A warm welcome to MIPIM 2025, which has gathered delegates and speakers from around the world to bring you the views and insights on the topics that matter the most.

In a time when the globe is being shaped by geopolitical shifts, we have assembled a cast of political experts to guide you, from keynote speaker Dr Mario Draghi to Mayor of London Sadiq Khan. Ministers from Brazil, Denmark, France and Oman will also offer valuable insights, while several mayors of European capitals, from Athens, Copenhagen, Madrid, Rome and Vilnius will be in attendance too. We heard important interventions on the critical topic of homes at Housing Matters!, our one-day summit that took place yesterday. This brought together leading lights from real estate, politics, academia and the non-profit world to explore how the public and private sector are relieving pressures on the residential sector. On Wednesday, don’t miss contributions from executive director of UN-Habitat, Anacláudia Rossbach, an economist with over 20 years of experience in housing, informal settlements and urban policies. MIPIM will showcase five stages offering insights, lessons and networking opportunities, highlighting key geographies, megatrends

and the industry’s dominant asset classes. Our Road to Zero stage will focus on the leading sustainability solutions from sector experts, while powerful change-makers in real estate will speak on the Leaders’ Perspective Stage.

The key topics that matter to you, matter to us. We will examine innovations in artificial intelligence (AI) over a series of talks about how they are changing business practices and the future of work. MIPIM will also explore questions around finding and nurturing talent in sessions exploring the benefits of diversity, equity and inclusion, while our MIPIM Challengers initiative creates space for the next generation of real estate professionals to bring fresh ideas and new perspectives to the industry.

Finally, leaders from key sources of global capital will be in attendance to seek out the best new projects to back, and to network with those generating ideas at the forefront of real estate.

MIPIM has always been about sitting down with industry leaders in order to drive your business forward. We are also proud to stand alongside you in unpredictable times to promote dialogue, growth and action.

Al Alamein Hotel stands as a timeless retreat along the pristine shores of Sidi Abd El Rahman.

It is a historic sanctuary not just a place to stay,it's a cherished destination that holds a special place in the hearts of its guests.

Dr Mario Draghi, former president of the European Central Bank and Italian Prime Minister, will deliver the keynote address examining the economic shifts shaping local, European and international investment and real estate.

Considered one of the greatest economic leaders of our time, Dr Draghi continues to inspire with his insightful analysis of the global economy. As president of the European Central Bank (2011–2019), he was celebrated for his pivotal role in saving the Eurozone, notably through bold monetary policies that led to the creation of 13 million jobs.

Dr Draghi also established himself as a key figure in European politics as the Prime Minister of Italy (2021–2022). His term was marked by critical initiatives, including managing the pandemic and driving forward the European Next Generation EU programme. The economic and political leader is also the author of the report on The Future of European Competitiveness, which outlines a roadmap for Europe’s economic revitalisation.

Logistics, Romania, construction, technology, ESG trends, planning, Japanese development, Bahrain, Norway, hospitality, macroeconomic outlook

LIVING:

Smart investors are innovating across all types of beds

EMERGING ASSET CLASSES: Data centres and life sciences are attracting attention

All the session details, expert speakers, conferences and events, to help you plan your time at MIPIM and make the most of the latest intelligence, insights and debate Conferences

Mayor of London, Sadiq Khan, arrived in Cannes to take part in MIPIM for the first time and met with MIPIM director Nicolas Kozubek before speaking at Housing Matters! (see page 7)

DIRECTOR OF PUBLICATIONS Michel Filzi EDITORIAL DEPARTMENT Editor in Chief, Isobel Lee; News Editor, Julian Newby; Sub Editors, Neil Churchman, Joanna Stephens; Proof Reader, Debbie Lincoln; Reporters, Adam Branson, Clive Bull, Ben Cooper, Mark Faithful, Andy Fry, Liz Morrell, Nigel Willmott; Editorial Management, Boutique Media International; Graphic Studio, studioA Design; Layout Designers, Harriet Palmer, Sunnie Newby; Head of Photographers, Yann Coatsaliou/360 Medias; Photographers, Cyril Chateau, Patrick Frega, Phyrass Haidar, Olivier Houeix, Sebastien Nogier PRODUCTION DEPARTMENT Publishing Director, Martin Screpel; Publishing Manager, Amrane Lamiri; Printer CREAMANIA (France).

Advertising contact in Cannes Aswad Regent aswad.regent@rxglobal.com RX France, a French joint stock company with a capital of 90,000,000 euros, having its registered offices at 52 Quai de Dion Bouton 92800 Puteaux, France, registered with the Nanterre Trade and Companies Register under n°410 219 364 - VAT number: FR92 410 219 364. Contents © 2025, RX France Market Publications. Printed on PEFC certified paper

AFTER MORE THEN 30 YEARS OF DYNAMIC ECONOMIC GROWTH, POLAND HAS ESTABLISHED ITSELF AS ONE OF EUROPE’S MOST COMPETITIVE MARKETS. IN 2024, IT WAS THE FASTEST-GROWING LARGE ECONOMY IN THE EU, AND IT IS PROJECTED TO MAINTAIN THIS POSITION IN 2025.

KEY SESSIONS:

POLAND’S LOGISTICS & INDUSTRIAL SAFE BET: What is capturing investors’ attention?

TUESDAY March 11 | 11:30 – 12:30

POLAND’S SILESIA REGION & KATOWICE MEGACITY: A new powerhouse for global investments

WEDNESDAY March 12 | 13:45 – 14:45

AND SESSIONS FEATURING WARSAW AS A GUEST SPEAKER:

INVEST IN… BLACKPOOL, CALAIS, OSTRAVA, OTTAWA, NICE, PORTO, ROMA, WARSAW

TUESDAY March 11 | 16:00 – 17:00

NIGHT-TIME ECONOMY AND 24-HOUR CITIES

WEDNESDAY March 12 | 15:00 – 15:45

JOIN US AT THE POLAND INVESTMENT FORUM AT MIPIM 2025 FOR EXPERT INSIGHTS ON POLAND’S BOOMING INVESTMENT LANDSCAPE.

FINANCING NEIGHBOURHOOD REGENERATION IN EUROPE: Cities and re’s path to tackle the housing crisis without sacrificing climate goals – c40 cities

THURSDAY March 13 | 16:00 – 17:00

DON’T MISS YOUR CHANCE TO CONNECT WITH GLOBAL LEADERS, EXPLORE INVESTMENT OPPORTUNITIES, AND SHAPE THE FUTURE OF EUROPEAN CITIES.

‘A new government gamechanger’ is a

LEADING experts on housing gathered at the first conference of this year’s MIPIM yesterday to discuss the challenges posed by the global housing shortage in the residential sector.

Senior figures from the worlds of politics, real estate investment and housing development took part in an afternoon of sessions under the Housing Matters! programme, which included a keynote speech by London Mayor, Sir Sadiq Khan.

Panelists across the sessions were asked to consider the factors behind the widespread lack of housing, especially affordable housing, and the role the property industry can play in tackling it.

In a speech ahead of the second Housing Matters! session, the London Mayor admitted that the UK capital “faces an acute housing crisis”, and that “recent years have been challenging” for the authority he leads.

But he added that the election of a new government in Britain, and subsequent reforms and relaxations of the national planning system to enable quicker housebuilding, were “game changers” for the city.

“I firmly believe that the election of a new, pro-growth government marks a turning point and a huge opportunity. Because as far as London is concerned a new government isn’t just a welcome ray of light, it’s a game changer.

“It’s a game changer for our efforts to fix London’s housing crisis and a

game-changer for developers and investors who are tired of being blocked and just want to get on and build projects with local communities.”

Addressing delegates at the first panel of the afternoon, Mahdi Mokrane, head of investment strategy and research at multinational real estate investment firm Patrizia, said that “stability and predictability” in the rules governing capital flows will be key to engaging investors to tackle the global housing shortage.

He said: “The rule of the game is fine. We can operate successfully, win-winwin — win for the tenant, win for the public good and for the capital as long as the rule of the game is predictable and stable. [Change] is something investors do not really like.”

