026 Winter Olympic Village into Italy’s largest purpose-built student accommodation development.

The investment has been made through the National Fund for Sustainable Housing (FNAS).

FNAS is a closed-end alternative investment fund managed by CDP Real Assets, which aims to promote real estate projects of up to €1bn that have a strong focus on sustainability and social impact.

The investment sees CDP Real Asset join Coima’s ESG City Impact Fund (Coima Impact), Italy’s largest urban regeneration fund, which has now raised over €900m from leading Italian institutional investors. The fund has increased its target size from to €1bn to €2bn, with Coima now embarking on a fresh round of fundraising activity. To deploy the €50m investment in the 1,700-bed student accommodation scheme at Porta Romana, Coima will establish a new fund, backed by FNAS and the Coima Housing Fund, a closed-end real estate fund dedicated to sustain-

able living that was launched by Coima in March 2023.

Coima Housing, which focuses on the development of a range of social and subsidised housing, as well as the development and operation of student schemes, is backed by Coima Impact and Intesa Sanpaolo.

The €50m investment will see the ultra-sustainable 2026 Winter Olympic Village at Porta Romana transformed into high quality student accommodation after the Games, helping address a major shortage of student beds in Milan. Manfredi Catella, founder and CEO of Coima, said: “We are honoured that Italy’s sovereign wealth fund has joined Coima’s ESG City Impact Fund as co-investor in the transformation of the 2026 Winter Olympic Village into Italy’s largest student accommodation development. The Coima ESG City Impact Fund has now raised over €900m from primary institutional investors, underlining the value investors continue to place on sustainable urban regeneration that generates strong positive social and economic impacts.”

THE ITALIAN region of Emilia-Romagna is presenting a united front at MIPIM, according to Councillor Vincenzo Colla, as the Metropolitan City of Bologna, the Municipalities of Piacenza, Ravenna and Reggio Emilia and Forli Airport join together to attract investment, innovation and talent. Flagship projects on show will include Bologna’s Tecnopolo Manifattura – Data Valley Hub, which hosts the ECMWF supercomputer and Leonardo, two strategic investments in the big data and AI sector. “We’ll be talking to investors at MIPIM about a 15,000 sq m tower which will be built here, to host international research centres, labo -

ratories and accelerators,” Colla said. “Emilia-Romagna also offers opportunities for urban regeneration around the Tecnopolo and university campuses throughout the region, as well as manufacturing and hospitality projects.” Another topic of debate will be the Port of Ravenna, which is considered an important gateway to the Mediterranean, as well as an emerging hub for the production and distribution of energy, with a focus on renewables.

“Two of Europe’s most important carbon-capture projects are taking shape here, and one of the largest floating photovoltaic and offshore wind farms in Italy will be built nearby,” he said. “In addition, the

natural gas storage facility, while in Modena, Hydrogen Valley will be the next exciting project.”

region hosts the largest European Vincenzo Colla, Councillor, Emilia-Romagna The 2026 Winter Olympic Village is set for a post-event transformation PGIM Real Estate’s Christine FritzScotland

Belfast

Dublin

Ireland

Wales

England

London Brussels

JAPAN’s Sumitomo Forestry Co (SFC) is currently building a six-story office building in south London, made of timber, in a joint venture with British real estate developer Bywater Properties. It is SFC’s first construction project in the UK, and indeed in Europe, though the company has been active on the continent for several decades through its former representative office in Amsterdam.

By chiefly using wood as the building material, the ‘upfront carbon’ of the building will be reduced by 60% compared to conventional reinforced concrete and steel construction.

“One of our goals as a forestry management and timber supply company is to achieve a decarbonised society,” said On Nakagawa, presi-

dent of Sumitomo Forestry Europe. “We partnered with Bywater after we realised we shared a vision about decarbonisation.”

According to Nakagawa, wood has become a more popular building material, even for high rise construction, due to the fact that trees capture carbon, rather than emit it. Since carbon is one of the main causes of global warming, carbon-neutral construction is essential for addressing climate change and promoting sustainability.

“SFC promotes the value of wood,” he added. “We started more than 300 years ago as part of the Sumitomo family copper-mine business, which needed timber for reinforcing tunnels and refining copper as fuel. The group cultivated forests.

“Now we own forests, manage them, harvest trees and replant them, using the wood we produce for construction and furniture. We also now have some biomass power plants. When it comes to wood, we operate at any point in the supply chain, which we call the Wood Cycle.” The London office building is only the start. SFC hopes to help build residential buildings and industrial facilities using wood.

