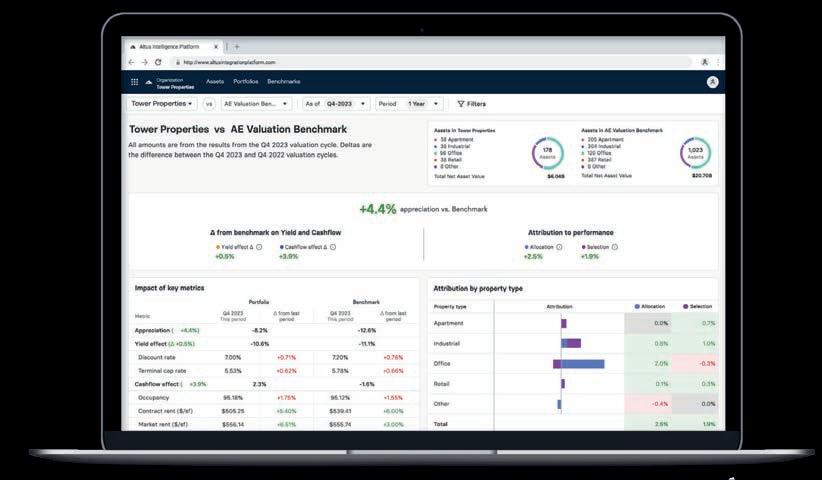

Revolutionising how you model, monitor, and manage your assets, portfolios, and funds.

Make data-driven decisions with ARGUS Intelligence, our next-generation solution for CRE investment management.

Unlock valuable insights and transform the way you analyse and manage your CRE portfolio. With ARGUS Intelligence, you will be able to:

• Conduct scenario analysis while accessing asset-level metrics and underlying assumptions.

• Generate insights into asset, portfolio or market-level performance.

• Perform comprehensive attribution analysis and compare against the ARGUS ecosystem.

• Compare and analyse both TradVal and DCF valuations in one model.

We’re exhibiting: R9.E.T

Stop by our booth to learn about Benchmark Manager, the newest add-on to ARGUS Intelligence.

For an inside look, scan the QR code.

Coliving, Vilnius, hospitality, Montreal, decarbonisation, talent, Wallonia, student housing, regeneration, industry trends, Egypt, affordable homes, Porto, Stockholm

All the session details, expert speakers, conferences and events, to help you plan your time at MIPIM and make the most of the latest intelligence, insights and debate

at MIPIM

Italia Trade Agency ITA launched proceedings with a ribbon cutting by ITA’s Marco Leone (left); Emilio Lolli, the Italian consul to Nice, and ITA’s Luigi Ferrelli

DIRECTOR OF PUBLICATIONS Michel Filzi EDITORIAL DEPARTMENT Editor in Chief, Isobel Lee; News Editor, Julian Newby; Sub Editors, Neil Churchman, Joanna Stephens; Proof Reader, Debbie Lincoln; Reporters, Adam Branson, Clive Bull, Ben Cooper, Mark Faithful, Andy Fry, Liz Morrell, Nigel Willmott; Editorial Management, Boutique Media International; Graphic Studio, studioA Design; Layout Designers, Harriet Palmer, Sunnie Newby; Head of Photographers, Yann Coatsaliou/360 Medias; Photographers, Cyril Chateau, Patrick Frega, Phyrass Haidar, Olivier Houeix, Sebastien Nogier PRODUCTION DEPARTMENT Publishing Director, Martin Screpel; Publishing Manager, Amrane Lamiri; Printer CREAMANIA (France).

Advertising contact in Cannes Aswad Regent aswad.regent@rxglobal.com RX France, a French joint stock company with a capital of 90,000,000 euros, having its registered offices at 52 Quai de Dion Bouton 92800 Puteaux, France, registered with the Nanterre Trade and Companies Register under n°410 219 364 - VAT number: FR92 410 219 364. Contents © 2025, RX France Market Publications. Printed on PEFC certified paper

The MIPIM opening reception gave delegates the chance to network, making old and new acquaintances in Cannes

20 000 m2 de bureaux, loggias privées et espaces exclusifs en plein cœur de Paris La Défense, le ciel est à vous.

Al Alamein Hotel stands as a timeless retreat along the pristine shores of Sidi Abd El Rahman.

It is a historic sanctuary not just a place to stay,it's a cherished destination that holds a special place in the hearts of its guests.

Famous

You provided the colour and the entertainment in Cannes, unveiling bold stands, welcoming events and even sensational outfits on Tuesday at MIPIM

The Palais des Festivals Grand Auditorium was standing room only to hear Dr Mario Draghi, former president of the council of ministers in Italy and president of the European Central Bank, deliver the 2025 opening keynote at MIPIM. Greeted enthusiastically by delegates, Dr Draghi covered an intriguing range of topics from interest-rate policy to the link between innovation and productivity. In a series of thoughtful exchanges with Les Echos editor in chief Christophe Jakubyszyn and Newmark CEO Barry Gosin, he declared that decarbonisation is crucial to the future of Europe. He signed off by telling his audience to “have faith in Europe”.

In the largest adaptive reuse project in NYC in recent history, Terminal Warehouse in West Chelsea has been successfully restored and transformed into a high-performance workplace and retail destination. Originally constructed in 1891, the sensitive redevelopment emphasizes restoration and authenticity. The result is a 700-foot-long groundscraper with unrivaled character, form and functionality. A 21st century work-play asset.

MOHAMED Saad, president of the Diriyah Development Company (DevCo), yesterday unveiled two new projects that will form part of the second phase of Diriyah’s urban masterplan in Saudi Arabia.

They include a future-focused Media and Innovation District, which will comprise 250,000 sq m of space, 80% of which will consist of office space for headquarters of multinational companies looking to come to the region. “It is a hub for media, tech, creative and AI companies,” Saad said. In addition to the offices, the district will include 450 residential homes and more than 15,000 sq m of retail and dining space. It will also feature a 325-room luxury 1 Hotel Diriyah, which will be located near the planned multipurpose 20,000-seater Diriyah Arena. Saad also announced the launch of Armani Residences Diriyah, which he described as “15 beautifully curated apartments designed personally by Giorgio Armani”. The apartments will be located in Diriyah Square near the Armani Hotel Diriyah, which broke ground last November. They will

range in size from 1,200 to 1,900 sq m and will include three design concepts: the Palm Residences, The Botanical Residences and The Royal Penthouses.

Like many of the other branded residences launched previously as part of the development, Saad said he expected the Armani apartments to sell out fast. Such intense interest is driven by the fact that the project is coming to fruition. Saad added: “We are on budget and on time. It is challenging and, inevitably, we will face challenges, but we are actively managing them. When you look at Diriyah, people can see that we are actually delivering. We are actively working onsite. This is not a future project — something planned for 30 or 40 years from now. In the next five or six years, people will be walking the streets of Diriyah, staying in the hotels, and working and living there. We are delivering on our promise.”

Once completed, Diriyah aims to provide homes for more than 100,000 residents, create an estimated 178,000 jobs, attract 50 million annual visits and contribute $18.6bn (€17bn) directly to Saudi Arabia’s GDP.

MAYOR of London Sadiq Khan is at MIPIM to bang the drum for the UK capital, seek new investment to accelerate the delivery of affordable homes and unlock new infrastructure and jobs in the city.

In a keynote address yesterday, Khan — in partnership with London Councils, the City of London Corporation, the UK Government and the private sector — launched the Opportunity London investment prospectus, which details 20 live opportunities for investment. Speaking at the London Stand, Khan pointed out that the UK government’s Planning and Infrastructure Bill was being published on the same day. “If you need evidence that you’ve got the government, the mayor, councils and businesses all on the same page, that is it,” he said. “We have a situation, unlike many other countries, where you’ve got the national government, in our case, the Prime Minister, the mayor of the capital city [and the] councils all on the same page.”

Khan cited the recently published London Growth plan as further evidence of collaboration: “We managed to get not just London councils and city hall [but also] the

business community, universities, trade unions, faith communities — everyone in London — coming together with a plan to grow the London economy by more than £100bn [€118bn] over the course of the next 10 years,” he said.