Speaking during the second session of the afternoon, aimed at exploring collaborative solutions to the problem, Svitlana Gubriy, head of indirect real assets at Aberdeen Investments, emphasised the role of Build to Rent (BTR) development as a solution to the challenge.

She said: “BTR is an important part of the provision of social housing overall. BTR allows people who may not have enough capital to buy their own home to live in modern accommodation. That will relieve pressure on the housing shortage and allow other people to have access to affordable and social housing. BTR done correctly can create a sense of community and social value, and at the end we are all about building inclusively and sustainably over the long term.”

Former President of the European Central Bank and Italian Prime Minister, Dr. Mario Draghi will open MIPIM 2025. Author of the report on “The Future of European Competitiveness”, he will shed light on Europe’s economic transformation plans in a rapidly changing geopolitical climate.

Considered one of the greatest economic leaders of our time, Dr. Draghi continues to inspire with his insightful analysis of the global economy. As President of the European Central Bank (2011–2019), he was celebrated for his pivotal role in saving the Eurozone, notably through bold monetary policies that led to the creation of 13 million jobs.

Dr. Draghi also established himself as a key figure in European politics as the Prime Minister of Italy (2021–2022).

Join us on Tuesday 11 March at 15:00 in the Grand Auditorium

WITH a new cycle in a world undergoing rapid transition, while geopolitical uncertainties remain but inflation and interest rates are stabilising, investors should find a more predictable market environment, according to Asoka Wöhrmann, CEO of global asset management advisor Patrizia. Against this shifting landscape, he identified the megatrends of digitalisation, urbanisation, energy transition and living as key forces driving the sector’s recovery and unlocking new investment opportunities, he predicted.

“The convergence of real estate and infrastructure is creating a new emerging asset class that we call ‘RE-infra’. As cities become more connected with technology reshaping urban connectivity, mobility and energy efficiency, investors will increasingly look beyond traditional real estate towards smart real asset solutions that offer resilience, adaptability and stable attractive returns,” Wöhrmann said.

Investors are already seeking out future-proof smart assets where refurbishment, modernisation and decarbonisation are key enablers for long-term value creation, he said, stressing that technology will play an equally critical role in shaping the sector’s evolution as AI, digital twins and data analytics become indispensable in the optimisation of asset performance.

“At Patrizia, we are positioning ourselves at the forefront of these trends. Our goal is to lead this transformation, delivering innovative, sustainable investment opportunities that shape smarter urban living and build the resilient infrastructure necessary for future societies and economies,” he said.

At this year’s MIPIM Wöhrmann believes that value-add living will also be a key area of growth, as urbanisation and demographic shifts drive demand for more affordable, sustainable and digitally connected housing, while decarbonising and smart refurbishment of existing assets will also remain crucial investment themes.

“We are a long-term participant of MIPIM, and MIPIM has become a major business forum for our clients and for Patrizia, where we have the opportunity to showcase our expertise as a leading smart real asset manager and get a better sense of industry trends and investor sentiment,” Wöhrmann said.

“As we expand across Europe, Asia-Pacific and Japan, MIPIM allows us to connect with institutional investors who share our vision for impact-driven investments in our main growth areas of living, value-add, ‘RE-infra’, European infrastructure, and our independent club investment platform, Advantage Investment Partners.”

ITALIAN real estate giant COIMA Group is in Cannes to further its core development agenda of delivering and investing sustainable urban transformation projects.

Led by founder and chief executive Manfredi Catella, a team from COIMA has come to MIPIM to meet with business and city leaders, and to discuss the major trends impacting real estate.

Catella said that Europe is primed to shape the future of the real estate industry, and to face, and resolve, the many economic and political challenges faced by property professionals around the world.

He said: “Europe — and European real estate in particular — has a great opportunity to lead the way on a global stage to align financial performance with sustainability objectives to create more liveable urban communities — and this is COIMA’s mission as well.

“It will be good to hear from the range of different city leaders attending MIPIM this year on these issues as well, particularly as we see political pressures from some quarters to row back on ESG commitments and the wider sustainability agenda.”

He said that in COIMA’s domestic

market a key trend of interest to investors is the great “latent potential” it possesses due to years of underinvestment during a “period of challenging market conditions”.

“Compared to other European countries,” he said, “Italy has a larger stock of obsolete real estate that offers transition opportunities for development and repositioning.

“For years, little has been invested in modern real estate in Italy. Today, with demand increasingly oriented towards quality and sustainable assets, supply is not able to meet the new needs of the market across a range of asset classes.”

Catella pointed to an “acute shortage of modern purpose-built student-living schemes” as a major opportunity, as well as the need for more affordable housing in Italy.

Headquartered in Milan, the group’s investment division, COIMA SGR, currently oversees 30 real estate funds in Italy and internationally, while its property arm, COIMA REM, manages some five million sq m of real estate.

COIMA SGR was responsible for the development of the Porto Nuova project, a transformative 290,000 sq m urban-regeneration scheme in Milan.

REAL ESTATE leaders globally are braced for another challenging year, with lingering inflation, largely driven by geopolitical instability and persistently higher interest rates in some regions potentially delaying a hoped-for recovery in capital markets and occupancy metrics.

This is according to the Emerging Trends In Real Estate Global Outlook 2025 from PwC and the Urban Land Institute (ULI), which is launched at MIPIM today. The report gauges global sentiment for investment and development prospects, amalgamating and updating three regional reports that canvas thousands of real estate leaders across Europe, the US and Asia Pacific (APAC).

This year’s global report notes that political risk is an overarching industry concern, particularly in relation to how policy and legislative decisions will influence

monetary policy, the prospects for economic growth, and the continuing impacts of global conflicts and disputes.

Uncertainty, driven by factors such as the US administration’s tariff policies and broader geopolitical shifts, is reshaping the global investment landscape, the research finds. Financial markets and investment decisions across all three regions are being influenced by growing challenges and increasing regional divergences, potentially creating barriers to joint approaches to global crises. In this context, political pushback against climate targets and the ESG agenda in the US is beginning to influence Europe and potentially APAC. Sentiment varies by region, with 67% of respondents in Europe citing environmental or decarbonisation requirements as key concerns, though these issues rank lower

among APAC and North American respondents.

Among some respondents, however, there is also optimism that the industry is close to ending a three-year journey to recovery. There is also a view that 2025 may be a ‘reset point’ or the beginning of a new cycle, although there is also caution regarding the pace of recovery.

Lisette van Doorn, CEO of ULI Europe, said: “Our annual global weatherglass for real estate investment and development prospects shows that the industry is very keen to turn the page and start a new cycle on the back of lower inflation and subsequent initial interest-rate cuts. However, wider geopolitical risks with potential monetary and macroeconomic knock-on effects will lead to ongoing uncertainty for real estate investors and managers, and this calls for continued caution.”

THE MAYOR of London, Sadiq Khan, is attending MIPIM for the first time to seek record investment for the UK capital and promote London as the greatest city in the world for developers and investors. Khan is leading a delegation that is directly lobbying key developers and investors to deliver more affordable homes and regeneration projects in London, and support the city’s growth, delivering new jobs both in the capital and across the UK.

The mayor will officially launch the new investment prospectus from Opportunity London, the capital investment partnership for the city, which presents opportunities all over London.

Khan said: “I am here at MIPIM

to bang the drum for London and seek the record investment the capital needs to deliver growth, boost the economy and build the fairer,

safer and greener London that all of London’s communities deserve. “London is the greatest city in the world and I am looking forward to

Emerging Trends In Real Estate In 2025 And Beyond will be launched on The Leaders’ Perspective Stage (Palais 5) today at 14:00

meeting with key developers and investors to deliver regeneration, new transport infrastructure and housing across all four corners of our wonderful city.”

Jace Tyrrell, chief executive of Opportunity London, said: “Joining forces with the Mayor of London, the City of London Corporation and London Councils, I’m proud to be championing our capital to the world at MIPIM. This is a pivotal moment for global investors to engage with London’s next phase of growth and innovation, with over £15bn (€18bn) of live opportunities.”

