MIPIM has a unique role in gathering the vast world of real estate in one place, from pioneering projects and investment opportunities to dynamic solutions for urban development.

Instead of having to travel the globe, the globe comes to you — with neighbouring stands offering insights into distant geographies, unique developments and regulatory approaches, financial sources and more.

Today, more than ever, the topic of geopolitics has become synonymous with misunderstanding and global uncertainty. By opening the doors to dialogue, we aim to help the real estate community navigate the complexities of the international markets.

This year’s event in Cannes will be characterised by innovation, sustainability, networking and expert insights. Our keynote speaker, Dr Mario Draghi, is a renaissance man who has in turn assumed the role of economist, academic, banker, statesman and civil servant, who served as Italy’s prime minister from February 2021 to October 2022.

Public and private sector collaboration is now so important for driving change in our cities, especially on matters such as housing, development and infrastructure. That’s why we are summoning a roster of mayors from key, global cities to make their ambitions clear.

On a national level, if 2024 was a stand-out year for the number of elections globally, that means there are a record number of new administrations trying to make an impact in 2025.

We will also deliver five stages offering insights, lessons and networking opportunities, highlighting key geographies, megatrends and the industry’s dominant asset classes. Dedicated residential summit Housing Matters!, meanwhile, returns on Monday to explore innovative solutions for the housing sector and drive industry collaboration.

Megatrends under the spotlight include those topics at the heart of society and the real estate industry which drive change in dynamic and indirect ways. Artificial intelligence is one innovation with a huge capacity to change both everyday life and transform industry processes, so we’ve scheduled a series of talks on best practice. Other key themes, including the hunt for talent, explore the benefits of diversity, equity and inclusion for the hiring process, and set up our MIPIM Challengers programme, once again promoting young people.

MIPIM 2025 also looks forward to welcoming the world’s leading institutional investors, fund managers and industry leaders. With investors making up one-third of MIPIM delegates, they will be at the heart of this year’s conference programme, with sessions dedicated to the unique challenges and opportunities they face.

THE COMMERCIAL real estate industry in 2025 is likely to be driven by “strategic opportunities and evolving market dynamics”, according to François Trausch, CEO & CIO PIMCO Prime Real Estate. Trausch said that the climate was one of “cautious optimism”, following the recent cycle of interest rate cuts. However, unlike the rapid post-global financial crisis rebound, he said that recovery was expected to be slow and uneven. “The decline in long-term rates will not match the levels seen in 2021, keeping capitalisation rates elevated and extending the thawing process,” he said. Trausch identified a divergence between public and private markets, with the former showing signs of recovery, as valuations for equity real estate investment trusts (REITs) and collateralised mortgage-backed securities (CMBS) approach 2021 levels. This suggests that private markets may “catch up” in 2025. “Investors should monitor this convergence, as it presents opportunities to align private market strategies with public market trends,” he said.

One trend that has negatively impacted commercial real estate over the past 12-18 months has been decreasing valuations, but Trausch said that valuations are “nearing their bottom”, particularly for Class A properties. However, Class B and C properties, especially in office and life sciences sectors, may continue to face declines. Trausch warned that investors should be mindful of potential distress masked by current delinquency rates and maturity defaults. “As forced sales could increase, further pressure on valuations is possible,” he said. The market is also witnessing a shift in tenant preferences towards higher quality, sustainable assets. “This trend presents opportunities for upgrading properties to core-plus status but also highlights risks for weaker assets facing declining occupancy,” he said. Looking at Europe, Trausch said that the adjustment to a higher interest rate environment would require “a shift in investment strategy”. Rather than relying on low rates, he suggested that investors should seek growth pockets where rent and net operating income

GREECE has been impressing the world with its economic fundamentals following several strong years of performance, according to Marinos Giannopoulos, CEO, Enterprise Greece. “Foreign direct investment in Greece surpassed €6bn in 2023, marking consecutive years of record-breaking investments. This surge is driven by major projects in energy, real estate and infrastructure, reflecting growing international confidence in Greece’s market potential,” he said. “Greece offers a pro-investment climate with tax

breaks, streamlined licensing processes for strategic investments, and subsidies for sectors such as tourism and digital transformation, creating a highly attractive environment for foreign and domestic investors.”

Greece is also at the forefront of the green-energy transition, with renewables accounting for over 50% of electricity generation in 2023.

Landmark projects such as Europe’s largest solar park in Kozani and pioneering wind-energy developments in the Aegean underscore Greece’s role as a renewable energy leader.

(NOI) are expected to rise. Trausch identified promise in the residential sector due to long-term supply and demand dynamics. In the US a housing shortage is anticipated, supporting build-to-rent strategies and existing properties. Multifamily housing in Japan, with its favourable financing conditions and low tenant delinquency, also offers attractive opportunities. Additionally, student housing is experiencing strong rental growth in both traditional and emerging markets. Elsewhere, data centres, particularly in Europe, continue to be a priority investment. “The gap in data-centre capacity relative to population presents significant growth potential,” Trausch said. In contrast, while the life-sciences sector was highly sought after during the COVID-19 pandemic, Trausch said that recent trends revealed reduced tenant demand and new supply challenges.

Overall, the commercial real estate sector in 2025 will be defined by strategic shifts in response to interest-rate changes, evolving tenant preferences and geographic opportunities. “Investors should remain vigilant, leveraging insights to navigate the complexities of this unique cycle and capitalise on emerging opportunities across public and private markets,” he said.

Greece’s digital economy has also experienced growth, attracting investments from tech giants including Microsoft, AWS and Pfizer. He added: “The hospitality sector in Greece presents an abundance of opportunities for investors and operators, spanning diverse niches such as luxury tourism, agritourism, wellness retreats and sustainable ventures. By embracing innovation, sustainability and emerging trends, investors can capitalise on Greece’s dynamic and lucrative hospitality landscape.”

A NEW city in Uzbekistan, New Tashkent, has been dubbed the largest and most ambitious urban development project in Central Asia. Covering an area of 20,000 ha, it is expected to accommodate over 2.5 million residents, along with government agencies, universities, hospitals, and more. The Cabinet of Ministers of the Republic of Uzbekistan has established the New Tashkent City Construction Directorate to oversee this initiative. New Tashkent is designed around both green and water infrastructure, according to Temur Akhmedov, the ecologist of the directorate for the construction of New Tashkent City under the Cabinet of Ministers, and Saidazim Sharipov, architect of the same directorate. The two spokespersons said: “An international team of experts began by creating a framework that incorporates mobility infrastructure, utilities, social facilities and other essential layers over

this green and water layout.

“Instead of conventional transportation systems, the mobility infrastructure will offer residents a multitude of options, including bicycles, scooters and other low-speed mobility devices. Addition-

Plans for the city aim to create a comfortable microclimate, while conserving the region’s most precious resource: water

ally, electric buses, subways and electric cars are integral to New Tashkent’s electrification strategy, which will not include natural gas for buildings.”

The project sets high standards for the buildings, mandating certification from international green building standards including LEED, BREEAM and EDGE. The directorate has established criteria for energy efficiency, effective water

usage and rainwater reuse. These green-building standards aim to reduce energy and water consumption by over 20%. Furthermore, New Tashkent will rely predominantly on renewable energy sources, utilising existing hydro and solar capabilities while developing new ones. The new city’s construction and operational carbon footprint is expected to decrease by over 20%.

The spokespersons added: “New Tashkent is a challenging, ambitious and innovative project. The City of Tashkent boasts a rich history of over 2,000 years, which establishes certain expectations for the new development. The concepts and strategies outlined above represent some of the ways that an international team of experts intends to meet these expectations.”

The Alisher Navoi International Research Centre project, set to be constructed in New Tashkent City, is currently receiving significant global attention. This large-scale initiative is designed by Zaha Hadid Architects, renowned for its futuristic and distinctive architectural works.

FOR OVER 30 years, real estate-backed charity Land Aid has brought together remarkable businesses and individuals from across the property industry in a bid to achieve lasting change. One of the charity’s main goals has become the ambitious and laudable task of ending youth homelessness across the UK. “Land Aid raises money from the industry and allocates it throughout the UK targeting a wide range of communities,” said Redevco CEO, Neil Slater, chair of Land Aid’s board. “No cause is too small, from a tiny women’s shelter in Dundee to a large homeless shelter in London.”