“There are some challenges, of course,” Nakagawa said. “For this project we had to do extra fire testing to convince local authorities and the market. We are also working with material suppliers and sustainability consultants.”

He emphasised that, in line with sustainability practices, as much wood as possible is obtained locally, if possible through other forest management companies, because reducing carbon also means reducing transportation and processing of constituent materials.

SFC also plans to work with wood in the renovation of existing buildings. “There are a lot of old buildings in London,” Nakagawa said. “In terms of decarbonisation, it is better to preserve buildings. When you demolish and rebuild, you emit a lot of carbon. We look at renovation as a real estate concern — adding value by using lighter wooden materials and maybe more storeys to existing structures. Since last year we’ve acquired some buildings that we plan to refurbish and expand.”

At MIPIM, Nakagawa hopes to meet other businesses and individuals who are interested in wooden buildings. “We’ve already set up some meetings with investors and other partners,” he said.

In addition to London, Nakagawa thinks that France and the Netherlands, which have shown interest in wooden construction, could provide good information and potential partners going forward.

And when asked what sort of tenants he thinks will be moving into the London office building when it’s finished, Nakagawa said: “Ideally, they would be companies that understand what we’re doing. But we have to be profitable if we want to run a truly sustainable business.”

THE HOTEL sector has bounced back following the COVID-19 pandemic and is now proving resilient in the face of substantial increases in interest rates, according to Felicity Black-Roberts, vice president, acquisitions and development, Europe, at Hyatt.

“There is a lot going on in the hotel sector currently, with demand, — particularly for leisure destinations — remaining very strong,” she said. “Post-pandemic there

has been no shortage of investors in the sector but the frustration remains the lack of supply for investors and the pricing levels.”

She added: “What we have seen post-pandemic is more, not less, investors in the hotel sector — especially in the urban and non-urban leisure segment. We will certainly continue to see investors ensuring that every element of the business is maximised, with increasing ingenuity and imagi -

nation applied to reinventing ancillary functions such as meeting space and F&B, and reacting to changing working patterns.”

Black-Roberts said that the pandemic highlighted just how strong people’s desire to travel and visit new places remains.

“Consumers appear to be prioritising travel over other expenditure and I do not see this trend reversing,” she said. “In my view we will see a lot of new destinations finding prominence with travellers and this is an exciting opportunity for a brand like Hyatt to work with investors in these emerging destinations.”

In particular, Black-Roberts said that travellers are increasingly attracted to all-inclusive resorts.

“There is a lot of interest in resorts and the rise of the all-inclusive segment,” she said. “With Hyatt’s dominance in this segment, we are looking to expand our brands outside of the Spanish Mediterranean and explore new markets for these increasingly in-demand hotels.”

THE GLOBAL real estate investor, developer and property manager Hines has acquired a new 260-bed student development at Gas Lane in Bristol on behalf of the Hines European Property Partners Fund (HEPP). The purpose-built student accommodation (PBSA) is next to the University of Bristol’s new Temple Quarter Enterprise Campus and is expected to be completed in time for the start of the 2025/26 academic year.

“The number of students going into education has grown exponentially and the undersupply of purpose-built student housing in the UK is well documented,” Jorge Duarte, senior managing director and fund manager of HEPP said. “Schemes like this one provide the opportunity to play our part in building the PBSA that the UK desperately needs, while seeking to deliver real value to our investors.”

AFTER a tumultuous and unpredictable period, developers in the UK can look forward to greater stability, according to Thomas Vandecasteele, managing director at Legendre UK.

“The last few years have been challenging with Brexit, COVID, inflation and the mini-budget,” he said, referring to the fiscal event in the autumn of 2022 that led to market turmoil within days.

“[But] even with the impending general election, we are very much hoping for stability and certainty, which will give the confidence to developers and investors to carry

on with their projects. From what we see at the moment, it appears to be the case.”

In particular, Vandecasteele sees multiple opportunities opening up in the repurposing of older office buildings.

“Generally, we expect to see high levels of activity in terms of refurbishing offices to upgrade the assets to the latest environmental standard,” he said.

“Likewise, we forecast that the repositioning of offices into new forms of residential product — such as co-living — will become more and more popular.”

THE NEW West End Company represents 600 retail, restaurant, hotel and property owners across London’s West End and its chief executive, Dee Corsi, is at MIPIM with a busy schedule.