He added: “London has long been defined by its ability to evolve and, as we enter a new cycle of transformation, our Team London delegation is here to showcase the ambition, energy and diversity that makes our city truly distinctive and unsurpassed across the globe.”

Agence spécialisée dans la création et la réalisation de lieux expérientiels et durables.

NEARSHORING will fuel demand for European logistics this year and beyond, Andrew Wooler, CEO at Burstone Group, told MIPIM News.

“The ongoing trend of nearshoring and regionalised supply chains will drive demand for industrial facilities closer to major European transport hubs and manufacturing clusters, which will particularly benefit markets in Central and Eastern Europe, as well as established logistics strongholds in Germany, the Netherlands and France,” he said. “We expect to see a strong but evolving market in 2025 with prime logistics rents remaining resilient, particularly in urban areas where demand continues to outstrip supply.”

Wooler added: “However, higher interest rates mean investors and occupiers are becoming increasingly discerning about asset quality, with sustainability and micro location playing a crucial role in decision-making — reflected in pricing and liquidity.”

Meanwhile, Wooler believes MIPIM remains vital for companies such as Burstone: “Our key focus is on engaging with capital providers, developers and occupiers across European markets as we continue to expand our presence.”

INSTITUTIONAL investors are finding the student living and hotels sectors increasingly attractive, according to Jay Ahluwalia, principal director at Dominus.

“While there is wider macroeconomic uncertainty, there is still plenty of capital looking for a home that will deliver sustainable, long-term income,” he said. “We’ve seen increased investment inflows in sectors that were once deemed alternatives but are increasingly part of the mainstream. Assets in sectors such as student living and hotels, which we specialise in, have become increasingly appealing to institutional investors.”

Ahluwalia added that, despite such inflows, the sectors remain undersupplied. “While investment flows have increased in each of these, the supply/demand mismatch means the underlying fundamentals remain strong,” he added. “Both student living and hotels will con-

tinue to attract capital in 2025. There will be an increased push for the development and operation of best-in-class assets in prime locations, especially in key cities where there are structural supply issues.”

In addition, Ahluwalia said, secondary office stock is ripe for investment: “While the push for prime, grade-A office stock has seen an uptick in demand as people return to the office, there is a wealth of secondary obsolete office stock that can be repurposed for alternative use. Developers who can add value through sustainably redeveloping these assets for the long term will continue to have a competitive advantage.”

He added: “There will be increased interest in the operationalisation of real estate, with more and more operators looking at a platform approach to drive efficiencies and a higher ROI, which is especially attractive at times of uncertainty.”

THE NEED to rejuvenate or redevelop the increasing volume of ageing office stock around the world will be one of the significant trends for 2025, according to Adriana Paice Kent, founder and chief executive of asset enhancement specialist firm Woven Spaces.

Large sections of the office markets in most major countries have been made “obsolete” by changing trends and next-generation building designs, Paice Kent added. These offices, she said, are now are at risk of becoming dead assets without redevelopment.

Paice Kent said that the need to “revitalise office spaces at risk of obsolescence” presents a big opportunity to investors and developers globally. She added that this opportunity is also a significant challenge, given the many changes in workplace culture and working patterns over the past

five years, along with increasingly demanding office occupiers.

“The challenge of encouraging a return to the office will remain, with businesses needing to create workspaces that not only meet occupancy and ROI goals but also attract employees back full-time,”

Paice Kent said. “Looking ahead, workspaces will need to foster

meaningful moments of connection through thoughtful design and storytelling to remain competitive.”

Paice Kent also believes that throughout 2025 “sustainability will become an even more pertinent topic”, driving increased interest in energy performance, responsible material use and carbon-conscious design in real estate.

Tuesday 11 March 2025

19.00 to 22.00 Join the Opening Night tonight on the Croisette, Riviera 9 and Gare Maritime, featuring a live band DJ sets, food & cocktails.

industry should focus on reusing existing structures rather than demolition and building afresh, according to Ondrej Chybik, co-founder of Chybik + Kristof.

“At MIPIM 2025, we will focus on the creative reuse of cities — our approach to architecture and urban design that integrates adaptation, environmental consciousness and inclusivity,” he said.

“By focusing on repurposing existing structures and transforming brownfield land into vibrant masterplans, we aim to address the housing crisis while creating modern, affordable living spaces. This strategy balances heritage with innovation, emphasising the integration of public spaces and essential infrastructure to meet contemporary community needs.”

In addition, Chybik predicted that his firm’s approach would prove popular at this year’s show. “In 2025, we anticipate a significant rise in adaptive reuse projects, as cities increasingly prioritise resource efficiency,” he said.

“This approach will also play a crucial role in addressing the housing shortage, one of the most pressing crises to tackle.”

THE INCREASING emergence of alternative residential sectors as an attractive asset class for investors will be a highlight at MIPIM this year, a UK residential architectural practice has predicted. But challenges remain for the sector.

“The alternative residential sectors, such as coliving and purpose-built student accommodation (PBSA), have seen some of highest levels of interest among investors, with more of these set to come forward this year. However, inflation and the ongoing building regulation changes, such as the recent revisions to [British Standard] BS9991, will continue to compound viability challenges within the residential market this year,” Jo Cowen, principal CEO at London-based architect Cowen + Partners said.

“There is optimism in the industry ahead of Cannes this year and I foresee opportunities in phased largescale mixed-use urban regeneration

being unlocked by investors able to take a longer-term view.”

The practice, which recently rebranded from Jo Cowen Architects, is seeing significant growth in its strategic advisory services alongside new design-led appointments, including for Modern Wharf, Greenwich for Galliard Homes and City Developments. As a result, Cowen+Partners has expanded its team with five new joiners.

Cowen said that she has a number of meetings organised at MIPIM to discuss specific viability and deliverability challenges with residential developers and investors looking at complex urban sites.

“MIPIM has always been a focal point in the year for our business. This has increased since the pandemic as it has been more senior-led and focused on key areas within the conference, such as the London Stand,” Cowen added. “This senior focus is particu-

larly useful for the strategic advisory side of our business as it is an opportunity to meet directly with investors and developers to discuss a range of challenges and opportunities.”

FINDING ways to tackle the housing crisis in the UK will be top of the agenda for developer HUB at this year’s MIPIM, Damien Sharkey, the company’s managing director told MIPIM News.

“The housing crisis is one of the most challenging issues of our generation and I expect this will be high on the agenda for many at MIPIM,” he said.

“However, for the first time in many years, we have a proactive government willing to engage with industry to find

solutions and bring about change.”

Sharkey said that there is no magic bullet when it comes to delivering the homes that the country needs.

“The country’s housing dilemma can only be solved by boosting delivery of all types and tenures, including alternative housing models,” he said.

“Build-to-rent (BTR) delivers homes at scale and pace, providing people with affordable, well-built, community-centric homes. Similarly, coliving — a sub-sector of BTR — can provide

higher quality housing than typical private rentals for those wanting to live in the most central urban locations.”

He added: “Importantly, the delivery of such schemes simultaneously revitalises previously neglected parts of our towns and cities, acting as catalysts for wider regeneration.”

The still-nascent Labour government has made a good start when it comes to housing — but still needs to go further, Sharkey said. “The government has set itself — and the industry — a challenge of delivering 1.5 million homes over the course of this parliament,” he said.

“Progress has already been made in terms of incentivising brownfield development and ruling out rent controls, which had been stalling investment for some time. However, the Building Safety Act remains a huge barrier to housing delivery and regulations must be streamlined if we are to come anywhere close to our targets.”

This project focused on Osaka's potential as a municipality. It attracted the Four Seasons, an internationally competitive luxury hotel, and contributed to the city by fostering a lively area atmosphere through art and landscape planning. Numerous works of art adorn the building, based on the concept of “Journey and Art." The exterior design is reminiscent of the sails of a yacht, and its integrated, high-rise residence+hotel design gives the building an overwhelming presence as a new landmark for Osaka, which is known as a "city of water."

Tokyo Tatemono Co., Ltd.