The Opportunity London prospectus includes new housing schemes and build-to-rent developments, for which there is a clear need in London, as well as student accommodation, office buildings, logistics, urban sciences and leisure developments. Khan is also promoting infrastructure and transport-hub development opportunities across Network Rail’s estate, which is worth more than £10bn.

Khan is determined that London will play its part in delivering the UK Government’s growth mission and believes attracting new investment for major housing and transport projects is vital to boosting productivity and improving living standards in London and across the UK.

His message to investors and developers at MIPIM is that now is the perfect time to invest in the UK capital. “London is not only the greatest city in the world but also the greatest city in the world to invest in,” he said.

Prime location in the business district of Krakow

Class A office with 11,900 m2 leasable office space

7 floors above ground and 3 underground levels with a car park

Flexible office spaces, by Co-Work by Memos BREEAM Certification “Excellent” WELL Health-Safety Certification mogilska35-office.com

Warimpex is a listed real estate development and investment company founded in 1959, headquartered in Vienna. Today, it focuses on dynamic markets, especially Poland, with key projects like Ogrodowa Office and Red Tower in Łódź, and Mogilska 35 and 43 in Krakow. Sustainability plays a key role at Warimpex, with 96% of the building portfolio certified. Additionally, 25-33% of spaces in new developments are designed as flexible offices to support future-oriented work environments.

Warimpex follows a long-term strategy, blending family-business agility with the transparency of a listed company. With over 60 years of experience, it has developed properties worth over one billion euros, focusing on Poland, Hungary, Germany, and Austria.

www.warimpex.com

THE MIPIM 2025 Poland Investment Forum includes the session Poland’s Silesia Region & Katowice Megacity: A New Powerhouse For Global Investments, during which a panel will examine the fundamentals that are driving growth in this emerging hotspot.

With Poland’s GDP growth among the strongest in Europe and a booming real estate sector, global investors are increasingly looking beyond the capital Warsaw. Katowice, the capital of Metropolis GZM, and the Silesia Region have evolved from an industrial centre into a hub for advanced manufacturing, business services and technology-driven industries.

Included on the panel is Piotr Staniszewski, partner in Dentons’ Warsaw office, a member of the real estate team and co-head of the construction practice group, who advises on lease projects and the construction aspects of forward-funding acquisitions of build-to-rent (BTR) projects in Poland.

CONFERENCES AND EVENTS AT MIPIM

Poland’s Silesia Region & Katowice Megacity: A New Powerhouse For Global Investments

Wednesday, March 12 13.45, Auditorium K

YESTERDAY evening’s Global ESG Awards Trophy Ceremony was a celebration of innovation, sustainability and the achievements of industry leaders from around the world in environmental, social, and governance (ESG) initiatives.

The event began with the presentation of trophies to winners of the annual GRESB Awards, presented by the Amsterdam ESG data provider’s Mathilde Petriat and Katie Aylward. A panel discussion followed that included Aleksandra Njagulj of the UK’s DWS Group — the winner of last year’s Leadership Award; sponsors Caroline Tailleferd of ESG platform Deepki and Susanne Eick-

ermann-Riepe, chair of the RICS European World Regional Board; and Mathilde Petriat of global partner GRESB.

“Amid economic challenges and growing investor pressure, the real estate sector must balance decarbonisation and building adaptation with swift, pragmatic decision-making.

Embracing ESG principles is essential for long-term value,” Tailleferd said. “Award nominees are transforming businesses, integrating sustainability, compliance and social impact into every strategy.”

Robbie Epsom, winner of the ESG Leadership Award, said the honour was a “powerful validation” of his

and his team’s “hard work and dedication”. He extended his gratitude to “fellow nominees and peers, whose collaboration and shared passion are essential. Together, we are making a real difference.”

Categories and winners:

Compliancy Award: ESG management software provider, SINGU (Poland)

EcoBalance Award: solar energy company Sunday Power (Norway)

Aqua Biodiversity Award: sustainability assessment and labelling provider NL Greenlabel (the Netherlands)

Resource Excellence Award: provider of sustainable materials Modulina Straw Panels (Lithuania)

CommuniCare Impact Award: neighbourhood social network company Hoplr (Belgium)

ESG Leadership Award: Robbie Epsom of CBRE Investment Management

PROFESSIONAL services firm

Colliers appointed four new CEOs in 2025 to operations in Germany, Italy, the Netherlands and the UK. All four were on hand at MIPIM to share their predictions and hopes for real estate.

Felix von Saucken, CEO of Colliers Germany, told MIPIM News: “I expect to see some optimism in the markets. We need to work on solutions to the big challenges that surround us, both nationally and internationally.”

Jeroen Lokerse, CEO of Colliers Netherlands said: “I look forward to adapting and making a difference in times of uncertainty. Flexibility and resilience are the keys to success in a changing world.”

John Munday, CEO of Colliers UK, added: “I’m hoping that final-

ly we see the market return to its previous strengths. As soon as we see some stability, then we can start implementing our plans for growth, which include expanding our offering to clients.”

Valeria Falcone, CEO, Colliers Italy, said: “Geopolitical tensions have caused market uncertainties

to remain. But there’s hope for stabilisation and I believe this MIPIM signals a market shift, with pandemic-resilient asset classes gaining prominence over traditional ones like offices and retail.

“If I had to identify this MIPIM in two words, I would say: a restart and forward-looking event.”

Develop the future by drawing on the expertise of a market leader with 10 years' experience in coworking and flexible office space.

Higher profitability for your spaces

Financial performance driver New approach to work through hospitality

HTL Connection Stand C21

Schedule an appointment

MULTINATIONALS nearshoring will drive demand for European industrial space because of the geopolitical landscape and EU policies, according to Bert Hesselink, client relationship director at industrial and logistics developer CTP.

“The CEE, which offers competitive prices, is wellplaced to benefit, while stronger economic growth in CEE economies should also see leasing demand for industrial space outperform most other markets,” he said. “We believe that 2025 will offer opportunities, with new demand coming from growing sectors, particularly defence and high-tech. This should mean those able to transform brownfield sites for occupiers involved in higher-value activities will be rewarded.”

The company has 1.9 million sq m GLA under construction and a landbank of over 27 million sq m, with CTP planning to raise around €2bn of debt annually to support expansion.

He added: “We see value in redeveloping brownfield sites and refurbishing older industrial properties. This has been a key part of our strategy in markets like Germany and will continue going forward.”

COMPANIES have the opportunity to optimise their building energy consumption through intelligent grid networks, according to Eaton director Andreea Laplace.

Based at the company’s EMEA headquarters in Switzerland, she said that managing building energy usage through improved strategies and automated software management can help with sustainability targets, reduce energy use and increase an organisation’s energy resilience.

“Energy storage has emerged as a major priority area for many organisations,” Laplace said. “With so many buildings now with solar panels, for example, building users can find that the utilities will pay very little during the day for power exported back to the grid, yet those buildings still

require more expensive energy later in the day. By storing the energy, buildings can operate on their own generated power.”

Laplace added that energy resilience had also become an increasingly important issue, not just for critical uses such as in

hospitals, but for broader occupier requirements in countries like the Netherlands where there are supply constraints.

“If, for example, you run a hotel you can’t just tell the guests to turn off the air conditioning, or the chefs to stop cooking,” she said. “So using energy storage can bring power resilience and make buildings more self-reliant.”

From a sustainability perspective, Laplace said that the focus was on local generation from many points, including solar panels and renewables such as wind power, with that energy then used very locally.

“This means that intelligently managed buildings can run hand in hand with the utility infrastructure, using automated software to optimise energy generation and usage,” she added.

THE HOUSING-supply shortage currently experienced by many European cities is the driving force behind the Valdecarros Madrid project, Spain’s largest urban regeneration scheme.

Leading the project, Luis Roca de Togores, president of Valdecarros Madrid, is at MIPIM to tell the story of the development, which spans 19 million sq m.

“Madrid is growing in the next 10 years to a metropolis of eight million people, and Madrid is an investment opportunity people should not lose,” he said. “We have a clear shortage of housing supply, but Madrid is working on 28 different housing developments to cover that shortage over the next five to 10 years. Within those developments Valdecarros is the biggest bet in terms of affordable housing. We are working to develop 51,000 housing units.”