“The MIPIM agenda is always absolutely packed,” she said, “and I have found that some of the most interesting conversations are those that emerge unexpectedly over a cup of coffee.” Corsi is looking forward to sharing the findings of the company’s Oxford Street 2030 Report which will be launching in Cannes.

“It is an exploration of what it means to be a flagship retail and leisure destination, both now and in the future, and is packed full of insights from stakeholders in the street — from international retailers to occupiers and futurists,” she said.

THE GREATER London Authority (GLA) has launched the search for a new development partner to transform Royal Albert Dock in London. Extending to 12 ha with potential for 400,000 sq m of new development, the site sits within the capital’s only enterprise zone.

Royal Albert Dock is located within the wider Royal Docks area and is one of seven significant development sites being brought forward across 175 ha of public land belonging to the GLA. Approximately £5bn (€5.87m) of investment is planned for the area

over the next 20 years, providing 36,000 new homes and creating 55,000 new jobs.

City Hall relocated to the Royal Docks in 2022 and the site itself is located on the north side of the Royal Albert Dock.

Procurement of a new development partner is being led by the Royal Docks Team (a joint initiative from the Mayor of London and the Mayor of Newham) on behalf of GLA Land and Property (GLAP) as freeholder. Following the selection process, the GLA and its partner will work with the

London Borough of Newham on a shared vision and delivery strategy. Planning and development consultancy Montagu Evans is advising the Royal Docks Team and formal procurement is expected to start in summer 2024.

“As well as new homes people can afford, we’ll be opening up a vast array of jobs and opportunities reflecting the way we now need to live and work to secure a sustainable, inclusive and fairer Newham for present and future generations,” said Rokhsana Fiaz, Mayor of Newham.

LONDON is now the most attractive market for office investors in Europe following a difficult period for the market, according to James Carrington, head of city investment at BNP Paribas Real Estate.

“The London market has essentially reached the bottom and is probably the most attractive major city for investment in Europe right now, which means capital is coming back,” he said.

“Rental growth is a key driver with continued upwards pressure in the likes of Mayfair and the City, which saw prime rents reach £150 per sq ft

(€176) and £75 per sq ft respectively in Q4 2023. Those are attractive numbers and are forecast to grow further over the next 24 months.”

Carrington added that the lack of new, Grade A stock means that there are also opportunities for proactive investors to profit from repurposing older assets. “Investors should take note that occupiers are starting to consider alternative options,” he said.

“Those who can take on a refurbishment risk or have good local knowledge of supply and demand dynamics, could emerge as the winners of the next few years.”

BNP Paribas Real Estate’s James Carrington

Royal Albert Dock: partner wanted

New West End Company’s Dee Corsi

BNP Paribas Real Estate’s James Carrington

Royal Albert Dock: partner wanted

New West End Company’s Dee Corsi

13 March 2024 - 11.00 // Verrière Californie 5th floor (french session)

Our Speakers:

Hélène Peskine Permanent secretary Plan Urbanisme Construction Architecture

Mark Brearley Professor London Metropolitan University

Oana Bogdan Architect / Founder &bogdan Luk Peeters Managing Partner ORG Permanent Modernity

Benjamin Cadranel CEO citydev.brussels

Nathalie Renneboog General Director - Urban Renewal citydev.brussels

Philippe Antoine General Director - Economic Expansion citydev.brussels

DANIEL May, director at mixed-use developer Socius, will be wearing “at least two hats” at this year’s MIPIM. “One for Socius, where our focus is on looking at opportunities to deliver people-focused places in urban locations that draw upon our expertise across a broad spectrum of uses,” he said. “The second is as an ambassador for the London Cancer Hub in Sutton, where we will be delivering the world’s leading cancer research district alongside Aviva Capital Partners.”

May predicts that the second half of the year could become very active as private equity seeks out thematic opportunities.

“Our cross-sector experience will become very desirable for those investors with stranded assets, too,” he said. “I feel like we’ve passed peak pessimism and are moving into a world of cautious optimism.”

IN THE wake of the COVID-19 pandemic and the subsequent changes to working patterns seen in most parts of the world, property companies can no longer rely on offices as the bedrock of the industry, according to Robin Rivaton, CEO of technology firm Stonal.

“The office will no longer be the mammoth that it once was,” he said. “We can no longer rely on the office sector to be the foremost contributing factor to the commercial real estate industry.