Hotel Properties Limited

Four Seasons Hotels and Resorts

NIKKEN SEKKEI LTD

TAKENAKA CORPORATION

STUDIO PIET BOON

11-14 March 2025

Palais des Festivals, Verrière Grand Audi, Cannes

MIPIM proudly presents the UK Hub, an exclusive platform to uncover the wealth of opportunities within the thriving UK property market.

At the UK Hub, international investors, developers, and decision-makers will gain unparalleled access to regional authorities, groundbreaking projects, and key private sector leaders. This premium space is your gateway to discovering the UK’s most attractive investment opportunities, forging high-value connections, and unlocking new business potential.

IN TODAY’s session Poland’s Logistics & Industrial Safe Bet: What is Capturing Investors’ Attention?, an expert panel will examine the key factors driving Poland’s attractiveness to investors, including the evolving liquidity of asset classes, new capital inflows and the market’s competitiveness. The session will focus on who is investing and which asset classes are most attractive as well as future trends, including ESG and the rising demand for data centres.

The panel includes Renata Osiecka, founder and owner of AXI Immo, which specialises in commercial real estate advisory services in the industrial and logistics, land, office and investment sectors.

In its 2024 report Polish Industrial and Logistics Market, AXI Immo reported that “the transaction volume in the industrial and logistics sector in 2024 reach €1.26bn — 25% of the total for the commercial real estate market — marking a 27% yearon-year increase”. A total of 29 transactions within the industrial and logistics sector were completed in 2024, including nine portfolio deals, the report said.

Poland’s Logistics & Industrial Safe Bet: What is Capturing Investors’ Attention?

Tuesday, March 11

11.30-12.30, Auditorium K

THE MADRID Nuevo Norte project is delivering “massive transformation” to the Spanish capital, according to Álvaro Aresti, president, Crea Madrid Nuevo Norte.

“MIPIM is the perfect global platform to present the Madrid Nuevo Norte project and highlight the massive transformation it will bring to Madrid,” he said. “Right now, the region is experiencing an incredible moment and is firmly on the radar of international investors.”

He added: “This project will provide Madrid with a next-generation business district, more affordable housing and major urban infrastructure improvements. Its unique location, with Spain’s largest railway station at its heart and just 15 minutes from Barajas International Airport, will offer businesses unparalleled connectivity.”

Aresti told MIPIM News the

project is of sufficient scale to catapult Madrid into the premiere league of world cities. “Madrid is at a turning point and Madrid Nuevo Norte is the final push the city needs to consolidate its status as one of the most competitive global capitals,” he said.

“Prestigious reports already rank Madrid as the most attractive city for real estate investment in the EU and thanks to Madrid Nuevo Norte the city will be able to meet this growing demand. With over a million square metres of state-of-the-art office space, Madrid will gain a tertiary building offer comparable to what Canary Wharf brought to London.”

However, Aresti added that Madrid Nuevo Norte is intended to be far more than a business district. “We’re creating a vibrant, human-scale urban environment with Madrid’s renowned lifestyle, featuring affordable hous -

ing, green spaces, retail and leisure options,” he said.

“This means we’re not just building a business district — we’re shaping a vibrant, liveable destination where companies will want to set up shop and people will want to live and work.”

A NEED to “build more, and build better” is a key issue for this year’s MIPIM, according to Frédéric Bôl, president of ASPIM, the association for French real estate companies. “We are facing climate and social challenges. Real estate needs to adapt to new ways of life with remote working and an ageing population, but also tackle the need to build eco-friendly schemes that are global warming-ready.”

He added that investment strategies need to be in step with these new challenges, supporting both energy-transition goals and the energy-efficient renovation of existing assets. “I expect this MIPIM to be forward-looking, and to explore how we can collectively overcome this crisis for our sector, and above all for cit -

izens, who will need sustainable housing solutions in the decades to come.”

Another key topic will be how to “restore confidence and stimulate investment in real estate once again”, he added.

Higher interest rates have “profoundly destabilised the rental and new-build markets, resulting in a double crisis of both supply and demand, worsened by political instability,” he said.

Bôl noted that obsolete offices have become one of the most pressing topics for the industry, but that the industry, and ASPIM, are working on fixing the problem. “During MIPIM, we should reflect on solutions such as strategies to convert empty offices into housing, or how to better channel savings towards new homes,” he said. “Converting offices is not easy to implement; there are financial, regulatory and technical obstacles to overcome. At ASPIM, we are working on concrete proposals to contribute to the debate.”

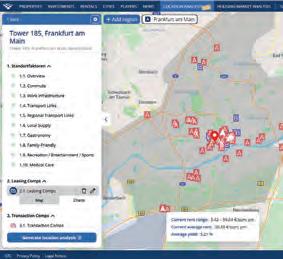

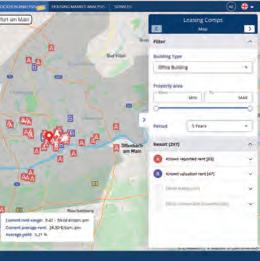

→ Individual modules for location factors, comparables, market data and more → Easy to use - created with just a few clicks → All-in-one dashboard with Word export → Whitelabel solution in your corporate design The perfect solution for brokers, surveyors, investors, project developers, banks and financiers.

HYATT’s lifestyle portfolio has shown strong growth in the last year, Felicity Black-Roberts, senior vice-president of development for Europe, Africa and the Middle East told MIPIM News.

“We are actively leaning into the lifestyle space and our global lifestyle portfolio pipeline has grown by nearly 50% year-over-year, off the back of our acquisition of The Standard brand in 2024,” she said. “Demand for world-class lifestyle hotels will continue to grow — so, I will certainly focus on opportunities to grow our lifestyle brands like Andaz, Thompson and Me and All Hotels across Europe during MIPIM.”

In terms of geography, Black-Roberts said that Hyatt remains very focused on growth opportunities across Europe, with a particular interest in France, Germany, the UK and Italy. “These markets will be well represented by real estate owners at MIPIM, so I’m looking

forward to connecting with delegates through the week,” she said.

“We’re committed to actively expanding Hyatt’s presence across geographies and are open to managed or franchise deals for new builds but also conversions, which can often be more sustainable and a quicker route to market. This includes inorganic growth through strategic master-franchise agreements for larger portfolios — or even M&A.”

Deloitte’s 2025 Commercial Real Estate Outlook ranks hotel assets fifth among the most promising asset classes for real estate investors over the next 12 to 18 months. “This leap from 12th place underscores the investment opportunity for the sector,” Black-Roberts said.

“We’re seeing more movement in the European hotel-investment market, with an increased number of distressed assets coming through — which isn’t nice to

see — and a lot of competition on price.”

She added: “So, there are investment opportunities materialising that were not available last year. We’ve also started to see the return to work bringing activity back to city centres across Europe — and this is clearly positive for urban hotels. And Germany, France and the UK — markets which benefit from strong domestic tourism — will continue to drive leisure spend this year.”

Black-Roberts said that Hyatt plans to expand into 13 new European and African markets by 2028, including Estonia, Iceland, Romania, Cape Verde and Mauritius.

“Spain is at the forefront of this accelerated growth journey, with Hyatt expanding from just four hotels in 2020 to 55 hotels and 14,500 rooms today. We firmly believe in the opportunity for significant growth in the region,”

Black-Roberts added.

STONEWEG will use this year’s MIPIM to explore opportunities in the hospitality and data-centre sectors, Jaume Sabater, the company’s CEO told MIPIM News.

“We are looking forward to exploring how we can apply the deep expertise of the expanded platform in living and logistics to new markets and discussing investment prospects in hospitality and data centres, which are also major targets for us this year,” he said.

More generally, Sabater said that he expected the mood at MIPIM to be brighter than it has been in recent years. “As for the wider in -

dustry discussion, we expect European real estate investors to be in a more positive mood about performance prospects this year against a backdrop of improving fundamentals,” he said. “It is likely key topics will include the segments best positioned for growth, the impact of geopolitical volatility on performance and the polarisation between different types of space.”