De Togores added that the pro -

ject is more than just a housing development. “It’s a city within Madrid. So actually, there need to be a mix of uses that really represent a city. We are working very strongly from both private and public points of view on facilities to develop hospitals, schools and any services that the people that are going to live there may need.”

Enabling works have begun, and building is expected to commence next year.

“We have the product. We have the resources but we want the rest of the investment community to join us so that we can make a stronger and more diverse city and environment for the people in the years to come,” he said.

e assemblaggio

del cantiere

Impiego in hotel strutture ricettive ospedali, condomini centri commerciali

THE CITY of London is enjoying a revival in the wake of the COVID pandemic, according to Chris Hayward, policy chairman of the City of London Corporation.

“London is open for business,” he said. “The City of London in particular is really having something of a renaissance at the moment. Post-COVID, I launched a policy called Destination City, which was designed to get new footfall and new spend into the City.

“We’ve built a really strong night-time economy. We’ve built a really strong retail offering as well, and what we found is that we can’t actually build tall towers fast enough to deal with the appetite from global investors and developers.”

As a result, Hayward said that the demographic of the City had changed significantly.

“It’s much younger than it used to be and young people want to work in Grade A sustainable buildings,” he said. “They want to work and play in the same place. They don’t want to do what they did 30 years ago, when the pubs closed at nine o’clock and you had to go to the West End or you had to go home.”

MKG Consulting chief operating officer, Sylvie Bergeret, has the difficult task of organising market studies and conferences, including at MIPIM, in the face of uncertainty created by the often contradictory statements and actions of the new American administration.

She thinks the industry’s response for now is to keep calm and carry on, continuing with existing plans until the real-world impacts of Trumpism are clear. For the moment, that means that the hotel sector is a dynamic one. However, while dynamic overall, the sector is also a mixed story.

“The upscale, luxury end of the market is doing very well, but the economy sector is struggling,” Bergeret said.

One of the mainstays of the budget-hotel sector is construction workers, but, with both the housing and commercial sectors

faltering, there are fewer developments and fewer workers needing hotel rooms.

Across Europe, this means that hotels are booming in Spain and Italy, driven by their appeal to well-off US tourists; France and the UK are stable; but the German market is more difficult, Bergeret said.

The ongoing importance of the hotel sector has been recognised at MIPIM by the new hotel, tourism and leisure hub, HTL Connection. Bergeret has been involved in organising the conference sessions covering what has become one of the most attractive assets in the property market.

With most of the main hotel operators exhibiting, including Hyatt, Accor, Best Western and Radisson, the HTL sector has moved from niche to being a primary focus of international interest and investment.

THE RECENT upsurge in support for spending on defence across Europe could provide an unexpected boost for old industrial areas still in economic transition like the Wallonia region of Belgium.

It is a sector in which Wallonia has long had expertise, according to Alphi Cartuyvels, senior executive for public and corporate affairs at the Wallonia Export and Investment Agency. Defence contractors based there include FN Herstal Browning, John Cockerill and Safran. The former coal-mining region has already seen new large companies emerge in sectors including biotech, medical and logistics — one of the region’s main assets is its central position in Europe, he added. It is the 23rd year that Wallonia has participated at MIPIM, along with many of the same public agencies

and real estate companies. This year the stand has 15 co-exhibitors and 68 partner companies.

“The theme this year is circularity,” Cartuyvels said. “That’s to say, sustainability, waste reduction, reduction in carbon footprint, and efficiency in use of resources and materials. It’s a condition of survival for all our companies and a goal all of them pursue.”

Visibility of the region to the real estate industry is one of the main aims of the investment agency at MIPIM. “If the real estate companies know we exist and the region’s potential, then they will help bring the industrial and commercial companies that we need to rebuild our economy,” Cartuyvels said.

And the organisation is not just doing its best to help its region. Ac-

cording to Cartuyvels, 400 of the around 1,000 Belgians at MIPIM have registered through the agency.

13H30

Chaque semaine, SMART IMMO explore les tendances du marché immobilier, les innovations durables, les enjeux économiques et réglementaires, pour anticiper les transformations et valoriser les projets immobiliers. Une émission incontournable pour celles et ceux qui façonnent la ville de demain.

MARCO Grassidonio, country head, Italy, at real estate giant Garbe, is using MIPIM to persuade investors that now is the time to stake their claim in his home country.

Grassidonio, who is also on Garbe’s investment board, said that several factors have aligned to make Italy an irresistible investment opportunity. “Inflation is low, unemployment is down and we have a stable government, which is something of an exception in Europe right now. So if you look at the political and economic fundamentals Italy is not what investors have found in the past.”

Drilling down, Grassidonio said

the country also offers some tantalising opportunities in areas where Garbe is at its strongest — logistics, retail, residential and infrastructure. “In logistics, Italy has a much lower level of stock than Poland — but double the population,” he said. “When you also consider that it has the lowest ecommerce penetration in Europe, there is a clear opportunity for growth.”

There is similar untapped potential in areas like student housing, supermarkets and renewables infrastructure. On the supermarket front, Garbe was involved in a statement €230m deal for 22 Coop retail outlets at the start of this year. As for renewables,

“there is such a lot of sun in Italy, that there is a big opportunity in terms of highly-efficient photovoltaic installations”, he said. At group level, Garbe is active across Europe and recently made its first move beyond the continent — opening an office in Singapore. “Asia is a key opportunity and Singapore is the perfect place to start fund-raising for our expansion,” he said.

In terms of the temperature of the investment market, Grassidonio believed things are hotting up: “There is huge pressure from opportunistic investors to invest, because they believe that core investors are poised to come back. As for the core investors, they are looking at opportunities they didn’t want to consider one or two years ago. I think that everyone is waiting for someone else to make the first move.”

AS SAUDI Arabia looks to deliver on its Saudi Vision 2030 growth plan, improving the standards of employee accommodation offers a key opportunity for investment, according to Mark Taylor, CEO of Smart Accommodation for Residential Complexes Company (SARCC). SARCC was created by the KSA’s (Kingdom of Saudi Arabia) Public Investment Fund (PIF) at the back end of 2022 with its first asset acquired at the end of 2023. It is working as a financier, developer and operator.

“We have a mandate to elevate employee accommodation,” Taylor said. “We’ve chosen those words carefully as they cover three segments — workers, staff and management,” he added.

Saudi Arabia currently has a requirement for four million beds for the expat workforce needed to deliver the 2030 plan. “We’ve

got a big market that is arguably there for the taking,” Taylor said. “There is a lot of opportunity up and down the country,”

Taylor said.

The focus is on offering quality of life to help attract a quality workforce and reduce attrition. “We have got to elevate standards for the future.” This plan will involve a more tailored offer being developed by better understanding the facilities that different workers — and different nationalities — might need and use.

The company’s first products will be launched next year. Taylor said the SARCC brand would be used but that the company was also developing sub-brands depending on the price point. For instance, the workers offer will include worker, worker plus and worker premium.

“We are elevating market standards in employee accommodation

from what it has been historically. The end goal is quality of life for everyone.

“That’s our vision. We do that

by better quality construction and better design — designed for the target audience that will live there.”

3-4 December 2025

Rosewood Hong Kong

NREP, Urban Partners’ real estate investment and development vehicle, has entered into a joint venture focused on the Finnish care-home market with Plus Hoivakiinteistöt, a local company that specialises in carehome operations.

The joint venture will cover the development and operation of the care homes, with €400m allocated for investment over the next three years. The development of an initial eleven care homes — valued at €70m — is scheduled to begin this year. Negotiations are ongoing for more than €100m-worth of further projects.

“All assets must benefit from strong transport connections and be within, or in the vicinity of, growth centres,” Nrep said in a statement. “Solutions such as geothermal heat, solar panels and lower-emission building materials will be utilised in the portfolio’s construction, aligning with Nrep’s sustainable investment principles.”

Joonas Lemström, head of Nrep Finland, said: “The Finnish care-home market has suffered from a lack of investment in recent years, which has created significant pentup demand, something which has only been exacerbated by the country’s ageing population.”