MIPIM will likely be centred around discussing what’s next for the industry in terms of diversifying uses of portfolios.”

Rivaton added that property companies will need to become more interventionist when it comes to operational management.

“Operational management of assets is also becoming a notable requirement,” Rivaton said. “Today, asset managers are at a crossroads. They have access to

more data and information than ever before, meaning they must decide to stop working in inefficient data silos, instead, focusing on the operational management of assets and employing technological solutions to support this. “There is an increasing need for actionable insights and information about your portfolio,” he added. “Most importantly, having the right information on assets to determine the right level of CapEx will no longer be a nice-to-have, but a necessity.”

The industry, Rivaton said, is at an inflection point but embracing new technology should allow it to become more efficient.

“Technology is enabling people to manage more [assets] without requiring an increase in headcount to handle this,” he said. “Asset managers can utilise technology to increase capacity while seeing little need to increase costs.”

NUNO Brito e Cunha, lead ESG advisor EMEA, at Measurabl, an ESG platform for real estate, is in Cannes this week to discuss sustainability trends, regulatory changes and technological innovations. In a landscape undergoing significant repricing, market fundamentals remain steady but the focus is shifting, according to Brito e Cunha.

“The industry is recognising the financial and environmental risks of unchecked carbon emissions,” he told MIPIM News.

“Implementing an internal carbon price is emerging as a strategic measure to direct capital expenditure towards mitigating these risks, emphasising the fi -

nancial imperatives of sustainability efforts,” he added.

“Far from being just an ethical consideration, sustainability is becoming a strategic business move,” he said.

“The potential for sustainability to drive revenue, reduce costs and mitigate risks is real and actionable. This shift reflects a broader understanding of the economic benefits of sustainable practices,” he added.

The sector is in a transformative period, according to Brito e Cunha, where sustainability becomes integral to operational, financial and strategic decision-making, setting the stage for a more sustainable and financially resilient industry.

Measurabl’s Nuno Brito e Cunha

Stonal’s Robin Rivaton

Measurabl’s Nuno Brito e Cunha

Stonal’s Robin Rivaton

ASSET manager Commerz Real has acquired a mixed-use development that includes office, retail and other uses at Maximilianstrasse 12-14 and Falkenturmstrasse 5-7 in central Munich from developer Centrum on behalf of a private investor for an undisclosed sum.

“The current environment and the swift action taken by all the participants mean we have been able to acquire a rare gem on Munich’s property market for our client,” said Kerstin Struckmann, global head of product management, institutional clients, at Commerz Real.

The ground floor and the first floor of the building on Maximilianstrasse houses brands including Louis Vuitton, Montblanc and Swatch. Offices are located on the remaining floors. The building on Falkenturmstrasse, meanwhile, includes a hotel and two residential units. The development is located close to Marienplatz, Munich’s main square, as well as the Bavarian State Opera.

Maximilianstrasse 12-14, central Munich

HIGHER yields thanks to rent growth and valuation decline, reduced development activity, higher input costs and ESG requirements will underpin the value of

high-quality existing assets according to John O’Driscoll, global cohead of real estate, AXA IM Alts. In particular, he foresees positive tailwinds for logistics, which the company believes will continue to perform strongly despite having seen some of the highest rental growth of any European real estate sector.

“We also expect continued performance in operational real estate sectors, including life sciences and film studios, each of which has experienced marked rental growth in recent years driven by a supply/demand imbalance,” he said. “However, despite the potential to make a case for investment there are also some areas to be mindful of, including the interest rate trajectory, selling activity from those who haven’t been able to execute in 2023 and the potential for some restructuring.” From a capital markets perspec -

tive, questions around access to debt are likely to dominate conversations at MIPIM, he believes, presenting opportunities for alternative lenders looking to back best-in-class sponsors with high-quality assets at rebased valuation and an attractive loan-tovalue and debt yield, offering an attractive rate of return.

“There are some questions in the market as to how long these rates of return will prevail, but there is little debate around the role and potential for growth of non-bank lenders, which has increased consistently since the previous financial crisis,” he added.

Decarbonisation and digitalisation are also likely to be key themes this year, presenting significant value-add opportunities for those with the right strategies and investments in place to support the green-energy transition, O’Driscoll said.

LONDON-based FRISIA Real Estate has built a pipeline of over £40m (€47m) of UK development projects including a £20m residential scheme in Hayes, to the west of London, a £15m aparthotel in Birmingham and a £6m student-accommodation project in Lancaster.