Land Aid also acts as a pro bono agency for the industry, connecting professionals from lawyers to housing experts with

charities in need. The charity drove the provision of some £1m (€1.2m) in pro bono services last year, Slater said. “We also involve other businesses in our goals, such as Vodafone, which has provided sim cards for the homeless.”

To date, Land Aid has attracted the involvement of many pillars of the UK real estate industry, from professional services firms such as CBRE, JLL, Allsop, Avison Young and Carter Jonas, to major developers and landlords including Blackstone, Lendlease, British Land, LaSalle, Segro, Fiera Real Estate and Grainger. Knight Frank has sponsored a major sleep-out slated for February, which will once again see hundreds of people sleeping rough in cities across the UK to raise funds and awareness. Slater said that Redevco has always

been socially engaged throughout its 25 years of existence in line with the “force for good” ethos within the wider group of businesses and philanthropic organisations that the firm is a part of. He added: “Through our Redevco Foundation, we allocate funds to improving the lives and the living environment of the less privileged, as well as focusing on environmental sustainability, and historic and cultural heritage. Our employees select the good causes that are close to their hearts through a ‘Giving Rewards’ initiative.”

Doing Business With Purpose Leaders Perspective Stage Wednesday, March 12 10.00 - 11.00

SWISS Life Asset Managers (SLAM) will remain focused on delivering attractive returns by “building high-quality portfolios in the living, logistics, light

industrial, life sciences and technology sectors”, according to Per Erikson, head of real estate. “Hospitality is a significant part of the living segment and has been one of the strongest performers in terms of transaction volume growth in 2024,” he said. “We expect this trend to continue. Additionally, we’ve observed growing investor interest not only in traditional tourist hotspots but also in regions that combine business and leisure opportunities.”

A pro-social approach is also important. “Since most people spend most of their lives in buildings, health and wellbeing are crucial considerations in real estate,” he added. “To address this, Swiss Life Asset Managers prioritises sustainable construction standards, targeted certifications and thoughtful design to enhance user experiences while meeting ESG objectives.

“While health, wellbeing and social

TIMISOARA authorities are focusing on making the city more attractive.

“For the last 300 years, Timișoara has been one of the best-planned cities in this part of Europe,” according to Timișoara’s mayor, Dominic Fritz.

“Designed by Austrian planners after the city was conquered in 1716, Timișoara still amazes with its clear development vision and soundly integrated urban layers,”

Timișoara has firmly established itself as a cornerstone of Romania’s real estate and business-development landscape, at the crossroads of Central and Southeastern Europe. Landmark projects have set new standards in urban regeneration and Class A office development, attracting multinational corporations, tech startups and creative industries alike.

“Companies choosing Timișoara tell

me they’ve picked the city because we have highly skilled employees, fluent in foreign languages and incredibly motivated. Timișoara’s diversity isn’t just a point of pride — it’s a driver of prosperity,” Fritz added. Improving the quality of life in Timișoara and making the city more

inclusion are key priorities for occupants, one of the biggest challenges is the severe shortage of housing in many European countries. This challenge is central to our strategy with our primary focus on creating additional supply, including quality affordable housing that meets municipal requirements and aligns with our investor’s growing emphasis on affordability.”

For logistics and light industrial, the firm focuses on strategic locations near urban centres and major trade corridors for big-box solutions. “The attractiveness of this asset class is the strong demand for modern logistics spaces driven by factors such as e-commerce, food, trade, nearshoring, friendly shoring, and even new industries such as battery storage and recycling. The logistics market is heading strongly forward to pre-pandemic demand for modern logistics space,” he said.

attractive are top priorities. The city has transitioned from one-off projects to strategic initiatives, investing heavily in the digitalisation of administration, public transportation, education and healthcare. Fritz added that the city is “a magnet for talent” and “also attracts top companies and highly qualified professionals. That’s why, as an administration, we’re steadily improving the quality of life in Timișoara, investing in the city and celebrating when private companies do the same.”

Timișoara, in western Romania

SEVERAL associations and development agencies will unite in Cannes under the Canadian banner. The Canadian Real Estate Association (CREA) returns to MIPIM, joined by the Manitoba Real Estate Association (MREA) and The Nova Scotia Association of Realtors (NSAR). Also, four economic development agencies will complete Team Canada: Economic Development Winnipeg and Rural Manitoba Economic Development Corporation from Manitoba, as well as Halifax Partnership and Cape Breton Partnership from Nova Scotia.

Representatives from these organisations will be at MIPIM to build connections, promote Canada and showcase their projects to a leading investor audience.

This year Canada’s projects and investment opportunities will be featured on a 3D interactive platform powered by PureBlink, a Canadian creative agency. Attendees will be encouraged to stop by to view projects, engage in conversations with economic development partners and learn about life in Canada, exploring the country’s affordability and quality of life.

BBF, A LEADING developer of world-class residential and commercial properties in Cyprus and Greece, has unveiled two new landmark projects, dubbed Land of Tomorrow (LoT) and KEAN. “These transformative initiatives are underpinned by principles of sustainability and innovation, aimed at elevating Cyprus’s international profile while revitalising the cities of Larnaka and Limassol,” said Vadim Romanov, CEO and founding partner of BBF.

LoT, a groundbreaking development for both Cyprus and the Mediterranean region, spans over 300,000 sq m along a 2.5 km coastline. “This project transforms a former industrial area into a dynamic, sustainable community,” Romanov said. “With advanced infrastructure, vibrant public spaces and ecologically enhanced beachfronts, LoT sets a new benchmark for mixed-use developments, fostering eco-conscious living and unlocking substantial oppor-

tunities for tourism, business and cultural integration.”

KEAN, meanwhile, reimagines an iconic location in Limassol, combining luxury residential living, modern commercial facilities and expansive green zones. “This project underscores the importance of sustainable building practices and innovative design in creating thriving, inclusive urban hubs,” he added. Beyond these flagship projects, BBF has an impressive portfolio that includes over 150 completed residential and commercial developments across Cyprus, Greece and beyond. These include high-end residences, mixed-use complexes and iconic urban landmarks, each reflecting the company’s dedication to quality, innovation and sustainability.

Romanov said: “Cyprus is becoming increasingly attractive for business relocation, fostering significant growth in the IT and financial sectors, attracting substantial foreign investments and strengthening its position as a leading tourist destination. This progress has been reinforced by Cyprus recently achieving an A investment grade, as evaluated by leading financial institutions, reflecting the country’s economic stability and appeal to global investors.”

THE HOWDEN Beach Club, in association with Padel Social Club, is back at MIPIM 2025 for the third year running, offering real estate networking while bringing out the competitive spirit in delegates, according to the organisers.

“Our Howden Beach Club adds leisure into networking at MIPIM,” said Jamie Thomson, real estate industry lead for Howden, the global retail, specialty and reinsurance broker. “Participating in a sport like padel is the best way to break down barriers and get to know people. It can also get really dynamic — players find themselves across the net from those they meet at the deal table,” he added.

This year will see premium beverage brands The Lost Explorer and Mirabeau both sponsoring Howden’s event.

Thomson said that participants can expect a padel & paloma reception after the main competition on Wednesday, March 12, as well as many other chances to pause and enjoy the experience.

“The tournament will involve 32 teams, all from private equity real es-

tate,” he added. “They will play against each other until a winner is crowned on Wednesday.” The Howden Beach Club will also be active throughout the week with other events and contests ensuring that the court is used for the entirety of MIPIM.