ARCADIS, the Netherlands-based global design, engineering and management-consulting company, has officially launched its first-ever design forecast at MIPIM. The report, The Design Perspective, offers a blueprint for human-centric design, innovation and sustainability

in a rapidly changing world.

Mansoor Kazerouni, Arcadis’ global director of architecture and urbanism, told MIPIM News: “It’s really a forward-looking perspective on the future of cities and how we address some of the greatest challenges that we’re confronting in the built environment as they relate to climate change, rapid urbanisation, technology and digitisation, and of course human centricity, which I think has come to the forefront post-COVID.”

The Design Perspective explores 10 questions, and while there is no one simple answer, there is a common theme, Kazerouni said. “Sustainability needs to be at the core of everything that we do as it relates to the built environment. It’s not a one-size-fitsall solution, and the report actually outlines multiple paths of achieving those sustainable outcomes.”

He cited regenerative design, the use of sustainable materials, passive house building through engineered facades, adaptive re-use and transit-oriented communities as examples of solutions

that lead to sustainable outcomes. “What’s interesting about it is the outcome. The objectives are always aligned and the same. There are different ways to get there.”

He added: “I think the advent of AI and digital twins and technology also gives us a unique advantage in terms of achieving these outcomes because we have the ability to use evidence-based research and quick optioneering to arrive at simulated outcomes, so that we don’t waste effort, energy and material cost in building something. It’s a highly predictive kind of process.”

“So, there are these themes that are emerging where we know what the challenges are, we know what the objective is, and we have the tools to achieve them. I guess that’s the big finding.”

And MIPIM, he said, is a perfect fit for launching the company’s first-ever report. “It’s a great forum to exchange ideas related to the future of cities, and as you can surmise The Design Perspective is addressing just that.”

TRANSACTION volumes in European real estate are recovering despite some institutional investors having arguably too much property on their balance sheets, according to Holger Matheis, CEO of Swiss Life Asset Managers, Germany.

“We won’t be back to where we were three years ago, that’s for sure,” he said. “Nevertheless, we see already that last year the take-up in the market was much better than the year before. Investments are being done. Transactions have increased, especially in the last quarter of last year.”

Matheis added that lower interest rates have certainly helped. “Interest rates have come down, although not as much as we were expecting, so that helps as well. We will have a better market this year than we have had.”

In terms of sectors, Matheis said that Swiss Life is concentrating its

efforts on what it calls the “four Ls”: living, light industrial, logistics, and life sciences and technology. “We always take life sciences

and tech together,” he said.

Matheis also highlighted Swiss Life’s vast Frankfurt Westside project. The former industrial site, which was originally used to produce chemicals, was acquired by Swiss Life and its subsidiary BEOS in 2020 and is currently being regenerated.

The development requires an investment of around €1.3bn, includes plans for more than 70 buildings and will create a new mixed-use commercial and industrial district. Completion is scheduled for 2035.

Matheis said that Swiss Life has the financial firepower to deliver the entire project by itself, but added that he would be open to working with other investors. “We would look at working with partners,” he said. “We don’t need that, but it could be that it makes sense to slice the elephant into smaller parts.”

“WE’RE here, we can help, we can deliver homes, we can do this.”

That is the message from Mike De’Ath, partner at UK-based HTA Design.

Addressing the drive for new housing in the UK, De’Ath told MIPIM News that he is very positive about the “innovative ability” of the housing sector to rise to the challenge.

“We have a government that has set its sights on a very high goal,” he said. “That’s a very good thing and to be applauded and supported. So, in many ways, my time here is to meet with government people, to support them and not to continually challenge,” he said. However, De’Ath said there still remain barriers to delivery that need to be resolved.

While the UK government is tackling planning issues — which he strongly welcomes — the regulatory environment has become harder because of the introduction of the Building Safety Act. “I’m confident that the machinery will get slicker, but it’s far from slick at the moment,” he said. De’Ath added that the sector is also dealing with a slew of unintended consequences from regulation.

Striking a note of cautious optimism, De’Ath said: “Let’s celebrate that we have a government that’s steadfastly focused on the delivery of more homes and, — alongside that — infrastructure.”

Further cause for optimism comes in the form of the government’s upcoming comprehensive spending review and long-term housing strategy, along with the New Towns Taskforce and the UK’s Industrial Strategy.

“All these things coming together is very good news,” he said.

With the number of imminent UK initiatives, De’Ath said the housing sector now has a responsibility to deliver.

“This is the government setting out its stall and it’s up to all of us here from the private sector and the public sector to meet that challenge,” he said.

Meanwhile, HTA Design’s Eden

Dock scheme — a new public space in the heart of London’s Canary Wharf — has been delivered and is shortlisted at the MIPIM Awards.

“We pride ourselves on not just designing great buildings and places and gardens and parks, but delivering them,” De’Ath added.

RURAL Manitoba Economic Development (RMED) CEO Margot Cathcart is at MIPIM to connect with investors and highlight the Canadian province’s investment-ready opportunities in industrial parks, business hubs and key infrastructure. She is part of a wider collaboration of Canadian representatives in Cannes to promote opportunities in the country.

Cathcart said the Manitoba area was ideal for manufacturing, logistics, agri-food processing and industrial development, with a range of opportunities available for interested investors. “We’ll be highlighting our capital Winnipeg and we’ve also got four rural communities that are open and investment-ready,” she added. These include the city of Brandon, a food and chemical manufacturing hub that offers 178 acres of rail-accessible industrial land, as well as the city of Dauphin, which is focused on agriculture and offers 123 acres of fully-serviced industrial land. Dauphin also offers strong incentives for businesses looking to establish operations in the city.

The region of Portage La Prairie, meanwhile, is one of Manitoba’s

largest industrial clusters. With more than 300 acres of available land, it is already home to businesses including the world’s largest pea protein-processing company Roquette and frozen-food giant McCain.

In addition, the municipality of Richot offers significant manufacturing and logistics opportunities, Cathcart said.

Cost-effectiveness, “from the cost of the land to operating costs”, alongside a reputation for reliability are key factors in attracting investors to Manitoba, Cathcart said, noting that the province also offers a talented workforce, a focus on green energy — 99.6% of the region’s electricity comes from renewable sources— and free-trade agreements with more than 50 countries.

“They are stable agreements,” she added. “We have great relationships with countries all over the world. We are open for business, affordable and green. Manitoba is a very exciting place to be.”

This is Rural Manitoba Economic Development’s third year at MIPIM. “The first year, it was just Manitoba, but it’s now expanded to include the region of Nova Scotia,” Cathcart said.

Subscribe to Property Week and get your

first 6 months at 50% off*

Subscribe now to get:

Instant access to propertyweek.com

Weekly digital magazine (47 issues a year)

Property Week app on multiple devices

Tailored newsletters of your choice

Special features and supplements

PLUS £100 off on Property Week conferences

Upgrade to print and include a weekly copy delivered to your door or desk.

Subscribe here using the QR code

Our key events this year include Later Living, ESG EDGE, Rental Living, Student Accommodation, and more! Check out all events on the propertyweek.com website.

Plus, access your exclusive MIPIM saving of £180 on this year’s Later Living Conference using code MIPIM415!**

proptech

firm Silex is attending MIPIM for the first time in order to drum up business in Europe and the Middle East.

“We’re looking to get to know people, get to know the market, understand where the biggest developments are happening right now in the world and target those potential clients,” said Firas Saab, associate at Silex. “We want to bring forward our solution and collaborate with clients to add value.”

Saab said that he and his team have already held several productive meetings in Cannes. “MIPIM creates a big buzz around the city,” he said. “We’ve met very interesting people and built very fruitful relationships that we believe are going to be useful for us in the coming months and years.”

Silex, which was founded in 2017, has been deployed at multiple complexes in the Montreal region. “We’re looking to expand now and we’re in talks with a lot of projects in the Middle East as well as Europe,” Saab said. “We’re hoping to be deployed there within the next couple of years.”

FIRST-time MIPIM attendee and leader of Newport City Council, Dimitri Batrouni, is in Cannes to showcase the investment opportunities in the Welsh city and to build on the location’s growing reputation as a hub for semiconductor manufacturing and data centres.