In Lancaster, FRISIA has now received planning permission and work has started for the Pump House site, St George’s Quay, to provide 35 purpose-built student en-suite studios behind the original pump house façade.

The site was acquired from Landsec U+I and is being developed to BREEAM Excellent standards.

The transaction is fully funded with equity from an international high-net-worth individual and

debt from a UK development finance lender, FRISIA said.

“We see huge opportunities in the UK living market, including build-to-rent, private rented, build-to-sell, purpose-built student accommodation, senior liv-

ing and aparthotels — especially in the £5m to £25m bracket — and we are at MIPIM to seek out more development opportunities,” FRISIA development director Nick Langford added of the company’s strategy.

FRISIA Real Estate founder Adenekan Adeniran (left) and development director Nick Langford

AXA IM Alts’ John O’Driscoll

FRISIA Real Estate founder Adenekan Adeniran (left) and development director Nick Langford

AXA IM Alts’ John O’Driscoll

Selbst nach der Transformation der Branche wird ESG ein beherrschendes Thema bleiben. Egal ob für Bestandshalter, Banker, Immobilienentwickler oder Dienstleister – ohne Nachhaltigkeit im E, S und G-Sinne, wird Geschäft kaum noch möglich sein.

Die Themen im Überblick:

• Welche ESG-Maßnahmen bei der Transformation helfen?

• Warum es jetzt wichtig ist, auch in das „S“ zu investieren?

• Wie ESG die zukünftigen Bilanzen verändern wird?

Mehr Infos unter www.immobilienmanager.de/imfokus

Partner:

GERMANY’s Deka Immobilien has acquired an office in the historic centre of Rome on Via Veneto from investment house Ardian. “The fantastic location and quality of the property are unique selling points on the Roman market. It’s the first building in Rome to receive triple certification,” said Victor Stoltenburg, managing director of Deka Immobilien.

The office building, Veneto 89, was built in 1928 and has recently been fully renovated. It is occupied by two tenants, of which Deloitte Italy is the main one.

The building has achieved a first in Rome, winning the Leadership in Energy and Environmental Design (LEED) Gold standard, a Very Good rating by BREEAM, and the WELL Silver standard, which places strong emphasis on the health and comfort of a building’s users.

THE LOMBARDY region’s “diverse opportunities” will be on show at MIPIM once again, according to regional councillor, Guido Guidesi, who has invited international investors to visit the Lombardy stand to get to know this part of Italy better.

“This year we have identified 23 projects, ranging from hospitality/tourism to education/ training, from student to senior housing, from residential to ser-

vices,” Guidesi said. “The range of projects represents almost all the provinces of Lombardy, in greatly varying contexts, from mountains to lakes, from historic centres to rural plains.” Guidesi said that the region had been able to bring together this rich tapestry of opportunities, thanks to the support and co-ordination of its varied towns and boroughs. He added: “As a region, we have a duty to back the

realisation of these projects and to facilitate connections with international operators. Once enquiries have been gathered, we are ready to work together to turn that potential interest into real investment.” Guidesi said that Lombardy had become one of Europe’s most attractive regions, thanks to an “ecosystem ranging from education to research, through supplies, services, and production; this is the added value that Lombardy offers to those who want to invest.” He also noted that many of the most exciting projects across the region were connected to its vibrant past, namely “ideas linked to the industrial and productive history of Lombardy’s various boroughs”. He said that the region also wanted to make known its wider territory, beyond Milan, while boosting the connection between the region and its capital with its Milan & Lombardy initiative, launched jointly with the Municipality of Milan.

EXTENSIVE plans for infrastructure investment are set to revamp the coastline around Geona and help regenerate many of the western parts of the city, according to Mayor Marco Bucci. “Our port will once again become a central hub in the Mediterranean, thanks to our new dam,” he said.

The breakwater dam under construction — set to be the deepest in Europe — will allow larger ships to enter the facility.

Bucci said that there were also plans to improve rail connections with Milan and improve its motorways. “This will enable our city

to attract more inhabitants, tourists, and investors from all over the world,” Bucci said.

The city is also about to launch its new public park — the Parco dei Forti — “where people can visit the ancient walls and fortifications of the city: it’s the longest city wall in Europe and the second in the world after the Great Wall of China!”

Bucci said that the plans were being executed with an eye on sustainability, “including interventions for climate change mitigation and adaptation across services and infrastructure”.