Morph’s plans for

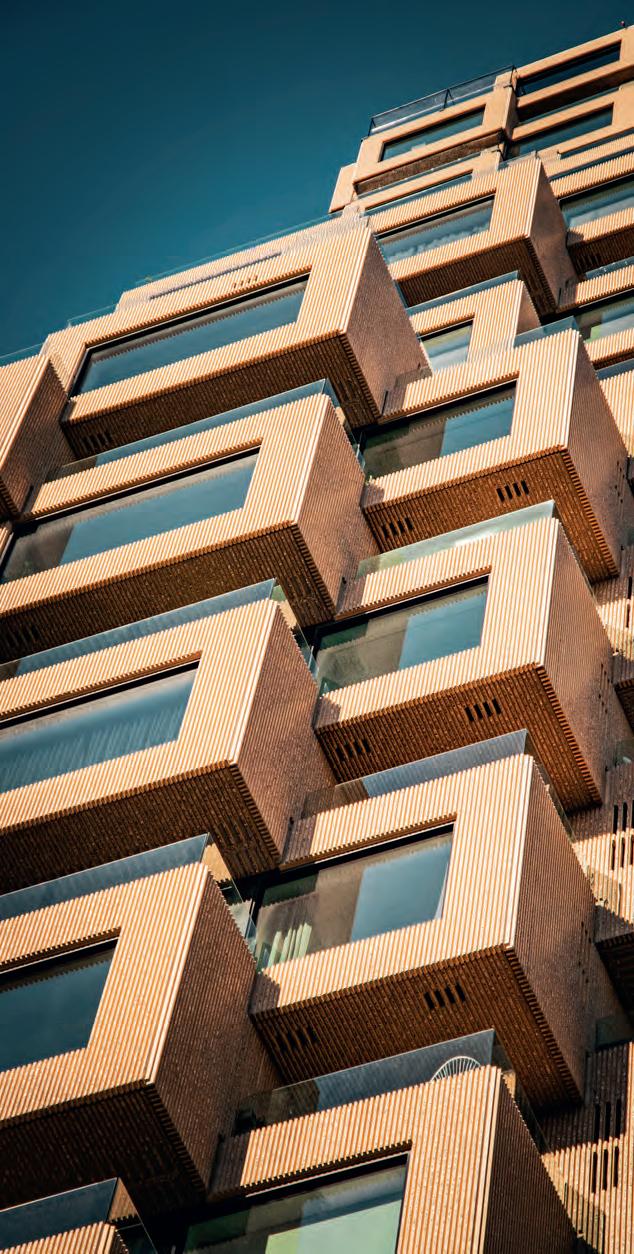

THE YEAR 2025 is likely to be another incredible year for Spanish architects Morph, going by 2024’s achievements.

“Last year, we completed two singular projects in the centre of Madrid, including an organic residential tower called Becrux, and the renewal of hotel Príncipe Pío,” said César Frías Enciso, studio founder. “We also delivered the renewal of Malaga Stadium and a zero-carbon footprint Research Centre for the Spanish Army in Jaén. Outside Spain, we are developing projects in Portugal, Andorra, the Dominican Republic and Saudi Arabia, and have the prospect of starting schemes in Panamá, Mexico and Canada.” These projects will include branded luxury residences and residential towers, as well as museums, masterplans and more. Morph, founded a decade ago, has featured in the WA100 list of the 100 biggest architectural studios in the world for five out of those 10 years.

Former President of the European Central Bank and Italian Prime Minister, Dr. Mario Draghi will open MIPIM 2025. Author of the report on “The Future of European Competitiveness”, he will shed light on Europe’s economic transformation plans in a rapidly changing geopolitical climate.

Considered one of the greatest economic leaders of our time, Dr. Draghi continues to inspire with his insightful analysis of the global economy. As President of the European Central Bank (2011–2019), he was celebrated for his pivotal role in saving the Eurozone, notably through bold monetary policies that led to the creation of 13 million jobs.

Dr. Draghi also established himself as a key figure in European politics as the Prime Minister of Italy (2021–2022).

Join us on Tuesday 11 March at 15:00 in the Grand Auditorium

AROUND €115bn will be invested in real estate and infrastructure projects across the Stockholm region by 2040, according to Stockholm’s investment agency. Staffan Ingvarsson, CEO Stockholm Business Region, praised the city’s “dynamic landscape” and “the canvas of our urban future”, adding: “With an estimated 30-40,000 construction workers needed, pre-

dominantly in manual labour trades, we are not merely building structures but fostering livelihoods, shaping communities and nurturing the essence of our city’s growth.”

The largest investment share is expected to be in housing, with an investment volume of €59bn, followed by infrastructure investments in railway, subway and light rail, with an invest-

ment volume of €18bn.

While construction projects are being planned throughout the whole region, there is a concentration of projects in central Stockholm. For example, Stockholm Wood City, which will rise in Sickla, in the Nacka Municipality, is expected to offer a vibrant urban environment with a mix of workplaces, housing, restaurants and shops. Stockholmshusen, meanwhile, is one of Stockholm city’s largest development projects with the goal of building thousands of new rental apartments.

Approximately 3,300 new tenancies are to be created, divided into 25 different projects. The homes will incorporate smart solutions such as green roofs or photovoltaic roofing.

“The Stockholm region is leading the way in building sustainable societies through groundbreaking innovation and strong collaborations. Our presence at MIPIM is an opportunity to showcase solutions that can inspire the world — from the world’s largest wooden city project to fossil-free marine transport and climate-smart concrete. We want to invite actors from all over the world to Stockholm, to co-create the future together with us,” Ingvarsson said.

LATVIA’s capital city, Riga, has been impressing international investors with its commitment to sustainability, innovation and functionality. A slate of recently completed and pipeline projects underlines its ambitions, including the transformative New Hanza district. Next to Riga’s historical centre and Skanste, a modern Riga neighbourhood, the new urban district of New Hanza is rising on the site of one of Riga’s most important transport, logistics and business hubs.

On nearly 25 hectares of land, a network of streets with underground utility lines has already been built, while an old cargo railway station has been transformed into the Hanzas Perons, а multifunctional cultural venue. The first of many New Hanza A-class office buildings are now rising in the area.

According to the Riga Investment and Tourism Agency, Live Riga, the city and its metropolitan area is the largest economic, financial and cultural centre in Latvia and the Baltic region, attracting up to 90% of all investment in Latvia.

As an office destination, it is a re-

gional leader. Riga enjoys the highest prime yields among the Baltic capitals, exceeding the European average at 4.9%. Riga also continues to experience strong demand for high-quality, certified industrial premises, driving growth in sustainable and energy-efficient properties.

Riga is on the road to sustainability and innovation

THE MAYOR of Rome, Roberto Gualtieri, will be leading the city’s delegation at MIPIM again this year to present the investment and development opportunities of a city in transformation. “We have recently completed some important works, such as those relating to the 2025 Jubilee,” Gualtieri said. “Record numbers of visitors are in evidence, and high-quality projects continue to arrive.” He added: “Rome’s regeneration doesn’t only concern urban and architectural aspects, but also social and environmental ones, thanks to an unprecedented amount of public and private commitments.” He said that the city would welcome international investors keen to get involved, with a focus on “projects that allow us to regenerate new areas and buildings in the city, help us enhance public assets, promote housing supply and establish or strengthen non-residential activities in the hospitality, training, management and commercial sectors.”

MAKING cities sustainable is “a complex challenge, which requires partnerships to solve it”, according to Jakob Norman-Hansen, director, global networks & partnerships, Bloxhub.

Danish initiative Bloxhub is a hub for sustainable urbanisation, which has been seeking to tackle the challenge head on by creating an ecosystem of companies, organisations, research institutions and public bodies focused on the task of making cities better. Bloxhub has around 350 member companies all working within architecture, design, construction, tech or other fields related to sustainable urbanisation.

“We live in a 9,000 sq m co-working space in two neighbouring buildings in the heart of Copenhagen,” Norman-Hansen said. “As a member, you can have your office here, or visit for activities and use community space.”

While many members are based in the Nordics, Bloxhub has also been pursuing international collaboration, working with stakeholders and experts across Europe, Asia and the US to create best-

use cases for the wider construction and development industry. “One key topic is the circular economy in real estate, which has been under discussion for a long time,” he added. “A universal framework isn’t there yet, so we need to talk to construction and materials firms, as well as architects and developers.”

Bloxhub also collaborates with global organisation, the Urban Land Institute (ULI), to address topics including social equity in housing and real estate’s transformation agenda. “Many cities are now implementing regulations about when you can build something new and when you should pursue renovation or the refurbishment of existing assets,” he said.

He added: “We’ll be attending MIPIM to inspire new solutions and fresh ways of thinking about business models within real estate.”

THE CITY of Ostrava in the Czech Republic is being transformed through the work of world-renowned architects.

At MIPIM the city will showcase its latest stand-out projects, as well as presenting new opportunities for investors and developers.