Among the major companies to have opened facilities in Newport are: the US data-centre giant Vantage; Microsoft, which has also opened a data centre on the edge of the city; and KLA, which has developed a £100m (€118.5m), 19,500 sq m manufacturing and R&D centre.

Batrouni, who has been at the helm of the council for under a year, is focused on accelerating inward investment into Newport.

“We are just one hour and 40 minutes from London by train and the station is at the heart of the city,

which gives us great connectivity with the capital,” he said. “We believe there is huge untapped potential to regenerate Newport as an important data-led hub. With high-end engineering jobs here, this is also an affluent area, with city-centre living available in what is a beautiful historic city.”

As leader of the council, Batrouni said that he is keen to engender a culture of entrepreneurship within the local government, to facilitate the delivery of investment and change. “We are the fastest growing city in Wales and our message is that we have power, people and land,” he added. “What we’re looking for is more inward investment to fulfil the huge potential that Newport offers.”

Newport is attending MIPIM as part of the Cardiff Capital Region delegation.

VILNIUS, the capital and largest city in Lithuania, is showcasing its investment opportunities under the banner ‘the city of natural intelligence’, a theme that emphasises its desire to preserve its many green spaces while developing its infrastructure in a sustainable and innovative way.

The Baltic’s most populous city, Vilnius was awarded the title European Green Capital 2025 and the programme of events at the Vilnius stand reflects this environmental awareness.

Andrius Grigonis, deputy mayor of Vilnius City Municipality, is in Cannes to help spread the word about a city he feels is something of a hidden gem. He told MIPIM News: “Vilnius is a very green, very innovative, growing city, which has not been discovered by enough people yet.” He added that, while it is an honour to be named this year’s European Green Capital, it is also a responsibility — and one that the city is taking seriously, combining its nat-

ural green spaces with new developments as it expands its reputation as a hub for global businesses.

Vilnius is a green city in the literal sense. Being surrounded by forests and parks, 60% of the territory is green space. But Grigonis stressed that the green label is also about the city’s environmental vision and its implementation, its future

plans and commitments, and the involvement of city residents.

A full programme of events at the Vilnius stand includes sessions on how sustainable street construction through the EU’s Green Public Procurement initiative can drive circular, climate-neutral solutions, the future of public transport and the route to sustainable mobility.

JAE20

JAE22

JAE24

JAE26

GLOBAL commercial real estate investment recovered in 2024, up 8% year-on-year to $806bn (€740bn) having previously contracted by 43% in 2023. Global cross-border capital also grew, up 12% to $171bn, according to The Wealth Report from Knight Frank.

Private capital dominated, with institutional buyers the second most active group accounting for a third of the total at $268bn. Buyers in public markets saw the largest rise, posting a year-on-year increase of 22% in 2024. Industrial was the most invested sector — as in 2023 — accounting for just over a quarter of all global investment at $216bn. Living accounted for $205bn and office, $173bn. Retail investment declined, its global share falling from 18% in 2023 to 16%, while senior housing and care declined from 3% to 2%.

Investors from the US, Canada and the UK were the most active in cross-border capital in 2024 although, among the top 10 global sources, the only investors to increase investment in 2024 were from Sweden (+128%), Canada (+73%), the UK (+70%), the US (+61%) and the Chinese mainland (+41%).

Will Matthews, head of UK commercial research at Knight Frank, said: “The global CRE market is firmly in recovery mode, and while 2025 won’t be without its difficulties, it is set to be a pivotal year for commercial real estate.”

THE NORTH of England is being represented for the first time as a combined grouping at MIPIM

this week, with 58 partners and more than 100 delegates involved.

“We are the biggest ever first-time exhibitor with the biggest delegation attending the show,” said Dino Moutsopoulos, managing partner and head of commercial of news and events company Place North. The North of England stand is part of the UK Hub at MIPIM.

“It’s a broad offering supporting multiple towns and cities,” Moutsopoulos said. These include representatives from six local authorities — Salford, Wigan, Trafford, Bolton, Blackpool and Stockport — showcasing a range of investment opportunities. Because of its connectivity to the North Atlantic Loop— a subsea fibre optic cable connecting the US, UK and Ireland — Blackpool

is expected to be more attractive to tech companies. It is looking for investors for data centres.

Moutsopoulos said a full programme of events will showcase the region in an effort to attract additional investors and developers.

“The North of England is having its moment,” he said. “It’s highly investable and is a good proposition in terms of land and joined-up politics. Global companies looking to invest outside of London know they can do that in the north.”

Although making a big splash with their MIPIM debut, Moutsopoulos said those involved in promoting the North of England this week were already thinking about their plans for MIPIM 2026. “This is just the beginning — we are looking to expand for next year,” he said.

EINDHOVEN is entering a period of economic and demographic growth driven by a planned programme of urban development and investment, two senior figures from the city’s leadership team have said.

Carlo Schreuder, director of spatial economic development at the City of Eindhoven, said that a wave of planned urban projects — including a major new residential scheme — present a rich opportunity for partnerships with outside investors and developers.

Among the programme of projects on the table is a new housing development scheme to deliver 9,000 new apartments close to Eindhoven’s Central Station, on the edge of the Eindhoven University of Technology campus.

Eindhoven city leaders and planners are working on a series of development projects backed up by some €4bn of funding raised regionally and with the assistance of the Dutch national government.

The plans will encourage growth in housing, education, transport and mobility, and the campus of the city’s university.

Schreuder is in Cannes along with Frank van Swol, director of the Stations District project for the City of Eindhoven. Schreuder took part in Monday’s Housing Matters! Reboot Workshop session, to discuss solutions to widespread housing-shortage problems.

He said that Eindhoven is only interested in finding “long-stay partners” who will commit to the city over a long period.

Eindhoven’s growth has been historically linked with the rise of multinational technology giant Philips. The company was founded in the city in 1891, since when numerous tech firms have been established in the region.

Followed by a cocktail reception open to all participants

Thursday 13 March 2025, from 18.30 Grand Auditorium, Palais des Festivals

Main Room - Gare Maritime Forum des Élus 11.00 - 15.00

Asset Class stage Leaders’ perspective stage Doing business with purpose

10.00 - 11.00

AI Lecture I: How some organizations get an unfair advantage in RE investment decisions with AI - don’t get left behind! 10.00 - 11.00

Trends

Invest in Japan 11.00 - 12.00

AI Lecture II: AI - A 101 for senior Real Estate leaders 11.30 - 12.30 Sponsored by

The Logistics Forum: Part I - The global big picture, demand patterns, what’s hot and investment trends

14.00 - 15.00 From Brown to Green: Decarbonizing Real Estate for Sustainable Returns 14.00 - 15.00

11.00 - 12.45 Interactive speeches and debates

12.45 - 13.15 Cocktail reception

13.15 - 14.15 Seated lunch

14.15 - 14.45 Press coffee break

Lecture III: How can

15.30 - 16.30

What does it take to become an effective urban change maker?

16.45 - 18.15

Organised by

The Logistics Forum: Part II - ‘Not in my back yard!’ Addressing land use shortages to serve houses and industry 15.00 - 16.00

The Logistics Forum: Part III - Tackling ESG sustainability initiatives and impacts on the market and occupiers 16.00 - 17.00

The Logistics Forum Networking Cocktail 17.00 - 17.30

14.00 - 15.00

15.30 - 16.30

Smarter Buildings for a Sustainable Future with Smart Readiness Indicator

AI Lecture IV: Readying your business for a digital world 15.30 - 16.30

Equality of opportunities in Real Estate 16.00 - 18.00

Nordic Edge - Global Opportunities in the Nordic Market

Why is Portugal a leading opportunity for Real Estate Investors? 18.00 - 18.45 18.45 - 19.30

16.00 - 18.00

Main Room - Gare Maritime Equality of opportunities in Real Estate

UK Hub Verrière Grand Audi London stand

8.30 - 10.00

10.00 - 10.45

Green returns: the state of sustainability ROI in 2025

Sponsored by

10.00 - 10.30 Hosted by Madrid in transformation, an opportunity for the future 9.30 - 10.30 Organised by

10.45 - 11.30

Attracting investment: Sound future strategies for UK Real Estate

8.30 - 10.30 By invitation only Organised by

9.45 - 10.40

Metropolises in Motion: Liège and Lille, Attractiveness at the Core

10.00 - 11.00

Old Trafford Regeneration: A catalyst for UK growth

Organised by

14.00 - 14.45

Building the innovation economy: Working together to shape up a new breed of investment assets

15.00 - 15.45

Ox(vs)Cam Arc: the relationship between the UK’s top life sciences markets

11.00 - 11.45

Delivering Property for Science and Innovation

Organised by

11.00 - 12.00

C’est dans les vieux pots qu’on fait les meilleures soupes : nos actifs ont de la ressource !