Mayor Marco Bucci, city of Genoa

Guido Guidesi, Lombardy region

Mayor Marco Bucci, city of Genoa

Guido Guidesi, Lombardy region

DEMANDEZ UNE DÉMO

Visualisez et explorez les données de marché en temps réel* avec un niveau de détail inégalé (chaque transaction est détaillée)

*Source CFNEWS DATA, données compilées et structurées par nos analystes, vérifiées par nos journalistes experts du Real Estate

Filtrage des données par stratégie, régions, typologie d’actifs, investisseur, valorisation métrique...

Suivi jour après jour des grandes tendances de l’investissement immobilier

Cartographie complète des transactions en France avec géolocalisation

Graphiques et transactions exportables & exploitables immédiatement (Excel, PDF, PNG, JPEG)

AFTER a turbulent 2023, concern that commercial real estate will face additional challenges in 2024 is being tempered by emerging opportunities, according to Seema Shah, chief global strategist at Principal Asset Management. “While the office sector may remain vulnerable, other sectors remain well-funded and will be supported by a constructive economic backdrop, setting the stage for a transformative year in commercial real estate,” Shah said.

Turning to refinancing matters, she added: “While the maturity wall is undoubtedly significant, the overall refinancing risk to the commercial real estate market should be relatively well contained for several reasons.” Such reasons include policymakers wanting to shield the economy from stress, the resilient US economy, and the stronger fundamentals of assets such as residential, which represent some 30% of the outstanding debt, she noted.

RESEARCH from asset manager

AEW suggests that Europe is the region most challenged by the imminent wall of refinancings in real estate.

The firm’s first global Debt Funding Gap (DFG) analysis provides insights on the relative refinancing challenges faced by Europe, the US and Asia Pacific. According to the research, Europe leads with the largest DFG on a relative basis, standing at 16% of loan originations, closely followed by the US at 14%, with Asia Pacific remaining relatively immune.

Office loans consistently emerge as the primary concern across all three regions, followed by multi-family and retail sectors, which have experienced significant capital value declines during the recent economic cycle.

In Europe, Germany and the Nordics exhibit the highest DFGs at over 22% and 18%, respectively,

while the UK and Southern Europe are best placed at 9% and 11%.

Hans Vrensen, head of AEW research & strategy said: “This is the first time we’ve expanded our DFG analysis to show the extent of the refinancing challenge globally.

“Europe has the widest gap, closely followed by the US, with Asia relatively immune. Unsurprisingly the office sector shows the widest gap,” he added.

Despite the US seeing similar value declines to Europe, detailed loan maturity data for 2024-26 contributes to a declining DFG in 2025 and 2026, compared to 2024. There is a more diverse landscape in the APAC region, with major markets such as Australia, Singapore, South Korea and Japan, as well as Tier 1 cities in China, all facing a DFG of 7.6%, lower than that for both the US and Europe.

AAREAL Bank has financed the majority of a hotel portfolio deal in London acquired by a controlled affiliate of Starwood Capital Group.

The portfolio comprises a collection of 10 hotels with 2,053 rooms, all located in London and operated under the Radisson Blu brand.

The bank provided a loan for eight assets within the portfolio while acting as the arranger, facility agent and security agent.

The acquisition adds to Starwood Capital’s existing portfolio of European hotel investments, which following the transaction will comprise 47 hotels with around 10,000 rooms across Europe.

Bettina Graef-Parker, managing director, special property Finance at Aareal Bank, said: “We are honoured to support Starwood Capital in this significant acquisition, leveraging our expertise in the hospitality sector and providing financial solutions to realise their strategic vision.” Tim Abram, managing director at Starwood Capital said: “We are delighted to have Aareal Bank as our partner on the acquisition of this one-of-a-kind portfolio of London hotels. The transaction continues our long-standing relationship with Aareal Bank, whose team has a deep and impressive knowledge of the hotel industry.”

Aareal Bank’s Bettina Graef-Parker

AEW’s Hans Vrensen

Principal Asset Management ‘s Seema Shah

Aareal Bank’s Bettina Graef-Parker

AEW’s Hans Vrensen

Principal Asset Management ‘s Seema Shah

THE RESULTS of a survey on the adoption of artificial intelligence (AI) within the real estate sector have revealed a mixed level of integration among large firms. The survey by Remit Consulting highlighted the challenge of adoption and also ensuring that staff are adequately trained. In all, 64% of firms surveyed are either experimenting with AI on a trial basis or using it ad hoc, while the UK-focused research also highlighted that only about a third of firms have policies to navigate challenges, including confidentiality, intellectual property and the credibility of AI-generated outputs. Andrew Waller, founding partner of Remit Consulting, said: “This mixed reality of AI adoption serves as a wake-up call to firms.” He will present the findings during BPF’s Top Tech Trends In Real Estate, today at the JLL Marquee.