With a reputation for integrating modern architecture with historic buildings, Ostrava has attracted widespread attention in recent years. One notable scheme is private residential complex Nové Lauby, located in the heart of the historic city centre; most of the apartments have already found buyers. Meanwhile, Ostrava’s tallest building, built in the 1960s on Ostrčilova Street, is set to undergo a major revamp following designs by Czech architect Eva Jiřičná.

Another architectural gem is the new concert hall, which will be paired with the reconstruction of the existing City of Ostrava Cultural Centre. Work

commenced in July on the concert hall’s striking design, created by American architect Steven Holl.

This spring, reconstruction work was completed at the Grossmann Villa, built in the 1920s by the Ostrava architect and building contractor František

Grossmann as his family home. The modern Organica office complex opened recently, also at Nová Karolina.

A further striking success in Ostrava has been the transformation of its slaughterhouse complex, recently converted into a contemporary art gallery.

An architectural competition is under way for the city’s new football stadium

GLOBAL alternative asset manager GLP Capital Partners (GCP) has acquired three logistics properties in Germany from Segro European Logistics Partnership (SELP).

The portfolio comprises properties in Neuenstadt, Grevenbroich-Kapellen and Malsfeld with a combined rental space of 129,000 sq m, all of which are fully let.

The logistics property in Neuenstadt am Kocher on Wilhelm-Maybach-Strasse 2-10 was built in 2009 and comprises seven units offering 73,400 sq m of space. The 35,000 sq m property in Malsfeld was built in 2006 and expanded in 2020. The 20,400 sq m asset in Grevenbroich-Kapellen comprises three units, built in 2005 and 2007. Jim Hartley, managing director Germany & Netherlands at Segro, said: “This transaction is another great example of our capital recycling programme. SELP will reinvest these proceeds into higher value-add activities such as our attractive development pipeline.”

Tuesday 11 March 2025

19.00 to 22.00

Kick off MIPIM 2025 in style!

Join the revamped Opening Night, inside the venue for the very first time.

Network with 2,000+ real estate professionals at the biggest official event of MIPIM.

Open to all registered participants.

ACCORDING to Itsuhiro Miura, the deputy director general, city and housing bureau, of Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT), the theme of the Japan booth at this year’s MIPIM will be ‘Sustainable Urban Development in Japan’.

Miura said the ministry plans to share the initiatives of the Japanese government and exhibiting companies on topics including sustainability and resilience, affordable housing and inclusion, digital solutions and innovation, and Japan’s appeal as a place to invest. International urban and housing policy co-ordination will be a priority for the MLIT, and so Miura wants to discuss related matters with as many countries as possible. “Housing affordability has become a major issue worldwide,” he added. “So we definitely want to talk to countries like the UK, which has set a policy of supplying 1.5 million hous-

ing units in five years.”

Miura also wants to deepen Japan’s partnerships in Asia regarding urban policy and development. “In Asian countries, the problem of traffic congestion is becoming more serious, and

we would like to exchange views on the know-how and benefits of urban development from the standpoint of public transportation, namely Transit Oriented Development (TOD), an area that Japan is very strong in.”

In terms of the convention’s theme of cities and urban development, MLIT will promote its knowledge in fields that can help others, such as earthquake resistance and coping with typhoons. He added: “As far as housing supply goes, we will talk about manufactured housing technologies and introduce Japanese companies that have been at the vanguard of these technologies. In terms of digital technology, we have developed a 3D urban model project called PLATEAU that is beginning to be recognised overseas.”

Invest in Japan Geo Focus Stage Wednesday, March 12 11:00 - 12:00

POSITIVE signs abound this year for Panattoni, the world’s largest privately owned industrial developer, according to Robert Dobrzycki, CEO & co-owner Panattoni Europe, UK, India & Middle East.

“In 2025 our focus is on expanding into underrepresented areas, particularly in Western Europe and Asia,” Dobrzycki said. “We aim to deepen our presence in less-covered regions of Europe and further penetrate Asian markets. For instance, we have recently entered Saudi Arabia and are considering the UAE, while continuing to grow in India and push further east.”

He added: “Our approach is strategic: wherever we expand, we aim to establish a significant and impact-

ful presence rather than spreading ourselves thin.” This means building a robust platform that delivers substantial space, supports clients and investors globally, and leverages deep local expertise, Dobrzycki added. “Additionally, 2025 is a milestone year for Poland and for us at Panattoni in Europe. We’re starting the year with the Polish presidency of the EU Council — an opportunity to drive forward key initiatives for economic security and sustainable growth. This year also mark’s Panattoni’s 20th anniversary in Europe. Starting in Warsaw in 2005, we’ve expanded into 18 European countries and continue to grow beyond the continent with a portfolio of 24 million sq m of space.”

ICELAND’s trade agency will be flanked by a raft of exciting projects and investment opportunities at this year’s MIPIM. Development company Kadeco, which oversees land owned by the Icelandic state in the vicinity of KEF Airport, will be sharing its K64 masterplan for the airport area. This plan outlines the area’s development potential over the next 25 years, highlighting the unique qualities of the location. The international airport, situated in the North Atlantic, enjoys access to cargo and a large ship harbour, as well as a vibrant local community, all situated just a 40-minute drive from the capital area. The plan has five focus areas: three industrial sites, one commercial and one residential plot. One of the industrial developments, dubbed Helguvík and Bergvík, is a circular industrial park prioritising sustainability.

2025 PROMISES to be a big year for Osaka, the largest city in the heart of western Japan’s thriving Kansai region. In 2016, Osaka hosted MIPIM Japan, declaring its intention to become an international metropolis, and this year progress towards that goal will be confirmed with Expo 2025 Osaka, Kansai, which opens in April and will run until the third quarter.

But Osaka’s ambitions don’t end with the Expo. “Last September, Grand Green Osaka opened in front of JR Osaka Station,” said Osaka deputy mayor Toru Takahashi. “To realise the city development policy of being a hub that combines greenery and innovation, Umekita Park, which is

one of the largest in the world at 4.5 hectares, was integrated with the railway terminal to create a beautiful natural landscape in the heart of the city.” He added: “Osaka’s public and private sectors are working together to create new attractions and strengthen its international competitiveness.”

These ideals extend to the Expo, which is being held under the theme ‘Designing a Future Society for Our Lives’. Approximately 160 countries and regions from around the world are expected to participate.

Yumeshima, the site of the Expo, is an artificial island located on the waterfront, and the planned site of Japan’s first integrated resort (IR), scheduled to open in 2030. The

Expo site next to the IR is called Yumeshima Second Phase Area and covers an area of 50 hectares. A master plan for development is currently being drawn up, and a public call for developers is scheduled for the second half of 2025.

Other large-scale urban projects planned for Osaka include the redevelopment of the area east of Osaka Castle, Osaka’s most famous tourist spot; the “people-centred” spatial development along Midosuji, Osaka’s main north-south street; and the plaza in front of Namba Station, another major thoroughfare. All of these projects will be announced at the Japan Pavilion at MIPIM. “I believe that Osaka will become a city of choice for foreign companies and foreign talent,” Takahashi said. “We hope that by participating in MIPIM more people will become aware of Osaka’s potential and business opportunities.”

IF DAIWA House Industry pioneered the use of prefabrication technology several decades ago to become one of Japan’s biggest house builders, it has since expanded into related fields, including logistics and commercial facilities, while adopting a trailblazing environmental stance using carbon-neutral building methods.

Head of the overseas division, Hirotsugu Otomo, told MIPIM News that Daiwa House’s initial move overseas was earlier than that of most Japanese companies, having built more than 10,000 homes in the US in the 1970s and 1980s, before expanding across the country via mergers and acquisitions. Today, Daiwa House works with partners in the US on logistics and hotel development

and is also expanding its business in Australia and the EU. “We are currently moving forward on a project in London,” Otomo added.

In the coming years, overseas business will account for an ever-increasing portion of the company’s income, with the firm aiming for more than ¥1trn in overseas net income for fiscal year 2026.

“As you know, Japan’s population is decreasing,” Otomo said.

“So we are looking overseas for growth possibilities. Nevertheless, Japan is still a priority. Japan is working together with the public and private sectors to achieve carbon neutrality, and, as a leading company, achieving carbon neutrality through construction is one of our top priorities,” Otomo said, adding: “Since Japan is

susceptible to weather and geological disasters, resilience is also an important consideration, and it is essential to create disaster-resilient cities and buildings.”