Organised by

Leases and contractualization: Understanding the specificities of hotel asset leases

Sponsored by

Retrofitting for sustainable Real Estate: synchronizing decarbonization and climate adaptation plans to maximize performance 11.00 - 12.00

12.00 - 12.20

Keynote - What is the Money Doing? Taxation and the Property Industry

13.00 - 13.20

Retrofit vs. Demolition: Is London’s planning fit for purpose post M&S?

14.00 - 14.45

Navigating the Growth of Rental Living

14.45 - 14.55

Bringing the London Model to Life

15.00 - 15.45

SwiMIPIM 10.45 - 10.50 Nighttime Economy and 24-hour Cities

10.45 - 11.40

Transforming yesterday’s spaces into tommorow’s cityscapes. A dialogue between Charleroi and Nantes Métropole.

Organised by

Organised by

Organised by Organised by By invitation only

11.30 - 12.30

Invest In … Blackpool, Calais, Ottawa, Nice, Porto, Roma, Warsaw

11.45 - 12.30

Fundraising Pitch session by Proptech Lab

Organised by

14.30 - 15.30

Recovery: not everywhere all at once

Organised by

16.00 - 16.45

Tomorrow’s housing market: Debating investment, Government’s role and product types

11.45 - 12.30 Sport and Placemaking

14.00 - 15.00

Montpellier, l’avenir s’invente ici

Organised by

15.30 - 16.15

13.45 - 14.45 Hosted by

14.00 - 15.00

Sponsored by Poland’s Silesia Region & Katowice Megacity: A New Powerhouse for Global Investments

15.00 - 15.55

Shifting sands: the impact of falling interest rates on hotel investments and asset values

15.30 - 16.30

Organised by Sponsored by Get Britain Building - Constructing our Future

16.00 - 16.45

17.00 - 19.00 Hosted by

16.00 - 17.00

Life Sciences: the roadmap for the reindustrialisation

Organised by

Leveraging UK Innovation: Major investment opportunities in the new London-Birmingham corridor

Organised by

16.45 - 17.45

Beyond Compliance: Brussels Turning CSRD Challenges into Opportunities

Leisure products: Resorts and campsites

Sponsored by

Between market correction and economic challenges: Where and how should you currently invest in Germany?

17.30 - 19.00

Growing the UK architecture sector and the economy

17.00 - 19.00 Hosted by

Brazilian Architecture and Urban Planning: Solutions for a Changing World

Organised by

Organised by

18.15 - 19.30

Italian Networking Cocktail by ITA (Italian Trade Agency)

Organised by

ASIA Pacific investors are set to target Europe again, with industrial and logistics, the living sector — especially student accommodation — and data centres particularly attractive real estate classes according to Singapore-based James Young, head of investor services EMEA and APAC, Cushman & Wakefield.

Young said that a number of Asianbased investors are “on the cusp” of deploying capital in the European market again after a period of low activity, given the lower interest rate environment that has developed over the last 12 months, and could also be attracted by value-add office opportunities and retail, in which there is renewed interest.

“My sense is that investor sentiment is going to be much more positive this

year than at the last MIPIM,” he said.

“While we can’t ignore the geopolitical situation, I think most investors are going to be looking beyond shortterm issues towards the fundamentals of real estate for opportunities and it is broadly the same asset classes that are doing well in the APAC region that are appealing in Europe.”

He added that with a more positive attitude over the office market coming out of the US, he also believed that APAC investors would increasingly consider opportunities both for modern commercial real estate stock plus older assets that could be refurbished or repurposed and that MIPIM would prove a “litmus test” to assess investor confidence.

Of the APAC markets, Young said that investor interest is primarily

focused on the same asset classes as in Europe, with China’s student accommodation market a standout given its relatively nascent status, plus industrial and logistics in Australia, Japan, and to a lesser extent India. China’s logistics market is also beginning to become more active, while Japan’s hospitality sector looks set for growth.

“Japan was one of the few countries that did not experience an interest-rate spike and consequently it has been a very stable real estate market, with a mature living sector too,” Young said. “Currently, an increasing number of tourists are visiting Japan, especially from China, and that has been boosting the hospitality sector and the opportunities to invest in and develop real estate.”

“RESIDENTIAL property is the safe haven for the real estate industry, and Berlin is the place to be,” according to Michael Schick, CEO of investment brokerage company Schick Immobilien, which is based in the city. Migration has been the main factor in driving demand for residential property in Germany, he said, with the refugee crisis and migration into the EU’s largest economy from southern and eastern Europe mainly responsible for a population increase of 3.5 million in 10 years. But the sector profiting from this is that for existing buildings, not new construction, which is in crisis over costs, or the commercial sector, which is in structural crisis. And the main beneficiary is Berlin, where

demand easily exceeds supply.

“Berlin is by far the largest market in this sector, accounting for 20% of the national market for investment in existing buildings. International investment is flocking in, attracted by the size of the market and its affordability, with a price per square metre much lower than other European capital cities such as London and Paris,” he said. He added that reviving new residential construction will be a key challenge for the incoming CDU/SDP coalition government. “There is a high expectancy that there will be action to lower building standards to get new building going.”

He mentioned energy efficiency and noise reduction as areas where standards could be relaxed, along

with a reduction in the 20,000 or so technical standards construction companies face.

Housing would be the key topic at MIPIM 2025, he said, with cities all over Europe struggling with the demand for affordable property. “But there is a stock of multi-family housing which is affordable and it is in already built properties. The policy solution lies in subsidising this type of housing.”

He sees little change in the market if a peace is negotiated in Ukraine, saying that nine out of 10 who fled the war will stay for one simple reason: “Wages here are nine times what they are in Ukraine. But the labour market profits from the migrants and they drive the demand which stabilises the real estate market.”

Chaque trimestre, Objectif Métropoles de France decrypte l’actualité des grandes villes et métropoles et met en lumière les ambitions des territoires. objectifmetropolesdefrance.fr

INVESTING in environ-

mental sustainability isn’t just essential for the future of the planet, it is also a business imperative, according to Nuno Brito e Cunha, lead ESG advisor, EMEA, Measurabl.

“Far from being just an ethical consideration, sustainability is becoming a strategic business move,” he said.

“The potential for sustainability to drive revenue, reduce costs and mitigate risks is real and actionable. This shift reflects a broader understanding of the economic benefits of sustainable practices, making them a priority for investors and operators alike.”

He added: “The industry is recognising the financial and environmental risks of unchecked carbon emissions. Implementing an internal carbon price is emerging as a strategic measure to direct capital expenditure towards mitigating these risks, emphasising the financial imperatives of sustainability efforts.”

Brito e Cunha described nothing short of a “transformative” period for the real estate sector, “where sustainability becomes integral to operational, financial and strategic decision-making, setting the stage for a more sustainable and financially resilient industry”.

THE HEAD of global investment firm AEW’s European division has said that lingering concerns over wider political and economic uncertainties are likely to be replaced by increasing confidence as 2025 progresses.

AEW Europe chief executive Rob Wilkinson, who is leading a team at MIPIM, said that signs are pointing to a period of greater stabilisation for investors, boosted by likely drops in interest rates later in the year.

He said: “The macroeconomic environment will continue to cause some caution among investors, however we expect to see a gradual improvement in sentiment towards the sector as the year goes on and interest rates stabilise and come down.

“While recent events have increased volatility, the overriding trend is of lowering inflation and interest rates. This will be helpful for real estate markets and we are beginning to see greater activity and momentum in the market.