Sabater said that Stoneweg has brought a large delegation to Cannes this year. “MIPIM is a chance for us to meet existing and future partners and to introduce the enlarged Stoneweg-Icona group to the investor com -

munity,” he said. “As we enter a year with improving real estate potential backed by falling interest rates, tamed inflation and consistent European GDP and employment growth, it is a way to take the pulse of the industry and clarify the main focus areas for the business. MIPIM is an efficient way to meet many investors in one location which saves travel time, cost and carbon emissions.”

Stoneweg recently completed the acquisition of Cromwell Property Group’s European platform, creating a combined entity with assets under management of around €8bn.

11-14 March 2025

La Croisette, Cannes, France

Hotel & Tourism takes center stage at MIPIM: Explore top hospitality projects, gain expert insights, and network with the most influential players in the industry - all in an exclusive 500-sqm space designed for high-level business connections.

1,000+ H&T and

GYODER, the umbrella organisation for the Turkish real estate sector, is aiming to inspire the wider industry at MIPIM this year by “showcasing Türkiye’s values to the world”, according to president Neşecan Çekici.

“Türkiye is one of the most resilient countries in the face of global crises and challenges, continuing to be a reliable hub for investors,” Çekici said. Reflecting this resilience, “the Turkish real estate sector stands out globally due to the knowledge and experience it has gained over the years”.

Today, Türkiye is reshaping the industry by developing new business models, investment opportunities, innovative financial tools and sustainable real estate solutions, she said, adding:

“With its strategic position, Türkiye is preparing to build stronger and more lasting connections with global investors.”

Affordable housing is one of the topics that will come under the spotlight at this year’s MIPIM, a growing issue worldwide. “According to many reports, housing accessibility concerns have risen from 20th place to eighth place in Europe and worldwide,” she said.

el, we can accelerate the housing production process, regulate rent prices and provide a permanent solution to the crisis,” she said. The financing for this model, where the public takes the role of landlord, has been supported by various scenarios, including capital-market instruments. The model was presented at last year’s MIPIM, drawing industry plaudits. Looking to the year ahead, Çekici made a number of predictions for real estate. “In 2025, we anticipate that sustainable and accessible housing models will take centre stage, financing mechanisms will diversify and urban transformation will be approached in a more systematic way,” she said. “In Türkiye the demand for housing and the rising prices make alternative solutions a necessity.”

The housing crisis will ultimately require a “holistic policy approach”, Çekici said. “In the long run, accelerating urban transformation and increasing home-ownership rates again will require public-private partnerships, and even division of labour in certain areas. As GYODER, we will continue to provide sustainable solutions to the housing accessibility issue through projects that are in harmony with nature, make the best use of technology and prioritise design.”

‘‘Real estate worldwide has a changing macro backdrop’’

“This crisis, deepened by factors such as population growth, natural disasters, migration and poverty, has now become a global issue. According to UN-Habitat data, by 2030, three billion people, representing 40% of the world’s population, will need access to affordable housing.”

She added that the housing crisis reached its peak in Türkiye “due to the COVID-19 pandemic, waves of migration, the Ukraine-Russia war, excessive rent increases and, most recently, the two major earthquakes in Kahramanmaraş”. GYODER’s proprietary New Housing Model seeks to address this issue and accelerate the urban-transformation process. “If we can implement this mod-

And MIPIM remains a vital meeting place for sharing such messages. “Just as in our country, real estate worldwide has a changing macro backdrop,” she said. “As GYODER, we prioritise being part of this transformation and connecting our members with innovations. MIPIM is an important platform where real estate professionals from around the world come together. Participating in this event offers us the opportunity to keep up with global real estate trends and develop international collaborations.

“Additionally, it allows us to increase the visibility of the Turkish real estate sector on the international stage, share industry knowledge and evaluate sector developments from a broader perspective.”

Learn more about Premium Residency and its benefits by Visiting our booth: C14b

Scan to learn more

TO KNOW MORE ABOUT SAUDI PROJECTS VISIT US AT THE PAVILIONS C14 B | C20 | HALL MÉDITERRANÉE

Subscribe to Property Week and get your

first 6 months at 50% off*

Subscribe now to get:

Instant access to propertyweek.com

Weekly digital magazine (47 issues a year)

Property Week app on multiple devices

Tailored newsletters of your choice

Special features and supplements

PLUS £100 off on Property Week conferences

Upgrade to print and include a weekly copy delivered to your door or desk.

Subscribe here using the QR code

Our key events this year include Later Living, ESG EDGE, Rental Living, Student Accommodation, and more! Check out all events on the propertyweek.com website.

Plus, access your exclusive MIPIM saving of £180 on this year’s Later Living Conference using code MIPIM415!**

INVESTORS curious about opportunities in Oslo may find answers to their questions at today’s Oslo Investor Summit, taking place on the Geo Focus Stage in Palais 3 at 13.00. The moderator of the event, Stig L Bech, chairman of the board of Norsk Eiendom, The Norwegian Real Estate Organisation, described some of the summit’s highlights. “We will give an update on the Norwegian market, an overview of key regulatory and political frameworks, and a summary of market practices in transactions. Part of this is an analysis of the state of Norwegian politics, after the recent change of government, as many international players question current developments, tax evasion, et cetera.”

He added: “We have seen how important knowledge of the Norwegian market and Norwegian transaction processes can be for international investors to succeed with investments in Norway. This is particularly true for the speed and transparency that characterise the standardised Norwegian market. In addition, we believe in creating a physical meeting place to help connect the relevant players with each other. This has worked before, and it will work again.”

Bech said that wider topics under the lens at MIPIM are ones that concern all of real estate. “High inflation, high interest rates, flattening incomes and lower loan-to-value ratios are giving many real estate companies more strained liquidity

than before,” he said. “This is often resolved by existing owners injecting fresh equity, but in today’s market, fresh capital is also raised through partial or complete sales of individual assets or portfolios, or through loans and hybrid capital from lenders offering higher loan-to-value ratios than traditional banks. International investors

have previously been an important source of capital in the region, and are once again showing increasing interest in the Norwegian market.”

He added: “MIPIM is an important meeting place for Norwegian players and international investors. That is related to a number of facts, including 20,000 participants from over 90 countries.”

A NEW luxury residential icon is taking shape in Bahrain, which is expected to attract buyers from all over the world, according to Hussain Yousif, deputy general manager of developer Grnata. “Rising above the breathtaking turquoise waters of Bahrain Bay, Golden Gate is the epitome of modern luxury architecture,” he said, noting that the project seeks to marry world-class design with advanced technology, offering over 70 premium amenities. He added: “At Grnata, our mission is to provide residents in this particular project and future luxurious projects with an exclusive lifestyle while offering investors profitable and sustainable opportunities. As such, Golden Gate will be operated by our own Grnata Signature, a luxury real estate entity.”

Hussain said that over 70% of the work is now finished, with model units currently available for view-

ing. “These exclusive residences feature modern, high-quality interiors, cutting-edge technology, and breathtaking views of Bahrain Bay. Whether you’re looking for a personal residence to enjoy an elevated lifestyle or a solid invest-

ment opportunity, Golden Gate is definitely your ideal choice.”

He said that the project has made possible through first-class teamwork. “At Grnata Real Estate, our leadership has been pivotal in driving the success of the Golden

Gate Project. With our extensive experience in real estate, we have implemented strategies aligning with both our quality standards and our vision of innovation.

“Acquiring Golden Gate was a step toward transforming Bahrain’s real estate landscape, blending international best practices with local expertise.”

Grnata Contracting, the firm’s construction arm, has led the efforts on the ground, with a team of over 500 professionals, including 40 skilled Bahraini engineers.

“These individuals have been integral to the project’s success, ensuring that each milestone is met with precision and excellence. Our leadership’s commitment to fostering Bahraini talent is a core part of our mission, as we believe in empowering local professionals to play a major role in our projects while we continue to adopt global construction innovations,” Hussain said.

JAE20

JAE22

JAE24

JAE26

JAPANESE real estate developer

Tokyo Tatemono is currently carrying out several large-scale redevelopment projects in the vicinity of Tokyo Station in the city centre.

One is called the Yaesu Project, which is scheduled for completion in 2026 and will include a bus terminal and a cultural centre.