Following the devastating Lahaina fire on the island of Maui in Hawaii in 2023, the company provided 50 temporary housing units for displaced residents. In Europe, Daiwa House has been providing a number of modular housing types, including 1,800 housing units for refugees.

These “social impact” activities are one of the main points that Daiwa House is stressing for its 70th anniversary this year, whilst endeavouring to expand its European business. “Not just by producing temporary housing,” Otomo added, “but new technologies that tackle energy efficiency.”

Improved collaboration between local authorities and private real estate will be crucial to making cities better for all

Collaboration between the private and public sector is one of the chief challenges facing the real estate industry. However, the successful resolution of this challenge could be key to unlocking better cities and outcomes for all, according to experts in the sector. Neil Slater, CEO of Redevco, says: “Wherever we embark on city projects, be that in Paris, Hamburg, London or Amsterdam, collaboration with local authorities is crucial for getting the project off the ground. But even more important is a partnership which leans towards the achievement

of social goals, that defines how the asset will contribute to the city.” Slater says that developers and investors should never lose sight of an asset’s complete lifecycle, which involves the opportunity to make a positive difference both in social and environmental terms over the long term. He also asks that authorities “recognise that real estate investors are here to make a difference. The quality of the collaboration is important to achieve shared goals”. Slater says that a more holistic approach reflects Redevco’s wider mission, “to enrich communities and make them flourish”. He says: “This not only requires us to massively

reduce operational and embodied emissions within our assets, as we are working towards net zero carbon by 2040, but to also evaluate the social impact of everything we do.” The firm’s latest project in Paris, 126 Rivoli, marries together significant environmental and societal ambitions. Once redeveloped, the Haussmann building will offer eight levels of retail, offices, urban logistics, a lifestyle hotel and a restaurant, with both the construction and operational phases having won BREEAM Excellent certification. He adds: “The last year has been quite transformative in terms of the deals we have completed. We are probably

an example of a company that is very business minded but believes that transformative real estate is possible in our industry and in partnership with cities.”

Social and affordable housing

Global real assets investment manager Patrizia has been working with local authorities on the provision of social and affordable housing via its Patrizia Sustainable Communities initiative, which is targeting the creation of a €500m pan-European social and affordable housing portfolio.

Marleen Bekkers, Patrizia Sustainable Communities fund manager, says that social and environmental goals are as important as investor returns for the strategy. “We have a dual return purpose. Financially, our target return for our investors is 12%, while we have seven social and environmental KPIs. We scrutinise every opportunity, and won’t invest unless all criteria are met,” she says. The platform launched with two social housing schemes in Dublin, both shaped through public consultation. “We received hundreds of responses from local residents to our questionnaires which enabled us to quantify their needs and improve the overall result,” she says. These questionnaires as well as local authority input resulted in the addition of a 1,500 sq m library to the final development, featuring educational and community spaces. Patrizia also saw fit to create its own social-value framework to make sure that the schemes were meeting its goals. Further projects have seen the creation of social and affordable housing in the UK, Spain and Belgium. With the fund now close to being fully committed and having already exited projects in Ireland and recycled that capital, the team is exploring how it might further develop this strategic initiative within Patrizia.

Mahdi Mokrane, Patrizia head of investment strategy & research, co-head fund management and head of fund management real estate, adds: “Patrizia has been successfully investing in residential real estate for all of its 40 years and the expanding living sector will continue to play a large role in the company’s future.”

General (L&G) has long sought to build a bridge between private capital and the needs of urban communities.

Last year, L&G secured funding for its third build-to-rent (BTR) scheme in Leeds, which is being developed by Glenbrook with a target completion of April 2026. The £140m funding is enabling the duo to deliver 500 new apartments, alongside resident facilities such as a concierge, lobby, gym, podium gardens and terraces. The project includes ground floor retail and 60 parking spaces.

As the development forms part of the wider masterplan for Whitehall Riverside, the scheme involves collaboration with local authorities on the creation of a new mixed-use riverside destination. The development’s location has been carefully considered to ensure that residents benefit from the diverse and growing employment opportunities, as well as its cultural destinations, local amenities

and strong transport links, including Leeds Central station, which is within a five-minute walk.

Adam Burney, head of annuity BTR at Legal & General Investment Management Real Assets, says: “The Whitehall Riverside development has been designed with a focus on lifestyle and resident satisfaction, aiming to ensure quality, operational efficiency and long-term environmental sustainability that meet the needs and aspirations of residents.

“As a major investor in UK real estate, we remain committed to levelling up the UK by ensuring communities across the country have adequate access to employment, infrastructure and housing, seeking to make policy objectives a reality.”

UK financial services group Legal &

Andrew Kail, CEO of Legal & General Retirement Institutional adds: “By investing in the growth of residential areas, such as the Whitehall Riverside development in Leeds, we are supporting a truly vibrant city that hosts key economic and employment sectors such as healthcare, life sciences, digital technologies, advanced manufacturing, as well as financial and professional services. This investment has a powerful intergenerational aspect — an example of how we are using pension savings to create productive assets for future generations.”

Other schemes in which L&G has invested in society include its provision of financing for Anchor, the UK’s largest provider of housing and care for older adults. A series of funding rounds, dating back to 2014, are assisting Anchor with its vision of building at least 500 affordable, energy-efficient homes per year over the next decade.

Steven Bolton, head of corporate private credit, Europe, L&G Asset Management, says: “We believe institutional investment can play an important role in helping to address societal challenges, and organisations like Anchor provide an enormous contribution in terms of social value. In the UK, we urgently need to drive up the delivery of all types of homes, across all tenures. As well as a housing shortage, affordability proves challenging, so funding the delivery of energy-efficient and affordable homes is ever more important.”

Real estate is teaming up with other industries to explore the latest solutions for reducing carbon emissions, backed by government drives

If macroeconomic headwinds and geopolitical differences have been placing pressure on the real estate industry’s environmental goals, the topic is still expected to maintain primacy in strategy calls this year, experts predict.

“No aspect of ESG is slowing down in the European market,” says Robbie Epsom, head of EMEA sustainability, CBRE Investment Management.

“Net zero is almost business as usual — pathways have been integrated into our investment processes. Over the coming year, we’ll be looking at how we can make that even more efficient.”

Evolving legislation is likely to provide

the “carrot and stick” for many property owners as they consider their ESG responsibilities at the start of 2025, according to Ludovic Chambe, CBRE’s head of ESG and sustainability solutions for Continental Europe.

“The challenges are different for all, but many clients are having difficulties navigating the complex legislative environment,” he says. “Since 2021, we have been moving from voluntary to mandatory reporting and tracking when it comes to building performance and emissions. During Cop21, we saw the launch of public commitments from various countries — there’s now a drive to move from

Feldberg Capital’s transformational strategies include London village within a street, Lonsdale Road

commitments to concrete action.”

As far as property owners go, Chambe says that most are currently drilling down into capex requirements to get their portfolios up to scratch. “They want to understand the levels of investment required now, as well as build sustainability into their business plans going forward,” he says. “The return on investment is key, and expectations around this are in flux.”

Public sector role

Gjermund Grimsby, chief advisor for climate change at KLP, Norway’s largest pension fund, suggests that “huge” action from governments

worldwide is now mandatory to drive long-lasting change across business and industry. “The only way we can stop fossil-fuel investments is to make renewable energy really cheap,” he says.

KLP’s investments in this area have been widespread to date. Two years ago, the pension provider teamed up with the Norwegian government to fund a major solar power plant project in India, while last year, KLP committed to an investment fund focused on solar and energy storage assets located in OECD countries.

The European Commission is mobilising with new guidelines and rules to support the industry. For example, areas such as the EU’s Corporate Sustainability Reporting Directive (CSRD) are expected to reach a more formalised stage this year. Companies in the EU had been obliged to consider the new reporting rules for the first time in the 2024 financial year in preparation for reports published in 2025, which should disclose information on what large companies see as the risks and opportunities arising from social and environmental issues, and the impact of their activities on people and the environment.

Another growing area of interest is climate risk, with landlords not only wanting to understand the degree of risk, but also the right actions to mitigate that exposure. Contrary to popular belief, there are lots of things building owners can do to defend against freak weather incidents, Chambe says. “We can implement measures like elevating buildings, reinforce foundations, install flood barriers, or move technical equipment from the basement to the roof, Landlords and occupiers are now seeking to include such aspects in their ongoing business plans. After the recent floods in Valencia, a lot of our clients came back to us to discuss how they could future-proof their portfolios.”