DENMARK’s Urban Partners has been selected by the Science Based Targets initiative (SBTi) to pilot guidelines aimed at helping companies across the built environment to set targets that align with science-based decarbonisation pathways.

Urban Partners is one of only 15 firms from across the world that have been selected to test SBTi’s Buildings Science-Based Target-Setting Guidance and Tool which contains science-based target-setting methodologies, tools and guidance for companies in the building sector and other stakeholders.

Urban Partners’ contribution is grounded in the portfolio of its real estate investor, Nrep, and considerable experience as a sustainability-led real estate investor and developer. The guidance intends to enable companies to meet the 1.5°C goal

of the Paris Agreement through appropriate emissions accounting and reporting, as well as target setting and validation.

Over the last year, the firm has worked to establish a GHG emissions measurement and target setting framework that is based on the SBTi’s draft, published in May 2023. After being selected to pilot the industry guidelines, Urban Partners will share their datasets and actively engage in identifying possible amendments to be made to SBTi’s resources.

Elisabeth Hermann Frederiksen, head of sustainability at Urban Partners, said: “No company can achieve a full transition in isolation. Collaboration and alignment is crucial in framework development to identify best-practises and work transparently towards a shared objective. By actively supporting SBTi on this industry guidance and target-setting tool, we contribute with our knowledge and aim to collaborate in a global context to help accelerate clarity and action together.”

UNION Investment has sold the VisionCrest Commercial office building in Singapore to a real estate fund managed by TE Capital Partners, for a price above current valuation. Union Investment acquired the property in 2007 as a development for the portfolio of the open-ended real estate fund UniImmo: Global.

Adam Irányi, head of investment management global at Union Investment said: “After a holding period of around 16 years and the successful implementation of planned asset management initiatives, we have taken the opportunity to optimise the portfolio, as the age and size of the building in particular no longer fit in with the current strategy of UniImmo: Global.

“The freed-up liquidity gives us scope for new acquisition opportunities, as we plan to continue investing in the Asia-Pacific region for our funds in the future.”

VisionCrest Commercial is located

in Central Singapore at the Eastern end of Orchard Road. Completed in 2008, the property comprises 11 upper floors and two basement floors. It is currently 99% let and holds a LEED Gold sustainability certificate.

The VisionCrest Commercial office building in Singapore

Urban Partners’ Elisabeth Hermann Frederiksen

The VisionCrest Commercial office building in Singapore

Urban Partners’ Elisabeth Hermann Frederiksen

Leeds

MIDDLESBROUGH

Liverpool

PRESTON

POLISH industrial developer LemonTree has unveiled plans for a new warehouse and office project destined for Zabrze in Upper Silesia. Booster Zabrze will be a modern business complex with offices and service and logistics space, which will be built directly on the Silesian Central Motorway, at the intersection of the A1 and A4 motorways. Commercecon has been appointed as general contractor.

“This investment is not only another boost for the local economy but also creates a new area for the local community,” said Małgorzata Mańka-Szulik, the Mayor of Zabrze. “The developer has presented an interesting project that fits into the modern image of Silesia, promoting innovation and sustainability. We hope that the development will attract more investors to our region, and will serve the residents of Zabrze for years to come.”

LOGISTICS specialist Clarion Partners Europe has acquired a portfolio of eight modern logistics properties across Germany and the Netherlands for €270m, on behalf of one of its co-mingled funds.

The portfolio, totalling 241,400 sq m, was acquired from funds managed by Blackstone. Since March 2023, Clarion Partners Europe has now deployed, or committed to deploy, some €960m into high-quality European logistics assets.

Rory Buck, managing director, Clarion Partners Europe, said: “Germany and the Netherlands are logistics markets where we see significant opportunity given their favourable supply/demand dynamics.

“Since Q1 last year we have accelerated our investment activity and over the course of 2023 committed to acquire approximately €1bn of assets. With further significant capital to deploy, we are targeting a similar trajectory in 2024.”

The portfolio consists of six mod-