However, the domestic project that Tokyo Tatemono is most proud of at the moment is One Dojima Project, which was recently completed in Osaka, the largest city in west-

ern Japan. “This project is the first high-rise residence in Japan that has been combined with a 5-star hotel,” said director Hideshi Akita. “It is 195 metres tall, and residents can access an assembly room and rooftop deck, from which they can enjoy a full view of Osaka Castle and the Dojima and Okawa Rivers.” The Four Seasons Hotel occupies the middle floor of the building, but condominium residents living above the hotel floor have access to the hotel restaurant and gym via a private elevator.

The first floor is occupied by entrances to both the residences and the hotel, as well as a restaurant and bakery. The surrounding environment consists of lush landscaping and is natural and private.

“10 residences on the upper floors have deep roof balconies,” he added. “The condominiums combine exhilarating outdoor living with a panoramic view of the city, thus increasing the residences’ value enormously.”

Another unique feature of One Dojima Project is the way it incorporates fine art into its interior design. The exterior appearance is

meant to mimic that of a yacht’s sails, while stand-alone art works are distributed throughout the building and in public spaces. “It provides a series of encounters with art that stimulates the aesthetic sense of residents and hotel guests, thus making life an endless journey of curiosity,” Akita said. The company is also looking overseas for opportunities, he added. “We aim to take advantage of business opportunities in growing markets like Asia by leveraging our strengths and experience. We have good relationships with overseas partners in Japan and so can accelerate investment in countries in Europe and other places.” Currently, Tokyo Tatemono is involved with two residential projects in the US and one in Australia, eight residential and logistics projects in Thailand, and three residential and logistics projects in China. With this mission in mind, Tokyo Tatemono thinks it can increase the overseas portion of its revenue from 1% to 10% by 2030. Tokyo Tatemono also has its eye on Europe. “Europe is very promising in terms of advanced environmental initiatives,” he said. “We want to proactively incorporate these initiatives in our development strategy so that they can produce effects that will transcend borders.”

INTERNATIONAL real estate

investors are ready to spend funds in a range of geographies, according to Rasheed Hassan, head of global cross-border investment at Savills.

“Beds and sheds remain in favour and we anticipate a good number of investors will enquire about these sectors at MIPIM this year and throughout 2025. However, we are also seeing a material uptick in interest for CBD offices, hotels, data centres and various retail sectors in Europe,” he said.

“This reflects a combination of repricing feeding through into

the market, robust occupational datapoints and the return of cashflow accretive financing in certain sub-sectors, particularly in the Eurozone.”

He added: “The anticipated further cuts in interest rates by the European Central Bank and others will support the growing improvement in investor sentiment and activity. ESG will remain a key consideration for many investors and those holding real estate assets as many European markets have put EPC deadlines in place. The geopolitical environment will continue to be of interest.”

Preferred destinations have evolved, he added. “Southern Europe has become more favourable for investors over the last few years with Spain now the most popular country to invest in, followed by the UK, France, the Netherlands and Germany, according to a recent European and Middle Eastern investor survey we conducted. As a result, we expect to get many more enquiries around these markets at MIPIM and throughout the year.

“MIPIM is always a very good barometer of sentiment, which is helpful for everyone,” he said.

INPARK CEO Albrecht Armand anticipates further growth and expansion in Hungary’s industrial and logistics real estate sector this year and said that the Budapest-based company aims to make eastern and southern Hungary more attractive to investors, contributing to the region’s economic development and job creation.

“We expect even more international companies to choose Hungary, as demonstrated by the [Chinese car manufacturer] Xinzhi Group project, which selected Hungary — and specifically our industrial park in Hatvan — for its first European investment,” he said. “The key factors for investors include site readiness, development speed and infrastructure quality. Sustainability is also becoming indispensable, which is why InPark is installing energy-storage systems and solar

panels at several industrial parks this year.”

Overall, Hungary’s industrial and logistics market is experiencing stable growth, with increasing investor interest and intensified infrastructure development, he added, with MIPIM providing the company with an opportunity to showcase the investment potential in Hungary.

InPark — which is the brand name for the Hungarian stateowned National Industrial Park Management and Development Company (NIPÜF) — will use the event to emphasise the economic appeal of the country’s regional cities and demonstrate how the industrial and logistics sector has expanded significantly in recent years.

With 900 ha of development land, Armand said that InPark is the only industrial real estate de -

veloper in Hungary with full nationwide coverage. The company is present in 15 counties and 20 cities and is expanding its development areas towards Hungary’s eastern and southern regions.

“We consider it our mission to participate in MIPIM, the world’s leading real estate development exhibition, where the most influential professionals of the industry gather. This event provides us with a unique opportunity to showcase Hungary’s competitiveness and the dynamic growth of our industrial and logistics sector on a global scale,” he added.

“Additionally, it allows us to highlight Hungary’s industrial and logistics developments, particularly in rural regions, and to build strategic partnerships that contribute to the country’s longterm economic growth. In recent

years, we have seen growing investor interest in developments outside Budapest and in regional cities, as these areas offer competitive alternatives within Central Europe.”

THE HEAD of real estate at a UK specialist pension fund insurer has said that reforms to the UK’s planning system present numerous new opportunities and challenges to real estate developers and private-sector investors.

James Agar, head of real estate origination at Pension Insurance Corporation, has said that UK real estate developers are approaching the new landscape following reforms to planning laws with “cautious optimism”.

Planning-law reforms have been introduced by the new Labour government in a drive to streamline and speed up real estate development in the UK.

The reforms have been introduced in a large part to deliver more quick-

ly to ambitious housebuilding targets. The government has set itself the target of delivering 1.5 million new homes during the course of this Parliament, alongside some 150 major public projects.

Agar said a number of factors would dictate how successfully private-sector real estate firms and public bodies with shared interests could work together to meet national targets.

He said: “The UK has ambitious targets to meet within the real estate sector, and with new planning reforms in place as well as environmental challenges, meeting these targets will largely come down to sentiment and viability.

“Long-term public-private partnerships will be key to unlock institu-

tional investment, so l hope there will be more conversation and excitement around the potential here.”

Agar said that the presence of such high targets, and the many opportunities they present, would mean an increasing presence of private investment and “private-sector finance” in the affordable housing market.

“I believe there will be continued focus and capital allocation to the living sectors, with affordable housing rising in prominence and transactional activity,” Agar said.

“Private-sector finance entering the affordable space has been long expected, but 2025 is likely to be the tipping point for major investment into the sector, particularly as institutional investors increasingly look to commit to social-impact projects.”

YASIR Yilmaz, general manager and CEO of Turkish real estate developer Emlak Konut, said “low-carbon initiatives, green buildings and sustainability” will be top of his agenda for this year’s MIPIM. Speaking to MIPIM News ahead of the event, he added: “We plan to focus on key topics such as mega-city developments, urban transformation, smart-city technologies and innovative financing models. Establishing new partnerships with foreign investors, looking into public-private partnership prospects and showcasing Türkiye’s robust real estate potential will be our top priorities.”

He observed “three major pillars” shaping the real estate sector in 2025. Sustainability and the green tran-

066_ICE_N1_PIM

sition would remain top priorities, both locally and globally. “Investor interests in ESG-compliant developments is expected to rise significantly, reinforcing the need for sustainable urban planning and responsible real estate investments,” he said. Secondly, there will be a rapid acceleration in digitalisation and smart city technologies. “The integration of smart-building systems, big-data analytics and blockchain innovations will play an increasingly vital role in adding value to real estate assets and enhancing urban living standards,” Yilmaz said.

And lastly, despite global economic fluctuations, he expects “strong demand for secure and long-term real estate investments in strategic locations. Mixed-use

In the 2025 edition of Mipim in Cannes, Italy presents itself as a united frontier, creating a bridge between North and South. Housing, social and digital infrastructures, enhancement of real estate assets and waterfronts. These are the themes at the heart of the Italian Pavilion of the main international real estate event promoted by the Italian Trade Agency at the Palais des Festivals from 11 to 14 March.