Jon Cochrane, head of asset management at real estate investment manager Feldberg Capital, says that its

workplace-focused strategies have been helping to reassure occupiers about the climate-change question. Cora, Feldberg’s recently launched £500m (€603m) brown-to-green workplace impact fund, is targeting offices ripe for redevelopment in locations such as Soho, Marylebone and Fitzrovia. Focusing on energy-inefficient ‘brown’ offices, Feldberg is using its ESG framework to transform older office assets into modern energy-efficient green workplaces.

“With Cora, we are seeing occupiers engage with the impact strategy much more than they might have done in the past,” Cochrane says. They want to see a “net-zero trajectory for decarbonisation, and evidence of the resilience of the asset in the face of freak weather events, for reasons of business continuity”, he says. “IT and comms teams will come along to inspect assets and ask a lot more questions about whether buildings are equipped to handle overheating, flood risks or power outages.”

Materials matter

In the midst of the race to decarbonise and improve asset resilience, building materials are increasingly coming under the lens. One frontrunner on the road to carbon neutrality and circular economy in this area is Heidelberg Materials. The global firm, which prides itself on innovation and creativity, has been working on intelligent and sustainable building materials as well as solutions for the future.

As part of its goal to accelerate growth and circularity in the US, the business acquired Giant Cement Holding in November of last year. The acquisition includes one cement plant, two deep-water import terminals, five distribution terminals, and an alternative fuel-recycling business.

“Our latest additions are yet another great strategic fit creating value in the near term through significant synergies with our existingassets on the East Coast,” says Dr Dominik von Achten, chairman of the managing board of Heidelberg Materials. “At the same time, we are excited about taking further steps

in building a sustainable future and positioning Heidelberg Materials as the front runner on the path to net zero and a circular economy in the key North American market.”

Pan-European steel and mining company ArcelorMittal is seeking to create smarter steels for people and the planet. In addition to a 2050 net-zero target, the company has recently set a global target of reducing its CO2 emissions intensity by 25% by 2030, while in Europe the target is of a 35% reduction by 2030. Its pioneering Torero plant in Gent, Belgium is the first of its kind in the European steel industry, using self-produced bio-coal for its blast furnace. Under its umbrella brand, XCarb, the firm is grouping together all of the reduced, low and zero-carbon steelmaking activity of ArcelorMittal, as well as wider initiatives and green innovation projects to help demonstrate progress and boost transparency.

ROAD TO ZERO STAGE

WHERE ARE WE ON THE ROAD TO ZERO?: TUESDAY, MARCH 11 14.00 - 15.00

PLAN YOUR TRANSITION TO ZERO CARBON: TUESDAY, MARCH 11 16.00 - 17.00

SURVIVING EU TAXONOMY: WEDNESDAY, MARCH 12 10.00 - 11.00

TRANSITION KPIS UNPACKED: WEDNESDAY, MARCH 12 11.30 - 12.30

FROM BROWN TO GREEN: WEDNESDAY, MARCH 12 14.00 - 15.00

ASSESSING AND ADDRESSING PHYSICAL CLIMATE RISK: THURSDAY, MARCH 13 10.00 - 11.00

Dealmaking should accelerate in 2025, as experts predict a cycle reset for real estate’s capital markets

Real estate investing in 2025 will be anything but dull, with global politics, macroeconomic movements and capital flows all shaping the dealmaking environment, according to sector experts. Victor Stoltenburg, global head of acquisitions and sales at Deka Immobilien, suggests that “2025 will be an interesting year”, noting that Donald Trump’s return to The White House will come under plenty of scrutiny. In Europe, he suggests that interest-rate cuts by the European Central Bank (ECB) will not be as numerous as once thought. A key alternative to real estate, the German bond market, may put pressure on capital raising for certain parts of the industry, he adds. “There are concerns that the German 10-year bond yield will stabilise somewhere above 2%, which is an important benchmark for us,” he says. Capital raising for core real estate,

which has been sluggish over the last two years, may be slow to improve, meaning core deals will continue to lag opportunistic ones at the deals table. “While there is good liquidity for value-add strategies, with opportunistic funds able to target double-digit investments, core money takes longer to return. While we are seeing signs of the core market coming back all over Europe, core investors are more cautious on principle,” he says.

In the light of this, Stoltenburg suggests that Deka Immobilien’s acquisition strategy will remain “opportunity based”. Globally, Deka’s funds have continued to find interesting deals across the core asset classes of offices, retail, logistics and hotels in recent years. In the US and Asia, the focus has often been on offices, and Stoltenburg notes that this “counter-cyclical” approach is likely to continue.

“On the face of it US offices are very weak at the moment, but we consider the asset class something of a ‘hidden champion’,” he says. “I was in New York at the end of 2024, touring the Manhattan market, and was surprised by how quickly recovery is happening there. In Asia, offices are still the easiest part of the market for us to understand, although logistics there, as elsewhere, has an enduring appeal for us.”

In Europe, Deka’s investments are well diversified. “Although offices represent 65% of our portfolio, we have always invested in hotels and logistics, as well as retail,” he says. “We have more than 80 hotels across Europe. Retail has been slower over the past decade, but it is currently coming back, on a different yield basis.”

Cushman & Wakefield’s recent Investment Atlas reveals that 84% of European prime office, retail and logistics

markets are currently undervalued, 16% are fairly priced, while none are fully priced.

The UK and Germany emerge as the most compelling destinations, with a high concentration of underpriced markets. Germany boasts all 17 prime markets classified as underpriced, while the UK showcases 24 out of 27 markets in the same category.

The report highlights the logistics sector as particularly promising, with 95% of its markets considered undervalued. Notably, the retail sector has experienced a remarkable turnaround, witnessing a 24-percentage point increase in underpriced markets over the past two quarters. This positive shift, coupled with improving consumer sentiment, positions retail for potential growth.

Historically, real estate cycles have demonstrated a consistent pattern, taking an average of 6.7 years for markets to transition from undervalued to overvalued. This cycle suggests that European markets are poised for a period of growth and value appreciation.

Sukhdeep Dhillon, head of EMEA Forecasting at Cushman & Wakefield, says: “Underpriced markets are attractive targets for real estate investments, with opportunities for capital appreciation as the market adjusts towards fair value. There have been notable improvements across most markets, facilitated by stable total returns forecasts, a reduction in bond yields, and an improvement in the risk premium.

“Germany has experienced significant repricing, but yields have largely stabilised across the board. Despite current economic challenges, there is a cautious optimism for the German real estate market, and momentum is expected to improve.”

David Hutchings, head of EMEA investment strategy at Cushman & Wakefield, adds: “The market is turning and investors must reset their strategies. Multiple opportunities in commercial real estate across various risk profiles are emerging, balancing income security with operational gains.

“Geopolitical risks mean that the recovery will be uneven, but some of the best purchases may be in the year ahead. While prime values bottomed out in Q2, secondary stock remains threatened and legacy assets remain at risk of stranding. Repositioning and

repurposing such assets is a major area of opportunity, but for all assets, defining their ‘reason to be’ is key.”

Brian Klinksiek, global head of research and strategy at LaSalle, adds a big-picture view. “Global real estate sentiment is gradually improving following a long period of negativity and signs are pointing to the beginning of a new real estate cycle,” he suggests.

“History has shown that investing early in a cycle tends to lead to relatively strong performance. There are, however, still risks on the horizon, and investors are advised to focus on diversified strategies that are flexible and broad enough to adapt to a complex and evolving relative value landscape. A comprehensive look at value across a wide range of sectors and markets will

be required to build a well-positioned real estate portfolio.”

According to the latest LaSalle data, certain European retail sectors are now highly attractive investments in the wake of a significant downturn. Outlet centres in the UK and Northern Europe, along with retail parks in Spain and France, and convenience centres in the Netherlands, are showing strong tenant-operator alignment and high-income potential.

Europe is at the forefront of the office market’s shift to hybrid work, driven by its predominantly mixed-use, mid-rise buildings. This adaptation is currently under way, as seen in rising return-to-office rates and improving market fundamentals. London, for example, has seen five consecutive quarters of declining office vacancy, leading to increased prime rents.