“After three years of challenging

market conditions I have no doubt that the focus will be on the expectation of a better 2025 than 2024.” Discussing sectors of potential growth looking ahead, Wilkinson said that alternative assets such as data centres are likely to continue to be hot property in 2025, as will certain “traditional sectors” such as prime offices “where occupier demand for CBD locations has been strong and prime rents have continued to grow due to a lack of supply”.

He added: “In our latest market outlook, which was published in November 2024, prime offices were forecast to be the top performing sector in Europe over the next five years.

“The other traditional sectors should also deliver good returns as interest rates stabilise and supply remains constrained.”

Wilkinson has headed up AEW Europe since 2014, leading a number of funds with interests across the real estate spectrum. The firm counts 11 offices on the continent, including bases in London, Paris, Warsaw, Prague,

Luxembourg, Madrid and Milan. An experienced MIPIM delegate, Wilkinson described the show as “the standout real estate event for AEW”, saying that “over the years we have been able to secure deals, meet new investors, even sign deals with our occupier customers.”

CAVATINA Group, a leading Polish developer specialising in class-A office projects, is back at MIPIM after a six-year absence.

The company’s top priority for the week is the sale of a robust multi-city portfolio with a total leasable area of 200,000 sq m.

The Cavatina portfolio encompasses 13 projects in capital city

Warsaw and five other major conurbations including Krakow and Wrocław. Hot properties include Chmielna 89, a distinctive office building located in Warsaw’s business centre; and Grundmanna Office Park, a Katowice development delivered at the end of 2024.

According to Cavatina, Poland has established itself as a dynamic

business hub, attracting multinational corporations and startups.

In particular, it has witnessed growing demand from shared service centres, business process outsourcing companies, and IT firms — attracted by the company’s economic stability.

In 2024, Cavatina signed lease agreements for over 35,000 sq m of office space, while existing tenants extended their leases for an additional 10,000 sq m. Overall, the company enjoyed an average occupancy rate of around 90% by the end of the year.

With strong rental yields, increasing demand and ongoing infrastructure improvements, Cavatina predicts that Poland will continue to be an attractive opportunity for both domestic and international investors.

Nous vous mettons en relation avec des experts de l’immobilier de prestige pour réaliser la plus juste estimation de vos biens.

INCREASED

volumes in Europe are a sign of growing confidence and a “broad-based recovery taking shape”, according to international real estate consultancy Savills. New figures from Savills’ research show investment volumes breaking through the €50bn for the first quarter of 2025. If that is the case it would be a total volume increase of 28% on the same period last year. The research highlights key asset classes for their potential to investors, including data centres, CBD offices, hotels, and “various retail sectors”.

It also identifies the countries currently experiencing the highest levels of growth compared to last year as the Czech Republic, Portugal, France, Ireland and Romania.

Savills says that, if continued, the current upward trend would lead to a 13% increase in volumes for 2025, and an overall €216bn in transactions.

Lydia Brissy, director in the Savills European commercial research team, said: “Despite some near-term challenges, the overall investment trajectory remains positive. The European market is poised for further growth, with investment volumes projected to rise by 25% in 2026 and another 19% in 2027.”

THIS year will see the start of the next cycle of growth in the real estate industry, Rory Allan, managing director and portfolio manager for the European closed-end

value-add real estate fund series at Barings told MIPIM News.

“With European markets having largely bottomed out in 2024, we expect 2025 to signal the first year of the next growth cycle and we expect positive total returns for the year,” he said.

“While macroeconomic and geopolitical risk remains elevated, we expect transaction volumes to pick up from the low levels of the previous two years on the back of monetary policy loosening and robust fundamentals in many areas of the real estate market where supply/ demand dynamics continue to drive above trend rental growth.”

Core capital, which has been largely absent from the market since mid-2022, Allan continued, will start to re-emerge during the year, “probably in the second half”, providing much needed liquidity and balance to the market which has,

up until now, been dominated by value-add capital.

“Capital will continue to be focused on logistics and living strategies, together with data centres and more nascent sectors like self-storage, but we expect that demand for best-in-class office will also pick up. We expect 2025 to be an excellent vintage for European real estate investing across the board.”

As a result, Allan predicted that the mood at MIPIM this year would be markedly more optimistic. “Markets are undoubtedly on a stronger footing so we expect the week to focus on transaction sourcing and capital raising,” he said.

“We have seen a noticeable improvement in appetite from our client base for European real estate in the last six months, for both core and value add, so we anticipate MIPIM to advance a number of ongoing discussions.”

AI HAS the potential to “solve the challenges it creates” by bringing about huge efficiencies in the construction and operation of power-intensive data centres, a leading figure in the sector has said.

Rennie Dalrymple, partner at British-built environment consultancy Ridge and Partners, said AI is potentially capable of streamlining the process of building and running data centres to such an extent that it could cancel out the additional energy requirements of the technology.

Increased demand for AI and associated technologies is leading to a vast increase in the use of the powerful and high energy-consuming data centres needed to run it.

But Dalrymple said that AI also had the potential to help real estate and construction firms identify and

eliminate operational inefficiencies, thus mitigating the environmental harm the buildings do.

He said: “As public cloud expan-

sion and the rapidly intensification of AI increases demand for data centres, the latter has the potential to solve the challenges it creates: AI itself will help reveal construction inefficiencies, optimise operations, predict maintenance requirements, helping make data centres more sustainable and efficient to procure, build and operate.

“Together, these will create opportunities for data centres to use comparatively less energy even as they’re processing more data, alongside exciting evolutions in all-important data-centre cooling systems.”

Dalrymple said that Ridge and Partners is engaged in “delivering the next generation of data centres needed to realise the huge potential AI has to boost national productivity across all industries”.

THERE is likely to be an increase in distressed German assets with opportunities for companies who offer work-out solutions, according to Torsten Hollstein of advisor and asset management company CR Investment Management.

“The first wave of liquidity problems in the residential sector is levelling out, but we are now seeing problems in the office area,” he said. “Companies that financed projects five years ago are now finding that refinancing is not what they expected it to be.” CR’s business is currently around 90% in Germany, where the company has offices in Berlin and Frankfurt. But it also has offices in Ireland, Netherlands and Luxembourg. Its track record “spans more than €30bn of transactions across multiple real estate assets”. The private company was set up in 2004 and entered the work-out market with the financial crash of 2008, helping companies to exit or restructure their investments after many banks withdrew from the sector, Hollstein said.

In 2023, CR announced it was to focus on non-performing property developments, including

advice and assisting in work-out solutions from optimisation to alternative uses and possible disposal of properties.

It was appointed this year as transaction adviser, along with Mellum Capital, for the sale of a commercial portfolio of Demire, comprising properties in Aschheim, Essen, Kassel and Cologne.

Hollstein said he believes that foreign investors are also looking at the German distressed assets sector, though they have yet to be involved in a serious way: “They are waiting on the sidelines at the moment.”

He is at MIPIM mainly to check out the business trends and make contact with new people to the market. He is already struck this year by the impact of Saudi Arabia as their ambitious projects start to come on line.

“The market is full of young people from the region all enthusiastic about what they can do — maybe looking for some old Europeans who know how to do it,” he said.

However, CR Group is not looking to become involved itself. “It’s just for inspiration,” he added.

EUROPEAN property values have now bottomed out and the industry is at the beginning of a new cycle — that is the message that Gerhard Meitinger, head of real estate finance, Germany, at pbb Deutsche Pfandbriefbank, is bringing to MIPIM.

“The European market has had a lot of downsides, but I think that now we are nearly or completely through this, which means we are at the bottom now,” Meitinger told MIPIM News. “Germany is one of the worst markets in Europe, but even here we are starting to see green shoots.”

Meitinger highlighted hotels, student accommodation and serviced apartments as particularly attractive sectors, especially in major European cities, and added that the logistics market had stabilised.

However, he also said that, overall, the property market had not recovered to the extent that had been predicted a year ago. In part, that was because the European Central Bank had not cut interest rates as far as had been expected. “Interest rates are not going down

significantly,” Meitinger said, adding that the prospect of US tariffs could lead to stronger inflation. “They’re going down a little bit, but not as much as everybody expected. I suspect that they will go down slightly again though.”