The ribbon cutting of the Italian Pavilion is scheduled for March 11th at 10:30.

developments, wellness-oriented residential and commercial spaces, and tourism-centric real estate projects will continue to attract investors seeking sustainable and high-yield opportunities.”

His company remains committed to adapting to these evolving trends, Yilmaz said, “driving innovation, and ensuring that our projects align with both market expectations and societal needs. We will continue to foster global collaborations, invest in smart and sustainable solutions, and contribute to shaping the future of the real estate industry.”

Emlak Konut is “deeply committed to expanding its global presence and strengthening its international collaborations,” he said, and MIPIM is central to that strategy. “We consider MIPIM as a critical venue for engaging with global investors, exchanging expertise and identifying new opportunities that align with our long-term vision.”

A new Pavilion to bring visitors into an Italian atmosphere. Italy shows its potential through an Italian Gallery, with pictures representing 10 large real estate projects of national level to show the enormous potential of the country.

The Pavilion also hosts an Arena, with a rich program of Workshops: three days and three macro-themes will be the common thread. In addition to this program, will be eight Side Events that will further explore the themes.

On March 12th, don't miss the Italian Conference: listen to the voice of Italian Real Estate, local authorities, institutional representatives and trade associations awaiting you to discover the best of Italian Real Estate.

Living the italian way. More than real estate, it's a lifestyle. Discover more here:

FOR AS long as Shibuya, Tokyo’s celebrated “youth mecca” has been around, the Tokyu Corporation, one of Japan’s major conglomerates as a developer and hotelier, has been the area’s heart and soul in terms of business. Until a few years ago it owned and operated the two big department stores that dominated Shibuya retail, as well as Bunkamura, a cultural and entertainment complex that is now being renovated. Most significantly, Tokyu operates two train lines that terminate in Shibuya, the Toyoko Line that connects Tokyo to Yokohama, and the Denentoshi Line, which connects Shibuya Ward to the affluent suburbs of northern Kanagawa Prefecture.

Akinori Kanayama, Tokyu’s executive officer in charge of hotels and resorts, told MIPIM News that his company is now in the midst of rebuilding Shibuya for the 21st century. “We are a hotel operator,” Kanayama said. “But we are also a developer, and we are working on mixeduse projects that will cover all of

‘‘The legacy of Shibuya as a place to live is day-to-day luxury’’

Shibuya.” As part of this plan, Tokyu tore down its two department stores in Shibuya and is now collaborating with the luxury fashion brand Louis Vuitton as a co-developer and co-investor, working toward a “new shopping culture” that Tokyu can deliver in its future retail spaces. “We also want to make Shibuya a centre of entertainment,” he added. “So in addition to renovating Bunka -

mura” — which boasts a large hall that can handle opera and ballet, a playhouse, museums and cinemas — “we’ve just completed a hotel complex in Tokyo’s main entertainment district of Kabukicho near Shibuya that includes entertainment facilities.” What ties all these projects together is Tokyu’s commitment to keeping things Japanese. “Tourists from other countries want a local experience, so our hotels incorporate Japanese taste and sensibility.” The four hotels that Tokyu operates in Shibuya comprise more than 1,200 guest rooms. These hotels will be integrated with retail spaces that cater to “shoppers with experience”, he said. Beyond the area’s reputation as a place where young people gather, these new projects also take advantage of Shibuya’s nearby high-end residential district. “The legacy of Shibuya as a place to live is day-to-day luxury,” he said, a situation that covers what he calls “Greater Shibuya”, which extends in all directions to encompass other trendy neighbourhoods, like Harajuku and

Ebisu. But he added that this vision of retail accommodates a wider class of consumer who demands “more average prices”. Tokyu is also promoting its long-running property timeshare business called Tokyu Sharing. Though Tokyu’s timeshare business is mostly limited to Japan, it collaborates with other timeshare businesses overseas. Likewise, Tokyu is quickly adapting to the new digital work-life dynamic, which Kanayama says distinguishes Tokyu from other developers in the hotel field.

“Google’s offices are in Shibuya,” he said, emphasising the more forward-looking business sensibility that Shibuya offers.

All these aspects will be discussed during MIPIM, where Kanayama is presenting Tokyu’s projects — especially new hotels— to attract investors to their projects.

“I think they can get a higher, stable return,” he said. The presentation will emphasise Japan as a “country of peace” where inbound tourists can feel secure and at ease, as well as Japan’s close affinity with nature.

Nous vous mettons en relation avec des experts de l’immobilier de prestige pour réaliser la plus juste estimation de vos biens.

MIPIM delegates should explore Romania’s dynamic real estate markets, according to Ciprian Ciucu, mayor of the sixth district of Bucharest. Ciucu emphasised “the country’s strong economic growth, increasing investor interest and favourable business environment”, adding: “Romania has one of the fastest growing economies in the EU, with consistent GDP growth, low corporate taxes — a 16% flat tax — and increasing foreign direct investment.”

He noted that compared to Western European markets, “Romanian real estate offers higher yields, particularly in the office, industrial and logistics sectors”. Romania also benefits from significant EU funding for infrastructure development enhancing transport and logistics capabilities.

“Cities like Bucharest, Cluj-Napoca, Iași and Timișoara are becoming regional business hubs, attracting multinational companies and startups,” he said. This in turn is boosting demand for high-quality residential properties, backed by urbanisation, a growing middle class and increasing mortgage accessibility.

He added: “MIPIM delegates looking for high-growth, highyield opportunities should strongly consider Romania as an emerging market with longterm potential.”

Bucharest’s Sector 6, in particular, presents several “compelling investment and development opportunities across various sectors”, the mayor said.

“The Municipality of Sector 6, with support from the Council of Europe Development Bank, is advancing the construction of a new public hospital. The project aims to enhance healthcare services for approximately 400,000 residents.”

The district has also embarked on a comprehensive energy-efficiency programme. “This initiative includes the thermal rehabilitation of multi-family residential structures and the construction of new, energy-efficient public schools and kindergartens,” Ciucu said. “Sector 6 has furthermore emerged as a hotspot for young families and investors, driven by new residential projects and enhanced public transportation infrastructure. The area has seen significant residential growth, with over 28,500 apartments under development in adjacent zones. Improved connectivity, including new trolleybus lines and the metro line M5, has further increased the area’s appeal, indicating a promising future for property value appreciation.”

He added: “Collectively, these initiatives underscore Sector 6’s commitment to sustainable development and its attractiveness to investors seeking opportunities in healthcare, energy efficiency, international trade and residential real estate.”

ELEVATE YOUR OFFICE EXPERIENCE

skylinerbykarimpol.pl

LOCATION: WARSAW CBD

GLA 24,000 SQM

130 M OF HEIGHT / 28 FLOORS

900 SQM OF GREEN TERRACES ON THE TOP FLOORS

COMPLETION: Q4 2026

BREEAM OUTSTANDING

MEET US AT WARSAW STAND

RIVIERA 8 D1

Projet Immobilier et impact RSE : comment en faire un couple gagnant ? 14.00 - 15.00 Organised by

16.00 - 17.00

16.20 - 18.00

Majestic Hotel - Salon Diane The Political Leaders

By invitation only

UK Hub Verrière Grand Audi London stand

16.15 - 17.15

Grand Auditorium ESG Awards

Organised by

19.00 - 22.00

Croisette & Riviera 9 Opening Night

Open to all registered attendees and included in your MIPIM pass

14.00 - 14.15

The UK Hub Stage official launch and welcome speeches

14.15 - 15.00

Investment strategies for clean buildings: Determining the right pathway forward

16.15 - 17.00

Faster, bigger, better - How can the North become the UK’s development driver?

Organised by

17.15 - 18.00

From trains to cranes: a residential development boom in the UK’s best connected region

London and leisure: all fun and games

Sponsored by

10.00 - 10.45 Keynote 10.45 - 10.55

11.00 - 11.45

Planning Change, Driving Growth

9.00 - 10.30

HTL Connection ribbon cutting ceremony & Networking Breakfast

Hosted by

11.30 - 12.30

Poland’s Logistics & Industrial Safe Bet: What is capturing investors’ attention?