The European residential market is diverse, encompassing many sub-sectors with varying financial characteristics, regulations and target renters, according to LaSalle research. While investment opportunities exist, careful sector selection is crucial, the firm says; PBSA in Spain and Germany remains particularly noteworthy.

THE RE-INVEST SUMMIT TUESDAY, MARCH 11 08.00 - 14.00 HOTEL MARTINEZ

THE GLOBAL INVESTORS’ VISION TUESDAY, MARCH 11 16.00 - 17.00

LEADERS’ PERSPECTIVE STAGE

MACROECONOMICS, ATTRACTING INVESTMENT AND INSURANCE OF REAL ESTATE

THURSDAY, MARCH 13 11.30 - 12.30

LEADERS’ PERSPECTIVE STAGE

Palais des Festivals, Cannes, France

This international half day summit (1pm - 8pm) aims to bring together key stakeholders from the public, private, and civil society sectors, encouraging cross-sector collaboration to address the critical housing challenges of today.

Its second edition introduces new and more interactive formats featuring sessions with speeches from key players in the housing sector, an immersive workshop focused on exploring the key aspects of the new housing deal, networking opportunities, ending with a cocktail.

Despite real estate lagging other sectors in tech take-up, the potential of AI is now driving industry efforts that embrace big data

The real estate industry is warming to the multiple applications of artificial intelligence (AI), as the adoption of machine-learning tools moves into the mainstream.

“It is natural for industries to adopt new technologies at different paces,” says Andreas Horn, head of AIOps EMEA at IBM Consulting. “Traditional sectors like real estate tend to be more conservative and slower to embrace innovation compared to tech-driven fields such as finance or retail, which are inherently more adaptive and fast-paced.

“In addition, real estate is also a more

fragmented market split across countries and regions, which relies often on personal networks and therefore faces unique challenges that complicate widespread adoption.

“However, there is a noticeable shift happening. I observe a growing interest in AI in this sector, which should unlock its further potential.”

Jorge Martin, executive director, capital markets transactions at JLL, sees a data issue complicating the use of AI. “The real estate industry’s slower adoption of AI applications can be attributed to a fundamental challenge in real estate data, which sets it apart from other sectors and makes technological integration more complex.

“Unlike other industries where data can be created and structured specifically for AI model training and intelligence extraction, real estate data is inherently tied to physical assets. It cannot be generated digitally or simplified into a few contract fields like in financial markets.” Usually requiring on-the-ground efforts to gather information about buildings, owners, tenants and their intricate relationships, Martin sees a “process which is time-consuming and resource-intensive”.

As a result, while powerful AI applications for the real estate sector are in development, their full potential is only beginning to emerge. Despite this, the

Since 1896, The Architectural Review has scoured the globe for architecture that challenges and inspires.

Support independent critical writing and receive a year of provocative ideas and inspiring projects from around the world.

Become a subscriber today

Subscribe today and receive:

• print issues you will refer to for years to come

• full access to AR online and past digital editions

• editorial newsletters with pieces from the archive

• online reading lists, films and podcasts

• weekly competition updates

architectural-review.com/subscriptions

industry expects to see significant advancements in AI utility over the next 12 to 18 months as these challenges are addressed and overcome.

Horn says that there are several exciting applications where AI is already driving efficiency in real estate. “In market analysis and investment, AI is very powerful at analysing datasets to uncover trends and forecast property values,” he says. By considering factors like demographics and economic indicators, AI can enable smarter, faster investment decisions, he says, adding: “I am already seeing this use case being applied on a very large scale by many companies.”

Altus Group is a technology and data specialist working with the commercial real estate industry to improve efficiencies in asset management. Its recent software launch, Argus Intelligence, is a portfolio performance offer that transforms how investors model, monitor and manage assets, portfolios and funds. David Ross, chief technology officer at Altus, says: “This launch marks a significant evolution for Argus, transforming it from its forecasting and modelling roots into a mission-critical solution for driving CRE performance. CRE investors can now consistently measure their performance against both internal plans and relevant peers and identify key metrics to stress-test their cash flows.”

He adds: “Altus is investing in enhancing CRE intelligence. We’re leveraging AI to solve critical data challenges and providing the industry with a new data model that connects the Argus ecosystem.”

Horn notes that customer engagement is another area where AI is making strides in real estate. “When combined with VR and AR, AI enables virtual tours and personalised recommendations, creating enhanced tenant experiences while saving time.” He adds: “I also like to think of AI as a powerful tool to automate all kinds of mundane tasks like rent collection or compliance checks. It can really help to speed things up and reduce errors and allowing focus on strategic initiatives.”

Another important area of AI application for Horn is property management, where “AI-driven predictive analytics can help to turn maintenance into a proactive process, reducing costs and enhancing tenant satisfaction”, Horn says. “By addressing inefficiencies, AI can provide practical solutions to these kinds of challenges. Additionally, another field in the same context is AI-powered chatbots, which streamline tenant communication, allowing property managers to focus on more complex and strategic tasks.”

AI-powered automation specialist askporter works with housing providers in the UK to improve the resident experience. Ben Yexley, the firm’s head of business development, says that local councils and building managers have been surprised by how effective tools like chatbots can be. “One council told us that they didn’t want chatbots in their system as they felt they would lose contact with their customers,” Yexley says. “But when they used them, they found that almost 40% of complaints online were from silent residents who don’t open the door to council workers. Many of these residents don’t feel like they have an avenue to raise problems or are non-English speakers.”

AI can also interpret and monitor residential scenarios via IOT devices in properties, which are able to give early-warning signals about factors like condensation, mould and even noise.

Despite enthusiasm around AI, Horn warns investors and property owners to be cognizant of the risks involved. “I always say that in IT, caution with sensitive personal and financial data is essential. This applies not only to AI-related stuff. Mask data where possible and avoid sharing it publicly or through tools like ChatGPT. Be mindful of bias in AI outcomes, always validate results and remember AI should enhance human efforts, not replace them.”

Potential problem areas include operational disruption, financial losses,

reputational damage and matters of regulatory compliance. In the midst of the industry’s rush to embrace proptech and AI, some experts are concerned that real estate firms may not have been paying sufficient attention to the vulnerabilities that come with it.

Martin says: “Cybercrime is a new and dangerous industry which is already impacting all of us. As much as real estate keeps embracing tech, these risks will increase, but already today cyber risks are well present for all of us.” He also points out that AI is quite expensive tech and says that “investing in AI only for the sake of it, without any real problem to solve, could drive negative return investments or applications without any value-add for the industry”.

Horn adds: “Initial AI implementation can be costly, but in the midterm, it leads to greater productivity and efficiency. Equally important is workforce enablement — ensuring teams are trained to fully leverage AI’s potential is crucial and often overlooked.”

WEDNESDAY, MARCH 12 MAKE IT HAPPEN STAGE

HOW SOME ORGANISATIONS GET AN UNFAIR ADVANTAGE WITH AI: 10.00 - 11.00

A 101 FOR SENIOR REAL ESTATE LEADERS: 11.30 - 12.30

HOW DATA CAN HELP SOLVE REAL ESTATE PROBLEMS: 14.00 - 15.00

READYING YOUR BUSINESS FOR A DIGITAL WORLD: 15.30 - 16.30

The need for shelter that caters to a wide variety of communities is prompting incredible blue-sky thinking in the housing space

As global housing shortages deepen, the international real estate community is seeking to offer solutions to the public sector and progressing projects of its own.

In recent years MIPIM’s Housing Matters! summit has shared many remarkable stories. One of these is Fratries, a French initiative to tackle issues around poor-quality housing and inclusion for young people with disabilities. The solution — modern coliving spaces in which young workers, with and without disabilities, simply live together — has already transformed

hundreds of lives. Since its launch in 2021, Fratries has opened six houses — three in Nantes, one in Rennes and two in the Paris region — and plans to launch another three in 2025, including one in the city of Paris.

Co-founded by Emmanuel de Carayon and Aurélien L’Hermitte, de Carayon says that the original plan for Fratries was for a place where “everyone could live together, disabled or not — like any other coliving”. He adds: “Today, we are well on the road to fulfilling this vision, if not even further along than we envisioned.”