On balance, Meitinger believes that the market is finally on an upward trajectory. “Exactly one year ago, everyone’s expectation was that in March 2025 we would be in a better situation than we are,” he said.

“But the good thing, in my opinion, is that we are through to the next cycle. Now, the question is how quickly do we restart? It always takes time, but looking forward to MIPIM 2026, I am convinced that we will be in a better position than we are now. I think things will start moving in the second half of this year.”

Meitinger acknowledged that nobody can know how global events, not least Europe’s emerging security position, will impact the real estate market, but added that there is little to be gained from predicting the unpredictable. “Do your thing — go ahead,” he urged.

Bleiben Sie immer auf dem Laufenden!

Mit den kostenlosen Newslettern vom immobilienmanager haben Sie alle Themen der Branche im Blick – einfach und bequem per Mail.

Redaktionsletter: Neuigkeiten und Meldungen zu Branchentrends sowie aktuellen Themen aus der Immobilienwirtschaft.

Themenletter:

Tiefergehende Informationen zu Themenwelten wie z.B. Nachhaltigkeit & ESG oder Digitalisierung sowie exklusive Inhalte aus unserem Magazin.

Jetzt anmelden unter www.immobilienmanager.de/newsletter

Infoletter: Informationen zu exklusiven Fachveranstaltungen, Sonderheften zu Spezialthemen sowie weiteren relevanten Produkten für die Immobilienbrache.

STUDENT specialist Dot Group is at MIPIM with its key brands — Global Student Accommodation (GSA), Kinetic Capital, Yugo and Student.com — as it continues to seek opportunities to expand, having recently taken its first steps into France and Italy.

The company believes that the opportunity to develop purpose-built student accommodation (PBSA) across Europe has emerged thanks to an international generational shift, which is seeing students from around the world look for opportunities to study outside their home cities.

Citing Dot’s recent entrance into Italy, Yugo chief operational officer Joe Persechino said the country has around 20 cities suitable for PBSA schemes, where only a 6% of demand is currently being fulfilled.

“There is enormous competition to study at the best educational facilities and a strong desire from parents to find accommodation for their children that is secure and has a strong sense of community,” Persechino said. “We believe there is a huge untapped opportunity in Italy and many other European markets are relatively nascent compared with the UK and US.” Yugo’s senior vice-president of commercial, Robin Moorcroft, added that Poland was another promising market, with PBSA facilities being developed from old office buildings. “In markets such as Poland, there is very little data available and so that’s something we can offer — that insight and a track record, which is very important for prospective investors,” he said.

Kinetic Capital CEO Paddy Allen is head of Dot’s specialist stu-

dent-housing lending arm, which provides debt to GSA and third parties. Noting that Kinetic is open to both development and the acquisition of existing assets, he said that being a specialist also means the group has a nuanced understanding of student requirements. “What

we’re seeing is similar requirements across all G20 markets we’re looking at for investment,” he added.

“As investors and operators, we tend to focus on the tangible elements of assets, but it’s also important to consider how the buildings make students feel.”

One million businesses £350 billion economy 15 million people

TUESDAY

Welcome from Northern local authorities

Hear from Blackpool Council, Salford City Council, Trafford Council, Bolton Council, Wigan Council, and Stockport Council North of England stand

In conversation with Homes England chief executive Eamonn Boylan North of England stand

Faster, bigger, better: How can the North become the UK’s development driver?

Hear from Gateshead Council, Igloo Regeneration, Trafford Council, Wigan Council, Salford City Council, and WSP UK Stage

WEDNESDAY

Flip_it at MIPIM WSP, Layer.studio, and Studio Hoodless introduce Flip_it, an immersive brainstorming session that redefines regeneration North of England stand

THURSDAY

Investible North: Where should investors put their money?

Hear from Liverpool City Council, Newcastle City Council, Blackpool Council, Manchester City Council, Bolton Council, and Stockport Council UK Stage

Place North MIPIM wrap-up

Get the thoughts of private sector giants including Urban Splash founder Tom Bloxham, Muse managing director Phil Mayall, and Igloo Regeneration’s senior development manager Insiyah Khushnood on how MIPIM 2025 has panned out and enjoy some casual drinks as we kick off the MIPIM wind-down North of England stand 10:30am 3pm 4:15pm 2:30pm 11:15am 2:30pm

TSC REAL Estate Germany managing director Berthold Becker is in Cannes to champion the merits of healthcare as an asset class.

Speaking to MIPIM News, he said: “Looking back at 2023, there was a danger that investors were losing trust in the healthcare sector, in particular the nursing-care segment. But the market has recovered and has proved to be one of the most stable asset classes. My message this week is that healthcare is a sustainable and predictable class that can play a defensive role within a portfolio.”

TSC covers a broad range of healthbased segments, from elderly living to life sciences via ambulance/medical-supply real estate. “We have offices in Germany, Luxembourg, Italy and Spain and around €2.3bn

of assets under management,” Becker said. “We’re looking to expand in the Benelux and Nordics.”

Senior living still accounts for the lion’s share of the company’s business. In terms of trends in this area, Becker said the issues that need to be addressed include a general skill shortage and the cost of regulatory compliance. But on the plus side, the sector will be “very strong and predictable over the coming decades”, he added.

Becker also said there is a need for the senior-living sector to place more emphasis on “customer-centric” solutions. “The bandwidth of elderly people is not just the ones who are 80-plus and in need of nursing care, but a broad spectrum of people who need concepts and facilities specifi-

cally tailored to their needs. Historically, the sector hasn’t thought of this group as customers, but that is now changing for the better.”

The provision of medical support is another priority for TSC, although this segment has a German focus. “Essentially, there is an oversupply of inpatient clinics in Germany and an undersupply of outpatient medical services,” Becker said. “So you might have a situation where someone who has a hip replacement spends three weeks as an inpatient, when they could probably leave the next day as an outpatient. There is currently a transformation going on to make Germany’s healthcare spending more effective and this is an area that has opportunities for TSC’s business.”

Sur tous les fronts, nous enquêtons pour vous raconter notre époque en encourageant le doute et la curiosité. Rejoignez les esprits libres.

la première année (sans engagement)

RENDEZ-VOUS SUR LE SITE OU directabo.lepoint.fr/partenariats

SCANNEZ CE QR CODE

Des contenus variés L’accès à tous les contenus du Point, les palmarès, des newsletters thématiques…

Des chroniqueurs et invités inédits à retrouver uniquement sur nos supports.

En exclusivité

Le journal numérique en avant-première dès le mercredi soir.

LONDON is “leading the world” in built-environment planning and development thanks to a unique combination of talent and the city’s high standing in global real estate rankings, according to the head of an organisation that brings property professionals together.

Nick McKeogh, co-founder and chief executive of the NLA, a membership organisation for London’s built-environment community, said that the UK capital is setting standards that are being emulated around the world.

“London is a major city globally,” he added. “There is this ecosystem of the best talent of property and construction professionals and investors, and links with the financial-services sector. The London built-environment community is in a unique position. We have global players from all over the world coming to London to learn about built-environment initiatives.”

McKeogh said that he and the NLA are at MIPIM to “bang the drum” for London and engage with city leaders from all over the world: “MIPIM is unique. It’s an event that brings together so many

people from so many places.”

The NLA was founded as a body to unite and represent the disparate members and professions within the London built-environment community, which includes architects, urban planners, local authorities, construction companies and developers.

McKeogh said that a fundamental ongoing area of activity for the NLA is the promotion of skills and training aimed at young people. “Education is essential to the future of the industry,” he said.

Last year the organisation launched the New London Agenda, which laid out the NLA’s ‘Six Pillars of Placemaking’ as a guide to promoting equity, sustainability and prosperity among its members. The agenda identifies opportunities for planning and building a healthier London, and how the various organisations within the built-environment community can work together to achieve this.

The NLA also oversees a number of major events in the capital, including the London Festival of Architecture, the London Real Estate Forum and Opportunity London, at which it unveils its annual London Boroughs report.

REAL ESTATE investors need to go back to focusing on longterm macroeconomic trends rather than short-term social and political volatility, according to Tom Mundy, JLL’s director of EMEA capital markets strategy and research.