Homes

14.00 - 14.45

- 12.45 5 years on: Workplace Trends

14.45 - 14.55

Bringing the London Model to Life

16.00 - 16.45

How the Saudi Giga Projects are contributing to the development of the Kingdom’s economy and the realisation of Vision 2030.

14.00 - 15.00

14.00 - 15.00 Organised by Reimagining Cities: Disrupting the Urban Doom Loop

Organised by

Hosted by

14.00 - 15.00

New Tashkent : The Future of Uzbekistan’s Capital City

Organised by

16.00 - 17.00 Stronger Together: Cross-borough working in London

16.30 - 18.00

Table-ronde « Revitalisation du patrimoine bâti »

From 17.00

Organised by London Stand Opening Reception

18.00 - 19.00

Universities as Drivers of Economic Growth

Organised by Closed door event

16.30 - 17.30

From Vision to Value: Generating Alpha and Driving Total Returns Leveraging Digital

Organised by

Tech vs. Real Estate Giants: Collaboration or Competition?

14.30 - 15.30

Hybrid Hospitality: Multi-Destination Assets and Evolving Institutional Appetite

16.00 - 17.00

Invest In … Blackpool, Calais, Ottawa, Nice, Porto, Roma, Warsaw

17.30 - 18.30

7 Years of dreaming big: the story of the New Capital

Organised by Brazil Networking Cocktail 17.30 - 19.00

Sponsored by

Organised by

Organised by

Bleiben Sie immer auf dem Laufenden!

Mit den kostenlosen Newslettern vom immobilienmanager haben Sie alle Themen der Branche im Blick – einfach und bequem per Mail.

Redaktionsletter: Neuigkeiten und Meldungen zu Branchentrends sowie aktuellen Themen aus der Immobilienwirtschaft.

Themenletter:

Tiefergehende Informationen zu Themenwelten wie z.B. Nachhaltigkeit & ESG oder Digitalisierung sowie exklusive Inhalte aus unserem Magazin.

Jetzt anmelden unter www.immobilienmanager.de/newsletter

Infoletter: Informationen zu exklusiven Fachveranstaltungen, Sonderheften zu Spezialthemen sowie weiteren relevanten Produkten für die Immobilienbrache.

Colliers’

Jan Kamoji-Czapinski

STATE incentives across the CEE region continue to attract R&D and business support system (BSS) projects, with government backing covering up to 70% of costs, according to new research from Colliers. Jan Kamoji-Czapinski, director, incentives advisory, Europe at Colliers said: “Most of the countries focus on supporting industrial and R&D projects. However, office projects can benefit from financial aid through cash subsidies and tax incentives in most of the regional and select capital cities, such as Tallinn, Riga, Vilnius and Zagreb.”

He added: “Landlords are often disregarding incentives, but in some locations, they can directly benefit from measures like property-tax exemptions.” The Colliers research finds that tenants, especially large manufacturing companies and shared-services centres, consider the availability of public aid as one of the key factors when selecting a location. If two properties are comparable in terms of costs, location and workforce availability, but one is situated in a region offering a higher level of support, the likelihood of it being leased increases significantly.

THE VIBRANT logistics sector but also recovering retail assets are among target acquisitions for international investor WP Carey this year, according to Christopher Mertlitz, head of European investments. “Industrial and warehouse properties will remain a key part of our strategy, as both segments continue to be driven by sustained ecommerce growth and robust demand for logistics infrastructure,” he said. “Likewise, we continue to see opportunities in grocery and other retail properties given the asset class’ resilience, underpinned by demand for essential goods during times of economic instability.”

This recovery theme reflects more positive sentiment for the wider market, he added.

“After a focus on ‘survive till 2025’ through much of last year, many investors are now hoping the market is poised to thrive this year,” he said. “While the economic outlook remains uncertain, we expect sale-leasebacks will continue to play

a vital role in unlocking liquidity for businesses which can be reinvested into core operations and growth. In addition, we anticipate that we’ll continue to see interest from private-equity firms in sale-leasebacks as a means of financing new acquisitions or bolstering the growth of portfolio companies.”

Emerging asset classes remain under the spotlight, he said: “We also expect some newer sectors to receive an influx of investor capital. Self-storage, cold storage, senior living, hospitality and data centres have emerged as popular investments, with strong operating fundamentals and positive long-term growth potential.”

For Mertlitz, Cannes is the place to discuss all this and more. “MIPIM 2025 offers a good opportunity to get together with our peers and assess the trajectory, trends and topics that will likely dominate the European real estate market this year,” he said. “We are expecting discussions to centre

around evolving monetary policy decisions and the wider economic landscape in Europe, all of which will provide valuable perspectives on how the sector is looking to adapt to shifting conditions.”

THE EAST Midlands region of the UK is rich with opportunities for international real estate investment across a range of sectors, a senior politician from the recently-devolved authority overseeing the area has said.

Councillor Nadine Peatfield, deputy mayor of the East Midlands Combined County Authority (EMCCA), is in Cannes to meet with potential investment and development partners seeking regional opportunities across growth sectors including advanced manufacturing, nuclear energy and engineering. Peatfield is leading the first-ever EMCCA delegation to MIPIM since the authority was formed in February 2024 under a UKwide regional devolution agenda.

EMCCA covers the central counties of Derbyshire and Nottinghamshire, home to internationally renowned companies including Rolls Royce, Boots and Toyota as well as a plethora of manufacturing and engineering businesses. Peatfield, who is also the leader of Derby City Council, said: “We’ve got some big-hitters in the region. Global companies are based here because it’s the centre of the country. Transport links are brilliant, you can get anywhere in England in the space of a few hours.” She added: “We’ve got some big international investment in the region, in advanced manufacturing, green energy and small nuclear reactors. We’re training up the next generation of nuclear engineers.”

One of MIPIM’s UK Diversity partners, Regeneration Brainery is a not-forprofit programme that gives brilliant young minds a pathway into property and regeneration careers.

It’s already inspired more than 6,000 young people from under-represented backgrounds through its free immersive bootcamps, networking with industry leaders, hands-on work experience and internships.

And it’s on the hunt for more partners to join its mission!

Supported by

GET INVOLVED!

RUDOLF Nemes, managing director and co-founder at industrial developer Hello Parks, is at MIPIM with an expectation of significant changes and fresh approaches set to emerge in 2025.

As a Hungarian property developer, he said that the company believes that there are encouraging signs, with indications of increased investor attention turning towards the Hungarian real estate market.

“However, the US’ new international role could significantly reshape tenant and investor supply-demand markets. Restoring Europe’s competitiveness will be crucial in maintaining positive real estate market trends,” he said. Nemes also feels that 2025 will be a defining year in terms of the eventual composition of the German government following the country’s recent election results,

European migration policy and the green transition, which he stressed in combination will determine Europe’s future role on the international stage.

“The direction that will emerge by the end of the year poses a serious challenge to predict, even for the most experienced profes -

sionals,” he said.

Hello Parks has established a presence in four locations: Maglód, Fót, Páty and Alsónémedi, with a portfolio of sustainable and energy-efficient megaparks and the company is actively working on the development of over one million sq m of industrial space

THE NEED for investment in social infrastructure will be a clear theme at this year’s MIPIM, according to Chris Gill, managing director at Kajima Partnerships, who added that the need for partnership working between the public and private sectors is on the rise.

“The demand for investment in social infrastructure will continue to grow,” he said. “Schools, hospitals and town centres need innovative approaches and sustainable funding solutions.”

To illustrate his point, Gill pointed to Kajima projects such as the 18,580 sq m Rochdale Riverside scheme, as well as the forthcoming Springfield Vil -

lage in London, €596m Health Innovation Neighbourhood in Newcastle and Etruscan Square in Stoke-on-Trent.

“Kajima Partnerships will continue to develop and invest in these vital areas across our key markets, unlocking complex projects that others might overlook,” he said.

“While macroeconomic factors like interest rates will continue to shape the outlook for real assets, they will also create opportunities for long-term, strategic investors who can navigate these challenges and deliver lasting value.”

Gill added that MIPIM presents an “excellent opportunity for us” as there is significant mo -