He notes that the solution is not merely about shelter. “Fratries is changing

mentalities and expectations about disability by offering young professionals with mental disability the opportunity to live the life they want to. Our next goal is not only to open a few more coliving spaces, but also to inspire other actors in the coliving and real estate sectors that housing people with a mental disability is not hard — it should even be the norm.”

He adds: “The roommates are really enjoying their experiences in a Fratries coliving. They stay for an average of 18 months, which is longer than the usual time in a coliving. They like to say they live in a sort of ideal micro-society where everyone is equal.”

Fratries has found key partners for its schemes in the Paris region. “In Versailles, we worked alongside Solifap, a social investment company which bought the house and is renting it to Fratries with a very low rent,” he says. The 10-bedroomed property, with ensuite bathrooms, also has generous shared amenities including a media room and garden, while the home manager has an apartment in a private section of the house.

Last year also saw Fratries acquire its first building in the heart of Paris, in the 15th arrondissement, in partnership with Remake Asset Manage-

ment on behalf of the SCPI Remake Live fund. “This 750 sq m building will house 16 roommates, with a bedroom and a private bathroom each, with an expected opening in the third quarter of 2025.”

De Carayon adds: “We’d now like to organise a big get-together for all the Fratries roommates across our coliving houses, to enhance the sense of community they already feel. They are eager to meet each other and share their experiences, as each house of course works differently.”

Importantly, there are now plenty of initiatives across Europe which are seeking to tackle both specific and general issues around housing. In the UK, SoloHaus homes are innovative, low-cost modular homes designed specifically to support and protect vulnerable residents. Delivered through a partnership between Harlow Council and The Hill Group, a recent tranche of SoloHaus schemes will support homeless people in the region.

Andy Hill, founder and group chief executive of The Hill Group says: “We’re excited to begin work on the deployment of these SoloHaus homes, which will offer essential housing for vulnerable individuals seeking a safe and supportive environment to rebuild their lives. Our regeneration

partnership with Harlow Council continues to grow as we take on new projects across the town, and we’re eager to keep working toward a brighter future for the local community.”

SoloHaus homes are purpose built in factories in the West Midlands by Hill’s manufacturing partner, Volumetric Modular. Each home arrives ready for installation which is quick and straightforward and comes complete with furniture, bedding and kitchen equipment such as plates and cutlery.

Building sustainable homes is another way to make a meaningful difference to communities. In October, the Urban Splash Residential Fund (USRF), and its Investment Adviser Sure Capital Partners, entered into a £200m partnership with sustainable developer Citu for the provision of resilient, mixed-use neighbourhoods in northern England.

The strategic partnership covers 600 homes with opportunity to grow, and includes an initial purchase of 52 Citu homes within the Climate Innovation District in Leeds and Kelham Central, Sheffield. Both developments follow Citu’s placemaking principles creating resilient, green, mixed-use neighbourhoods of low-energy homes, focused on peo-

HOUSING MATTERS! SUMMIT GRAND AUDITORIUM STAGE MONDAY, MARCH 10

13.00 - 18.00

ple and communities. “Our mission is to cultivate a portfolio of design-led homes for renters,” says Akeel Malik, partner at Sure.

Yorkshire-born Citu creates homes that work to Passivhaus principles, making them approximately 75% more energy efficient than a traditional home in the UK. Citu’s homes are also manufactured locally in its Yorkshire factory using modern methods of construction (MMC) that substantially lower carbon emissions.

In Germany, meanwhile, Urban Partners’ real estate investor Nrep recently inked a strategic joint venture focused on the German residential rental market with Frankfurt-based asset and investment manager aam2core Holding. The €300m joint venture covers the acquisition, modernisation and operation of rental assets across demographically attractive German cities and metropolitan regions, in particular the seven most populous cities. The aim is to create an institutional-grade, sustainability-focused portfolio, achieved through energy-efficient renovations and exploring untapped building rights potential.

Rune Kock, CEO of Nrep, says: “The discrepancy between supply and demand in the German housing market remains acute. This, combined with the pressing need to accelerate the green transition of the built environment, has created a strong investment thesis for this type of sustainability-focused residential product.

“This represents the latest commitment from Nrep’s NSF V Fund, the €3.65bn value-add fund that targets unmet societal needs arising from urbanisation, including the lack of customer centric and sustainability focused housing in large and growing cities.”

The joint venture has already signed its first acquisition in Cologne, a residential building with more than 5,000 sq m of rental space and a reserve of building land. In conjunction with a green retrofit of the existing building, an additional 3,000 sq m of new residential space will be developed.

11-14 March 2025

La Croisette, Cannes, France

Hotel & Tourism takes center stage at the entrance of La Croisette: Explore top hospitality projects, gain expert insights, and network with the most influential players in the industry - all in an exclusive 500-sqm space designed for high-level business connections.

1,000+ H&T and investment leaders

Research showing that diversity, equity and inclusion increase creativity, innovation and financial performance is igniting change in real estate

Commercial real estate (CRE) has taken huge strides in recent years in terms of its approach to diversity, equity and inclusion (DEI). The third iteration of The Global Real Estate DEI Survey, published in 2024, found not only that 96% of CRE firms have DEI strategies, but are increasingly focused on scholarships and internships within the workforce. Firms adopting formal DEI strategies increased by 5% yearon-year, according to the survey, which is supported by 19 real estate industry associations globally. Key highlights from the Global Real

Estate DEI Survey show commercial real estate firms are increasingly focused on attracting more underrepresented people to the industry as a whole — with 31.6% of firms saying the most impactful DEI policy in 2023 was creating scholarships and internships to increase diversity in candidate pools, up from just 18% of firms the year prior.

In terms of employee demographics, headline data shows the representation of women in commercial real estate ranged from 39.8% to 45.6% across the four regions surveyed, which comprise Asia-Pacific, Europe, Canada and the US.

The real estate industry is uniquely equipped to build more diverse and equitable communities

In Europe, which represents 11.9% of respondents, the survey found that 39.8% of all commercial real estate roles in Europe are held by women, with women making the most gains in 2023 at the executive management level. Meanwhile, 25.4% of executive management roles are held by women, up from 12.9% in the year prior. European firms also actively hired and promoted women for the most senior roles in their organisations in 2023. At the executive management and senior level, firms promoted and hired more women than was currently represented, helping to move the needle on representation.

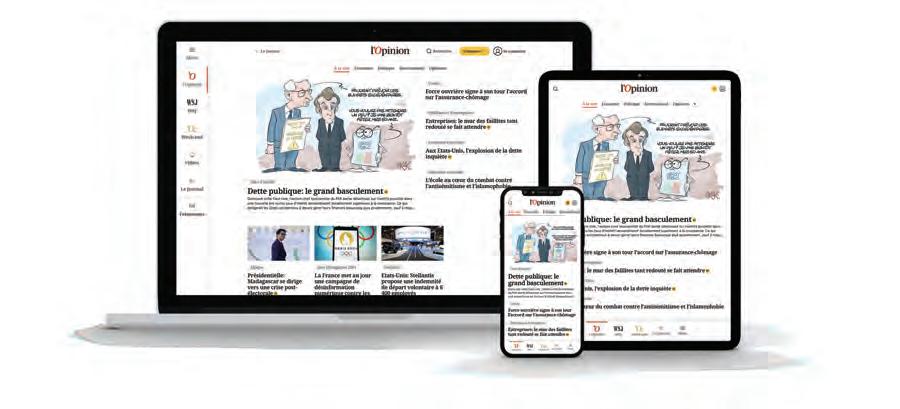

FLASHEZ POUR VOUS ABONNER !

Lisez l’Opinion sur tous vos écrans et retrouvez nos contenus

1

Explorez toute la richesse de l’Opinion

Par le biais de notre site web ou de notre application mobile, profitez d’un accès illimité à tous les articles réservés aux abonnés.

Accédez aux meilleurs articles de The Wall Street Journal sélectionnés et traduits en français par notre rédaction. 2 LES AVANTAGES DE L’OFFRE

engagement

3

Feuilletez l’Opinion en avant-première

Accédez à votre journal numérique dès 20h, la veille de sa parution.

Stéphanie Bensimon, head of real estate, Ardian France, says: “There are still fewer women working in real estate than men, either because there are not enough applicants for hire or because women leave the business at a certain stage of their career, often during life-cycle events such as maternity. And certain gender pay gaps still exist. So, there is still a long way to go, but we can already see positive changes.”